Attached files

| file | filename |

|---|---|

| 8-K - Cheniere Energy Partners, L.P. | cqp2012form8kjunecorpprese.htm |

Corporate Presentation June 2012

2 This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended”. All statements, other than statements of historical facts, included herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things: statements regarding our ability to pay distributions to our unitholders; statements regarding our expected receipt of cash distributions from Sabine Pass LNG, L.P.; statements regarding future levels of domestic natural gas production, supply or consumption; future levels of liquefied natural gas imports into North America; sales of natural gas in North America or other markets; exports of LNG from North America; and the transportation, other infrastructure or prices related to natural gas, LNG or other energy sources; statements regarding any financing or refinancing transactions or arrangements, or ability to enter into such transactions or arrangements, whether on the part of Cheniere Energy Partners, L.P. or any subsidiary or at the project level; statements regarding any commercial arrangements presently contracted, optioned or marketed, or potential arrangements, to be performed substantially in the future, including any cash distributions and revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, liquefaction or storage capacity that are, or may become, subject to such commercial arrangements; statements regarding counterparties to our commercial contracts, construction contracts and other contracts; statements relating to the construction and operations of our proposed LNG liquefaction facilities, including statements concerning the completion by certain dates or at all, the costs related thereto and certain characteristics, including amounts of liquefaction capacity and storage capacity and the number of LNG trains; statements that we expect to receive an order from the Federal Energy Regulatory Commission authorizing us to construct and operate our proposed liquefaction facilities by certain dates, or at all; statements regarding any business strategy, any business plans or any other plans, forecasts, projections or objectives, including potential revenues and capital expenditures, any or all of which are subject to change; statements regarding projections of revenues, expenses, earnings or losses, working capital or other financial items; statements regarding legislative, governmental, regulatory, administrative or other public body actions, requirements, permits, investigations, proceedings or decisions; and any other statements that relate to non-historical or future information. These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “contemplate,” “develop,” “estimate,” “example,” “expect,” “forecast,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” and similar terms and phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in “Risk Factors” in the Cheniere Energy Partners, L.P. Annual Report on Form 10-K filed with the SEC on February 24, 2012, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors”. These forward-looking statements are made as of the date of this presentation, and we undertake no obligation to publicly update or revise any forward-looking statements. Forward Looking Statements

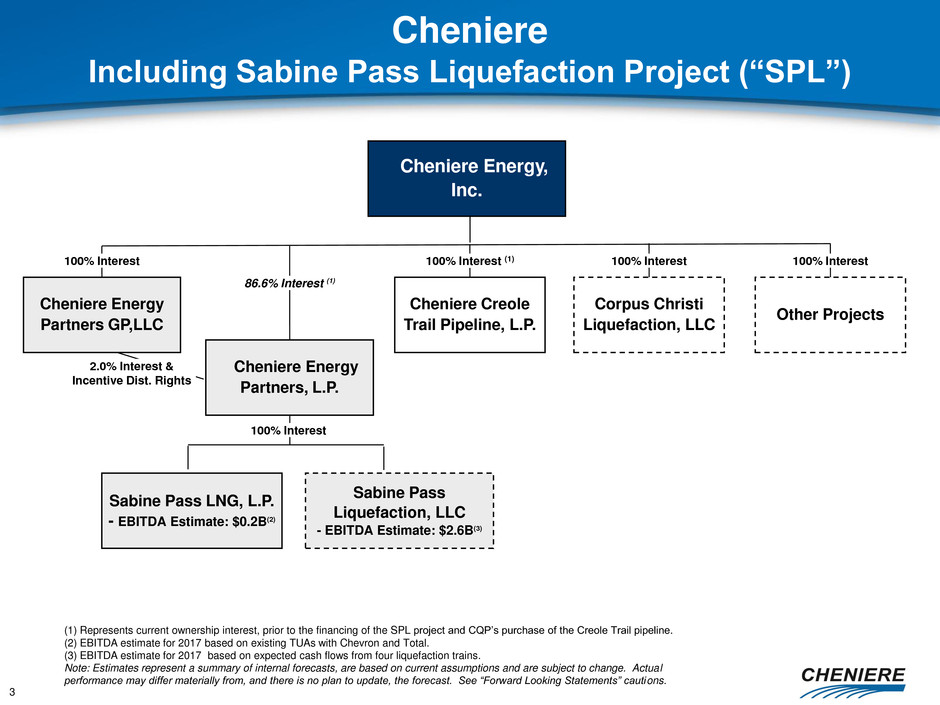

3 Cheniere Including Sabine Pass Liquefaction Project (“SPL”) Cheniere Energy, Inc. Sabine Pass LNG, L.P. - EBITDA Estimate: $0.2B(2) Sabine Pass Liquefaction, LLC - EBITDA Estimate: $2.6B(3) Cheniere Energy Partners, L.P. 2.0% Interest & Incentive Dist. Rights Cheniere Creole Trail Pipeline, L.P. Corpus Christi Liquefaction, LLC Other Projects Cheniere Energy Partners GP,LLC 86.6% Interest (1) 100% Interest 100% Interest (1) 100% Interest 100% Interest 100% Interest (1) Represents current ownership interest, prior to the financing of the SPL project and CQP’s purchase of the Creole Trail pipeline. (2) EBITDA estimate for 2017 based on existing TUAs with Chevron and Total. (3) EBITDA estimate for 2017 based on expected cash flows from four liquefaction trains. Note: Estimates represent a summary of internal forecasts, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” cautions.

4 Financial Forecast Summary including Sabine Pass Liquefaction Project Current Debt Estimated EBITDA - including SPL Trains 1 & 2: $4.5B to $5.0B Trains 3 & 4: $4.5B to $5.0B CQP: $2.2B LNG: $0.5B(2) Total: $2.7B(3) 90% from long-term fixed contracts with investment-grade customers (1) Expected construction costs before financing costs. SPL has entered into a lump-sum turnkey EPC contract with Bechtel for Phase 1 of the liquefaction project (Trains 1 and 2). (2) Debt includes 2008 loans and convertible senior unsecured notes due 8/1/12. (3) EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. Because we have not forecasted such depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP. As a result, we are unable to reconcile differences between forecasts of EBITDA and net income. Note: Estimates represent a summary of internal forecasts, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” cautions. Expected Construction Costs – SPL(1)

$53,513 $56,617 $31,648 $28,630 $14,925 $16,040 $28,600 $8,398 – $20,000 $40,000 $60,000 TRP ENB SE WMB NI OKE KMI EQT 12.6x 15.4x 10.2x 10.4x 9.2x 10.1x 18.0x 8.0x $4,253 $3,667 $3,095 $2,762 $1,620 $1,590 $1,589 $1,046 – $1,000 $2,000 $3,000 $4,000 $5,000 TRP ENB SE WMB NI OKE KMI EQT 5 Cheniere’s EBITDA expected to be bolstered from Sabine Liquefaction contracts (1) Estimated based on May 10, 2012 Kinder Morgan investor presentation. Cheniere Ranks Among Large Cap Midstream/Pipeline C-Corps by EBITDA with Sabine Liquefaction Contracts 2012E EBITDA Enterprise Value (EV) ($ in millions) Source: I/B/E/S consensus estimates, May 25, 2012 Cheniere estimated EBITDA: $2.7B* ($ in millions) Cheniere’s estimated contracted EBITDA (2017) expected to be comparable to large-cap midstream/pipeline energy companies –Estimated EBITDA includes SPAs at SPL for ~16.0 mtpa and additional LNG sales of ~2.0 mtpa of excess volumes plus existing TUAs at SPLNG for 2.0 Bcf/d Energy group trades at an average multiple of > 10x (EV/2012E EBITDA) –Cheniere’s current EV is ~$3.5B –Estimated capital costs for 4 liquefaction trains, before financing costs, are ~$9.0B to ~$10.0B (1) (1) Estimated based on May 10, 2012 Kinder Morgan investor presentation. (1) Note: Estimates represent a summary of internal forecasts, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. EBITDA is a non-GAAP figure and does not include projections of depreciation and amortization. See “Forward Looking Statements” cautions. *Includes Cheniere and its subsidiaries based on expected cash flows from four liquefaction trains. EBITDA multiple

6 Sabine Pass with Liquefaction Expansion Sabine Pass LNG

7 Proposed SPL Project: Development Utilizing Existing Assets Current Facility ~1,000 acres in Cameron Parish, LA 40 ft ship channel 3.7 miles from coast 2 berths; 4 dedicated tugs 5 LNG storage tanks (17 Bcf of storage) 4.3 Bcf/d peak regasification capacity 5.3 Bcf/d of pipeline interconnection to the US pipeline network Liquefaction Expansion LSTK EPC contract w/Bechtel for Trains 1 & 2 Up to four liquefaction trains designed with ConocoPhillips’ Optimized Cascade® Process technology Six GE LM2500+ G4 gas turbine driven refrigerant compressors per train Gas treating and environmental compliance Modifications to the Creole Trail Pipeline for bi- directional service Sixth tank if needed for fourth train Existing operational facility Proposed expansion Significant infrastructure in place including storage, marine and pipeline interconnection facilities; pipeline quality natural gas to be sourced from U.S. pipeline network

Current Facility Delivery from SPLNG: 2.0 Bcf/d Diameter: 42-inch Length: 94 miles Interconnects: NGPL, Transco, TGPL, FGT, Bridgeline, Tetco, Trunkline Pipeline Modifications Reconfigure for bi-directional flow One new compressor station with three new units Two new meter stations Modification of existing meter stations Est. ~$90MM capital cost Delivery to SPLNG: 1.5 Bcf/d Est. in-service: 4Q2014 – 4Q2015 CQP to Purchase Creole Trail Pipeline CTPL infrastructure is critical to purchasing gas & providing Liquefaction services CQP to purchase CTPL for $300MM cash plus 12MM Class B Units – CEI to use proceeds to pay down debt and for general corporate purposes Sabine Pass Liquefaction & CTPL to enter into a Firm Transport Service Agreement – ~$80MM annual payments to CTPL after in-service of Liquefaction Train 1 8

DOE export authorization Definitive commercial agreements EPC contract 4Q12 FERC construction authorization Financing commitments 2Q12 1Q13 Commence construction 2012 2013 Commence operations 2015/2016 2017/2018 Milestone Target Date Note: Past results not a guarantee of future performance. Trains 1 & 2 Trains 3 & 4 Progress on Liquefaction Project Project teams in place with the same key people that developed Sabine Pass LNG and Creole Trail Pipeline on-time and on-budget 9 Trains 1 & 2: Obtaining financing is last step prior to commencing construction Trains 3 & 4: Commercial contracts complete

10 Contracted Capacity at SPLNG Third Party Terminal Use Agreements (TUAs) Long-term, 20 year “take-or-pay” style commercial contracts Total Gas & Power N.A. Chevron USA Capacity 1.0 Bcf/d 1.0 Bcf/d Fees (1) Reservation Fee (2) $0.28/MMBTU $0.28/MMBTU Opex Fee (3) $0.04/MMBTU $0.04/MMBTU 2011 Full-Year Payments $124 million $129 million Term 20 years 20 years Guarantor Total S.A. Chevron Corp. Guarantor Credit Rating** Aa1/AA Aa1/AA Payment Start Date April 1, 2009 July 1, 2009 (1) Fees do not vary with the actual quantity of LNG processed; tax reimbursement not included in the fees. (2) No inflation adjustments. (3) Subject to annual inflation adjustment. Note: Termination Conditions – (a) force majeure of 18 months (b) unable to satisfy customer delivery requirements of ~192MMbtu in a 12-month period, 15 cargoes over 90 days or 50 cargoes in a 12-month period. In the case of force majeure, the customers are required to pay their capacity reservation fees for the initial 18 months. **Ratings may be changed, suspended or withdrawn at anytime and are not a recommendation to buy, hold or sell any security.

Contracted Capacity at SPL Sale and Purchase Agreements (SPAs) (1) Conditions precedent must be satisfied by December 31, 2012 for BG Group and Gas Natural Fenosa and by June 30, 2013 for KOGAS and GAIL (India) Ltd. or either party can terminate. CPs include financing, regulatory approvals, positive final investment decision, issuance of notice to proceed and entering into common facilities agreements (other than KOGAS and GAIL (India) Ltd.). (2) A portion of the fee is subject to inflation, approximately 15% for BG Group, 13.6% for Gas Natural Fenosa and 15% for KOGAS and GAIL (India) Ltd. (3) Ratings may be changed, suspended or withdrawn at anytime and are not a recommendation to buy, hold or sell any security. (4) SPAs have a 20 year term with the right to extend up to an additional 10 years. Gas Natural Fenosa has an extension right up to an additional 12 years in certain circumstances. (5) BG will provide annual fixed fees of approximately $520 million for trains 1-2 and $203 million for trains 3-4. BG Gulf Coast LNG (1) Gas Natural Fenosa (1) Annual Contract Quantity (MMBtu) 286,500,000 Fixed Fees $/MMBtu (2) Annual Fixed Fees (5) ~$723 MM ~$454 MM Term (4) Guarantor 20 years BG Energy Holdings Ltd. Gas Natural SDG S.A. Guarantor Credit Rating (3) A2/A Baa2/BBB Fee During Force Majeure Up to 24 months Up to 24 months 20 years GAIL (India) Limited (1) ~$548 MM 20 years Baa2/NR/BBB- N/A Long-term, “take-or-pay” style commercial contracts equating to ~16 mtpa N/A Contract Start Date Train 1 + additional volumes with Trains 2,3,4 Train 2 Train 4 $2.25 - $3.00 $2.49 $3.00 182,500,000 182,500,000 20 years N/A N/A A / A1 Train 3 $3.00 182,500,000 ~$548 MM Korea Gas Corporation (1) 11

12 Sabine Pass LNG Exports Will Provide Global LNG Buyers With an Attractive, Long-term, Alternative Source of Supply Henry Hub 3.00 $ Capacity Charge 3.00 Shipping 1.25 Fuel/Basis 0.35 Delivered Cost 7.60 $ 3.00 $ 3.00 3.00 0.35 9.35 $ Europe Asia ($/MMBtu) Cost of delivered gas from Sabine Pass to Americas / Europe / Asia = $7 - $9 / MMBtu Worldwide LNG prices predominantly based on oil prices = $11 - $23 / MMBtu Current LNG Market 30 – 40 Bcf/d LNG contracts indexed to oil prices – rule of thumb 11% to 15% of crude oil prices Growth Market 100 Bcf/d Power generators switching from oil to gas – paying $13 to $19 / MMBtu for fuel oil and diesel at $100/bbl 11.00 15.00 at $150/bbl 16.50 22.50 LNG Contract Price Indexation % 11% 15% $ $ $ $ Source: Waterborne, GIIGNL, PIRA Energy Group, Cheniere Research 3.00 $ 3.00 0.75 0.35 7.10 $ Americas

U.S. Natural Gas Markets US Gas Consumptions vs. Production US Proved Non-Producing Reserves Productive Capacity from Unconventional Reservoirs US Natural Gas Resources Tcf Bcf/d MMB/d Tcf Current market fundamentals in the U.S. – increased production, increased natural gas reserves and lackluster increase in natural gas demand – have created an opportunity to expand into exports – benefitting U.S. economy, creating jobs and reducing balance of trade Source: EIA historical, December 2011 Short-Term Energy Outlook (2011 data). 49 51 60 67 78 85 98 0 20 40 60 80 100 120 2003 2004 2005 2006 2007 2008 2009 Source: EIA, US Crude Oil, Natural Gas and Natural Gas Liquids Proved Reserves, 2009. Source: Advanced Resource Intl; Cheniere Research. 1,365 1,747 2,119 2,543 0 500 1,000 1,500 2,000 2,5 0 3,0 0 2008 2009 2010 2011 Conventional Shale Source: DOE, Annual Energy Outlook 2008-2011. 18.1 18.5 19.3 20.2 20.6 21.6 23.0 23.6 22.0 21.7 23.1 23.3 22.8 24.1 24.5 24.9 10 12 14 16 18 20 22 24 26 2005 2006 2007 2008 2009 2010 2011 2012E US Gas Production US Gas Consumption Tcf 13 Includes Eagle Ford, Barnett Combo, Bakken, Permian, Anadarko, W. Marcellus, Utica, Cotton Valley, Piceance & Uinta

14 Global Petroleum Demand – Stationary Sources Asia 6.9 MM b/d ~41 Bcf/d Europe 2.9 MM b/d ~17 Bcf/d Mid East 2.8 MM b/d ~17 Bcf/d Latin America 2.3 MM b/d ~14 Bcf/d FSU 0.9 MM b/d ~5 Bcf/d Africa 1.2 MM b/d ~7 Bcf/d US & Canada 2.2 MM b/d ~13 Bcf/d Global oil use totals 19 million b/d (~22%) in stationary sources, such as industrial, power and heating, that could be switched to natural gas: equivalent to 100+ Bcf/d natural gas demand Source: PIRA Energy Group, “The Potential for Natural Gas Substitution of Stationary Petroleum Demand”, January 2010

15 Liquefaction Project Financing Options Trains 1 & 2 Debt: project finance market and Term Loan B market - $2.5B bank debt - $2.0B Term Loan B - $1.25B @ Liquefaction for the Liquefaction Project - $0.75B @ CQP for the Creole Trail Acquisition - ~$1.0B of EBITDA from customers - ~$100MM - $200MM potential EBITDA from marketing activities Equity: ~133.3MM newly formed Class B units at $15/unit - $1.5B equity commitment with Blackstone - $0.5B equity commitment with Cheniere Energy, Inc. (raised on May 7, 2012 from equity offering with Temasek and RRJ Capital) - 3.5% quarterly accretion rate; convert into common units at completion of Train 3 Trains 3 & 4 Debt: term loans/bonds - ~$1.4B of EBITDA for coverage Equity: optional Trains 1 – 4 total expected EBITDA = ~$2.6 B (1) The closing of the Financing is subject to, among other things, the execution of definitive documents, receipt of regulatory approvals required to permit commencement of construction of the Liquefaction Project, closing of the purchase of the Creole Trail pipeline, closing of the debt financing for the first two trains and other conditions necessary to complete the transaction. (1) Note: The above represents potential financing options. Estimates represent a summary of internal forecasts, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” cautions

16 Summary Steady State Cash Flows Trains 1 & 2 (1) Includes operating expenses, management fees, maintenance expenditures and marketing costs associated with purchasing gas. (2) TUA payments to SPLNG to increase from original $250MM per year for inflation indexation and cargo loading fees. (3) EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. Because we have not forecasted such depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP. As a result, we are unable to reconcile differences between forecasts of EBITDA and net income. (4) Excludes potential EBITDA from marketing activities. ($ in millions) SPLNG CTPL SPL Contracted payments $250 – $980 Other cash received 10 – 130 Operating expenses(1) (50) (20) (150) EBITDA before intercompany $210 ($20) $960 Intercompany TUA payments(2) 265 – (140) Creole Trail Pipeline fees – 80 (80) EBITDA(3) $475 $60 $740 (4)

Appendix

18 Customer Annual SPA Pmt BG Gulf Coast LNG $723MM Gas Natural Fenosa $454MM GAIL (India) Ltd. $548MM Korea Gas Corp. $548MM Organizational Structure 11.4% LP Interest 100% Ownership Interest Cheniere Energy Partners, L.P. $205 mm 2.25% Convertible Senior Unsecured Notes due 2012 NYSE Amex US: LNG NYSE Amex US: CQP $273 mm 12.0% Senior Secured Loans due 2018 Note: Abridged version of organization structure as of March 31, 2012. Sabine Pass LNG, L.P. Sabine Pass Liquefaction, LLC Cheniere LNG, Inc. Creole Trail Pipeline Other Pipeline Projects 100% Ownership Interest 86.6% thru LP Interest 2% thru GP Interest $550 mm 7.25% Senior Secured Notes due 2013 $1,666 mm 7.50% Senior Secured Notes due 2016 Public Unitholders 100% Ownership Interest 100% Ownership Interest Cheniere LNG Holding, LLC 100% Ownership Interest Customer Annual TUA Pmt Total $124MM Chevron $129MM Investments $252MM Cheniere Energy Investments, LLC (“Investments”)

19 Condensed Balance Sheets As of March 31, 2012 Cheniere Energy Other Cheniere Consolidated Partners, L.P. Energy, Inc. (1) Cheniere Energy, Inc. (2) Unrestricted cash and equivalents $ - 440 $ 440 $ Restricted cash and securities (3) 197 9 206 Property, plant and equipment, net 1,505 588 2,093 Goodwill and other assets 60 134 194 Total assets 1,762 $ 1,173 $ 2,935 $ Deferred revenue and other liabilities 143 $ $ 143 $ Current & long-term debt 2,194 481 2,675 Non-Controlling interest - 201 201 Deficit (575) 491 (84) 1,762 $ 1,173 $ 2,935 $ (1) Includes intercompany eliminations and reclassifications. (2) For complete balance sheets, see the Cheniere Energy, Inc., Cheniere Energy Partners, L.P and Sabine Pass LNG, L.P. Quarterly Reports on Form 10-Q for the period ended March 31, 2012, filed with the SEC. (3) Restricted cash includes debt service reserves as required per Sabine Pass indenture. Cash is presented as restricted at the consolidated level (4) Includes related parties - Accounts and interest receivable 2 2 Total liabilities and deficit ($ in MM) (4) 2

20 Global LNG Market A sia E u r o p e South America 2010 Total Global LNG Liquefaction Capacity ~37 Bcf/d N o r th A me r i c a 18 8.6 1.8 1.3 A ust r alia - 3.1 B r unei - 1.0 Indonesia - 4.6 M al a y sia - 3.0 A lge r ia - 2.7 N o r w a y - 0.6 Q a tar - 9.3 R ussia - 1.3 E g ypt - 1.6 Y emen - 1.0 Nige r ia - 2.9 T r inidad & T obago - 2.0 Equatorial Guinea – 0.5 Oman - 1.4 U AE - 0.8 USA - 0.2 P e r u - 0.6 2010 Regional LNG Demand – 30 Bcf/d LNG Importers – Price Indexation Oil Products Natural Gas JCC Source: Waterborne, Cheniere Research

21 Q1 Q1 Q1 Q1 Q2 Q2 Q2 Q3 Q4 Q2 Q3 Q4 Q2 Q3 Q4 Q3 Q4 Q1 Q3 Q4 Firm Liquefaction Capacity Additions Source: Cheniere Research - 0.5 1.0 1.5 2.0 2.5 3.0 Bcf/d Middle East Gulf Asia Pacific Atlantic Basin Nameplate Liquefaction Capacity ~ 37 Bcf/d as of YE 2010 ~ 44 Bcf/d by YE 2015 2011 2012 2013 2014 2015 Angola LNG Skikda Gorgon T1 & Gassi Touil Papua New Guinea Gorgon T2 & Curtis T1 Gorgon T3 & Curtis T2 Gladstone T1 T1 Pluto Q1 Q1 Q2 Q2 Q3 Q4 Q3 Q4 Wheatstone Gladstone T2 Prelude 2016 2017 Australia Pacific T2* *FID pending

Cheniere Energy Contacts Katie Pipkin, Vice President Finance & Investor Relations (713) 375-5110 – katie.pipkin@cheniere.com Nancy Bui, Director Finance & Investor Relations (713) 375-5280 – nancy.bui@cheniere.com Christina Burke, Manager Investor Relations (713) 375-5104 – christina.burke@cheniere.com CHENIERE ENERGY