Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - EQUITY ONE, INC. | d350767dex991.htm |

| 8-K - FORM 8-K - EQUITY ONE, INC. | d350767d8k.htm |

INVESTOR

PRESENTATION MAY 2012

Exhibit 99.2 |

Certain matters discussed by Equity One in this presentation constitute

forward-looking statements within the meaning of the federal

securities laws. Although Equity One believes that the expectations reflected in such forward-looking

statements

are

based

upon

reasonable

assumptions,

it

can

give

no

assurance

that

these

expectations

will

be

achieved.

Factors that could cause actual results to differ materially from current

expectations include changes in macro-economic conditions and the

demand for retail space in the states in which Equity One owns properties; the continuing financial

success

of

Equity

One’s

current

and

prospective

tenants;

the

risks

that

Equity

One

may

not

be

able

to

proceed

with

or

obtain necessary approvals for development or redevelopment projects or that it

may take more time to complete such projects or incur costs greater than

anticipated; the availability of properties for acquisition; the extent to which continuing

supply constraints occur in geographic markets where Equity One owns properties;

the success of its efforts to lease up vacant space; the effects of

natural and other disasters; the ability of Equity One to successfully integrate the operations

and systems of acquired companies and properties; changes in Equity One’s

credit ratings; and other risks, which are described in Equity One’s

filings with the Securities and Exchange Commission. This presentation

also contains non-GAAP financial measures, including Funds from Operations, or FFO.

Reconciliations of these non-GAAP financial measures to the most directly

comparable GAAP measures can be found in

Equity

One’s

quarterly

supplemental

information

package

and

in

filings

made

with

the

SEC

which

are

available

on

its website at www.equityone.net.

Forward Looking Statements

1 |

Mission Statement

2

Improving retail real estate in urban communities

|

Corporate Overview

3

•

Equity One specializes in the acquisition, asset management, development and

redevelopment of quality retail properties primarily located in the

coastal markets across the United States •

We

own

157

properties

in

13

states

(1)

•

Our largest markets as measured by approximate fair market values are: South

Florida (29%), California (22%), Northeast (22%)

,

North

Florida

(11%),

and

Atlanta

(8%)

(2)

•

Total equity capitalization / total enterprise value as of 03/31/12: $2.5

billion / $3.9 billion •

Investment

grade

credit

ratings

of

Baa3

(positive)

from

Moody’s

and

BBB -

(stable)

from

S&P

•

Management and board have substantial ownership stake and experience:

–

Beneficial ownership: 52.2%

(3)

–

Management team has over 80 years of collective experience

(1)

As of 3/31/12; includes acquisitions & dispositions under contract.

Excludes land and non-core assets not associated with retail centers. Additionally, we had joint venture interests in seventeen

shopping centers and two office buildings totaling approximately 2.8

million square feet. (2)

Ranked by percentage of total estimated fair value as of 03/31/12

inclusive of all acquisitions and dispositions currently under contract and excluding land. Does not include unconsolidated JV

properties.

(3)

Beneficial ownership of current executive officers and directors as of

3/31/12 in accordance with rules of the SEC and including options exercisable within 60 days. Beneficial ownership: Chaim

Katzman 47.6%, Jeff Olson 2.1% and Nathan Hetz 1.4% on a

fully diluted basis including shares issuable to Liberty. |

As of Mar 31, 2012

As of Dec 31, 2008

Fair Value ($M)

% FV

Fair Value ($M)

% FV

South Florida

$977

29%

$1,007

43%

California

$732

22%

$0

0%

Northeast

$736

22%

$168

7%

Central/North Florida

$374

11%

$525

22%

Atlanta

$271

8%

$297

13%

Other

$258

8%

$368

15%

Total

$3,348

100%

$2,365

100%

Equity One is on the move…

Then vs. Now

4

As of Mar 31, 2012

As of Dec 31, 2008

3-mile population

153,550

82,368

3-mile household income

$92,794

$72,878

Grocery sales per sq.ft

$526

$406

(1)

Data includes acquisitions & dispositions under contract as of 03/31/12 .

Excludes land and non-core assets not associated with retail centers.

(2)

Demographic data weighted on estimated fair market value of assets

Asset Composition by Region

(1)

Demographic Quality of Assets

(2)

|

Significant Investment Activity is Transforming the Portfolio

5

•

Approximately

$1.7B

of

acquisitions

completed

since

2009

in

our

target

markets

(1)

–

Approximately $760M of assets in West Coast markets

–

Approximately $730M of premium quality assets in Northeast portfolio

–

Added $154M of assets in West Coast and Northeast markets since January

2012 –

Acquired

rights

to

develop

the

Broadway

Plaza

site

in

the

Bronx,

New

York

•

Sold approximately over $800M of non-strategic/non-core assets since

2009, the most prominent being –

$473M sale of 36 non-strategic retail assets to Blackstone closed in

December 2011 –

$191M asset dispositions related to non-retail CapCo assets

–

$62M of asset dispositions executed in first quarter 2012

•

Seeded new joint venture with New York Common Retirement Fund

–

Institutional

JV

partner

seeking

to

acquire

high

quality

grocery

anchored

centers

–

Provides attractive source of capital that can help us leverage our

platform As of Mar 31, 2012. - includes assets under contract as

of Mar 31, 2012 and joint venture properties. Figures are computed based on weighted average estimated fair values.

(1) |

2012 Strategic Goals

6

Operating

Fundamentals

Increase same property occupancy by 50 basis points

Generate same property NOI growth of 1.5% to 2.5%

Maximize value of assets via cost containment measures and prudent tenanting

Focused on Execution

Balance Sheet

Management

Portfolio

Quality

Value

Creation

Acquire $200M -

$300M of shopping centers in target markets

Sell $50M -

$75M of assets located in secondary markets

Recycle capital from dispositions into major urban markets

Execute plans to launch redevelopment at Serramonte and the Bronx site

Build pipeline of urban infill development and redevelopment properties that

represents 10% of total asset value

Increase ownership concentration in targeted markets through accretive

development projects Maintain quality balance sheet / financial

discipline Keep targeted leverage ratio of 40-45%

Net Debt to EBITDA goal of 6.5X

Extend debt maturity profile

Maintain access to multiple sources of capital |

Operating Fundamentals

7

•

2012 goal to increase same property NOI by 1.5% to 2.5% focused on the

following –

Increase occupancy with an emphasis on small shop space

–

Increase rent spreads particularly on lease renewals

–

Continue implementation of cost containment initiatives within property

operations –

Reduce concentration of assets in secondary markets

–

Expand tenant relations and marketing efforts with national and regional

retailers |

Portfolio Quality

8

•

We plan to further diversify our portfolio into supply constrained, urban

markets •

Recent acquisitions in California and Connecticut highlight our focused approach

on properties which meet the following key criteria aimed at enhancing

the quality and performance of our overall portfolio: –

Strong

demographics

–

average

3-mile

populations

of

nearly

200,000

as

compared

to

EQY’s

historical

portfolio

average of approximately 80,000

–

Strong barriers to entry due to scarcity of land and strict zoning

restrictions –

Highly productive anchor sales volumes

–

Below market anchor rents

–

Redevelopment and densification opportunities

•

These acquisitions have enabled us to diversify our portfolio into higher

quality centers in major MSAs which will ultimately result in greater

stability and higher internal growth |

Disposition

Plans for Secondary Market Centers

9

•

We plan to sell at least $50-$75 million of our existing assets located in

secondary markets annually •

The average three mile population density of most centers targeted for

disposition is 40-70K people •

Ultimate

size

of

disposition

pool

for

2012

dependent

on

expected

pricing

–

we

would

be

more

aggressive

if pricing is attractive |

Development / Redevelopment Update

10

•

The Gallery at Westbury Plaza

•

Executed leases at Westbury now include The Container Store, Trader Joe’s,

Nordstrom Rack, Bloomindales Outlet, Saks OFF 5TH, Ulta, SA Elite, Old

Navy, Verizon and Shake Shack. Nordstrom Rack, Trader Joe’s

and The Container Store have accepted possession.

•

Construction is in progress with targeted opening by Fall of 2012

•

2012

CAPEX

expected

to

be

$55M

-

$65M

•

Serramonte

•

Feasibility / architectural review underway

•

Actively

discussing

tenanting

options

–

big

box

retail,

entertainment,

value/convenience

retail

•

No significant redevelopment CAPEX expected in 2012

•

Boca Village / Pine Ridge

•

Addresses layout / structural design weakness

•

Reduces shop tenant exposure

•

Target stabilization late 2013 / early 2014

•

2012 expected CAPEX is approximately $4.5M-$5.0M for Boca Village and less

than $2.5M for Pine Ridge •

Boynton Plaza

•

Public expansion (from 39K sq ft to 54K sq ft)

•

Reduce small shop exposure

•

Expected to increase occupancy from 86% to more than 96%

•

2012 expected CAPEX is approximately $3.0M |

Pro-forma Concentration of Assets As of Mar 31, 2012

Estimated FMV:

$736M

% of FV: 22%

Estimated FMV:

$29M

% of FV: 1%

Estimated FMV:

$271M

% of FV: 8%

Estimated FMV:

$977M

% of FV: 29%

Estimated FMV:

$374M

% of FV: 11%

11

Estimated FMV:

$537M

% of FV: 16%

Estimated FMV:

$194M

% of FV: 6%

* Estimated fair market values are as of 3/31/12. Excludes land and non-core

assets not associated with retail centers. Includes acquisitions and dispositions currently under contract.

Region

$ (M)

%

South Florida

977

29%

North Florida

374

11%

San Francisco

537

16%

Los Angeles

194

6%

Atlanta

271

8%

Charlotte/Raleigh/Durham

29

1%

Washington DC to Boston

736

22%

Other

229

7%

TOTAL

$3,348

100% |

Benefits of EQY’s Portfolio Concentration

12

•

Increase in our overall portfolio value through strategic acquisitions in key,

high value markets and disposition of our non-core assets in

secondary markets •

“Fewer

but

better

assets”

–

14%

of

our

assets

(22/157)

account

for

approximately

50%

of

our

value

•

71% of these 22 assets have been acquired since November 2009 signifying

execution of our stated vision •

These

assets

are

concentrated

in

8

important

retail

markets

with

an

average

value

of

$76M+

and

97%

occupancy

•

Generally the acquired assets are the most dominant assets in their respective

markets and provide significant future redevelopment potential

•

Concentration of fewer, higher value assets provides opportunities to streamline

and increase efficiencies in operations and management. For example,

these 22 assets account for 23% of our leases yet 50% of our asset

value.

* Estimated fair market values are as of 3/31/12. Excludes land and non-core

assets not associated with retail centers. Includes acquisitions and dispositions currently under contract. |

Balance

Sheet

Discipline

–

Maintained

During

Portfolio

Transformation

13

•

Key leverage ratios:

–

Net Debt to Total Market Cap as of 3/31/12: 35.3%

–

Net Debt to Gross Real Estate as of 3/31/12: 42.4%

–

Net Debt to Adjusted EBITDA of 6.8X as of 3/31/12

–

Adjusted EBITDA to interest expense coverage of 2.8X as of 3/31/12

–

Adjusted EBITDA to fixed charges of 2.5X as of 3/31/12

–

Weighted average term to maturity for our total debt of 4.7 years as of

3/31/12 Source: Company filings and SNL financial. Credit ratings from

S&P and Moody's as of 12/31/11 30.0%

35.0%

40.0%

45.0%

50.0%

55.0%

60.0%

EQY (BBB-/Baa3)

KIM (BBB+/Baa1)

FRT (BBB+/Baa1)

REG (BBB/NR)

WRI (BBB/Baa2)

Q1 2012 Leverage (Total Debt + Preferred / Gross Assets)

(1)

Based on net debt as of 3/31/12 and Adjusted EBITDA (excluding gains/losses on

property sales, debt extinguishment, impairments, and other non-recurring items) calculated by

annualizing 1Q12 numbers as reported in the 3/31/12 supplement.

(1)

(1) |

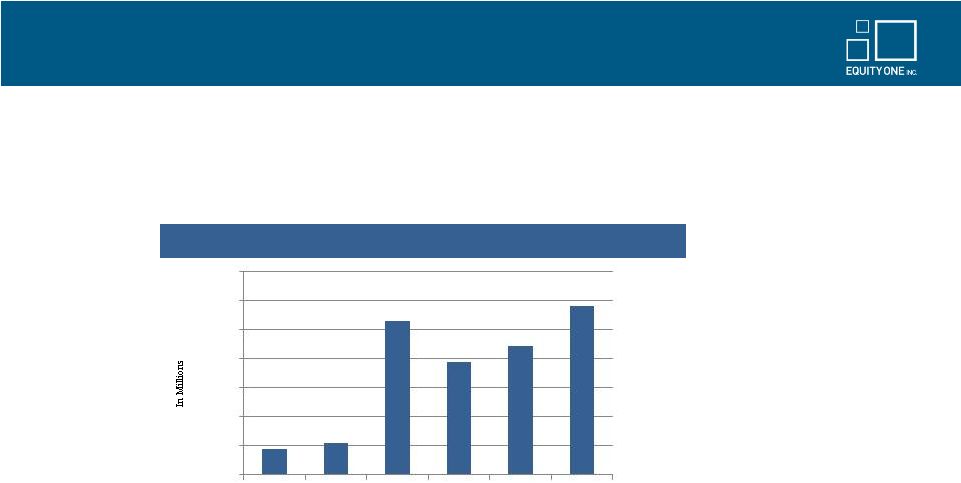

Current Liquidity Position

14

•

Cash and cash equivalents amounted to $17.3M as of March 31, 2012

•

Total available undrawn capacity on our various lines of credit of $443M at

March 31, 2012 •

We maintain a manageable debt maturity schedule with maturities through

2017: Note: Cash includes $1.7M in Escrow account

Debt maturity schedule as of 3/31/12. Includes scheduled principal

amortization. Credit facilities are shown as due on the initial maturity dates, though certain extension options may be

available.

•

Increased unencumbered Cash NOI to approximately 71.6% at 3/31/12 (versus 63.1%

at Q1 2011) •

Strong lending relationships with both traditional banks and life insurance

companies •

Demonstrated access to the public markets

$0

$50

$100

$150

$200

$250

$300

$350

2012

2013

2014

2015

2016

2017

Debt Maturity Schedule |

Investment Thesis

15

A

management

team

who

has

proven

to

execute

a

stated

strategy

of

significant

portfolio

improvement

while

maintaining

financial

discipline

A

management

team

who

has

proven

to

execute

a

stated

strategy

of

significant

portfolio

improvement

while

maintaining

financial

discipline

Well-located, high quality, and productive grocery-anchored shopping

centers with an intensive focus on asset management

Investment strategy focused on identified core markets leading to an upgrade in

portfolio quality and further geographic diversity

A healthy financial structure including a strong balance sheet, modest leverage

and ample liquidity We are a premier operator positioned for growth

We are a premier operator positioned for growth |

Appendix

16

•Broadway Plaza

•Potrero Center

•Culver Center

•Gateway of Aventura/ Aventura

Square

•Loehmann’s-

107 Seventh Avenue

•90-30 Metropolitan (Queens, NY)

•Westbury Properties

Aerial •The Gallery

at Westbury Plaza

•Serramonte Shopping

Center •Plaza

Escuela •Sub-market Portfolio Metrics |

Broadway Plaza, Bronx, NY

17 |

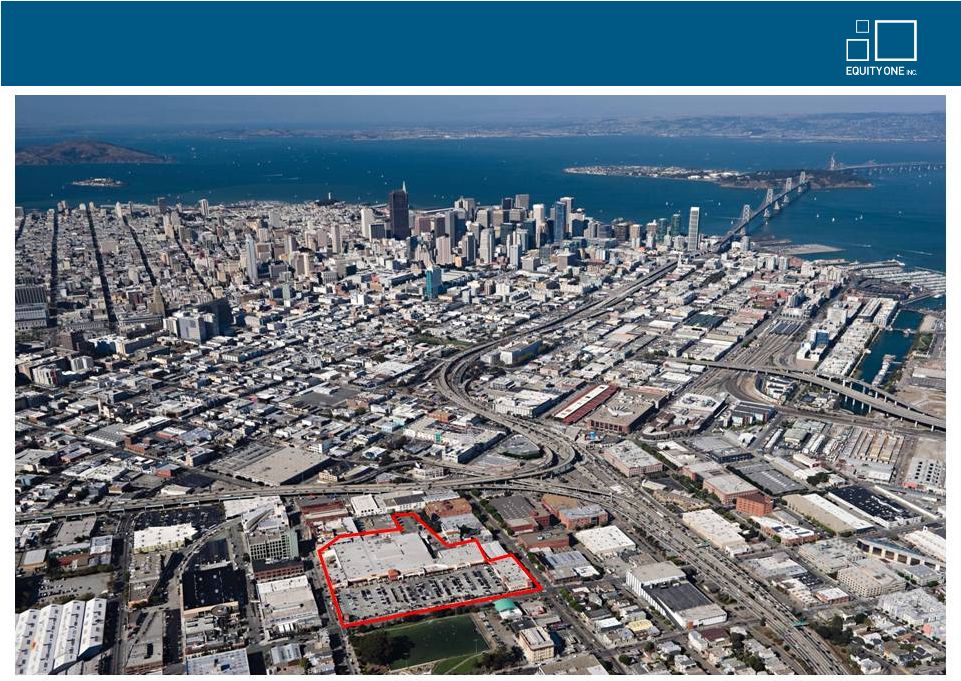

Potrero Center, San Francisco, CA

18 |

Culver Center, Los Angeles, CA

19 |

Gateway of Aventura and Aventura Square

20 |

21

Property Overview

•

56,870 sf retail property in the

heart of the Chelsea

neighborhood in New York City.

•

Loehmann’s currently occupies

the entire space.

•

Prime Manhattan location

which attracts heavy foot traffic

from surrounding Meat Packing

District, Chelsea Market and The

High Line Park.

•

Google’s New York

Headquarters is one block west

of the site.

•

Significantly below market rent.

Loehmann’s-

107 Seventh Avenue |

22

90-30 Metropolitan , Queens, NY

Acquisition Overview

•

60,000 sf two-level retail

building located in Forest Hills,

NY.

•

94% occupied and anchored by

Trader Joe’s, Staples and

Michaels.

•

Situated in one of the most

affluent and dense

neighborhoods in Queens, NY

with nearly 1 million people living

within a 3-Mile radius.

•

Queens is one of the most

under-retailed areas in the

country (estimated at 9 sf of retail

space per capita or 1/3 average

for the U.S.

(1)

).

(1)

Source –

Eastdil Secured |

23

Westbury Properties |

24

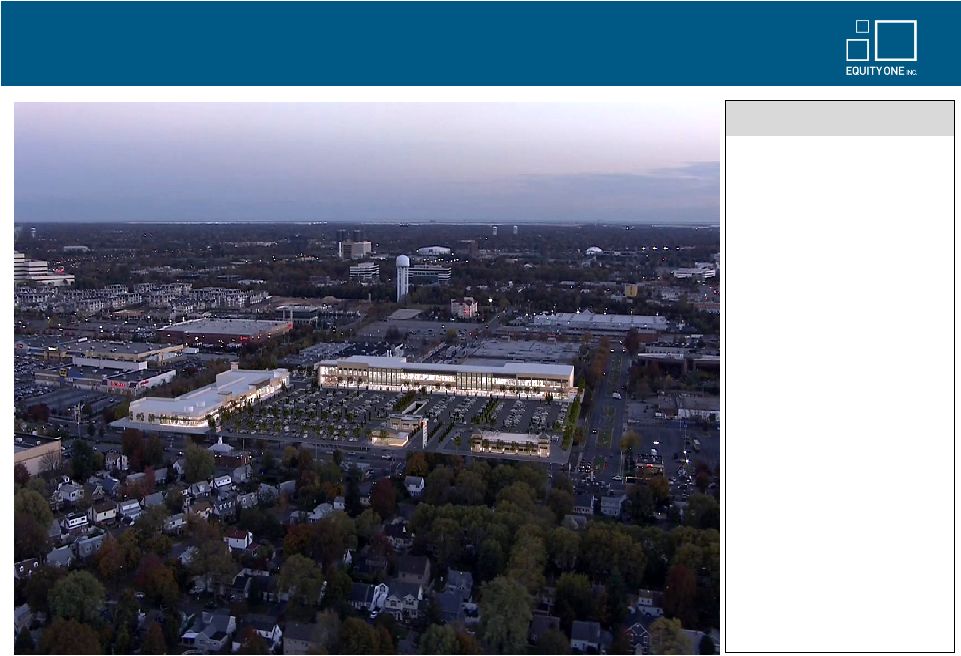

The Gallery at Westbury Plaza

Property Overview

•

The Gallery at Westbury Plaza

sits at the center of Nassau

County, one of the most affluent

and densely populated regions in

the nation.

•

Development site is located in

one of the strongest retail

corridors between Roosevelt

Field Mall and Westbury Plaza.

•

Current plan anticipates

330,000 sf of retail GLA.

•

Anchor leases now signed with

The Container Store, Trader

Joe’s, ULTA, Saks OFF 5TH,

Nordstroms Rack and Shake

Shack.

•

Targeted opening date –

Fall

2012. |

25

Property Profile

GLA (sf)

818,177

Year Built

1968

Site Area (acres)

80

Occupancy (as of 3/31/12)

97%

Population (3 miles)

186,810

Average HH income (3 miles)

$88,882

Serramonte Shopping Center -

Ideally Positioned for Further Development

|

26

GLA (SF)

152,452

Year Built

2002

Site Area (acres)

5.2

Occupancy (as of 3/31/12)

99%

Population (3 miles)

93,841

Average HH income (3 miles)

$119,406

Property Profile

Plaza

Escuela

–

Centrally

Located

in

a

Prime,

High-End

Retail

Market |

27

Sub-market Portfolio Metrics

(1)

GLA, Occupancy and Base Rent data exclude the Gallery at Westbury, which is in

development status. (2)

Excludes land and non-core assets not associated with retail centers.

Includes acquisitions and dispositions currently under contract. |