Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Essex Rental Corp. | v314870_8k.htm |

Essex Rental Corp. 11 th Annual KeyBanc Capital Markets Industrial, Automotive and Transportation Conference May 31, 2012 1

This document does not constitute an offer to sell or a solicitation of an offer to buy any securities. It is an outline of mat ters for discussion only. Some of the statements in this presentation and other written and oral statements made from time to time by the Company and i ts representatives are “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, an d Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent and bel ief or current expectations of Essex and its management team and may be identified by the use of words like "anticipate", "believe", "e stimate", "expect", "intend", "may", "plan", "will", "should", "seek", the negative of these terms or other comparable terminology. Inves tors are cautioned that any such forward - looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward - looking statements. Important factors that could cause actual results to differ materially from Essex’s expectations include, without limitation, the continued ability of Essex to success ful ly execute its business plan, the possibility of a change in demand for the products and services that Essex provides, intense competition which may require us to lower prices or offer more favorable terms of sale, our reliance on third party suppliers, our indebtedness whi ch could limit our operational and financial flexibility, global economic factors including interest rates, general economic conditions, geo pol itical events and regulatory changes, our dependence on our management team and key personnel, as well as other relevant risks detailed in our Annual Report on Form 10 - K and subsequent periodic reports filed with the Securities and Exchange Commission and available on our website, www.essexrentalcorp.com . The factors listed here are not exhaustive. Many of these uncertainties and risks are difficult to predict and beyond management’s control. Forward - looking statements are not guarantees of future performance, results or events. Essex assumes no obligation to update or supplement forward - looking information in this presentation whether to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results or financial conditions, or otherw ise . This presentation contains unaudited non - GAAP financial measures, including Total EBITDA. Management believes that the presentation of these non - GAAP financial measures serves to enhance understanding of Essex’s individual operating and financial performance. The se non - GAAP financial measures should be considered in addition to, but not as substitutes for, the most directly comparable U.S. G AAP measures. A reconciliation of Total EBITDA to income from operations for the three month period ended March 31, 2012 can be found in Essex’s Current Report on Form 8 - K filed with the Securities and Exchange Commission (the “SEC”) on May 8, 2012. We believe the non - Company information provided herein is reliable, as of the date hereof, but do not warrant its accuracy or completeness. In preparing these materials, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. Except as required by law, the Company, Essex and their respec tiv e directors, officers, employees, agents and consultants make no representation or warranty as to the accuracy or completeness of the non - Company information contained in this document, and take no responsibility under any circumstances for any loss or damage suf fer ed as a result of any omission, inadequacy, or inaccuracy in this document. The Company does not guaranty the performance or return of capital from investments. ©2011 Essex Rental Corp. 2

Introduction 1 3

Introduction 4 ▪ Laurence S . Levy, Chairman – Chairman of Hyde Park Holdings, an investment firm specializing in private equity investments since 1986 – History of acquiring and building businesses, primarily in the logistics and infrastructure markets ▪ Edward Levy, Vice Chairman – Managing Director of Hyde Park Holdings – 6 years of actively managing a private equity fund for CIBC – History of acquiring and building middle - market businesses ▪ Ronald Schad, President, Chief Executive Officer, Director – President & CEO of Essex Crane since 2000 – 15 years with Manitowoc Crane Group, including Executive Vice President and General Manager of the Crane Group responsible for over $ 350 miles in sales ▪ Martin Kroll, Chief Financial Officer & Senior Vice President – CFO & Senior Vice President of Essex Crane since May 2001 – Over 25 years of CFO/Operations experience in middle - market manufacturing and service companies (Outokumpu Copper Group and American Brass) – 8 years with PricewaterhouseCoopers LLP (Certified Public Accountant) ▪ Kory Glen, Director of Finance – Director of Finance of Essex Crane since August 2009 – 5 years with Equity Residential in an SEC reporting and technical accounting research role – 5 years with Ernst & Young LLP (Certified Public Accountant) ▪ Management and Directors collectively own approximately 30 % of the Company

▪ Leading national rental equipment company with a fleet, consisting primarily of heavy lift cranes, as well as other equipment used in a variety of construction applications ▪ Focused on bare rental of construction and lifting equipment with approximately 900 pieces of equipment and attachments ▪ Rental fleet has an Orderly Liquidation Value (“OLV”) in excess of $ 360 million ( $ 6 . 15 per share net of debt) as of 3 / 31 / 12 as determined by independent third party appraiser ▪ Highly diversified end markets served across a national footprint . Markets served include ; Power Generations Petro Chemicals Refineries Water Treatment & Purification Bridges/Highway Shipbuilding/Offshore Oil Fabrication Industrial Plants Commercial/Residential Construction ▪ Acquisition of Coast Crane Company in November 2010 increased the Company’s geographic footprint, product offerings and lines of business, and diversified its earnings stream Essex Rental Corp. 5

Integrated Business Model — Rental — New and Used Sales — Parts and Service — Multi – faceted offering of diverse lifting needs — Multiple lines of business driving growth — Cyclical “earnings smoothing” Geographic & End Market Diversity — 22 locations in 12 states and Canada — Serve a broad array of end markets, with no exposure to a single industry or geography — Significant focus on infrastructure and energy - related end markets Significant Asset Value — Appraised OLV fleet value of over $360 million as of 3/31/12 — Replacement value of approximately $600 million Return on Capital Business Model — Focus on long economic lived assets — High residual value relative to original cost — Attractive ROIC business model due to efficient conversion of EBITDA to free cash flow 3 Primary Growth Drivers — Rental equipment — New and used equipment sales — Parts and services support Investment Highlights 6

Company Overview 2 7

Essex’s three pronged strategy for creating shareholder value: Rental Equipment Keen focus on return on capital equipment with medium to long duration rentals Leverage customer relationships by offering bundled equipment solutions to drive increased utilization Organic growth through increasing fleet size New and Used Equipment Sales Aggressive push to add new manufacturers in existing and new territories Continue to evolve into a broad line dealer by providing exceptional service and support Leverages rental equipment customer relationships High ROE business Parts and Service Support Predictable , high margin, counter cycle Proactively market our expertise to drive growth Not capital intensive Provides opportunity to differentiate offering and sets customers up for a future rental or sale. Provides multi - faceted offering to service our customers’ varied equipment needs Business Strategy 8

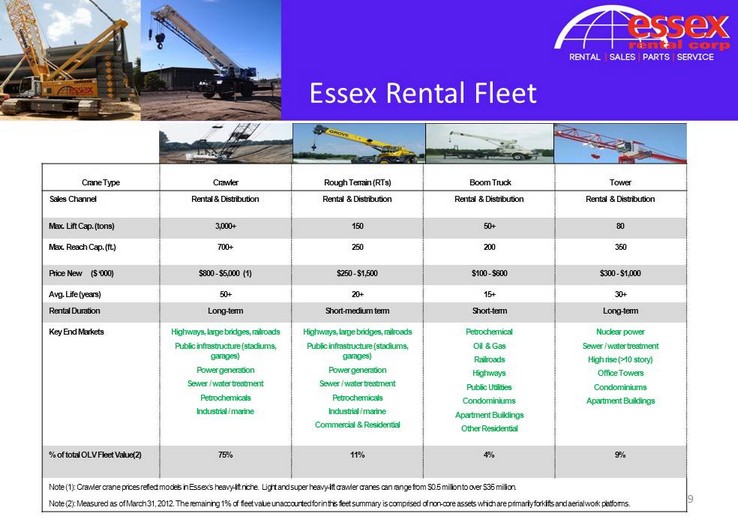

9 Essex Rental Fleet Crane Type Crawler Rough Terrain (RTs) Boom Truck Tower Sales Channel Rental & Distribution Rental & Distribution Rental & Distribution Rental & Distribution Max. Lift Cap. (tons) 3,000+ 150 50+ 80 Max. Reach Cap. (ft.) 700+ 250 200 350 Price New ($ ‘000) $800 - $5,000 (1) $250 - $1,500 $100 - $600 $300 - $1,000 Avg. Life (years) 50+ 20+ 15+ 30+ Rental Duration Long - term Short - medium term Short - term Long - term Key End Markets Highways, large bridges, railroads Public infrastructure (stadiums, garages) Power generation Sewer / water treatment Petrochemicals Industrial / marine Highways, large bridges, railroads Public infrastructure (stadiums, garages) Power generation Sewer / water treatment Petrochemicals Industrial / marine Commercial & Residential Petrochemical Oil & Gas Railroads Highways Public Utilities Condominiums Apartment Buildings Other Residential Nuclear power Sewer / water treatment High rise (>10 story) Office Towers Condominiums Apartment Buildings % of total OLV Fleet Value(2) 75% 11% 4% 9% Note (1): Crawler crane prices reflect models in Essex’s heavy - lift niche. Light and super heavy - lift crawler cranes can range from $0.5 million to over $35 million. Note (2): Measured as of March 31, 2012. The remaining 1% of fleet value unaccounted for in this fleet summary is comprised of non - core assets which are primarily forklifts and aerial work platforms.

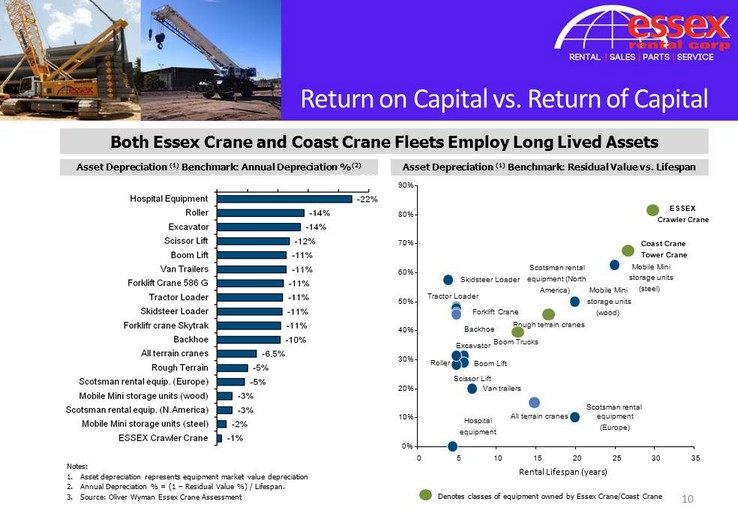

Both Essex Crane and Coast Crane Fleets Employ Long Lived Assets Asset Depreciation (1) Benchmark: Annual Depreciation % (2) Asset Depreciation (1) Benchmark: Residual Value vs. Lifespan Notes: 1. Asset depreciation represents equipment market value depreciation 2. Annual Depreciation % = (1 – Residual Value %) / Lifespan. 3. Source: Oliver Wyman Essex Crane Assessment Return on Capital vs. Return of Capital Rental Lifespan (years) Van trailers Boom Lift Scissor Lift Roller Backhoe Tractor Loader Forklift Crane Excavator Skidsteer Loader Hospital equipment Mobile Mini storage units (steel) Scotsman rental equipment (North America) Mobile Mini storage units (wood) Scotsman rental equipment (Europe) All terrain cranes ESSEX Crawler Crane 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 0 5 10 15 20 25 30 35 Rough terrain cranes Boom Trucks Coast Crane Tower Crane 10 Denotes classes of equipment owned by Essex Crane/Coast Crane

▪ Continue to leverage the Essex and Coast brands in the territories in which they are strongest, yet achieve the benefits of geographic and product diversity Headquarters Service Center Equipment Storage Yard Satellite Service Center National Footprint 11

Essex End Markets Essex 2008 YTD Rental Revenues by End Market Business is Dependent on Energy & Infrastructure Industrial / Marine (17%) Industrial Facilities Factories Petrochemicals (9%) Chemical Plants Petrochemical Plants General Building (17%) Hospitals Stadiums Power (15%) Power Plants Wind Power Transportation ( 21%) Road construction Bridge construction Sewer & Water (10%) Sewers Water Treatment Essex 2011 YTD Rental Revenues by End Market 12 General Building 9% Other 2% Transportation 14% Industrial / Marine 31% Power 25% Petrochemicals 13% Sewer & Water 4% Levee 2% General Building 17% Other 2% Transportation 21% Industrial / Marine 17% Power 15% Petrochemicals 9% Sewer & Water 10% Levee 9%

New & Used Equipment Sales 13 ▪ New and used equipment sales segment provides a countercyclical balance to rental business segment. New Equipment Sales ▪ Distribution agreements signed with Tadano, Manitex, Terex, Mantis, Broderson and Sany: ▪ Distribution agreements in Western United States, British Columbia, the Yukon, Guam and Republic of the Marshall Islands. Rental Equipment Sales ▪ Continue to rebalance the Essex crawler crane fleet by selling $20M of older underutilized cranes ▪ Near term opportunity to divest non - core AWP assets that have shorter economic lives. These assets were acquired as part of the Coast fleet ▪ Emphasize a “rent - to - sell” business model by selecting appropriate time and equipment to create a used equipment offering for customers not prepared to buy new.

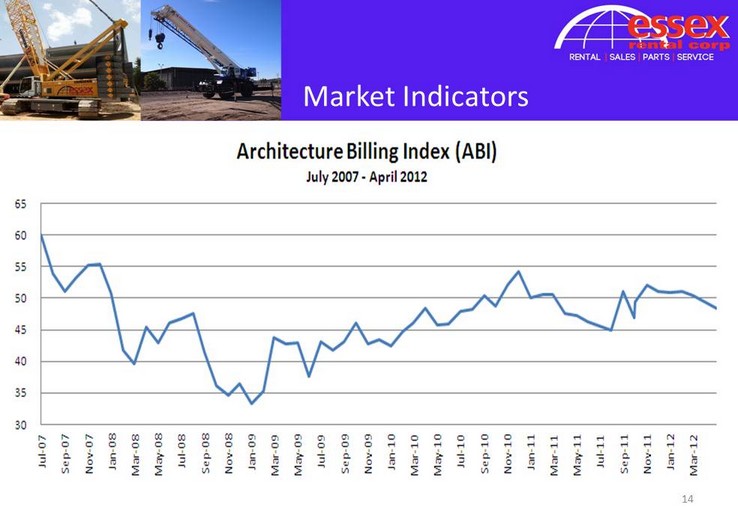

Market Indicators 14

Current Business Initiatives 15 ▪ The Company is pursuing a number of business initiatives to improve return on invested capital, including; Asset Rebalancing ▪ Dispose of approximately $20 million of older under utilized crawler crane assets ▪ Divest non - core AWP assets with short economic lives that were acquired as part of the Coast acquisition but do not fit our return on capital business philosophy Asset Utilization ▪ Improve utilization on rental fleet with a replacement cost estimated at $600 million consisting of diverse assets produced by leading manufacturers ▪ Drive utilization on the $24 million investment in Coast rental equipment that was purchased in 2011 Earnings Improvements ▪ Aggressively manage Coast operation to capitalize on meaningful profit opportunities; capitalize on IT system implementation at Coast ▪ Increase rental rates in certain asset classes with current high utilization

Summary Financial Information and Valuation 3 16

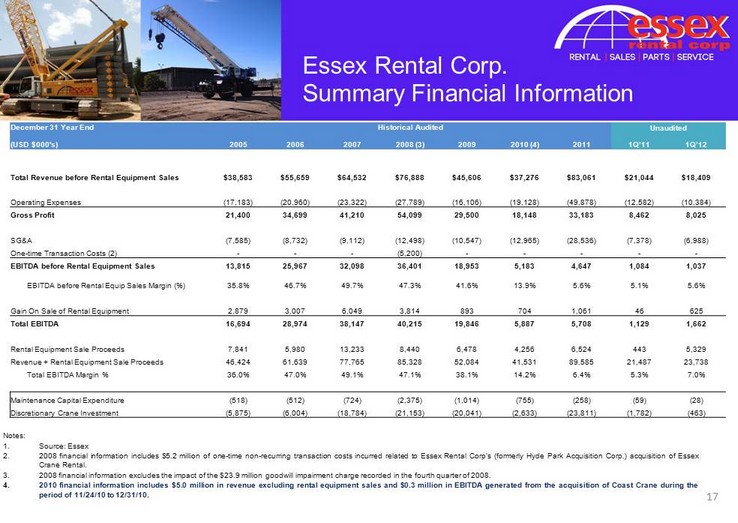

Notes : 1. Source : Essex 2. 2008 financial information includes $ 5 . 2 million of one - time non - recurring transaction costs incurred related to Essex Rental Corp’s (formerly Hyde Park Acquisition Corp . ) acquisition of Essex Crane Rental . 3. 2008 financial information excludes the impact of the $ 23 . 9 million goodwill impairment charge recorded in the fourth quarter of 2008 . 4. 2010 financial information includes $ 5 . 0 million in revenue excluding rental equipment sales and $ 0 . 3 million in EBITDA generated from the acquisition of Coast Crane during the period of 11 / 24 / 10 to 12 / 31 / 10 . December 31 Year End Historical Audited Unaudited (USD $000's) 2005 2006 2007 2008 (3) 2009 2010 (4) 2011 1Q’11 1Q’12 Total Revenue before Rental Equipment Sales $38,583 $55,659 $64,532 $76,888 $45,606 $37,276 $83,061 $21,044 $18,409 Operating Expenses (17,183) (20,960) (23,322) (27,789) (16,106) (19,128) (49,878) (12,582) (10,384) Gross Profit 21,400 34,699 41,210 54,099 29,500 18,148 33,183 8,462 8,025 SG&A (7,585) (8,732) (9,112) (12,498) (10,547) (12,965) (28,536) (7,378) (6,988) One - time Transaction Costs (2) - - - (5,200) - - - - - EBITDA before Rental Equipment Sales 13,815 25,967 32,098 36,401 18,953 5,183 4,647 1,084 1,037 EBITDA before Rental Equip Sales Margin (%) 35.8% 46.7% 49.7% 47.3% 41.6% 13.9% 5.6% 5.1% 5.6% Gain On Sale of Rental Equipment 2,879 3,007 6,049 3,814 893 704 1,061 46 625 Total EBITDA 16,694 28,974 38,147 40,215 19,846 5,887 5,708 1,129 1,662 Rental Equipment Sale Proceeds 7,841 5,980 13,233 8,440 6,478 4,256 6,524 443 5,329 Revenue + Rental Equipment Sale Proceeds 46,424 61,639 77,765 85,328 52,084 41,531 89,585 21,487 23,738 Total EBITDA Margin % 36.0% 47.0% 49.1% 47.1% 38.1% 14.2% 6.4% 5.3% 7.0% Maintenance Capital Expenditure (518) (512) (724) (2,375) (1,014) (755) (258) (59) (28) Discretionary Crane Investment (5,875) (6,004) (18,784) (21,153) (20,041) (2,633) (23,811) (1,782) (463) Essex Rental Corp. Summary Financial Information 17

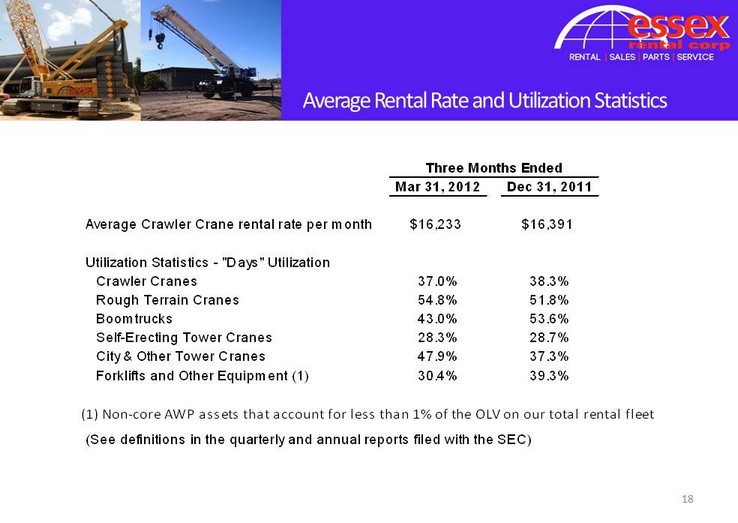

18 Average Rental Rate and Utilization Statistics Mar 31, 2012 Dec 31, 2011 Average Crawler Crane rental rate per month $16,233 $16,391 Utilization Statistics - "Days" Utilization Crawler Cranes 37.0% 38.3% Rough Terrain Cranes 54.8% 51.8% Boomtrucks 43.0% 53.6% Self-Erecting Tower Cranes 28.3% 28.7% City & Other Tower Cranes 47.9% 37.3% Forklifts and Other Equipment (1) 30.4% 39.3% (1) Non-core AWP assets that account for less than 1% of the OLV on our total rental fleet (See definitions in the quarterly and annual reports filed with the SEC) Three Months Ended

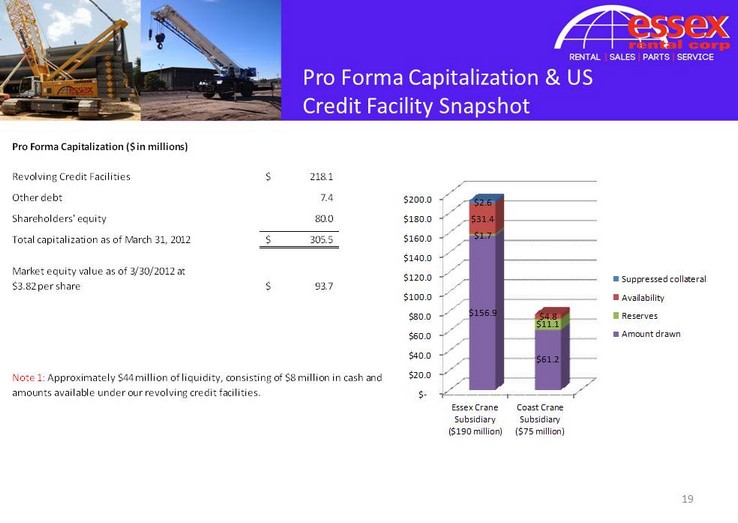

Pro Forma Capitalization & US Credit Facility Snapshot 19 Pro Forma Capitalization ($ in millions) Revolving Credit Facilities 218.1$ Other debt 7.4 Shareholders' equity 80.0 Total capitalization as of March 31, 2012 305.5$ Market equity value as of 3/30/2012 at $3.82 per share 93.7$ Note 1: Approximately $44 million of liquidity, consisting of $8 million in cash and amounts available under our revolving credit facilities. $ - $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 $200.0 Essex Crane Subsidiary ($190 million) Coast Crane Subsidiary ($75 million) $156.9 $61.2 $1.7 $11.1 $31.4 $4.8 $2.6 Suppressed collateral Availability Reserves Amount drawn

▪ Essex Rental Corp. – Total consolidated debt outstanding of $225.5 million. ▪ Essex Crane Rental Corp. – Revolving Credit Facility: • $156.9 million outstanding as of March 31, 2012 • $190 million facility size • 5 - year facility • Libor plus 225 bps • 2 financial covenants (only become effective if availability is below $20 million) • Availability under facility of $31.4 million as of March 31, 2012 ▪ Coast Crane – Total debt outstanding (3/31/12): $63.6 million – Revolving Credit Facility: • $61.2 million outstanding as of March 31, 2012 • $75 million facility size • 4 - year facility • Libor plus 375 bps (Libor floor of 150 bps) • Availability under facility of $4.8 million as of March 31, 2012 after total reserves of $11.1 million, which includes a $3.7 million discretionary lender reserve Debt Summary 20

Investment Summary 21 ▪ Market leader with significant operating leverage ▪ Utilization in certain asset classes is increasing and rental rates have bottomed ▪ Management and Board of Directors represent ownership of approximately 30 % of common shares outstanding and recently invested substantial capital in our stock ▪ Return on capital business model with high conversion rate of EBITDA to free cash flow ▪ Poised to participate in growing infrastructure & energy related markets as economy recovers … . companies are beginning to make long term decisions again ▪ Numerous organic and strategic growth opportunities ▪ Sound capital structure including attractive, flexible debt facilities Essex is considered to be an attractive investment opportunity for the following reasons: