Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BUCKEYE PARTNERS, L.P. | d362565d8k.htm |

Buckeye Partners, L.P.

2012 Annual Unitholders Meeting

June 5, 2012

Four Seasons Hotel, Houston, Texas

Exhibit 99.1 |

2

Legal Notice / Forward–Looking Statements

This

presentation

contains

"forward-looking

statements"

that

we

believe

to

be

reasonable

as

of

the

date

of

this

presentation.

These

statements,

which

include

any

statement

that

does

not

relate

strictly

to

historical

facts,

use

terms

such

as

“anticipate,”

“assume,”

“believe,”

“estimate,”

“expect,”

“forecast,”

“intend,”

“plan,”

“position,”

“predict,”

“project,”

or

“strategy”

or

the

negative

connotation

or

other

variations

of

such

terms

or

other

similar

terminology.

In

particular,

statements,

express

or

implied,

regarding

future

results

of

operations

or

ability

to

generate

sales,

income

or

cash

flow,

to

make

acquisitions,

or

to

make

distributions

to

unitholders

are

forward-looking

statements.

These

forward-looking

statements

are

based

on

management’s

current

plans,

expectations,

estimates,

assumptions

and

beliefs

concerning

future

events

impacting

Buckeye

Partners,

L.P.

(the

“Partnership”

or

“BPL”)

and

therefore

involve

a

number

of

risks

and

uncertainties,

many

of

which

are

beyond

management’s

control.

Although

the

Partnership

believes

that

its

expectations

stated

in

this

presentation

are

based

on

reasonable

assumptions,

actual

results

may

differ

materially

from

those

expressed

or

implied

in

the

forward-looking

statements.

The

factors

listed

in

the

“Risk

Factors”

sections

of,

as

well

as

any

other

cautionary

language

in,

the

Partnership’s

public

filings

with

the

Securities

and

Exchange

Commission,

provide

examples

of

risks,

uncertainties

and

events

that

may

cause

the

Partnership’s

actual

results

to

differ

materially

from

the

expectations

it

describes

in

its

forward-looking

statements.

Each

forward-looking

statement

speaks

only

as

of

the

date

of

this

presentation,

and

the

Partnership

undertakes

no

obligation

to

update

or

revise

any

forward-looking

statement.

Pending

Perth

Amboy

Terminal

Acquisition.

Our

pending

Perth

Amboy

Terminal

acquisition

may

not

be

consummated.

The

closing

of

the

acquisition

is

subject

to

certain

environmental

and

real

property

regulatory

conditions

and

customary

closing

conditions,

and

the

acquisition

agreement

may,

in

certain

circumstances,

be

terminated.

Please

see

page

25

“Our

pending

acquisition

of

Perth

Amboy

Terminal

may

not

be

consummated”

for

more

information. |

3

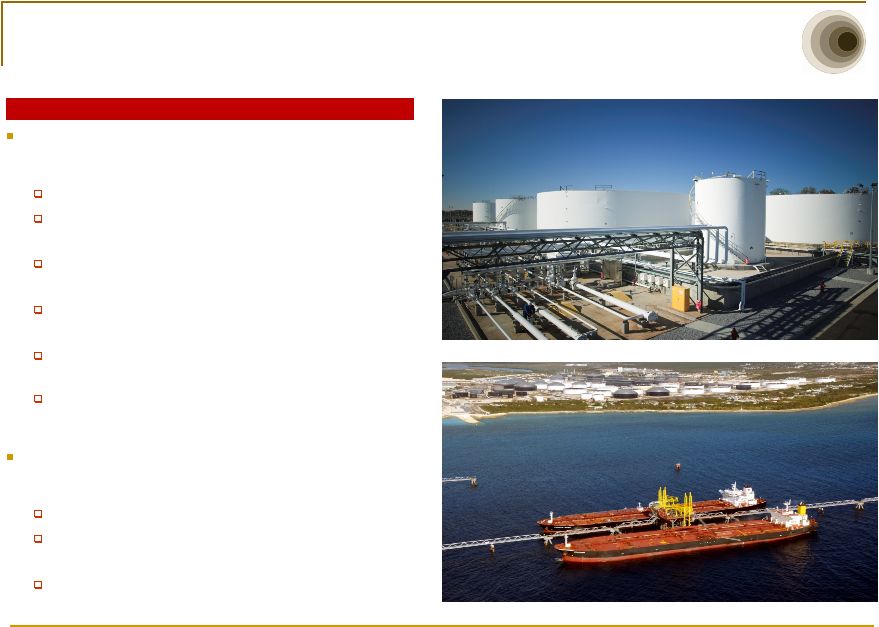

Buckeye Investment Highlights

Over 125 years of continuous operations, with 26-year

track record as a publicly traded MLP on the NYSE

Market capitalization of approx. $4.5 billion

Lower cost of capital realized from elimination of

general partner incentive distribution rights (IDRs)

Investment grade financial metrics and a conservative

approach toward financing growth

Increased geographic and product diversity resulting

from recent acquisitions

Opportunities for significant internal growth projects on

legacy and recently acquired assets

Paid cash distributions each quarter since formation in

1986

Ariel view of BORCO’s 6 offshore jetties with tank farm in the

distance Petroleum storage tanks at our Macungie terminal in

Pennsylvania |

4

Management Objectives

The current management team has consistently executed

on each element of our strategy to transform Buckeye

into a best-in-class asset manager by:

Implementing best practices across our business

Improving our cost structure through an

organizational restructuring in 2009

Expanding our asset portfolio through accretive

acquisitions and organic growth projects

Diversifying our legacy business into new

geographies, products, and asset classes

Reducing cost of capital through buy-in of our

general partner

Financing acquisitions with conservative mix of debt

and equity

We continue to be committed to our mission of

delivering superior returns through our talented, valued

employees and our core strengths of:

Best-in-class customer service

An unwavering commitment to safety,

environmental responsibility, and personal integrity

An entrepreneurial approach toward asset acquisition

and development

Buckeye Strategy

Piping infrastructure at one of our petroleum products terminals

Newly refurbished off shore jetty placed in service in the fourth quarter of

2011 |

5

CEO Succession and Strategic Organizational

Realignment

Management Structure after Reorganization

CEO succession effective February 10, 2012:

Clark C. Smith, Buckeye’s President and Chief Operating

Officer, succeeded Forrest E. Wylie as Chief Executive Officer,

and joined the Board of Directors of Buckeye’s general partner.

Forrest E. Wylie continues to serve as Non-Executive Chairman

of the Board, where he remains active in developing our strategic

vision.

Strategic Organizational Realignment, effective January

16, 2012; Buckeye operations organized into three

business units, each headed by a President.

Domestic Pipelines and Terminals

International Pipelines and Terminals

Buckeye Services

Board of Directors

Forrest E. Wylie, Chairman

Clark C. Smith

Chief Executive Officer

Mary F. Morgan

President, International

Pipelines and Terminals

Robert A. Malecky

President, Domestic

Pipelines and Terminals

Jeremiah J. Ashcroft III

President,

Buckeye Services

Domestic

Pipelines

Domestic

Terminals

BORCO

Terminal

Yabucoa

Terminal

Energy

Services

Natural Gas

Storage

Strategic Organizational Realignment rationale:

Previous structure organized around functions (e.g.,

commercial, operations, etc.).

Growth has resulted in increased complexities in each of

Buckeye’s business areas, requiring focus and ownership

of skilled executives on daily basis.

Allows business unit Presidents to focus on all aspects

of performance -

including commercial, operational, and

financial performance -

of their respective business unit.

Presidents of business units accountable for overall

performance of those units.

Development

& Logistics

Keith E. St.Clair

Chief Financial

Officer

Khalid A. Muslih

Corp. Development

Strategic Planning

William H.

Schmidt, Jr.

General Counsel

Mark S. Esselman

Global

Human Resources |

6

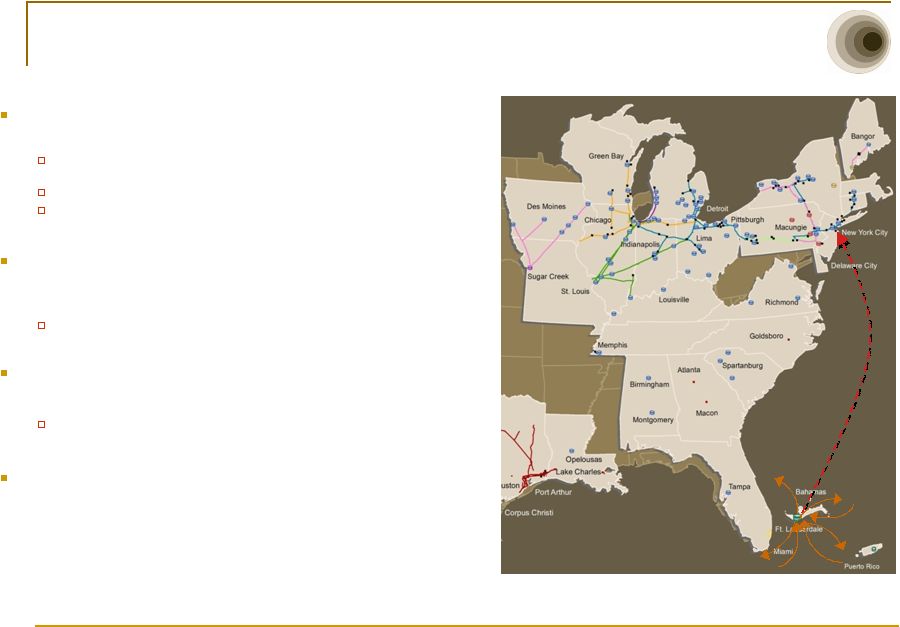

Organizational Overview

Three Business Operating Units

Domestic Pipelines & Terminals

Over 6,000 miles of pipeline with ~ 100 delivery locations

Approximately 100 liquid petroleum product terminals

Over 37 million barrels of liquid petroleum product storage

capacity

International Pipelines & Terminals

Over 26 million barrels of storage capacity at 2 terminal

facilities in The Bahamas (~21 million) and Puerto Rico (~5

million)

Deep water berthing capability to handle ULCCs and VLCCs in

The Bahamas

Announced expansion underway to add approx. 4.7 million

barrels at Bahamian facility

Buckeye Services

Energy Services

Markets refined petroleum products in areas served by

Domestic Pipelines & Terminals

5 terminals with ~ 1 million barrels of storage capacity

Natural Gas Storage

~30 Bcf of working natural gas storage capacity in

northern California

Development & Logistics

Operates ~2,800 miles of pipeline and 1.4 million barrels

of storage capacity under operation and maintenance

contracts

(1)

See Appendix for Non-GAAP Reconciliations |

7

Buckeye System Map |

8

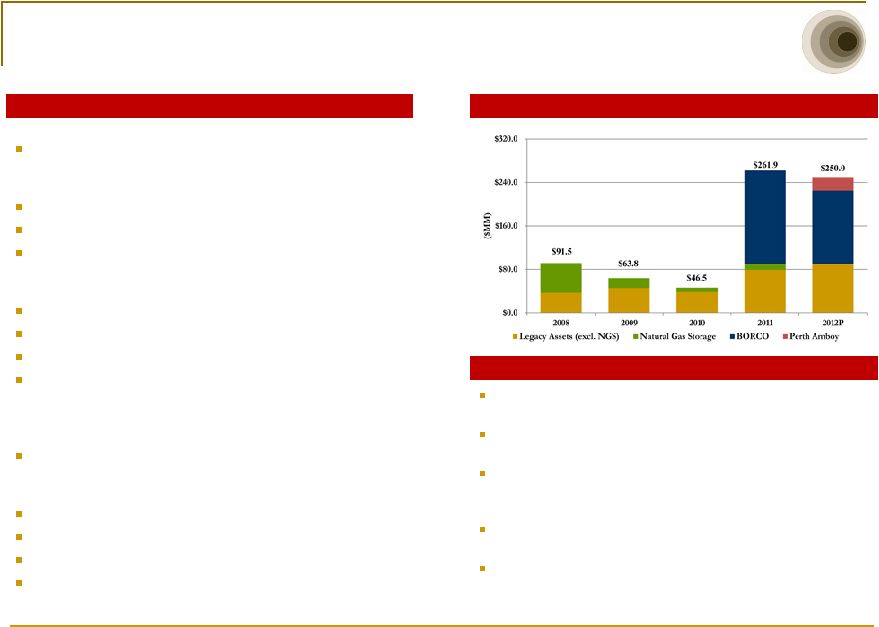

Value Creation / Growth Drivers

$3.4 Billion Invested Since 2008

Organic Growth Capital Spending

Major Capital Projects

2012

Perth Amboy, NJ Marine Terminal, $260.0 million -

Pending

2011

BORCO Marine Terminal, $1.7 billion

BP Pipeline & Terminal Assets, $165.0 million

Maine Terminals and Pipeline, $23.5 million

2010

Buy-in of BPL’s general partner, 20 million units issued

Yabucoa, Puerto Rico Terminal, $32.6 million

Opelousas, Louisiana Terminal, $13.0 million

Additional Equity Interest in West Shore Pipe Line Company,

$13.5 million

2009

Blue/Gold Pipeline and Terminal Assets, $54.4 million

2008

Lodi Natural Gas Storage, $442.4 million

Farm & Home Oil Company

(2)

, $146.2 million

(3)

Niles and Ferrysburg, Michigan Terminals, $13.9 million

Albany, NY Terminal, $46.9 million

(1)

Excludes acquisitions with a value of $10 million or lower

(2)

Now Buckeye Energy Services

(3)

Buckeye sold the retail division of Farm & Home Oil Company in 2008 for $52.6

million Recent and Pending Transactions

(1)

Transformation of Perth Amboy terminal into highly efficient,

multi-product storage, blending, and throughput facility

Significant expansion and product diversity plans at BORCO

facility

Propylene rail loading and storage project and storage

expansion and unit train rack construction at two terminals

within our Chicago complex

Pipeline expansion between our Linden, NJ and Macungie, PA

terminals to increase capacity to western PA

Butane blending and vapor recovery installations planned for

numerous terminal facilities across our system |

9

Domestic Pipelines & Terminals |

10

Domestic Pipelines & Terminals Overview

Pipelines & Terminals segment represents Buckeye’s largest

segment contribution to Adjusted EBITDA

Over 6,000 miles of pipeline located primarily in the

Northeast and Midwest United States moving over 1.3

million barrels of liquid petroleum products per day with

more than 100 delivery points

Approximately 100 liquid petroleum product storage

terminals located throughout the United States

Over 37 million barrels of storage capacity

Terminal

Throughput

Volumes

(2)

Pipeline

Throughput

Volumes

(1)

(2)

(1)

YTD as of March 31, 2012

(2)

Pipeline volumes exclude contribution from the Buckeye NGL Pipeline sold in

January of 2010 Petroleum storage tanks at our Macungie terminal in

Pennsylvania |

11

BP Acquisition –

Strong Results

Belton, SC

Pittsburgh, PA

Pipeline and terminal volumes have exceeded plan since

inception

Continued growth expected with several additional new

contracts still to be signed in the short-term

Belton, SC and Pittsburgh, PA are select examples that

highlight significant growth through incremental third-

party business and new products and service offerings

A Successful Start

27

Number of new third-party terminal

customers

330

Million gallons of new business added since

acquisition

7.9

Percentage of volume growth across all new

33 acquired terminals since inception

Preliminary plans to build a new tank and add a new rack

bay to accommodate growing business

Biodiesel blending project underway and expected to be

completed by September 2012 |

12

Perth Amboy Acquisition Overview

Acquisition of a New York Harbor marine terminal for liquid petroleum products

from Chevron for $260 million in cash Unique opportunity to acquire key

link in the product logistics chain to unlock significant long-term value across the Buckeye

enterprise

Near-term plans to transform existing terminal into a highly efficient,

multi-product storage, blending and throughput facility Anticipated

growth capex investment in the facility of ~$200-225 million over the next three years at attractive annual Adjusted

EBITDA investment multiple of 4 –

5x, resulting in all-in Adjusted EBITDA investment multiple of 7

– 8x

(2)

Transaction supported by multi-year storage, blending, and throughput

commitments from Chevron Estimated to close in late Q2 2012 or early Q3

2012 Expected to be accretive to distributable cash flow per unit in

2013 Transaction Overview

(1)

Facility Overview

Located in New York Harbor as a NYMEX delivery point

Approximately 4.0 MMBbls total storage capacity

4 docks (1 ship, 3 barge

(3)

) with water draft up to 37’

Pipeline, water, rail, and truck access

~250 acre site with significant undeveloped acreage for

expansion potential

Close proximity for integration with Buckeye’s Linden

complex

(1)

The acquisition is subject to closing conditions and the acquisition agreement

may, in certain circumstances, be terminated. As a result, we cannot

assure you if or when the acquisition will

close. Please see page 25 “Our pending acquisition of Perth Amboy

Terminal may not be consummated”

for more information.

Aerial Overview

Note: Facility located in Perth Amboy, NJ. Green line above

indicates approximate property boundaries (2)

Includes acquisition purchase price and capital spent on tanks, terminal piping,

dock and truck rack improvements, and ~6 miles of new 16”

pipeline to be constructed from Perth Amboy to Buckeye’s Linden, NJ

complex. (3)

One of the barge docks is currently out of service

~2.7 MMBbls of active refined product storage

~1.3 MMBbls of refurbishable storage |

13

Long-Term Vision –

“Connecting the Dots…”

Global supply locations and product flows will shift over

the long-term

Buckeye

recognized

the

need

to

further

accommodate

waterborne refined product imports into the Northeast

U.S.

Execution

on

this

strategy

will

continue

to

differentiate

Buckeye’s

service

offerings

and

provide

sustainability

and

optionality

for

further

growth

in

our

core

businesses

BORCO

Perth Amboy

Northeast

U.S.

refineries

face

long-term

challenges

from

high cost and low investment

Anticipate

new

sources

of

product

supply

in

the

future

New

global

refining

capacity

coming

online

will

seek

deficit markets

A

component

of

our

strategy

in

acquiring

BORCO

was

to help facilitate product flow into the Buckeye system

in PADD I

Create

a

more

fully

integrated

and

flexible

system

that

offers

unparalleled connectivity and service capabilities

BORCO

and

Perth

Amboy

are

two

key

components

of

a

long-term strategy: |

14

Domestic Pipelines & Terminals Growth Potential

Projects

Utica Shale Opportunity:

Development is in early

stages, but industry

consensus is need for

crude logistics solutions

will arise

Buckeye has presence in

area and has opportunity

to utilize existing

infrastructure, including

ROW and underutilized

lines, to be key logistics

provider

Propylene Rail Facility (in progress):

Construction of new propylene storage at East Chicago

facility

Add rail loading capability at that facility

NY Harbor to PA Expansion (completed 4/1/12):

Increased Buckeye’s ability to handle NY Harbor barrels

destined for the Pennsylvania market

Incremental 30,000 bpd of pipeline capacity

Bakken Crude:

Contracted to offload approx. 8600 bpd of Bakken crude

for refinery customer at Woodhaven, MI facility

In preliminary discussions with multiple customers

regarding supplying Bakken crude to the East Coast

refineries

Butane Blending:

Significant growth driven by strong blending margins

Improved blending efficiencies and oversight

Opportunities for further locational deployment of

blending capabilities

Miami and JFK Airports Pipeline Expansions

(potential):

Reviewing expansion options as a result of jet fuel

volume growth

Chicago Complex Crude Oil Storage Opportunity

(potential):

Opportunity to leverage asset footprint in Chicago to

take advantage of changing crude oil slates in the

market |

15

FERC Order

Buckeye Pipe Line’s Market-Rate Program

Program Footprint

Possible Outcomes

In 1991, FERC approved Buckeye Pipe Line Company,

L.P.’s (“BPL Co.”) use of an innovative rate-setting

system.

In competitive markets, BPL Co. sets rates

competitively under the program, subject to a cap

Rates in the other markets are tied to changes in

competitive market rates

On March 1, 2012, BPL Co. filed for system-wide rate

increases under the program, to which a single shipper in

the New York City area protested.

On March 30, 2012, FERC issued an order rejecting the

rate increases and indicated FERC would review whether

to continue the program. BPL Co.’s response, which was

filed May 15

th

, affirmed that the program has functioned

reasonably, has adjusted rates in line with the pipeline

industry, and has not caused undue discrimination among

its shippers.

Interested parties have until June 29 to reply to our

response.

History of Program

Buckeye believes the program should be preserved

because the markets remain competitive and the program

is in line with industry experience and overall cost trends.

FERC may discontinue or modify the program to it’s

generic rate-setting methodology of indexing or one of

the alternative methodologies (market-based, cost-based,

or settlement-based rates).

Depending on the outcome of FERC’s review, the level

of some or all of BPL Co.’s rates could be subject to

change, which could have a material impact on our

revenues.

Approximately 70% of Buckeye’s total pipeline revenue in

2011 and under 50% of our Pipeline & Terminals

segment’s 2011 revenues.

In 1991, when FERC last reviewed BPL Co.’s markets:

15 of the 20 markets (50% of BPL Co.’s 2011

revenues) were designated competitive

Four out of 20 markets (25% of BPL Co.’s 2011

revenues) were considered non-competitive

No determination was made regarding the NYC

market (remaining 25% of BPL Co.’s 2011 revenues)

FERC order does not affect any pipelines or terminals

owned by our other operating subsidiaries. |

16

International Pipelines & Terminals

Yabucoa

BORCO |

17

International Pipelines & Terminals Overview

BORCO

World-class marine storage terminal for crude oil, fuel oil, and refined

petroleum products

21.4 MMBbls capacity

Located in Freeport, Bahamas, 80 miles from Southern Florida and

920 miles from New York Harbor

Deep-water access (up to 91 feet) and the ability to berth VLCCs and

ULCCs

Majority of capacity under long-term (3-5 year) take or pay

contracts World class customer base

Variable revenue generation from ancillary services such as berthing,

blending, bunkering, and transshipping

Hub for international logistics

Expansion project approved for 4.7 million barrels with room to

double existing storage capacity

(1)

Excludes non-cash amortization of unfavorable storage contracts.

Well maintained facility with superior blending/manufacturing

facilities

4.6 million barrels of refined petroleum product, fuel oil, and crude

oil storage capacity

Strategic location supports a strong local market and also provides

regional growth opportunities

Long-term fee-based revenues supported by multi-year volume

commitments from Shell

Yabucoa, Puerto Rico |

18

BORCO Berthing Capabilities

Six Offshore Jetties and Inland Dock

Berth 5

Fuel Oil

Clean Products

Berth 6

Fuel Oil

Clean Products

Berth 7

Fuel Oil

Clean Products

Berth 8

Fuel Oil

Clean Products

Berth 9

Crude Oil

Fuel Oil

Berth 10

Crude Oil

Fuel Oil

Berth 12 (Inland Dock)

Fuel Oil

Clean Products |

19

BORCO Internal Growth Projects

Expansion and Other Growth Opportunities

Expansion project at BORCO well underway

Phase 1 to add approximately 3.5 million barrels of storage

capacity

~ 1.9 million barrels expected to be in-service in the

second half of 2012; combination of refined products

and fuel oil storage

~ 1.6 million barrels to be in-service in first half of

2013; refined products storage

Initiation of Phase 2 expansion of 1.2 million barrels expected

to be in service Q3 2013

Supported by long-term contract with major customer

Longer term opportunity to double existing storage capacity

Offshore jetty (2 berths) and inland dock construction

completed and operations initiated in Q4 2011

(1)

Graph reflects expected midpoint of capital spend range. Dates represent expected

date that capacity is placed in service. Q3 ‘12

Q4 ‘12

Q2 ‘13

Q3 ‘13

Q3 ‘14

Q3 ‘15

Significant Land Available for Expansion

BORCO

Expansion

Capacity

(1)

Q3 ‘12

Q4 ‘12

Q3 ‘13

Q1 ‘13

Q3 ‘15

Crude Unit

Strong interest in setting up crude topping unit at

BORCO

Driver: need for low sulfur fuel oil

Strategic alliance could also support GC exports as

shale/Canadian crude floods into GC (export after

“minor processing”)

Bunkering Opportunities –

Blended Fuel Oil

BORCO is the logical, geographical, optimum spot for

a new “Bunker filling station”

Other

Internal

Growth

Opportunities |

20

Buckeye Services |

21

Buckeye Services Overview

Natural Gas Storage

Buckeye Energy Services (“BES”) markets refined

petroleum products and other ancillary products in

areas served by Buckeye’s pipelines and terminals

BES offers a wide range of products such as heating

oil, diesel, kerosene, propane, gasoline, and ethanol

and other bio fuels

Over 1 billion gallons of products sold in 2011

Executing new strategy for mitigating basis risk,

including a reduction of refined product inventories

in the Midwest and focusing on fewer, more strategic

locations for transacting business

Energy Services

Development & Logistics

Buckeye Development & Logistics (“BDL”)

currently operates approximately 2,800 miles of

pipelines and 1.4 million barrels of storage capacity

BDL is also responsible for identifying and

completing potential acquisitions and organic growth

projects for Buckeye

BDL services offered to customers

Contract operations

Project origination

Asset development

Engineering design

Project management

Buckeye’s Lodi Gas Storage facility is a high performance natural gas

storage facility with approximately 30 Bcf of working gas capacity in

Northern California serving the greater San Francisco Bay Area Revenue is

generated through firm storage services and hub services The facilities

collectively have a maximum injection and withdrawal capability of approximately

550 million cubic

feet per day (MMcf/day) and

750 MMcf/day, respectively

Lodi's facilities are designed to provide high deliverability natural gas

storage service and have a proven track record

of safe and reliable operations |

22

Financial Overview |

23

Financial Performance

Adjusted EBITDA ($MM)

(1) (2)

Cash Distributions per Unit

Cash

Distribution

Coverage

(2)

(3)

(1)

LTM as of March 31, 2012

(2)

See Appendix for Non-GAAP Reconciliations

(3)

Distributable cash flow divided by cash distributions declared for the respective

periods (4)

Long-term debt less cash and cash equivalents divided by Adjusted

EBITDA Net LT Debt/ Adjusted EBITDA

(1)(4)(6)

(5) Pro forma distribution coverage excludes $17.1

million of acquisition and integration expenses incurred in 2011 and

$19.1 million during the LTM period ended March 31, 2012

(6) For purposes of calculating the leverage, Adjusted

EBITDA is adjusted for pro forma impacts of acquisitions

|

24

Investment Summary

Proven 26-year track record as a publicly traded partnership through varying

economic and commodity price cycles

Diversified portfolio of assets provides balanced mix of stability and growth

and is well positioned to take advantage of improving economic

conditions Recent acquisitions provide Buckeye with increased geographic

and product diversity, including access to international logistics

opportunities, and provide significant near term growth projects Pending

acquisition of marine terminal facility in Perth Amboy, NJ from Chevron furthers Buckeye’s

strategy to create a fully integrated and flexible system that offers

unparalleled connectivity and service capabilities; provides significant

near term growth opportunities at attractive multiple.

World-class

BORCO

marine

storage

terminal

with

21.6

million

barrels

of

storage

capacity

for

crude

oil

and

liquid petroleum products in Freeport, Bahamas with approved expansion project

of 4.7million barrels; serves as important logistics hub for

international petroleum product flows. Management continues to drive

operational excellence through its best practices initiative

Stability and Growth |

25

Our pending acquisition of Perth Amboy Terminal may not be

consummated

Risks Related to Consummation of Perth Amboy Acquisition

Our

pending

acquisition

of

the

Perth

Amboy

Terminal

may

not

be

consummated.

Our

pending

acquisition

of

the

Perth

Amboy

Terminal

is

expected

to

close

in

late

second

quarter or early third quarter of 2012 and is subject to closing

conditions and regulatory approvals. If these conditions and

regulatory approvals are not satisfied or waived, the

acquisition will not be consummated. If the closing of the acquisition

is substantially delayed or does not occur at all, or if the terms of the acquisition are required to be

modified substantially due to regulatory concerns, we may not realize

the anticipated benefits of the acquisition fully or at all. Certain of the conditions remaining to be

satisfied include:

In

addition,

the

Perth

Amboy

Purchase

and

Sale

Agreement

may

be

terminated

by

mutual

agreement

of

the

parties

thereto

or

as

follows

(i)

by

Buckeye,

if

the

acquisition

has

not

closed

on

or

before

June

30,

2012

and,

because

the

HSWA

Permit

had

not

been

released

for

public

comment

on

or

before

March

31,

2012,

by

Chevron

if

the

acquisition

has

not

closed

on

or

before

July

31,

2012

(in

each

case,

subject

to

a

30-day

extension

to

give

effect

to

certain

cure

periods),

(ii)

by

either

Chevron

or

Buckeye,

if

the

other

party

has

materially

breached

its

obligations

under

the

Purchase

and

Sale

Agreement,

which

breaches

have

not

been

cured

within

the

applicable

time

frame

or

that

by

their

nature

cannot

be

cured,

(iii)

by

either

Chevron

or

Buckeye,

if

any

statute,

rule

or

regulation

makes

consummation

of

the

acquisition

illegal

or

otherwise

prohibited,

or

if

any

order,

decree,

ruling

or

other

action

by

any

governmental

authority

permanently

restraining,

enjoining

or

otherwise

prohibiting

the

consummation

of

the

acquisition

has

become

final

and

non-appealable,

(iv)

by

Chevron,

if

Buckeye

conducts

internal

inspections

of

out

of

service

tanks

on

the

Facility,

retains

or

utilizes

the

services

of

a

New

Jersey

licensed

site

remediation

professional

or

has

any

communications

with

any

governmental

authority

with

respect

to

the

assets

subject

to

the

Purchase

and

Sale

Agreement

(other

than

pursuant

to

the

HSR

Act

or

solely

in

anticipation

of

the

transfer

of

the

assets

to

Buckeye

at

the

closing),

(v)

by

Buckeye,

upon

the

occurrence

of

a

Material

Discovery

or

a

Material

Adverse

Change,

subject

to

certain

cure

rights

of

Chevron,

(vi)

by

Chevron,

upon

its

reasonable

determination

that

a

Material

Discovery

relating

to

environmental

liabilities

cannot

be

cured

or

remediated

using

reasonable

methods

or

resources,

(vii)

by

either

Chevron

or

Buckeye,

upon

the

occurrence

of

certain

damage

to,

or

destruction

or

condemnation

of,

the

assets

subject

to

the

Purchase

and

Sale

Agreement

not

constituting

a

Material

Adverse

Change,

subject

to

certain

cure

rights

of

Chevron,

and

(viii)

by

Chevron,

if

it

determines

in

its

sole

discretion

that

the

HSWA

Permit

is

not

satisfactory.

•

the issuance by the United States Environmental Protection Agency of an

amended hazardous and solid waste permit (the “HSWA Permit”) on terms satisfactory to

Chevron in its sole discretion;

•

the grant of a legal subdivision of certain real property to be

retained by Chevron; •

the absence of any damage to, or destruction or condemnation of,

the assets subject to the Purchase and Sale Agreement which reduces

the economic value of such assets by $20,000,000 or more (a

“Material Adverse Change”); or, if any Material Adverse Change has occurred, the cure or other mutually agreeable resolution

thereof;

•

the absence of certain factual discoveries by Buckeye of certain

matters relating to title, environmental liabilities or regulatory

obstacles which reduce the economic value of the assets subject

to the Purchase and Sale Agreement by $20,000,000 or more, subject to certain exclusions (a “Material Discovery”); or, if any Material

Discovery has occurred, the cure or other mutually agreeable resolution

thereof; and •

the absence of any pending or threatened litigation or administrative

proceeding, or any pending investigation, by any party or any third party seeking to restrain or

prohibit (or questioning the validity or legality of) the consummation

of the transactions contemplated by the Purchase and Sale

Agreement or seeking damages in

connection therewith which makes it unreasonable to proceed with

the consummation of the transactions contemplated thereby.

|

26

Non-GAAP Reconciliations |

27

Basis of Representation; Explanation of Non–GAAP Measures

Buckeye’s equity-funded merger with Buckeye GP Holdings, L.P.

(“BGH”) in the fourth quarter of 2010 has been treated as a reverse merger for accounting purposes. As a result,

the historical results presented herein for periods prior to the

completion of the merger are those of BGH, and the diluted weighted average

number of LP units outstanding increase from 20.0 million in the fourth

quarter of 2009 to 44.3 million in the fourth quarter of 2010. Additionally, Buckeye incurred a

non-cash charge to compensation expense of $21.1

million in the fourth quarter of 2010 as a result of a distribution of LP units

owned by BGH GP Holdings, LLC to certain officers of Buckeye, which triggered a revaluation of an

equity incentive plan that had been instituted in 2007.

Adjusted EBITDA and distributable cash flow are measures not defined by

GAAP. Adjusted EBITDA is the primary measure used by our senior management, including our Chief

Executive Officer, to (i)

evaluate our consolidated operating performance and the operating performance

of our business segments, (ii) allocate resources and capital to business

segments, (iii) evaluate the viability of proposed projects, and

(iv) determine overall rates of return on alternative investment opportunities.

Distributable cash flow is another measure used by our senior management

to provide a clearer picture of Buckeye’s cash available for distribution to its unitholders. EBITDA, another measure not defined under GAAP, is

defined as net income attributable to Buckeye’s unitholders before interest

and debt expense, income taxes and depreciation and amortization.

Adjusted EBITDA and distributable cash flow eliminate (i) non-cash

expenses, including, but not limited, to depreciation and amortization expense resulting from the significant capital investments we make in our

businesses and from intangible assets recognized in business combinations, (ii)

charges for obligations expected to be settled with the issuance of equity instruments, and (iii) items

that are not indicative of our core operating performance results and business

outlook. Buckeye believes that investors benefit from having access to the

same financial measures used by senior management and that these measures are useful to investors because they aid

in comparing Buckeye’s operating performance with that of other companies

with similar operations. The Adjusted EBITDA and distributable cash flow data presented by Buckeye

may not be comparable to similarly titled measures at other companies because

these items may be defined differently by other companies. Please see the

attached reconciliations of each of Adjusted EBITDA and distributable cash flow to net income.

This presentation references forward-looking estimates of Adjusted EBITDA

and investment multiples projected to be generated by the Perth Amboy terminal. A reconciliation of

estimated Adjusted EBITDA to GAAP net income is not provided because GAAP net

income generated by the Perth Amboy terminal for the applicable periods is not accessible.

Buckeye has not yet completed the necessary valuation of the various assets to

be acquired, a determination of the useful lives of these assets for accounting purposes, or an allocation

of the purchase price among the various types of assets. In

addition, interest and debt expense is a corporate-level expense that is not allocated among Buckeye’s segments and could

not be allocated to the Perth Amboy terminal operations without unreasonable

effort. Accordingly, the amount of depreciation and amortization and interest and debt expense that

will be included in the additional net income generated as a result of the

acquisition of the Perth Amboy terminal is not accessible or estimable at this time. The amount of such

additional resulting depreciation and amortization and applicable interest and

debt expense could be significant, such that the amount of additional net income would vary

substantially from the amount of projected Adjusted EBITDA.

Buckeye believes that investors benefit from having access to the same financial

measures used by Buckeye’s management. Further, Buckeye believes that these measures are useful to

investors because they are one of the bases for comparing Buckeye’s

operating performance with that of other companies with similar operations, although Buckeye’s measures may

not be directly comparable to similar measures used by other companies.

|

28

Non-GAAP Reconciliations

Net Income to Adjusted EBITDA ($M)

(1)

LTM as of March 31, 2012.

(2)

On November 19, 2010, Buckeye merged with Buckeye GP Holdings L.P.

(3)

In 2010, Buckeye revised its definition of Adjusted EBITDA to exclude

non-cash unit-based compensation expense, the 2010 non-cash equity plan modification expense and income attributable to

noncontrolling interests affected by the merger for periods prior to our

buy-in of our general partner. These amounts were excluded

from Adjusted EBITDA presented for 2008, 2009 and 2010 in our

Annual Report on Form 10-K for the year ended December 31, 2010, as

amended. Adjusted EBITDA for 2007 has been restated in this

presentation to exclude these amounts for comparison purposes.

2007

2008

2009

2010

2011

LTM

(1)

Net income attributable to BPL

22,921

26,477

49,594

43,080

108,501

93,967

Interest and debt expense

51,721

75,410

75,147

89,169

119,561

119,874

Income tax expense (benefit)

760

801

(343)

(919)

(192)

321

Depreciation and amortization

40,236

50,834

54,699

59,590

119,534

126,320

EBITDA

115,638

153,522

179,097

190,920

347,404

340,482

-

Net

income

attributable

to

noncontrolling

interests

affected

by

merger

(2)

131,941

153,546

90,381

157,467

-

-

Amortization of unfavorable storage contracts

-

-

-

-

(7,562)

(8,378)

Gain on sale of equity investment

-

-

-

-

(34,727)

(34,727)

Non-cash deferred lease expense

-

4,598

4,500

4,235

4,122

4,067

Non-cash unit-based compensation expense

968

1,909

4,408

8,960

9,150

9,691

Equity plan modification expense

-

-

-

21,058

-

-

Asset impairment expense

-

-

59,724

-

-

-

Goodwill impairment expense

-

-

-

-

169,560

169,560

Reorganization expense

-

-

32,057

-

-

-

Adjusted

EBITDA

(3)

248,547

313,575

370,167

382,640

487,947

480,695

-

Adjusted Segment EBITDA

-

Pipelines & Terminals

238,830

253,790

302,164

346,447

361,018

359,130

International Operations

-

-

-

(4,655)

112,996

119,155

Natural Gas Storage

-

41,814

41,950

29,794

4,204

484

Energy Services

-

9,443

19,335

5,861

1,797

(7,134)

Development & Logistics

9,717

8,528

6,718

5,193

7,932

9,060

Total Adjusted EBITDA

248,547

313,575

370,167

382,640

487,947

480,695 |

29

Non-GAAP Reconciliations

Net Income to Distributable Cash Flow ($M)

(1)

LTM as of March 31, 2012.

(2)

On November, 19, 2010, Buckeye merged with Buckeye GP Holdings

L.P. (3)

In 2011, Buckeye revised its definition of Distributable Cash Flow to

exclude amortization of deferred financing costs and debt discounts. Distributable Cash Flow for 2007-2010 have been restated to

exclude those amounts for comparison purposes.

(4) Represents cash distributions declared

for limited partner units (LP units) outstanding as of each respective period. 2012 amounts reflect estimated cash distributions to be paid on LP units for the quarter

ended March 31, 2012. Distributions with respect to the 7,445,999 Class

B units outstanding on the record date for the quarter ended March 31, 2012 will be paid in additional Class B units rather than in

cash.

2007

2008

2009

2010

2011

LTM

(1)

Net income attributable to BPL

22,921

26,477

49,594

43,080

108,501

93,967

Depreciation and amortization

40,236

50,834

54,699

59,590

119,534

126,320

Net

income

attributable

to

noncontrolling

interests

affected

by

merger

(2)

131,941

153,546

90,381

157,467

-

-

Gain on sale of equity investment

-

-

-

-

(34,727)

(34,727)

Non-cash deferred lease expense

-

4,598

4,500

4,235

4,122

4,067

Non-cash unit-based compensation expense

968

1,909

4,408

8,960

9,150

9,691

Equity plan modification expense

-

-

-

21,058

-

-

Asset impairment expense

-

-

59,724

-

-

-

Reorganization expense

-

-

32,057

-

-

-

Non-cash senior administrative charge

950

1,900

475

-

-

-

Amortization of unfavorable storage contracts

-

-

-

-

(7,562)

(8,378)

Write-off of deferred financing costs

-

-

-

-

3,331

3,331

Amortization of deferred financing costs and debt discounts

(3)

1,448

1,737

3,134

4,411

4,289

4078

Goodwill impairment expense

-

-

-

-

169,560

169,560

Maintenance capital expenditures

(33,803)

(28,936)

(23,496)

(31,244)

(57,467)

(63,104)

Distributable Cash Flow

164,661

212,065

275,476

267,557

318,731

304,805

Distributions for Coverage ratio

(4)

173,689

209,412

237,687

259,315

351,245

359,292

Coverage Ratio

0.95

1.01

1.16

1.03

0.91

0.85 |