Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Allison Transmission Holdings Inc | d365642d8k.htm |

0

Deutsche Bank Global Industrial & Basic Materials Conference

June 13, 2012

Lawrence Dewey, Chairman, President & Chief Executive Officer

David Graziosi, Executive Vice President & Chief Financial Officer

Exhibit 99.1 |

Safe

Harbor Statement 1

The following information contains, or may be deemed to contain, “forward-looking

statements” (as defined in the U.S. Private Securities Litigation Reform Act of

1995). Most forward-looking statements contain words that identify them as

forward-looking, such as “may”, “plan”, “seek”, “will”,

“expect”, “intend”, “estimate”, “anticipate”,

“believe”, “project”, “opportunity”, “target”, “goal”,

“growing” and “continue” or other words that relate to future events, as opposed

to past or current events. By their nature, forward-looking statements are not

statements of historical facts and involve risks and uncertainties because they relate to events

and depend on circumstances that may or may not occur in the future. These statements give

Allison Transmission’s current expectation of future events or its future performance and

do not relate directly to historical or current events or Allison Transmission’s historical

or future performance. As such, Allison Transmission’s future results may vary from

any expectations or goals expressed in, or implied by, the forward-looking statements

included in this presentation, possibly to a material degree.

Allison Transmission cannot assure you that the assumptions made in preparing any of the

forward- looking statements will prove accurate or that any long-term financial goals

will be realized. All forward-looking statements included in this presentation speak only as

of the date made, and Allison Transmission undertakes no obligation to update or revise publicly

any such forward-looking statements, whether as a result of new information, future events,

or otherwise. In particular, Allison Transmission cautions you not to place undue weight

on certain forward-looking statements pertaining to potential growth opportunities,

long-term financial goals or the value we currently ascribe to certain tax attributes set

forth herein. Actual results may vary significantly from these statements. Allison

Transmission’s business is subject to numerous risks and uncertainties, which may cause

future results of operations to vary significantly from those presented herein. |

Business Overview

2 |

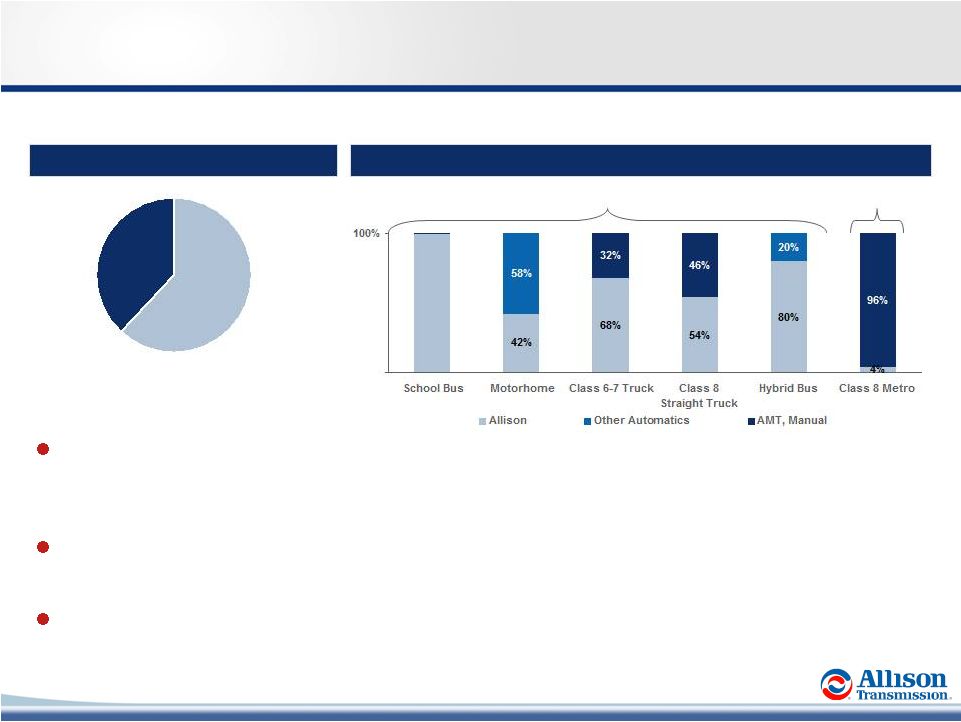

3

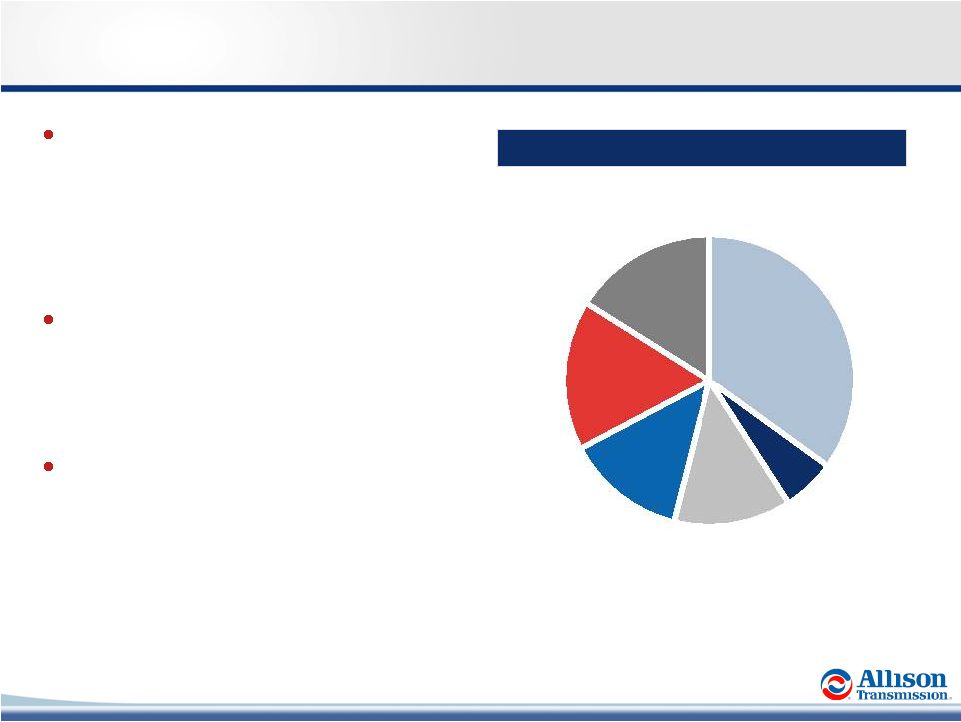

Allison Transmission at a Glance

LTM

(1)

Net Sales by End Market

(1) LTM 3/31/2012.

LTM Net Sales: $2.2 billion

World’s largest manufacturer of fully-

automatic

transmissions

for

medium-

and

heavy-duty commercial vehicles

–

62% global market share of fully-automatic

transmissions

–

Virtually no exposure to Class 8 line-haul

tractors

Allison is the premier fully-automatic

transmission brand

–

Premium price component frequently

specified by end users

–

Differentiated technology

Well positioned for revenue and earnings

growth

–

Continued recovery in North America

–

Further adoption outside North America

–

Global off-highway growth opportunities

–

Expanding addressable market

North

America

On-highway

35%

North

America

Off-highway

13%

Outside

North America

17%

Parts,

Support

Equipment

and Other

16%

Hybrid

Transit Bus

6%

Military

13% |

4

Allison Is a Premier Industrial Asset

Technology

Leadership

-

The

Allison

Advantage

Improved Margins and Low Capex Drive Strong Cash Flow Generation

Experienced Management Team

Premier Brand and End User Value Proposition

Multiple Organic Growth Opportunities

Global Market Leader

Diverse End Markets with Long-Standing OEM Customer Relationships

|

5

The “de facto”

standard in medium-

and heavy-duty applications

–

Well established as standard in North America

Increasing presence in rapidly growing emerging markets (China and India) which

today are predominantly manual

Virtually no exposure to more cyclical Class 8 line-haul tractors

Global On-Highway Fully-Automatic Share

(1)

North American Market Share

(1)

Allison

~62%

Other

(2)

~38%

Global Market Leader

(1) 2011 Units. Source: Allison management estimates and ACT research.

(2) Majority of “Other”

volume is in North American Class 4-5 truck and European bus.

Substantially

All

Allison’s Core Addressable Market

Expansion Market |

6

End User Value Proposition

Productivity (acceleration)

Maintenance Savings (life cycle

costs)

Fuel Efficiency

Driver Skillset / Wages

Training (time, cost)

Shift Quality

Safety

Residual Value

Low

High

Included in Vehicle Price

$3,000 - $7,000

$3,000 - $11,000

Manual

Transmission

Automated

Manual

Transmission

(AMT)

Relative

Customer

Value

Approximate Option Pricing

End Users are Willing to Pay a Premium Price for Allison

Allison Advantage

Allison

(Fully-Automatic) |

7

Distribution

Emergency

Vehicle

Motorhome

Rugged Duty

School Bus /

Shuttle Bus

Transit Bus

End Market & Vocation Overview

Global On-Highway

Military

Sample Vocations

Select End Users

Select End Users

North America Hybrid Transit Bus

Select End Users

British Airport Authority

Beijing City

Transit

New Delhi

Transit

Global Off-Highway

Select End Users

Parts, Support Equipment and

Other |

8

Multiple Organic Growth Opportunities

Benefit from Developed Markets Recovery

Increase Penetration of Fully Automatic Transmissions

Accelerate Adoption in Emerging Markets

Capitalize on Rising Demand for Energy and Commodities

Continue New Technology and Product Development

Increase Share in Underserved Markets |

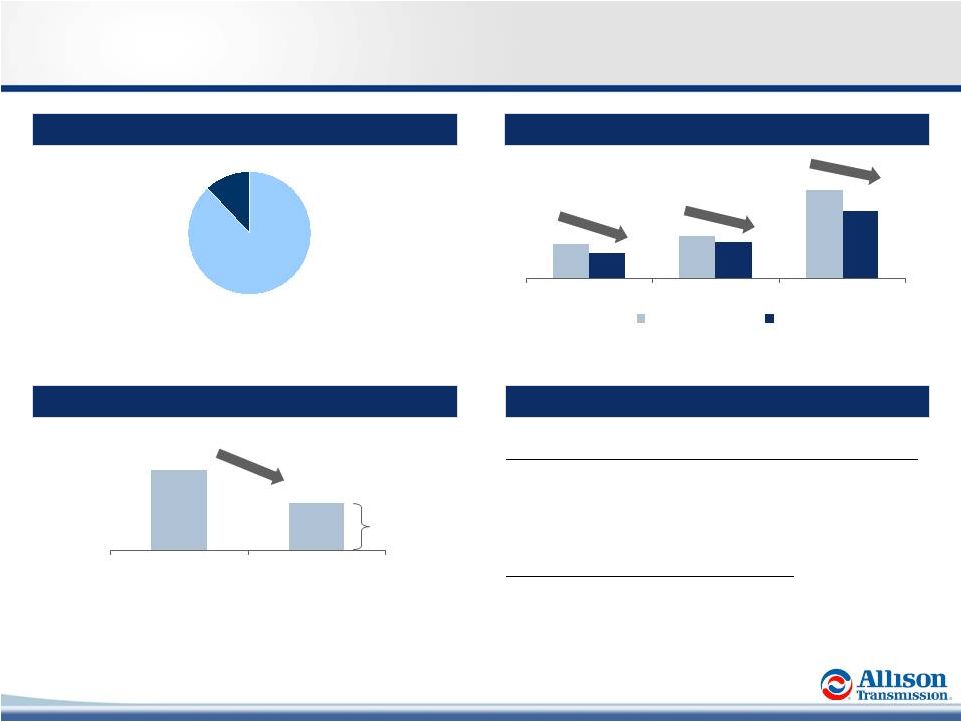

9

New Product Development

Hybrid Commercial Vehicle

Class 8 Metro

Developing a ten-speed fully-automatic

transmission targeted at Class 8 tractors serving

urban markets

–

Large, addressable market size of ~60k units

–

Historically

a

“manual”

market

under

addressed

by Allison’s fully-automatic product portfolio

Currently being tested by customers

Leading development of first fully-automatic hybrid

truck transmission for the Class 6-7 market

Awarded $62.8 million U.S. Department of Energy

cost-share grant for hybrid development

–

Fuel economy improvements of ~25%-35%

–

Target Vocations: Refuse, Pick-Up &

Delivery/Distribution, Utility and Shuttle Bus

Average Annual Spend over $110 Million in Product-Related Research and

Development Since Acquisition |

Strategic Priorities

Expand global market leadership

–

Capitalize on continued market recovery

–

New vocational offerings

Emerging markets penetration

–

Vocational ladder strategy

–

Increase number of vehicle releases

Continued focus on new technologies and product development

–

Address markets adjacent to core

–

Advanced fuel efficient technologies

Deliver strong financial results

–

Earnings growth and cash flow generation

–

Focus on continued margin enhancement

10 |

Financial Overview

11 |

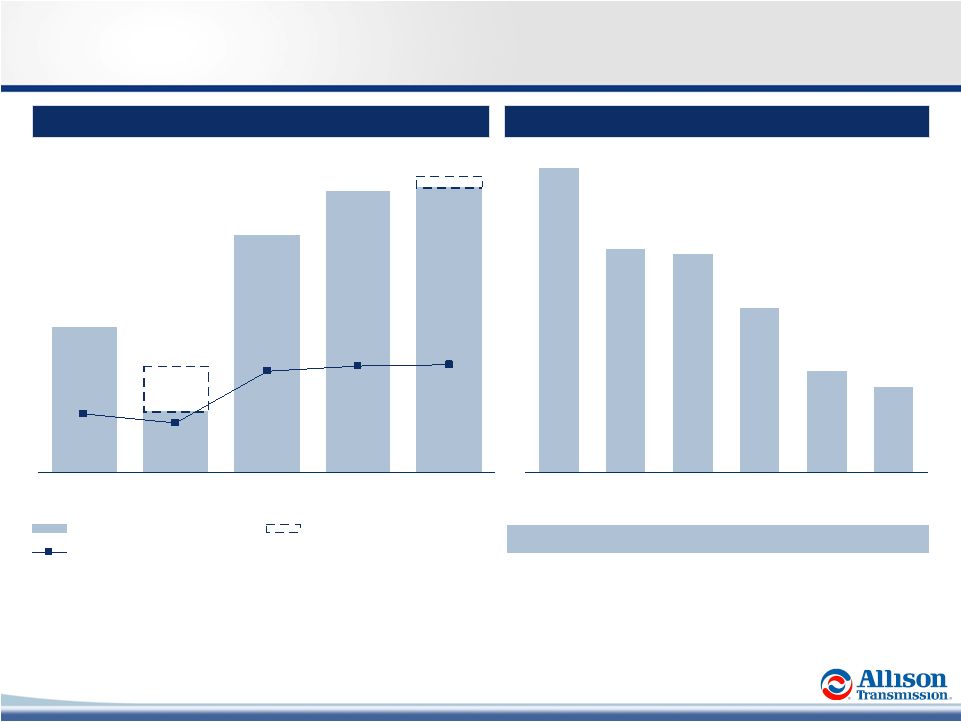

12

Allison Key Financial Highlights

(1) LTM 3/31/2012.

(2) Note: See appendix for comments regarding the presentation of non-GAAP financial

information. Strong Financial Profile

(2)

($ in millions)

Strong, sustainable operating margins

Low capital expenditure requirements

Minimal cash income taxes / valuable U.S. tax shield ($0.9-1.1bn present value)

Positioned for long-term cash earnings growth

$501

$766

$712

$544

$617

34.1%

32.9%

32.0%

28.4%

26.4%

4.5%

2.8%

17.5%

9.4%

8.0%

16.4%

17.2%

2008

2009

2010

2011

Adj. EBITDA

Adj. EBITDA Margin

Adj. NI Margin

Free Cash Flow (% of Net Sales)

(1)

LTM

14.2%

14.1%

15.1% |

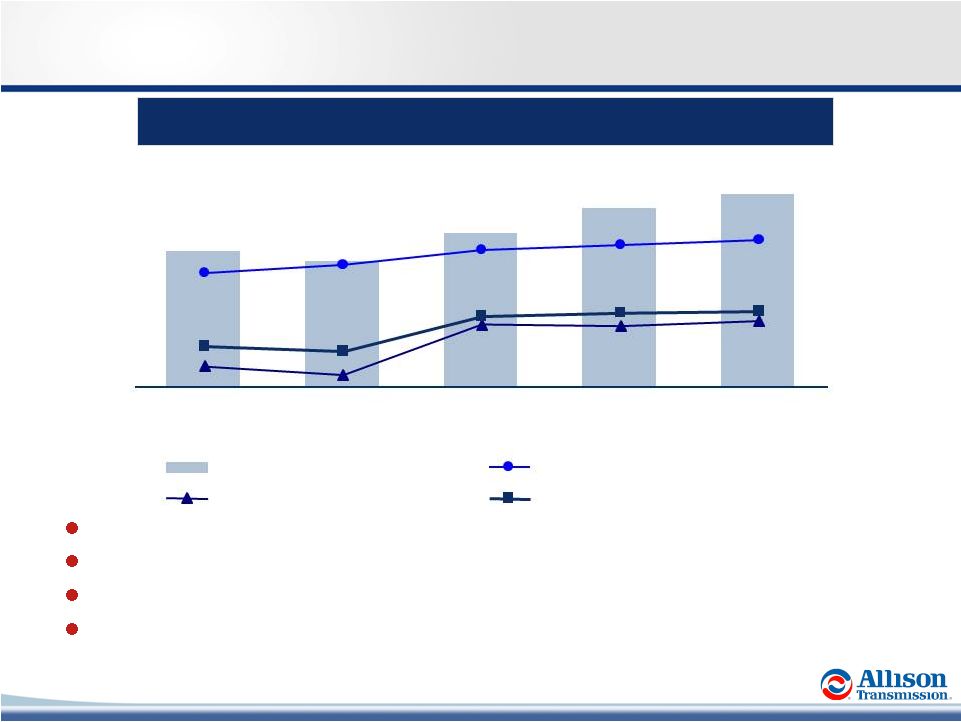

Sustainable Margins with Further Enhancement Opportunities

13

International Manufacturing

India (~$107mm total investment; ~$7mm remaining

(1)

)

–

New facility constructed to better serve Asia-Pacific

–

Phase I: In-source component manufacturing (Q3 2010)

–

Phase II: Assembly of 1000/2000 Series (Q3 2012)

Hungary (~$17mm total investment

(1)

)

–

Relocate assembly of 3000/4000 Series (Q2 2011)

~90% of 2011 N.A. On-Highway Unit Volume was covered by long-

term customer supply agreements

Workforce Optimization (cost/employee)

Hours Per Unit continue to decline

Source: Allison.

(1) As of 3/31/2012.

~30% of total

UAW workforce

Manufacturing Efficiencies (hours/unit)

Long-Term Customer Supply Agreements

~90%

Significant savings driven by retirement of Tier I workers; 800 hourly

employees are retirement eligible (~53% of workforce)

Tier I

Tier II

1000/2000 Series

3000 Series

4000 Series

2005

2011 |

14

Significant Cash Flow Generation

$4,204

$3,753

$3,721

$3,419

$3,065

$2,981

6.9x

7.4x

5.5x

4.3x

3.9x

At

Acquisition

2008

2009

2010

2011

LTM

Free Cash Flow Generation

(1)

Net Debt

(2)

$378

$81

$61

$16

$315

$142

$193

$372

$394

9.4%

17.2%

17.5%

16.4%

8.0%

2008

2009

2010

2011

LTM

Free Cash Flow

Certain Non-Recurring Activity

% of Sales

($ in millions)

($ in millions)

(3,4)

Net

debt

reduction

of

more

than

$1.2

bn

since

acquisition

(6)

(5)

(5)

Note: See appendix for comments regarding the presentation of non-GAAP measures.

(1)

Free cash flow defined as cash flow from operations less capex. (2)

Net debt defined as total debt minus cash and cash equivalents. (3)

2009 free cash flow adjusted for certain non-recurring activity of (a) capitalized accrued

interest on Senior Toggle Notes ($29) million, (b) cash restructuring charge $51

million, (c) accounts payable early payments $3 million, (d) delayed accounts receivable receipts $19 million and (e) Lehman LIBOR swap settlement $17 million.

(4)

LTM free cash flow adjusted for certain non-recurring activity: 1Q 2012 Fee to

terminate services agreement with sponsors $16

(5)

LTM 3/31/2012

(6)

Represents debt reduction through 3/31/2012. |

Q&A

15 |

Appendix: Non-GAAP Financial Information

16 |

Non-GAAP Financial Information

17

We use Adjusted net income, Adjusted EBITDA, Adjusted EBITDA margin, adjusted free cash flow and free

cash flow to evaluate our performance relative to that of our peers. In addition, the Senior

Secured Credit Facility has certain covenants that incorporate Adjusted EBITDA. However,

Adjusted net income, Adjusted EBITDA, Adjusted EBITDA margin, adjusted free cash flow and free

cash flow are not measurements of financial performance under GAAP, and these metrics may not be

comparable to similarly titled measures of other companies. Adjusted net income is calculated as the

sum of net income (loss), interest expense, net, income tax expense, trade name impairment and

amortization of intangible assets, less cash interest expense, net and cash income taxes.

Adjusted EBITDA is calculated as the sum of Adjusted net income, cash interest expense, net,

cash income taxes, depreciation of property, plant and equipment and other adjustments as

defined by the Senior Secured Credit Facility and as further described below. Adjusted EBITDA

margin is calculated as Adjusted EBITDA divided by net sales. Free cash flow is calculated as net cash

provided by operating activities less capital expenditures. Adjusted free cash flow is free cash

flow adjusted for non-recurring items.

We use Adjusted net income to measure our overall profitability because it better reflects our cash

flow generation by capturing the actual cash taxes paid rather than our tax expense as

calculated under GAAP and excludes the impact of the non-cash annual amortization of certain

intangible assets that were created at the time of the Acquisition Transaction. We use Adjusted

EBITDA and Adjusted EBITDA margin to evaluate and control our cash operating costs and to measure

our operating profitability. We use adjusted free cash flow and free cash flow to evaluate the amount

of cash generated by the business that, after the capital investment needed to maintain and grow

our business, can be used for strategic opportunities, including investing in our business and

strengthening our balance sheet. We believe the presentation of Adjusted net income, Adjusted

EBITDA, Adjusted EBITDA margin, adjusted free cash and free cash flow enhances our investors'

overall understanding of the financial performance and cash flow of our business.

You should not consider Adjusted net income, Adjusted EBITDA, Adjusted EBITDA margin, adjusted free

cash flow and free cash flow as an alternative to net income (loss), determined in accordance

with GAAP, as an indicator of operating performance, or as an alternative to net cash provided

by operating activities, determined in accordance with GAAP, as an indicator of Allison’s

cash flow. |

Non-GAAP Reconciliations

(1 of 2)

18

Adjusted Net Income and Adjusted EBITDA Reconciliation

(1) Includes charges or income related to legacy employee

benefits, shared income with General Motors, benefit plan adjustments, transitional costs to establish

Allison as a stand-alone entity, pension curtailment adjustments, employee

stock compensation expense, service fees paid to Allison’s Sponsors and an

adjustment for the settlement of litigation which originated with the Predecessor

but was assumed by the Company as part of the Acquisition Transaction.

$ in millions

Last twelve

months ended

March 31,

2008

2009

2010

2011

2011

2012

2012

Net (Loss) Income

($328.1)

($323.9)

$29.6

$103.0

$36.9

$58.0

$124.1

plus:

Interest expense,

net

385.9

234.2

277.5

217.3

49.6

40.7

208.4

Cash interest expense,

net

(334.2)

(242.5)

(239.1)

(208.6)

(29.9)

(36.1)

(214.8)

Income tax

expense

37.1

41.4

53.7

47.6

18.0

25.2

54.8

Cash income

taxes

(4.3)

(5.5)

(2.2)

(5.8)

(1.6)

(2.9)

(7.1)

Fee to terminate services agreement with Sponsors

—

—

—

—

—

16.0

16.0

Initial public offering expenses

—

—

—

—

—

5.7

5.7

Trade name

impairment

179.8

190.0

—

—

—

—

—

Amortization of intangible

assets

156.5

155.9

154.2

151.9

38.0

37.5

151.4

Adjusted Net

Income

$92.7

$49.6

$273.7

$305.4

$111.0

$144.1

$338.5

Cash interest expense,

net

334.2

242.5

239.1

208.6

29.9

36.1

214.8

Cash income

taxes

4.3

5.5

2.2

5.8

1.6

2.9

7.1

Depreciation of property, plant and equipment

106.6

105.9

99.6

103.8

25.7

24.6

102.7

Loss on repurchases of long-term debt

—

—

—

—

—

13.5

13.5

Premiums and expenses on tender offer of long-term debt

—

—

—

56.9

—

—

56.9

Dual power inverter module extended coverage

2.2

11.4

(1.9)

—

—

—

—

(Gain) / loss on repurchases of long-term debt

(21.0)

(8.9)

(3.3)

16.0

—

—

16.0

Unrealized (gain) loss on hedge contracts

—

(5.8)

0.1

6.8

(1.6)

(0.7)

7.7

Reduction of supply contract liability

—

—

(3.4)

—

—

—

—

Restructuring charges

15.7

47.9

—

—

—

—

—

Other, net

(1)

9.3

53.2

10.9

8.6

2.7

2.5

8.4

Adjusted

EBITDA

$544.0

$501.3

$617.0

$711.9

$169.3

$223.0

$765.6

Net

Sales

$2,061.4

$1,766.7

$1,926.3

$2,162.8

$517.0

$601.9

$2,247.7

Adjusted EBITDA

Margin

26.4%

28.4%

32.0%

32.9%

32.7%

37.0%

34.1%

For the year ended December 31,

Three months ended

March 31, |

Non-GAAP Reconciliations

(2 of 2)

19

Adjusted Free Cash Flow

$ in millions

Last twelve

months ended

March 31,

2008

2009

2010

2011

2011

2012

2012

Net Cash Provided by Operating Activities

$268.1

$168.7

$388.9

$469.2

$109.9

$139.6

$498.9

(Deductions) or Additions:

Long-lived assets

(75.3)

(88.2)

(73.8)

(96.9)

(11.6)

(35.7)

(121.0)

Fee to terminate services agreement with Sponsors

—

—

—

—

—

16.0

16.0

Non-Recurring Activity

(1)

—

61.0

—

—

—

—

—

Adjusted Free Cash Flow

$192.8

$141.5

$315.1

$372.3

$98.3

$119.9

$393.9

Net

Sales

$2,061.4

$1,766.7

$1,926.3

$2,162.8

$517.0

$601.9

$2,247.7

Adjusted Free Cash Flow (% to Net Sales)

9.4%

8.0%

16.4%

17.2%

19.0%

19.9%

17.5%

For the year ended December 31,

Three months

ended

March 31,

(1)

2009 adjusted for certain non-recurring activity: (a) capitalized accrued interest on Senior

Toggle Notes ($29) million, (b) cash restructuring charge $51 million, (c) accounts payable

early payments $3 million, (d) delayed accounts receivable receipts $19 million and (e) Lehman LIBOR swap

settlement $17 million.

|