Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Xylem Inc. | d360276d8k.htm |

KeyBanc Capital Markets Industrial,

Automotive, & Transportation Conference

May 30, 2012

Exhibit 99.1 |

Forward Looking Statements

2

This document contains information that may constitute “forward-looking statements.”

Forward-looking statements by their nature address matters that are, to different degrees,

uncertain. Generally, the words “anticipate,” “estimate,”

“expect,” “project,” “intend,” “plan,” “believe,”

“target” and similar expressions identify forward-looking statements, which

generally are not historical in nature. However, the absence of these words or similar expressions

does not mean that a statement is not forward-looking.

These forward-looking statements include, but are not limited to, statements about the separation

of Xylem Inc. (the “Company”) from ITT Corporation, the terms and the effect of the

separation, the nature and impact of the separation, capitalization of the Company, future

strategic plans and other statements that describe the Company’s business strategy,

outlook, objectives, plans, intentions or goals, and any discussion of future operating or financial performance.

All statements that address operating performance, events or developments that we expect or anticipate

will occur in the future — including statements relating to orders, revenues, operating

margins and earnings per share growth, and statements expressing general views about future

operating results — are forward-looking statements.

Caution should be taken not to place undue reliance on any such forward-looking statements because

they involve risks, uncertainties and other factors that could cause actual results to differ

materially from those expressed or implied in, or reasonably inferred from, such

statements. The Company undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise, except as required

by law. In addition, forward-looking statements are subject to certain risks and uncertainties

that could cause actual results to differ materially from the Company’s historical

experience and our present expectations or projections. These risks and uncertainties include,

but are not limited to, those set forth in Item 1A of our Annual Report on Form 10-K, and

those described from time to time in subsequent reports filed with the Securities and Exchange

Commission. |

•

Design, Manufacture, & Service Highly Engineered Technologies

•

A True Water Pure Play

•

Diverse End Market & Geographic Mix

•

Leading Brands & Large Installed Base

•

Unrivaled Global Reach …

Serving 150+ Countries

Global Leader in Water

Application Solutions

3

$3.8B Company Uniquely Positioned in the Attractive Water Industry

$3.8B Company Uniquely Positioned in the Attractive Water Industry

|

Where

do we play in the $500B Global Water Industry? Public Utility

~250,000

Utilities

Globally

Water Infrastructure

~5%-10% EBIT

Margin

Design

& Build

~8,000 EPC

Firms Globally

~2%-5%

EBIT

Margin

Equipment &

Equipment &

Services

Services

~20,000

~20,000

Companies

Companies

Globally

Globally

~5%-20+% EBIT

Margin

$280B

$280B

End Use

Applications

Farms, Power

Plants, Homes

Applied Water

$220B

Source: GWI, Company Estimates

$250B

$250B

Predominately Commodity-like

Equipment & Service

•

Pipes, valves, fittings and low value pumps

•

Low-value services

•

Low or no differentiation

•

Generally either capital or labor intensive

•

Generally single-digit margins…

some

pockets of higher profitability

$30B

$30B

Xylem Focus

Xylem Focus

4

Xylem Focused on Attractive End-Markets in Equipment & Services

Xylem Focused on Attractive End-Markets in Equipment & Services

Technology Intensive

•

Higher value equipment

-

Energy efficiency, perform

in harsh conditions, high reliability

•

Knowledge-based services

-

Analytics, energy audits

•

Differentiated solutions

•

~10-20%+ margins |

How

Does Xylem Create Value? 5

By Partnering with Our Customers to Solve Water Challenges

By Partnering with Our Customers to Solve Water Challenges

•

•

Depleting Water Supply

Depleting Water Supply

•

•

Tightening Regulation

Tightening Regulation

•

•

Aging Infrastructure

Aging Infrastructure

•

•

Population Growth

Population Growth

•

•

Urbanization

Urbanization

•

•

Sustainability / Energy Efficiency

Sustainability / Energy Efficiency

•

•

Fragmented Industry

Fragmented Industry

•

•

Geographically Diverse

Geographically Diverse

•

•

Attractive End Markets

Attractive End Markets

•

•

Installed Base Importance

Installed Base Importance

•

•

Customer Reliance on Expertise

Customer Reliance on Expertise

Understanding

Global Water Challenges

Leading Within the

Global Water Industry

Unique

Assets

Key

Partners

Industry

Relations

Innovative

Solutions |

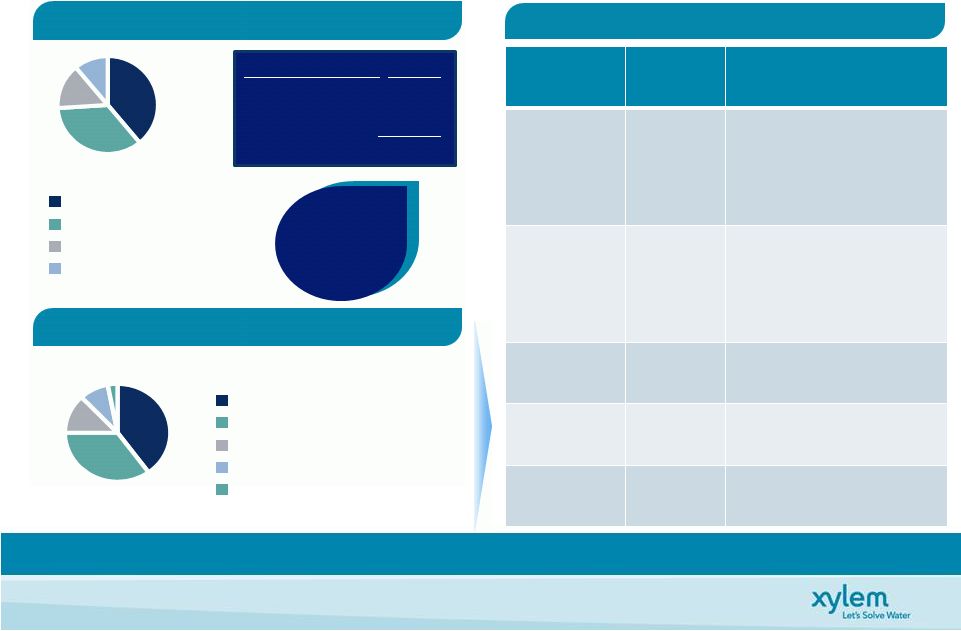

6

…

…

With Attractive Growth Rates and Strong Fundamentals

With Attractive Growth Rates and Strong Fundamentals

Balanced Portfolio …

Diversified Market Exposure

Europe

37%

U.S.

36%

Asia Pac

11%

Other

16%

End Market Mix*

End Market Mix*

Geographical Mix*

Geographical Mix*

Industrial

40%

Public Utility

36%

Commercial

12%

Residential

9%

Agricultural

3%

Xylem

Xylem

Emerging

Emerging

Market Revenue

Market Revenue

= 19% in 2011

= 19% in 2011

*2011 Revenues

End Market

End Market

Cycle

Cycle

Fundamentals

Fundamentals

Industrial

Less

Cyclical/

Late Cycle

•

Critical products

•

Strong aftermarket &

replacement

Public

Utility

Non-

Cyclical

•

Tariffs protected &

growing

•

~70% for O&M activity

•

Strong aftermarket &

replacement

Commercial

Late Cycle

•

Strong replacement

•

Green regulation

Residential

Early

Cycle

•

Strong replacement

•

Energy efficiency

Agriculture

Mid Cycle

•

Growing demand

Balanced End Market

Balanced End Market

Mkt Growth Rates

’10 -’15

Developed

1 -

3%

Emerging

8 -

10+%

Global

3 -

5% |

Dewatering and Industrial

Water Applications

7

Dewatering Applications

Dewatering Applications

Industrial Water Applications

Industrial Water Applications

Diverse Applications

•

Construction

•

Disaster Recovery

•

Environmental

•

Heavy Industry

Diverse Applications

Diverse Applications

•

•

Construction

Construction

•

•

Disaster Recovery

Disaster Recovery

•

•

Environmental

Environmental

•

•

Heavy Industry

Heavy Industry

•

Mining

•

Oil, Gas & Chemical

•

Water

&

Waste

Water

•

Marine

•

•

Mining

Mining

•

•

Oil, Gas & Chemical

Oil, Gas & Chemical

•

•

Water

Water

&

&

Waste

Waste

Water

Water

•

•

Marine

Marine

Heating

Cooling

Pressure

Boosting

Waste Water

Removal |

Public Utility & Industrial

Transport, Treatment & Test

8

Application Technologies

•

Waste Water Transport

•

Filtration

•

Biological Treatment

•

UV & Ozone Disinfection

•

Analytical Instrumentation

Application Technologies

Application Technologies

•

•

Waste Water Transport

Waste Water Transport

•

•

Filtration

Filtration

•

•

Biological Treatment

Biological Treatment

•

•

UV & Ozone Disinfection

UV & Ozone Disinfection

•

•

Analytical Instrumentation

Analytical Instrumentation |

Commercial & Residential

9

Customers

•

Developers

•

Building Operators

•

Building Designers

•

HVAC Specialists

•

Contractors

•

Plumbers

HVAC -

Heating

Pressure boosters

Fire protection

HVAC -

Cooling

Wastewater

Zone Control |

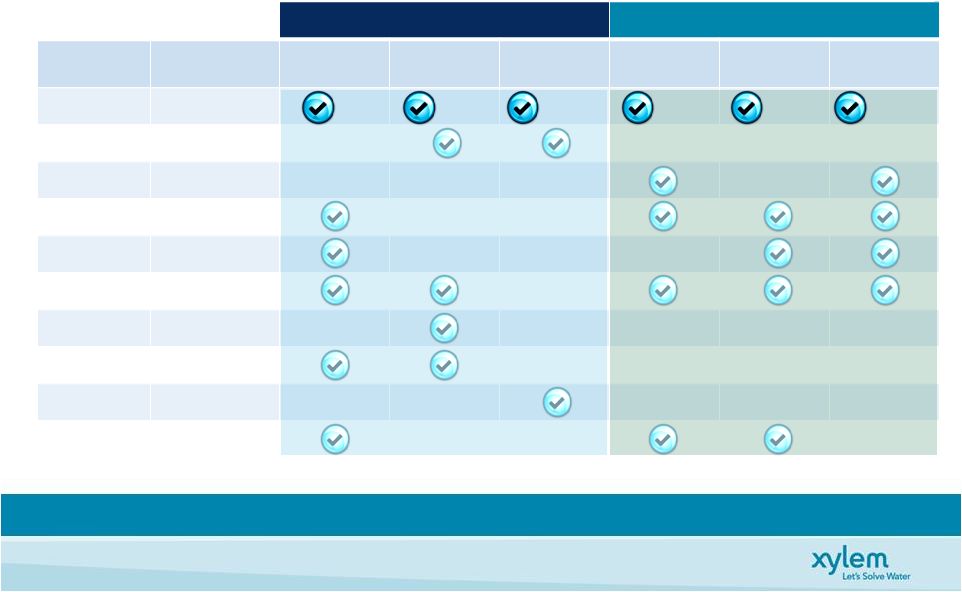

A

Unique Spectrum of Applications Expertise 10

Source: Citi Investment Research and Xylem Company Estimates

A Genuine Water Company With the Broadest Portfolio

* 2011 Revenues

46*

11%*

6%*

19%*

15%*

3%*

Water Infrastructure

Applied Water

Water as %

of Total Revs

Transport

Treatment

Test

Building

Services

Industrial

Water

Irrigation

Xylem

>90%

Danaher

~15%

Franklin

~85%

Grundfos

~85%

KSB

~25%

Pentair

~50%

Siemens

~5%

Sulzer (ABS)

~50%

Thermo

~5%

Wilo

~30% |

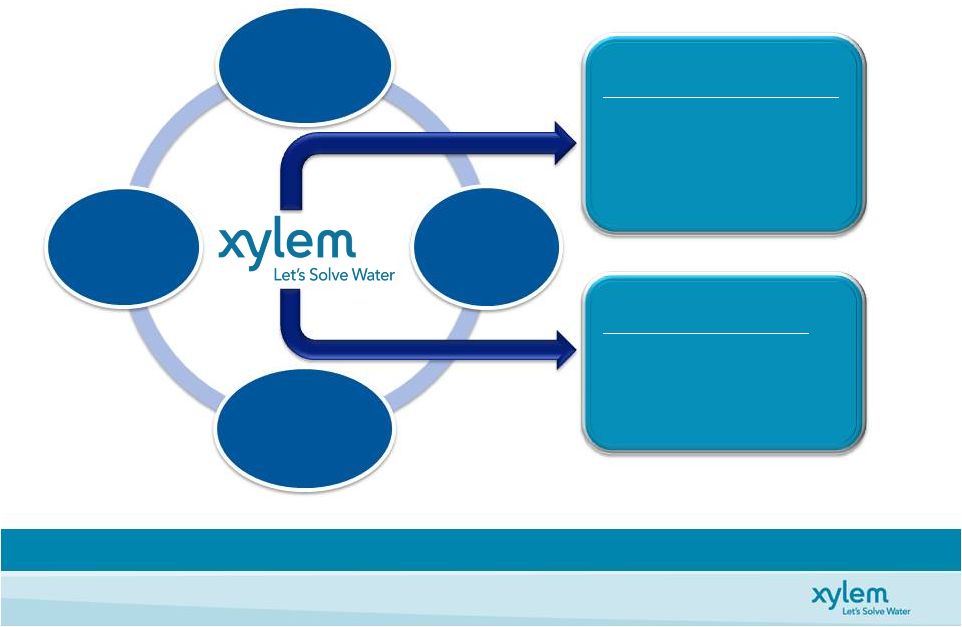

Xylem

Has a Focused Growth Strategy •

Replicate leadership positions

•

Leverage brands with global

partners

•

Strong aftermarket opportunities

•

Innovative application solutions

•

Sustainable infrastructure

initiatives

Xylem Target Organic Growth ~ 2 points Faster Than Market

•

Established footprint

•

Localized innovation centers

•

Partnerships with leading, global

water companies

•

Focused BRIC & ROW Strategy

•

Disciplined approach

•

Build upon Dewatering and

Analytics acquisition platforms

•

Dewatering & Analytics

•

History of successful integration

•

Bolt-on, niche go-forward strategy

11

Organic Growth

Organic Growth

Emerging Markets

Emerging Markets

Acquisition Strategy

Acquisition Strategy |

12

Highly Attractive Recurring Revenue Profile

•

Approximately 22% of Xylem revenue

•

Installed base drives replacement sales

•

Brand loyalty drives like-for-like

replacement

•

Installed base provides opportunity for

upgrades, next generation and services

Parts & Service

Replacement Equipment

(1)

$M

Note:

(1) Based on company estimates.

Aftermarket Provides Stability and Drives Strong Profitable Growth

Aftermarket Parts & Services Revenues

2006

2007

2008

2009

2010

2011

$370

$382

$396

$433

$512

$570

•

15% of Xylem revenue •

Strong global presence •

120+ owned service centers •

600+ service

employees

•

Extensive channel partner network

•

9% Revenue CAGR ‘06-’11 despite

economic downturn

•

~11% revenue growth 2010-2011 |

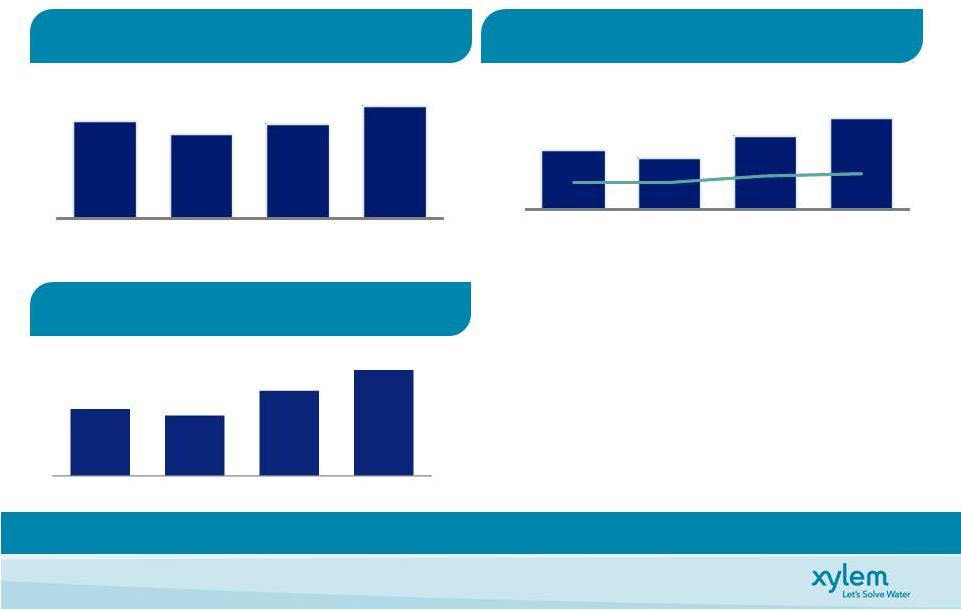

Strong Growth in Revenue and Profitability

13

Revenues ($M)

Revenues ($M)

Operating

Operating

Income

Income

&

&

Margin*

Margin*

($M)

($M)

Op Margin expands 310 bps

•

Operational & Commercial Excellence Initiatives

•

Price & Productivity more than offset inflation

•

Includes restructuring costs $41M, $31M,

and $15M (’08 -

‘10)

Demonstrated Record of Growing Revenue and Profitability

Demonstrated Record of Growing Revenue and Profitability

EBITDA*

$384

$356

$489

$637

EBITDA %*

11.7%

12.5%

15.3%

16.7%

Earnings Per Share*

Earnings Per Share*

Organic

-8.8%

3.4% 7.1%

Growth*

* See non-GAAP reconciliations.

$315

$276

$388

$482

9.6%

9.7%

12.1%

12.7%

2008

2009

2010

2011

$3,291

$2,849

$3,202

$3,803

2008

2009

2010

2011

2008

2009

2010

2011

$1.22

$1.10

$1.55

$1.93

EPS

CAGR

of

16.5%

(’08

–

’11) |

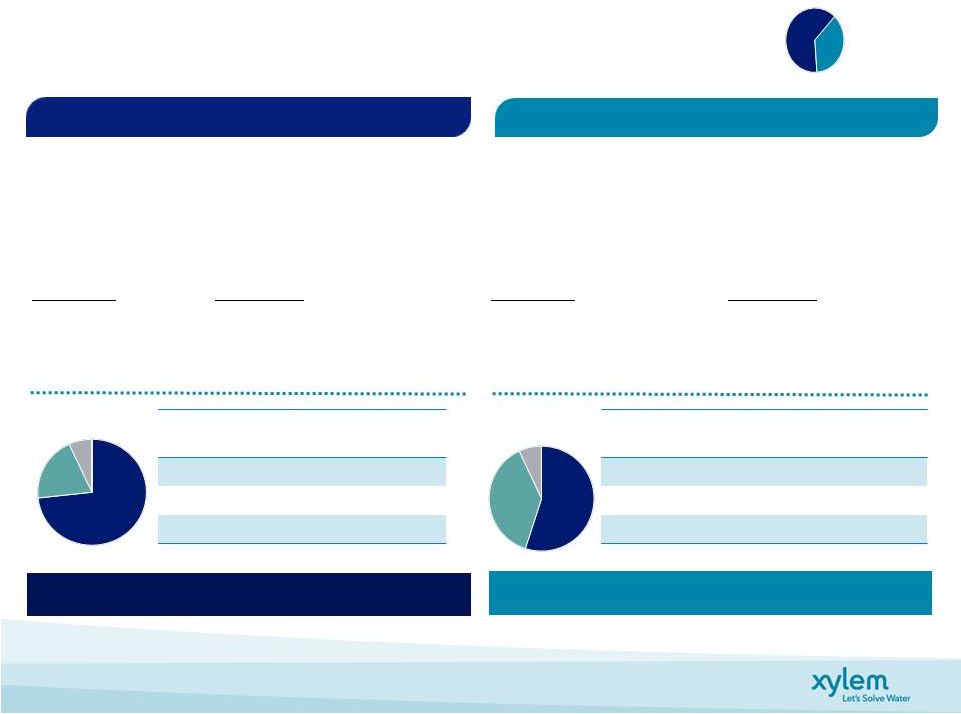

Xylem Segment Overview

Market Size: $16B

2011 Revenues: $2.4B

2011 Op Margin*: 14.9%

Water

Infrastructure

63%

Water Infrastructure Overview

Water Infrastructure Overview

Applied Water

37%

Market Size: $14B

2011 Revenues: $1.4B

2011 Op Margin*: 12.0%

Customers

Residential & Commercial,

Industrial Facilities, Agriculture

Applied Water Overview

Applied Water Overview

Customers

Public Utilities

Industrial Facilities

Distribution

World-Class Global Direct (~70%)

& Indirect Channels

Note: (1) Global market share based on company estimates.

Distribution

Primarily through World-Class

Indirect (+70%) Channels

14

*Excluding separation costs of $16M

*Excluding separation costs of $13M

Revenue by

Application

Market

Share

(1)

Treatment

18%

#1

Test

9%

#2

Transport

73%

#1

Revenue by

Application

Market

Share

(1)

Bldg. Services

53%

#2

Industrial Water

18%

#2

Irrigation

9%

#3

Unique

Position

-

Only

Provider

of

All

Three

“T’s”

Large Installed Base, Growth Despite Slow New

Construction |

Gross

Margin Improvement Funds Future Growth Xylem Continues to Invest While

Increasing Profitability Xylem Continues to Invest While Increasing

Profitability 15

•

Operational and Commercial excellence

•

Growth in higher margin Analytics and Dewatering applications

•

Xylem’s Water Infrastructure direct sales force a key competitive advantage

32.0%

33.0%

34.0%

35.0%

36.0%

37.0%

38.0%

39.0%

2008

2009

2010

2011

34.7%

36.4%

37.9%

38.4%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

2008

2009

2010

2011

1.9%

2.2%

2.3%

2.6%

R&D

12.8%

14.8%

16.8%

18.8%

20.8%

22.8%

24.8%

2008

2009

2010

2011

21.9%

23.4%

23.0%

23.1%

SG&A

Gross Margin |

Free

Cash Flow Free Cash Flow

1*

1*

and Conversion ($M)

and Conversion ($M)

Focused on Free Cash Flow

16

1

Free

Cash

Flow

=

Net

cash

from

operating

activities

-

Capital

expenditures

Strong

Free

Cash

Flow

&

Solid

Balance

Sheet

to

Fund

Growth

Initiatives

Capital Structure & Liquidity Position

Capital Structure & Liquidity Position

March 31, 2012

Cash

347

Debt

1,206

Net Debt

859

Shareholders’

Equity

1,949

Net Capital

2,808

Net Debt to Net Capital

31%

•

Strong Cash Position

•

No Significant Debt Maturities Until 2016

•

31% Net Debt to Net Capital

•

1.3x Net Debt/Adj. TTM EBITDA

•

$600M Revolving Credit Facility Undrawn

•

Access to Commercial Paper

* See non-GAAP reconciliations.

$341

$308

$301

$388

152%

117%

91%

111%

2008

2009

2010

2011 |

Disciplined Capital Deployment

17

•

2.5% –

3.5% of sales

•

~$0.10/share

•

In-line with peers

•

Up to $300M / year

Capital Deployment Strategy

•

Balance of organic & inorganic investment

•

Return value to shareholders

•

Maintain solid investment grade metrics

•

Debt & pension

Organic Growth

World Class Facilities

Cash return to

shareholders

Cash to meet key

obligations

Inorganic investment

to fuel growth

Capital Deployment Evaluation

•

Fold targeted performance into Operating plans

•

Quarterly / Annual investment review

•

Ensure targeted returns achieved

Focused on LT Shareholder Returns

Cash from

Operations

Capex

Return to

Shareholders

Financial

Obligations

Acquisition

Strategy |

Financial Projections

18

•

Market growth of 3-5%...4-6% Xylem targeted growth

•

Acquisition strategy adds 1-2 % points of growth

•

Emerging markets > 20% of revenues

Xylem is poised to achieve our long-term financial objectives

•

Operational & Commercial excellence expand segment margins 50-75 bps per

year –

Gross margin > 40%

•

Continued cash management discipline to achieve cash conversion of ~100%

•

Capital deployment strategy to drive ROIC

2012 Guidance

2015 Target

Revenues

$3.9B to $4.0B

$4.5B to $5.0B

Operating Margin*

12.7% to 13.3%

14.5% to 15.5%

Free Cash Flow Conversion

95%

100%

EPS Growth*

+8% to +17%

* See non-GAAP reconciliations.

Long-Term Targets |

19

Q&A

Q&A |

Investment Highlights

20

•

Uniquely

Positioned

…

Global

leader

in

Attractive

Water

Industry

•

Balanced

Portfolio

…

Diversified

End

&

Geographic

Market

Mix

•

Large

Installed

Base

…

Stability,

Profitable

Aftermarket

Growth

•

Attractive

Growth

Opportunities

…

Organic

&

Inorganic

•

Increasing

Profitability

…

Proven

Track

Record,

Continued

Focus

•

Solid

Cash

Flow

Generation

…

Funds

Growth

and

Shareholder

Returns

Ability to Deliver Strong & Consistent Financial Performance

Ability to Deliver Strong & Consistent Financial Performance

|

21

Thank you for your interest !

Thank you for your interest !

NYSE: XYL

http://investors.xyleminc.com

Phil De Sousa, Investor Relations Officer

(914) 323-5930

(914) 323-5931

Janice Tedesco, Investor Relations Coordinator |

Appendix |

Non-GAAP Reconciliation: Organic Revenue

23

(A)

(B)

(C)

(D)

(E)

(F) = B+C+D+E

(G) = F/A

Change

% Change

Change

% Change

Revenue

Revenue

2011 v. 2010

2011 v. 2010

FX Contribution

Eliminations

Adj. 2011 v. 2010

Adj. 2011 v. 2010

2011

2010

Year Ended December 31, 2011

Xylem Inc.

3,803

3,202

601

18.8%

(264)

(111)

-

226

7.1%

Water infrastructure

2,416

1,930

486

25.2%

(264)

(87)

2

137

7.1%

Applied Water

1,444

1,327

117

8.8%

-

(28)

(1)

88

6.6%

Change

% Change

Change

% Change

Revenue

Revenue

2010 v. 2009

2010 v. 2009

FX Contribution

Eliminations

Adj. 2010 v. 2009

Adj. 2010 v. 2009

2010

2009

Year Ended December 31, 2010

Xylem Inc.

3,202

2,849

353

12.4%

(263)

6

-

96

3.4%

Water Infrastructure

1,930

1,651

279

16.9%

(247)

(8)

-

24

1.5%

Applied Water

1,327

1,254

73

5.8%

(16)

16

-

73

5.8%

Change

% Change

Change

% Change

Revenue

Revenue

2009 v. 2008

2009 v. 2008

FX Contribution

Eliminations

Adj. 2009 v. 2008

Adj. 2009 v. 2008

2009

2008

Year Ended December 31, 2009

Xylem Inc.

2,849

3,291

(442)

-13.4%

(7)

158

-

(291)

-8.8%

Water infrastructure

1,651

1,824

(173)

-9.5%

-

108

-

(65)

-3.6%

Applied Water

1,254

1,527

(273)

-17.9%

(7)

53

-

(227)

-14.9%

Acquisitions /

Divestitures

Acquisitions /

Divestitures

Xylem Inc. Non-GAAP Reconciliation

Reported vs. Organic Revenue

($ Millions)

(As Reported -

GAAP)

(As Adjusted -

Organic)

Acquisitions /

Divestitures |

Non-GAAP Reconciliation: EBITDA

24

Xylem Inc. Non-GAAP Reconciliation

Net Cash - Operating Activities vs. Free Cash Flow

Years ended 2011, 2010, 2009, & 2008

($ Millions)

Year Ended

2011

2010

2009

2008

Net Cash - Operating Activities

449

395

370

408

Capital Expenditures

(126)

(94)

(62)

(67)

Free Cash Flow, including separation costs

323

301

308

341

Separation Costs (Cash Paid incl. Capex)

65

-

-

-

Free Cash Flow, excluding separation costs

388

301

308

341

Net Income

279

329

263

224

Separation Costs, net of tax

72

-

-

-

Adjusted Net Income

351

329

263

224

Free Cash Flow Conversion

111%

91%

117%

152% |

Non-GAAP Reconciliation: Earnings Per Share

25

FY 2009

FY 2010

FY 2011

Net Income

263

329

279

Separation costs, net of tax

-

-

72

Adjusted Net Income before Special

Tax Items 263

329

351

Special Tax Items

(61)

(43)

7

Adjusted Net

Income 202

286

358

Diluted Earnings per Share

$1.42

$1.78

$1.50

Separation costs per Share

-

-

$0.39

Adjusted diluted EPS before Special Tax Items

$1.42

$1.78

$1.89

Special Tax Items per Share

($0.32)

($0.23)

$0.04

Adjusted diluted EPS

$1.10

$1.55

$1.93

Xylem Inc. Non-GAAP Reconciliation

Adjusted Diluted EPS

2009, 2010, & 2011

($ Millions, except per share amounts) |

Non-GAAP Reconciliation: Free Cash Flow

26

Xylem Inc. Non-GAAP Reconciliation

Net Cash -

Operating Activities vs. Free Cash Flow

Years ended 2011, 2010, 2009, & 2008

($ Millions)

Year Ended

2011

2010

2009

2008

Net Cash -

Operating Activities

449

395

370

408

Capital Expenditures

(126)

(94)

(62)

(67)

Free Cash Flow, including separation costs

323

301

308

341

Separation Costs (Cash Paid incl. Capex)

65

-

-

-

Free Cash Flow, excluding separation costs

388

301

308

341

Net Income

279

329

263

224

Separation Costs, net of tax

72

-

-

-

Adjusted Net Income

351

329

263

224

Free Cash Flow Conversion

111%

91%

117%

152% |

Non-GAAP Reconciliation: Guidance

27

Illustration of Mid Point Guidance

2012 Guidance

FY '11

FY '12

As Reported

Adjustments

Adjusted

Adjustments

Normalized

As Reported

Adjustments

Adjusted

Total Revenue

3,803

3,803

3,803

3,950

3,950

Segment Operating Income

503

29

a

532

(8)

d

524

577

8

h

585

Segment Operating Margin

13.2%

14.0%

13.8%

14.6%

14.8%

Corporate Expense

108

(58)

b

50

20

e

70

81

(10)

h

71

Operating Income

395

87

482

(28)

454

496

18

514

Operating Margin

10.4%

12.7%

11.9%

12.6%

13.0%

Interest Expense

(17)

(17)

(39)

f

(56)

(51)

(51)

Other Non-Operating Income (Expense)

5

5

5

-

-

Income before Taxes

383

87

470

(67)

403

445

18

463

Provision for Income Taxes

(104)

(7)

c

(111)

16

g

(95)

(111)

(5)

i

(116)

Net Income

279

80

359

(51)

308

334

13

347

Diluted Shares (j)

185.3

185.3

185.9

185.9

Diluted EPS

1.50

$

0.43

$

1.93

$

(0.27)

$

1.66

1.80

0.07

1.87

a

One time separation costs incurred at the segment level

b

One time separation costs incurred at the corporate level

c

Net

tax

impact

of

above

items,

plus

the

addition

of

2011

special

tax

items

d

Incremental stand alone costs to be incurred in 2012 at the segment level ($8M)

e

Incremental stand alone costs to be incurred in 2012 at the corporate level ($20M)

f

Incremental interest expense on long-term debt to be incurred in 2012

g

Tax

impact

of

incremental

interest

expense

and

stand

alone

costs

to

be

incurred

in

2012

h

Expected one time separation costs of $8M and $10M to be incurred at the segments and

headquarters, respectively. i

Tax impact of one time separation costs expected to be incurred in 2012.

j

Full year 2012 diluted shares outstanding are based on diluted shares outstanding for quarter

ended March 31, 2012 ($ Millions, except per share amounts)

Guidance

Xylem Inc. Non-GAAP Reconciliation |