Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER - Annie's, Inc. | d362973dex311.htm |

| EX-32.1 - CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER AND PRINCIPAL FINANCIAL - Annie's, Inc. | d362973dex321.htm |

| EX-31.2 - CERTIFICATION OF PRINCIPAL FINANCIAL OFFICER - Annie's, Inc. | d362973dex312.htm |

| EX-23.1 - CONSENT OF PRICEWATERHOUSECOOPERS LLP - Annie's, Inc. | d362973dex231.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended March 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From To

Commission File Number: 001-35470

Annie’s, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 20-1266625 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1610 Fifth Street Berkeley, CA |

94710 | |

| (Address of principal executive offices) | ( Zip Code) |

(510) 558-7500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.001 par value per share | The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

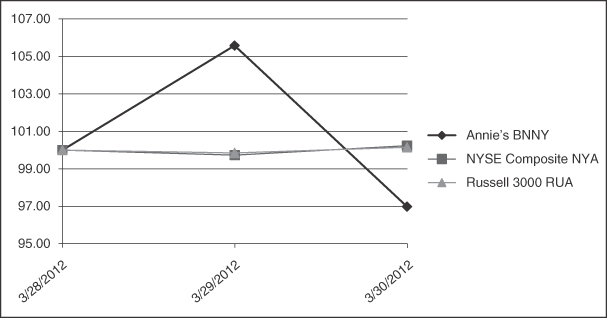

As of September 30, 2011, the last business day of the registrant’s most recently completed second fiscal quarter, there was no public market for the registrant’s common stock. The registrant’s common stock began trading on the New York Stock Exchange on March 28, 2012. As of May 31, 2012, the aggregate market value of the common stock held by non-affiliates of the registrant was $262.0 million based on the number of shares held by non-affiliates as of May 31, 2012 and the closing price of the registrant’s common stock on the New York Stock Exchange on May 31, 2012.

On May 31, 2012 the registrant had 17,060,111 shares of common stock, par value $0.001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement to be filed with the Commission pursuant to Regulation 14A in connection with the registrant’s 2012 Annual Meeting of Stockholders, to be filed subsequent to the date hereof, are incorporated by reference into Part III of this Report. Such Definitive Proxy Statement will be filed with the Securities and Exchange Commission not later than 120 days after the conclusion of the registrant’s fiscal year ended March 31, 2012. Except with respect to information specifically incorporated by reference in this Form 10-K, the Proxy Statement is not deemed to be filed as part of this Form 10-K.

Table of Contents

Annie’s, Inc.

Annual Report on Form 10-K

2

Table of Contents

Forward Looking Statements

This Annual Report on Form 10-K includes forward-looking statements in addition to historical information. These forward-looking statements are included throughout this Form 10-K, including in the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” and relate to matters such as our industry, business strategy, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information. We have used the words “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “future,” “will,” “seek,” “foreseeable” and similar terms and phrases to identify forward-looking statements in this Form 10-K.

The forward-looking statements contained in this Form 10-K are based on management’s current expectations and are subject to uncertainty and changes in circumstances. We cannot assure you that future developments affecting us will be those that we have anticipated. Actual results may differ materially from these expectations due to changes in global, regional or local economic, business, competitive, market, regulatory and other factors, many of which are beyond our control. We believe that these factors include those described in “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, our actual results may vary in material respects from those projected in these forward-looking statements. Any forward-looking statement made by us in this Form 10-K speaks only as of the date of this Form 10-K. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable securities laws.

PART I

Overview

Annie’s, Inc. is a rapidly growing natural and organic food company with a widely recognized brand, offering consumers great-tasting products in large packaged food categories. We sell premium products made from high-quality ingredients at affordable prices. Our products appeal to health-conscious consumers who seek to avoid artificial flavors, synthetic colors and preservatives that are used in many conventional packaged foods. We have the #1 natural and organic market position in four product lines: macaroni and cheese, snack crackers, fruit snacks and graham crackers.

Our loyal and growing consumer following has enabled us to migrate from our natural and organic roots to a brand sold across the mainstream grocery, mass merchandiser and natural retailer channels. Over the past three years, we have significantly increased both the number of retail locations where our products can be found and the number of our products found in individual stores. Today, we offer over 125 products and are present in over 25,000 retail locations in the United States and Canada. We expect that increasing penetration of the mainstream grocery and mass merchandiser channels, combined with greater brand awareness, new product introductions, line extensions and favorable consumer trends, will continue to fuel sales growth in all channels.

Innovation, including new product development, is a key component of our growth strategy. We invest significant resources to understand our consumers and develop products that address their desire for natural and organic alternatives to conventional packaged foods. We have a demonstrated track record of extending our product offerings into large food categories, such as fruit snacks and snack mix, and introducing products in existing categories with new sizes, flavors and ingredients. In order to quickly and economically introduce our new products to market, we partner with contract manufacturers that make our products according to our formulas and specifications.

3

Table of Contents

We are mission-driven and committed to operating in a socially responsible and environmentally sustainable manner, with an open and honest corporate culture. Our corporate culture embodies these values and, as a result, we enjoy a highly motivated and skilled work force that is committed to our business and our mission. Our colorful, informative and whimsical packaging featuring our iconic mascot, Bernie, the “Rabbit of Approval,” conveys these values. We believe our consumers connect with us because they love our products and relate to our values, resulting in loyal and trusting relationships.

We have experienced strong sales and profit growth over the past few years. Our net sales have increased from $76.8 million in fiscal 2008 to $141.3 million in fiscal 2012, representing a 16.5% compound annual growth rate. Over the same period, our income from operations has increased from of $1.4 million in fiscal 2008 to $17.9 million in fiscal 2012.

Our Company History

Annie Withey co-founded Annie’s Homegrown, Inc. with Andrew Martin in 1989 with the goal of giving families healthy and delicious macaroni and cheese and to show by example that a successful business can also be socially responsible. Initially, the company sold natural macaroni and cheese dinners to regional supermarkets and independent natural retailers in New England. Over the next 10 years, Annie’s Homegrown grew by expanding its line of natural macaroni and cheese across a broader national footprint in the mainstream grocery and natural retailer channels.

In December 1999, Homegrown Natural Foods, Inc., which was founded by our CEO, John M. Foraker, made an investment in Annie’s Homegrown and Mr. Foraker joined the board of directors. This investment enabled us to expand distribution in the mainstream grocery channel. At the time of this investment, our annual revenues were approximately $7 million. In December 1999, Mr. Martin left Annie’s Homegrown. Annie Withey continued in her role as our Inspirational President.

From 2002 to 2005, Solera Capital, LLC, or Solera, a private equity firm based in New York, made several significant equity investments in the company, acquiring control and providing capital for internal growth and acquisitions. Under Solera’s ownership, Annie’s Homegrown embarked on a strategy to expand into new food categories, introducing Cheddar Bunnies snack crackers in 2003. In 2004, Solera formed a company later named Annie’s, Inc. to acquire all of the stock of Annie’s Homegrown held by Homegrown Naturals Foods, as well as Fantastic Foods, Inc. and Napa Valley Kitchens, Inc., two of Homegrown Natural Foods’ subsidiaries. We acquired the Annie’s Naturals brand of salad dressings in 2005.

In connection with our initial public offering, or IPO, that closed on April 2, 2012, our common stock began trading under the stock symbol “BNNY” on the New York Stock Exchange, or NYSE, on March 28, 2012. Prior to such date, there was no public market for our common stock. The closing price for our common stock at the end of the first day of trading was $35.92.

More than 20 years after the company’s founding, our original values still guide our business. Annie Withey remains involved in the business, writing the personal letters printed on the back of our boxes and responding to letters from our consumers. The company remains a mission-driven business grounded in using natural and organic ingredients to make great-tasting products that consumers love.

Our Company Mission

Our mission is to cultivate a healthier, happier world by spreading goodness through nourishing foods, honest words and conduct that is considerate and forever kind to the planet. We have focused on building a successful and growing business in pursuit of our mission. Our corporate motto is Eat Responsibly—Act Responsibly. We offer great-tasting, high-quality natural and organic foods, while striving to act in a socially responsible and environmentally sustainable manner. We are committed to growing our business and profitability, while staying true to our mission and core values.

4

Table of Contents

Our Culture

Our corporate culture is anchored by the following core values:

| • | Annie’s is real, authentic and trusted by consumers. As a company, we strive to build upon this legacy with every decision we make. |

| • | Annie’s makes products that taste great and delight our consumers. |

| • | Annie’s uses simple, natural and organic ingredients. |

| • | Annie’s sources from places and people we trust, with an emphasis on quality and environmental sustainability. |

| • | Annie’s is socially responsible, and we spread awareness and act as a positive role model for consumers and other businesses. |

| • | Annie’s and its valued employees treat consumers, customers, suppliers, stockholders and each other with the same high degree of respect, fairness and honesty that we expect of others. |

These core values are integrally woven into our culture and serve as important guiding principles for our strategies and business decisions. Over many years, our commitment to these core values has helped us build a brand consumers trust. We believe this trust is our most important asset. We believe the more consumers trust us, the more willing they are to support our brand by purchasing our current products, trying our new products and recommending them to their friends and family. We believe that our culture has been, and we expect it will remain, a source of competitive advantage.

Our Commitment to Community

We believe we have a responsibility to the planet and its people. We have a commitment to minimizing our environmental impact, which we refer to as reducing our bunny footprint. To that end, we engage in a number of programs and partnerships supporting our communities by encouraging sustainability and providing financial and in-kind support to organizations committed to healthy foods and environmental sustainability. We believe that our consumers and organic and natural suppliers value the efforts we make in the areas of social responsibility and environmental sustainability, including:

| • | Grants for Gardens, a program that offers small grants to community gardens, school gardens and other educational programs that educate children about the origins and benefits of healthy food. |

| • | Cases for Causes, one of our oldest grassroots programs, which provides schools and non-profit organizations with free cases of our products. |

| • | Sustainable Agriculture Scholarships, which provide financial assistance to students committed to studying sustainable and organic agriculture. |

We also provide financial support to organizations that promote organic farming and advocacy.

Business Segments

We have determined that we operate as one segment: the marketing and distribution of natural and organic food products. Our chief executive officer is considered to be our chief operating decision maker. He reviews our operating results on an aggregate basis for purposes of allocating resources and evaluating financial performance. In each of fiscal 2012, 2011 and 2010, net sales from outside of the U.S. was 3% of our total net sales, respectively. All of our long-lived assets are located in the U.S.

Industry Overview

According to a leading industry source, the U.S. is the world’s largest organic food market, with sales of natural and organic foods exceeding $40 billion in 2010. From 2000 to 2010, the U.S. natural and organic food

5

Table of Contents

market grew at a compound annual growth rate of approximately 12% and is projected by the same industry source to grow at a compound annual growth rate of approximately 8% from 2010 to 2013. We believe growth rates for the U.S. natural and organic food market have been, and will continue to be, higher than those for the overall U.S. food market.

We believe growth in the natural and organic food market is driven by various factors, including heightened awareness of the role that food and nutrition play in long-term health and wellness. Many consumers prefer natural and organic products due to increasing concerns over the purity and safety of food as a result of the presence of pesticide residues, growth hormones and artificial and genetically engineered ingredients in the foods we eat. The development and implementation of USDA standards for organic certification have increased consumer awareness of, and confidence in, products labeled as organic. According to a well-regarded consumer research firm, 75% of adults in the U.S. purchased natural or organic foods in 2010, with 33% of consumers using organic products at least once a month as compared to 22% ten years before.

Products that are independently certified as organic in accordance with the 2002 USDA Organic Foods Act are made with ingredients free of synthetic pesticides, fertilizers, chemicals and, in the case of dairy products, synthetic growth hormones. The USDA requires that certified organic products need to be composed of at least 95% organic ingredients, while “made with organic” products need to be composed of at least 70% organic ingredients. Although not certified, natural products are generally considered in the industry to be minimally processed and largely or completely free of artificial ingredients, preservatives and other non-naturally occurring chemicals.

We believe growth in the natural and organic food market was historically anchored by a core of informed, health-conscious consumers, who remained committed to buying high-quality products for themselves and their families, even through the recent economic downturn. While the average consumer basket in dedicated organic and natural stores carries a price premium compared to the same basket in mainstream stores, according to a leading national business journal study, that premium is shrinking. As economic conditions improve, and natural and organic products become more readily available in the mainstream grocery and mass merchandiser channels, there is an opportunity for increased demand through expansion of the consumer base.

Historically, natural and organic foods were primarily available at independent organic retailers or natural and organic retail chains. Mainstream grocery stores and mass merchandisers have expanded their natural and organic product offerings because of increasing consumer demand for natural and organic products, which command a higher margin for the retailer. The percentage of natural and organic food sales has been rising, and, according to an industry source, in 2010, 73% of consumers purchased organic products at grocery stores as compared to 25% at natural food stores. We believe the emergence of strong natural and organic brands, driven by a loyal and growing consumer base, will act as an additional catalyst for higher penetration in the mainstream grocery and mass merchandiser channels.

Our Competitive Strengths

We believe that the following strengths differentiate our company and create the foundation for continued sales and profit growth:

Leading natural and organic brand. We are a market leading premium natural and organic brand with proven success in large categories across multiple channels. We have the #1 natural and organic market position in four product lines: macaroni and cheese, snack crackers, fruit snacks and graham crackers. Our brand is reinforced by distinctive packaging that communicates the fun and whimsical nature of the brand with bright colors and our iconic mascot, Bernie, the “Rabbit of Approval.” Our commitment to high-quality and great-tasting products has led to proven success in the mainstream grocery, mass merchandiser and natural retailer channels, making us a successful crossover brand.

Strong consumer loyalty. Many of our consumers are loyal and enthusiastic brand advocates. Our consumers trust us to deliver great-tasting products made with natural and organic ingredients. We believe that consumer enthusiasm for our brand inspires repeat purchases, attracts new consumers and generates

6

Table of Contents

interest in our new products. We receive hundreds of hand-written letters and messages through social media each month from parents and children, with many telling us they love Annie’s and often asking us to expand our product offerings.

Track record of innovation. Since the introduction of our original macaroni and cheese products in 1989, we have successfully extended our brand into a number of large product lines, such as snack crackers, graham crackers, fruit snacks and granola bars, and introduced extensions of our existing product lines. Our most recent new product is frozen organic rising crust pizza, which we introduced in January 2012. We have made a sustained investment in innovation and regularly validate product concepts with our consumers and customers. We maintain an active new product pipeline, and our relationships with our ingredient suppliers and manufacturing partners enable us to efficiently introduce new products. In fiscal 2012, we estimate that 19% of our net sales were generated by products introduced since the beginning of fiscal 2010.

Strategic and valuable brand for retailers. Our brand is valuable to retailers in the mainstream grocery, mass merchandiser and natural retailer channels. We understand retailers carry our products for several reasons, including, we believe, because our products satisfy consumer demand for premium natural and organic products and many of our consumers spend more on food and buy higher margin items than average consumers. Further, we believe our products offer better profitability for retailers compared to conventional packaged foods.

Core competency in organic sourcing. We have long-standing strategic relationships with key suppliers of organic ingredients. We have significant knowledge and experience sourcing these ingredients and, for some key ingredients, our supply chain relationships extend to farmers and farmer cooperatives. We consider our sourcing relationships and our knowledge of the complex organic supply chain to be a competitive advantage and barrier to entry.

Our Business Strategy

Pursue top line growth. We are pursuing three growth strategies as we continue to build our business:

Expand distribution and improve placement. We intend to increase sales by expanding the number of stores that sell our products in the mainstream grocery and mass merchandiser channels and by securing placements adjacent to conventional products in the mainstream aisle. We believe increased distribution and enhanced shelf placement will lead more consumers to purchase our products and will expand our market share.

Expand household penetration and consumer base. We intend to increase the number of consumers who buy our products by using grassroots marketing, social media tools and advertising. We believe these efforts will educate consumers about our brand and the benefits of natural and organic food, create demand for our products and, ultimately, expand our consumer base. We intend to broaden our product offerings to appeal to all members of the family at meal and snack times.

Continue innovation and brand extensions. Our market studies, analyses and consumer testing enable us to identify attractive product opportunities. We intend to continue to introduce products in both existing and new product lines that appeal to the whole family.

Remain authentic: stay true to our values. We believe authentic brands are brands that win. We are a mission-driven business with long-standing core values. We strive to operate in an honest, socially responsible and environmentally sustainable manner because it is the right thing to do and it is good for business. We believe our authenticity better enables us to build loyalty and trust with current consumers and helps us attract new ones.

Invest in infrastructure and capabilities. We invest in our people, supply chain and systems to ensure that our business is scalable and profitable. During the upcoming fiscal year we expect to add new employees to our sales, marketing, operations and finance teams as necessary to support our growth. We actively seek opportunities to invest in the specific capabilities of our supply chain partners to reduce costs, increase manufacturing efficiencies and improve quality. Additionally, we continue to invest in our systems and technology, including an enterprise resource planning system, to support growth and increase efficiency.

7

Table of Contents

Our Products

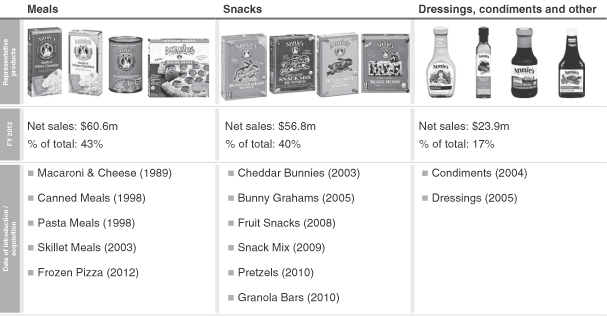

We sell our products in three primary product categories: meals; snacks; and dressings, condiments and other. Meals are an important family occasion, and we make it easier for families to share wholesome meal solutions, despite time-pressed schedules, without sacrificing quality. Consumers are eating more snacks, and we offer natural and organic alternatives that parents prefer while satisfying the most discriminating snacker in the family. Dressings and condiments are important complements to meals, and we offer natural and organic alternatives to conventional offerings. We are primarily focused on growing and expanding our meals and snacks categories because we believe they provide the greatest opportunities for sales growth.

Our product lines include natural products, products “made with organic” ingredients and certified organic products. We source only ingredients stated to be free of genetically modified organisms and strive to use ingredients that are as near to their whole, natural state as possible. In fiscal 2012, we estimate that over 80% of our net sales were generated by certified organic or products made with organic ingredients.

Within our various product lines, we offer many products suitable for consumers seeking to avoid certain ingredients and attempting to adhere to specialized dietary plans, including gluten-free and vegan products. We continue to develop new products using ingredients that address our consumers’ health and dietary preferences.

We offer over 125 products across our product lines in various sizes and flavors. In fiscal 2012, the break-down of our three product categories was as follows:

Product Innovation

Innovation is a core competency of ours and an important component of our growth strategy. Our innovation strategy is based on market studies, analyses and consumer testing. We identify large, conventional food categories and assess the demand for natural and organic products in each category. Further, we work closely with certain of our customers to identify attractive opportunities based on their insight and market perspectives. Based on our consumer tests and insights, we develop competing natural or organic products. Once developed, we design the appropriate package with Annie’s colors and messaging. Typically, we launch new products in the natural retailer channel and then expand distribution into the mainstream grocery and mass merchandiser channels. We also regularly review our current product offerings and determine if product extensions or reformulations are desirable.

8

Table of Contents

In fiscal 2012, we estimate that 19% of our net sales were generated by products introduced since the beginning of fiscal 2010. In fiscal 2012, 2011 and 2010, we spent $2.0 million, $2.1 million and $1.3 million, respectively, in research and development expenses, which consisted primarily of market studies, consumer research and analyses, product development and employee-related expenses.

In January 2012, we shipped our first frozen product, certified organic rising crust pizza, which is being distributed on a national basis through a major industry-leading national retailer. In March 2012, we announced a pizza product line extension, rising crust frozen pizza “made with organic” ingredients, which we intend to introduce during the first two quarters of fiscal 2013. We expect to develop additional frozen products over the coming years.

Marketing and Advertising

We have built the Annie’s brand using traditional grassroots marketing efforts such as sampling, public relations and participation in community events and festivals. In the early years, Annie Withey’s own home phone number and address were on our box so consumers could reach her directly. We continue to value direct and honest communication with our consumers.

Our current marketing efforts are focused on outreach to a broader audience while holding true to our mission and core values. We believe we have a significant opportunity to grow our business by increasing communications about our brand, product quality, taste and convenience to a wider audience of families seeking healthier alternatives. To accomplish this objective, we will continue to employ social media and other marketing tools that complement long-standing public relations efforts and allow for a personal dialogue with consumers. We work hard to ensure that consumers recognize our message as authentic. We believe that our community programs and partnerships reinforce our brand’s authenticity and fuel loyal and trusting relationships with consumers.

Customers and Distribution

We market our products throughout the United States and Canada. The vast majority of our sales are in the United States. During fiscal 2012, approximately 3% of our net sales were from Canada. We sell our products through three primary channels: mainstream grocery, mass merchandiser and natural retailer. Because of our brand equity and high-quality products, we believe there are attractive growth prospects for us in each of these channels.

| • | Mainstream Grocery: Our customers in this channel include large national chains such as Kroger, Ahold and Safeway and regional chains such as Wegmans, Harris Teeter, H-E-B and Raley’s. During fiscal 2012, we estimate that the mainstream grocery channel represented approximately 36% of our net sales. |

| • | Mass Merchandiser/Other Channels: Our customers in this channel include large national and regional retailers such as Target Stores, Costco Wholesale and Wal-Mart. We also sell a limited number of products through food service, military and e-commerce channels. During fiscal 2012, we estimate that the mass merchandiser channel, including the other channels mentioned above, represented approximately 37% of our net sales. |

| • | Natural Retailer: Our customers in this channel include large retailers such as Whole Foods Market and Trader Joe’s (where our products are sold under its own store brand), regional natural chains such as Sprouts Farmers Market and Earth Fare and independent natural foods cooperatives. During fiscal 2012, we estimate that the natural retailer channel represented approximately 27% of our net sales. |

9

Table of Contents

We sell our products directly to retailers and through distributors. We use brokers to support our sales efforts.

| • | Direct Sales. The majority of our products are sold direct to retailers. We sell direct predominantly in the mass merchandiser channel, but we also maintain select direct relationships in the mainstream grocery channel. In fiscal 2012, 26% of our net sales were generated from sales to our top two customers, Target (15%) and Costco (11%). In some cases, we sell products to the same grocery chain using both direct relationships and distributors. |

| • | Distributors. Many of our products are sold through independent food distributors, including the majority sold to the natural retailer channel. Food distributors purchase products from us for resale to retailers, taking title to the products upon purchase. The prices consumers pay for these products are set by our distributors, in their sole discretion, although we may influence the retail price with the use of promotional incentives. In fiscal 2012, 25% of our net sales were generated from sales to our largest distributor, United Natural Foods Inc., or UNFI. We estimate that approximately 24% of our fiscal 2012 sales to UNFI were supplied to the mainstream grocery channel, which percentage we expect to increase based on UNFI’s pursuit of additional grocery business, such as its recently announced supply agreement with Safeway. |

Working Capital Practices

We generate cash from operations with which we finance the day-to-day operations of our business. We control credit risk through credit approvals, credit limits and monitoring procedures, and perform periodic credit evaluation of our customers. Our vendors offer us accelerated payment discounts, usually 1% for net-10 payment and we typically take advantage of accelerated payment discounts offered to us by our vendors.

If cash from operations is not sufficient to fund our day-to-day operations or other expenditures, we have a credit facility of $20.0 million which is available to us for future borrowings through August 2014. Upon the consummation of our IPO, we paid down the outstanding balance of $12.8 million on our credit facility. As of May 31, 2012, the full $20.0 million of the credit facility was available to us and if needed, we may borrow amounts from our credit facility to finance our operations and working capital requirements.

Backlog

Our backlog of unshipped orders was $3.7 million and $4.1 million at March 31, 2012 and 2011, respectively.

Our Supply Chain

Manufacturing

Independent manufacturers, referred to in our industry as contract manufacturers or co-packers, manufacture all of our products. Utilizing contract manufacturers provides us with the flexibility to produce a large variety of products and the ability to enter new categories quickly and economically. Our contract manufacturers have been selected based on their specific product line expertise, and we expect them to partner with us to improve and expand our product offerings. We regularly meet with our contract manufacturers to review costs and their performance and to set performance, quality and cost-saving targets. In many cases we enter into long-term contracts with our contract manufacturers. During fiscal 2012, we estimate that the products manufactured by our three largest contract manufacturers amounted to approximately 72% of net sales.

We have invested significant resources to improve operating margins by reducing costs and increasing productivity. Our efficiency initiatives have focused on selecting better and more efficient manufacturers, renegotiating tolling fees with existing manufacturers, managing in-bound freight, leveraging warehouse expenses and reducing ingredient and packaging costs through increased volume buys, contract consolidation and price negotiation.

10

Table of Contents

As part of our efficiency initiatives, we have begun to look for opportunities to invest capital in equipment to drive down costs, improve throughput and improve product quality at our contract manufacturers. In fiscal 2012, we invested approximately $1.2 million in manufacturing equipment, which is located at the facilities of our contract manufacturers and remains our property. We expect to continue these investments in the future, as we believe this approach improves efficiency and creates shared cost reductions with our manufacturing partners.

Ingredient and Packaging Suppliers

Our natural and organic ingredients, raw materials and packaging materials are sourced primarily from suppliers in the United States and Canada. We have rigorous standards for food quality and safety. Our raw materials and packaging are mostly purchased through contract manufacturers from suppliers we have approved and based upon our specifications. In order to mitigate commodity cost fluctuations, we enter either directly or through our contract manufacturers into forward-pricing contracts with certain ingredient suppliers. In fiscal 2012, our contracted ingredients represented approximately 48% of our materials costs and approximately 25% of our cost of sales.

Quality Control

We take precautions designed to ensure the quality and safety of our products. In addition to routine third-party inspections of our contract manufacturers, we have instituted regular audits to address topics such as allergen control, ingredient, packaging and product specifications and sanitation. Under the FDA Food Modernization Act, each of our contract manufacturers is required to have a hazard analysis critical control points plan that identifies critical pathways for contaminants and mandates control measures that must be used to prevent, eliminate or reduce relevant food-borne hazards.

All of our contract manufacturers are required to be certified in the Safe Quality Food Program or the BRC Global Standard for Food Safety. We expect most of our contract manufacturers to complete their certification in calendar year 2012. These standards are integrated food safety and quality management protocols designed specifically for the food sector and offer a comprehensive methodology to manage food safety and quality simultaneously. Certification provides an independent and external validation that a product, process or service complies with applicable regulations and standards.

We work with suppliers who assure the quality and safety of their ingredients. These assurances are supported by our purchasing contracts or quality assurance specification packets, including affidavits, certificates of analysis and analytical testing, where required. The quality assurance staff of both our contract manufacturers and our own internal operations department conducts periodic on-site routine audits of critical ingredient suppliers. Additionally, our contract manufacturers and our quality assurance and procurement teams periodically visit critical suppliers to certify their facilities and assure quality.

Order Fulfillment

A majority of our customer fulfillment requirements are met by an outside contract warehouse, which is operated by a third party and based in the Chicago, Illinois area. Products are manufactured by our contract manufacturers and typically are shipped to this distribution center. We store and ready products for shipment for the majority of our North American retailers and distributors from this facility. In April 2012, in order to support our growing operations, reduce costs and facilitate order fulfillment, we relocated our existing distribution operations to a nearby larger facility owned and operated by the same third party. Concurrent with this move, our new agreement, which was entered into in September 2011, became effective in April 2012 and will remain in effect through June 2015. The new agreement will automatically renew for an additional period of two years and two months, unless either party provides proper notice of non-renewal. Under the new agreement, our products are stored and shipped on a cost-plus basis by the third party. In addition to third party distribution, a smaller portion of our products are shipped directly from our contract manufacturers to retailers or distributors.

11

Table of Contents

Seasonality

Historically, we have experienced greater net sales in the second and fourth fiscal quarters than in the first and third fiscal quarters due to our customers’ merchandising and promotional activities around the back-to-school and spring seasons. Concurrently, inventory levels and working capital requirements increase during the first and third fiscal quarters of each fiscal year to support higher levels of net sales in the subsequent quarters. We anticipate that this seasonal impact on our net sales and working capital is likely to continue. In fiscal 2012, 27.5% and 30.4% of our net sales, 25.5% and 30.9% of our gross profit and 33.9% and 27.1% of our operating income were generated in the second and fourth fiscal quarters, respectively. Accordingly, our results of operations for any particular quarter are not indicative of the results we expect for the full year.

Competition

We operate in a highly competitive environment. Our products compete with both very large mainstream conventional packaged foods companies and natural and organic packaged foods companies. Many of these competitors enjoy significantly greater resources. Large mainstream conventional packaged foods competitors include Kraft Foods Inc., General Mills, Inc., Campbell Soup Company, PepsiCo, Inc., Nestle S.A. and Kellogg Company. Natural and organic packaged foods competitors include The Hain Celestial Group, Inc., Newman’s Own, Inc., Nature’s Path Foods, Inc., Clif Bar & Company and Amy’s Kitchen. In addition to these competitors, in each of our categories we compete with many regional and small, local niche brands. Given limited retailer shelf space and merchandising events, competitors actively support their respective brands with marketing, advertising and promotional spending. In addition, most retailers market similar items under their own private label, which compete for the same shelf space.

Competitive factors in the packaged foods industry include product quality and taste, brand awareness and loyalty, product variety, interesting or unique product names, product packaging and package design, shelf space, reputation, price, advertising, promotion and nutritional claims. We believe that we currently compete effectively with respect to each of these factors.

Employees

As of March 31, 2012, excluding interns, we had 85 full-time employees and eight part-time employees, including 32 in sales and marketing, 20 in finance, 14 in operations, seven in information technology, five in innovation and 15 in other departments. None of our employees is represented by a labor union. We have never experienced a labor-related work stoppage. Until February 1, 2012, we operated in a co-employer relationship with TriNet Group Inc., or TriNet, a professional employer organization. In December 2011, we terminated our agreement with TriNet, effective February 1, 2012, at which time all of the employees covered by the TriNet arrangement became our direct employees.

Trademarks and Other Intellectual Property

We believe that our intellectual property has substantial value and has contributed significantly to the success of our business. Our primary trademarks include Annie’s®, Annie’s Homegrown®, Annie’s Naturals® and Bernie Rabbit of Approval®, all of which are registered with the U.S. Patent and Trademark Office. Our trademarks are valuable assets that reinforce the distinctiveness of our brand and our consumers’ favorable perception of our products. We also have multiple trademark registrations or pending applications for products within each of our product categories. Certain of our marks are also registered in Canada. In addition to trademark protection, we own copyright registrations for the artwork depicted on our dressing labels and other product packaging. Our web content and the domain names www.annies.com and www.anniesnaturals.com are owned by us and copyright protected. We also rely on unpatented proprietary expertise, recipes and formulations, continuing innovation and other trade secrets to develop and maintain our competitive position.

12

Table of Contents

Government Regulation

Along with our contract manufacturers, brokers, distributors and ingredients and packaging suppliers, we are subject to extensive laws and regulations in the United States by federal, state and local government authorities. In the United States, the federal agencies governing the manufacture, distribution and advertising of our products include, among others, the FTC, the FDA, the USDA, the United States Environmental Protection Agency and the Occupational Safety and Health Administration. Under various statutes, these agencies, among other things, prescribe the requirements and establish the standards for quality and safety and regulate our marketing and advertising to consumers. Certain of these agencies, in certain circumstances, must not only approve our products, but also review the manufacturing processes and facilities used to produce these products before they can be marketed in the United States. We are also subject to the laws of Canada, including the Canadian Food Inspection Agency, as well as provincial and local regulations.

We are subject to labor and employment laws, laws governing advertising, privacy laws, safety regulations and other laws, including consumer protection regulations that regulate retailers or govern the promotion and sale of merchandise. Our operations, and those of our contract manufacturers, distributors and suppliers, are subject to various laws and regulations relating to environmental protection and worker health and safety matters. We monitor changes in these laws and believe that we are in material compliance with applicable laws.

Corporate and Available Information

Our principal corporate offices are located at 1610 Fifth Street, Berkeley, California 94710 and our telephone number is (510) 558-7500. We were incorporated in Delaware in April 2004.

Our internet address is www.annies.com. We make available on our website, free of charge, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities Exchange Commission, or the SEC. Our SEC reports can be accessed through the Investor Relations section of our internet website. The information found on our internet website is not part of this or any other report we file with or furnish to the SEC.

13

Table of Contents

You should carefully consider the risks described below together with the other information set forth in this Annual Report on Form 10-K, which could materially affect our business, financial condition or future results. The risks described below are not the only risks facing our company. Risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition and/or operating results.

Risks Related to Our Business and Industry

We may not be able to successfully implement our growth strategy on a timely basis or at all.

Our future success depends, in large part, on our ability to implement our growth strategy of expanding distribution and improving placement of our products, attracting new consumers to our brand and introducing new product lines and product extensions. Our ability to implement this growth strategy depends, among other things, on our ability to:

| • | enter into distribution and other strategic arrangements with third-party retailers and other potential distributors of our products; |

| • | continue to compete in conventional grocery and mass merchandiser retail channels in addition to the natural and organic channel; |

| • | secure shelf space in mainstream aisles; |

| • | increase our brand recognition; |

| • | expand and maintain brand loyalty; and |

| • | develop new product lines and extensions. |

We may not be able to implement our growth strategy successfully. Our sales and operating results will be adversely affected if we fail to implement our growth strategy or if we invest resources in a growth strategy that ultimately proves unsuccessful.

If we fail to develop and maintain our brand, our business could suffer.

We believe that developing and maintaining our brand is critical to our success. The importance of our brand recognition may become greater as competitors offer more products similar to ours. Our brand-building activities involve increasing awareness of our brand, creating and maintaining brand loyalty and increasing the availability of our products. If our brand-building activities are unsuccessful, we may never recover the expenses incurred in connection with these efforts, and we may be unable to implement our business strategy and increase our future sales.

Our brand and reputation may be diminished due to real or perceived quality or health issues with our products, which could have an adverse effect on our business and operating results.

We believe our consumers rely on us to provide them with high-quality natural and organic food products. Concerns regarding the ingredients used in our products or the safety or quality of our products or our supply chain may cause consumers to stop purchasing our products, even if the basis for the concern is unfounded, has been addressed or is outside of our control. Although we believe we have a rigorous quality control process, there can be no assurance that our products will always comply with the standards set for our products. For example, although we strive to keep our products free of genetically modified organisms, they may not be easily detected and contamination can occur through cross-pollination. Also, we use epoxy linings that contain bisphenol-A, commonly called BPA, as part of the protective barrier between the metal can and food contents in our canned

14

Table of Contents

pasta meals. Although the Food and Drug Administration, or FDA, currently allows the use of BPA in food packaging materials and has not approved a BPA-free can for use with our type of products, public reports and concerns regarding the potential hazards of BPA could contribute to a perceived safety risk for products packaged using BPA. Adverse publicity about the quality or safety of our products, whether or not ultimately based on fact, may discourage consumers from buying our products and have an adverse effect on our brand, reputation and operating results.

We have no control over our products once purchased by consumers. Accordingly, consumers may prepare our products in a manner that is inconsistent with our directions or store our products for long periods of time, which may adversely affect the quality of our products. If consumers do not perceive our products to be of high quality, then the value of our brand would be diminished, and our business, results of operations and financial condition would be adversely affected.

Any loss of confidence on the part of consumers in the ingredients used in our products or in the safety and quality of our products would be difficult and costly to overcome. Any such adverse effect could be exacerbated by our position in the market as a purveyor of high-quality natural and organic food products and may significantly reduce our brand value. Issues regarding the safety of any of our products, regardless of the cause, may have a substantial and adverse effect on our brand, reputation and operating results.

We may be subject to significant liability if the consumption of any of our products causes illness or physical harm.

The sale of food products for human consumption involves the risk of injury or illness to consumers. Such injuries or illness may result from inadvertent mislabeling, tampering or product contamination or spoilage. Under certain circumstances, we may be required to recall or withdraw products, which may have a material adverse effect on our business. For example, in 2008, we carried out an FDA Class 1 recall for approximately 680 cases of our salad dressing due to ingredient mislabeling. Even if a situation does not necessitate a recall or market withdrawal, product liability claims may be asserted against us. If the consumption of any of our products causes, or is alleged to have caused, a health-related illness, we may become subject to claims or lawsuits relating to such matters. Even if a product liability claim is unsuccessful, the negative publicity surrounding any assertion that our products caused illness or physical harm could adversely affect our reputation with existing and potential distributors, retailers and consumers and our corporate image and brand equity. Moreover, claims or liabilities of this sort might not be covered by insurance or by any rights of indemnity or contribution that we may have against others. A product liability judgment against us or a product recall or market withdrawal could have a material adverse effect on our business, reputation and operating results.

Disruptions in the worldwide economy may adversely affect our business, results of operations and financial condition.

Adverse and uncertain economic conditions may impact distributor, retailer and consumer demand for our products. In addition, our ability to manage normal commercial relationships with our suppliers, contract manufacturers, distributors, retailers, consumers and creditors may suffer. Consumers may shift purchases to lower-priced or other perceived value offerings during economic downturns. In particular, consumers may reduce the amount of natural and organic products that they purchase where there are conventional offerings, which generally have lower retail prices. In addition, consumers may choose to purchase private label products rather than branded products because they are generally less expensive. Distributors and retailers may become more conservative in response to these conditions and seek to reduce their inventories. For example, during the economic downturn from 2007 through 2009, distributors and retailers significantly reduced their inventories, and inventory levels have not returned to, and are not expected to return to, pre-downturn levels. Our results of operations depend upon, among other things, our ability to maintain and increase sales volume with our existing distributors and retailers, to attract new consumers and to provide products that appeal to consumers at prices they are willing and able to pay. Prolonged unfavorable economic conditions may have an adverse effect on our sales and profitability.

15

Table of Contents

Consumer preferences for our products are difficult to predict and may change, and, if we are unable to respond quickly to new trends, our business may be adversely affected.

Our business is focused on the development, manufacture, marketing and distribution of a line of branded natural and organic food products. If consumer demand for our products decreased, our business would suffer. In addition, sales of natural and organic products are subject to evolving consumer preferences. Consumer trends that we believe favor sales of our products could change based on a number of possible factors, including a shift in preference from organic to non-organic and from natural to non-natural products, economic factors and social trends. A significant shift in consumer demand away from our products could reduce our sales or the prestige of our brand, which would harm our business.

We may not have the resources to compete successfully in our highly competitive markets.

We operate in a highly competitive market. Numerous brands and products compete for limited retailer shelf space and consumers. In our market, competition is based on, among other things, product quality and taste, brand recognition and loyalty, product variety, interesting or unique product names, product packaging and package design, shelf space, reputation, price, advertising, promotion and nutritional claims.

The packaged food industry is dominated by multinational corporations with substantially greater resources and operations than us. We cannot be certain that we will successfully compete with larger competitors that have greater financial, sales and technical resources. Conventional food companies, including Kraft Foods Inc., General Mills, Inc., Campbell Soup Company, PepsiCo, Inc., Nestle S.A. and Kellogg Company, may be able to use their resources and scale to respond to competitive pressures and changes in consumer preferences by introducing new products, reducing prices or increasing promotional activities, among other things. We also compete with other natural and organic packaged food brands and companies, including The Hain Celestial Group, Inc., Newman’s Own, Inc., Nature’s Path Foods, Inc., Clif Bar & Company and Amy’s Kitchen, and with smaller companies, which may be more innovative and able to bring new products to market faster and to more quickly exploit and serve niche markets. Retailers also market competitive products under their own private labels, which are generally sold at lower prices and compete with some of our products. As a result of competition, we may need to increase our marketing, advertising and promotional spending to protect our existing market share, which may adversely impact our profitability. We may not have the financial resources to increase such spending when necessary.

Failure to introduce new products or improve existing products successfully would adversely affect our ability to continue to grow.

A key element of our growth strategy depends on our ability to develop and market new products and improvements to our existing products that meet our standards for quality and appeal to consumer preferences. The success of our innovation and product development efforts is affected by our ability to anticipate changes in consumer preferences, the technical capability of our product development staff in developing and testing product prototypes, including complying with governmental regulations, and the success of our management and sales team in introducing and marketing new products. Failure to develop and market new products that appeal to consumers may lead to a decrease in our growth, sales and profitability.

Additionally, the development and introduction of new products requires substantial research, development and marketing expenditures, which we may be unable to recoup if the new products do not gain widespread market acceptance. If we are unsuccessful in meeting our objectives with respect to new or improved products, our business could be harmed.

Ingredient and packaging costs are volatile and may rise significantly, which may negatively impact the profitability of our business.

We purchase large quantities of raw materials, including ingredients such as wheat and flour, dairy products, oils and sugar. In addition, we purchase and use significant quantities of cardboard, film and glass to package our

16

Table of Contents

products. Costs of ingredients and packaging are volatile and can fluctuate due to conditions that are difficult to predict, including global competition for resources, weather conditions, consumer demand and changes in governmental trade and agricultural programs. In fiscal 2012, our ingredient costs were higher than in fiscal 2011, and we expect that the cost of certain of our key ingredients will continue to increase. Continued volatility in the prices of raw materials and other supplies we purchase could increase our cost of sales and reduce our profitability. Moreover, we may not be able to implement price increases for our products to cover any increased costs, and any price increases we do implement may result in lower sales volumes. If we are not successful in managing our ingredient and packaging costs, if we are unable to increase our prices to cover increased costs or if such price increases reduce our sales volumes, then such increases in costs will adversely affect our business, results of operations and financial condition.

Our future business, results of operations and financial condition may be adversely affected by reduced availability of organic ingredients.

Our ability to ensure a continuing supply of organic ingredients at competitive prices depends on many factors beyond our control, such as the number and size of farms that grow organic crops or raise organic livestock, the vagaries of these farming businesses (including poor harvests), changes in national and world economic conditions and our ability to forecast our ingredient requirements. The organic ingredients used in many of our products are vulnerable to adverse weather conditions and natural disasters, such as floods, droughts, frosts, earthquakes, hurricanes and pestilences. Adverse weather conditions and natural disasters can lower crop yields and reduce crop size and quality, which in turn could reduce the available supply of, or increase the price of, organic ingredients. For example, in fiscal 2011, organic wheat and sunflower oil were in shorter supply than we expected. In addition, we purchase some ingredients offshore, and the availability of such ingredients may be affected by events in other countries, including Colombia, Paraguay, Thailand and Brazil. In addition, we compete with other food producers in the procurement of organic ingredients, which are often less plentiful in the open market than conventional ingredients. This competition may increase in the future if consumer demand for organic products increases. If supplies of organic ingredients are reduced or there is greater demand for such ingredients from us and others, we may not be able to obtain sufficient supply on favorable terms, or at all, which could impact our ability to supply products to distributors and retailers and may adversely affect our business, results of operations and financial condition.

We rely on sales to a limited number of distributors and retailers for the substantial majority of our sales, and the loss of one or more significant distributors or retailers may harm our business.

A substantial majority of our sales are generated from a limited number of distributors and retailers. For fiscal 2012, sales to our principal distributor and largest customer, UNFI, represented approximately 25% of our net sales, and sales to our top two retailers, Target and Costco, represented an aggregate of approximately 26% of our net sales. Although the composition of our significant distributors and retailers will vary from period to period, we expect that most of our sales will continue to come from a relatively small number of distributors and retailers for the foreseeable future. We do not have commitments or minimum volumes that ensure future sales of our products. Consequently, our financial results may fluctuate significantly from period to period based on the actions of one or more significant distributors or retailers. For example, in fiscal 2010, sales to Costco were $3.2 million lower than in fiscal 2009, which contributed to lower sales growth. A distributor or retailer may take actions that affect us for reasons that we cannot always anticipate or control, such as their financial condition, changes in their business strategy or operations, the introduction of competing products or the perceived quality of our products. In addition, despite operating in different channels, our retailers sometimes compete for the same consumers. As a result of actual or perceived conflicts resulting from this competition, retailers may take actions that negatively affect us. Our agreements with our distributors and retailers may be canceled if we materially breach the agreements or for other reasons, including reasons outside of our control. In addition, our distributors and retailers may seek to renegotiate the terms of current agreements or renewals. The loss of, or a reduction in sales or anticipated sales to, one or more of our most significant distributors or retailers may have a material adverse effect on our business, results of operation and financial condition.

17

Table of Contents

Loss of one or more of our contract manufacturers or our failure to identify timely new contract manufacturers could harm our business and impede our growth.

We derive all of our sales from products manufactured at manufacturing facilities owned and operated by our contract manufacturers. During fiscal 2012, we paid $62.4 million in the aggregate to our top three contract manufacturers. We do not have written contracts with all of our contract manufacturers, including Lucerne Foods, one of our top three contract manufacturers that manufactures several of our top selling products. Any of our contract manufacturers could seek to alter its relationship with us. If we need to replace a contract manufacturer, there can be no assurance that additional capacity will be available when required on acceptable terms, or at all.

An interruption in, or the loss of operations at, one or more of our contract manufacturing facilities, which may be caused by work stoppages, disease outbreaks or pandemics, acts of war, terrorism, fire, earthquakes, flooding or other natural disasters at one or more of these facilities, could delay or postpone production of our products, which could have a material adverse effect on our business, results of operations and financial condition until such time as such interruption is resolved or an alternate source of production is secured.

The success of our business depends, in part, on maintaining a strong manufacturing platform. We believe there are a limited number of competent, high-quality contract manufacturers in the industry that meet our strict standards, and if we were required to obtain additional or alternative contract manufacturing arrangements in the future, there can be no assurance that we would be able to do so on satisfactory terms, in a timely manner or at all. Therefore, the loss of one or more contract manufacturers, any disruption or delay at a contract manufacturer or any failure to identify and engage contract manufacturers for new products could delay or postpone production of our products, which could have a material adverse effect on our business, results of operations and financial condition. For example, in the past, changing the contract manufacturer for one of our product lines took approximately six months to implement. At present, we do not have back-up contract manufacturers identified for certain of our product lines, and the loss of contract manufacturers for any of these product lines would result in our inability to produce and deliver the products to our customers until we could identify and retain an alternative contract manufacturer and until that contract manufacturer was able to produce the products to our specifications.

Because we rely on a limited number of third-party suppliers, we may not be able to obtain raw materials on a timely basis or in sufficient quantities to produce our products.

We rely on a limited number of vendors to supply us with raw materials. Our financial performance depends in large part on our ability to arrange for the purchase of raw materials in sufficient quantities at competitive prices. We are not assured of continued supply, pricing or exclusive access to raw materials from these sources. Any of our suppliers could discontinue or seek to alter their relationship with us. For example, we may be adversely affected if they raise their prices, stop selling to us or our contract manufacturers or enter into arrangements that impair their ability to provide raw materials for us.

We have a single supplier for the cheese powders used in our products, including macaroni and cheese, cheddar crackers and snack mix. Any disruption in this or other supplier relationships would have a material adverse effect on our business.

Events that adversely affect our suppliers could impair our ability to obtain raw material inventory in the quantities that we desire. Such events include problems with our suppliers’ businesses, finances, labor relations, ability to import raw materials, costs, production, insurance and reputation, as well as natural disasters or other catastrophic occurrences.

If we experience significant increased demand for our products, or need to replace an existing supplier, there can be no assurance that additional supplies of raw materials will be available when required on acceptable terms, or at all, or that any supplier would allocate sufficient capacity to us in order to meet our requirements, fill

18

Table of Contents

our orders in a timely manner or meet our strict quality standards. Even if our existing suppliers are able to expand their capacity to meet our needs or we are able to find new sources of raw materials, we may encounter delays in production, inconsistencies in quality and added costs. Any delays or interruption in, or increased costs of, our supply of raw materials could have an adverse effect on our ability to meet consumer demand for our products and result in lower net sales and profitability both in the short and long term.

We may not be able to protect our intellectual property adequately, which may harm the value of our brand.

We believe that our intellectual property has substantial value and has contributed significantly to the success of our business. Our trademarks, including our “Annie’s®,” “Annie’s Homegrown®,” “Annie’s Naturals®” and “Bernie Rabbit of Approval®” marks, are valuable assets that reinforce our brand and consumers’ favorable perception of our products. We also rely on unpatented proprietary expertise, recipes and formulations and other trade secrets and copyright protection to develop and maintain our competitive position. Our continued success depends, to a significant degree, upon our ability to protect and preserve our intellectual property, including our trademarks, trade dress, trade secrets and copyrights. We rely on confidentiality agreements and trademark, trade secret and copyright law to protect our intellectual property rights.

Our confidentiality agreements with our employees, and certain of our consultants, suppliers and independent contractors, including some of our contract manufacturers who use our recipes to manufacture our products, generally require that all information made known to them be kept strictly confidential. Nevertheless, trade secrets are difficult to protect. Although we attempt to protect our trade secrets, our confidentiality agreements may not effectively prevent disclosure of our proprietary information and may not provide an adequate remedy in the event of unauthorized disclosure of such information. In addition, others may independently discover our trade secrets, in which case we would not be able to assert trade secret rights against such parties. Further, some of our recipes and ingredient formulations have been developed by or with our suppliers and contract manufacturers and are not exclusive to us. Finally, we do not have written confidentiality agreements with all of our contract manufacturers. As a result, we may not be able to prevent others from using our recipes or formulations.

From time to time, third parties have used names or packaging similar to ours, have applied to register trademarks similar to ours and, we believe, have infringed or misappropriated our intellectual property rights. We respond to these actions on a case-by-case basis, including, where appropriate, by sending cease and desist letters and commencing opposition actions and litigation.

We cannot assure you that the steps we have taken to protect our intellectual property rights are adequate, that our intellectual property rights can be successfully defended and asserted in the future or that third parties will not infringe upon or misappropriate any such rights. In addition, our trademark rights and related registrations may be challenged in the future and could be canceled or narrowed. Failure to protect our trademark rights could prevent us in the future from challenging third parties who use names and logos similar to our trademarks, which may in turn cause consumer confusion or negatively affect consumers’ perception of our brand and products. In addition, if we do not keep our trade secrets confidential, others may produce products with our recipes or formulations. Moreover, intellectual property disputes and proceedings and infringement claims may result in a significant distraction for management and significant expense, which may not be recoverable regardless of whether we are successful. Such proceedings may be protracted with no certainty of success, and an adverse outcome could subject us to liabilities, force us to cease use of certain trademarks or other intellectual property or force us to enter into licenses with others. Any one of these occurrences may have a material adverse affect on our business, results of operations and financial condition.

Failure by our suppliers of raw materials or contract manufacturers to comply with food safety, environmental or other laws and regulations may disrupt our supply of products and adversely affect our business.

If our suppliers or contract manufacturers fail to comply with food safety, environmental or other laws and regulations, or face allegations of non-compliance, their operations may be disrupted. For example, the USDA

19

Table of Contents

requires that our certified organic products be free of genetically modified organisms, but unavoidable cross-pollination at one of our suppliers may result in genetically modified organisms in our supply chain. In the event of actual or alleged non-compliance, we might be forced to find an alternative supplier or contract manufacturer. As a result, our supply of raw materials or finished inventory could be disrupted or our costs could increase, which would adversely affect our business, results of operations and financial condition. Additionally, actions we may take to mitigate the impact of any such disruption or potential disruption, including increasing inventory in anticipation of a potential supply or production interruption, may adversely affect our business, results of operations and financial condition.

Changes in existing regulations and the adoption of new regulations may increase our costs and otherwise adversely affect our business, results of operations and financial condition.

The manufacture and marketing of food products is highly regulated. We and our suppliers and contract manufacturers are subject to a variety of laws and regulations. These laws and regulations apply to many aspects of our business, including the manufacture, packaging, labeling, distribution, advertising, sale, quality and safety of our products, as well as the health and safety of our employees and the protection of the environment.

In the U.S., we are subject to regulation by various government agencies, including the FDA, USDA, Federal Trade Commission, or FTC, Occupational Safety and Health Administration and the Environmental Protection Agency, as well as various state and local agencies. We are also regulated outside the United States by the Canadian Food Inspection Agency, as well as Canadian provincial and local agencies. In addition, we are subject to review by voluntary organizations, such as the Council of Better Business Bureaus’ National Advertising Division and the Children’s Food and Beverage Advertising Initiative. We could incur costs, including fines, penalties and third-party claims, as a result of any violations of, or liabilities under, such requirements. For example, in connection with the marketing and advertisement of our products, we could be the target of claims relating to false or deceptive advertising, including under the auspices of the FTC and the consumer protection statutes of some states.

Any change in manufacturing, labeling or packaging requirements for our products may lead to an increase in costs or interruptions in production, either of which could adversely affect our operations and financial condition. New or revised government laws and regulations, such as the U.S. Food Safety Modernization Act passed in January 2011, which grants the FDA greater authority over the safety of the national food supply, as well as increased enforcement by government agencies, could result in additional compliance costs and civil remedies, including fines, injunctions, withdrawals, recalls or seizures and confiscations, as well as potential criminal sanctions, any of which may adversely affect our business, results of operations and financial condition.

Our brand and reputation may suffer from real or perceived issues involving the labeling and marketing of our products as “natural.”

Although the FDA and USDA have each issued statements regarding the appropriate use of the word “natural,” there is no single, U.S. government-regulated definition of the term “natural” for use in the food industry. The resulting uncertainty has led to consumer confusion, distrust and legal challenges. Plaintiffs have commenced legal actions against a number of food companies that market “natural” products, asserting false, misleading and deceptive advertising and labeling claims. Should we become subject to similar claims, consumers may avoid purchasing products from us or seek alternatives, even if the basis for the claim is unfounded. Adverse publicity about these matters may discourage consumers from buying our products. The cost of defending against any such claims could be significant. Any loss of confidence on the part of consumers in the truthfulness of our labeling or ingredient claims would be difficult and costly to overcome and may significantly reduce our brand value. Uncertainty as to the ingredients used in our products, regardless of the cause, may have a substantial and adverse effect on our brand and our business, results of operations and financial condition.

20

Table of Contents