Attached files

Exhibit 4.3

Execution Version

THE SECURITIES REPRESENTED BY THIS WARRANT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES REPRESENTED BY THIS WARRANT HAVE BEEN ACQUIRED FOR INVESTMENT AND MAY NOT BE OFFERED, SOLD, TRANSFERRED OR ASSIGNED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR AN OPINION OF COUNSEL, REASONABLY SATISFACTORY TO THE COMPANY, THAT REGISTRATION IS NOT REQUIRED UNDER THE SECURITIES ACT OR APPLICABLE STATE SECURITIES LAWS UNLESS SOLD PURSUANT TO RULE 144 UNDER THE SECURITIES ACT. THE SECURITIES REPRESENTED BY THIS WARRANT ARE SUBJECT TO THE TERMS AND CONDITIONS OF, AND MAY ONLY BE TRANSFERRED IN ACCORDANCE WITH, THE TERMS OF THIS WARRANT.

LIGHTING SCIENCE GROUP CORPORATION

WARRANT TO PURCHASE COMMON STOCK

| Warrant No.: RW1 |

Number of Shares: 18,092,511 |

Issuance Date: May 25, 2012

THIS CERTIFIES THAT, for value received, RW LSG Management Holdings LLC (the “Holder”) is entitled to purchase from Lighting Science Group Corporation, a Delaware corporation (the “Company”), at any time and from time to time during the applicable Warrant Exercise Period (defined below) at the Exercise Price (defined below) 18,092,511 fully paid nonassessable shares of Common Stock (defined below) (as may be adjusted from time in accordance with the terms of this Warrant, the “Warrant Shares”), all subject to adjustment and upon the terms and conditions provided herein. This Warrant is being issued to the Holder in connection with the Subscription Agreement, dated May 25, 2012, by and between the Holder and the Company.

Section 1. Definitions.

The following terms as used in this Warrant have the following meanings:

(a) “Acquiring Entity” has the meaning attributed to it in Section 8.

(b) “Affiliate” of, or a Person “Affiliated” with, a specified Person, is a Person that directly or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, the Person specified.

(c) “Business Day” means any day other than Saturday, Sunday or other day on which commercial banks in New York, New York or San Francisco, California are authorized or obligated to close.

(d) “Capital Stock” means any of the Company’s shares of Common Stock or preferred stock or any other Derivative Security of the Company.

(e) “Change of Control” means (i) the sale, conveyance or disposition, including but not limited to any spin-off or in-kind distribution, by the Company or by one or more of its subsidiaries, of all or substantially all of the assets of the Company (on a consolidated basis) to any Person or group (other than the Company or its wholly-owned subsidiaries and other than pursuant to a joint venture arrangement in which the Company, directly or indirectly, receives at least fifty percent (50%) of the equity and voting interests); (ii) the effectuation of a transaction or series of related transactions in which more than thirty-five percent (35)% of the voting power of the Company is disposed of (other than (A) as a direct result of normal, uncoordinated trading activities in the Common Stock generally or (B) solely as a result of the disposition by a stockholder of the Company to an Affiliate of such stockholder); (iii) any merger, consolidation, stock or asset purchase, recapitalization or other business combination transaction (or series of related transactions) as a result of which the shares of Capital Stock entitled to vote generally in the election of directors and the Preferred Shares (treated on an as-converted basis) immediately prior to such transaction (or series of related transactions) are converted into and/or continue to represent (on an as-converted basis), in the aggregate, less than sixty-five percent (65%) of the total voting power of all shares of capital stock that are entitled to vote generally in the election of directors of the entity surviving or resulting from such transaction (or ultimate parent thereof); (iv) a transaction or series of transactions in which any Person, entity or “group” (as such term is used in Sections 13(d) and 14(d) of the Exchange Act) acquires more than thirty-five percent (35)% of the voting equity of the Company (other than the acquisition by a Person, entity or “group” that is an Affiliate of or Affiliated with a Person, entity or “group” that immediately prior to such acquisition, beneficially owned thirty-five percent (35)% or more of the voting equity of the Company) or (v) Pegasus ceases to beneficially own in the aggregate at least ten percent (10%) of the outstanding Capital Stock of the Company, on a fully-diluted basis.

(f) “Common Stock” means (i) the Company’s common stock, $0.001 par value per share, and (ii) any capital stock into which the Common Stock is changed or any capital stock resulting from a reclassification of the Common Stock.

(g) “Delivery Date” has the meaning attributed to it in Section 2(c).

(h) “Derivative Security” means any right, option, warrant, convertible preferred stock or other security or right convertible into or exercisable or exchangeable for shares of Common Stock.

(i) “Effective Consideration” means the amount paid or payable to acquire shares of Common Stock (or, in the case of Derivative Securities, the amount paid or payable to acquire the Derivative Security, if any, plus the exercise price for the underlying Common Stock).

2

(j) “Ex-Date” means (i) when used with respect to any issuance or distribution, the first date on which the Common Stock trades, regular way, on the relevant Trading Market or such other market without the right to receive such issuance or distribution, and (ii) when used with respect to any subdivision, split, combination or reclassification of shares of Common Stock, the first date on which the Common Stock trades, regular way, on such Trading Market or such other market after the time at which such subdivision, split, combination or reclassification becomes effective.

(k) “Exchange Act” means the Securities Exchange Act of 1934, as amended.

(l) “Exercise Date” has the meaning attributed to it in Section 2(c).

(m) “Exercise Documents” has the meaning attributed to it in Section 2(c).

(n) “Exercise Notice” has the meaning attributed to it in Section 2(a)(i).

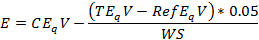

(o) “Exercise Price” is equal to the price computed using the following formula (for the avoidance of doubt, Exercise Price shall be determined after all other adjustments to the number of Warrant Shares are taken into account):

where:

| CEqV | means, as of any date, the Fair Market Value per share of Common Stock on the Trading Day immediately preceding the Exercise Date; |

| RefEqV | $500,000,000; provided, that such amount shall be increased by any cash amounts raised by the Company (net of costs and expenses) pursuant to any issuance or sale of any Capital Stock; provided, further, that such amount shall be decreased by any cash amounts paid by the Company pursuant to any redemption, repurchase, retirement or other acquisition of, or dividends or distributions in respect of, any Capital Stock; |

| WS | means, as of any date, the number of Warrant Shares issuable upon exercise of this Warrant; |

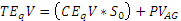

| TEqV | means, as of any date, the dollar value computed using the following formula: |

| S0 | means, as of any date, the number of shares of Common Stock outstanding on a fully-diluted basis (accounting for all Derivative Securities using the treasury stock method, which, for the avoidance of doubt, would include any shares of Common Stock into which any outstanding shares of preferred stock are convertible if the liquidation value of such preferred stock is less than the Fair Market Value of the Common Stock issuable upon conversion thereof); provided, that for purposes of calculating the number of shares of |

3

| Common Stock outstanding on a fully-diluted basis, up to 10,750,000 shares of Common Stock or Derivative Securities (as adjusted for any subdivision, split, combination or reclassification of shares of Common Stock) issued after the Issuance Date to the executives, directors and employees of the Company in their capacity as such pursuant to an option, stock or other equity plan approved by the Board of Directors shall not be included in such calculation. |

| PVAG | means, as of any date, the aggregate value of all outstanding shares of any class or series of the Company’s preferred stock, calculated as the greater of (i) the liquidation value of each outstanding share of preferred stock and (ii) if applicable, the Fair Market Value of all shares of Common Stock (determined prior to the Open for Business on such date) issuable upon conversion of each share of preferred stock, excluding the value of any shares of preferred stock that are included in the calculation of S0 under the treasury stock method; |

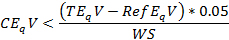

provided, that, if:

then this Warrant shall be deemed to have no value;

provided, further, that, if:

then the Exercise Price shall not be negative and shall be deemed to equal zero.

(p) “Event of Default” means (a) any default by the Company or any of its subsidiaries under any mortgage, indenture or instrument under which there may be issued or by which there may be secured or evidenced any Indebtedness for money borrowed by the Company or any of its subsidiaries, whether such Indebtedness now exists, or is created after the Issuance Date, if that default: (i) is caused by a failure to pay the principal of, or interest or premium, if any, on, such Indebtedness prior to the expiration of any grace period provided pursuant to the terms of such Indebtedness on the date of such default and (x) the aggregate amount unpaid equals $10.0 million or more or (y) the principal amount of such Indebtedness aggregates to $15.0 million or more; or (ii) results in the acceleration of such Indebtedness prior to its express maturity, and, in each case, the principal amount of any such Indebtedness aggregates to $8.0 million or more; provided, that if such default is cured or waived or any such acceleration rescinded, or such Indebtedness is repaid, within a period of ten (10) days from the continuation of such default beyond the applicable grace period or the occurrence of such acceleration, as the case may be, no Event of Default shall be deemed to have occurred; (b) any material breach or default under the Series H Certificate of Designation; provided, that if such breach or default is cured or waived within a period of ten (10) days from the continuation of such breach or default beyond any applicable grace period, no Event of Default shall be deemed to have occurred; and (c) any material breach of default under the

4

certificate of designation with respect to the Company’s Series G Preferred Stock, the Series I Certificate of Designation or the certificate of designation of any other series of preferred stock of the Company (other than the Series H Convertible Preferred Stock), in each case to the extent outstanding; provided, that in the case of this clause (c), if such breach or default is cured or waived within a period of ten (10) days from the continuation of such breach or default beyond any applicable grace period, no Event of Default shall be deemed to have occurred.

(q) “Fair Market Value” means, as of any date with respect to a share of Common Stock, the Trading Price as of such date; provided, that if “Fair Market Value” is being determined in connection with a transaction with an Acquiring Entity for which Section 8(a) or Section 8(b) applies, then the fair market value of a share of Common Stock shall be the value of the consideration payable by such Acquiring Entity for each share of Common Stock; provided, further, that for accounting purposes only, to the extent that the “Fair Market Value” is not determinable in accordance with the foregoing provisions of this definition, “Fair Market Value” means, as of any date with respect to a share of Common Stock, the fair market value of a share of Common Stock as determined in good faith by the Board of Directors of the Company.

(r) “Indebtedness” means, with respect to the Company and its subsidiaries: (i) any liabilities for borrowed money or amounts owed or indebtedness issued in substitution for or exchange of indebtedness for borrowed money; (ii) obligations evidenced by notes, bonds, debentures or other similar instruments; (iii) obligations under leases (contingent or otherwise, as obligor, guarantor or otherwise) required to be accounted for as capitalized leases pursuant to generally accepted accounting principles; (iv) obligations for amounts drawn and outstanding under acceptances, letters of credit, contingent reimbursement liabilities with respect to letters of credit or similar facilities; (v) any liability for deferred purchase price of property or services, contingent or otherwise, as obligor or otherwise, other than accounts payable incurred in the ordinary course of business and (vi) any accrued and unpaid interest on, and any prepayment premiums, penalties or similar contractual charges in respect of, any of the foregoing.

(s) “Issuance Date” means May 25, 2012.

(t) “Open of Business” means 9:00 a.m. New York City time.

(u) “Payment” has the meaning attributed to it in Section 2(a)(ii).

(v) “Pegasus” means Pegasus Capital Advisors, L.P. and its Affiliates.

(w) “Permitted Transfer” means any transfer by Holder of all or any portion of this Warrant or all or any portion of the Common Stock issued upon exercise of this Warrant: (i) to any Affiliate or direct or indirect equityholder of Holder or any of its Affiliates, (ii) to Pegasus, (iii) to the Company or any of the Company’s subsidiaries, (iv) pursuant to the exercise of the co-sale rights set forth in that certain co-sale agreement, dated as of May 25, 2012, among Holder, Pegasus and certain of their Affiliates, (v) in any transaction in which all or substantially all of the equity interests of the Company are transferred pursuant to any reorganization, merger, consolidation or sale of the Company, (vi) in a Qualified Public Offering or in another offering registered pursuant to the Securities Act after a Qualified Public Offering, (vii) pursuant to a tender or exchange offer pursuant to the Securities Act or the Exchange Act, (viii) with the prior written consent of the Company or (ix) pursuant to a pro rata in-kind distribution or dividend to the equityholders of Holder (and any intermediary transfers amongst Affiliates of Holder as part of giving effect thereto.

5

(x) “Person” means a natural person or entity, or a government or any division, department or agency thereof.

(y) “Preferred Shares” means the Company’s shares of Series H Convertible Preferred Stock and Series I Convertible Preferred Stock.

(z) “Qualified Public Offering” means a firmly committed underwritten public offering of the Common Stock on the NASDAQ Stock Market or the New York Stock Exchange pursuant to an effective registration statement filed under the Securities Act, where (a) the gross proceeds received by the Company and any selling stockholders in the offering are no less than $100 million and (b) the market capitalization of the Company immediately after consummation of the offering is no less than $500 million.

(aa) “Restrictive Period” has the meaning attributed to it in Section 6(a).

(bb) “Riverwood” means Riverwood Capital Partners, L.P. and its Affiliates.

(cc) “Securities Act” means the Securities Act of 1933, as amended.

(dd) “Series G Holder” means any holder of the Company’s outstanding shares of Series G Preferred Stock.

(ee) “Series H Certificate of Designation” means the Certificate of Designation of Series H Convertible Preferred Stock of the Company, as filed with the Secretary of State of the State of Delaware and as the same may be amended, restated, supplemented or otherwise modified from time to time.

(ff) “Series H Holder” means any holder of the Company’s outstanding shares of Series H Convertible Preferred Stock.

(gg) “Series I Certificate of Designation” means the Certificate of Designation of Series I Convertible Preferred Stock of the Company, as filed with the Secretary of State of the State of Delaware and as the same may be amended, restated, supplemented or otherwise modified from time to time.

(hh) “Series I Holder” means any holder of the Company’s outstanding shares of Series I Convertible Preferred Stock.

(ii) “Trading Day” means a day on which the Common Stock is traded on a Trading Market.

(jj) “Trading Market” means The NASDAQ Stock Market or the New York Stock Exchange.

6

(kk) “Trading Price” means, for any date, the price determined by the first of the following clauses that applies:

(i) after a Qualified Public Offering, the closing sale price or, if no closing sale price is reported, the last reported sale price of the Common Stock for such date (or the nearest preceding date) on the principal Trading Market on which the Common Stock is listed or quoted for trading as reported by Bloomberg, L.P. (based on a Trading Day from 9:30 a.m. (New York City time) to 4:02 p.m. (New York City time)); or

(ii) in all other cases, the fair market value of a share of Common Stock as determined by an independent appraiser selected in good faith by the Holder and reasonably acceptable to the Company, the fees and expenses of which shall be paid by the Company.

(ll) “Warrant” means this Warrant and all Warrants issued in exchange, transfer or replacement thereof.

(mm) “Warrant Exercise Period” has the meaning attributed to it in Section 2(a).

(nn) “Warrant Shares” has the meaning attributed to it in the preamble of this Warrant, as may be adjusted from time to time in accordance with this Warrant.

Section 2. Exercise of Warrant.

(a) This Warrant may be exercised, to the extent permitted by applicable laws and regulations, for Warrant Shares, in whole or in part, by the Holder registered on the books of the Company at any time on or before 5:00 p.m., New York City time on May 25, 2022 (the “Warrant Exercise Period”). Any exercise of this Warrant shall be effected by:

(i) delivery of a written notice, in the form attached as Exhibit A (the “Exercise Notice”), of Holder’s election to exercise this Warrant with respect to the Warrant Shares;

(ii) payment to the Company of an amount equal to the Exercise Price (determined as of the close of business on the Trading Day prior to exercise) multiplied by the number of Warrant Shares being purchased, either (A) in cash or by wire transfer of immediately available funds or (B) by means of a cashless exercise pursuant to Section 2(d) (the foregoing methods of payment set forth in (A) and (B), including any combination of such methods, referred to herein as the “Payment”); and

(iii) the surrender at the principal office of the Company or to a nationally recognized courier for overnight delivery to the Company, simultaneously with or as soon as practicable following the delivery of the Exercise Notice and the Payment, of this Warrant (or an indemnification undertaking with respect to this Warrant in the case of its loss, theft or destruction, in such form and substance as is reasonably satisfactory to the Company).

7

(b) If the Holder does not exercise this Warrant in its entirety, the Holder will be entitled to receive from the Company within a reasonable time, and in any event not exceeding five (5) Business Days, a new warrant in substantially identical form for the purchase of that number of shares of Common Stock equal to the difference between the number of shares of Common Stock subject to this Warrant and the number of shares of Common Stock as to which this Warrant is so exercised. Notwithstanding anything in this Warrant to the contrary, the Holder hereby acknowledges and agrees that its exercise of this Warrant for shares of Common Stock is subject to the condition (for the benefit of the Company and the Holder) that the Holder will have first received any applicable regulatory approvals required to be obtained by Holder with respect to such exercise of the Warrants and issuance of the Warrant Shares. Unless the rights represented by this Warrant have expired or been fully exercised, the Company shall, as soon as practicable and in no event later than five (5) Business Days after receipt of the Exercise Documents and at its own expense, issue a new Warrant identical in all respects to this Warrant, except it shall represent rights to purchase the number of Warrant Shares purchasable immediately prior to exercise, less the number purchased.

(c) The Company shall, not later than the fifth (5th) Business Day (the “Delivery Date”) following receipt of an Exercise Notice, the Payment and this Warrant or such indemnification (collectively, the “Exercise Documents”), arrange for its transfer agent, on or before the Delivery Date, to issue and surrender to a nationally recognized courier for overnight delivery to the address specified in the Exercise Notice, a certificate, registered in the name of the Holder or its permitted designee, for the number of shares of Common Stock to which the Holder is entitled. Upon delivery of the Exercise Notice and the Payment (the “Exercise Date”), the Holder shall be deemed for all corporate purposes to have become the holder of record of the Warrant Shares with respect to which this Warrant has been exercised on the Delivery Date, irrespective of the date of delivery of the certificates evidencing such Warrant Shares.

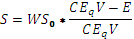

(d) In lieu of or in addition to exercising this Warrant and making the Payment in cash or by wire transfer pursuant to Section 2(a)(ii)(A), the Holder may elect to make the Payment by means of receiving shares of Common Stock equal to the value of this Warrant (or portion thereof being exercised) by delivery and surrender of the Warrant together with the Exercise Notice in accordance with the terms hereof, duly completed to indicate a net issuance exercise and executed by the Holder, in which event the Company shall issue to the Holder a number of shares of Common Stock computed using the following formula:

where:

| S | equals the number of shares of Common Stock to be issued as Warrant Shares to the Holder; |

| WS0 | means, as of any date, the number of Warrant Shares purchasable (or portion thereof) under this Warrant that are being exercised at the applicable date of determination; |

8

| CEqV | means, as of any date, the Fair Market Value per share of Common Stock on the Trading Day immediately preceding the Exercise Date (for the avoidance of doubt, CEqV as used in this equation must equal CEqV used for purposes of determining the Exercise Price); and |

| E | the Exercise Price on the Exercise Date. |

(e) No fractional shares of Common Stock or scrip representing fractional shares of Common Stock shall be issued upon any exercise of this Warrant. In lieu of any fractional share of Common Stock to which the Holder would otherwise be entitled, the Company shall issue a number of shares of Common Stock to Holder rounded up to the nearest whole number of shares of Common Stock. No cash shall be payable to any Holder upon exercise of the Warrant Shares.

(f) This Warrant shall not be exercisable for any shares (and, for the avoidance of doubt, shall have no other value) if, in accordance with, and solely to the extent and in the circumstances specifically provided in, the definition of “Exercise Price,” this Warrant is “deemed to have no value”.

Section 3. Representations, Warranties, Covenants and Agreements. The Company hereby represents, warrants, covenants and agrees, as applicable, as follows:

(a) This Warrant is, and any Warrants issued in substitution for or in replacement of this Warrant upon issuance will be, duly authorized, executed and delivered.

(b) All shares of Common Stock issuable upon exercise of this Warrant have been duly authorized and when issued upon such exercise will be validly issued, fully paid and nonassessable and free from all taxes, liens and charges with respect to the issue thereof.

(c) As long as this Warrant may be exercised, the Company will at all times have authorized and reserved for issuance and delivery upon exercise of this Warrant at least the number of shares of Common Stock needed to provide for the exercise in full of the rights then represented by this Warrant.

(d) The Company will use its reasonable best efforts to ensure that the Common Stock may be issued without violation of any law or regulation applicable to the Company or of any requirement of any securities exchange applicable to the Company on which the shares of Common Stock are listed or traded.

Section 4. Warrant Holder Not Deemed a Stockholder. Nothing contained in this Warrant shall be construed to (a) grant the Holder any rights to vote or receive dividends or be deemed the holder of shares of the Company for any purpose, (b) confer upon the Holder any of the rights of a stockholder of the Company or any right to vote, give or withhold consent to any corporate action (whether any reorganization, issue of stock, reclassification of stock, consolidation, merger, conveyance or otherwise), receive notice of meetings, receive dividends or subscription rights, or otherwise, or (c) impose any liabilities on the Holder to purchase any securities or as a stockholder of the Company, whether asserted by the Company or creditors of the Company, prior to the exercise hereof.

9

Section 5. Representations of Holder. The Holder, by the acceptance hereof, represents that it is acquiring this Warrant and the Warrant Shares for its own account for investment only and not with a view towards, or for resale in connection with, the public sale or distribution of this Warrant or the Warrant Shares, except pursuant to sales registered or exempted under the Securities Act. Upon exercise of this Warrant, the Holder shall, if requested by the Company, confirm in writing, in a form satisfactory to the Company, that the Warrant Shares are being acquired solely for the Holder’s own account and not as a nominee for any other party, for investment, and not with a view toward distribution or resale. If Holder cannot make such representations because they would be factually incorrect, it shall be a condition to Holder’s exercise of this Warrant that the Company receives such other representations as the Company considers reasonably necessary to assure the Company that the issuance of its securities upon exercise of this Warrant shall not violate any federal or state securities laws. The Company shall not be penalized or disadvantaged by the Holder’s inability to exercise this Warrant due to its inability to make the required representations in connection with the exercise of this Warrant.

Section 6. Ownership and Transfer.

(a) (a) This Warrant, and any shares of Common Stock issued upon exercise of this Warrant, may be offered, sold, transferred or assigned by any Holder to a transferee in a Permitted Transfer. Subject to this Section 6, during the Restrictive Period, this Warrant, and any shares of Common Stock issued upon exercise of this Warrant, may not be offered, sold, transferred or assigned by any Holder except pursuant to a Permitted Transfer. As used herein, the “Restrictive Period” shall mean the period commencing on the Issuance Date and ending upon the earliest of (A) the three-year anniversary of the Issuance Date, (B) a Qualified Public Offering and (C) an Event of Default.

(b) To the extent the Restrictive Period ends by reason of the occurrence of the three-year anniversary of the Issuance Date as provided in clause (i) of the definition thereof, and neither a Qualified Public Offering nor an Event of Default has occurred, this Warrant, and any shares of Common Stock issued upon exercise of this Warrant, may only be offered, sold, transferred or assigned by any Holder with the prior written consent of the Company, such consent not to be unreasonably withheld, conditioned or delayed, or pursuant to a Permitted Transfer.

(c) All offers, sales, transfers and assignments of this Warrant, or any shares of Common Stock issued upon exercise of this Warrant must also be made in accordance with the Securities Act, and applicable state securities laws. Any attempted transfer of this Warrant, or any shares of Common Stock issued upon exercise of this Warrant, in violation of this Section 6 shall be null and void ab initio.

(d) Subject to Section 6(a), upon surrender of this Warrant to the Company, together with instructions by the applicable Holder that all or a portion of this Warrant be assigned, the Company shall, without charge, execute and deliver a new Warrant in the name of the assignee or assignees named in such instrument of assignment and, if the applicable Holder’s entire interest is not being assigned, in the name of the Holder and this Warrant shall promptly be canceled. All expenses (other than stock transfer taxes) and other charges payable in connection with the preparation, execution and delivery of the new Warrants pursuant to this Section 6(b) shall be paid by the Company.

10

(e) Issuance of certificates for Warrant Shares (or other securities) to the Holder upon exercise of this Warrant shall be made without charge to the Holder for any issue or transfer tax or other incidental expense in respect of the issuance of such certificates, all of which taxes and expenses shall be paid by the Company.

(f) The Company shall maintain a registry showing the name and address of the Holder as the registered holder of this Warrant, and the Company shall be entitled to rely in all respects, prior to written notice to the contrary, upon such registry. This Warrant is exchangeable, upon the surrender hereof by the Holder to the Company, for a new Warrant or Warrants of like tenor and representing the right to purchase the same aggregate number of Warrant Shares.

Section 7. Adjustment of Number of Warrant Shares.

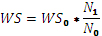

(a) In the event of any issuance of Common Stock as a dividend or distribution to all holders of Common Stock, or a subdivision, split, combination or reclassification of the outstanding shares of Common Stock into a greater or smaller number of shares, the number of Warrant Shares for which this Warrant is exercisable shall be adjusted pursuant to the following formula:

where:

| WS = | the number of Warrant Shares for which this Warrant is exercisable immediately after the Open of Business on the Ex-Date for such dividend or distribution, or immediately after the Open of Business on the effective date for such subdivision, combination or reclassification, as the case may be; |

| WS0 = | the number of Warrant Shares for which this Warrant is exercisable immediately prior to the Open of Business on the Ex-Date for such dividend or distribution, or immediately prior to the Open of Business on the effective date for such subdivision, combination or reclassification, as the case may be; |

| N0 = | the number of shares of Common Stock outstanding immediately prior to the Open of Business on the Ex-Date for such dividend or distribution, or immediately prior to the Open of Business on the effective date for such subdivision, combination or reclassification, as the case may be; and |

| N1 = | the number of shares of Common Stock equal to (i) in the case of a dividend or distribution, the sum of (A) the number of shares outstanding immediately prior to the Open of Business on the Ex-Date for such dividend or distribution plus (B) the total number of shares issued pursuant to such dividend or distribution or (ii) in the case of a subdivision, combination or reclassification, the number of shares outstanding immediately after such subdivision, combination or reclassification. |

11

Such adjustment shall become effective (i) in the case of a dividend or distribution, immediately after the Open of Business on the Ex-Date for such dividend or distribution or (ii) in the case of a subdivision, split, combination or reclassification, immediately after the Open of Business on the effective date for such subdivision, split, combination or reclassification. If any dividend or distribution or subdivision, split, combination or reclassification of the type described in this Section 7(a) is declared or announced but not made, the number of Warrant Shares for which this Warrant is exercisable shall again be adjusted to the number of Warrant Shares that would then be in effect if such dividend or distribution or subdivision, split, combination or reclassification had not been declared or announced, as the case may be.

(b) In the event of (w) any or a subdivision, split, combination or reclassification of the outstanding shares of Common Stock, (x) any declaration or making of a dividend or other distribution to holders of Common Stock, (y) the dissolution, liquidation or winding up of the Company, or (z) the entry into, or commitment by the Company to effect, any event described in clauses (a) or (b) of Section 8 (including a Change of Control), then the Company shall file with its corporate records and mail to the Holder at its last address as shown on the records of the Company, at least ten (10) days prior to the record or other date specified below, a notice stating:

(i) the record date of such split, dividend or other distribution, or, if a record is not to be taken, the date as of which the holders of Common Stock of record to be entitled to such subdivision, split, combination or reclassification, dividend or other distribution are to be determined; or

(ii) the date on which such subdivision, reclassification, liquidation, dissolution, winding up, combination, event, transaction or Change of Control, is estimated to become effective, and the date as of which it is expected that holders of Common Stock of record will be entitled to exchange their shares of Common Stock for the capital stock, other securities or other property (including but not limited to cash and evidences of indebtedness) deliverable upon such subdivision, reclassification, liquidation, dissolution, winding up, combination, event, transaction or Change of Control.

(c) Upon the occurrence of each adjustment or readjustment of the number of Warrant Shares pursuant to this Section 7, the Company at its expense shall promptly as reasonably practicable compute such adjustment or readjustment in accordance with the terms hereof and furnish to each Holder a certificate, signed by an executive officer of the Company, setting forth such adjustment or readjustment and showing in detail the facts upon which such adjustment or readjustment is based and shall file a copy of such certificate with its corporate records. The Company shall, upon the reasonable written request of any Holder, furnish to such Holder a similar certificate setting forth (i) the calculation of such adjustments and readjustments in reasonable detail and (ii) the number of shares of Common Stock and the amount, if any, of capital stock, other securities or other property (including but not limited to cash and evidences of indebtedness) which then would be received upon the exercise of this Warrant.

Section 8. Purchase Rights; Reorganization, Reclassification, Consolidation, Merger or Sale. Upon the consummation of any (a) sale of all or substantially all of the Company’s assets to an acquiring Person or (b) other Change of Control following which the Company is not a surviving entity, the Company will secure from the Person purchasing the assets or the successor

12

resulting from the Change of Control (in each case, the “Acquiring Entity”) a written agreement to deliver to the Holder, in exchange for this Warrant, a security of the Acquiring Entity evidenced by a written instrument substantially similar in form and substance to this Warrant and reasonably satisfactory to the Holder. Prior to the consummation of any other Change of Control, the Company shall make appropriate provision to insure that the Holder will thereafter have the right to acquire and receive, in lieu of the shares of Common Stock immediately theretofore acquirable and receivable upon the exercise of this Warrant, such shares of stock, securities or assets that would have been issued or payable in the Change of Control with respect to or in exchange for the number of Warrant Shares that would have been acquirable as of the date of the Change of Control.

Section 9. Lost, Stolen, Mutilated or Destroyed Warrant. If this Warrant is lost, stolen, mutilated or destroyed, the Company shall promptly, on receipt of an indemnification undertaking reasonably satisfactory to the Company (or, in the case of a mutilated Warrant, the Warrant), issue a new Warrant of like denomination and tenor as this Warrant so lost, stolen, mutilated or destroyed.

Section 10. Notice. Any notices, consents, waivers or other communications required or permitted to be given under the terms of this Warrant must be in writing and will be deemed to have been delivered: (i) upon receipt, when delivered personally; (ii) upon receipt, when sent by fax (provided confirmation of transmission is mechanically or electronically generated and kept on file by the sending party); or (iii) one (1) Business Day after deposit with a nationally recognized overnight delivery service, in each case properly addressed to the party to receive the same. The addresses, fax numbers and email addresses for communications shall be:

If to the Company:

Lighting Science Group Corporation

1227 South Patrick Drive

Building 2A

Satellite Beach, FL 32937

Attention: Gregory T. Kaiser, Chief Financial Officer

Fax: (321) 779-5521

With a copy (which shall not constitute notice or constructive notice) to:

Haynes and Boone, LLP

2323 Victory Avenue, Suite 700

Dallas, TX 75219

Attention: Greg R. Samuel, Esq.

Fax: (214) 200-0577

If to the Holder:

c/o Riverwood Capital Management L.P.

70 Willow Road, Suite 100

Menlo Park, CA 94025

Attention: Jeffrey T. Parks

Fax: (650) 618-7114

13

With a copy (which shall not constitute notice or constructive notice) to:

Simpson Thacher & Bartlett LLP

2550 Hanover Street

Palo Alto, CA 94304

Attention: Kirsten Jensen

Fax: (650) 251-5002

Each party shall provide five (5) days’ prior written notice to the other party of any change in address or fax number or email address. Written confirmation of receipt (A) given by the recipient of any notice, consent, waiver or other communication, (B) mechanically or electronically generated by the sender’s fax machine or computer containing the time, date, recipient fax number or email address and an image of the first page of the fax transmission or the content of the email, or (C) provided by a nationally recognized overnight delivery service, shall be rebuttable evidence of receipt.

Section 11. Amendment and Waiver. This Warrant may not be modified or amended except pursuant to an instrument in writing signed by the Company and the Holder. No provision hereunder may be waived other than in a written instrument executed by the waiving party. No failure or delay by either party in exercising any right, power or privilege hereunder shall operate as a waiver thereof nor shall any single or partial exercise thereof preclude any other or further exercise thereof or the exercise of any other right, power or privilege. The rights and remedies herein provided shall be cumulative and not exclusive of any rights or remedies provided by law.

Section 12. Governing Law. This Warrant shall be construed and enforced in accordance with, and all questions concerning the construction, validity, interpretation and performance of this Warrant shall be governed by, the internal laws of the State of New York, without giving effect to any choice of law or conflict of law provision or rule (whether of the State of New York or any other jurisdictions) that would cause the application of the laws of any jurisdictions other than the State of New York.

Section 13. Restrictive Legends. At all times this Warrant, and until such time as a registration statement has been declared effective by the U.S. Securities and Exchange Commission or the Warrant Shares may be sold pursuant to Rule 144 under the Securities Act without any restriction as to the number of securities that can then be immediately sold, certificates for any Warrant Shares will, in addition to any legend required under applicable securities law, bear a restrictive legend substantially in the form set forth on the first page of this Warrant.

Section 14. Binding Effect. This Warrant shall be binding upon any successors or assigns of the Company.

Section 15. Entire Agreement. This Warrant and the Support Services Agreement entered into between the Company and Holder and dated as of the Issuance Date (and the other documents referenced therein), contain the entire agreement between the parties with respect to the

14

subject matter hereof and supersede all prior and contemporaneous arrangement or undertakings with respect thereto.

* * * * *

15

IN WITNESS WHEREOF, the Company has caused this Warrant to be signed as of May 25, 2012.

| LIGHTING SCIENCE GROUP CORPORATION | ||

| By: | /s/ Gregory T. Kaiser | |

| Name: | Gregory T. Kaiser | |

| Title: | Chief Financial Officer | |

[Signature Page to Warrant]

Agreed and Acknowledged on May 25, 2012.

| RW LSG MANAGEMENT HOLDINGS LLC | ||

| By: | Riverwood Capital Management L.P., | |

| its Managing Member | ||

| By: | Riverwood Capital Management Ltd., | |

| its General Partner | ||

| By: | /s/ Michael E. Marks | |

| Name: Michael E. Marks | ||

| Title: Director and CEO | ||

17

Exhibit A To Warrant

LIGHTING SCIENCE GROUP CORPORATION

EXERCISE NOTICE

TO BE EXECUTED BY THE REGISTERED HOLDER

TO EXERCISE THIS WARRANT

The undersigned holder hereby exercises the right to purchase shares of Common Stock (“Warrant Shares”) of Lighting Science Group Corporation, a Delaware corporation (the “Company”), evidenced by the attached Warrant (the “Warrant”). Capitalized terms used herein and not otherwise defined shall have the respective meanings set forth in the Warrant.

| 1. | Payment of Exercise Price (check applicable box). |

| Payment in the sum of $ is enclosed in accordance with the terms of the Warrant. |

| ‘ | Payment in the sum of $ has been wire transferred to the Company at the following account: in accordance with the terms of the Warrant. |

| Holder hereby elects to make the Payment for the Warrant Shares in accordance with Section 2(d) of the Warrant. |

| 2. | Delivery of Warrant Shares. The Company shall deliver the Warrant Shares in the name of the undersigned or in such other name as is specified below in accordance with Section 2(c) of the Warrant at the following address: |

Date: ,

| By: | ||

| Name: | ||

| Title: | ||