Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bristow Group Inc | d356498d8k.htm |

Fourth Quarter FY 2012

Earnings Presentation

Bristow Group Inc.

May 24, 2012

Exhibit 99.1 |

2

Fourth quarter earnings call agenda

Introduction

CEO remarks and operational highlights

Current and future financial performance

-

Q4 and FY12 Financial discussion

-

FY13 –

Moving Forward

Closing remarks

Questions and answers

Linda McNeill, Director Investor Relations

Bill Chiles, President and CEO

Jonathan Baliff, SVP and CFO

Bill Chiles, President and CEO |

3

Forward-looking statements

This presentation may contain “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward-looking statements include

statements about our future business, operations, capital expenditures, fleet composition,

capabilities and results; modeling information, earnings guidance, expected operating margins

and other financial projections; future dividends, share repurchase and other uses of excess

cash; plans, strategies and objectives of our management, including our plans and strategies to

grow earnings and our business, our general strategy going forward and our business model;

expected actions by us and by third parties, including our customers, competitors and

regulators; the valuation of our company and its valuation relative to relevant financial

indices; assumptions underlying or relating to any of the foregoing, including assumptions regarding

factors impacting our business, financial results and industry; and other matters. Our

forward-looking statements reflect our views and assumptions on the date of this

presentation regarding future events and operating performance. They involve known and unknown

risks, uncertainties and other factors, many of which may be beyond our control, that may cause

actual results to differ materially from any future results, performance or achievements

expressed or implied by the forward-looking statements. These risks, uncertainties and

other factors include those discussed under the captions “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our

Annual Report on Form 10-K for the fiscal year-ended March 31, 2012. We do not undertake

any obligation, other than as required by law, to update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise. |

4

Chief Executive Officer comments

,

President

and

CEO

Bill

Chiles |

5

Operational safety review

* Includes consolidated commercial operations only

Total Recordable Injury Rate per 200,000 man-

hours (cumulative)

Lost Work Case Rate per 200,000

man-hours (cumulative)

Air Accident Rate* per 100,000

Flight Hours (Fiscal Year)

FY12

FY12

0.78

0.78

0

0.54

0

0.53

0

1

2

3

2007

2008

2009

2010

2011

2012

0

0

0.25

0.18

0.28

0.23

0.25

0.22

0.19

0.20

0.22

0.23

0

0.3

A

M

J

J

A

S

O

N

D

J

F

M

0

0

0.25

0.18

0.28

0.23

0.20

0.17

0.15

0.13

0.15

0.14

0

0.3

A

M

J

J

A

S

O

N

D

J

F

M |

6

Q4 and FY12 highlights

•

Increased LACE Rate with high utilization yielded an excellent quarter for Bristow

with adjusted EPS of $1.22 •

Record cash flow of over $230 million from operations in FY12, an increase of over

50% from the same period last year

•

Total liquidity (cash plus undrawn revolver capacity) of $402 million is over 50%

increase from $261 million in FY11

•

Board of Directors approved 33% increase in the quarterly dividend

•

Bristow’s

earnings

per

diluted

share

guidance

for

the

full

FY13

is

$3.25

-

$3.55

•

Q4 operating revenue of $318.7M (16.4% increase

from Q4 FY11, 7.4% increase from Q3 FY12)

•

Q4 GAAP EPS of $0.39 (53.6% decrease from Q4

FY11, 44.3% decrease from in Q3 FY12)

•

Q4 adjusted EPS* of $1.22 (41.9% increase from Q4

FY11, 60.5% increase from Q3 FY12)

•

Q4 adjusted EBITDAR* of $99.5M (22.7% increase

from Q4 FY11, 21.6%

increase

from Q3 FY12) * Adjusted

EPS

and

adjusted

EBITDAR

amounts

exclude

gains

and

losses

on

dispositions

of

assets

and

any

special

items

during

the

period.

See

reconciliation of these items to GAAP measures in appendix and our earnings release

for the quarter ended March 31, 2012. •

FY12 operating revenue of $1.2B (7.6% increase

from FY11)

•

FY12 GAAP EPS of $1.73 (51.9% decrease from

FY11)

•

FY12 adjusted EPS* of $3.12 (1.3% increase from

FY11)

•

FY12 adjusted EBITDAR* of $319.5M (7.3% increase

from FY11) |

7

•

Price of oil continues to fluctuate given political instability in the

Middle East and North Africa coupled with the uncertainty in Europe

•

Global E & P spending remains strong with approximately 12% and

13% growth expected for 2012 and 2013, respectively

•

Most of our customers in Australia have locked in pricing for their

existing LNG projects, securing continued operations for this market

•

Market signals confirm robust offshore market in Europe and

deepwater growth in Latin America, particularly Brazil, U.S. Gulf of

Mexico and West Africa

•

Based on the number of outstanding global tenders, the

supply/demand balance for new technology medium and large

helicopters is tightening

Current market environment |

8

•

Europe represents 39% of Bristow operating

revenue and 41% of adjusted EBITDAR* in Q4

FY12

•

Operating revenue increased to $121.0M from

$101.2M in Q4 FY11 due to increased flying

activity

•

Adjusted EBITDAR margin increased to 36.1%

in Q4 FY12 from 34.4% in Q4 FY11 reflecting

higher activity levels and was 32.9% for FY12

Outlook:

•

Awarded GAP Search and Rescue contract

in the Northern North Sea that will require

four large aircraft beginning in July 2013

•

Historically high bidding activity for

contracts for over 20 large aircraft all

starting between October 2012 –

September 2014

FY13 adjusted EBITDAR margin

expected to be ~ in the low thirties

Europe (EBU)

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other. |

9

West Africa (WASBU)

•

Nigeria represents 22% of Bristow operating

revenue and 23% of adjusted EBITDAR* in Q4

FY12

•

Operating revenue of $66.2M in Q4 FY12

increased from $50.8M in Q4 FY11 due to new

contracts and price increases

•

Adjusted EBITDAR margin of 36.6% in Q4 FY12

vs 34.3% in Q4 FY11 and 35% for FY12

•

Increased activity reflected in increase in flying

hours and ad hoc work over prior year quarter

Outlook:

•

Opportunities exist for the extension of

several contracts with improved contract

terms

•

Key changes to our operating model in

order to compete more effectively on a

local basis

FY13 adjusted EBITDAR margin

expected to be ~ low thirties

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other. |

10

Australia (AUSBU)

•

Australia represented 14% of Bristow operating

revenue and adjusted EBITDAR* in Q4 FY12

•

Operating revenue of $43.4M in Q4 FY12

increased f rom $40.8M in Q4 FY11 due to

increased utilization

•

Adjusted EBITDAR increased to $15.5M in Q4

FY12 from $12.7M in Q4 FY11 and was $36.0M

for FY12

•

Increase in adjusted EBITDAR margin to 35.6% in

Q4 FY12 from 23.5% in Q3 FY12, reflecting higher

utilization, which increased the adjusted EBITDAR

margin for FY12 to 24.3%

Outlook:

•

Awaiting the results of a large tender

•

Some short term contracts roll off in Q1

FY13 and will allow for ad hoc work or

redeployment

FY13 adjusted EBITDAR margin

expected to be ~ mid to high

twenties

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other. |

11

Other International (OIBU)

•

Other International represented 11% of Bristow

operating revenue and 14% of adjusted EBITDAR* in

Q4 FY12

•

Operating

revenue

decreased

to

$34.6M

in

Q4

FY12

vs. $36.3M in Q4 FY11 due to exiting Libya and was

partially offset by new contracts

•

Adjusted EBITDAR margin of 42.9% in Q4 FY12

decreased over Q4 FY11 of 59.4% and was 39.5% for

FY12 (Lider Impact)

•

Lider equity earnings decreased to $1.0M in Q4 FY12

from $6.2M in Q4 FY11, negative $3.3M in FY12 vs.

$8.5M in FY11 due to the foreign exchange impact

and aircraft maintenance in Q4 FY12

Outlook:

•

Awaiting result of the Petrobras tender for up to

10 large aircraft

•

Major IOC contract in Brazil extended until

FY14 while adding a fourth medium aircraft

•

Exploring East Africa as future growth market

FY13 adjusted EBITDAR margin

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other. expected to be ~ low to mid forties |

12

•

•

North America represents 14% of Bristow operating

revenue and 8% of adjusted EBITDAR in Q4 FY12

•

Adjusted EBITDAR increased to $8.2M in Q4 FY12 vs.

$3.4M in Q4 FY11

•

Adjusted EBITDAR margin of 19.4% in Q4 FY12

increased significantly from 8.5% in Q4 FY11; FY12

adjusted EBITDAR margin was 17.3%.

•

Increase in adjusted EBITDAR margin from prior year

quarter is a result of the higher LACE Rates for larger

aircraft as well as cost management

Outlook:

•

Activity in the Gulf of Mexico picking up with

continued inquiries for additional medium and

large aircraft to support seismic and deepwater

exploration

•

Successfully negotiating better contract terms

with several clients in GoM and Alaska

•

Supply and demand on medium and large

aircraft tightening significantly

FY13 adjusted EBITDAR margin expected

to be ~ low twenties

North America (NABU)

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other. |

13

Financial discussion

Jonathan

Baliff

,

SVP

and

CFO |

14

Financial highlights:

Adjusted EPS Summary

Q4FY11 to Q4 FY12 adjusted EPS bridge

FY11 to FY12 adjusted EPS

* Adjusted EPS amounts exclude gains and losses on dispositions of assets and any special items

during the period. See reconciliation of these items to GAAP in our earnings release for the

quarter ended March 31, 2012. |

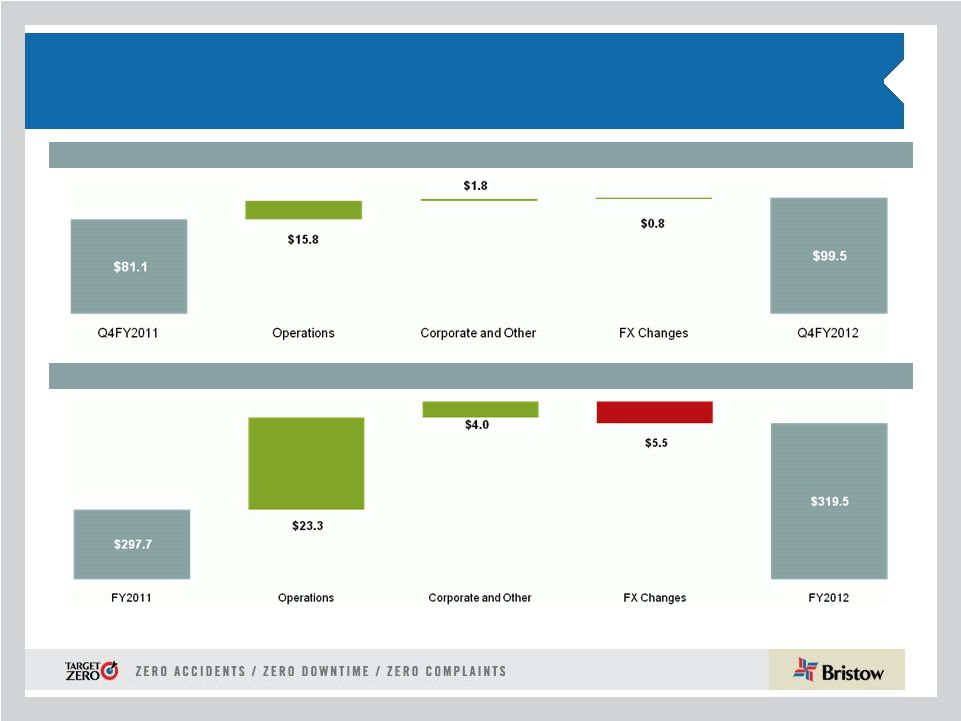

15

Financial highlights:

Adjusted EBITDAR Summary

Q4FY11 to Q4 FY12 adjusted EBITDAR bridge (in millions)

FY11 to FY12 adjusted EBITDAR bridge (in millions)

* Adjusted EBITDAR amounts exclude gains and losses on dispositions of assets and any special

items during the period. See reconciliation of these items to GAAP in our earnings release for

the quarter ended March 31, 2012. |

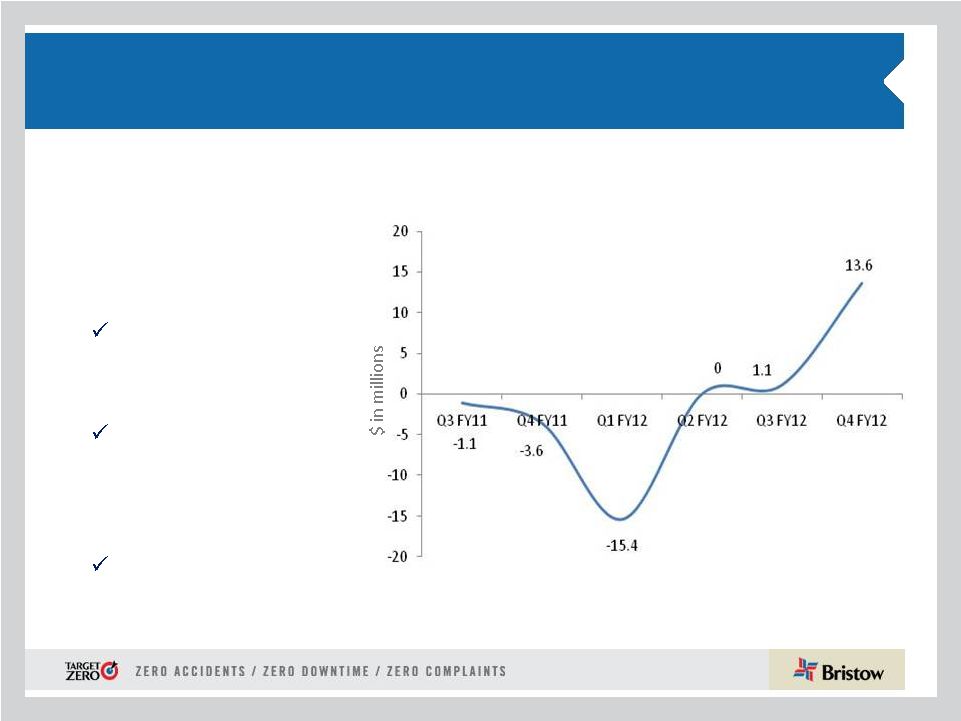

16

BVA –

Six Quarters

Sequential quarterly improvement

BVA Q3 FY11 –

Q4 FY12

See 10-K for more information on BVA

•

FY12 consolidated BVA is

-$0.7M, representing 8.4M

year-over-year increase

•

Positive change in BVA

driven is by:

Revenue growth in

Europe, West Africa,

and North America

Capital efficiency

through leasing of

aircraft and working

capital management

Some margin

improvements |

17

LACE rate increases drove BVA and cash flow improvement

as overall LACE declined due to aircraft sales

LACE

and

LACE

Rate

excludes

Bristow

Academy,

affiliate

aircraft,

aircraft

held

for

sale,

aircraft

construction in progress, and reimbursable revenue

($ in millions)

See appendix for more information on LACE and LACE Rate

161

164

159

153

149

5.72

6.14

6.49

7.15

7.89

0

1

2

3

4

5

6

7

8

9

141

144

147

150

153

156

159

162

165

168

FY08

FY09

FY10

FY11

FY12

LACE

LACE Rate

324

295

290

279

268

161

164

159

153

149

0

50

100

150

200

250

300

350

FY08

FY09

FY10

FY11

FY12

Consolidated commerical aircraft

Large Aircraft Equivalent (LACE) |

18

Adjusted EBITDAR margin has returned to pre-

recession levels

Calculated by taking adjusted EBITDAR divided by operating revenue; adjusted

EBITDAR excludes special items and asset dispositions |

19

Our progress on BVA has yielded increased operating

cash flow generation in FY12

Bristow generated 53% more operating cash flow in FY12

compared to FY11

Net cash provided by operating activities

See 10-K for more information on cash flow provided by operating

activities 87.6

127.9

195.4

151.4

231.3

0

40

80

120

160

200

240

280

FY08

FY09

FY10

FY11

FY12 |

20

Operating lease strategy: lowering the cost and amount of

capital needed to grow

•

We leased nine existing and in-construction aircraft for $171.2 million from

December 2011 to March 2012

•

Currently

approximately

14%

of

our

commercial

fleet

is

leased

on

a

LACE

basis

•

The initial aim for the operating leases to account for 20-30% of our LACE

Leased aircraft as of March 31, 2012

Large

Medium

Small

Total

Leased LACE

Total LACE

% Leased

EBU

9

-

-

9

9

45

20.0%

WASBU

-

1

-

1

1

22

2.3%

AUSBU

1

-

2

3

2

19

10.5%

OIBU

1

-

-

1

1

33

3.0%

NABU

2

11

1

14

8

30

25.8%

Total

13

12

3

28

20

149

13.6% |

21

Changes in fleet strategy have been driven by Client

Promise and BVA initiatives

•

In Q2 FY12, management updated our global fleet strategy

which incorporated aspects of Client Promise and BVA

•

Subsequent pre-tax inventory written down $25.9M (non-cash)

•

Excellent year for aircraft sales with significant transactions

improving fleet mix

•

29 aircraft were sold for $53.8M; 12 in Q4 FY12 including nine

AS 332L large aircraft sold for $28.9M

Aircraft

impairments

•

Seven other AS332Ls impaired, resulting in a non-cash charge

of $23.6M

•

Non-cash impairment charge of $2.8M on two medium aircraft

to be sold in Q2 FY13

Inventory

review

Aircraft

sales

Aircraft

impairment |

22

All of these efforts have led to a robust cash and liquidity

position at year end

Total liquidity as of March 31

•

Total liquidity, including cash on

hand and unused revolver

capacity, has increased by more

than 50% from FY11

•

In FY12 cash on hand increased

by ~ 125%

•

In Q4 FY12 we have also paid

down over $75M of long and short

term debt

•

Higher liquidity allows for internal

funding of growth and protection in

uncertain economic times |

23

Financial highlights:

FY13 guidance

•

EPS guidance range $3.25

- $3.55 excluding aircraft sales and

special items •

Depreciation and amortization expense ~ $90 –

$95 million

•

SG & A expense ~ $135 -

$140 million

•

Interest expense ~ $38 -

$43 million

•

Tax ~

20% -

24 %

(assuming revenue earned in same regions and same mix)

•

LACE* (Large Aircraft Equivalent) ~ 152-156 (FY13 average)

•

LACE Rate* ~ $7.90 -

$8.20 million per LACE aircraft per year

•

Anticipate a second half better than the first half

* Excludes Bristow Academy, aircraft held for sale, CIP, and reimbursable

revenue. |

24

Conclusions

•

We have built a great company –

now the focus is on

execution

•

Target Zero / Client Promise is the top priority

•

Smarter growth with a prudent capital structure, low cost

and capital efficient financings

•

Strong financial profile with liquidity, cash flow and a

commitment to credit quality

•

Balanced shareholder return: growth and capital return

through dividend increases and opportunistic share

repurchases |

25

Appendix |

26

Organizational

Chart

-

as

of

March

31,

2012

Business

Unit

(*

%

of

FY12

Operating

Revenue)

Corporate

Region

( # of Aircraft / # of Locations)

Joint

Venture

(No.

of

aircraft)

Key

Operated Aircraft

Bristow owns and/or operates 361

aircraft as of March 31, 2012

Affiliated Aircraft

Bristow affiliates and joint

ventures operate 195 aircraft

as of March 31, 2012 |

27

Aircraft Fleet –

Medium and Large

As of March 31, 2012

Next Generation Aircraft

Medium capacity 12-16 passengers

Large capacity 18-25 passengers

Mature Aircraft Models

Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

Large Helicopters

AS332L Super Puma

18

Twin Turbine

25

-

25

-

AW189

16

Twin Turbine

-

-

-

6

EC225

25

Twin Turbine

18

-

18

-

Mil MI 8

20

Twin Turbine

7

-

7

-

Sikorsky S-61

18

Twin Turbine

2

-

2

-

Sikorsky S-92

19

Twin Turbine

30

2

32

9

82

2

84

15

LACE

75

Medium Helicopters

AW139

12

Twin Turbine

7

2

9

-

Bell 212

12

Twin Turbine

2

14

16

-

Bell 412

13

Twin Turbine

34

20

54

-

EC155

13

Twin Turbine

3

-

3

-

Sikorsky S-76A/A++

12

Twin Turbine

16

6

22

-

Sikorsky S-76C/C++

12

Twin Turbine

54

33

87

-

116

75

191

-

LACE

53 |

28

Aircraft Fleet –

Small, Training and Fixed

As of March 31, 2012 (continued)

Next Generation Aircraft

Mature Aircraft Models

Small capacity 4-7 passengers

Training capacity 2-6 passengers

•LACE does not include held for sale, training and fixed wing

helicopters Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

Small Helicopters

Bell 206B

4

Turbine

1

2

3

-

Bell 206 L-3

6

Turbine

4

6

10

-

Bell 206 L-4

6

Turbine

29

1

30

-

Bell 407

6

Turbine

39

-

39

-

BK 117

7

Twin Turbine

2

-

2

-

BO-105

4

Twin Turbine

2

-

2

-

EC135

7

Twin Turbine

6

3

9

-

83

12

95

-

LACE

21

Training Helicopters

AW139

12

Twin Turbine

-

3

3

-

Bell 412

13

Twin Turbine

-

8

8

-

Bell 212

12

Twin Turbine

-

15

15

-

AS355

4

Twin Turbine

2

-

2

-

AS350BB

4

Turbine

-

36

36

-

Agusta 109

8

Twin Turbine

-

2

2

-

Bell 206B

6

Single Engine

14

-

14

-

Robinson R22

2

Piston

11

-

11

-

Robinson R44

2

Piston

2

-

2

-

Sikorsky 300CB/Cbi

2

Piston

46

-

46

-

Fixed Wing

1

-

1

-

76

64

140

-

Fixed Wing

4

42

46

-

Total

361

195

556

15

TOTAL LACE (Large Aircraft Equivalent)

149 |

29

Consolidated Fleet Changes and Aircraft Sales for

Q4 FY12

Q 1 FY12

Q 2 FY12

Q 3 FY12

Q 4 FY12

YTD

Fleet Count Beginning Period

373

372

366

364

373

Delivered

EC225

2

1

3

S-92

2

3

1

6

Bell 412EP

1

1

Citation XLS

1

1

Total Delivered

2

3

4

2

11

Removed

Sales

(3)

(5)

(7)

(10)

(25)

Other*

(4)

1

5

2

Total Removed

(3)

(9)

(6)

(5)

(23)

372

366

364

361

361

* Includes destroyed aircraft, lease returns and commencements

Fleet changes

EBU

WASBU

AUSBU

OIBU

NABU

Total *

Large

3

-

3

1

-

7

Medium

2

1

1

6

-

10

Small

-

-

-

-

-

-

Total

5

1

4

7

-

17

* Table does not include two training helicopters held for sale

Aircraft held for sale by BU

EBU

WASBU

AUSBU

OIBU

NABU

BA

Total

Large

9

-

1

1

2

-

13

Medium

-

1

-

-

11

-

12

Small

-

-

2

-

1

-

3

Fixed

-

1

-

-

-

-

1

Training

-

-

-

-

-

28

28

Total

9

2

3

1

14

28

57

Leased aircraft in consolidated fleet

# of A/C Sold

Cash

Received*

Q1 FY12

3

2,478

Q2 FY12

5

10,674

Q3 FY12

7

9,075

Q4 FY12

14

31,640

Totals

29

53,867

* Amounts stated in thousands |

30

Operating Revenue, LACE and LACE rate by BU

Op revenue*

LACE

LACE Rate*

AUSBU

148.3

19

7.78

NABU

176.5

30

5.79

WASBU

246.3

22

11.46

EBU

449.9

45

10.10

IBU

141.5

34

4.22

Total

1,162.5

149

7.89

* $ in millions

Operating Revenue, LACE, and LACE Rate by BU

as of March 31, 2012 |

31

#

Helicopter

Class

Delivery Date

Location

Contracted

#

Helicopter

Class

Delivery Date

1

Large

June 2012

OIBU

1 of 1

1

Medium

June 2013

1

Large

June 2012

WASBU

1 of 1

2

Medium

September 2013

5

Large

December 2012

EBU

3 of 5

1

Large

September 2013

2

Large

March 2013

EBU

2 of 2

2

Medium

December 2013

1

Large

September 2014

NABU

5

Large

December 2013

1

Large

December 2014

OIBU

1

Large

March 2014

1

Large

March 2015

OIBU

1

Large

June 2014

1

Large

June 2015

EBU

1

Medium

September 2014

1

Large

March 2016

EBU

1

Large

September 2014

1

Large

June 2016

AUSBU

2

Medium

December 2014

15

7 of 15

1

Large

December 2014

2

Medium

March 2015

* Six large ordered aircraft expected to enter service late

1

Large

March 2015

calendar 2014 are subject to the successful development

2

Medium

June 2015

and certification of the aircraft.

2

Large

June 2015

Order book does not include two large leased aircraft

2

Large

September 2015

under contract with delivery dates in June and September

2

Large

December 2015

2012 quarters.

1

Large

March 2016

2

Large

June2016

2

Large

September 2016

2

Large

December 2016

1

Large

March 2017

1

Large

June2017

1

Large

September 2017

1

Large

December 2017

40

ORDER BOOK*

OPTIONS BOOK

Order and options book as of March 31, 2012

Fair market value of our fleet is ~$1.9

billion as of March 31, 2012. |

32

Adjusted EBITDAR margin* trend and reconciliation

($ in millions)

2008

2009

2010

2011

2012

Income from continuing operations

$107.7

$125.5

$113.5

$133.3

$65.2

Income tax expense

$44.5

$50.5

$29.0

$7.1

$14.2

Interest expense

$23.8

$35.1

$42.4

$46.2

$38.1

Gain on disposal of assets

($9.4)

($9.1)

(18.7)

(10.2)

31.7

Depreciation and amortization

54.1

65.5

74.7

90.9

96.1

Special items

(1.4)

(42)

–

1.2

28.1

EBITDA Subtotal

219.3

225.6

240.9

268.5

273.5

Rental expense

22.8

21.1

27.3

29.2

46.0

Adjusted EBITDAR

$242.1

$246.7

$268.2

$297.7

$319.5

Fiscal year ended March 31,

Q1

Q2

Q3

Q4

YTD

Q1

Q2

Q3

Q4

YTD

Q1

Q2

Q3

Q4

YTD

EBU

31.2%

31.7%

31.9%

28.0%

30.8%

29.8%

31.5%

34.6%

34.4%

32.7%

33.0%

31.4%

30.7%

36.1%

32.9%

WASBU

31.7%

36.8%

33.7%

39.1%

36.0%

33.7%

36.9%

35.8%

34.3%

35.2%

29.5%

35.5%

37.2%

36.6%

35.0%

NABU

18.3%

20.0%

14.9%

17.7%

17.8%

20.8%

25.8%

15.9%

8.5%

18.5%

14.3%

20.6%

14.8%

19.4%

17.3%

AUSBU

26.5%

36.7%

34.4%

31.3%

32.4%

33.2%

26.1%

27.0%

31.1%

29.3%

20.2%

14.4%

23.5%

35.6%

24.3%

OIBU

34.4%

37.6%

25.9%

25.1%

31.0%

18.3%

40.2%

37.4%

59.4%

39.3%

48.1%

19.1%

47.8%

42.9%

39.5%

Consolidated

24.7%

27.8%

24.7%

23.9%

25.3%

23.8%

27.5%

25.9%

29.6%

26.7%

23.4%

24.0%

27.6%

31.2%

26.6%

2010

2011

2012

* Adjusted EBITDAR excludes special items and asset dispositions and calculated by taking adjusted

EBITDAR divided by operating revenue |

33

GAAP reconciliation

Three Months Ended

Fiscal Year

Ended

March

31,

March

31,

2012

2011

2012

2011

Adjusted EBITDAR

Gain (loss) on disposal of assets

Special items

Rent expense

.............................................................

Interest expense

.......................................................

Depreciation and amortization

................................

Benefit (provision) for income taxes ............................

Net income

.....................................................................

Adjusted operating income ...........................................

Gain (loss) on disposal of assets................................

Special items .............................................................

Operating income

.........................................................

Adjusted net income

.....................................................

Gain (loss) on disposal of assets................................

Special items

.............................................................

Net income attributable to Bristow Group........................

Adjusted earnings per share

............................................

Gain (loss) on disposal of assets

Special items

...............................................................

Earnings per share

............................................................

$

99,458

$

81,055

$

319,488

297,714

5,096

(31,670)

(3,451)

(2,445)

(28,061)

(1,245)

(15,143)

(46,041)

(29,184)

(9,960)

(38,130)

(46,187)

(25,296)

(27,740)

(96,144)

(89,377)

(2,422)

(14,201)

(7,104)

$

14,576

31,225

$

65,241

133,295

60,963

$

180,864

$

(31,670)

8,678

(33,428)

(1,806)

$

115,766

$

189,724

$

114,641

$

113,045

(26,008)

7,145

(25,103)

12,125

$

63,530

$

132,315

$

3.12

$

3.08

(0.71)

0.19

(0.68)

0.34

1.73

3.60

(28,610)

(7,071)

$

8,678

$

0.86

0.11

(0.13)

0.84

$

1.12

(0.67)

(0.16)

0.39

182,852

50,057

$

5,096

(5,306)

49,847

$

(28,610)

(6,140)

26,213

$

$

44,558

(24,533)

(5,783)

$

14,242

$

31,711

4,195

(5,038)

$

30,868

$

(9,924)

(7,746)

.........................................................

................................

................................................................

................................

(Unaudited)

(In thousands, except per share amounts)

$

$ |

34

Special items reconciliation

Three Months Ended

March 31, 2012

Adjusted

Operating

Income

Adjusted

EBITDAR

Adjusted

Net Income

Adjusted

Diluted

Earnings

Per Share

Impairment of inventories

(1)

Impairment of aircraft

(2)

.....................

AS332L sale costs

(3)

.........................

Tax items

(4)

.......................................

Total special items..........................

$

(1,309)

$

(1,309)

$

(934)

(Unaudited)

(In thousands, except per share amounts)

$

(0.03)

(2,690)

—

(2,661)

(0.07)

(2,142)

(2,142)

(0.04)

—

(795)

(0.02)

$

(6,141)

$

(3,451)

$

(5,783)

(0.16)

(1,393)

—

Fiscal Year Ended

March 31, 2012

Adjusted

Operating

Income

Adjusted

EBITDAR

Adjusted

Net Income

Adjusted

Diluted

Earnings

Per Share

Impairment of inventories..........................

Impairment of aircraft

.............................

Impairment

of assets in Creole,

Louisiana

...............................................

AS332L sale costs.................................

Tax items

..............................................

Total special items...............................

$

(25,919)

$

(25,919)

$

(18,514)

$

(0.50)

(2,690)

—

(2,661)

(0.07)

(2,677)

—

(1,740)

(0.05)

(2,142)

(2,142)

(1,393)

(0.04)

—

—

(795)

(0.02)

$

(33,428)

$

(28,061)

$

(25,103)

(0.68)

(In thousands, except per share amounts)

(Unaudited)

.............. |

35

Leverage Reconciliation

*Adjusted EBITDAR exclude gains and losses on dispositions of assets

Debt

Investment

Capital

Leverage

(a)

(b)

(c) = (a) + (b)

(a) / (c)

(in millions)

As of March 31, 2012

757.2

$

1,521.8

$

2,279.1

$

33.2%

Adjust for:

Unfunded Pension Liability

111.7

111.7

NPV of Lease Obligations

190.2

190.2

Guarantees

16.0

16.0

Letters of credit

1.5

1.5

Adjusted

1,076.7

$

(d)

1,521.8

$

2,598.5

$

41.4%

Calculation of debt to adjusted EBITDAR multiple

Adjusted EBITDAR*:

FY 2012

319.5

$

(e)

Annualized

426.0

$

= (d) / (e)

3.37:1 |

36

Bristow Group Inc. (NYSE: BRS)

2103

City

West

Blvd.,

4

th

Floor

Houston, Texas 77042

t

713.267.7600

f

713.267.7620

bristowgroup.com

Contact Us |