Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - Forestar Group Inc. | a12-13406_18k.htm |

| EX-2.1 - EX-2.1 - Forestar Group Inc. | a12-13406_1ex2d1.htm |

| EX-99.1 - EX-99.1 - Forestar Group Inc. | a12-13406_1ex99d1.htm |

| EX-10.1 - EX-10.1 - Forestar Group Inc. | a12-13406_1ex10d1.htm |

Exhibit 99.2

|

|

Acquisition of CREDO Petroleum June 4, 2012 Recognizing and Responsibly Delivering the Greatest Value From Every Acre and Growing Through Disciplined Investments |

|

|

Notice to Investors This presentation contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are typically identified by words or phrases such as “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning. These statements reflect management’s current views with respect to future events and are subject to risk and uncertainties. We note that a variety of factors and uncertainties could cause our actual results to differ significantly from the results discussed in the forward-looking statements, including the timing to consummate the proposed merger, the risk that a condition to closing of the proposed merger may not be satisfied; our ability to achieve the synergies and value creation contemplated by the proposed merger; our ability to promptly and effectively integrate Credo’s businesses, and the diversion of management time on merger-related matters. Other factors and uncertainties that might cause such differences include, but are not limited to: general economic, market, or business conditions; changes in commodity prices; the opportunities (or lack thereof) that may be presented to us and that we may pursue; fluctuations in costs and expenses including development costs; demand for new housing, including impacts from mortgage credit availability; lengthy and uncertain entitlement processes; cyclicality of our businesses; accuracy of accounting assumptions; competitive actions by other companies; changes in laws or regulations; and other factors, many of which are beyond our control. Except as required by law, we expressly disclaim any obligation to publicly revise any forward-looking statements contained in this presentation to reflect the occurrence of events after the date of this presentation. Important Additional Information and Where to Find It Credo intends to file with the SEC and mail to its stockholders a Proxy Statement on Schedule 14A pursuant to Section 14(a) of the Exchange Act in connection with the merger. This document will contain important information about Forestar, Credo, the merger and other related matters. Credo’s investors and security holders are urged to read this document carefully when it is available. Credo’s investors and security holders will be able to obtain free copies of the Proxy Statement and other documents to be filed with the SEC by Credo through the web site maintained by the SEC at www.sec.gov. Credo’s investors and security holders may also obtain these documents, free of charge, from Credo’s website (www.credopetroleum.com) under the tab “Corporate Governance” and then under the heading “SEC Filings” or by contacting Credo’s Investor Relations Department at 303-297-2200. Credo and its directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the transactions contemplated by the merger agreement. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of Credo stockholders in connection with the merger will be set forth in the proxy statement when it is filed with the SEC. Credo’s investors and security holders can find information about Credo’s executive officers and directors in its definitive proxy statement filed with the SEC on February 28, 2012. 2 |

|

|

Credo Acquisition Overview Acquisition of CREDO Petroleum (NASDAQ:CRED) for $14.50 per share Total equity value $146 million - all cash Acquisition price = 34% premium* Consistent with Strategy and Triple in FOR initiatives 3 * Based on Credo closing price of $10.86 per share on June 1, 2012 Acquisition consistent with our Triple in FOR strategic initiatives to accelerate value realization, optimize transparency and raise net asset value through strategic and disciplined investments |

|

|

Acquisition Benefits Doubles production and reserves, enhances disclosure Creates meaningful scale, ownership and operations in strategic basins Maintains solid financial position, enhanced by recurring cash flows Provides a strong operating platform for growth and investment Exceeds return requirements Operating option accelerates Forestar Minerals value realization 4 |

|

|

Attractive Leasehold Interests In Prolific Basins 5 CREDO Leasehold Interests – Q1 2012 Market Net Acres Basins Formations North Dakota 6,000 Williston Bakken & Three Forks Kansas 43,000 Central Uplift Lansing – Kansas City Nebraska 41,000 Denver – Julesburg Central Uplift Lansing – Kansas City Oklahoma 17,000 Anadarko Morrow Texas 4,000 Anadarko Tonkawa & Cleveland Other* 14,000 Total 125,000 Q1 2012 Producing Wells Working Interest** 337 Royalty Interest 1,180 Total Wells 1,517 Q1 2012 Leasehold Interest (Acres) Held By Production 30,000 Undeveloped 95,000 Total Net Mineral Acres 125,000 * Includes approximately 8,000 net mineral acres located in various states related to overriding royalty interests **Includes approximately 108 wells operated by CREDO Note: Acres may vary |

|

|

Bakken Provides Significant Value Creation Potential 6,000 net mineral acres in core of Bakken & Three Forks Bakken Well Assumptions Avg. Well production (EUR) >500 Mboe Average working interest 8.0% Units 50 Wells Completed* 16 Wells Drilling* 9 Wells Planned by YE 2012* 9 Total Potential Wells up to 400 * Source: Credo Petroleum news release dated April 17, 2012 FORT BERTHOLD RESERVATION PARSHALL FIELD Bakken / Three Forks Acres Locator Map Leasehold Mineral Interests Locations Leasehold Interests Drilling Locations Units Bakken Vertical Wells Historical Production Three Forks Vertical Well Bakken Horizontal Well Three Forks Horizontal Well 6 |

|

|

Acquisition Provides Meaningful Scale and Solid Platform For Future Growth and Additional Investment 3 7 Future growth in production and reserves driven by oil and liquid rich opportunities Combined Mineral Interests Market Net Acres* Texas 256,000 Georgia 156,000 Louisiana 144,000 Kansas 43,000 Nebraska 41,000 Alabama 40,000 Oklahoma 17,000 North Dakota 6,000 Other** 16,000 Total 719,000 *Note: As of first quarter 2012; includes both fee and leasehold interests ** Includes approximately 8,000 net mineral acres located in various states related to overriding royalty interests |

|

|

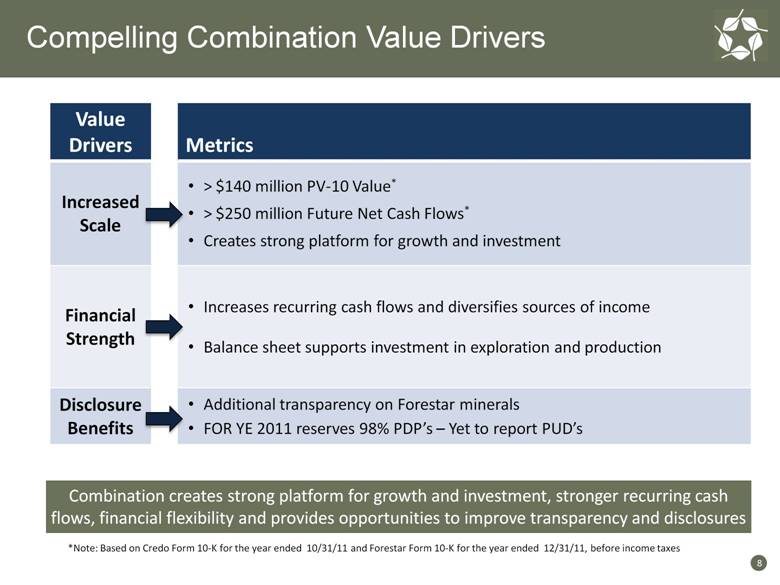

Compelling Combination Value Drivers Combination creates strong platform for growth and investment, stronger recurring cash flows, financial flexibility and provides opportunities to improve transparency and disclosures Value Drivers Metrics Increased Scale > $140 million PV-10 Value* > $250 million Future Net Cash Flows* Creates strong platform for growth and investment Financial Strength Increases recurring cash flows and diversifies sources of income Balance sheet supports investment in exploration and production Disclosure Benefits Additional transparency on Forestar minerals FOR YE 2011 reserves 98% PDP’s – Yet to report PUD’s 8 *Note: Based on Credo Form 10-K for the year ended 10/31/11 and Forestar Form 10-K for the year ended 12/31/11, before income taxes |

|

|

Compelling Combination Value Drivers Combination creates significant scale through production and reserve growth, meaningful ownership and operations in prolific basins and is focused on oil and NGL’s Value Drivers 2011 Metrics* CRED FOR Combined Doubles Production and Reserves Meaningful Ownership and Operations in Prolific Basins Oil Focus 43% of combined reserves at YE 2011 Significant additional upside in natural gas ($ in millions) Production (BOE) 301,000 422,200 723,200 Reserves (MMBOE) 4.1 3.0 7.1 PV-10 $62 $81 $143 Future Net Cash Flows $116 $134 $250 Net Mineral Acreage** 125,000 594,000 719,000 Basins 5 5 10 States 7 7 14 ** Note: Includes both fee and leasehold interests; Forestar acres as of Q1 2012 9 *Note: Based on Credo Form 10-K for the year ended 10/31/11 and Forestar Form 10-K for the year ended 12/31/11, before income taxes |

|

|

Accelerating Realization of Oil & Gas Through Increased Production and Reserve Growth (BOE) 10 Acquisition Accelerates Value Realization of Forestar Minerals 28% Oil 36% Oil Future Net Cash Flows From Reserves * ($ in millions) *Note: Based on Credo Form 10-K for period ending 10/31/11 and Forestar Form 10-K for period ending 12/31/11, before income taxes |

|

|

Acquisition Analysis 3 Credo Acquisition Price Per Share $14.50 Premium to Pre-announcement Credo Price ($10.86 - 6/1/12) 34% Equity Purchase $146 + Closing Costs* 7 Total Purchase Price $153 Financing** Committed Loan $75 Revolver Availability & Cash 78 $153 11 ($ in millions) Following the acquisition of Credo, Forestar will have a solid balance sheet, improved cash flow profile and ample liquidity *Excludes financing costs **Forestar intends to pursue amendments to its existing credit facilities to fund a significant portion of the purchase price. |

|

|

Credo Acquisition Generates Scale, Creates Platform for Growth and Investment and Accelerates Value Realization Proforma Combined Portfolio of Assets Oil & Gas ($ in millions) Net Minerals Acres* 719,000 Proforma Q1 2012 Investment - $200 million Reserves (MMBOE) 7.1 PV-10 Reserves $143 Future Net Cash Flows $250 Real Estate Acres 146,000 Q1 2012 Investment - $570 million Projects 99 Acres in Entitlement 27,600 Income Producing Properties 4 Water Acres 1.6 million** Low-Cost Option 12 *Includes both fee and leasehold mineral acreage ** Includes a 45% nonparticipating royalty interest in groundwater produced or withdrawn for commercial purposes or sold from approximately 1.4 million acres in TX, LA, GA, and AL Note: Reserve information before income taxes |

|

|

Compelling Combination Value Drivers Combination creates scale by increasing production and reserves, providing solid platform for growth, maintaining solid balance sheet, and creating additional shareholder value 19 Creates meaningful scale, with ownership and operations in strategic basins Increasing exposure to Oil and NGLs Enhances reserve reporting ability benefitting Forestar Minerals Experienced management team with proven track record Accretive to earnings in first full year of ownership Maintain solid financial profile and ample liquidity 13 |

|

|

Acquisition of Credo Petroleum June 4, 2012 Recognizing and Responsibly Delivering the Greatest Value From Every Acre and Growing Through Disciplined Investments 14 |