Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ECB BANCORP INC | d351336d8k.htm |

ECB BANCORP,

INC. Gulf South Bank Conference

May 14 –

May 16, 2012

Exhibit 99.1 |

Forward

Looking Statements 2

ECB BANCORP, INC.

Statements in this presentation relating to plans, strategies, economic performance and

trends, projections of results of specific activities or investments, expectations or

beliefs about future events or results, and other statements that are not descriptions

of historical facts, may be forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934. Forward-looking information is inherently

subject to risks and uncertainties, and actual results could differ materially from

those currently anticipated due to a number of factors, which include, but are not limited to, risk

factors discussed in the Company's Annual Report on Form 10-K and in other documents

filed by the Company with the Securities and Exchange Commission from time to time.

Forward-looking statements may be identified by terms such as "may",

"will", "should", "could", "expects", "plans", "intends", "anticipates", "believes", "estimates", "predicts",

"forecasts", "potential" or "continue," or similar terms or the

negative of these terms, or other statements concerning opinions or judgments of the

Company's management about future events. Factors that could influence the accuracy

of such forward-looking statements include, but are not limited to pressures on the

earnings, capital and liquidity of financial institutions in general, resulting from

current and future conditions in the credit and equity markets, the financial success

or changing strategies of the Company's customers, actions of government regulators, the level of

market interest rates, weather and similar conditions, particularly the effect of hurricanes

on the Company's banking and operations facilities and on the Company's customers and

the communities in which it does business, changes in general economic conditions and

the real estate values in our banking market (particularly changes that affect our loan

portfolio, the abilities of our borrowers to repay their loans, and the values of loan

collateral). Although the Company believes that the expectations reflected in the

forward-looking statements are reasonable, it cannot guarantee future results,

levels of activity, performance or achievements. All forward-looking statements attributable to the Company

are expressly qualified in their entirety by the cautionary statements in this

paragraph. The Company has no obligations, and does not intend to update these

forward-looking statements. |

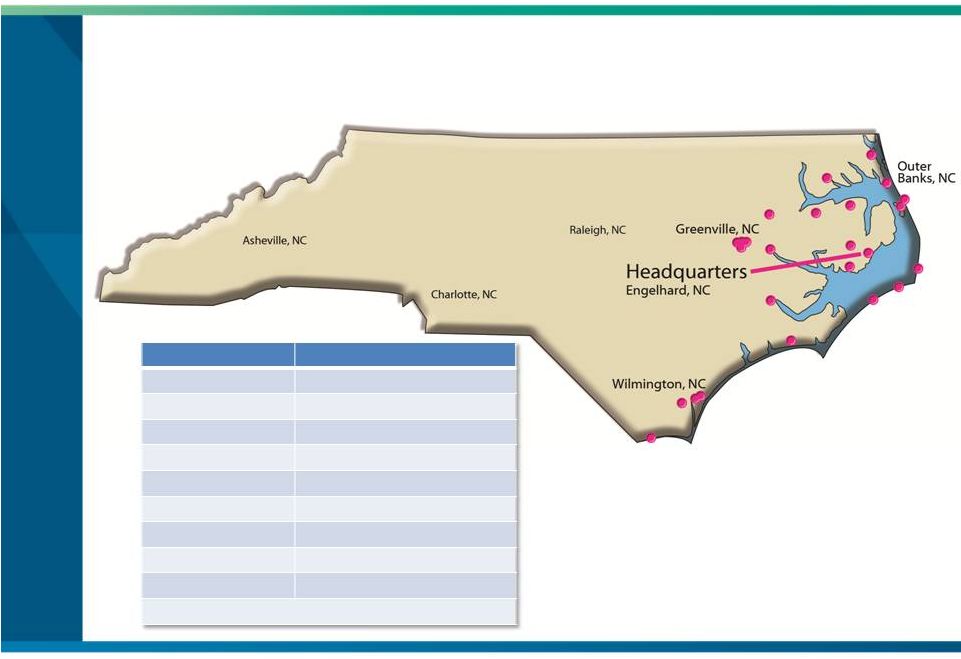

ECB Bancorp,

Inc. Overview 3

ECB BANCORP, INC.

NYSE Amex traded

ECBE

Headquarters

Engelhard, NC

Founded

1919

Market Cap

$26,788,505

Branches

25

FTEs

250

Asset Size

$916.3 million

Deposits

$491.4 million

Loans

$546.6 million

Customers

19,456 Households in 13 counties

As of 3/31/2012 |

Strategic

Focus •

Earnings Enhancement

•

Customer Engagement

•

Employee Engagement

•

Communication

•

Branding

•

Business Innovation

•

Market Development

•

Enterprise Risk Management Framework

4

ECB BANCORP, INC. |

ECB

Highlights •

Well capitalized

•

Financial Strength and Soundness

•

Pre-eminent Community Bank franchise in eastern

North Carolina

•

Attractive growth markets in NC

•

Leadership Team

•

Aggressive multi-prong growth strategy

-

Organic

-

De novo

-

Lines of business

5

ECB BANCORP, INC. |

Key

Accomplishments Within Last 24 Months

–

Commercial, Agri-business, Mortgages, Wealth

Management

6

ECB BANCORP, INC.

•

•

•

•

•

•

Enhanced Loan Loss Reserve Modeling

Core Processing –

reporting, technology, customer

intelligence, new products

Enterprise Risk Management

Commitment to Growing Lines of Business

Customer Care Center

Development of ECB University |

Executive

Leadership 7

ECB BANCORP, INC.

Experienced Executive Management Team

Executive

Position

Years in Banking

A. Dwight Utz

President & CEO

39

James J. Burson

EVP, Chief Revenue Officer

28

Thomas M. Crowder

EVP, Chief Financial Officer

33

T. Olin Davis

EVP, Chief Credit Officer

33

M. Jeanne Mauney

SVP, Chief Enterprise Risk Officer

28

Lorie Y. Runion

EVP, Chief Administrative Officer

33

William S. Sampson

EVP, Chief Information Officer

9 |

CAPITAL

|

Capital

9

ECB BANCORP, INC.

March 31, 2012

March

31, 2011

Capital Ratios

Leverage

8.23%

8.42%

Tier 1 Capital

12.39%

11.97%

Total Risk –

Based

Capitol Ratio

13.65%

13.24%

Tangible Equity/

Total Assets

6.95%

6.75%

Equity/Assets

8.85%

8.64% |

Capital

Tangible Book Equity

10

ECB BANCORP, INC.

$22.88

$23.89

$23.62

$22.32

$22.11

$22.34

$21.00

$21.50

$22.00

$22.50

$23.00

$23.50

$24.00

2007

2008

2009

2010

2011

03/2012 |

FINANCIAL

STRENGTH AND SOUNDNESS |

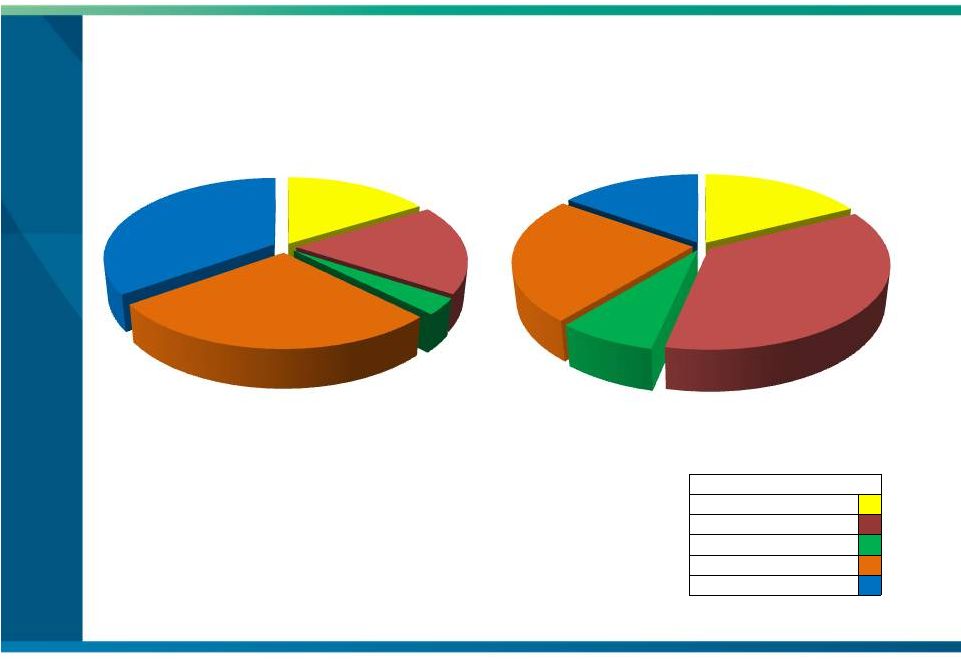

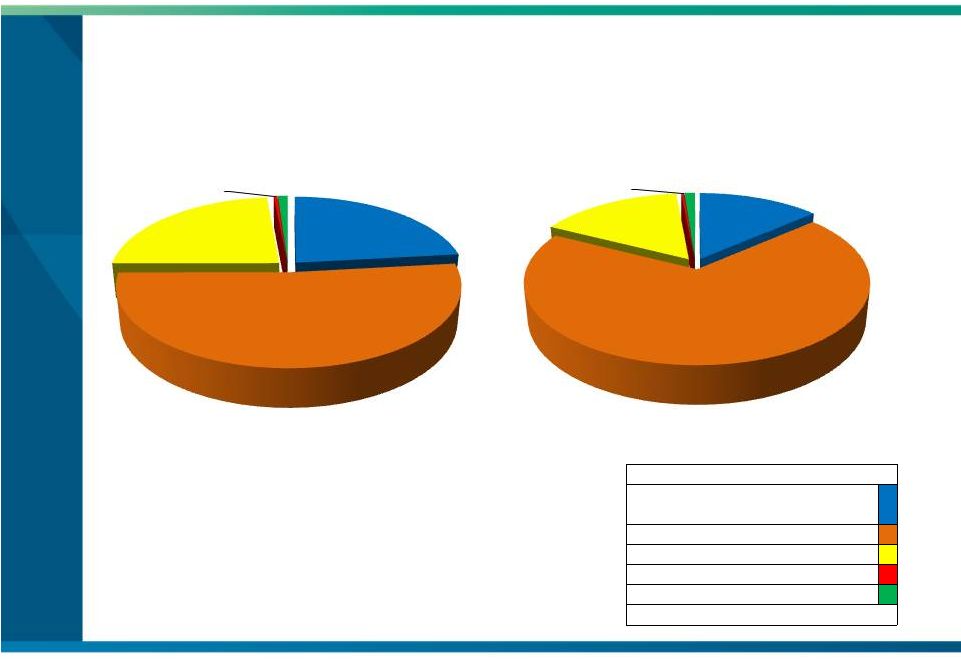

Deposit

Portfolio Composition 12

ECB BANCORP, INC.

Chart Key:

Demand Non-Interest

Demand Interest

Savings

Retail CDs < $100K

CDs > $100K

•

Good migration to lower cost deposits

•

Reduced Jumbo CDs by 56.7%

•

Contracted retail CDs

•

Grew demand interest products

Total Deposit $555.6 million

Total Deposit $772.6 million

15.1%

17.5%

7.5%

24.1%

3.3%

18.0%

16.2%

34.9%

27.6%

March 31, 2008

March 31, 2012

35.9% |

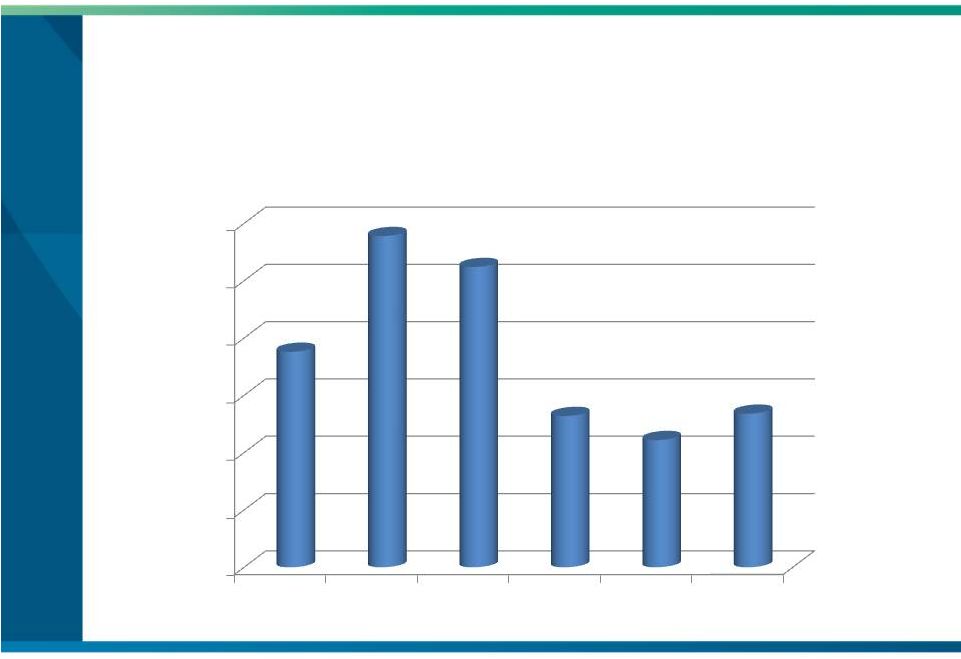

Cost of

Deposits 13

ECB BANCORP, INC.

1.26%

1.17%

1.13%

0.99%

0.87%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012 |

Loan

Portfolio Composition 14

ECB BANCORP, INC.

Chart Key:

RE-Construction, Land Development

& Other Land

RE-Commercial, Residential Other**

Commercial & Other

Credit Cards & Related Plans

Consumer

**Includes Farmland

•

Stable year-end portfolio yield

•

2009 = 5.30%; 2010 = 5.37%; 2011 = 5.36%

•

Our top ten loan relationships account for only 13% of

the total portfolio in dollars

•

Variable rate loans account for approximately 59% of

our loan portfolio

•

Average loan size: $79,985

Total Loans: $485.8 million

Total Loans: $491.4 million

1.1%

23.5%

51.7%

23.2%

0.4%

13.6%

68.9%

16.0%

0.3%

1.2%

March 31, 2012

March 31, 2008 |

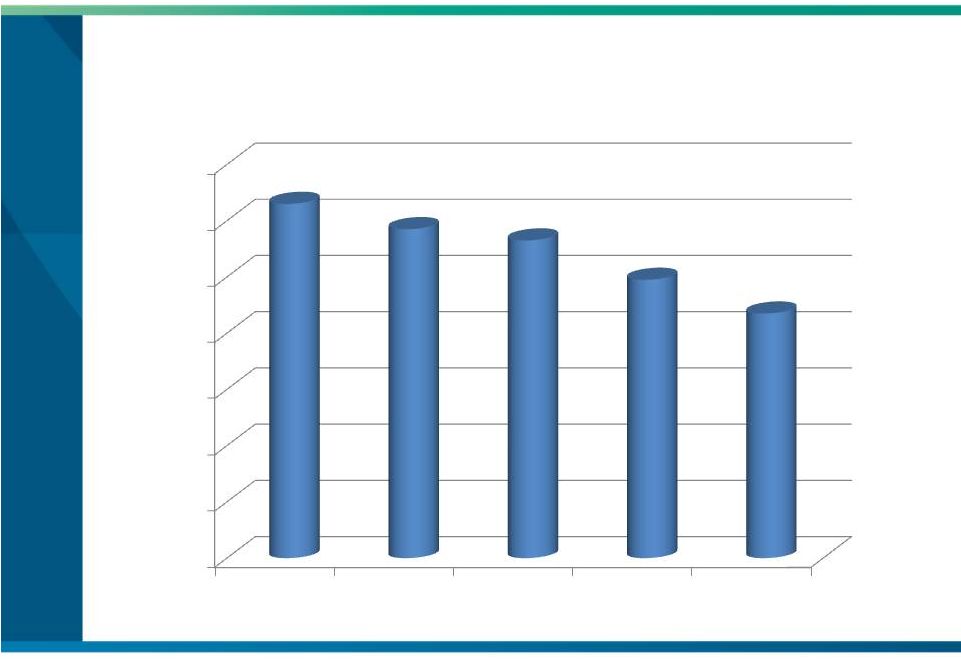

Net Charge

Offs/Average Loans 1.40%

1.11%

1.86%

1.89%

0.51%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1.60%

1.80%

2.00%

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012 |

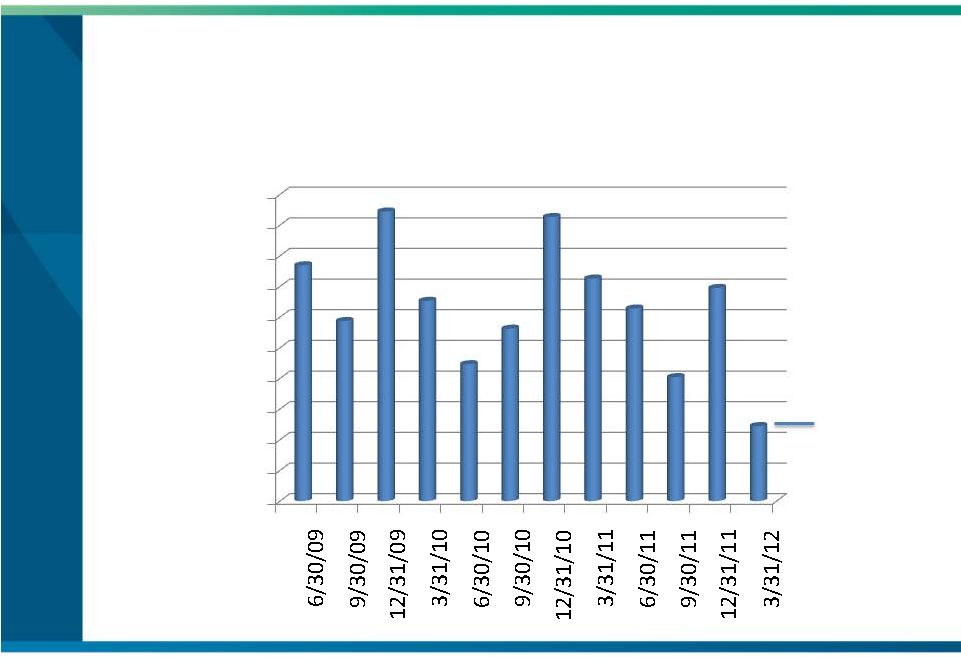

Slow

Pays 16

ECB BANCORP, INC.

3 YR Quarterly Migration for 30-60-90 Day Past Dues

$1,222,806

$0

$500,000

$1,000,000

$1,500,000

$2,000,000

$2,500,000

$3,000,000

$3,500,000

$4,000,000

$4,500,000

$5,000,000 |

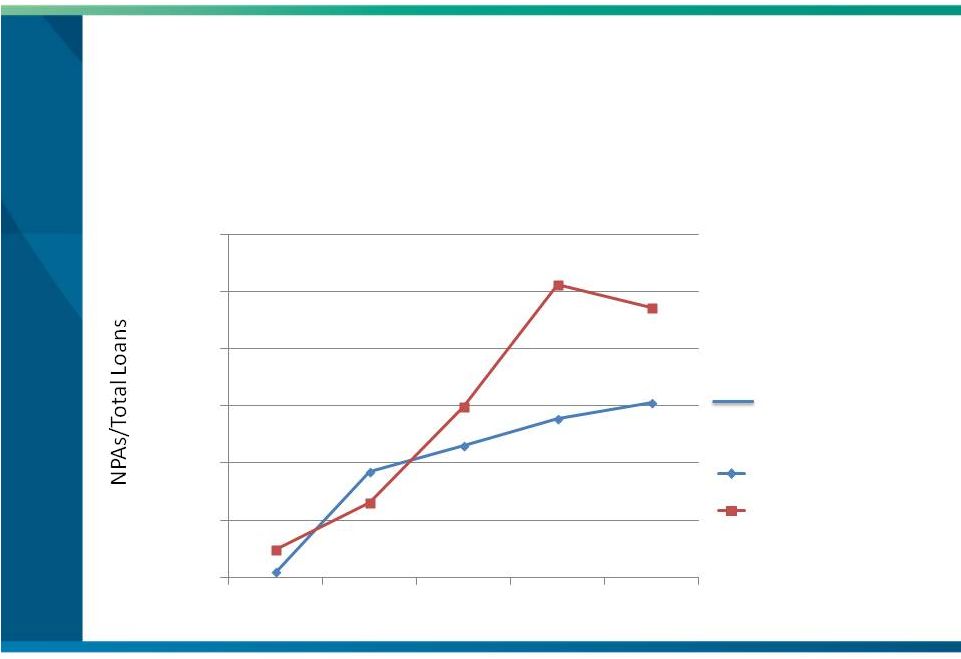

Financial

Strength Overall

Increase

in

Problem

Assets

–

much

lower

than

most

other

North

Carolina

banks

NPAs/Total Loans

Period: 2007 –

2011

17

ECB BANCORP, INC.

3.06%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

12/2007

12/2008

12/2009

12/2010

12/2011

ECB Bancorp, Inc.

Peer Average |

GROWTH

|

Update

•

In June 2011, ECB entered into a securities purchase agreement with

certain institutional investors to issue $79.7 million in company common

stock in a private placement offering.

•

In July 2011, we entered into an agreement with Bank of Hampton Roads

to acquire deposits and selected assets associated with seven Gateway

branches predominantly in the Raleigh-Durham/Chapel Hill, NC MSAs.

•

Earlier this year, ECB and the investors mutually terminated the

securities

purchase agreement since not all required regulatory approvals necessary

to complete the transaction had been received as of the termination date.

•

Although there was an attempt to restructure an alternate transaction

with the remaining investors, we were not able to reach an agreement of

revised terms and conditions we deemed were in best interest of our

Company and our shareholders.

•

The termination of the securities purchase agreement also resulted in

termination of our branch acquisition agreement with Bank of Hampton

Roads.

19

ECB BANCORP, INC. |

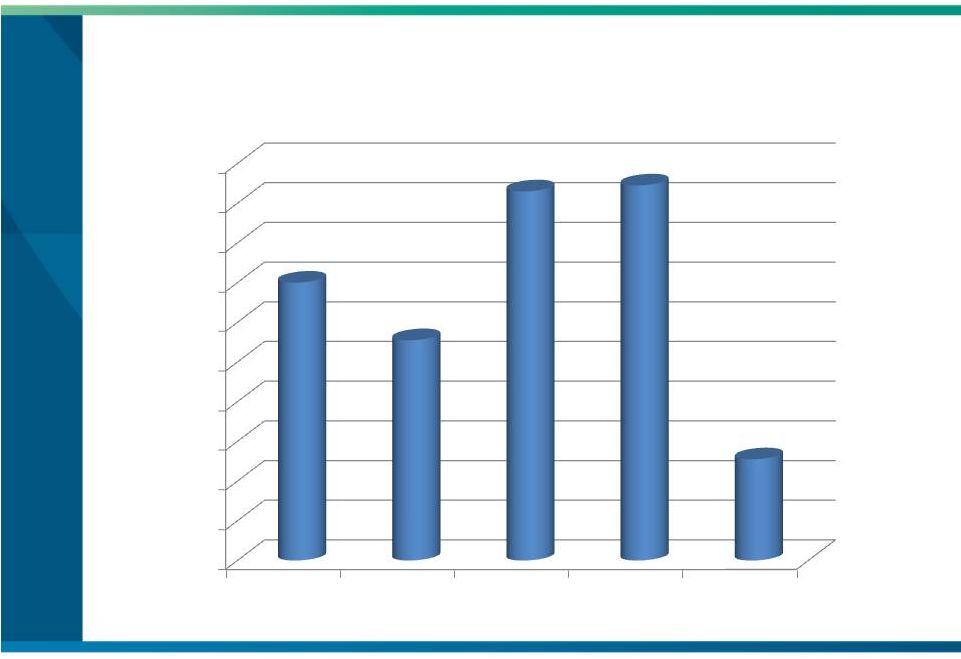

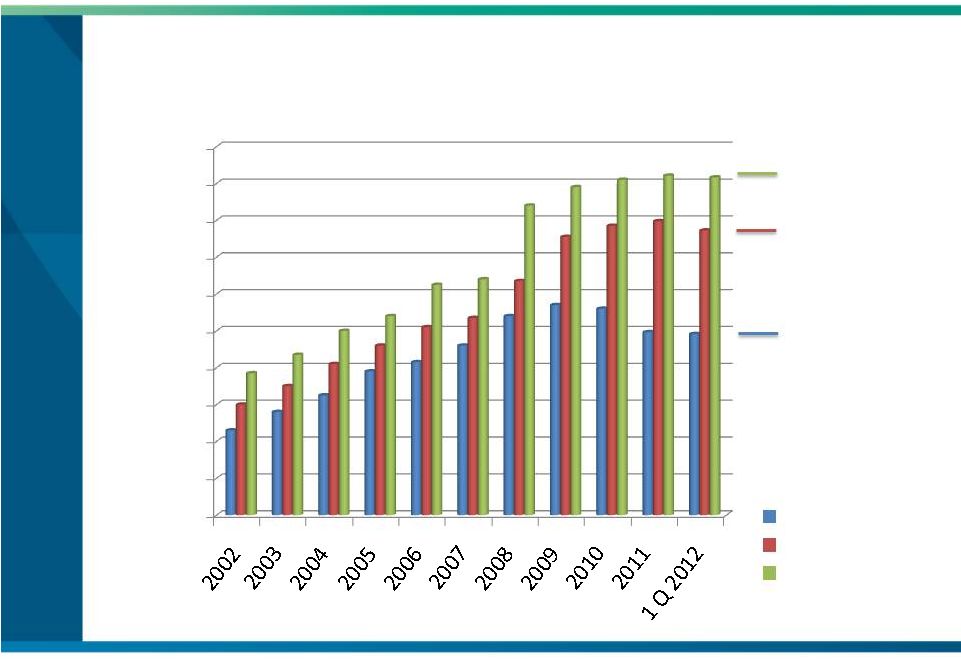

Historical

Growth 20

ECB BANCORP, INC.

$916.6

$772.6

$491.4

(in millions)

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

Gross Loans

Deposits

Total Assets |

Wealth

Management •

In first four months of 2012, we have doubled revenue related to

in-bank referrals

•

Untapped potential with our client base

•

Focus is on building revenue streams rather than transaction focus

•

Attractive demographics especially in ECB’s coastal markets supporting

future growth in wealth management

Mortgage Banking

•

Demand remains high in core ECB markets

•

Mortgage fees increased 25% in the 1

st

quarter of 2012 compared to the

prior year period.

•

In process of expanding presence into additional markets including

Raleigh, Fayetteville and Goldsboro

•

Beginning to portfolio selected high quality 5/1 ARM’s to augment existing

loan book

21

ECB BANCORP, INC. |

Agricultural

Banking •

ECB now ranks 2

nd

of all NC community Banks in

Agricultural Banking

•

Goal is to be ranked #1

•

Building our Agricultural Banking Team

•

Strong presence in four of thirteen eastern NC

counties

•

Very successful part of ECB’s portfolio for past

twelve years; 15% of ECB’s total loan portfolio

22

ECB BANCORP, INC. |

Attractive

Market Area 23

ECB BANCORP, INC.

Highlights Include:

ECB has 25 locations located east of

I-95 stretching from the VA to SC

state lines

Markets we serve offer diversity in

that we have branches both coastal

and inland; we serve rural and the

MSAs of Greenville, Wilmington

and OBX of NC

Our intermediate target area may

cover Richmond and portions of VA,

and westward in NC to include

Raleigh/Durham /Chapel Hill MSAs

Likely near term de novo markets

include Fayetteville, Jacksonville,

Elizabeth City |

Future

Direction •

25% growth in de novo growth of branches in

next three to five years within our footprint

•

Expansion into other lines of business such as

real estate, insurance, unbanked

•

Leveraging our Relationship Banking strategy to

grow our customer base

•

Continue our focus on small business which has

been ECB’s forte for over 90 years

24

ECB BANCORP, INC. |

QUESTIONS

AND ANSWERS |