Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALMOST FAMILY INC | form8-k.htm |

Bank of America Merrill Lynch Health Care Conference

Las Vegas, NV May 16, 2012

Exhibit 99.1

Forward Looking Statements

This presentation contains, and answers given to questions that may be asked today may constitute, forward-looking

statements that are subject to a number of risks and uncertainties, many of which are outside our control. All

statements regarding our strategy, future operations, financial position, estimated revenues or losses, projected costs,

prospects, plans and objectives, other than statements of historical fact included in the presentation, are forward-

looking statements. When used in this presentation or in answers given to questions asked today, the words “may,”

“will,” “could,” “would,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “potential,” “continue,” and

similar expressions are intended to identify forward-looking statements, although not all forward-looking statements

contain these identifying words. You should not place undue reliance on forward-looking statements. While we believe

that we have a reasonable basis for each forward-looking statement that we make, we caution you that these

statements are based on a combination of facts and factors currently known by us and projections of future events or

conditions, about which we cannot be certain. For a more complete discussion regarding these and other factors which

could affect the Company's financial performance, refer to the Company's various filings with the Securities and

Exchange Commission, including its filing on Form 10-K for the year ended December 31, 2011 and subsequently filed

Forms 10-Q, in particular information under the headings "Special Caution Regarding Forward-Looking Statements"

and “Risk Factors.” These cautionary statements qualify all of the forward-looking statements. In addition, market and

industry statistics contained in this presentation are based on information available to us that we believe is accurate.

This information is generally based on publications that are not produced for purposes of securities offerings or

economic analysis.

statements that are subject to a number of risks and uncertainties, many of which are outside our control. All

statements regarding our strategy, future operations, financial position, estimated revenues or losses, projected costs,

prospects, plans and objectives, other than statements of historical fact included in the presentation, are forward-

looking statements. When used in this presentation or in answers given to questions asked today, the words “may,”

“will,” “could,” “would,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “potential,” “continue,” and

similar expressions are intended to identify forward-looking statements, although not all forward-looking statements

contain these identifying words. You should not place undue reliance on forward-looking statements. While we believe

that we have a reasonable basis for each forward-looking statement that we make, we caution you that these

statements are based on a combination of facts and factors currently known by us and projections of future events or

conditions, about which we cannot be certain. For a more complete discussion regarding these and other factors which

could affect the Company's financial performance, refer to the Company's various filings with the Securities and

Exchange Commission, including its filing on Form 10-K for the year ended December 31, 2011 and subsequently filed

Forms 10-Q, in particular information under the headings "Special Caution Regarding Forward-Looking Statements"

and “Risk Factors.” These cautionary statements qualify all of the forward-looking statements. In addition, market and

industry statistics contained in this presentation are based on information available to us that we believe is accurate.

This information is generally based on publications that are not produced for purposes of securities offerings or

economic analysis.

All forward-looking statements speak only as of the date of this presentation. Except as required by law, we assume

no obligation to update these forward-looking statements publicly or to update the factors that could cause actual

results to differ materially, even if new information becomes available in the future.

no obligation to update these forward-looking statements publicly or to update the factors that could cause actual

results to differ materially, even if new information becomes available in the future.

2

Almost Family

Overview

Overview

Almost Family

Operate 160 Branches in 3 Geographic

Clusters

Clusters

Two Home Health Segments:

- Visiting Nurse, Medicare-certified

Skilled (~79% of Revenue)

- Personal Care, primarily Medicaid-Waiver

Non-skilled (~21% of Revenue)

Revenue Run Rate of approximately

$360 Million

$360 Million

Founded in Louisville KY -- 1976

4

AFAM - Business Thesis

þ Compelling demographics and fragmentation present

long-term opportunity - outweigh short term

regulatory pressures

long-term opportunity - outweigh short term

regulatory pressures

þ Proven ability to grow the platform with a balanced

approach - organic and acquisitions

approach - organic and acquisitions

þ Long history of outstanding revenue and earnings

growth, cash flows and strong capital structure

growth, cash flows and strong capital structure

þ Strong geographic cluster focus

5

Focused Geographic Development

6

|

Cluster

|

Revenue

|

Branches

|

|

Midwest

|

$148M

|

88

|

|

Northeast

|

$ 80M

|

25

|

|

Southeast

|

$132M

|

53

|

|

Total

|

$360M

|

166

|

Track Record of Strong Performance

($Millions)

$209.

3

3

$81.3

Revenue

- 4 Yr CAGR Revenue 27%

- 4 Yr CAGR EPS 13%

- Last 4 Yrs:

- 70% Organic Growth

- Acquired $116 Million

in Revenue

$128.8

7

$296.0

$82.6

$90.0

$335.3

Where home health fits in healthcare

• Preferred setting of care

• Lowest Cost

• About half the patients are from in

-patient discharge and half are

“pre-acute”

-patient discharge and half are

“pre-acute”

• Growing Demographics

• Fiscally infeasible to build enough

inpatient facilities

inpatient facilities

• Patients don’t want inpatient care

8

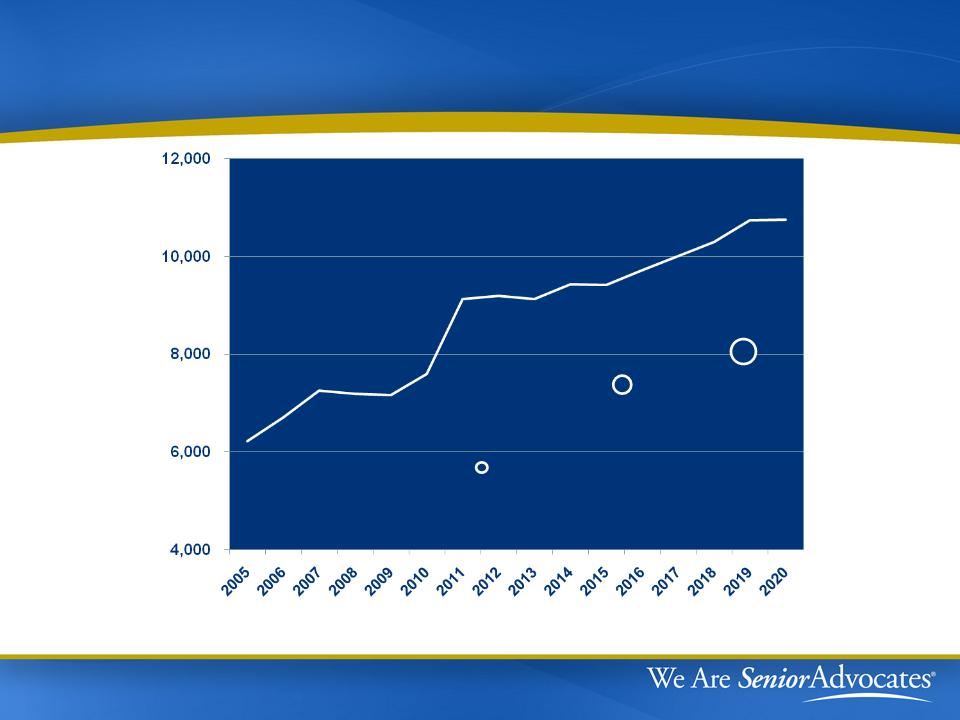

Number of New 65 Year Olds Per Day

9

2010

40.2 mil

2016

48.3 mil

2020

54.8 mil

65+ Population

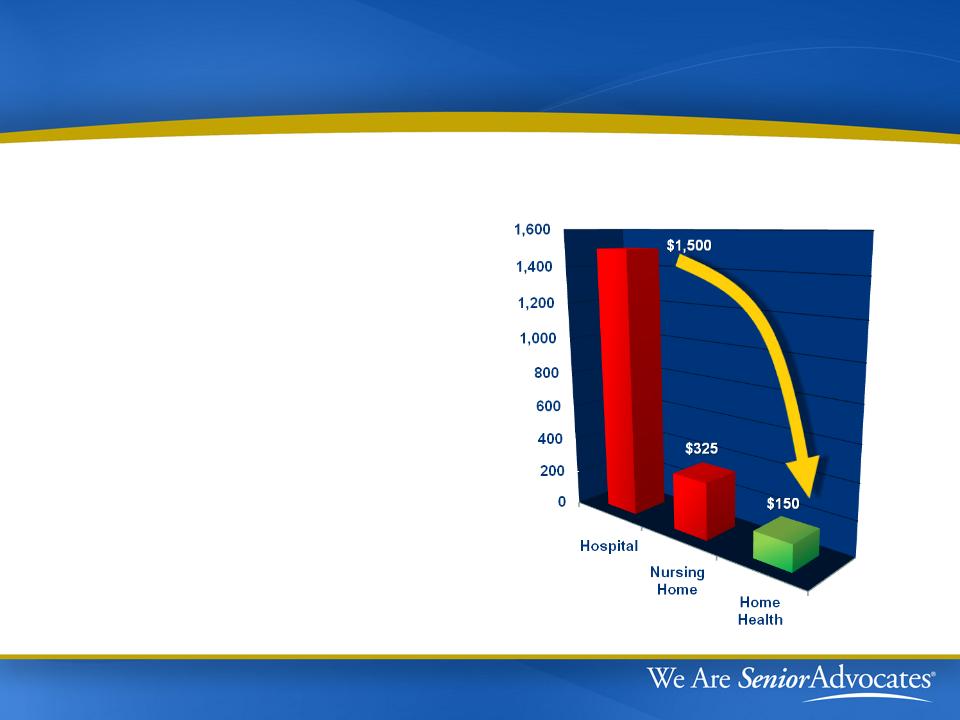

The Benefits of Home Health Care

Bending the Cost Curve

- Lower cost per day vs.

hospital & nursing homes

hospital & nursing homes

- Lower costs to Medicare

Program

Program

- Prevents mild exacerbations

from escalating into critical

situations

from escalating into critical

situations

Cost per day

10

Regulatory Front

According to CBO….

12

|

|

Home

|

|

Facilities

|

||

|

CBO: Projected Medicare Spending

|

Health

|

|

Hospitals

|

|

SNF's

|

|

|

|

|

|

|

|

|

10 year spend years 2013-2022

|

|

|

|

|

|

|

in billions

|

$275B

|

|

$2.5T

|

|

$469B

|

|

|

|

|

|

|

|

|

2012 Spend Per Enrollee

|

|

|

|

|

|

|

in dollars

|

$ 538

|

|

$ 4,540

|

|

$742

|

|

|

|

|

|

|

|

|

Annual Growth Rate

|

6%

|

|

8%

|

|

9%

|

• Home health is the smallest, slowest growing, lowest cost

venue in which skilled services can be provided to seniors

venue in which skilled services can be provided to seniors

• The total spend on home health decreased by 3.6% from 2010

to 2011, unmatched by any other sector

to 2011, unmatched by any other sector

According to HHS-OIG….

Source: OIG April 2012 testimony and March 2012 Report

“Medical records document that almost all

home health beneficiaries met Medicare

coverage requirements”

home health beneficiaries met Medicare

coverage requirements”

• 2.5% National extrapolated error rate

13

Daniel Levinson testimony before SFC:

•“…as we move towards increasing reliance on the home health

model - which is good for taxpayers because costs will be

reduced overall - we need to address the fraud risk inherent in the

home health setting.”

model - which is good for taxpayers because costs will be

reduced overall - we need to address the fraud risk inherent in the

home health setting.”

•“…a study of home health compliance showed a high level of

home health agency compliance, but still a high level of fraud as

well.”

home health agency compliance, but still a high level of fraud as

well.”

Protecting Seniors from Fraud & Abuse

HH Industry proposes reforms that work

HH Industry proposes reforms that work

14

• $850M-$930M saved by Medicare

“Outlier” payment limits in the

first year of implementation

“Outlier” payment limits in the

first year of implementation

• $1.1B per year can be saved by

Medicare with a similar

“Episode” limit and “LUPA”

minimums - if Congress will

implement them

Medicare with a similar

“Episode” limit and “LUPA”

minimums - if Congress will

implement them

Total of $2B in annual savings from our proposals:

Geographic overlay with “bad actors” is striking

Misperception: HH has widespread F&A in

home health

home health

15

Detroit, MI

Chicago, IL

Dallas, TX

Houston, TX

Miami-Dade, FL

Los Angeles, CA

Three limits

could

collectively =

could

collectively =

$2 billion in

annual

savings.

annual

savings.

Reality: F&A occurs in isolated geography with too many providers

Recent Provider Indictments

16

|

Metro

|

Eligibles per Provider

|

|

Miami-Dade

|

552

|

|

Dallas

|

721

|

|

Houston

|

812

|

|

Chicago

|

1,862

|

|

Detroit

|

2,079

|

|

Los Angeles

|

2,198

|

|

Population

|

44M

|

|

Eligibles

|

3.7M

|

|

Spend

|

$3.5B

|

|

$ Per Eligible

|

$938

|

|

Limit Savings

|

$1.2B

|

|

% of Spend

|

33%

|

Cities with Fraud Busts

Comparable Cities

|

Metro

|

Eligibles per Provider

|

|

Seattle

|

21,077

|

|

New York City

|

19,794

|

|

Atlanta

|

18,638

|

|

Phoenix

|

8,019

|

|

Philadelphia

|

7,445

|

|

Boston

|

7,053

|

|

Population

|

42M

|

|

Eligibles

|

3.7M

|

|

Spend

|

$1.2B

|

|

$ Per Eligible

|

$322

|

|

Limit Savings

|

$22M

|

|

% of Spend

|

2%

|

Improved Regulation Builds Confidence

Recent regulatory actions:

•Face to face encounters

•Therapy assessments and

reassessments

reassessments

•OIG/DOJ enforcement actions

•Increased audit efforts

(“ADR’s”)

(“ADR’s”)

17

What regulators need to know:

•If a patient is receiving home health services - they really

should be

should be

PPACA Long-Term Impact

|

Topic

|

Impact

|

|

Market Basket

Updates |

Reduces updates by 1% in 2011,

2012 and 2013 |

|

Re-basing

Rates |

Begin 2014, phased in over 4 years

with adjustments limited to 3.5% per year |

|

Productivity

Adjustment |

Begin 2015

|

|

Rural Add-on

|

3% in 4/1/2010 - 2015

|

|

Outlier Cap

|

10% of revenue beginning 2011

(implemented by CMS in 2010)

|

18

Upcoming Events

|

Source

|

Event

|

|

SCOTUS

|

Possible ruling on constitutionality of

PPACA - June 2012 |

|

CMS

|

Publish preliminary regulations for

2013 |

|

Pre-Election

|

Probably not much legislation - quiet

time to make our points |

|

Post-Election

|

Depends on who wins and what

SCOTUS does |

|

Before Jan 1,

2013 |

Maybe a scramble to avoid

sequestration |

19

2013 - What might CMS do?

|

Topic

|

Discussion

|

|

Market basket

|

• “Market basket update” rate increase of 2.0-

2.5% minus 1% statutory reduction |

|

Case Mix

Creep - ?? |

• 2011 and 2012 regs reduced 3.79%

• 2012 regs suggested 1.32% left for 2013

• Observed causes of “creep”:

• 75% of creep comes from therapy

• Hypertension diagnoses removed in 2012

|

|

Sequestration

|

• Unless repealed will reduce payment rate 2%

|

|

Expectation

|

• Current predicted range is 0% to -3%

• Difference in case mix creep gets offset in

rebasing |

20

Financial Highlights

2012 Medicare Changes

|

Topic

|

Discussion

|

|

Reimbursement

Rate Cut |

• “Market basket update” rate increase of 1.4%

• “Case mix creep” adjustment of 3.79%

• Effective rate cut of approximately 2.31%

nationwide |

|

Other changes

|

• Reduced payments for high therapy episodes

• Removed two hypertension codes

• Recalibrated case-mix weights

• Shifted a -1.32% case-mix adjustment to 2013

|

|

Impact on

AFAM reimbursement |

• Current analysis indicates 4.0% effective 2012

rate cut for AFAM with Q4 2011 phase-in |

22

AFAM Regulatory Update

|

Issue

|

Status

|

|

SFC Inquiry

|

Report: No evidence of executives

pushing therapy |

|

Federal

Shareholder Suit |

Dismissed and appeal period expired

|

|

State Shareholder

Suit |

Motion to dismiss pending

|

|

Qui Tam Cases

|

Dismissed following US refusal to join

|

|

SEC Inquiry

|

No action since January depositions

|

23

2011 and YTD Q1 12 Highlights

YE2011 Q1-12

- Revenues + 1% +9%

- Diluted EPS -32% -13%

- MCR Admissions + 6% + 2%

- MCR Episodes + 1% + 2%

24

Organic Medicare Growth

YE2011 Q1-12

- Admissions +5% +1%

- Episodes +1% +1%

Cambridge Acquisition

- $15.5M Revenue and $0.16 EPS

for 5 months in 2011

- Transition proceeding

according to expectations

Investment Highlights

Annual Revenue run rate over $360 million

Leading Regional Home Health Provider

- 27% four year revenue CAGR

- Decentralized operating model

Strong Capital Position

- $155 million immediately available

for future growth

Disciplined Approach to acquisitions driven

by Seasoned Management

Growing Force in consolidating home health care market

- 10 acquisitions in four years

- Three geographic clusters: Northeast, Southeast & Midwest

25

Contact Information

26