Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TrueBlue, Inc. | a2012q2ir8-k.htm |

TrueBlue™ (NYSE:TBI) 2011 Q2 Results 1 Investor Presentation Q2 2012

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation Cautionary Note About Forward-Looking Statements: Certain statements made by us in this presentation that are not historical facts or that relate to future plans, events or performances are forward-looking statements that reflect management’s current outlook for future periods, including statements regarding future financial performance. These forward-looking statements are based upon our current expectations, and our actual results may differ materially from those described or contemplated in the forward–looking statements. Factors that may cause our actual results to differ materially from those contained in the forward- looking statements, include without limitation the following: 1) national and global economic conditions, including the impact of changes in national and global credit markets and other changes on our customers; 2) our ability to continue to attract and retain customers and maintain profit margins in the face of new and existing competition; 3) new laws and regulations that could have a materially adverse effect on our operations and financial results; 4) significant labor disturbances which could disrupt industries we serve; 5) increased costs and collateral requirements in connection with our insurance obligations, including workers’ compensation insurance; 6) the adequacy of our financial reserves; 7) our continuing ability to comply with financial covenants in our lines of credit and other financing agreements; 8) our ability to attract and retain competent employees in key positions or to find temporary employees to fulfill the needs of our customers; 9) our ability to successfully complete and integrate acquisitions that we may make from time to time; and 10) other risks described in our filings with the Securities and Exchange Commission, including our most recent Form 10-K and Form 10-Q filings. Use of estimates and forecasts: Any references made to Q-2 2012 or fiscal year 2012 are based on management guidance issued April 25, 2012, and are included for informational purposes only and are not an update or reaffirmation. Any other reference to future financial estimates are included for informational purposes only and subject to factors discussed in our 10-K and 10-Q filings.

Successful vertical industry approach Compelling growth potential for staffing industry Unique industry-related growth drivers for TrueBlue Multiple strategies to drive growth and efficiency Strong operating leverage Solid balance sheet TrueBlue Investment Highlights TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation 3

Every day, we use our specialized approach to the market to find new opportunities to better serve customers and workers at all skill levels. A LEADING PROVIDER OF BLUE-COLLAR STAFFING TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation 4

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation General labor, on demand Specialized skills for manufacturing & logistics Skilled trades for energy, industrial, & construction projects Aviation mechanics & technicians Truck drivers Blue-Collar Specialties 5

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation The Leading Provider of Blue-Collar Staffing 2011 Revenues = $1.3 Billion* *Brand revenue amounts rounded to the nearest $5 million. 6

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation 7 Sales by Industry 2011 2006 Construction 25% 37% Manufacturing 20% 17% Transportation 12% 9% Wholesale Trade 9% 10% Retail 7% 8% Services & Other 15% 19% Aviation 12% 0%

TrueBlue Recognized as a Credible Industry Leader “Best practices by DHS/ICE Partner” “Forbes Most Trustworthy Companies” “Gold Standard accreditation for promoting employee health and wellness” “Platinum 400” “Award of Excellence” “Hot Growth Company” “National Universal Agreement to Mediate” TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation 8

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation Other Finance Healthcare Office IT 9 Staffing Industry: A $90 Billion Industry Staffing Industry Analysts 2011 forecast, rounded $25 Billion Industrial/ Blue-Collar $65 Billion

Economic volatility & uncertainty Greater need for flexibility & agility Increased government regulation Construction rebound Growing need and shortage of truck drivers Manufacturing growth expected to continue 10 Aging workforce Staffing Industry and TrueBlue-Specific Growth Drivers ATTRACTIVE DRIVERS FOR STAFFING INDUSTRY UNIQUE INDUSTRY DRIVERS TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation

2014 MARKET FORECAST 2011 MARKET Blue-Collar Staffing: STRONG FUTURE GROWTH Source: Staffing Industry Analysts, Moody’s economic forecasts, TrueBlue estimates TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation 11

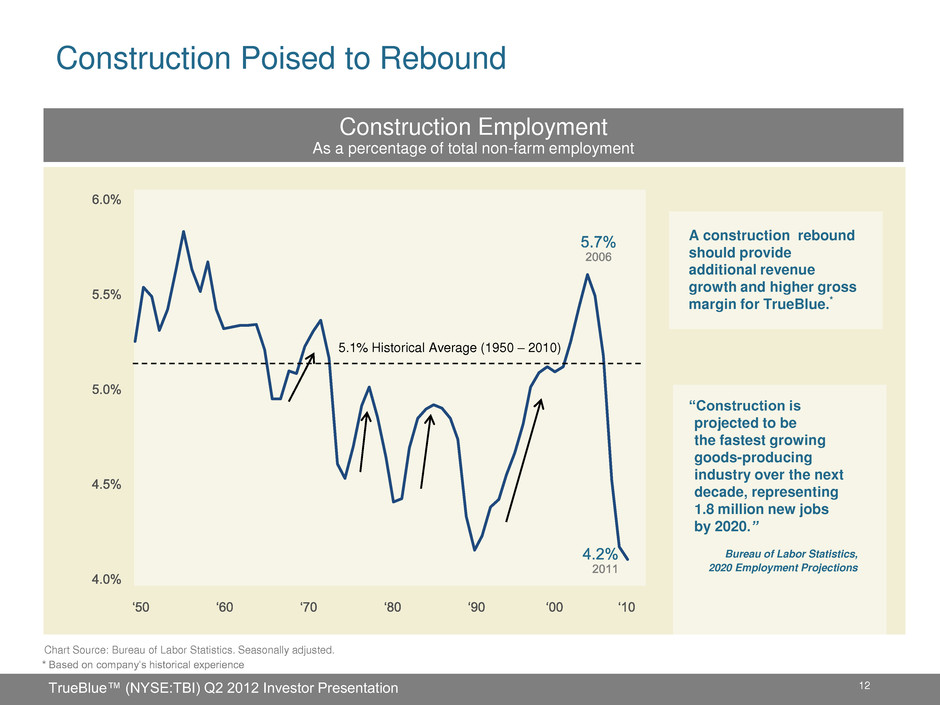

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation Construction Poised to Rebound Construction Employment As a percentage of total non-farm employment 12 5.1% Historical Average (1950 – 2010) “Construction is projected to be the fastest growing goods-producing industry over the next decade, representing 1.8 million new jobs by 2020.” Bureau of Labor Statistics, 2020 Employment Projections A construction rebound should provide additional revenue growth and higher gross margin for TrueBlue.* Chart Source: Bureau of Labor Statistics. Seasonally adjusted. * Based on company’s historical experience

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation Bureau of Labor Statistics, 2020 Employment Projections Rosalyn Wilson, Council of Supply Chain Management Professionals Transportation Employment Poised for Growth U.S. Transportation Employment 000s Source: Bureau of Labor Statistics. Seasonally adjusted. 13 2,500 3,000 3,500 4,000 '9 2 '9 3 '9 4 '9 5 '9 6 '9 7 '9 8 '9 9 '0 0 '0 1 '0 2 '0 3 '0 4 '0 5 '0 6 '0 7 '0 8 '0 9 '1 0 '1 1 '1 2 20-yr. average

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation Boston Consulting Group, May 5, 2011 New Boom Ahead for U.S. Manufacturing Purchasing Managers Index PMI Source: Federal Reserve Bank of St. Louis. A PMI reading above 50 percent indicates that the manufacturing economy is general ly expanding; below 50 percent that it is generally declining. 14 30 35 40 45 50 55 60 65 '00 '05 '10

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation $1.35B Revenue Labor Ready (89%) CLP (11%) $5 Billion Market 2006 $1.3B Revenue Labor Ready (62%) CLP (13%) Spartan (10%) PlaneTechs (11%) Centerline (4%) 2011 $15 Billion Market 15 More Opportunities to Serve the Market Percentages in parentheses represent the mix of total company revenue by brand

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation $4.5 Billion (20%) $7.5 Billion (2%) $1 Billion (17%) $1 Billion (15%) $1 Billion (5%) Market Share Opportunities 1 Staffing Industry Analysts 2011 forecast, 2 Market share (%) based on TrueBlue estimates Market Size1 & (Market Share)2 16

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation 17 Multiple Strategies to Drive Growth and Efficiency Focus How Why Organic Growth in Existing Geographies Geographic Expansion Acquisitions +++ + + Operating Leverage & Market Share Market Share Market Share • Vertical Market Specialization • Technology supports growth and efficiency • On-site Management • Multi-Branded Locations • Primarily Tuck-ins • Secondary focus: new service lines

18 Strategy: Vertical Market Specialization Dedicated sales leaders with expertise in the specific industries we serve Specialized national sales and service teams deliver tailored solutions to our national customers Local sales and service staff use industry best practices to serve local customers better Strong focus on customer relationships and loyalty on both the local and national level TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation Incremental Revenue $100 Gross Profit Generated $25- 26 Operating Expense Associated with Incremental Revenue $(9) – (10) People Investments $(2) – (3) Incremental EBITDA $12 - 15 19 Strong Operating Leverage from Organic Revenue Organic growth from existing geographies = 12% - 15% incremental EBITDA margins* * Reflects an approximation of the incremental EBITDA that management believes can be achieved, in general, with favorable revenue growth and current gross margin, revenue mix and geographic footprint. See disclosure and reconciliation of EBITDA in Appendix.

Geographic Expansion Opportunities Existing markets KEY 20 TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation Successful Acquisition Record Acquisition Results How We Vet Acquisitions Does it fit our strategy? Does it exceed our return on investment requirements? Does it fit our culture and operational structure? Does it bring unnecessary financial or legal risks? 21

TrueBlue™ (NYSE:TBI) 2011 Q2 Results 22 Financial Review

23 Financial Summary Q-1 2012 Q-1 2011 Growth % Revenue $ 311 $ 274 13% Gross profit $ 79 $ 70 13% % of Revenue 25.5% 25.5% SG&A expense $ 72 $ 65 11% % of Revenue 23.2% 23.8% Depreciation & amortization $ 5 $ 4 22% % of Revenue 1.5% 1.4% Income from operations $ 2 $ 1 151% % of Revenue 0.8% 0.3% Net income $ 2 $ 1 100% % of Revenue 0.5% 0.3% Earnings per share $ 0.04 $ 0.02 119% Dollar amounts in millions, except EPS. Certain amounts may not sum or recalculate due to rounding. TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation 24 Solid Balance Sheet In millions Q-1 2012 Q-4 2011 Cash & investments $125 $109 Accounts receivable $144 $154 Current ratio 2.5 2.5 Restricted cash & investments $131 $130 Workers’ comp reserve $191 $192 Debt $0 $0 Shareholders’ equity $300 $294

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation Recent Revenue Trends 25 * Q4 ’10 was a 14 -week quarter vs. 13 weeks for Q4 ‘11. 22% normal- ized growth*

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation Gross Margin Change 24.0% 24.5% 25.0% 25.5% 26.0% Q1 2011 2011 HIRE Act Credits Pricing/Other Q1 2012 25.5% 25.5% -0.4% +0.4% TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation 26

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation 27 SG&A Expense Change $0 $10 $20 $30 $40 $50 $60 $70 $80 Q1 2011 Variable People Investments Other Q1 2012 +$4M $65M +$2M +$1M $72M

TrueBlue™ (NYSE:TBI) 2011 Q2 Results 28 Appendix

TrueBlue™ (NYSE:TBI) Q2 2012 Investor Presentation 29 Reconciliation of Net Income to EBITDA $ $ $ $ $ $ $ $ $ $ $ $ $ $ * EBITDA is non-GAAP financial measure which excludes interest, taxes, depreciation and amortization from net income. EBITDA is a key measure used by management in evaluating performance. EBITDA should not be considered a measure of financial performance in isolation or as an alternative to net income (loss) in the Statement of Operations in accordance with GAAP, and, as presented, may not be comparable to similarly titled measures of other companies. ** Certain amounts may not sum or recalculate due to rounding.