Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - IBERIABANK CORP | d351862d8k.htm |

Gulf

South Banking Conference May 2012

Gulf South Banking Conference

May 2012 |

2

Safe Harbor Language

Safe Harbor Language

In connection with the proposed acquisition of Florida Gulf Bancorp, Inc.,

IBERIABANK Corporation

will

file

a

Registration

Statement

on

Form

S-4

that

will

contain

a

proxy

statement/prospectus.

INVESTORS

ARE

URGED

TO

CAREFULLY

READ

THE

PROXY

STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES

AVAILABLE, BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors may obtain a

free copy

of

the

proxy

statement/prospectus

(when

it

is

available)

and

other

documents

containing

information about IBERIABANK Corporation and Florida Gulf Bancorp, Inc., without

charge, at the SEC's web site at http://www.sec.gov. Copies of the proxy

statement/prospectus and the SEC filings that will be incorporated by

reference in the proxy statement/prospectus may also be obtained for free

from

the

IBERIABANK

Corporation

website,

www.iberiabank.com,

under

the

heading

“Investor

Information”.

Statements contained in this presentation which are not historical facts and which pertain

to future operating results of IBERIABANK Corporation and its subsidiaries constitute

“forward- looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements involve significant risks

and uncertainties. Actual results may differ materially from the results discussed in these

forward-looking statements. Factors that might cause such a difference include, but are not

limited to, those discussed in the Company’s periodic filings with the SEC. This communication is not a

solicitation of any vote or approval, is not an offer to purchase shares of Florida Gulf

Bancorp, Inc. common stock, nor is it an offer to sell shares of IBERIABANK Corporation common

stock which may be issued in the proposed merger. Any issuance of IBERIABANK Corporation

common stock in the proposed merger would have to be registered under the Securities Act of

1933, as amended, and such IBERIABANK Corporation common stock would be offered only by means of

a prospectus complying with the Act.

|

3

Company

Company

Overview

Overview |

| 4

•

Headquartered In Lafayette, Louisiana

•

Since 1887 –Oldest And Largest LA-Based Bank

•

Approximately $12 Billion in Assets

•

Market Cap of Approximately $1.5 Billion

•

Relatively Strong Asset Quality Measures

•

Conservative and We Don’t Cut Corners

•

Minimize Loan Concentrations

•

Core Funded

•

Slightly Asset Sensitive From An Interest Rate Risk Position

•

Large Fee-Based Businesses

•

Completed Five FDIC-Assisted Transactions

•

Completed Two Live-Bank Deals; 1 Live-Bank Deal

Pending

•

Operations in 12 States

IBKC Overview

IBKC Overview

Summary |

5

Acquisitions

Recent Conversions

Capital Activities

New Initiatives

ANB (Bentonville, AR) - 2Q09

Pulaski Bank & Trust Becomes

IBERIABANK fsb - 2Q09

Issued $7 Million in Trust

Preferred - 1Q08

Added Teams in Mobile, New

Orleans and Houston - 1Q09

CapitalSouth

Bank

(Birmingham, AL) - 3Q09

Converted Systems For

CapitalSouth Bank - 4Q09

Issued $90 Million in TARP

Preferred Stock - 4Q08

Added Team In Birmingham -

3Q09

Orion

Bank

(Naples, FL) - 4Q09

Converted Systems For Orion

Bank - 2Q10

Issued $110 Million in Common

Stock - 4Q08

Launched IBERIA Capital

Partners - 4Q10

Century

Bank

(Sarasota, FL) - 4Q09

Converted Systems For

Century Bank - 2Q10

First in the U.S. To Pay Back

TARP Preferred Stock - 1Q09

Launched IBERIA Wealth

Advisors - 4Q10

Sterling

Bank

(Lantana, FL) - 3Q10

Converted Systems For

Sterling Bank - 3Q10

Second in the U.S. To Buy Back

TARP Warrants - 2Q09

OMNI BANCSHARES, Inc.

(Metairie, LA) - 1Q11

Merged And Converted

IBERIABANK fsb - 1Q11

Issued $165 Million in Common

Stock - 3Q09

Florida Trust Company

(Naples/Ft. Lauderdale, FL) - 1Q11

Converted Systems For OMNI

Bancshares - 2Q11

Issued $329 Million in Common

Stock - 1Q10

Cameron Bancshares, Inc.

(Lake Charles, LA) - 1Q11

Converted Systems for

Cameron Bancshares - 3Q11

Completed Share Repurchase

Program for 3% of oustanding

shares - 3Q11

Florida Gulf Bancorp, Inc.

(Fort Myers, FL) - 1Q12

Announced Share Repurchase

Program for 3% of oustanding

shares - 4Q11

Business

Type

Number of

Locations

2011 Revenues

($ MMs)

Number of

FTEs

IBERIABANK, incl Subs and Holding Co.

Commercial Banking

175

391

2,003

IBERIABANK Mortgage Company

Mortgage Lending

59

48

309

Lenders Title Company

Title Insurance

24

18

179

IBERIA Wealth Advisors

Wealth Advisory

IBERIA Capital Partners

Capital Markets

7

13

100

IBERIA Financial Services

Brokerage

IBERIABANK Corporation

265

470

2,591

Activities

IBKC Overview

IBKC Overview |

Indicates

cities

in

which

our

11

members

of

Executive

Management

have

resided/worked

Indicates cities in which our members of Senior Management (Market Presidents,

Executive Vice Presidents, etc.) have resided/worked.

Albuquerque, NM

Annapolis, MD

Boston, MA

Buffalo, NY

Charlottetown,

PE, Canada

Chennai, India

Cleveland, OH

Columbus, OH

Detroit, MI

Flint, MI

Hartford, CT

Experience in Additional Cities:

Indianapolis, IN

Las Vegas, NV

Mansfield, PA

Morris Plains, NJ

New York, NJ

Pittsburgh, PA

Phoenix, AZ

San Diego, CA

Scottsdale, AZ

Wilmington, DE

IBKC Overview

IBKC Overview

Where We Lived & Worked

Broad Experience Throughout

Broad Experience Throughout

Southeastern U.S.

Southeastern U.S.

6

Resides in Greensboro, GA

James B. Gburek, EVP

Chief Risk Officer

Resides in New Orleans, LA

Michael J. Brown, VC

Chief Operating Officer

Jefferson G. Parker, VC

Manager of Brokerage, Trust,

and Wealth and Management

Anthony J. Restel, SEVP

Chief Financial Officer

Robert B. Worley, EVP

General Counsel

Daryl G. Byrd

President and CEO

Beth A. Ardoin, EVP

Director of Communications

George J. Becker III, EVP

Director of Corporate Operations

Barry F. Berthelot, EVP

Director of Organizational Development

Resides in Lafayette, LA

Resides in Greensboro, NC

Gregg Strader, EVP

Chief Credit Officer

Resides in Raleigh, NC

John R. Davis, SEVP

Director of Financial Strategy and Mortgage

Resides in Annapolis, MD

Robert M. Kottler, EVP

Director of Retail and Small Business

Resides in Gastonia, NC

H. Spurgeon Mackie, EVP

Executive Credit Officer |

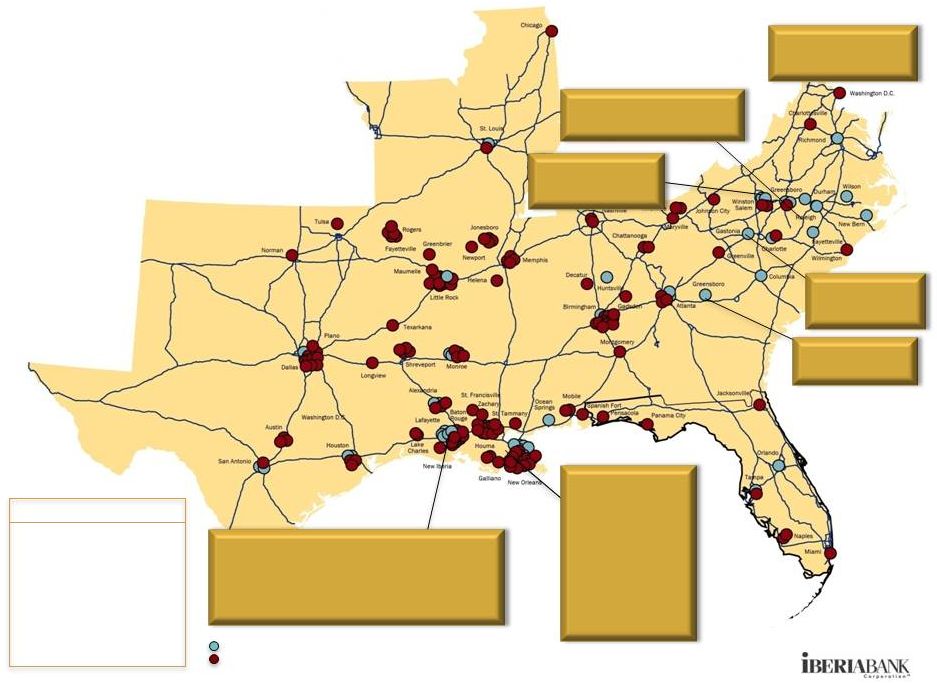

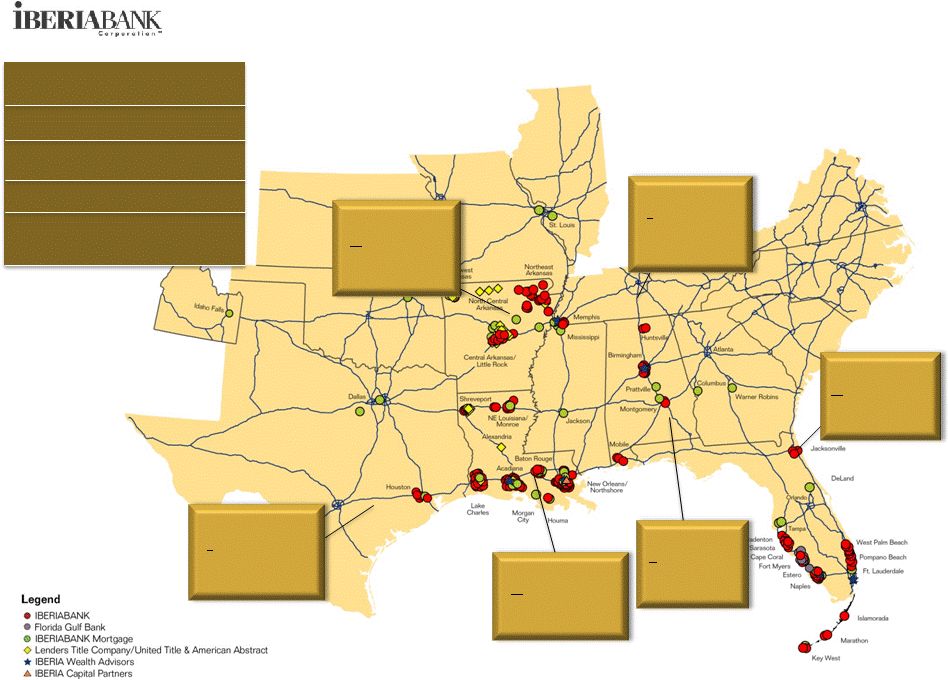

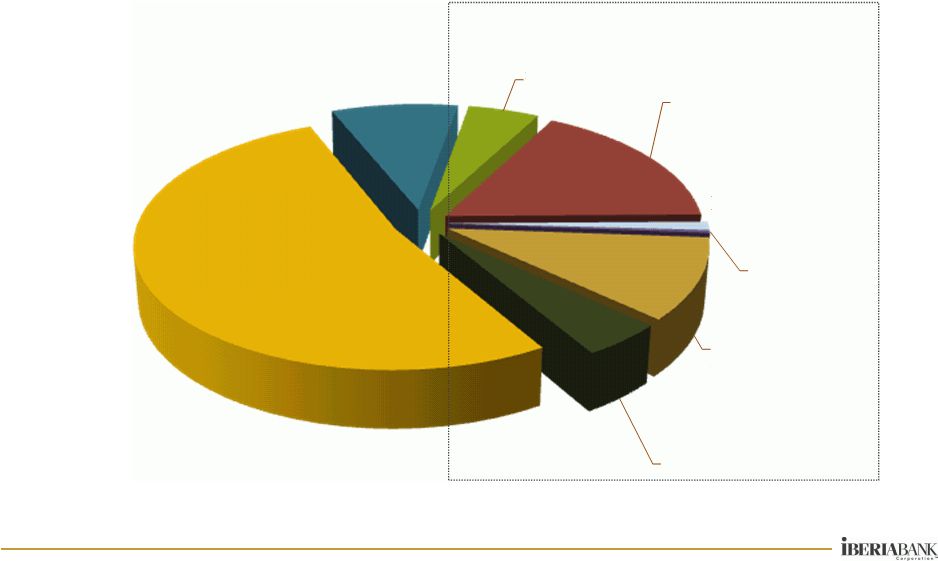

Deposit Market

Share as of June 30, 2011 Florida branch and deposit information reflects pro

forma Florida Gulf Bank acquisition Source: SNL Financial

Map Reflects Locations as of April 15, 2012

7

IBKC Overview

IBKC Overview

Locations

Locations

274

(Bank

Branches 175)

Total Assets

$ 11.8 Billion

Total

Deposits $ 9.5 Billion

Total

Loans $ 7.5 Billion

Market Capitalization $ 1.5 Billion

Texas

4 Bank locations

3

Non-bank locations

7 Total locations

$185 million deposits

#227 Rank

Louisiana

79 Bank locations

30

Non-bank locations

109 Total Locations

$5.1 billion deposits

#5 Deposit Rank

Alabama

13 Bank Locations

6

Non-bank locations

19 Total locations

$500 million deposits

#20 Rank

Florida

50 Bank locations

12

Non-bank locations

62 Total locations

$2.5 billion deposits

#22 Rank

Arkansas

34 Bank locations

30

Non-bank locations

64 Total locations

$1.0 billion deposits

#12 Rank

Tennessee

3 Bank locations

1

Non-bank locations

4 Total locations

$155 million deposits

#113 Rank |

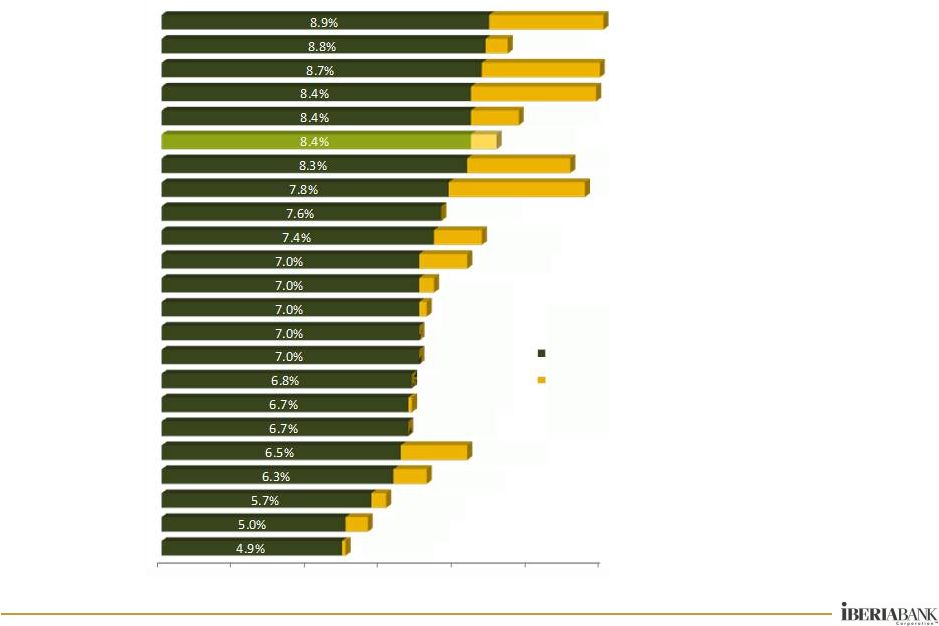

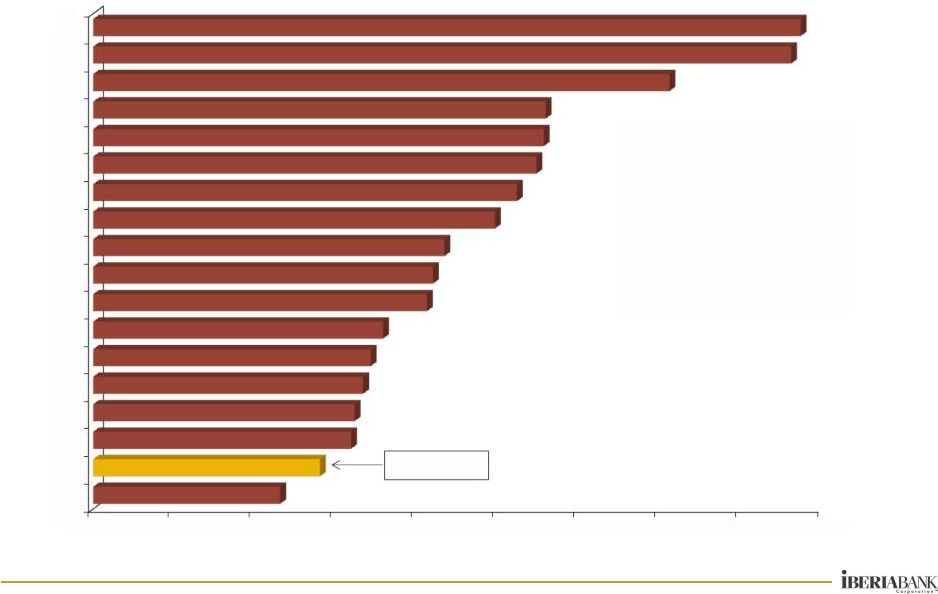

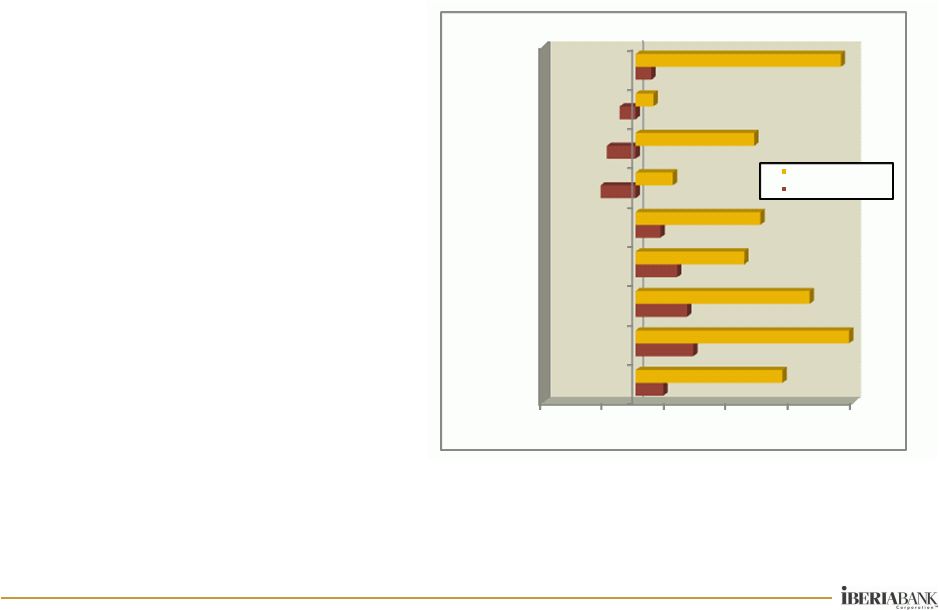

8

IBKC Overview

IBKC Overview

Unemployment Rate by MSA

•

Consistently Low

Rates Of

Unemployment

In Our Legacy

MSAs

•

Many Of Our

Legacy Markets

Not Dependent

On Housing For

Growth

•

Assets In FDIC-

Assisted

Acquisition

Markets Are

Protected Under

Loss-Share

Agreements

* Markets entered via FDIC-

assisted acquisitions

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

9.4%

11.9%

11.8%

9.7%

9.1%

11.1%

11.5%

7.6%

8.5%

8.3%

7.4%

7.2%

7.0%

6.8%

6.5%

6.8%

6.7%

5.6%

6.1%

7.2%

8.3%

March 2012

December 2010

12.6%

5.0%

Lafayette, LA

NW Arkansas

* Huntsville, AL

* Birmingham, AL

Lake Charles, LA

Little Rock, AR

Shreveport, LA

Alexandria, LA

New Orleans, LA

Baton Rouge, LA

Jonesboro, AR

Houston, TX

* Montgomery, AL

Monroe, LA

* Naples, FL

* Jacksonville, FL

US Average

* Mobile, AL

* Miami, FL

* Bradenton, FL

Memphis, TN

* Cape Coral, FL

Houma, LA

Unemployment Rate |

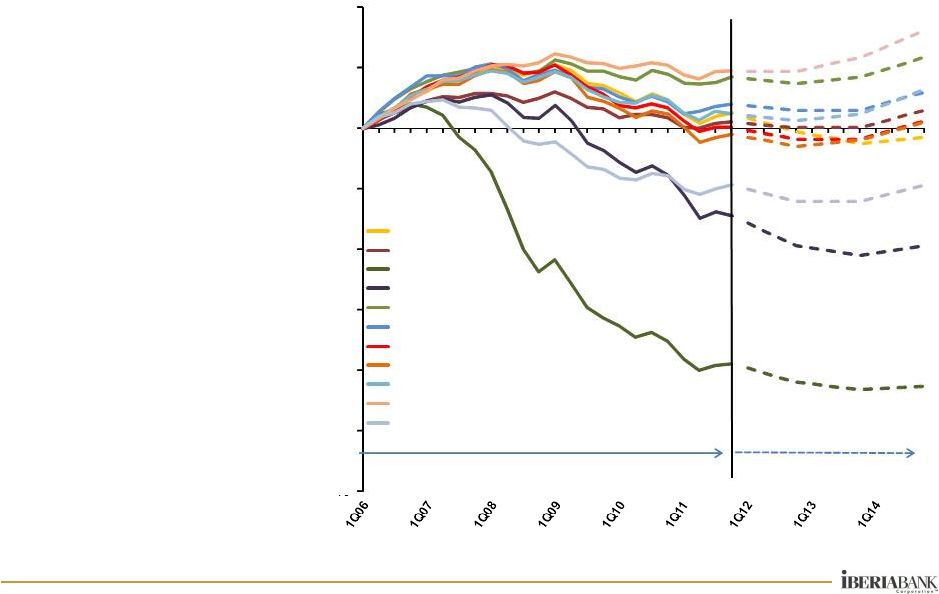

9

IBKC Overview

IBKC Overview

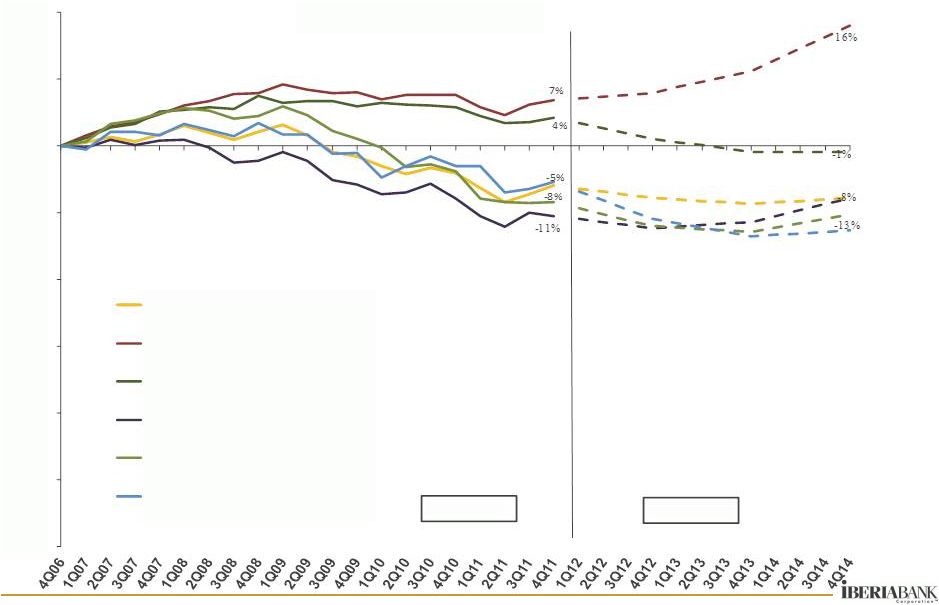

Housing Market Trends

•

Impact Varies By

State And Market

•

Strength –

TX & LA

•

Weakness: FL, GA &

VA

•

Very Limited

Rebound

•

Florida -

Decline

•

Georgia -

Decline

•

Virginia –

Flatten

•

Large Embedded

Losses Remain In

Banks’

Balance

Sheets

Source:

Local

Market

Monitor

4Q2011

14%

1%

2%

3%

42%

19%

12%

2%

9%

9%

7%

16%

9%

60%

50%

40%

30%

20%

10%

0%

10%

20%

Southeastern States

Alabama

Arkansas

Florida

Georgia

Louisiana

Mississippi

North Carolina

South Carolina

Tennessee

Texas

Virginia

Actual

Forecast

Florida

Georgia

Virginia

Louisiana

Texas

S.C.

39%

4%

1%

-

-

-

-

-

-

-

-

-

-

-

-

-

- |

|

11

Solid Organic Loan Growth

Loans

Loans

•

$164 Million

Organic Loan

Growth In

YTD 2012

•

Counter To

Industry

Trends

0%

10%

20%

30%

40%

50%

60%

70%

80%

Organic Loan Growth

December 2006 -

March 2012

IBKC

data

based

on

organic

growth

-

excluding

one-time

impact

of

acquisitions

IBERIABANK Corporation

U.S. Commercial Banks |

12

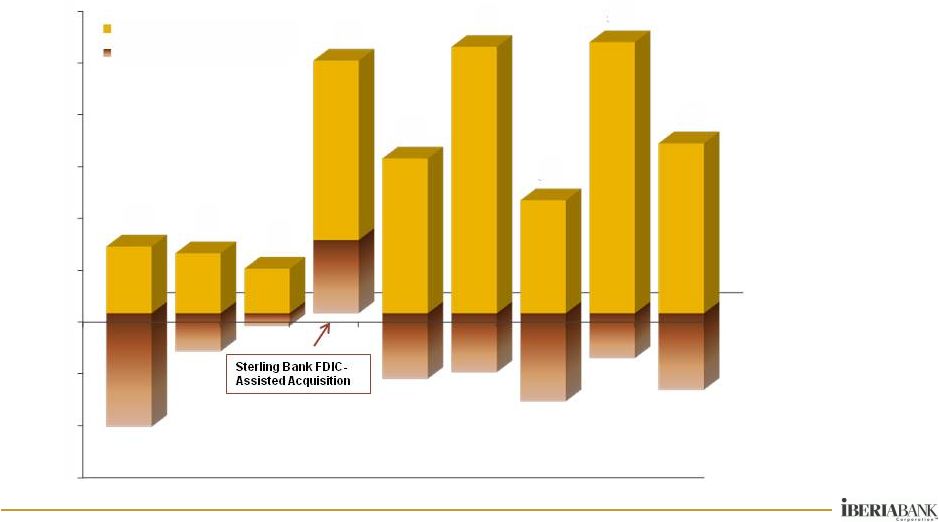

Growth In Organic And Covered Loans

Loans

Loans

•

Organic Loan

Growth of $1.3

Billion or 31%

Since December

2009 (14%

Annualized)

•

FDIC Covered

Loan Portfolio

Declined $409

Million or -25%

Since December

2009 (-11%

Annualized)

$ in millions

-$150

-$100

-$50

$0

$50

$100

$150

$200

$250

$300

Mar-10

Jun-10

Sep

-10

Dec

-10

Mar-11

Jun-11

Sep

-11

Dec

-11

Mar-12

$64

$58

$43

$173

$149

$257

$109

$262

$164

Organic Loan Growth

Covered Loan Portfolio |

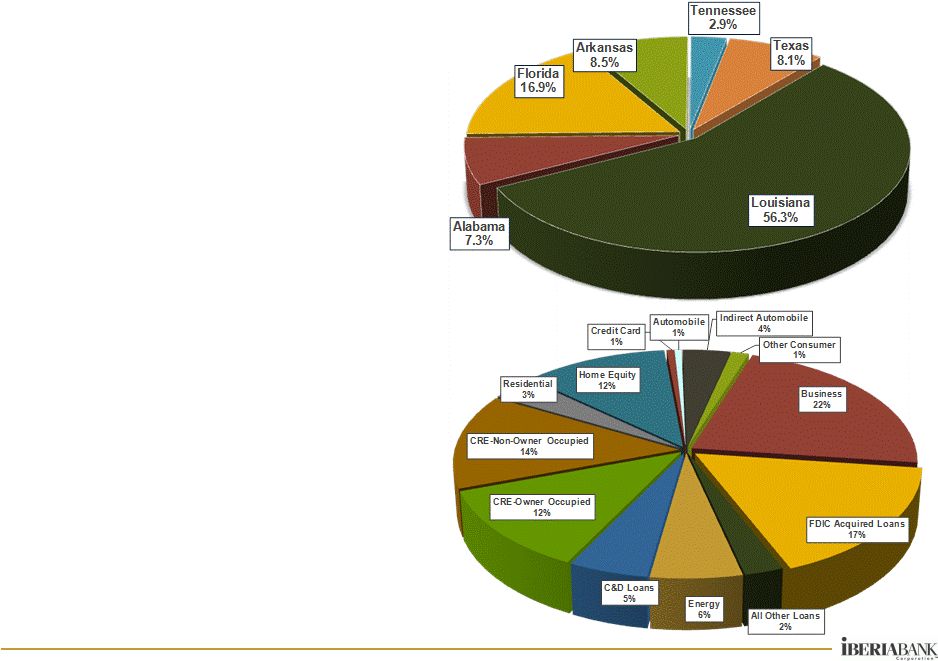

13

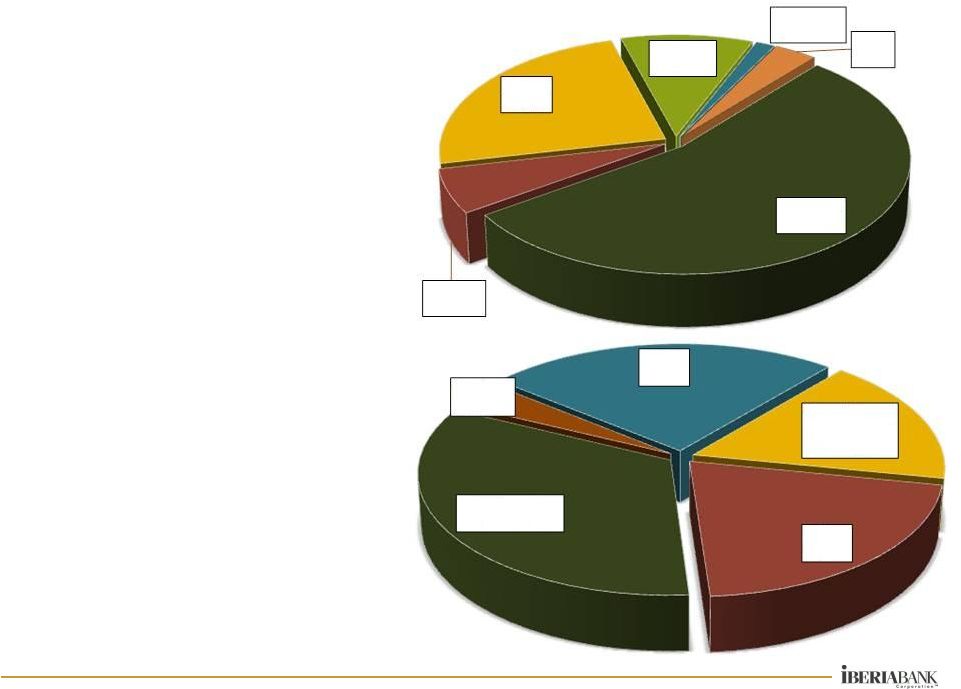

•

$7.5 Billion Loan

Portfolio

•

Acquired $3.2 Billion

Of Gross Loans In

FDIC-Assisted

Acquisitions Covered

Under Loss Share

Agreements

•

Includes $824 Million

Of Fair Value Loans

Acquired at Cameron

and OMNI

•

1Q12 Net Loan Yield

of 4.87%

Note: Loans Net of Purchase Discounts at March 31, 2012

Loan Portfolio Summary

Loans

Loans |

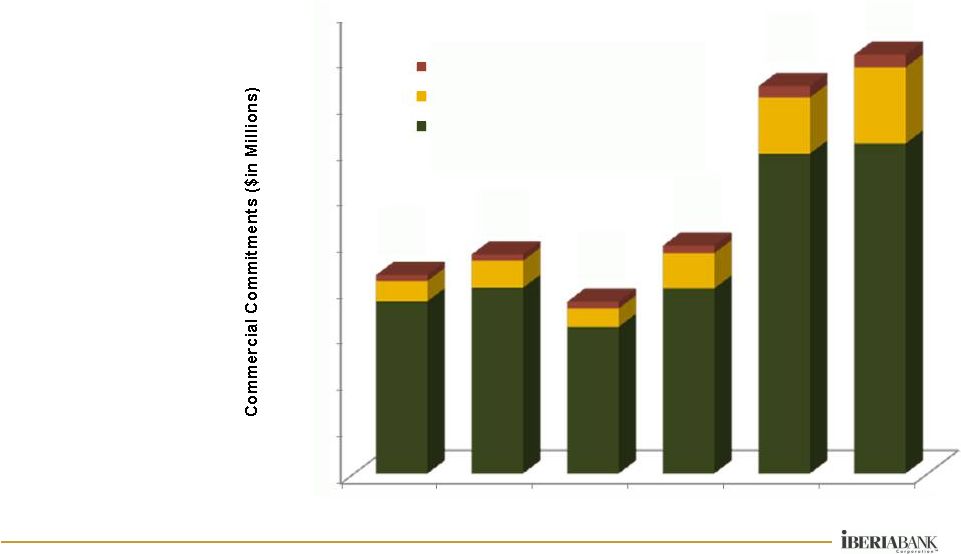

14

Commercial Commitments Trend

Loans

Loans

•

Unfunded And

Unused

Commitments

Nearly Doubled

Over The Last 15

Months

•

Strength In

Houston, New

Orleans, Baton

Rouge And

Birmingham

•

Funding A

Significant

Portion Of These

Commitments

Would Expand

Our Balance

Sheet

$863

$952

$747

$990

$1,683

$1,819

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

Standby Letters of Credit

Unfunded Loan Commitments

Unused Commercial Lines

12/31/07

12/31/08

12/31/09

12/31/10

12/31/11

3/31/12 |

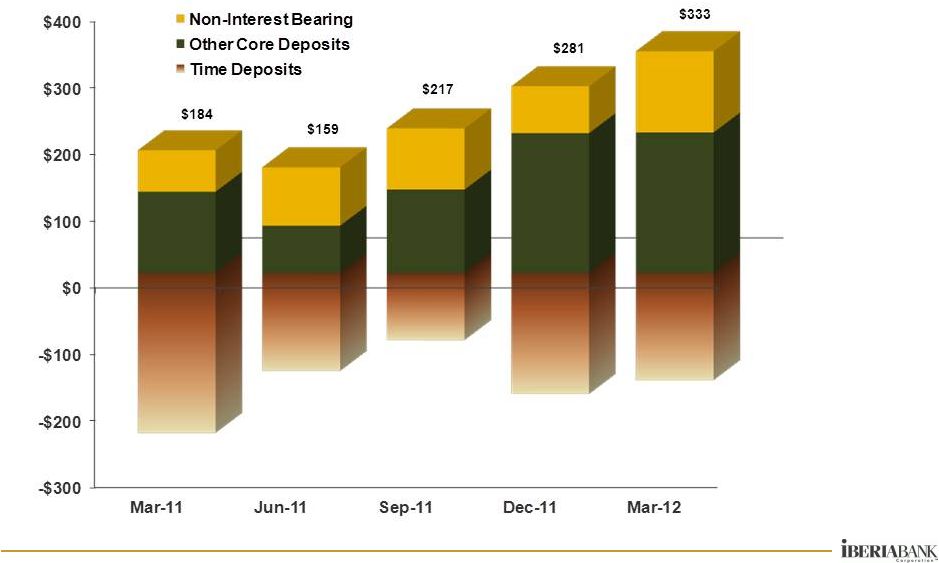

15

Deposits

Deposits

Growth In Organic Deposits

•

Organic Core

Deposit Growth Of

$1.2 Billion Or

23% Since

December 2010

(19% Annualized)

•

Organic Non-

Interest Bearing

Deposit Growth of

$435 Million or

50% Since

December 2010

(40% Annualized)

•

Cost of Core

Deposits Has

Fallen 34 bps To

0.47% Since

December 2010

Excludes acquired deposits

$ in millions |

16

Deposit Summary

Deposits

Deposits

•

Balanced And

Diverse

Deposit

Portfolio

•

Average Cost Of

Interest Bearing

Deposits Was

0.72% In 1Q12

Note: Deposits Net of Purchase Discounts at March 31 ,2012

•

Total Cost Of

Deposits Was

0.60% In 1Q12

Non-Interest

Bearing

17.0%

NOW

20.8%

Money Market

33.3%

Savings

3.7%

CD

25.2%

Louisiana

54.3%

Alabama

6.2%

Florida

24.1%

Arkansas

10.5%

Tennessee

1.5%

Texas

3.4% |

17

Asset

Asset

Quality

Quality |

18

Asset Quality

Asset Quality

U.S. Nonperforming Assets

•

Banks Invested In Real

Estate At The Top Of

The Cycle

•

Industry NPA Ratios

Improved; A Long Way

To Recovery

•

Historically, Typically

Takes Many Years To

Recover From Peak In

NPAs

•

Recovery Tied To:

•

Borrower Health

•

Property Values

•

Sustained Low

Interest Rates

U.S Bank Holding Companies

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

12/31/11

NPAs/Total

Assets

-

US

BHCs

Top 10%

Median = 2.76%

Average = 4.07%

Our NPA Ratio: 0.83% |

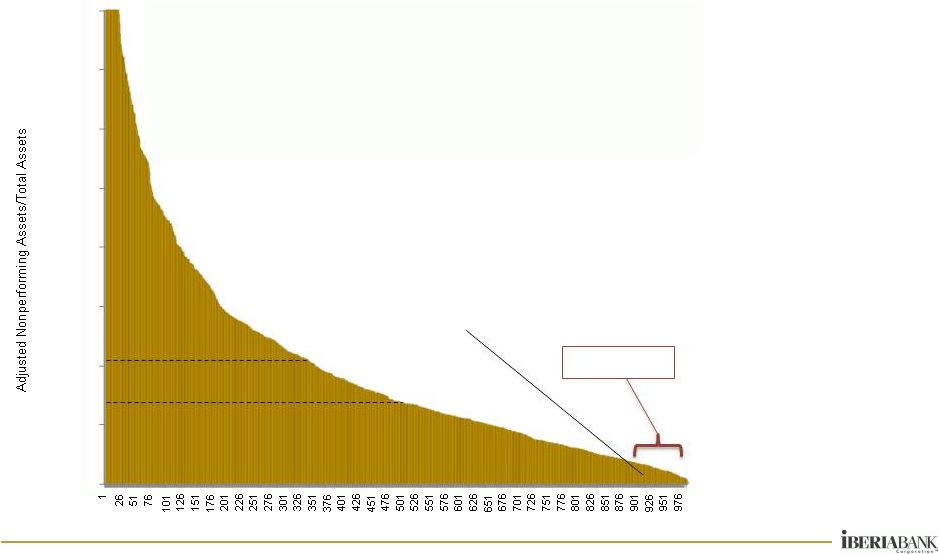

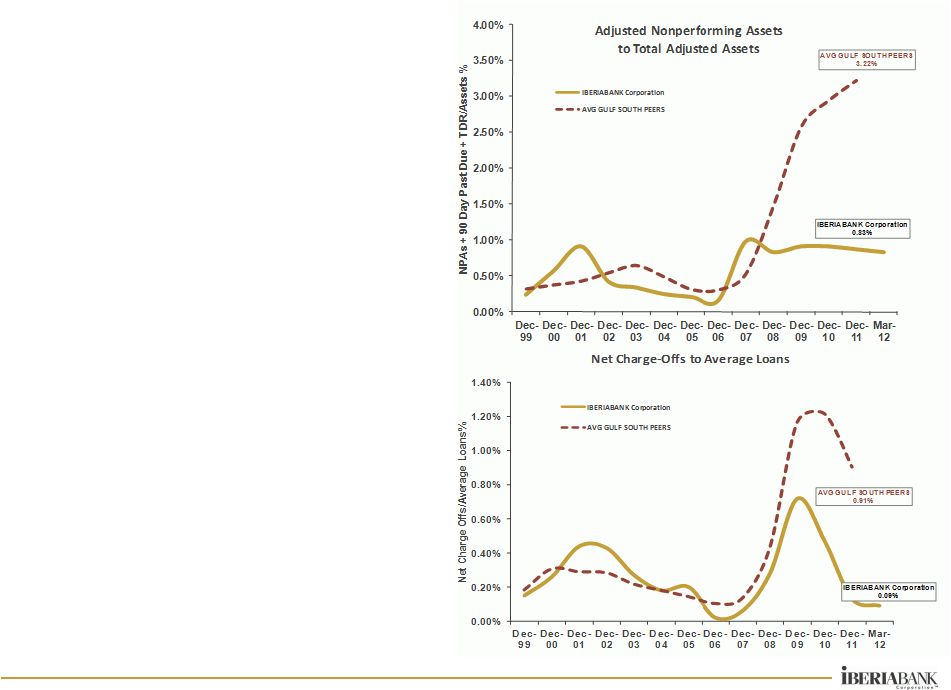

19

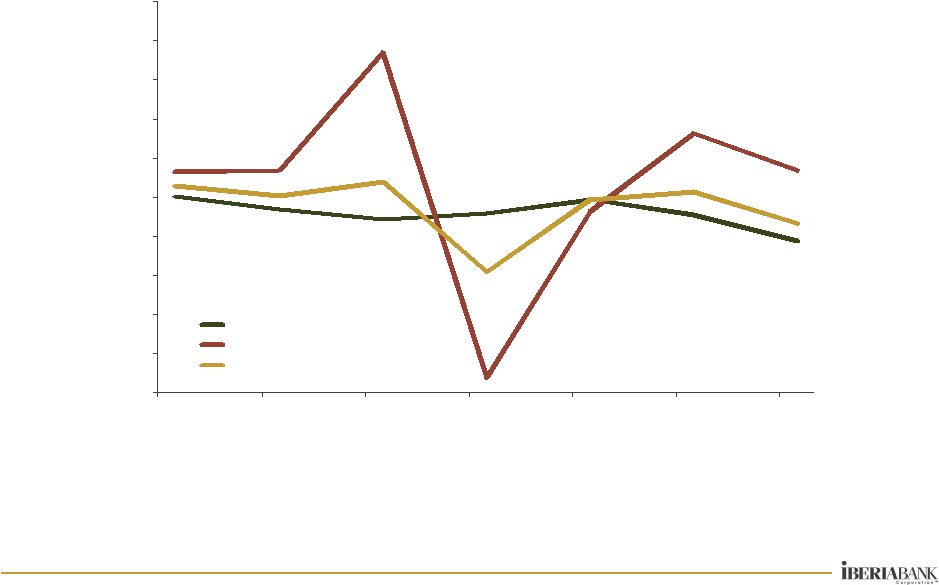

Peer Comparison Trends

Asset Quality

Asset Quality

•

$812 Million in

NPAs, But $729

Million Covered

Under FDIC Loss

Share Or Acquired

Impaired Assets

•

Legacy TDRs

Total Only $27

Million

* Excludes FDIC Covered Assets

•

17% Of Loans

Are FDIC

Covered Assets |

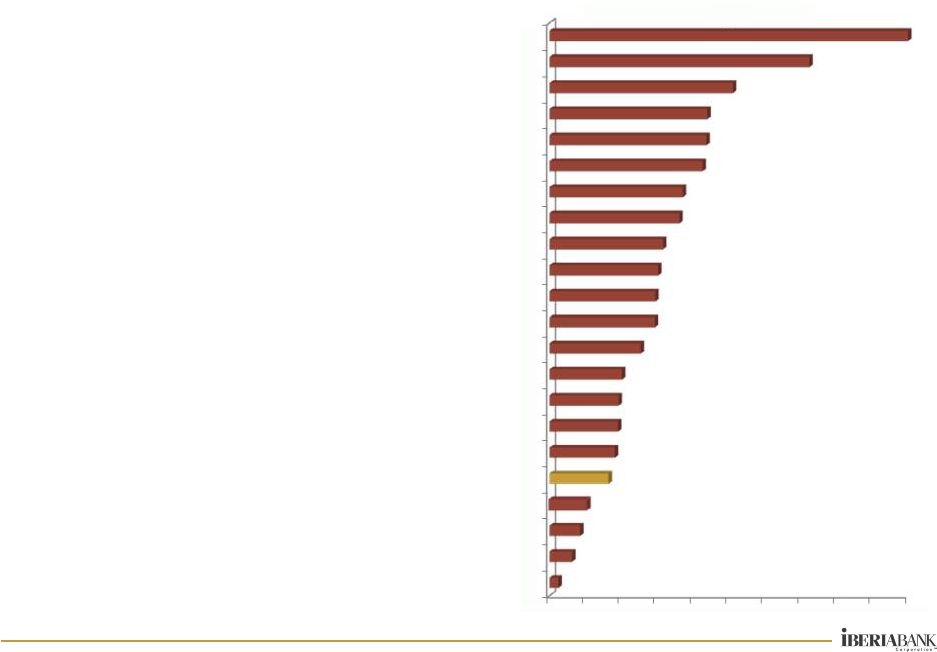

20

Asset Quality

Asset Quality

Classified Assets

•

“Classified Assets”

Are

Loans That Exhibit Stress

And Warrant Close

Watching

•

Classified Assets were

$206 million at December

31, 2011 and $194 million

at March 31, 2012

•

Our Classified Assets As A

Percentage Of Total Assets

Are Very Low, Particularly

Compared To Our Local

Peers

Note: Excludes FDIC Covered Assets.

Source: SNL, Company Filings for 2011

IBKC Data as

of

March

31

,2012

-

Excludes

covered

loans

related

to

FDIC-

Assisted Acquisitions

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

STBZ

SBSI

HBOS

OZRK

IBERIABANK

SFNC

MSL

TSH

RNST

HOMB

TRMK

FFCH

HBHC

FBMS

CSFL

ECBE

SCBT

FMFC

BNCN

BXS

PFBX

CCBG

Classified

Assets-to-Total

Assets

At March 31, 2012 |

Financials |

22

Financials

Financials

First Quarter 2012 vs. Fourth Quarter 2011

•

Revenues Up 1%

•

Expenses Up Less Than 1%

•

Margin Down 3 Bps.

•

EPS Up 11%

•

Stable Dividends

•

Assets Up Less Than 1%

•

Deposits Up 2%

•

Market Cap Up 9%

•

Book Value Per Share Up

Less Than 1%

•

Tangible Book Value Per

Share Up 1%

•

Share Price Up 8%

•

Strong Organic Growth:

Loans

Up

$164

Million

(11%

Annualized)

Core

Deposits

Up

$333

Million

(20%

Annualized)

•

Favorable Asset Quality Measures:

NPA/Assets

=

0.83%

(4Q11:

0.87%)

30+

Days

Past

Due

=

1.28%

(4Q11:

1.37%)

LLR/Loans

=

1.21%

(4Q11:

1.24%)

Net

COs/Avg.

Loans

=

0.09%

(4Q11:

0.31%)

Provision

=

$3mm

(4Q11:

$4mm)

•

Formidable Capital Position:

TCE

Ratio

=

9.64%

(4Q11:

9.52%)

Total

RB

Capital

=

16.10%

(4Q11:

16.20%) |

23

Financials

Financials

Loan Yield Trends

•

Net Covered Loan Yield In 2Q12 Yield Is Expected To Be Approximately 5.05%

•

The Covered Portfolio Is Expected To Decline Approximately $75 Million Based

On Current FDIC Loss Share Accounting Assumptions And Estimates

4.78%

5.14%

4.87%

4.00%

4.20%

4.40%

4.60%

4.80%

5.00%

5.20%

5.40%

5.60%

5.80%

6.00%

Sep-10

Dec-10

Mar-11

Jun-11

Sep-11

Dec-11

Mar-12

Non Covered Loan Yield

Net Covered Loan Yield

Total Net Loan Yield |

24

•

$1.8 Billion In Aggregate Time Deposits Repricing Over The

Next 12 Months At A Weighted Average Rate Of 1.16%

Financials

Financials

Repricing Schedule

2Q12

3Q12

4Q12

1Q13

2Q13

Cash Equivalents

450.7

$

-

$

-

$

-

$

-

$

0.61%

0.00%

0.00%

0.00%

0.00%

Investments

176.5

$

142.2

$

97.6

$

84.6

$

90.5

$

3.15%

3.24%

3.23%

3.29%

3.17%

Loans

3,633.8

$

354.1

$

289.3

$

293.8

$

283.6

$

3.94%

5.43%

5.50%

5.41%

4.82%

Time Deposits

653.5

$

527.4

$

355.5

$

250.3

$

84.3

$

1.19%

1.27%

1.00%

1.04%

1.01%

Borrowed Funds

407.8

$

1.5

$

5.8

$

7.1

$

37.7

$

1.22%

4.00%

2.23%

3.28%

3.44%

Source: Bancware March 31, 2012 |

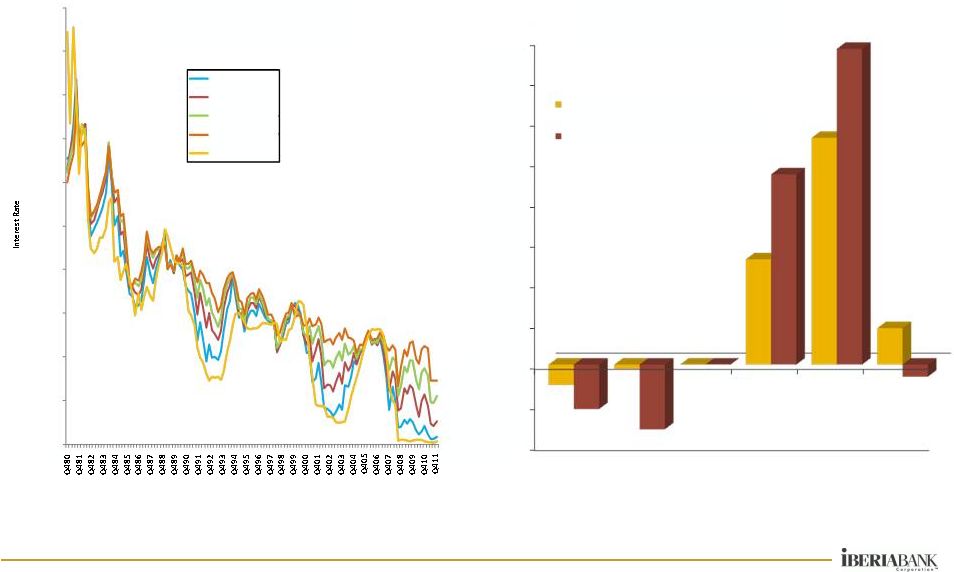

25

Financials

Financials

Interest Rate Risk

IRR Simulation Results

Source: Bancware March 31, 2012

Source: Bloomberg

-2.00%

-1.00%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

-200 bps

-100 bps

Base

Case

+100

bps

+200

bps

Forward

Curve

Change in Net Interest Income

Change in Economic Value of Equity

Interest Rate Trends

2

Year Treasury

5-Year Treasury

10

Year Treasury

30

Year Treasury

Fed Funds

-

-

-

1.04%

2.21%

2.89%

0.13%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

20.00%

0.33%

Quarters |

26

Financials

Financials

Service Charges As A Percentage Of Revenues

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

PBIB

IBKC

CSFL

SBCF

HOMB

UCBI

OZRK

PFBX

HBHC

FSGI

RNST

TRMK

BXS

SFNC

FMFC

SBSI

CCBG

MSL

IBKC = 5%

•

Less Reliance On

Service Charge

Income And

Consumer Fees

Than Peers

Source: SNLData as of most recent quarter

Non-Interest Income Excludes Gains on Acquisitions and Investment Sales

|

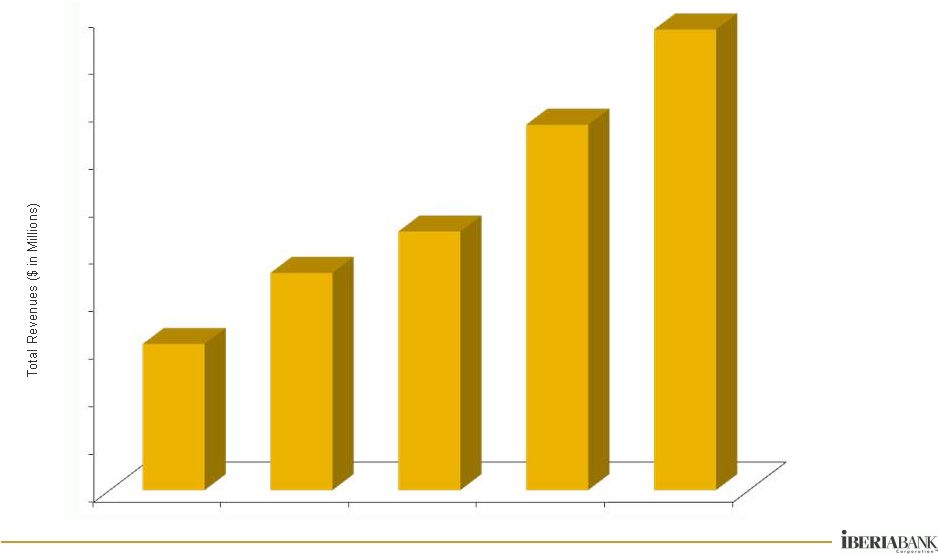

27

Financials

Financials

Quarterly Trend In Revenues

IBERIA Capital Partners And IBERIA Wealth Advisors

•

Steady

Progress In

Revenue

Growth

Since

Launch In

4Q10

•

ICP/IWA

Revenues Of

$1.9 Million

(+25% Vs.

4Q11)

$0.0

$0.2

$0.4

$0.8

$1.0

$1.2

$1.4

$1.6

$1.8

$2.0

1Q11

2Q11

3Q11

4Q11

1Q12

$0.6 |

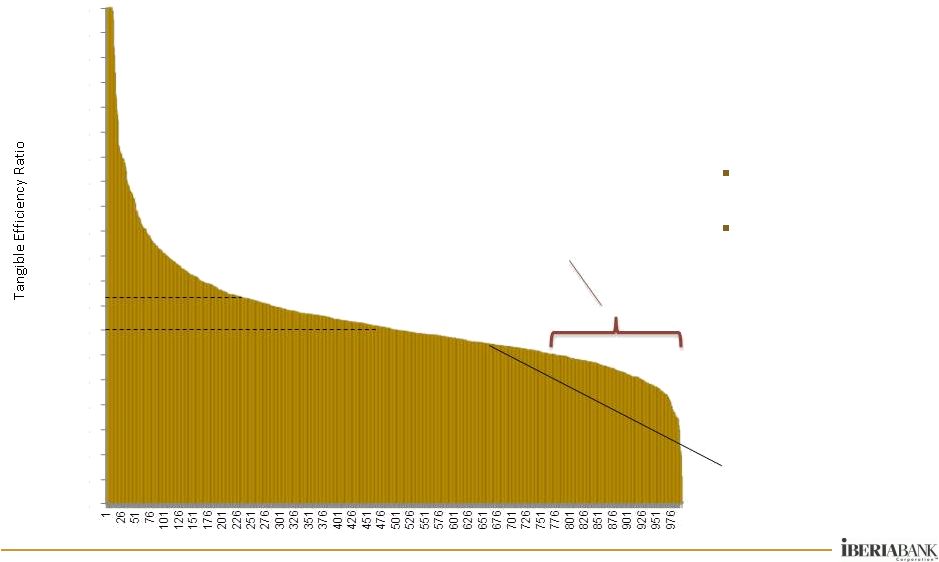

28

Financials

Financials

U.S. Tangible Efficiency Ratio

•

Our Strategic Goal Is

A Tangible Efficiency

Ratio Of Less Than

60%

•

Efficiency Gains Via:

Revenue

Improvements

Expense Discipline

•

Consolidation Within

The Banking Industry

May Improve Industry

Efficiency Over Time

Our Tangible

Efficiency Ratio:

65%

Median = 70%

Average = 83%

Tangible Efficiency

Ratio Less Than

60%

Source: SNL

4Q11

Tangible

Efficiency

Ratio

-

US

BHCs

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

90.00%

100.00%

110.00%

120.00%

130.00%

140.00%

150.00%

160.00%

170.00%

180.00%

190.00%

200.00% |

29

Acquisitions

Acquisitions |

30

Acquisitions

Acquisitions

Forces Accelerating Consolidation

30

•

Environmental Issues

•

Credit

•

Interest Rate

•

Regulatory

•

Legislative

•

Real Estate Sector

•

Client Issues

•

Deleveraging

•

Core Client Base Aging

•

Technological Change

•

Competitive Issues

•

Shadow Banks

•

Government Backing

•

Government Life Support

•

Future Disintermediation

•

Fluid Capital/Returns

•

Company-Specific Issues

•

Asset Concentration

•

Broken Business Models

•

Limited Access To Capital |

31

•

Total Assets of $4.4 Billion

•

Total Deposits of $3.5 Billion

•

Net Loans of $1.9 Billion

•

Loans Bought at a $515

Million Discount

•

Loans Have FDIC Loss

Share Protection

•

Pre-Tax Gain of $243 Million

•

60 Offices in 10 MSAs in

Alabama, Arkansas & Florida

•

Average 121 Days To

Convert Systems

•

Total Assets of $3.5 Billion

•

Total Deposits of $2.7 Billion

•

Net Loans of $2.1 Billion

•

Issued Common Equity of

$507 Million

•

Goodwill of $324 Million

•

84 Offices in 9 MSAs in LA,

AR & Memphis

•

Average of 43 Days to

Convert Systems

Acquisitions

Acquisitions

Completed Acquisitions Since 2003

Completed FDIC

Acquisitions

Completed Live Bank

Acquisitions |

32

Source: SNL Financial Deposit Data as of June 2011

•

Announced March 19, 2012

•

Adds 8 branches in Fort Myers-Cape

Coral, Florida MSA

•

Attractive, established client base

complements our existing client base

•

Total Loans: $262 million

•

Total Assets: $350 million

•

Total Deposits: $279 million

•

Total Equity: $24 million common stock

plus $4 million preferred stock

•

Total deal value of $35 million for

common stock, $4 million for preferred

stock outstanding, plus up to additional

$4 million based on performance of

certain acquired loans over 3-year

period

•

Includes $28 million, pre-tax credit mark

(11% of loans)

•

Price / Tangible Book: 1.41x

•

Adjusted Core Deposit Premium: 4.9%

•

Accretive to EPS

•

Slightly dilutive to TBVS

•

IRR in excess of cost of capital

Proposed Acquisition of

Proposed Acquisition of

Florida Gulf Bancorp, Inc.

•

IBERIABANK branches

Florida Gulf branches |

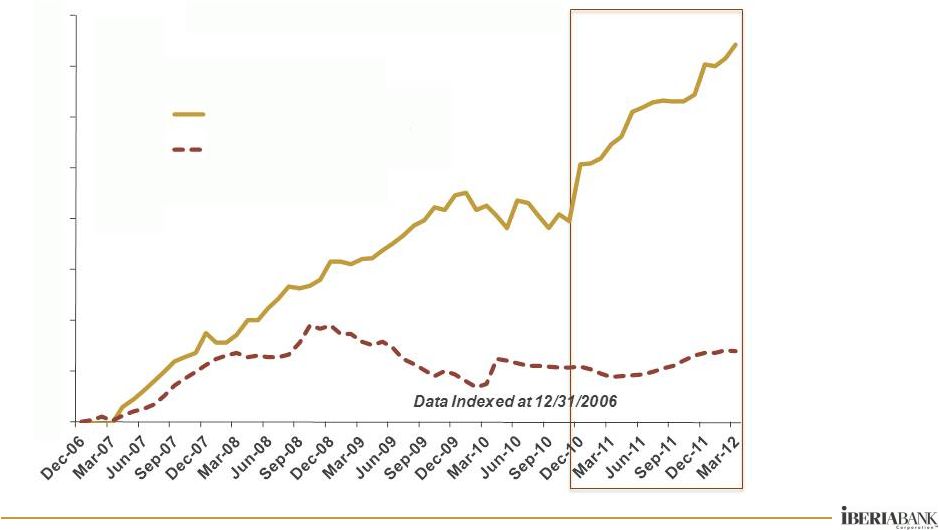

Summary

Summary |

34

Total Return Since August 2007

Summary

Summary

34

* August 2007 -

signifies the start of the financial crisis

Source: SNL Through April 16, 2012

•

Outperformed

During A Very

Tumultuous

Time Period

•

Driven By Our

Very Unique

Position And

Opportunities

-80%

-70%

-60%

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

30%

SNL Southeast U.S. Bank

SNL U.S. Bank < $250M

SNL Micro Cap U.S. Bank

SNL Mid Cap U.S. Bank

S&P Bank

SNL U.S. Bank > $10B

KBW Bank

S&P Financials

SNL U.S. Bank < $500M

SNL TARP Participants

SNL U.S. Bank

SNL Large Cap U.S. Bank

SNL Mid-Atlantic U.S. Bank

SNL U.S. Bank $250M-$500M

SNL U.S. Bank $500M-$1B

SNL All Financial Institutions

SNL U.S. Bank $1B-$5B

SNL Midwest U.S. Bank

NASDAQ Bank

SNL Small Cap U.S. Bank

SNL New England U.S. Bank

SNL U.S. Bank $5B-$10B

SNL Southwest U.S. Bank

NASDAQ Finl

NYSE

SNL Western U.S. Bank

S&P 500

Russell 3000

Russell 2000

S&P Small-Cap

S&P Mid-Cap

NASDAQ

+28%

IBERIABANK Corporation |

35

Over The Past Four Years…

Summary

Summary

35

•

Total Revenues Of $1.8 Billion

•

Earned $320 Million; $15.79

EPS

•

Paid

$125

Million

In

Dividends,

Or $5.78 Per Share (39%

Payout)

•

Improved Asset Quality And

Capital Strength

•

Added:

•

+$6.9 Billion Assets

•

+124 New Locations

•

+1,297 Associates

•

+$18.17 In Tangible BVS

•

+$1.0 Billion Market Cap.

•

At

The

End

Of

1Q12:

•

Total

Assets

Of

$11.8

Billion

•

2,591

Associates

•

Operations

In

12

States

-75%

-25%

25%

75%

125%

175%

Loans

Deposits

Assets

Offices

# FTE

BVS

TBVS

Stock Price

Market Cap

22%

46%

41%

33%

20%

-28%

-23%

-13%

13%

118%

172%

140%

87%

100%

30%

95%

14%

165%

IBERIABANK

Gulf South Peers

% Change Since 2007 |

| 36

Summary

Summary

IBERIABANK Corporation

•

Longevity And Experience

•

Economically Vibrant Legacy Markets

•

Diversified Markets And Revenues

•

Multiple Growth Engines (Organic And M&A)

•

Disciplined, Yet Opportunistic

•

Exceptional Asset Quality

•

Outsized FDIC Loss Share Protection

•

Tremendous Liquidity And Capital

•

Funded By Stable Core Deposits

•

Asset-Sensitive (Interest Rate Risk Position)

•

Unique Business Model

•

Favorable Risk/Return Trade-Off

36 |

|

Appendix

Appendix

Other

Other

38 |

39

Appendix

Appendix

MSA Home Price Trends

Source: Local Market Monitor 4Q2011

-60%

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

Louisiana MSAs

Alexandria, LA

Baton Rouge, LA

Houma-Bayou

Cane-Thibodaux,

LA

Lafayette, LA

Lake Charles, LA

Monroe, LA

New

Orleans-Metairie-Kenner,

LA

Shreveport-Bossier

City,

LA

Forecast

Actual |

Appendix

Appendix

MSA Home Price Trends

-17%

2%

4%

-13%

3%

-60%

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

Fayetteville-Springdale-Rogers,

AR-MO

Little

Rock-North

Little

Rock-Conway,

AR

Jonesboro, AR

Actual

Forecast

Source: Local Market Monitor

4Q2011

40

Arkansas MSAs |

Appendix

Appendix

MSA Home Price Trends

Source: Local Market Monitor 4Q2011

-34%

-44%

-51%

-47%

-54%

-39%

-46%

-48%

-70%

-60%

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

Cape Coral-Fort Myers, FL

Jacksonville, FL

Miami-Miami

Beach-Kendall,

FL

(MSAD)

Naples-Marco

Island,

FL

North

Port-Bradenton-Sarasota-Venice,

FL

Actual

Forecast

41

Florida MSAs |

42

Appendix

Appendix

MSA Home Price Trends

Source:

Local

Market

Monitor

4Q2011

-60%

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

Other MSAs

Birmingham-Hoover, AL

Houston-Sugar

Land-Baytown,

TX

Huntsville, AL

Memphis,

TN-MS-AR

Mobile, AL

Montgomery, AL

Actual

Forecast |

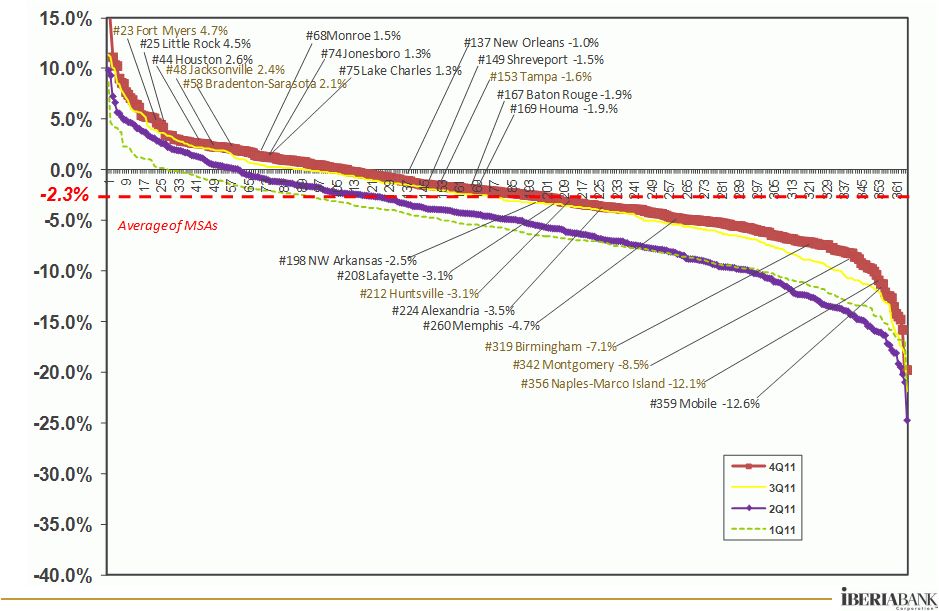

43

Appendix

Appendix

MSA Housing Price Declines –

Last Year

Source: Freddie Mac, FMHPI data series for 4Q2011 |

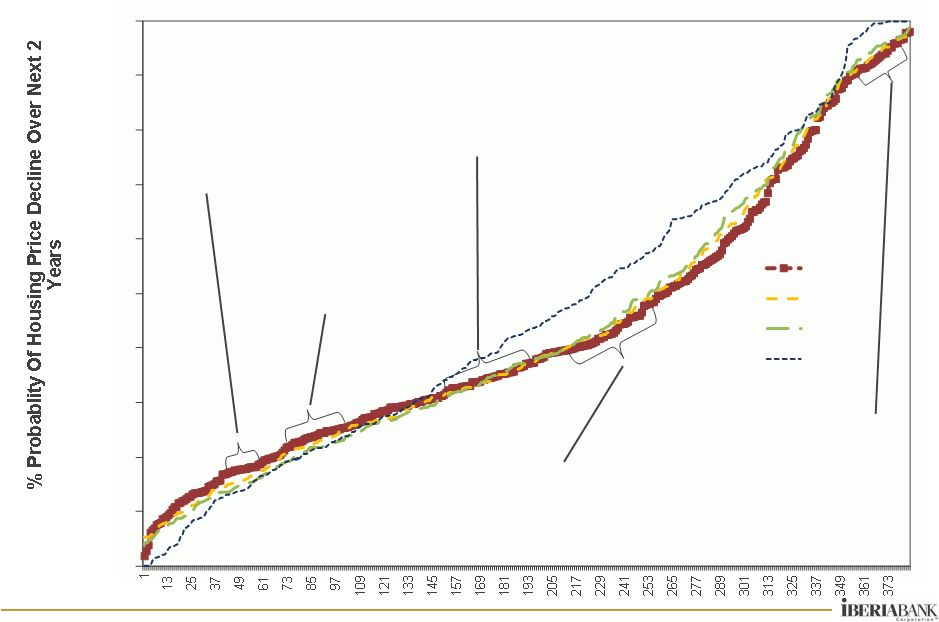

44

Appendix

Appendix

Housing Price Decline Probability –

Next 2 Years

Source: PMI Economic Real Estate Trends: 2Q11 data

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2Q11

1Q11

4Q10

2Q10

Shreveport, LA 17.6%

Jonesboro, AR 17.7%

Lafayette, LA 18.1%

Mobile, AL 39.4%

Baton Rouge, LA 40.9%

New Orleans, LA 45.9%

Memphis, TN 46.0%

Lake Charles, LA 47.8%

Little Rock, AR 23.7%

NW Arkansas, 25.0%

W. Palm Beach, FL 90.0%

Jacksonville, FL 92.6%

Tampa, FL 93.2%

Bradenton, FL 93.5%

Cape Coral, FL 96.0%

Naples, FL 96.8%

Monroe, LA 31.3%

Houston, TX 32.7%

Birmingham, AL 33.3%

Huntsville, AL 36.5%

Montgomery, AL 36.8% |

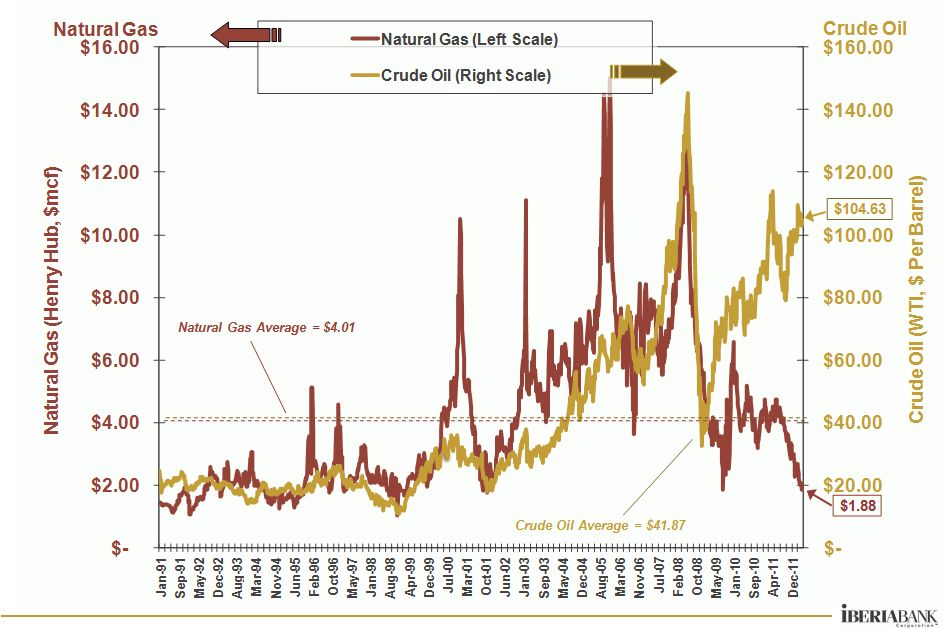

45

Appendix

Appendix

Energy Price Trends |

46

Appendix

Appendix

Low Risk Balance Sheet At March 31, 2012

Cash and

Equivalents,

5%

Investment

Securities, 17%

Mortgage

Loans Held

For Sale, 1%

Acquired

Loans -

Fair

Value, 0.3%

Loans -

FDIC

Covered, 11%

FDIC Loss

Share

Receivable, 5%

Loans -

Noncovered,

52%

Other Assets,

9%

39%

Of

Balance

Sheet

In

Very

Low

Risk

Components |

47

Appendix

Appendix

FDIC Covered Loan Portfolio Roll Forward

($ in thousands)

Average

Income /

Expense

Average

Yield

Average

Income /

Expense

Average

Yield

Average

Income /

Expense

Average

Yield

Average

Income /

Expense

Average

Yield

Covered Loans

1,489,782

40,454

10.768%

1,421,784

28,201

7.819%

1,350,935

55,518

16.139%

1,293,160

52,019

15.968%

Mortgage Loans

243,303

4,487

7.378%

229,678

5,209

9.072%

218,922

4,799

8.768%

211,640

4,946

9.347%

Indirect Automobile

-

-

0.000%

-

-

0.000%

-

-

0.000%

-

-

0.000%

Credit Card

1,026

17

6.721%

972

16

6.693%

957

15

6.246%

901

14

6.199%

Consumer

189,022

(234)

-0.497%

172,391

3,780

8.698%

162,815

3,701

9.019%

155,406

3,895

10.080%

Line Of Credit-Consumer Loans

81,575

2,967

14.588%

80,650

2,372

11.669%

79,220

2,502

12.528%

75,164

2,927

15.663%

Commercial & Business Banking

975,301

33,217

13.477%

938,554

16,824

7.018%

889,481

44,502

19.581%

850,519

40,238

18.719%

Loans in Process

(445)

-

0.000%

(460)

-

0.000%

(461)

-

0.000%

(469)

-

0.000%

Overdrafts

0

-

0.000%

0

-

0.000%

0

-

0.000%

0

-

0.000%

FDIC Loss Share Receivable

666,159

(18,315)

-10.877%

626,551

(2,602)

-1.625%

592,985

(29,255)

-19.305%

573,776

(27,927)

-19.255%

Net Covered Loan Portfolio

2,155,941

22,139

4.080%

2,048,335

25,599

4.930%

1,943,920

26,263

5.327%

1,866,937

24,092

5.142%

Average

Income /

Expense

Average

Yield

Average

Income /

Expense

Average

Yield

Average

Income /

Expense

Average

Yield

Average

Income /

Expense

Average

Yield

Covered Loans

1,489,782

40,454

10.768%

1,421,784

28,201

7.819%

1,350,935

55,518

16.139%

1,293,160

52,019

15.968%

240,511

5,196

8.536%

227,549

(1,827)

-3.080%

209,043

14,372

26.967%

198,491

6,203

12.416%

Orion Bank

794,202

29,013

14.479%

759,860

24,875

12.861%

734,021

29,565

15.817%

710,111

34,820

19.448%

Century Bank

323,681

4,105

5.072%

303,773

3,024

3.979%

281,888

5,261

7.387%

264,864

6,697

10.080%

Sterling Bank

131,388

2,140

6.464%

130,602

2,130

6.405%

125,983

6,319

19.631%

119,694

4,299

14.239%

FDIC Loss Share Receivable

666,159

(18,315)

-10.877%

626,551

(2,602)

-1.625%

592,985

(29,255)

-19.305%

573,776

(27,927)

-19.255%

58,676

(4,456)

-30.041%

57,146

5,754

39.402%

56,241

(8,707)

-60.581%

49,433

(1,917)

-15.338%

Orion Bank

392,880

(13,256)

-13.348%

375,943

(11,021)

-11.472%

355,317

(16,430)

-18.095%

349,685

(21,626)

-24.466%

Century Bank

157,959

(756)

-1.894%

145,807

2,505

6.723%

137,868

(761)

-2.160%

136,205

(2,380)

-6.913%

Sterling Bank

56,644

152

1.065%

47,655

159

1.310%

43,559

(3,357)

-30.153%

38,453

(2,004)

-20.621%

Net Covered Loan Portfolio

2,155,941

22,139

4.080%

2,048,335

25,599

4.930%

1,943,920

26,263

5.327%

1,866,937

24,092

5.142%

299,187

740

0.954%

284,696

3,927

5.448%

265,284

5,665

8.406%

247,924

4,286

6.882%

Orion Bank

1,187,083

15,757

5.269%

1,135,803

13,853

4.807%

1,089,338

13,135

4.756%

1,059,796

13,194

4.952%

Century Bank

481,639

3,349

2.787%

449,580

5,529

4.869%

419,756

4,500

4.252%

401,069

4,317

4.309%

Sterling Bank

188,032

2,293

4.838%

178,257

2,290

5.043%

169,542

2,963

6.841%

158,148

2,294

5.763%

4Q2011

4Q2011

3Q2011

1Q2012

2Q2011

3Q2011

1Q2012

2Q2011

Capital South Bank

Capital South Bank

Capital South Bank

|

48

Appendix

Appendix

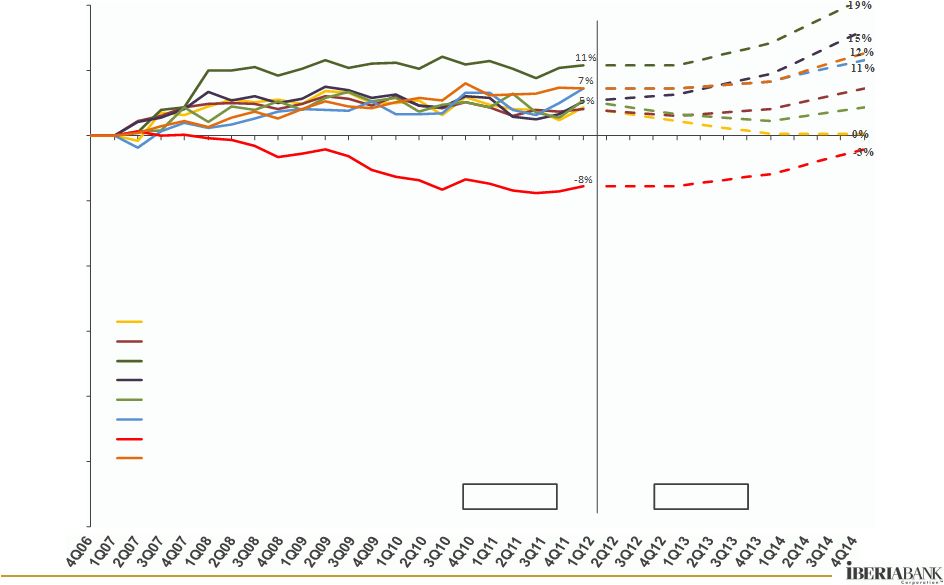

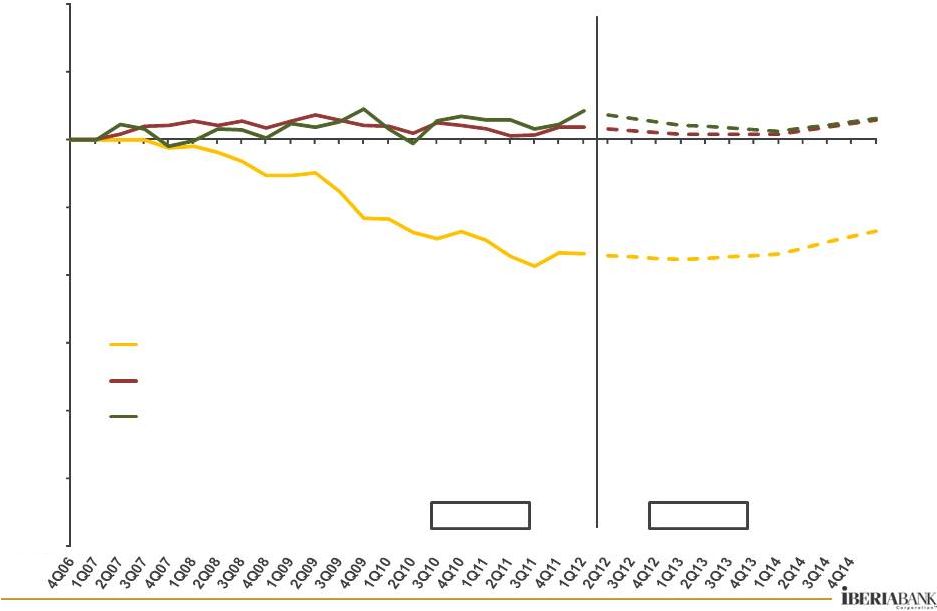

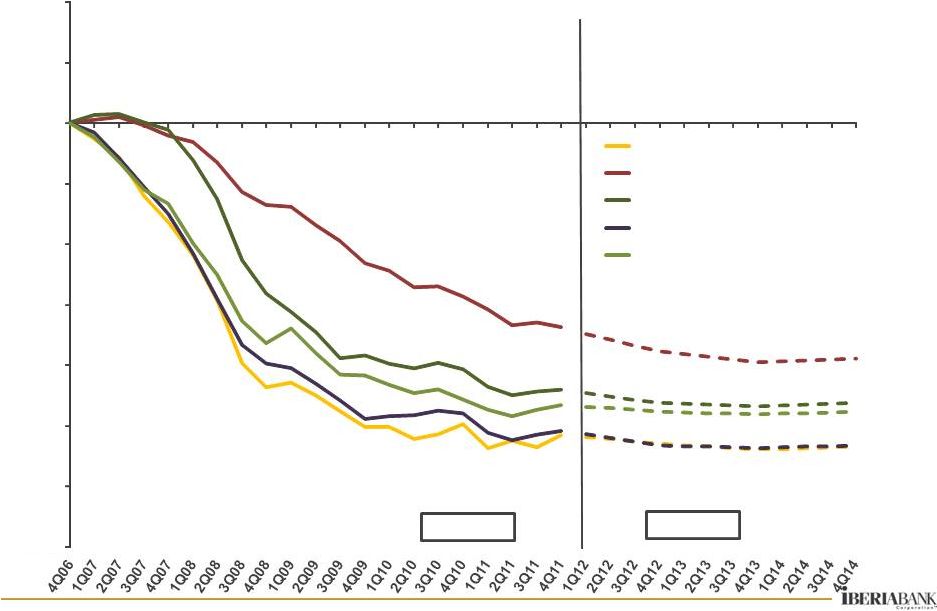

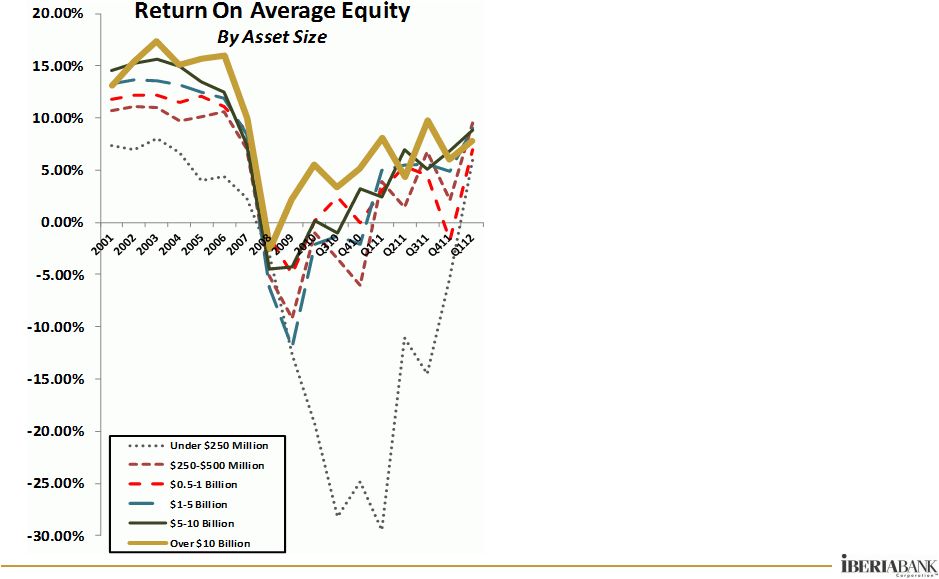

Industry Profitability Trends

•

Industry Profitability Has

Improved, But Structurally Well

Below Historical Levels

•

Highly Regulated Industry

•

Industry Actions Needed:

•

Favorable Asset Quality

•

Watch Interest Rate Risk

•

Offset Regulatory Costs

•

Improve Efficiency

•

Add Revenues

•

Improve L/T Earnings

•

Hit Investor Expectations

•

Consolidation Is Likely Required

To Achieve These Actions

Source: SNL |

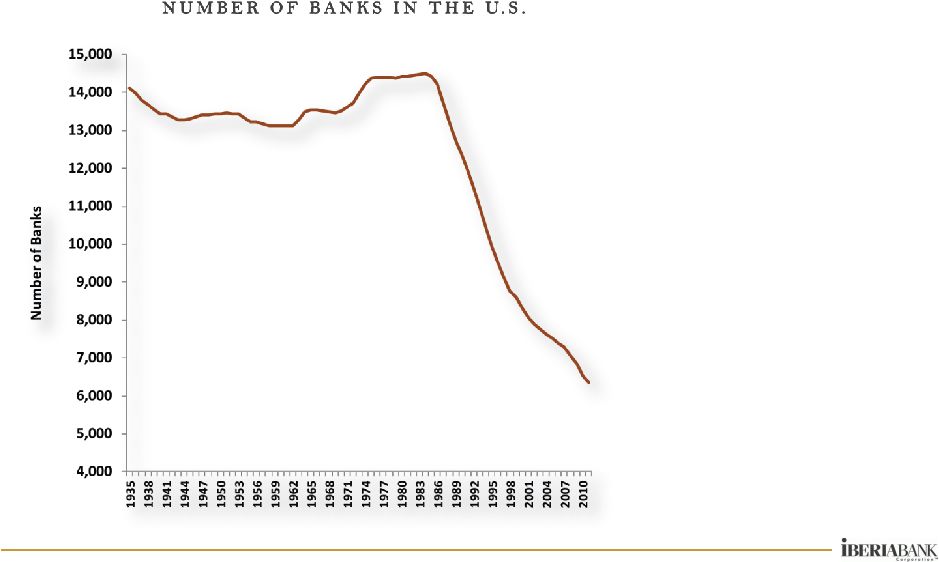

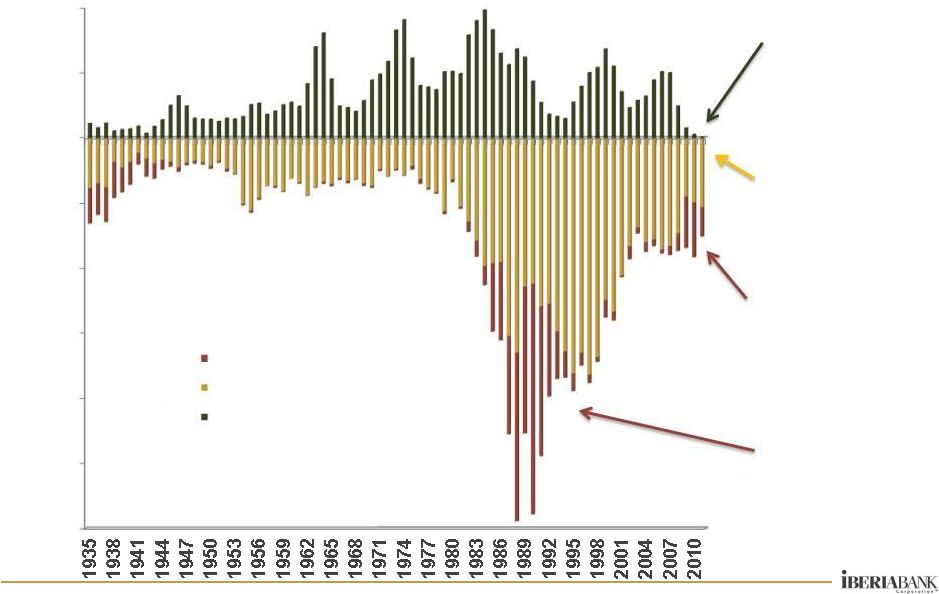

49

New Charters, Acquisitions & Failures

Appendix

Appendix

Source:

FDIC

And

OTS.

–

data

through

December

31,

2011

•

New Charters

Have Gone

Away

•

The Number

of Bank

Mergers Has

Declined

•

The Number

of Failures

Has

Increased….

•

…But Remain

Well Below

The Last

Cycle

(1,200)

(1,000)

(800)

(600)

(400)

(200)

-

200

400

Failures & Others

Mergers

New Charters |

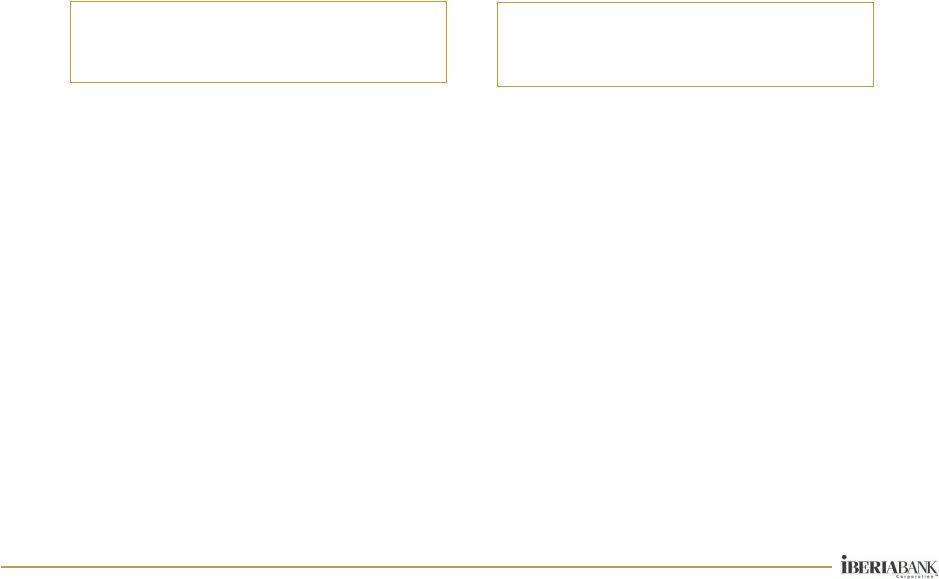

50

Florida Gulf Bancorp, Inc. Distribution

Fort Myers -

College Pointe

Deposits: $92 million

Fort Myers -

First Street

Deposits: $65 million

Fort Myers -

Daniels Parkway

Deposits: $27 million

Cape Coral -

Del Prado Blvd

Deposits: $21 million

Fort Myers -Winkler Road

Deposits: $30 million

Fort Myers -

Dani Drive

Deposits: $20 million

Appendix

Appendix |

51

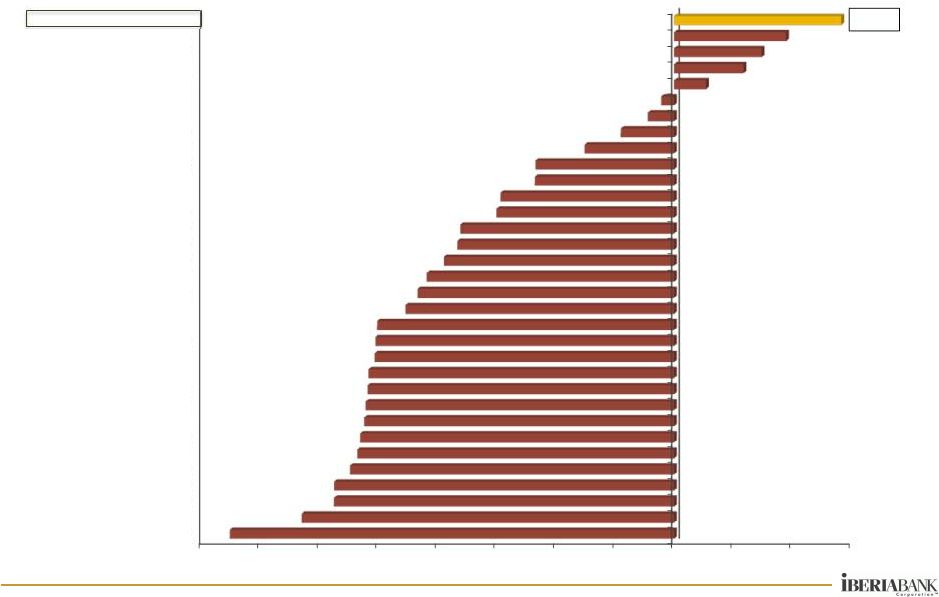

Shareholder Return Over Last 10 Years

Appendix

Appendix

51

•

The Result Has Been

A Dramatic Reduction

In Bank Stock Prices

•

In Contrast, Our Share

Price Was Up 93%

Over The Last 10

Years

•

Many Banks Slashed

Or Eliminated

Dividends Over That

Period To Conserve

Capital

•

Our Dividends Per

Share Increased 136%

Over The Last 10

Years

IBKC = 149%

Source: SNL and Bloomberg

-100%

0%

100%

200%

300%

400%

500%

600%

10 Year Total Cumulative Return %

Publicly Traded BHCs in AL, AR, FL, GA, LA, MS, NC, SC, TN, TX

|

|