Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - Future FinTech Group Inc. | ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Future FinTech Group Inc. | ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Future FinTech Group Inc. | ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Future FinTech Group Inc. | ex32-2.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Future FinTech Group Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

ý

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended March 31, 2012

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ____ to ____

Commission file number: 001-34502

|

SKYPEOPLE FRUIT JUICE, INC.

|

||

|

(Exact name of registrant as specified in its charter)

|

||

|

Florida

|

98-0222013

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

16F, China Development Bank Tower, No. 2, Gaoxin 1st Road, Xi’an, PRC

710075

|

||

|

(Address of principal executive offices including zip code)

|

||

|

86-29-88377161

|

||

|

(Registrant’s telephone number, including area code)

|

||

|

N/A

|

||

|

(Former name, former address and former fiscal year, if changed since last report)

|

||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨

|

Smaller reporting company ý

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes ý No.

|

Class

|

Outstanding at May 14, 2012

|

|

|

Preferred Stock, $0.001 par value per share

|

1,456,647

|

|

|

Common Stock, $0.001 par value per share

|

25,690,402

|

TABLE OF CONTENTS

|

PART I.

|

FINANCIAL INFORMATION

|

|

Item 1.

|

Financial Statements

|

|

SKYPEOPLE FRUIT JUICE, INC.

|

||||||||

|

CONSOLIDATED BALANCE SHEETS

|

||||||||

|

March

31,

|

December

31,

|

|||||||

|

2012

|

2011

|

|||||||

|

ASSETS

|

(Unaudited)

|

|||||||

|

CURRENT ASSETS

|

||||||||

|

Cash and cash equivalents

|

$ | 76,713,489 | $ | 61,154,007 | ||||

|

Restricted cash

|

31,775 | 316,396 | ||||||

|

Accounts receivables, net of allowance of $46,577 and $46,529 as of March 31, 2012 and December 31, 2011, respectively

|

21,782,597 | 35,999,858 | ||||||

|

Other receivables

|

190,210 | 192,032 | ||||||

|

Inventories

|

5,335,964 | 6,126,376 | ||||||

|

Deferred tax assets

|

113,770 | 174,285 | ||||||

|

Advances to suppliers and other current assets

|

175,832 | 66,528 | ||||||

|

TOTAL CURRENT ASSETS

|

104,343,637 | 104,029,482 | ||||||

|

PROPERTY, PLANT AND EQUIPMENT, NET

|

49,784,454 | 44,277,228 | ||||||

|

LAND USE RIGHT, NET

|

6,635,133 | 6,673,496 | ||||||

|

OTHER ASSETS

|

173,233 | 5,323,162 | ||||||

|

TOTAL ASSETS

|

$ | 160,936,457 | $ | 160,303,368 | ||||

|

LIABILITIES

|

||||||||

|

CURRENT LIABILITIES

|

||||||||

|

Accounts payable

|

$ | 2,099,190 | $ | 2,972,916 | ||||

|

Accrued expenses

|

3,468,696 | 4,701,054 | ||||||

|

Income tax payable

|

855,217 | 1,910,779 | ||||||

|

Advances from customers

|

- | 178,857 | ||||||

|

Short-term bank loans

|

8,467,979 | 6,425,713 | ||||||

|

Short-term notes payable

|

- | 284,654 | ||||||

|

TOTAL CURRENT LIABILITIES

|

14,891,082 | 16,473,973 | ||||||

|

STOCKHOLDERS' EQUITY

|

||||||||

|

SkyPeople Fruit Juice, Inc, Stockholders' equity

|

||||||||

|

Series B Preferred stock, $0.001 par value;10,000,000 shares authorized; 1,456,647 issued and outstanding as of March 31, 2012 and December 31, 2011

|

1,457 | 1,457 | ||||||

|

Common stock, $0.001 par value; 66,666,666 shares authorized; 25,690,402 shares issued and outstanding as of March 31, 2012 and December 31, 2011

|

25,690 | 25,690 | ||||||

|

Additional paid-in capital

|

59,189,374 | 59,189,374 | ||||||

|

Retained earnings

|

66,542,611 | 64,623,453 | ||||||

|

Accumulated other comprehensive income

|

14,236,710 | 14,086,620 | ||||||

|

Total SkyPeople Fruit Juice, Inc. stockholders' equity

|

139,995,842 | 137,926,594 | ||||||

|

Non-controlling interests

|

6,049,533 | 5,902,801 | ||||||

|

TOTAL EQUITY

|

146,045,375 | 143,829,395 | ||||||

|

TOTAL LIABILITIES AND EQUITY

|

$ | 160,936,457 | $ | 160,303,368 | ||||

|

The accompanying notes are an intagral part of these consolidated financial statements.

|

||||||||

|

SKYPEOPLE FRUIT JUICE, INC.

|

||||||||

|

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

|

||||||||

|

(Unaudited)

|

||||||||

|

For the Three months

Ended March 31,

|

||||||||

|

2012

|

2011

|

|||||||

|

Revenue

|

$ | 14,993,500 | $ | 19,414,915 | ||||

|

Cost of goods sold

|

10,207,501 | 10,809,357 | ||||||

|

Gross profit

|

4,785,999 | 8,605,558 | ||||||

|

Operating Expenses

|

||||||||

|

General and administrative expenses

|

1,477,604 | 816,160 | ||||||

|

Selling expenses

|

525,334 | 454,674 | ||||||

|

Research and development expenses

|

142,685 | 136,467 | ||||||

|

Total operating expenses

|

2,145,623 | 1,407,301 | ||||||

|

Income from operations

|

2,640,376 | 7,198,257 | ||||||

|

Other income (expenses)

|

||||||||

|

Interest income

|

69,689 | 76,312 | ||||||

|

Subsidy income

|

433,504 | 483,067 | ||||||

|

Interest expenses

|

(154,812 | ) | (163,795 | ) | ||||

|

Others

|

(968 | ) | (3,033 | ) | ||||

|

Total other income (expenses)

|

347,413 | 392,551 | ||||||

|

Income before income tax

|

2,987,789 | 7,590,808 | ||||||

|

Income tax provision

|

928,380 | 1,929,808 | ||||||

|

Net income

|

2,059,409 | 5,661,000 | ||||||

|

Less: Net income attributable to non-controlling interests

|

140,251 | 368,824 | ||||||

|

NET INCOME ATTRIBUTABLE TO SKYPEOPLE FRUIT JUICE, INC.

|

$ | 1,919,158 | $ | 5,292,176 | ||||

|

Earnings per share:

|

||||||||

|

Basic earnings per share

|

$ | 0.07 | $ | 0.20 | ||||

|

Diluted earnings per share

|

$ | 0.07 | $ | 0.20 | ||||

|

Weighted average number of shares outstanding

|

||||||||

|

Basic

|

25,690,402 | 25,690,402 | ||||||

|

Diluted

|

26,661,500 | 26,662,599 | ||||||

|

Comprehensive Income

|

||||||||

|

Net income

|

$ | 2,059,409 | $ | 5,661,000 | ||||

|

Foreign currency translation adjustment

|

156,571 | 1,141,578 | ||||||

|

Total Comprehensive income

|

2,215,980 | 6,802,578 | ||||||

|

Comprehensive income attributable to non-controlling interests

|

146,732 | 413,802 | ||||||

|

Comprehensive income attributable to SkyPeople Fruit Juice, Inc.

|

$ | 2,069,248 | $ | 6,388,776 | ||||

|

The accompanying notes are an intagral part of these consolidated financial statements.

|

||||||||

|

SKYPEOPLE FRUIT JUICE, INC.

|

||||||||

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

||||||||

|

(Unaudited)

|

||||||||

|

For the Three months

Ended March 31,

|

||||||||

|

2012

|

2011

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

||||||||

|

Net income

|

$ | 2,059,409 | $ | 5,661,000 | ||||

|

Adjustments to reconcile net income to net cash provided by operating activities

|

||||||||

|

Depreciation and amortization

|

706,064 | 865,108 | ||||||

|

Deferred income tax assets

|

60,515 | - | ||||||

|

Changes in operating assets and liabilities

|

||||||||

|

Accounts receivable

|

14,225,403 | 10,143,930 | ||||||

|

Other receivable

|

2,009 | (108,542 | ) | |||||

|

Advances to suppliers and other current assets

|

(109,276 | ) | (28,135 | ) | ||||

|

Inventories

|

1,163,961 | (837,263 | ) | |||||

|

Accounts payable

|

(875,022 | ) | 2,457,839 | |||||

|

Accrued expenses

|

(1,233,484 | ) | (1,699,172 | ) | ||||

|

Income tax payable

|

(1,055,393 | ) | (2,451,649 | ) | ||||

|

Advances from customers

|

(178,673 | ) | (394,573 | ) | ||||

|

Net cash provided by operating activities

|

14,765,513 | 13,608,543 | ||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

||||||||

|

Additions to property, plant and equipment

|

(1,320,608 | ) | (60,901 | ) | ||||

|

Prepayment for other assets

|

(13,621 | ) | (225,513 | ) | ||||

|

Net cash used in investing activities

|

(1,334,229 | ) | (286,414 | ) | ||||

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

||||||||

|

Decreased in restricted cash

|

284,361 | 103,574 | ||||||

|

Short-term notes payable

|

(284,361 | ) | (103,574 | ) | ||||

|

Proceeds from short-term bank loans

|

3,170,879 | 2,486,808 | ||||||

|

Repayment of short-term bank loans

|

(1,139,578 | ) | - | |||||

|

Net cash provided by financing activities

|

2,031,301 | 2,486,808 | ||||||

|

Effect of change in exchange rate

|

96,897 | 560,614 | ||||||

|

NET INCREASE IN CASH AND CASH EQUIVALENTS

|

15,559,482 | 16,369,551 | ||||||

|

Cash and cash equivalents, beginning of period

|

61,154,007 | 49,350,385 | ||||||

|

Cash and cash equivalents, end of period

|

$ | 76,713,489 | $ | 65,719,936 | ||||

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION

|

||||||||

|

Cash paid for interest

|

$ | 154,812 | $ | 163,795 | ||||

|

Cash paid for income taxes

|

$ | 1,923,258 | $ | 4,381,457 | ||||

|

SUPPLEMENTARY DISCLOSURE OF SIGNIFICANT NON-CASH TRANSACTION

|

||||||||

|

Transferred from other assets to property, plant and equipment and construction in process

|

$ | 5,158,425 | $ | 445,487 | ||||

|

The accompanying notes are an intagral part of these consolidated financial statements.

|

||||||||

-3-

SKYPEOPLE FRUIT JUICE, INC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

|

1.

|

Basis of Presentation

|

The unaudited financial statements have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information and the rules and regulations of the Securities and Exchange Commission. In the opinion of management, the unaudited financial statements have been prepared on the same basis as the annual financial statements and reflect all adjustments, which include only normal recurring adjustments, necessary to present fairly the financial position as of March 31, 2012 and the results of operations and cash flows for the periods ended March 31, 2012 and 2011. The financial data and other information disclosed in these notes to the interim financial statements related to these periods are unaudited. The results for the three months ended March 31, 2012 are not necessarily indicative of the results to be expected for any subsequent periods or for the entire year ending December 31, 2012. The balance sheet at December 31, 2011 has been derived from the audited financial statements at that date.

Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted pursuant to the Securities and Exchange Commission’s rules and regulations. These unaudited financial statements should be read in conjunction with our audited financial statements and notes thereto for the year ended December 31, 2011 as included in our Annual Report on Form 10-K.

|

2.

|

BUSINESS DESCRIPTION AND SIGNIFICANT ACCOUNTING POLICIES

|

The principal activities of the Company consist of production and sales of fruit juice concentrates, fruit juice beverages, and other fruit-related products in the PRC and overseas markets. All activities of the Company are principally conducted by subsidiaries operating in the PRC.

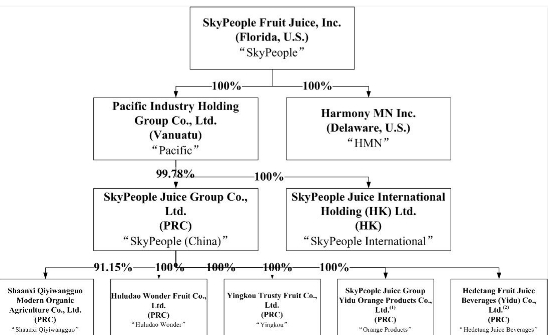

Organizational Structure

-4-

SKYPEOPLE FRUIT JUICE, INC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Current organizational structure is set forth in the diagram below:

|

(1)

|

SkyPeople Juice Group Yidu Orange Products Co., Ltd. was established on March 13, 2012. Its scope of business includes deep processing and sales of oranges.

|

|

(2)

|

Hedetang Fruit Juice Beverages (Yidu) Co., Ltd. was established on March 31, 2012. Its scope of business includes production and sales of fruit juice beverages.

|

Principals of Consolidation

Our consolidated financial statements include the accounts of the Company and its subsidiaries. All material intercompany accounts and transactions have been eliminated in consolidation.

The consolidated financial statements are prepared in accordance with U.S. GAAP. This basis differs from that used in the statutory accounts of SkyPeople (China), Shaanxi Qiyiwangguo, Huludao Wonder, Yingkou, Hedetang Juice Beverages and Orange Products, which were prepared in accordance with the accounting principles and relevant financial regulations applicable to enterprises in the PRC. All necessary adjustments have been made to present the financial statements in accordance with U.S. GAAP.

Uses of estimates in the preparation of financial statements

The Company’s consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and this requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and reported amounts of revenue and expenses during the reporting period. The significant areas requiring the use of management estimates include, but not limited to, the allowance for doubtful accounts receivable, estimated useful life and residual value of property, plant and equipment, provision for staff benefit, valuation of change in fair value of warrant liability, recognition and measurement of deferred income taxes and valuation allowance for deferred tax assets. Although these estimates are based on management’s knowledge of current events and actions management may undertake in the future, actual results may ultimately differ from those estimates.

-5-

SKYPEOPLE FRUIT JUICE, INC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Impairment of long-lived assets

In accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 360-10, Accounting for the Impairment or Disposal of Long-Lived Assets, long-lived assets, such as property, plant and equipment and purchased intangibles subject to amortization are reviewed for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable, or it is reasonably possible that these assets could become impaired as a result of technological or other industrial changes. The determination of recoverability of assets to be held and used is made by comparing the carrying amount of an asset to future undiscounted cash flows to be generated by the assets.

If such assets are considered to be impaired, the impairment to be recognized is measured as the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less cost to sell. During the reporting periods there was no impairment loss of long-lived assets recognized.

Inventories

Inventories consist of raw materials, packaging materials (which include ingredients and supplies) and finished goods (which include finished juice in the bottling and canning operations). Inventories are valued at the lower of cost or market. We determine cost on the basis of the weighted average method. The Company periodically reviews inventories for obsolescence and any inventories identified as obsolete are reserved or written off.

Revenue Recognition

The Company recognizes revenue in accordance with ASC 605, Revenue Recognition. Revenue from sales of products is recognized upon shipment or delivery to customers, provided that persuasive evidence of sales arrangements exist, title and risk of loss have been transferred to the customers, the sales amounts are fixed and determinable and collection of the revenue is reasonably assured. Customers have no contractual right to return products. Historically, the Company has not had any returned products. Accordingly, no provision has been made for returnable goods. The Company is not required to rebate or credit a portion of the original fee if it subsequently reduces the price of its product and the distributor still has rights with respect to that product.

Shipping and Handling Costs

Shipping and handling amounts billed to customers in related sales transactions are included in sales revenues and shipping expenses incurred by the Company are reported as a component of selling expenses. The shipping and handling expenses of $279,812 and $318,400 for three months ended March 31, 2012 and 2011, respectively, are reported in the Consolidated Statements of Income and Comprehensive Income as a component of selling expenses.

Foreign Currency and Other Comprehensive Income

The financial statements of the Company’s foreign subsidiaries are measured using the local currency as the functional currency; however, the functional currency and the reporting currency of the Company are the United States dollar (“USD”). Assets and liabilities of the Company’s foreign subsidiaries have been translated into USD using the exchange rate at the balance sheet date while equity accounts are translated using the historical exchange rate. The average exchange rate for the period has been used to translate revenues and expenses. Translation adjustments are reported separately and accumulated in a separate component of equity (cumulative translation adjustment).

-6-

SKYPEOPLE FRUIT JUICE, INC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Other comprehensive income for three months ended March 31, 2012 and 2011 represented foreign currency translation adjustments and were included in the consolidated statements of income and comprehensive income.

Income Taxes

We use the asset and liability method of accounting for income taxes in accordance with ASC Topic 740, “Income Taxes.” Under this method, income tax expense is recognized for the amount of: (i) taxes payable or refundable for the current year and (ii) deferred tax consequences of temporary differences resulting from matters that have been recognized in an entity’s financial statements or tax returns. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the results of operations in the period that includes the enactment date. A valuation allowance is provided to reduce the deferred tax assets reported if based on the weight of the available positive and negative evidence, it is more likely than not some portion or all of the deferred tax assets will not be realized.

ASC Topic 740.10.30 clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements and prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. ASC Topic 740.10.40 provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure, and transition. We have no material uncertain tax positions for any of the reporting periods presented.

Earnings per share

Under ASC 260-10, Earnings Per Share, basic EPS excludes dilution for Common Stock equivalents and is calculated by dividing net income available to common stockholders by the weighted-average number of Common Stock outstanding for the period. Our Series B Convertible Preferred Stock is a participating security. Consequently, the two-class method of income allocation is used in determining net income available to common stockholders.

Diluted EPS is calculated by using the treasury stock method, assuming conversion of all potentially dilutive securities, such as stock options and warrants. Under this method, (i) exercise of options and warrants is assumed at the beginning of the period and shares of Common Stock are assumed to be issued, (ii) the proceeds from exercise are assumed to be used to purchase Common Stock at the average market price during the period, and (iii) the incremental shares (the difference between the number of shares assumed issued and the number of shares assumed purchased) are included in the denominator of the diluted EPS computation. The numerators and denominators used in the computations of basic and diluted EPS are presented in the following table.

-7-

SKYPEOPLE FRUIT JUICE, INC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

|

Three Months Ended March 31,

|

||||||||||

| 2012 | 2011 | |||||||||

|

NUMERATOR FOR BASIC AND DILUTED EPS

|

||||||||||

|

Net income (numerator for Diluted EPS)

|

$ | 1,919,158 | $ | 5,292,176 | ||||||

|

Net income allocated to Preferred Stock holders

|

|

69,902 |

|

192,635 | ||||||

|

Net income allocated to Common Stock holders (Basic EPS)

|

$ | 1,849,256 | $ | 5,099,541 | ||||||

|

DENOMINATORS FOR BASIC AND DILUTED EPS

|

||||||||||

|

Weighted average Common Stock outstanding

|

|

25,690,402 |

|

25,690,402 | ||||||

|

DENOMINATOR FOR BASIC EPS

|

25,690,402 | 25,690,402 | ||||||||

|

Add: Weighted average Preferred Stock, as if converted

|

971,098 | 971,098 | ||||||||

|

Add: Weighted average stock warrants outstanding

|

|

- |

|

1,099 | ||||||

|

DENOMINATOR FOR DILUTIVED EPS

|

|

26,661,500 |

|

26,662,599 | ||||||

|

EPS - Basic

|

$ | 0.07 | $ | 0.20 | ||||||

|

EPS - Diluted

|

$ | 0.07 | $ | 0.20 | ||||||

The diluted earnings per share calculation for the three months ended March 31, 2012 and 2011 did not include the warrants to purchase up to 175,000 shares of common stock, because their effect was anti-dilutive.

|

3.

|

Inventories

|

Inventories by major categories are summarized as follows:

|

|

March 31,

2012

|

|

December 31,

2011

|

||||||||

|

Raw materials and packaging

|

$ | 1,497,803 |

|

$ | 576,028 | ||||||

|

Finished goods

|

|

3,838,161 |

|

|

5,550,348 | ||||||

|

Inventories

|

$ | 5,335,964 |

|

$ | 6,126,376 | ||||||

|

4.

|

Property, Plant and Equipment

|

Property, plant and equipment consist of the following:

|

|

March 31,

2012

|

|

December 31,

2011

|

||||||||

|

Machinery and equipment

|

$ | 32,594,571 |

|

$ | 30,856,247 | ||||||

|

Furniture and office equipment

|

|

182,319 |

|

|

178,045 | ||||||

|

Motor vehicles

|

444,335 |

|

443,870 | ||||||||

|

Buildings

|

30,587,305 | 25,777,820 | |||||||||

|

Property, plant and equipment, gross

|

63,808,530 | 57,255,982 | |||||||||

|

Less: accumulated depreciation

|

(14,024,076 | ) | (12,978,754 | ) | |||||||

|

Property, plant and equipment, net

|

$ | 49,784,454 | $ | 44,277,228 | |||||||

Depreciation expense included in general and administration expenses for the three months ended March 31, 2012 and 2011 was $82,839 and $48,072, respectively. Depreciation expense included in cost of sales for the three months ended March 31, 2012 and 2011 was $577,959 and $772,181, respectively.

-8-

SKYPEOPLE FRUIT JUICE, INC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

|

5.

|

Short-term Bank Loans

|

Short-term bank loans consist of the following loans collateralized by assets of the Company:

|

March 31, 2012

|

December 31, 2011

|

|||||||

|

Loan payable to Bank of Huludao, Suizhong branch due on June 22, 2012, bearing interest at 10.727% per annum, collateralized by the buildings, machinery and land usage rights of Huludao Wonder

|

$ | 5,290,501 | $ | 5,284,959 | ||||

|

Loan payable to Bank of Chongqing, due on March 20, 2013, bearing interest at 8.528% per annum, collateralized by the buildings and land usage rights of SkyPeople (China).

|

3,177,478 | - | ||||||

|

Loan payable to China Construction Bank due on February 4, 2012, bearing interest at 4.4794% per annum, collateralized by certain accounts receivable of SkyPeople (China) This loan was paid off in January 2012

|

- | 420,387 | ||||||

|

Loan payable to China Citic Bank due on February 3, 2012, bearing interest at 4.19465% per annum, collateralized by certain accounts receivable of SkyPeople (China) This loan was paid off by February 2012

|

- | 720,367 | ||||||

|

Total

|

$ | 8,467,979 | $ | 6,425,713 | ||||

|

6.

|

Commitments and Contingencies

|

On April 20, 2011, plaintiff Paul Kubala (on behalf of his minor child N.K.) filed a securities fraud class action lawsuit in the United States District Court, Southern District of New York against the Company, certain of its individual officers and/or directors, Yongke Xue and Xiaoqin Yan, and Rodman & Renshaw, LLC, the underwriter of the Company’s follow-on public offering consummated in August 2010, alleging violations of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 promulgated thereunder. On June 20, 2011, plaintiff Benjamin Padnos filed a securities fraud class action lawsuit in the United States District Court, Southern District of New York against the Company, all of its individual officers and/or directors, Yongke Xue, Xiaoqin Yan, Norman Ko, John W. Smagula, Spring Liu, Child Van Wagner & Bradshaw, PLLC, BDO Limited and Rodman & Renshaw, LLC, the underwriter of the Company’s follow-on public offering consummated in August 2010, alleging violations of Sections10(b) and 20(a) of the Exchange Act and Rule 10b-5 promulgated thereunder. On August 30, 2011, the court consolidated the foregoing two actions and appointed Zachary Lewy as lead plaintiff. On September 30, 2011, pursuant to the Court’s order, Lead Plaintiff filed a consolidated complaint, which names the Company, Rodman & Renshaw, LLC, BDO Limited, Child Van Wagoner & Bradshaw PLLC and certain of the Company’s current and former directors and majority shareholders as defendants and alleges violations of Section 11 and 12 of the Securities Act of 1933 and Section 10(b) and 20(a) of the Exchange Act, and the rules promulgated thereunder. In the consolidated complaint, the plaintiffs are seeking to be awarded, among other things, compensatory damages, reasonable costs and expenses incurred in the action. On May 3, 2012, Lead Plaintiff voluntarily dismissed the claims against BDO Limited and Child Van Wagoner & Bradshaw PLLC. We believe the allegations against the Company are baseless and are contesting the case vigorously. In this regard, the Company has filed a motion to dismiss the consolidated complaint, which is currently under submission. The company believes the suit is without merit and is vigorously defending its position and has made no accrual for any potential contingencies.

-9-

SKYPEOPLE FRUIT JUICE, INC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

On August 5, 2011, we received a shareholder demand letter from counsel for a purported shareholder. The letter is addressed to the Company’s Board of Directors and requests the Board of Directors take a number of actions in order to repair the alleged “harm” caused to the Company by certain of its directors and officers, as well as its current and former auditors. The Board of Directors is currently reviewing this shareholder demand letter and considering appropriate action that the Company should undertake. On November 7, 2011, two directors were appointed to serve as directors of the board and the independent directors of the board appointed these directors to serve as the members of the evaluation committee. The evaluation committee is expected to evaluate the actions demanded by the shareholder. The evaluation committee is in the process of retaining counsel to respond to the shareholder inquiry. No formal shareholder derivative complaint has been filed to date on behalf of us. The company believes the suit is without merit and is vigorously defending its position and has made no accrual for any potential contingencies.

On July 8, 2011, we brought suit against Absaroka Capital Management, LLC (“Absaroka”) and its principal Kevin Barnes in the U.S. District Court of Wyoming under the caption SkyPeople, Inc. v. Absaroka Capital Management, LLC, et al., No. 11-cv-238. Absaroka is a purported independent investment analyst who, while holding a short position in our stock, issued a so-called research report asserting, inter alia, that we had inflated revenues. We brought suit alleging three causes of action for libel per se, libel per quod and intentional interference with a prospective business relationship. In or around November, 2011, Absaroka and Barnes brought counter claims against us for defamation per se, defamation per quod and abuse of process. The matter is currently in discovery. The company believes the suit is without merit and is vigorously defending its position and has made no accrual for any potential contingencies.

Other than the above, from time to time we may be a party to various litigation proceedings arising in the ordinary course of our business, none of which, in the opinion of management, is likely to have a material adverse effect on our financial condition or results of operations.

|

7.

|

Concentrations

|

|

(1)

|

Concentration of customers

|

Sales to five largest customers accounted for approximately 28% and 29% of our net sales during the three months ended March 31, 2012 and 2011, respectively. There was no single customer represented over 10% of total sales for the three months ended March 31, 2012. Sales to one customer accounted for 10% of total sales for the three months ended March 31, 2011.

The Company has not experienced any significant difficulty in collecting its accounts receivable in the past and is not aware of any financial difficulties being experienced by its major customers. There was no bad debt expense during the three months ended March 31, 2012 and 2011, respectively.

-10-

SKYPEOPLE FRUIT JUICE, INC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

|

8.

|

Segment Reporting

|

The Company operates in six segments: concentrated apple juice and apple aroma, concentrated kiwifruit juice and kiwifruit puree, concentrated pear juice, fruit juice beverages and fresh fruits and vegetables, and others. Our concentrated apple juice and apple aroma is primarily produced by the Company’s Huludao Wonder factory; concentrated pear juice is primarily produced by the Company’s Jingyang factory. However, as the Company use the same production line to manufacture concentrated apple juice and concentrated pear juice. In addition, both Shaanxi Province, where the factory of Jingyang factory is located, and Liaoning Province, where the factory of Huludao Wonder is located, are rich in fresh apple and pear supplies, Jingyang factory also produces concentrated apple juice and Huludao Wonder factory also produces concentrated pear juice when necessary. Concentrated kiwifruit juice and kiwifruit puree is primarily produced by the Company’s Qiyiwangguo factory, and fruit juice beverages is primarily produced by the Company’s Qiyiwangguo factory. The Company’s other products include fructose, concentrated turnjujube juice, and other by products, such as kiwifruit seeds.

Concentrated fruit juice is used as a basic ingredient for manufacturing juice drinks and as an additive to fruit wine and fruit jam, cosmetics and medicines. The Company sells its concentrated fruit juice to domestic customers and exported directly or via distributors. The Company believes that its main export markets are the United States, the European Union, South Korea, Russia and the Middle East to North America, Europe, Russia, South Korea and the Middle East. The Company sells its Hedetang branded bottled fruit beverages domestically primarily to supermarkets in the PRC. The Company sells its fresh fruit and vegetables to supermarkets and whole sellers in the PRC.

Some of these product segments might never individually meet the quantitative thresholds for determining reportable segments and we determine the reportable segments based on the discrete financial information provided to the chief operating decision maker. The chief operating decision maker evaluates the results of each segment in assessing performance and allocating resources among the segments. Since there is an overlap of services provided and products manufactured between different subsidiaries of the Company, the Company does not allocate operating expenses and assets based on the product segments. Therefore, operating expenses and assets information by segment are not presented. Segment profit represents the gross profit of each reportable segment.

-11-

SKYPEOPLE FRUIT JUICE, INC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

|

For the Three Months Ended March 31, 2012

|

Concentrated apple juice and apple aroma

|

Concentrated kiwifruit juice and kiwifruit puree

|

Concentrated pear juice

|

Fruit juice beverages

|

Fresh fruits and vegetables

|

Others

|

Total

|

|||||||||||||||||||||

|

Reportable segment revenue

|

$ | 3,226 | $ | 3,952 | $ | 4,829 | $ | 3,370 | $ | 588 | $ | - | $ | 15,965 | ||||||||||||||

|

Inter-segment revenue

|

(718 | ) | (191 | ) | (62 | ) | - | - | - | (971 | ) | |||||||||||||||||

|

Revenue from external customers

|

2,508 | 3,761 | 4,767 | 3,370 | 588 | - | 14,994 | |||||||||||||||||||||

|

Segment gross profit

|

$ | 414 | $ | 1,687 | $ | 1,534 | $ | 855 | $ | 296 | $ | - | $ | 4,786 | ||||||||||||||

|

For the Three Months Ended March 31, 2011

|

Concentrated apple juice and apple aroma

|

Concentrated kiwifruit juice and kiwifruit puree

|

Concentrated pear juice

|

Fruit juice beverages

|

Fresh fruits and vegetables

|

Others

|

Total

|

|||||||||||||||||||||

|

Reportable segment revenue

|

$ | 3,734 | $ | 3,158 | $ | 4,047 | $ | 7,277 | $ | 1,458 | $ | - | $ | 19,674 | ||||||||||||||

|

Inter-segment revenue

|

(61 | ) | (173 | ) | (25 | ) | - | - | - | (259 | ) | |||||||||||||||||

|

Revenue from external customers

|

3,673 | 2,985 | 4,022 | 7,277 | 1,458 | - | 19,415 | |||||||||||||||||||||

|

Segment gross profit

|

$ | 1,082 | $ | 1,587 | $ | 1,221 | $ | 3,946 | $ | 770 | $ | - | $ | 8,606 | ||||||||||||||

The following table reconciles reportable segment profit to the Company’s condensed consolidated income before income tax provision for the three months ended March 31, 2012 and 2011:

|

2012

|

2011

|

|||||||

|

Segment profit

|

$ | 4,785,999 | $ | 8,605,558 | ||||

|

Unallocated amounts:

|

||||||||

|

Operating expenses

|

2,145,623 | 1,407,301 | ||||||

|

Other (income)/expenses

|

(347,413 | ) | (392,551 | ) | ||||

|

Income before tax provision

|

$ | 2,987,789 | $ | 7,590,808 | ||||

|

9.

|

Subsequent Events

|

Our former Chief Financial Officer resigned on April 30, 2012, and was replaced by the former Vice President of the Company.

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

The following discussion should be read in conjunction with the Financial Statements and Notes thereto appearing elsewhere in this Form 10-Q.

DISCLAIMER REGARDING FORWARD-LOOKING STATEMENTS

The following discussion and analysis of the condensed consolidated financial condition and results of operations should be read in conjunction with the condensed consolidated financial statements and notes in Item I above and with the audited consolidated financial statements and notes, and with the information under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Annual Report on Form 10-K. This discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results could differ materially from the results described in or implied by these forward-looking statements as a result of various factors, including those discussed in this report and under the heading “Risk Factors” in our most recent Annual Report on Form 10-K.

Overview of Our Business

We are engaged in the production and sales of fruit juice concentrates (including fruit purees, concentrated fruit purees and concentrated fruit juices), fruit beverages (including fruit juice beverages and fruit cider beverages), and other fruit related products (including organic and non-organic fresh fruits) in and from the PRC. Our fruit juice concentrates, which include apple, pear and kiwifruit concentrates, are sold to domestic customers and exported directly or via distributors. We sell our Hedetang branded bottled fruit beverages domestically primarily to supermarkets in the PRC. For the three months ended March 31, 2012, sales of our fruit concentrates, fruit beverages, fresh fruits and other fruit related products represented 74%, 23% and 3% of our revenue, respectively, compared to 55%, 38% and 7%, respectively, for the same period of 2011.

We export our products as well as sell them domestically. We sell our products either through distributors with good credit or to end users directly. We believe that our main export markets are the United States, the European Union, South Korea, Russia and the Middle East. We sell our Hedetang brand bottled fruit beverages domestically, primarily to supermarkets in the PRC. We sell our other fruit related products to domestic customers.

We currently market our Hedetang brand fruit beverages in only certain regions of the PRC. We plan to expand the market presence of Hedetang over a broader geographic area in the PRC. In particular, we plan to expand our glass bottle production line to produce higher margin portable fruit juice beverages targeting consumers in more populated Chinese cities. Currently we produce six flavors of fruit beverages in 280 ml glass bottles and 500 ml glass bottles, including apple juice, pear juice, kiwifruit juice, mulberry juice, kiwifruit cider and mulberry cider. We currently sell our fruit beverages to distributors and retail stores in approximately 12 provinces, and our direct sales to the retail stores amounted to $1,176,133 in aggregate for the quarter ended March 31, 2012. Our products are sold through distributors in stores such as 14 Wal-Mart stores in Beijing, 6 Wal-Mart stores in Xi’an and 23 Carrefour in Shanghai.

We plan to continue to focus on creating new products with high margins to supplement our current product offering.

We believe that continuous investment in research and development is a key component to be a leader with respect to the quality of fruit juice concentrates and fruit beverages. As of March 31, 2012, we had an internal research and development team of approximately 40 employees, and we retained external experts and research institutions for additional consultation when necessary. In three months ended March 31, 2012 and 2011, our research and development expenses were $142,685 and $136,467, respectively.

Our business is highly seasonal and can be greatly affected by weather because of the seasonal nature in the growing and harvesting of fruits and vegetables. Our core products are apple, pear and kiwifruit juice concentrates, which are produced from July or August to April of the following year. The squeezing season for apples is from August to January or February of the following year, the squeezing season for pears is from July or August until April of next year, the squeezing season for kiwifruit is from September through December each year. Typically, a substantial portion of our revenues is earned during our first and fourth quarters. To minimize the seasonality of our business, we make continued efforts in identifying new products with harvesting seasons complementary to our current product mix. Our goal is to lengthen our squeezing season, thus increase our annual production of fruit juice concentrates and fruit beverages. In the first quarter of 2009, we introduced mulberry and kiwifruit cider beverages in the Chinese market. Unlike fruit juice concentrates, which can only be produced during the squeezing season, such fruit beverages are made out of fruit juice concentrates and can be produced and sold throughout the year. With continuous efforts in marketing our beverages in the domestic market, we expect that impact of our production seasonality to be reduced.

Fresh fruits are the primary raw materials needed for the production of our products. Our raw materials mainly consist of apples, pears and kiwifruits. Other raw materials used in our business include pectic enzyme, amylase, auxiliary power fuels and other power sources such as coal, electricity and water.

We purchase raw materials from local markets and fruit growers that deliver directly to our plants. We have implemented a fruit-purchasing program in areas surrounding our factories. In addition, we organize purchasing centers in rich fruit production areas, helping farmers deliver fruits to our purchasing agents easily and in a timely manner. We are then able to deliver the fruits directly to our factory for production. We have assisted local farmers in their development of kiwifruit fields to help ensure high quality products throughout the production channel. Our raw material supply chain is highly fragmented and raw fruit prices are highly volatile in China. Fruit concentrate and fruit juice beverage companies generally do not enter into purchasing agreements. In addition to raw materials, we purchase various ingredients and packaging materials such as sweeteners, glass and plastic bottles, cans and packing barrels. We generally purchase our materials or supplies from multiple suppliers. We are not dependent on any one supplier or group of suppliers.

Shaanxi and Liaoning Provinces, where our manufacturing facilities are located, are large fruit producing provinces. We own and operate four manufacturing facilities in the PRC, all of which are strategically located near fruit growing centers so that we can better preserve the freshness of the fruits and lower our transportation costs. To take advantage of economies of scale and to enhance our production efficiency, generally, each of our manufacturing facilities focuses on certain products made from one particular fruit according to the proximity of such manufacturing to the sources of that fruit supply Our kiwifruit processing facilities are located in Zhouzhi County of Shaanxi Province, which has the largest planting area of apples and kiwifruits in the PRC. Our pear processing facilities are located in Shaanxi Province, which is the main pear-producing province in the PRC. Our apple processing facilities are located in Liaoning Province, a region that abounds with high acidity apples. As we use the same production line for both concentrated apple juices and concentrated pears juice and both Shaanxi Province and Liaoning Province are rich in production of fresh apples and pears, our Liaoning facilities also produce concentrated apple juices and our Shaanxi Province facilities also produce concentrated apple juices depending on customers’ needs. We believe that these regions provide adequate supply of raw materials for our production needs in the foreseeable future.

On August 30, 2010, we closed the public offering of 5,181,285 shares of our Common Stock at a price of $5.00 per share for approximately $25.9 million. We received an aggregate of approximately $24 million as net proceeds after deducting underwriting discounts and commissions and offering expenses. As of March 31, 2012, we had spent approximately $11 million on various capital projects in Huludao Wonder as described in projects (4) and (5) below. We set forth below the capital projects on which we currently plan to use the proceeds from this offering. We review these projects and capital expenditures on a quarterly basis based on the market conditions and associated costs of these projects.

Huludao Wonder Projects

|

Subsidiary

|

No.

|

Priority Projects

|

Progress

|

Estimated capital expenditure

(in Millions)

|

|||||||

|

Huludao Wonder

|

(1) |

Construction of a refrigeration storage unit for the storage of concentrated fruit juices and fresh fruits and vegetables

|

The design of the facility has been completed.

Construction has been delayed due to change of plan. New plan is to build such refrigeration storage unit in a new location in a Suizhong of Liaoning province.

The Company is now in the progress of evaluating the changes to the plan and in negotiation with local government to acquire land usage right of block of land of the new location.

It is expected that the construction of such refrigeration storage will start in the second quarter of 2012.

|

$ | 2.7 | ||||||

|

Huludao Wonder

|

(2) |

Construction of concentrated fruit juice mixing center

|

The design of the facility has been completed.

It is expected that construction of such mixing center will start in the second quarter of 2012.

|

1.9 | |||||||

|

Huludao Wonder

|

(3) |

Construction of a 30 ton/hour comprehensive fruits and vegetables processing line

|

Construction delayed due to extreme weather condition.

It is expected construction work will start in the second quarter of 2012.

|

3 | |||||||

|

Huludao Wonder

|

(4) |

Construction of a fruit juice beverage production line of 6,000 bottles/hour

|

The construction of such production line has been substantially finished. Trail operation of the new production line has been conducted. On April 25, 2012, “China Food Production License” for production of Beverage (including fruit juice and vegetable juice) has been granted to Huludao Wonder by Liaoning Bureau of Quality and Technical Supervision. Huludao Wonder commenced operation of this new production line on April 28, 2012.

|

3 | |||||||

|

Huludao Wonder

|

(5) |

Environmental project (waste water treatment facility for concentrated apple juice production line)

|

The construction of such environmental project has been substantially finished.

|

8 | |||||||

|

Total Capital Expenditure

|

$ | 18.6 | |||||||||

|

(1)

|

Our initial plan was to construct both the refrigeration storage (see (1) above) and fruit juice mixing center (see (2) above) in Huludao Wonder, for which original estimation of total capital expenditure was $4.4 million. We initially planned to start the construction of the refrigeration storage unit for the storage of concentrated fruit juices and fresh fruits and vegetables and a concentrated fruit juice-mixing center in the fourth quarter of 2011. However, the construction of refrigeration storage unit has been delayed due to a change of plan. Management concluded that it is in the best interest of the Company to build the refrigeration storage unit in Suizhong, Liaoning Province. The total estimated capital expenditure for (1) and (2) based on the changed plan would be $4.6 million. The Company is now in the process of evaluating the new plan and in negotiation with the local government to acquire land usage right for the new location. If the Company is able to acquire the land use right at terms acceptable to the Company, it is expected that the construction of such refrigeration storage would start during the second quarter of 2012.

|

|

(2)

|

The fruit juice-mixing center will be built in Huludao Wonder. The design of the fruit juice-mixing center has been completed. It is expected that construction of such mixing center would start in the second quarter of 2012.

|

|

(3)

|

Our initial plan was to construct a 50 ton/hour concentrated apple juice production line in Huludao Wonder. On March 27, 2011, the National Development and Reform Commission and the relevant departments of the State Council of the PRC amended the Catalogue of Industry Structure Adjustment issued in 2005 and released the Catalogue of Industry Structure Adjustment for 2011 (the “New Catalogue”), which was effective on June 1, 2011. In the New Catalogue, concentrated apple juice business is classified in the category of Restricted Industry, which means that the government may restrict the expansion of this industry by, among other things, putting limitations on the increase in production capacity, increasing the product quality standard, reducing government financial support. We expect the restrictions under the New Catalogue will reduce government financial support of concentrated apple juice businesses and have a negative impact on the future expansion and development of our concentrated apple juice segment. Considering the government potential restriction on the approval of increase in the production capacity of concentrated apple juice, we decided to cancel our original plan for the construction of a 50 ton/hour concentrated apple juice line, which we previously estimated to use up to $10.7 million of the proceeds generated from our public financing consummated in August 2010. We are currently considering other different potential projects for our Huludao Wonder factory. In addition, to minimize the potential negative impact of the new regulation, we planned to change our existing 30 ton/hour concentrated apple juice line into a 30 ton/hour comprehensive fruits and vegetables processing line by adding additional equipment and machinery. The 30 ton/hour comprehensive fruits and vegetables processing line is expected to process a variety of fruits and vegetables (including apple, pear, and other fruits and vegetables) into juices. The estimated investment for this project is $3.0 million. We believe that this project could provide us more flexibility. Due to extreme weather conditions, the construction of this 30 ton/hour comprehensive fruits and vegetables processing line has been delayed. It is expected that construction of the project would start in the second quarter of 2012.

|

|

(4)

|

We started the construction of infrastructure for the fruit juice beverage production line on September 28, 2010. The construction of a fruit juice beverage production line with maximum production capacity of 6,000 bottles per hour has been substantially finished. Trail operation of the new production line has been conducted. On April 25, 2012, “China Food Production License” for production of Beverage (including fruit juice and vegetable juice) has been granted to Huludao Wonder by Liaoning Bureau of Quality and Technical Supervision. Huludao Wonder commenced operation of this new production line on April 28, 2012.

|

|

(5)

|

The environmental project mainly consists of a wastewater processing facility that is required in our production of fruit and vegetable juice concentrates. The construction of environmental project (waste water treatment facility for concentrated apple juice production line) has been substantially finished.

|

Shaanxi Qiyiwangguo Projects

We previously identified several projects for our Shaanxi Qiyiwangguo factory, which we expected to finance by using our operating cash flow. These projects included a 24,000 PET bottle/hour fruit juice beverage aseptic cold-filling line, and a PET bottle blowing machine system. Based on the current market conditions and other potential opportunities, management has decided to delay these projects to a future date when appropriate.

Other Projects

We added another 20 tons per hour concentrated pear juice production line in production facility in Jingyang Branch Office of SkyPeople (China) by using the cash generated from operating cash flows. As of December 31, 2011, the construction of such production line had been completed. We have started operation of the new production line. The Company invested approximately $7.6 million in this project, including $4.4 million in purchasing machinery and equipment and $3.2 million in construction of the project.

Results of Operations

Comparison of Three Months ended March 31, 2012 and 2011:

Revenue

The following table presents our consolidated revenues for each of our main products for the three months ended March 31, 2012 and 2011, respectively (in thousands):

|

Three month ended March 31,

|

Change

|

|||||||||||||||

|

2012

|

2011

|

Amount

|

%

|

|||||||||||||

|

Concentrated apple juice and apple aroma

|

$ | 2,508 | $ | 3,673 | $ | (1,165 | ) | $ | (32 | %) | ||||||

|

Concentrated kiwifruit juice and kiwifruit puree

|

3,761 | 2,985 | 776 | 26 | % | |||||||||||

|

Concentrated pear juice

|

4,767 | 4,022 | 745 | 19 | % | |||||||||||

|

Fruit juice beverages

|

3,370 | 7,277 | (3,907 | ) | (54 | %) | ||||||||||

|

Fresh fruits and vegetables

|

588 | 1,458 | (870 | ) | (60 | %) | ||||||||||

|

Total

|

$ | 14,994 | $ | 19,415 | $ | (4,421 | ) | $ | (23 | %) | ||||||

Our gross revenue for the three months ended March 31, 2012 was $15.0 million, a decrease of $4.4 million, or 23%, from $19.4 million for the same period of 2011. This decrease was primarily due to a decrease in sales of concentrated apple juice, fruit juice beverages, as well as fresh fruits and vegetable, which was partially offset by an increase in revenue generated from sales of the concentrated pear juice, kiwi juice and kiwi puree.

Sales from apple related products decreased by $1.2 million, or 32%, to $2.5 million for the three months ended March 31, 2012, from $3.7 million for the same period of 2011. During the first quarter of 2012, the Company sold approximately 1,200 tons of concentrated apple juice, a 43% decrease from 2,100 tons of concentrated apple juice sold in the same period of 2011. Such decrease was partially offset by an increase in unit price of concentrated apple juice.

Sales of concentrated pear juice increased to $4.8 million in the first quarter of 2012, an increase of $0.8 million, or 19%, from $4.0 million in the same quarter of 2011. During the first quarter of 2012, the unit selling price of concentrated pear juice increased, which was partially offset by an 18% decrease of the quantity of pear juice sold. The Company sold approximately 2,800 tons and 3,400 tons, respectively, of pear juice during first quarter of 2012 and 2011.

Sales from concentrated kiwifruit juice and kiwifruit puree were $3.8 million for the first quarter of 2012, an increase of $0.8 million, or 26%, from $3.0 million in the same quarter of 2011, primarily due to a 19% increase in the quantity of concentrated kiwifruit puree sold in the first quarter of 2012 compared to that in the same quarter of 2011 as well as an increase in unit selling price.

Revenue from our fruit juice beverages in the PRC decreased to $3.4 million, a decrease of $3.9 million or 54%, from $7.3 million for the same period of 2011, primarily due to the downward adjustment of the price of our beverage products in order to improve our competitiveness and to gain more market shares.

Revenue from our fresh fruits and vegetables in the PRC decreased to $0.6 million, a decrease of $0.9 million or 60%, from $1.5 million for the same period of 2011, primarily due to a decrease in the sales volume of the fresh fruits as well as a decrease in the unit price of the fresh fruits in the first quarter of 2012 compared to those in the same period of 2011.

Gross Margin

The following table presents the consolidated gross profit of each of our main products and the consolidated gross profit margin, which is gross profit as a percentage of the related revenues, for the three months ended March 31, 2012 and 2011, respectively (in thousands for the gross profit):

|

2012

|

2011

|

|||||||||||||||

|

Gross

profit

|

Gross

margin

|

Gross

profit

|

Gross

margin

|

|||||||||||||

|

Concentrated apple juice

and apple aroma

|

$ | 414 | 16 | % | $ | 1,082 | 29 | % | ||||||||

|

Concentrated kiwifruit

juice and kiwifruit puree

|

1,687 | 45 | % | 1,587 | 53 | % | ||||||||||

|

Concentrated pear juice

|

1,534 | 32 | % | 1,221 | 30 | % | ||||||||||

|

Fruit juice beverages

|

855 | 25 | % | 3,946 | 54 | % | ||||||||||

|

Fresh fruits and vegetables

|

296 | 50 | % | 770 | 53 | % | ||||||||||

|

Total/Overall (for gross margin)

|

$ | 4,786 | 32 | % | $ | 8,606 | 44 | % | ||||||||

The consolidated gross profit for the three months ended March 31, 2012 was $4.8 million, a decrease of $3.8 million, or 44%, from $8.6 million for the same period of 2011, primarily due to a decrease in revenue and reduced overall gross profit margin.

The consolidated gross profit margin for the three months ended March 31, 2012 was 32%, a decrease of 12%, from 44% for the same period of 2011, primarily due to a decrease in gross margin of all of the product lines, except concentrated pear juice, which has increased slightly.

The gross margin of concentrated the apple juice and apple aroma decreased to 16% for the three months ended March 31, 2012 from 29% for the same period of 2011, the company did not produce any apple juice during first quarter of 2012. Cost of goods sold was from last year’s inventory.

The gross profit margin of the concentrated kiwifruit juice and kiwifruit puree decreased from 53% for the three months ended March 31, 2011 to 45% for the same period of 2012, primarily due to the higher price of the fresh kiwi in three months ended March 31, 2012 as compared to the same period of 2011.

The gross margin of the concentrated pear juice increased slightly from 30% to 32%.

The gross profit margin of our fruit juice beverages decreased from 54% for the three months ended March 31, 2011, to 25% for the same period of 2012, primarily due to the Company’s downward adjustment to the price of our beverage products aiming to improve our competitiveness and gain more market shares.

Gross margin for the fruits and vegetables was 53% for the first quarter of 2011, similar to the gross profit margin of 50% for the same period of 2012.

Operating Expenses

The following table presents our consolidated operating expenses and operating expenses as a percentage of revenue for the three months ended March 31, 2012 and 2011, respectively:

|

Three Months Ended March 31,

|

||||||||||||||

|

2012

|

2011

|

Change

|

||||||||||||

|

Amount

|

% of revenue

|

Amount

|

% of revenue

|

Amount

|

%

|

|||||||||

|

General and administrative expenses

|

$

|

1,477,604

|

10%

|

$

|

816,160

|

4%

|

$ |

661,444

|

81%

|

|||||

|

Selling expenses

|

525,334

|

4%

|

454,674

|

2%

|

70,660

|

16%

|

||||||||

|

Research and development expenses

|

142,685

|

1%

|

136,467

|

1%

|

6,218

|

5%

|

||||||||

|

Total operating expenses

|

$

|

2,145,623

|

15%

|

$

|

1,407,301

|

7%

|

$ |

738,322

|

52%

|

|||||

Our operating expenses consist of general and administrative expenses, selling expenses and research and development expenses. Operating expenses increased by 52% to $2.1 million for the three months ended March 31, 2012, from $1.4 million for the corresponding period in 2011.

General and administrative expenses increased by $661,444, or 81%, to $1,477,604 for the three months ended March 31, 2012, from $816,160 for the same period of 2011. The increase in general and administrative expenses was mainly due to an increase in legal fees related to our current pending litigations, payroll and related expenses as the result of an increased in our employees to handle the increased general and administrative work.

Selling expenses increased by $70,660, or 16%, to $525,334 for the three months ended March 31, 2012 from $454,674 for the same period of 2011, mainly due to an increase in the payroll and related expenses as a result of an increase in our headcounts to the handle the increased sales work.

Research and development expenses increased by $6,218, or 5%, to $142,685 for the three months ended March 31, 2012, from $136,467 for the same periods of fiscal 2011.

Income from Operations

Income from operations decreased to $2,640,376 million, a decrease of 63% or $4,557,881, for the three months ended March 31, 2012 from $7,198,257 for the same period of 2011. The decrease in the income from operations was mainly due to a decrease in both revenue as well as gross margin and increase in the operating expenses.

Other Income (Expense), Net

Other income, net was $347,413 for the three months ended March 31, 2012, a decrease of $45,138 or 11% from other income of $392,551 in the same period of 2011, primarily due to a decrease of $49,563 or 10% in the subsidy income and $6,623 or 9% decrease in the interest income. The subsidy income was provided with respect to the value added tax rebates on our exports in the first quarters of 2012 and 2011.

Income Tax

Our provision for income taxes was $928,380 and $1,929,808 for the three months ended March 31, 2012 and 2011, respectively, a decrease of $1,001,428, or 52%. The decrease in tax provision was due to less income before taxes in the first quarter of 2012. Our consolidated income tax rates were 31% and 25% for the three months ended March 31, 2012 and 2011, respectively.

Net Income

Net income was $2,059,409 for the three months ended March 31, 2012, a decrease of $3,601,591, or 64%, from $5,661,000 for same period of 2011, primarily due to the decreased revenue and the increase in operating expenses, as previously discussed.

Noncontrolling Interests

As of March 31, 2012, SkyPeople (China) held a 91.15% interest in Shaanxi Qiyiwangguo and Pacific held a 99.78% interest in SkyPeople (China). Net income attributable to noncontrolling interests, which is deducted from our net income, was $140,251 and $368,824 for the three months ended March 31, 2012 and 2011, respectively. The decrease in the net income attributable to noncontrolling interests was mainly due to the decrease in the net income generated from SkyPeople (China).

Net Income Attributable to SkyPeople Fruit Juice, Inc.

Net income attributable to the Company was $1,919,158 for the three months ended March 31, 2012, a $3,373,018 million or 64% decrease from $5,292,176 for the same period of 2011 for the reasons described above.

Liquidity and Capital Resources

As of March 31, 2012, we had cash, cash equivalents and restricted cash of $76,713,489, an increase of $15,559,482, or 25%, from $61,154,007 as of December 31, 2011. We expect the projected cash flows from operation, anticipated cash receipts, cash on hand, and trade credit to provide necessary capital to meet our projected operating cash requirements at least for the next 12 months, which does not take into account any potential expenditures related to the potential expansion of our current production capacity. Our restricted cash of $31,775 is used as collateral to obtain a short-term note payable.

Our working capital has historically been generated from our operating cash flows, advances from our customers and loans from bank facilities. Our working capital was $89,452,555 as of March 31, 2012, an increase of $1,897,046, from working capital of $87,555,509 as of December 31, 2011, mainly due to an increase in cash. During the first quarter of 2012, our operating activities generated net cash inflow of $14,765,513, an increase of $1,156,970 or 8.5%from $13,608,543, net cash inflow from operating activities of same period of 2011.

During the three months ended March 31, 2012, our investing activities used net cash of $1,334,229, including $1,320,608 of additions to property, plant and equipment.

During the three months ended March 31, 2012, our financing activities generated net cash inflow of $2,031,301, as compare to $2,486,808 in the same period of 2011. During the first quarter of 2012, $1,139,578 was paid for our short-term bank loans and $3,170,879 was generated through short-term bank loans; and in the same period of 2011, $2,486,808 was generated through short-term bank loans.

Off-balance sheet arrangements

As of March 31, 2012, we did not have any off-balance sheet arrangements.

|

Item 3.

|

Quantitative and Qualitative Disclosures about Market Risk

|

Not applicable.

|

Item 4.

|

Controls and Procedures

|

Disclosure Controls and Procedures

An evaluation was carried out by the Company’s Chief Executive Officer and Chief Financial Officer of the effectiveness of the Company’s disclosure controls and procedures (as defined in Rule 13a-15(e) or 15d-15(e) under the Securities Exchange Act of 1934, as amended) as of March 31, 2012, the end of the period covered by this Quarterly Report on Form 10-Q. Management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives and management necessarily applies its judgment in evaluating the cost-benefit relationship of possible controls and procedures. Based upon that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that as of March 31, 2012, and as of the date that the evaluation of the effectiveness of our disclosure controls and procedures were completed, our disclosure controls and procedures were effective in providing reasonable assurance of achieving their objectives for the three months ended March 31, 2012.

Changes in Internal Controls Over Financial Reporting

There have been no changes to the Company’s internal control over financial reporting during the three months ended March 31, 2012 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

|

PART II.

|

OTHER INFORMATION

|

|

Item 1.

|

Legal Proceedings

|

On April 20, 2011, plaintiff Paul Kubala (on behalf of his minor child N.K.) filed a securities fraud class action lawsuit in the United States District Court, Southern District of New York against the Company, certain of its individual officers and/or directors, Yongke Xue and Xiaoqin Yan, and Rodman & Renshaw, LLC, the underwriter of the Company’s follow-on public offering consummated in August 2010, alleging violations of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 promulgated thereunder. On June 20, 2011, plaintiff Benjamin Padnos filed a securities fraud class action lawsuit in the United States District Court, Southern District of New York against the Company, all of its individual officers and/or directors, Yongke Xue, Xiaoqin Yan, Norman Ko, John W. Smagula, Spring Liu, Child Van Wagner & Bradshaw, PLLC, BDO Limited and Rodman & Renshaw, LLC, the underwriter of the Company’s follow-on public offering consummated in August 2010, alleging violations of Sections10(b) and 20(a) of the Exchange Act and Rule 10b-5 promulgated thereunder. On August 30, 2011, the court consolidated the foregoing two actions and appointed Zachary Lewy as lead plaintiff. On September 30, 2011, pursuant to the Court’s order, Lead Plaintiff filed a consolidated complaint, which names the Company, Rodman & Renshaw, LLC, BDO Limited, Child Van Wagoner & Bradshaw PLLC and certain of the Company’s current and former directors and majority shareholders as defendants and alleges violations of Section 11 and 12 of the Securities Act of 1933 and Section 10(b) and 20(a) of the Exchange Act, and the rules promulgated thereunder. In the consolidated complaint, the plaintiffs are seeking to be awarded, among other things, compensatory damages, reasonable costs and expenses incurred in the action. On May 3, 2012, Lead Plaintiff voluntarily dismissed the claims against BDO Limited and Child Van Wagoner & Bradshaw PLLC. We believe the allegations against the Company are baseless and are contesting the case vigorously. In this regard, the Company has filed a motion to dismiss the consolidated complaint, which is currently under submission. The company believes the suit is without merit and is vigorously defending its position and has made no accrual for any potential contingencies.

On August 5, 2011, we received a shareholder demand letter from counsel for a purported shareholder. The letter is addressed to the Company’s Board of Directors and requests the Board of Directors take a number of actions in order to repair the alleged “harm” caused to the Company by certain of its directors and officers, as well as its current and former auditors. The Board of Directors is currently reviewing this shareholder demand letter and considering appropriate action that the Company should undertake. On November 7, 2011, two directors were appointed to serve as directors of the board and the independent directors of the board appointed these directors to serve as the members of the evaluation committee. The evaluation committee is expected to evaluate the actions demanded by the shareholder. The evaluation committee is in the process of retaining counsel to respond to the shareholder inquiry. No formal shareholder derivative complaint has been filed to date on behalf of us. The company believes the suit is without merit and is vigorously defending its position and has made no accrual for any potential contingencies.

On July 8, 2011, we brought suit against Absaroka Capital Management, LLC (“Absaroka”) and its principal Kevin Barnes in the U.S. District Court of Wyoming under the caption SkyPeople, Inc. v. Absaroka Capital Management, LLC, et al., No. 11-cv-238. Absaroka is a purported independent investment analyst who, while holding a short position in our stock, issued a so-called research report asserting, inter alia, that we had inflated revenues. We brought suit alleging three causes of action for libel per se, libel per quod and intentional interference with a prospective business relationship. In or around November, 2011, Absaroka and Barnes brought counter claims against us for defamation per se, defamation per quod and abuse of process. The matter is currently in discovery. The company believes the suit is without merit and is vigorously defending its position and has made no accrual for any potential contingencies.

Other than the above, from time to time we may be a party to various litigation proceedings arising in the ordinary course of our business, none of which, in the opinion of management, is likely to have a material adverse effect on our financial condition or results of operations.

|

Item 1A.

|

Risk Factors

|

Not applicable.

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

None.

|

Item 3.

|

Defaults upon Senior Securities

|

None.

|

Item 4.

|

(Removed and Reserved)

|

Not applicable.

|

Item 5.

|

Other Information

|

None.

|

Item 6.

|

|

Exhibit No.

|

Description

|

|

31.1

|

Certification of Principal Executive Officer pursuant to Rule 13a-14(a) and Rule15d-14(a) of the Securities Exchange Act of 1934, as amended*

|

|

31.2

|

Certification of Principal Financial Officer pursuant to Rule 13a-14(a) and Rule 15d-14(a) of the Securities Exchange Act of 1934, as amended*

|

|

32.1

|

Certification of Principal Executive Officer, pursuant to 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002*

|

|

32.2

|