Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Discover Financial Services | d352272d8k.htm |

Barclays Americas Select Franchise Conference

Mark Graf

EVP & Chief Financial Officer

May 15, 2012

Exhibit 99.1 |

2

Notice

The following slides are part of a presentation by Discover Financial Services (the

"Company") and are intended to be viewed as part of that

presentation. No representation is made that the information in these slides is complete.

The

information

provided

herein

includes

certain

non-GAAP

financial

measures.

The

reconciliations

of

such

measures

to

the comparable GAAP figures are included at the end of this presentation and in the

Company's Current Report on Form 8-K

dated

May

15,

2012,

which

is

available

on

the

Company's

website

at

www.discoverfinancial.com.

The presentation contains forward-looking statements. You are cautioned not to

place undue reliance on forward-looking statements, which speak only as

of the date on which they are made, which reflect management’s estimates,

projections, expectations or beliefs at that time and which are subject to risks

and uncertainties that may cause actual results to differ materially. For a

discussion of certain risks and uncertainties that may affect the future results of the

Company,

please

see

"Special

Note

Regarding

Forward-Looking

Statements,"

"Risk

Factors,"

"Business

–

Competition,"

"Business –

Supervision and Regulation" and "Management’s Discussion and Analysis

of Financial Condition and Results of Operations" in the Company’s

Annual Report on Form 10-K for the year ended November 30, 2011, and

“Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operations”

in

the

Company’s

Quarterly

Report on Form 10-Q for the quarter ended February 29, 2012, which are on file

with the SEC. Certain historical financial information about the

Company that we have included in this presentation has been derived from

Morgan Stanley’s consolidated financial statements and does not necessarily reflect what our financial condition,

results of operations or cash flows would have been had we operated as a separate,

stand-alone company during the periods presented.

We own or have rights to use the trademarks, trade names and service marks that we

use in conjunction with the operation

of

our

business,

including,

but

not

limited

to:

Discover

®

,

PULSE

®

,

Cashback

Bonus

®

,

Discover

®

Network

and

Diners

Club

International

®

.

All

other

trademarks,

trade

names

and

service

marks

included

in

this

presentation

are

the

property of their respective owners. |

3

Our Direct Banking and Payments strategy

is delivering profitable growth

•

Growing receivables, sales and profits in card

–

Using brand, service and rewards competitive advantages to grow wallet share

–

Leveraging credit risk management capabilities to maximize returns

•

Diversifying our lending portfolio

–

Applying unsecured lending and marketing capabilities to drive asset growth

–

Generating attractive risk-adjusted returns from student and personal loans

•

Increasing acceptance globally and exploiting opportunities in payments

–

New network/acquirer/issuer partnerships driving acceptance and volume

–

Aggressively pursuing alternative payments

•

Deploying excess capital to drive shareholder value |

4

Become the leading direct banking and payments company

Note:

Balances

as

of

February

29,

2012;

volume

based

on

the

trailing

four

quarters

ending

1Q12

•

$46Bn in receivables

•

Leading

cash

rewards

program

•

1 in 4 U.S. households

•

$27Bn direct-to-consumer

deposits

•

$10Bn personal loans and

private student loans

Deposits and Other Lending

Deposits and Other Lending

U.S. Card Issuing

U.S. Card Issuing

•

$143Bn volume

•

4,300 issuers

•

$113Bn volume

•

30+ issuers

•

$29Bn volume

•

80+ licensees

•

185+ countries /

territories

Direct Banking

Direct Banking

Payment Services

Payment Services |

5

2012 strategic priorities

Discover card

•

Grow sales and loans through

expanding wallet share and new

accounts

•

Expand partnerships, advertising,

rewards and online/mobile

presence to enhance brand and

customer usage

Banking products

•

Increase private student and

personal loans with strong credit

and profit performance

•

Launch direct checking,

complete acquisition of Home

Loan Center business and

launch Discover Home Loans

Payments

•

Accelerate growth of US and

international merchant acceptance

•

Build global volume through new

and expanding network and issuer

partnerships

•

Focus on alternative payments,

including mobile

Overall

•

Ensure disciplined expense

management and drive

efficiencies

•

Effectively deploy capital to

maximize shareholder value |

6

Profitable long-term growth model

Updated Business Model

Asset / Volume

Growth

EPS Growth /

Contribution

Card

2 - 4%

3 - 4%

Other Consumer Lending

10-15%

3 - 4%

Payments

10%+

2%+/-

Organic Asset Growth

5 - 6%

8 - 10%

Capital Management /

Acquisitions

0 - 4%

2 - 5%

Total Growth

5 - 10%

10 - 15%

Targets:

Tier 1 Common Ratio

(1)

~9.5%

ROE

15% +

Note(s)

1.

Tier 1 common capital (non-GAAP measure) as a percent of risk-weighted

assets under Basel I; see appendix for more information |

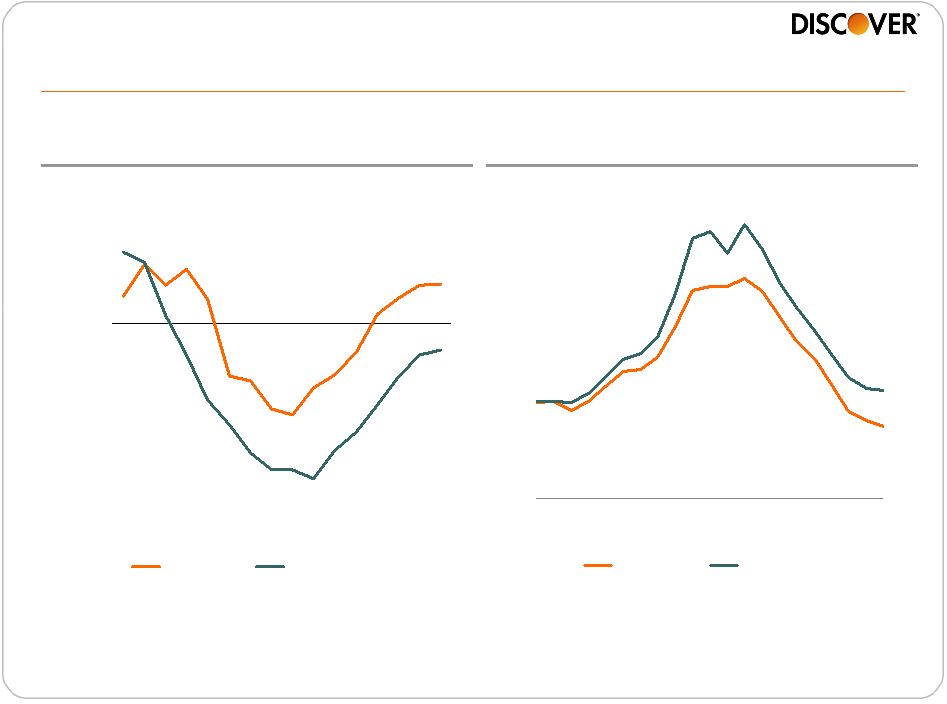

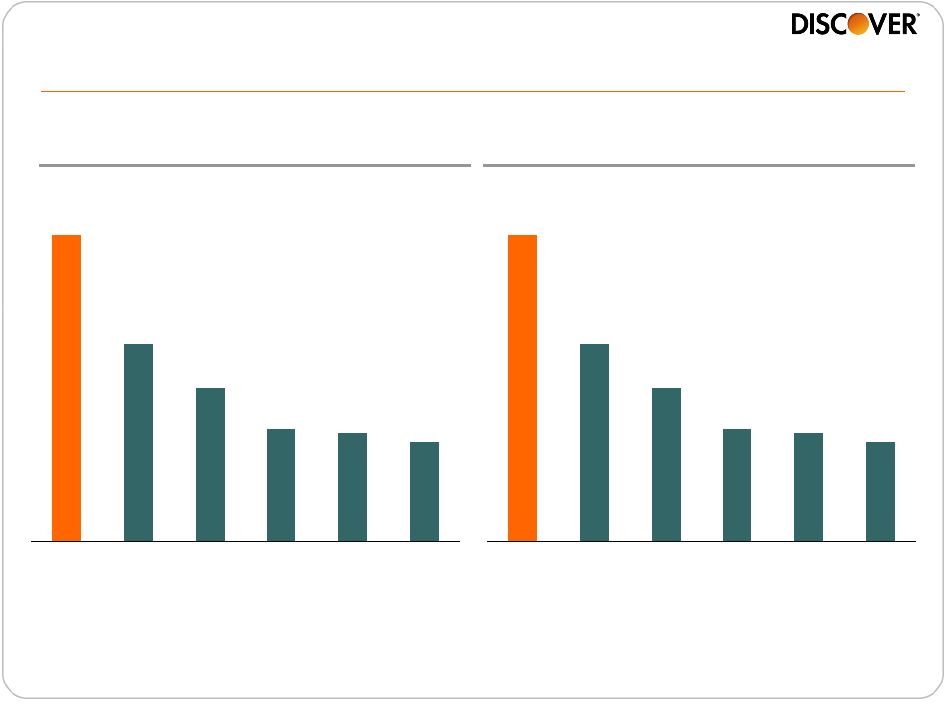

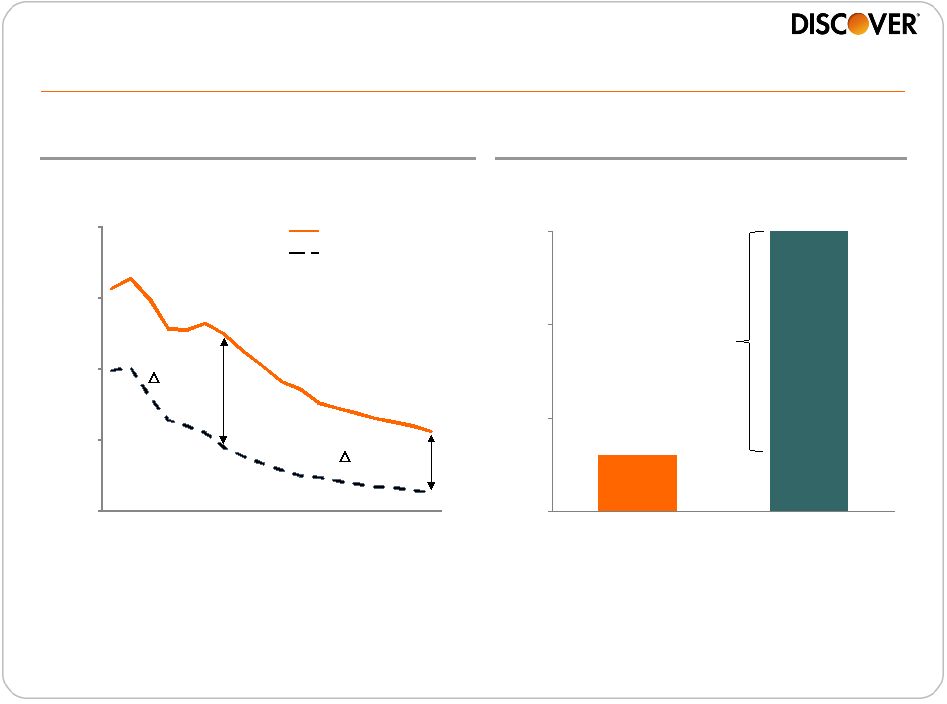

7

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

2Q08

1Q09

4Q09

3Q10

2Q11

1Q12

DFS (CY)

Industry

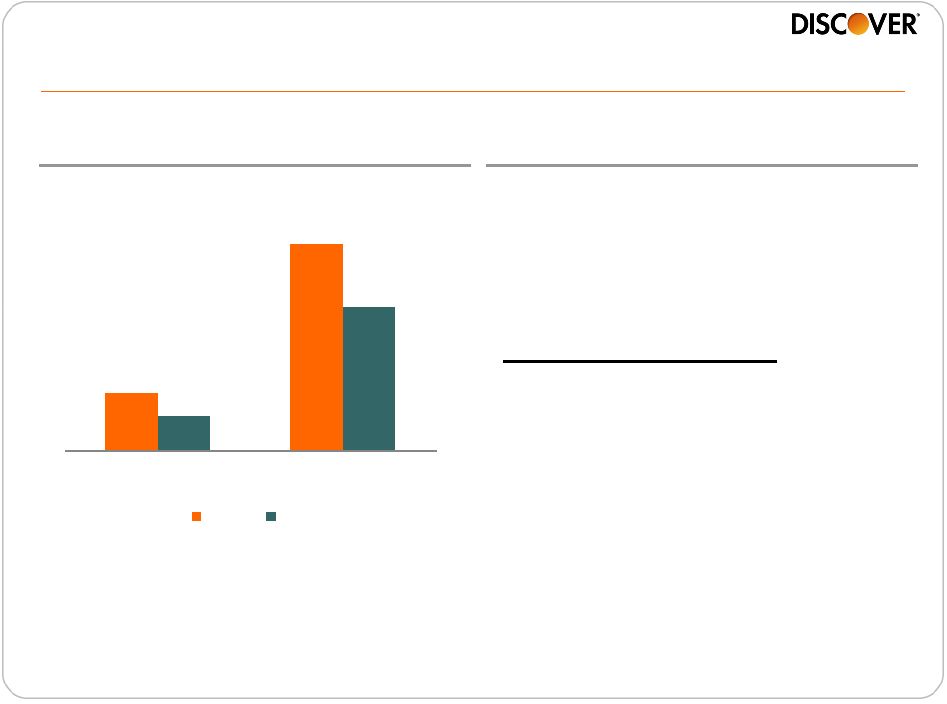

Delivering better than industry card loan growth

and credit performance

Loans (%YOY)

Net Charge-off Rate (%)

Source

SEC Filings, calendar year data, internal estimates

0%

2%

4%

6%

8%

10%

12%

1Q07

1Q08

1Q09

1Q10

1Q11

1Q12

Discover

Peer Group

(2)

(1)

Note(s)

1.

Includes weighted average card receivables growth for American Express (U.S. Card),

Bank of America (U.S. Card), Capital One (U.S. Card excl. installment loans), Citi

(Citi-branded Cards N.A.), and JPMorgan Chase (Card Services); periods

prior to 3Q08 adjusted to include estimated WaMu receivables

2.

Weighted average rate; includes U.S. card net charge-off rates for Citibank ,

JP Morgan Chase, Capital One, American Express and Bank of America |

8

A leader in cash rewards

68%

44%

34%

25%

24%

22%

DFS

JPM

AXP

COF

C

BAC

Best Cash Rewards

(1)

Cash Rewards

Household Penetration

(2)

Note(s)

1.

4Q 2011 Brand Tracker study, Millward Brown -

% of unaided cardmembers who identify the brand with the statement “best cash

rewards”; among cardholders who say they use that brand’s card

most often to make purchases 2.

2011 TNS Consumer Card Research -

Household ownership of cash rewards cards; percentages add to more than 100% due

to household use of multiple brands 68%

44%

34%

25%

24%

22%

DFS

JPM

AXP

COF

C

BAC |

9

2007

2011

Active Outlet Growth

Highlights

Significant gains in U.S. acceptance in 2011

•

40%+ increase since moving to open

acquiring model

•

Fueling growth in key merchant

awareness measures

2012 Priorities

•

Enhance acquirer sales channel

efforts

•

Increase direct engagement with

small merchants

•

Close key acceptance gaps with

national / regional merchants

2007 –

2011

CAGR: 7% |

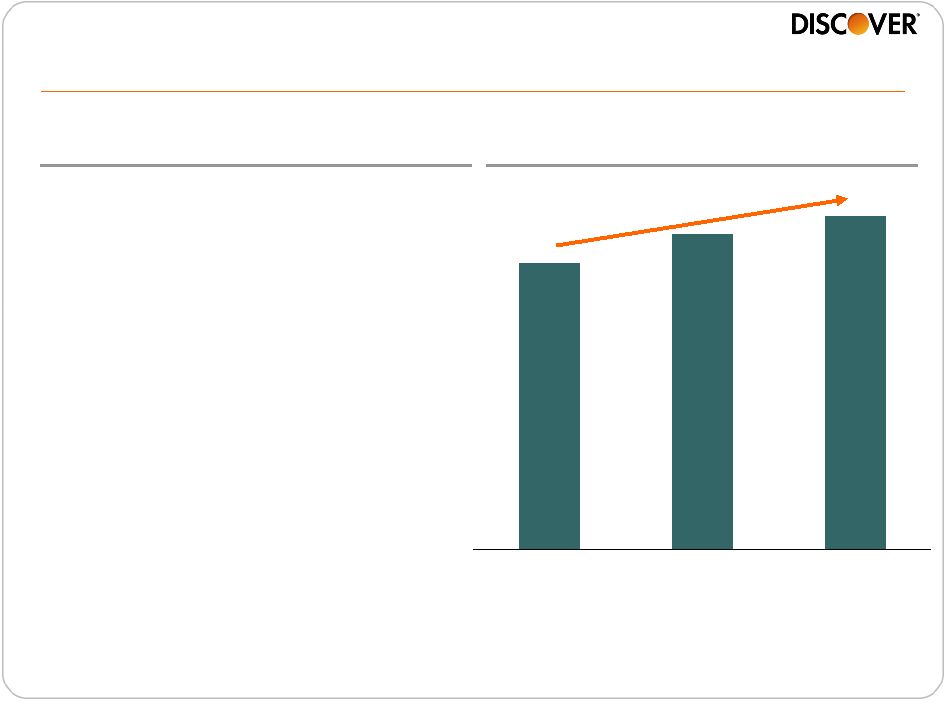

10

2009

2010

2011

Increasing card usage driving wallet share of loans

Wallet Share of Loans

(2)

Note(s)

1.

Primary customers use their card at least 15 times a month

2.

Wallet Share is the amount of customer loans with Discover vs. other cards in the

wallet; share based upon credit bureau data and internal modeling Source

Internal calendar year data and public company data

300bps

•

8% growth in primary customers

(1)

•

13% growth in sales per active

customer

2009 –

2011 Growth |

11

Delivering strong growth and profits

Note(s)

1.

Revenue margin includes net interest margin and other card-related revenues and

fees net of rewards expense. Operating expense margin represents internally based allocation

2.

Pre-tax, excluding reserve actions

Growth

Sales

8.3%

Loan

3.3%

P&L

(1)

Revenue Margin

14.1%

Net Charge-offs

4.5%

Operating Expenses

4.8%

ROA

(2)

4.8%

2011

Card Business Model Performance |

12

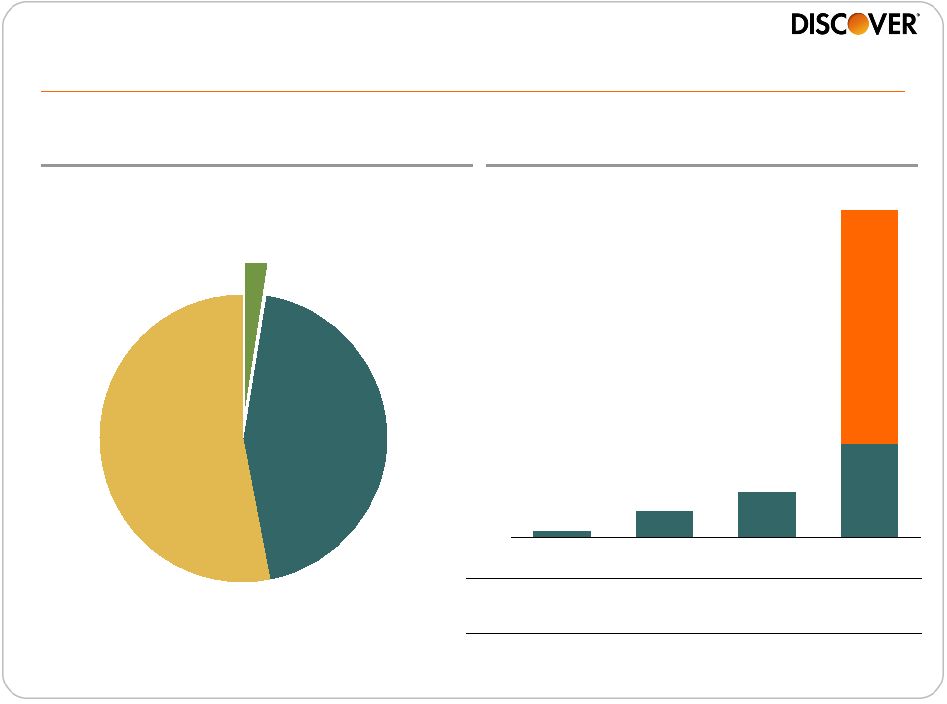

2.1

5.3

$0.1

$0.6

$1.0

$7.3

2008

2009

2010

2011

Private Student Loans:

Valuable source of funding for students

Source

College Board, Trends in Student Aid (2011);

excludes family contribution totals

Private

Loans

$6

Grants and

Other

$125

Federal Loans

$104

Total: $235Bn

Sources of U.S. Educational

Funding (2011)

Discover Private Student

Loan Growth ($Bn)

% in

Repay

(2)

1%

8%

20%

66%

Acquired

(1)

Note(s)

1.

Purchase credit impaired loan value. Contractual receivables, a

non-GAAP measure, were $5.7Bn at 11/30/11. See appendix for

reconciliation 2.

Includes loans in forbearance but excludes loans in deferment for period end

|

13

Superior credit performance in private student loans

2011 Portfolio

Net Charge-off Rates

Underwriting Approach

Source

Company filings for Sallie Mae, calendar-year figures for Discover

1.0%

2.9%

DFS

SLM

Note(s)

1.

Average cosigner rate and average FICO are for the organic portfolio as of the end

of fiscal year 2011 2.

Defined as net losses to average managed contractual receivables

which is a non-GAAP measure for DFS, see appendix for reconciliation

3.

Defined as net losses to average receivables for the private education loan

portfolio •

Card underwriting capabilities

leveraged to enhance decision

making

•

High cosigner rate –

90%

(1)

•

High origination FICO –

750

(1)

•

Focus on not for profit 4-year

colleges and graduate schools

•

School certification and direct

disbursement of funds to schools

(2)

(3) |

14

Student loans delivering attractive returns

Net Interest Income

Loss Provision

Operating Expenses

Pre-tax ROA

5%

(1%)

(1.5%)

2.5%

•

Continued enhancement of

underwriting capabilities

•

Higher repeat business and cross-

sell penetration

•

Targeted graduate and professional

degree products

•

Introduction of differentiated loan

types

2012 Focus

Targeted Returns

(1)

Note(s)

1. Over life of loan |

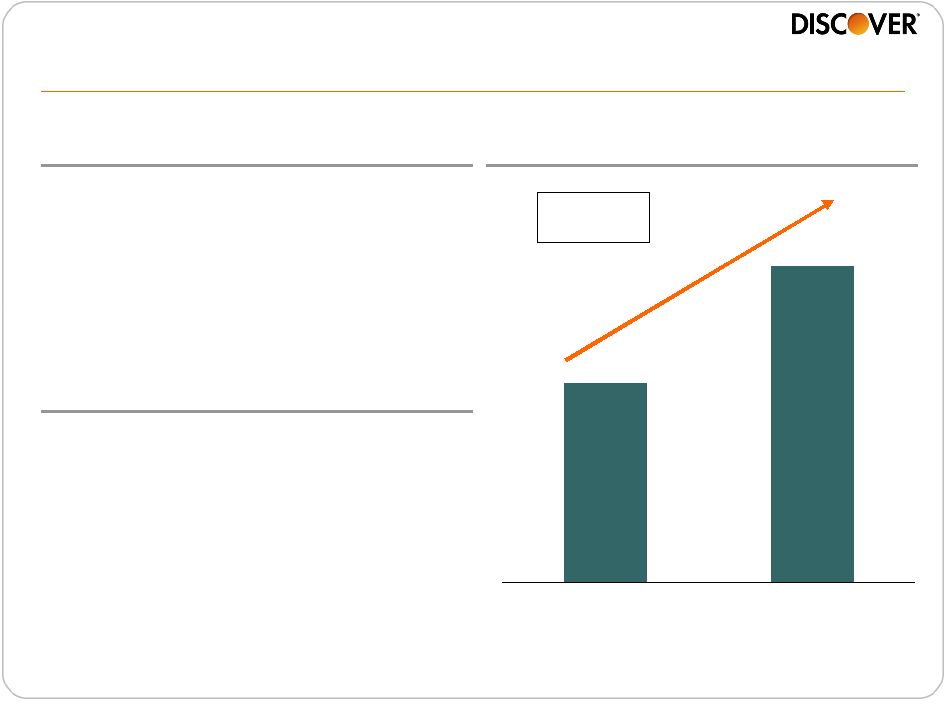

15

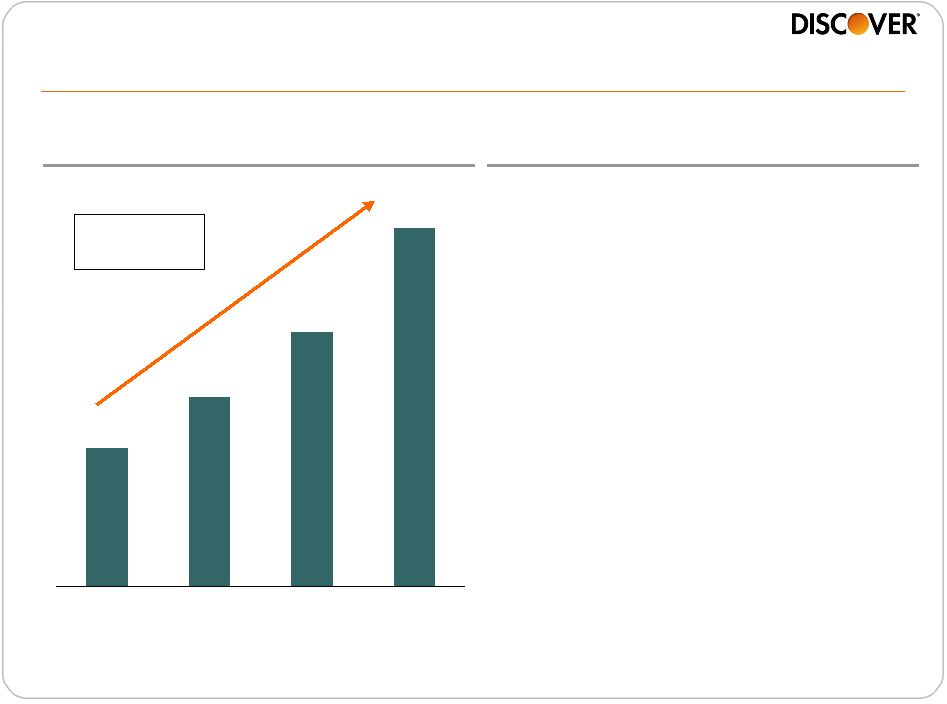

Personal Loans: Natural adjacency with attractive returns

Overview

Personal Loan Growth ($Bn)

$1.0

$1.4

$1.9

$2.6

2008

2009

2010

2011

•

Superior alternative for

consolidating debt

•

Judgmental underwriting with

cash flow analysis

•

60%+ from cross-sell,

expanding further into broad

market

•

Average loan life at origination

of ~5 years

•

Opportunities to leverage this

platform in areas other than

debt consolidation

2008 –

2011

CAGR: 38% |

16

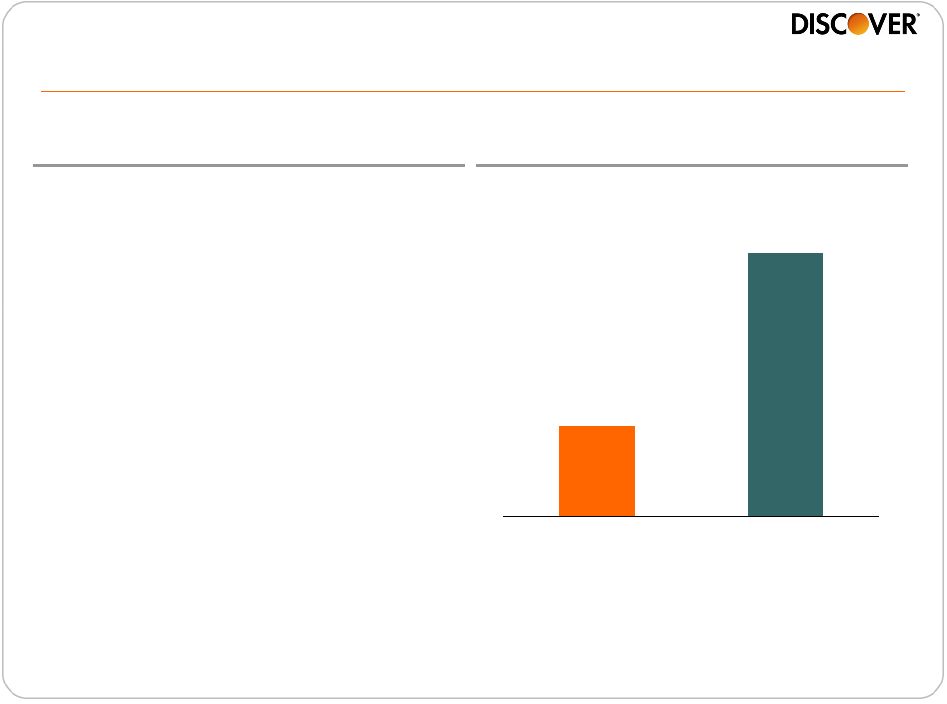

Personal loans delivering superior credit

performance with attractive returns

Source

Calendar year data; Industry -

credit bureau data (10% sample)

60+ Delinquency rates

Net Interest Income

Loss Provision

Operating Expenses

Pre-tax ROA

9%

(4%)

(2%)

3%

Targeted Returns

(1)

1.0%

3.6%

0.6%

2.5%

Discover

Industry

2010

2011 |

17

Acquisition of Home Loan Center business

provides a low cost, targeted expansion path into home loans

•

Structured as asset purchase with

no legacy portfolio exposure

•

Experienced management team

•

Proprietary direct-to-consumer

technology platform scalable to

accommodate future growth

•

Acquisition scheduled to close

mid-year

Acquisition

Business Model

•

Fee-based model, loan assets sold to

investors with servicing released

•

Primarily 1

st

lien conforming loans

•

Marketing efforts directed to Discover

customers and online lead

aggregation

•

Streamlined service delivery

processes differentiated for purchase

and refinance |

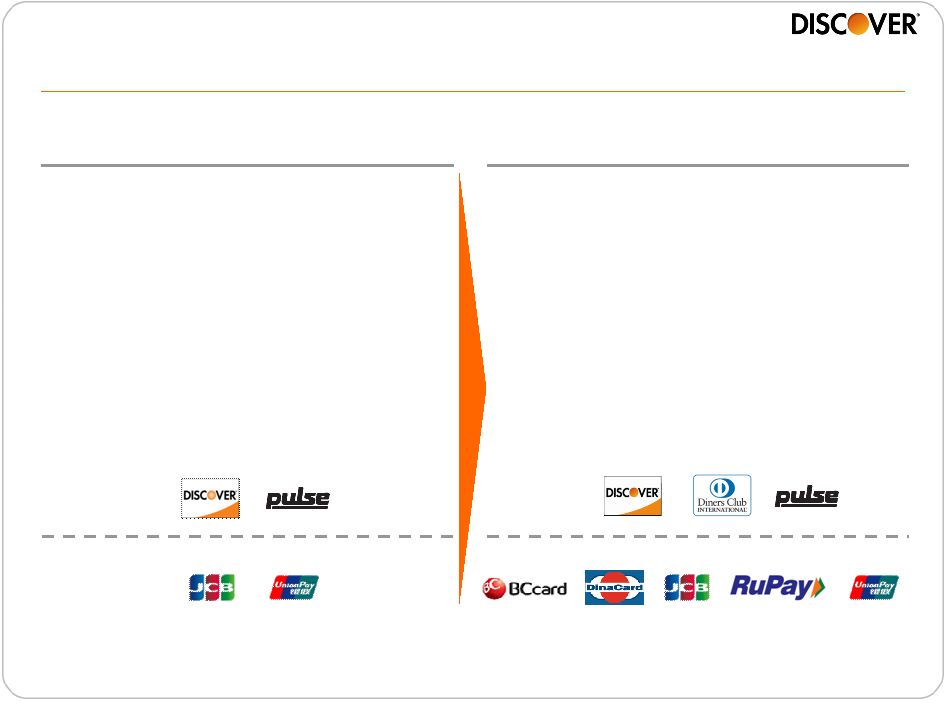

18

2007

2011 / 2012

Payment Services: Delivering on our strategy

•

Domestic-only network

•

$186Bn volume

•

$37MM PBT

•

265,000+ ATMs

•

7MM+ acceptance locations

•

Settled in 1 currency

•

Global payments network

•

$281Bn volume

(1)

•

$166MM PBT

(1)

•

845,000+ ATMs

•

21MM+ acceptance locations

•

Settle in 27 currencies

Owned

Network

Alliances

Note(s)

1.

FY 2011 data |

19

Leverage our unique combination of assets and our partnerships to deliver

growth

•

Improve domestic and international merchant acceptance

–

Accelerate acceptance growth through open acquiring model with key

partners

–

Aggressively close remaining gaps domestically and internationally

•

Build network volume through new and expanding partnerships

–

Drive volume for key partners by leveraging direct merchant relationships

–

Provide strategic alternative to legacy payment network model through

network-to-network alliances

–

Manage through debit industry changes to achieve future profitable growth

–

Strengthen Diners’

presence in key markets and add new, high impact

franchises

•

Continue to invest in alternative payments and mobile

–

Partner with multiple players to help shape the landscape

–

Develop relevant, customer-centric solutions

Building on our global network vision through partnerships

|

20

96

104

86

106

109

118

140

13

26

$186

$221

$232

$248

94

96

91

8

7

6

6

5

27

29

$281

2007

2008

2009

2010

2011

$37

$81

$107

$141

$166

2007

2008

2009

2010

2011

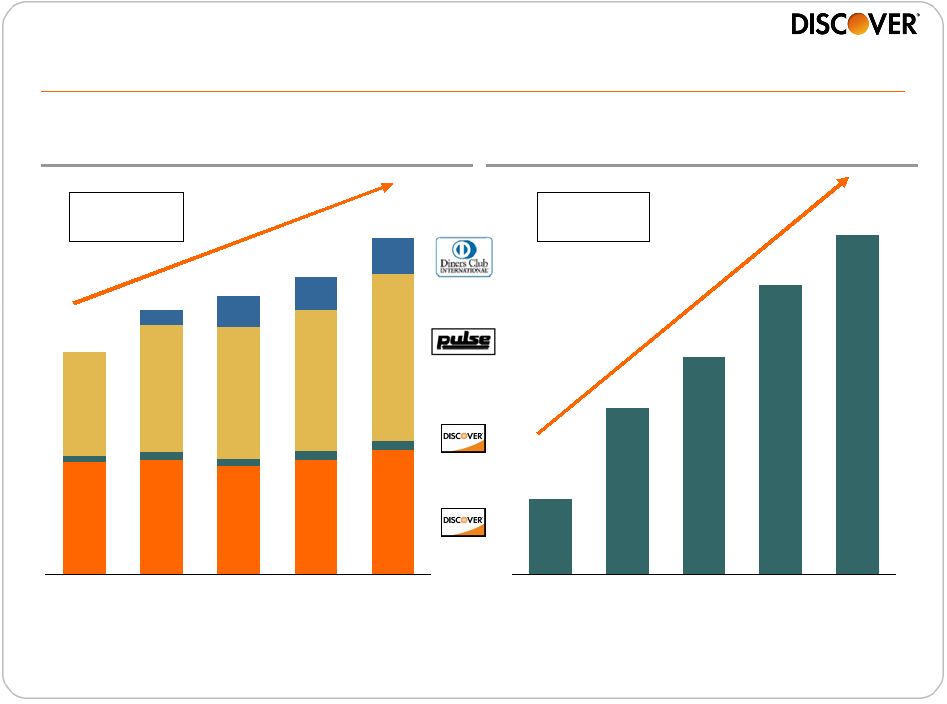

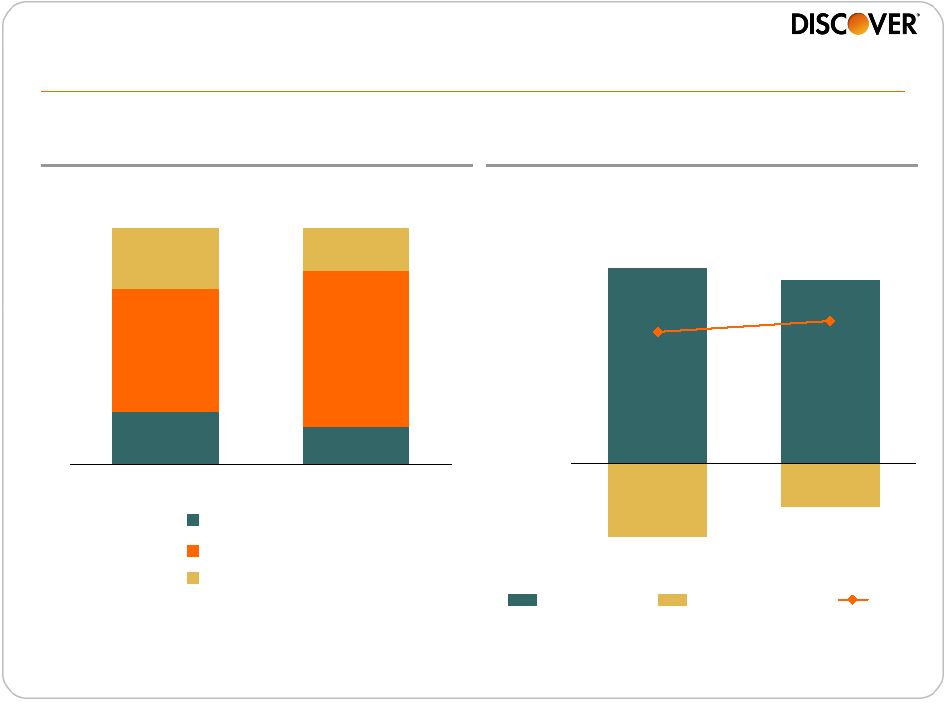

Continue to deliver growth in volume and profit

Volume Growth ($Bn)

Payment Services PBT ($MM)

Partner

Issuance

Proprietary

2007 –

2011

CAGR: 46%

2007 –

2011

CAGR: 11% |

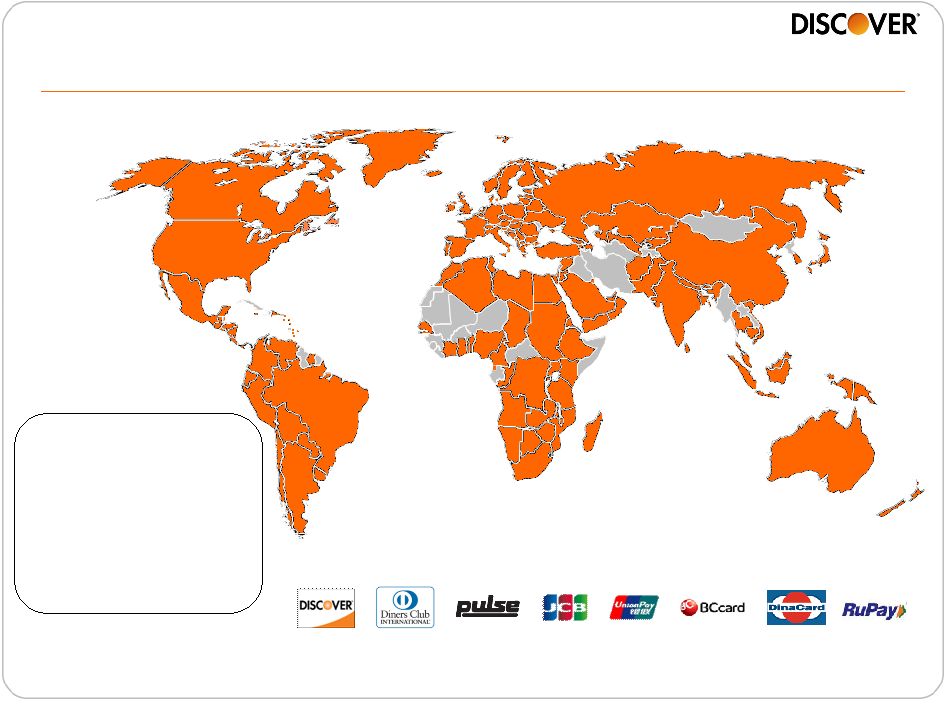

21

Expanding global acceptance to drive growth

•

Third largest global card

acceptance network

(2)

•

Complementary networks with

strong global presence

•

Operates in over 185

countries / territories

(3)

•

Over 845,000 ATMs in more

than 100 countries

North America

8.8MM

Asia Pacific

7.1MM

EMEA

2.0MM

Latin America

2.9MM

Note(s)

1.

Total reflects the number of merchant outlets that accept one or

more card brands

2.

The Nilson Report #989, March 2012

3.

The map denotes countries or territories with transactional activity in the last

year 4.

Enablement of ~90k Rupay ATMs expected by 3Q12

Total Merchant Locations 20.8MM

(1)

(4) |

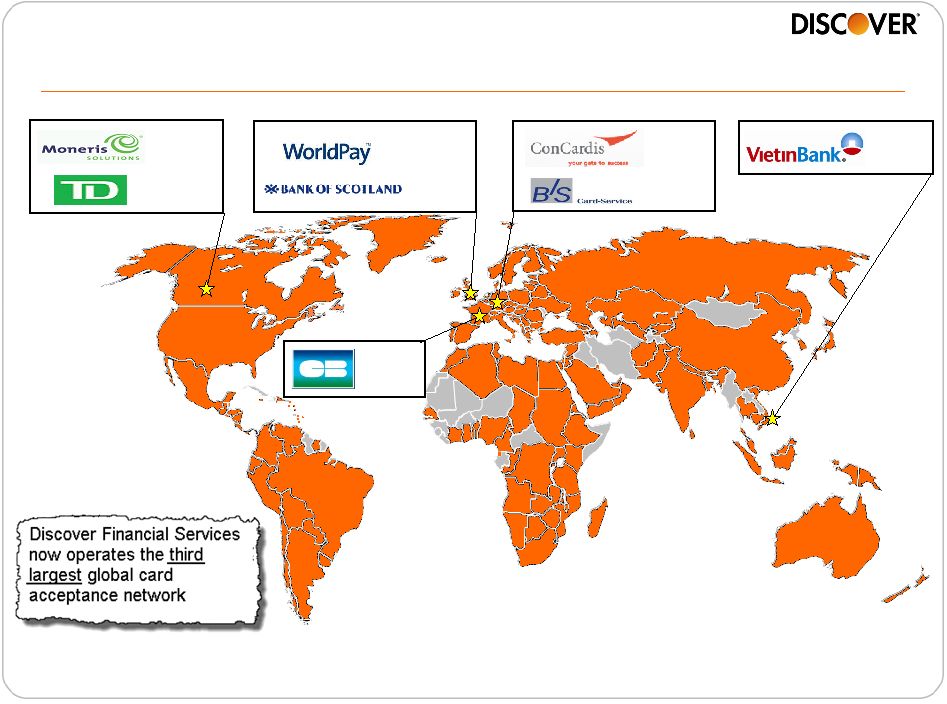

22

Building momentum in international acceptance

Dec ’10

Sep ’11

Sep ’11

Nov ’11

Jan ’12*

Oct ’11

Feb ’12

Apr ’10

Source

2012 Nilson Issue #989 |

23

Adding Issuers

•

First step in growing

volume and revenue

•

In 2011, PULSE

added 129 new direct

issuer participants

Navigating debit industry changes to drive

profitable volume growth

Other Factors

•

Competitors’

new

debit strategies may

negatively impact

volume

•

Merchant / Acquirer

routing sophistication

•

Industry pricing

changes

Influencing

Transaction Routing

•

Routing decisions by

merchants and acquirers

will drive volume

•

Short-term acquirer

agreements have

produced volume capture

•

Disciplined approach to

routing incentives |

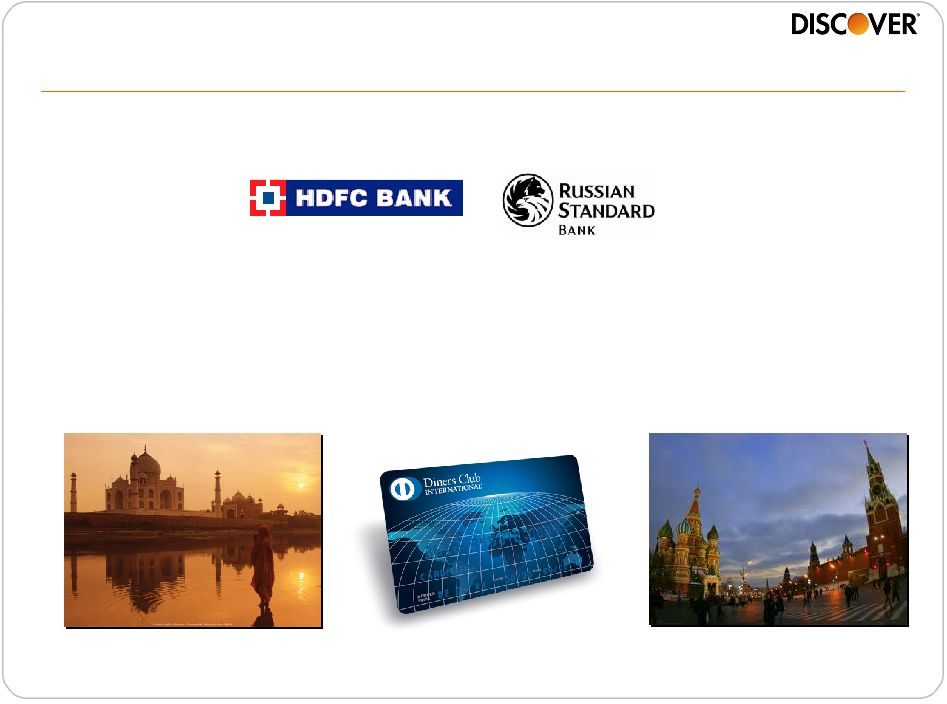

24

•

New franchise partnerships formed in key growth markets

•

Pursuing new partnerships in China and Turkey

•

Majority of Western European franchises transferred to new and

engaged ownership

(India)

(Russia)

Diners Club –

building strong relationships |

25

Helping shape the emerging payments landscape

Consumers

Merchants

Issuers

DFS

Leveraging the network for

new technology solutions

•

NFC acceptance parity

•

90+ EMV initiatives

worldwide

•

Relationships: Google,

PayPal, Isis, C-SAM

•

Security: Certification with

the top 3 Trusted Service

Managers (TSMs)

Leveraging the network for

non-traditional payments

•

White label services: 65%

growth (Bill Me Later)

•

B2C prepaid: Campus

payment + identification /

access function

•

B2B prepaid: PreCash

leveraging Discover’s

network rails

•

Security: Acculynk,

Obopay, SecureKey |

26

Strong quarterly financial performance

($ MM, except per share data)

1Q12

1Q11

Net Interest Income

$1,293

$1,170

$123

11%

Other Operating Revenue

550

563

(13)

(2%)

Total Revenue

$1,843

$1,733

$110

6%

Net Charge-offs

$378

$689

($311)

(45%)

Reserve Changes build/(release)

(226)

(271)

45

17%

Provision for Loan Loss

$152

$418

($266)

(64%)

Total Operating Expenses

$677

$595

$82

14%

Total Expense

829

1,013

(184)

(18%)

Pretax Income

$1,014

$720

$294

41%

Net Income (Loss)

$631

$465

$166

36%

EPS

$1.18

$0.84

$0.34

40%

ROE

29%

28%

1%

Total Average Receivables

$57,606

$51,488

$6,118

12%

Net Interest Margin

9.03%

9.22%

-19bps

YOY

Change |

27

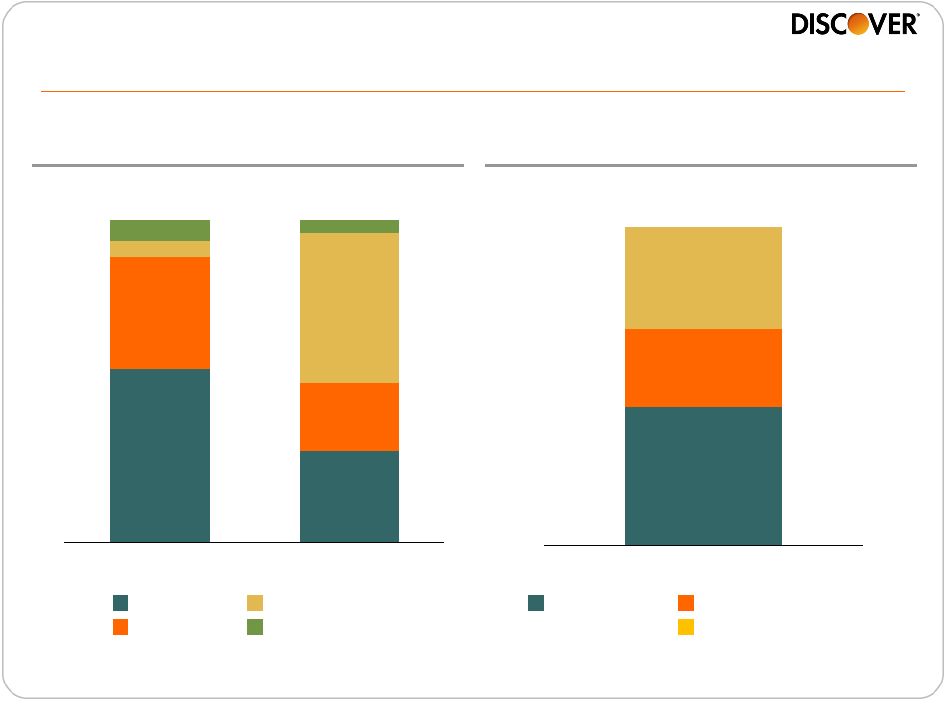

Funding cost tailwind helping to offset yield compression

-5.0%

0.0%

5.0%

10.0%

15.0%

2008

2011

Total Yield

Cost of Funds

NIM

Credit Card Receivables

Mix by APR

Net Interest Margin

(NIM)

Note(s)

1.

Interest expense divided by average receivables

2.

Net interest income divided by average receivables

Source

Fiscal year ending data

(1)

(2)

52%

66%

26%

18%

16%

22%

2008

2011

Promotional

Standard

Cash and Other |

28

Source

SNL, Fed Call Reports and Boston Consulting Group / internal analysis

Operating Costs

Net of Fee Income

(3)

Gained meaningful ground on cost-of-funds and

all-in economics

Deposit Rates

50

100

150

0

Discover

non-interest

expense

120 bps

600

450

300

150

0

Largest Traditional

Banks

(1)

Discover Bank

2007

2008

2009

2010

2011

128bps

(2)

239bps

Note(s)

1.

Average of the top 25 U.S. banks; excludes the following: thrifts, investment

banks, money processing banks, specialty finance companies, non continental US banks, and

acquisition targets; analysis excludes banks missing financial data for the periods

reported 2.

As of 4Q11

3.

Total operating costs net of fee income divided by average total

deposits portfolio balance

4.

Total operating costs and fee income estimated based on public filings; costs for

other large-bank reduced by 100 bps to reflect impact of fee revenue. Discover's fee

revenue on deposits is not material

Source

SNL

(bps)

Other large U.S.

bank non-interest

expense

(4)

(bps) |

29

6.8

8.9

$27.7

12.1

2/29/12

ABS

BCDs

DTC

(1)

Other

Diversified funding with strong liquidity

28%

35%

21%

46%

54%

5%

6%

4%

Spin (6/30/07)

2/29/12

Funding Mix

($Bn)

Liquidity

Portfolio

ABCP Open Lines

Fed Discount Window

Contingent Liquidity Sources

($Bn)

$58.9

$49.7

Note(s)

1.

Includes affinity deposits |

30

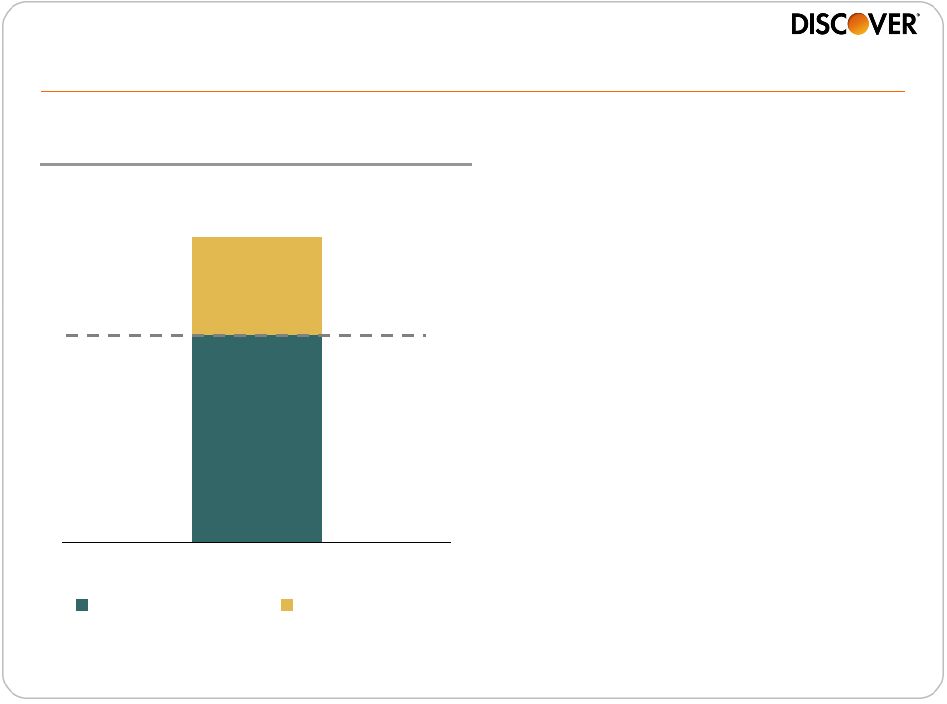

Capital position enables effective capital deployment

•

Repurchased $425MM in shares

during 2H ‘11 and authorized new

two-year share repurchase program

of $2Bn in 2012

•

Revisit dividend at least annually

•

Generating returns above 15% ROE

target with excess capital

•

Will deploy excess capital through

–

Organic growth

–

Dividend actions

–

Share repurchases

–

Disciplined acquisitions

$2.7

$5.7

3/31/12

Illustrative Target

Excess Capital

Target Tier 1 Common Ratio

(1)

9.5%+/-

Target

14%

Source

Company Filings

Note(s)

1.

Tier 1 common capital (non-GAAP measure) as a percent of risk-weighted

assets under Basel I; see appendix for reconciliation |

31

•

Growing receivables, sales and profits in card

•

Diversifying our lending portfolio

•

Increasing acceptance globally and exploiting opportunities in payments

•

Deploying excess capital to drive shareholder value

Our Direct Banking and Payments strategy is

delivering profitable growth |

Barclays Americas Select Franchise Conference

May 15, 2012 |

33

Reconciliation of GAAP to Non-GAAP data

(

$MM)

3/31/2012

Tier 1 Common Equity Reconciliation

Total Shareholders' Equity

$8,703

Effect of certain items in Accumulated

Other Comprehensive Income (Loss)

excluded from Tier 1 Common Equity

59

Less: Ineligible Goodwill and

Intangible Assets

(441)

Total

Tier

1

Common

Equity

(1)

$8,321

Risk Weighted Assets

$59,526

Tier 1 Common Ratio

(2)

14.0%

Note(s)

1. Tier 1 common equity, a non-GAAP financial measure, represents common equity

and the effect of certain items in accumulated other comprehensive income

(loss) excluded from tier 1 common equity, less goodwill and intangibles. Other financial services

companies

may

also

use

tier

1

common

equity

and

definitions

may

vary,

so

we

advise

users

of

this

information

to

exercise

caution

in

comparing tier 1 common equity of different companies. Tier 1 common equity is

included to support the tier 1 common capital ratio which is meaningful to

investors to assess the quality and composition of the Company’s capital. Additionally, proposed international

banking

capital

standards

(Basel

III)

include

measures

that

rely

on

the

tier

1

common

capital

ratio.

2. Tier

1

Common

Capital

Ratio

represents

tier

1

common

equity,

a

non-GAAP

measure,

divided

by

risk-weighted

assets. |

34

Reconciliation of GAAP to Non-GAAP data (cont’d)

(unaudited, $ in billions)

11/30/11

2/29/12

GAAP Recorded Balance Purchased (Private) Credit Impaired Student Loans (ending

loans) $5.3

$5.1

Adjustment for Purchase Accounting Discount

0.4

0.4

Contractual

Value

Purchased

(Private)

Credit

Impaired

Student

Loans

(ending

loans)

(1)

$5.7

$5.5

GAAP Private Student Loans (ending loans)

2.1

2.2

Contractual

Value

Private

Student

Loans

(ending

loans)

(1)

$7.8

$7.7

(unaudited, $ in billions)

Twelve Months Ended

12/31/11

GAAP Recorded Balance Purchased (Private) Credit Impaired Student Loans (average

loans) $3.5

Adjustment for Purchase Accounting Discount

0.5

Contractual

Value

Purchased

(Private)

Credit

Impaired

Student

Loans

(average

loans)

(1)

$4.1

GAAP Private Student Loans (average loans)

1.7

Contractual

Value

Private

Student

Loans

(average

loans)

(1)

$5.8

(unaudited, $ in millions)

Twelve Months Ended

12/31/11

GAAP Private Student Loan Net Principal Charge-offs

$8.1

Adjustment

for

Purchased

(Private)

Credit

Impaired

Student

Loans

Net

Principal

Charge-offs

47.5

Contractual

Private

Student

Loan

Net

Principal

Charge-offs

(2)

$55.6

Note(s)

1. The contractual value of the purchased private student loan portfolio is a

non-GAAP measure and represents purchased private student loans excluding the

purchase accounting discount. The contractual value of the private student loan

portfolio is meaningful to investors to understand total outstanding student loan

balances without the purchase accounting discount.

2. Contractual private student loan net principal charge-offs is a

non-GAAP measure and include net charge-offs on purchase credit impaired loans. Under GAAP any

losses on such loans are charged against the nonaccretable difference established

in purchased credit impaired accounting and are not reported as charge-offs.

Contractual net principal charge-offs is meaningful to investors to see total

portfolio losses. |