Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Polypore International, Inc. | a12-14105_18k.htm |

Exhibit 99.1

|

|

1 (NYSE Listed: PPO) William Blair & Company Annual Growth Stock Conference June 2012 |

|

|

2 These materials include "forward-looking statements". In these materials, the words “Polypore,” “Polypore International,” “Company,” “we,” “us” and “our” refer to Polypore International, Inc. together with its subsidiaries, unless the context indicates otherwise. All statements other than statements of historical facts included in these materials that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements, including, in particular, the statements about Polypore International's plans, objectives, strategies and prospects regarding, among other things, the financial condition, results of operations and business of Polypore International and its subsidiaries. We have identified some of these forward-looking statements with words like "believe," "may," "will," "should," "expect," "intend," "plan," "predict," "anticipate," "estimate" or "continue" and other words and terms of similar meaning. These forward-looking statements are based on current expectations about future events affecting us and are subject to uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control. Many factors mentioned in our discussion in these materials will be important in determining future results. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. They can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including with respect to Polypore International, the following, among other things: the highly competitive nature of the markets in which we sell our products; the failure to continue to develop innovative products; the loss of our customers; the vertical integration by our customers of the production of our products into their own manufacturing process; increases in prices for raw materials or the loss of key supplier contracts; our substantial indebtedness; interest rate risk related to our variable rate indebtedness; our inability to generate cash; restrictions related to the senior secured credit agreement; employee slowdowns, strikes or similar actions; product liability claims exposure; risks in connection with our operations outside the United States, including compliance with applicable anti-corruption laws; the incurrence of substantial costs to comply with, or as a result of violations of, or liabilities under environmental laws; the failure to protect our intellectual property; the loss of senior management; the incurrence of additional debt, contingent liabilities and expenses in connection with future acquisitions; the failure to effectively integrate newly acquired operations; absence of expected returns from intangible assets we have recorded; the adverse impact from legal proceedings on our financial condition; and natural disasters, epidemics, terrorist acts and other events beyond our control. Because our actual results, performance or achievements could differ materially from those expressed in, or implied by, the forward looking statements, we cannot give any assurance that any of the events anticipated by the forward looking statements will occur or, if any of them do, what impact they will have on Polypore International's results of operations and financial condition. You are cautioned not to place undue reliance on these forward looking statements, which speak only as of the date of these materials. We do not undertake any obligation to update these forward looking statements in these materials or the risk factors set forth above to reflect new information, future events or otherwise, except as may be required under federal securities laws. This presentation contains certain non-GAAP financial measures, including Adjusted EBITDA. For more information regarding the computation of Adjusted EBITDA and reconciliation to the most directly comparable GAAP measure, see the information and table at the end of the presentation. Safe Harbor Statement |

|

|

Polypore Overview LYNN AMOS Chief Financial Officer 3 |

|

|

4 Polypore is a leading global high technology filtration company specializing in microporous membranes |

|

|

Investment Highlights World Leader in microporous membrane technology Strong foundation of four core growing businesses High recurring revenue Positive long-term trends and leading market positions Businesses have high operating leverage, and substantial capacity investments will drive earnings growth Broad global footprint with large presence in rapid growth Asia region Significant growth opportunity in electric drive vehicles (EDVs), where Polypore has preferred technology and early leadership position 5 Growth driven by positive, long-term demand trends in mobile and portable energy as well as high-performance filtration © 2012 Polypore International, Inc. |

|

|

6 Leading Positions in Our Business Segments Lead acid battery separators for Auto/truck/bus Forklifts Backup power Lithium battery separators for Portable hand-held devices Power tools Electric drive vehicles (“EDVs”) Membranes used in blood filtration applications Hemodialysis Blood oxygenation Plasmapheresis Membranes and devices used for Liquid filtration Degasification/ gasification Water treatment, microelectronics, pharmaceutical, food & beverage, etc. Energy Storage LTM Q1-2012 Sales $565mm TRANSPORTATION & INDUSTRIAL LTM Sales $364mm ELECTRONICS & EDVs LTM Sales $201mm Separations Media LTM Q1-2012 Sales $186mm HEALTHCARE LTM Sales $117mm INDUSTRIAL & SPECIALTY LTM Sales $69mm LTM Q1-2012 Sales $751mm LTM Q1-2012 Adjusted EBITDA* $244mm * As defined in Polypore’s senior secured credit agreement © 2012 Polypore International, Inc... |

|

|

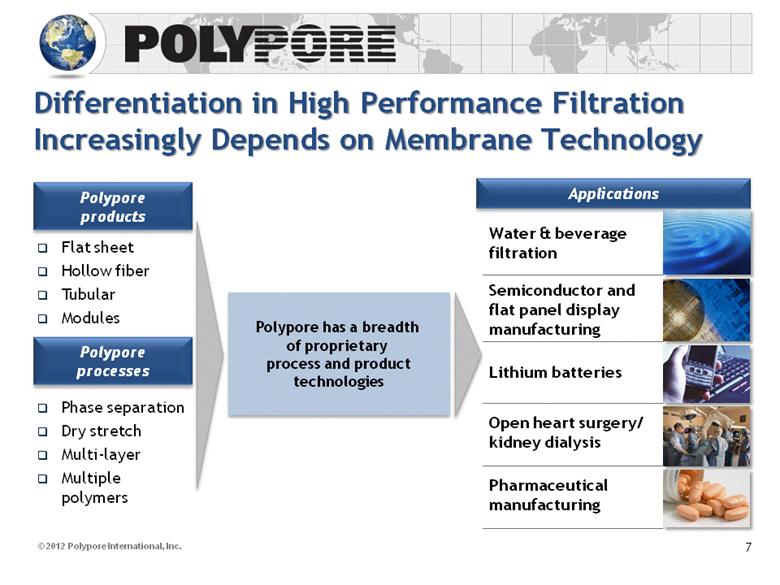

7 Differentiation in High Performance Filtration Increasingly Depends on Membrane Technology Water & beverage filtration Semiconductor and flat panel display manufacturing Lithium batteries Open heart surgery/ kidney dialysis Pharmaceutical manufacturing Polypore products Flat sheet Hollow fiber Tubular Modules Phase separation Dry stretch Multi-layer Multiple polymers Polypore processes Polypore has a breadth of proprietary process and product technologies Applications |

|

|

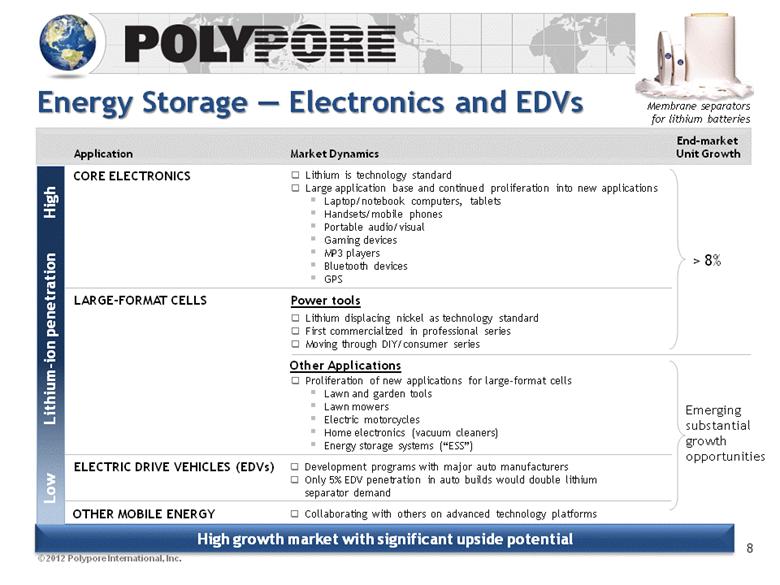

8 Energy Storage — Electronics and EDVs Membrane separators for lithium batteries High growth market with significant upside potential Emerging substantial growth opportunities > 8% Application Market Dynamics Other Applications CORE ELECTRONICS Lithium is technology standard Large application base and continued proliferation into new applications Laptop/notebook computers, tablets Handsets/mobile phones Portable audio/visual Gaming devices MP3 players Bluetooth devices GPS LARGE-FORMAT CELLS Lithium displacing nickel as technology standard First commercialized in professional series Moving through DIY/consumer series Proliferation of new applications for large-format cells Lawn and garden tools Lawn mowers Electric motorcycles Home electronics (vacuum cleaners) Energy storage systems (“ESS”) ELECTRIC DRIVE VEHICLES (EDVs) Development programs with major auto manufacturers Only 5% EDV penetration in auto builds would double lithium separator demand OTHER MOBILE ENERGY Collaborating with others on advanced technology platforms End-market Unit Growth Low Lithium-ion penetration High Power tools © 2012 Polypore International, Inc. |

|

|

9 Substantial Capacity Investments Will Drive Earnings Growth in Lithium Battery Separators Approximately $235 million of $334 million announced capital expenditures have been made Charlotte, NC Final Phase of Charlotte ramping up by mid-2012 Concord, NC (new facility) First phase ramping up in mid-2012 Second phase ramping up later in 2012 and into 2013 Capacity expansions through the second phase will provide $400 million annualized revenue potential sometime in 2013 Third phase ramping up in 2013 and into 2014 © 2012 Polypore International, Inc. Capacity investments are being made to drive substantial growth |

|

|

10 Replacement batteries are 80% of global battery sales Number of vehicles in operation worldwide* * Source: WardsAuto.com and Wards Motor Vehicle Facts & Figures (2007 and 2009 data) 1982-2009 CAGR = 3% Energy Storage — Transportation & Industrial Well positioned in high-growth Asian region. High recurring revenue business due to large replacement market. millions Membrane separators for lead-acid batteries Global leader in lead-acid battery separators Product breadth, scale and global supply capability lead the industry Well-positioned to take advantage of high-growth Asian market Production in Thailand, China, India Thailand facility is the largest lead acid battery separator producer in the region Multi-year sales growth has exceeded 20% per annum Asia is largest separator consuming region in the world Two ongoing expansions in Asia to begin in 2012 Majority-owned JV with leading Chinese lead-acid battery producer (Camel) Additional production line in existing Thailand facility Largest technology portfolio in the industry © 2012 Polypore International, Inc. 0 100 200 300 400 500 600 700 800 900 1,000 1982 1987 1992 1997 2002 2007 2009 |

|

|

11 Separations Media — Healthcare Membranes for medical applications Clinically demonstrated best-in-class PUREMA® membrane. New capacity beginning to ramp up Unique position as leading independent producer with broad product line World’s leading supplier High switching costs Plasmapheresis New treatment methodologies Technology driven growth opportunities 6% growth Modest growth 8% growth Blood Oxygenation Hemodialysis Other Medical Applications © 2012 Polypore International, Inc. — Polypore has leading expertise in blood/membrane interaction — Polypore leverages its healthcare membrane technologies to serve broader filtration applications |

|

|

12 Separations Media — Industrial & Specialty Filtration Membranes & modules for industrial & specialty applications Technology driven growth opportunities New applications for gas transfer technologies Forward integrating into hollow fiber-based modules for MF and UF markets Extending membrane technology to new polymers and configurations End markets Semiconductor and flat panel display manufacturing Ink deaeration Municipal water treatment Desalination prefiltration Wine clarification Ultrapure water for microelectronics and pharmaceutical manufacturing Serum and blood purification Venting applications in pharmaceutical manufacturing Growing End Markets Pharmaceutical/ biotechnology 7–10% growth* Potable water 5–8% growth* Desalination prefiltration 20–25% growth* Source: Frost & Sullivan; Company management. * Based on U.S. markets. OEM Membranes Liqui-Flux® Modules Liqui-Cel® Contactors Polypore is well positioned to serve high-growth and high-value membrane filtration opportunities |

|

|

13 Polypore Serves Attractive End Markets ELECTRONICS & EDVs Laptops, tablets, mobile phones and other handheld devices, portable audio/visual devices, power tools, EDVs High growth, short customer product life cycles >8% + EDV growth TRANSPORTATION & INDUSTRIAL Worldwide fleet of motor vehicles Conversion to high–performance polyethylene separators Major growth region is Asia 80% replacement market >GDP HEALTHCARE Hemodialysis Blood Oxygenation Plasmapheresis >6% Modest 8% End-stage renal disease patient population Conversion to single-use dialyzers Aging population Incidence of heart disease New treatment technologies 100% recurring revenue High switching costs Small base, growth through new adoption INDUSTRIAL & SPECIALTY FILTRATION >8% Global demand for clean water Increasing need for purity in industrial and pharmaceutical processes Multiple fast growing, high-value applications © 2012 Polypore International, Inc. |

|

|

14 Global Infrastructure and Customer Base * Indicates technical center in addition to manufacturing facility Piney Flats, TN Corydon, IN Charlotte, NC* Owensboro, KY* Sélestat, France* Wuppertal, Germany* Tokyo, Japan Shanghai, China Prachinburi, Thailand* Sao Paulo, Brazil Obernberg, Germany Tianjin, China Norderstedt, Germany Seoul, Korea Feistritz, Austria Shenzhen, China Bangalore, India Xiangyang, China 2011 Net Sales by Geography** Manufacturing facility Sales office Operating headquarters ** Net sales by customer location © 2012 Polypore International, Inc. Europe 24% North America 22% Asia 39% Other 15% |

|

|

15 2012 Update Q1 results consistent with February comments Two key EDV customers modified production schedules in the first half of 2012 Expect Q2 lithium sales to be similar to Q1 Sequential improvement expected in other core businesses Based on updated customer forecasts and production schedules, expect strong second half of the year Year-over-year growth is expected in 2012 Momentum carrying into 2013 © 2012 Polypore International, Inc. |

|

|

Financials ROB WHITSETT VP, Finance 16 © 2012 Polypore International, Inc. |

|

|

17 Revenue and Adjusted EBITDA © 2012 Polypore International, Inc. Net sales ($ millions) Adjusted EBITDA ($ millions) |

|

|

18 * Capital Structure in Place to Support Growth ($ in Millions) $294.8 * $90 Million Revolver matures July 2013 Debt Balance As of 3/31/12 2012 2013 2014 2017 US Term Loan $2.4 $3.2 $ Euro Term Loan 0.4 0.5 43.6 7.5% Senior Notes 365.0 $90 Million Revolver * Total Debt $2.8 $3.7 $338.4 $365.0 Cash on Hand Net Debt Net Leverage Ratio $630.9 2.6x $300.4 44.5 365.0 -- $709.9 $79.0 -- -- -- -- -- -- -- -- -- © 2012 Polypore International, Inc. |

|

|

19 Cash & Liquidity Summary Strengthened capital structure and increased liquidity over the last 5 years Total net leverage improved from 5x at year-end 2007 to 2.6x at the end of Q1-2012 Cash generating businesses Generated cash from operations of $145 million in 2011 Funding all announced growth projects with cash from operations Approximately $100 million remaining to be spent of $375 million in growth projects initiated since August 2009 5 Lithium separator expansions in U.S. targeted for EDV applications Lithium separator expansion in Korea for consumer electronics Hemodialysis membrane (PUREMA®) expansion in Germany Lead Acid separator expansions in China and Thailand © 2012 Polypore International, Inc. |

|

|

Takeaways World Leader in microporous membrane technology Strong foundation of four core growing businesses High recurring revenue Positive long-term trends and leading market positions Businesses have high operating leverage, and substantial capacity investments will drive earnings growth Broad global footprint with large presence in rapid growth Asia region Significant growth opportunity in electric drive vehicles (EDVs), where Polypore has preferred technology and early leadership position 20 Growth driven by positive, long-term demand trends in mobile and portable energy as well as high-performance filtration © 2012 Polypore International, Inc. |

|

|

APPENDIX 21 © 2012 Polypore International, Inc. |

|

|

22 Non-GAAP Supplemental Information Adjusted EBITDA is a non-GAAP financial measure presented herein as a supplemental disclosure to net income and reported results. Adjusted EBITDA is defined in our credit agreement and represents earnings before interest, taxes, depreciation and amortization and certain non-operating items, business restructuring costs and other non-cash or non-recurring charges. For more information regarding the computation of Adjusted EBITDA and the reconciliation of Adjusted EBITDA to net income, please see the attached financial table. We present Adjusted EBITDA because we believe that it is a useful indicator of our operating performance. Adjusted EBITDA is a measure used in our credit agreement to determine the availability of borrowings under our revolving credit facility. We also use Adjusted EBITDA to review and assess operating performance in connection with employee incentive programs and the preparation of our annual budget and financial projections. We believe that the use of Adjusted EBITDA also facilitates the comparison of results between periods. © 2012 Polypore International, Inc. |

|

|

23 Appendix A Adjusted EBITDA © 2012 Polypore International, Inc. Twelve Months Ended March 31, 2012 Net income $98.3 Add/Subtract: Depreciation and amortization expense 52.8 Interest expense, net 34.3 Income taxes 48.2 EBITDA 233.6 Stock-based compensation 12.6 Foreign currency gain (3.0) Loss on disposal of property, plant and equipment 0.5 Costs related to the FTC litigation 0.4 Other non-cash or non-recurring charges 0.1 Adjusted EBITDA $244.2 |