Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AXESSTEL INC | d356441d8k.htm |

| EX-99.1 - PRESS RELEASE - AXESSTEL INC | d356441dex991.htm |

Exhibit 99.2

Axesstel, Inc.

AXST

13

Annual B. Riley & Co. Investor Conference

May 21

, 2012

th

st

©

2012 Axesstel, Inc. |

2

Safe Harbor Statement

©

2012 Axesstel, Inc.

This

presentation

contains

forward

looking

statements.

These

statements

relate

to

future

events

or

our

future

financial

performance

and

involve

known

and

unknown

risks,

uncertainties

and

other

factors

that

may

cause

our

actual

results,

levels

of

activity,

performance

or

achievements

to

differ

materially

from

any

future

results,

levels

of

activity,

performance

or

achievements

expressed

or

implied

by

these

forward-looking

statements.

You

can

identify

forward-looking

statements

by

terminology

such

as

“may,”

“will,”

“should,”

“expects,”

“intends,”

“plans,”

“anticipates,”

“believes,”

“estimates,”

“predicts,”

“potential,”

“continues”

or

the

negative

of

these

terms

or

other

comparable

terminology.

These

risks

and

other

factors

include

those

listed

under

“Risk

Factors”

and

elsewhere

in

the

company's

prospectus.

Although

we

believe

that

the

expectations

reflected

in

the

forward-looking

statements

are

reasonable,

we

cannot

guarantee

future

results,

levels

of

activity,

performance

or

achievements.

You

should

not

place

undue

reliance

on

any

forward-looking

statements

that

reflect

our

management’s

view

only

as

of

the

date

of

this

presentation

and

prospectus.

We

will

not

update

any

forward-looking

statements

to

reflect

events

or

circumstances

that

occur

after

the

date

on

which

such

statement

is

made. |

©

2012 Axesstel, Inc.

3

Providing fixed wireless voice and broadband access

solutions for the worldwide telecommunications market

Axesstel At A Glance

•

Quoted as AXST on the OTC Markets’

OTCQB

•

Founded in 2000 –

In business 12 years

•

Completed business transition in mid-2011 |

©

2012 Axesstel, Inc.

4

Voice and Data Cord Cutting Pure Play

“Cutting the Cord” |

©

2012 Axesstel, Inc.

AXST Transformed!

5

•

Spent

past

two

years

transforming

the

company

–

completed

in

mid-

2011

•

Reorganized company to cut OpEx from $23-$26M in 2007/2008 to

$10M in 2011

•

Repositioned ODM & manufacturing to China

•

Launched key new products including:

•

Reported three consecutive profitable quarters: 3Q11, 4Q11 & 1Q12

•

Expect to achieve consistent quarterly profitability and year-over-year

revenue growth in 2012

Wire-line replacement terminals into the US markets (Sprint &

Verizon) MV600 series gateway product into Europe featuring 4G data speeds

and VoIP voice application

HSPA gateway devices into MEA |

©

2012 Axesstel, Inc.

Product Portfolio

6

3G & 4G Gateways

Wire-line Replacement

Terminals

Fixed Wireless

Phones |

7

•

Only company focused exclusively on cord cutting opportunity

–

Focused on both voice and data products

–

Overall growth trend moving toward wireless solutions and fixed wire-line

networks will become less profitable as more people cut the cord

–

Regulatory regime is moving in favor of wireless with many governments

removing requirements to offer fixed lines to everyone

•

Strong relationships with current customers

–

Customized products for specific customer needs

–

Majority of revenue comes from sole source customers

•

Barrier to entry: Testing and design process can take 3-15 months

•

Recognized leader in CDMA 450MHz telecom gateway products

–

Ideal for rural areas

–

Low frequency travels farther and lowers network investment to operators

Competitive Advantages

©

2012 Axesstel, Inc. |

©

2012 Axesstel, Inc.

Sprint Agreement

Sprint Phone Connect: Sole source supplier of voice terminal

•

Sprint’s “Cut the Cord”

initiative

•

$19.99/month unlimited local and long-distance service

Sprint Agreement

•

Began joint development in 2010

•

Began shipping in 3Q11

•

Initial rollout to Sprint store locations with further rollout planed

to “big box”

stores (Radio Shack, Best Buy)

•

Recognized $14.4M in 2011 revenue from Sprint

8

Sprint

®

Phone

Connect |

©

2012 Axesstel, Inc.

Tomorrow’s Opportunities

•

Delivering next generation wire-line replacement devices for Sprint in second

half of 2012 •

Continuing to roll-out our HSPA and EVDO gateway devices into MEA

•

Penetrating European market with 4G gateway product (EV-DO Rev B) and

leveraging our first in market combination of Rev. B gateway device with

VoIP (QoS) functionality for both voice and broadband data service

•

Commencing development and expect to launch in second half of 2012:

–

Specialized dual-mode (GSM & CDMA) gateway device for Europe market

–

Security alert device for North America market

9 |

©

2012 Axesstel, Inc.

Macro Themes/Long-Term Trends

•

450

MHz

expansion

into

Latin

America;

key

spectrum

auction

expected

in

June

for Brazil market

•

Continued expansion of wire-line replacement roll-out and migration to

“all-in” device with 4G data speeds, combining voice, data,

security and potential “smart-home”

applications

•

Roll out of security alert devices to US and European operators,

adding

diversification to existing product lines

•

Expansion of rural telecom operators to roll-out 3G and 4G technology

benefiting from Rural Broadband Stimulus Plan

•

Selective LTE opportunities for Tier 1 and Tier 2 USA operators

•

Selective fixed wireless phone opportunities

10 |

©

2012 Axesstel, Inc.

11

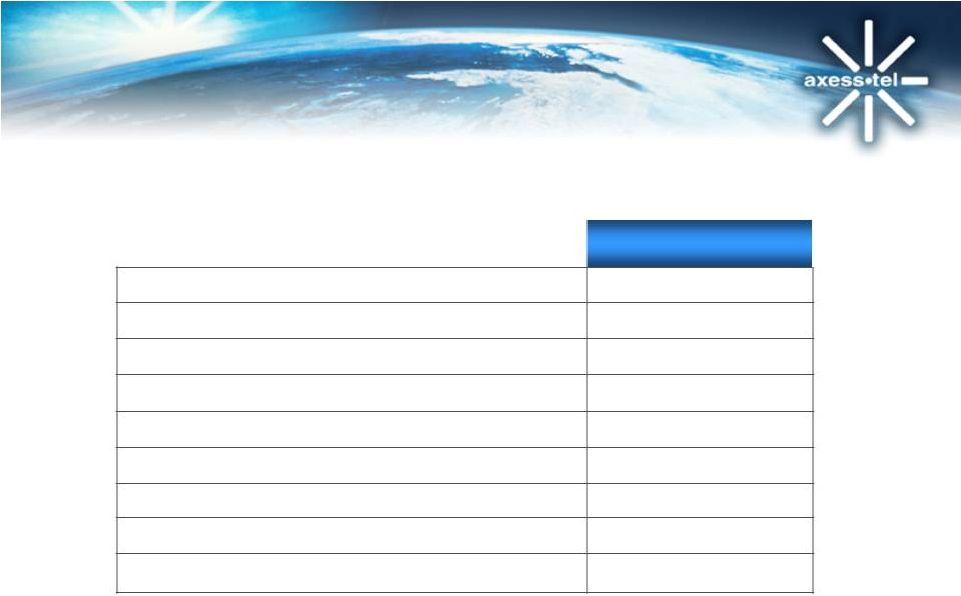

Year Ended

12/31/11

Year Ended

12/31/10

Year Ended

12/31/09

Year Ended

12/31/08

Revenues

$ 54.1

$

45.4

$ 50.8

$ 109.6

Gross profits

12.9

7.5

8.3

26.3 Gross

margins 24%

17%

16%

24%

Operating expense

10.3

12.6

17.1

23.1

Operating income

(loss)

2.6

(5.1)

(8.8)

3.2

Net income (loss)

1.1

(6.3)

(10.1)

1.4

EPS (loss)

$ 0.05

$ (0.27)

$ (0.43)

$ 0.06

Ave. diluted shares

23.7

23.6

23.4

23.6

Annual Operating Results

$ in millions |

©

2012 Axesstel, Inc.

12

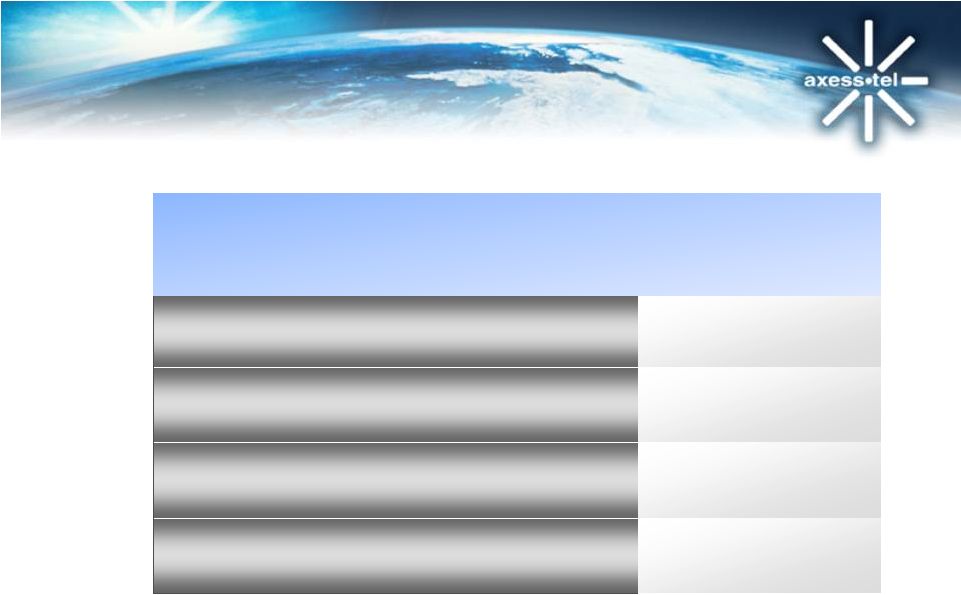

Quarter Ended

3/31/12

Quarter Ended

3/31/11

Revenues

$ 12.0

$ 12.6

Gross profits

3.2

2.5

Gross margins

26%

20%

Operating expense

2.3

2.8

Operating income

(loss)

0.9

(0.2)

Net income (loss)

0.5

(0.5)

EPS (loss)

$ 0.02

$ (0.02)

Ave. diluted shares

25.6

23.7

Quarterly Operating Results

$ in millions |

©

2012 Axesstel, Inc.

13

Balance Sheet Highlights

3/31/12

Cash and cash equivalents

$

1,941,000 Accounts

receivable $ 9,637,000

Total current assets

$ 12,855,000

Total assets

$ 13,019,000

Accounts payable

$ 12,757,000

Bank financings

$ 6,696,000

Total liabilities

$ 24,167,000

Stockholders

’

deficit

$

(11,148,000)

Total liabilities & stockholders’

deficit

$ 13,019,000 |

©

2012 Axesstel, Inc.

14

•

Delivered in support of Sprint Phone Connect launch in 2011, and

expect to release next generation of this product in 2012

•

Recognized leader in CDMA 450MHz telecom gateway products

•

Planned rollout of several new products in 2012

•

Successfully penetrated five key carriers, both domestically and

internationally with potential for additional key customers

Investor Highlights |

©

2012 Axesstel, Inc.

15

•

Major turnaround completed

•

Outstanding shares of 23.7M largely unchanged since 2008

•

Management has purchased 1M+ shares since May 2011

•

Significant operating leverage to grow EPS

–

Reduced OPEX from $23M (2008) to $10M (2011)

–

Expect to reduce cost of capital in 2012

•

Anticipate continuing profitability and year-over-year revenue growth

•

Our Goal: return to a $100+ million revenue company

Committed To The Future |

©

2012 Axesstel, Inc.

16

Target Model

Revenues

$100.0

Gross Margins as % of Revenue

Low to mid-

20% range

Operating Expenses as % of Revenue

10%-11%

Operating Income

$10.0+

Target Operating Model

$ in millions |

©

2012 Axesstel, Inc.

17

Thank You |