Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Cardiff Oncology, Inc. | a2209502zex-23_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

Index to Consolidated Financial Statements

As filed with the Securities and Exchange Commission on May 25, 2012

Registration No. 333-180810

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 5

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TROVAGENE, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

2836 (Primary Standard Industrial Classification Code Number) |

27-2004382 (I.R.S. Employer Identification Number) |

11055 Flintkote Avenue, Suite B

San Diego, CA 92121

858-217-4838

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Antonius Schuh, Ph.D

Chief Executive Officer

11055 Flintkote Avenue, Suite B

San Diego, CA 92121

858-217-4838

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Jeffrey Fessler, Esq. Sichenzia Ross Friedman Ference LLP 61 Broadway, 32nd Floor New York, New York 10006 Telephone: (212) 930-9700 Facsimile: (212) 930-9725 |

Yvan-Claude Pierre, Esq. Daniel I. Goldberg, Esq. Reed Smith LLP 599 Lexington Avenue New York, New York 10022 Telephone: (212) 549-5400 Facsimile: (212) 521-5450 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company ý |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(1) |

Amount of registration fee(2) |

||

|---|---|---|---|---|

Units consisting of two shares of Common Stock, $0.0001 par value and one Common Stock Purchase Warrant(2)(3) |

$23,000,000 | $2,635.80 | ||

Common Stock issuable upon exercise of Common Stock Purchase Warrants(2) |

$15,333,333 | $1,757.20 | ||

Representative's Common Stock Purchase Warrant |

— | (4) | ||

Shares of Common Stock underlying Representative's Common Stock Purchase Warrant (2)(5) |

$1,400,000 | $160.44 | ||

Total |

$39,733,333 | $4,553.44(6) | ||

|

||||

- (1)

- Estimated

solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended.

- (2)

- Pursuant

to Rule 416, the securities being registered hereunder include such indeterminate number of additional securities as may be issued after the

date hereof as a result of stock splits, stock dividends or similar transactions.

- (3)

- Includes

units the underwriters have the option to purchase to cover over-allotments, if any.

- (4)

- No

fee pursuant to Rule 457(g) under the Securities Act of 1933, as amended.

- (5)

- Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act of 1933, as amended, based on

an estimated proposed maximum aggregate offering price of $1,400,000, or 175% of $800,000 (4% of $20,000,000).

- (6)

- $4,507.60 of the registration fee has been previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED MAY 25, 2012

1,666,667 Units

Units Consisting of Two Shares of Common Stock and

One Warrant to Purchase One Share of Common Stock

We are offering 1,666,667 (assuming an offering price of $12.00 per unit, which is based on the closing price of our common stock on May 23, 2012), with each unit consisting of two shares of common stock and one warrant to purchase one share of common stock (and the shares of common stock issuable from time to time upon exercise of the offered warrants) pursuant to this prospectus. We expect to effect a 1-for-6 reverse stock split of our outstanding common stock just prior to the date of this prospectus. The units may not be separated into the underlying shares of common stock and warrants until the earlier of (1) the exercise in full of the underwriters' over-allotment option or (2) forty-five (45) days from the date of this prospectus; and thereafter the units may be separable only upon the request of a holder. Each warrant will have an initial exercise price of $ per share [133% of public offering price of one share of common stock], will be exercisable upon separation of the units and will expire five years from the closing of this offering.

Our common stock is presently quoted on the OTC QB under the symbol "TROV.PK". We have applied to have the units, common stock and warrants listed on The NASDAQ Capital Market under the symbols "TROVU," "TROV" and "TROVW". On May 23, 2012, the last reported sale price for our common stock on the OTC QB was $6.00 per share after giving pro forma effect to the 1-for-6 reverse stock split of our outstanding common stock.

Our business and an investment in our securities involves a high degree of risk. See "Risk Factors" beginning on page 12 of this prospectus for a discussion of information that you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

||||

| |

Per Unit |

Total |

||

|---|---|---|---|---|

Public offering price |

$ | $ | ||

Underwriting discount(1) |

$ | $ | ||

Proceeds, before expenses, to us |

$ | $ | ||

|

||||

- (1)

- The underwriters will receive compensation in addition to the underwriting discount. See "Underwriting" beginning on page 60 of this prospectus for a description of compensation payable to the underwriters.

The underwriters may also purchase up to an additional 250,000 units from us at the public offering price, less the underwriting discount, within 45 days from the date of this prospectus to cover over-allotments, if any.

The underwriters expect to deliver the units against payment therefor on or about , 2012.

Aegis Capital Corp

| Summer Street Research Partners | Brean Murray, Carret & Co. |

, 2012

You should rely only on the information contained in this prospectus or in any free writing prospectus that we may specifically authorize to be delivered or made available to you. We have not, and the underwriters have not, authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our units. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our units. Our business, financial condition, results of operations and prospects may have changed since that date. We are not, and the underwriters are not, making an offer of these securities in any jurisdiction where the offer is not permitted.

For investors outside the United States: We have not and the underwriters have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the units and the distribution of this prospectus outside the United States.

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our financial statements and the related notes and the information set forth under the headings "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in each case included elsewhere in this prospectus. Unless otherwise stated or the context requires otherwise, references in this prospectus to "Trovagene", the "Company", "we", "us", or "our" refer to Trovagene, Inc.

Unless otherwise indicated, except for our consolidated financial statements and the notes thereto, all share amounts and per share amounts in this prospectus have been presented on a pro forma basis as if a reverse stock split of our outstanding shares of common stock at a ratio of 1-for-6 that we expect to effect just prior to the date of this prospectus, has occurred.

Business Overview

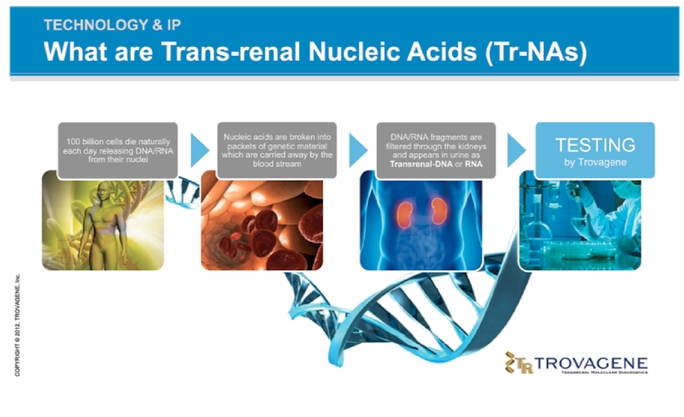

We are a development stage molecular diagnostic company that focuses on the development and marketing of urine-based nucleic acid tests for patient/disease screening and monitoring. Our novel tests predominantly use transrenal DNA, or Tr-DNA, and transrenal RNA, or Tr-RNA. Our primary focus is to leverage our urine-based testing platform to facilitate improvements in the management of cancer care and women's healthcare. Tr-DNAs and Tr-RNAs are fragments of nucleic acids derived from dying cells inside the body. The intact DNA is fragmented in dying cells and released into the blood stream. These fragments have been shown to cross the kidney barrier (i.e., are transrenal) and can be detected in urine. In addition, there is evidence that some species of RNA or their fragments are stable enough to cross the renal barrier. These RNA can also be isolated from urine, detected and analyzed. Our technology is applicable to all transrenal nucleic acids, or Tr-NA.

Our patented technology platform uses safe, non-invasive, cost effective and simple urine collection which can be applied to a broad range of testing including: tumor detection and monitoring (e.g., KRAS mutations in pancreatic cancer), prenatal genetic testing, infectious diseases, tissue transplantation, forensic identification, and for patient selection in clinical trials. Our products are developed using commercially available chemicals and biologicals, as well as instrumentation and equipment. The only custom components we use are specific synthetic sequences of nucleic acids (DNA and RNA) synthesized in a sequence to order. We believe that our technology is ideally suited to be used in developing molecular diagnostic assays that will allow physicians to provide simple, non-invasive and convenient screening and monitoring tests for their patients by identifying specific biomarkers involved in a disease process. If we are successful, our novel assays may facilitate improved testing compliance resulting in earlier diagnosis of disease, more targeted treatment which will be more cost-effective, and improvements in the quality of life for the patient.

In order to facilitate early availability and use of our products and technologies, on February 1, 2012, we acquired the CLIA laboratory assets of MultiGEN Diagnostics, Inc., or MultiGEN, which included CLIA (Clinical Laboratory Improvement Amendments of 1998) certification and licensing documentation, laboratory procedures, customer lists and marketing materials. A CLIA lab is a clinical reference laboratory that can perform high complexity diagnostic assays (e.g., those requiring PCR amplification). Through this CLIA laboratory we are able to offer laboratory developed tests, or LDTs, in compliance with CLIA guidelines, and, depending on the diagnostic assay, without the need for Food and Drug Administration, or FDA review. This will make our tests and technology available to physicians to order for their patient management, and in turn generate revenue. We will determine on a case-by-case basis whether an eventual FDA review of a given diagnostic assay is necessary. This decision will, amongst other factors, be based on the desired route of commercialization (e.g., in vitro

1

diagnostic product vs. laboratory testing service) and the specific nature of the respective diagnostic test.

Market Opportunity

Estimates of the size of the global molecular diagnostics market vary, however the market was projected to approach $7.0 billion in 2011 (final data not yet available). The market is poised to deliver strong double-digit annual growth during the next 5 years, with one industry source quoting a compound annual growth rate (CAGR) of 19%. The molecular diagnostics market has emerged as the fastest growing segment of the in-vitro diagnostics, or IVD market. Geographically, the United States and Europe are the most advanced in terms of adoption of molecular diagnostics and make up the majority of the existing global market (greater than 75% share). It is noteworthy that the Indian molecular diagnostics market is showing growth, expected to reach 1.0 billion INR ($220 million) by 2011 (final data not yet available). United States and Europe markets were projected to surpass $4.0 billion and $1.0 billion, respectively (final data not yet available). Key drivers for this impressive growth include the exceptional ability to accurately and quickly detect the primary cause of disease and provide a strong tool for quick therapy decisions, need for automated and easier techniques, and the increased availability of tests for monitoring the efficacy of expensive drugs.

We believe transrenal molecular diagnostics will provide relevant diagnostic information that will lead to improvements in personalized patient management. Infectious diseases, cancer diagnosis and monitoring are where most of the use and progress in personalized molecular diagnostic medicine has occurred to date. In addition, new products that facilitate personalized care are emerging in the areas of central nervous system, or CNS, autism, diabetes, and depression, and most major pharmaceutical companies have active pharmacogenomic programs in their clinical studies in anticipation of the need to utilize diagnostic testing to stratify patients for efficacy.

Our Technologies

We believe that our scientists were the first to report the discovery that a portion of cell-free DNA or RNA found in the bloodstream can cross the kidney barrier and be detected in the urine. This genetic material is referred to as Tr-DNA or Tr-RNA, or in aggregate Tr-nucleic acid. Analysis of Tr-DNA or Tr-RNA provides a simple, non-invasive and cost-effective method for molecular diagnostics and a platform for a broad range of diagnostic tests. In comparison with conventional tissue, sputum or plasma-based tests, this urine-based methodology has significant advantages with respect to patient convenience, privacy and compliance, ease of testing by elimination of difficult extraction steps in sample preparation, speed in performing the assay, amount of sample available, and cost effectiveness.

We have a dominant patent position as it relates to transrenal molecular testing. We own issued U.S. and European patents that cover any and all testing for molecular targets that pass through the kidney (i.e,. transrenal). In addition to these core patents, we have numerous patent applications pending in the areas of cancer, infectious diseases, transplantation, prenatal and genetic testing.

In order to test the feasibility of testing urine samples for human papillomavirus, or HPV DNA, we engaged in an in-house study of clinical samples from India during January through August 2008. This study was not sanctioned by the FDA nor conducted under the guidance of the FDA. Results from this study may be presented to the FDA in the event of a pre-IND meeting and are not directly applicable to seeking regulatory approval. Samples were collected from high and low risk populations in India including those from staged cancer patients by Simbiosys Biowares Inc. and Metropolis Inc. High risk subjects were recruited either from sexually transmitted disease clinics in hospitals or district brothels in West Bengal in eastern India. The study enrolled 320 patients during January through May, 2008. Pap smears and QIAGEN High-Risk HPV DNA hc2 tests were performed on collected cervical cells by Simbiosys Biowares Inc. and Metropolis Inc. Urine samples were shipped to us for in-house

2

PCR amplification and detection. Urine samples which gave results discordant with the cervical specimen-based hc2 assay were further examined by DNA sequencing for resolution. PCR product sequences were examined by the NCBI Blastn algorithm to match specific human papillomavirus strains.

We generated positive clinical study results with our HPV urine-based test to identify women at risk for developing cervical cancer. In this study, 31 out of 38 cervical swab samples that were initially classified as "negative" were subsequently determined to be positive by PCR followed by DNA sequencing of the urine using our urine-based platform. Additionally, 24 out of 34 cervical swab samples initially classified as "positive" were determined to be negative based on DNA sequencing of the urine. Our urine-based test only had 10 false negatives and 7 false positives, which represents 93% sensitivity and 96% specificity. As a result we believe that the sensitivity and specificity of our urine-based test is at least similar to and potentially better than the currently used cervical-cell-based tests. As noted earlier, our urine-based test is non-invasive, more convenient and private for the patient, simpler, less technically demanding in terms of cytology proficiency and potentially cost effective. Our unique primer pair focused on the E1 region of the HPV genome is expected to provide freedom to operate within the HPV patent landscape (i.e., we believe that our HPV patent will issue in the major geographic areas and be enforceable). It should be noted that these studies were research studies, not regulatory studies. These studies resulted in valuable insight that needs further work and validation by us. While the results were encouraging, they were not sufficient to complete the development of, seek approval for and launch a product in the U.S. or ex-U.S. markets. Consequently, we have initiated development of a diagnostic test to determine the presence of high risk HPV subtypes from urine specimens. The proprietary test (U.S. patent application pending) might, once available, be particularly useful for the determination of carrier status in males.

Presently, we are working towards finalizing a clinical study protocol and recruiting study sites in conjunction with key opinion leaders in the field of Ob/Gyn pathologists. We may use the results of this study, anticipated to begin at the earliest in 2012, toward the pursuit of a CE Mark in Europe and all other countries that recognize CE Marks for marketing approval.

In order to test the feasibility of using urine samples in tumor detection and monitoring, we have successfully completed the analytical development of digital PCR assays for the detection of both the most prevalent KRAS mutations and wild type KRAS DNA sequences. KRAS mutations are found in 90% of patients with pancreatic cancer, in 23% of all tumor samples examined by the Sanger Centre, and have been previously detected in the urine of colorectal cancer patients by others. Furthermore, three specific KRAS mutations account for approximately 96% of all KRAS mutations in pancreatic cancer and all three are among those we have established in-house. In order to quickly apply our technology to tumor detection and monitoring we have established protocols for the isolation of DNA from 100ml of urine and the concentration of the DNA for mutation and wild type KRAS analysis using commercial means, and we are in late-stage discussions with two premier cancer centers to procure urine samples from patients with pancreatic cancer.

In addition, our technology can be applied to the development and subsequent commercialization of our fetal medicine assay, initially to screen for Down Syndrome, one of many genetic disorders caused by chromosomal abnormalities. There is a huge unmet market need for a simple, convenient and truly non-invasive screening approach in the maternal arena. Initial studies of our transrenal assays with maternal urine clearly showed that we can detect Y chromosomal sequences which in turn clearly demonstrates the ability to detect transrenal fetal nucleic acids in this maternal urine. Additionally, our novel assays show and incorporate a complete representation of the maternal and most likely fetal genome in maternal urine. The combination of our transrenal nucleic acid platform in combination with next generation sequencing may allow for the development and commercialization of the first truly non-invasive prenatal screening test for these chromosomal-related diseases.

3

Our August 2010 acquisition of a highly sensitive molecular detection platform utilizing proprietary probe chemistry and on chip CMOS signal detection expands our reach within the molecular diagnostic arena. This analytical platform is synergistic and complementary to our transrenal nucleic acid technology and will be leveraged in our women's healthcare and other development endeavors by providing unsurpassed analytical and detection capabilities. Patents for this detection platform are pending in the U.S., Europe and Japan. The technology platform consists of several novel inventions: (i) direct attachment of a probe to a CMOS sensor chip, (ii) a proprietary conjugate capture and (iii) a conjugate reporter probe. In combination they enable ultra-sensitive detection of nucleic acids or proteins, without the need for a separate amplification step such as with PCR. As such, no expensive equipment is required to be purchased by labs or hospitals, all of which constantly look for ways to reduce their expenses wherever possible. The chips may be processed using off-the-shelf available liquid handling systems and the results are read with a simple USB to an existing computer running our proprietary software. The demonstrated sensitivity using an engineering prototype is 300 molecules.

Highly complementary to our Tr-DNA and Tr-RNA platform and projects, we have the exclusive worldwide rights to the use of the nucleophosmin protein gene (NPM1) for use in human in-vitro diagnostic testing, monitoring, prognostic evaluation and drug therapy selection for patients with acute myeloid leukemia, or AML. These rights and subsequent sublicenses have been crucial in terms of generating a steady incoming cash flow stream. We actively seek sublicense agreements with diagnostic laboratories planning to offer lab testing services to the clinical market based on an LDT for this marker. Two of our early sublicensees, LabCorp and Invivoscribe Technologies, have already announced commercial availability of a validated LDT molecular test for the NPM1 gene either as a standalone test or as part of an AML profile assay. In addition, two companies, Asuragen and Ipsogen, have sublicensed the rights to make and sell tests kits for the NPM1 mutations and are now offering these products as Research Use Only kits to the market. Lastly, we will be seeking drug development partnerships with pharmaceutical companies with active AML drug development initiatives as NPM1 is a valuable biomarker to guide patient selection in clinical trials.

Our Business Strategy

We plan to leverage our transrenal technology to develop and market, either independently or in conjunction with corporate partners, molecular diagnostic products in each of our initial focus markets of women's healthcare, infectious diseases and cancer. Our marketing strategy includes multiple approaches. During the late stages of development of each product, while collecting clinical data for regulatory submissions, we intend to market the products as LDTs through our CLIA laboratory. CLIA laboratories may offer the tests and receive reimbursement under the laboratory developed test, or LDT, regulations and it is our plan to establish a CLIA laboratory market presence and generate revenues for tests not subject to FDA clearance or approval.

While most common laboratory tests are commercial tests, manufactured and marketed to several labs, some new tests are developed, evaluated, and validated within one particular laboratory. These LDTs are used solely within that laboratory and are not distributed or sold to any other labs or health care facilities.

Because LDTs are not marketed to others, they do not require approval for marketing from the FDA as do commercially developed and marketed tests. However, these types of tests must go through rigorous validation procedures and must meet several criteria before results can be used for decisions regarding patient care. These include demonstration of test accuracy, precision, sensitivity, and specificity.

We intend to pursue FDA pre-market review and as we receive FDA clearance or approval for our products, we intend to market urine-based test kits through a U.S. commercial organization directly to CLIA medical testing laboratories. We also intend to complete business partnerships (out-license

4

agreements) with diagnostic and pharmaceutical companies in the U.S., Europe, Asia Pacific and the rest of the world as appropriate given market conditions and opportunity. This would provide both short term (license fees) and long term (royalties) revenue streams. These licensees will license and use our platform in clinical development of their products, monitor patients taking their marketed products (i.e. TNF inhibitors) and in certain situations license the rights to develop, test and commercialize our transrenal products in predefined fields of use and geographic territories. We plan to become a fully integrated business in which we develop, test, manufacture, register, market and sell our products.

In comparison with many other genetic tests, our Tr-DNA or Tr-RNA tests are expected to be cost effective. These tests involve a relatively simple process and can easily be automated. Therefore, major advantages of our Tr-DNA or Tr-RNA test, if and when commercially available, will be the ease of sample collection, enhanced sensitivity and specificity, patient convenience (i.e., home-based test), non-invasive and will potentially provide more efficient and effective monitoring protocols (e.g., for opportunistic infections).

During the last decade, medical laboratory operating margins have declined in the face of Medicare fee schedule reductions, managed care contracts, competitive bidding and other cost containment measures. If our technology were commercially available today, reimbursement may be available under the current procedural terminology, or CPT codes, for molecular-based testing. We expect to initially market our tests to independent and hospital-based laboratories at price points that we believe will translate into substantially higher operating margins than has been traditional in the laboratory industry. We believe this will create a strong incentive for laboratories to adopt our transrenal molecular diagnostic tests.

Risks

We are a development stage company and have generated minimal revenues to date. Since our inception, we have incurred substantial losses. Our business and our ability to execute our business strategy are subject to a number of risks of which you should be aware before you decide to buy our units. In particular, you should carefully consider the following risks, which are discussed more fully in "Risk Factors" beginning on page 12 of this prospectus.

- •

- We are a development stage company and may never commercialize any of our products or services or earn a profit.

- •

- Our independent registered public accounting firm has expressed doubt about our ability to continue as a going concern,

which may hinder our ability to obtain future financing.

- •

- We will need to raise substantial additional capital to commercialize our transrenal molecular technology, and our failure

to obtain funding when needed may force us to delay, reduce or eliminate our product development programs or collaboration efforts.

- •

- Our ability to successfully commercialize our technology will depend largely upon the extent to which third-party payors

reimburse our tests.

- •

- The commercial success of our product candidates will depend upon the degree of market acceptance of these products among

physicians, patients, health care payors and the medical community.

- •

- If our potential medical diagnostic tests are unable to compete effectively with current and future medical diagnostic

tests targeting similar markets as our potential products, our commercial opportunities will be reduced or eliminated.

- •

- Our failure to obtain human urine samples from medical institutions for our clinical studies will adversely impact the development of our transrenal molecular technology.

5

- •

- Our inability to establish strong business relationships with leading clinical reference laboratories to perform

Tr-DNA/Tr-RNA tests using our technologies will limit our revenue growth.

- •

- We depend upon our officers, and if we are not able to retain them or recruit additional qualified personnel, the

commercialization of our product candidates and any future tests that we develop could be delayed or negatively impacted.

- •

- We will need to increase the size of our organization, and we may experience difficulties in managing growth.

- •

- If we do not receive regulatory approvals, we may not be able to develop and commercialize our transrenal molecular

technology.

- •

- Changes in healthcare policy could subject us to additional regulatory requirements that may delay the commercialization

of our tests and increase our costs.

- •

- If the FDA were to begin regulating our LDTs, we could be forced to delay commercialization of our current product

candidates, experience significant delays in commercializing any future tests, incur substantial costs and time delays associated with meeting requirements for pre-market clearance or

approval and/or experience decreased demand for or reimbursement of our test.

- •

- If we are unable to protect our intellectual property effectively, we may be unable to prevent third parties from using

our technologies, which would impair our competitive advantage.

- •

- We cannot guarantee that the patents issued to us will be broad enough to provide any meaningful protection nor can we

assure you that one of our competitors may not develop more effective technologies, designs or methods without infringing our intellectual property rights or that one of our competitors might not

design around our proprietary technologies.

- •

- We may incur substantial costs as a result of litigation or other proceedings relating to patent and other intellectual

property rights and we may be unable to protect our rights to, or use, our transrenal molecular technology.

- •

- In preparing our consolidated financial statements, our management determined that our disclosure controls and procedures

and internal controls were ineffective as of December 31, 2011 which could result in material misstatements in our financial statements.

- •

- If we continue to fail to comply with the rules under the Sarbanes-Oxley Act of 2002 related to disclosure controls and

procedures, or, if we discover material weaknesses and other deficiencies in our internal control and accounting procedures, our stock price could decline significantly and raising capital could be

more difficult.

- •

- We have not filed any Federal, state or foreign tax returns since inception, except for Delaware franchise tax returns and

we do not know the amount of any tax liability, interest and penalties.

- •

- Our Series A Convertible Preferred Stock contain certain covenants that limit the way we can conduct business.

- •

- The rights of the holders of common stock may be impaired by the potential issuance of preferred stock.

- •

- Because we will have broad discretion and flexibility in how the net proceeds from this offering are used, we may use the

net proceeds in ways in which you disagree.

- •

- Our stockholders may experience significant dilution as a result of any additional financing using our equity securities and/or debt securities.

6

- •

- Our common stock price may be volatile and could fluctuate widely in price, which could result in substantial losses for

investors.

- •

- If our common stock remains subject to the SEC's penny stock rules, broker-dealers may experience difficulty in completing

customer transactions and trading activity in our securities may be adversely affected.

- •

- Because certain of our stockholders control a significant number of shares of our common stock, they may have effective

control over actions requiring stockholder approval.

- •

- We have not paid dividends on our common stock in the past and do not expect to pay dividends on our common stock for the

foreseeable future. Any return on investment may be limited to the value of our common stock.

- •

- If securities or industry analysts do not publish research or reports about our business, or if they change their

recommendations regarding our stock adversely, our stock price and trading volume could decline.

- •

- Delaware law and our corporate charter and bylaws will contain anti-takeover provisions that could delay or

discourage takeover attempts that stockholders may consider favorable.

- •

- A sale of a substantial number of shares of our common stock may cause the price of our common stock to decline and may

impair our ability to raise capital in the future.

- •

- Our common stock is subject to volatility.

- •

- You will experience immediate and substantial dilution as a result of this offering and may experience additional dilution

in the future.

- •

- There is presently no public market for the units and the warrants to purchase common stock being sold in this offering.

- •

- We intend to effect a 1-for-6 reverse stock split of our outstanding common stock immediately

prior to this offering. However, the reverse stock split may not increase our stock price sufficiently and we may not be able to list our common stock on The NASDAQ Capital Market, in which case this

offering will not be completed.

- •

- Even if the reverse stock split achieves the requisite increase in the market price of our common stock, we cannot assure

you that we will be able to continue to comply with the minimum bid price requirement of The NASDAQ Capital Market.

- •

- Even if the reverse stock split increases the market price of our common stock, there can be no assurance that we will be

able to comply with other continued listing standards of The NASDAQ Capital Market.

- •

- The reverse stock split may decrease the liquidity of the shares of our common

stock.

- •

- Following the reverse stock split, the resulting market price of our common stock may not attract new investors, including institutional investors, and may not satisfy the investing requirements of those investors. Consequently, the trading liquidity of our common stock may not improve.

Recent Developments

On April 27, 2012, holders of a majority of our common stock voted in favor of the following proposals at a special meeting of our shareholders:

- •

- an amendment to our 2004 Stock Option Plan to increase the number of shares issuable thereunder to 3,666,667 from 2,000,000;

7

- •

- an amendment to our Amended and Restated Certificate of Incorporation to effect a reverse stock split of our issued and

outstanding common stock at a ratio of not less than one-for-two and not greater than one-for-six at any time prior to April, 27, 2013, at the

discretion of the Board of Directors; and

- •

- an amendment to our Amended and Restated Certificate of Incorporation to effect an increase in our authorized shares of common stock from 100,000,000 to 150,000,000

On May 1, 2012, we announced that Dr. Carlo Croce joined us as a consultant and member of our Scientic Advisory Board. Dr. Croce is the John W. Wolfe Chair in cancer genetics, and Chairman, Department of Molecular Virology, Immunology and Medical Genetics and also Director of the Human Cancer Genetics Program and the Genetics Institute at Ohio State University.

On May 2, 2012, we closed a private placement which raised gross proceeds of $300,000. We issued 100,000 shares of our common stock and warrants to purchase 100,000 shares of common stock in this transaction. The purchase price paid by the investors was $3.00 for each unit. The warrants expire December 31, 2018 and are exercisable at $3.00 per share.

Corporate Information

We were incorporated in the State of Florida on April 26, 2002 under the name "Used Kar Parts, Inc." Our name was changed to Trovagene, Inc. and we redomesticated our state of incorporation from Florida to Delaware in January 2010. Our principal executive offices are located at 11055 Flintkote Avenue, Suite B, San Diego, CA 92121, and our telephone number is (858) 217-4838. Our website address is www.trovagene.com. The information on our website is not part of this prospectus. We have included our website address as a factual reference and do not intend it to be an active link to our website.

8

Securities offered by us |

1,666,667 units, each unit consisting of two shares of common stock and a warrant to purchase one share of common stock. The units may not be separated into the underlying shares of common stock and warrants until the earlier of (1) the exercise in full of the underwriters' over-allotment option or (2) forty-five (45) days from the date of this prospectus; and thereafter the units may be separable only upon the request of a holder. Each warrant will have an initial exercise price of $ per share [133% of public offering price of one share of common stock], will be exercisable upon separation of the units and will expire five years from the closing of this offering. | |

Common stock to be outstanding after this offering |

14,863,393 shares or 16,530,060 shares if the warrants sold in this offering are exercised in full. |

|

Warrants |

Warrants to purchase an aggregate of 1,666,667 shares of common stock will be offered as part of the units being sold in this offering. |

|

Warrant exercise price |

The initial exercise price of the warrants is $ per share [133% of public offering price of one share of common stock]. |

|

Anti-dilution |

The exercise price and the number of shares of common stock purchasable upon the exercise of the warrants are subject to adjustment upon the occurrence of specific events, including stock dividends, stock splits, combinations and reclassifications of our common stock. |

|

Use of Proceeds |

We intend to use the net proceeds received from this offering to fund our research and development activities and for working capital and general corporate purposes and possibly acquisitions of other companies, products or technologies, though no such acquisitions are currently contemplated. See "Use of Proceeds" on page 30. |

|

Risk Factors |

See "Risk Factors" beginning on page 12 and the other information included in this prospectus for a discussion of factors you should carefully consider before investing in our securities. |

|

OTC Bulletin Board trading symbol |

TROV.PK |

|

Proposed Symbol and Listing |

We have applied for listing of our units, common stock and warrants on The NASDAQ Capital Market under the symbols "TROVU," "TROV" and "TROVW". |

Unless we indicate otherwise, all information in this prospectus (i) reflects a 1-for-6 reverse stock split of our issued and outstanding shares of common stock, options and warrants to be effected just prior to the date of this prospectus and the corresponding adjustment of all common stock price per share and stock option and warrant exercise price data, except for the consolidated financial statements and the notes thereto, and have assumed an offering price of $12.00 per unit, which is based on the

9

closing price of our common stock on May 23, 2012; (ii) is based on 11,530,059 shares of common stock issued and outstanding as of May 23, 2012; (iii) assumes no exercise by the underwriters of their option to purchase up to an additional 250,000 units to cover over-allotments, if any; (iv) excludes 99,583 shares of common stock issuable upon conversion of outstanding Series A Convertible Preferred Stock; (v) excludes 3,061,817 shares of our common stock issuable upon exercise of outstanding stock options under our stock incentive plans at a weighted average exercise price of $6.35 per share as of May 23, 2012; (vi) excludes 4,315,258 shares of our common stock issuable upon exercise of outstanding warrants at a weighted average exercise price of $3.07 per share as of May 23, 2012; and (vii) excludes 133,333 shares of common stock underlying the warrants to be issued to the underwriters in connection with this offering.

10

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table sets forth our (i) summary statement of operations data for the years ended December 31, 2011 and 2010, derived from our audited financial statements and related notes included elsewhere in this prospectus, (ii) summary statement of operations data for the three months ended March 31, 2012 and 2011 derived from our unaudited financial statements included elsewhere in this prospectus, and (iii) summary consolidated balance sheet data as of March 31, 2012 derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The summary consolidated financial data for the three months ended March 31, 2012 and 2011 and as of March 31, 2012 are not indicative of results to be expected for the full year. Our financial statements are prepared and presented in accordance with generally accepted accounting principles in the United States. The results indicated below are not necessarily indicative of our future performance. You should read this information together with the sections entitled "Capitalization," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes included elsewhere in this prospectus.

| |

Year ended December 31, | Three months ended March 31, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2011 | 2010 | 2012 | 2011 | |||||||||

Statement of Operations Data: |

|||||||||||||

Royalty income |

$ | 227,696 | $ | 255,665 | $ | 34,153 | $ | 69,082 | |||||

License fees |

30,000 | 10,000 | — | 20,000 | |||||||||

Total Revenues |

257,696 | 265,665 | 34,153 | 89,082 | |||||||||

Operating Expenses: |

|||||||||||||

Research and development |

910,685 | 1,024,159 | 337,407 | 258,016 | |||||||||

Purchased in-process research and development expenses-related party |

— | 2,666,869 | — | — | |||||||||

General and administrative |

2,323,814 | 1,953,925 | 826,964 | 551,044 | |||||||||

Operating loss |

(2,976,803 | ) | (5,379,288 | ) | (1,130,218 | ) | (719,978 | ) | |||||

Other income (expense) |

737,591 | (69,850 | ) | (32,424 | ) | 167,991 | |||||||

Preferred stock dividend |

(38,240 | ) | (38,240 | ) | (9,560 | ) | (9,560 | ) | |||||

Net loss and Comprehensive loss attributable to common stockholders |

$ | (2,277,452 | ) | $ | (5,487,378 | ) | $ | 1,172,202 | $ | 561,547 | |||

Weighted average shares of common stock outstanding—basic and diluted |

9,711,519 | 7,158,792 | 11,001,679 | 9,022,982 | |||||||||

Net loss per common share—basic and diluted |

$ | (0.23 | ) | $ | (0.77 | ) | $ | (0.11 | ) | $ | (0.06 | ) | |

| |

As of March 31, 2012 | ||||||

|---|---|---|---|---|---|---|---|

| |

Actual | Pro Forma, As Adjusted(1) |

|||||

Balance Sheet Data: |

|||||||

Cash and cash equivalents |

$ | 586,777 | $ | 19,590,781 | |||

Total assets |

1,182,155 | 20,186,159 | |||||

Total liabilities |

5,516,157 | 5,896,157 | |||||

Total stockholders' equity (deficiency) |

(4,334,002 | ) | 14,290,001 | ||||

- (1)

- Pro forma, as adjusted amounts give effect to (i) the issuance of common stock and warrants from April 1, 2012 through and immediately prior to the date of this prospectus and (ii) the sale of the units in this offering at the assumed public offering price of $12.00 per unit, which is based on the closing price of our common stock on May 23, 2012, and after deducting underwriting discounts and commissions and other estimated offering expenses payable by us.

11

Any investment in our securities involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our units. Our business, financial condition or results of operations could be materially adversely affected by these risks if any of them actually occur. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus.

Risks Related to Our Business

We are a development stage company and may never commercialize any of our products or services or earn a profit.

We are a development stage company and have incurred losses since we were formed. As of December 31, 2011 and March 31, 2012, we have an accumulated total deficit of $43,598,431 and $44,770,633, respectively. For the fiscal year ended December 31, 2011 and the three months ended March 31, 2012, we had net losses attributable to common stockholders of $2,277,452 and $1,172,202, respectively. To date, we have experienced negative cash flow from development of our transrenal molecular technology. We currently have no products ready for commercialization, have not generated any revenue from operations except for licensing and royalty income and expect to incur substantial net losses for the foreseeable future to further develop and commercialize the transrenal molecular technology. We cannot predict the extent of these future net losses, or when we may attain profitability, if at all. If we are unable to generate significant revenue from the transrenal molecular technology or attain profitability, we will not be able to sustain operations.

Because of the numerous risks and uncertainties associated with developing and commercializing our transrenal molecular technology and any future tests, we are unable to predict the extent of any future losses or when we will become profitable, if ever. We may never become profitable and you may never receive a return on an investment in our common stock. An investor in our common stock must carefully consider the substantial challenges, risks and uncertainties inherent in the attempted development and commercialization of tests in the medical diagnostic industry. We may never successfully commercialize transrenal molecular technology or any future tests, and our business may fail.

Our independent registered public accounting firm has expressed doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

In their report dated March 30, 2012 our independent registered public accountants stated that our financial statements for the year ended December 31, 2011 were prepared assuming that we would continue as a going concern. Our ability to continue as a going concern, which may hinder our ability to obtain future financing, is an issue raised as a result of recurring losses from operations. We continue to experience net operating losses. Our ability to continue as a going concern is subject to our ability to generate a profit and/or obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities, increasing sales or obtaining loans and grants from various financial institutions where possible. Our continued net operating losses increase the difficulty in meeting such goals and there can be no assurances that such methods will prove successful.

12

We will need to raise substantial additional capital to commercialize our transrenal molecular technology, and our failure to obtain funding when needed may force us to delay, reduce or eliminate our product development programs or collaboration efforts.

As of May 23, 2012 our cash balance was $727,656 and our working capital deficit was $491,891. Our existing capital resources are not sufficient to fund our operations for the next 12 months. At our current burn rate, we estimate that our existing capital resources will fund our operations for the next four months. We estimate that we will require approximately $5 million over the next 12 months in order to sustain our operations and implement our business strategy. Consequently, we will be required to raise additional capital to complete the development and commercialization of our current product candidates. The development of our business will require substantial additional capital in the future to conduct research and development and commercialize our transrenal molecular technology. For example, we currently estimate that $5 million of capital resources will be required over the next 12 months. This amount will be sufficient to launch our products in the marketplace currently under development as LDTs. An additional $5 to $10 million will be required in 2013 to implement our business strategy and launch additional products as LDTs. We have historically relied upon private sales of our equity and issuances of notes to fund our operations. We currently have no credit facility or committed sources of capital. During the next 12 months, we will have to raise additional funds to continue the development and commercialization of our transrenal molecular technology. When we seek additional capital, we may seek to sell additional equity and/or debt securities or to obtain a credit facility, which we may not be able to do on favorable terms, or at all. Our ability to obtain additional financing will be subject to a number of factors, including market conditions, our operating performance and investor sentiment. If we are unable to raise additional capital when required or on acceptable terms, we may have to significantly delay, scale back or discontinue the development and/or commercialization of one or more of our product candidates, restrict our operations or obtain funds by entering into agreements on unattractive terms.

Our ability to successfully commercialize our technology will depend largely upon the extent to which third-party payors reimburse our tests.

Physicians and patients may decide not to order our products unless third-party payors, such as managed care organizations as well as government payors such as Medicare and Medicaid pay a substantial portion of the test price. Reimbursement by a third-party payor may depend on a number of factors, including a payor's determination that our product candidates are:

- •

- not experimental or investigational;

- •

- effective;

- •

- medically necessary;

- •

- appropriate for the specific patient;

- •

- cost-effective;

- •

- supported by peer-reviewed publications; and

- •

- included in clinical practice guidelines.

Market acceptance, sales of products based upon the Tr-DNA or Tr-RNA technology and our profitability may depend on reimbursement policies and health care reform measures. Several entities conduct technology assessments of medical tests and devices and provide the results of their assessments for informational purposes to other parties. These assessments may be used by third-party payors and health care providers as grounds to deny coverage for a test or procedure. The levels at which government authorities and third-party payors, such as private health insurers and health maintenance organizations, may reimburse the price patients pay for such products could affect whether

13

we are able to commercialize our products. Our product candidates may receive negative assessments that may impact our ability to receive reimbursement of the test. Since each payor makes its own decision as to whether to establish a policy to reimburse our test, seeking these approvals may be a time-consuming and costly process. We cannot be sure that reimbursement in the U.S. or elsewhere will be available for any of our products in the future. If reimbursement is not available or is limited, we may not be able to commercialize our products.

If we are unable to obtain reimbursement approval from private payors and Medicare and Medicaid programs for our product candidates, or if the amount reimbursed is inadequate, our ability to generate revenues could be limited. Even if we are being reimbursed, insurers may withdraw their coverage policies or cancel their contracts with us at any time, stop paying for our test or reduce the payment rate for our test, which would reduce our revenue. Moreover, we may depend upon a limited number of third-party payors for a significant portion of our test revenues and if these or other third-party payors stop providing reimbursement or decrease the amount of reimbursement for our test, our revenues could decline.

The commercial success of our product candidates will depend upon the degree of market acceptance of these products among physicians, patients, health care payors and the medical community.

We believe our scientists were the first to discover Tr-DNA. The use of the transrenal molecular technology has never been commercialized for any indication. Even if approved for sale by the appropriate regulatory authorities, physicians may not order diagnostic tests based upon the Tr-DNA or Tr-RNA technology, in which event we may be unable to generate significant revenue or become profitable. Acceptance of the transrenal molecular technology will depend on a number of factors including:

- •

- acceptance of products based upon the Tr-DNA or Tr-RNA technology by physicians and patients;

- •

- successful integration into clinical practice;

- •

- adequate reimbursement by third parties;

- •

- cost effectiveness;

- •

- potential advantages over alternative treatments; and

- •

- relative convenience and ease of administration.

We will need to make leading physicians aware of the benefits of tests using our technology through published papers, presentations at scientific conferences and favorable results from our clinical studies. In addition, we will need to gain support from thought leaders who believe that testing a urine specimen for these molecular markers will provide superior performance. Ideally, we will need these individuals to publish support papers and articles which will be necessary to gain acceptance of our products. There is no guarantee that we will be able to obtain this support. Our failure to be successful in these efforts would make it difficult for us to convince medical practitioners to order Tr-DNA tests for their patients and consequently our revenue and profitability will be limited.

If our potential medical diagnostic tests are unable to compete effectively with current and future medical diagnostic tests targeting similar markets as our potential products, our commercial opportunities will be reduced or eliminated.

The medical diagnostic industry is intensely competitive and characterized by rapid technological progress. In each of our potential product areas, we face significant competition from large biotechnology, medical diagnostic and other companies. The technologies associated with the molecular diagnostics industry are evolving rapidly and there is intense competition within such industry. Certain

14

molecular diagnostics companies have established technologies that may be competitive to our product candidates and any future tests that we develop. Some of these tests may use different approaches or means to obtain diagnostic results, which could be more effective or less expensive than our tests for similar indications. Moreover, these and other future competitors have or may have considerably greater resources than we do in terms of technology, sales, marketing, commercialization and capital resources. These competitors may have substantial advantages over us in terms of research and development expertise, experience in clinical studies, experience in regulatory issues, brand name exposure and expertise in sales and marketing as well as in operating central laboratory services. Many of these organizations have financial, marketing and human resources greater than ours; therefore, there can be no assurance that we can successfully compete with present or potential competitors or that such competition will not have a materially adverse effect on our business, financial position or results of operations.

Since the transrenal molecular diagnostic (Tr-DNA or Tr-RNA) technology is under development, we cannot predict the relative competitive position of any product based upon the transrenal molecular technology. However, we expect that the following factors will determine our ability to compete effectively: safety and efficacy; product price; turnaround time; ease of administration; performance; reimbursement; and marketing and sales capability.

We believe that many of our competitors spend significantly more on research and development-related activities than we do. Our competitors may discover new diagnostic tools or develop existing technologies to compete with the transrenal molecular diagnostic technology. Our commercial opportunities will be reduced or eliminated if these competing products are more effective, are more convenient or are less expensive than our products.

Our failure to obtain human urine samples from medical institutions for our clinical studies will adversely impact the development of our transrenal molecular technology.

We will need to establish relationships with medical institutions in order to obtain urine specimens from patients who are testing positive for a relevant infectious disease or from patients that have been diagnosed with solid tumors. We must obtain a sufficient number in order to statistically prove the equivalency of the performance of our assays versus existing assays that are already on the market.

If our clinical studies do not prove the superiority of our technologies, we may never sell our products and services.

The results of our clinical studies may not show that tests using our transrenal molecular technology are superior to existing testing methods. In that event, we will have to devote significant financial and other resources to further research and development, and commercialization of tests using our technologies will be delayed or may never occur. Our earlier clinical studies were small and included samples from high-risk patients. The results from these earlier studies may not be representative of the results we obtain from any future studies, including our next two clinical studies, which will include substantially more samples and a larger percentage of normal-risk patients.

Our inability to establish strong business relationships with leading clinical reference laboratories to perform Tr-DNA/Tr-RNA tests using our technologies will limit our revenue growth.

A key step in our strategy is to sell diagnostic products that use our proprietary technologies to leading clinical reference laboratories that will perform Tr-DNA or Tr-RNA tests. We currently have no business relationships with these laboratories and have limited experience in establishing these business relationships. If we are unable to establish these business relationships, we will have limited ability to obtain revenues beyond the revenue we can generate from our limited in-house capacity to process tests.

15

We depend upon our officers, and if we are not able to retain them or recruit additional qualified personnel, the commercialization of our product candidates and any future tests that we develop could be delayed or negatively impacted.

Our success is largely dependent upon the continued contributions of our officers such as our current key employee, Dr. Antonius Schuh, Chief Executive Officer. Our success also depends in part on our ability to attract and retain highly qualified scientific, commercial and administrative personnel. In order to pursue our test development and commercialization strategies, we will need to attract and hire, or engage as consultants, additional personnel with specialized experience in a number of disciplines, including assay development, bioinformatics and statistics, laboratory and clinical operations, clinical affairs and studies, government regulation, sales and marketing, billing and reimbursement and information systems. There is intense competition for personnel in the fields in which we operate. If we are unable to attract new employees and retain existing employees, the development and commercialization of our product candidates and any future tests could be delayed or negatively impacted.

We will need to increase the size of our organization, and we may experience difficulties in managing growth.

We are a small company with only four full-time employees as of May 23, 2012. Future growth will impose significant added responsibilities on members of management, including the need to identify, attract, retain, motivate and integrate highly skilled personnel. We may increase the number of employees in the future depending on the progress of our development of transrenal molecular technology. Our future financial performance and our ability to commercialize Tr-DNA and Tr-RNA assays and to compete effectively will depend, in part, on our ability to manage any future growth effectively. To that end, we must be able to:

- •

- manage our clinical studies effectively;

- •

- integrate additional management, administrative, manufacturing and regulatory personnel;

- •

- maintain sufficient administrative, accounting and management information systems and controls; and

- •

- hire and train additional qualified personnel.

We may not be able to accomplish these tasks, and our failure to accomplish any of them could harm our financial results.

If we do not receive regulatory approvals, we may not be able to develop and commercialize our transrenal molecular technology.

We may need FDA approval to market products based on the transrenal molecular technology for diagnostic uses in the United States and approvals from foreign regulatory authorities to market products based on the Tr-DNA or Tr-RNA technology outside the United States. We have not yet filed an application with the FDA to obtain approval to market any of our proposed products. If we fail to obtain regulatory approval for the marketing of products based on the Tr-DNA or Tr-RNA technology, we will be unable to sell such products and will not be able to sustain operations.

We believe the estimated molecular diagnostics market for many diseases in Europe is approximately as large as that of the United States. If we seek to market products or services such as a urine-based HPV test in Europe, we need to receive a CE Mark. If we do not obtain a CE Mark for our urine-based HPV DNA test, we will be unable to sell this product in Europe and countries that recognize the CE Mark.

The regulatory review and approval process, which may include evaluation of preclinical studies and clinical trials of products based on the Tr-DNA or Tr-RNA technology, as well as the evaluation of

16

manufacturing processes and contract manufacturers' facilities, is lengthy, expensive and uncertain. Securing regulatory approval for products based upon the transrenal molecular technology may require the submission of extensive preclinical and clinical data and supporting information to regulatory authorities to establish such products' safety and effectiveness for each indication. We have limited experience in filing and pursuing applications necessary to gain regulatory approvals.

Regulatory authorities generally have substantial discretion in the approval process and may either refuse to accept an application, or may decide after review of an application that the data submitted is insufficient to allow approval of any product based upon the transrenal molecular technology. If regulatory authorities do not accept or approve our applications, they may require that we conduct additional clinical, preclinical or manufacturing studies and submit that data before regulatory authorities will reconsider such application. We may need to expend substantial resources to conduct further studies to obtain data that regulatory authorities believe is sufficient. Depending on the extent of these studies, approval of applications may be delayed by several years, or may require us to expend more resources than we may have available. It is also possible that additional studies may not suffice to make applications approvable. If any of these outcomes occur, we may be forced to abandon our applications for approval, which might cause us to cease operations.

Changes in healthcare policy could subject us to additional regulatory requirements that may delay the commercialization of our tests and increase our costs.

The U.S. government and other governments have shown significant interest in pursuing healthcare reform. Any government-adopted reform measures could adversely impact the pricing of our diagnostic products and tests in the United States or internationally and the amount of reimbursement available from governmental agencies or other third party payors. The continuing efforts of the U.S. and foreign governments, insurance companies, managed care organizations and other payors of health care services to contain or reduce health care costs may adversely affect our ability to set prices for our products and services which we believe are fair, and our ability to generate revenues and achieve and maintain profitability.

New laws, regulations and judicial decisions, or new interpretations of existing laws, regulations and decisions, that relate to healthcare availability, methods of delivery or payment for products and services, or sales, marketing or pricing, may limit our potential revenue, and we may need to revise our research and development programs. The pricing and reimbursement environment may change in the future and become more challenging due to several reasons, including policies advanced by the current executive administration in the United States, new healthcare legislation or fiscal challenges faced by government health administration authorities. Specifically, in both the United States and some foreign jurisdictions, there have been a number of legislative and regulatory proposals to change the health care system in ways that could affect our ability to sell our products profitably.

For example, in March 2010, President Obama signed the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Affordability Reconciliation Act, or the PPACA. This law will substantially change the way health care is financed by both government health plans and private insurers, and significantly impact the pharmaceutical industry. The PPACA contains a number of provisions that are expected to impact our business and operations in ways that may negatively affect our potential revenues in the future. While it is too early to predict all the specific effects the PPACA or any future healthcare reform legislation will have on our business, they could have a material adverse effect on our business and financial condition.

In September 2007, the Food and Drug Administration Amendments Act of 2007 was enacted, giving the FDA enhanced post-marketing authority, including the authority to require post-marketing studies and clinical trials, labeling changes based on new safety information, and compliance with risk evaluations and mitigation strategies approved by the FDA. The FDA's exercise of this authority could

17

result in delays or increased costs during product development, clinical trials and regulatory review, increased costs to assure compliance with post-approval regulatory requirements, and potential restrictions on the sale and/or distribution of approved products.

If the FDA were to begin regulating our LDTs, we could be forced to delay commercialization of our current product candidates, experience significant delays in commercializing any future tests, incur substantial costs and time delays associated with meeting requirements for pre-market clearance or approval and/or experience decreased demand for or reimbursement of our test.

We intend to develop products that are considered to be medical devices and are subject to federal regulations including those covering Quality System Regulations (QSR) and Medical Device Reporting (MDR).

The QSR includes requirements related to the methods used in and the facilities and controls used for designing, purchasing, manufacturing, packaging, labeling, storing, installing and servicing of medical devices. Manufacturing facilities undergo FDA inspections to assure compliance with the QS requirements. The quality systems for FDA-regulated products are known as current good manufacturing practices (cGMPs) as described in the Code of Federal Regulations, part 820 (21 CFR part 820). Among the cGMP requirements are those requiring manufacturers to have sufficient appropriate personnel to implement required design controls and other portions of the QSR guidelines.

Design controls include procedures that describe the product design requirements (design goals) and compare actual output to these requirements, including documented Design Reviews. Required Design History Files (DHFs) for each device will document the records necessary to demonstrate that the design was developed in accordance with the approved design plan and the requirements of the QSRs.

QSRs also include stipulation for control of all documents used in design and production, including history of any changes made. Production and process controls include stipulations to ensure products are in fact produced as specified by controlled documents resulting from the controlled design phase, using products and services purchased under controlled purchasing procedures.

Incidents in which a device may have caused or contributed to a death or serious injury must to be reported to FDA under the Medical Device Reporting (MDR) program. In addition, certain malfunctions must also be reported. The MDR regulation is a mechanism for FDA and manufacturers to identify and monitor significant adverse events involving medical devices. The goals of the regulation are to detect and correct problems in a timely manner.

We may be required to participate in MDR through two routes. As a manufacturer of products for sale within the United States, we will need to report to the FDA any deaths, serious injuries and malfunctions, and events requiring remedial action to prevent an unreasonable risk of substantial harm to the public health. Our CLIA lab offering services for sale is required to report suspected medical device related deaths to both the FDA and the relevant manufacturers of products we purchase and use.

Clinical laboratory tests like our current product offerings are regulated in the United States under CLIA as well as by applicable state laws. Diagnostic kits that are sold and distributed through interstate commerce are regulated as medical devices by the FDA. Clinical laboratory tests that are developed and validated by a laboratory for its own use are called LDTs. Most LDTs currently are not subject to FDA regulation, although reagents or software provided by third parties and used to perform LDTs may be subject to regulation. We expect that, upon the commencement of commercialization, our product candidates will be an LDT and not a diagnostic kit. As a result, we believe that our product candidates should not be subject to regulation under current FDA policies, however there is no assurance that it will not be subject to such regulation in the future. The container we expect to

18

provide for collection and transport of tumor samples from a pathology laboratory to our clinical reference laboratory may be a medical device subject to FDA regulation and while we expect that it will be exempt from pre-market review by FDA, there is no certainty in that respect.

We cannot provide any assurance that FDA regulation, including pre-market review, will not be required in the future for our LDT product candidates, either through new policies adopted by the FDA or new legislation enacted by Congress. It is possible that legislation will be enacted into law and may result in increased regulatory burdens for us to offer or continue to offer our product as a clinical laboratory service.

If pre-market review is required, our business could be negatively impacted until such review is completed and clearance to market or approval is obtained, and the FDA could require that we stop selling. If pre-market review of our LDTs is required by the FDA, there can be no assurance that our product offerings will be cleared or approved on a timely basis, if at all. Ongoing compliance with FDA regulations, such as the Quality System Regulation and Medical Device Reporting, would increase the cost of conducting our business, and subject us to inspection by the FDA and to the requirements of the FDA and penalties for failure to comply with these requirements. We may also decide voluntarily to pursue FDA pre-market review of our product offerings if we determine that doing so would be appropriate. Some competitors may develop competing tests cleared for marketing by the FDA. There may be a marketing differentiation or perception that an FDA-cleared test is more desirable than our product offerings, and that could discourage adoption and reimbursement of our test.

Should any of the reagents obtained by us from vendors and used in conducting our clinical laboratory service be affected by future regulatory actions, our business could be adversely affected by those actions, including increasing the cost of testing or delaying, limiting or prohibiting the purchase of reagents necessary to perform testing.

If the FDA decides to regulate our LDTS, it may require that we conduct extensive pre-market clinical studies prior to submitting a regulatory application for commercial sales. If we are required to conduct pre-market clinical studies, whether using retrospectively collected and banked samples or prospectively collected samples, delays in the commencement or completion of clinical studies could significantly increase our test development costs and delay commercialization. Many of the factors that may cause or lead to a delay in the commencement or completion of clinical studies may also ultimately lead to delay or denial of regulatory clearance or approval.