Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MRC GLOBAL INC. | d361189d8k.htm |

MRC

Global Inc. // 2012 KeyBanc Capital Markets Conference

May 31, 2012

Exhibit 99.1 |

Page 2

MRC

//

Global

Supplier

of

Choice

®

®

Forward Looking Statements and GAAP

Disclaimer

This

presentation

contains

forward-looking

statements,

including,

for

example,

statements

about

the

Company’s business

strategy, its industry, its future profitability, growth in the Company’s

various markets, the strength of future activity levels, and the

Company’s expectations, beliefs, plans, strategies, objectives, prospects and assumptions. These forward-looking

statements are not guarantees of future performance. These statements involve

known and unknown risks, uncertainties and

other

factors

that

may

cause

the

Company’s

actual

results

and

performance

to

be

materially

different

from

any future

results or performance expressed or implied by these forward-looking

statements. For a discussion of key risk factors, please see the risk

factors disclosed in the Company’s registration statement on Form S-1 effective April 11, 2012, related

to our common stock, and our Quarterly Statement on Form 10-Q for the quarter

ended March 31, 2012, both of which are available on the SEC’s website

at www.sec.gov. Undue reliance should not

be placed on the Company’s forward-looking statements. Although forward-looking statements

reflect the Company’s good faith beliefs, reliance should not be placed on

forward-looking statements because they involve known and unknown risks,

uncertainties and other factors, which may cause our actual results, performance or

achievements to differ materially from anticipated future results, performance or

achievements expressed or implied by such forward-looking

statements. The Company undertakes no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events, changed

circumstances or otherwise, except to the extent required by law.

Statement Regarding use of Non-GAAP Measures:

The Non-GAAP financial measures contained in this presentation (including,

without limitation, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin,

Adjusted Gross Profit, Return on Net Assets (RONA) and variations thereof) are not measures of

financial performance calculated in accordance with GAAP and should not be

considered as alternatives to net income (loss) or any other performance

measure derived in accordance with GAAP or as alternatives to cash flows from operating

activities

as

a

measure

of

our

liquidity.

They

should

be

viewed

in

addition to, and not as a substitute for, analysis of our

results reported in accordance with GAAP, or as alternative measures of

liquidity. Management believes that certain non- GAAP financial

measures provide a view to measures similar to those used in evaluating our compliance with certain

financial covenants under our credit facilities and provide financial statement

users meaningful comparisons between current and prior year period

results. They are also used as a metric to determine certain components of performance-

based compensation. The adjustments and Adjusted EBITDA are based on

currently available information and certain adjustments that we believe are

reasonable and are presented as an aid in understanding our operating results. They are

not necessarily indicative of future results of operations that may be obtained by

the Company. |

Page 3

®

MRC

//

Global

Supplier

of

Choice

®

Executive Management

Andrew Lane

Chairman, President & Chief Executive Officer

•

Former Executive VP and COO of Halliburton

•

Former CEO of Kellogg Brown & Root

•

Former CEO of Landmark Graphics

Jim Braun

Executive Vice President & Chief Financial Officer

•

Former CFO of Newpark Resources

•

Former CFO of Baker Oil Tools

•

CPA and Former Partner with Deloitte & Touche |

Page

4 MRC

//

Global

Supplier

of

Choice

®

®

Investment Considerations

•

World-Class Management Team With Significant Distribution and

Energy Experience

•

Clear Market Leader With Global Reach

•

Comprehensive Suite of Products and Services

•

Strong Long-Term Customer and Supplier Relationships

•

Scale and Reach Create Competitive Advantage

•

Robust Organic Growth Supported by Positive Secular Trends

and Acquisition Opportunities

•

Operating leverage drives strong financial performance

|

Page 5

MRC

//

Global

Supplier

of

Choice

®

®

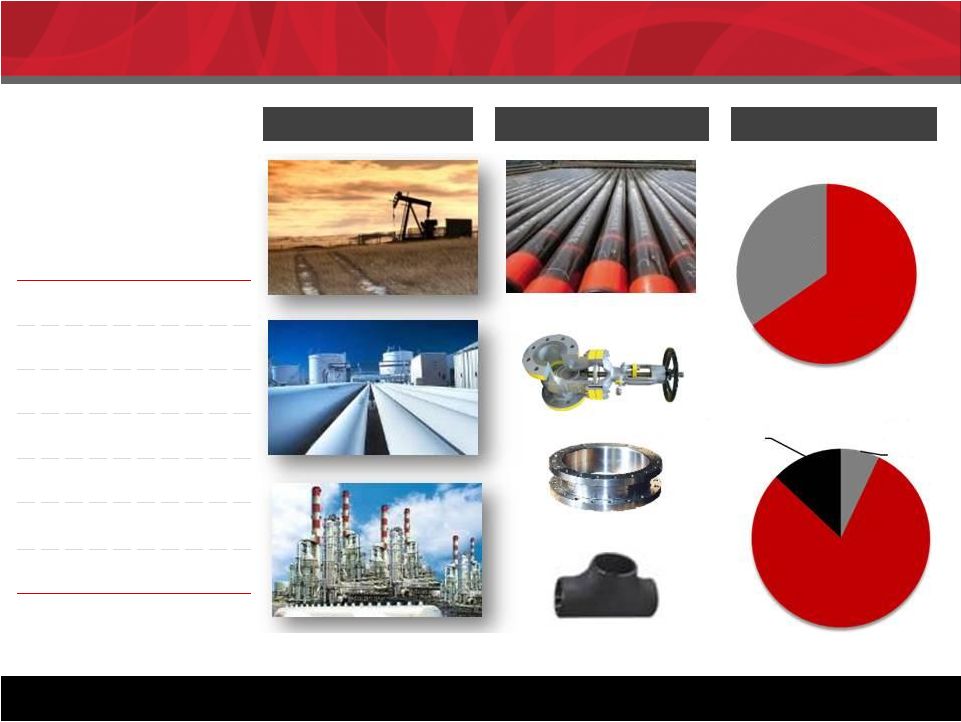

Company Snapshot

MRC by the numbers:

2011 Sales

$4.8 B

Locations

410+

Countries

18

Customers

12,000+

Suppliers

12,000+

SKU’s

150,000+

Employees

4,425

MRC is the largest global distributor of pipe, valves and fittings (PVF) to the

energy industry. MRC is the largest global distributor of pipe, valves and

fittings (PVF) to the energy industry. Upstream

Midstream

Downstream /

Industrial

Fittings

Line Pipe / OCTG

Flanges

Valves

Business Model

Product Categories

Industry Sector

Projects

34%

MRO

66%

U.S.

80%

Canada

13%

lntl

7% |

Page 6

MRC

//

Global

Supplier

of

Choice

®

®

MRC History

Founded

1921

1989

Acquires

Appalachian

Pipe & Supply

2007

Goldman Sachs

Capital Partners

Strategic

Investment

1977

Founded

2005

Acquires

Midfield

Supply

2008

MRC

acquires

LaBarge

2007

Merger of

McJunkin

and Red Man

to form

MRC

2009

MRC opens

Houston HQ

2009

MRC

acquires

Transmark

2010

MRC

acquires

South

Texas

Supply

2010

MRC

acquires

Dresser

Oil Tools

2011

MRC

acquires

SPF

2011

MRC

acquires

VSC

2012

MRC

acquires

OneSteel

Piping

Systems

2012

MRC

Global

IPO;

begins

trading

on NYSE

VSC |

Page 7

MRC

//

Global

Supplier

of

Choice

®

®

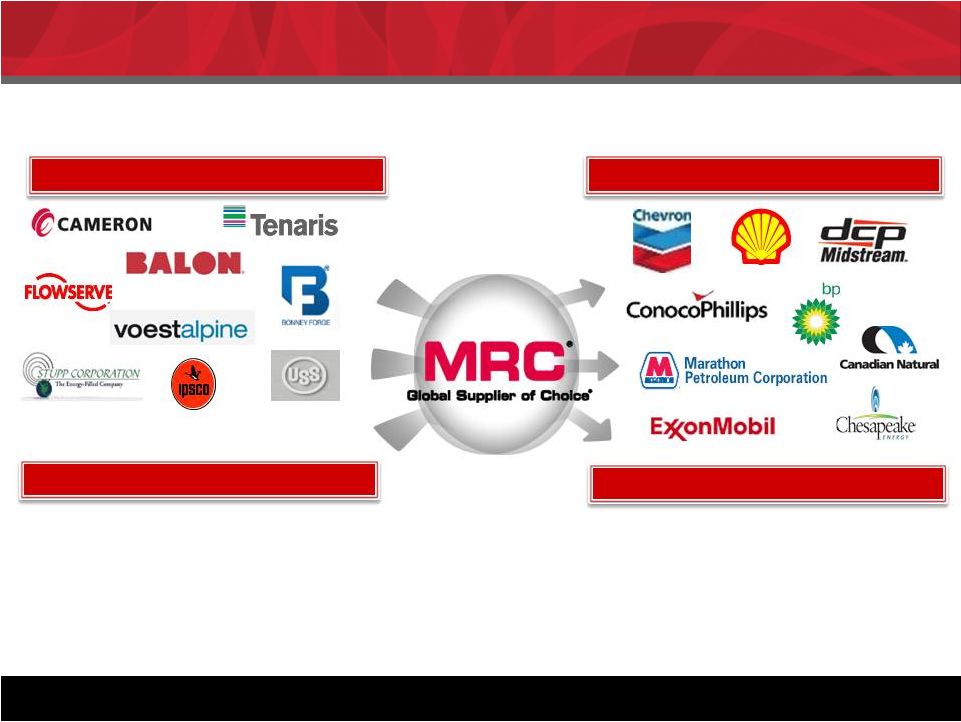

Business Model

•

Access to over 12,000+ customers worldwide

•

Manufacturing and scale efficiencies

•

Reduced administrative and selling costs

•

Demand visibility

•

Customer feedback

•

Access to over 12,000+ suppliers worldwide

•

Scale / supplier consolidation benefits

•

Efficiencies and inventory management

•

Trusted long-term partnerships

•

Seamless integration, “customer

connectivity”

MRC plays a critical role in the complex, technical, global energy supply chain

Suppliers

Customers

Supplier Benefits

Customer Benefits |

Page 8

®

MRC

//

Global

Supplier

of

Choice

®

MRC Value Proposition

MRC’s size and scale enable it to provide value-added services

that create competitive advantages

Customer Need

MRC Value Add

1.

Product Availability

•

Broad product offering

•

Over $1 billion in inventory

2.

Achieve Lowest Installed Cost

•

Volume purchasing

•

Global sourcing from 35 countries

3.

Outsource Non-core

Functions

•

Inventory management

•

Integrated supply service

4.

Ease of Doing Business

•

One-Stop Solution

•

Customized IT system interface

5.

Product Support •

Technical support

•

Product specialists

6. Financial Stability •

Fortune 500 company

•

Over $4.8B sales

7. Quality Assurance •

Manufacturer assessment & approved supplier list •

Supplier

Registration

Process

(SRP) |

Page 9

MRC

//

Global

Supplier

of

Choice

®

®

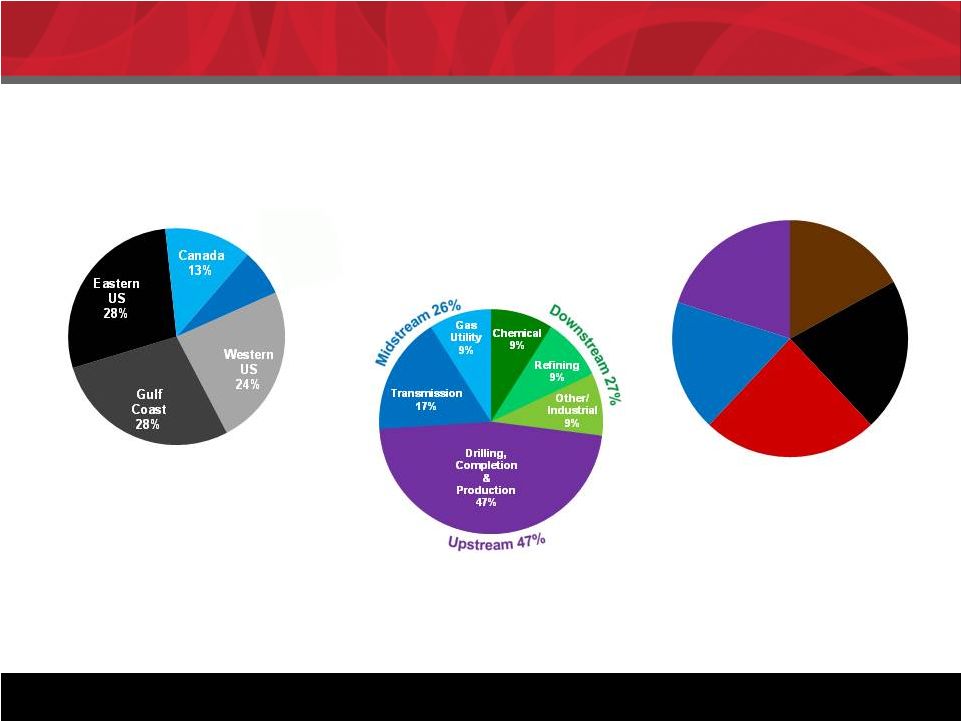

MRC Presence

By Geography

Note: Business mix based on 2011 sales

By Product Line

Diversified by geography, sector, and product line

By Industry Sector

Rest of

World

7%

OCTG

17%

Line

Pipe

21%

Valves

24%

Fittings

&

Flanges

18%

Other

20% |

Page 10

MRC

//

Global

Supplier

of

Choice

®

®

North America

Well positioned to capitalize on shale, heavy oil and oil sands activity.

Infrastructure

Strong North American

•

175+ Branches

•

150+ pipe yards

•

7 DCs

•

12 Valve Automation Centers |

Page 11

MRC

//

Global

Supplier

of

Choice

®

®

International

International E&P spending forecast to grow 12% in 2012*

Expanding International Presence

* Barclays Equity Research

MRC Branches / Locations

Regional Distribution Centers

•

40+ branches

•

DCs in UK, Singapore and Australia

•

11 valve automation centers |

Page 12

MRC

//

Global

Supplier

of

Choice

®

®

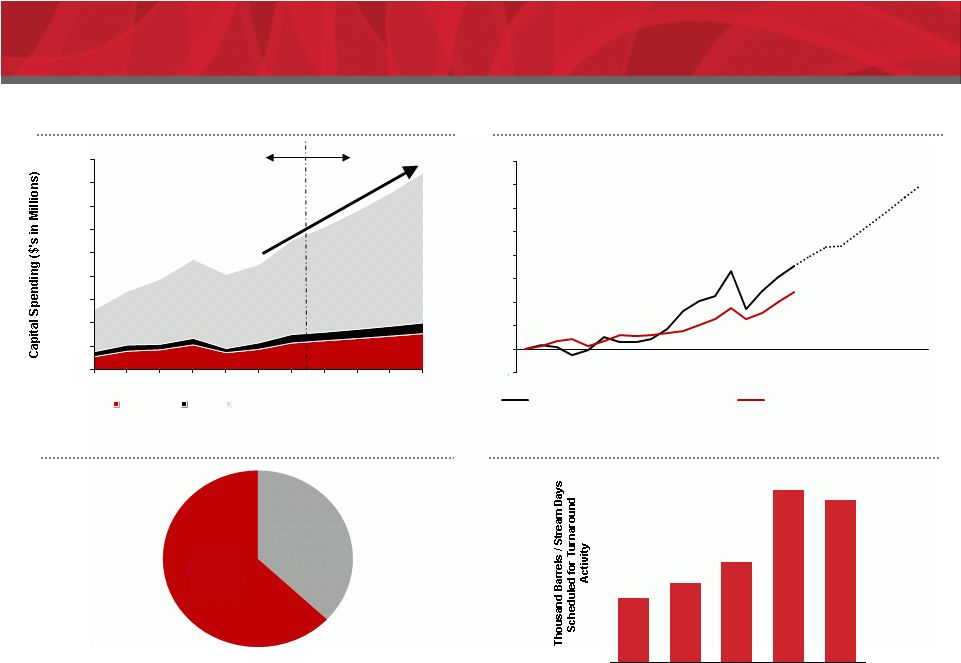

Positive Trends

12

Strong Growth in Global

E&P Spending

1

Source: Barclays 2012 E&P Spending Outlook Mid Year Update.

2

Source: Barclays 2012 E&P Spending Outlook Mid Year Update.

3

Source: Pipeline Safety and Hazardous Materials Administration, Wall Street Journal,

for Top 10 states by pipeline mileage 4

Source: Industrial Info Resource, Inc. Based on quarterly average planned unit

outages. Aging Infrastructure and New Legislation

To Drive Pipeline Replacement

444

548

688

1,193

1,126

2009A

2010A

2011E

2012E

2013E

WTI Prices and Global E&P

Spending Continue Upward Trend

Actual

Estimates

U.S. Refining Turnaround Activity

Poised for Growth

4

Built After

1970

37%

Built

Before

1970

63%

0

100,000

200,000

300,000

400,000

600,000

700,000

800,000

900,000

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

500,000

-

100%

0%

100%

200%

300%

400%

500%

600%

700%

800%

1995

2000

2005

2010

2015E

2020E

Inflation Adjusted WTI Prices (indexed)

Global E&P Spending (indexed)

1

2

3

United States

Canada

Outside North America |

Page 13

MRC

//

Global

Supplier

of

Choice

®

®

Changing PVF Distribution Landscape

Decentralized

Procurement

•

PVF purchasing

handled locally

•

Facility-by-facility

basis

•

Separate contracts

by product class:

•

Pipe

•

Valves

•

Fittings

•

Flanges

•

Supplies

Centralized

Procurement

•

Purchasing more

consolidated

•

Contracts by “stream”:

•

National purchasing

•

Contracts cover all PVF

•

Customers seek

vendors with size/scale

Global

•

Far more consolidated

•

Global up / mid /

downstream PVF contracts

•

National Oil Companies

adopting distribution model

Today

10 –

15 Years Ago

Next 5 to 10 Years

Consolidating energy industry benefits global players

•

Up

•

Mid

•

Down |

Page 14

MRC

//

Global

Supplier

of

Choice

®

®

Increasing Shareholder Value

Growth

Efficiency / Profitability

Increase Capital

Investment

Increase Returns on

New Capital

Increase Profits on

Existing Capital

Optimize Cost of

Capital

Organic Growth

•

North American

shale

•

Unconventional

shale drilling

•

Midstream growth

•

Downstream –

turnaround activity

•

Improve

purchasing

•

Optimize inventory

mix

•

Global sourcing

•

Focus on higher

margin products

•

Leverage fixed

costs

•

Improve working

capital efficiency

•

Maintain leverage

at 2.0x –

3.0x

•

Reduce overall

cost of debt

Acquisitions

•

International product line extensions

•

Valve & actuation

•

North American tuck-ins

Revenue Growth: Target 10% to 12% per year

Organic:

8% to 9%

Acquisitions:

2% to 3%

Projected Adjusted EBITDA margins

8.0 to 8.5% near term

9.0 to 9.5% mid term

10% 5 years |

Page 15

MRC

//

Global

Supplier

of

Choice

®

®

Unconventional Drilling Opportunity

Legacy Basins

Shale Plays

Representative area

Permian

Bakersfield (Monterey)

Marcellus

Bakken

Eagle Ford

Utica

Barnett

Haynesville

Utica

Niobrara

Age

50 to 100 years

1 to 10 years

Primary resources

Oil and Gas

Oil, wet gas and dry gas

Drilling method

Vertical

Horizontal

Horizontal drilling with hydraulic

fracturing “fracking”

Typical environment

Shallow well;

typically low

pressure

Up to 3-5x the

pipe

requirements of

a vertical well

•

Deeper wells

•

Higher pressure

•

Higher volumes

Existing infrastructure

Mature

Requires

upgrading

Non existent, new or under

construction

PVF spend vs.

traditional non-shale

3 –

5x

Wellhead only

Total spend

3 –

5x

5 –

10x

Unconventional shale drilling is driving higher PVF spend

|

Page 16

MRC

//

Global

Supplier

of

Choice

®

®

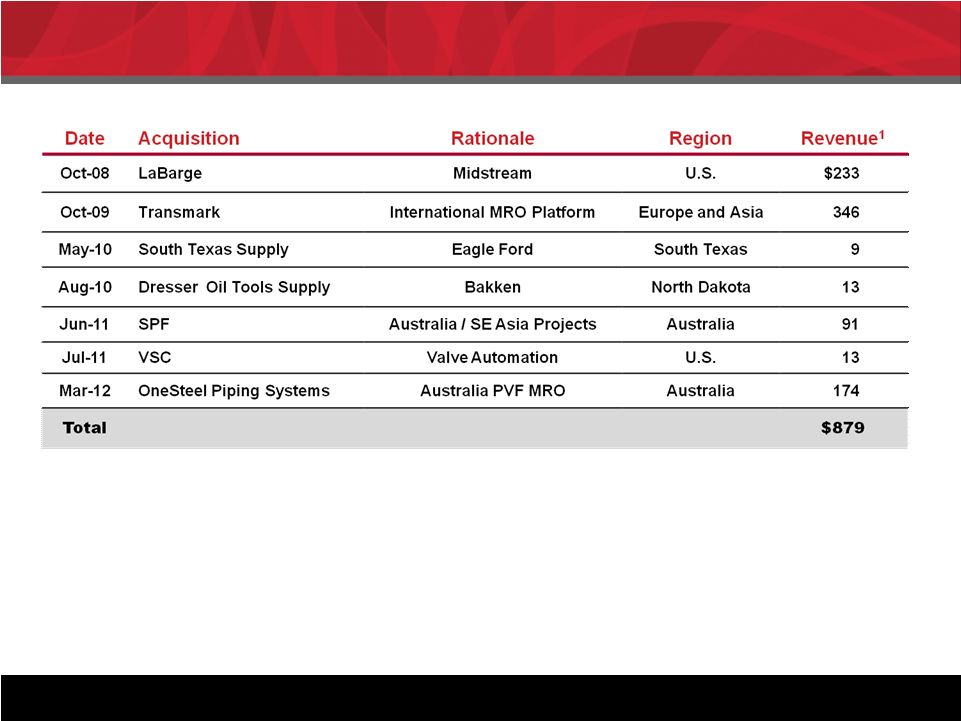

Track Record of Successful M&A

1

Reflects

reported

revenues

for

the

year

of

acquisition

(US$ in millions)

MRC has completed and successfully acquired $879 million of revenues since mid

2008 Current M&A Focus

•

International expansion

•

North America expansion

•

Valve and automation

•

Bolt-ons

|

Page 17

MRC

//

Global

Supplier

of

Choice

®

®

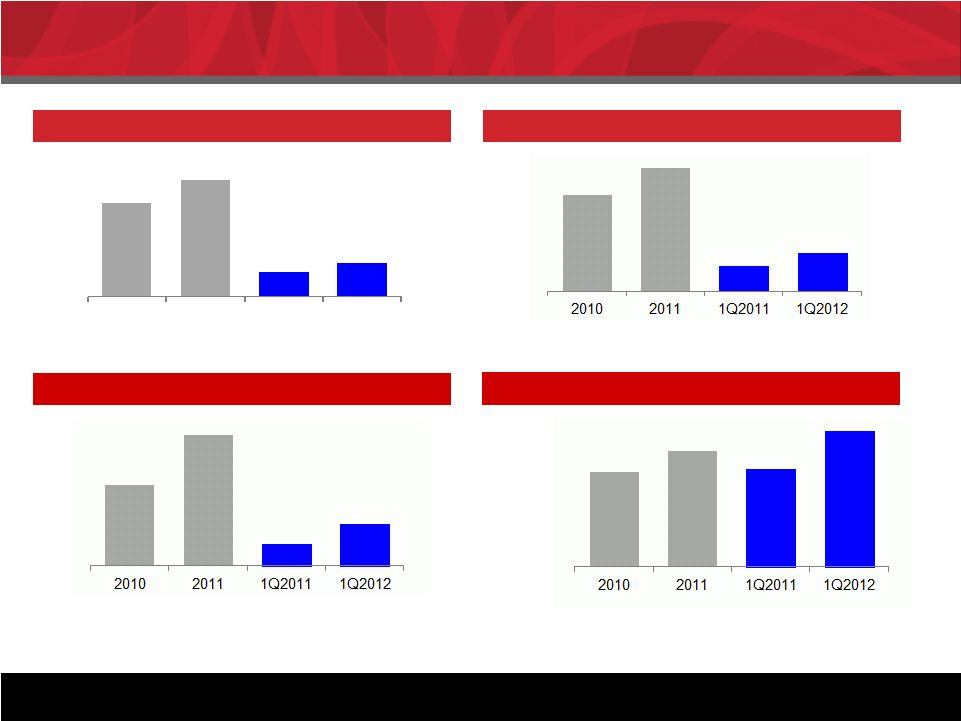

Financial Trends

Sales

Adjusted Gross Profit and % Margin

Source: Company management

RONA calculation = Adjusted EBITDA divided by the sum of accounts receivable,

inventory (plus the LIFO reserve), and PP&E less accounts payable. Adjusted

EBITDA and % Margin Return on Net Assets (RONA)

Strong growth and increasing profitability

Y-o-Y Growth

26%

39%

Y-o-Y Growth

26%

39%

Y-o-Y Growth

61%

92%

5.8%

7.5%

6.1%

8.3%

(US$ in millions)

$3,846

$4,832

$992

$1,383

2010

2011

1Q2011

1Q2012

19.6%

24.1%

20.4%

28.2%

$224

$361

$60

$115

$663

$850

$174

$260

17.2%

17.6%

17.5%

18.8% |

Page 18

First Quarter Update

18

In millions, except per share data

¹

As of May 31, 2012

First Quarter

Full

Year

2012

Outlook

1

2012

2011

Sales

1,383

$

992

$

Sales

$5.4 to $5.6 billion

Cost of sales

1,146

845

Adjusted EBITDA %

8.0% to 8.5% of sales

Gross profit

237

147

SG&A

146

117

Operating income

90

30

Net income

38

$

(1)

$

EPS

0.44

$

(0.01)

$

Adjusted EBITDA

115

$

60

$

Adjusted EBITDA %

8.3%

6.0%

First Quarter 2012 versus First Quarter 2011

•

Revenues: Up 39%

•

Double digit growth rates in each of upstream,

midstream and downstream and industrial sectors •

Adjusted EBITDA: Up 92%

MRC

//

Global

Supplier

of

Choice

®

® |

Page 19

MRC

//

Global

Supplier

of

Choice

®

®

Capital Structure

19

•

Pro forma for IPO with net proceeds of $334 million used to repay debt

•

New multi-currency Global ABL facility

•

ABL / HY bond ensures capital structure flexibility given absence of maintenance

covenants ($ in millions)

Pro Forma

3/31/2012

Cash and equivalents

59

$

$1.25 billion MRC Global ABL credit facility (2017)

237

$

9.5% senior secured notes, net of discount (2016)

1,033

Other

8

Total debt

1,278

$

Stockholders' equity

1,099

$

Total capitalization

2,377

$

March 2012 TTM Adjusted EBITDA

415

$

Total debt/Adjusted EBITDA

3.1x

Net debt/Adjusted EBITDA

2.9x |

Page 20

MRC

//

Global

Supplier

of

Choice

®

®

THANK YOU! |

Page 21

MRC

//

Global

Supplier

of

Choice

®

®

Appendix

•

First Quarter 2012 financial statements

•

Management Biographies |

Page 22

MRC

//

Global

Supplier

of

Choice

®

®

Appendix

*In April 2012, MRC Global issued 17.0 million shares of common stock

as part of its initial public offering, resulting in a total of 101.5 million

shares outstanding post transaction

MRC Global Inc.

Condensed Consolidated Statements of Operations (Unaudited)

(Dollars in thousands, except per share amounts)

Three Months Ended

March 31,

March 31,

2012

2011

Sales

$

1,382,632

$

991,813

Cost of sales

1,146,071

844,847

Gross profit

236,561

146,966

Selling, general and administrative expenses

146,384

117,357

Operating income

90,177

29,609

Other income (expense):

Interest expense

(33,717)

(33,500)

Write off

of debt issuance costs

(1,685)

-

Change in fair value of derivative instruments

2,125

1,868

Other, net

1,747

205

(31,530)

(31,427)

Income (l

oss) before income taxes

58,647

(1,818)

Income tax

expense

(benefit)

21,113

(690)

Net income

(loss)

$

37,534

$

(1,128)

Effective tax rate

36.0%

38.0%

Basic earnings

(loss) per common share

$

0.44

$

(0.01)

Diluted earnings (loss) per common share

$

0.44

$

(0.01)

Weighted

-average common shares, basic

*

84,437

84,413

Weighted

-average common shares, diluted

*

84,756

84,413 |

Page 23

MRC

// Global Supplier of Choice

®

®

Appendix

MRC Global Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(Dollars in thousands)

March 31,

December 31,

March 31,

2012

2011

2011

Assets

Current assets:

Cash

$

58,833

$

46,127

$

42,080

Accounts receivables, net

871,227

791,280

594,892

Inventories, net

1,022,851

899,064

783,554

Other current assets

17,598

11,437

39,554

Total current assets

1,970,509

1,747,908

1,460,080

Other assets

44,767

39,212

45,534

Property, plant and equipment, net

114,173

107,430

103,950

Intangible assets:

Goodwill

568,811

561,270

551,720

Other intangible assets, net

780,198

771,867

808,220

1,349,009

1,333,137

1,359,940

$

3,478,458

$

3,227,687

$

2,969,504

Liabilities and stockholders’

equity

Current liabilities:

Trade accounts payable

$

555,556

$

479,584

$

420,085

Accrued expenses and other current liabilities

142,500

108,973

106,909

Income taxes payable

26,133

11,950

-

Deferred revenue

2,440

4,450

14,026

Deferred income taxes

69,155

68,210

70,825

Total current liabilities

795,784

673,167

611,845

Long-term obligations:

Long-term debt, net

1,611,960

1,526,740

1,333,008

Deferred income taxes

287,585

288,985

302,274

Other liabilities

18,108

17,933

21,797

1,917,653

1,833,658

1,657,079

Stockholders’

equity

765,021

720,862

700,580

$

3,478,458

$

3,227,687

$

2,969,504 |

Page 24

MRC

//

Global

Supplier

of

Choice

®

®

Net proceeds (payments) on/from revolving credit facilities

Appendix

MRC Global Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(Dollars in thousands)

Three

Months

Ended

March

31,

March

31,

2012

2011

Operating activities

Net income (loss)

$

37,534

$

(1,128)

Depreciation and amortization

4,131

4,003

Amortization of intangibles

12,317

12,443

Equity-based compensation expense

1,841

1,483

Deferred income tax benefit

(2,110)

(1,127)

Amortization of debt issuance costs

2,326

2,990

Write off of debt issuance costs

1,685

-

Increase in LIFO reserve

6,900

10,065

Change in fair value of derivative instruments

(2,125)

(1,868)

Provision for uncollectible accounts

727

(278)

700

2,264

Changes in operating assets and liabilities:

Accounts receivable

(44,150)

8,257

Inventories

(68,807)

(24,706)

14,044

2,983

Other current assets

(5,834)

539

Accounts payable

43,816

(10,685)

Deferred revenue

(2,026)

(4,137)

Accrued expenses and other current liabilities

17,346

4,714

18,315

5,812

Investing activities

Purchases of property, plant and equipment

(4,458)

(1,964)

1,195

140

Acquisition

of the assets and operations of OneSteel Piping Systems

(72,816)

-

Proceeds from the sale of assets held for sale

-

10,933

(3,813)

2,830

Net cash (used in) provided by investing activities

(79,892)

11,939

Financing activities

114,146

(30,830)

(31,456)

-

Debt issuance costs paid

(7,099)

-

75,591

(30,830)

Increase

(decrease)

in cash

14,014

(13,079)

Effect of foreign exchange rate on cash

(1,308)

(1,043)

Cash -

beginning of period

46,127

56,202

Cash -

end of period

$

58,833

$

42,080

Proceeds from the disposition of property, plant and equipment

Other investment and notes receivable transactions

Non-operating losses and other items not using cash

Adjustments to reconcile net income (loss) to net cash provided by

operations: Income taxes payable

Net cash provided by operations

Payments on long-term obligations

Net cash provided by (used in) financing activities

|

Page 25

MRC

//

Global

Supplier

of

Choice

®

®

Appendix

MRC Global Inc.

Supplemental Infomation (Unaudited)

Calculation of Adjusted EBITDA

(Dollars in millions)

Three Months Ended

March 31,

March 31,

2012

2011

Net income (loss)

$

37.5

$

(1.1)

Income tax expense (benefit)

21.1

(0.7)

Interest expense

33.7

33.5

Write off of debt issuance costs

1.7

-

Depreciation and amortization

4.1

4.0

Amortization of intangibles

12.3

12.4

Increase in LIFO reserve

6.9

10.1

Change in fair value of derivative instruments

(2.1)

(1.9)

Equity-based compensation expense

1.8

1.5

Legal and consulting expenses

(1.2)

1.2

Other non-cash expenses

(0.6)

1.0

Adjusted EBITDA

$

115.2

$

60.0

Note

to

above:

Adjusted EBITDA consists of net income plus interest, income taxes,

depreciation and amortization, amortization of intangibles and

other non-recurring,

non-cash charges (such as gains/losses on the early extinguishment

of debt, changes in the fair value of derivative instruments

and goodwill impairment), and plus or minus the impact of our LIFO costing methodology. The Company has included

Facility

and provides investors a helpful measure for comparing its operating

performance with the performance of other companies that have

different financing and capital structures or tax rates.

Adjusted

EBITDA

as

a

supplemental

disclosure

because

we

believe

Adjusted

EBITDA

is

an

important

measure

under

its

Global

ABL |

Page 26

MRC

//

Global

Supplier

of

Choice

®

®

Appendix

Andy

Lane

Chairman, President & CEO

Andrew Lane has served as our president and chief executive officer since September

2008. Andrew became the chairman of the board in December 2009. He has also

served as a director of our company since September 2008. From December 2004 to December 2007, he served as executive vice

president and chief operating officer of Halliburton Company, where he was

responsible for Halliburton’s overall operational performance, managed over

50,000 employees worldwide and oversaw several mergers and acquisitions

integrations. Prior to that, he held a variety of leadership roles within

Halliburton,

serving

as

president

and

chief

executive

officer

of

Kellogg Brown & Root, Inc. from July 2004 to November 2004, as senior vice

president, global operations of Halliburton Energy Services Group from April

2004 to July 2004, as president of the Landmark Division of Halliburton Energy Services

Group

from

May

2003

to

March

2004,

and

as

president

and

chief

executive

officer

of

Landmark

Graphics

Corporation

from

April

2002

to

April 2003. He

was

also

chief

operating

officer

of

Landmark

Graphics

from

January

2002

to

March

2002

and

vice

president,

production

enhancement

PSL,

completion

products

PSL

and

tools/testing/TCP

of

Halliburton

Energy

Services

Group

from

January

2000

to

December

2001.

Mr.

Lane

also

served

as

a

director

of

KBR, Inc. from June 2006 to April 2007. He began his career in the oil and gas

industry as a field engineer for Gulf Oil Corporation in 1982, and later

worked

as

a

production

engineer

in

Gulf

Oil’s

Pipeline

Design

and

Permits

Group.

Mr.

Lane

received

a

B.S.

in

mechanical

engineering

from

Southern

Methodist University. He is a member of the executive board of the Southern

Methodist University School of Engineering. Jim

Braun

Executive VP & CFO

Jim Braun has served as our executive vice president and chief financial officer

since November 2011. Prior to joining the company, Mr. Braun served as

chief

financial

officer

of

Newpark

Resources,

Inc.

He

joined

Newpark

in

2006

where

he

led

financial

management

and

furthered

the

execution

of

that

company’s

strategic

business

plan

as

a

member

of

the

executive

team.

Newpark

provides

drilling

fluids

and

other

products

and

services

to

the

oil

and gas

exploration and production industry, both inside and outside of the U.S. Before

joining Newpark, Mr. Braun was chief financial officer, of Baker Oil Tools,

one of the largest divisions of Baker Hughes Incorporated, a Fortune 500 provider

of drilling, formation evaluation, completion and production products and

services to the worldwide oil and gas industry. In his role at Baker Oil Tools, he was responsible for the divisional financial management of the

company including accounting, planning, internal controls, tax, IT, acquisitions

and divestitures. From 1998 until 2002, he was vice president, finance and

administration, of Baker Petrolite, the oilfield specialty chemical business

division of Baker Hughes. Previously, he served as vice president and controller

of Baker Hughes. Earlier in his career, he was a partner with Deloitte & Touche

in Houston, Texas. Mr. Braun graduated from the University of Illinois at

Urbana-Champaign with a B.A. and is a certified public accountant.

|

Page 27

MRC

//

Global

Supplier

of

Choice

®

®

Appendix

Rory

Isaac

Executive VP Global Business Development

Rory M. Isaac has served as executive vice president business development at our

company since December 2008. Prior to that, he served as senior

corporate

vice

president

of

sales

(focusing

on

downstream,

industrials

and

gas

utilities

operations)

at

our

company

since

November

2007.

He

served

as

senior

corporate

vice

president

national

accounts

at

McJunkin

from

1995

to

2000

and

as

senior

corporate

vice

president

national

accounts,

utilities

and

marketing

at

McJunkin

from

2000

to

2007.

Mr. Isaac joined McJunkin in 1981. He has extensive experience in sales,

customer relations and management and has served at McJunkin as a branch manager,

regional manager and regional vice president. In 1995 he began

working

in

the

corporate

office

of

McJunkin

in

Charleston,

West

Virginia

as

senior

vice

president

for

national

accounts,

where

he

was

responsible for managing and growing McJunkin’s national accounts customer

base and directing business development efforts into integrated supply

markets.

In

1999

he

took

on

the

additional

responsibility

of

growing

McJunkin’s

market

share

in

key

initiative

areas

including

gas

products

and marketing McJunkin’s capabilities. Prior to joining McJunkin, Mr. Isaac

worked at Consolidated Services, Inc. and Charleston Supply Company. Mr.

Isaac attended the Citadel. Jim

Underhill

Executive VP & Chief Operating Officer (COO) North America

James F. Underhill has served as our executive vice president and chief operating

officer of our company since November 2011. Jim served as executive vice

president and chief financial officer from November 2007 through November 2011. At McJunkin, he served as chief financial officer from

May 2006 through October 2007, as senior vice president of accounting and

information services from 1994 to May 2006, and vice president and

controller from 1987 to 1994. Prior to 1987, Mr. Underhill served as controller,

assistant controller, and corporate accounting manager. Mr. Underhill joined

McJunkin in 1980 and has since overseen McJunkin’s accounting, information systems, and mergers and acquisitions areas. He has been

involved

in

numerous

implementations

of

electronic

customer

solutions

and

has

had

primary

responsibility

for

the

acquisition

and

integration

of

more

than 30 businesses. Mr. Underhill was also project manager for the design,

development, and implementation of McJunkin’s FOCUS operating system.

He

received

a

B.A.

in

accounting

and

economics

from

Lehigh

University

in

1977

and

is

a

certified

public

accountant.

Prior

to

joining

McJunkin,

Mr.

Underhill worked in the New York City office of the accounting firm of Main

Hurdman. Dan Churay

Executive VP Corporate Affairs, General Counsel & Corporate Secretary

Daniel J. Churay has served as our executive vice president and general counsel since August 2011.

Prior to joining the company, Mr. Churay served as the president and chief executive officer of

Rex Energy Corporation, an independent oil and gas company, from December 2010 to June 2011. From September

2002 to December 2010, Mr. Churay served as executive vice president, general counsel and secretary of

YRC Worldwide Inc., a Fortune 500 transportation and logistics company, with primary

responsibility for YRC Worldwide Inc.’s legal, risk, compliance and external affairs matters, including its internal audit

function. From 1995 to 2002, Mr. Churay served as the deputy general counsel and assistant secretary

of Baker Hughes Incorporated, a Fortune 500 company that provides products and services to the

petroleum and continuous process industries, where he was responsible for legal matters relating to

acquisitions, divestitures, treasury matters and securities offerings. From 1989 to 1995, Mr. Churay

was an attorney at the law firm of Fulbright & Jaworski LLP in Houston, Texas.

Mr. Churay received a bachelor’s degree in economics from the University of Texas and a Juris Doctor degree from the University

of Houston Law Center, where he was a member of the law review.

|

Page 28

MRC

//

Global

Supplier

of

Choice

®

®

Appendix

Scott

Hutchinson

Executive VP North America Operations

Scott Hutchinson has served MRC as our executive vice president North America

operations since November 2009. Mr. Hutchinson began his career with MRC as

an outside sales representative for Grant Supply in Houston, TX when the company was acquired by McJunkin Corporation. In May 1990,

he was

promoted

to

regional

manager

of

Northern

and

Southern

California.

He

was

promoted

to

senior

vice

president

of

the

Midwest

region

in

October

1998.

During

this

time

he

was

key

in

the

acquisitions

of

Wilkins

Supply,

Joliet

Valve,

Cigma

and

Valvax,

solidifying

and

expanding

the

market

reach

of

the company in the Midwest. On January 1, 2009, his responsibility increased when

he was promoted to senior vice president of the Eastern region, which

combined

the

Midwest

and

Eastern

regions,

covering

most

operational

units

east

of

the

Mississippi

River

including

the

Chicago

market.

On

June

1, 2009,

MRC

rolled

the

Appalachian

region

into

the

Eastern

region,

and

Mr.

Hutchinson

assumed

responsibility

for

those

upstream

operations

based in

the Appalachian basin. His extensive background in branch sales and operations was

instrumental as he led a very effective integration effort. Prior to

MRC,

Mr.

Hutchinson

received

a

Bachelor

of

Arts

degree

in

Marketing

from

the

University

of

Central

Florida

in

1977.

Between

1979

and

1984

he

worked

for Fluor as a senior buyer, and then started work with Grant Supply in 1984.

Neil P.

Wagstaff

Executive VP International Operations

Neil P. Wagstaff has served as our executive vice president international

operations and as chief executive officer of MRC Transmark since November

2009. From July 2006 until November 2009, he served as group chief executive of

Transmark Fcx Group B.V. where he was responsible for the group’s

overall performance in 13 operating companies in Europe, Asia and Australia and

overseeing a number of acquisitions and integrations. Prior to that, he held

a variety of positions within Transmark Fcx, serving as a group divisional director from 2003, responsible for operations in the UK and Asia, as well

as managing director for the UK businesses. He was also sales and marketing

director of Heaton Valves prior to the acquisition by Transmark group in

1996, as well as Sales and Marketing Director for Hattersley Heaton valves and

Shipham Valves. He has extensive experience in international sales

management and marketing having worked in the international arena since

1987. Mr. Wagstaff began his career in the valve manufacturing business in

1983

when

he

studied

mechanical

engineering

at

the

Saunders

Valve

Company

and

developed

professionally

through

a

number

of

sales

management

positions. Educated at London Business School he is a chartered director and fellow

of the UK Institute of Directors. Gary

Ittner

Executive VP Global Supply Chain Management

Gary A. Ittner has served as our executive vice president and chief administrative

officer since September 2010. Prior to that, he served as executive vice

president supply chain management from October 2008 and prior to that, he served as our senior corporate vice president of supply

chain management since November 2007. He has specific responsibility for the

procurement of all industrial valves, automation, fittings and alloy tubular

products. Prior to November 2007, he served as senior corporate vice president of supply management at McJunkin since March 2001.

Before

joining

the

Supply

Management

Group,

Mr.

Ittner

worked

in

various

field

positions

including

branch

manager,

regional

manager,

and

senior

regional vice president. He is a past chairman of the executive committee of the

American Supply Association’s Industrial Piping Division. Mr. Ittner

began working at McJunkin in 1971 following his freshman year at the University of Cincinnati and joined the company full-time following his

graduation in 1974. |