Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED MAY 30, 2012 - PACIFIC GAS & ELECTRIC Co | form8k05302012.htm |

* PG&E Corporation The attached materials are a subset of the presentation slides used at PG&E Corporation’s May 2, 2012 earnings conference call and webcast, and are not intended as a reconfirmation of the forward-looking statements made on that date. The full set of presentation slides and the companion earnings release dated May 2, 2012 are available on PG&E Corporation’s website under the Investors tab: www.pgecorp.com. Exhibit 99

* Position company for success Resolve gas issues Rebuild relationships with key stakeholders Move forward with gas work planned in 2012 Work to resolve regulatory proceedings Conduct rigorous benchmarking Build culture of continuous improvement Provide excellent service Meet commitments to customers and regulators Key Focus Areas

* Regulatory and Operational Updates Operational Updates Pipeline work completed: Pressure tested several miles of pipeline Validated MAOP for 900 miles of pipeline Began scheduled refueling of Diablo Canyon Unit 1 Established Hinkley whole-house water replacement program; accrued $71 million Regulatory Developments PSEP and 3 investigations move forward Filed cost of capital proposal Requested 52% equity ratio, 11% ROE, and continuation of automatic adjustment mechanism GRC Notice of Intent will be filed in summer 2012

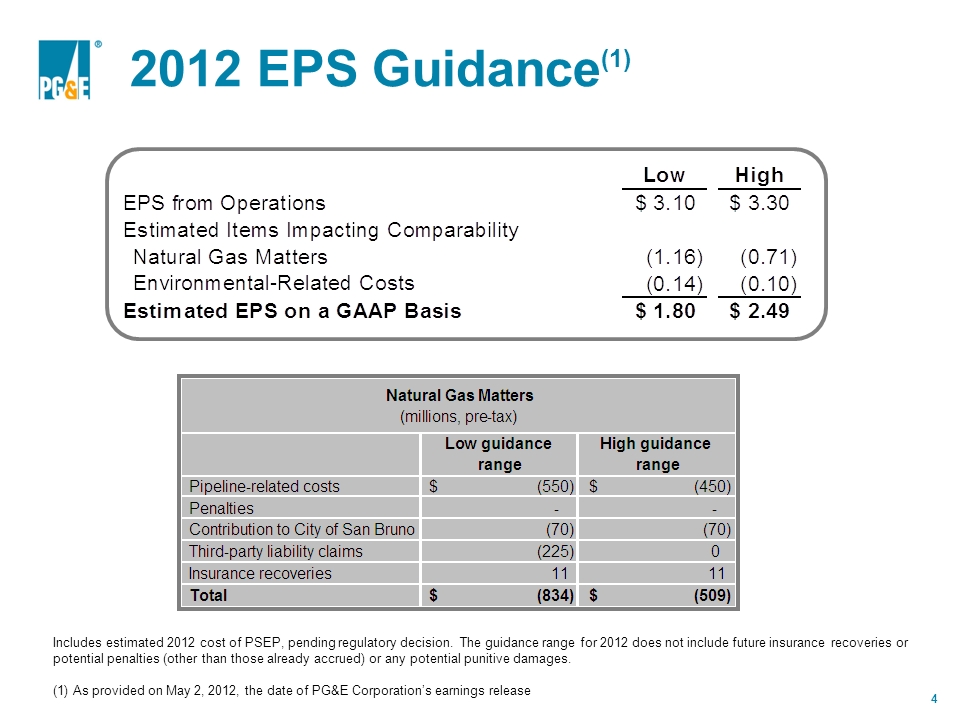

* Includes estimated 2012 cost of PSEP, pending regulatory decision. The guidance range for 2012 does not include future insurance recoveries or potential penalties (other than those already accrued) or any potential punitive damages. (1) As provided on May 2, 2012, the date of PG&E Corporation’s earnings release 2012 EPS Guidance(1)

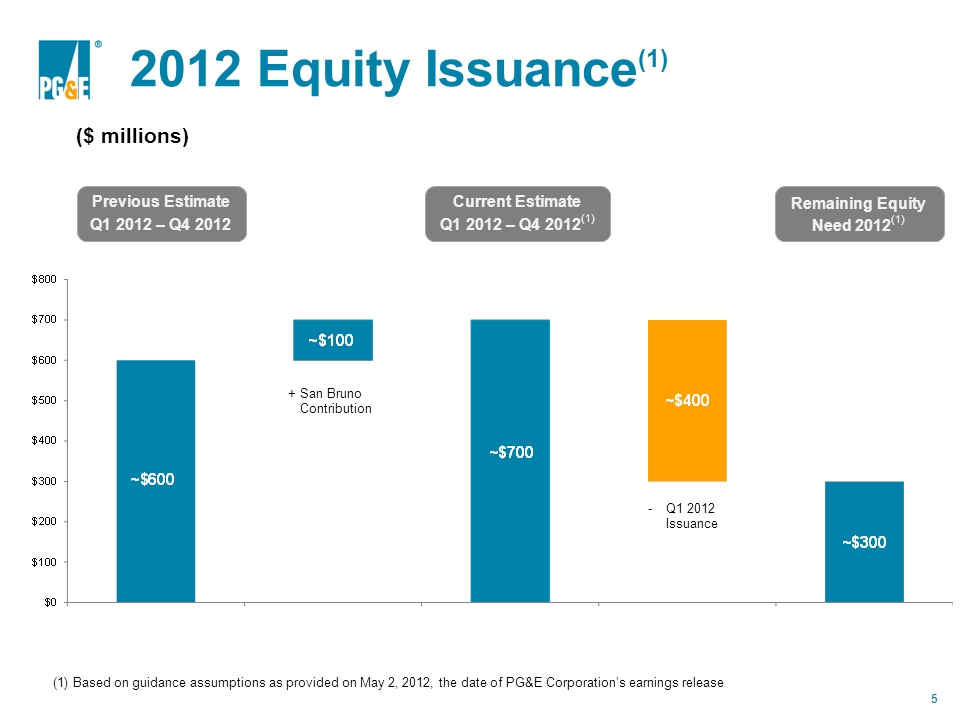

* (1) Based on guidance assumptions as provided on May 2, 2012, the date of PG&E Corporation’s earnings release San Bruno Contribution Previous Estimate Q1 2012 – Q4 2012 Current Estimate Q1 2012 – Q4 2012(1) 2012 Equity Issuance(1) Remaining Equity Need 2012(1) ($ millions) Q1 2012 Issuance

* This presentation contains forward-looking statements about management's guidance for PG&E Corporation’s 2012 earnings per share and various assumptions and estimates on which such guidance is based, including forecasts of costs, capital expenditures, and future equity issuances, and estimated liabilities for penalties associated with natural gas matters, third-party liabilities associated with the September 9, 2010 natural gas pipeline accident in San Bruno, California, and environmental remediation. These statements are necessarily subject to various risks and uncertainties, the realization or resolution of which may be outside of management's control. Actual results may differ materially. Factors that could cause actual results to differ materially include: •the outcomes of pending and future investigations, enforcement matters, and regulatory proceedings related to the San Bruno accident and the safety of the Utility’s natural gas system; the ultimate amount of third-party claims associated with the San Bruno accident that are not recovered through insurance; the ultimate amount of any civil or criminal penalties, or punitive damages, if any, the Utility may incur related to these matters, and the ultimate amount of costs the Utility incurs for natural gas matters that are not recovered through rates; •the outcome of future investigations or proceedings that may be commenced by the California Public Utilities Commission (“CPUC”) or other regulatory authorities relating to the Utility’s compliance with laws, rules, regulations, or orders applicable to the operation, inspection, and maintenance of its electric and gas facilities (in addition to investigations or proceedings related to the San Bruno accident and natural gas matters); •whether PG&E Corporation and the Utility are able to repair the reputational harm that they have suffered which, in part, will depend on their ability to implement the recommendations made by the National Transportation Safety Board (“NTSB”) and the CPUC’s independent review panel and comply with new state and federal regulations applicable to natural gas pipeline operations; whether additional deficiencies are identified in the Utility’s operating practices and procedures or corporate culture; developments that may occur in the various investigations of the San Bruno accident and natural gas matters; the decisions, findings, or orders issued in connection with these investigations, including the amount of civil or criminal penalties that may be imposed on the Utility; developments that may occur in the civil litigation related to the San Bruno accident; and the extent of service disruptions that may occur due to changes in pipeline pressure as the Utility continues to inspect and test pipelines; •the adequacy and price of electricity and natural gas supplies, the extent to which the Utility can manage and respond to the volatility of electricity and natural gas prices, the ability of the Utility and its counterparties to post or return collateral in connection with price risk management activities; and the availability and price of nuclear fuel used in the two nuclear generation units at Diablo Canyon; •explosions, fires, accidents, mechanical breakdowns, equipment failures, human errors, labor disruptions, and similar events, as well as acts of terrorism, war, or vandalism, including cyber-attacks, that can cause unplanned outages, reduce generating output, disrupt the Utility’s service to customers, or damage or disrupt the facilities, operations, or information technology and systems owned by the Utility, its customers, or third parties on which the Utility relies; and subject the Utility to third-party liability for property damage or personal injury, or result in the imposition of civil, criminal, or regulatory penalties on the Utility; •the impact of storms, tornadoes, floods, drought, earthquakes, tsunamis, wildland and other fires, pandemics, solar events, electromagnetic events, and other natural disasters, which affect customer demand or that damage or disrupt the facilities, operations, or information technology and systems owned by the Utility, its customers, or third parties on which the Utility relies; •the potential impacts of climate change, the impact of environmental laws and regulations aimed at the reduction of carbon dioxide and other greenhouse gases (“GHGs”), and whether the Utility is able to recover associated compliance costs, including the cost of emission allowances and offsets, that the Utility may incur under cap-and-trade regulations; •changes in customer demand for electricity (“load”) and natural gas resulting from unanticipated population growth or decline in the Utility’s service area, general and regional economic and financial market conditions, the development of alternative energy technologies including self-generation and distributed generation technologies, or other reasons; •the occurrence of unplanned outages at the Utility’s generation facilities and the ability of the Utility to procure replacement electricity if certain generation facilities were unavailable; •the results of seismic studies the Utility is conducting that could affect the Utility’s ability to continue operating Diablo Canyon or renew the operating licenses for Diablo Canyon; the impact of the recently issued NRC orders to implement various recommendations made by the NRC’s task force following the March 2011 earthquake and tsunami that caused significant damage to nuclear facilities in Japan; and the impact of new legislation, regulations, or policies that may be adopted in the future to address the operations, security, safety, or decommissioning of nuclear facilities, the storage of spent nuclear fuel, seismic design, cooling water intake, or other issues; •the impact of federal or state laws or regulations, or their interpretation, on energy policy and the regulation of utilities and their holding companies, including how the CPUC interprets and enforces the financial and other conditions imposed on PG&E Corporation when it became the Utility’s holding company, and whether the outcome of proceedings and investigations relating to the Utility’s natural gas operations affects the Utility’s ability to make distributions to PG&E Corporation in the form of dividends or share repurchases; •whether the Utility’s newly installed advanced metering system infrastructure, consisting of electric and gas SmartMeterTM devices and related software systems and wireless communications equipment, continues to function accurately and timely measure customer energy usage and generate billing information; whether the Utility can timely implement “dynamic pricing” retail electric rates that are more closely aligned with real-time wholesale electricity market prices; and whether the Utility can continue to rely on third-party vendors and contractors to maintain and support the advanced metering system infrastructure; •whether the Utility is able to protect its information technology, operating systems, and networks, including the advanced metering system infrastructure from damage, disruption, or failure caused by cyber-attacks, computer viruses, and other hazards; and whether the Utility’s security measures are sufficient to protect confidential customer, vendor, and financial data contained in such systems and networks from unauthorized access and disclosure; •the extent to which PG&E Corporation or the Utility incurs costs in connection with third-party claims or litigation that are not recoverable through insurance, rates, or from other third parties; •the amount of equity issued by PG&E Corporation in the future to fund equity contributions to the Utility to enable the Utility to maintain its authorized capital structure that will primarily depend on the timing and amount of charges and costs the Utility incurs that will not be recoverable through rates or insurance; and the ability of PG&E Corporation, the Utility, and their counterparties to access capital markets and other sources of credit in a timely manner on acceptable terms; •the impact of environmental remediation laws, regulations, and orders; the extent to which the Utility is able to recover compliance and remediation costs from third parties or through rates or insurance; and the ultimate amount of costs the Utility incurs in connection with its natural gas compressor station located near Hinkley, California (“Hinkley natural gas compressor site”), which are not recoverable through rates or insurance; •the loss of customers due to various forms of bypass and competition, including municipalization of the Utility’s electric distribution facilities, increasing levels of “direct access,” by which consumers procure electricity from alternative energy providers, and implementation of “community choice aggregation,” which permits certain types of governmental bodies to purchase and sell electricity for their local residents and businesses; •the outcome of federal or state tax audits and the impact of any changes in federal or state tax laws, policies, or regulations; and, •other factors and risks discussed in PG&E Corporation and the Utility’s combined 2011 Annual Report on Form 10-K, together with the information incorporated by reference into such report, that has been filed with the Securities and Exchange Commission. Safe Harbor Statement

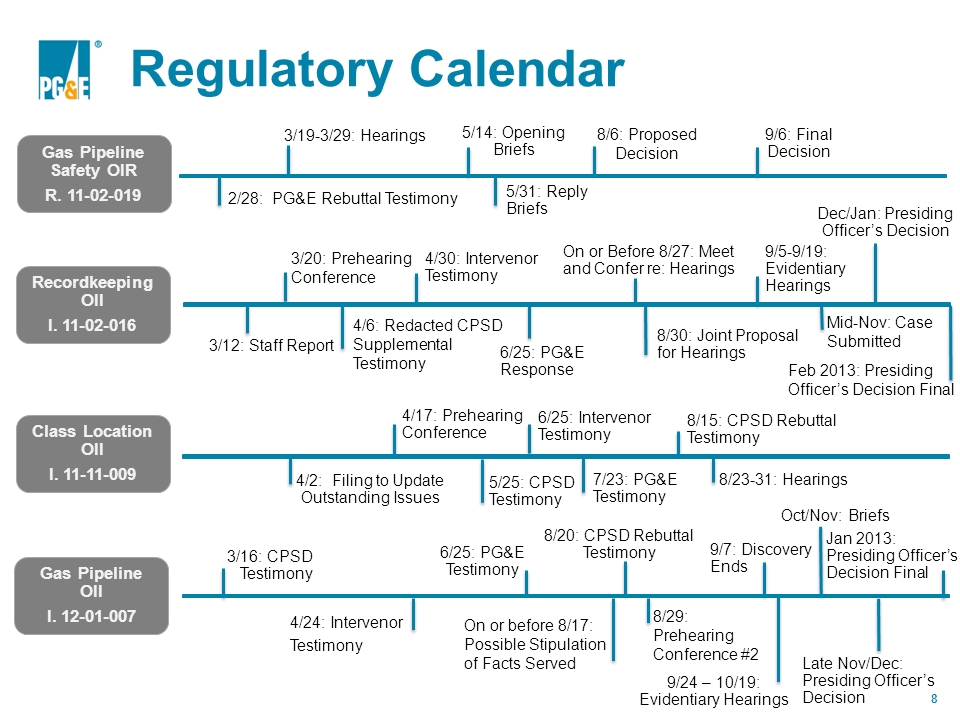

* Appendix

* 8/15: CPSD Rebuttal Testimony 8/29: Prehearing Conference #2 4/2: Filing to Update Outstanding Issues 5/25: CPSD Testimony On or Before 8/27: Meet and Confer re: Hearings 9/6: Final Decision Mid-Nov: Case Submitted 4/6: Redacted CPSD Supplemental Testimony 6/25: PG&E Response 3/20: Prehearing Conference 3/12: Staff Report Recordkeeping OII I. 11-02-016 2/28: PG&E Rebuttal Testimony Gas Pipeline Safety OIR R. 11-02-019 3/19-3/29: Hearings 5/14: Opening Briefs 5/31: Reply Briefs 8/6: Proposed Decision 4/17: Prehearing Conference 7/23: PG&E Testimony Class Location OII I. 11-11-009 6/25: Intervenor Testimony 8/23-31: Hearings 9/24 – 10/19: Evidentiary Hearings Oct/Nov: Briefs Jan 2013: Presiding Officer’s Decision Final 3/16: CPSD Testimony On or before 8/17: Possible Stipulation of Facts Served 9/7: Discovery Ends 6/25: PG&E Testimony Late Nov/Dec: Presiding Officer’s Decision 4/24: Intervenor Testimony Gas Pipeline OII I. 12-01-007 8/20: CPSD Rebuttal Testimony 4/30: Intervenor Testimony 8/30: Joint Proposal for Hearings 9/5-9/19: Evidentiary Hearings Dec/Jan: Presiding Officer’s Decision Feb 2013: Presiding Officer’s Decision Final Regulatory Calendar

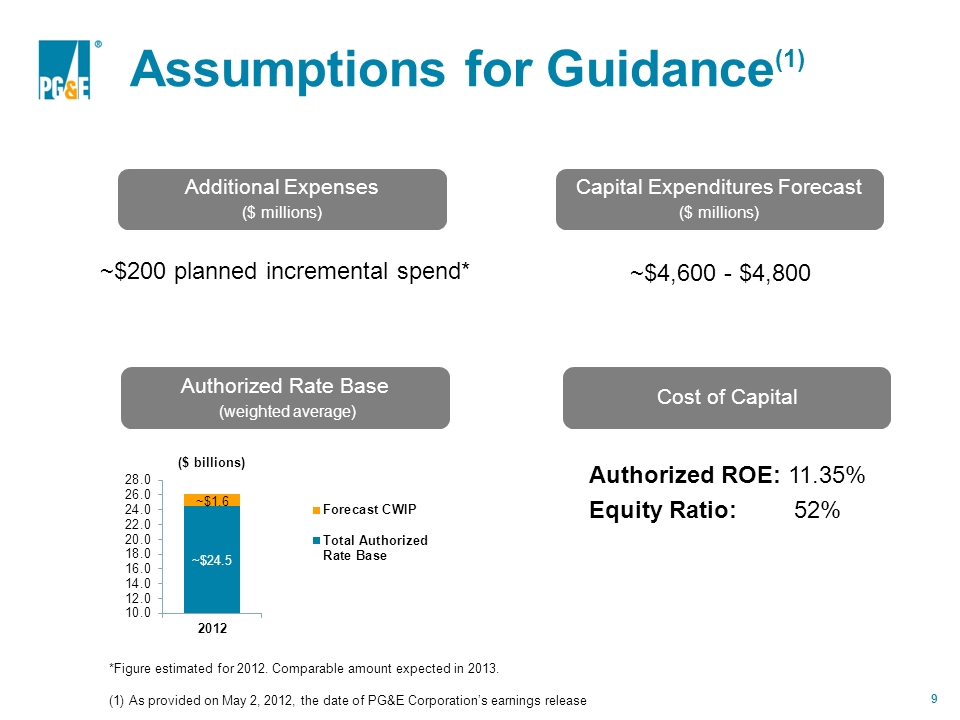

* ~$4,600 - $4,800 Capital Expenditures Forecast ($ millions) Authorized ROE: 11.35% Equity Ratio: 52% Cost of Capital Additional Expenses ($ millions) ~$200 planned incremental spend* Authorized Rate Base (weighted average) *Figure estimated for 2012. Comparable amount expected in 2013. (1) As provided on May 2, 2012, the date of PG&E Corporation’s earnings release Assumptions for Guidance(1)