Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ShengdaTech, Inc. | v313820_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - ShengdaTech, Inc. | v313820_ex99-1.htm |

| EX-99.3 - EXHIBIT 99.3 - ShengdaTech, Inc. | v313820_ex99-3.htm |

| KEITH J. SHAPIRO, ESQ. | BOB L. OLSON, Esq. |

| Illinois Bar No. 6184374 | Nevada Bar No. 3783 |

| NANCY A. PETERMAN, ESQ. | GREENBERG TRAURIG, LLP |

| Illinois Bar No. 6208120 | 3773 Howard Hughes Parkway, |

| GREENBERG TRAURIG, LLP | Suite 400 North |

| 77 West Wacker Drive, Suite 3100 | Las Vegas, Nevada 89169 |

| Chicago, Illinois 60601 | Telephone: 702-792-3773 |

| Telephone: 312-456-8400 | Facsimile: 702-792-9002 |

| Facsimile: 312-456-8435 | Email: olsonb@gtlaw.com |

| Email: shapirok@gtlaw.com | |

| Email: petermann@gtlaw.com | |

| Counsel for Debtor and Debtor-in-Possession |

UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF NEVADA

| In re: | Case No. BK-11-52649-BTB |

| SHENGDATECH, INC., | Chapter 11 |

| Debtor. | |

DISCLOSURE STATEMENT FOR

THE CHAPTER 11 PLAN OF REORGANIZATION

May 16, 2012

THIS DISCLOSURE STATEMENT HAS NOT BEEN APPROVED BY THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF NEVADA UNDER SECTION 1125(b) OF THE BANKRUPTCY CODE FOR USE IN THE SOLICITATION OF ACCEPTANCES OF THE PLAN DESCRIBED HEREIN. ACCORDINGLY, THE FILING AND DISTRIBUTION OF THIS DISCLOSURE STATEMENT IS NOT INTENDED, AND SHOULD NOT BE CONSTRUED, AS A SOLICITATION OF ACCEPTANCES OF SUCH PLAN. THE INFORMATION CONTAINED HEREIN SHOULD NOT BE RELIED UPON FOR ANY PURPOSE BEFORE A DETERMINATION BY THE BANKRUPTCY COURT THAT THIS DISCLOSURE STATEMENT CONTAINS “ADEQUATE INFORMATION” WITHIN THE MEANING OF SECTION 1125(a) OF THE BANKRUPTCY CODE.1

1 Legend to be removed upon entry of Order of the Bankruptcy Court approving this Disclosure Statement.

IMPORTANT DATES

| • | Date and time by which Ballots must be received: [August 16, 2012 at 5:00 p.m. (prevailing Pacific Time)] |

| • | Date and time by which objections to Confirmation of the Plan must be Filed and served: [August 16, 2012 at 4:00 p.m. (prevailing Pacific Time)] |

| • | Hearing on Confirmation of the Plan: [August 30, 2012, at 10:00 a.m. (prevailing Pacific Time)] |

| • | Voting Record Date: [April 3, 2012] |

| • | Date and time by which Claims Estimation Motions must be Filed: [August 2, 2012 at 4:00 p.m. (prevailing Pacific Time)] |

DISCLAIMER

THE INFORMATION SET FORTH IN THIS DISCLOSURE STATEMENT IS INCLUDED FOR PURPOSES OF SOLICITING ACCEPTANCES OF THE CHAPTER 11 PLAN OF REORGANIZATION FILED BY THE DEBTOR AND MAY NOT BE RELIED UPON FOR ANY PURPOSE OTHER THAN TO DETERMINE HOW TO VOTE ON THE PLAN. NO PERSON MAY GIVE ANY INFORMATION OR MAKE ANY REPRESENTATIONS, OTHER THAN THE INFORMATION AND REPRESENTATIONS CONTAINED IN THIS DISCLOSURE STATEMENT, REGARDING THE PLAN OR THE SOLICITATION OF ACCEPTANCES OF THE PLAN.

ALL CREDITORS AND INTEREST HOLDERS ARE ADVISED AND ENCOURAGED TO READ THIS DISCLOSURE STATEMENT AND THE PLAN IN THEIR ENTIRETY BEFORE VOTING TO ACCEPT OR REJECT THE PLAN. PLAN SUMMARIES AND STATEMENTS MADE IN THIS DISCLOSURE STATEMENT WITH RESPECT TO THE PLAN ARE QUALIFIED IN THEIR ENTIRETY BY REFERENCE TO THE PLAN, THE EXHIBITS ANNEXED TO THE PLAN AND ANY OTHER PLAN DOCUMENTS. THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE MADE ONLY AS OF THE DATE HEREOF, AND THERE CAN BE NO ASSURANCE THAT (A) THE STATEMENTS CONTAINED HEREIN WILL BE CORRECT AT ANY TIME AFTER THE DATE HEREOF, OR (B) THIS DISCLOSURE STATEMENT CONTAINS ALL MATERIAL INFORMATION.

THIS DISCLOSURE STATEMENT HAS BEEN PREPARED IN ACCORDANCE WITH SECTION 1125 OF THE BANKRUPTCY CODE AND RULE 3016 OF THE FEDERAL RULES OF BANKRUPTCY PROCEDURE AND NOT IN ACCORDANCE WITH FEDERAL OR STATE SECURITIES LAWS OR OTHER NON-BANKRUPTCY LAWS. THIS DISCLOSURE STATEMENT HAS NEITHER BEEN APPROVED NOR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”), AND THE SEC HAS NOT PASSED UPON THE ACCURACY OR ADEQUACY OF THE STATEMENTS CONTAINED HEREIN. THIS DISCLOSURE STATEMENT WAS PREPARED TO PROVIDE HOLDERS OF CLAIMS AGAINST AND INTERESTS IN THE DEBTOR WITH “ADEQUATE INFORMATION” WITHIN THE MEANING OF THE BANKRUPTCY CODE, SO THAT THEY CAN MAKE AN INFORMED JUDGMENT ABOUT THE PLAN. PERSONS OR ENTITIES TRADING IN OR OTHERWISE PURCHASING, SELLING OR TRANSFERRING SECURITIES OR CLAIMS OF THE DEBTOR SHOULD NOT RELY UPON THIS DISCLOSURE STATEMENT FOR SUCH PURPOSES AND SHOULD EVALUATE THIS DISCLOSURE STATEMENT AND THE PLAN IN LIGHT OF THE PURPOSES FOR WHICH THEY WERE PREPARED.

NOTHING CONTAINED IN THE DISCLOSURE STATEMENT CONSTITUTES AN ADMISSION OR ACKNOWLEDGMENT THAT ANY CLAIMS OR INTERESTS DESCRIBED AND IDENTIFIED IN THE DISCLOSURE STATEMENT ARE VALID, ENFORCEABLE, ALLOWABLE, OR NOT SUBJECT TO DISPUTES, COUNTERCLAIMS OR SETOFFS.

THIS DISCLOSURE STATEMENT SHALL NOT CONSTITUTE OR BE CONSTRUED AS AN ADMISSION OF ANY FACT OR LIABILITY, STIPULATION OR WAIVER, BUT, RATHER, AS A STATEMENT MADE IN SETTLEMENT NEGOTIATIONS. THIS DISCLOSURE STATEMENT SHALL NOT BE ADMISSIBLE IN ANY NON-BANKRUPTCY PROCEEDING NOR SHALL IT BE CONSTRUED TO CONSTITUTE ADVICE ON THE TAX, SECURITIES OR OTHER LEGAL EFFECTS OF THE PLAN AS IT RELATES TO HOLDERS OF CLAIMS AGAINST OR INTERESTS IN THE DEBTOR. PARTIES SHOULD CONSULT WITH THEIR OWN COUNSEL, ACCOUNTANTS, AND/OR TAX ADVISORS WITH RESPECT TO THE LEGAL EFFECTS AND OTHER CONSEQUENCES OF THE PLAN.

| ii |

THE DEBTOR AND THE LIQUIDATING TRUSTEE RESERVE THE RIGHT TO OBJECT TO THE AMOUNT OR CLASSIFICATION OF ANY CLAIM OR INTEREST.

THE ESTIMATES SET FORTH IN THIS DISCLOSURE STATEMENT CANNOT BE RELIED ON BY ANY CREDITOR OR INTEREST HOLDER WHOSE CLAIM OR INTEREST IS SUBJECT TO AN OBJECTION. A CLAIM HOLDER OR EQUITY INTEREST HOLDER WHOSE CLAIM OR EQUITY INTEREST IS SUBJECT TO AN OBJECTION MAY NOT RECEIVE THE SPECIFIED SHARE OF THE ESTIMATED DISTRIBUTIONS DESCRIBED IN THIS DISCLOSURE STATEMENT.

| iii |

TABLE OF CONTENTS

| Page | |||||

| I. | INTRODUCTION | - 1 - | |||

| A. | Disclosure Statement Exhibits | - 2 - | |||

| B. | Only Impaired Classes Receiving a Distribution Vote | - 2 - | |||

| C. | Voting Procedures | - 3 - | |||

| D. | Confirmation Hearing | - 4 - | |||

| II. | OVERVIEW OF THE PLAN | - 4 - | |||

| A. | Summary of Treatment of Claims and Equity Interests Under the Plan | - 4 - | |||

| III. | GENERAL INFORMATION CONCERNING THE DEBTOR | - 9 - | |||

| A. | Overview of the Debtor and Its Business Operations | - 9 - | |||

| 1. | Generally | - 9 - | |||

| 2. | Corporate Structure | - 9 - | |||

| 3. | Management and Board of Directors | - 10 - | |||

| (a) | The Debtor | - 10 - | |||

| (b) | Faith Bloom | - 10 - | |||

| B. | The Debtor’s Capital and Debt Structure | - 10 - | |||

| 1. | Prepetition Unsecured Debt | - 10 - | |||

| 2. | Equity Interests | - 11 - | |||

| C. | The Debtor’s Assets | - 11 - | |||

| D. | Events Leading up to the Chapter 11 Filing | - 11 - | |||

| 1. | The March 2011 Report from KPMG, the Formation of the Special Committee, and the Resulting Investigation Into the Debtor’s Affairs | - 11 - | |||

| 2. | Debtor’s Payment Obligations Under the Notes and Litigation Filed Against the Debtor | - 14 - | |||

| 3. | Subsequent Findings From the Special Committee’s Investigation Into the Debtor’s Financial Condition and Business Operations | - 15 - | |||

| 4. | The Debtor Was Subject to the Shareholder Litigation | - 15 - | |||

| (a) | Turner v. ShengaTech, Inc. et al., Case No. 11-CV-1918 (S.D.N.Y. 2011) | - 15 - | |||

| (b) | Marlon Fund SICAV plc v. ShengaTech, Inc. et al., Case No. 11-CV-1996 (S.D.N.Y. 2011) | - 15 - | |||

| (c) | Mathes v. ShengaTech, Inc. et al., Case No. 11-CV-2064 (S.D.N.Y. 2011) | - 16 - | |||

| (d) | Yaw v. ShengaTech, Inc. et al., Case No. 11-CV-3325 (S.D.N.Y. 2011) | - 16 - | |||

| (e) | McDermott v. ShengaTech, Inc. et al., Case No. 11-CV-02557-GHK-CW (C.D. Cal. 2011) | - 16 - | |||

| (f) | Corwin v. ShengaTech, Inc. et al., Case No. 11-CV-2457 (S.D.N.Y. 2011) | - 16 - | |||

| (g) | Schweiger v. Xiangzhi Chen et al., Case No. A-11-639644-B (Clark County, Nev. 2011) | - 17 - | |||

| (h) | Komsky v. Xiangzhi Chen et al., Case No. A-11-640249-B (Clark County, Nev. 2011) | - 17 - | |||

| (i) | Johnson v. Xiangzhi Chen et al., Case No. 2:11-CV-01250 (D. Nev. 2011) | - 17 - | |||

| iv |

| E. | The Debtor’s Decision to File for Chapter 11 Protection | - 17 - | |||

| IV. | EVENTS DURING THE CHAPTER 11 CASE | - 18 - | |||

| A. | Litigation in the PRC and Related Asset Matters | - 18 - | |||

| 1. | Shaanxi Haize | - 18 - | |||

| (a) | Litigation | - 18 - | |||

| (b) | Related Assets | - 19 - | |||

| 2. | Anhui Yuanzhong | - 19 - | |||

| (a) | Litigation | - 19 - | |||

| (b) | Related Assets | - 20 - | |||

| 3. | Shandong Haize | - 20 - | |||

| 4. | Shandong Bangsheng | - 20 - | |||

| 5. | Zibo Jiaze | - 21 - | |||

| (a) | Litigation | - 21 - | |||

| (b) | Related Assets | - 21 - | |||

| B. | Continuation of Business After the Petition Date | - 21 - | |||

| 1. | First and Second Day Motions | - 21 - | |||

| (a) | CRO Appointment Motion | - 21 - | |||

| (b) | Extension Motion for Schedules | - 22 - | |||

| (c) | Bank Account Motion | - 22 - | |||

| (d) | Authorized Representatives Motion | - 22 - | |||

| (e) | Director Agreements Motion | - 22 - | |||

| (f) | Insurance Motion | - 22 - | |||

| 2. | The Preliminary Injunction Proceedings | - 23 - | |||

| 3. | Professional Retention. | - 24 - | |||

| (a) | Debtor’s Professionals | - 24 - | |||

| (b) | Special Committee Professionals | - 24 - | |||

| (c) | Committee | - 25 - | |||

| (d) | Interim Compensation Procedures | - 25 - | |||

| 4. | Retained Companies. | - 25 - | |||

| 5. | Bank Account Stay Relief Motion. | - 26 - | |||

| C. | The Debtor’s Schedules and SOFAs | - 26 - | |||

| D. | Rule 2015.3 Motion. | - 27 - | |||

| E. | Exclusivity Motions | - 27 - | |||

| F. | Insurance Stay Motion | - 27 - | |||

| G. | The Shareholder Litigation | - 27 - | |||

| H. | Postpetition Efforts to Secure and Recover the Debtor’s Assets and Control of the Debtor’s Subsidiaries | - 28 - | |||

| 1. | Special Committee Investigation | - 28 - | |||

| 2. | Faith Bloom Bank Accounts | - 28 - | |||

| 3. | Efforts to Gain Access to the Bank Records of the PRC Subsidiaries. | - 28 - | |||

| (a) | Bank Account Discovery Motion | - 28 - | |||

| (b) | Motion to Compel Enforcement of the Subpoenas | - 29 - | |||

| 4. | The HB&M Discovery Motion | - 29 - | |||

| 5. | Third-Party Litigation | - 30 - | |||

| I. | SEC Investigation | - 30 - | |||

| J. | Committee Letter | - 31 - | |||

| K. | The Bar Dates | - 31 - | |||

| v |

| L. | Stipulation Regarding General Unsecured Claims. | - 31 - | |||

| V. | SUMMARY OF THE PLAN OF REORGANIZATION | - 31 - | |||

| A. | Overview of Chapter 11 | - 32 - | |||

| B. | Plan Objectives | - 32 - | |||

| C. | Overall Structure of the Plan | - 33 - | |||

| D. | Classification and Allowance of Claims and Equity Interests Generally | - 33 - | |||

| E. | Treatment of Unclassified Claims Under the Plan | - 34 - | |||

| 1. | Administrative Claims | - 34 - | |||

| (a) | Bar Date for Administrative Claims | - 34 - | |||

| (b) | Bar Date for Applications for Professional Fees | - 35 - | |||

| 2. | U.S. Trustee Fees | - 35 - | |||

| 3. | Priority Tax Claims | - 35 - | |||

| F. | Treatment of Classified Claims and Equity Interests Under the Plan | - 35 - | |||

| 1. | Class 1: Other Priority Claims | - 36 - | |||

| 2. | Class 2: Secured Claims | - 36 - | |||

| 3. | Class 3: General Unsecured Claims | - 36 - | |||

| 4. | Class 4: Noteholders’ Securities Claims | - 37 - | |||

| 5. | Class 5: Shareholders’ Securities Claims | - 37 - | |||

| 6. | Class 6: Equity Interests | - 37 - | |||

| G. | Miscellaneous Provisions | - 38 - | |||

| 1. | Reservation of Rights Regarding Claims and Equity Interests | - 38 - | |||

| 2. | Confirmation Pursuant to Section 1129(b) of the Bankruptcy Code | - 38 - | |||

| 3. | Controversy Concerning Impairment | - 38 - | |||

| H. | Means of Implementing the Plan | - 38 - | |||

| 1. | Funding of Plan | - 38 - | |||

| 2. | Liquidating Trust | - 39 - | |||

| (a) | Appointment of the Liquidating Trustee | - 39 - | |||

| (b) | Liquidating Trust Advisory Board | - 39 - | |||

| (c) | Establishment of a Liquidating Trust | - 39 - | |||

| (d) | Liquidating Trust Assets | - 40 - | |||

| (e) | Treatment of Liquidating Trust for Federal Income Tax Purposes; No Successor in-Interest | - 40 - | |||

| (f) | Responsibilities of Liquidating Trustee; Litigation | - 41 - | |||

| (g) | Expenses of Liquidating Trustee | - 42 - | |||

| (h) | Bonding of Liquidating Trustee | - 42 - | |||

| (i) | Fiduciary Duties of the Liquidating Trustee | - 42 - | |||

| (j) | Dissolution of the Liquidating Trust | - 42 - | |||

| (k) | Liability, Indemnification of the Liquidating Trust Protected Parties | - 43 - | |||

| (l) | Full and Final Satisfaction against Liquidating Trust | - 43 - | |||

| 3. | Resolution of D&O Policies | - 43 - | |||

| 4. | Cancellation of Instruments and Stock | - 43 - | |||

| 5. | Operating Reports | - 44 - | |||

| 6. | Post-Confirmation Professional Fees and Expenses | - 44 - | |||

| 7. | Disposition of Books and Records | - 44 - | |||

| 8. | Corporate Action | - 45 - | |||

| 9. | Dissolution of Debtor | - 45 - | |||

| I. | Reserves and Distributions | - 45 - | |||

| 1. | Establishment of Reserves | - 45 - | |||

| vi |

| 2. | Funding of Reserves | - 46 - | |||

| 3. | Disbursing Agent | - 47 - | |||

| 4. | Distributions by Liquidating Trustee | - 47 - | |||

| 5. | Distributions on Account of Allowed Shareholders’ Securities Claims and Allowed Equity Interests | - 47 - | |||

| 6. | Timing of Distributions | - 47 - | |||

| 7. | Distributions Upon Allowance of Disputed Claims and Disputed Equity Interests | - 49 - | |||

| 8. | Undeliverable and Unclaimed Distributions | - 49 - | |||

| (a) | Holding Undeliverable and Unclaimed Distributions | - 49 - | |||

| (b) | After Distributions Become Deliverable | - 49 - | |||

| (c) | Failure to Claim Unclaimed/Undeliverable Distributions | - 49 - | |||

| (d) | Charitable Contributions | - 50 - | |||

| 9. | Interest | - 50 - | |||

| 10. | No Distribution in Excess of Allowed Amount of Claim | - 50 - | |||

| 11. | Means of Cash Payment | - 50 - | |||

| 12. | Delivery of Distribution | - 50 - | |||

| 13. | Record Date for Distributions | - 50 - | |||

| 14. | No Distributions Pending Allowance | - 51 - | |||

| 15. | Withholding and Reporting Requirements | - 51 - | |||

| 16. | Setoffs | - 51 - | |||

| 17. | De Minimis Distributions | - 51 - | |||

| 18. | Extensions of Time | - 51 - | |||

| J. | Provisions for Claims Objections and Estimation of Claims | - 52 - | |||

| 1. | Claims Objection Deadline; Prosecution of Claims Objections | - 52 - | |||

| 2. | Estimation of Claims | - 52 - | |||

| VI. | EXECUTORY CONTRACTS AND UNEXPIRED LEASES | - 52 - | |||

| A. | Executory Contracts and Unexpired Leases Deemed Rejected | - 52 - | |||

| B. | Bar Date for Rejection Damages | - 53 - | |||

| VII. | CONFIRMATION AND CONSUMMATION OF THE PLAN | - 53 - | |||

| A. | Conditions Precedent to the Effective Date | - 53 - | |||

| B. | Notice of Effective Date | - 53 - | |||

| C. | Waiver of Conditions Precedent to the Effective Date | - 53 - | |||

| D. | Effect of Non-Occurrence of Effective Date | - 54 - | |||

| VIII. | EFFECTS OF CONFIRMATION OF THE PLAN | - 54 - | |||

| A. | Exculpation and Releases | - 54 - | |||

| 1. | Exculpation and Limitation of Liability | - 54 - | |||

| 2. | Releases by the Debtor | - 55 - | |||

| 3. | Releases by Holders of Claims and Equity Interests | - 56 - | |||

| 4. | Parties Excepted from Releases | - 57 - | |||

| 5. | Zurich Settlement | - 57 - | |||

| 6. | Injunction Related to Exculpation and Releases | - 57 - | |||

| 7. | Summary of Release Provisions | - 58 - | |||

| B. | Injunction | - 58 - | |||

| C. | Term of Bankruptcy Injunction or Stays | - 59 - | |||

| D. | Vesting Provision | - 59 - | |||

| vii |

| IX. | MISCELLANEOUS PLAN PROVISIONS | - 59 - | ||||

| A. | Exclusive Jurisdiction of Bankruptcy Court | - 59 - | ||||

| B. | Modification of the Plan | - 61 - | ||||

| C. | Revocation, Withdrawal, or Non-Confirmation of the Plan | - 61 - | ||||

| D. | Binding Effect | - 62 - | ||||

| E. | Subordination Rights | - 62 - | ||||

| F. | Severability of Plan Provisions | - 62 - | ||||

| G. | Payment of Fees and Expenses of the Indenture Trustee. | - 62 - | ||||

| H. | Dissolution of the Committee | - 63 - | ||||

| I. | Exemption from Section 1146 | - 63 - | ||||

| J. | Filing of Additional Documents | - 63 - | ||||

| K. | Insurance | - 63 - | ||||

| L. | Successors and Assigns | - 64 - | ||||

| M. | Governing Law | - 64 - | ||||

| N. | Exhibits and Schedules | - 64 - | ||||

| O. | Computation of Time | - 64 - | ||||

| P. | Notices | - 64 - | ||||

| X. | GENERAL INFORMATION ON VOTING AND CONFIRMATION PROCEDURE | - 65 - | ||||

| A. | Purpose of Disclosure Statement | - 65 - | ||||

| B. | Voting On the Plan | - 65 - | ||||

| C. | Voting Record Date | - 66 - | ||||

| 1. | Who May Vote | - 66 - | ||||

| 2. | Eligibility | - 67 - | ||||

| 3. | Binding Effect | - 67 - | ||||

| D. | Procedure/Voting Deadlines | - 67 - | ||||

| E. | Plan Confirmation Process | - 68 - | ||||

| 1. | Requirements | - 68 - | ||||

| (a) | Acceptance by All Impaired Classes | - 69 - | ||||

| (b) | Feasibility | - 69 - | ||||

| (c) | “Best Interests” Test | - 69 - | ||||

| (i) | Costs and Expenses of Liquidation | - 69 - | ||||

| (ii) | The Plan Meets the Best Interests Test | - 70 - | ||||

| (d) | “Cramdown” Provisions | - 71 - | ||||

| 2. | Confirmation Hearing | - 71 - | ||||

| 3. | Objections to Confirmation | - 71 - | ||||

| XI. | RISK FACTORS | - 73 - | ||||

| A. | Bankruptcy Factors | - 73 - | ||||

| 1. | Classifications of Claims and Equity Interests | - 73 - | ||||

| 2. | Non-Occurrence of the Effective Date | - 73 - | ||||

| 3. | Failure to Receive Requisite Accepting Votes | - 73 - | ||||

| 4. | Failure to Confirm the Plan | - 74 - | ||||

| 5. | Uncertainty Relating to the Value the Debtor’s Assets | - 74 - | ||||

| 6. | Risk of Additional or Larger Claims | - 75 - | ||||

| 7. | Risk of Not Regaining Control of the PRC Subsidiaries | - 75 - | ||||

| 8. | Alternative Chapter 11 Plan | - 75 - | ||||

| viii |

| XII. | CERTAIN FEDERAL INCOME TAX CONSEQUENCES | - 75 - | ||

| A. | Certain U.S. Federal Income Tax Consequences to the Debtor | - 77 - | ||

| B. | Certain U.S. Federal Income Tax Consequences to Holders of Allowed Claims or Equity Interests | - 77 - | ||

| 1. | Exchange of Allowed Claims and Allowed Equity Interests for Liquidating Trust Assets | - 77 - | ||

| 2. | Taxation of Interests in Liquidating Trust | - 79 - | ||

| C. | Importance of Obtaining Professional Tax Assistance | - 80 - | ||

| XIII. | ALTERNATIVES TO THE PLAN | - 80 - | ||

| A. | Liquidation under Chapter 7 | - 80 - | ||

| B. | Dismissal | - 80 - | ||

| XIV. | RECOMMENDATIONS | - 80 - | ||

| XV. | CONCLUSION | - 81 - | ||

| Exhibit A | The Plan |

| ix |

I. INTRODUCTION

ShengdaTech, Inc. (the “Debtor” or the “Company”), as debtor and debtor in possession in the above-captioned case (the “Chapter 11 Case”) has filed the Debtor’s Chapter 11 Plan of Reorganization (the “Plan”) with the United States Bankruptcy Court for the District of Nevada (the “Bankruptcy Court”). A copy of the Plan is annexed hereto as Exhibit A.

The Debtor hereby submits this disclosure statement, dated May 16, 2012 (the “Disclosure Statement”), pursuant to the Bankruptcy Code in connection with the solicitation of acceptances on the Plan from certain Holders of Claims against the Debtor.

The purpose of this Disclosure Statement is to set forth information (a) regarding the Debtor’s history, its business and the Chapter 11 Case, (b) concerning the Plan and alternatives to the Plan, (c) advising the Holders of Claims against and Equity Interests in the Debtor of their rights under the Plan, (d) assisting the Holders of Claims against and Equity Interests in the Debtor in making an informed judgment regarding whether they should vote to accept or reject the Plan and (e) assisting the Bankruptcy Court in determining whether the Plan complies with the provisions of chapter 11 of the Bankruptcy Code and should be confirmed.

Following a hearing held on [June 25, 2012], this Disclosure Statement was approved by the Bankruptcy Court as containing “adequate information” in accordance with section 1125 of the Bankruptcy Code. Pursuant to section 1125(a)(1) of the Bankruptcy Code, “adequate information” is defined as “information of a kind, and in sufficient detail, as far as is reasonably practicable in light of the nature and the history of the debtor and the condition of the debtor’s books and records, that would enable a hypothetical reasonable investor typical of holders of claims or interests in the relevant class to make an informed judgment about the plan.” NO STATEMENTS OR INFORMATION CONCERNING THE PLAN AND THE TRANSACTIONS CONTEMPLATED THEREBY HAVE BEEN AUTHORIZED, OTHER THAN THE STATEMENTS AND INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT AND THE INFORMATION ACCOMPANYING THIS DISCLOSURE STATEMENT.

APPROVAL OF THIS DISCLOSURE STATEMENT BY THE BANKRUPTCY COURT DOES NOT INDICATE THAT THE BANKRUPTCY COURT RECOMMENDS EITHER ACCEPTANCE OR REJECTION OF THE PLAN NOR DOES SUCH APPROVAL CONSTITUTE A DETERMINATION BY THE BANKRUPTCY COURT OF THE FAIRNESS OR MERITS OF THE PLAN.

THIS DISCLOSURE STATEMENT CONTAINS INFORMATION SUPPLEMENTARY TO THE PLAN AND IS NOT INTENDED TO TAKE THE PLACE OF THE PLAN. CREDITORS AND INTEREST HOLDERS ARE ADVISED TO STUDY THE PLAN CAREFULLY TO DETERMINE THE PLAN’S IMPACT ON THEIR CLAIMS OR INTERESTS. THE INFORMATION CONTAINED HEREIN HAS NOT BEEN SUBJECT TO A CERTIFIED AUDIT. ALTHOUGH GREAT EFFORT WAS TAKEN TO ENSURE THE ACCURACY OF THIS DISCLOSURE STATEMENT AND THE ACCOMPANYING PLAN, NEITHER THE DEBTOR NOR ITS RESPECTIVE PROFESSIONALS CAN WARRANT OR REPRESENT THAT THE INFORMATION CONTAINED HEREIN AND THEREIN IS WITHOUT INACCURACIES OR ERRORS.

This Disclosure Statement contains important information that may bear upon your decision to accept or reject the Plan. The Disclosure Statement also provides information regarding alternatives to the Plan. Each Holder of a Claim or Equity Interest should read this Disclosure Statement and the Plan in their entirety, including the conditions precedent to the Effective Date of the Plan contained in Article X of the Plan.

If you are a Holder of a Claim or Equity Interest that is entitled to vote to accept or reject the Plan, a ballot for the acceptance or rejection of the Plan (the “Ballot”) is enclosed herewith. After carefully reviewing these documents, please indicate your vote with respect to the Plan on the enclosed Ballot and return it as instructed below and on the Ballot.

The Debtor may supplement or amend this Disclosure Statement or any exhibits, schedules, and appendices attached hereto at any time prior to the hearing to approve this Disclosure Statement.

The information set forth herein is the product of the Debtor’s books and records, available at the time of preparing this Disclosure Statement. The Debtor only had access to information in the possession of A. Carl Mudd and Sheldon B. Saidman, two of the Debtor’s independent board members, Greenberg Traurig, LLP, the Debtor’s legal counsel and other third parties, including, without limitation, JPMorgan Chase which maintains the Debtor’s sole bank account, and various bank accounts of Faith Bloom (as defined below), over which the Debtor has obtained control. Although the Debtor has made reasonable efforts to ensure the accuracy and completeness of the information set forth herein, subsequent information or discovery may result in changes to this Disclosure Statement, particularly given the concerns surrounding accurate financial reporting by the Debtor’s prior management, as further discussed below.

UNLESS OTHERWISE DEFINED HEREIN, ALL CAPITALIZED TERMS CONTAINED IN THIS DISCLOSURE STATEMENT SHALL HAVE THE MEANINGS ASCRIBED TO THEM IN THE PLAN.

| A. | Disclosure Statement Exhibits |

The Plan is attached as “Exhibit A” to this Disclosure Statement.

| B. | Only Impaired Classes Receiving a Distribution Vote |

Pursuant to the provisions of the Bankruptcy Code, only classes of claims or interests that are “impaired” under a plan may vote to accept or reject such plan. Generally, a claim or interest is impaired under a plan if the holder’s legal, equitable, or contractual rights are changed under such plan. If the holders of claims or interests in an impaired class do not receive or retain any property under a plan on account of such claims or interests, such impaired class is deemed to have rejected such Plan under section 1126(g) of the Bankruptcy Code and therefore, such holders do not cast votes on such Plan. In addition, Classes of Claims that are “unimpaired” are deemed to have accepted the Plan and do not cast votes on the Plan.

Under the Plan, Holders of Claims in Classes 1 and 2 are Unimpaired and therefore deemed to accept the Plan. Holders of Claims in Classes 3, 4 and 5 and Holders of Equity Interests in Class 6 are Impaired and are entitled to vote on the Plan.

| - 2 - |

ACCORDINGLY, A BALLOT FOR ACCEPTANCE OR REJECTION OF THE PLAN IS BEING PROVIDED TO HOLDERS OF CLAIMS IN CLASSES 3, 4 AND 5 AND HOLDERS OF EQUITY INTERESTS IN CLASS 6.

Holders of Claims or

Equity Interests may obtain copies of the Plan Supplement that will be Filed with the Bankruptcy Court at least ten (10) days prior

to the Voting Deadline by: (a) accessing the website of the Debtor’s claims, noticing and balloting agent, GCG, Inc. (the

“Voting Agent”) at www.gcg.inc.com/cases/sdt; (b) requesting the Plan Supplement by e-mail to SDTteam@gcginc.com;

(c) calling the Voting Agent at (888) 624-6718; or (d) sending a request to the Voting Agent by (i) first-class mail at ShengdaTech

Inc., c/o GCG, Inc., P.O. Box 9811

Dublin, Ohio USA 43017-5711 or (ii) hand delivery, courier service or overnight mail at ShengdaTech Inc., c/o GCG, Inc., 5151 Blazer

Parkway, Suite A, Dublin, Ohio USA 43017.

For a summary of the treatment of each Class of Claims and Equity Interests, see section II of this Disclosure Statement, “Overview of the Plan” below.

| C. | Voting Procedures |

If you are entitled to vote to accept or reject the Plan, a Ballot for the acceptance or rejection of the Plan is enclosed for the purpose of voting on the Plan. If you hold Claims in more than one Class and you are entitled to vote Claims in more than one Class, you will receive separate Ballots that must be used to vote in each separate Class. Please vote and return your Ballot(s) to the Voting Agent at the addresses set forth below by

| (i) | first-class mail: |

ShengdaTech, Inc.

c/o GCG, Inc.

P.O. Box 9811

Dublin, Ohio USA 43017-5711

| (ii) | hand delivery, courier service or overnight mail: |

ShengdaTech Inc.

c/o GCG, Inc.

5151 Blazer Parkway

Suite A

Dublin, Ohio USA 43017.

TO BE COUNTED, YOUR BALLOT WITH ORIGINAL SIGNATURE INDICATING ACCEPTANCE OR REJECTION OF THE PLAN MUST BE RECEIVED BY THE CLAIMS AGENT NO LATER THAN 5:00 P.M. (PREVAILING PACIFIC TIME) ON [AUGUST 16, 2012] (the “Voting Deadline”).

If you are a Holder of a Claim entitled to vote on the Plan and you did not receive a Ballot, received a damaged Ballot or lost your Ballot, or if you have any questions concerning this Disclosure Statement, the Plan or the procedures for voting on the Plan, please contact the Voting Agent by e-mail at SDTteam@gcginc.com, by phone at (888) 624-6718, by first-class mail to ShengdaTech Inc., c/o GCG, Inc., P.O. Box 9811, Dublin, Ohio USA 43017-5711 or by hand delivery, courier service or overnight mail to ShengdaTech Inc., c/o GCG, Inc., 5151 Blazer Parkway, Suite A, Dublin, Ohio USA 43017.

| - 3 - |

| D. | Confirmation Hearing |

The Bankruptcy Court has scheduled a hearing to consider confirmation of the Plan for [August 30, 2012, at 10:00 a.m.] (prevailing Pacific Time) in the Bankruptcy Court, Reno, C. Clifton Young Federal Building, 300 Booth Street, Courtroom 2, Reno, Nevada 89509 (the “Confirmation Hearing”). The Bankruptcy Court has directed that objections, if any, to confirmation of the Plan be served and Filed on or before [August 16, 2012], at 4:00 p.m. (prevailing Pacific Time) (the “Confirmation Objection Deadline”) in the manner described in the Confirmation Hearing Notice accompanying this Disclosure Statement. The date of the Confirmation Hearing may be adjourned from time to time without further notice except for an in-court announcement at the Confirmation Hearing of the date and time as to which the Confirmation Hearing has been adjourned or an appropriate Filing on the Bankruptcy Court’s docket.

THE DEBTOR URGES ALL HOLDERS OF CLAIMS IN CLASSES 3, 4 AND 5 AND HOLDERS OF EQUITY INTERESTS IN CLASS 6 TO VOTE IN FAVOR OF THE PLAN. VOTING INSTRUCTIONS ARE DESCRIBED IN SECTION X(D) OF THIS DISCLOSURE STATEMENT.

The classification and treatment of Claims and Equity Interests under the Plan are described in detail below. Because the Plan provides the greatest likelihood of recovery to all Holders of Allowed Claims and Allowed Equity Interests in this Chapter 11 Case, the Debtor strongly encourages all Holders of Claims and Equity Interests entitled to vote on the Plan to vote to accept the Plan. The Official Committee of Unsecured Creditors (the “Committee”) has reviewed the Plan and urges all Holders of Claims to vote to accept the Plan.

II. OVERVIEW OF THE PLAN

THE FOLLOWING IS A BRIEF SUMMARY OF THE TREATMENT OF CLAIMS AND INTERESTS UNDER THE PLAN. THE DESCRIPTION OF THE PLAN SET FORTH BELOW CONSTITUTES A SUMMARY ONLY AND IS QUALIFIED, IN ITS ENTIRETY, BY THE PLAN, THE PLAN SUPPLEMENT, AND ANY OTHER PLAN DOCUMENTS. CREDITORS, INTEREST HOLDERS, AND OTHER PARTIES IN INTEREST ARE URGED TO REVIEW THE PLAN ITSELF, AND NOT TO RELY ON THE SUMMARY PROVIDED HEREIN. IN THE EVENT OF AN INCONSISTENCY BETWEEN THIS DISCLOSURE STATEMENT AND THE PLAN, THE PLAN SHALL CONTROL.

| A. | Summary of Treatment of Claims and Equity Interests Under the Plan |

The table below summarizes the classification and treatment of Claims and Equity Interests under the Plan. The table also sets forth the treatment of unclassified Claims.

The estimated recovery percentages set forth below have been calculated based upon a number of assumptions, including the estimated amount of Allowed Claims or Allowed Equity Interests in each Class. For the reasons discussed herein, it is difficult to determine the recovery percentages, if any, for Allowed Claims or Allowed Equity Interests because the value of the Debtor’s assets are speculative, contingent and/or otherwise unknown. For certain Classes of Claims or Equity Interests, the actual amounts of Allowed Claims or Allowed Equity Interests could materially exceed or could be materially less than the estimated amounts shown in the table below. Therefore, the actual Distributions may differ from the estimates set forth in the table below.

| - 4 - |

The Debtor has not yet fully reviewed and analyzed all Claims and Equity Interests. Estimated Claim or Equity Interest amounts set forth below are based upon Filed proofs of Claim, the schedules of assets and liabilities (the “Schedules”) and the statements of financial affairs (the “SOFAs”) and include estimates for a number of Claims that are Contingent, Disputed, and/or unliquidated.

Because the nature of the Debtor’s assets are contingent, difficult to valuate, and/or unknown, the actual recoveries for Classes 3, 4, 5 and 6 may differ from the recoveries estimated herein.

| Class | Estimated Aggregate Allowed Amount |

Treatment Pursuant to the Plan | Estimated Recovery | |||

| Unclassified: Administrative Claims | US$900,000.00 | Unimpaired. Within the time period provided in Article VII of the Plan, each Holder of an Allowed Administrative Claim shall receive in full and final satisfaction, settlement, and release of and in exchange for such Allowed Administrative Claim: (a) cash equal to the amount of such Allowed Administrative Claim; or (b) such other treatment as agreed to by the Holder of such Allowed Administrative Claim. | 100% | |||

| Unclassified: Priority Tax Claims | US$0.00 | Unimpaired. Each Holder of an Allowed Priority Tax Claim shall receive in full and final satisfaction, settlement, and release of and in exchange for such Allowed Priority Tax Claim: cash equal to the amount of such Allowed Priority Tax Claim; (i) on the later of the Effective Date or the date on which such Claim becomes Allowed, (ii) if after the Effective Date, then over a period not to exceed five (5) years from the Petition Date, together with interest at the rate required by the Bankruptcy Code, or (iii) such other treatment as agreed to by the Holder of such Allowed Priority Tax Claim. | 100% |

| - 5 - |

| Class | Estimated Aggregate Allowed Amount |

Treatment Pursuant to the Plan | Estimated Recovery | |||

| Class 1: Other Priority Claims | US$0.00 | Unimpaired. Within the time period provided in Article VII of the Plan, each Holder of an Allowed Class 1 Claim shall receive in full and final satisfaction, settlement, and release of and in exchange for such Allowed Class 1 Claim: (a) cash equal to the amount of such Allowed Class 1 Claim; or (b) such other treatment as agreed to by the Holder of such Allowed Class 1 Claim. | 100% | |||

| Class 2: Secured Claims | US$0.00 | Unimpaired. Within the time period provided in Article VII of the Plan, each Holder of an Allowed Class 2 Claim shall receive in full and final satisfaction settlement, and release of and in exchange for such Allowed Class 2 Claim: (a) one of the treatments specified in section 1124 of the Bankruptcy Code; or (b) such other treatment as agreed to by the Holder of such Allowed Class 2 Claim. | 100% | |||

| Class 3: General Unsecured Claims | US$173 million | Impaired. Each Holder of an Allowed Class 3 Claim shall receive in full and final satisfaction, settlement, and release of and in exchange for such Allowed Class 3 Claim its Pro Rata share of Liquidating Trust Assets remaining after payment in full in cash of all Allowed Administrative Claims, Allowed Priority Tax Claims, Allowed Other Priority Claims, Allowed Secured Claims and any expenses of the Liquidating Trust. | Unknown >1.0% |

| - 6 - |

| Class | Estimated Aggregate Allowed Amount |

Treatment Pursuant to the Plan | Estimated Recovery | |||

| Class 4: Noteholders’ Securities Claims | Unknown | Impaired. Each Holder of an Allowed Class 4 Claim shall receive in full and final satisfaction, settlement, and release of and in exchange for such Allowed Class 4 Claim its Pro Rata share of Liquidating Trust Assets remaining after payment in full in cash and/or other distributable property, as applicable, of all Allowed Administrative Claims, Allowed Priority Tax Claims, Allowed Other Priority Claims, Allowed Secured Claims, Allowed General Unsecured Claims and any expenses of the Liquidating Trust, provided, however, that no distributions shall be made on account of any Allowed Class 4 Claim that is duplicative of an Allowed Class 3 Claim. | Unknown 0.0% or greater | |||

| Class 5: Shareholders’ Securities Claims | Unknown | Impaired. Each Holder of an Allowed Class 5 Claim shall receive in full and final satisfaction, settlement, and release of and in exchange for such Allowed Class 5 Claim its Pro Rata share of Liquidating Trust Assets remaining after payment in full in cash and/or other distributable property, as applicable, of all Allowed Administrative Claims, Allowed Priority Tax Claims, Allowed Other Priority Claims, Allowed Secured Claims, Allowed General Unsecured Claims, Allowed Noteholders’ Securities Claims and any expenses of the Liquidating Trust and shall be treated pari passu with Allowed Class 6 Equity Interests. | Unknown 0.0% or greater |

| - 7 - |

| Class | Estimated Aggregate Allowed Amount |

Treatment Pursuant to the Plan | Estimated Recovery | |||

| Class 6: Equity Interests | Unknown | Impaired. Each Holder of an Allowed Class 6 Equity Interest shall receive in full and final satisfaction, settlement, and release of and in exchange for such Allowed Class 6 Equity Interest its Pro Rata share of Liquidating Trust Assets remaining after payment in full in cash and/or other distributable property, as applicable, of all Allowed Administrative Claims, Allowed Priority Tax Claims, Allowed Other Priority Claims, Allowed Secured Claims, Allowed General Unsecured Claims, Allowed Noteholders’ Securities Claims and any expenses of the Liquidating Trust shall be treated pari passu with Allowed Class 5 Claims, provided however, that on the Effective Date, all Class 6 Equity Interests shall be deemed canceled, extinguished and discharged and of no further force or effect and, in lieu thereof, such Holders of Class 6 Equity Interests shall receive beneficial interests in the Liquidating Trust. To the extent the Liquidating Trustee believes there is a reasonable probability that there will be assets available for distribution on account of Allowed Class 6 Equity Interests, the Liquidating Trustee may, in his sole discretion, set a deadline for the filing of proofs of Interest. | Unknown 0.0% or greater |

THE DEBTOR BELIEVES THAT THE PLAN BEST POSITIONS, UNDER THE UNIQUE CIRCUMSTANCES OF THIS CHAPTER 11 CASE, HOLDERS OF CLAIMS AGAINST AND INTERESTS IN THE DEBTOR TO ACHIEVE A RECOVERY AND THUS STRONGLY RECOMMEND THAT YOU VOTE TO ACCEPT THE PLAN.

NOTHING IN THE DISCLOSURE STATEMENT SHALL AFFECT RIGHTS AND DEFENSES, BOTH LEGAL AND EQUITABLE, OF THE DEBTOR, AND/OR THE LIQUIDATING TRUSTEE WITH RESPECT TO ANY CLAIMS OR EQUITY INTERESTS, INCLUDING, BUT NOT LIMITED TO, ALL RIGHTS WITH RESPECT TO LEGAL AND EQUITABLE DEFENSES TO ALLEGED RIGHTS OF SETOFF OR RECOUPMENT.

| - 8 - |

III. GENERAL INFORMATION CONCERNING THE DEBTOR

| A. | Overview of the Debtor and Its Business Operations |

| 1. | Generally |

The Debtor was organized as a Nevada corporation on May 11, 2001, under the name Zeolite Exploration Company. On March 31, 2006, the Debtor consummated a share exchange pursuant to a Securities Purchase Agreement and Plan of Reorganization with Faith Bloom Limited (“Faith Bloom”), a company formed under the laws of the British Virgin Islands, and its stockholders. As a result of this share exchange, the Debtor acquired all of the issued and outstanding capital stock of Faith Bloom in exchange for a total of 50,957,603 shares of the Debtor’s common stock. The Debtor went public in late March 2006, and began trading on the NASDAQ early in 2007.

| 2. | Corporate Structure |

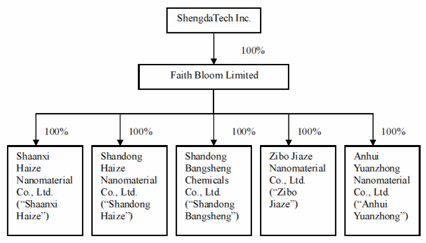

Faith Bloom, which remains the Debtor’s wholly owned subsidiary, is the direct parent company of the following entities formed under the laws of the People’s Republic of China (the “PRC”): Shandong Haize Nanomaterials Co., Ltd. (“Shandong Haize”), Shandong Bangsheng Chemical Co., Ltd. (“Shandong Bangsheng”), Shaanxi Haize Nanomaterials Co., Ltd. (“Shaanxi Haize”), Zibo Jiaze Nanomaterials Co., Ltd. (“Zibo Jiaze”) and Anhui Yuanzhong Nanomaterials Co., Ltd. (“Anhui Yuanzhong,” and together with Shandong Haize, Shandong Bangsheng, Shaanxi Haize, Zibo Jiaze, the “PRC Subsidiaries”). Other than Shandong Bangsheng Chemical Co., Ltd., which, upon information and belief is not an operating entity, all of the other PRC Subsidiaries are believed to be operating entities (the “PRC Operating Subsidiaries”). The PRC Operating Subsidiaries manufacture a specialty additive known as nano-precipitated calcium carbonate, which is used in a variety of products to enhance their durability and efficiency and is widely applied in the paint, paper, plastic and rubber industries and used for building materials such as PVC. Neither the Debtor nor Faith Bloom are operating entities.

| - 9 - |

| 3. | Management and Board of Directors |

| (a) | The Debtor |

Xiangzhi Chen is the founder of Faith Bloom and its subsidiaries. Mr. Chen also owns over 42.25% of the outstanding shares of the Debtor, making him the Debtor’s largest shareholder. In addition, Mr. Chen served as a member of the Debtor’s Board of Directors (the “Board”), and as President and Chief Executive Officer of the Debtor until his removal. As discussed below, immediately prior to the commencement of the Chapter 11 Case, the Special Committee of the Debtor’s Board of Directors (the “Special Committee”) determined that it was necessary to remove Mr. Chen from his positions as President and Chief Executive Officer of the Debtor and to appoint an independent party to oversee the Debtor’s business and assist the Special Committee with its ongoing investigation.

By resolution dated August 19, 2011 (the “August 19, 2011 Resolution”), the Special Committee removed management, including Mr. Chen, from their management positions, and appointed Michael Kang of Alvarez & Marsal (“A&M”) to serve as Chief Restructuring Officer (“CRO”). At the same time, the Special Committee authorized the filing of the Chapter 11 Case.

On the Petition Date, the Board was comprised of Mr. Chen, Donquan Zhang, A. Carl Mudd and Sheldon B. Saidman. Prior to the Petition Date, Mr. Chen and other shareholders of the Debtor were attempting to appoint Mr. Gongbo Wang to the Debtor’s Board. However, as discussed below, on September 2, 2011, the Bankruptcy Court enjoined them from taking any action that seeks to appoint or has the purpose or effect of appointing Mr. Wang, or anyone else, to the Debtor’s Board [Docket Nos. 26 and 27, Case No. 11-05082 (Bankr. D. Nev. Sept. 2, 2011)]. On September 9, 2011, Mr. Chen resigned from the Board. On October 12, 2011, Mr. Zhang’s term expired and he was not reappointed. The Board is currently comprised of two independent directors: A. Carl Mudd and Sheldon B. Saidman. Each of the independent directors has served on the Board since 2007.

The CRO continues to work with the Special Committee to investigate the discrepancies in the Debtor’s financial records, including verifying the Debtor’s cash account and tracing any funds that appear to have been moved out of the Debtor’s accounts to certain of the PRC Subsidiaries. The CRO was also charged with working with the Noteholders, who are the Debtor’s largest creditor constituency, other creditors, and shareholders to attempt to achieve a consensual resolution of the Debtor’s outstanding obligations.

| (b) | Faith Bloom |

On August 20, 2011, the Debtor, as shareholder of Faith Bloom, (a) removed the individuals then serving as directors of Faith Bloom, (b) appointed A. Carl Mudd and Sheldon B. Saidman as the directors of Faith Bloom and (c) the new Board members appointed Michael Kang and other individuals as officers of Faith Bloom. Subsequently, Faith Bloom’s Board passed resolutions removing and replacing the legal representatives and managers of the PRC Subsidiaries. The August 19, 2011 Resolution served to also remove each of the Debtor’s officers. On August 19, 2011, the Board of Directors of Faith Bloom also removed Mr. Chen, and A. Carl Mudd and Sheldon Saidman were elected as the new directors of Faith Bloom.

| B. | The Debtor’s Capital and Debt Structure |

| 1. | Prepetition Unsecured Debt |

The Debtor reported revenues of US$102.1 million and net profits of US$23.5 million in 2009. The Debtor’s only material debt obligations result from two note issuances completed in 2008 and 2010. In 2008, the Debtor issued notes totaling US$115,000,000 with an interest rate of 6.0% and a maturity of June 1, 2018 (the “6.0% Notes”). As of July 6, 2011, the outstanding principal amount of the 6.0% Notes was US$25,578,000.

| - 10 - |

In 2010, the Debtor issued notes totaling US$130 million (all of which remain outstanding) with an interest rate of 6.5% and a maturity date of December 15, 2015 (the “6.5% Notes” and, together with the 6.0% Notes, the “Notes”). No interest payments have been made on the 6.5% Notes.

The completion of the offering of the 6.5% Notes was conditioned upon a certain amount of the 6.0% Notes being repurchased by the Debtor and surrendered to the 6.0% Notes’ trustee for cancellation such that at least 75% of the original issuance amount of the 6.0% Notes were no longer outstanding. Specifically, approximately US$67.2 million of the net proceeds of the 6.5% Notes were to be used and in fact were used to repurchase a portion of the 6.0% Notes.

| 2. | Equity Interests |

On August 31, 2011, the Debtor filed the List of Equity Holders [Docket No. 66]. As reflected therein, the Debtor’s largest shareholder is Mr. Chen, who owns over 42.25% of the Debtor’s outstanding shares. Cede & Co. is the Debtor’s second largest shareholder owning approximately 30.51% of the Debtor’s outstanding shares. The remaining 27.24% of the Debtor’s outstanding shares are owned by various individuals and entities.

As discussed above, the Debtor is the sole shareholder of Faith Bloom, which is the direct parent company of the PRC Subsidiaries.

| C. | The Debtor’s Assets |

As a holding company, the Debtor’s primary assets are its cash, its ownership of the stock of Faith Bloom, potential Causes of Action and any other assets the Debtor is able to recover through litigation or investigation, as discussed below in more detail.

| D. | Events Leading up to the Chapter 11 Filing |

| 1. | The March 2011 Report from KPMG, the Formation of the Special Committee, and the Resulting Investigation Into the Debtor’s Affairs |

The Debtor engaged KPMG as its independent certified public accounting firm from November 11, 2008 until its resignation on April 29, 2011. During this period, KPMG audited the Debtor’s financial statements for the fiscal years ending December 31, 2008 and 2009. When issued, KPMG’s audit report for 2008 found a material internal control weakness, but the 2009 report did not contain any adverse opinion and did not call into question any of the Debtor’s accounting or financial reporting practices.

When auditing the Debtor’s financial statements for the fiscal year ending December 31, 2010, however, KPMG reported discovering “potentially serious discrepancies and unexplained issues” relating to the Debtor’s financial records. On March 2, 2011, KPMG contacted and informed the Audit Committee of these potential discrepancies, and, on March 3, 2011, provided written notice to the Audit Committee detailing information relating to, among other things, the inability to confirm sales amounts, sales terms, and outstanding balances and undisclosed related party transactions. KPMG explained that it would be unable to complete its audit until these potential discrepancies and issues were resolved.

| - 11 - |

The Debtor’s Form 10-K was due on March 16, 2011. Since KPMG alerted the Debtor of its concerns only two weeks before this due date, the Debtor was unable to complete the thorough investigation necessary to properly resolve these potential issues and thereby enable KPMG to complete the audit. Therefore, on March 17, 2011, the Debtor submitted the requisite Notification of Late Filing Form 12b-25 (“Notification of Late Filing”) with the SEC.

On March 4, 2011, one day after KPMG informed the Audit Committee of the potential issues it discovered, the Debtor held a special meeting of the Board and, by Board resolution, created the Special Committee to oversee an internal investigation (the “March 4, 2011 Resolution”). The March 4, 2011 Resolution granted the Special Committee broad authority to “(i) conduct an independent review and investigation of issues identified by KPMG and any other matters the Special Committee deems appropriate”; (ii) “execute whatever agreements, including but not limited to engagement of independent counsel, independent accountants and other independent experts . . . as deemed necessary by the Special Committee”; (iii) “take any legal or other action(s) that the Special Committee in its sole discretion deems in the interests of the Company and its stockholders”; and (iv) to commence any “actions as may be needed to identify, collect and safeguard the Company’s assets.”

On March 7, 2011, the Special Committee engaged the law firm of O’Melveny & Myers LLP (“OMM”) to conduct an independent investigation into the potential issues raised by KPMG. In turn, OMM retained PricewaterhouseCoopers LLP (“PwC”) to provide forensic accounting support for its investigation. OMM commenced its investigation the following day and began preserving the Debtor’s documents and records at that time by preserving and imaging relevant computers and accounting servers in the PRC. OMM was also given access to data from KPMG.

Soon after the investigation began, problems began to surface, including the inability of KPMG to verify the Debtor’s cash accounts. As a result, the Special Committee proposed and the Board approved a resolution to transfer control of the Debtor’s cash assets by consolidating all excess cash into accounts over which only the Audit Committee Chairman, would have signatory authority and adopting a cash control validation plan (the “Cash Control Plan”). To date, the Special Committee has been able to exercise control over approximately $14 million which has been used to fund the bankruptcy case. In addition, the Debtor has obtained control of three PRC bank accounts under the Faith Bloom name with a combined balance of approximately $50,000.

Further efforts to verify and control the Debtor’s cash accounts pursuant to the Cash Control Plan were thwarted and unsuccessful. The Special Committee instructed teams of professionals from OMM and PwC to visit financial institutions holding the Debtor’s accounts in the PRC, but managers at the Debtor’s PRC Companies and certain local bank officials obstructed those efforts. The Special Committee was informed that the managers stalled or otherwise attempted to derail trips to the Debtor’s financial institutions; refused to cooperate with OMM and PwC; attempted to steer the team to specific persons at the banks, rather than permit the OMM and PwC teams to speak with other identified individuals; and when the OMM and PwC teams refused to meet with particular bank employees chosen by the managers, the managers departed and refused to assist the OMM and PwC teams.

| - 12 - |

The Special Committee was also unable to authenticate the veracity of certain U.S. certificates of deposits. As part of the Cash Control Plan, Mr. Chen provided photocopies of CDs allegedly held in the name of Faith Bloom, the Debtor’s wholly owned subsidiary, as evidence that the Debtor had certain cash on hand. The Special Committee has been unable to verify the authenticity of those CDs and despite making repeated requests for such information, Mr. Chen has been nonresponsive. The Special Committee has learned that the bank which issued the CDs has been unable to verify them and, in fact, has no record of issuing them to Faith Bloom.

On April 19, 2011, KPMG issued a letter to the Debtor pursuant to Section 10A of the Securities Exchange Act of 1934.2 In the letter, KPMG referred to its prior correspondence regarding the discrepancies and/or unexplained issues relating to the Debtor’s financial records, stated that it had not received adequate explanations addressing those issues, and found that senior management had not taken timely and appropriate remedial actions with respect those issues. KPMG indicated that “this failure to take remedial action is expected to warrant our resignation from the audit engagement.” On April 29, 2011, KPMG formally resigned.

On March 16, 2011, as a result of the Debtor’s submission of the requisite Notification of Late Filing, the Listing Qualifications Department of the Nasdaq Stock Market (“NASDAQ”) issued a notification letter to the Debtor advising the Debtor that as a result of its inability to file its 2010 Form 10-K in a timely manner, the Debtor was not in compliance with NASDAQ Listing Rule 5250(e)(1). NASDAQ requested in the notification letter that the Debtor submit prior to March 31, 2011, a plan to regain compliance. In response thereto, on March 31, 2011, the Debtor submitted a plan to regain compliance and asked NASDAQ to grant the Debtor a period in which to file its Form 10-K and to regain compliance.

After receiving the Debtor’s submission, on April 20, 2011, the NASDAQ Listing Qualification Staff (the “Staff”) issued a Delisting Letter to the Debtor wherein it determined to delist the Company’s securities from NASDAQ as a result of the Debtor’s failure to file its 2010 Form 10-K, among other things. On May 19, 2011, the Debtor appealed the Staff’s decision to the NASDAQ Listing Qualifications Panel (the “Panel”) and submitted a detailed plan for compliance which included the completion of the Cash Control Plan. On June 8, 2011, the Panel determined to delist the Company’s securities from NASDAQ pursuant to the Listing Rule 5101. In its decision, the Panel cited the discrepancies found by KPMG and the Debtor’s failure to complete its Cash Control Plan. Believing that the Cash Control Plan was a “critical component” of the investigation, the Panel determined that management was obstructing the Audit Committee’s ability to fulfill its duties and responsibilities under the Listing Rules and, the Exchange Act and raised public interest concerns under Listing Rule 5101. The Panel decision resulted in the suspension of the Company’s securities on the NASDAQ market effective with the open of business on June 10, 2011.

On June 21, 2011 the Company appealed the Panel Decision to the NASDAQ Listing and Hearing Review Council (the “Listing Council”). On July 1, 2011, the Staff submitted a brief to the Listing Council in opposition. In its brief, the Staff highlighted the Debtor’s failure to implement the Cash Control Plan. On August 22, 2011, the Listing Counsel issued its decision affirming the decision of the Panel to delist the Debtor’s securities from NASDAQ pursuant to Listing Rule 5101. In its decision, the Listing Counsel again cited the issues raised by KPMG and the Debtor’s inability to implement and complete the Cash Control Plan. On November 23, 2011, the Debtor was informed that the NASDAQ Board of Directors had declined to call for review of the August 22, 2011 decision of the Listing Counsel, which thereafter became a final decision.

2 Section 10A provides that where an auditor discovers, whether through its own work, through the client itself, or through an advisor to the client, that a reporting client may have committed an illegal act, the auditor must disclose the matter to the institution’s management, audit committee, and the board of directors.

| - 13 - |

On December 15, 2011, the NASDAQ Stock Market LLC (“NASDAQ”) issued a press release announcing that the common stock of the Debtor would be delisted. On December 16, 2011, NASDAQ issued the Notification of Removal from Listing and/or Registration Under Section 12(B) of the Securities Exchange Act of 1934.

As of this date, the Debtor has been unable to and has not fully implemented or completed the Cash Control Plan.

| 2. | Debtor’s Payment Obligations Under the Notes and Litigation Filed Against the Debtor |

Holders of the 6.0% Notes became entitled to require the Debtor to repurchase, for cash, all or any portion of their 6.0% Notes on June 1, 2011, at a price equal to 100% of the principal amount of the 6.0% Notes to be purchased, plus accrued and unpaid interest (the “Put Right”). As of May 24, 2011, all of the eligible 6.0% Noteholders exercised the Put Right in the aggregate principal amount of US$25,578,000. As of the Petition Date, the Debtor had not paid and was and remains unable to pay the 6.0% Noteholders on account of the exercise of the Put Right.

As a result of the Debtor’s failure to make payment in accordance with the Put Right on June 1, 2011, the Debtor was obligated to pay interest on the still-outstanding 6.0% Notes on June 1, 2011 under Section 4.01 of the 6.0% Note indenture. The Debtor failed to pay any portion of this interest on such date, or during the 30-day grace period applicable to interest payments under the 6.0% Notes indenture. As of the Petition Date, the Debtor had not made the required interest payment.

In addition, under Section 4.01 of the 6.5% Note indenture, the Debtor was obligated to pay interest on the 6.5% Notes (in the amount of approximately US$4.4 million) on June 15, 2011. The Debtor failed to pay any portion of this interest on such date, or during the 30-day grace period applicable to interest payments under the 6.5% Notes indenture. As of the Petition Date, the Debtor had not made the required interest payment.

As of the Petition Date, the Debtor owed over US$163 million under the Notes which it has no ability to pay.

The disclosures made by the Debtor and KPMG, as well as the actions taken by NASDAQ, have resulted in the filing of numerous lawsuits seeking damages under the securities laws and other causes of action, as discussed below in more detail.

| - 14 - |

| 3. | Subsequent Findings From the Special Committee’s Investigation Into the Debtor’s Financial Condition and Business Operations |

As set forth above, since learning of the potential serious discrepancies in the Debtor’s financial statements in March 2011, the Special Committee has been working tirelessly with various professionals to investigate the financial condition of the Debtor and its business operations. As part of that process, the Special Committee retained OMM, which was later replaced by the international law firm of Skadden, Arps (“Special Committee Counsel”), to work with PricewaterhouseCoopers, LLP (“PwC”) and assist with the investigation. As started by OMM and continued by Special Committee Counsel, the investigation has involved company visits, interviews, and the imaging and review of accounting records and other electronic data. Special Committee Counsel has provided the Special Committee with regular updates to address issues related to the investigation. Special Committee Counsel and the Special Committee, however, have been unable to complete the investigation because their efforts to do so have been obstructed by Mr. Chen and former managers who, on information and belief, have been acting in concert with him. Prior to the commencement of this Chapter 11 Case, Mr. Chen refused to participate in meetings with the Board and the Special Committee, further jeopardizing the Debtor’s business operations and its ability to address the serious issues it is facing.

Special Committee Counsel determined that certain of the financial records of the Debtor may have been falsified in whole or in part and that serious issues remain unanswered regarding the financial condition of the Debtor and its overall business operations. On August 19, 2011, Special Committee Counsel presented its preliminary report and findings to the Special Committee. In its preliminary report, Special Committee Counsel detailed the investigative efforts to date, the efforts undertaken by Mr. Chen and others to obstruct and hinder the Special Committee’s investigation, and confirmed material irregularities and/or inaccuracies in the financial records of the Debtor. Among other things, the report calls into serious question the accuracy of payments allegedly made to the Debtor by various customers or the sales allegedly made, transactions the Debtor is reported to have engaged in with related parties owned by Mr. Chen which have not been supported, and suggests that sales are vastly overstated.

| 4. | The Debtor Was Subject to the Shareholder Litigation |

Prior to the Petition Date, the Debtor was a party to various actions, including, without limitation, the actions discussed below (collectively, the “Shareholder Litigation”).3 As discussed below, the cases filed in the U.S. District Court for the Southern District of New York have been consolidated under the lead case styled Yaw v. ShengaTech, Inc. et al., Case No. 11-CV-3325 (S.D.N.Y. 2011).

| (a) | Turner v. ShengaTech, Inc. et al., Case No. 11-CV-1918 (S.D.N.Y. 2011) |

On March 18, 2011, John Thomas Turner et al. filed a putative class action complaint in the United States District Court for the Southern District of New York against the Debtor, Mr. Chen, Andrew Weiwen Chen (“Andrew Chen”), the Debtor’s former Chief Financial Officer and Anhui Guo (“Guo”), the Debtor’s former Chief Operating Officer. The lawsuit, titled Turner v. ShengaTech, Inc. et al., Case No. 11-CV-1918 (S.D.N.Y. 2011) (the “Turner Shareholder Litigation”), asserts claims under the federal securities laws based upon allegations that the defendants misrepresented facts about the Debtor’s business and operations, thereby artificially inflating the price of its stock.

| (b) | Marlon Fund SICAV plc v. ShengaTech, Inc. et al., Case No. 11-CV-1996 (S.D.N.Y. 2011) |

On March 22, 2011, Marlon Fund SICAV plc et al. filed a putative class action complaint in the United States District Court for the Southern District of New York against the Debtor, Mr. Chen, Andrew Chen, and Guo. The lawsuit, titled Marlon Fund SICAV plc v. ShengaTech, Inc. et al., Case No. 11-CV-1996 (S.D.N.Y. 2011) (the “Marlon Fund Shareholder Litigation”), asserts claims under the federal securities laws based upon allegations that the defendants misrepresented facts about the Debtor’s business and operations, thereby artificially inflating the price of its stock.

3 The Debtor may be a named party to other proceedings not discussed herein and the term “Civil Actions” shall be deemed to reference any such other proceedings, if any

| - 15 - |

| (c) | Mathes v. ShengaTech, Inc. et al., Case No. 11-CV-2064 (S.D.N.Y. 2011) |

On March 24, 2011, Erik Mathes et al. filed a putative class action complaint in the United States District Court for the Southern District of New York against the Debtor, Mr. Chen, Andrew Chen, and Guo. The lawsuit, titled Mathes v. ShengaTech, Inc. et al., Case No. 11-CV-2064 (S.D.N.Y. 2011) (the “Mathes Shareholder Litigation”), asserts claims under the federal securities laws based upon allegations that the defendants misrepresented facts about the Debtor’s business and operations, thereby artificially inflating the price of its stock.

| (d) | Yaw v. ShengaTech, Inc. et al., Case No. 11-CV-3325 (S.D.N.Y. 2011) |

On May 16, 2011, Donald Yaw and Edward Schaul et al. filed a putative class action complaint in the United States District Court for the Southern District of New York against the Debtor, Mr. Chen, Andrew Chen, and Guo. The lawsuit, titled Yaw v. ShengaTech, Inc. et al., Case No. 11-CV-3325 (S.D.N.Y. 2011) (the “Yaw Shareholder Litigation,” and together with the Turner Shareholder Litigation, the Marlon Fund Shareholder Litigation and the Mathes Fund Shareholder Litigation, the “SDNY Shareholder Litigation”),4 asserts claims under the federal securities laws based upon allegations that the defendants misrepresented facts about the Debtor’s business and operations, thereby artificially inflating the price of its stock.

On December 6, 2011, the U.S. District Court for the Southern District of New York consolidated the SDNY Shareholder Litigation under the Yaw Shareholder Litigation [Docket No. 5]. Accordingly, the lead plaintiffs of the SDNY Shareholder Litigation are Messrs. Yaw and Schaul.

| (e) | McDermott v. ShengaTech, Inc. et al., Case No. 11-CV-02557-GHK-CW (C.D. Cal. 2011) |

On March 25, 2011, Tom McDermott et al. filed a putative class action complaint in the United States District Court for the Central District of California against the Debtor, Mr. Chen, Andrew Chen, and Guo. The lawsuit, titled McDermott v. ShengaTech, Inc. et al., Case No. 11-CV-02557-GHK-CW (C.D. Cal. 2011), asserts claims under the federal securities laws based upon allegations that the defendants misrepresented facts about the Debtor’s business and operations, thereby artificially inflating the price of its stock.

| (f) | Corwin v. ShengaTech, Inc. et al., Case No. 11-CV-2457 (S.D.N.Y. 2011) |

On April 11, 2011, Robert Corwin et al. filed a shareholder derivative complaint in the United States District Court for the Southern District of New York against the Debtor, Mr. Chen, Andrew Chen, and Guo. The lawsuit, titled Corwin v. ShengaTech, Inc. et al., Case No. 11-CV-2457 (S.D.N.Y. 2011), purports to assert claims under the federal securities laws, alleges that the Debtor’s financial statements were false and misleading, and seeks damages, equitable, and injunctive relief.

4 This case has been assigned to the Honorable Debra C. Freeman, who is presiding over the Turner Case. See Notice of Assignment, Yaw v. ShengaTech, Inc. et al., Case No. 11-CV-3325, (S.D.N.Y. Mar. 25, 2011) [Docket No. 2].

| - 16 - |

| (g) | Schweiger v. Xiangzhi Chen et al., Case No. A-11-639644-B (Clark County, Nev. 2011) |

On April 18, 2011, Matthew Schweiger et al. filed a shareholder derivative complaint in the District Court of Clark County, Nevada against Chen, Andrew Chen, Guo, and Dongquan Zhang (“Zhang”) as well as the Debtor’s independent Board Members Sheldon B. Saidman and A. Carl Mudd. The lawsuit, titled Schweiger v. Xiangzhi Chen et al., Case No. A-11-639644-B (Clark County, Nev. 2011), asserts claims under various theories, including breach of fiduciary duty and unjust enrichment, alleges that the defendants disseminated false information and/or failed to adequately oversee the company, and seeks damages, equitable relief and injunctive relief.

| (h) | Komsky v. Xiangzhi Chen et al., Case No. A-11-640249-B (Clark County, Nev. 2011) |

On April 28, 2011, Michael Komsky, on behalf of the Bamboo Trust dated January 8, 2007, et al. filed a shareholder derivative complaint in the District Court of Clark County, Nevada against Mr. Chen, Andrew Chen, Guo, Zhang, Sheldon B. Saidman and A. Carl Mudd. The lawsuit, titled Komsky v. Xiangzhi Chen et al., Case No. A-11-640249-B (Clark County, Nev. 2011), asserts claims under various theories including breach of fiduciary duty and unjust enrichment, alleges that the defendants disseminated false information and/or failed to adequately oversee the company, and seeks damages, equitable relief and injunctive relief.

| (i) | Johnson v. Xiangzhi Chen et al., Case No. 2:11-CV-01250 (D. Nev. 2011) |

On August 3, 2011, and Robert Johnson et al. filed a shareholder derivative complaint in the United States District Court for the District of Nevada against Mr. Chen, Andrew Chen, Guo, Zhang, Sheldon B. Saidman and A. Carl Mudd. The lawsuit, titled Johnson v. Xiangzhi Chen et al., Case No. 2:11-CV-01250 (D. Nev. 2011), asserts claims under various theories, including breach of fiduciary duty and unjust enrichment, alleges that the defendants disseminated false information and/or failed to adequately oversee the company, and seeks damages, equitable relief and injunctive relief.

| E. | The Debtor’s Decision to File for Chapter 11 Protection |

The combination of the foregoing factors made it necessary for the Debtor to consider seeking protection under chapter 11 of the Bankruptcy Code.

Under the power of its formation resolution and applicable law, the Special Committee ultimately determined that the most effective way to continue its investigation, safeguard assets and maximize the value of the Debtor’s Estate for the benefit of their stakeholders was to seek protection under chapter 11 of the Bankruptcy Code in order to continue its investigation and pursue either a sale or a plan, or both, while allowing the Debtor a breathing spell from litigation. During a meeting of the Special Committee held on August 19, 2011, the Special Committee voted to approve a resolution giving authority to File a voluntary petition for relief under chapter 11 of the Bankruptcy Code for the Debtor. The Debtor Filed a voluntary petition for relief under chapter 11 of the Bankruptcy Code on August 19, 2011 (the “Petition Date”).

| - 17 - |

IV. EVENTS DURING THE CHAPTER 11 CASE

| A. | Litigation in the PRC and Related Asset Matters |

The Debtor, through Faith Bloom, has filed civil actions in the PRC against former legal representatives and managers of the PRC subsidiaries. These actions have been pursued aggressively and have yielded positive results. The litigation will effectuate, among other things, the transfer of assets embodying corporate authority under Chinese laws, including the corporate seals, business licenses, and relevant licenses, to Faith Bloom. The Debtor intends to continue its vigorous efforts in order to achieve these goals. The following is a status summary as of May 4, 2012.

| 1. | Shaanxi Haize |

| (a) | Litigation |

On December 22, 2011, Faith Bloom, through its Chinese counsel, the Jun He Law Offices (“Jun He”), filed a Statement of Claims with the Intermediate People’s Court of Xianyang, Shaanxi Province (the “Xianyang Court”). Defendants listed in the Statement of Claims include Li Fu, the former general manager and former legal representative of Shaanxi Haize, Ma Zhaowei, a former director of Shaanxi Haize, Chen Xukui, a former director of Shaanxi Haize and Li Shujin, a former director of Shaanxi Haize (Li Fu, Ma Zhaowei, Chen Xukui, and Li Shujin collectively, the “Shaanxi Haize Defendants”).

The Statement of Claims’ demands for relief are: (i) the immediate cessation of the Shaanxi Haize Defendants’ infringement of Shaanxi Haize’s interests; (ii) transfer of all Shaanxi Haize seals, licenses (including business license), financial records, lists of assets, certificates of ownership, employment records, and other records to Faith Bloom; (iii) the Shaanxi Haize Defendants’ assistance in amending records maintained at the applicable Administrations of Industry and Commerce (the “AIC”), including assistance in the registration of a new general manager and legal representative appointed by Faith Bloom; and (iv) litigation costs.

The Statement of Claims was accepted by the Xianyang Court’s Department of Case Registrations on the filing date, formally commencing the litigation process. The Xianyang Court is currently in the process of serving the Shaanxi Haize Defendants.

The court has stated that constructive notice through publication was made on April 21, 2012. Based on this and assuming the Shaanxi Haize Defendants do not respond, it is expected that the trial will commence some time in early July. Should the Shaanxi Haize Defendants not respond, the trial will be held without them. It is the Debtor’s understanding that under such circumstances, the chance of a favorable ruling will be significant, although not guaranteed since the judge has the independent ability to apply the law. The Shaanxi Haize Defendants have requested to meet with the professionals working on behalf of Faith Bloom and such meeting is scheduled to be held.

Faith Bloom has also considered pursuing an evidence preservation claim against the Shaanxi Haize Defendants so that the presiding Judge would hold the chops, business license and other corporate documents pending the outcome of the ligation. Based upon discussions with June He, evidence preservation would be difficult because the Shaanxi Haize Defendants cannot be located. In addition, the Xianyang Court is requiring Faith Bloom to provide CNY7.5 million cash guarantee as a precondition to conducting a property preservation.

| - 18 - |

| (b) | Related Assets |

Shaanxi Haize has executed a negative pledge agreement with the Tai’an Guarantee Fund Company (“Tai’an Guarantee Company”) purporting to support two (2) loans from the Tai’an Commercial Bank totaling CNY54 million for the benefit of two (2) other PRC companies owned by Mr. Chen. The negative pledge agreement is set to expire in May, 2012. Correspondence has been sent to the Tai’an Guarantee Company to request supporting documentation and to notify the Tai’an Guarantee Company that Shaanxi Haize will not renew the guarantee and that the former management of Shaanxi Haize does not have authority to renew the agreement. The Debtor has disputed the Tai’an Commercial Bank’s position that it maintains a direct pledge and has requested documentation establishing a direct pledge. To date, however, the Tai’an Commercial Bank has failed to provide any supporting documentation.

| 2. | Anhui Yuanzhong |

| (a) | Litigation |

On December 23, 2011, Faith Bloom, through its Chinese counsel, filed a Statement of Claims against Chen Bo, the former general manager and legal representative of Anhui Yuanzhong, with the Hefei New and High Tech Zone Court, Anhui Province (the “Hefei Court”).

The Statement of Claims’ demands for relief are: (i) the immediate cessation of Chen Bo’s infringement of Anhui Yuanzhong’s interests; (ii) transfer of all Anhui Yuanzhong’s seals, licenses (including business license), financial records, lists of assets, certificates of ownership, employment records, and other records to Faith Bloom; (iii) Chen Bo’s assistance in amending records maintained at the applicable AIC, including assistance in the registration of a new general manager and legal representative appointed by Faith Bloom; (iv) transferring control of all the assets of Anhui Yuanzhong, including but not limited to bank deposits, cash, machinery equipments, raw materials, spare parts, products, vehicles, buildings, and other relevant assets to Faith Bloom; and (v) litigation costs.

The Statement of Claims was accepted by the Hefei Court’s Department of Case Registrations on the filing date, formally commencing the litigation process. The Hefei Court has completed service of process on Chen Bo. On February 13, 2012, Chen Bo filed an appeal arguing that the Hefei Court lacked original jurisdiction over the matter.

On March 29, 2012, the presiding Judge, accompanied by members of the local government (including personnel from the local Hanshan County court) and Jun He, attempted to conduct an evidence preservation. However, their efforts were unsuccessful because, with the exception of doorman, no personnel could be located on the premises. In addition, the general manager’s office, which is the likely location for keeping the company’s business license, chops, and other important evidence, was locked.

As of May 4, 2012, no decision has been made by the Hefei Intermediate People’s Court regarding Chen Bo’s appeal. Professionals working on behalf of Faith Bloom in this matter explained that the delay stemmed from the requirement that all parties to a suit must receive notification that an appeal was being made before the High Tech Zone Court could forward the matter to the Hefei Intermediate People’s Court for decision. Given that notice has now successfully been provided to Anhui Yuanzhong, the appeal is ready to be forwarded to the Hefei Intermediate People’s Court. A decision is expected to be entered within the next few weeks.

| - 19 - |

| (b) | Related Assets |

Based on due diligence conducted on Anhui Yuanzhong in November, 2011, Anhui Yuanzhong owns two (2) parcels of land. The smaller parcel of land is approximately 106 mu.5 Based on what Jun He learned during the evidence preservation on March 29, 2012, this parcel of land has been “frozen” by the tax bureau due to unpaid taxes. As a result, the tax bureau is preventing the alienation of the land and, in unlikely circumstances, may decide to auction the land. The larger parcel of land is approximately 503 mu and was purchased by Anhui Yuanzhong for approximately RMB90. This larger parcel has been seized by the local government due to an alleged breach of an investment agreement entered into by Anhui Yuanzhong and the local government.

The local government officials have refused to meet with Faith Bloom representatives unless the current PRC management on record also attends such meetings. While Jun He continues its efforts to communicate with the local government to obtain further information regarding the two (2) parcels of land, no additional information has yet been provided.

| 3. | Shandong Haize |

In March 2012, Faith Bloom, through its Chinese counsel, filed a Statement of Claims against Du Lei, the former general manager and former legal representative of Shandong Haize, with the Intermediate People’s Court of Tai’an, Shandong Province (the “Tai’an Court”).

The Statement of Claims’ demands for relief are: (i) the immediate cessation of Du Lei’s illegal possession and control of Shandong Haize chops, licenses and certificates; (ii) the return of Shandong Haize chops, certificates, and licenses to Faith Bloom; (iii) Du Lei’s assistance in amending records maintained at the applicable AIC, including assistance in the registration of a new general manager and legal representative appointed by Faith Bloom; and (iv) litigation costs.

The Statement of Claims was accepted by the Tai’an Court’s Department of Case Registrations on the filing date, formally commencing the litigation process. The Tai’an Court is currently is currently in the process of serving the defendant.

| 4. | Shandong Bangsheng |

In March 2012, Faith Bloom, through its Chinese counsel, filed a Statement of Claims against Chen Xukui, the former general manager and former legal representative of Shandong Bangsheng, with the Tai’an Court.