Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) May 17, 2012

Carrols Restaurant Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-33174 | 16-1287774 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 968 James Street, Syracuse, New York | 13203 | |||

| (Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code (315) 424-0513

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

ITEM 7.01. REGULATION FD DISCLOSURE.

We refer to Carrols Restaurant Group, Inc. as “Carrols Restaurant Group” and, together with its consolidated subsidiaries, as “we,” “our” and “us” unless otherwise indicated or the context otherwise requires. Any reference to “Carrols” refers to our wholly-owned subsidiary, Carrols Corporation, a Delaware corporation, and its consolidated subsidiaries, unless otherwise indicated or the context otherwise requires. Any reference to “Carrols LLC” refers to the wholly-owned subsidiary of Carrols, Carrols LLC, a Delaware limited liability company, unless otherwise indicated or the context otherwise requires. Any reference to “Fiesta Restaurant Group” refers to our former indirect wholly-owned subsidiary, Fiesta Restaurant Group, Inc., a Delaware corporation, unless otherwise indicated or the context otherwise requires.

We use a 52 or 53 week fiscal year ending on the Sunday closest to December 31. For convenience, all references herein to the fiscal years ended January 3, 2010, January 2, 2011 and January 1, 2012 will hereinafter be referred to as the fiscal years ended December 31, 2009, 2010 and 2011, respectively. All references herein to the three months ended April 3, 2011 and April 1, 2012 will hereinafter be referred to as the three months ended March 31, 2011 and 2012, respectively. Our fiscal year ended December 31, 2009 contained 53 weeks. Our fiscal years ended December 31, 2010 and 2011 each contained 52 weeks. The three months ended March 31, 2011 and 2012 each contained thirteen weeks.

Our common stock is listed on The NASDAQ Global Market under the symbol “TAST.” As previously disclosed by us, on May 7, 2012, we completed the spin-off of our former wholly-owned subsidiary, Fiesta Restaurant Group by distributing all of the outstanding shares of Fiesta Restaurant Group common stock to our stockholders, which we refer to as the “spin-off.”

Any reference herein to BKC refers to Burger King Holdings, Inc. and its wholly-owned subsidiaries, including Burger King Corporation.

In upcoming presentations, we will be providing certain information with respect to, among other things, the previously announced entry into an Asset Purchase Agreement (the “Purchase Agreement”), dated as of March 26, 2012, with BKC pursuant to which Carrols Restaurant Group, through Carrols LLC, agreed to purchase (the “Acquisition”) 278 of BKC’s company-owned Burger King® restaurants (the “Acquired Restaurants”).

Our Business Strategy

Our primary business strategies are as follows:

Increase Restaurant Sales and Customer Traffic. BKC has recently identified and implemented a number of strategies to reinvigorate the brand, increase market share, improve overall operations and drive future growth. These strategies are central to our strategic objectives to deliver profitable growth.

| • | Product. On April 2, 2012, BKC launched one of the broadest expansions of food offerings in its 58-year history, including the introduction of Thick Cut Fries, Garden Fresh Salads, Wraps, Real Fruit Smoothies and Frappes. There have also been a number of enhancements to food preparation procedures to improve the quality of BKC’s existing products. These new menu platforms and quality improvements form the backbone of BKC’s strategy to appeal to a broader consumer base and to increase restaurant sales. |

| • | Image. In connection with the Acquisition, we have agreed to remodel 455 restaurants over the next three and a half years to BKC’s “20/20” restaurant image which features a fresh, sleek, eye-catching design. The restaurant redesign incorporates easy-to-navigate digital menu boards in the dining room, streamlined merchandising at the drive-thru, flat screen televisions in the dining area and new employee uniforms. We believe the restaurant remodeling plan will improve our guests’ dining experience, increase dining frequency and help drive increases in average check size from more dine-in visits. |

| • | Advertising. We believe that we will benefit from BKC’s advertising support of its new menu, product enhancement and reimaging initiatives. In late 2011, BKC launched a revamped national, multi-platform marketing campaign centered around the quality of its food, featuring both new and core offerings. The campaign, which features celebrities, |

2

| highlights the new menu platforms and returns the brand to its roots with a refreshed focus on the flagship Whopper sandwich. We believe the campaign will broaden the appeal of the brand while increasing trial, customer frequency and brand loyalty. |

Improve Profitability of Acquired Restaurants by Leveraging Our Existing Infrastructure and Best-Practices. With the acquisition of 278 restaurants from BKC, we believe we have opportunities to realize benefits from economies of scale, including leveraging our existing infrastructure across a larger number of restaurants. We believe that our skilled management team, sophisticated information technology, operating systems and training and development programs support our ability to enhance operating efficiencies at the Acquired Restaurants. We have identified a number of opportunities to enhance the profitability of the newly acquired restaurants and we believe, over time, these new restaurants can achieve comparable levels of profitability and operational efficiency as our current store base.

Selectively Acquire and Develop Additional Burger King Restaurants. We are the largest U.S. franchisee of Burger King restaurants based on number of restaurants. Upon completion of the Acquisition, we will operate a total of 575 Burger King restaurants, making us the largest Burger King franchisee in the world. Pursuant to an Operating Agreement (the “Operating Agreement”) to be entered into upon the closing of the Acquisition between Carrols LLC, BKC will assign its right of first refusal (the “ROFR”) on franchisee restaurant transfers in 20 states as follows: Connecticut (except Hartford county), Delaware, Indiana, Kentucky, Maine, Maryland, Massachusetts (except for Middlesex, Norfolk and Suffolk counties), Michigan, New Hampshire, New Jersey, New York (except for Bronx, Kings, Nassau, New York, Queens, Richmond, Suffolk and Westchester counties), North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Vermont, Virginia, Washington DC, and West Virginia (collectively, the “DMAs”). BKC will also grant certain pre-approval rights to acquire additional franchised restaurants and to develop new restaurants in those markets. Due to the number of restaurants and franchisees in the Burger King franchise system and our historical success in acquiring and integrating restaurants, we believe that there is considerable opportunity for future growth. While our primary focus in the near-term is to successfully integrate, remodel and improve the profitability of the Acquired Restaurants, we believe that the assignment of the ROFR and the pre-approval to acquire and develop additional restaurants will provide us with the opportunity to expand our ownership of Burger King restaurants in the future through selective acquisitions and new restaurant openings.

Business

Overview

Our Company

We are the largest U.S. Burger King franchisee, based on number of restaurants, and have operated Burger King restaurants since 1976. As of April 1, 2012, we owned and operated 297 Burger King restaurants located in 12 Northeastern, Midwestern and Southeastern states. Burger King restaurants feature the popular flame-broiled Whopper sandwich, as well as a variety of hamburgers, chicken and other specialty sandwiches, french fries, salads, breakfast items, snacks and other offerings. We believe that our size, seasoned management team, extensive operating infrastructure, experience and proven operating disciplines differentiate us from many of our competitors as well as many other Burger King operators. For the fiscal year ended December 31, 2011, we generated average annual sales per restaurant of $1,154,000. On a pro forma basis after giving effect to the spin-off, for the fiscal year ended December 31, 2011 and the three months ended March 31, 2012, our restaurants generated revenues of $347.5 million and $85.5 million, respectively. Our comparable Burger King restaurant sales for the first quarter of 2012 increased 5.9%.

On March 26, 2012, we entered into the Purchase Agreement with BKC to acquire 278 Burger King restaurants. Total cash consideration of approximately $16.2 million includes $3.8 million to be paid over five years. Non-cash consideration to BKC includes a 28.9% equity ownership interest in Carrols Restaurant Group (subject to certain limitations). The Acquired Restaurants are located in seven Mid-Atlantic, Midwestern and Southeastern states. Additionally, pursuant to the Operating Agreement, which will be entered into upon the closing of the Acquisition, BKC will assign the ROFR to us in 20 states for 20 years or until we operate 1,000 Burger King restaurants, subject to compliance with the Operating Agreement. We have agreed to remodel 455 Burger King restaurants to BKC’s “20/20” restaurant image, including 57 restaurants in 2012, 154 restaurants in 2013, 154 restaurants in 2014 and 90 restaurants in 2015. For the fiscal year ended December 31, 2011, the Acquired Restaurants generated average annual sales per restaurant of $1,060,719. For the fiscal year ended December 31, 2011 and the three months ended March 31, 2012, the Acquired Restaurants generated total revenues of $294.9 million and $73.4 million, respectively.

On a pro forma combined basis, after giving effect to the spin-off, the Acquisition and the other transactions as further described herein, for the fiscal year ended December 31, 2011, we would have generated average annual sales per restaurant of $1,109,066. For the fiscal year ended December 31, 2011 and the three months ended March 31, 2012, we would have generated pro forma combined revenues of $642.4 million and $158.9 million, respectively.

3

Industry

The Restaurant Market

According to Technomic Information Services (“Technomic”) report entitled “2012 Technomic Top 500 Chain Restaurant Report,” in 2011, total restaurant industry revenues in the United States were approximately $370.2 billion, representing an increase of 2.5% from 2010. Technomic projects total restaurant industry revenue to grow by 2.9% in 2012. Restaurant sales historically have closely tracked several macroeconomic indicators and we believe that “away-from-home” food consumption will continue to rebound as the economy recovers. Historically, unemployment has been inversely related to restaurant sales and, as the unemployment rate decreases, and disposable income increases restaurant sales have increased. In 2011, 47.5% of food dollars were spent on food away from home and demand continues to outpace at-home dining, with food away from home projected to surpass at-home dining in 2021 according to the U.S. Department of Agriculture.

Limited-service Restaurants. Limited-service restaurants are distinguished by high speed of service and efficiency, convenience, limited menu and service and value pricing. According to Technomic in 2011, sales at all limited-service restaurants in the United States were $200.9 billion, an increase of 3.1% from 2010 and representing 54.3% of total U.S. restaurant industry sales. This constitutes an increase in overall market share when compared to the 53.9% of total U.S. restaurant industry sales attributed to limited-service restaurants in 2010. According to Technomic, in 2012, sales for limited-service restaurants are projected to increase 3.5%.

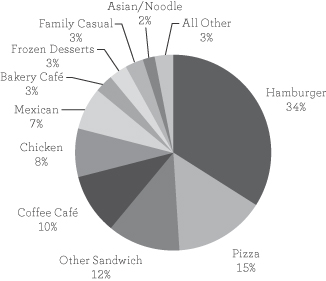

Technomic reports that sales in the limited-service industry in 2011 were divided by menu category as follows:

At $68.9 billion in sales in 2011, the Burger menu category is the largest within the limited-service segment, representing 34% of limited-service restaurant 2011 sales. According to Technomic, sales in the Burger menu category grew by 3.7% in 2011 and are forecasted to grow by 4.1% in 2012, outpacing the overall limited-service segment. The Burger menu category is the fifth fastest-growing menu category in the limited-service restaurant segment by sales.

According to Technomic, in 2011, franchises contributed 72% of sales to the limited-service restaurant segment and accounted for eight out of ten stores.

According to BKC, as of March 31, 2012, there were a total of 12,534 Burger King restaurants operating in 81 countries, of which 11,249 were franchised restaurants and 7,488 were located in the United States and Canada. Burger King is the second largest hamburger restaurant chain in the world (as measured by number of restaurants) and we believe that the Burger King brand is one of the world’s most recognized consumer brands. Burger King restaurants are part of the Burger menu category within the limited service segment. Burger King restaurants have a distinctive image and are generally located in high-traffic areas throughout the United States. Burger King restaurants are designed to appeal to a broad spectrum of consumers, with multiple day-part meal segments targeted to different groups of consumers.

4

BKC’s marketing strategy is characterized by its HAVE IT YOUR WAY® service, flame grilling, generous portions and competitive prices. Burger King restaurants feature flame-grilled hamburgers, the most popular of which is the Whopper sandwich, a large, flame-grilled hamburger garnished with mayonnaise, lettuce, onions, pickles and tomatoes. The basic menu of all Burger King restaurants also includes a variety of hamburgers, chicken and other specialty sandwiches, french fries, salads, breakfast items, snacks, and other offerings. BKC and its franchisees have historically spent between 4% and 5% of their respective sales on marketing, advertising and promotion to sustain high brand awareness. BKC has recently launched marketing initiatives to reach a more diverse consumer base and has introduced a number of new and enhanced menu items to broaden offerings and drive customer traffic in all day parts.

Our Burger King restaurants are typically open seven days per week and generally have operating hours ranging from 6:00 am to midnight on Sunday to Wednesday and 2:00 am on Thursday to Saturday.

We believe that the competitive attributes of Burger King restaurants include significant brand recognition, convenience of location, quality, speed of service and price.

Our existing restaurants consist of one of several building types with various seating capacities. Our typical freestanding restaurant contains approximately 2,800 to 3,200 square feet with seating capacity for 90 to 100 customers, has drive-thru service windows and has adjacent parking areas. The building types for recently constructed or remodeled Burger King restaurants utilize 2,600 square feet and typically have seating capacity for 60 to 70 customers. As of March 31, 2012, almost all of our restaurants were freestanding. We operate our restaurants under franchise agreements with BKC.

Restaurant Economics

Selected restaurant operating data for our restaurants is as follows:

| Year Ended December 31 | ||||||||||||

| 2009(1) | 2010(1) | 2011(1) | ||||||||||

| Burger King: |

||||||||||||

| Average annual sales per restaurant (in thousands) |

$ | 1,206 | $ | 1,162 | $ | 1,154 | ||||||

| Average sales transaction |

$ | 5.56 | $ | 5.44 | $ | 5.80 | ||||||

| Drive-through sales as a percentage of total sales |

64.5 | % | 65.0 | % | 64.9 | % | ||||||

| Day-part sales percentages: |

||||||||||||

| Breakfast |

13.1 | % | 13.8 | % | 13.1 | % | ||||||

| Lunch |

32.3 | % | 31.9 | % | 32.1 | % | ||||||

| Dinner |

27.2 | % | 26.8 | % | 27.1 | % | ||||||

| Afternoon and late night |

27.4 | % | 27.5 | % | 27.7 | % | ||||||

| (1) | 2010 and 2011 were each a 52-week fiscal year and 2009 was a 53-week fiscal year. Average annual sales for company owned or operated restaurants are derived by dividing restaurant sales for such year for the applicable segment by the average number of restaurants for the applicable segment for such year. For comparative purposes, the calculation of average annual sales per company-owned restaurant is based on a 52-week year. For purposes of calculating average annual sales per company-owned restaurant for 2009, we have excluded restaurant sales for the extra week in 2009. |

Restaurant Capital Costs

The initial cost of the franchise fee, equipment, seating, signage and other interior costs of a standard new Burger King restaurant currently is approximately $350,000 (excluding the cost of the land, building and site improvements). In the markets in which we primarily operate, the cost of land generally ranges from $600,000 to $800,000 and the cost of building and site improvements generally ranges from $650,000 to $700,000.

With respect to development of freestanding restaurants, we generally seek to acquire the land to construct the building, and thereafter enter into an arrangement to sell and leaseback the land and building

5

under a long-term lease. Historically, we have been able to acquire and finance many of our locations under such leasing arrangements. Where we are unable to purchase the underlying land, we enter into a long-term lease for the land and fund the construction of the building from cash generated from our operations or with borrowings under our senior credit facility rather than through long-term leasing arrangements.

The cost of developing and equipping new restaurants can vary significantly and depends on a number of factors, including the local economic conditions and the characteristics of a particular site. Accordingly, the cost of opening new restaurants in the future may differ substantially from, and may be significantly higher than, both the historical cost of restaurants previously opened and the estimated costs above.

We anticipate that the cost of remodeling certain of our restaurants and certain of the Acquired Restaurants to BKC’s 20/20 restaurant image pursuant to the Operating Agreement will generally range from $200,000 to $500,000 per restaurant with an average cost of approximately $300,000 per restaurant.

Seasonality

Our business is moderately seasonal due to regional weather conditions. Sales from our restaurants (primarily located in the northeastern United States) are generally higher during the summer months than during the winter months. The Acquired Restaurants will increase the number of our restaurants in the states which we currently operate in and, will moderate the seasonal impact on our business as we have increased the number of Burger King restaurants which we operate in the states outside the northeastern United States.

Restaurant Locations

The following table details the locations of our 297 Burger King restaurants as of April 1, 2012:

| State |

Total Restaurants |

|||

| Indiana |

5 | |||

| Kentucky |

9 | |||

| Maine |

4 | |||

| Massachusetts |

1 | |||

| Michigan |

24 | |||

| New Jersey |

2 | |||

| New York |

117 | |||

| North Carolina |

30 | |||

| Ohio |

75 | |||

| Pennsylvania |

12 | |||

| South Carolina |

17 | |||

| Vermont |

1 | |||

|

|

|

|||

| Total |

297 | |||

|

|

|

|||

The following table details the locations of the 278 Acquired Restaurants:

| State |

Total Restaurants |

|||

| Indiana |

68 | |||

| Kentucky |

8 | |||

| North Carolina |

111 | |||

| Ohio |

10 | |||

| Pennsylvania |

22 | |||

| South Carolina |

15 | |||

| Virginia |

44 | |||

|

|

|

|||

| Total |

278 | |||

|

|

|

|||

6

Operations

Management Structure

We conduct substantially all of our executive management, finance, marketing and operations support functions from our corporate headquarters in Syracuse, New York. Carrols Restaurant Group is led by our Chief Executive Officer and President, Daniel T. Accordino. Mr. Accordino has nearly 40 years of Burger King and quick-service restaurant experience at our company.

Our Burger King operations for our restaurants are overseen by five Regional Directors, three of whom are Vice Presidents, that have an average of over 28 years of Burger King restaurant experience. Forty district managers that have an average of over 22 years of restaurant management experience in the Burger King system support the Regional Directors for our restaurants. In connection with the Acquisition, we will add two additional Regional Director positions and approximately thirty district managers.

For our restaurants, a district manager is responsible for the direct oversight of the day-to-day operations of an average of approximately seven restaurants. Typically, district managers have previously served as restaurant managers at one of our restaurants. Regional directors, district managers and restaurant managers are compensated with a fixed salary plus an incentive bonus based upon the performance of the restaurants under their supervision. Typically, our restaurants are staffed with hourly employees who are typically supervised by a salaried manager and two or three salaried assistant managers.

Training

We maintain a comprehensive training and development program for all of our personnel and provide both classroom and in-restaurant training for our salaried and hourly personnel. The program emphasizes system-wide operating procedures, food preparation methods and customer service standards for each of the concepts. In addition, BKC’s training and development programs are also available to us as a franchisee.

Management Information Systems

Our sophisticated management information systems provide us with the ability to efficiently and effectively manage our restaurants and to ensure consistent application of operating controls at our restaurants. Our size also affords us the ability to maintain an in-house staff of information technology and restaurant systems professionals dedicated to continuously enhancing our systems. In addition, these capabilities allow us to integrate newly developed or restaurants that we acquire and achieve greater economies of scale and operating efficiencies. We will retain the current information systems used at the Acquired Restaurants following the closing of the Acquisition. We plan to implement our point-of-sale (POS) system software at the Acquired Restaurants over time.

Our restaurants employ touch-screen POS systems that are designed to facilitate accuracy and speed of order taking. These systems are user-friendly, require limited cashier training and improve speed-of-service through the use of conversational order-taking techniques. The POS systems are integrated with PC-based applications at the restaurant that are designed to facilitate financial and management control of our restaurant operations. We began installing new POS systems at our restaurants in 2011 and expect to have all restaurants installed with the new POS system in May of 2012.

Our restaurant systems provide daily tracking and reporting of traffic counts, menu item sales, labor and food data including costs, and other key operating information for each restaurant. We communicate electronically with our restaurants on a continuous basis, which enables us to collect this information for use in our corporate management systems in near real-time. Our corporate and divisional administrative headquarters house web-based systems that support all of our accounting, operating and reporting systems. We also operate a 24-hour, seven-day help desk at our corporate headquarters that enables us to provide systems and operational support to our restaurant operations as required. Among other things, our restaurant information systems provide us with the ability to:

| • | monitor labor utilization and sales trends on a real-time basis at each restaurant, enabling the restaurant manager to effectively manage to our established labor standards on a timely basis; |

| • | reduce inventory shrinkage using restaurant-level inventory management and centralized standard costing systems; |

| • | analyze sales and product mix data to help restaurant managers forecast production levels; |

| • | monitor day-part drive-thru speed of service at each of our restaurants; |

| • | systematically communicate human resource and payroll data to our administrative offices for efficient centralized management of labor costs and payroll processing; |

| • | employ centralized control over price, menu and inventory management activities at the restaurant utilizing the remote management capabilities of our systems; |

| • | take advantage of electronic commerce including our ability to place orders with suppliers and to integrate detailed invoice, receiving and product data with our inventory and accounting systems; and |

| • | provide analyses, reporting and tools to enable all levels of management to review a wide-range of financial, product mix and operational data. |

7

Critical information from our systems is available in near real-time to our restaurant managers, who are expected to react quickly to trends or situations in their restaurant. Our district managers also receive near real-time information from all restaurants under their control and have computer access to key operating data on a remote basis using our corporate intranet. Management personnel at all levels, from the restaurant manager through senior management, utilize key restaurant performance indicators to manage our business.

Site Selection

We believe that the location of our restaurants is a critical component of each restaurant’s success. We evaluate potential new sites on many critical criteria including accessibility, visibility, costs, surrounding traffic patterns, competition and demographic characteristics. Our senior management determines the acceptability of all acquisition prospects and new sites, based upon analyses prepared by our real estate, financial and operations professionals.

Pursuant to the Operating Agreement, Carrols LLC will agree to remodel 455 Burger King restaurants to BKC’s 20/20 restaurant image, including 57 restaurants in 2012, 154 restaurants in 2013, 154 restaurants in 2014 and 90 restaurants in 2015, subject to and in accordance with the terms of the Operating Agreement. BKC’s 20/20 restaurant design draws inspiration from its signature flame-grilled cooking process and incorporates a variety of innovative elements to a backdrop that evokes the industrial look of corrugated metal, brick, wood and concrete.

Burger King Franchise Agreements

Each of our Burger King restaurants operates under a separate franchise agreement with BKC. Our franchise agreements with BKC generally require, among other things, that all restaurants comply with specified design criteria and operate in a prescribed manner, including utilization of the standard Burger King menu. In addition, our Burger King franchise agreements generally require that our restaurants conform to BKC’s current image and provide for remodeling of our restaurants during the tenth year of the agreements to conform to such current image, which may require the expenditure of considerable funds. These franchise agreements with BKC generally provide for an initial term of 20 years and currently have an initial franchise fee of $50,000. In the event that we terminate any franchise agreement and close the related BKC restaurant prior to the expiration of its term, we may be required to pay BKC an amount based on the net present value of the royalty stream that would have been realized by BKC had such franchise agreement not been terminated. Any franchise agreement, including renewals, can be extended at our discretion for an additional 20-year term, with BKC’s approval, provided that, among other things, the restaurant meets the current Burger King operating and image standards and that we are not in default under the terms of the franchise agreement. The franchise agreement fee for subsequent renewals is currently $50,000. BKC may terminate any of the franchise agreements if an act of default is committed by us under these agreements and such default is not cured. Defaults under the franchise agreements include, among other things, our failure to operate such Burger King restaurant in accordance with the operating standards and specifications established by BKC (including failure to use equipment, uniforms or decor approved by BKC), our failure to sell products approved or designated by BKC, our failure to pay royalties or advertising and sales promotion contributions as required, our unauthorized sale, transfer or assignment of such franchise agreement or the related restaurant, certain events of bankruptcy or insolvency with respect to us, conduct by us or our employees that has a harmful effect on the Burger King restaurant system, conviction of us or our executive officers for certain indictable offenses, our failure to maintain a responsible credit rating or the acquisition by us of an interest in any other hamburger restaurant business. We are not in default under any of the franchise agreements with BKC.

Pursuant to the Operating Agreement, we will enter into franchise agreements with BKC for the Acquired Restaurants with terms of varying durations up to 20 years, depending upon the term of the underlying leases or subleases. Each franchise agreement will provide for a royalty rate of 4.5% of sales and an advertising contribution payment of 4% of sales and investment spending of no less than 0.75% of restaurant sales in the designated market areas where the franchised restaurants are located. Pursuant to the new franchise agreements for the Acquired Restaurants, we will pay BKC a franchise fee of $50,000 for each franchise agreement with a term of 20 years for an Acquired Restaurant with a pro rata reduction in the amount of the franchise fee for franchise agreements with terms of less than 20 years with respect to an Acquired Restaurant. We will pay BKC approximately $13.3 million in the aggregate for franchise agreement fees with respect to the Acquired Restaurants.

In order to obtain a successor franchise agreement with BKC, a franchisee is typically required to make capital improvements to the restaurant to bring it up to BKC’s current image standards. The cost of these improvements may vary widely depending upon the magnitude of the required changes and the degree to which we have made interim improvements to the restaurant. We have 25 franchise agreements due to expire in 2012, 12 franchise agreements due to expire in 2013 and 13 franchise agreements due to expire in 2014. In recent years, the historical costs of improving our Burger King restaurants in connection with franchise renewals generally have ranged from $200,000 to $550,000 per restaurant. The cost of capital improvements made in connection with future franchise agreement renewals may differ substantially from past franchise renewals depending on the current image requirements established from time to time by BKC. Certain of our restaurants with franchise agreements due to expire in 2012, 2013 and 2014, if the franchise agreements for such restaurants are renewed, are included in the remodel plan set forth in the Operating Agreement.

8

We believe that we will be able to satisfy BKC’s normal franchise agreement renewal criteria. Accordingly, we believe that renewal franchise agreements will be granted on a timely basis by BKC at the expiration of our existing franchise agreements. Historically, BKC has granted all of our requests for successor franchise agreements. However, there can be no assurances that BKC will grant these requests in the future.

We evaluate the performance of our Burger King restaurants on an ongoing basis. Such evaluation depends on many factors, including our assessment of the anticipated future operating results of the subject restaurants and the cost of required capital improvements that we would need to commit for such restaurants. If we determine that a Burger King restaurant is under-performing, or that we do not anticipate an adequate return on the capital required to renew the franchise agreement, we may elect to close such restaurant. We may also relocate (offset) a restaurant within its trade area and build a new Burger King restaurant as part of the franchise renewal process. In 2011 we closed a total of nine Burger King restaurants, which included one location that was offset. In 2012, we closed one Burger King restaurant and currently anticipate that we will likely elect to close three additional Burger King restaurants, which includes two predetermined Acquired Restaurants. However, based on the current operating results of these restaurants, we believe that the impact on our results of operations as a result of such restaurant closures will not be material, although there can be no assurance in this regard. Our determination to close these restaurants in 2012 is subject to further evaluation and may change. Additionally, we will have the right, at our election, to close a very limited number of predetermined Acquired Restaurants in accordance with the terms of the Operating Agreement. We may also elect to close additional Burger King restaurants in the future.

In addition to the initial franchise fee, we generally pay BKC a monthly royalty. The royalty rate for both new restaurants and for successor franchise agreements is 4.5% of sales. The royalty rate was increased from 3.5% of sales in 2000, and generally for restaurants in existence in 2000, becomes effective upon the renewal of the franchise agreement. Burger King royalties, as a percentage of our Burger King restaurant sales, were 4.0% in both 2011 and 2010 and 3.9% in 2009. Royalty payments to BKC under new franchise agreements for the Acquired Restaurants are at a contractual rate of 4.5%. We anticipate our Burger King royalties, as a percentage of our Burger King restaurant sales, including the Acquired Restaurants, will increase to 4.2% in 2012 as a result of the terms outlined above.

We also generally contribute 4% of restaurant sales from our Burger King restaurants to fund BKC’s national and regional advertising. BKC engages in substantial national and regional advertising and promotional activities and other efforts to maintain and enhance the Burger King brand. From time to time we supplement BKC’s marketing with our own local advertising and promotional campaigns. See “— Advertising and Promotion” below.

Our franchise agreements with BKC do not give us exclusive rights to operate Burger King restaurants in any defined territory. Although we believe that BKC generally seeks to ensure that newly granted franchises do not materially adversely affect the operations of existing Burger King restaurants, we cannot assure you that franchises granted by BKC to third parties will not adversely affect any Burger King restaurants that we operate.

Except as set forth in the Operating Agreement, we are required to obtain BKC’s consent before we acquire existing Burger King restaurants from other franchisees or develop new Burger King restaurants. BKC also has the right of first refusal to purchase any Burger King restaurant that is being offered for sale by a franchisee. To date, BKC has approved almost all of our acquisitions of Burger King restaurants from other franchisees. Pursuant to the Operating Agreement, BKC will assign its ROFR to us in the DMAs and will grant us franchise pre-approval to build new Burger King restaurants or acquire Burger King restaurants from Burger King franchisees until the date that we operate 1,000 Burger King restaurants.

Advertising and Promotion

We are generally required to contribute 4% of restaurant sales from our restaurants to an advertising fund utilized by BKC for its advertising, promotional programs and public relations activities. Pursuant to the Operating Agreement, the franchise agreements for the Acquired Restaurants will provide for an advertising contribution of 4% of restaurant sales and investment spending of no less than 0.75% of restaurant sales in the designated market areas where the franchised restaurants are located. BKC’s advertising programs consist of national campaigns supplemented by local advertising. BKC’s advertising campaigns are generally carried on television, radio and in circulated print media (national and regional newspapers and magazines). As a percentage of our restaurant sales advertising expense was 4.2% in each of 2011, 2010 and 2009.

The efficiency and quality of advertising and promotional programs can significantly affect the quick-casual and quick-service restaurant businesses. We believe that one of the major advantages of being a Burger King franchisee is the value of the extensive national and regional advertising and promotional programs conducted by BKC. In addition to the benefits derived from BKC’s advertising spending, we sometimes supplement BKC’s advertising and promotional activities with our own local advertising and promotions, including the purchase of additional television, radio and print advertising. The concentration of our Burger King restaurants in many of our markets permits us to leverage advertising in those markets. We also utilize promotional programs, such as combination value meals and discounted prices, targeted to our customers, in order to create a flexible and directed marketing program.

9

In connection with BKC’s 2011 initiatives to support the installation of digital menu boards, the introduction of new menu items and enhancements to the quality of our food preparation, we have made expenditures in our restaurants of approximately $9.0 million in 2011 and expect to make an additional $0.5 million in related expenditures in 2012. For those franchisees who made or have committed to make these expenditures including those for digital menu boards, BKC, beginning in 2012, will reduce the required advertising contribution by $5,400 per restaurant per year through 2015, for those restaurants whose expenditures included a digital menu board, and $3,000 per restaurant per year through 2015, for those restaurants whose expenditures excluded a digital menu board. At March 31, 2012 we had 285 existing Burger King restaurants qualifying for the $5,400 per year advertising reduction and 11 existing Burger King restaurants qualifying for the $3,000 per year advertising reduction. In addition, to receive the advertising reductions prospectively the franchisee must be in full compliance with its franchise agreements including being current all on payments to BKC for royalties, advertising and occupancy related charges.

We are a member of a national purchasing cooperative, Restaurant Services, Inc. (“RSI”), created for the Burger King system. RSI is a non-profit independent cooperative that acts as the purchasing agent for approved distributors to the Burger King system and serves to negotiate the lowest cost for the system. We use our purchasing power to negotiate directly with certain other vendors, to obtain favorable pricing and terms for supplying our restaurants. For our restaurants, we are required to purchase all of our foodstuffs, paper goods and packaging materials from BKC-approved suppliers. We currently utilize and will utilize three distributors, Maines Paper & Food Service, Inc., Reinhart Food Service L.L.C. and MBM Food Service Inc., to supply our restaurants and the Acquired Restaurants, respectively, with the majority of their foodstuffs and, as of March 31, 2012, such distributors supplied 64%, 32% and 4%, respectively, of our restaurants and 9%, 34% and 57%, respectively, of the Acquired Restaurants. We may purchase non-food items such as kitchen utensils, equipment maintenance tools and other supplies from any suitable source so long as such items meet BKC product uniformity standards. All BKC-approved distributors are required to purchase foodstuffs and supplies from BKC-approved manufacturers and purveyors. BKC is responsible for monitoring quality control and supervision of these manufacturers and conducts regular visits to observe the preparation of foodstuffs, and to run various tests to ensure that only quality foodstuffs are sold to its approved suppliers. In addition, BKC coordinates and supervises audits of approved suppliers and distributors to determine continuing product specification compliance and to ensure that manufacturing plant and distribution center standards are met. Although we believe that we have alternative sources of supply available to our restaurants, in the event any distributor or supplier for our restaurants was unable to service us, this could lead to a disruption of service or supply at our restaurants until a new distributor or supplier is engaged, which could have an adverse effect on our business.

Quality Assurance

Our operational focus is closely monitored to achieve a high level of customer satisfaction via speed of service, order accuracy and quality of service. Our senior management and restaurant management staffs are principally responsible for ensuring compliance with BKC’s required operating procedures. We have uniform operating standards and specifications relating to the quality, preparation and selection of menu items, maintenance and cleanliness of the premises and employee conduct. In order to maintain compliance with these operating standards and specifications, we distribute to our restaurant operations management team detailed reports measuring compliance with various customer service standards and objectives, including feedback obtained directly from our customers through instructions given to them at the point of sale. The customer feedback is monitored by an independent agency and us and consists of evaluations of speed of service, quality of service, quality of our menu items and other operational objectives including the cleanliness of our restaurants. We also have our own customer service representatives that handle customer inquiries and complaints.

We operate in accordance with quality assurance and health standards mandated by federal, state and local governmental laws and regulations. These standards include food preparation rules regarding, among other things, minimum cooking times and temperatures, maximum time standards for holding prepared food, food handling guidelines and cleanliness. To maintain these standards, we conduct unscheduled inspections of our restaurants. In addition, restaurant managers conduct internal inspections for taste, quality, cleanliness and food safety on a regular basis.

Trademarks

As a franchisee of Burger King, we also have contractual rights to use certain BKC-owned trademarks, service marks and other intellectual property relating to the Burger King concept. We have no proprietary intellectual property other than the Carrols logo and trademark.

Government Regulation

Various federal, state and local laws affect our business, including various health, sanitation, fire and safety standards. Restaurants to be constructed or remodeled are subject to state and local building code and zoning requirements. In connection with the development and remodeling of our restaurants, we may incur costs to meet certain federal, state and local regulations, including regulations promulgated under the Americans with Disabilities Act.

10

We are subject to the federal Fair Labor Standards Act and various other federal and state laws governing such matters as:

| • | minimum wage requirements; |

| • | health care; |

| • | unemployment compensation; |

| • | overtime; and |

| • | other working conditions and citizenship requirements. |

A significant number of our food service personnel are paid at rates related to the federal, and where applicable, state minimum wage and, accordingly, increases in the minimum wage have increased and in the future will increase wage rates at our restaurants.

We are assessing the various provisions of the comprehensive federal health care reform law enacted in 2010, including the impact on our business of this new law as it becomes effective. There are no assurances that a combination of cost management and menu price increases can accommodate all of the potential increased costs associated with these regulations.

We are also subject to various federal, state and local environmental laws, rules and regulations. We believe that we conduct our operations in substantial compliance with applicable environmental laws and regulations. Our costs for compliance with environmental laws or regulations have not had a material adverse effect on our results of operations, cash flows or financial condition in the past.

Competition

The restaurant industry is highly competitive with respect to price, service, location and food quality. In each of our markets, our restaurants compete with a large number of national and regional restaurant chains, as well as locally owned restaurants, offering low and medium-priced fare. We also compete with convenience stores, delicatessens and prepared food counters in supermarkets, grocery stores, cafeterias and other purveyors of moderately priced and quickly prepared foods.

We believe that:

| • | product quality and taste; |

| • | brand recognition; |

| • | convenience of location; |

| • | speed of service; |

| • | menu variety; |

| • | price; and |

| • | ambiance |

are the most important competitive factors in the quick-service restaurant segment and that our restaurants effectively compete in each category.

Our largest competitors are McDonald’s and Wendy’s restaurants. According to Technomic, McDonald’s restaurants had aggregate U.S. system-wide sales of $34.2 billion for the year ended December 31, 2011 and operated 14,098 restaurants in the United States at that date, and Wendy’s restaurants had aggregate system-wide sales of $8.5 billion for the year ended December 31, 2011 and operated 5,876 restaurants in the United States at that date.

Employees

As of March 31, 2012 (after giving effect to the spin-off), we employed approximately 8,170 persons of which approximately 170 were administrative personnel and approximately 8,000 were restaurant operations personnel. None of our employees is covered by collective bargaining agreements. We believe that our overall relations with our employees are good.

After giving effect to the Acquisition, we expect to employ approximately 7,415 additional employees of which approximately 15 are expected to be administrative personnel and approximately 7,400 are expected to be restaurant operations personnel.

Properties

We owned or leased the following restaurant properties:

| Owned | Leased | Total | ||||||||||

| Restaurants: |

||||||||||||

| Burger King restaurants as of March 31, 2012 |

8 | 289 | 297 | |||||||||

| Burger King restaurants after the closing of the Acquisition |

8 | 567 | 575 | |||||||||

11

Most of our restaurant leases are coterminous with the related franchise agreements. We believe that we generally will be able to renew, at commercially reasonable rates, the leases whose terms expire prior to the expiration of that location’s Burger King franchise agreement, although there can be no assurance that this will occur.

Most leases require us to pay utility and water charges and real estate taxes. Certain leases also require contingent rentals based upon a percentage of gross sales of the particular restaurant that exceed specified minimums. In some of our mall locations, we are also required to pay certain other charges such as a pro rata share of the mall’s common area maintenance costs, insurance and security costs.

In addition to the restaurant locations set forth under “— Restaurant Locations,” we own a building with approximately 25,300 square feet at 968 James Street, Syracuse, New York, which houses our executive offices and most of our administrative operations for our restaurants. We lease five small regional offices that support the management of our restaurants.

Legal Proceedings

On November 16, 1998, the Equal Employment Opportunity Commission (“EEOC”) filed suit in the United States District Court for the Northern District of New York (the “Court”), under Title VII of the Civil Rights Act of 1964, as amended, against Carrols. The complaint alleged that Carrols engaged in a pattern or practice of unlawful discrimination, harassment and retaliation against former and current female employees. The EEOC ultimately attempted to present evidence of 511 individuals that it believed constituted the “class” of claimants for which it was seeking monetary and injunctive relief from Carrols. On April 20, 2005, the Court issued a decision and order granting Carrols’ Motion for Summary Judgment that it filed in January 2004, dismissing the EEOC’s pattern or practice claim. Carrols then moved for summary judgment against the claims of the 511 individual claimants. On March 2, 2011, the Court issued a decision and order granting summary judgment against the claims of all but 131 of the 511 individual claimants and dismissed 380 of the individual claimants from the case. Both the EEOC and Carrols subsequently filed motions for reconsideration in part of the Court’s March 2, 2011 decision and order, which motions were denied by the Court in a decision and order issued February 10, 2012. Pursuant to the Court’s order the parties submitted on March 1, 2012 letter briefs outlining their respective proposals on how the Court should proceed with the trials of the remaining claimants. The court has ruled in part on the March 1, 2012 letter briefs requiring that depositions of the remaining claimants and other identified witnesses should move forward to be completed in 2012.

Subject to possible appeal by the EEOC, the EEOC’s pattern or practice claim is dismissed however; the Court has yet to determine how the claims of the individual claimants will proceed. Although Carrols believes that the EEOC’s continued class litigation argument is without merit, it is not possible to predict the outcome of that matter on an appeal, if one is taken. We do not believe that any of the remaining claims, individually or in the aggregate, would have a material adverse impact on our business, results of operations or financial condition.

Following Alan Vituli’s, our former chairman and chief executive officer, departure from us and Fiesta Restaurant Group, Mr. Vituli contacted us to express grievances regarding his departure. Since that time, we have been in discussions with Mr. Vituli regarding matters under his employment agreement and other matters. Mr. Vituli’s counsel ultimately failed to respond to our proposals. On May 17, 2012, our counsel received a letter from Mr. Vituli’s new counsel alleging, among other things, that we failed to comply with our obligations to Mr. Vituli, that our and Fiesta Restaurant Group’s boards of directors failed to comply with their obligations to act in the best interests of the shareholders, that he has been deprived of information and property to which he is entitled and that the companies have not honored promises made to him. We believe that we have fully complied with Mr. Vituli’s employment agreement and that the other allegations are without merit and, if Mr. Vituli chooses to bring an action against us, we will contest such action vigorously. While Mr. Vituli’s new counsel has offered to continue negotiations regarding these matters, we have not yet determined our course of action.

We are a party to various litigation matters incidental to the conduct of our business. We do not believe that the outcome of any of these matters will have a material adverse effect on our business, results of operations or financial condition.

Certain Financial Information

The unaudited condensed pro forma statements of operations of Carrols Restaurant Group for the fiscal years ended December 31, 2009 and 2010, the unaudited condensed combined pro forma statements of operations of Carrols Restaurant Group for the three months ended March 31, 2011 and 2012 and the fiscal year ended December 31, 2011 and the unaudited condensed combined pro forma balance sheet of Carrols Restaurant Group as of March 31, 2012 are filed as Exhibit 99.1 hereto and are incorporated by reference herein.

The audited Statements of Assets Acquired and Liabilities Assumed for the Acquired Restaurants for the twelve-months ended December 31, 2010 and 2011 and the Statements of Revenues and Direct Operating Expenses for the Acquired Restaurants for the year ended December 31, 2009, the period from January 1, 2010 to October 18, 2010, the period from October 19, 2010 to December 31, 2010 and the year ended December 31, 2011 and the Statements of Assets Acquired and Liabilities Assumed for the Acquired Restaurants for the three-months ended March 31, 2012 and the year ended December 31, 2011 and the Statements of Revenues and Direct Operating Expenses for the Acquired Restaurants for the three-months ended March 31, 2012 and 2011 (collectively, the “Special Purpose Financial Statements”) are filed as Exhibit 99.2 hereto and are incorporated by reference herein. Financial statements for the Acquired Restaurants prepared in accordance with the requirements of Rule 3-05 of Regulation S-X with respect to the Acquired Restaurants are

12

not available and are not presented because the Acquired Restaurants represent a small portion of the business of BKC, the current owner of the Acquired Restaurants, and BKC has not prepared separate financial statements for the Acquired Restaurants, nor has it accounted for or managed the Acquired Restaurants separately from its other restaurants. Financial statements for the Acquired Restaurants prepared in accordance with the requirements of Rule 3-05 of Regulation S-X cannot be provided without unreasonable effort and expense. The omission of the financial statements for the Acquired Restaurants prepared in accordance with the requirements of Rule 3-05 of Regulation S-X in this Form 8-K will not have a material impact on an investor’s understanding of our financial results and condition and related trends.

On May 17, 2012, Carrols Restaurant Group issued a press release announcing that it plans to offer, in a private placement, senior secured second lien notes in the aggregate amount of approximately $140 million. The notes are being offered in the United States pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”) and outside of the United States pursuant to Regulation S under of the Securities Act. The entire text of the press release is attached as Exhibit 99.3 and is incorporated by reference herein.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

| 99.1 | Unaudited Condensed Combined Pro Forma Financial Information of Carrols Restaurant Group, Inc. |

| 99.2 | The Special Purpose Financial Statements of the Acquired Restaurants. |

| 99.3 | Carrols Restaurant Group, Inc. Press Release, dated May 17, 2012. |

13

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

CARROLS RESTAURANT GROUP, INC.

Date: May 18, 2012

| By: | /s/ Paul R. Flanders | |

| Name: | Paul R. Flanders | |

| Title: | Vice President, Chief Financial Officer and Treasurer |

14