Attached files

| file | filename |

|---|---|

| 8-K - SYNERGETICS USA, INC. 8-K - SYNERGETICS USA INC | synergetics8k.htm |

Investor Presentation

MAY 2012

OPHTHALMOLOGY

NEUROSURGERY

QUALITY. PERFORMANCE. INNOVATION.

OPHTHALMOLOGY

NEUROSURGERY

QUALITY. PERFORMANCE. INNOVATION.

Safe Harbor Statement

Certain statements made in this presentation are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Among other, statements concerning managements expectations of future financial results, potential business, acquisitions, government agency approvals, additional indications and therapeutic applications for medical devices, as well as their outcomes, clinical efficacy and potential markets are forward looking. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from predicted results. For a discussion of such risks and uncertainties, please refer to the information set forth under Risk Factors included in Synergetics USA, Inc.s Annual Report on Form 10-K for the year ended July 31, 2011, and information contained in subsequent filings with the Securities and Exchange Commission. These forward looking statements are made based upon our current expectations and we undertake no duty to update information provided in this presentation.

Certain statements made in this presentation are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Among other, statements concerning managements expectations of future financial results, potential business, acquisitions, government agency approvals, additional indications and therapeutic applications for medical devices, as well as their outcomes, clinical efficacy and potential markets are forward looking. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from predicted results. For a discussion of such risks and uncertainties, please refer to the information set forth under Risk Factors included in Synergetics USA, Inc.s Annual Report on Form 10-K for the year ended July 31, 2011, and information contained in subsequent filings with the Securities and Exchange Commission. These forward looking statements are made based upon our current expectations and we undertake no duty to update information provided in this presentation.

Overview

Corporate Information

Synergetics USA, Inc. is a medical device company focused in the fast-growing ophthalmology and neurosurgery markets

Formed through a reverse merger of Synergetics, Inc. and Valley Forge Scientific in 2005

Synergetics was founded in 1991 and Valley Forge was founded in 1980

Corporate Headquarters: OFallon, MO

Manufacturing Facilities: OFallon, MO and King of Prussia, PA

Market Information*

NASDAQ: SURG

Market Cap: $132mm

52 Week Range: $4.61 $7.55

Shares Outstanding: 25mm

Institutional Ownership: 44%

Russell 2000 & 3000 Indexes

*Source: Google Finance, as of 5/24/12.

Corporate Information

Synergetics USA, Inc. is a medical device company focused in the fast-growing ophthalmology and neurosurgery markets

Formed through a reverse merger of Synergetics, Inc. and Valley Forge Scientific in 2005

Synergetics was founded in 1991 and Valley Forge was founded in 1980

Corporate Headquarters: OFallon, MO

Manufacturing Facilities: OFallon, MO and King of Prussia, PA

Market Information*

NASDAQ: SURG

Market Cap: $132mm

52 Week Range: $4.61 $7.55

Shares Outstanding: 25mm

Institutional Ownership: 44%

Russell 2000 & 3000 Indexes

*Source: Google Finance, as of 5/24/12.

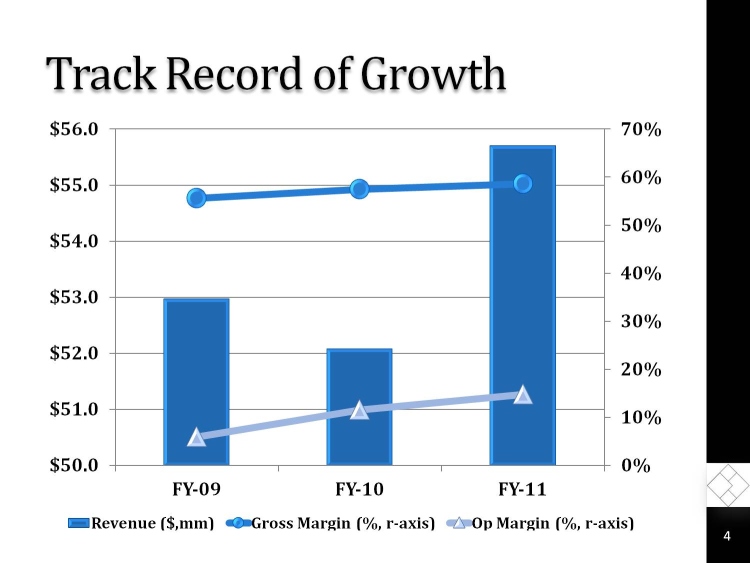

Track Record of Growth

FY-09

FY-10

FY-11

Revenue ($,mm)

Gross Margin (%, r-axis)

Op Margin (%, r-axis)

0%

10%

20%

30%

40%

50%

60%

70%

$50.0

$51.0

$52.0

$53.0

$54.0

$55.0

$56.0

FY-09

FY-10

FY-11

Revenue ($,mm)

Gross Margin (%, r-axis)

Op Margin (%, r-axis)

0%

10%

20%

30%

40%

50%

60%

70%

$50.0

$51.0

$52.0

$53.0

$54.0

$55.0

$56.0

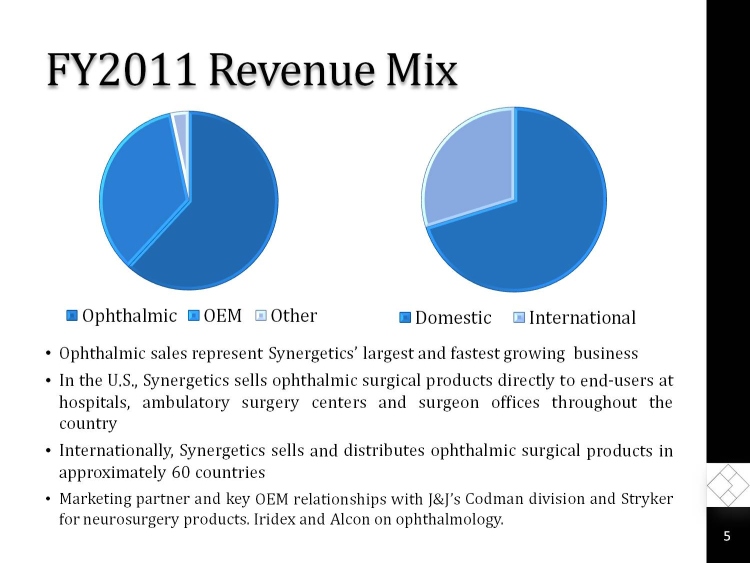

FY2011 Revenue Mix

Ophthalmic

OEM

Other

Domestic

International

Ophthalmic sales represent Synergetics largest and fastest growing business

In the U.S., Synergetics sells ophthalmic surgical products directly to end-users at hospitals, ambulatory surgery centers and surgeon offices throughout the country

Internationally, Synergetics sells and distributes ophthalmic surgical products in approximately 60 countries

Marketing partner and key OEM relationships with J&Js Codman division and Stryker for neurosurgery products. Iridex and Alcon on ophthalmology.

Ophthalmic

OEM

Other

Domestic

International

Ophthalmic sales represent Synergetics largest and fastest growing business

In the U.S., Synergetics sells ophthalmic surgical products directly to end-users at hospitals, ambulatory surgery centers and surgeon offices throughout the country

Internationally, Synergetics sells and distributes ophthalmic surgical products in approximately 60 countries

Marketing partner and key OEM relationships with J&Js Codman division and Stryker for neurosurgery products. Iridex and Alcon on ophthalmology.

Overall Strategy

1.Drive accelerating growth in Ophthalmology

2.Manage OEM neurosurgery business for stable growth and strong cash flows

3.Deliver improving profitability through enterprise-wide lean initiatives

4.Demonstrate solid financial performance

1.Drive accelerating growth in Ophthalmology

2.Manage OEM neurosurgery business for stable growth and strong cash flows

3.Deliver improving profitability through enterprise-wide lean initiatives

4.Demonstrate solid financial performance

Recent Events

1.Implementation of corporate-wide lean initiatives

2.Project Restore to improve cost structure

3.Transition of Neurosurgery business to OEM marketing partners from direct sales

4.Alcon settlement and discontinuation of supply agreement

1.Implementation of corporate-wide lean initiatives

2.Project Restore to improve cost structure

3.Transition of Neurosurgery business to OEM marketing partners from direct sales

4.Alcon settlement and discontinuation of supply agreement

Ophthalmic Surgical Market

Ophthalmic Surgical Market

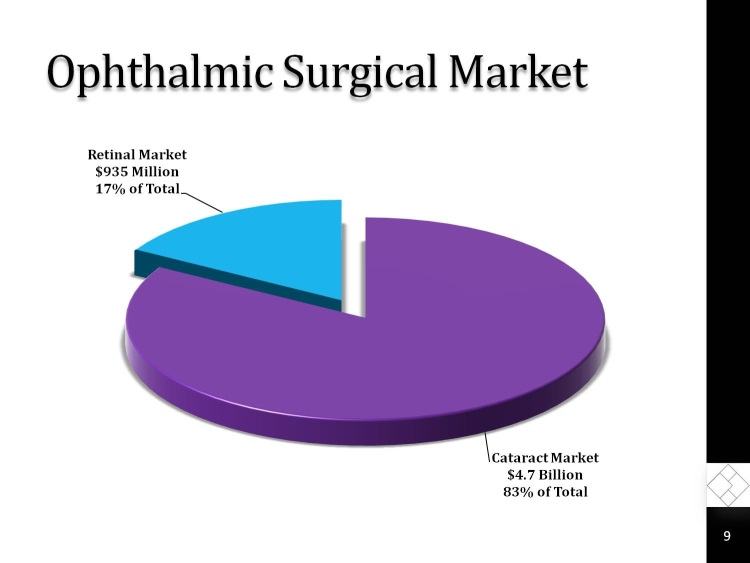

Retinal Market $935 Million 17% of Total

Cataract Market $4.7 Billion 83% of Total

Retinal Market $935 Million 17% of Total

Cataract Market $4.7 Billion 83% of Total

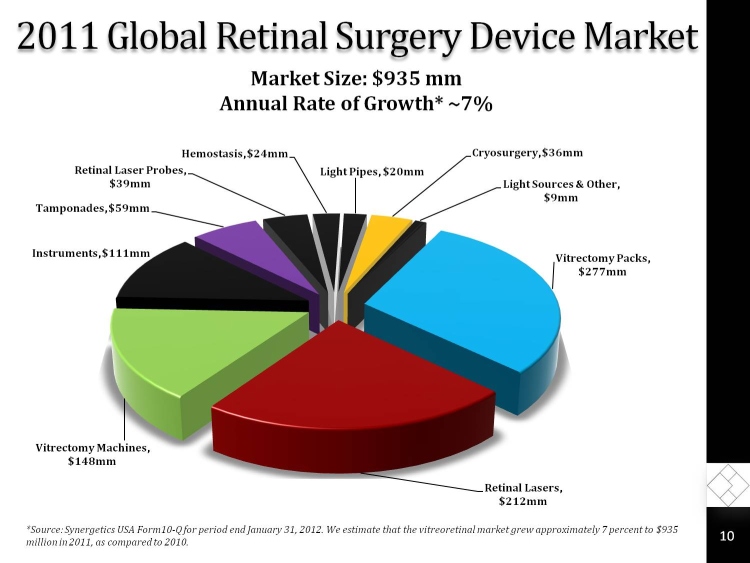

2011 Global Retinal Surgery Device Market

Market Size: $935 mm Annual Rate of Growth* ~7%

Vitrectomy Packs, $277mm

Retinal Lasers, $212mm

Vitrectomy Machines, $148mm

Instruments, $111mm

Tamponades, $59mm

Retinal Laser Probes, $39mm

Hemostasis, $24mm

Light Pipes, $20mm

Cryosurgery, $36mm

Light Sources & Other, $9mm

*Source: Synergetics USA Form10-Q for period end January 31, 2012. We estimate that the vitreoretinal market grew approximately 7 percent to $935 million in 2011, as compared to 2010.

Market Size: $935 mm Annual Rate of Growth* ~7%

Vitrectomy Packs, $277mm

Retinal Lasers, $212mm

Vitrectomy Machines, $148mm

Instruments, $111mm

Tamponades, $59mm

Retinal Laser Probes, $39mm

Hemostasis, $24mm

Light Pipes, $20mm

Cryosurgery, $36mm

Light Sources & Other, $9mm

*Source: Synergetics USA Form10-Q for period end January 31, 2012. We estimate that the vitreoretinal market grew approximately 7 percent to $935 million in 2011, as compared to 2010.

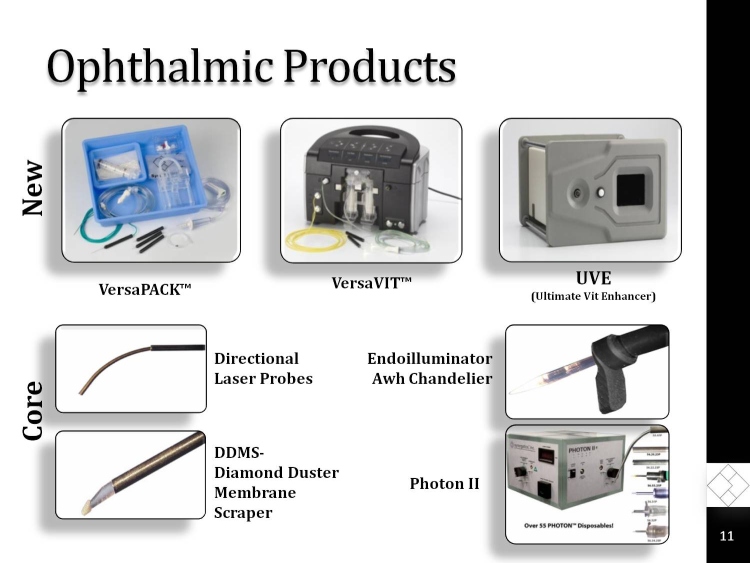

Ophthalmic Products

Core

New

VersaPACK

UVE

(Ultimate Vit Enhancer)

VersaVIT

Directional Laser Probes

DDMS-

Diamond Duster Membrane Scraper

Endoilluminator Awh Chandelier

Photon II

Core

New

VersaPACK

UVE

(Ultimate Vit Enhancer)

VersaVIT

Directional Laser Probes

DDMS-

Diamond Duster Membrane Scraper

Endoilluminator Awh Chandelier

Photon II

VersaPACK: Compelling Value Proposition

VersaPACK is our first product for the $275 million vitrectomy pack market

Compelling value proposition to retinal surgeons

Competitively priced vs. other packs

Compatible with existing competitive vitrectomy machines

Enables continued use of 1st gen machines thus avoiding large capital expenditure

Estimated 200,000 vitrectomies performed yearly (U.S.)

High margin, recurring disposable product

VersaPACK is our first product for the $275 million vitrectomy pack market

Compelling value proposition to retinal surgeons

Competitively priced vs. other packs

Compatible with existing competitive vitrectomy machines

Enables continued use of 1st gen machines thus avoiding large capital expenditure

Estimated 200,000 vitrectomies performed yearly (U.S.)

High margin, recurring disposable product

VersaVIT: A Game Changer

VersaVIT is our first product for the lucrative vitrectomy machine market

Entry into a new market opportunity valued at $150 million annually

A new concept in retinal surgery

Highly portable,

Moderately priced, and

Easy to use

Compact, lightweight and portable

Small footprint

< 25 pounds

Capable of running on battery power and gas cartridges

Ideally suited for ambulatory surgery centers, as a traveling unit for satellite offices and potentially for in-office procedures

Very competitively priced

VersaVIT is our first product for the lucrative vitrectomy machine market

Entry into a new market opportunity valued at $150 million annually

A new concept in retinal surgery

Highly portable,

Moderately priced, and

Easy to use

Compact, lightweight and portable

Small footprint

< 25 pounds

Capable of running on battery power and gas cartridges

Ideally suited for ambulatory surgery centers, as a traveling unit for satellite offices and potentially for in-office procedures

Very competitively priced

VersaVIT vs. the Competition

VersaVIT vs. ACCURUS

(25lbs vs. 90lbs)

CONSTELLATION Vision System

CONSTELLATION Vision System and ACCURUS are registered trademarks of Alcon Laboratories a division of Novartis

VersaVIT vs. ACCURUS

(25lbs vs. 90lbs)

CONSTELLATION Vision System

CONSTELLATION Vision System and ACCURUS are registered trademarks of Alcon Laboratories a division of Novartis

Ophthalmology Product Video

Neurosurgery Market

Neurosurgery Overview

Best-in-class neurosurgical technologies

Ultrasonic aspirators

Disposable tips and tubing

Electrosurgical generators

Disposable bipolar forceps

Strong OEM partnerships

J&Js Codman division distributes our electrosurgical generators and bipolar forceps

Stryker distributes our ultrasonic aspirator disposables

Multi-year OEM contracts with Codman and Stryker provide high visibility

Attractive operating margins

High barriers to entry

Expanding OEM platform complements our strategic focus

Packaging Mitosol, a drug used in glaucoma surgery, for Mobius TherapeuticsTM

Best-in-class neurosurgical technologies

Ultrasonic aspirators

Disposable tips and tubing

Electrosurgical generators

Disposable bipolar forceps

Strong OEM partnerships

J&Js Codman division distributes our electrosurgical generators and bipolar forceps

Stryker distributes our ultrasonic aspirator disposables

Multi-year OEM contracts with Codman and Stryker provide high visibility

Attractive operating margins

High barriers to entry

Expanding OEM platform complements our strategic focus

Packaging Mitosol, a drug used in glaucoma surgery, for Mobius TherapeuticsTM

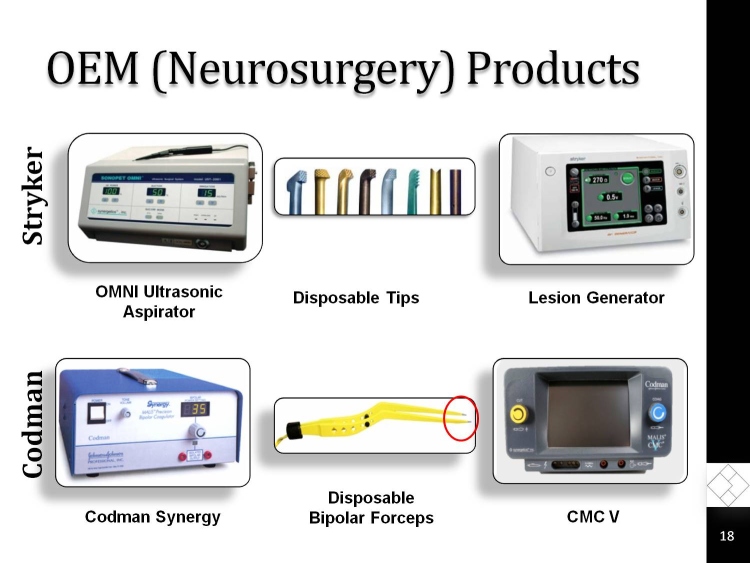

OEM (Neurosurgery) Products

Codman

Stryker

Lesion Generator

OMNI Ultrasonic Aspirator

Disposable Tips

Codman Synergy

Disposable

Bipolar Forceps

CMC V

Codman

Stryker

Lesion Generator

OMNI Ultrasonic Aspirator

Disposable Tips

Codman Synergy

Disposable

Bipolar Forceps

CMC V

Neurology Product Video

Financials

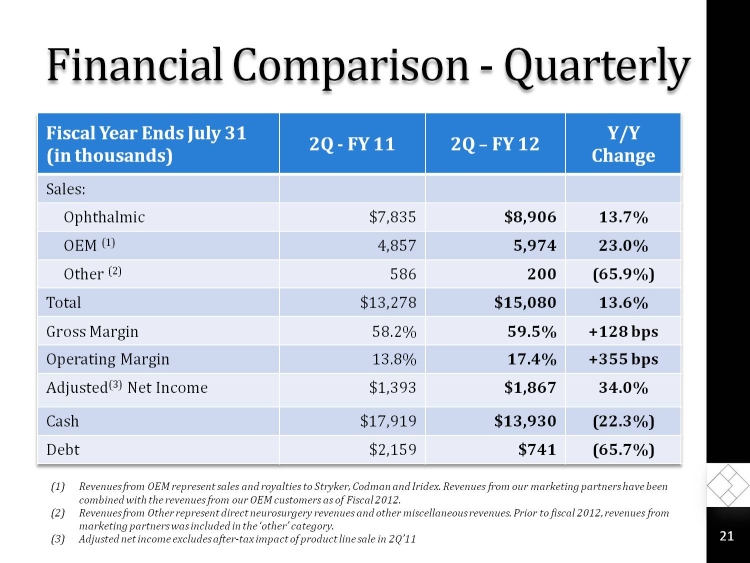

Financial Comparison - Quarterly

Fiscal Year Ends July 31

(in thousands)

2Q - FY 11

2Q FY 12

Y/Y Change

Sales:

Ophthalmic

$7,835

$8,906

13.7%

OEM (1)

4,857

5,974

23.0%

Other (2)

586

200

(65.9%)

Total

$13,278

$15,080

13.6%

Gross Margin

58.2%

59.5%

+128 bps

Operating Margin

13.8%

17.4%

+355 bps

Adjusted(3) Net Income

$1,393

$1,867

34.0%

Cash

$17,919

$13,930

(22.3%)

Debt

$2,159

$741

(65.7%)

(1)Revenues from OEM represent sales and royalties to Stryker, Codman and Iridex. Revenues from our marketing partners have been combined with the revenues from our OEM customers as of Fiscal 2012.

(2)Revenues from Other represent direct neurosurgery revenues and other miscellaneous revenues. Prior to fiscal 2012, revenues from marketing partners was included in the other category.

(3)Adjusted net income excludes after-tax impact of product line sale in 2Q11

Fiscal Year Ends July 31

(in thousands)

2Q - FY 11

2Q FY 12

Y/Y Change

Sales:

Ophthalmic

$7,835

$8,906

13.7%

OEM (1)

4,857

5,974

23.0%

Other (2)

586

200

(65.9%)

Total

$13,278

$15,080

13.6%

Gross Margin

58.2%

59.5%

+128 bps

Operating Margin

13.8%

17.4%

+355 bps

Adjusted(3) Net Income

$1,393

$1,867

34.0%

Cash

$17,919

$13,930

(22.3%)

Debt

$2,159

$741

(65.7%)

(1)Revenues from OEM represent sales and royalties to Stryker, Codman and Iridex. Revenues from our marketing partners have been combined with the revenues from our OEM customers as of Fiscal 2012.

(2)Revenues from Other represent direct neurosurgery revenues and other miscellaneous revenues. Prior to fiscal 2012, revenues from marketing partners was included in the other category.

(3)Adjusted net income excludes after-tax impact of product line sale in 2Q11

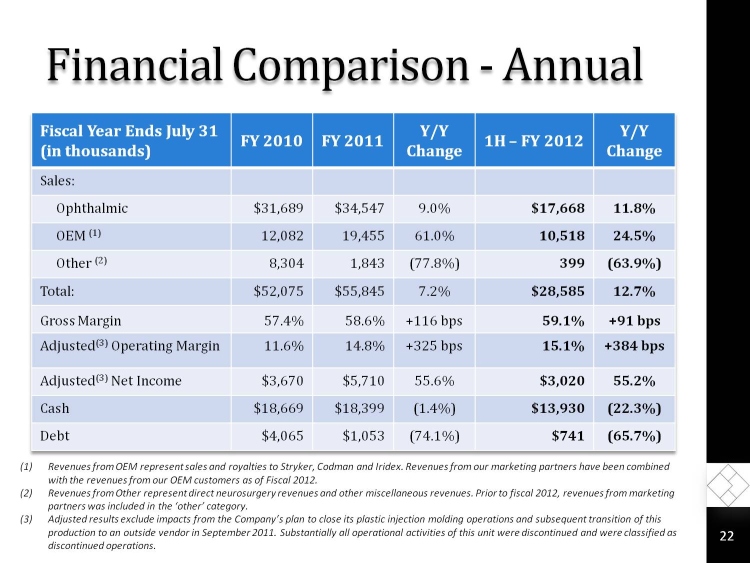

Financial Comparison - Annual

Fiscal Year Ends July 31

(in thousands)

FY 2010

FY 2011

Y/Y Change

1H FY 2012

Y/Y Change

Sales:

Ophthalmic

$31,689

$34,547

9.0%

$17,668

11.8%

OEM (1)

12,082

19,455

61.0%

10,518

24.5%

Other (2)

8,304

1,843

(77.8%)

399

(63.9%)

Total:

$52,075

$55,845

7.2%

$28,585

12.7%

Gross Margin

57.4%

58.6%

+116 bps

59.1%

+91 bps

Adjusted(3) Operating Margin

11.6%

14.8%

+325 bps

15.1%

+384 bps

Adjusted(3) Net Income

$3,670

$5,710

55.6%

$3,020

55.2%

Cash

$18,669

$18,399

(1.4%)

$13,930

(22.3%)

Debt

$4,065

$1,053

(74.1%)

$741

(65.7%)

(1)Revenues from OEM represent sales and royalties to Stryker, Codman and Iridex. Revenues from our marketing partners have been combined with the revenues from our OEM customers as of Fiscal 2012.

(2)Revenues from Other represent direct neurosurgery revenues and other miscellaneous revenues. Prior to fiscal 2012, revenues from marketing partners was included in the other category.

(3)Adjusted results exclude impacts from the Companys plan to close its plastic injection molding operations and subsequent transition of this production to an outside vendor in September 2011. Substantially all operational activities of this unit were discontinued and were classified as discontinued operations.

Fiscal Year Ends July 31

(in thousands)

FY 2010

FY 2011

Y/Y Change

1H FY 2012

Y/Y Change

Sales:

Ophthalmic

$31,689

$34,547

9.0%

$17,668

11.8%

OEM (1)

12,082

19,455

61.0%

10,518

24.5%

Other (2)

8,304

1,843

(77.8%)

399

(63.9%)

Total:

$52,075

$55,845

7.2%

$28,585

12.7%

Gross Margin

57.4%

58.6%

+116 bps

59.1%

+91 bps

Adjusted(3) Operating Margin

11.6%

14.8%

+325 bps

15.1%

+384 bps

Adjusted(3) Net Income

$3,670

$5,710

55.6%

$3,020

55.2%

Cash

$18,669

$18,399

(1.4%)

$13,930

(22.3%)

Debt

$4,065

$1,053

(74.1%)

$741

(65.7%)

(1)Revenues from OEM represent sales and royalties to Stryker, Codman and Iridex. Revenues from our marketing partners have been combined with the revenues from our OEM customers as of Fiscal 2012.

(2)Revenues from Other represent direct neurosurgery revenues and other miscellaneous revenues. Prior to fiscal 2012, revenues from marketing partners was included in the other category.

(3)Adjusted results exclude impacts from the Companys plan to close its plastic injection molding operations and subsequent transition of this production to an outside vendor in September 2011. Substantially all operational activities of this unit were discontinued and were classified as discontinued operations.

Investment Rationale

Serving growing ophthalmic and neurosurgery markets with leading technologies

Retinal surgery a compelling segment of ophthalmology

High barriers to entry and limited competition

New product introductions to help drive acceleration in revenue growth

Business model favors high margin disposables and leverages off our capital equipment

Lean initiatives fueling improving operating margins

Serving growing ophthalmic and neurosurgery markets with leading technologies

Retinal surgery a compelling segment of ophthalmology

High barriers to entry and limited competition

New product introductions to help drive acceleration in revenue growth

Business model favors high margin disposables and leverages off our capital equipment

Lean initiatives fueling improving operating margins

Management Team

David M. Hable President, CEO

Over 30 years of progressive responsibility in sales, marketing, new business development and general management in the medical device industry. 20+ years with J&J/Codman.

Pamela Boone Executive Vice President, CFO

Previously served as CFO, VP and Corporate Controller for Maverick Tube Corporation. 25 years of financial expertise.

Jerry Malis, M.D. Executive Vice President, CSO

Served as President, CEO and Chairman of Valley Forge. Over 40 years of industry experience. Published over 50 articles in the biological science, electronics and engineering fields. Issued ten U.S. patents.

Michael Fanning Vice President, Domestic Sales

Over 20 years in sales and management roles, working in service, medical device and manufacturing sectors.

Jason Stroisch Vice President, International Sales & Marketing

Over 15 years in the medical device industry covering engineering, international sales and marketing management roles.

Joan Kraus Vice President, Regulatory Affairs / Quality Assurance

Over 20 years in quality systems and process improvement roles working in healthcare, manufacturing, distribution and service sectors.

David M. Hable President, CEO

Over 30 years of progressive responsibility in sales, marketing, new business development and general management in the medical device industry. 20+ years with J&J/Codman.

Pamela Boone Executive Vice President, CFO

Previously served as CFO, VP and Corporate Controller for Maverick Tube Corporation. 25 years of financial expertise.

Jerry Malis, M.D. Executive Vice President, CSO

Served as President, CEO and Chairman of Valley Forge. Over 40 years of industry experience. Published over 50 articles in the biological science, electronics and engineering fields. Issued ten U.S. patents.

Michael Fanning Vice President, Domestic Sales

Over 20 years in sales and management roles, working in service, medical device and manufacturing sectors.

Jason Stroisch Vice President, International Sales & Marketing

Over 15 years in the medical device industry covering engineering, international sales and marketing management roles.

Joan Kraus Vice President, Regulatory Affairs / Quality Assurance

Over 20 years in quality systems and process improvement roles working in healthcare, manufacturing, distribution and service sectors.

OPHTHALMOLOGY

QUALITY. PERFORMANCE. INNOVATION.

NEUROSURGERY

QUALITY. PERFORMANCE. INNOVATION.

NEUROSURGERY