Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMEDISYS INC | d362882d8k.htm |

| EX-99.2 - RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES TO GAAP FINANCIAL MEASURES - AMEDISYS INC | d362882dex992.htm |

June

2012 Investor Presentation

Leading Home Health & Hospice

clinical

quality

innovative

care models

better

communities

Exhibit 99.1 |

Forward-looking Statements

This presentation may include forward-looking statements as defined by the Private

Securities Litigation Reform Act of 1995. These forward-looking statements are based

upon current expectations and assumptions about our business that are subject to a

variety of risks and uncertainties that could cause actual results to differ materially

from those described in this presentation. You should not rely on forward-looking

statements as a prediction of future events.

Additional

information

regarding

factors

that

could

cause

actual

results

to

differ

materially from those discussed in any forward-looking statements are described in

reports and registration statements we file with the SEC, including our Annual Report on

Form 10-K and subsequent Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K, copies of which are available on the Amedisys internet website

at (800) 467-2662.

We disclaim any obligation to update any forward-looking statements or any changes in

events, conditions or circumstances upon which any forward-looking statement may be

based except as required by law.

2

www.amedisys.com

NASDAQ: AMED

We encourage everyone to visit the

Investors Section of our website at

www.amedisys.com, where we have

posted additional important

information such as press releases,

profiles concerning our business and

clinical operations and control

processes, and SEC filings.

We intend to use our website to

expedite public access to time-critical

information regarding the Company in

advance of or in lieu of distributing a

press release or a filing with the SEC

disclosing the same information.

or by contacting the Amedisys Investor Relations department

http://www.amedisys.com |

Company

Overview 1

3

•

Founded in 1982, publicly listed 1994

•

525 care centers in 38

states

•

16,600 employees

•

$1.5 billion in 2011 revenue

•

Largest provider of skilled home health

services

•

4

th

largest hospice business

•

83% of revenue is Medicare

1

For the quarter ended March 31, 2012

Revenue Mix |

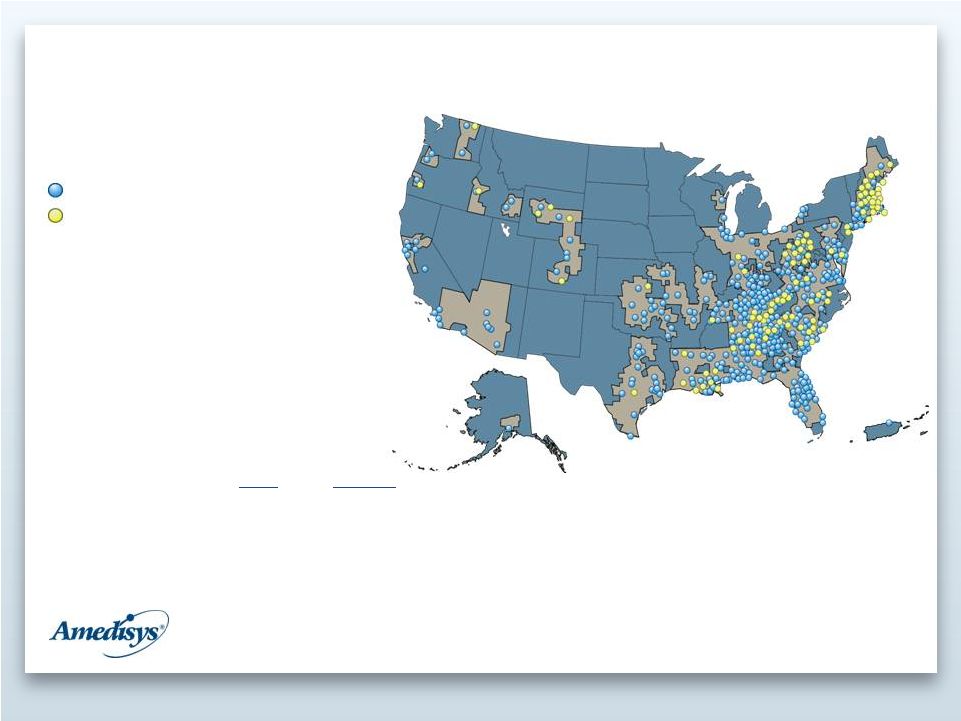

Care Center

Locations 2012 4

437 -

Home health care centers

88 -

Hospice care centers

2 -

Hospice inpatient units

*As of March 31, 2012

Counties

3,143

1,375

44%

65+ Population

40.9 M

25.1 M

61%

AMED

U.S. |

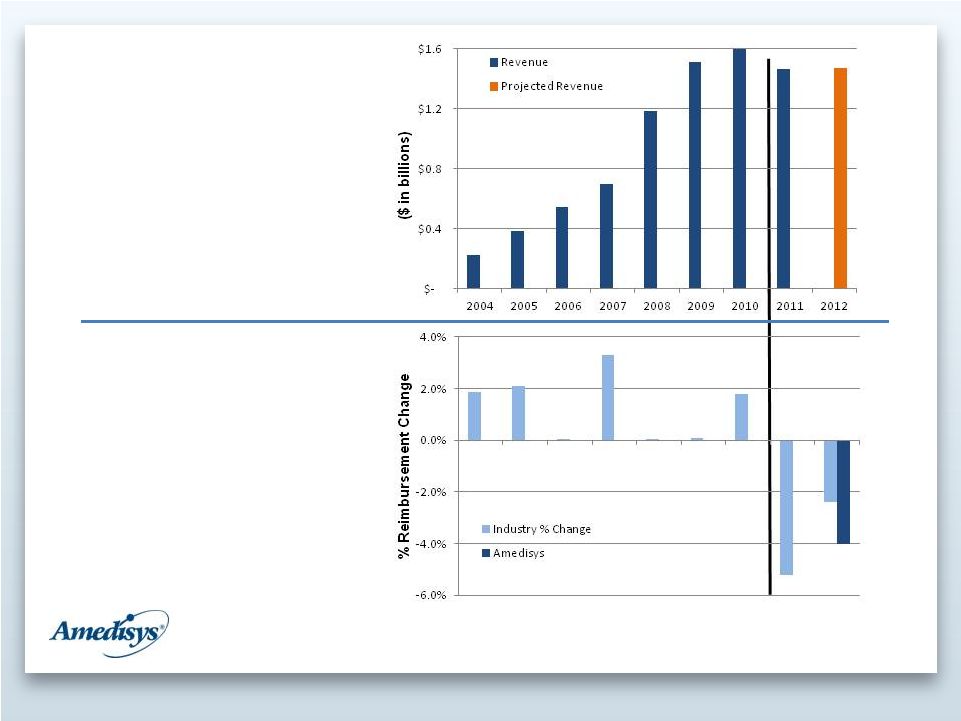

5

Medicare

Reimbursement¹

Amedisys

Revenue

1

2008 industry cut was 2.9%, however due to other HHRG

changes overall reimbursement was budget neutral. |

Washington

Update 6

Issues

•

Supreme Court Ruling

•

Sequestration

•

Rebasing

•

Hospice issues

•

Copay

Industry Groups

•

NAHC

•

Partnership

•

Alliance |

Favorable Long

Term Trends •

Compelling demographics

•

Patient preference

•

Low cost of care delivery

•

Increased payor and hospital focus

7

*Source: Hospital numbers are from

US Census Bureau, others from MedPac March 2012 report

Hospital

LTAC

IRF

SNF

Hospice

Home

Health

Average Cost of Stay

$10,043

$38,582

$17,085

$10,833

$11,217

$5,706

Average Length of Stay

5 days

27 days

13 days

27 days

86 days

120 days

Average Per Diem Cost

$1,853

$1,450

$1,304

$400

$130

$48 |

Today and

Tomorrow 8

Traditional

HHC & HSP

Care

Management

Solutions

•

Fee for service

•

High volume / low

margins

•

Technology investments

to drive efficiency

•

Need for scale

•

Clinical quality

•

Superior outcomes

•

Partnering with payors and

other providers

•

Clinical management

technology

•

Partner connectivity

•

Risk-bearing partnerships |

Post Acute Care

Challenges Today 9

Poor care coordination

Misaligned incentives

Poor communication

Multiple conditions

Numerous physicians

Polypharmacy

Physicians

Hospital

Post Acute

Facilities

Payors

Home

Health

Patient

Home

Hospice

Patient

Key Issues |

Post Acute

– ACO / Bundling

10

•

Aligned incentives

•

Data exchange

•

Communications

•

Care Protocol

Healthcare at home

AMS3

Mercury Doc

Hospital partnerships

Managed care business

CMS Bundled payment

pilot

Hospital

Physicians

Post Acute

Facilities

Payors

Patient

Home

Home

Health

Hospice

AMED Initiatives |

Post Acute

– Value Enhancement

11

Med. reconciliation

Multidisciplinary care

Telemonitoring

Focus on readmissions

Telefax

Connectivity –

Mercury Doc

Pre-discharge planning

Facility Care Coordination

Agreements

Reporting

Facilities

Physician

Payors

Patient

Home

CARE TRANSITIONS

CARE MANAGEMENT

CARE COORDINATION |

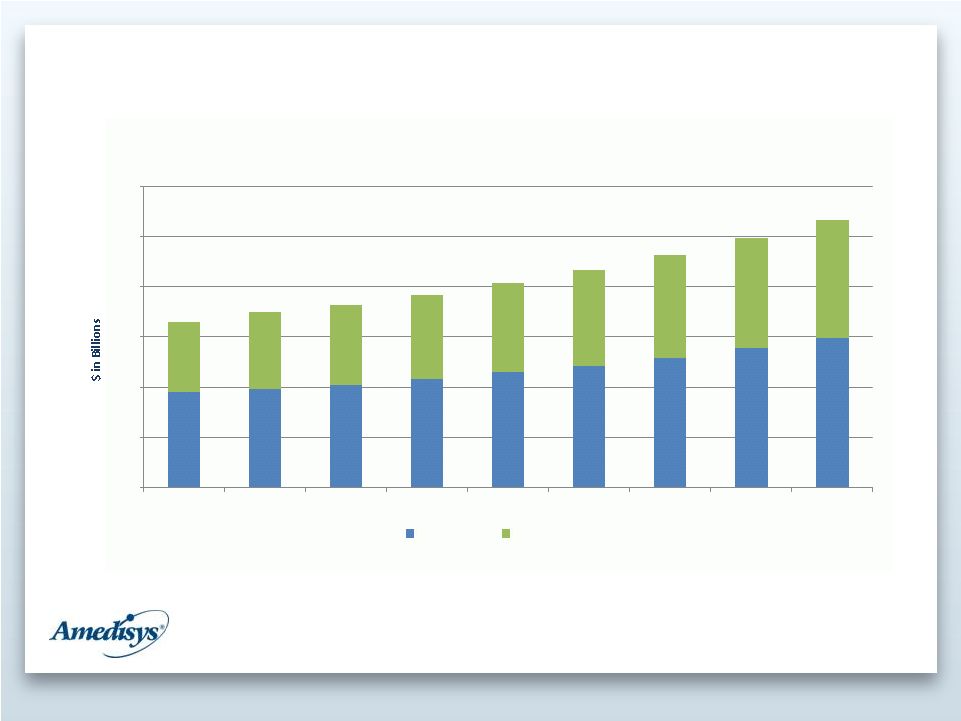

Home

Health/Hospice Medicare Spend 12

Source: Home Health is from CBO March 2012 Baseline report; Hospice is from CBO March 2010

Baseline report and applied growth rate in Others section of March 2012 Baseline

report. Hospice CAGR = 6.7%

Home Health CAGR = 5.1%

$19

$20

$21

$22

$23

$24

$26

$28

$30

$15

$16

$17

$18

$19

$21

$22

$23

$

$10

$30

$40

$50

$60

2011

2012

2013

2014

2015

2016

2017

2018

2019

Medicare Reimbursement

Home Health

Hospice

$14

$20 |

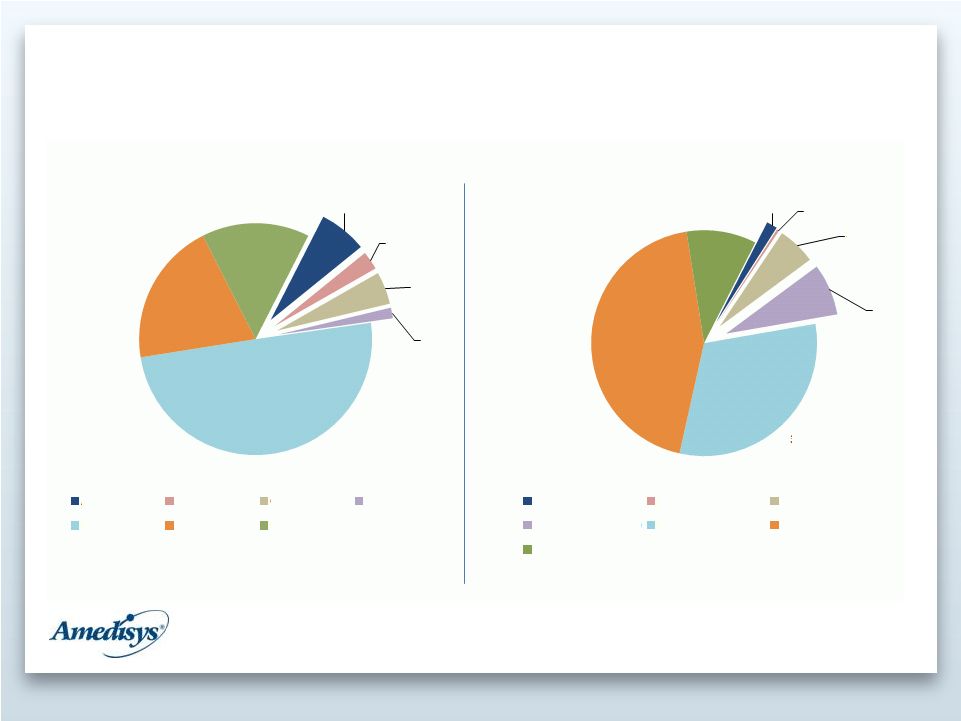

Market Share

– Medicare Revenue

13

Sources: Company financials, Medicare claims data

6.7%

2.6%

4.5%

1.5%

49.8%

20.0%

15.0%

Home Health

Amedisys

LHCG

Gentiva

Almost Family

For Profit

Non Profit

Hospital Based

1.5%

0.3%

5.5%

7.4%

31.2%

44.0%

10.0%

Hospice

Amedisys

LHCG

Gentiva

Chemed (Vitas only)

For Profit

Non Profit

Hospital Based |

Business

Fundamentals 14

Clinical

Excellence

Growth

Efficiency |

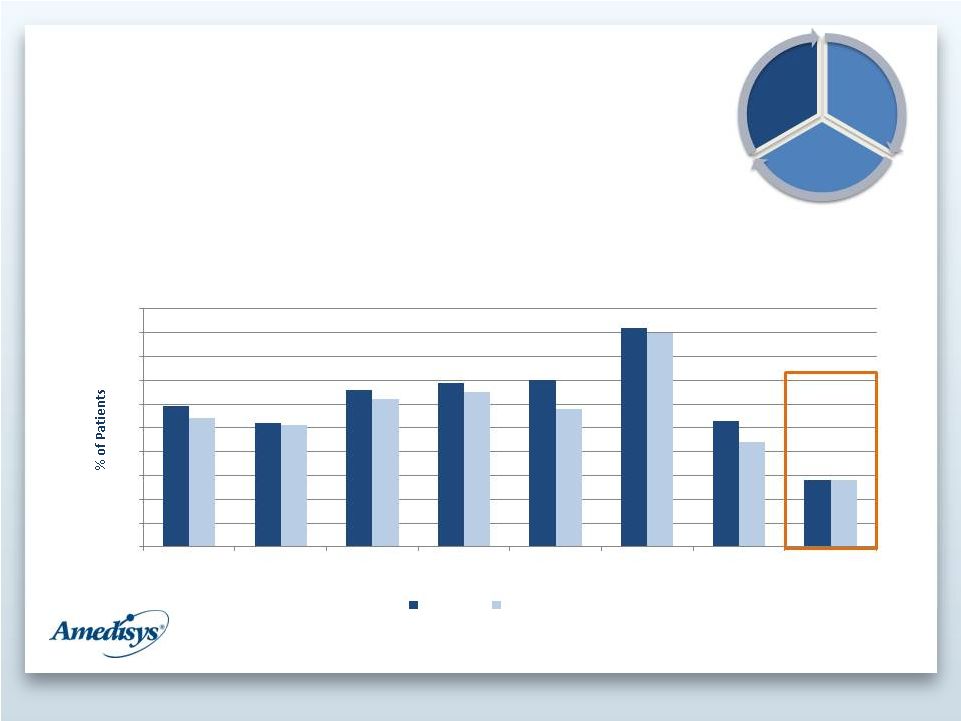

Clinical

Excellence 15

•

Clinical Outcomes

–

Exceeded

or

met

8

out

of

8

outcomes

vs.

footprint

of

reported

measures

*

Lower % is better

Source: Medicare

Amedisys vs. Footprint –

Outcomes December 2011

59

52

66

69

70

92

53

28

54

51

62

65

58

90

44

28

0

10

20

40

50

60

70

80

90

100

Ambulation

Transferring

Bathing

Pain

Breathing

Surgical Wounds

Mgmt of Oral

Meds

Acute Care

Hospitalization*

Amedisys

Footprint

30

Clinical

Excellence

Growth

Efficiency |

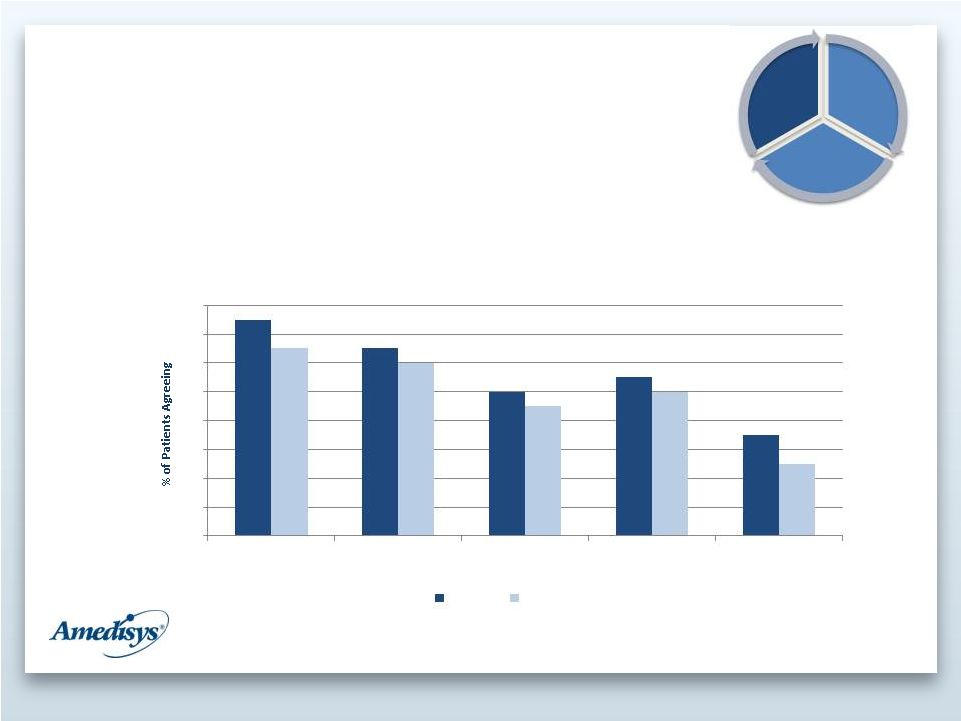

16

Clinical Excellence

•

Survey Questions

–

Exceeded all 5 survey questions vs. footprint of reported measures

Growth

Efficiency

Clinical

Excellence

89

87

84

85

81

87

86

83

84

79

74

76

78

80

82

84

86

88

90

Professional care

Communicated well

Discussed Meds, pain,

safety

Rating of 9 or 10

Recommend

Survey Questions September 2011

Amedisys

Footprint |

17

•

Clinical leadership

investment

•

Enhanced clinical processes

–

Telemonitoring

–

Patient care conferences

–

Medical director

involvement

•

Specialty Programs

–

Speech language

–

Behavioral health

–

Balanced for Life

•

Future technology upgrades

–

Patient-specific care

treatment

Clinical Excellence

Growth

Efficiency

Clinical

Excellence |

Growth

18

•

Managed Care

•

Care

coordination

relationships

with

hospitals

and

health

systems

•

Market-specific

sales plans / CRM tool

•

Home health/hospice opportunities

Growth

Efficiency

Clinical

Excellence |

Operational

Efficiency 19

•

Leadership training

•

Hospice point-of-care

•

Managing functional assessments

•

Industry leading operating system (AMS)

–

Technical

–

Economic

–

Strategic

•

Portfolio rationalization

–

Clinical

–

Quality

–

Connectivity

Growth

Efficiency

Clinical

Excellence |

Inquiry/Investigations

20

•

SFC/SEC/DOJ

•

Other |

Financial

Review 21 |

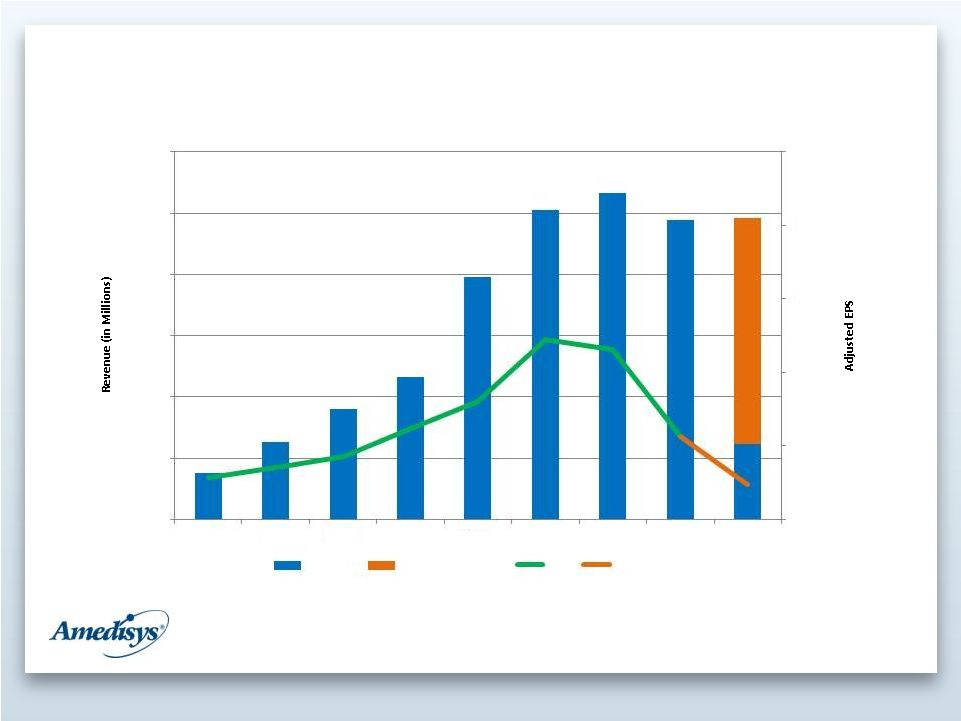

Financial

Highlights 22

$ -

$2.00

$4.00

$6.00

$8.00

$10.00

$ -

$300

$600

$900

$1,200

$1,500

$1,800

2004

2005

2006

2007

2008

2009

2010

2011

2012

Revenue

Projected Revenue

EPS

Projected EPS |

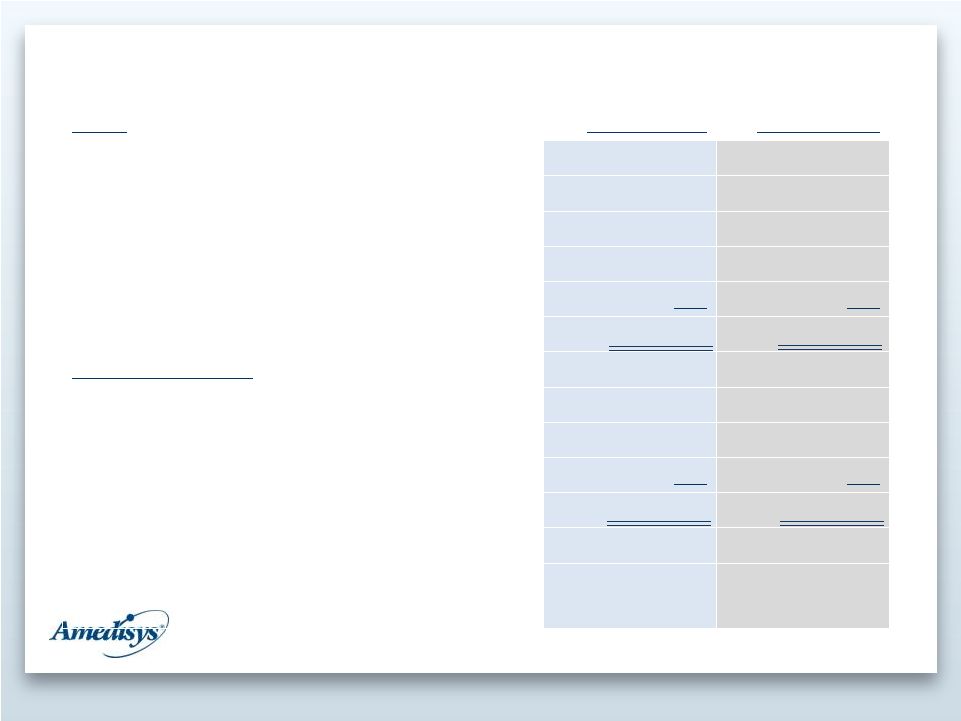

23

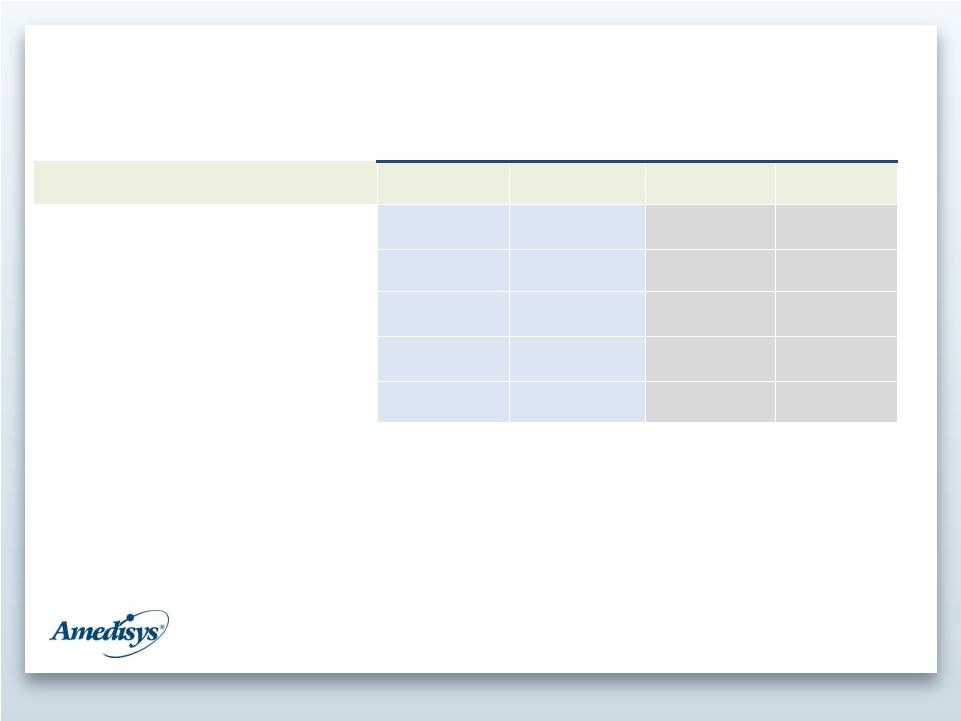

Summary Financial Results

($ in millions, except per share data)

2010

(1)

(2)

2011

(1) (2)

1Q11

(3)

1Q12

(3)

Continuing Operations

Net Revenue

$ 1,597

$ 1,466

$ 359

$ 371

Gross Margin %

50.1%

46.6%

47.9%

43.8%

EBITDA

$ 256

$ 156

$ 39

$ 23

EBITDA Margin

16.0%

10.7%

10.9%

6.3%

Fully-diluted EPS

$4.61

$2.27

$0.53

$0.18

(1)The financial results for the years 2011 and 2010 are adjusted for

certain items incurred in 2011 and 2010 and should be considered non-GAAP financial measures. A reconciliation of these non-GAAP

financial measures is included as Exhibit 99.2 to our Form 8-K filed with the Securities and Exchange Commission on June 6, 2012.

(2) Results as reported in our Annual Report on Form 10-K for the year ended December 31,

2011 as filed with the Securities and Exchange Commission on February 28, 2012.

(3) Results as reported in our Quarterly Report on Form 10-Q for the quarter ended March

31, 2012 as filed with the Securities and Exchange Commission on May 9, 2012. |

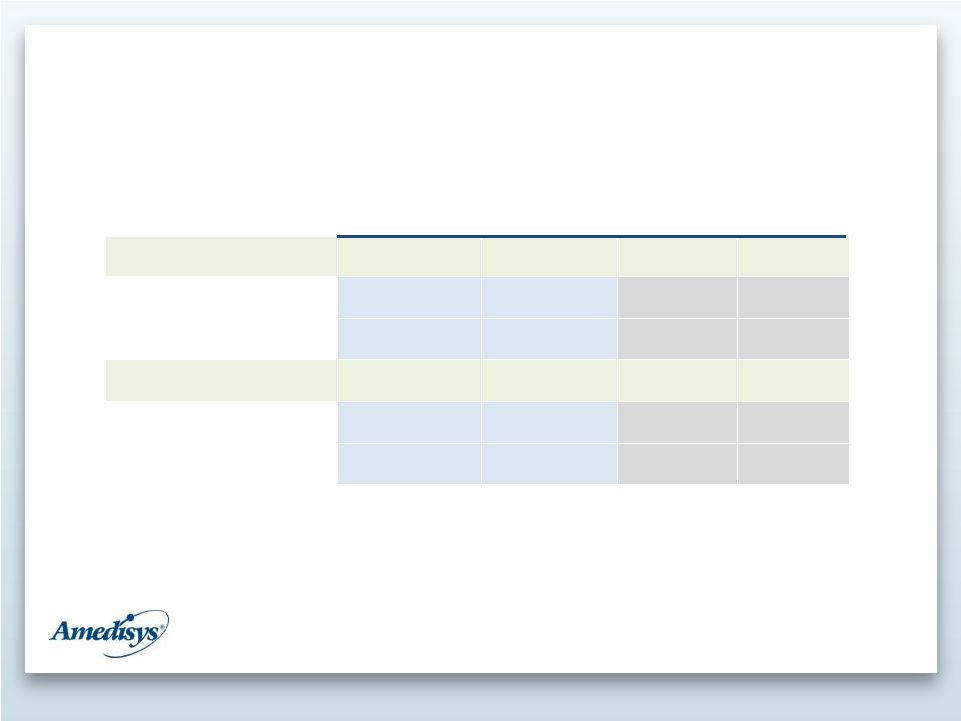

Summary Division

Results 24

($ in millions)

2010

(1)

2011

(1)

1Q11

(2)

1Q12

(2)

Home Health

Net Revenue

$ 1,458

$ 1,248

$ 321

$ 302

Gross Margin %

51%

47%

48%

43%

Hospice

Net Revenue

$ 139

$ 218

$ 38

$ 69

Gross Margin %

47%

46%

48%

47%

Continuing Operations

(2) Results as reported in our Quarterly Report on Form 10-Q for the quarter ended March

31, 2012 as filed with the Securities and Exchange Commission on May 9, 2012.

(1) Results as reported in our Annual Report on Form 10-K for the year ended December 31,

2011 as filed with the Securities and Exchange Commission on February 28, 2012.

addition, 2010 net revenue is adjusted $3.7 million for the Georgia indigent care liability

settlement.

For 2010 and 2011, net revenue is adjusted for a CMS bonus payment as the result of the pay

for performance demonstration of $3.6 and $4.7 million, respectively. In |

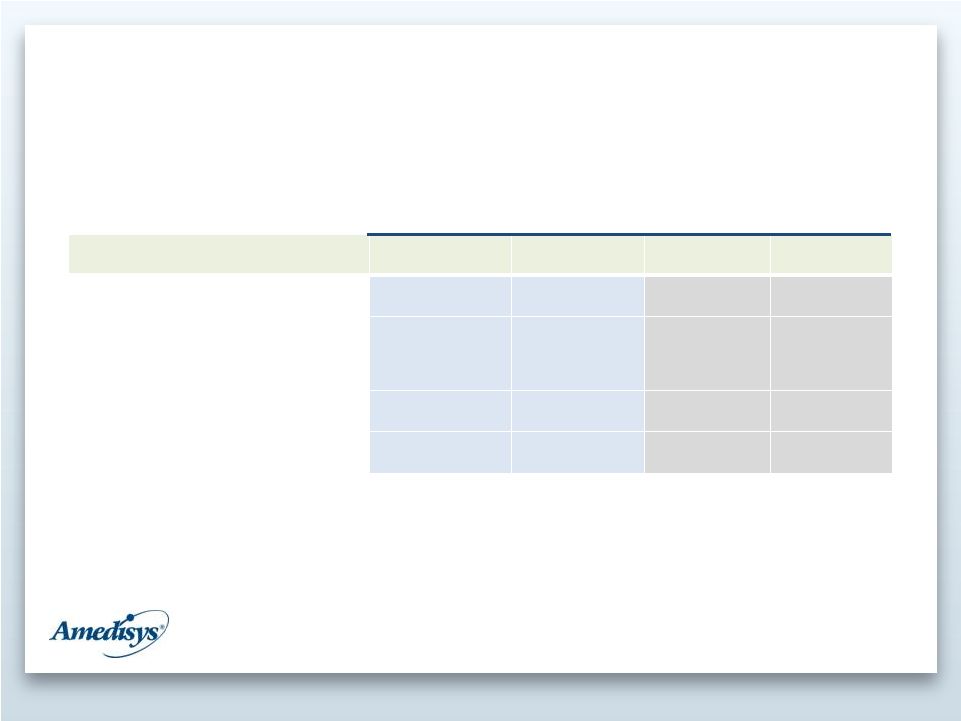

25

Summary Operating Statistics

(Numbers in thousands, except rev. per

episode)

2010

(1)

2011

(1)

1Q11

(2)

1Q12

(2)

Home Health

Total visits

8,899

8,335

2,107

2,130

Episodic-based

admissions

248

234

61

60

Completed episodes

416

392

98

95

Revenue per episode

$3,312

$3,005

$3,028

$2,854

Statistics are for continuing operations only.

(1) Results as reported in our Annual Report on Form 10-K for the year ended December 31,

2011 as filed with the Securities and Exchange Commission on February 28, 2012.

(2) Results as reported in our Quarterly Report on Form 10-Q for the quarter ended March

31, 2012 as filed with the Securities and Exchange Commission on May 9, 2012. |

Summary

Operating Statistics 26

2010

(1)

2011

(1)

1Q11

(2)

1Q12

(2)

Hospice

Total admissions

11,275

15,889

3,163

4,902

Daily census

2,832

4,197

3,125

5,190

Average length of stay

88

88

88

91

Statistics are for continuing operations only.

(1) Results as reported in our Annual Report on Form 10-K for the year ended December 31,

2011 as filed with the Securities and Exchange Commission on February 28, 2012.

(2) Results as reported in our Quarterly Report on Form 10-Q for the quarter ended March

31, 2012 as filed with the Securities and Exchange Commission on May 9, 2012. |

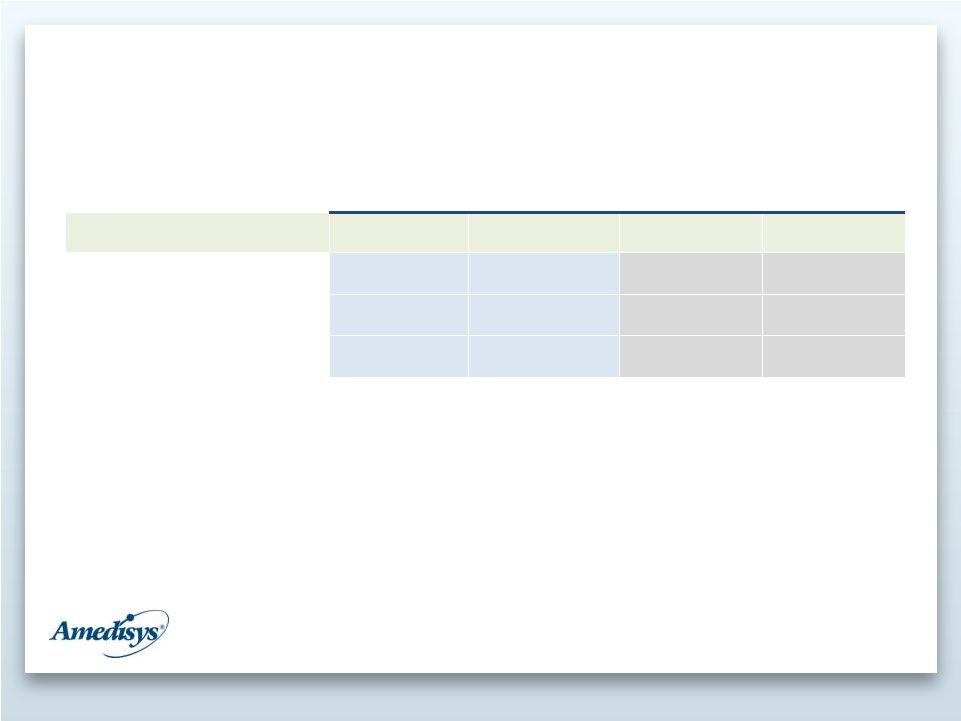

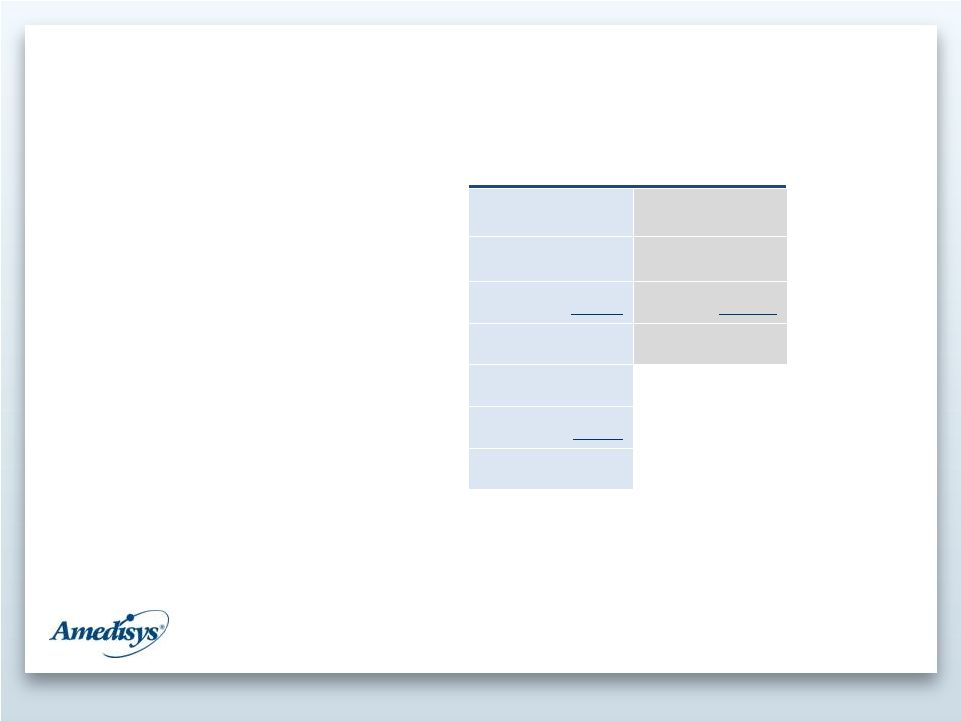

27

Summary Balance Sheet

Assets

Dec. 31, 2011

Mar. 31, 2012

Cash

$ 48

$ 41

Accounts Receivable, Net

148

162

Property and Equipment

148

144

Goodwill

335

335

Other

179

173

Total Assets

$ 858

$ 855

Liabilities and Equity

Debt

$ 145

$ 137

All Other Liabilities

193

188

Equity

520

530

Total Liabilities and Equity

$ 858

$ 855

Leverage Ratio

1.0x

1.1x

Days Sales Outstanding

35

38

($ in millions) |

28

Liquidity

Available line of credit (LOC): 3/31/12 = $230M

($ in millions)

2011

2012

Cash Flow From Operations

$ 142

$ 100-110

Cap Ex

44

40-45

Debt repayments

38

34

Cash Flow, Net

60

26-31

Beginning Cash

120

Acquisitions

(132)

End Cash

$ 48 |

29

Guidance

Calendar

Year

2012

Net revenue:

$1.475 -

$1.525 billion

EPS:

$0.95 -

$1.10

Diluted shares:

30.2 million

1

2

1

Guidance excludes the effects of the following: any future acquisitions, if any are made;

effects of any share repurchases;

non-recurring

costs

(i.e.

certain

items)

that

may

be

incurred

during

the

year

and

the

impact

of

any future Medicare rate changes.

2

Provided as of the date of our form 8-K filed with the Securities and Exchange Commission

on May 8, 2012. |

Investment

Rationale •

Favorable demographic trends

•

IT infrastructure/scalability

•

Clinical quality and innovation

•

Strong liquidity and capital position

•

Market share capture opportunities

30

Efficient Core

Business

Care Mgmt

Solutions |

Contact

Information Kevin B. LeBlanc

Director of Investor Relations

Amedisys, Inc.

5959 S. Sherwood Forest Boulevard

Baton Rouge, LA 70816

Office: 225.299.3391

Fax: 225.298.6435

kevin.leblanc@amedisys.com

31 |