Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - KRANEM CORP | exhibit32.htm |

| EX-31.1 - EXHIBIT 31.1 - KRANEM CORP | exhibit31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - KRANEM CORP | exhibit31-2.htm |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-53563

| Kranem Corporation |

| (Exact name of registrant as specified in its charter) |

| Colorado | 02-0585306 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| 560 S. Winchester Blvd., Suite 500 |

| San Jose, CA 95128 |

| (Address of principal executive offices) (Zip Code) |

| (650) 319-6743 |

| (Registrant’s telephone number, including area code) |

| Securities registered pursuant to Section 12(b) of the Act: None |

| Securities registered pursuant to Section 12(g) of the Act: |

| Title of each class |

| Common Stock, no par value |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

[X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

At June 30, 2011, the aggregate market value of shares held by non-affiliates of the registrant was $1,111,109.

At March 31, 2012, there were 39,888,750 shares of the registrant’s common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

KRANEM CORPORATION

FORM 10-K

For the Fiscal Year Ended December 31,

2011

TABLE OF CONTENTS

| Page | ||

| PART I | ||

| Item 1. | Business | 3 |

| Item 1A. | Risk Factors | 18 |

| Item 1B. | Unresolved Staff Comments | 34 |

| Item 2. | Properties | 34 |

| Item 3. | Legal Proceedings | 34 |

| Item 4. | Mine Safety Disclosures | 35 |

| PART II | ||

| Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 35 |

| Item 6. | Selected Financial Data | 37 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 37 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 48 |

| Item 8. | Financial Statements and Supplementary Data | 48 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 48 |

| Item 9A. | Controls and Procedures | 48 |

| Item 9B. | Other Information | 50 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 50 |

| Item 11. | Executive Compensation | 54 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 55 |

| Item 13. | Certain Relationships and Related Transactions | 56 |

| Item 14. | Principal Accountant Fees and Services | 57 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedules | 58 |

1

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

In addition to historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

USE OF CERTAIN DEFINED TERMS

Except where the context otherwise requires and for the purposes of this report only, references to:

-

the “Company,” “we,” “us,” and “our” are to the combined business of Kranem Corporation, a Colorado corporation, and its consolidated subsidiaries, Xalted Networks, Xalted Information, Alfa Sistemi and Adora;

-

“Xalted Holding” are to Xalted Holding Corporation, a Delaware corporation, formerly known as Xalted Networks, Inc., which changed its name to Xalted Holding Corporation on March 14, 2011;

-

“Xalted” is to the combination of Xalted Networks and Xalted Information;

-

“Xalted Networks” are to Xalted Networks, Inc., a Delaware corporation, incorporated on March 14, 2011;

-

“Xalted Information” are to Xalted Information Systems (Pvt.) Ltd., an Indian company;

-

“India” are to the Republic of India;

-

“Italy” are to the Republic of Italy;

-

“Adora” are to Adora ICT Srl, or Adora, an Italian company;

-

“Alfa Sistemi” are to Alfa Sistemi Telemedia Srl, an Italian company;

-

“SEC” are to the Securities and Exchange Commission;

-

“Securities Act” are to the Securities Act of 1933, as amended;

-

“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

-

“Rupees” and “Rs.” are to the legal currency of India;

-

“Euros” and “€” are to the legal currency of the European Union;

-

“U.S. dollars,” “dollars” and “$” are to the legal currency of the United States.

2

PART I

Item 1. Description of Business

Xalted provides advanced software solutions that enable companies and public organizations, including governments and law enforcement agencies, to capture, manage and analyze structured and unstructured data to enhance business and operational performance and address security threats. The two principal markets that our software solutions address are the telecom security market and the homeland security market. Xalted includes law enforcement as part of the homeland security market. Our current and past geographic focus is on India and the surrounding countries in Asia, Africa, and the Middle East.

Our software products are developed internally. In some cases we incorporate software licensed from Oracle Corporation, BMC Corporation or other third-party suppliers specified by our customers. Our software is licensed to our customers and is sometimes delivered together with hardware products at the time of sale.

In the telecom security market, we provide four software modules that address different aspects of the telecom security market: revenue maximization, revenue assurance, fraud management and OSS/BSS (short for operations support systems and business support systems). The revenue maximization module allows a telecom service provider to identify trends in the usage of various services provided, so that it can tailor its service offering to maximize revenue. Revenue assurance locates potential users that are trying to use portions of the telecom service provider’s system capabilities without being a valid user of those services. The software module identifies illegal users, allowing the telecom service provider to take appropriate measures, generally comprised of locking the user out of a specific service or service package within the service network. The fraud management system module, or FMS, identifies a larger scale attempted use of the telecom service provider’s network by an individual or individuals who are not valid network users. The operations support systems, or OSS, and business support systems, or BSS, are business management tools that allow a telecom service provider to develop and deploy a new service offering more rapidly. The module automatically accounts for potential equipment limitations in the roll-out of a new service offering. The term OSS is commonly used to describe network systems dealing with the telecom network itself, as well as supporting processes such as maintaining network inventory, provisioning services, configuring network components and managing faults.

Our telecom security customers include major telecom companies and organizations in India, such as Bharat Sanchar Nigam Ltd., or BSNL, Mahanagar Telephone Nigam Limited, or MTNL, and the Centre for Development of Telematics, or CDOT, the telecom technology development center of the Government of India. BSNL is India’s oldest and largest communications service provider and one of its largest cellular service providers. It has footprints throughout India, except for the metropolitan cities of Mumbai and New Delhi, which are managed by MTNL. Telecom customers outside of India include Mozambique Cellular, or Mcel, Nepal Telecom, Nepal Satellite Telecom, Telecom Italia and Hutchison 3G.

In the homeland security market, our security solutions are used by governments and law enforcement agencies in their efforts to protect people and property and combat terrorism and crime. Our homeland security customers and end users include the national Government of India and local and regional law enforcement agencies and bodies in India, such as the Anti-Terrorist Squads in Mumbai, Maharashtra and Goa, the STF or special task force in Uttarakand, and the Cyber Crime division of the Thane District Police.

Our sales consist of licenses of software, sometimes resident on hardware which we acquire from standard industry sources as well as, in some cases, service fees for installation, commissioning, testing, training and/or ongoing technical support for our software modules. The terms of our licenses with our customers vary widely, but typically include progress payments based on delivery and installation or performance benchmarks and a final payment after commissioning, testing and acceptance by the customer.

Our corporate headquarters are located in San Jose, California. We have two operational centers in India and one in Rome, Italy. Our telecom security operations group is located in Bangaluru, India. Our homeland security operations are located in Mumbai, India. Our sales offices are located in Delhi, India, and Rome, Italy.

3

Our Corporate History and Background

Background and History of Kranem Corporation

We were incorporated in the State of Colorado on April 18, 2002 under the name Kranem Corporation. We previously offered high-quality office and office supply products to businesses, educational institutions, government agencies and individuals through our website, www.learningwire.com. We operated our business under our “Learningwire” trade name, which is registered with the Colorado Secretary of State. However, we ceased our online operations in January 2006 and from that time until the acquisition of Xalted Networks described below, we did not engage in any active operations, other than our search for a privately owned corporation to merge with or acquire.

Background and History of Xalted Networks and Xalted Information

Xalted Holding was originally established in Delaware in 1999 under the name “Xalted Networks, Inc.” On October 1, 2004, that company acquired 100% of Xalted Information pursuant to a Share Exchange and Restricted Stock Purchase Agreement executed with the owners of Xalted Information, Rajendra Manikonda, or Mr. Manikonda, and Pratap (Bob) Kondamoori, or Mr. Kondamoori. In 2004, Mr. Manikonda was a director of Xalted Information and the managing director of that company. As of July 7, 2011, he no longer held any position with Xalted Information. In 2004, Mr. Kondamoori was a board member of Xalted Information, a position he resigned in November 2011. Effective March 4, 2011, the name of Xalted Networks, Inc. was changed to Xalted Holding Corporation.

In 2006, we were advised by our major customer that it favored dealing with companies majority-owned by Indian citizens. Accordingly, effective as of February 15, 2006, we amended our earlier Share Exchange and Restricted Stock Purchase Agreement to rescind 30% of the 2004 equity transfer, so that Xalted Networks, now known as Xalted Holding, would hold 70% of Xalted Information directly and of record, and the remaining equity would be held of record 7.53% by Mr. Manikonda and 22.47% by Mr. Kondamoori, both of whom are Indian citizens. We refer to the 30% of the equity of Xalted Information which was the subject of the 2006 amendment as the Rescinded Stock. Additional equity of Xalted Information was issued to Mr. Manikonda and Mr. Kondamoori, and made subject to the same terms as the Rescinded Stock, pursuant to a Stock Purchase Agreement, also effective as of February 15, 2006. As a result, the equity owned by each of Mr. Manikonda and Mr. Kondamoori increased to 13.55% and 40.58% respectively and Xalted Network’s equity decreased to 45.87% . As of the date hereof, to our knowledge, the reasons for our reduction in our direct, record ownership of Xalted Information are still applicable and we are not aware of any indication that this will not remain the case for the foreseeable future.

Under the 2004 Share Exchange and Restricted Stock Purchase Agreement, as amended, and the 2006 Stock Purchase Agreement, Xalted Networks, now known as Xalted Holding, had an option to purchase the Rescinded Stock from its holders, or the Holders, for a total price of US$1.00 when the parties agree in good faith that the relevant restrictions are no longer applicable. The agreements also allowed the Holders to sell the Rescinded Stock only to Xalted Networks, now known as Xalted Holding when the parties agree in good faith that the relevant restrictions are no longer applicable; required the Holders to transfer to Xalted Networks, now known as Xalted Holding, any dividends or other distributions of any kind, including any liquidation proceeds, received by them from Xalted Information; and gave to Xalted Networks, now known as Xalted Holding, all voting rights associated with the Rescinded Stock. The voting and other rights of Xalted Networks, now known as Xalted Holding, with regard to the equity of Xalted Information are exercised by Xalted Networks, now known as Xalted Holding, acting through its board of directors and authorized executive officers.

On March 16, 2011, Xalted Holding, formerly known as Xalted Networks, Inc., transferred its 45.87% record ownership of Xalted Information, the beneficial ownership of the remaining 54.13%, and all of its rights on the equity in Xalted Information to a new wholly-owned subsidiary, to which it had given its former name, Xalted Networks, Inc. This transfer is evidenced by a Transfer Agreement dated March 16, 2011, a copy of which is attached hereto as Exhibit 10.7.

4

Thus, as of May 13, 2011, when we closed our acquisition of Xalted Networks, that company held 45.87% of Xalted Information directly and of record; the remaining equity was held 13.55% by Mr. Manikonda and 40.58% by Mr. Kondamoori for the benefit of Xalted Networks; and Xalted Networks had 100% voting control as well as other rights over the equity of Xalted Information. This acquisition is described in the following section.

Acquisition of Xalted Networks

On May 12, 2011, we entered into a Share Exchange Agreement and related agreements pursuant to which we agreed to acquire Xalted Networks, a Delaware holding company, and its operating subsidiary in India, Xalted Information, in exchange for the issuance of 35% of our outstanding stock to Xalted Holding, the parent corporation of Xalted Networks, the issuance of 45% of our outstanding stock to three investors who were convertible note holders of Xalted Holding, the forgiveness of $2,500,000 of Xalted Holding convertible debt which we acquired from the note holders, and the cancellation of 14,687,500 outstanding shares of our common stock held by three individuals. These transactions resulted in a change of control of Kranem Corporation. These transactions closed on May 13, 2011.

We originally accounted for these transactions using the purchase method of accounting. On October 4, 2011, after consultation with our independent auditor, De Joya Griffith & Co. LLC, or De Joya, and other financial and legal advisors, our board adopted resolutions to reclassify these transactions as a reverse recapitalization. Reverse recapitalizations are often referred to as “reverse acquisitions,” which in substance are capital transactions, rather than acquisition transactions, under the business combination rules of accounting. The accounting for a reverse recapitalization is equivalent to the issuance of stock by a private company for the net monetary assets of a non-operating public company accompanied by a recapitalization. The historical financial statements disclosed in any filing with the SEC are those of the private company, which is treated as the continuing reporting entity.

We describe these transactions, or the Transactions, immediately below.

Our Acquisition and Cancellation of $2,500,000 in Xalted Holding Debt Represented by the Notes

A part of the Transactions was our acquisition and subsequent cancellation of convertible notes issued by Xalted Holding. Those notes, or the Notes, were issued by Xalted Holding to three of its existing investors in November 2010. The total principal amount of the Notes was $2,500,000. The investors purchasing the Notes were Imprenord ME (principal amount $1,750,000), Empire Capital Partners, L.P. ($500,000), and Peter J. Richards ($250,000). Imprenord ME is a private equity fund organized in Dubai and was at the time of the issuance of the Notes, and still is, a 10.3% shareholder of Xalted Holding. Its investment decisions are made by Jeetendra Chauhan, the treasurer of Imprenord ME. Empire Capital Partners, L.P., or Empire Capital, is a limited partnership organized in Delaware and was at the time of the issuance of the Notes, and still is, a 15.7% shareholder of Xalted Holding. According to the Schedule 13G filed on July 1, 2011 by Empire Capital and its Affiliates, voting and investment authority with regard to the shares held by Empire Capital Partners, LP may be considered to be held by Empire Capital and its affiliates, including: Empire GP, LLC, or Empire GP, a Delaware limited liability company, which serves as the General Partner to Empire Capital and Empire Capital Management, LLC, or Empire LLC, a Delaware limited liability company, which serves as Investment Manager to Empire Capital as retained by Empire GP. Scott A. Fine and Peter J. Richards are the only Managing Members of Empire LLC and the only Managing Partners of Empire GP. As such, Mr. Fine and Mr. Richards may be considered as the persons having voting and dispositive powers over the other Empire entities, and thus, the shares held by Empire Capital.

Each of the Notes accrued interest at the lowest legal annual rate of interest, all matured on March 31, 2011, and was convertible at the option of all the Note holders collectively into shares of Xalted Holding representing 40% of that company’s equity capital on a fully diluted basis. By Assignment of Note Agreements dated in April 2011, in anticipation of a closing of the Transactions, the Note holders agreed to assign their Notes to us in exchange for shares of the common stock to be issued to them in the Transactions, at the consummation of which the Notes would be cancelled. The May 6, 2011 termination date under the Assignment of Note Agreements was extended until the effective date of the Share Exchange Agreement entered into as a part of the Transactions by an Extension of Assignment of Note Agreements signed by the parties effective as of May 6, 2011.

5

The Assignment of Note Agreements provided the Notes would be transferred to us in exchange for a number of our shares to be set forth in the Share Exchange Agreement we were then negotiating with Xalted Holding, and that the Notes would be cancelled immediately upon issuance of the shares. The effect of this agreement was to relieve Xalted Holding of $2,500,000 of debt as partial consideration for our acquisition of its wholly owned subsidiary, Xalted Network. For their part, the Note holders were willing to exchange their right to demand cash payment of the Notes, or convert their Notes into equity in Xalted Holding, for an aggregate 45% interest in Kranem.

The Share Exchange Agreement

On May 12, 2011, we entered into a Share Exchange Agreement with Xalted Holding and Xalted Networks pursuant to which we agreed to acquire Xalted Networks from Xalted Holding in exchange for the issuance to Xalted Holding of 11,634,220 newly issued shares of our common stock representing 35% of our issued and outstanding common stock after the completion of the Transactions; the issuance of 14,958,280 newly issued shares of our common stock to the three Note holders, in proportion to the principal amounts of their Notes; the cancellation of the Xalted Holding debt represented by those Notes; and the repurchase and cancellation of a total of 14,687,500 shares of our common stock held by three individuals. Under the Share Exchange Agreement, the shares we agreed to issue to the Note holders were allocated as follows: 10,470,795 shares to Imprenord ME, 2,991,655 shares to Empire Capital, and 1,495,830 shares to Peter Richards. These shares would represent 31.4%, 9.0%, and 4.5%, respectively, of our issued and outstanding stock after the completion of the Transactions. The number of shares to be issued to the Note holders was arrived at, after negotiations, to result in an aggregate shareholding by the Note holders of 45% of our issued and outstanding stock immediately after the closing of the Transactions. We closed the transactions contemplated by the Share Exchange Agreement on May 13, 2011.

Our Repurchase and Cancellation of 14,687,500 Shares of Our Common Stock

On May 13, 2011, as further contemplated by the Share Exchange Agreement, we entered into separate agreements to repurchase and cancel a total of 14,687,500 shares of our common stock11,025,000 shares of which were held by Stephen K. Smith, then our President, sole director and controlling shareholder; 180,000 shares of which were held by Michael Grove, then our Secretary, Treasurer and Principal Financial Officer; and 2,762,500 shares of which were held by Andrea Brady, who had no relationship with us other than as a shareholder, in each case in consideration for the payment of $10 in cash. The number of shares to be repurchased and cancelled was agreed upon by the parties, after negotiations, to arrive at the final ownership percentages for Xalted Holding and the Note holders after the closing of the Transactions without repurchasing or cancelling shares held by members of the public.

Change of Control and Resulting Capital Structure

After the closing of the Transactions on May 13, 2011, our issued and outstanding shares were held 35% by Xalted Holding, 31.5% by Imprenord ME, 18.5% by unaffiliated public shareholders, 9% by Empire Capital, 4.5% by Peter Richards, and less than 1% each by Stephen K. Smith, Michael Grove and Andrea Brady.

Changes to Our Board of Directors and Management

As a part of the Transactions, the parties agreed Michael Grove would resign from all positions held with us effective as of the closing of the transaction; Stephen K. Smith would resign from his position as our President effective as of the closing of the transaction, and as a member of our board of directors effective upon the tenth day following the mailing of a 14f-1 Notice to our shareholders, or June 4, 2011; Ajay Batheja would be appointed to our board of directors effective as of the closing; other individuals as might be designated by Xalted Holding would be appointed to our board effective upon the tenth day following the mailing of a 14f-1 Notice to our shareholders, or June 4, 2011; Ajay Batheja would be appointed as our Chief Executive officer effective as of the closing; and Edward Miller would be appointed as our Chief Financial Officer effective as of the closing. Ajay Batheja was then, and still is, a member of the board of directors and the CEO of Xalted Holding, and the CEO of Xalted Information. Edward Miller had no position with us, Xalted Holding or any affiliate of either prior to the closing. Since the closing, Luigi Caramico and V.R. Ranganath, both of whom are directors of Xalted Holding, have been appointed to our board of directors, effective as of the tenth day following the mailing of a 14f-1 Notice to our shareholders, or June 4, 2011. The security ownership of certain beneficial owners and management is set out below under Security Ownership of Certain Beneficial Owners and Management.

6

Acquisition of Alfa Sistemi and Adora

On November 30, 2011, we entered into a Stock Purchase Agreement, or the Alfa Sistemi Purchase Agreement, and consummated the transactions set forth in the Alfa Sistemi Purchase Agreement, to acquire 100% ownership of Alfa Sistemi Telemedia Srl, an Italian company, or Alfa Sistemi, from Mr. Aldo Greco and Ms. Mario Fausto Greco, the existing stockholders of Alfa Sistemi for (a) $800,000 in cash, payable on the later of (i) 6 months from the effective date of the Alfa Sistemi Purchase Agreement or (ii) the date of the Company’s equity next financing and (b) 200,000 shares of common stock to be issued as soon as possible. Alfa Sistemi provides telecommunications equipment and services to various customers in Italy.

On December 21, 2011, we entered into a Stock Purchase Agreement, or the Adora Purchase Agreement, to acquire 100% ownership of Adora ICT Srl, or Adora, an Italian company, from E-Company Srl and Ms. Cristina Carra, the existing stockholders of Adora. The Adora Purchase Agreement was fully executed by the parties on December 21, 2011 and the acquisition completed, with agreed-upon effect as from November 1, 2011. Adora provides telecommunications equipment and services to various customers in Italy. The aggregate consideration, which we estimate to be no more than $2,500,000, is contingent on the 2011 audited revenues of Adora and comprises 50% in cash and 50% in shares of common stock, payable by installments upon the delivery of Adora’s 2011 and 2012 audited financials, respectively. The stock consideration is calculated using the closing market price of our stock on the effective date of the Adora Purchase Agreement.

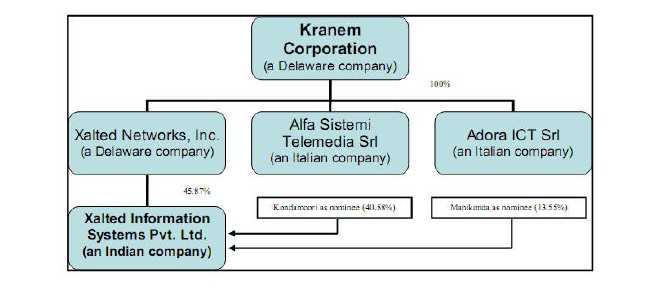

Our Corporate Structure

The chart below presents our current corporate structure:

Our Industry

Telecom Security Solutions Market and Trends

We believe that the key trends driving demand for our telecom security solutions are:

Increasing revenue generation. Increasing the company’s revenue stream is the single greatest challenge in the telecom industry today. The telecom industry can improve most of its operating metrics by simply increasing revenue while controlling costs. The fastest method to increasing revenue is through its service and package offering to its users. The best possible revenue solution for the industry is to revise its service offering in such a manner, so that it requires minimal changes in the network but provides increased revenue generation. Inherently implied in this trend is that the existing revenue cannot be compromised, which is to say eliminate the potential for fraudulent use of the service providers network. To address this trend, Xalted has developed the two modules revenue maximization and revenue assurance.

7

Increased focus on productivity, operational performance and profitability. In today’s economy, companies are increasingly focused on improving productivity and increasing profitability by creating better-quality customer experiences and through achieving higher efficiencies across the enterprise. These objectives require organizations to better manage their customer, partner and employee relationships, analyze critical customer data, maximize the value of customer interactions and execute customer-focused business processes. Considering the high cost of acquiring new customers and the maturation of many industries, it is increasingly important to maximize revenue from the retention and continued satisfaction of current customers. Similarly, due to the high cost of upgrading the telecom network with new equipment and technologies is very expensive. Accordingly, the telecom industry would prefer to minimize capital costs while improving the overall performance of its network. The solution is have a system that can integrate new technologies and capabilities on top of the existing equipment and network capabilities or at a minimum replace the least amount of equipment possible for a new capability. To address the industry’s needs Xalted has developed its OSS/BSS software module. Within the OSS portion of the module exists tools that will allow the user to assess the networks capabilities in modifying legacy systems and equipment.

Heightened regulatory and compliance requirements and the need for dispute resolution. Compliance and regulatory pressures have increased for corporations and public organizations worldwide. These include both internal and external regulations, such as compliance and regulations that may be driven by accounting scandals (e.g., the Sarbanes-Oxley Act), security concerns (e.g., anti-money laundering legislation) and recent events in the financial industry (e.g., the increase in fraud attempts related to wire transfers). In addition, it is important to be able to eliminate and/or resolve communication disputes, such as between counterparties in a securities trade, in an efficient and definitive manner. Existing business intelligence and other IT solutions have addressed these growing challenges to some degree. However, institutions require improved solutions that not only provide better compliance and surveillance, but also more current, real-time information with increased operational visibility. Advanced FMS and OSS/BSS enable the reduction of the costs associated with ongoing compliance, improved customer service, while creating the required audit trail for regulatory purposes.

Homeland Security Solutions Market and Trends

We believe that terrorism and organized crime, which includes drug trafficking and other security threats, combined with an expanding range of communication and information media, are driving demand for innovative security solutions that collect, integrate, and analyze information from voice, video, and data communications, as well as from other sources such as private and public databases. We believe the key trends driving demand for our homeland security solutions are:

Increasing complexity of communications networks and growing network traffic. Law enforcement and certain other government agencies are typically given the authority to intercept communication transmissions to and from specified targets for the purpose of generating evidence and supporting investigations. National security and intelligence agencies intercept communications, often in massive volumes, for these purposes. We believe these agencies are seeking technically advanced solutions to help them keep pace with increasingly complex communications networks and the growing amount of network traffic.

Improved ease of use, processing capabilities and reduced size of handheld communication devices. The advent of advanced handheld technology devices such as the iPhone and Blackberry have increased the communication capabilities of both terrorists and organized crime organizations. These new devices can send and receive telephone calls, text messages, emails, data files, pictures, and videos. The devices can browse the Internet, store data and provide GPS information. These handheld devices have only increased the complexities faced by the law enforcement community, intelligence and national security agencies. Law enforcement and security organizations are looking for solutions to help them track terrorists and other criminals and their communication devices. The solutions needed are those that allow law enforcement and security agencies to monitor multiple communication mediums, and to store and process the complex information obtained into a useable source of information for fact-based decision making.

8

Growing demand for advanced intelligence and investigative solutions. Investigations related to criminal and terrorist networks, drugs, financial crimes, and other illegal activities are highly complex and often involve collecting and analyzing information from multiple sources. We believe law enforcement, national security, intelligence, and other government agencies are seeking advanced solutions that enable them to integrate and analyze information from multiple sources and collaborate more efficiently with various other agencies in order to unearth suspicious activity, optimize investigative workflows, and make investigations more effective.

Emerging needs for holistic situational awareness and event management. The number and variety of physical security sensors is growing substantially, with public and private organizations deploying security systems, such as surveillance cameras and access control and intrusion detection sensors. Organizations, municipalities and governmental entities are struggling to eliminate the number of information silos created by deployment of redundant security systems. These silos limit the control room operators’ ability to gain a cohesive and unified picture of situations. The lack of unified solutions undermines the ability to take decisive actions; furthermore, the lack of adequate tools for sharing information in real time between the various field security personnel, emergency forces and law enforcement agencies, among others, can substantially prolong response time and reduce the probability of successful event mitigation.

Increased urbanization raises rates of crime and risks of terror attacks. Increased urbanization in both developed and developing countries results in higher rates of various types of crime (such as robbery, theft, murder and other assaults) and greater fears of terror attacks in city centers and other metropolitan areas and systems (such as mass transit). These growing concerns are driving large-scale security projects in these areas, aiming at improving the security of the citizens. These large-scale projects include installation and implementation of wide-scale security systems, which better synchronize and correlate multimedia data sources in order to assist law enforcement officials to detect and prevent crimes and terror attacks and investigate quickly in order to apprehend the suspects.

Our Competitive Strengths

We anticipate that the following competitive strengths enable us to compete effectively and to capitalize on the growth of the telecom and homeland information security industries:

-

We have established business relationships. We have established relationships with national and lower- level governments and law enforcement agencies as well as major telecom companies. We have been working with the Government of India since 2006 to create homeland security solutions. As a result this collaboration, our InteliANALYZER solution was deployed in four metropolitan areas in India. We also have established relationships with local and regional law enforcement agencies and bodies in India, such as the Anti-Terrorist Squads in Mumbai, Maharashtra and Goa, a special law enforcement task force in Uttarakand, and the Cyber Crime Division of Thane District Police. We have been able to build upon our established relationships in both the government and telecom sectors by obtaining introductions to potentially new customers/users of our products. In the government sector, as we roll-out our products to the state and local law enforcement agencies, we are opening new opportunities for additional product sales. In the telecom security sector, we have been providing OSS/BSS services to MTNL since 2004 and to BSNL since 2005. Other customers include Mcel, Nepal Telecom, Nepal Satellite Telecom, Telecom Italia and Hutchison 3G.

-

We have developed highly scalable advanced solutions. We believe the data capture, retention, and retrieval system we have developed is among the fastest, most secure, and scalable systems in the world. This system was initially developed to track the demanding requirements of wireless telecom operators, including Telecom Italia, Fastweb and Albacom (British telecom) for their billing systems. Because it was built with linear scalability in mind, with high retrieval rates, it turned out to be the perfect platform to supply the increasingly complex needs of government clients, whose data needs are demanding.

9

- We have a broad portfolio of information security solutions. We have worked closely with our customers over the past three years and developed proprietary, configurable modules that deliver “out of the box” value for customers. Our solutions can be deployed stand-alone or collectively as part of a large-scale system to address the needs of our clients that require advanced, comprehensive solutions. Our homeland security solutions are designed to handle massive amounts of unstructured and structured information from different sources (including fixed and mobile networks, IP networks, and the Internet), can quickly make sense of complex scenarios and generate evidence and intelligence. These highly specialized, unique, domain expertise-filled modules have helped our clients foil or mitigate over ten terrorist plans in last two years.

Our Growth Strategy

We are committed to enhancing profitability and cash flows through the following strategies:

- We plan to continue our penetration of the homeland information

security market in India. We believe our current penetration of the

homeland information security market in India represents less than 1% of the

total market opportunity in that country. Given our established business

relationships, advanced product offerings and proven track record, we expect

sustained growth in this market. We are negotiating an incremental $30 million

agreement with the government of India that we expect to close in the second

half of 2012.

- We plan to continue to expand our market presence outside of

India. We intend to continue expanding our existing relationships

outside of India while creating new ones. We are currently in discussions with

key agencies and governments in Nigeria, Malaysia, Saudi Arabia, Ghana and

Oman to expand our homeland security business. We also plan to leverage our

current relationships in other areas such as Italy, Africa and the Middle East

to develop significant customer relationships over time.

- We plan to augment our organic grown with strategic acquisitions. We examine acquisition opportunities regularly as a means to add technology, increase our geographic presence or expand into adjacent markets. We completed two acquisitions in 2011 in Italy and hope to complete one additional acquisition in the second half of 2012.

Our Products

Telecom Information Security Solutions

We provide integrated, end to end, flexible and multi-purpose OSS/BSS solutions to telecom companies, which accelerate the order to bill cycle, reduce integration costs and minimize error rates. Our solutions automate all processes from order to cash for any service, on any technology. They are designed to support multiple services and technologies, both existing and evolving, and also support new content-based service components.

Following is a summary of our telecom security solutions:

| Product | Purpose |

| Revenue Maximization | Revenue Maximization is an software solution that addresses the challenges faced by Communication Service Providers (“CSP”) at various stages in the development of their revenue-generation value proposition. Revenue Maximization empowers CSPs with real-time dynamic market information while designing new services and products, and enables them with tools like market simulators and scenario modeling to predict and control the revenue outcome. |

| Revenue Assurance | Revenue Assurance is a flexible Revenue Assurance System that allows traffic to be monitored, highlighting “anomalies” which could indicate an incorrect use of service(s), providing a flexible environment for the control of suspicious events, and allowing an automatic interruption of specific services to be implemented, should a particular set of conditions arise. |

| Fraud Management | Fraud Management delivers a suite of fraud management solutions that empowers telecommunications companies to identify, capture and prevent fraudulent activities across their manifold of service offerings. Our fraud detection solutions provide our customers with powerful controls to permit real-time monitoring, customer profiling and a comprehensive analysis across an extensive range of environments. |

| OSS/BSS | OSS/BSS software solutions reduce the time-to-market for new services while helping service providers control development and deployment costs. We offer a complete suite of OSS/BSS solutions for managing complex networks ranging from Legacy systems to today’s next-generation services. |

10

For the fiscal years ended December 31, 2011 and 2010, approximately 74.9% and 69.9%, respectively, of our revenues were generated from sales of our telecom security solutions.

Homeland Information Security Solutions

In the homeland security sector, we have developed our Actionable Intelligence System product, or InteliCENTER. InteliCENTER is a sophisticated data analytics and monitoring platform for intelligence agencies that acquires, correlates and analyzes large volumes of structured and unstructured data received from varied information sources (such as telecommunications service providers, internet service providers, government agencies and other information systems) and provides actionable intelligence to proactively counter criminal activities. Unstructured data includes cross-channel analysis of phone calls, internet sessions, email, chat, instant messaging, video captured by closed circuit cameras and radio communications.

InteliCENTER empowers intelligence agencies with strategic, operational and tactical information to bring out unforeseen intelligence, which can lead to proactive measures to address criminal activity potentially endangering public safety. It helps intelligence agencies gain insight into data by analyzing data patterns, uncovering links within the data, discerning relationships, monitoring target movements, etc. InteliCENTER can be customized to a significant extent to cater to the requirements of clients.

InteliCENTER was the Company’s first product to address the needs of the homeland security market. Since the development of InteliCENTER, we have developed four additional modules based upon the request of our customers.

| Product | Purpose |

| InteliCENTER | InteliCENTER provides law enforcement and intelligence agencies with proactive monitoring of communications, transactions and events across domains, and draws intelligence from the information assisting authorities to act in a timely manner and to develop strategies and processes to predict and prevent criminal activities. InteliCENTER provides both the strategic and operational information required through real-time tactical analysis, empowering decision-makers with key data points to allow them to intelligently formulate their strategy to a given threat. |

| InteliCURATOR | InteliCURATOR acquires and analyzes a variety of disparate data sources. The data sources handled by the system come from sources such as communication detail records, government information systems (passport, visa, driving license, permits, ID cards etc.), law enforcement systems, public and private sensors and surveillance records, and various transaction records (banking, financial, medical, and travel, etc.). The data is gathered, processed, sorted, and stored per identity, so that a profile can be built on a suspect. |

| InteliANALYZER | InteliANALYZER conducts analysis of curated digital data and provides law enforcement and intelligence agencies with proactive intelligence. It allows the investigating agency and its personnel to locate hidden links to piece together a picture of a planned criminal activity or terrorist threat. It offers focused investigative techniques for specific criminal activities and conducts real-time and historical analysis. |

| InteliSTRATEGIZER | InteliSTRATEGIZER produces configurable periodic reports for automatic pattern identification and recognition, social network analysis, trend analysis, dashboard monitoring, alarms and alerts to Law Enforcement Agencies. This software provides the data equipping Law Enforcement with the necessary information to detect suspicious activities in their early stages, allowing strategies to be developed based upon comprehensive situational awareness and knowledge driven insights to execute appropriate and timely tactical actions to avert the potential threat. |

| InteliRETENTION | InteliRETENTION is an integrated data retention solution built for the exact application of acquiring, storing and retrieving massive amounts of call detail records (CDRs) and internet protocol detail records (IPDRs) for Law Enforcement Agency (LEA) requests. InteliRETENTION is linearly scalable and proven for capturing beyond tens of billions of CDRs/IPDR’s daily, which adds up to the storage of trillions of these records. The solution enables near real- time retrieval and rapid analysis, cost effectively and securely. |

11

For the fiscal years ended December 31, 2011 and 2010, approximately 25.1% and 30.1%, respectively, of our revenues were generated from sales of our homeland security solutions.

Customer Service and Support

We offer a range of customer services, including implementation, training, consulting and maintenance to help our customers maximize their return on investments in our solutions. While our customer service and support fees have increased over time, they represent less than 10% of our revenue and are below those of our competition. This is an area in which we would like to significantly improve our revenue generation.

Our solutions are implemented and installed by business units within our operating subsidiaries, which we sometimes refer to as our service organizations. Our implementation services include project management, system installation, and commissioning, including integrating our applications with our customers’ environments and third-party solutions. In some cases, we have agreements with third parties, such as IBM and Mahindra Satyam, a major Indian technology company, to act as suppliers or subcontractors on projects in which they are a prime or superior contractor. On occasion we certify their personnel to sell, install and support the software we provide. Customer training is provided at the customer site, at our training centers, or remotely through webinars. Our consulting services are designed to enable our customers to maximize the value of our solutions in their own environments.

We offer a range of customer maintenance support programs to our customers and resellers, including phone, Web, and email access to technical personnel up to 24 hours a day, 7 days a week. Our support programs are designed to ensure long-term, successful use of our solutions. We believe that customer support is critical to retaining and expanding our customer base. Our solutions are sold with a warranty of generally one year for hardware and 90 days for software. In addition, customers are typically provided the option to purchase maintenance plans that provide a range of services, such as telephone support, advanced replacement, upgrades when and if available, and on-site repair or replacement.

12

Our Customers

We sell our products in India and internationally. Historically, a small number of customers have accounted for a substantial portion of our revenue. Due to nondisclosure agreements with certain key customers, we cannot disclose the exact percentages their sales represent for us. As we target new markets, we expect our customer composition as well as the identity and concentration of our top customers to change from period to period.

In the years ended December 31, 2011 and December 31, 2010, we derived approximately 26.9% and 67.7% of our revenue, respectively, from Indian customers, and approximately 73.1% and 32.3% of our revenue, respectively, from international customers.

For the year ended December 31, 2011, approximately 15.5% of our business was generated from contracts with various governments, including national, state, and lower-level government agencies. Some of the customer engagements on which we work require us to have the necessary security credentials or to participate in the project through an approved legal entity. In addition, because of the unique nature of the terms and conditions associated with government contracts generally, our government contracts may be subject to renegotiation or termination at the election of the government customer.

In 2010, our Indian subsidiary reported $2,260,000 in sales in the US market, which represented an intercompany receipt from its parent, Xalted Holding (then known as Xalted Networks, Inc.). The parent company had a similar amount of revenue from its customer, a company located in Sweden. The work under the contract has been substantially completed. The resulting “loss” of this revenue in 2011 is not due to any corporate reorganization but rather to the completion of work under the contract. We do not anticipate any material impact on our future financial results since we anticipate new contracts to replace those under which work has been completed.

In 2011, our material customer contracts were with an agency of the government of India; and with Ericsson India Pvt. Ltd., both directly as well as indirectly through Xalted Holding as a pass-through reseller. We are not permitted to disclose certain terms of our contract with an agency of the government of India based on Indian national security concerns.

- On June 7, 2006 Xalted Information and government of India signed a seven

year agreement to develop, install and implement software for the government

of India. The total value of the contract is approximately $9.5 million, which

will be invoiced in approximately 25% increments based upon the attainment of

certain thresholds. As of December 31, 2011, approximately 60% of the contract

had been fulfilled.

- In 2010 and 2011, we provided hardware, spare parts, software and support materials, together with maintenance services, to Ericsson India Pvt. Ltd., both directly and through Xalted Holding as a pass- through reseller. Until May 13, 2011, Xalted Holding was our corporate parent; it is now one of our significant shareholders. Any amounts received by Xalted Holding from Ericsson India Pvt. Ltd. were passed through without deduction to Xalted Information. In 2010, we invoiced $2,564,486 directly to Ericsson India Pvt. Ltd., and $2,154,535 indirectly through Xalted Holding, under this arrangement; and in 2011, we invoiced $410,063 directly and $2,207,038 indirectly under this arrangement. These amounts represented 59.6% and 31.5% of our revenues in 2010 and 2011, respectively. We anticipate the remaining work under these agreements will generate revenue of approximately $1.5 million in 2012. The term of the agreements is until May 31, 2016.

For a more detailed discussion of the risks associated with our government customers, see “Risk Factors—Risks Related to Our Business—We are dependent on contracts with governments for a significant portion of our revenue and these contracts also expose us to additional business risks and compliance obligations” and “—Indian and foreign governments could refuse to buy our homeland security solutions or could deactivate our security clearances in their countries thereby restricting or eliminating our ability to sell these solutions in those countries and perhaps influence other countries by such a decision.”

13

Sales and Marketing

We sell our software and services primarily through our direct sales teams and a small portion through our indirect channel consisting mostly of resellers. Each of our solutions is sold by trained, dedicated, regionally organized direct and indirect sales teams. Our direct sales teams are focused on large and mid-sized customers and, in many cases, co-sell with our sales agents. Our indirect sales teams are focused on developing and supporting relationships with our indirect channels, which provide us with broader market coverage, including access to their customer base, integration services, and presence in certain geographies and vertical markets. Our sales teams are supported by our internal implementation and installation specialists, who, during the sales process, determine customer requirements and develop technical responses to those requirements. While we sell directly and indirectly in both of our segments, sales of our telecom security solutions are primarily direct, and sales of our homeland security solutions are exclusively direct.

Research and Development

We continue to enhance the features and performance of our existing software solutions and introduce new solutions through extensive software development activities, including the development of new software modules and features as well as enhancements and customer requests to our existing software offering. We also offer consulting services, which allows us to evaluate and determine our customers’ needs and customize our software to meet those needs. In some instances, our customers will identify particular requirements and we will customize our products. We believe our future success depends on a number of factors, which include our ability to:

- identify and respond to emerging technological trends in our target

markets;

- develop and maintain competitive solutions that meet our customers’

changing needs and requirements;

- enhance our existing products by adding features and functionality to meet

specific customer needs or differentiate our products from those of our

competitors;

- constantly evaluate external opportunities to accelerate our product

offering through key acquisitions of businesses, business units and technology

licenses; and

- attract, recruit, and retain highly skilled and experienced employees.

To support these efforts, we make significant investments in research and development every year. In the years ended December 31, 2011 and 2010, we spent $957,606 and $1,002,980, respectively, on research and development. The cost of this research and development was built into the fees we charged our customers and to that extent was borne directly by our customers. We allocate our research and development resources in response to market research and customer demand for additional features and solutions. Our development strategy involves rolling out initial releases of our products and adding features over time. We incorporate product feedback received from our customers into our product development process. While our products are developed internally, in some cases, we also acquire or license technologies, products, and applications from third parties based on timing and cost considerations, and incorporate those in our products. We are not materially dependent on any such third party products or applications.

The Bidding Process for Government Contracts

The bidding process for our contracts is a multi-step process that generally requires months to complete. In most cases, the process begins with the posting of an RFI (Request for Information) by the prospective purchaser. The purpose of the RFI is to explore whether potential vendors meet basic requirements relating to capabilities and availability of products or services. After responses are made to the RFI, the purchaser typically issues a tender detailing the product or service requirements for the project and a list of specific information to be supplied by potential vendors. Each vendor must pay a tender fee, which is generally a nominal amount, in order to download a complete copy of the tender and evaluate whether it wishes to bid on the contract. If it wishes to bid, the vendor prepares and submits a “Technical Bid” containing the information and documentation required by the tender. If the purchaser determines that the Technical Bid meets the basic requirements of the tender, it will then request and consider a “Commercial Bid” from the vendor. The Commercial Bid contains price quotations for each item on which the vendor has bid on the tender. After the bids are submitted, and on the basis of the Technical attributes of the Bids, purchasers sometimes require product demonstrations. At the completion of a purchaser’s evaluation process, vendors are selected for portions of or all of the project tendered. Once vendors are selected, the necessary purchase orders are raised.

14

Intellectual Property

Our success depends, in part, on our ability to maintain and protect our proprietary technology and to conduct our business without infringing on the proprietary rights of others. We rely primarily on a combination of proprietary technology and trade secrets, as well as employee and third-party confidentiality agreements, to safeguard our intellectual property. Some of the software modules which we develop internally and license to our customers incorporate third-party software licensed from Oracle Corporation and BMC Software for that purpose. We are not materially dependent on the software from either vendor. If our customer prefers an alternative vendor, or if we were to determine for any reason to use the software of another vendor, we could do so without a material impact on our business.

We license certain software, technology, and related rights for use in the marketing of our software. We believe that our rights under such licenses and other agreements are sufficient for the marketing of our products and, in the case of licenses, extend for periods at least equal to the estimated useful lives of the related technology and know-how.

Our licenses are designed to prohibit unauthorized use, copying, and disclosure of our software technology. When we license our software to customers, we require license agreements containing restrictions and confidentiality terms customary in the industry in order to protect our proprietary rights in the software. These agreements generally warrant that the software and propriety hardware will materially comply with written documentation and assert that we own or have sufficient rights in the software we distribute and have not violated the intellectual property rights of others. We license our products in a format that does not permit users to change the software code.

We protect our trade secrets through confidentiality provisions in the employment contracts we enter into with our employees. In addition, our software engineers and programmers are generally divided into different project groups, each of which generally handles only a portion of the project software. As a result, no one software engineer or programmer generally has access to the entire design process and documentation for a particular product.

We cannot give any assurance that the protection afforded for our intellectual property will be adequate. It may be possible for third parties to obtain and use, without our consent, intellectual property that we own or are licensed to use. Unauthorized use of our intellectual property by third parties, and the expenses incurred in protecting our intellectual property rights, may adversely affect our business. We may also be subject to litigation involving claims of patent infringement or violation of other intellectual property rights of third parties. See “Risk Factors—Risks Related to Our Business—Our intellectual property may not be adequately protected,” “—Our products may infringe or may be alleged to infringe on the intellectual property rights of others, which could lead to costly disputes or disruptions for us and may require us to indemnify our customers and resellers for any damages they suffer” and —Reliance on or loss of third-party licensing agreements could materially adversely affect our business, financial condition, and results of operations.”

Our Competition

We face strong competition in all of our markets, and we expect that competition will persist and intensify. Our primary competitors are i2 Limited (U.K.) (now a subsidiary of IBM), Narus, Inc., Verint Systems Inc., NICE Systems Ltd. (Israel), Septier Communication Ltd. (Israel), SS8 Networks, Inc., Visual Analytics Inc., and many smaller companies, which can vary across regions. Some of our competitors have superior brand recognition and greater financial resources than we do, which may enable them to increase their market share at our expense. Furthermore, we expect that competition will increase as other established and emerging companies enter markets and as new products, services, and technologies are introduced.

15

We believe that we compete principally on the basis of:

- product performance and functionality;

- product quality and reliability;

- breadth of product portfolio and interoperability;

- high-quality customer service and support;

- specific industry knowledge, vision, and experience; and

- price.

We believe that our success depends primarily on our ability to provide technologically advanced and cost-effective solutions and services. We expect that competition will increase as other established and emerging companies enter our market and as new products, services, and technologies are introduced. In recent years, there has also been significant consolidation among our competitors, which has improved the competitive position of several of these companies and enabled new competitors to emerge in all of our markets. See “Risk Factors—Risks Related to Our Business—Intense competition in our markets and competitors with greater resources than us may limit our market share, profitability, and growth” for a more detailed discussion of the competitive risks we face.

Employees

As of March 31, 2012, we had 190 employees, all of whom were full-time employees. The following table sets forth our employees by function.

| Number of | |||

| Function | Employees | ||

| Senior Management | 7 | ||

| Research and Development, Technical Support | 150 | ||

| Sales and Marketing | 11 | ||

| General Administrative | 22 | ||

| TOTAL | 190 |

We maintain a satisfactory working relationship with our employees, and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations. None of our employees is represented by a labor union.

Regulation

Because most of our operations are in India, we are subject to national and local laws in India. This section summarizes the major regulations relating to our business. Employment, Health and Safety Laws

We are subject to various labor, health and safety laws which govern the terms of employment of the our employees, their working conditions, the benefits available to them and the general relationship between our management and such employees. These include:

16

Industrial Disputes Act, 1947 (“IDA”)

The IDA seeks to preempt industrial tensions in an establishment and provide the mechanics of dispute resolution, collective bargaining and the investigation and settlement of industrial disputes between unions and companies. While the IDA provides for the voluntary reference of disputes to arbitration, it also empowers the appropriate government agency to refer disputes for compulsory adjudication and prohibit strikes and lock-outs during the pendency of conciliation proceedings before a board of conciliation or adjudication proceedings before a labor court.

Contract Labor (Regulation and Abolition) Act, 1970 (“CLRA”)

The CLRA was enacted to regulate the employment of contract labor. The CLRA applies to every establishment in which 20 or more persons are employed or were employed on any day of the preceding 12 months as contract labor. The CLRA vests the responsibility on the principal employer of an establishment to register as an establishment that engages contract labor. Likewise, every contractor to whom the CLRA applies must obtain a license and may not undertake or execute any work through contract laborers except in accordance with the license issued.

To ensure the welfare and health of contract labor, the CLRA imposes certain obligations on the contractor in relation to establishment of canteens, rest rooms, drinking water, washing facilities, first aid and other facilities and payment of wages. However, in the event the contractor fails to provide these amenities, the principal employer is under an obligation to provide these facilities within a prescribed time period.

Employee State Insurance Act, 1948 (“ESIA”)

The ESIA requires the provision of certain benefits to employees or their beneficiaries in the event of sickness, maternity, disability or employment injury. Every factory or establishment to which the ESIA applies is required to be registered in the manner prescribed under the ESIA. Every employee, including casual and temporary employees, whether employed directly or through a contractor, who is in receipt of wages up to Rs. 6,500 per month, is entitled to be insured under the ESIA. The ESIA contemplates the payment of a contribution by the principal employer and each employee to the Employee State Insurance Corporation.

Payment of Wages Act, 1936 (“PWA”)

The PWA regulates the payment of wages to certain classes of employed persons and makes every employer responsible for the payment of wages to persons employed by such employer. No deductions are permitted from, nor is any fine permitted to be levied on, wages earned by a person employed except as provided under the PWA.

Minimum Wages Act, 1948 (“MWA”)

The MWA provides for a minimum wage payable by employers to employees. Under the MWA, every employer is required to pay the minimum wage to all employees, whether for skilled, unskilled, manual or clerical work, in accordance with the minimum rates of wages that have been fixed and revised under the MWA. Workers are to be paid for overtime at overtime rates stipulated by the appropriate government. Contravention of the provisions of this legislation may result in imprisonment up to six months, a fine up to Rs. 500 or both.

Workmen’s Compensation Act, 1923 (“WCA”)

The WCA makes every employer liable to pay compensation if injury, disability or death is caused to a workman (including those employed through a contractor) due to an accident arising out of or in the course of his employment. If the employer fails to pay the compensation due under the WCA within one month from the date it falls due, the commissioner may direct the employer to pay the compensation amount along with interest and impose a penalty for non-payment.

17

Payment of Gratuity Act, 1972 (“PGA”)

Under the PGA, an employee who has been in continuous service for a period of five years is eligible for gratuity upon retirement or resignation. The entitlement to gratuity in the event of superannuation or death or disablement due to accident or disease, will not be contingent on an employee having completed five years of continuous service. The maximum amount of gratuity payable must not exceed Rs. 350,000.

An employee is said to be in “continuous service” for a certain period notwithstanding that his service has been interrupted during that period by sickness, accident, leave, absence without leave, lay-off, strike, lock-out or cessation of work not due to the fault to of the employee. The employee is also deemed to be in continuous service if the employee has worked (in an establishment that works for at least six days in a week) for at least 240 days in a period of 12 months or 120 days in a period of six months immediately preceding the date of reckoning.

Payment of Bonus Act, 1965 (“PBA”)

The PBA provides for the payment of a minimum annual bonus to all employees regardless of whether the employer has made a profit or a loss in the accounting year in which the bonus is payable. Under the PBA, every employer is bound to pay to every employee, in respect of the relevant accounting year, a minimum bonus equal to 8.33% of the salary or wage earned by the employee during the accounting year or Rs. 100, whichever is higher. If the allocable surplus, as defined in the PBA, available to an employer in any accounting year exceeds the aggregate amount of minimum bonus payable to the employees, the employer is bound to pay bonuses at a higher rate which is in proportion to the salary or wage earned by the employee and the allocable surplus during the accounting year, subject to a maximum of 20% of such salary or wage. Contravention of the provisions of the PBA by a company will be punishable by imprisonment for up to six months or a fine of up to Rs. 1,000, or both, against persons in charge of, and responsible to the company for, the conduct of the business of the company at the time of contravention.

Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 (“EPFA”)

The EPFA creates provident funds for the benefit of employees in factories and other establishments. Contributions are required to be made by employers and employees to a provident fund and pension fund established and maintained by the Government of India. The employer is responsible for deducting employees’ contributions from the wages of employees and remitting the employees’ as well as its own contributions to the relevant fund. The EPFA empowers the Government of India to frame various funds such as the “Employees Provident Fund Scheme,” the “Employees Deposit-linked Insurance Scheme” and the “Employees Family Pension Scheme.”

Other Regulations

Land Acquisition Act, 1894 (“Land Acquisition Act”)

As per the provisions of the Land Acquisition Act, the central government or appropriate state government is empowered to acquire any land from private persons for ‘public purpose’ subject to payment of compensation to the persons from whom the land is so acquired. The Land Acquisition Act further prescribes the manner in which such acquisition may be made by the central government or the appropriate state government. Additionally, any person having an interest in such land has the right to object to such proposed acquisition.

Item 1A. Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

18

RISKS RELATED TO OUR BUSINESS

Our business is impacted by changes in general economic conditions and information technology spending in particular.

Our business is subject to risks arising from adverse changes in India and global economic conditions. Slowdowns or recessions around the world may cause companies and governments to delay, reduce, or even cancel planned spending. Customers who are facing business challenges or liquidity issues are also more likely to delay purchase decisions or cancel orders, as well as to delay or default on payments. If customers significantly reduce their spending with us or significantly delay or fail to make payments to us, our business, results of operations, and financial condition would be materially adversely affected. Moreover, as a result of recent economic conditions, like many companies, we engaged in significant cost-saving measures over the last two years. We cannot assure you that these measures will not negatively impact our ability to execute on our objectives and grow in the future, particularly if we are not able to invest in our business as a result of a protracted economic downturn.

If the pace of spending by the governments and security organizations is slower than anticipated, our homeland security business will likely be adversely affected.

The market for our homeland security solutions is highly dependent on the spending cycle and spending scope of the Government of India, as well as local, state and municipal governments and security organizations in international markets. We cannot be sure that the spending cycle will materialize as we expect and that we will be positioned to benefit from the potential opportunities, especially in light of the current unfavorable economic and market conditions.

Intense competition in our markets and competitors with greater resources than us may limit our market share, profitability, and growth.

We face aggressive competition from numerous and varied competitors in all of our markets, making it difficult to maintain market share, remain profitable, and grow. Even if we are able to maintain or increase our market share for a particular product, revenue or profitability could decline due to pricing pressures, increased competition from other types of products, or because the product is in a maturing industry.

Our competitors may be able to more quickly develop or adapt to new or emerging technologies, better respond to changes in customer requirements or preferences, or devote greater resources to the development, promotion, and sale of their products. Some of our competitors have, in relation to us, longer operating histories, larger customer bases, longer standing relationships with customers, greater name recognition, and significantly greater financial, technical, marketing, customer service, public relations, distribution, or other resources. Some of our competitors are also significantly larger than us and some of these companies have increased their presence in our markets in recent years through internal development, partnerships, and acquisitions. There has also been significant consolidation among our competitors, which has improved the competitive position of several of these companies and enabled new competitors to emerge in all of our markets. In addition, we may face competition from solutions developed internally by our customers. To the extent we cannot compete effectively, our market share and, therefore, results of operations, could be materially adversely affected.