Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - NATIONAL TECHNICAL SYSTEMS INC /CA/ | ex99_1.htm |

| 8-K - NATIONAL TECHNICAL SYSTEMS, INC 8-K 5-23-2012 - NATIONAL TECHNICAL SYSTEMS INC /CA/ | form8k.htm |

Exhibit 99.2

National Technical Systems, Inc.

(NASDAQ: NTSC)

(NASDAQ: NTSC)

May 2012

Meeting the Growing Demand From Industry and

Government for Skilled Engineering Solutions and Services

Government for Skilled Engineering Solutions and Services

13th Annual B. Riley & Co. Investor Conference

Santa Monica, CA

Largest independent provider in U.S. of advanced compliance

testing and engineering services to the aerospace, defense,

testing and engineering services to the aerospace, defense,

telecommunications, automotive and high technology markets

Company Overview

2

EMC/EMI Testing

Fire Testing

Mechanical Testing

Environmental Testing

Shock Vibration Testing

RF/Wireless Testing

ØOne-stop resource for broad range of services

ü Advanced technical product testing and certification

ü Certifications and data accepted in 21 countries

ü Engineering services for Engineering Services Outsourcing (ESO) market

ü Quality systems registration and supply chain management services

ü Special facilities, tools and capabilities

l Munitions, explosives, hazardous materials, ballistic and hydraulic burst tests

l Sophisticated data collection tools, very high-speed cameras, Doppler radar

l LabInsight on-line customer information portal - test data, status reports, etc.

Company Overview

3

Munitions Testing

Hydraulic Burst Testing

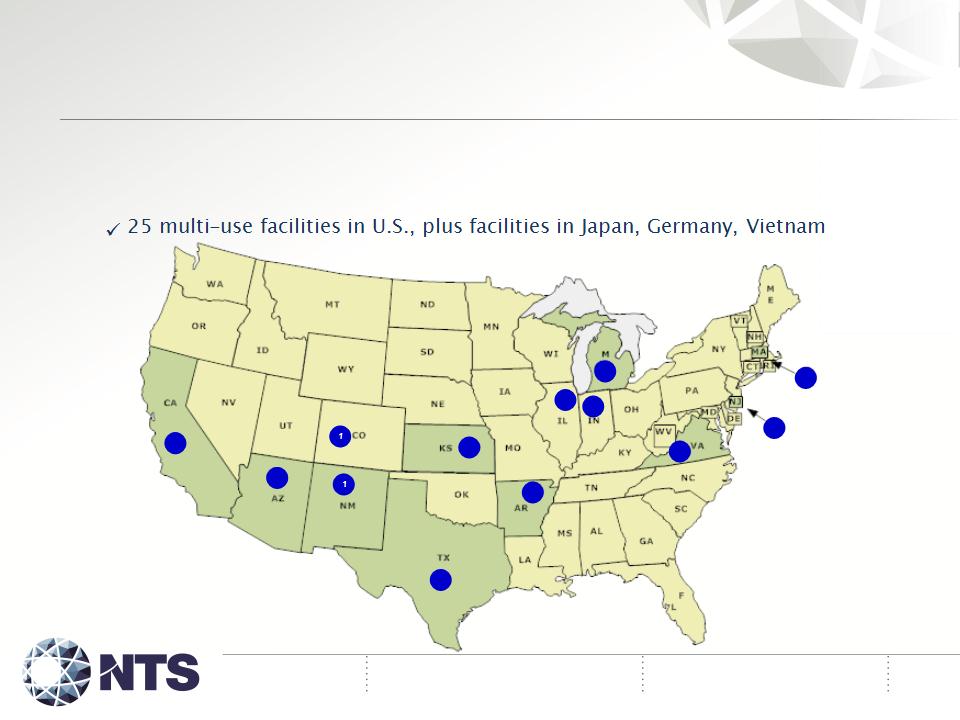

ØHeadquartered in Calabasas, CA; 1,100 employees

ØStrategic locations

10

1

1

1

1

1

2

1

3

1

1

4

Company Overview

ØStrong competitive position

ü A few large European companies

ü Mostly small, private local or regional labs in U.S.

ü In-house labs

ØIncreasing market share

ØNational sales force

ØDiversified base of 4,000+ customers

ü Incudes many of the world’s largest/strongest

ü Long-term relationships = consistent year-over-year revenue

Company Overview

5

Principal Customers Include

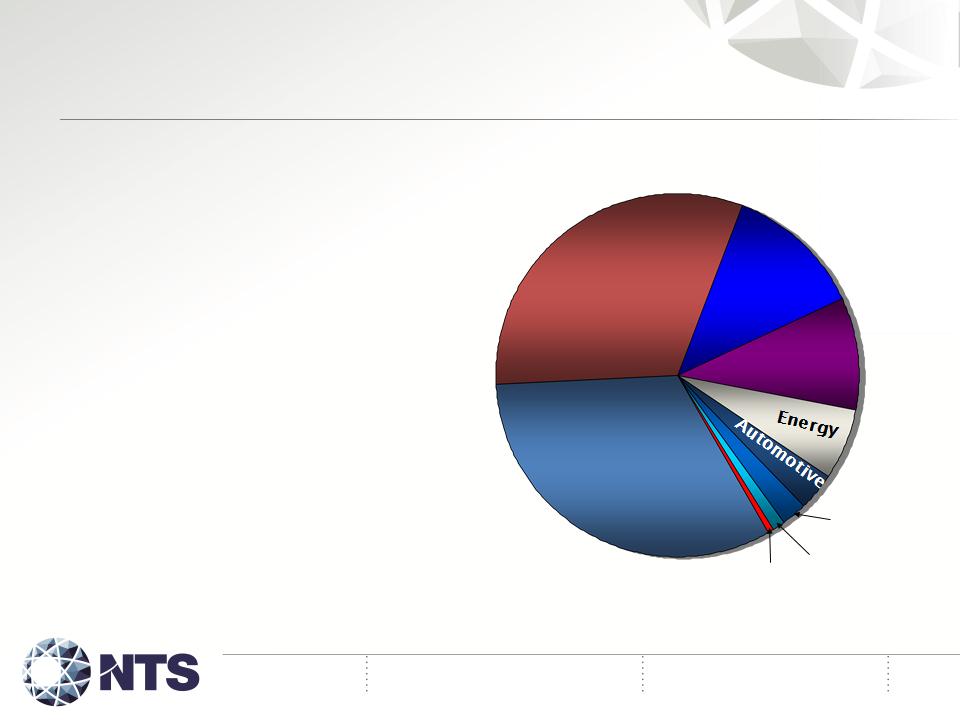

Principal Industries Served

n Defense

n Aerospace

n Telecommunications

n Consumer

n Energy

n Automotive

n Industrial

n Medical

n Other

7

Defense

Telecom

Telecom

Consumer

Consumer

Other

Other

Medical

Medical

Industrial

Industrial

Aerospace

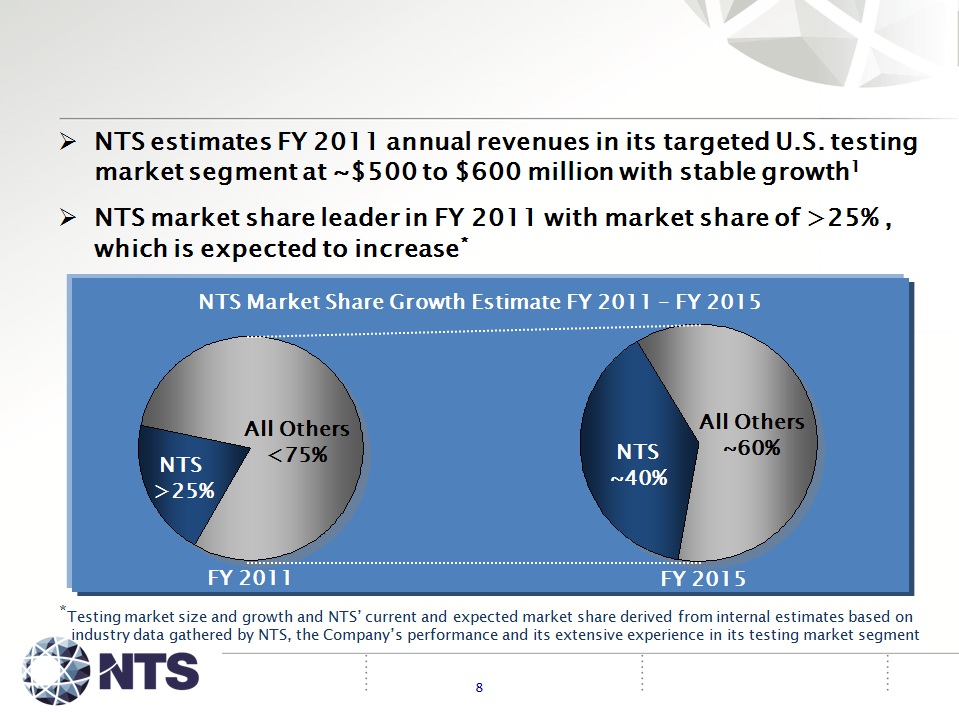

Laboratory Testing Market Trends in U.S.

Ø Key market drivers - regulatory, cost-effectiveness, time-to-

market

market

ü Scarcity of qualified engineers, trend towards greater outsourcing

l Engineering projects, new product development, supply chain management

ü Increasing government product safety regulations

ü Third party certification guidelines

Ø Significant barriers to entry

ü Niche specialization, high fixed costs, skilled labor force

ü Expect few new market entrants

Ø Fragmented market with number of smaller participants

ü Acquisition opportunities to expand services and reach

Why NTS is Approaching an Inflection Point

9

10

ØAggressively grow NTS until valuation metrics

improve significantly or strategic exit achieved

improve significantly or strategic exit achieved

üOrganic growth

l Increase market share through superior service, new offerings

l Invest in human resources / physical assets to strengthen NTS

l Expand sales and marketing program

üStrategic acquisitions

l Acquire companies that add significant value to NTS

l Add new, innovative service offerings to expand repertoire

l Goal to acquire 1 to 2 companies annually

l Experienced and proven acquisition team to seek, evaluate,

acquire and integrate acquired companies

acquire and integrate acquired companies

Aggressively Grow NTS & Drive Shareholder

Value

Value

Ø ESO market is fast growing, multi-billion dollar market expected

to grow at ~26% CAGR

to grow at ~26% CAGR

Ø NTS launched initiative in March 2009; currently doing selected

design/development ESO projects; drives added testing revenue

design/development ESO projects; drives added testing revenue

Ø Offering more Engineering Services is move up value chain

ü Positions NTS to provide higher-value, higher-margin services

DESIGN

DEVELOP

TEST

Engineering

Services

Services

Engineering

& Evaluation

& Evaluation

NTS Engineering Services (“ESO”) Initiative

11

ØGrowing source of additional revenue

ØLeverages Company’s large customer base

ØMoves NTS up the services value chain

ØMargins can increase - not a commodity business

ØDevelops closer working relationships with customers

ØDrives additional NTS testing business

Why Engineering Services Outsourcing?

12

13

ØChicago-based Ingenium Testing

ü One of North America’s most modern EMC/EMI testing labs

ü Customer base, capabilities and services

l Aerospace, heavy industry, automotive markets,

l All among NTS' core competencies

ü Gives NTS major presence in very important Chicago region

l Second largest U.S. market for NTS' testing/engineering services

ü Plan to expand facilities and resources

Recent Strategic Acquisitions - July 2011

14

ØPittsfield, MA-based Lightning Technologies

ü Engineering services/testing laboratory specializing in

lightning protection

lightning protection

ü Customer base, capabilities and services

l Aerospace, construction, wind power generation markets

l Complements current NTS’ capabilities

l Expands and strengthens NTS’ non-defense businesses

ü NTS currently only U.S. firm able to test/certify commercial

aircraft for all requirements of FAA’s specification DO160

aircraft for all requirements of FAA’s specification DO160

Recent Strategic Acquisitions - Sept 2011

15

ØSan Clemente, CA-based Garwood Laboratoties

ü Full-service product certification lab

ü Customer base, capabilities and services

l Commercial, military, space, medical

l Transportation, aviation

l Complements current NTS’ capabilities

l Expands and strengthens NTS’ non-defense businesses

ü Two Southern CA locations

l Expands footprint in very important Southern CA market

Recent Strategic Acquisitions - April 2012

P & L Highlights ($ in millions, except EPS)

Quarter Ended

Year-Ended

1/31/12

1/31/11

1/31/12

1/31/11

Net revenue (Up YOY 18.6%, 9.1%, respectively)

$

40.3

$

34.0

$

155.4

142.4

Gross profit as % of sales

24.2%

24.0%

24 .2%

27.4%

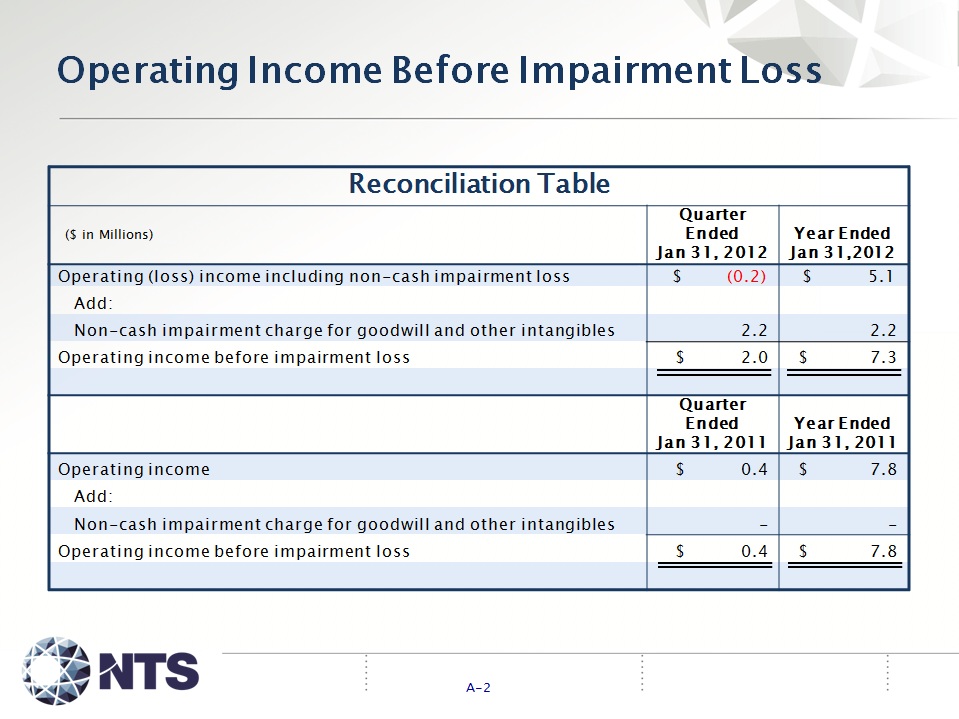

Operating income before impairment loss of

$2.2 million (Non-GAAP financial measure)

$2.2 million (Non-GAAP financial measure)

$

2.0

$

0.4

$

7.3

7.8

Income (loss) from continuing operations

$

(0.4)1

$

(0.3)

$

1.71

$

5.92

Net income (loss) attributable to NTS

$

(0.6)1

$

(0.3)

$

0.51

5.42

Net income (loss) per basic/fully diluted share

$

(0.05)1

$

(0.03)

$

0.041

$

0.512

Balance Sheet Highlights ($ in millions)

1/31/12

1/31/11

Cash and equivalents

$

7.7

$

11.7

Total assets

$

152.7

$

129.3

Working capital

$

30.9

$

31.1

Total debt

$

50.2

$

43.3

Stockholders’ equity

$

64.7

$

55.7

Financial Highlights -FY 2012 Q4 and Year

1Includes effect of non-cash, impairment charge for goodwill and other intangibles of $2.2 million, or $0.17 per diluted share.

2Includes one-time $1.7 million, or $0.16 per diluted share, net of tax gain from property sale

2Includes one-time $1.7 million, or $0.16 per diluted share, net of tax gain from property sale

16

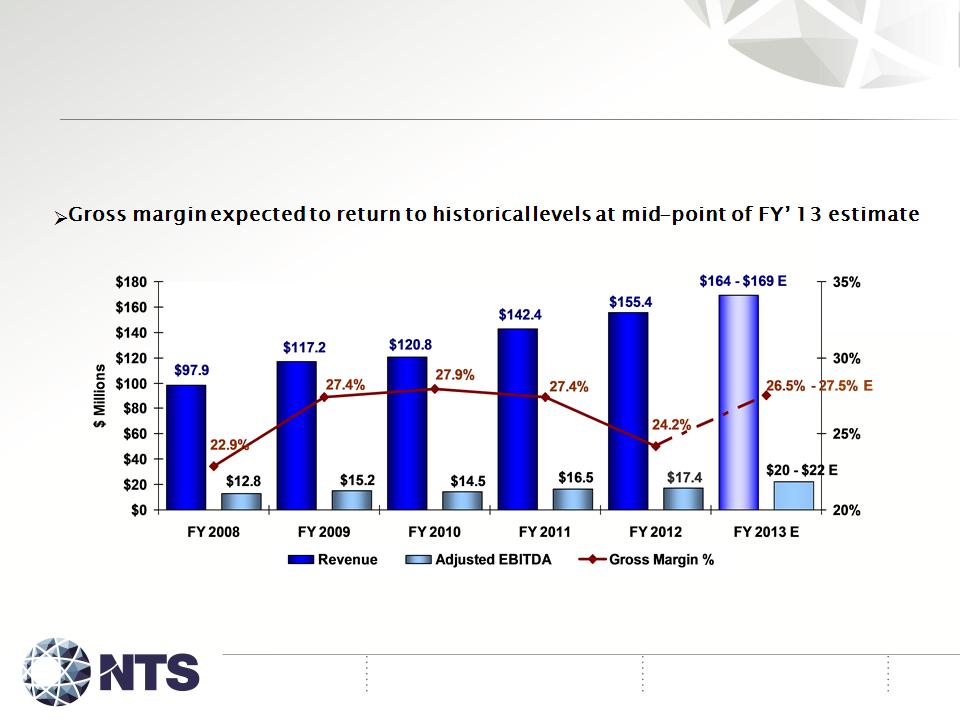

ØFY 2013

ü Revenues expected to increase to $164 million to $169 million

l Expected revenues do not include any FY 2013 acquisitions

ü Adjusted EBITDA3 expected to be between $20 million

and $22 million

and $22 million

ü Gross margin expected to be between 26.5 percent

and 27.5 percent

and 27.5 percent

ü SG&A as a percentage of sales expected to decline from FY 2012

l Acquisition and legal expense expected to be lower than in FY ‘12

ü Plan to update quarterly

Outlook

17

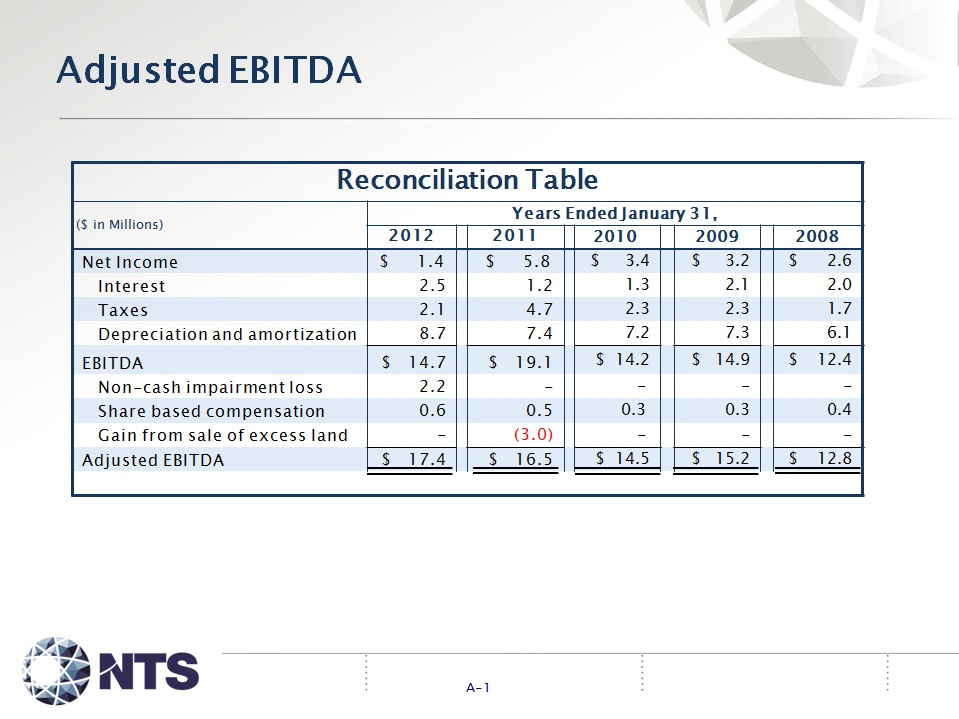

3Adjusted EBITDA, which is a Non-GAAP Measure, includes net income before interest, taxes, depreciation

and amortization, excluding share-based compensation, impairment loss, one-time gain on land sale

and amortization, excluding share-based compensation, impairment loss, one-time gain on land sale

Financial Highlights - FY ‘08 - Estimated FY ‘13

ØRevenues projected up ~69 % from FY’ 08 to mid-point of FY’ 13 estimate

ØAdj. EBITDA projected up ~64% from FY’ 08 to mid-point of FY’ 13 estimate

18

3Adjusted EBITDA, which is a Non-GAAP Measure, includes net income before interest, taxes,

depreciation and amortization, excluding share-based compensation, impairment loss, one-time gain on

land sale

depreciation and amortization, excluding share-based compensation, impairment loss, one-time gain on

land sale

3

19

Ø Largest independent, advanced technical testing services

company in U.S. with experienced/effective management team

company in U.S. with experienced/effective management team

Ø Strong competitive position with increasing market share

Ø Diversified base of 4,000+ customers; international presence

Ø Increasing trends towards outsourcing testing, registration,

engineering services driving market

engineering services driving market

Ø Acquisition opportunities to expand business

Ø Solid 5-year growth trends, positive outlook for FY 2013

Ø Committed to aggressively grow NTS until valuation metrics

improve substantially or strategic exit achieved

improve substantially or strategic exit achieved

Summary

20

Forward Looking Statements

The content of this presentation and statements made and/or answers given to questions

during this presentation that relate to future plans, events or performance are forward-looking

statements that involve risks and uncertainties, including risks associated with uncertainties

pertaining to customer orders, demand for services and products, development of markets for

NTS’ services and products, market growth and other risks identified in the Company’s SEC

filings. Actual results, events and performance may differ materially. Participants in this

presentation are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date hereof. NTS undertakes no obligation to release publicly the

result of any revisions to these forward-looking statements that may be made to reflect events

or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

during this presentation that relate to future plans, events or performance are forward-looking

statements that involve risks and uncertainties, including risks associated with uncertainties

pertaining to customer orders, demand for services and products, development of markets for

NTS’ services and products, market growth and other risks identified in the Company’s SEC

filings. Actual results, events and performance may differ materially. Participants in this

presentation are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date hereof. NTS undertakes no obligation to release publicly the

result of any revisions to these forward-looking statements that may be made to reflect events

or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

May 2012

This presentation includes Adjusted EBITDA and operating income before impairment

loss are non-GAAP financial measures. NTS management believes Adjusted EBITDA is

among the more important measures of performance in the Company’s industry because

it provides insight into operating cash flows independent of a company’s capital

structure or tax position and is a key factor in determining a company’s valuation.

Management also believes Adjusted EBITDA provides a meaningful trend of operating

performance, as well as a measure of liquidity and NTS’ ability to service debt. Adjusted

EBITDA and operating income before impairment loss should not be construed as

substitutes for net income (loss) (as determined in accordance with GAAP) for the

purpose of analyzing the Company’s operating performance or financial position. (Note:

See Appendix for Reconciliation Tables)

loss are non-GAAP financial measures. NTS management believes Adjusted EBITDA is

among the more important measures of performance in the Company’s industry because

it provides insight into operating cash flows independent of a company’s capital

structure or tax position and is a key factor in determining a company’s valuation.

Management also believes Adjusted EBITDA provides a meaningful trend of operating

performance, as well as a measure of liquidity and NTS’ ability to service debt. Adjusted

EBITDA and operating income before impairment loss should not be construed as

substitutes for net income (loss) (as determined in accordance with GAAP) for the

purpose of analyzing the Company’s operating performance or financial position. (Note:

See Appendix for Reconciliation Tables)

1 & 3

Non-GAAP Measures

National Technical Systems, Inc.

(NASDAQ: NTSC)

(NASDAQ: NTSC)

May 2012

Meeting the Growing Demand From Industry and

Government for Skilled Engineering Solutions and Services

Government for Skilled Engineering Solutions and Services

13th Annual B. Riley & Co. Investor Conference

Santa Monica, CA

Appendix

Reconciliation Tables