Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENCORE CAPITAL GROUP INC | d351477d8k.htm |

ENCORE CAPITAL GROUP

JMP Securities Research Conference

May 14, 2012

PROPRIETARY

Exhibit 99.1 |

2

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

The statements in this presentation that are not historical facts, including,

most importantly, those statements preceded by, or that include,

the words

“will,”

“may,”

“believe,”

“projects,”

“expects,”

“anticipates”

or the negation

thereof, or similar expressions, constitute “forward-looking

statements” within

the meaning of the Private Securities Litigation Reform Act of 1995 (the

“Reform Act”).

These statements may include, but are not limited to,

statements regarding our future operating results and growth.

For all

“forward-looking statements,”

the Company claims the protection of the safe

harbor for forward-looking statements contained in the Reform Act.

Such

forward-looking statements involve risks, uncertainties and other factors which

may cause actual results, performance or achievements of the Company and

its subsidiaries to be materially different from any future results,

performance or achievements expressed or implied by such forward-looking

statements. These risks, uncertainties and other factors are discussed in

the reports filed by the Company with the Securities and Exchange

Commission, including the most recent reports on Forms 10-K, 10-Q

and 8-K, each as it may be amended from time to time.

The Company disclaims any intent or obligation

to update these forward-looking statements.

PROPRIETARY |

3

INVESTMENT HIGHLIGHTS

•

Operating results continue to be strong and surpass our internal

projections

•

Recently completed the acquisition of the market leader in tax

lien transfer business

•

Exiting the underperforming bankruptcy servicing business

•

Significant purchases in late 2011 and early 2012 will drive

growth throughout this year and into 2013

PROPRIETARY

•

Effectively managing through a regulatory environment that

continues to be challenging |

4

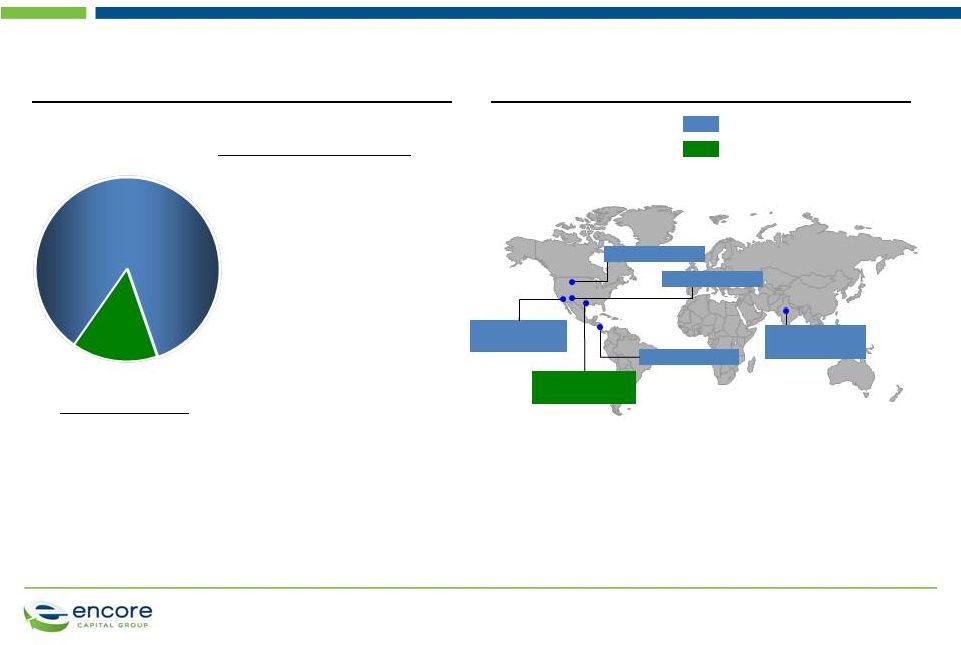

ENCORE IS A LEADING PLAYER IN THE CONSUMER DEBT BUYING AND

RECOVERY INDUSTRY

Global Capabilities

St Cloud, MN

San Antonio, TX

Phoenix, AZ

Delhi, India

Call Center /

Technology Site

Call Center Site

Propel Financial

Services

Call Center Site

San Diego, CA

Debt Purchasing & Collections

Tax Lien Purchasing

Headquarters/

Call Center Site

Receivable Portfolio Composition

Pro forma as of March 31, 2012

Debt Purchasing & Collections

Tax Lien Purchasing

•

Purchase and collection of

charged-off unsecured

consumer receivables

(primarily credit card)

•

Robust business model

emphasizing consumer

intelligence and

operational

specialization

•

Invested ~$2.2 billion to

acquire receivables with a

face value of ~$66 billion

•

Acquired ~40 million

consumer accounts

since

inception

•

Consumer and municipality friendly asset class with superior

returns

•

Allows consumers to protect their homes in a cost effective

manner

•

Highly secured position as tax liens rank above almost all other

liens

Call Center Site

Costa Rica

PROPRIETARY

15%

85%

15%

85% |

5

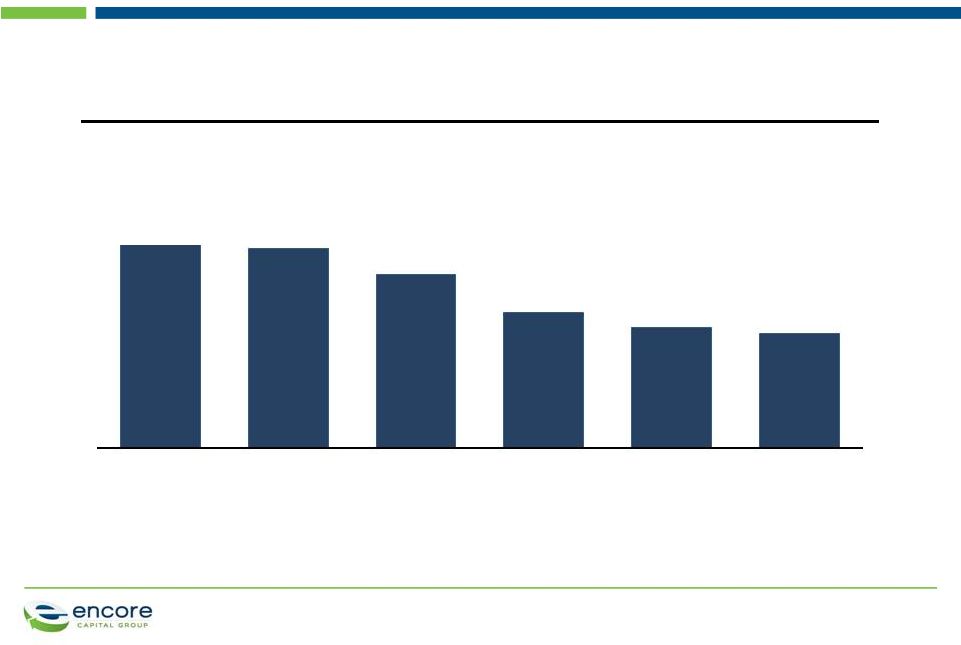

WE HAVE SIGNIFICANTLY INCREASED OPERATING CASH FLOW

(ADJUSTED EBITDA) AND CASH COLLECTIONS

($M)

*

Adjusted EBITDA is a non-GAAP number. The Company considers Adjusted EBITDA to

be a meaningful indicator of operating performance and uses it as a measure

to assess the operating performance of the Company. See Reconciliation of Adjusted EBITDA to GAAP Net Income at the end of this presentation.

Adjusted EBITDA* and gross collections by year

PROPRIETARY

Gross

collections

Adjusted

EBITDA

24%

CAGR

28%

CAGR

150

250

350

450

550

650

750

850

2007

2008

2009

2010

2011

Q1 2012

TTM |

6

WHILE FUNDAMENTALLY CHANGING THE COST STRUCTURE OF THE

COMPANY

PROPRIETARY

51.5

50.2

47.6

43.7

42.2

41.6

Annual, overall cost-to-collect

(%)

2007

2008

2009

2010

2011

Q1 2012

TTM |

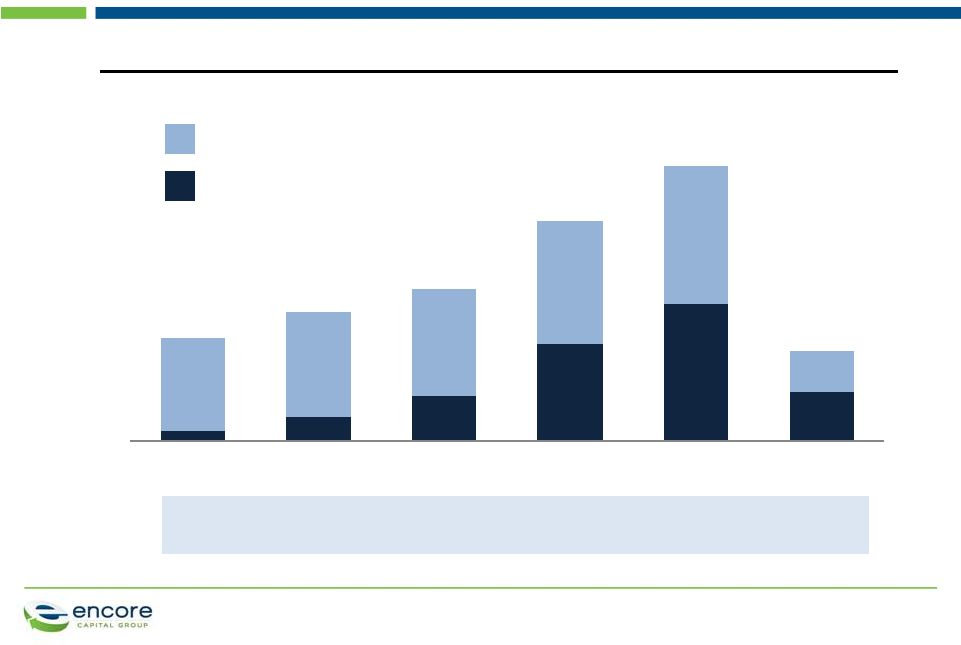

7

DRIVEN PRIMARILY BY THE GROWTH OF OUR INDIA OPERATIONS

CENTER

Collections from all call centers

($M)

126

157

186

268

Percent

of Total:

10%

19%

30%

44%

336

50%

PROPRIETARY

54%

110

India

U.S.

2007

2008

2009

2010

2011

Q1 2012 |

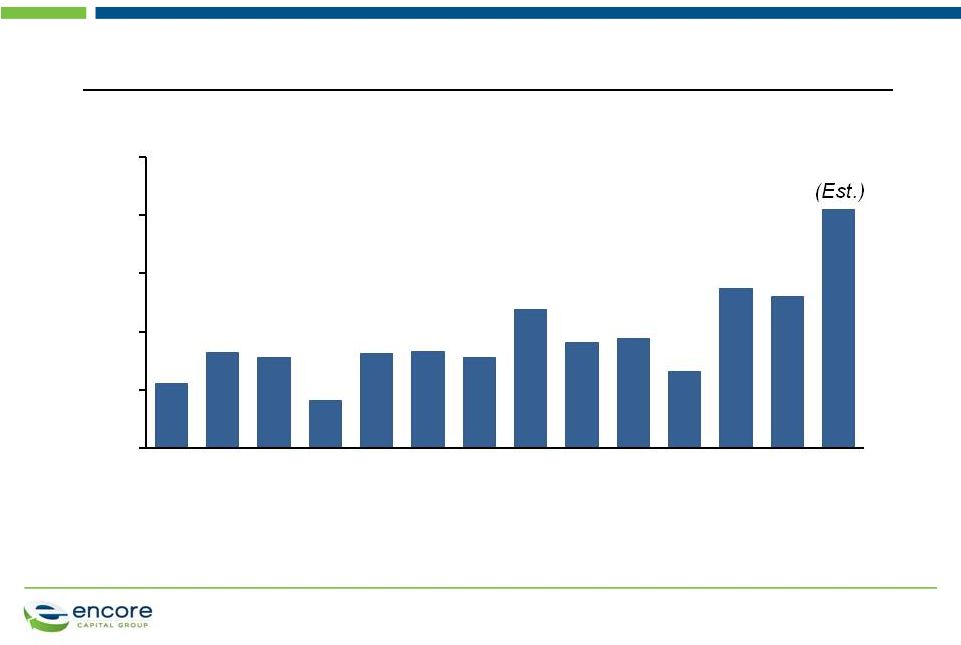

Quarterly purchases

($M)

(Est.)

THE STRONG COLLECTIONS AND IMPROVING COST STRUCTURE

HAVE CONTRIBUTED TO OUR ABILITY TO INCREASE PURCHASES

PROPRIETARY

8

0

50

100

150

200

250

Q1

2009

Q1

2010

Q1

2011

Q1

2012 |

OUR FLEXIBLE OPERATING PLATFORM ADJUSTS TO DIFFERENT

TYPES OF PORTFOLIOS, ALLOWING US TO MAXIMIZE RETURNS

9

Historical purchase mix by year

($M)

PROPRIETARY |

10

AND BUILD VALUE FOR THE FUTURE

Annual estimated remaining gross collection (ERC) and total debt

($M, End of period)

PROPRIETARY

1,338

1,724

385

398

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

2006

2007

2008

2009

2010

2011

Q1 2012

ERC

Total Debt |

11

PURCHASING ACCURACY AND OUR ANALYTIC OPERATING MODEL

HAVE LED US TO CONSISTENTLY OUTPERFORM OUR PEERS

Cumulative actual collection multiples by vintage year as of March 31, 2012

(Total Collections / Purchase Price)

Source: SEC Filings, Encore Capital Group Inc.

PROPRIETARY

0.00x

0.50x

1.00x

1.50x

2.00x

2.50x

2005

2006

2007

2008

2009

2010

2011

2012

ECPG

Peer 1

Peer 2 |

12

OUR BUSINESS MODEL IS CRITICALLY IMPORTANT, AS IT PROVIDES

THE CONSUMER WITH TIME TO RECOVER

Time frame

Process and

relationship

with consumers

Outcome

•

Charge-off threshold

extends a maximum of

6 months

Transactional

•

Attempt immediate

resolution during

delinquency cycle

(days 30 –

180)

•

Consumer is “charged-

off”

by issuer on day 181

•

Issuer offers to sell

unsecured, charged-off

debt or service through

3rd party agencies

•

Four-to-six month

collection cycle

Pressured

•

Artificial deadlines

•

Multiple collection

companies

•

Counterproductive

incentive structure

•

Consumer is

confused and

frustrated

•

Consumer has 84 months

to recover financially

Partnership

•

Create partnership strategy

and set goals

•

Tailor work strategies to

individual circumstances,

giving time for a consumer

to recover

•

Maximizes likelihood of

repayment, creates

consistency, and ensures

that consumers are treated

fairly

PROPRIETARY

CONTINGENCY

COLLECTION

AGENCY

ORIGINAL

CREDITOR |

13

WE HAVE POSITIONED OURSELVES TO

ADDRESS REGULATORY CHALLENGES AS THEY EMERGE

Building a consumer intelligence platform, focused on

financially stressed consumers, that can inform policy

discussions and identify strategies to promote financial

recovery

Revamped our consumer relations process and introduced

a Consumer Bill of Rights

Met with leadership of the CFPB and the staff of key federal

and state legislators

Hired a government relations firm and lobbyists in key

states

PROPRIETARY

Consumer

Alignment

Regulatory

Outreach

Advisors

Analytics |

WE ARE IN THE PROCESS OF TRANSITIONING OUR BANKRUPTCY

BUSINESS TO A NEW, MORE NATURAL OWNER

New,

strategic

owner

Bankruptcy

volumes

have shrunk

ACG has not

been, and

would not

be, material

to Encore

Business

requires a

significant

technology

investment

Buyer has

focused IT and

bankruptcy

expertise, and

currently serves

large, financial

institutions

PROPRIETARY

14 |

AN EXTENSIVE SEARCH FOR COMPLIMENTARY OPPORTUNITIES LED

US TO THE PROPERTY TAX LIEN SPACE

•

Provides significant portion of municipality

revenue, often used to fund essential services

•

Allows consumers to protect home from

foreclosure and avoid financial penalties

•

Propel enjoys 99% customer satisfaction

scores and was recently recognized as a “Top

Workplace”

by employees

Consumer

focus

Market

opportunity

•

Between $7B and $10B sold each year

•

Tax liens rank above mortgages and other

obligations, and bear high statutory interest

rates

•

Advantageous timing as large players exit

market for non-financial reasons

Encore’s

strengths

•

Consumer intelligence platform focused on

financially stressed consumers and recovery

•

Industry-leading asset valuation methodology

•

Low-cost operational platform dedicated to

building relationships and encouraging

repayment

PROPRIETARY

15

Acquisition of

dominant player

in tax lien space

Geography

Asset class

diversification

Operational

strengths |

Leading provider of

responsible debt

management and

recovery solutions

for consumers and

property owners

across a broad range

of asset classes

Property

Owners

Structured payment plans to

help residential and commercial

property owners settle tax

obligations and avoid

foreclosure

Consumer

Debt Holders

Robust collection plans to

maximize ability of consumers

to repay obligations and

ensure that consumers are

treated fairly

Financial

Institutions

Payment for

consumer debt

obligations

Municipal

Governments

Payment for residential

and commercial

property tax obligations

PROPRIETARY

16

THIS ACQUISITION EXPANDS UPON OUR ABILITY TO PARTNER WITH

FINANCIALLY STRESSED CONSUMERS |

THE LARGE VOLUME OF PORTFOLIO PURCHASES AND THE PROPEL

ACQUISITION WILL GENERATE SIGNIFICANT, ONGOING VALUE

Price

Source

of funds

Value

drivers

Nine portfolio purchases

from one seller

Propel acquisition

•

> $100 million

•

$187 million

•

Cash on hand and current

$555.5 million syndicated

lending facility (led by

SunTrust)

•

$160 million syndicated lending

facility (led by Texas Capital

Bank)

•

$65 million from current lending

facility

•

The portfolios are made up of

credit card and consumer debt

obligations

•

We know the products and

consumers well (1/3+ are

already in our database)

•

Large sample size (1.4 million

accounts) greatly increases

confidence in performance

•

Strong asset class that benefits

from our expertise with

distressed consumers

•

Attractive market that can be

served by leveraging our low

cost platform and marketing

experience

•

Consumer and municipality-

friendly

PROPRIETARY

17 |

WHILE WE REMAIN WELL WITHIN OUR COVENANT LIMITS

($M)

Covenant

analysis

(Encore

actuals

for

2010

and

2011,

Pro

forma

includes

Encore

with

May 2012 competitor portfolio purchases and Propel Financial Services)

Cash flow leverage ratio

Debt

Trailing 4-quarter adjusted EBITDA

Debt/adjusted EBITDA (maximum 2.0x)

Minimum net worth

Excess room

Interest coverage ratio

EBIT/interest expense (minimum 2.0x)

*

Subject to adjustments at closing based on originations and collections

2010

385.3

346.7

1.11

95.1

5.0

2011

389.0

444.9

0.87

133.5

5.7

Pro forma*

Q1 2012 TTM

715.5

515.4

1.39

140.7

4.8

PROPRIETARY

18 |

IN JUNE, WE WILL PROVIDE ADDITIONAL DETAIL ON THESE

TRANSACTIONS AND OUR GROWTH STRATEGY

Please

join

us

on

June

6

,

2012

for

our

Annual Investor Day meeting in New York

During the meeting we will discuss our evolving

operational and financial strategy, in addition to

providing new details about:

PROPRIETARY

19

•

Purchasing

and

financial

guidance

for

the

remainder of 2012

•

Performance

metrics

and

detailed

growth

strategy for Propel Financial Services

•

Update

on

our

Internal

Legal

platform

and

our

India and Costa Rica call centers

th |

20

SUMMARY

•

Operating results continue to be strong and surpass our internal

projections

•

Recently completed the acquisition of the market leader in tax

lien transfer business

•

Exiting the underperforming bankruptcy servicing business

•

Significant purchases in late 2011 and early 2012 will drive

growth throughout this year and into 2013

PROPRIETARY

•

Effectively managing through a regulatory environment that

continues to be challenging |

21

APPENDIX

PROPRIETARY |

22

APPENDIX A: CUMULATIVE COLLECTIONS BY PORTFOLIO VINTAGE

Cumulative Collections through March 31, 2012 (000’s)

Year

of

Purchase

Purchase

Price

<

2006

2006

2007

2008

2009

2010

2011

2012

Total

CCM

<

2005

$385,471

$974,411

$164,211

$85,333

$45,893

$27,708

$19,986

$15,180

$3,006

$1,335,728

3.5

2005

192,585

66,491

129,809

109,078

67,346

42,387

27,210

18,651

3,636

464,608

2.4

2006

141,027

42,354

92,265

70,743

44,553

26,201

18,306

3,771

298,193

2.1

2007

204,096

68,048

145,272

111,117

70,572

44,035

8,694

447,738

2.2

2008

227,862

69,049

165,164

127,799

87,850

17,456

467,318

2.1

2009

253,362

96,529

206,773

164,605

32,634

500,541

2.0

2010

358,786

125,853

288,788

64,005

478,646

1.3

2011

385,502

123,596

85,220

208,816

0.5

2012

129,998

12,586

12,586

0.1

Total

$2,278,689

$1,040,902

$336,374

$354,724

$398,303

$487,458

$604,394

$761,011

$231,008

$4,214,174

1.8

PROPRIETARY |

23

APPENDIX B: RECONCILIATION OF ADJUSTED EBITDA

Reconciliation of Adjusted EBITDA to GAAP Net Income

(Unaudited, In Thousands)

Three Months Ended

Note:

The

periods

3/31/07

through

12/31/08

have

been

adjusted

to

reflect

the

retrospective

application

of

ASC

470-20

PROPRIETARY

3/31/07

6/30/07

9/30/07

12/31/07

3/31/08

6/30/08

9/30/08

12/31/08

3/31/09

6/30/09

9/30/09

12/31/09

GAAP net income, as reported

4,991

(1,515)

4,568

4,187

6,751

6,162

3,028

(2,095)

8,997

6,641

9,004

8,405

Interest expense

4,042

4,506

4,840

5,260

5,200

4,831

5,140

5,401

4,273

3,958

3,970

3,959

Contingent interest expense

3,235

888

-

-

-

-

-

-

-

-

-

-

Pay-off of future contingent interest

-

11,733

-

-

-

-

-

-

-

-

-

-

Provision for income taxes

3,437

(1,031)

1,315

2,777

4,509

4,225

2,408

(1,442)

5,973

4,166

5,948

4,609

Depreciation and amortization

869

840

833

810

722

766

674

652

623

620

652

697

Amount applied to principal on receivable portfolios

28,259

29,452

26,114

29,498

40,212

35,785

35,140

46,364

42,851

48,303

49,188

47,384

Stock-based compensation expense

801

1,204

1,281

1,001

1,094

1,228

860

382

1,080

994

1,261

1,049

Impairment charge for goodwill and identifiable

intangible assets

-

-

-

-

-

-

-

-

-

-

-

-

Acquisition related expense

-

-

-

-

-

-

-

-

-

-

-

-

Adjusted EBITDA

45,634

46,077

38,951

43,533

58,488

52,997

47,250

49,262

63,797

64,682

70,023

66,103

3/31/10

6/30/10

9/30/10

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

3/31/12

GAAP net income, as reported

10,861

11,730

12,290

14,171

13,679

14,775

15,370

17,134

11,406

Interest expense

4,538

4,880

4,928

5,003

5,593

5,369

5,175

4,979

5,515

Contingent interest expense

-

-

-

-

-

-

-

-

-

Pay-off of future contingent interest

-

-

-

-

-

-

-

-

-

Provision for income taxes

6,490

6,749

6,632

9,075

8,601

9,486

9,868

10,351

7,344

Depreciation and amortization

673

752

816

958

1,053

1,105

1,194

1,309

1,363

Amount applied to principal on receivable portfolios

58,265

64,901

63,507

53,427

85,709

83,939

73,187

69,462

104,603

Stock-based compensation expense

1,761

1,446

1,549

1,254

1,765

1,810

2,405

1,729

2,266

Impairment charge for goodwill and identifiable

intangible assets

-

-

-

-

-

-

-

-

10,349

Acquisition related expense

-

-

-

-

-

-

-

-

489

Adjusted EBITDA

82,588

90,458

89,722

83,888

116,400

116,484

107,199

104,964

143,335

|