Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MOSAIC CO | d363718d8k.htm |

Navigating Today’s Volatile Crop Nutrient Markets

2012 CoBank Knowledge Exchange Forum:

The Globalization of Agriculture: An Era of Promise and Challenge

Chicago, Ill

June 6-7, 2012

Dr. Michael R. Rahm

Vice President, Market and Strategic Analysis

The Mosaic Company

Exhibit 99.1 |

2

Safe Harbor Statement

This presentation contains forward-looking statements within the meaning of the

Private Securities Litigation Reform

Act

of

1995.

Such

statements

include,

but

are

not

limited

to,

statements

about

future

financial

and

operating results. Such statements are based upon the current beliefs and

expectations of The Mosaic Company’s management and are subject to

significant risks and uncertainties. These

risks

and

uncertainties

include

but

are

not

limited

to

the

predictability

and

volatility

of,

and

customer

expectations

about,

agriculture,

fertilizer,

raw

material,

energy

and

transportation

markets

that

are

subject

to

competitive and other pressures and economic and credit market conditions; the

level of inventories in the distribution channels for crop nutrients;

changes in foreign currency and exchange rates; international trade risks;

changes

in

government

policy;

changes

in

environmental

and

other

governmental

regulation,

including

greenhouse gas regulation, and implementation of the U.S. Environmental Protection

Agency’s numeric water quality standards for the discharge of nutrients

into Florida lakes and streams or possible efforts to reduce the flow of

excess nutrients into the Gulf of Mexico; further developments in judicial or administrative proceedings;

difficulties or delays in receiving, or increased costs of or challenges to

necessary governmental permits or approvals;

the

effectiveness

of

our

processes

for

managing

our

strategic

priorities;

adverse

weather

conditions

affecting

operations

in

Central

Florida

or

the

Gulf

Coast

of

the

United

States,

including

potential

hurricanes

or

excess rainfall; actual costs of various items differing from management’s

current estimates, including, among others,

asset

retirement,

environmental

remediation,

reclamation

or

other

environmental

regulation,

or

Canadian

resources

taxes

and

royalties;

accidents

and

other

disruptions

involving

Mosaic’s

operations,

including

brine

inflows at its Esterhazy, Saskatchewan potash mine and other potential mine fires,

floods, explosions, seismic events or releases of hazardous or volatile

chemicals, as well as other risks and uncertainties reported from time to

time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may

differ from those set forth in the forward-looking statements.

|

Agenda

•

Crop Nutrients Overview

•

Demand Drivers and Prospects

•

Market Outlook –

Expected Features

•

Risk Management Challenges

•

Factors to Watch or Game Changers |

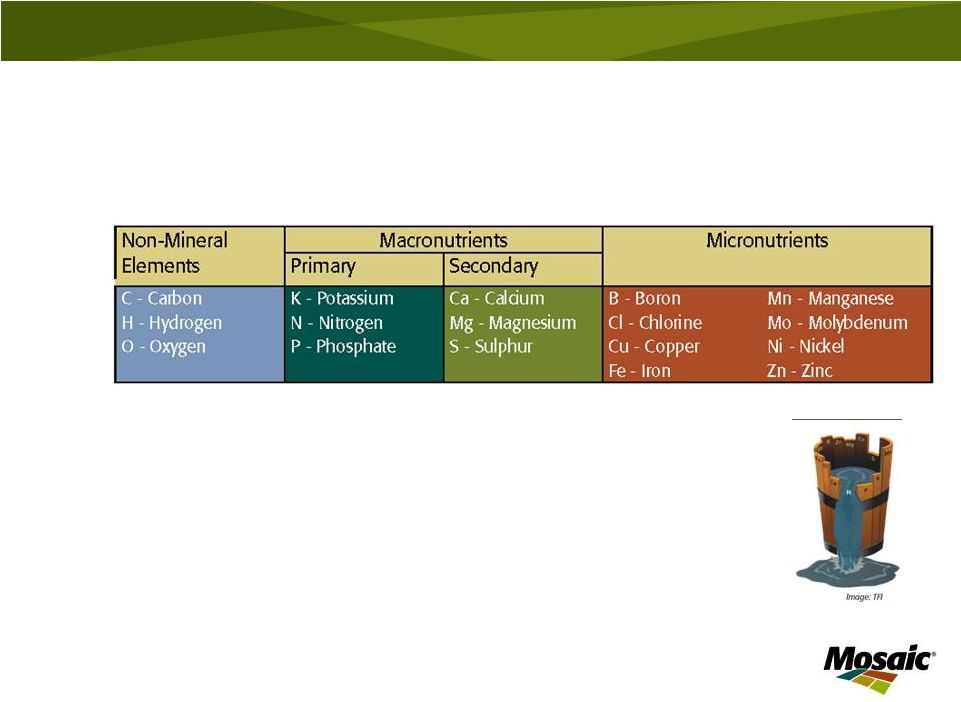

Crop Nutrients Overview |

Crop Nutrients Overview

•

Crop nutrients are plant food

•

17 chemical elements are required for plant growth

•

Justus von Liebig’s Law of the Minimum

•

N-P-K: the carbohydrates, protein and fat of a plant’s

diet •

Growing importance of secondary nutrients and micronutrients

•

Nutrients delivered in a variety of crop nutrient products

5

Liebig’s Barrel |

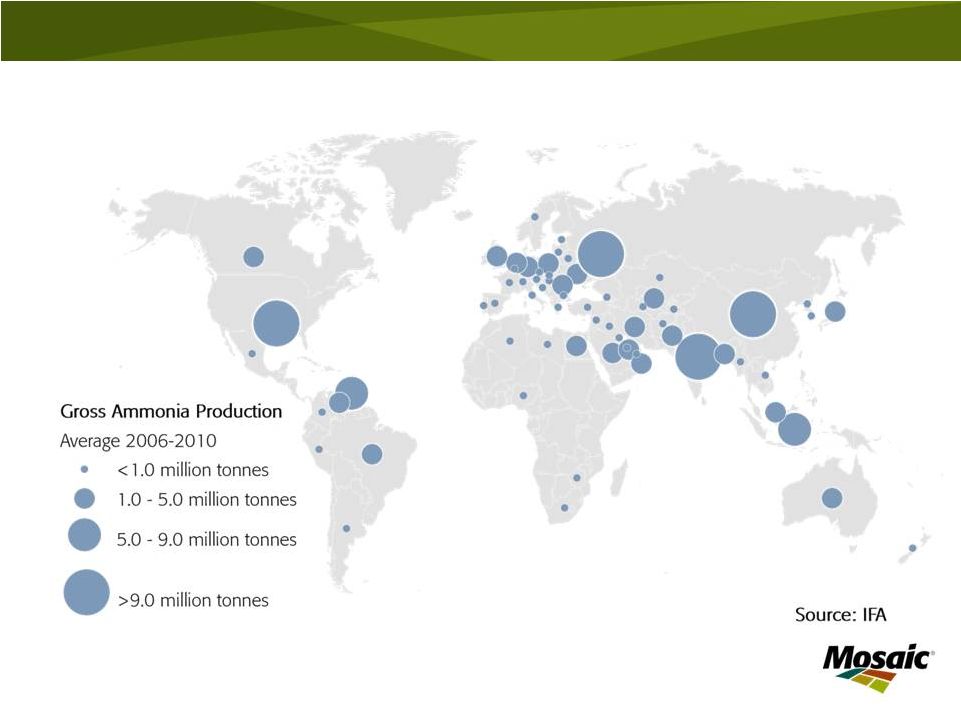

Primary Crop Nutrients Overview

•

Nitrogen (N)

–

Basic production process: highly energy intensive Haber-Bosch

process to synthesize anhydrous ammonia

–

Key input: a hydrocarbon feed stock (two-thirds from natural gas)

–

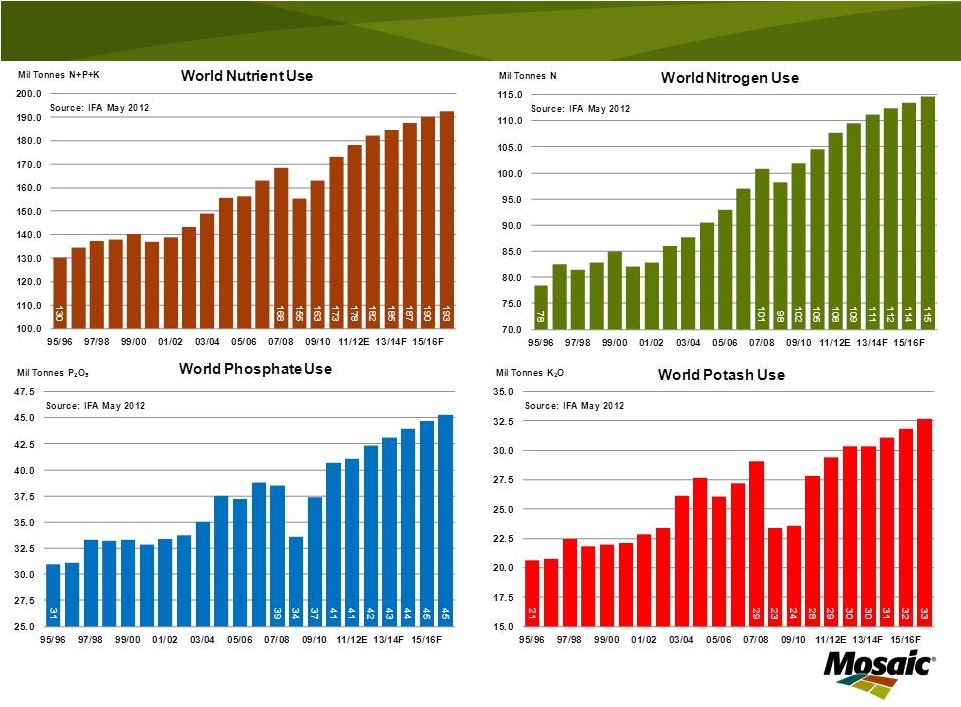

Global

agricultural

use:

~108

million

tonnes

N

contained

in

~

265

million tonnes of mostly downstream products

–

Main products

•

Anhydrous

ammonia

(82%

N

–

gas)

•

Urea (46% N –

solid)

•

Urea-ammonium

nitrate

(UAN)

solution

(28%-32%

N

–

liquid)

•

Ammonium

nitrate

(34%

N

–

solid)

•

Ammonium

sulphate

(21%

N

–

solid)

•

Ammonium

phosphate

products

(10%-18%

N

–

solid)

–

Leading producers: China, Russia, India, Mideast, Caribbean,

North America, Indonesia

6

N Use

by

Crop

N Use

by

Product

SOURCE: IFA, FERTECON AND

MOSAIC |

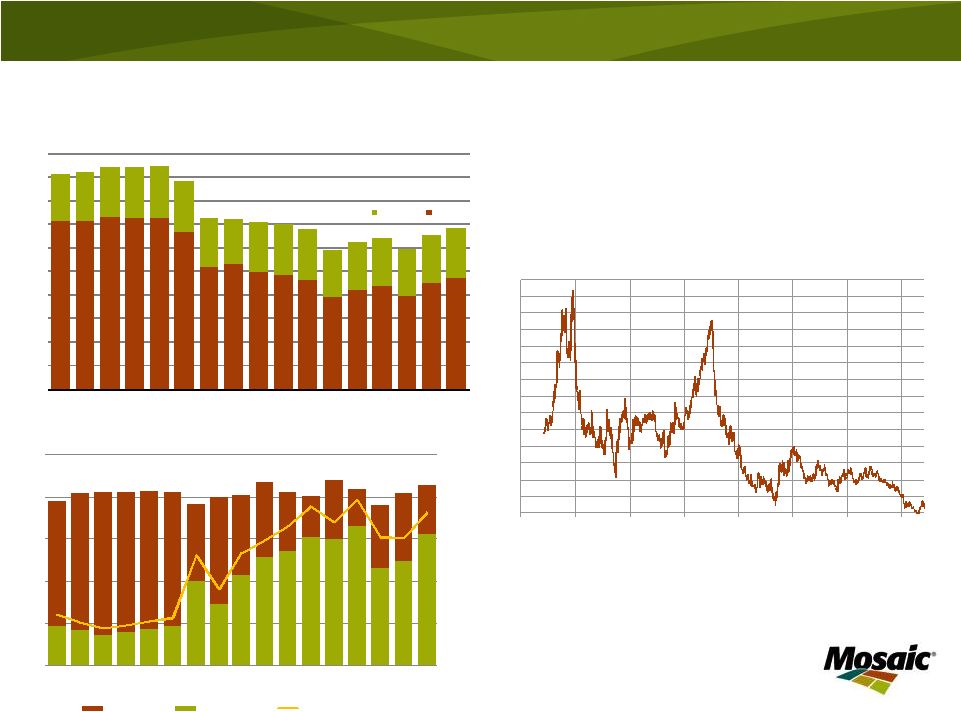

7

NH3 |

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

Jan 05

Jan 06

Jan 07

Jan 08

Jan 09

Jan 10

Jan 11

Jan 12

$ MM Btu

Henry Hub Natural Gas Price

Daily Closing Price of the Front Month Contract

Source: NYMEX

A re-birth of the U.S. nitrogen industry?

0.0

2.5

5.0

7.5

10.0

12.5

15.0

17.5

20.0

22.5

25.0

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

Mil Tons

North American Ammonia Production

Canada

U.S.

Source: TFI and Mosaic

Fertilizer Year Ending June 30

0%

20%

40%

60%

80%

100%

0.0

3.0

6.0

9.0

12.0

15.0

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

Percent

Mil Tons N

Fertilizer Year Ending June 30

U.S. Nitrogen Use

Total Use

Net Imports

Imports as Percent of Use

Source: USDC, AAPFCO and Mosaic |

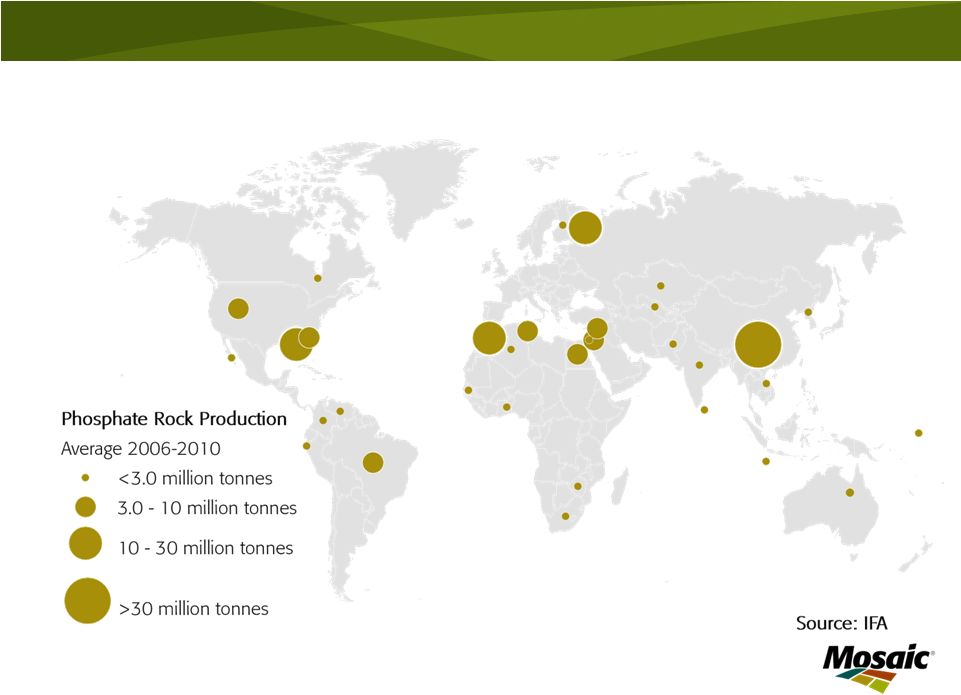

Primary Crop Nutrients Overview

•

Phosphate (P)

–

The

production

process

-

making

phosphorus

water

soluble

–

Key inputs: phosphate rock mineral ore, sulphur and ammonia

–

Global agricultural

use:

~41

million

tonnes

P

2

O

5

or

~

100

million

tonnes of product

–

Main products

•

Diammonium phosphate (DAP) (46% P

2

O

5

–

solid)

•

Monoammonium phosphate (MAP) (52% P

2

O

5

–

solid)

•

Triple superphosphate (TSP) (46% P

2

O

5

–

solid)

•

Single superphosphate (SSP) (18%-22% P

2

O

5

–

solid)

•

NPK

and

NP

compounds

(%

P

2

O

5

varies

–

both

solid

and

liquid)

•

Sulphur and micronutrient enhanced ammonium phosphate

products (% P

2

O

5

varies –

solid)

–

Leading producers: China, USA, Morocco/North Africa, Russia

9

P O

5

Use

by

Product

P O

5

Use

by

Crop

SOURCE: IFA, FERTECON AND

MOSAIC

2

2 |

10 |

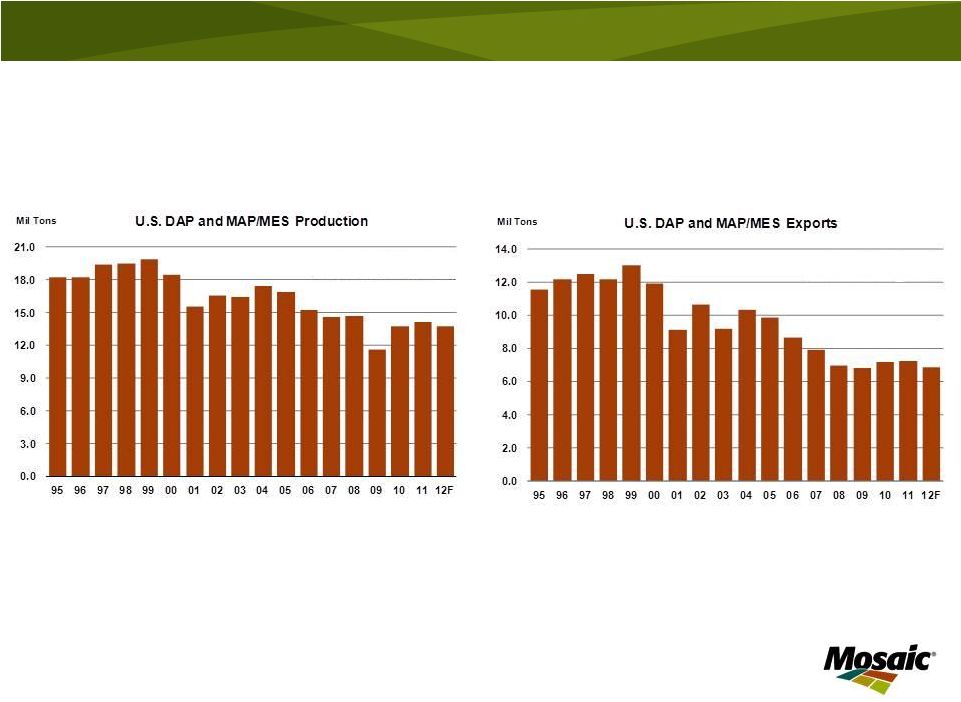

U.S. –

large but smaller role

11

Source: TFI and Mosaic

Fertilizer Year Ending June 30

Source: TFI and Mosaic

Fertilizer Year Ending June 30 |

Primary Crop Nutrients Overview

•

Potash (K)

–

Production process: simple separation processes

–

Key inputs: potash mineral ore (sylvinite, carnallite and langbeinite)

•

Conventional underground mines (500 to 1000+ meters deep)

•

Solution mines

•

Salt lake brines (e.g. Dead Sea, Qinghai and Great Salt Lake)

–

Global

agricultural

use:

~29

million

tonnes

K

2

O

or

~

49

million

tonnes

product

–

Main products

•

Potassium

chloride

(MOP)

(60-62%

K

2

O

–

solid)

•

Potassium

sulphate

(SOP)

(50%

K

2

O

–

solid)

•

Potassium-magnesium-sulphate

(22%

K

2

O

–

solid)

–

Leading producers: Canada, Russia, Belarus, Germany, Israel, Jordan

12

K O Use

by

Crop

K O Use

by

Product

SOURCE: IFA, FERTECON AND

MOSAIC

2

2 |

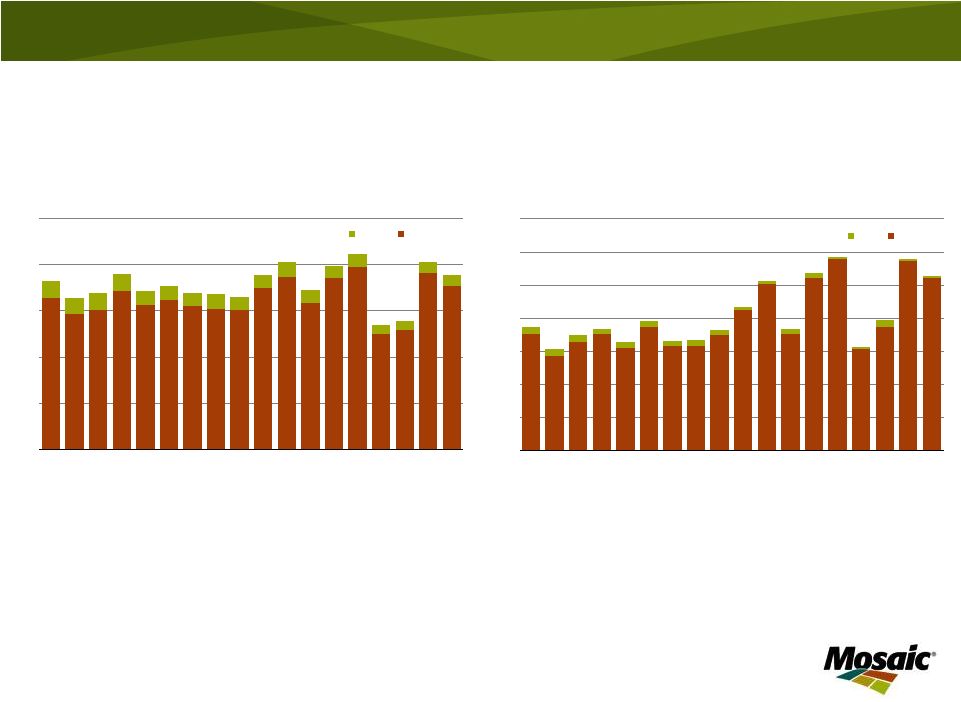

13 |

14

0

5

10

15

20

25

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11E

12F

Mil Tons

KCl

North American MOP Production

U.S.

Canada

Source: IPNI and Mosaic

Fertilizer Year Ending June 30

0

2

4

6

8

10

12

14

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11E

12F

Mil Tons

KCl

North American MOP Exports

U.S.

Canada

Source: IPNI and Mosaic

Fertilizer Year Ending June 30

Canada –

a large and growing role |

Crop Nutrient Markets

•

A separate and unique market for each nutrient

–

Common demand drivers

–

Different supply drivers

•

Natural resources required

•

Other raw materials

•

Location of resources

•

Technological processes

•

Market characteristics

–

Global

–

Commodity based

–

Cyclical

–

Long and large supply chain |

Market Characteristics

•

Global

–

Highly traded commodities

–

By a large number of successful trading companies

16

Exports as a

World Use

Total Exports

Percent of Use

Coarse Grain

1,074.8

119.1

11.1%

Wheat

634.4

127.7

20.1%

Rice

432.0

31.2

7.2%

Total Grain

2,141.2

278.1

13.0%

Nitrogen (N)

100.3

40.6

40.4%

Phosphate (P2

O

5

)

38.0

23.8

62.5%

Potash (K2

O)

26.2

18.7

71.3%

Total Nutrients

164.5

83.0

50.4%

Source: USDA, IFA, Fertecon, Mosaic

Five Year Averages 2006/07 - 2010/11

Note: Nitrogen includes ammonia, urea, ammonium nitrate, ammonium sulphate and

calcium ammonium nitrate. Phosphate includes rock, phosphoric acid, DAP, MAP, TSP, SSP.

Potash includes MOP only. Data exclude intra-North American shipments.

NPKs are not included.

World Fertilizer and Grain Trade

(million tonnes) |

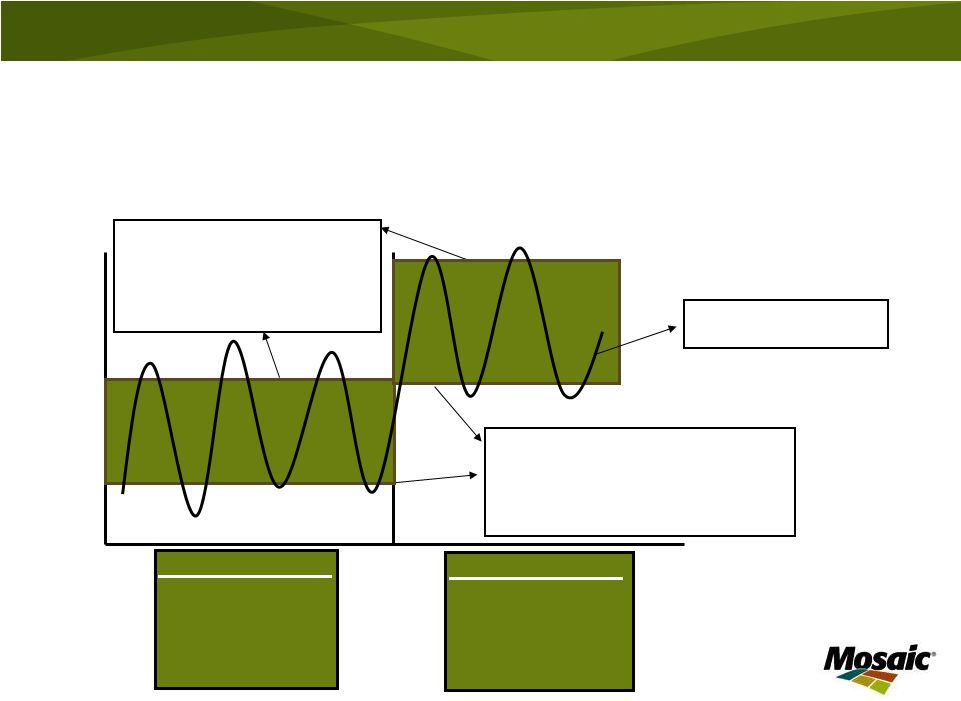

Market Characteristics

•

Cyclical –

But the cycle has shifted up

17

Time

Price

New Scenario

•

$5.00-$7.00 bu Corn

•

$80-100 bbl Oil

•

$4.50 MM Btu Gas

•

$100-$200 MT Rock

•

$2000+ MT K Capacity

Change

Old Scenario

•

$2.00-$2.50 bu Corn

•

$10-$20 bbl Oil

•

$2.00 MM Btu Gas

•

$30-$40 MT Rock

•

$1000 MT K Capacity

Market

prices

determined

by

supply

and

demand

•

When demand exceeds supply

price increases above this level

to attract capital into this sector

•

Higher operating and capital

costs are pushing up this ceiling

Price Required for New Capacity

Marginal Cost of Efficient Producers

•

When supply exceeds demand price

drops to or below this floor to force

high cost capacity to shut down

•

Increases in raw materials and energy

costs are pushing up this floor |

Crop Nutrient Markets

•

Long and large supply chain/distribution pipeline

–

Production –

beginning of the supply chain

•

Typically located near the source of the natural resource

(i.e. long pipeline)

•

Operations run 24-7-365

–

Farm

application

–

end

of

the

supply

chain

•

One or two short application windows (i.e. large pipeline)

–

Pipeline flow

•

Regular flow required to

–

Have product in place when farmers want to apply it

–

Keep mines and plants running

•

Flow impacted by

–

Weather

–

Price expectations

–

Supply/demand changes |

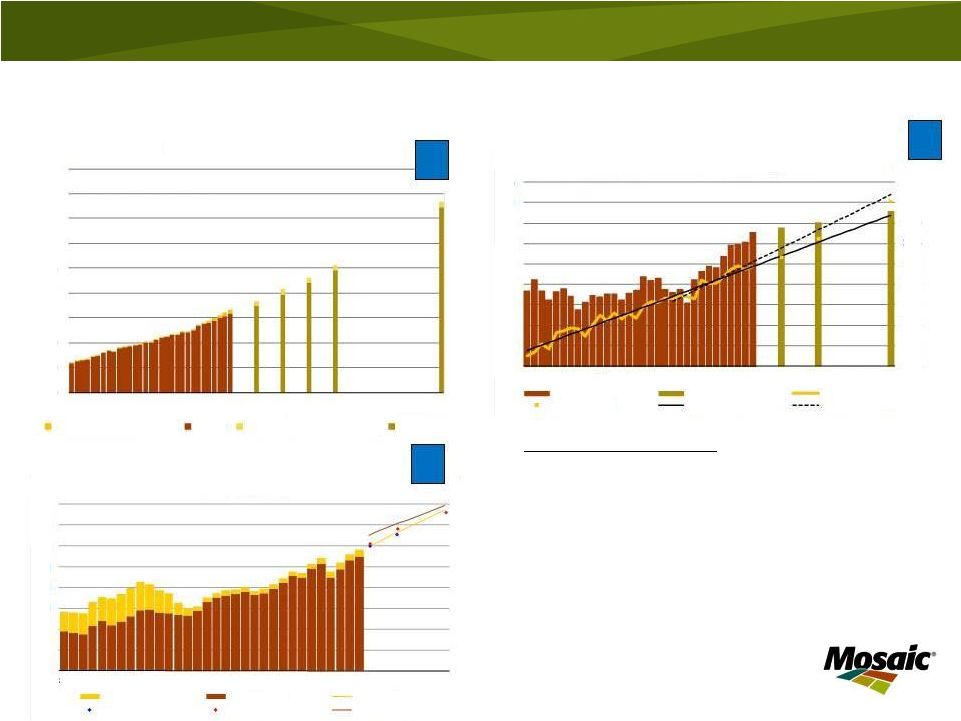

Demand Drivers and Prospects |

The

food story by the numbers 1.

Population growth and increases in per capital GDP

are expected to generate steady and predictable

increases in global grain and oilseed (food) demand.

2.

Farmers around the globe will need to harvest record

area and produce yields that exceed the 30-year

trend in order to meet projected demand.

3.

Additional harvested area and higher yields will drive

continued increases in crop nutrient demand.

2

3

1

Connecting the Dots

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

5,500

80

85

90

95

00

05

10

15

20

25

30

50

Mil Tonnes

Source: USDA and Mosaic

World Grain and Oilseed Use

60

80

100

120

140

160

180

200

220

80

85

90

95

00

05

10

15

20

Mil Tonnes

World Crop Nutrient Use

Actual -

FSU

Actual -

ROW

Mosaic Model

IFA

Fertecon

Mosaic Survey

1.75

2.00

2.25

2.50

2.75

3.00

3.25

3.50

3.75

4.00

750

775

800

825

850

875

900

925

950

975

80

85

90

95

00

05

10

15

20

25

30

MT Ha

Mil Ha

Source: USDA and Mosaic

World Harvested Area and Average Yield

Actual Area

Forecast Area

Actual Yield

Required Yield

1980-10 Yield Trend

2000-10 Yield Trend

Actual for U.S. Ethanol

Actual

Forecast for U.S. Ethanol

Forecast

20 |

21 |

22

Source: AAPFCO, TFI and Mosaic

3.00

3.25

3.50

3.75

4.00

4.25

4.50

4.75

5.00

95

97

99

01

03

05

07

09

11E

13F

15F

17F

Mil

Tons

P O

Fertilizer Year Ending June 30

U.S. Phosphate Use

2.50

3.00

3.50

4.00

4.50

5.00

5.50

6.00

95

97

99

01

03

05

07

09

11E

13F

15F

17F

Mil

Tons

K O

Fertilizer Year Ending June 30

U.S. Potash Use

2

2

5

16

17

18

19

20

21

22

23

24

95

97

99

01

03

05

07

09

11E

13F

15F

17F

Fertilizer Year Ending June 30

U.S. Nutrient Use

9.0

9.5

10.0

10.5

11.0

11.5

12.0

12.5

13.0

13.5

95

97

99

01

03

05

07

09

11E

13F

15F

17F

Million Tons N

Fertilizer Year Ending June 30

U.S. Nitrogen Use |

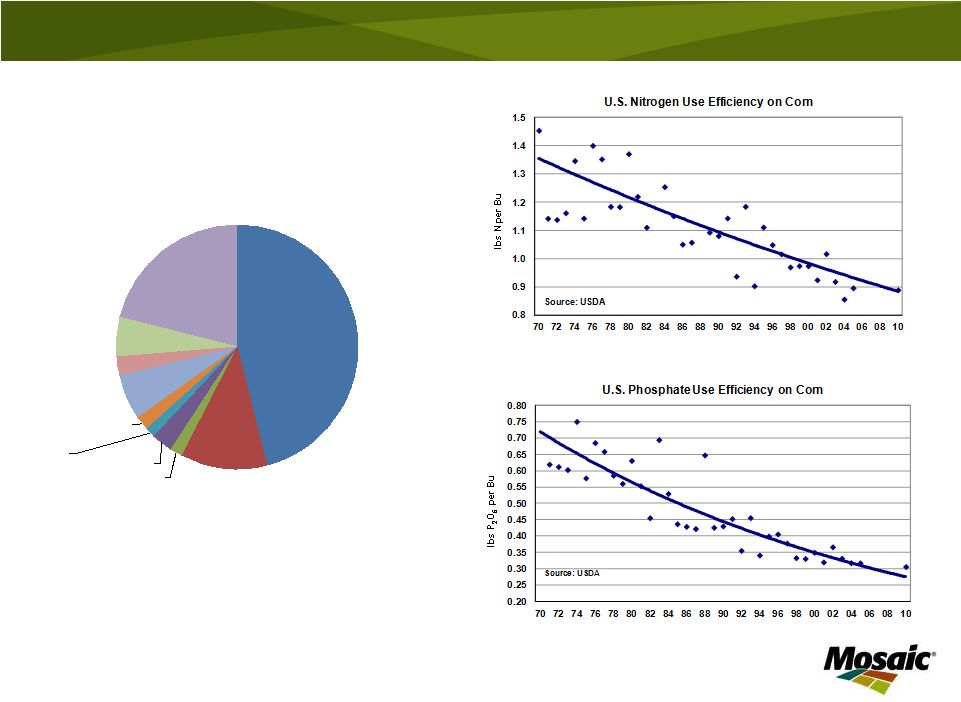

23

Corn

45.9%

Wheat

11.7%

Rice

1.7%

Other Coarse

Grains

2.7%

Sugar Crops

1.4%

Other Oilseed

1.8%

Soybean

6.0%

Cotton

2.5%

Fruits & Veg.

5.3%

Other Crops

21.0%

U.S. Fertilizer Use by Crop 2007/08

Source: IFA |

Market Outlook –

Expected Features |

Phosphate

Strong demand growth underpinned by the food

and energy stories

-

Relatively high commodity prices

-

Profitable farm economics worldwide

-

Global phosphate demand growth of 2.5%-3.0% per year

-

DAP/MAP/TSP shipment growth of ~3% per year

Net capacity increases expected to keep pace

with demand growth

Nearly all of the projected demand and capacity

growth outside North America

North American industry projected to remain a

large and stable producer and exporter |

Potash

26

Global market tightened beginning in 2004

-

Strong demand growth (BIC + Indonesia/Malaysia)

-

FSU supplies absorbed

-

Capacity atrophy

Also strong demand growth underpinned by the

food and energy stories

-

Global potash demand and MOP shipment growth of 3.0%-

3.5% per year

Large number of brownfield projects expected

online during the next several years

-

Existing producers heavily re-investing in new capacity

-

Prices move to justify brownfield but not greenfield projects

Large mining companies potential new entrants

Junior potash projects unlikely to move forward |

Risk Management Challenges |

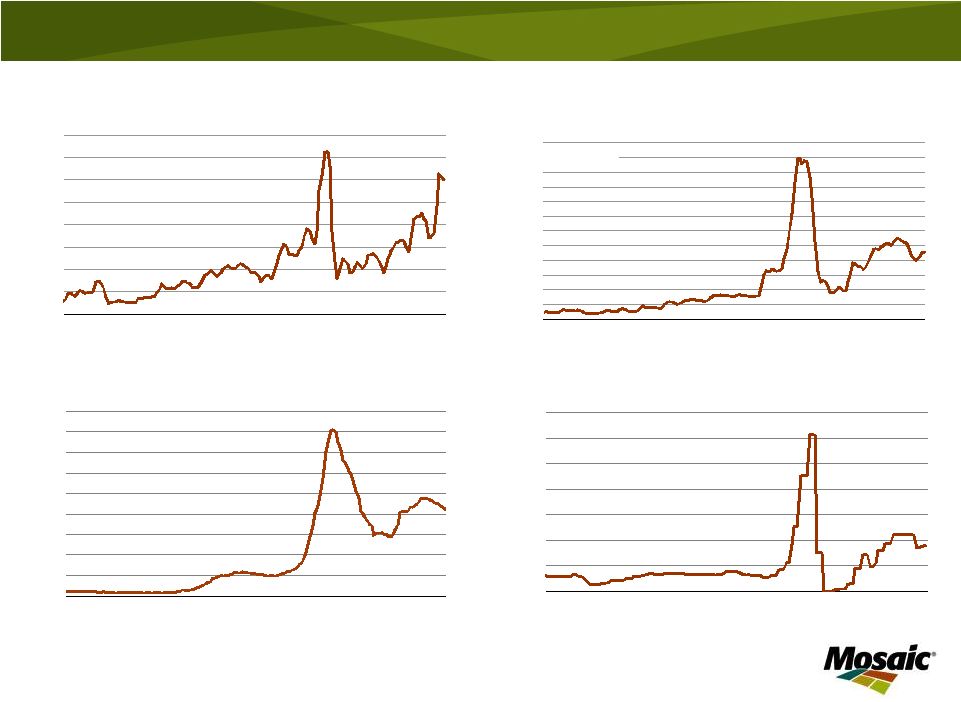

28

50

150

250

350

450

550

650

750

850

00

01

02

03

04

05

06

07

08

09

10

11

12

$ ST

Granular Urea Prices

NOLA Barge

Source: Green Markets

100

200

300

400

500

600

700

800

900

1000

1100

1200

1300

00

01

02

03

04

05

06

07

08

09

10

11

12

$ MT

DAP Prices

fob Tampa Vessel

Source: Fertecon

100

200

300

400

500

600

700

800

900

1000

00

01

02

03

04

05

06

07

08

09

10

11

12

$ ST

MOP Prices

Blend Grade fob U.S. Midwest Warehouse

Source: Green Markets

0

100

200

300

400

500

600

700

00

01

02

03

04

05

06

07

08

09

10

11

12

$ LT

Sulphur Prices

c&f Tampa

Source: Green Markets |

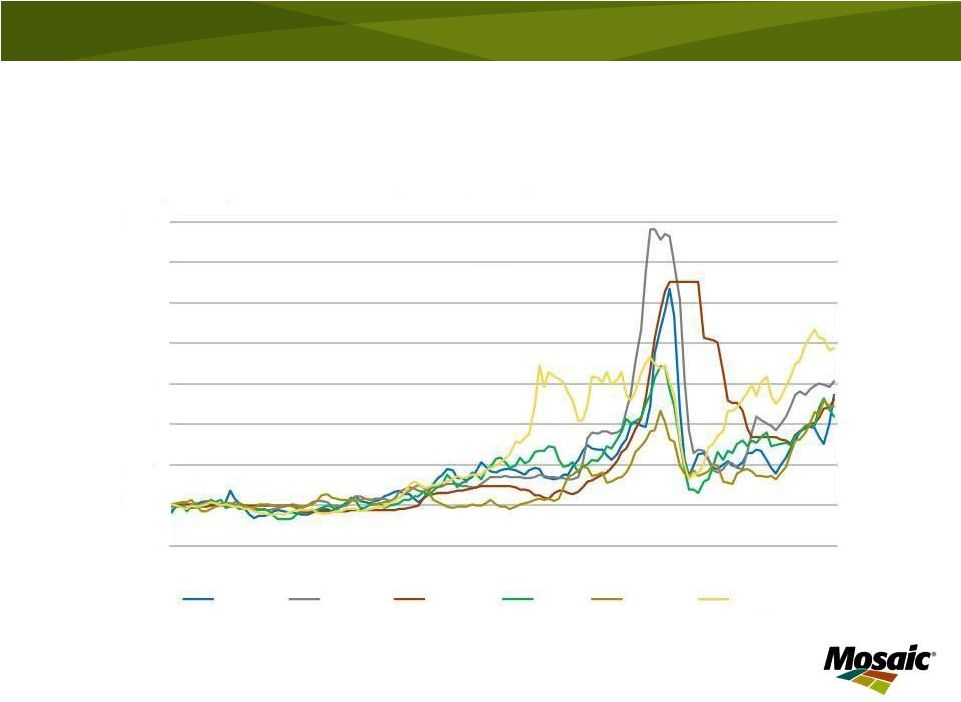

29

Extraordinary commodity price volatility

0

100

200

300

400

500

600

700

800

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Index

(2000 = 100)

Crop Nutrient and Other Commodity Prices

Urea

DAP

MOP

Oil

Corn

Copper

Source: CBOT,

NYMEX,

Green

Markets,

ICIS

and

Mosaic |

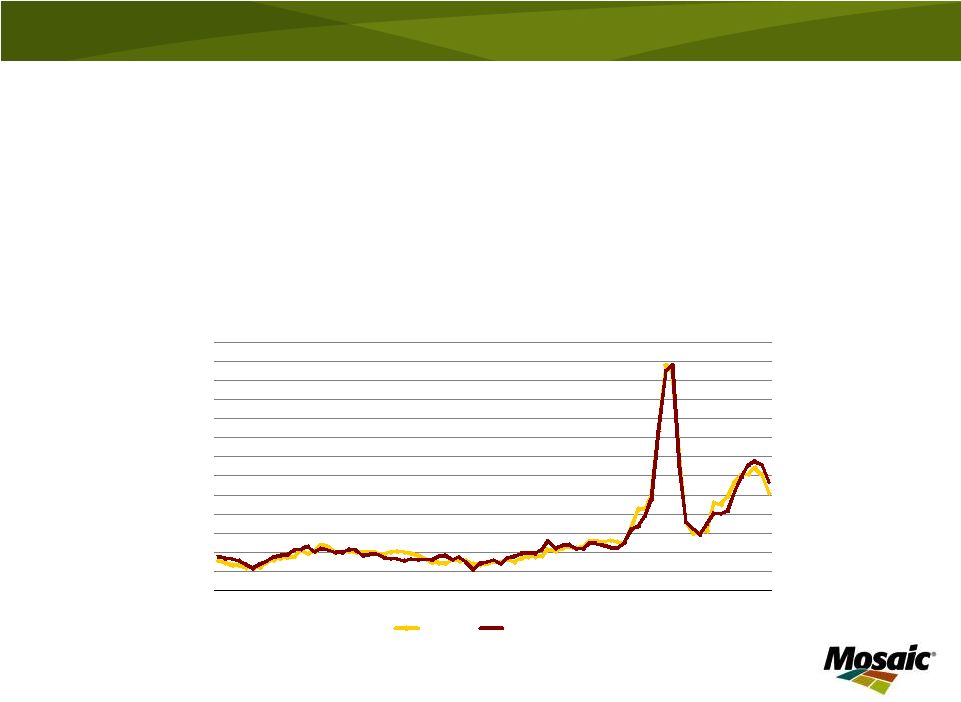

30

0

100

200

300

400

500

600

700

800

900

1000

1100

1200

1300

92

93

94

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12

$ MT

DAP Price

Quarterly Average fob Tampa Vessel

Actual

Model Forecast

“Just because crop nutrient prices are volatile does not mean

large price movements are not explainable.

However, just because statistical models explain price

movements does not imply that prices are predictable.”

Market Mosaic Winter 2009/10 |

Futures Markets

Forward Pricing

–

Temporary substitute for a cash market transaction

that will be made in the future

–

Forward price output and raw material to establish a

margin

•

Soybean Processing

•

Petroleum Refining

Hedging

–

True hedge: having equal and opposite priced

positions in a cash and futures market

•

Grain merchandiser

Crop

Nutrient

Future

Contracts

(Past)

–

CBOT and CME

•

Crop

Nutrient

Swaps

Contracts

(Present)

–

Freight Investor Services (FIS) and Direct Hedge |

Lack of Industry Interest?

More risk-loving than risk-averse?

Ability to pass price volatility on to the

end user

Shift as much price risk as possible

back to the manufacturers

Smaller and more frequent purchases

Relying on just-in-time inventory

Entering into warehousing and consignment

arrangements with manufacturer

Utilizing warehousing agreements and no-

price-established (NPE) contracts offered by

some manufacturers to limit inventory

valuation risk |

The Mosaic Company

Voice of Customers

–

Customers want risk management tools

–

But are they willing to pay for this insurance?

–

Way for a crop nutrient producer to differentiate

its offering from that of competitors

Expanding Toolkit

–

Consistent forward pricing programs

–

Final Price Deferred (FPDs) pricing

–

Others tools under development and in pilots

33 |

Factors to Watch or Game Changers |

35

Forecasting = Developing and handicapping plausible scenarios

Key Crop Nutrient Market

Drivers

Income Growth

Exchange Rates

Ag Commodity Prices

Farm Profitability

Energy Costs

Raw Materials Costs

New Project Development

New Industry Entrants

Consumer Tastes/Preferences

Uncontrollable and

Unpredictable Variables

Macroeconomic Environment

Political Change

Government Policies

Technical Change

Corporate Strategies

Social Change

Natural Disasters

Strategy = Placing bets on highest-handicapped scenarios

|

What are the Game Changers?

36

Potential Game Changers Today

1.

Macroeconomic Environment: Impact

of Dollar on Crop Prices

2.

Political Change: Political Unrest

Impact on Key Economies

3.

Government Policies: Political

Support for Biofuels

4.

Government Policies: NPK Capacity

Expansions for Diversification Goals

5.

Technical Change: Cheap Energy

Era Returns Due to Fracking

Technology

6.

Technical Change: New Seed

Varieties Require Innovative Products

7.

Corporate Strategies: Leading Mining

companies enter the PK industries

Top 5 Game Changers 1990-2011

1.

Government Policy: China develops

its own N&P industries

2.

Political Change: The break-up of the

former Soviet Union

3.

Government Policy: USA builds a

large ethanol industry

4.

Government Policy: Indian fertilizer

subsidy underpins demand growth

5.

Technical Change: Hydraulic

fracturing lowers U.S. natural gas

prices |

Navigating Today’s Volatile Crop Nutrient Markets

2012 CoBank Knowledge Exchange Forum:

The Globalization of Agriculture: An Era of Promise and Challenge

Chicago, Ill

June 6-7, 2012

Dr. Michael R. Rahm

Vice President, Market and Strategic Analysis

The Mosaic Company

Thank You! |