Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - IBERIABANK CORP | d353983d8k.htm |

Annual Shareholders’

Meeting

May 2012

Annual Shareholders’

Annual Shareholders’

Meeting

Meeting

May 2012

May 2012

Exhibit 99.1 |

2

Safe Harbor Language

Safe Harbor Language

Statements

contained

in

this

presentation

which

are

not

historical

facts

and

which

pertain

to

future

operating

results

of

IBERIABANK

Corporation

and

its

subsidiaries

constitute

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

These

forward-

looking

statements

involve

significant

risks

and

uncertainties.

Actual

results

may

differ

materially

from

the

results

discussed

in

these

forward-looking

statements.

Factors

that

might

cause

such

a

difference

include,

but

are

not

limited

to,

those

discussed

in

the

Company’s

periodic

filings

with

the

SEC.

In

connection

with

the

proposed

acquisition

of

Florida

Gulf

Bancorp,

Inc.,

IBERIABANK

Corporation

will

file

a

Registration

Statement

on

Form

S-4

that

will

contain

a

proxy

statement/prospectus.

INVESTORS

ARE

URGED

TO

CAREFULLY

READ

THE

PROXY

STATEMENT/PROSPECTUS

REGARDING

THE

PROPOSED

TRANSACTION

WHEN

IT

BECOMES

AVAILABLE,

BECAUSE

IT

WILL

CONTAIN

IMPORTANT

INFORMATION.

Investors

may

obtain

a

free

copy

of

the

proxy

statement/prospectus

(when

it

is

available)

and

other

documents

containing

information

about

IBERIABANK

Corporation

and

Florida

Gulf

Bancorp,

Inc.,

without

charge,

at

the

SEC's

web

site

at

http://www.sec.gov.

Copies

of

the

proxy

statement/prospectus

and

the

SEC

filings

that

will

be

incorporated

by

reference

in

the

proxy

statement/prospectus

may

also

be

obtained

for

free

from

the

IBERIABANK

Corporation

website,

www.iberiabank.com,

under

the

heading

“Investor

Information”.

This

communication

is

not

a

solicitation

of

any

vote

or

approval,

is

not

an

offer

to

purchase

shares

of

Florida

Gulf

Bancorp,

Inc.

common

stock,

nor

is

it

an

offer

to

sell

shares

of

IBERIABANK

Corporation

common

stock

which

may

be

issued

in

the

proposed

merger.

Any

issuance

of

IBERIABANK

Corporation

common

stock

in

the

proposed

merger

would

have

to

be

registered

under

the

Securities

Act

of

1933,

as

amended,

and

such

IBERIABANK

Corporation

common

stock

would

be

offered

only

by

means

of

a

prospectus

complying

with

the

Act. |

3

A History Of Progress

A History Of Progress

*******************************

*******************************

*******************************

******************************* |

4

Humble Beginnings

A History Of Progress

A History Of Progress

4

•

Founded On March 12, 1887

In New Iberia, Louisiana

•

“Iberia Building Association”

•

Philosophy Was To Help

Families In Financing The

Purchase Of Homes And

Encourage Thrift

•

First Home Loan Granted

Was For $600

•

Total Assets Of $4,341

•

111 Years Later, Surpassed

The $1 Billion Asset

Threshold |

5

In Unique Company

A History Of Progress

A History Of Progress

5

•

Over 6,000 Financial

Institutions In The U.S.

•

1,500 Of Which Have Their

Headquarters In The

Southeastern U.S.

•

Less Than 3% Attained 125

Years Of Continuous

Operations In The

southeastern U.S.

•

Now $12 Billion In Assets

•

66

th

Largest BHC In U.S.

•

12

th

Largest BHC In The

Southeastern U.S.

•

First To Pay Back TARP

•

Since 2002, 78% Of Our

Asset Growth Is A Result Of

Acquisitions

Commercial Banks in Southeastern U.S. Ranked By Age

Age of Southeastern U.S. Commercial Banks |

Indicates

Cities

In

Which

Our

11

Members

Of

Executive

Management

Have

Resided/Worked

Indicates Cities In Which Our Members Of Senior Management (Market Presidents, Executive Vice

Presidents, Etc.) Have Resided/Worked

Albuquerque, NM

Annapolis, MD

Boston, MA

Buffalo, NY

Charlotte, NC

Charlottetown,

PE, Canada

Chennai, India

Cleveland, OH

Columbus, OH

Detroit, MI

Flint, MI

Hartford, CT

Experience in Additional Cities:

Greensboro, NC

Indianapolis, IN

Las Vegas, NV

Mansfield, PA

Morris Plains, NJ

New York, NJ

Pittsburgh, PA

Phoenix, AZ

San Diego, CA

Scottsdale, AZ

Wilmington, DE

Broad Experience Throughout

Southeastern

U.S. 6

Resides in Annapolis, MD

Resides in Annapolis, MD

Robert M. Kottler, EVP

Robert M. Kottler, EVP

Director of Retail and Small

Director of Retail and Small

Business

Business

Daryl G. Byrd

President and CEO

Beth A. Ardoin, EVP

Director of Communications

George J. Becker III, EVP

Director of Corporate Operations

Barry F. Berthelot, EVP

Director of Organizational Development

Resides in Lafayette, LA

Resides in New Orleans, LA

Michael J. Brown, VC

Chief Operating Officer

Jefferson G. Parker, VC

Manager of Brokerage, Trust,

and Wealth and Management

Anthony J. Restel, SEVP

Chief Financial Officer

Robert B. Worley

General Counsel

Resides in Raleigh, NC

John R. Davis, SEVP

Director of Financial Strategy and

Mortgage

Resides in Greensboro, NC

Gregg Strader, EVP

Chief Credit Officer

Resides in Greensboro, GA

James B. Gburek, EVP

Chief

Chief

Risk

Officer

Officer

Resides in Gastonia, NC

H. Spurgeon Mackie,

EVP

Executive Credit Officer

A History Of Progress

A History Of Progress

Where We Have Lived |

7

•

FDIC Acquisitions Completed: 5

•

Assets:

+$4.4 Billion

•

Deposits:

+$3.5 Billion

•

Net Loans:

+$1.9 Billion

•

Loan Discount: $515 Million

•

Loans Have 80%-95% FDIC

Loss-Share Protection

•

Pre-Tax Gain: +$243 Million

•

Acquired 60 Offices

•

10 MSAs In Alabama, Arkansas

And Florida

•

Average Time To Complete

Conversions: 121 Days

•

Live

Bank

Acquisitions

Completed:

7

•

Assets:

+$3.5 Billion

•

Deposits:

+$2.7 Billion

•

Net Loans:

+$2.1 Billion

•

Issued $507 Million Common Equity

•

Acquired 84 Offices

•

9 MSAs In Louisiana, Arkansas And

Memphis

•

Average Time To Complete

Conversions: 43 Days

A History Of Progress

A History Of Progress

Completed Acquisitions Since 2002

Completed FDIC

Acquisitions

Completed Live Bank

Acquisitions |

8

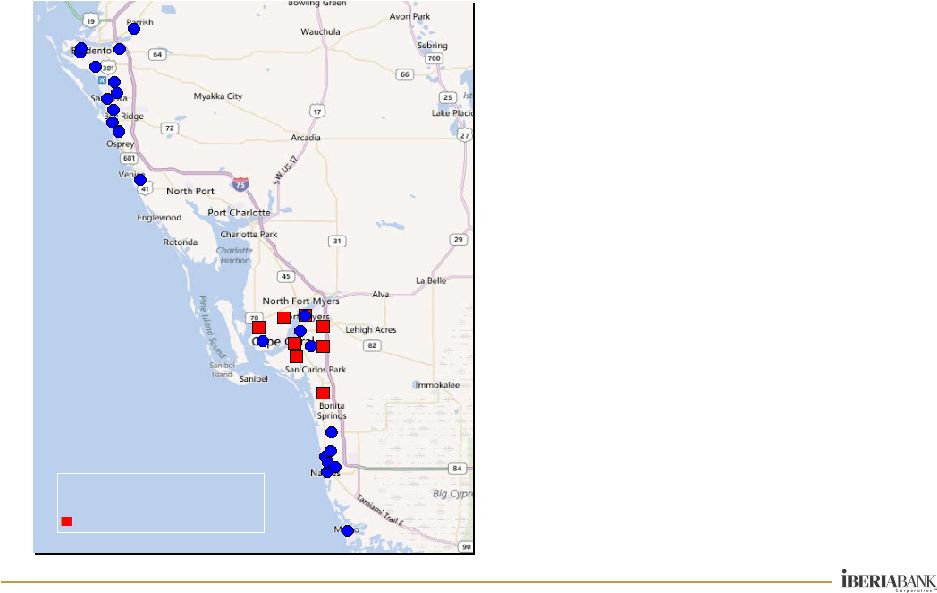

Source: SNL Financial Deposit Data As Of June 2011

•

Announced March 19, 2012

•

Adds 8 Branches In Fort Myers-Cape

Coral, Florida MSA

•

Attractive, Established Client Base

Complements Our Existing Client Base

•

Total Loans: $262 Million

•

Total Assets: $350 Million

•

Total Deposits: $279 Million

•

Total Equity: $24 Million Common Stock

Plus $4 Million Preferred Stock

•

Total Deal Value Of $35 Million For

Common Stock, $4 Million For Preferred

Stock Outstanding, Plus Up To Additional

$4 Million Based On Performance Of

Certain Acquired Loans Over 3-Year

Period

•

Includes $28 Million, Pre-Tax Credit Mark

(11% Of Loans)

•

Price / Tangible Book: 1.41x

•

Adjusted Core Deposit Premium: 4.9%

•

Accretive To EPS

•

Slightly Dilutive To TBVS

•

IRR In Excess Of Cost Of Capital

Proposed Acquisition of

Proposed Acquisition of

Florida Gulf Bancorp, Inc.

• IBERIABANK

branches Florida Gulf branches |

9

Branch Distribution

Fort Myers -

College Pointe

Deposits: $92 million

Fort Myers -

First Street

Deposits: $65 million

Fort Myers -

Daniels Parkway

Deposits: $27 million

Cape Coral -

Del Prado Blvd

Deposits: $21 million

Fort Myers -

Winkler Road

Deposits: $30 million

Fort Myers -

Colonial

Deposits: $20 million

Florida Gulf Bancorp, Inc.

Florida Gulf Bancorp, Inc. |

10

***************************************************

***************************************************

***************************************************

***************************************************

***************************************************

***************************************************

Market Overview

Market Overview |

Deposit Market

Share At June 30, 2011 Florida Branch And Deposit Information Reflects Pro Forma Florida

Gulf Bank Acquisition Source: SNL Financial

Map Reflects Locations At May 15, 2012

11

Texas

4 Bank locations

3

Non-bank locations

7 Total locations

$185 million deposits

#227 Rank

Louisiana

79 Bank locations

30

Non-bank locations

109 Total Locations

$5.1 billion deposits

#5 Deposit Rank

Alabama

13 Bank Locations

6

Non-bank locations

19 Total locations

$500 million deposits

#20 Rank

Florida

50 Bank locations

12

Non-bank locations

62 Total locations

$2.5 billion deposits

#22 Rank

Arkansas

34 Bank locations

30

Non-bank locations

64 Total locations

$1.0 billion deposits

#12 Rank

Tennessee

3 Bank locations

1

Non-bank locations

4 Total locations

$155 million deposits

#113 Rank

Market Overview

Market Overview

Our Geographic Reach |

12

New Branch Offices Opened In 2011

Market Overview

Market Overview

12 |

13

New Branch Offices Opened in 2011 (Continued)

Market Overview

Market Overview

13 |

14

New Branch Offices Opened in 2012

Market Overview

Market Overview

New Orleans, LA -

St. Charles Avenue

Baton Rouge, LA –

Acadian |

Client Growth

Client Growth

Client Growth |

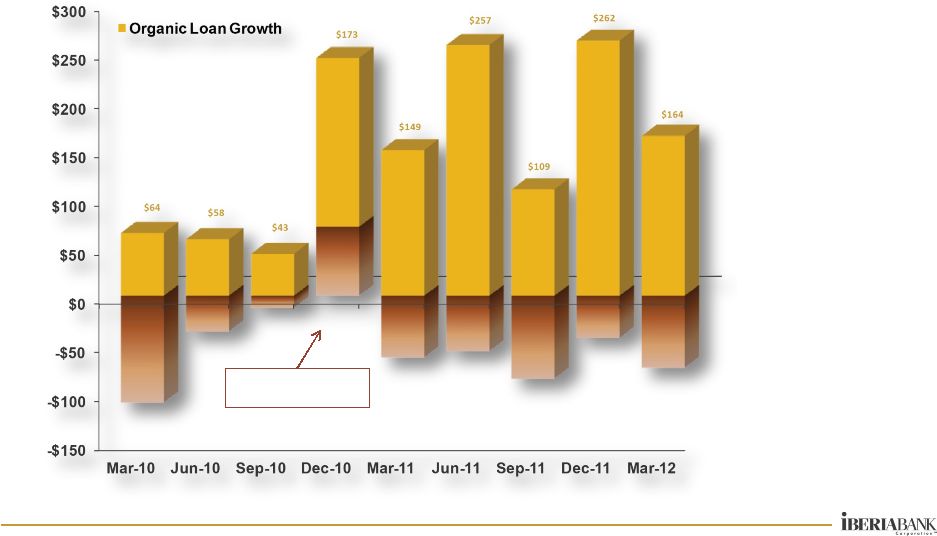

16

Solid Organic Loan Growth

Loans

Loans

•

$164 Million

Organic Loan

Growth In

YTD 2012

•

Counter To

Industry

Trends |

17

Growth In Organic And Covered Loans

Loans

Loans

•

Organic

Loan

Growth Of $1.3

Billion Or 31%

Since December

2009 (14%

Annualized)

•

FDIC Covered

Loan Portfolio

Declined $409

Million Or -25%

Since December

2009 (-11%

Annualized)

Sterling Bank FDIC-

Assisted Acquisition

$ In Millions |

18

Loan Portfolio

Summary

Loans

Loans

•

$7.5 Billion Loan

Portfolio

•

17% Of Loans Are

Covered Under Loss-

Share Agreements

•

Geographic Diversity

•

Limited Loan

Concentrations

•

Mix Of Commercial

And Retail Clients

Note: Loans Net Of Purchase Discounts At March 31, 2012

|

19

Market Expansion

Loans

Loans

19

•

Exceptional Organic

Loan Growth In:

Houston

New Orleans

Baton Rouge

Birmingham

Mobile

Memphis

•

Growth Primarily In

Commercial Clients

•

Recent Growth In

Consumer And

Indirect

Three-Year Loan Growth

Excluding FDIC-Assisted Acquisitions

3-Year Loan Growth ($ In Millions) |

20

Loans

Loans

Phenomenal Asset Quality

•

Many Banks

Invested In Real

Estate At The Top Of

The Cycle

•

We Avoided Many

Problems That

Plagued The

Industry

•

Our Results Have

Consistently Been In

Top 10% Of The

Industry

Average = 4.07%

Median = 2.76%

Our NPA Ratio:

0.87%

Top 10%

U.S. Bank Holding Companies |

21

Deposits

Deposits

Strong Organic Deposit Growth

•

Noninterest

Bearing

Deposits Nearly

Doubled

Over

The Past 15

Months

•

Over That

Period We Grew

Core Deposits

By $1.2 Billion

•

Cost of Core

Deposits Has

Fallen 34 bps To

0.47% Since

December 2010

Excludes Acquired Deposits

$ In Millions |

22

Market Expansion

Deposits

Deposits

22

•

Exceptional

Organic Deposit

Growth In:

New Orleans

Birmingham

Lafayette

Baton Rouge

•

Growth In

Commercial,

Retail, And

Small Business

Clients

Includes Acquisitions

3-Year Loan Growth ($ In Millions)

Three-Year Core Deposit Growth

(Excluding Time Deposits) |

23

Balanced Deposit Mix

Deposits

Deposits

•

We Have A Core

Funded Balance

Sheet

•

Balanced And

Diverse Deposit

Portfolio:

By Geography

By Deposit Type

By Source

Note: Deposits Net Of Purchase Discounts At March 31 ,2012

|

24

********************************************************************************

******************************************************************************

********************************************************************************

******************************************************************************

Retail

Retail

And Small Business

And Small Business

Banking

Banking |

| 25

Retail And Small Business Banking

Retail And Small Business Banking

Consumers:

•

New Branch And ATM Locations

•

Enhanced ATM, Phone, Online And Mobile

Solutions

•

Full And Integrated Product Set

Small Businesses:

•

Focused Bankers

•

Increased Lending

•

New Deposit And Treasury Management Products

•

Enhanced Online And Mobile Solutions

2011 Announced Improvements/Opportunities |

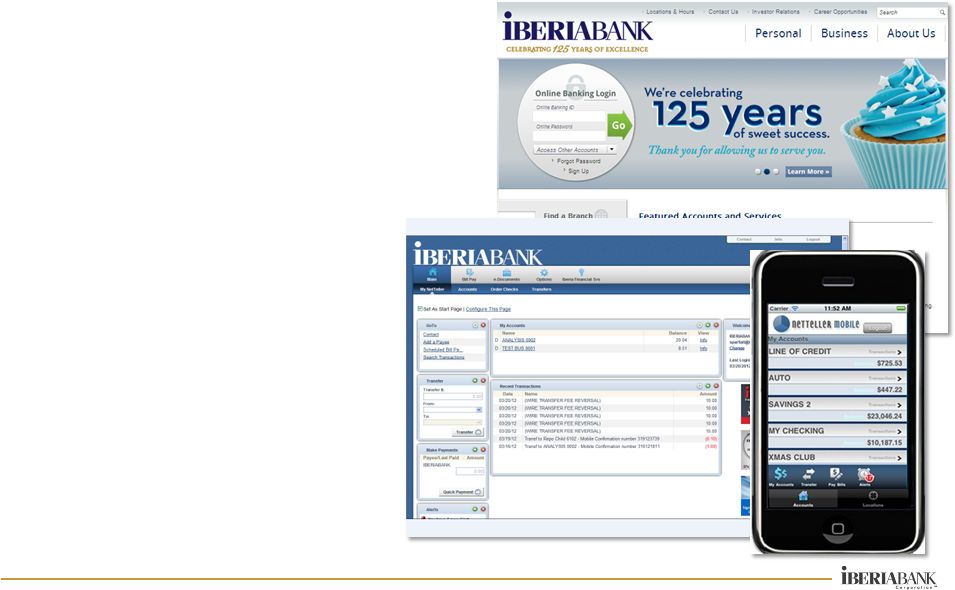

26

Steps Completed Include:

•

Launched New, Improved

Website

•

Improved Look-And-Feel Of

Online Banking

•

Launched Mobile Banking

•

Launched Text Banking

Next steps include:

•

Improved Online BillPay

•

Person-To-Person Payments

•

Bank-To-Bank Transfers

•

Personal Financial

Management (Quicken-Like

Capabilities)

•

Mobile Check Deposit

Capture

Retail And Small Business Banking

Retail And Small Business Banking

Digital Channel Improvements |

27

•

Launched Free Business And Choice

Checking Products

•

New Lending Products, Including 15-year

Owner Occupied Real Estate Loan

•

Payment Products, Including Merchant

Processing And Business Credit And

Purchasing Cards

•

Expanded Business Lending Center To

Support Bankers And Branch Managers In

Expanding Lending Focus

Retail And Small Business Banking

Retail And Small Business Banking

Investments In Small Business |

28

•

Increased Marketing

For Home Equity

Loans And Lines

•

Growth In Indirect

Auto Lending

Business Through

Expanded Dealer

Relationships

Consumer Lending Growth

Retail And Small Business Banking

Retail And Small Business Banking

Total Consumer Loans

$ In Millions |

29

Implemented Programs To Drive

Improved Retail/Small Business

Sales Performance, Leading To

Revenue Growth

•

New Incentive Program

For

Branch And Business Banking

Teams Focused On Balance

Growth And Fee Income

•

Branch And Business Banking

Dashboard To Provide

Visibility On Sales And

Financial Performance

•

Quarterly Retail Performance

Management (RPM) Meetings

•

Small Business Sales And

Coaching Program For Branch

Managers And Retail Market

Managers

Retail And Small Business Banking

Retail And Small Business Banking

Sales And Financial Performance |

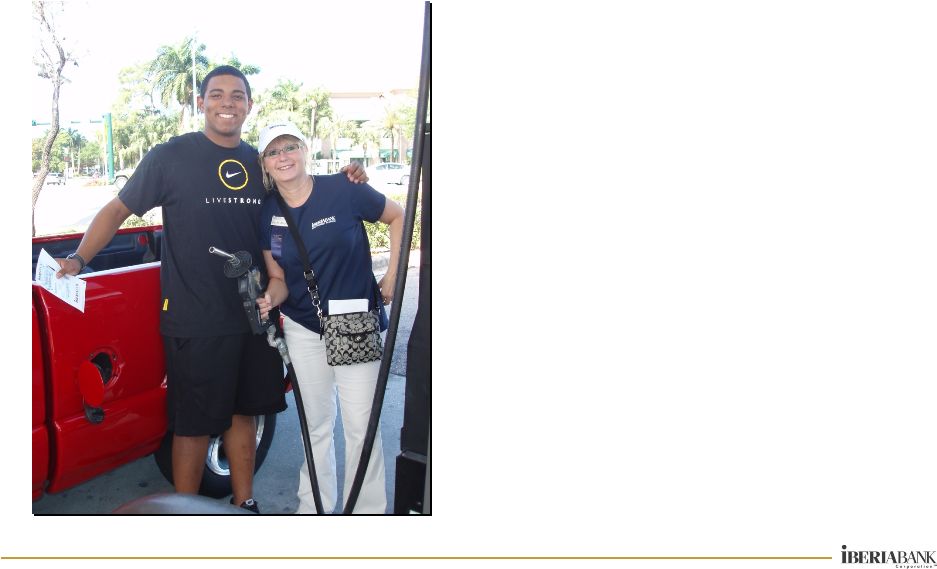

30

•

Expanding Our Community

Reinvestment Staff

•

Commitment To Financial

Literacy

•

Increased Community

Development, Mortgage Lending

In LMI Areas And Small Business

Lending

•

Random Acts Of Kindness

Retail And Small Business Banking

Retail And Small Business Banking

Giving Back To Our Communities |

| 31

Retail And Small Business Banking

Retail And Small Business Banking

•

Greater Convenience Through Continued

Investment In New Branches, ATMs And Online

Banking And Mobile Technology

•

New Products Focused On Businesses, Business

Owners And Consumers

•

Focus On Small Business -

Continued Investment

In New Bankers Who Can Spend More Time With

Customers And Increase Lending

•

Continued Emphasis On Serving Our

Communities

Looking Ahead |

32

************************************************************************

************************************************************************

********************************************************************

IBERIA Capital Partners

IBERIA Capital Partners

IBERIA Wealth Advisors

IBERIA Wealth Advisors

IBERIA Financial Services

IBERIA Financial Services |

33

Wealth Management, Brokerage & Capital Markets

Wealth Management, Brokerage & Capital Markets

Why Build Fee Businesses? |

34

IBERIA Wealth Advisors (IWA)

IBERIA Wealth Advisors (IWA)

From Building Infrastructure To Execution

•

Absorbed Operations Of Iberia Asset Management And IBERIABANK fsb

Trust Under IWA Umbrella

•

Completed Asset Purchase From Florida Trust Company, Including $415

Million In Assets Under Management |

35

IBERIA Wealth Advisors (IWA)

IBERIA Wealth Advisors (IWA)

From Building Infrastructure To Execution

IWA Growth In Assets Under Management |

36

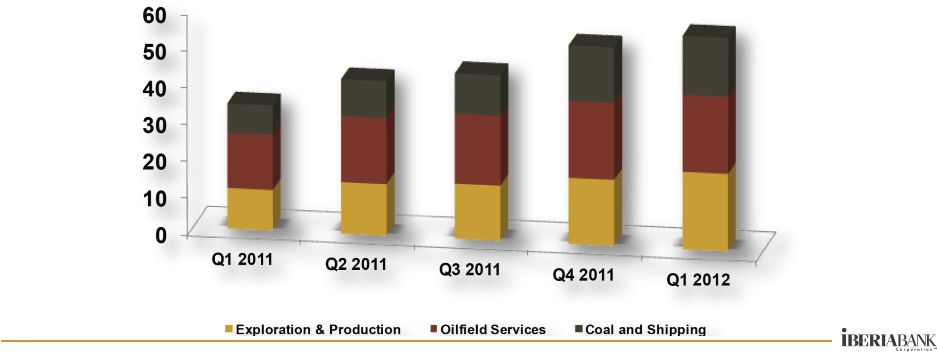

IBERIA Capital Partners (ICP)

IBERIA Capital Partners (ICP)

Gaining Traction

•

Increased Investment Banking Activity

•

Consistent Growth In Institutional Brokerage Activity

•

Growth In Coverage Universe

•

Synergistic

Opportunities

Between

Energy

Research

In

New

Orleans

And

Energy

Lending In Houston

Firms Under Coverage |

37

IBERIA Capital Partners & IBERIA Wealth Advisors

IBERIA Capital Partners & IBERIA Wealth Advisors

Quarterly Trend In Revenues

•

Steady

Progress In

Revenue

Growth Since

Launch In

4Q10

•

ICP/IWA

Revenues Of

$1.9 Million

(+25% Vs.

4Q11) |

38

IBERIA Financial Services (IFS)

IBERIA Financial Services (IFS)

Successfully Navigating Difficult Rate Environment

•

Revenue Continued To Be Strong

Overall In 2011

•

Headwinds Caused By Extremely

Low Interest Rates And Poor

Investor Confidence Have Slowed

Business Down In The Short Term

•

Growth In Markets Entered During

2010 And 2011 Help To Mitigate

Challenges

Five-Year Treasury Rate

$0

$2,000

$4,000

$6,000

$8,000

$10,000

2009

2010

2011

IFS Revenue ($ In Thousands) |

39

39

Financials

Financials

Financials |

40

Financials

Financials

2011 Compared To 2010

•

Revenues Up 15%

•

Expenses Up 23%

•

Margin Up 46 Bps.

•

Net Income Up 10%

•

EPS Unchanged

•

Stable Dividends

•

Assets Up 17%

•

Deposits Up 17%

•

Market Cap Down 9%

•

Book Value/Share Up 4%

•

Tangible Book Value Per

Share Down 5%

•

Strong Organic Growth:

Loans

Up

$533

Million

(+9%

Vs.

2010)

Core

Deposits

Up

$842

Million

(+17%

Vs.

2010)

•

Favorable Asset Quality Measures:

NPA/Assets

=

0.87%

(4Q10:

0.91%)

30+

Days

Past

Due

=

1.37%

(4Q10:

1.44%)

Net

COs/Avg.

Loans

=

0.12%

(2010:

0.47%)

Provision

=

$26

Million

(2010:

$42

Million)

•

Formidable Capital Position:

TCE

Ratio

=

9.52%

(4Q10:

10.65%)

Total

RB

Capital

=

16.21%

(4Q10:

19.74%) |

41

Relatively Low Risk Balance Sheet

Financials

Financials

41

•

39% Of

Balance

Sheet In Very

Low Risk

Components |

42

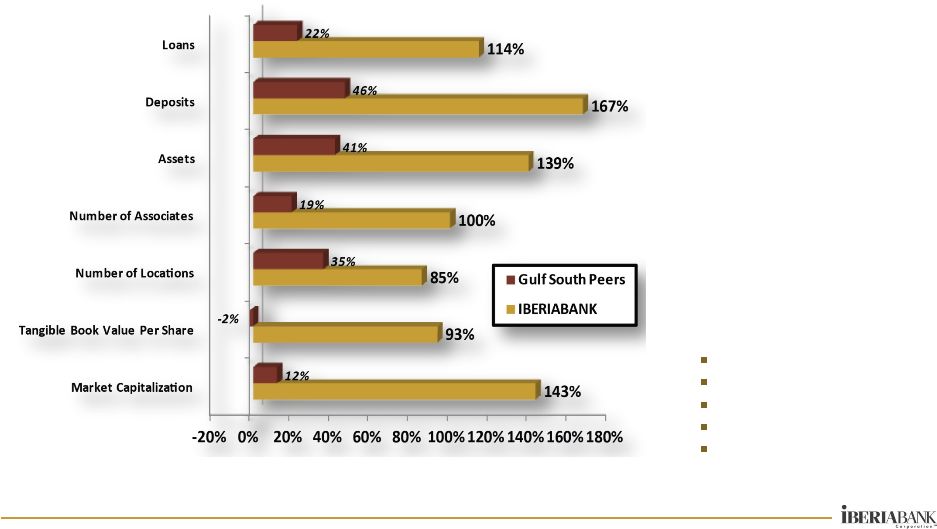

Between 2007 And 2011…

Financials

Financials

42

•

$1.7 Billion In Revenues

•

Earned $297 Million

•

Earned $15.13 Per Share

•

Paid $115 Million In

Shareholders Dividends

•

Dividends Equal To

$5.44 Per Share (39%

Payout)

•

Improved Asset Quality

And Capital Strength

•

Added:

+$6.8 Billion Assets

+121 New Locations

+1,288 Associates

+$17.74 Tangible BVS

+$900 Million Market

Capitalization

% Change Between Year-Ends 2007 And 2011

% Change In Last Four Years |

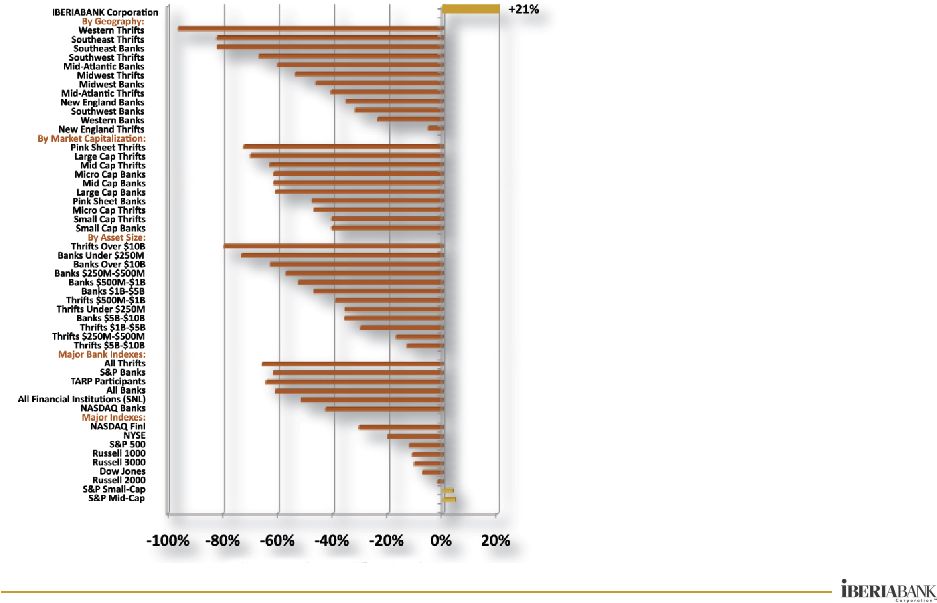

43

Financials

Financials

43

•

Most Difficult Banking Crisis

Since The Great Depression

•

414 Financial Institutions

Failed During This Period

And Countless More Remain

At Risk

•

Our Shares Outperformed

Nearly All The Major Stock

Indexes During This Period

•

Driven By Our Very Unique

Position And Opportunities

Share Price

Performance

During The Crisis

% Change in Price Between 8/4/07 –

12/31/11

% Change In Price

Between August 4, 2007 And December 2011 |

44

Shareholder Return Over Last 10 Years

Financials

Financials

44

•

The Result Has Been

A Dramatic Reduction

In Bank Stock Prices

•

In Contrast, Our Share

Price Was Up 93%

Over The Last 10

Years

•

Many Banks Slashed

Or Eliminated

Dividends Over That

Period To Conserve

Capital

•

Our Dividends Per

Share Increased 136%

Over The Last 10

Years

IBKC = 149%

Source: SNL And Bloomberg |

| 45

Financials

Financials

2011 Accomplishments

•

Added 12 New Branch Offices

•

Tremendous Organic Loan And Core Deposit Growth

•

Successfully Converted & Integrated OMNI Bank And

Cameron State Bank

•

Acquired Assets Of Florida Trust Company

•

Completed The Build-Out Of ICP And IWA

•

Launched Small Business Initiative

•

Favorable Mortgage & Title Insurance Results

•

Continued To Recruit Client-Facing And Support Associates

•

Reduced FDIC-Covered Assets By $248 Million (16%)

•

Completed

8

th

Share

Repurchase

Program

($45.98)

•

Continued Capital Strength And Superior Asset Quality

•

Launched New Website, Mobile Banking & Social Media

•

Set Strategic Goals For The Next 3-

To 5-Year Period

45 |

Preparing For The

Next 125 Years

Preparing For The

Preparing For The

Next 125 Years

Next 125 Years |

47

Unwavering Values And Focus

Preparing For The Next 125 Years

Preparing For The Next 125 Years

47

•

Corporate Mission Statement

Provide Exceptional

Value-based

Client Service

Growth That Is Consistent

With

High Performance

Shareholder-Focused

Strong Sense Of Community

•

Significant Investments

Consumer And Small Business

Fee-Based Businesses

Technology

Treasury Management

Branch and ATM Expansion |

48

The Next 125 Years

The Next 125 Years

Forces Accelerating

Consolidation

48

•

Environmental Issues

•

Credit

•

Interest Rate

•

Regulatory

•

Legislative

•

Real Estate Sector

•

Client Issues

•

Deleveraging

•

Core Client Base Aging

•

Technological Change

•

Competitive Issues

•

Shadow Banks

•

Government Backing

•

Government Life Support

•

Future Disintermediation

•

Fluid Capital/Returns

•

Company-Specific Issues

•

Asset Concentration

•

Broken Business Models

•

Limited Access To Capital

Number Of Banks In The U.S. |

| 49

Preparing For The Next 125 Years

Preparing For The Next 125 Years

Our Focus

•

Maintain Our Unique Culture

•

Continue To Invest In Our People And Our Future

•

Enhance Retail And Small Business

•

Fill Out Selected Markets In Our Current Footprint

•

Selected Market Expansion in Southeastern U.S.

•

Maintain Balance And Discipline

•

Prepare For Changing Regulatory Environment

•

Maintain Top 10% In Asset Quality Measures

•

Work Through Acquired FDIC Loss Share Assets

•

Deploy Excess Capital With Favorable Returns

•

Improve Franchise Profitability

•

Carefully Manage Enterprise Risk

•

Provide Solid Risk-Adjusted Shareholder Returns

49 |

|

51

Appendix

Appendix

Unemployment Rate by Market

•

Consistently Low

Rates Of

Unemployment In

Our Legacy MSAs

•

Many Of Our

Legacy Markets Not

Dependent On

Housing For Growth

•

Significant

Improvement In

Many Markets

•

We Have FDIC

Loss-Share

Protection In Many

Of The More

Economically

Challenged Markets

* Markets Entered Via FDIC-Assisted Acquisitions

12.6%

9.4%

11.9%

11.8%

9.7%

9.1%

11.1%

11.5%

7.6%

8.5%

8.3%

7.4%

7.2%

7.0%

6.8%

6.5%

6.8%

6.7%

5.6%

5.0%

6.1%

7.2%

8.3% |

52

Appendix

Appendix

Housing Price Trends

•

Impact Varies By

State And Market

•

Very Strong Housing

Markets In

Louisiana, Texas,

And Mississippi

•

Continued

Weakness In Florida,

Georgia, And

Virginia

•

Some Markets In

Florida Still Showing

Declining Trends

•

We Have FDIC

Loss-Share

Protection

Source: Local Market Monitor 4Q2011 |