Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - United Financial Bancorp, Inc. | d360511d8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - United Financial Bancorp, Inc. | d360511dex21.htm |

| EX-99.1 - JOINT PRESS RELEASE - United Financial Bancorp, Inc. | d360511dex991.htm |

Holding

Company for NASDAQ: UBNK

Acquisition of

New England Bancshares, Inc.

NASDAQ: NEBS

Exhibit 99.2

May 31, 2012 |

Safe Harbor

Statement 2

Certain comments made in the course of this presentation by United Financial Bancorp, Inc.

(“UBNK”) are forward-looking in nature. These include statements

about the merger, including the expected closing date and anticipated cost savings, and

about UBNK’s operating results or financial position and usually use words such as

“expect”, “anticipate”, “believe”, and similar

expressions. These comments represent management’s current beliefs, based upon information available to it at the

time the statements are made with regard to the matters addressed. All forward looking statements are subject to risks and uncertainties that could cause

UBNK’s actual results or financial condition to differ materially from those

expressed in or implied by such statements. Factors of particular importance to

UBNK include, but are not limited to: (1) delays in completing the merger; (2) difficulties in

achieving expected cost savings; (3) difficulties in integrating the two

organizations; (4) changes in general economic conditions, including interest rates; (5)

competition among providers of financial services; (6) changes in the interest rate environment

that reduce our margins or reduce the fair value of financial instruments; (7) adverse

changes in the securities markets; and (8) our ability to enter new markets successfully

and capitalize on growth opportunities. UBNK does not undertake any obligation to update or revise any

forward-looking statements, whether as a result of new information, future events or

otherwise. In connection with the proposed merger, UBNK will file with the SEC a Registration Statement on

Form S-4 that will include a Proxy Statement of New England Bancshares, Inc.

(“NEBS”) and a Proxy Statement and Prospectus of UBNK, as well as other

relevant documents concerning the proposed transaction. Shareholders are urged to read the

Registration Statement and the Joint Proxy Statement/Prospectus regarding the merger

when they become available and any other relevant documents filed with the SEC, as well

as any amendments or supplements to those documents, because they will contain important

information. You will be able to obtain a free copy of the Joint Proxy Statement/Prospectus, as

well as other filings containing information about UBNK and NEBS at the SEC’s

Internet site (http://www.sec.gov). You will also be able to obtain these documents,

free of charge, from UBNK at www.bankatunited.com under the tab “Investor Relations” and then under the

heading “SEC Filings” or from NEBS by accessing NEBS’ website at

www.nebankct.com under the tab “Shareholder Information” and then under the

heading “SEC Filings”. UBNK and NEBS and certain of their directors and executive officers

may be deemed to be participants in the solicitation of proxies from the shareholders of NEBS

in connection with the proposed merger. Information about the directors and executive

officers of UBNK is set forth in the proxy statement for UBNK’s 2012 annual meeting

of shareholders, as filed with the SEC. Information about the directors and executive officers of

NEBS is set forth in the proxy statement for NEBS’ 2011 annual meeting of shareholders, as

filed with the SEC. Additional information regarding the interests of those participants

and other persons who may be deemed participants in the transaction may be obtained by

reading the Joint Proxy Statement/Prospectus regarding the proposed merger when it

becomes available. You may obtain free copies of this document as described above. |

Strategic

Rationale 3

*Based on UBNK issue price of $15.89, or the 20 day Volume Weighted Average Price as of May 30,

2012 and pro forma shares outstanding. **Market area defined as Hampden, Worcester and

Hampshire counties in MA and Hartford, New Haven, Tolland and Litchfield counties in CT.

Strategic Acquisition That Improves Franchise Value

•

Immediate scale and strong footprint in markets with attractive demographic profile

•

Provides United with significant commercial lending and deposit growth opportunities

•

Low execution risk given expansion into contiguous market and similar business mix

•

Revenue expansion opportunities –

leverage existing platform, products and services in CT market area

•

Opportunistic acquisition that provides meaningful improvement in earnings

Improved Scale

•

Approximately $2.4 billion in combined assets

•

Larger capital base provides United the opportunity to compete for larger lending

opportunities •

Pro forma market capitalization of more than $330 million

*

–

opportunity for overall multiple expansion

•

United

becomes

top

10

largest

publicly

traded

bank

headquartered

in

New

England

by

asset

size

and

the

largest

community

bank in the pro forma market area based on deposit market share

**

Strong Transaction Fundamentals

•

Greater than 20% earnings accretion in 2013 based on realistic and achievable cost savings and

no revenue enhancements •

Greater than 15% IRR (significantly above UBNK’s cost of capital)

•

Reasonable tangible book value dilution of approximately 9% projected at close with acceptable

incremental earn back period Prudent Deployment of Excess Capital

•

Transaction provides attractive financial returns

•

Well positioned for future organic growth, strategic acquisitions and continued capital

deployment strategies •

As of March 31, 2012, pro forma entity ranks 2nd by TCE ratio among public banks or thrifts

headquartered in New England with assets > $2.0 billion

(approximately 5.5 years) |

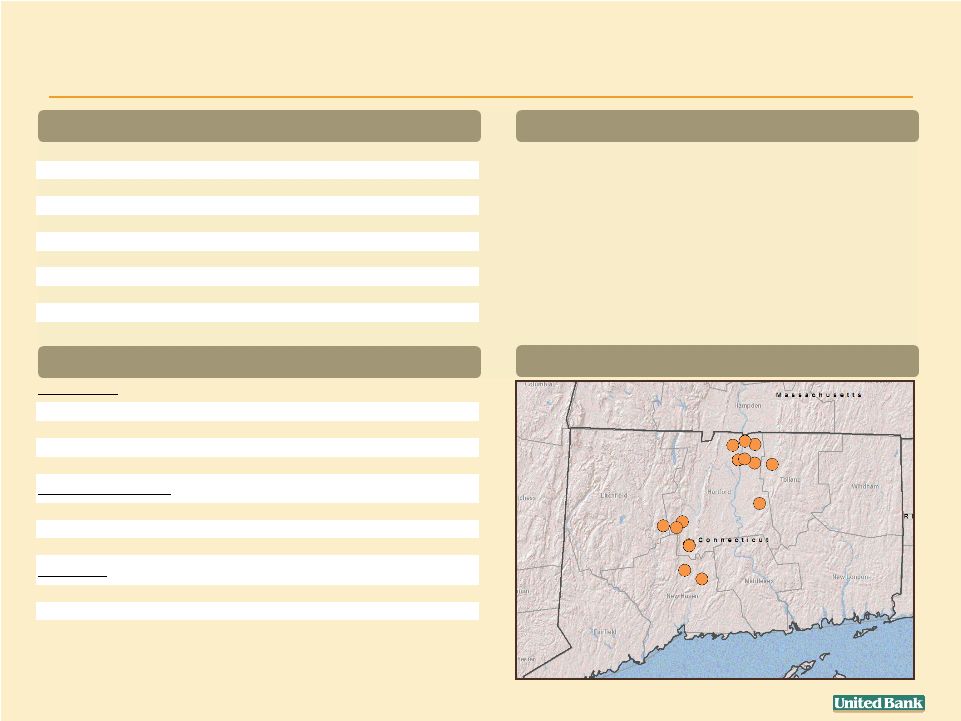

Bank

Subsidiary New England Bank

Headquarters

Enfield, CT

Exchange / Ticker

NASDAQ / NEBS

Number of Branches

15

Banking History

Established 1916

Bank Franchise (Dollars in thousands) (1)

Hartford

$461,655 deposits / 11 branches

New Haven

$60,266 deposits / 2 branches

Tolland

$24,598 deposits / 1 branch

Litchfield

$19,851 deposits / 1 branch

Total

$566,370 deposits / 15 branches

Balance Sheet

Total Assets (000s)

$726,502

Total Loans (000s)

$557,943

Total Deposits (000s)

$581,628

Total Equity (000s)

$73,370

Capital & Asset Quality

Tang. Comm. Eq. / Tang. Assets (3)

7.86%

Reported NPAs / Assets

2.29%

Reported NPLs / Loans

2.72%

Profitability

MRQ Annualized ROAA

0.65%

MRQ Annualized ROAE

6.40%

MRQ Annualized NIM

3.45%

New England Bancshares, Inc. Overview

•

2002

–

Completes MHC conversion

•

2003

–

Acquires Windsor Locks Community Bank, FSL

–

$37MM in assets / $16MM of loans

•

2005

–

Completes second step conversion

•

2007

–

Acquires First Valley Bancorp, Inc.

–

$185MM in assets / $129MM of loans

•

2009

–

Acquires Apple Valley Bank & Trust Company

–

$85MM in assets / $69MM of loans

Branch Map

History

Overview

Financial Summary (as of March 31, 2012) (2)

4

(1)

Deposits as of 6/30/11.

(2)

Reflects unaudited financial information as filed on Form 8-K on 5/8/12.

(3)

As of 12/31/11.

Source: SNL Financial. |

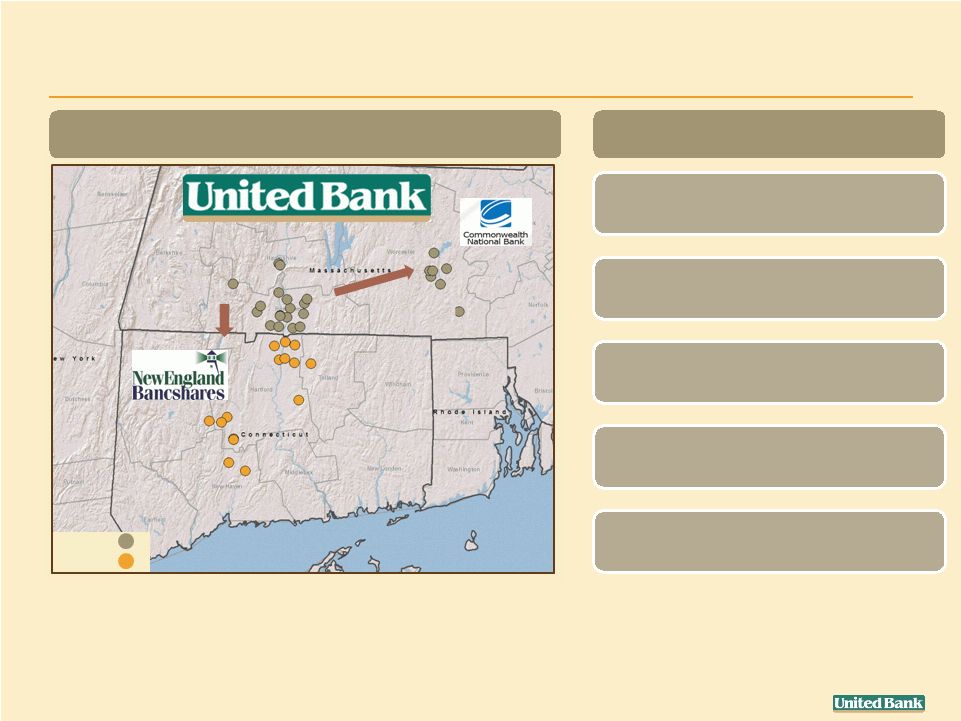

Building a

Scalable Community Bank Franchise Transaction Represents Logical Expansion of UBNK’s

Franchise into Attractive Markets

(2009)

5

(2012)

United Pro Forma

Source: SNL Financial.

$2.4 billion in combined assets

$1.7 billion in combined loans

$1.8 billion in combined deposits

7 counties with 39 branches

Pro Forma TCE/TA = 11.1%

UBNK

NEBS |

Building a

Significant Community Bank Franchise *Represents rank among banks/thrifts >$2.0

billion in assets headquartered in New England. **Represents Boston Private Bank &

Trust Company TCE/TA. ***Market area defined as Hampden, Worcester and Hampshire counties

in MA and Hartford, New Haven, Tolland and Litchfield counties in CT, excludes super regionals.

Source: SNL Financial.

6

•

Important player in New England region with capacity to grow

•

Considerable presence and largest community bank in pro forma market area

based on deposit market share

***

Company Name

Ticker

3/31/2012

Assets

($000)

3/31/2012

TCE/TA (%)

Rank by

Assets

Group Rank

by TCE/TA

*

State Street Corporation

STT

187,956,000

6.4

1

11

People's United Financial, Inc.

PBCT

27,807,900

11.7

2

1

Webster Financial Corporation

WBS

19,134,142

7.1

3

9

Boston Private Financial Holdings, Inc.

**

BPFH

6,148,562

8.6

4

6

Independent Bank Corp.

INDB

4,985,739

7.0

5

10

Brookline Bancorp, Inc.

BRKL

4,877,124

9.2

6

4

Berkshire Hills Bancorp, Inc.

BHLB

4,029,327

8.8

7

5

Washington Trust Bancorp, Inc.

WASH

3,028,690

7.5

8

8

Century Bancorp, Inc.

CNBKA

2,855,972

5.7

9

12

United Pro Forma

UBNK

2,400,000

11.1

10

2

Camden National Corporation

CAC

2,339,158

7.8

11

7

Meridian Interstate Bancorp, Inc. (MHC)

EBSB

2,033,738

10.4

12

3

UBNK Pre-deal

UBNK

1,660,198

13.2

14

NM |

NEBS footprint

and Hartford market area are additive to UBNK’s

demographic profile

Springfield/ Hartford area or the

“Knowledge Corridor”

is the second most

densely populated region in New

England with 1.9 million people*

385

762

506

88

0

200

400

600

800

UBNK

NEBS

Pro Forma

National

$52,126

$63,678

$55,819

$50,227

$0

$20,000

$40,000

$60,000

$80,000

UBNK

NEBS

Pro Forma

National

Entrance into Growth Market with Attractive Demographic

Median Household Income ($000)

Projected

Household

Income

Growth

(2011

-

2016)

Population Density**

13.98%

21.01%

16.23%

14.55%

0.00%

6.00%

12.00%

18.00%

24.00%

UBNK

NEBS

Pro Forma

National

7

Note: Deposit weighted by MSA.

*Source: Economic Development Data & Information (EDDI).

**Population density defined as persons per square mile.

Source: Demographic data is provided by ESRI based primarily on US Census data as of

2011. SNL Financial. |

0

500

1,000

1,500

2,000

2,500

UBNK MSAs

NEBS MSAs

Springfield, MA

Hartford-West Hartford-East Hartford, CT

Worcester, MA

New Haven-Milford, CT

Torrington, CT

Provides Significant Commercial Lending Opportunity

Less than 500 Employees Businesses

500+ Employees Middle Market and Corporate

•

Pro forma market area (Springfield/Hartford

area) is the second largest economic

area in New England

•

Hartford and New Haven market areas have attractive mix of large

and small

businesses

•

Cross selling opportunity for deposit products, cash management services and

wealth management services

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

50,000

UBNK MSAs

NEBS MSAs

Springfield, MA

Hartford-West Hartford-East Hartford, CT

Worcester, MA

New Haven-Milford, CT

Torrington, CT

Source: Statistics of U.S. Businesses, United States Census Bureau 2009; Economic

Development Data & Information (EDDI). 8 |

Similar Loan

Mix Pro Forma Loan Mix

(in millions)

$469

$260

$709

Total Loans $1,697

$157

$78

$43

$242

NEBS Loan Mix as of March 31, 2012

(in millions)

Total Loans $558

$12

$26

$73

$5

$312

$182

$30

$467

UBNK Loan Mix as of March 31, 2012

(in millions)

Total Loans $1,139

$14

$5

Source: SNL Financial.

Note: NEBS’

data reflects bank regulatory financials.

9

$134

$21

$155 |

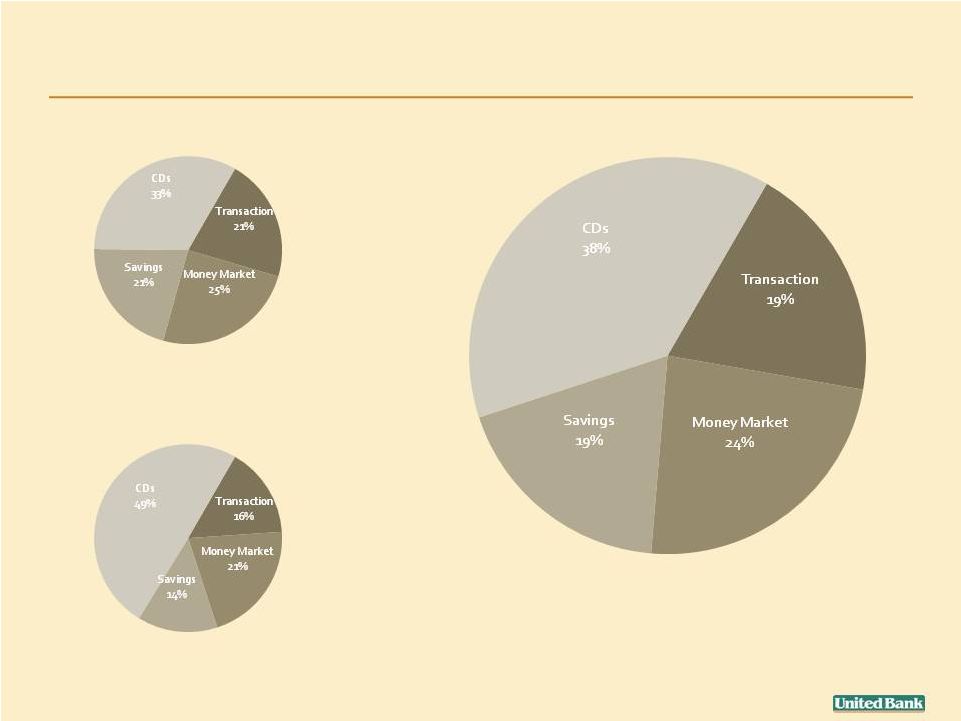

Pro Forma

Deposit Mix (in millions)

$435

Total Deposits $1,845

NEBS Deposit Mix as of March 31, 2012

(in millions)

Total Deposits $586

Core Deposits/Deposits 51%

$312

UBNK Deposit Mix as of March 31, 2012

(in millions)

Total Deposits $1,259

Core Deposits/Deposits 67%

$263

$267

$417

$291

$91

$123

$81

$344

$708

$358

Pro Forma Core Deposits/Deposits

62%

10

Strong Deposit Base with Significant Growth Opportunities

Core deposits defined as Non-CDs.

Source: SNL Financial.

Note: NEBS’

data reflects bank regulatory financials.

|

Comprehensive

Due Diligence Review •

“Line by line”

review of all operations and business lines

Realistic and achievable cost savings and growth assumptions

Comprehensive review of merger transaction costs

•

Detailed and robust credit review by UBNK management

100% of non-performing and classified loans and OREO

70% of the approved commercial loan pipeline

Site inspections of selected properties and performing construction loans

68% of commercial portfolio

Reviewed all jumbo residential loans (8% of residential portfolio) as 56% of portfolio

consists of loans less than $200,000

Engaged Chaston Associates to perform detailed loan review of pass rated commercial

(C&I, CRE and Construction) loans

Engaged McGladrey for additional credit review and ASC 805 fair value calculations

Conservative credit mark based on estimates of losses on performing and non-

performing loan portfolios

•

Seamless and successful integration experience

CNB Financial acquisition in 2009

11 |

Summary of Key

Terms Consideration

•

0.9575 fixed stock exchange ratio

•

Implied price of $15.21 (1) per share

•

Aggregate deal valuation of $91.0 million (2)

Form of

Consideration

•

100% stock (non-taxable merger transaction)

Board Seats

•

Two NEBS directors will join the boards of UBNK and

United Bank

Approvals

•

Customary regulatory and shareholder approvals for both

NEBS and UBNK

Expected Closing

•

Fourth Quarter 2012

12

(1)

Based on UBNK issue price of $15.89, or the 20 day Volume Weighted Average Price as of May 30,

2012. (2)

Based

on

5,982,386

shares

which

includes

in-the-money

options

outstanding

and

the

reduction

for

unallocated

ESOP

shares

retired

as

satisfaction for repayment of ESOP loan. |

Summary of Key

Assumptions Cost Savings

•

Pre-tax of $6.0 million or 33% of 2012 fiscal year NEBS

non-interest expense base

•

90% realized in 2013

Revenue

Synergies

•

None assumed although considerable opportunities in pro

forma market area

Credit Analysis

•

Gross credit mark of $11.0 million or 2.0% of loans

One Time Merger

Related

Expenses

•

Pre-tax of $10.8 million

Core Deposit

Intangible

•

1.3% of NEBS non-time deposits

13 |

Favorable Pricing

Relative to Comparable Transactions 14

UBNK/NEBS

Multiples

Recent Comparable

Transactions Median (1)

Price/ tangible book value

1.63x

1.75x

Premium/ core deposits (2)

7.4%

9.7%

Price/ LTM earnings per share

19.8x

25.2x

Price/ LTM core earnings per share (3)

24.1x

27.8x

Price/ LTM earnings per share w/ synergies

10.8x

--

NEBS financial data as of 3/31/2012.

(1)

Transactions greater than $15 million announced since 2011 where the seller was a bank or

thrift located in the New England region.

(2)

For comparable purposes, core deposits are defined as all deposits less jumbo time deposits

(deposits >= $100,000) and represents bank regulatory data for NEBS.

(3)

Excludes gain on legal settlement taken in Q4 2011 of $1.3 million.

Source: SNL Financial.

|

Strong

Transaction Fundamentals •

Immediately accretive in 2013 to both companies

Greater than 20% EPS accretion in 2013 for UBNK excluding transaction costs

Greater than 25% EPS accretion in 2014 for UBNK

•

Greater than 15% IRR (significantly above UBNK’s cost of capital)

•

Deploying excess capital to meaningfully grow franchise

Reasonable tangible book value dilution of approximately 9% projected at

closing with acceptable incremental earn back period (approximately 5.5 years)

Sustain strong pro forma capital levels: TCE/TA 11.1%

o

Continued ability/capacity to execute capital deployment strategies

Stock repurchases and dividends

Support organic growth and future accretive acquisitions

15 |

Summary

16

Logical Market Extension Transaction

Strong Transaction Fundamentals and Attractive Financial Returns

Prudent Deployment of Excess Capital to Increase Franchise Value

Remain Well Capitalized (pro forma TCE ratio of 11.1%)

•

Pro forma entity has significant presence along the I-91 corridor

•

Strategic expansion consistent with UBNK’s business plan

•

Strong earnings accretion

•

Acceptable incremental earn back period with reasonable tangible book value dilution

•

Attractive IRR

•

Strategic transaction that further demonstrates UBNK’s strategy to expand its franchise

into attractive markets

•

Ability and capacity to continue to execute capital deployment strategies

•

Well positioned for organic and strategic growth opportunities

Acquisition

of

CNB

Financial

in

November

2009

New

loan

production

offices:

In

2011,

opened

office

in

Beverly,

MA

and

in

Q1

2012

announced

new

office

in

northern

CT

De

novo

branching

(6

branches

in

Springfield

since

2006

and

1

new

branch

to

open

in

Q4

2012

in

Worcester

region) |

FOR

QUESTIONS, PLEASE CONTACT Mark A. Roberts, Executive Vice President and

Chief Financial Officer

(413) 787-1201

Thank you.

17

To access the conference call, please dial (877) 317-6789 |