Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ELECTRONIC ARTS INC. | d355338d8k.htm |

Exhibit 10.1

ELECTRONIC ARTS INC.

2000 EQUITY INCENTIVE PLAN

PERFORMANCE-BASED RESTRICTED STOCK UNIT AWARD

[PARTICIPANT INFORMATION]

Electronic Arts Inc., a Delaware corporation, (the “Company”) hereby grants on the date hereof (the “Award Date”) to the Participant named above a Performance-Based Restricted Stock Unit Award (the “Award”) consisting of Restricted Stock Units issued under the Company’s 2000 Equity Incentive Plan, as amended (the “Plan”), to receive the total number of units set forth below of the Company’s Common Stock (the “Award Units”). The Award is intended to qualify as “qualified performance-based compensation” as described in Section 162(m)(4)(C) of the Code. The Award is subject to all the terms and conditions set forth herein, in the attached Appendix A, Appendix B, Appendix C and in the Plan, the provisions of which are incorporated herein by reference. The principal features of the Award are as follows:

| TARGET NUMBER OF AWARD UNITS: |

[ | ] | ||||

| MAXMIMUM NUMBER OF AWARD UNITS*: |

[ | ] | ||||

| * | The actual number of Award Units that vest pursuant to the terms and condition of this Award will be between 0% and 200% of the Target Number of Award Units. The Maximum Number of Award Units represents 200% of the Target Number of Award Units. |

Performance-based Vesting Schedule: Subject to the terms and conditions of the Plan, Appendix A, Appendix B, and this paragraph, the number of Award Units that vest on the applicable Vest Date for each Measurement Period shall be based (after certification by the Committee as described below) on the relative total stockholder return (“Relative TSR”) percentile ranking of the Company for each Measurement Period, provided Participant is, and has remained continuously since the Award Date through each applicable Vest Date, employed by the Company or a Subsidiary. Participant shall not be considered to have terminated employment for purposes of the vesting requirements during a leave of absence that is protected under local law (which may include, but is not limited to, a maternity, paternity, disability, medical, or military leave), provided that such period shall not exceed the maximum leave of absence period protected by local law. Following the completion of each Measurement Period, the Committee shall determine and certify, on or before each Vest Date, in accordance with the requirements of Section 162(m) of the Code the Relative TSR percentile ranking for the applicable Measurement Period and the number of Award Units that vest according to the performance terms set forth in Appendix B; provided, however, that the Committee retains discretion to reduce, but not increase the number of Award Units that would

otherwise vest as a result of the Company’s Relative TSR percentile ranking for each Measurement Period.

PLEASE READ ALL OF APPENDIX A, APPENDIX B AND APPENDIX C WHICH CONTAIN THE SPECIFIC TERMS AND CONDITIONS OF THE AWARD.

| ELECTRONIC ARTS INC. | ||

| /s/ Stephen G. Bené |

| |

| Stephen G. Bené | DATE | |

| Senior Vice President and General Counsel |

ACCEPTANCE:

By accepting this Award and signing below, Participant hereby acknowledges that a copy of the Plan and a copy of the Prospectus, as amended, are available upon request from the Company’s Stock Administration department and can also be accessed electronically. Participant represents that Participant has read and understands the terms and conditions thereof, and accepts the Award subject to all the terms and conditions of the Plan, the Award, including appendices thereto. Participant acknowledges that there may be adverse tax consequences due to the Award and that Participant should consult a tax advisor to determine his or her actual tax consequences. Participant must accept this Award by executing and delivering a paper or electronic version to the Company within thirty (30) days. Otherwise the Company may, at its discretion, rescind the Award in its entirety.

|

|

||

| Participant Signature |

||

|

|

||

| Date | ||

2

APPENDIX A

ELECTRONIC ARTS INC.

PERFORMANCE-BASED RESTRICTED STOCK UNIT AWARD

1. Award. Each Award Unit represents the unsecured right to receive one share of Electronic Arts Inc. common stock, $0.01 par value per share (“Common Stock”), subject to certain restrictions and on the terms and conditions contained in this Restricted Stock Unit Award (“Award”), and the Electronic Arts’ 2000 Equity Incentive Plan, as amended (the “Plan”). In the event of any conflict between the terms of the Plan and this Award, including appendices thereto, the terms of the Plan shall govern. Any terms not defined herein shall have the meaning set forth in the Plan.

2. Award Date. The Award Date shall be the date on which the Committee makes the determination to grant such Restricted Stock Units, unless otherwise specified by the Committee. The Award will be delivered to Participant within a reasonable time after the Award Date.

3. No Stockholder Rights. The Award does not entitle Participant to any rights of a stockholder of Common Stock. The rights of Participant with respect to the Award shall remain forfeitable at all times prior to the date on which such rights become vested.

4. Conversion of Award Units; Issuance of Common Stock. No Shares of Common Stock shall be issued to Participant prior to each Vest Date. After any Award Units vest, the Company shall promptly cause to be issued in book-entry form, registered in Participant’s name or in the name of Participant’s legal representatives, beneficiaries or heirs, as the case may be, Common Stock in payment of such vested whole Award Units; provided, however, that in the event such Award Units do not vest on a day during which the Common Stock is quoted on the NASDAQ Global Select Market (or traded on such other principal national securities market or exchange on which the Common Stock may then be listed) (“Trading Day”), the Company shall cause Award Shares to be issued on the next Trading Day following the date on which such Award Units vest; provided, further, that in no event shall the Company cause such Shares to be issued later than two (2) months after each Vest Date. For purposes of this Award, the date on which vested Award Units are converted into Common Stock shall be referred to as the “Conversion Date.”

5. Fractional Award Units. In the event Participant is vested in a fractional portion of an Award Unit (a “Fractional Portion”), such Fractional Portion shall not be converted into a share or issued to Participant. Instead, the Fractional Portion shall remain unconverted until the final Vest Date for the Award Units; provided, however, if Participant vests in a subsequent Fractional Portion prior to the final Vest Date for the Award Units and such Fractional Portion taken together with a previous Fractional Portion accrued by Participant under this Award would equal or be greater than a whole Share, then such Fractional Portions shall be converted into one Share; provided, further, that following such conversion, any remaining Fractional Portion shall remain

A-1

unconverted. Upon the final Vest Date, the value of any remaining Fractional Portion(s) shall be rounded up to the nearest whole Award Unit at the same time as the conversion of the remaining Award Units and issuance of Common Stock described in Section 4 above.

6. Restriction on Transfer. Neither the Award Units nor any rights under this Award may be sold, assigned, transferred, pledged, hypothecated or otherwise disposed of by Participant other than by will or by the laws of descent and distribution, and any such purported sale, assignment, transfer, pledge, hypothecation or other disposition shall be void and unenforceable against the Company. Notwithstanding the foregoing, Participant may, in the manner established by the Committee, designate a beneficiary or beneficiaries to exercise Participant’s rights and receive any property distributable with respect to the Award Units upon Participant’s death.

7. Forfeiture Upon Termination of Employment.

(a) Except as otherwise provided in Section 7(b) or 10(b) hereof in the event that Participant’s employment or service is Terminated for any reason, any unvested Award Units that are not yet vested as of the date of Termination shall be forfeited immediately upon such Termination, as described in Section 12(l) below.

(b) In the event of a Termination due to the death or Disability of Participant, the Participant shall vest in a pro-rata portion of the Award Units on each remaining Vest Date in the Performance Period thereafter, with such number of Award Units vesting to be determined based upon the actual Relative TSR percentile ranking for the applicable Measurement Period, as set forth in Appendix B, and the number of months worked by the Participant during the Measurement Period, based upon the following pro-ration formula:

Number of Award Units determined to vest on each Vest Date multiplied by the number of calendar months worked by Participant from (i) April 1, 2012 through the date of Termination due to death or Disability divided by (i) twelve (12) for the 1st Measurement Period; (ii) twenty-four (24) for the 2nd Measurement Period; and (iii) thirty-six (36) for the 3rd Measurement Period.

Participant shall be deemed to have worked a calendar month if Participant has worked any portion of that month. The Committee’s determination of vested Award Units shall be in whole Award Units only and will be binding on the Participant.

8. Forfeiture Upon Termination of Performance Period. Any Award Units that do not vest on the Vest Date for each Measurement Period in the Performance Period shall be forfeited.

9. Suspension of Award and Repayment of Proceeds for Contributing Misconduct. If at any time the Committee reasonably believes that a Participant, other than an Outside Director, has engaged in an act of misconduct, including, but not limited

A-2

to an act of embezzlement, fraud or breach of fiduciary duty during the Participant’s employment that contributed to an obligation to restate the Company’s financial statements (“Contributing Misconduct”), the Committee may suspend the vesting of the Award pending a determination of whether an act of Contributing Misconduct has been committed. If the Committee determines that a Participant has engaged in an act of Contributing Misconduct, then the Award will terminate immediately upon such determination and the Committee may require Participant to repay to the Company, in cash and upon demand, the Award Proceeds (as defined below) resulting from any sale or other disposition (including to the Company) of Shares issued or issuable upon the vesting of the Award if the sale or disposition was effected during the twelve-month period following the first public issuance or filing with the SEC of the financial statements required to be restated. The term “Award Proceeds” means, with respect to any sale or other disposition (including to the Company) of Shares issued or issuable upon vesting of Award Units, an amount determined appropriate by the Committee to reflect the effect of the restatement on the Company’s stock price, up to the amount equal to the market value per Share at the time of such sale or other disposition multiplied by the number of Shares sold or disposed of. The return of Award Proceeds is in addition to and separate from any other relief available to the Company due to the Participant’s Contributing Misconduct. Any determination by the Committee with respect to the foregoing shall be final, conclusive and binding on all interested parties. For any Participant who is designated as an “executive officer”, the determination of the Committee shall be subject to the approval of the Board of Directors.

10. Change of Control.

(a) Upon a Change of Control prior to the expiration of the Performance Period, the Committee shall certify the Relative TSR percentile ranking as of the effective date of the Change of Control (the “CoC TSR percentile ranking”) as set forth in Appendix B. The CoC TSR percentile ranking shall thereafter be applied to determine the number of shares that vest on each remaining Vest Date in the Performance Period or pursuant to section 10(b), and no other performance terms applicable thereto shall have any force or effect for purposes of determining the vesting of the Award Units.

(b) Notwithstanding any provision to the contrary under the Electronic Arts Inc. Key Employee Continuity Plan (the “Continuity Plan”) or subsection (a) above, and subject to the timely execution, return, and non-revocation of a Severance Agreement and Release, unvested Award Units, shall automatically vest: (i) as of the date of the Participant’s Termination of employment with the Company if such Termination occurs during the time period beginning on the effective date of the Change of Control and ending on the first anniversary of the effective date of the Change of Control; and provided further that the Termination is initiated by the Company without Cause, or by Participant for Good Reason (as these terms are defined in Section 10(c)); or (ii) as of the effective date of the date of the Change of Control if a Participant’s employment is Terminated without Cause during the two (2) months immediately preceding a Change of Control, and such Termination is made in connection with the Change of Control, as determined by the Committee in its sole discretion; provided that in the case of either

A-3

clause (i) or clause (ii) of this provision, such employment Termination meets the criteria for a “separation from service” as defined in Treas. Reg. §1.409A-1(h).

(c) For purposes of this Award Agreement:

(i) “Cause” means (i) the continued failure by Participant to substantially perform Participant’s duties with the Company (other than any such failure resulting from Participant’s incapacity due to physical or mental illness), (ii) the engaging by Participant in conduct which is demonstrably injurious to the Company or any of its affiliates, monetarily or otherwise, (iii) Participant committing any felony or any crime involving fraud, breach of trust or misappropriation or (iv) any breach or violation of any agreement or written code of conduct relating to Participant’s employment with the Company where the Company, in its sole discretion, determines that such breach or violation materially and adversely affects the Company or any of its affiliates.

(ii) “Change of Control” means the occurrence of an event as set forth in any one of the following paragraphs:

(1) any Person (as defined in Section 3(a)(9) of the Securities Exchange Act of 1934, as amended, as modified and used in Sections 13(d) and 14(d) thereof, except that such term shall not include (A) the Company or any of its affiliates, (B) a trustee or other fiduciary holding securities under an employee benefit plan of the Company or any of its subsidiaries, (C) an underwriter temporarily holding securities pursuant to an offering of such securities or (D) a corporation owned, directly or indirectly, by the stockholders of the Company in substantially the same proportions as their ownership of stock of the Company) is or becomes the Beneficial Owner (as defined in Rule 13d-3 of the Securities Exchange Act of 1934, as amended), directly or indirectly, of securities of the Company (not including in the securities beneficially owned by such Person any securities acquired directly from the Company other than securities acquired by virtue of the exercise of a conversion or similar privilege or right unless the security being so converted or pursuant to which such right was exercised was itself acquired directly from the Company) representing 50% or more of (X) the then outstanding shares of common stock of the Company or (Y) the combined voting power of the Company’s then outstanding voting securities entitled to vote generally in the election of directors; or

(2) the following individuals cease for any reason to constitute a majority of the number of directors then serving on the Board (the “Incumbent Board”): individuals who, as of the date of this Award, constitute the Board and any new director (other than a director whose initial assumption of office is in connection with an actual or threatened election contest, including, without limitation, a consent solicitation, relating to the election of directors of the Company) whose appointment or election by the Board or nomination for election by the Company’s stockholders was approved or recommended by a vote of at least two-thirds of the directors then still in office who either were directors on the date of this Award, or whose appointment, election or nomination for election was previously so approved or recommended; or

A-4

(3) there is consummated a merger or consolidation of the Company or any Subsidiary of the Company with any other corporation, other than a merger or consolidation pursuant to which (A) the voting securities of the Company outstanding immediately prior to such merger or consolidation will continue to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity or any parent thereof) more than 50% of the outstanding shares of common stock and the combined voting power of the outstanding voting securities entitled to vote generally in the election of directors, as the case may be, of the Company or such surviving entity or any parent thereof outstanding immediately after such merger or consolidation; (B) no Person will become the Beneficial Owner, directly or indirectly, of securities of the Company or such surviving entity or any parent thereof representing 50% or more of the outstanding shares of common stock or the combined voting power of the outstanding voting securities entitled to vote generally in the election of directors (except to the extent that such ownership existed prior to such merger or consolidation); and (C) individuals who were members of the Incumbent Board will constitute at least a majority of the members of the board of directors of the corporation (or any parent thereof) resulting from such merger or consolidation; or

(4) the stockholders of the Company approve a plan of complete liquidation or dissolution of the Company or there is consummated an agreement for the sale or disposition by the Company of all or substantially all of the Company’s assets, other than a sale or disposition by the Company of all or substantially all of the Company’s assets to an entity, (A) more than 50% of the outstanding shares of common stock and the combined voting power of the outstanding voting securities entitled to vote generally in the election of directors, as the case may be, of which (or of any parent of such entity) is owned by stockholders of the Company in substantially the same proportions as their ownership of the Company immediately prior to such sale; (B) in which (or in any parent of such entity) no Person is or becomes the Beneficial Owner, directly or indirectly, of securities of the Company representing 50% or more of the outstanding shares of common stock resulting from such sale or disposition or the combined voting power of the outstanding voting securities entitled to vote generally in the election of directors (except to the extent that such ownership existed prior to such sale or disposition); and (C) in which (or in any parent of such entity) individuals who were members of the Incumbent Board will constitute at least a majority of the members of the board of directors.

(iii) “Good Reason” means: the occurrence without Participant’s written consent, of any of the following on or after the date of a Change of Control:

(1) a change in the location of Participant’s principal place of business by more than 50 miles when compared to Participant’s principal place of business immediately before the Change of Control; and

(A) a more than 10% reduction in Participant’s annual base salary in effect immediately before the Change of Control; (B) a more than 10% reduction in Participant’s target annual bonus or incentive opportunity from that in effect immediately before the Change

A-5

of Control, or (C) a more than 10% reduction in Participant’s total target annual cash compensation, including without limitation, annual base salary and target annual bonus or incentive opportunity, from that in effect immediately before the Change of Control; and (D) with respect to only those Participants in the position of CEO, CFO, Chief Human Resources Officer, EVP Legal and Business Affairs, SVP Tax and Treasury, General Counsel or Chief Accounting Officer of the Company on the Award Date, the occurrence without the affected Participant’s written consent, on or after the date of a Change of Control, of a material reduction in Participant’s authority, duties, or responsibilities, including, without limitation, a material diminution in the authority, duties, or responsibilities of the supervisor to whom Participant is required to report, which shall include a requirement that a Participant report to a corporate officer or employee instead of reporting directly to the board of directors of a corporation (or similar governing body with respect to an entity other than a corporation), when compared to Participant’s authority, duties, or responsibilities, or the authority, duties or responsibilities of the supervisor to whom Participant is required to report, immediately before the Change of Control.

(2) Notwithstanding the foregoing, Good Reason shall exist only if the following conditions are met: (A) Participant gives the Company written notice of his or her intention to terminate employment with the Company for Good Reason; (B) such notice is delivered to the Company within 90 days of the initial existence of the condition giving rise to the right to terminate for Good Reason, and at least 30 days in advance of the date of termination; (C) the Company fails to cure the alleged Good Reason to the reasonable satisfaction of Participant prior to Participant’s termination, and (D) the events described in the preceding sentence, singly or in combination, result in a material negative change in Participant’s employment relationship with the Company, so that Participant’s termination effectively constitutes an involuntary separation from service within the meaning of Section 409A of the Code.

(iv) “Severance Agreement and Release” means the written separation agreement and release substantially in the form set forth in Appendix C, as may be amended from time to time.

(d) Anything to the contrary in this Award or the Plan notwithstanding, in the event that following the Award Date and prior to a Change of Control the Committee determines, in its sole discretion, that the Award would fail to qualify as “qualified performance-based compensation” as described in Section 162(m)(4)(C) of the Code because of the provisions of Section 10(b) the Committee may adopt such amendments (including with retroactive effect) to the provisions of Section 10(b) , including eliminating the effect of the provisions of Section 10(b), that the Committee reasonably determines, in its sole discretion, are required to preserve the treatment of the Award as qualified performance-based compensation under Section 162(m) of the Code prior to a Change of Control. Notwithstanding the foregoing, nothing in the proceeding sentence provides the Committee with any rights or discretion that is not itself permitted under Section 162(m).

A-6

11. Section 280G Provision. If Participant, upon taking into account the benefit provided under this Award and all other payments that would be deemed to be “parachute payments” within the meaning of Section 280G of the Code (collectively, the “280G Payments”), would be subject to the excise tax under Section 4999 of the Code, notwithstanding any provision of this Award to the contrary, Participant’s benefit under this Award shall be reduced to an amount equal to (i) 2.99 times Participant’s “base amount” (within the meaning of Section 280G of the Code), (ii) minus the value of all other payments that would be deemed to be “parachute payments” within the meaning of Section 280G of the Code (but not below zero); provided, however, that the reduction provided by this sentence shall not be made if it would result in a smaller aggregate after-tax payment to Participant (taking into account all applicable federal, state and local taxes including the excise tax under Section 4999 of the Code). Participant’s benefit hereunder shall be reduced prior to any benefit owing to Participant under the Continuity Plan may be reduced pursuant to Section 2.11 of the Continuity Plan. Unless the Company and Participant otherwise agree in writing, all determinations required to be made under this Section 11, and the assumptions to be used in arriving at such determinations, shall be made in writing in good faith by the accounting firm serving as the Company’s independent public accountants immediately prior to the events giving rise to the payment of such benefits (the “Accountants”). For the purposes of making the calculations required under this Section 11, the Accountants may make reasonable assumptions and approximations concerning the application of Sections 280G and 4999 of the Code. The Company shall bear all costs the Accountants may reasonably incur in connection with any calculations contemplated by this Section 11.

12. Acknowledgement of Nature of Plan and Award. In accepting the Award, Participant acknowledges that:

(a) the Plan is established voluntarily by the Company, it is discretionary in nature, and it may be modified, amended, suspended or terminated by the Company at any time, unless otherwise provided in the Plan;

(b) the Award is voluntary and occasional and does not create any contractual or other right to receive future awards of Award Units, or benefits in lieu of Award Units, even if Award Units have been granted repeatedly in the past;

(c) all decisions with respect to future awards, if any, will be at the sole discretion of the Company;

(d) nothing in the Plan or the Award shall confer on Participant any right to continue in the employ of, or other relationship with, the Company or Participant’s employer or limit in any way the right of the Company or Participant’s employer to Terminate Participant’s employment or service relationship at any time, with or without cause;

(e) Participant’s participation in the Plan is voluntary;

A-7

(f) the Award Units are an extraordinary item that does not constitute compensation of any kind for services of any kind rendered to the Company or Participant’s employer, and which is outside the scope of Participant’s employment or service contract, if any;

(g) notwithstanding any other provisions of the Plan or this Award, this Award is intended to provide tax-qualified performance based compensation in accordance with Section 162(m)(4)(C) of the Code to Participant. Accordingly, this Award shall be construed consistent with that intent;

(h) the Award Units are not part of normal or expected compensation or salary for any purposes, including, but not limited to, calculating any severance, resignation, termination, redundancy, end of service payments, bonuses, long-service awards, pension or retirement or welfare benefits or similar payments and in no event may be considered as compensation for, or relating in any way to, past services for the Company or Participant’s employer;

(i) in the event that Participant is not an employee of the Company, the Award and Participant’s participation in the Plan will not be interpreted to form an employment or service contract or relationship with the Company; and furthermore, the Award will not be interpreted to form an employment or service contract or relationship with Participant’s employer or any Subsidiary;

(j) the future value of the underlying Shares of Common Stock is unknown and cannot be predicted with certainty;

(k) in consideration of the Award, no claim or entitlement to compensation or damages shall arise from termination of the Award Units or diminution in value of the Award Units or Shares of Common Stock received upon vesting of the Award Units resulting from Termination of Participant’s employment by the Company or Participant’s employer (for any reason whatsoever and whether or not in breach of local labor laws), and Participant irrevocably releases the Company and Participant’s employer from any such claim that may arise; if, notwithstanding the foregoing, any such claim is found by a court of competent jurisdiction to have arisen, then, by accepting the Award, Participant will be deemed irrevocably to have waived his or her entitlement to pursue such claim;

(l) except as otherwise provided by the Committee or pursuant to Section 10(b) hereof, in the event of Termination of Participant’s employment (whether or not in breach of local labor laws), Participant’s right to receive an Award and vest in the Award Units under the Plan, if any, will terminate effective as of the date that Participant is no longer actively employed and will not be extended by any notice period mandated under local law (e.g., active employment would not include a period of “garden leave” or similar period pursuant to local law); the Committee shall have the exclusive

A-8

discretion to determine when Participant is no longer actively employed for purposes of his or her Award;

(m) the Company is not providing any tax, legal or financial advice, nor is the Company making any recommendations regarding Participant’s participation in the Plan, or Participant’s acquisition or sale of the underlying Shares of Common Stock; and

(n) Participant is hereby advised to consult with his or her own tax, legal and financial advisors regarding Participant’s participation in the Plan before taking any action related to the Plan.

13. Tax Withholding. Regardless of any action the Company or Participant’s employer takes with respect to any or all income tax, social insurance, payroll tax, payment on account or other applicable taxes (“Tax Items”) in connection with the Award, Participant hereby acknowledges and agrees that the ultimate liability for all Tax Items legally due by Participant is and remains the responsibility of Participant. Further, if Participant has become subject to tax in more than one jurisdiction between the date of grant and the date of any relevant taxable or tax withholding event, as applicable, Participant acknowledges that the Company and/or the Employer (or former employer, as applicable) may be required to withhold or account for Tax-Related Items in more than one jurisdiction.

(a) Participant acknowledges and agrees that the Company and/or Participant’s employer: (i) make no representations or undertakings regarding the treatment of any Tax Items in connection with any aspect of the Award, including, but not limited to, the grant or vesting of the Award Units, the subsequent sale of Shares of Common Stock acquired under the Plan and the receipt of any dividends; and (ii) do not commit to structure the terms of the Award or any aspect of the Award to reduce or eliminate Participant’s liability for Tax Items.

(b) Prior to delivery of Shares of Common Stock upon the vesting of the Award Units (“Award Shares”), Participant must pay or make adequate arrangements satisfactory to the Company and/or Participant’s employer to satisfy all withholding obligations for Tax Items of the Company and/or Participant’s employer. In this regard, Participant authorizes the Company and/or Participant’s employer, at their discretion and if permissible under local law, to satisfy the obligations with regard to all Tax Items legally payable by Participant by one or a combination of the following:

(i) withholding Shares from the delivery of the Award Shares, provided that the Company only withholds a number of Shares with a Fair Market Value equal to or below the minimum withholding amount for Tax Items, provided, however, that in order to avoid issuing fractional Shares, the Company may round up to the next nearest number of whole Shares, as long as the Company issues no more than a single whole Share in excess of the minimum withholding obligation for Tax Items. For example, if the minimum withholding obligation for Tax Items is $200 and the Fair

A-9

Market Value of the Common Stock is $20 per share, then the Company may withhold up to ten (10) Shares from the delivery of Award Shares on the Conversion Date. The Company or Participant’s employer will remit the total amount withheld for Tax Items to the appropriate tax authorities; or

(ii) withholding from Participant’s wages or other cash compensation paid to Participant by the Company and/or Participant’s employer; or

(iii) selling or arranging for the sale of Award Shares.

Participant shall pay to the Company or Participant’s employer any amount of Tax Items that the Company or Participant’s employer may be required to withhold as a result of Participant’s participation in the Plan that cannot be satisfied by one or more of the means previously described. The Company may refuse to deliver the Award Shares if Participant fails to comply with his or her obligations in connection with the Tax Items as described in this section.

14. Compliance with Laws and Regulations. The issuance and transfer of Common Stock shall be subject to compliance by the Company and Participant with all applicable requirements of federal, state and non-U.S. laws and with all applicable requirements of any stock exchange or national market system on which the Company’s Common Stock may be listed at the time of such issuance or transfer. The Company is not required to issue or transfer Common Stock if to do so would violate such requirements.

15. Data Privacy. Participant hereby explicitly and unambiguously consents to the collection, use and transfer, in electronic or other form, of his or her personal data as described in the Award and any other Award materials by and among, as applicable, Participant’s employer, the Company and any Subsidiary for the exclusive purpose of implementing, administering and managing Participant’s participation in the Plan. Participant understands that the Company and Participant’s employer may hold certain personal information about him or her, including, but not limited to, Participant’s name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job title, any shares of stock or directorships held in the Company, details of all awards or any other entitlement to shares of stock awarded, canceled, exercised, vested, unvested or outstanding in Participant’s favor, for the exclusive purpose of implementing, administering and managing the Plan (“Data”).

Participant understands that Data will be transferred to E*Trade Financial Services, Inc. or such other stock plan service provider as may be selected by Participant or as may be selected by the Company in the future, which is assisting the Company with the implementation, administration and management of the Plan. Participant understands that the recipients of the Data may be located in the United States or elsewhere, and that the recipients’ country (e.g., the United States) may have different data privacy laws and protections than Participant’s country. Participant understands that he or she may request a list with the names and addresses of any potential recipients of the Data by contacting

A-10

Participant’s local human resources representative. Participant authorizes the Company, E*Trade Financial Services, Inc. and any other possible recipients which may assist the Company (presently or in the future) with implementing, administering and managing the Plan to receive, possess, use, retain and transfer the Data, in electronic or other form, for the sole purpose of implementing, administering and managing Participant’s participation in the Plan. Participant understands that Data will be held only as long as is necessary to implement, administer and manage Participant’s participation in the Plan. Participant understands that he or she may, at any time, view Data, request additional information about the storage and processing of Data, require any necessary amendments to Data or refuse or withdraw the consents herein, in any case without cost, by contacting in writing Participant’s local human resources representative. Participant understands, however, that refusing or withdrawing his or her consent may affect Participant’s ability to participate in the Plan. For more information on the consequences of Participant’s refusal to consent or withdrawal of consent, Participant understands that he or she may contact his or her local human resources representative.

16. Electronic Delivery. The Company may, in its sole discretion, decide to deliver any documents related to the Award or future awards made under the Plan by electronic means or request Participant’s consent to participate in the Plan by electronic means. Participant hereby consents to receive such documents by electronic delivery and, if requested, agrees to participate in the Plan through an on-line or electronic system established and maintained by the Company or another third party designated by the Company.

17. Authority of the Board and the Committee. Any dispute regarding the interpretation of the Award shall be submitted by Participant, Participant’s employer, or the Company, forthwith to either the Board or the Committee, which shall review such dispute at its next regular meeting. The resolution of such a dispute by the Board or Committee shall be final and binding on Participant, Participant’s employer, and/or the Company.

18. No Deferral of Compensation. Payments made pursuant to this Plan and Award are intended to qualify for the “short-term deferral” exemption from Section 409A of the Code. The Company reserves the right, to the extent the Company deems necessary or advisable in its sole discretion, to unilaterally amend or modify the Plan and/or this Award agreement to ensure that all Awards are made in a manner that qualifies for exemption from or complies with Section 409A of the Code, provided however, that the Company makes no representations that the Award will be exempt from Section 409A of the Code and makes no undertaking to preclude Section 409A of the Code from applying to this Award.

19. Governing Law and Choice of Venue. The Award as well as the terms and conditions set forth in the Plan shall be governed by, and subject to, the law of the State of California. For purposes of litigating any dispute that arises directly or indirectly from the relationship of the parties evidenced by the Award, the parties hereby submit to and consent to the exclusive jurisdiction of the State of California and agree that such

A-11

litigation shall be conducted only in the courts of San Mateo County, California, or the federal courts for the United States for the Northern District of California, and no other courts, where this grant is made and/or to be performed.

20. Captions. Captions provided herein are for convenience only and are not to serve as a basis for interpretation or construction of this Award.

21. Language. If Participant has received this Award agreement or any other document related to the Plan translated into a language other than English and if the translated version is different than the English version, the English version will control unless otherwise prescribed by local law.

22. Agreement Severable. In the event that any provision in this Award agreement is held to be invalid or unenforceable, such provision will be severable from, and such invalidity or unenforceability will not be construed to have any effect on, the remaining provisions of this Award agreement.

23. Entire Agreement. The Award, including the appendices thereto, and the Plan constitute the entire agreement of the parties and supersede all prior undertakings and agreements with respect to the subject matter hereof.

A-12

APPENDIX B

ELECTRONIC ARTS INC.

PERFORMANCE-BASED RESTRICTED STOCK UNIT AWARD

Performance Vesting Terms

1. Performance Period. The performance period for the Award Units shall be the period of time beginning April 1, 2012 and ending on March 28, 2015 (the “Performance Period”). During the Performance Period there will be three (3) separate measurement periods of the Company’s Relative TSR (each a “Measurement Period”). Each Measurement Period has a corresponding vest date (the “Vest Date”) on which Award Units will vest.

The Start Dates, End Dates and Vest Dates for the three (3) Measurement Periods are:

| 1st Measurement Period |

2nd Measurement Period |

3rd Measurement Period | ||||

| Start Date |

April 1, 2012 | April 1, 2012 | April 1, 2012 | |||

| End Date |

March 30, 2013 | March 29, 2014 | March 28, 2015 | |||

| Vest Date |

May 18, 2013 | May 18, 2014 | May 18, 2015 |

2. Target Number of Award Units. The Target Number of Award Units for each Measurement Period is:

| 1st Measurement Period |

2nd Measurement Period |

3rd Measurement Period | ||||

| Target Number of Award Units |

3. Performance Measure. The Performance Measure for the Performance Period is Relative TSR, as defined below. The number of Award Units that may vest for each Measurement Period will be determined by multiplying the Target Number of Award Units by the Maximum Vest Percentage that corresponds to the Company’s Relative TSR percentile ranking according to the following schedule and subject to the Maximum Value limitation described below:

| Relative TSR Percentile Ranking |

Maximum Vest Percentage | |||

| ³ 94th percentile | = 200% | |||

| 61st to 93rd percentile | = 100% plus 3% for each percentile >60th | |||

| TARGET | 60th percentile | = 100% | ||

| 11th to 59th percentile | = 100% minus 2% for each percentile <60th | |||

| £ 10th percentile | = 0% | |||

For example: if the Company’s Relative TSR percentile ranking is 65%, up to 115% of the Target Number of Award Units for that Measurement Period could vest.

B-1

4. Maximum Number of Award Units. The number of Award Units that vest will be between 0% and 200% of the Target Number of Award Units for each Measurement Period; provided that, under no circumstances will the monetary value of the actual number of Award Units that vest following each Measurement Period, exceed five (5) times the monetary value of those Award Units on the Award Date (the “Maximum Value”). For purposes of this Award Agreement “monetary value” refers to the value of a share of Company stock as determined on any specified date by the Company’s closing stock price for that date. The Maximum Value for each Measurement Period is determined by multiplying the number of Award Units determined to vest based on the Company’s Relative TSR percentile ranking for that Measurement Period by the closing price of the Company’s stock on the Award Date and then multiplying that product by five (5). Accordingly, the maximum number of Award Units that vest for each Measurement Period shall not exceed the lesser of:

(i) the number of Award Units determined by multiplying the Target Number of Award Units for each Measurement Period by the Maximum Vest Percentage corresponding to the Relative TSR percentile ranking of the Company for that Measurement Period; or

(ii) the number of Award Units determined not to exceed the Maximum Value, (with such number of Award Units calculated by dividing the Maximum Value by the closing price of the Company’s stock on the End Date of each Measurement Period.)

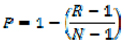

5. Determination of Relative TSR. “Relative TSR” means the Company’s Total Stockholder Return relative to the Total Stockholder Returns of the other Group Companies. Relative TSR will be determined by ranking the Group Companies from the highest to lowest according to their respective Total Stockholder Return, then calculating the Relative TSR percentile ranking of the Company relative to the other Group Companies as follows:

Where:

“P” represents the Relative TSR percentile ranking rounded to the nearest whole percentile

“R” represents the Company’s ranking among the Group Companies

“N” represents the number of Group Companies

“Total Stockholder Return” means the number calculated by dividing (i) the Closing Average Share Value minus the Opening Average Share Value (in each case adjusted to take into consideration the cumulative amount of dividends per share for the Measurement Period, assuming reinvestment, as of the of applicable ex-dividend date, of all cash dividends and other cash distributions (excluding cash distributions resulting

B-2

from share repurchases or redemptions by the Company) paid to stockholders) by (ii) the Opening Average Share Value.

“Opening Average Share Value” means the average of the daily closing prices per share of a Group Company’s stock as reported on the NASDAQ for all Trading Days in the 90 calendar days immediately following and including April 1, 2012.

“Closing Average Share Value” means the average of the daily closing prices per share of a Group Company’s stock as reported on the NASDAQ for all Trading Days in the Closing Average Period.

“Closing Average Period” means (i) in the absence of a Change of Control of the Company, the 90 calendar days immediately prior to and including March 30, 2013 for the 1st Measurement Period; the 90 calendar days immediately prior to and including March 29, 2014 for the 2nd Measurement Period; and the 90 calendar days immediately prior to and including March 28, 2015 for the 3rd Measurement Period; or (ii) in the event of a Change of Control, the 90 calendar days immediately prior to and including the effective date of the Change of Control.

“Group Companies” means those companies listed in the NASDAQ-100 Index on April 1, 2012. The Group Companies may be changed as follows:

(i) In the event of a merger, acquisition or business combination transaction of a Group Company with or by another Group Company, the surviving entity shall remain a Group Company;

(ii) In the event of a merger, acquisition, or business combination transaction of a Group Company with or by another company that is not a Group Company, or “going private transaction” where the Group Company is not the surviving entity or is otherwise no longer publicly traded, the company shall no longer be a Group Company; and

(iii) In the event of a bankruptcy of a Group Company, such company shall remain a Group Company and its stock price will continue to be tracked for purposes of the Relative TSR calculation. If the company liquidates, it will remain a Group Company and its stock price will be reduced to zero for all remaining Measurement Periods in the Performance Period.

6. Award Vesting. The Committee will certify the Relative TSR percentile ranking of the Company after the End Date of each Measurement Period and determine the actual number of Award Units that vest for that Measurement Period on or before each applicable Vest Date.

B-3

APPENDIX C

FORM OF

SEVERANCE AGREEMENT AND RELEASE

This SEVERANCE AGREEMENT AND RELEASE (this “Agreement”) is made as of [ ], 200[ ], by and between Electronic Arts Inc., a Delaware corporation, with its principal place of business at 209 Redwood Shores Parkway, Redwood City, California 94065-1175 (which together with its affiliates and subsidiaries, if any, will hereinafter collectively be called “Employer”) and [ ], an individual residing at [ ] (“Employee”).

A. Employee has been employed by Employer since on or about [ ]. [Employer and Employee have entered into a New Hire/Proprietary Information Agreement dated as of [ ] (the “New Hire/Proprietary Information Agreement”)]1

B. The Electronic Arts Inc. Key Employee Continuity Plan (as such plan may be amended from time to time, the “Plan”) and the Electronic Arts Inc. Restricted Stock Unit Award (“Award”), dated [ ] sets forth certain rights, benefits and obligations of the parties arising out of Employee’s employment by Employer and the severance of such employment in connection with a Change in Control as determined in accordance with the Plan and Award.

C. Employee recognizes that this Agreement will automatically be revoked and Employee shall forfeit any benefit to which he or she may be entitled under the Plan and Award unless Employee submits an executed copy of this Agreement [or similar agreement to be provided to persons employed by the Company outside the United States] to the Employer on or before [ ].

NOW, THEREFORE, in consideration of the mutual promises and covenants set forth below, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, Employer and Employee agree as follows:

1. Termination of Employment Relationship. The relationship between Employee and Employer shall terminate as of (the “Separation Date”). [Note that Separation Date cannot be later than the date the agreement is signed or the release will not provide the Company with full protection.]

2. Employee Severance. In consideration of Employee’s undertakings set forth in this Agreement, Employer will pay Employee $[ ] in accordance with the terms of the Plan, plus such other benefits as are provided under the terms of the Plan, the Award and this Agreement. Such payment and benefits will be less

| 1 | To be included if Employee has signed a New Hire/Proprietary Information Agreement. |

C-1

all applicable deductions (including, without limitation, any federal, state or local tax withholdings). Such payment and benefits are contingent upon the execution of this Agreement by Employee and Employee’s compliance with all terms and conditions of this Agreement, the Plan and Award. Employee agrees that if this Agreement does not become effective, Employer shall not be required to make any further payments or provide any further benefits to Employee pursuant to this Agreement, the Plan and Award and shall be entitled to recover all payments and be reimbursed for all benefits already made or provided by it (including interest thereon). Except for Employee’s final paycheck and the amounts and benefits set forth herein and in the Plan, Employee acknowledges and agrees that Employer has already paid Employee any and all wages, salary, benefit payments and/or other payments owed to Employee from Employer, and that no further payments, amounts or benefits are owed or will be owed. Employee further acknowledges and agrees that the amounts and benefits received under this Section 2 exceed that to which Employee would be entitled under Employer’s policies, practices, and benefit plans, if any.

3. Release of Employer. In consideration of the obligations of Employer described in Paragraph 2 above, Employee hereby completely releases and forever discharges Employer, its related corporations, divisions and entities, its predecessors, successors, and assigns, and its and each of their current and former officers, directors, employees and agents, (collectively referred to as the “Releasees”) from all claims, rights, demands, actions, liabilities and causes of action of any kind whatsoever, known and unknown, which Employee may have or have ever had against the Releasees (“claims”) including without limitation all claims arising from or connected with Employee’s employment by the Employer and his or her separation from employment, whether based in tort or contract (express or implied) or on federal, state or local law or regulation. Employee has been advised that Employee’s release does not apply to any rights or claims that may arise after the date that this Agreement is signed by the Employee (the “Effective Date”). This Agreement shall not affect Employee’s rights under the Older Workers Benefit Protection Act to have a judicial determination of the validity of the release contained herein. [Note: release to be reviewed in each case for purposes of compliance with laws of applicable jurisdiction.]

4. Acknowledgment. Employee understands and agrees that this is a final release and that Employee is waiving all rights now or in the future to pursue any remedies available under any employment related cause of action against the Releasees, including without limitation claims of wrongful discharge, emotional distress, defamation, harassment, discrimination, retaliation, breach of contract or covenant of good faith and fair dealing, claims of violation of the California Labor Code and claims under Title VII of the Civil Rights Act of 1964, as amended, the Equal Pay Act of 1963, the Civil Rights Act of 1866, as amended, the Americans with Disabilities Act, the Age Discrimination in Employment Act (the “ADEA”), the Family and Medical Leave Act, the California Family Rights Act, the California Fair Employment and Housing Act, the Employee Retirement Income Security Act, and any other laws and regulations relating to employment. Employee further acknowledges and agrees that Employee has received all leave to which Employee is entitled under all federal, state, and local laws and

C-2

regulations related to leave from employment, including, but not limited to, the Family and Medical Leave Act, the California Family Rights Act, and California worker’s compensation laws. [Note: release to be reviewed in each case for purposes of compliance with laws of applicable jurisdiction.]

5. Waiver of California Civil Code. Employee hereby expressly waives the provision of California Civil Code Section 1542 which provides as follows:

A general release does not extend to claims which the creditor does not know or suspect to exist in his/her favor at the time of executing the release, which if known by him/her must have materially affected his/her settlement with the debtor.

Employee acknowledges that the waiver of this Section of the California Civil Code set forth above is an essential and material term of this release, and that Employee has read this provision, and intends these consequences even as to unknown claims which may exist at the time of this release.

6. Covenant Not to Sue. Employee represents that Employee has not filed or commenced any proceeding against the Releasees and agrees that at no time in the future will Employee file or maintain any charge, claim or action of any kind, nature and character whatsoever against the Releasees, or cause or knowingly permit any such charge, claim or action to be filed or maintained, in any federal, state or municipal court, administrative agency or other tribunal, arising out of any of the matters covered by this Agreement, except as provided in the following sentence. Notwithstanding Employee’s release and waiver of remedies under the ADEA, this Agreement and the above covenant not to sue do not affect enforcement of the ADEA by the Equal Employment Opportunity Commission (“EEOC”), nor preclude Employee from (i) filing an ADEA charge with the EEOC, (ii) participating in an ADEA investigation or proceeding conducted by the EEOC, or (iii) initiating a proceeding regarding the enforceability of this Agreement with respect to ADEA rights and remedies. If Employee initiates any lawsuit or other legal proceeding in contravention of this covenant not to sue (other than a proceeding regarding the enforceability of this Agreement with respect to ADEA rights and remedies), Employee shall be required to immediately repay to Employer the full consideration paid to Employee pursuant to Paragraph 2 above, regardless of the outcome of Employee’s legal action.

7. Nondisclosure of Agreement. Employee will maintain the fact and terms of this Agreement and any payments made by Employer in strict confidence and will not disclose the same to any other person or entity (except Employee’s legal counsel, spouse and accountant) without the prior written consent of Employer. The parties agree that this confidentiality provision is a material term of this Agreement. A violation of the promise of nondisclosure shall be a material breach of this Agreement. It is acknowledged that in the event of such a violation, it will be impracticable or extremely difficult to calculate the actual damages and, therefore, the parties agree that upon a

C-3

breach, in addition to whatever rights and remedies Employer may have at law and in equity, Employee will pay to Employer as liquidated damages, and not as a penalty, the sum of Five Hundred Dollars ($500.00) for each such breach and each repetition thereof.

[8. Return of Property; Confidentiality; Inventions. 2

(a) Employee represents that Employee does not have in Employee’s possession any records, documents, specifications, or any confidential material or any equipment or other property of Employer.

(b) Employee represents that Employee has complied with and will continue to comply with Paragraphs 3 and 4 of the New Hire/Proprietary Information Agreement pertaining to Proprietary Information (as defined therein), and will preserve as confidential all confidential information pertaining to the business of Employer and its customers, licensees and affiliates.

(c) Employee represents that Employee has complied with and will continue to comply with Paragraphs 5 and 6 of the New Hire/Proprietary Information Agreement pertaining to Inventions (as defined therein).

(d) Employee acknowledges and agrees that the New Hire/Proprietary Information Agreement will continue in full force and effect following his/her separation from the employ of Employer.]

[8. Return of Property; Confidentiality; Inventions. 3

(a) Employee represents that Employee does not have in Employee’s possession any records, documents, specifications, or any confidential material or any equipment or other property of Employer.

(b) Employee understands and acknowledges that all Proprietary Information (as defined below) is the sole property of Employer and its assigns. Employee hereby assigns to Employer any rights Employee may have in all Proprietary Information. At all times, Employee shall keep in confidence and trust all Proprietary Information, and Employee will not use or disclose any Proprietary Information or anything relating to it without the prior written consent of Employer. Employee represents that Employee has delivered to Employer all materials, documents and data of any nature containing or pertaining to any Proprietary Information and has not taken and will not take with Employee any such materials, documents or data or any reproduction thereof. “Proprietary Information” means any information of a confidential or secret nature that may have been learned or developed by Employee during the period of Employee’s employment by Employer and which (i) relates to the business of Employer or to the business of any customer or supplier of Employer, or (ii) has been created, discovered or developed by, or has otherwise become known to Employer and has commercial value in the business in which Employer is engaged. By way of illustration,

| 2 | To be used for Employees who have signed a New Hire/Proprietary Information Agreement. |

| 3 | To be used for Employees who have NOT signed a New Hire/Proprietary Information Agreement. |

C-4

but not limitation, Proprietary Information includes trade secrets, processes, formulas, computer programs, data, know-how, inventions, improvements, techniques, marketing plans, product plans, strategies, forecasts, personnel information and customer lists.

(c) Employee represents that Employee has disclosed or will disclose in confidence to Employer, or any persons designated by it, all Inventions (as defined below) that have been made or conceived or first reduced to practice by Employee during Employee’s employment with Employer (or thereafter if Invention uses Proprietary Information of Employer). All such Inventions are the sole and exclusive property of Employer and its assigns, and Employer and its assigns shall have the right to use and/or to apply for patents, copyrights or other statutory or common law protections for such Inventions in any and all countries. Employee agrees to assist Employer in every proper way (but at Employer’s expense) to obtain and from time to time enforce patents, copyrights and other statutory or common law protections for such Inventions in any and all countries. To that end, Employee has executed or will execute all documents for use in applying for and obtaining such patents, copyrights and other statutory or common law protections therefore and enforcing same, as Employer may desire, together with any assignments thereof to Employer or to persons designated by Employer. Employer shall compensate Employee at a reasonable rate for any time after the Separation Date actually spent by Employee at Employer’s request on such assistance. “Inventions” means all inventions, improvements, original works or authorship, formulas, processes, computer programs, techniques, know-how and data, whether or not patentable or copyrightable, made or conceived or first reduced to practice or learned by Employee, whether or not in the course of Employee’s employment.]

[(d) Employee has been notified and understands that the provisions of Paragraph 8(c) above do not apply to an Invention which qualifies fully under the provisions of Section 2870 of the California Labor Code, which states as follows: 4

(i) Any provision in an employment agreement which provides that an employee shall assign, or offer to assign, any of his or her rights in an invention to his or her employer shall not apply to an invention that the employee developed entirely on his or her own time without using the employer’s equipment, supplies, facilities, or trade secret information except for those inventions that either:

| (1) | Relate at the time of conception or reduction to practice of the invention to the employer’s business, or actual or demonstrably anticipated research or development of the employer; or |

| (2) | Result from any work performed by the employee for the employer. |

| 4 | This Subsection (d) is to be included for California employees only. |

C-5

(ii) To the extent a provision in an employment agreement purports to require an employee to assign an invention otherwise excluded from being required to be assigned under subdivision (i), the provision is against the public policy of this state and is unenforceable.]

[(d) The provisions of Paragraph 8(c) above do not apply to an Invention for which all of the following are true:5

(i) The Invention was developed entirely on Employee’s own time;

(ii) Employee developed the Invention away from Employer’s facilities, and entirely without using the Employer’s equipment, supplies, or trade secret information;

(iii) The Invention does not relate to the business or any anticipated research or development of Employer; and

(iv) The Invention does not result from, and is not the extension of, any work done by Employee for Employer.]

9. Non-Disparagement. Without limiting the foregoing, Employee agrees that Employee will not make statements or representations to any other person, entity or firm which may cast Employer, or its directors, officers, agents or employees, in an unfavorable light, which are offensive, or which could adversely affect Employer’s name or reputation or the name or reputation of any director, officer, agent or employee of Employer. The parties agree that the provisions of this Paragraph 9 are material terms of this Agreement.

10. Cooperation with Employer. Employee agrees that Employee will cooperate with Employer, its agents, and its attorneys with respect to any matters in which Employee was involved during Employee’s employment with Employer or about which Employee has information, will provide upon request from Employer all such information or information about any such matter, will be available to assist with any litigation or potential litigation relating to Employee’s actions as an employee of Employer, and will testify truthfully in any legal proceeding related to his or her employment with Employer.

11. Non-Solicitation. [In accordance with the terms of the New Hire/Proprietary Information Agreement, until]6/[Until]7 the [first] anniversary of the Separation Date, Employee agrees not to recruit, solicit or induce, or attempt to induce, any employee or employees of Employer to terminate their employment with, or otherwise cease their relationship with, Employer.

| 5 | Subsection (d) is to be included for non-California employees only. |

| 6 | To be used for Employees who have signed a New Hire/Proprietary Information Agreement. |

| 7 | To be used for Employees who have NOT signed a New Hire/Proprietary Information Agreement. |

C-6

12. No Assignment By Employee. This Agreement, and any of the rights hereunder, may not be assigned or otherwise transferred, in whole or in part by Employee.

13. Arbitration. Any and all controversies arising out of or relating to the validity, interpretation, enforceability, or performance of this Agreement will be solely and finally settled by means of binding arbitration. Any arbitration shall be conducted in accordance with the then-current Employment Dispute Resolution Rules of the American Arbitration Association. The arbitration will be final, conclusive and binding upon the parties. All arbitrator’s fees and related expenses shall be divided equally between the parties. Further, each party shall bear its own attorney’s fees and costs incurred in connection with the arbitration.

14. Equitable Relief. Each party acknowledges and agrees that a breach of any term or condition of this Agreement may cause the non-breaching party irreparable harm for which its remedies at law may be inadequate. Each party hereby agrees that the non-breaching party will be entitled, in addition to any other remedies available to it at law or in equity, to seek injunctive relief to prevent the breach or threatened breach of the other party’s obligations hereunder. Notwithstanding Paragraph 13, above, the parties may seek injunctive relief through the civil court rather than through private arbitration if necessary to prevent irreparable harm.

15. No Admission. The execution of this Agreement and the performance of its terms shall in no way be construed as an admission of guilt or liability by either Employee or Employer. Both parties expressly disclaim any liability for claims by the other.

16. Consultation With Counsel and Time to Consider. Employee has been advised to consult an attorney before signing this Agreement. Employee acknowledges that Employee has been given the opportunity to consult counsel of Employee’s choice before signing this Agreement, and that Employee is fully aware of the contents and legal effect of this Agreement. Employee acknowledges that Employer has provided Employee with a list, which is Attachment A to this Agreement, of the job titles and ages of all employees being terminated on the Separation Date as well as the ages of the employees with the same titles who are not being terminated (“OWBPA Information”). Employee has been given [21/45] days from receipt of the OWBPA Information to consider this Agreement.

17. Right to Revoke.

(a) Employee and Employer have seven days from the date Employee signs this Agreement to revoke it in a writing delivered to the other party. After that seven-day period has elapsed, this Agreement is final and binding on both parties.

C-7

(b) Employee acknowledges and understands that if Employee fails to provide the Employer with an executed copy of this Agreement by the date indicated in paragraph C on the first page of this Agreement, Employer’s offer to enter into this Agreement and/or its execution of this Agreement is automatically revoked and Employee shall forfeit all rights under the Plan and Award.

18. Severability. It is the desire and intent of the parties that the provisions of this Agreement shall be enforced to the fullest extent permissible under the laws and public policies applied in each jurisdiction in which enforcement is sought. Accordingly, although Employer and Employee consider the restrictions contained in this Agreement to be reasonable for the purpose of preserving Employer’s goodwill and proprietary rights, if any provision or portion of this Agreement shall be determined to be invalid or unenforceable for any reason, the remaining provisions or portions of this Agreement shall be unaffected thereby and shall remain in full force and effect to the fullest extent permitted by law.

19. Entire Agreement. This Agreement together with the Plan, Award [and the New Hire/Proprietary Information Agreement]8 represents the complete understanding of Employee and Employer with respect to the subject matter herein.

20. Notices. Notices or other communications given pursuant to this Agreement shall be given in accordance with the Plan.

21. Governing Law. This Agreement will be construed and enforced in accordance with the laws of [ ].

22. Counterparts. This Agreement may be executed in two or more counterparts, all of which shall be considered one and the same agreement.

BY SIGNING THIS AGREEMENT, YOU STATE THAT:

(a) YOU HAVE READ THIS AGREEMENT AND HAVE HAD SUFFICIENT TIME TO CONSIDER ITS TERMS;

(b) YOU UNDERSTAND ALL OF THE TERMS AND CONDITIONS OF THIS AGREEMENT AND KNOW THAT YOU ARE GIVING UP IMPORTANT RIGHTS, INCLUDING, WITHOUT LIMITATION, THOSE ARISING UNDER THE ADEA;

(c) YOU AGREE WITH EVERYTHING IN THIS AGREEMENT;

(d) YOU ARE AWARE OF YOUR RIGHT TO CONSULT WITH AN ATTORNEY BEFORE SIGNING THIS AGREEMENT AND HAVE BEEN ADVISED OF SUCH RIGHT;

| 8 | To be included for Employees who have signed a New Hire/Proprietary Information Agreement. |

C-8

(e) YOU HAVE SIGNED THIS AGREEMENT KNOWINGLY AND VOLUNTARILY; AND

(f) THIS AGREEMENT INCLUDES A RELEASE BY YOU OF ALL KNOWN AND UNKNOWN CLAIMS AS OF ITS EFFECTIVE DATE, AND NO CLAIMS ARISING AFTER ITS EFFECTIVE DATE ARE WAIVED OR RELEASED IN THIS AGREEMENT.

| [ELECTRONIC ARTS INC.] | [EMPLOYEE NAME] | |||||||

| By: |

|

Signature: |

| |||||

| Name: [ ] | Date: |

| ||||||

| Title: General Counsel | ||||||||

| By: |

|

|||||||

| Name: [ ] | ||||||||

| Title: Chief Human Resources Officer | ||||||||

C-9

Attachment A to Severance Agreement and Release

This notice contains the information that is required to be provided to you by the Older Workers Benefit Protection Act.

The following is a listing of the job titles and ages of (a) persons who were selected for termination and offered enhanced severance benefits for signing the Severance Agreement and Release, and (b) all individuals in the same job classification or organizational unit who were not selected:

Table 1 - Positions Selected or Eligible for Severance Package

| Job Class or Group |

Job Title |

Age | ||

Table 2 - Positions Not Selected or Ineligible for Severance Package

| Job Class or Group |

Job Title |

Age | ||

C-10