Attached files

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

May 4, 2012

Mr. Kevin Jones, CEO/Director

North Texas Energy, Inc.

5057 Keller Springs Road, Suite 300

Addison, Texas 75001

Re: Independent Technical Report

Dear Mr. Jones:

At your request, I have prepared the following Technical Report (“Report”) for inclusion by North Texas Energy, Inc. (“Company”) in a prospectus projected to be issued in the first half of 2012.

I have prepared this Report using the new US Security and Exchange Commission rules effective for registration statements filed on or after January 1, 2010 for use by potential shareholders in the evaluation of the proposed exploration drilling and rework program of the Company within Texas and Oklahoma.

I certify that I am a Consulting Petroleum Engineer, registered with the State of Oklahoma, State Board of Registration for Professional Engineers and Land Surveyors, Number 14481 and that I hold no equity position in the Company.

Purpose

This report was prepared for North Texas Energy, Inc. The purpose of this report is to introduce North Texas Energy, Inc., its Strategic and Tactical Plan, its Management Team, and to outline the company’s progress toward those plan goals since incorporation in January 2011.

The effective date of this report is August 1, 2011. This report was revised on May 4, 2012 to incorporate changes required to comply with US Security and Exchange Commission rules.

The Company

North Texas Energy, Inc. (NTE) is an ‘Enhanced Oil Recovery’ company whose primary function is to increase the ultimate recovery of oil and gas from the wells it presently owns or will drill or will acquire in the future in order to maximize value to it’s stockholders. All (100%) of the registrant's total Proved Developed reserves are covered by this report and the Proved Developed reserves are in the state of Texas.

1

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

Strategy

The company will use modern analytical tools and the experience of the management team for due diligence to differentiate between projects suitable to the application of proven enhanced oil recovery techniques and to monitor new drilling and recovery technology for successful proof of concept.

Tactics

The company will acquire existing production projects, productive and non-productive leases, and new leases, will enter into joint ventures with other operators that will add reserves, necessary project acreage or improve the likelihood of a projects’ success.

Data and Assumptions

Information and data for the analysis of this acreage are from electric logs, drillers’ logs, completion and production reports obtained from the Texas Railroad Commission (RRC), IHS Energy Corporation, Dwight’s database, the Texas Well Log Library, the NRIS database, published reports, public well records of ongoing operations in the area and my private files.

This data was deterministically used to evaluate the New Diana and Minerva-Rockdale reservoir formation and field production history to estimate the level of recoverable proved reserves. All (100%) of the NTE Proved Developed reserves were reviewed in connection with the preparation of this report.

Engineering assessments of the M. W. Balch and New Diana leases were performed to determine which Enhanced Oil Recovery (EOR) methodologies would optimize the crude oil production of the reworked fields. For the M. W. Balch lease, Microbial EOR will be implemented to increase the reservoir pressures to achieve enhanced production. The assumption that greater reservoir pressure will increase production levels is based upon previous production history, well logs, and engineering data of analogous producing fields within the same reservoir.

The decision to increase reservoir pressure is also based upon data of producing fields within analogous reservoirs, that have the same characteristics that include but are not limited to formation depth, reservoir fluid gravity, reservoir size, porosity, permeability, and EOR development plan.

2

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

For the New Diana lease, existing wells will be reworked with new oil and gas extraction equipment and optimizing field operations (i.e. establish optimal pumping rates each well, etc.) will achieve increased production. The assumptions, data, methods, and procedures that were utilized are appropriate for the purpose served by this report. And all methods and procedures that were considered necessary under the circumstances were used to prepare this report.

EOR and production operations are subject to various types of regulation at the federal, state and local levels. The regulations include maintaining bonding requirements to rework or operate wells, defining potential well locations, specifying well casing integrity, plugging and abandoning well statutes, and the surface use and restoration of properties on which wells are operated. Operations are also subject to various conservation laws and regulations. These include the regulation of spacing or proration of wells (the density of wells in a given field). In addition, state conservation laws establish maximum rates of production from oil and natural gas wells. The effect of

these regulations is to limit the amounts of crude oil and natural gas we can produce from our wells.

Because federal, state and local statutes, rules, and regulations undergo constant review and often are amended, expanded, and reinterpreted, it is difficult to predict the future cost or impact of regulatory compliance. However, thoroughly understanding and adhering to federal, state, and local regulations will greatly reduce the operational costs associated with operating an oil and gas company.

The process of estimating oil and natural gas reserves is complex, requiring significant decisions and assumptions in the evaluation of available geological, engineering, and economic data for each reservoir. As a result, the estimates are inherently imprecise evaluations of reserve quantities and could materially affect the quantity and value of the reported reserves. Actual future production of recoverable oil and gas reserves may vary substantially from those assumed in the estimates.

Progress Toward the Company’s Goals

Rework New Diana Field-Upshur County, TX

North Texas Energy, Inc. controls 348 acres of the New Diana Field in Upshur County, Texas that consists of four leases 1) Bozie-Moore - 1 well, 2) Don Looney - 4 wells, 3) L. R. Smith - 1 well, and 4) Rogers Hill - 1 well. All seven wells are approximately 3,100 feet deep. The below ground infrastructure (casing, tubing, down hole pumps, and sucker rods) has been completed for each well. An Estimated Ultimate Recovery (EUR) was calculated for the New Diana field and is submitted as supplemental information to this engineering report.

3

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

Minerva-Rockdale Field-Milam County, TX

Microbial Enhanced Oil Recovery Project

North Texas Energy, Inc.

Balch Lease

4

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

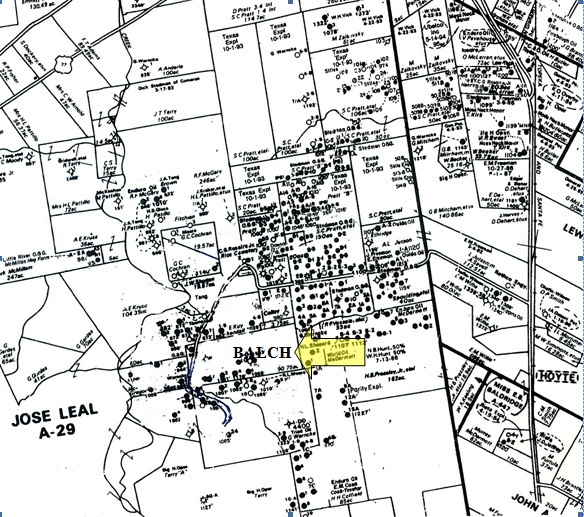

Figure 1. Map of part of the Minerva-Rockdale Oilfield showing location of the M. W. Balch lease

This report recounted data from a reserve report that apparently no longer exists. The sand at approximately 1050 feet deep had produced approximately 40,000 barrels of oil by primary production methods. It reportedly has 32% porosity and 35-degree oil gravity. It contains 4.8% paraffin that causes wellbore plugging and the static level of oil in the wells is approximately 300 feet below the surface.

The Microbial Enhanced Oil Recovery technique will be used on the M. W. Balch lease. In a report conducted by the DOE and the Venezuelan Ministry of Energy and Mines, concluded that, “MEOR has two distinct advantages: 1) microbes do not consume large amounts of energy, and 2) the use of microbes is not dependent on the price of crude oil, as compared with other EOR processes. In some reservoirs, beneficial microbes are indigenous and only need nutrients to stimulate growth. Because microbial growth ccurs at exponential rates, it should be possible to produce large amounts of useful products rapidly from inexpensive and/or renewable resources. Thus, MEOR has the potential

to be more cost-effective than other EOR processes.”1

__________________

1 “Microbial Enhanced Oil Recovery”, April 1997 (DOE/BC-97/3/SP OSTI ID:14278)

5

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

The M. W. Balch lease consists of 11 shallow well depths, 930 to 1,170 feet. The below ground infrastructure (casing, tubing, down hole pumps, sucker rods, etc.) for each well has been completed. An Estimated Ultimate Recovery (EUR) was calculated for the M. W. Balch lease and is submitted as supplemental information to this engineering report.

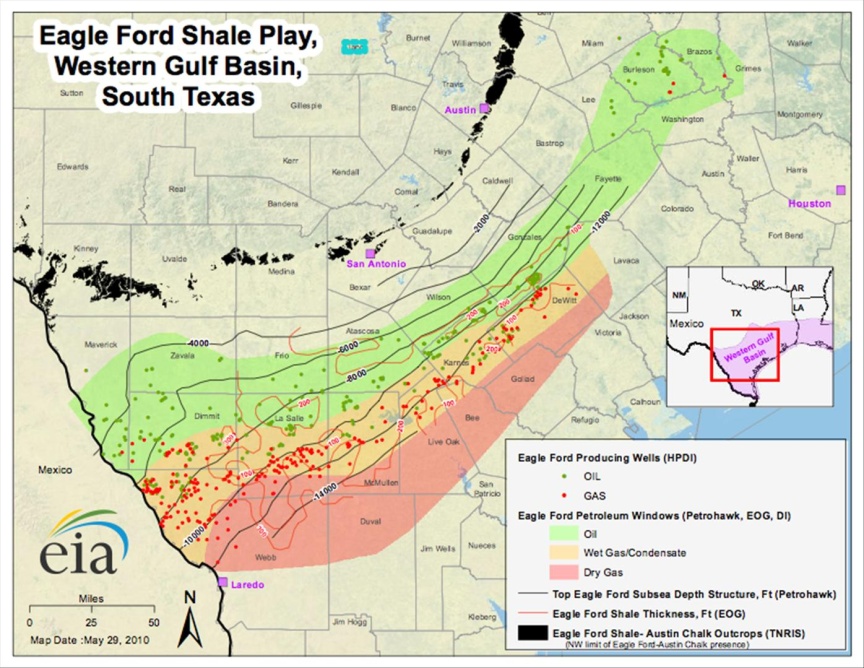

Eagle Ford Shale Oil Trend

The M. W. Balch lease is located in the shallow oil window of the Eagle Ford Shale Oil Trend. Production from the Eagle Ford Shale until quite recently was not considered practical. The twin techniques of highly accurate horizontal drilling of multiple laterals from a single drill pad and the ability to isolate each of fifteen or more stages of hydraulic fracturing, allowing the reservoir to be effectively shattered to create pathways for the oil and gas to reach the well bore, have touched off an oil boom that threatens to put every able bodied Texan to work.

Much of what follows is quoted from the Railroad Commission filings of the major exploration companies or is in today’s industry news as one of the major trends in oil and gas. Data presented in these filings indicate a very low risk of dry holes.

It has been projected that the Eagle Ford Shale Play has roughly the same amount of oil as Alaska, which is 5,000,000,000 barrels producible. Petrohawk drilled the discovery well of the Eagle Ford in 2008, it flowed 7.6 million cubic feet of gas per day from a 3,200-foot lateral at 11,141 feet total vertical depth.

Companies with familiar names, such as Chesapeake, Petrohawk, Anadarko, Apache, EOG, Lewis Petro, Geo Southern, Pioneer, SM Energy, Atlas and XTO are capitalizing on this trend of virtually ‘dry hole free’ exploration.

The Eagle Ford waltzes across Texas from the Mexican border north of Laredo up and into East Texas where it is the source rock for the prolific Spindletop Dome, the Austin Chalk and the Giant East Texas Field. It is roughly 50 miles wide and 400 miles long with an average thickness of 250 feet.

6

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

Figure 2, Map of Eagle Ford Shale courtesy of the Energy Information Administration (www.eia.gov/oil_gas/rpd/shaleusa9.pdf)

What is the Eagle Ford Shale?

“The Eagle Ford Shale is a hydrocarbon producing formation of significant importance due to its capability of producing both gas and more oil than other traditional shale plays. It contains a much higher carbonate shale percentage, up to 70% that makes it more brittle and ‘fracable’.

It is Cretaceous in age resting between the Austin Chalk and the Buda Lime at a depth of approximately 4,000 to 12,000 feet. The wells in the deeper part of the play deliver a dry gas, but moving northeastward updip, the wells produce more liquids.”

7

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

EOG’s Map, Results & Comments

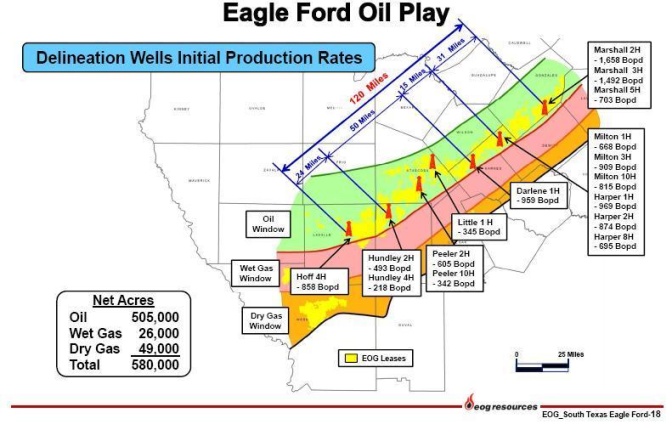

Figure 3. EOG Resources Map

“The map is from EOG Resources and shows the extent of their holdings (yellow) in the oil window. The Eagle Ford is now being seen as a major shale oil play, as well as one holding trillions of cubic feet of natural gas. Now that natural gas prices are low it may be oil that keeps this boom going in the short term until natural gas prices rise. EOG has made the bold statement that the Eagle Ford shale could be the sixth largest oil discovery on U.S. soil. That includes all the early discoveries like Pennsylvania, East Texas – Spindletop, Prudhoe Bay Alaska, California fields and the Permian Basin. This is the boldest statement yet and EOG Resources is

backing it up with test results from several wells drilled over a six county area that stretches approximately 130 miles.”

“They have divided the Eagle Ford oil play into two zones, the East and the West. They estimate a higher return on investment after taxes in the East Eagle Ford, with a recovery rate of 3.8% of 359 million barrels plus 478 billion cubic feet of natural gas. In the West Eagle Ford shale they estimate a recovery factor of 2.6% or 331 million barrels of oil and 183 billion cubic feet of gas. The production fall off rate will be lower in the West section, meaning longer well life.”

8

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

“It was big news in March when the Haynesville shale of Texas and Louisiana surpassed the nearby Barnett, in Texas’ Dallas-Fort Worth area, as the most productive shale play. Less widely reported, until very recently, has been the feverish rate of drilling in their new neighbor to the south, the liquids-rich Eagle Ford. As operators begin to bring those wells online and move in even more rigs while low gas prices take their toll on Barnett and Haynesville activity, the Eagle Ford is emerging as a dark horse with potential to overtake those two plays in production volume.” World Oil Magazine June

2011.

Reserve Potential of North Texas Energy, Inc.

The US Securities and Exchange Commission (the “SEC”) has adopted significant revisions to its oil and gas reporting requirements. The revisions are intended to provide shareholders with a more meaningful and comprehensive picture of the oil and gas reserves that a company holds. The revisions reflect current industry practices and technological changes in the oil and gas industry that expand upon simple formulae and that attempt to show the expected potential value that the company should achieve based on a reasonable set of circumstances.

The SEC definition of reserves now includes non-traditional and unconventional sources that are based upon reliable proven technologies.

Table of Oil Reserves

Stock Tank Barrels (42 gal.)

|

Owned

|

Developed

|

|

|

Leases

|

Reserves

|

|

|

M. W. Balch

|

291,794

|

|

|

New Diana

|

397,680

|

9

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

Summary & Conclusions

It is the opinion of the author, that the Company’s Plan, as described in this Report, has a reasonable opportunity of commercial success.

Qualifications and Site Inspection

Mr. Durkee is a Consulting Petroleum Engineer, registered with the State of Oklahoma, State Board of Registration for Professional Engineers and Land Surveyors, number 14481. He has initiated projects through geological and satellite studies, managed drilling and completion programs and operated oil and gas producing properties. He has designed and operated gas pipelines, an LPG extraction plant and several waterfloods, MEOR and polymer floods throughout the Mid-continent region.

He is native to the city of Tulsa and has been the operator of wells in Texas and Oklahoma since 1972.

Limitations and Risk

A copy of this report was given and reviewed by North Texas Energy, Inc. for comment on any factual errors; however, the analysis and conclusions contained herein are those of the author alone.

All parties reading this Report are advised of the inherent risks involved in drilling for oil and gas which are set out in detail in the Risk Section of the Prospectus. The possibility exists that the rework and drilling programs set forth in this Report may not recover commercial quantities of hydrocarbons. Oil and/or gas volumetrics presented in this Report are based on the best available data and published production histories.

Consent

John M. Durkee has consented to the inclusion of this Report in the Prospectus in the form and context in which it appears and has not withdrawn this consent before lodgment of the Prospectus with the U. S. Securities and Exchange Commission (SEC).

North Texas Energy, Inc. has reviewed this Report and has consented to the inclusion of the illustrations provided in Figures 1 through 3 inclusive, and to all statements attributed to North Texas Energy, Inc. by name in the form and context in which they appear, and has not withdrawn this consent before lodgment of this Prospectus with the U. S. Securities and Exchange Commission (SEC).

10