Attached files

| file | filename |

|---|---|

| 8-K - THE BANCORP, INC. FORM 8-K - Bancorp, Inc. | bancorp8k.htm |

Exhibit 99.1

NASDAQ: TBBK

The Bancorp, Inc. • Investor Presentation • JMP Securities Conference

May 16th, 2012

May 16th, 2012

Forward-Looking Statements

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995:

Statements in this presentation regarding The Bancorp, Inc.’s business that are not historical facts are “forward

-looking statements” that involve risks and uncertainties. These statements may be identified by the use of

forward-looking terminology, including the words “may,” “believe,” “will,” “expect,” “anticipate,” “estimate,”

“continue,” or similar words. For further discussion of these risks and uncertainties, see The Bancorp, Inc.’s

filings with the SEC, including the “risk factors” section of The Bancorp, Inc.’s Form 10-K. These risks and

uncertainties could cause actual results to differ materially from those projected in the forward-looking

statements. The forward-looking statements speak only as of the date of this presentation. The Bancorp, Inc.

does not undertake to publicly revise or update forward-looking statements in this presentation to reflect

events or circumstances that arise after the date of this presentation, except as may be required under

applicable law.

-looking statements” that involve risks and uncertainties. These statements may be identified by the use of

forward-looking terminology, including the words “may,” “believe,” “will,” “expect,” “anticipate,” “estimate,”

“continue,” or similar words. For further discussion of these risks and uncertainties, see The Bancorp, Inc.’s

filings with the SEC, including the “risk factors” section of The Bancorp, Inc.’s Form 10-K. These risks and

uncertainties could cause actual results to differ materially from those projected in the forward-looking

statements. The forward-looking statements speak only as of the date of this presentation. The Bancorp, Inc.

does not undertake to publicly revise or update forward-looking statements in this presentation to reflect

events or circumstances that arise after the date of this presentation, except as may be required under

applicable law.

1

The Bancorp, Inc. - Planning for Growth with Safety and Soundness

• Strategic Goal:

§ Create and grow a stable, profitable institution with the optimum reliance on capital, risk management

and technology, and manage it with knowledgeable and experienced management and senior

officers

and technology, and manage it with knowledgeable and experienced management and senior

officers

• Tactical Approach:

§ Deposits - Utilize a branchless banking network to gather scalable deposits through strong

contractual relationships at costs significantly below peers

contractual relationships at costs significantly below peers

§ Assets - Focus on asset classes including loans and securities appropriate to our expertise to

achieve returns above risk-adjusted peer net interest margins

achieve returns above risk-adjusted peer net interest margins

§ Non Interest Income - Grow non interest income disproportionately in relation to non interest

expense through our deposit and asset approaches

expense through our deposit and asset approaches

§ Operating Leverage - Leverage infrastructure investment to grow earnings by creating efficiencies

of scale

of scale

2

The Bancorp, Inc. - Planning for Growth

3

Consumer Distribution Channel Penetration

Percent of U.S. Households, 1980-2009

Source: Federal Reserve, FRB Boston, FRB Philadelphia, SRI Consulting, University of Michigan, Mintel, Celent, Bank of America, comScore, Nielsen Mobile, Wall Street Journal, Mercatus Analytics

Business Model: A Distinct Business Strategy (1)

4

Assets Deposits

Prepaid Cards

Open Loop Prepaid Cards

• Deposits

• Non interest Income

Healthcare

Health Savings Accounts

and Flexible Spending

Accounts

and Flexible Spending

Accounts

• Deposits

• Non interest Income

Merchant Processing

Credit, Debit Card and

ACH Processing

Credit, Debit Card and

ACH Processing

• Deposits

• Non interest Income

Wealth Management

Deposit and Lending for

Clients of Wealth Firms

Clients of Wealth Firms

• Interest Income

• Deposits

• Non interest Income

Securities Portfolio

Primarily highly rated

government obligations

government obligations

• Interest Income

Government Guaranteed

Lending

Lending

Loans to franchisees;

75% guaranteed by

U.S. government

75% guaranteed by

U.S. government

• Interest Income

Automobile Fleet

Leasing

Leasing

Well-collateralized

Automobile Fleet Leasing

Automobile Fleet Leasing

• Interest Income

• Non interest Income

Community Bank

Traditional Community

Banking Products

Banking Products

• Interest Income

• Deposits

• Non interest Income

36%

4%

3%

8%

34%

7%

GGL:

1%

1%

7%

(1) For the above presentation, departmental revenue for asset-generators includes half the revenue on assets they do not fund, the other half of which is

allocated to the deposit-producing departments. The balance of interest income is retained by the asset generators.

allocated to the deposit-producing departments. The balance of interest income is retained by the asset generators.

Revenue Composition

5

(1) Post provision net interest income and non interest income excluding securities gains and losses.

*Based on historical trends and is not intended to be, nor is, predictive of future results.

$

Non Interest Income-Generating Strategies: Growth and Sustainability

6

$

(1) Excludes gains on investment securities.

(2) Excluding a one time legal settlement of $485,000 for the first quarter 2011 the percentage increase would have been 134%.

(3) CAGR calculated 2009 through 2011

*Based on historical trends and is not intended to be, nor is, predictive of future results.

Continued Growth in Non Interest Income(1)

(2)

Prepaid Gross Dollar Volume (1) and Cardholder Growth (2)

7

(1) Gross Dollar Volume is the total amount spent on all cards outstanding within a given period.

(2) Number of active cards as of year-end of the stated year with the exception of 2012, which is end of the first quarter.

*Includes actual data from the first quarter and projected GDV for the remainder of the year. Projection for remainder of 2012 is not broken out by contracting year, is based on historical trends and is not

intended to be, nor is, predictive of future results.

intended to be, nor is, predictive of future results.

$

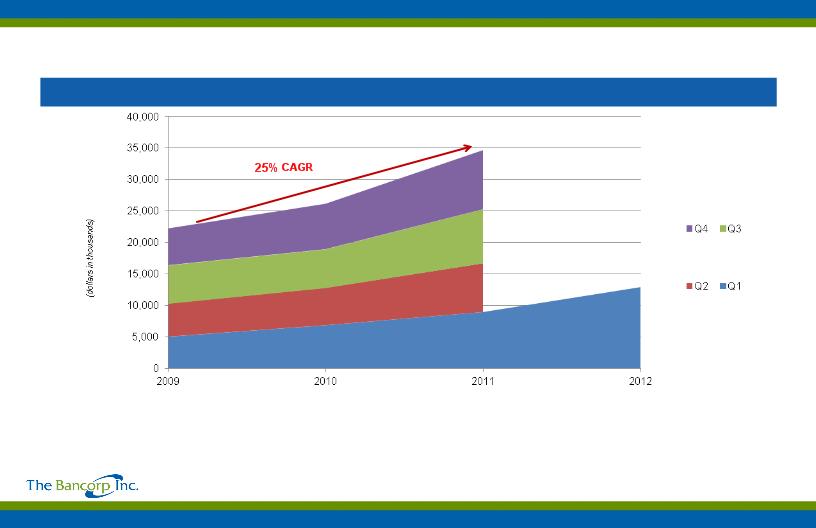

Net Interest Income Generators(1)

Compressed Interest Rate Environment

8

$

(1) CAGR calculated 2009 through 2011

*Based on historical trends and is not intended to be, nor is, predictive of future results.

Primary Asset-Generating Strategies: Business Line Overview

• Community Bank

§ Offers traditional community banking products and services

targeting the highly fragmented Philadelphia/Wilmington banking

market

targeting the highly fragmented Philadelphia/Wilmington banking

market

• Automobile Fleet Leasing

§ Well-collateralized automobile fleet leasing

• Average transaction: 8-15 automobiles, $350,000

• 25% of portfolio leased by state and federal agencies

• Wealth Management

§ 17 affinity groups, managing $400 billion in assets

• SEI Investments, Legg Mason, Genworth Financial Trust

Company

Company

§ Generates securities backed loans and other loans

• Government Guaranteed Lending

§ Loans from $250,000 to $1.5 million primarily to franchisees such

as UPS Stores, Massage Envy, FASTSIGNS and Save a Lot

which are 75% guaranteed by the U.S. government. Recently

approved lines $365 +million

as UPS Stores, Massage Envy, FASTSIGNS and Save a Lot

which are 75% guaranteed by the U.S. government. Recently

approved lines $365 +million

• Securities

§ High credit quality tax exempt municipal obligations

§ U.S. Government agency securities primarily 4-5 year average

lives and other highly rated mortgage-backed securities

lives and other highly rated mortgage-backed securities

9

|

Category

|

(in thousands)

|

Avg. Yield

|

|

Community Bank

|

$ 1,408,910

|

4.27%

|

|

Government

Guaranteed Lending |

43,378

|

5.16%

|

|

Wealth Management

|

166,258

|

2.90%

|

|

Leasing Portfolio

|

130,321

|

7.32%

|

|

Investment Securities

|

499,524

|

3.67%

|

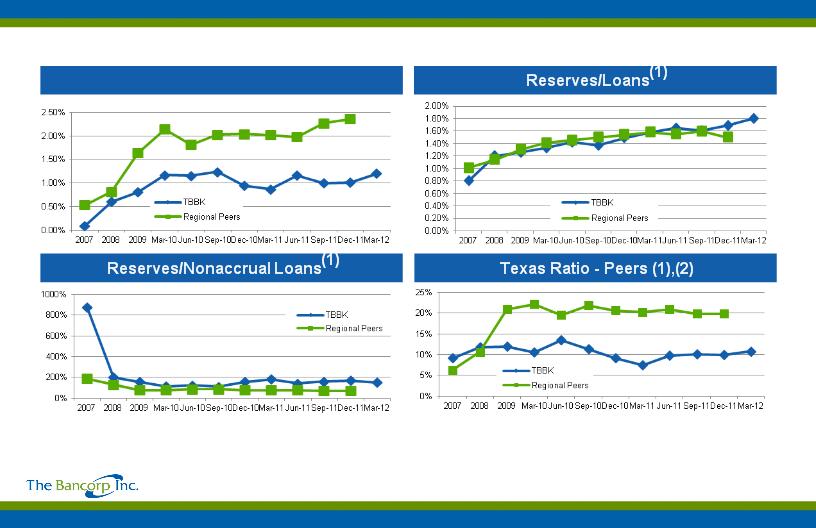

Non-Accrual Loans/Total Loans(1)

Asset Quality Overview

10

(1) Regional peers include publicly traded Mid-Atlantic commercial banks with assets between $1 billion and $4 billion as of December 31, 2011; graphs represent median values. (2) Texas Ratio = (Non-

accrual Loans + Restructured Loans + Loans 90 + days past due + OREO)/(Loss Reserves + Tangible Equity). TBBK computed with consolidated capital. Source: SNL Financial

accrual Loans + Restructured Loans + Loans 90 + days past due + OREO)/(Loss Reserves + Tangible Equity). TBBK computed with consolidated capital. Source: SNL Financial

Deposit-Generating Strategies: Growth and Low Cost

The Bancorp has experienced strong growth in deposits at below-peer costs.

11

|

Growth in Average Deposits

|

|||

|

|

YTD Average Deposits

(dollars in thousands)

|

Cost of Funds(2)

|

Peer Cost of Funds(1)

|

|

2012

|

$ 3,781,858

|

0.29%

|

0.68%

|

|

2011

|

$ 2,730,507

|

0.38%

|

0.93%

|

|

Change

|

$ 1,051,351

|

-0.09%

|

-0.25%

|

|

% Change

|

39%

|

-24%

|

-27%

|

(1) Peer data source as of December 2011: Uniform Bank Performance Report for Banks $1-5 B in assets measuring interest expense to average interest earning assets.

(2) Bancorp cost of funds is lower after consideration of seasonal deposits.

Deposit-Generating Strategies: Sticky and Long-Term

The Bancorp has long-term, often exclusive agreements in place with its private label banking

partners. We have retained 99% of maturing contracts.

partners. We have retained 99% of maturing contracts.

12

|

Private Label Agreements by Remaining Contractual Term(1)

|

(1) Calculation based upon amount of deposits generated through each agreement. Does not include deposits associated with a third party with which TBBK is disengaging in 2012.

Growth Engine: Where Do Deposits Come From?

13

|

March 31, 2012

|

|

Category

|

Balance

(in millions)

|

Avg. Cost

|

|

Community Bank

|

$ 358

|

0.38%

|

|

Healthcare

|

435

|

0.91%

|

|

Prepaid Cards

(including demand deposit accounts)

|

2,119

|

0.01%

|

|

Wealth Management

|

544

|

0.57%

|

|

Merchant Processing

|

167

|

0.69%

|

|

1031 Exchange

|

151

|

0.71%

|

|

Total Deposits: $3.8 billion

|

|

Average Cost: 0.29%

|

|

(Peer Average Cost: 0.68%)(1)

|

(1) Peer data source as of December 2011: Uniform Bank

Performance Report for Banks $1-5 B in assets measuring

interest expense to average interest earning assets.

Performance Report for Banks $1-5 B in assets measuring

interest expense to average interest earning assets.

Adjusted Operating Earnings(1),(2)

Operating Leverage

14

(1) As a supplement to GAAP, Bancorp has provided this non-GAAP performance result. The Bancorp believes that this non-GAAP financial measure is useful because it allows investors to assess its

operating performance. Management utilizes adjusted operating earnings to measure the combined impact of changes in net interest income, non-interest income and certain other expenses.

Adjusted operating earnings exclude the impact of the provision for loan losses, income taxes, securities gains and losses and certain non-recurring items. Other companies may calculate adjusted

operating earnings differently. Although this non-GAAP financial measure is intended to enhance investors’ understanding of Bancorp’s business and performance, it should not be considered, and

is not intended to be, a substitute for GAAP.

operating performance. Management utilizes adjusted operating earnings to measure the combined impact of changes in net interest income, non-interest income and certain other expenses.

Adjusted operating earnings exclude the impact of the provision for loan losses, income taxes, securities gains and losses and certain non-recurring items. Other companies may calculate adjusted

operating earnings differently. Although this non-GAAP financial measure is intended to enhance investors’ understanding of Bancorp’s business and performance, it should not be considered, and

is not intended to be, a substitute for GAAP.

(2) CAGR calculated 2009 through 2011

$

The Bancorp, Inc. - Planning for Growth with Safety and Soundness

• Strategic Goal:

§ Create and grow a stable, profitable institution with the optimum reliance on capital, risk management

and technology, and manage it with knowledgeable and experienced management and senior

officers

and technology, and manage it with knowledgeable and experienced management and senior

officers

• Tactical Approach:

§ Deposits - Utilize a branchless banking network to gather scalable deposits through strong

contractual relationships at costs significantly below peers

contractual relationships at costs significantly below peers

§ Assets - Focus on asset classes including loans and securities appropriate to our expertise to

achieve returns above risk-adjusted peer net interest margins

achieve returns above risk-adjusted peer net interest margins

§ Non Interest Income - Grow non interest income disproportionately in relation to non interest

expense through our deposit and asset approaches

expense through our deposit and asset approaches

§ Operating Leverage - Leverage infrastructure investment to grow earnings by creating efficiencies

of scale

of scale

15

NASDAQ: TBBK

APPENDIX

Capital Ratios and Selected Financial Data

17

|

|

|

As of or for the three months ended

|

As of or for the three months ended

|

|

|

|

March 31, 2012

|

March 31, 2011

|

|

|

|

(dollars in thousands)

|

(dollars in thousands)

|

|

Selected Capital and Asset Quality Ratios:

|

|

|

|

|

|

Equity/assets

|

6.78%

|

9.08%

|

|

|

Tier 1 capital to average assets

|

6.59%

|

8.62%

|

|

|

Tier 1 capital to total risk-weighted assets

|

14.94%

|

15.33%

|

|

|

Total Capital to total risk-weighted assets

|

16.19%

|

16.58%

|

|

|

Allowance for loan and lease losses to total loans

|

1.80%

|

1.58%

|

|

|

|||

|

Balance Sheet Data:

|

|

|

|

|

|

Total assets

|

$ 4,104,047

|

$2,836,697

|

|

|

Total loans, net of unearned costs (fees)

|

1,748,867

|

1,636,253

|

|

|

Allowance for loan and lease losses

|

31,500

|

25,802

|

|

|

Total cash and cash equivalents

|

1,805,787

|

853,944

|

|

`

|

Total investments

|

499,524

|

294,941

|

|

|

Deposits

|

3,773,878

|

2,531,109

|

|

|

Shareholders’ equity

|

278,233

|

257,601

|

|

|

|||

|

Selected Ratios:

|

|

|

|

|

|

Return on average assets

|

0.39%

|

0.36%

|

|

|

Return on average common equity

|

5.84%

|

5.07%

|

|

|

Net interest margin

|

2.19%

|

2.73%

|

|

|

Book value per share

|

$ 8.41

|

$ 7.76

|

Current Loan Portfolio and Asset Quality Overview at 3/31/2012

|

Category

(dollars in thousands)

|

Balance

|

% of Total

Loans |

Nonaccrual

Loans |

Nonaccrual/

Total Loans

|

OREO

|

30-89

Days Delinquent |

90+ Days

Delinquent |

Q1 2012

Quarterly Charge-offs (net) |

|

Commercial

|

$ 445,912

|

26%

|

$6,018

|

0.34%

|

$ 2,785

|

$241

|

$ 955

|

$ (1,421)

|

|

Commercial mortgage

|

617,871

|

36%

|

3,609

|

0.21%

|

1,845

|

-

|

1,900

|

(991)

|

|

Construction

|

248,232

|

14%

|

10,375

|

0.60%

|

-

|

3,009

|

667

|

( 701)

|

|

Direct financing leases

(auto leases) |

130,321

|

7%

|

-

|

0.00%

|

-

|

1,314

|

392

|

(86)

|

|

Residential mortgage

|

94,438

|

5%

|

-

|

0.00%

|

3,096

|

-

|

-

|

83

|

|

Securities backed loans

and other |

208,584

|

12%

|

927

|

0.05%

|

-

|

20

|

-

|

(172)

|

|

Total

|

$ 1,745,358

|

100%

|

$ 20,929

|

1.20%

|

$7,726

|

$ 4,584

|

$3,914

|

$ (3,288)

|

18

Bancorp’s Real Estate Lending Business Targets Well-Positioned Attractive,

Stable Markets

Stable Markets

• Commercial lending is substantially all in greater Philadelphia/Wilmington metropolitan area

§ Consists of the 12 counties surrounding Philadelphia and Wilmington, including Philadelphia,

Delaware, Chester, Montgomery, Bucks and Lehigh Counties in Pennsylvania; New Castle County in

Delaware; and Mercer, Burlington, Camden, Ocean and Cape May Counties in New Jersey.

Delaware, Chester, Montgomery, Bucks and Lehigh Counties in Pennsylvania; New Castle County in

Delaware; and Mercer, Burlington, Camden, Ocean and Cape May Counties in New Jersey.

• Philadelphia/Wilmington and the surrounding markets encompass a large population, stable economic

activity and attractive demographics.

activity and attractive demographics.

• Throughout the current down cycle and in prior cycles, the Philadelphia region has exhibited significant

stability, which is reflected in a lesser reduction in housing prices and negative equity compared to the rest

of the nation, as shown below.

stability, which is reflected in a lesser reduction in housing prices and negative equity compared to the rest

of the nation, as shown below.

19

|

|

Home Prices Q4-2008 to Q4-2011

(1) |

Home Prices Q4-2010 to Q4-2011

(1) |

|

United States

|

-13.4%

|

-3.9%

|

|

Philadelphia, PA

|

-10.10%

|

-3.9%

|

|

4th Quarter 2011 (2)

|

US

|

NJ

|

DE

|

PA

|

|

% of Homes with

Negative Equity |

22.8%

|

17.5%

|

15.8%

|

8.4%

|

(1) Source: Fiserv Case-Shiller Home Price Indexes

(2) Source: CoreLogic

Notes

20

NASDAQ: TBBK

www.thebancorp.com