Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CONSUMERS ENERGY CO | d355956d8k.htm |

| Exhibit 99.1

|

Exhibit 99.1

2012Annual Shareholders’ Meeting

|

Annual Shareholders’ Meeting

John Russell May 18, 2012

|

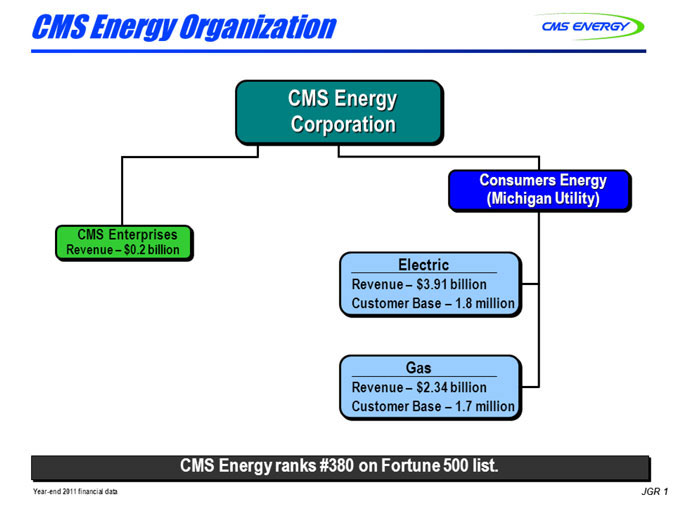

CMS Energy Organization

CMS Energy Corporation

Consumers Energy (Michigan Utility)

CMS Enterprises Revenue-$0.2 billion

Electric

Revenue- $3.91 billion Customer Base -1.8 million

Gas

Revenue- $2.34 billion Customer Base -1.7 million

Year-end 2011 financial data

CMS Energy ranks #380 on Fortune 500 list.

JGR 1

|

Consumers Energy

4th largest combination utility in United States

Committed to Michigan (State ranking)

#2 Investor

#7 Employer

#1 Renewable energy supplier

Spend over $2 billion annually with Michigan suppliers

Proudly serving the customers of Michigan for over 125 years.

JGR2

|

Growing Forward Strategy

Consistent financial performance

Fair and timely regulation

Utility investment Customer value

Safe, excellent operations

Durable strategy in place. Delivered on shareholder priorities.

JGR 3

|

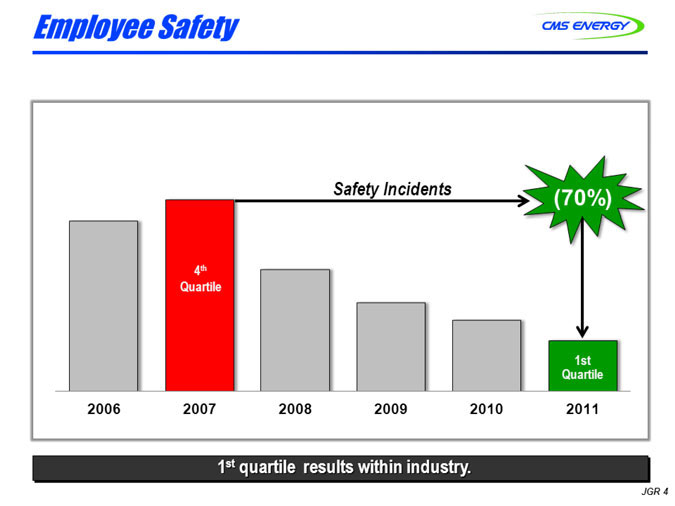

Employee Safety

1st quartile results within industry.

Safety Incidents

4th Quartile (70%)

2006 2007 2008 2009 2010 2011 1st Quartile

JGR 4

|

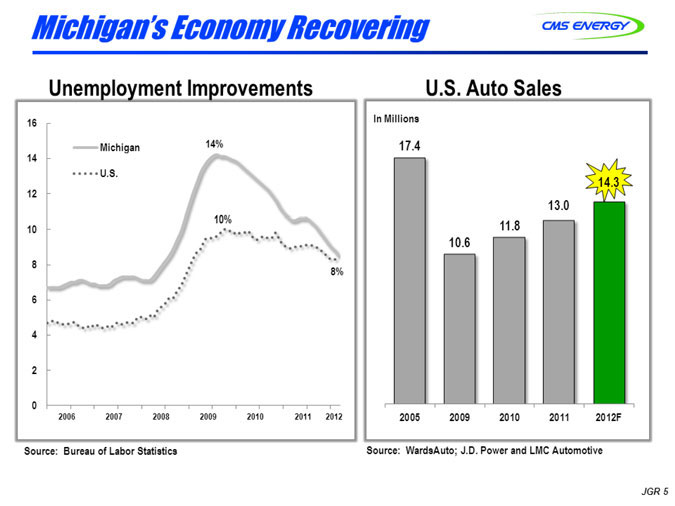

Michigan’s Economy Recovering

Unemployment Improvements

Michigan U.S.

16 14 12 10 8 6 4 2 0

2006 2007 2008 2009 2010 2011 2012

14% 10% 8%

Source: Bureau of Labor Statistics

U.S. Auto Sales

In Millions

17.4 10.6 11.8 13.0 14.3

2005 2009 2010 2011 2012F

Source: WardsAuto; J.D. Power and LMC Automotive

JGR 5

|

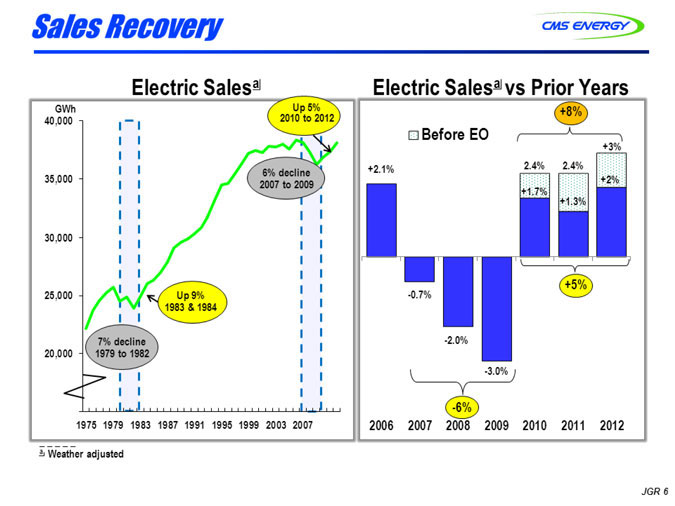

Sales Recovery

Electric Salesa

Gwh

Up 5%

7% deadline 1979 to 1982

Up 9% 1983 & 1984

6% decline 2007 to 2009

2010 to 2012

40,000 35,000 30,000 25,000 20,000

1975 1979 1983 1987 1991 1995 1999 2003 2007

Electric Salesa vs Prior Years

+8%

Before EO

+2.1% 2.4% 2.4% +3%

+1.7% +1.3% +2%

+5%

-0.7% -2.0% -3.0% -6%

2006 2007 2008 2009 2010 2011 2012

JGR 6

a weather adjusted

|

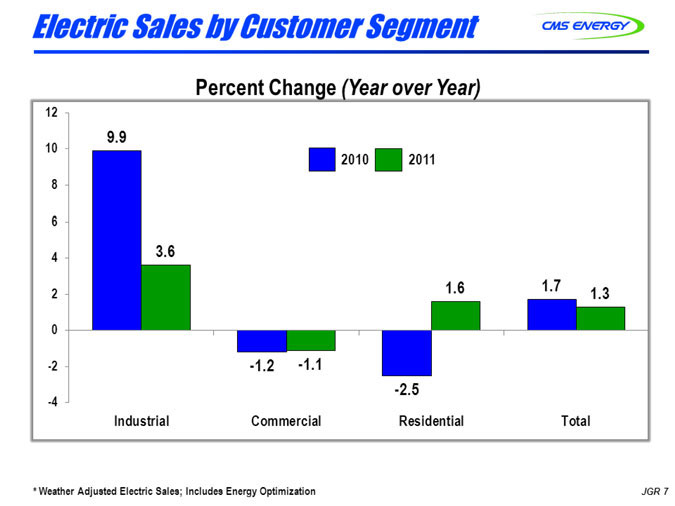

Electric Sales by Customer Segment

Percent Change (Year over Year)

2010 2011

12 10 8 6 4 2 0 -2 -4

9.9 3.6 1.6 1.7 1.3

-1.2 -1.1 -2.5

Industrial Commercial Residential Total

*Weather Adjusted Electric Sales; Includes Energy Optimization

JGR 7

|

2012 Priorities

Achieve financial objectives

5-7 percent earnings growth

Competitive dividend yield

Strong operational cash flow

Deliver consistent financial performance.

JGR 8

Continue to improve safety and operational performance

1st quartile—Employee safety

Operational costs down $40 million

“Best in Class”—Overhead cost management

|

2012 Priorities [Cont’d]

Enhance customer value

Customer Savings

Lower natural gas prices: ($100 million)

Energy efficiency program: (S175 million)

Base rate increases at or below rate of inflation

Residential customer pays less than $3/day

Execute investment plan

Disciplined, customer-focused approach

Reduce O&M and/or fuel expense

Environmental spend of $1,5 billion over 5 years

Deliver customer value.

JGR 9

|

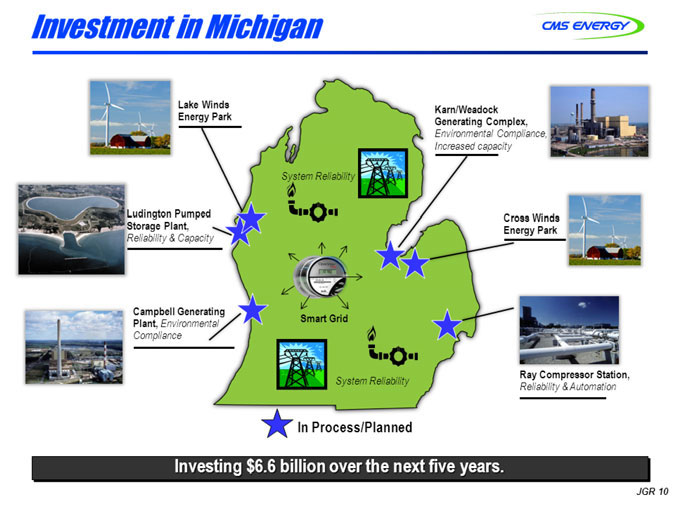

Investment in Michigan

Lake Winds Energy Park

Karn/Weadock

Generating Complex.

Environmental Compliance, Increased capacity

Ludinqton Pumped

Storage Plant.

Reliability & Capacity

Cross Winds Energy Park

Campbell Generating

Plant.

Environmental Compliance

Ray Compressor Station.

Reliability & Automation

In Process/Planned

Investing $6.6 billion over the next five years.

JGR 10

System Reliability

Smart Grid

System Reliability

|

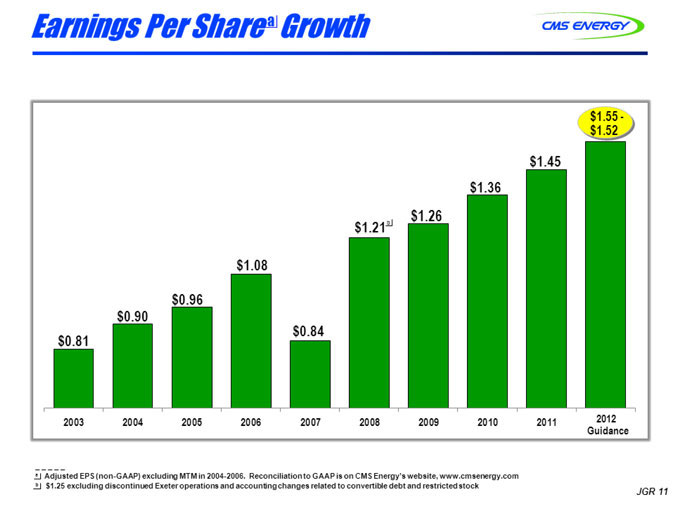

Earnings Per Sharea Growth

$1.55- 1.52

$1.45

$0.81

$0.90

$0.96

$1.08

$0.84

$1.21b

$1.26

$1.36

2005

2006

2003

2004

2007

2008

2009

2010

2011

2012

Guidance

a Adjusted EPS(non-GAAP)excluding MIM in 2004-2006, Reconciliationto GAAP is on CMS Energy’s website. www.crnsenergy.com

b $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock

JGR 11

|

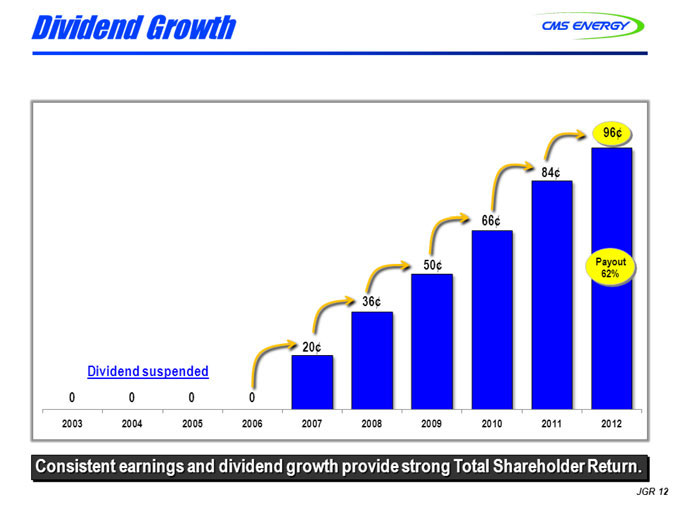

Dividend Growth

96¢

84¢

66¢

50¢

36¢

20¢

0

0

0

0

Dividend suspended

Payout 62%

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Consistent earnings and dividend growth provide strong Total Shareholder Return.

JGR 12

|

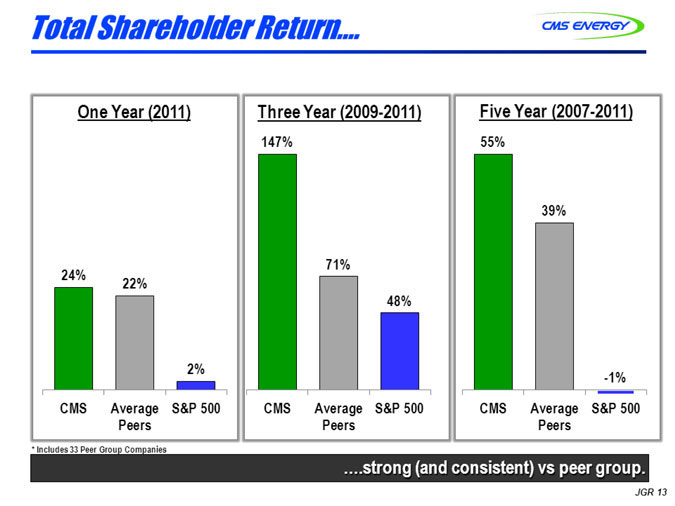

Total Shareholder Return…

One Year (2011)

Three Year (2009-2011)

147%

Five Year (2007-2011)

55%

39%

CMS Average S&P 500 Peers

24%

22%

2%

71%

48%CMS Average S&P 500 Peers

-1%

CMS Average

Peers

S&P 500

.strong (and consistent) vs peer group.

JGR 13

* includes 33 peer Group Companies

|

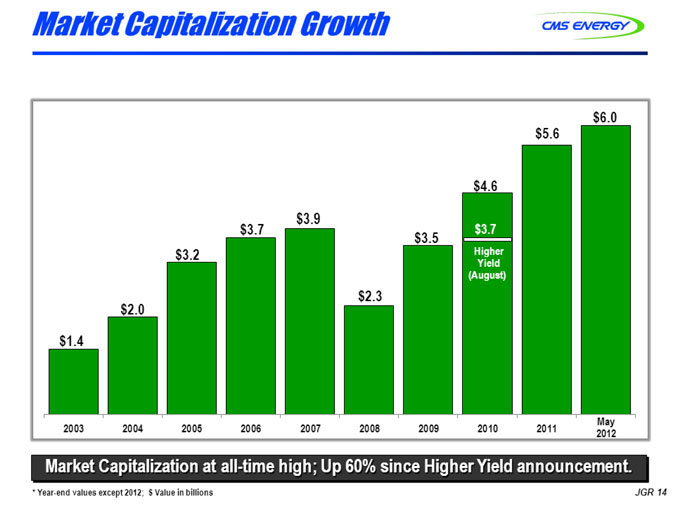

Market Capitalization Growth

$1.4 $2.0 $3.2 $3.7 $3.9 $2.3 $3.5 $4.6 (High Yield August) $5.6 $6.0

2003 2004 2005 2006 2007 2008 2009 2010 2011 May 2012

Market Capitalization at all-time high; Up 60% since Higher Yield announcement.

*Year-end values except 2012; $ Value in billions.

JGR 14

|

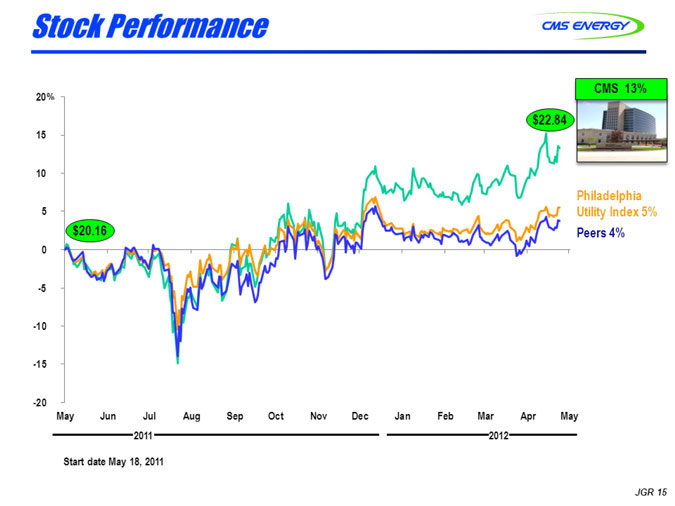

Stock Performance

Philadelphia

Utility Index 5% Peers 4%

$20.16 $22.84

20% 15 10 5 0 -5 -10 -15 -20

May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May

2011 2012

Start date May 18, 2011

JGR 15

CMS 13%

|

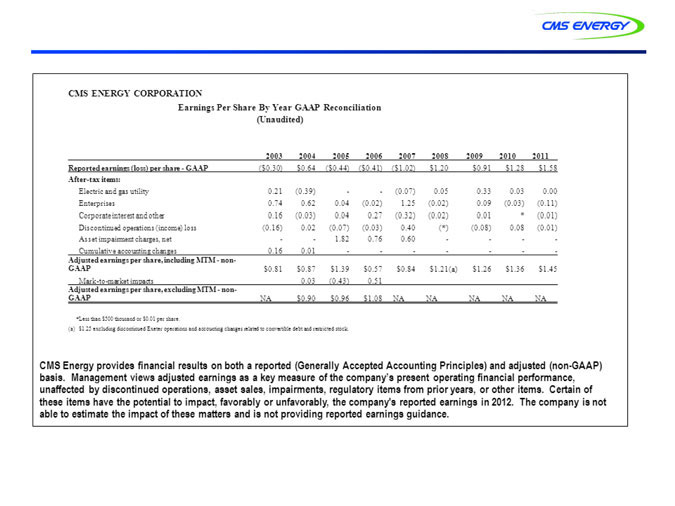

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation (Unaudited)

2003 2004 2005 2006 2007 2008 2009 2010 2011

Reported earnings (loss) per share-GAAP ($0.30) $0.64 ($0.44) ($0.41) ($1.02) $1.20 $0.91 $1.28 $1.58

After-tax items:

Electric and gas utility 0.21 (0.39)—- (0.07) 0.05 0.33 0.03 0.00

Enterprises 0.74 0.62 0.04 (0.02) 1.25 (0.02) 0.09 (0.03) (0.11)

Corporate interest and other 0.16 (0.03) 0.04 0.27 (0.32) (0.02) 0.01 * (0.01)

Discontinued operations (income) loss (0.16) 0.02 (0.07) (0.03) 0.40 (*) (0.08) 0.08 (0.01)

Asset impairment charges, net—- 1.82 0.76 0.60———

Cumulative accounting changes 0.16 0.01———— -

Adjusted earnings per share, including MTM-non-GAAP $0.81 $0.87 $1.39 $0.57 $0.84 $1.21(a) $1.26 $1.36 $1.45

Mark-to-market impacts 0.03 (0.43) 0.51

Adjusted earnings per share, excluding MTM-non-GAAP NA $0.90 $0.96 $1.08 NA NA NA NA NA

*Less than $500 thousand or $0.01 per share.

(a) $1.25 excluding discontinued Excess operations and accounting changes related to convertible debt and restricted stock

CMS Energy provides financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other items. Certain of these items have the potential to impact, favorably or unfavorably, the company’s reported earnings in 2012. The company is not able to estimate the impact of these matters and is not providing reported earnings guidance.

|

Questions

|

2012 Annual Shareholders’ Meeting