Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DORCHESTER MINERALS, L.P. | d352600d8k.htm |

1

Dorchester Minerals, LP

Annual Meeting

May 16, 2012

Dorchester Minerals

NASDAQ: DMLP

Exhibit 99.1 |

Dorchester Minerals

NASDAQ: DMLP

2

Forward-Looking Statements

•

Portions of this document may constitute "forward-looking

statements" as defined by federal law. Such statements are

subject to certain risks, uncertainties and assumptions.

Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those

anticipated, estimated or projected. Examples of such

uncertainties and risk factors include, but are not limited to,

changes in the price or demand for oil and natural gas,

changes in the operations on or development of the

Partnership’s properties, changes in economic and industry

conditions and changes in regulatory requirements (including

changes in environmental requirements) and the

Partnership’s consolidated financial position, business

strategy and other plans and objectives for future operations.

These and other factors are set forth in the Partnership's

filings with the Securities and Exchange Commission.

|

Dorchester Minerals

NASDAQ: DMLP

3

•

Overview of 2011

–

Distributions and Financial Results

–

Production

–

Reserves

•

Royalty Overview

•

Net Profits Interest Overview

–

Minerals NPI

•

Property Highlights

–

Barnett Shale

–

Hugoton Operations

–

Fayetteville Shale

–

Bakken/Three Forks

–

Permian Basin

•

Developing Plays

Presentation Outline |

Dorchester Minerals

NASDAQ: DMLP

4

Overview of 2011 Results |

Dorchester Minerals

NASDAQ: DMLP

5

2011 Distributions

•

Cash Distributions Paid in Calendar 2011

–

Reflects Q4 2010 to Q3 2011 activity

Royalty

Revenue

$47.1 MM

Other

Revenue

$0.6 MM

NPI

Revenue

$10.5 MM

Total Revenue

$58.2 MM

LP

Distribution

$50.7 MM

GP

Distribution

$1.8 MM

Total

Expenses

$5.7 MM |

Dorchester Minerals

NASDAQ: DMLP

6

2011 Financial Results

Operating Revenue ($MM)

(Accrual Basis)

Gas Price ($/Mcf)

Distributions ($/unit)

(Cash Basis)

•

Revenue –

Price –

Distributions

–

Royalty properties contributed 78% to total operating revenues

–

Gross Revenue

51% gas & plant product sales, 48% oil sales, 1% other revenue

–

NPI and lease bonuses have become a smaller portion of total revenues

Note:

Operating

Revenue

does

not

reflect

production

costs

or

other

expenses

incorporated

in

calculating

the

net

profits

interest

payments |

Dorchester Minerals

NASDAQ: DMLP

7

2011 Production Overview

Geographic

Breakdown

Fayetteville

Shale

15%

Mid-Continent

(Other)

5%

Permian

Basin

20%

South TX/

Gulf Coast

8%

Miscellaneous

11%

Mid-Continent

(Hugoton NPI)

25%

Daily Production (MMcfepd)

1-year Decline

+18.0%

3-year Decline

+24.1%

Decline Since Inception

+14.2%

Annualized Decline Rate

+1.7%

Production

Profile

•

Total Production of 12.7 Bcfe

–

82% of total production was gas and plant products, 18% oil and condensate

–

High

quality

properties

+

Diverse

portfolio

Low

decline

rate

–

Year-over-year

production

rate

increased

18%

Inclusion

of

Minerals

NPI

Note: Total production on wellhead basis, daily production on sales basis,

gas-oil equivalency of 6:1 ratio used throughout this presentation Barnett

Shale 10%

Rockies

3%

Bakken

3% |

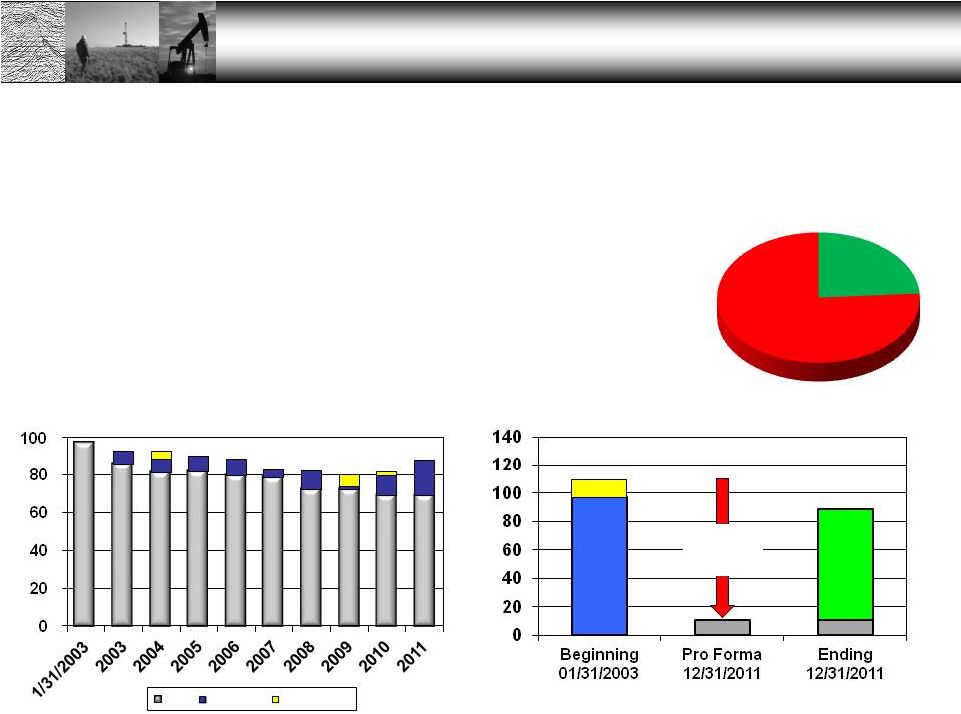

Dorchester Minerals

NASDAQ: DMLP

2011 Production Overview

8

Daily Equivalent Rate (Mcfed)

2003

50% Royalty

Royalty

Mid-2007

57% Royalty

Q3 2011

72% Royalty

Q4 2011

63% Royalty

Net Profits Interests

•

Historical Production Profile

–

Portfolio has shifted toward royalties over time, but net profits interests have a

new source

of

production

growth

after

inclusion

of

the

Minerals

NPI

Minerals

NPI Payout

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

2003

2004

2005

2006

2007

2008

2009

2010

2011 |

Dorchester Minerals

NASDAQ: DMLP

9

2011 Reserves Overview

•

Total Proved Reserves of 88.4 Bcfe on 12/31/11

Gas &

Products

76%

Oil

24%

Year-end Reserves (Bcfe)

97.0

10.5

Cumulative Reserve Revisions (Bcfe)

2003-2011

Production

(99.0 Bcfe)

–

All reserves are Proved Developed Producing

–

Demonstrated history of positive revisions

–

Revisions accounted for 88% of total reserves at year-end

–

Driven by new plays, field extensions, infill drilling, new

technology, etc.

–

Fayetteville Shale (RI & WI) represent 13% of reserves

Reserve

Revisions

Acquisitions

Pro Forma

Reserves

Note: 12.5 Bcfe of acquired reserves at time transactions closed.

88.4

Total

Reserves

77.9

12.5

109.5

Base

Revisions

Acquisitions |

Dorchester Minerals

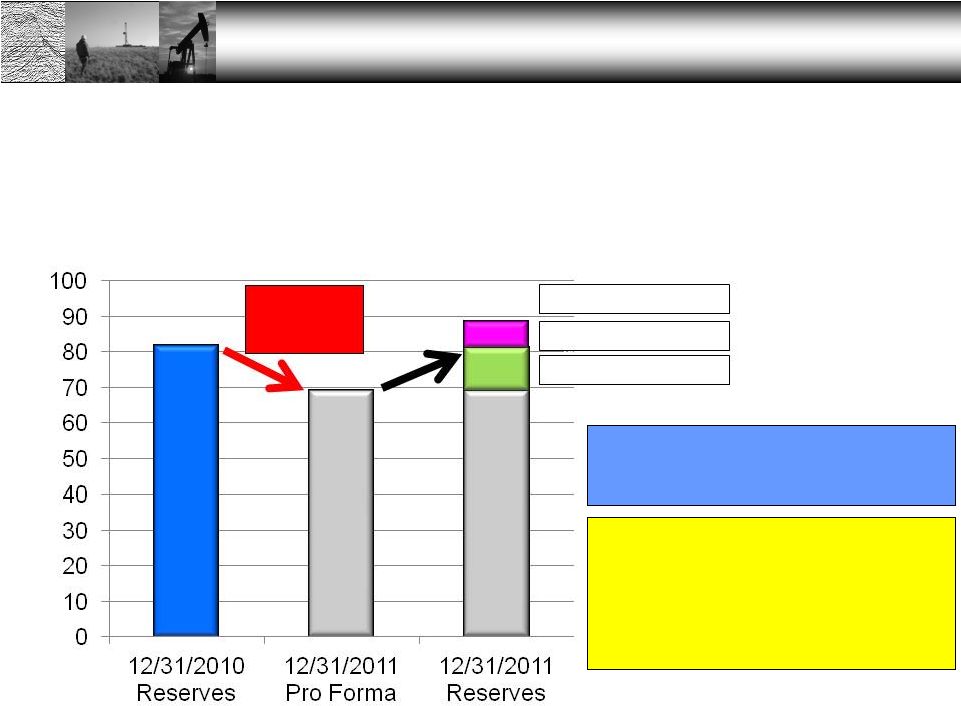

NASDAQ: DMLP

2011 Reserves Overview

10

Equivalent Reserves (Bcfe)

Replacement w/o Minerals NPI

96%

Replacement w/ Minerals NPI

153%

Change in Reserves (2010-2011)

+8.2%

81.7

2011

Production

12.7 Bcfe

7.2

12.2

88.4

•

12/31/2011 Revisions to Reported PDP Reserves

69.0

69.0

Minerals NPI

Base Revisions

Total Reserves

Major sources of upward revisions in

excess of 2011 production:

Minerals NPI

+7.2 Bcfe

Barnett Royalty

+3.4 Bcfe

Fayetteville Royalty +3.0 Bcfe |

Dorchester Minerals

NASDAQ: DMLP

2011 Reserves Overview

•

Composition of DMLP reserves

Geographic Breakdown

Royalty-NPI Split

Equivalent Reserves (Bcfe)

11

Barnett

8%

Bakken

2%

Other Mid-

Continent

5%

South TX/

Gulf Coast

6%

58.8

Bcfe

Royalty

67%

NPI

33%

29.6

Bcfe

Royalty

NPI

Gas

Oil

0

10

20

30

40

50

60

70 |

Dorchester Minerals

NASDAQ: DMLP

12

Royalty Overview |

Dorchester Minerals

NASDAQ: DMLP

13

Royalty Overview

Williston

110,000 net acres

Mid-Continent

35,000 net acres

Texas

152,000 net acres

Gulf Coast

20,000 net acres

Eastern

26,000 net acres

Appalachia

26,000 net acres

Other

4,000 net acres

Rockies

5,000 net acres

•

Diverse Portfolio –

574 counties in 25 states

–

378,000 net mineral acres (2,308,000 gross acres)

–

Varying NPRI’s, ORRI’s and leasehold interests in 862,000 gross

acres –

Majority of acreage is undeveloped

–

Wide geographic spread including most major producing basins

–

Assets range from mature legacy production to areas with exploratory

potential Basin/Area

Legacy

Production

Ongoing

Development

Expansion

Potential

West Texas

Southeast NM

Denver Unit

Wasson

Wolfberry

Bone Springs

Delaware Basin

West TX Overthrust

Gulf Coast

South Texas

Jeffress

McAllen Ranch

Horizontal Wilcox

Mid-Continent

Hugoton

Fayetteville

Horizontal

Granite Wash

Williston

Basin

Nesson

Anticline

Bakken

Red River

Three Forks

Sanish

Appalachia

Marcellus/Utica

Upper Devonian

Note: Acreage count as of 12/31/2011. Gross acres are not additive due to

overlapping ownership among categories |

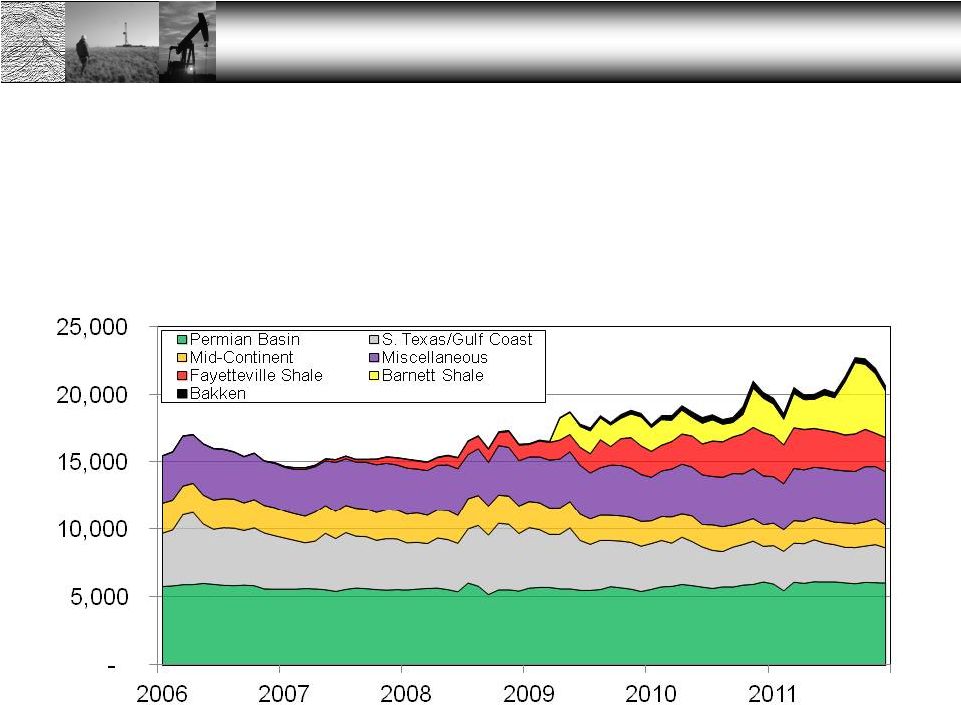

Dorchester Minerals

NASDAQ: DMLP

•

Diverse Sources of Production

Royalty Overview

14

–

New plays are replacing declines in legacy assets

–

Opportunities for production growth in mature basins

Daily Equivalent Rate (Mcfed) |

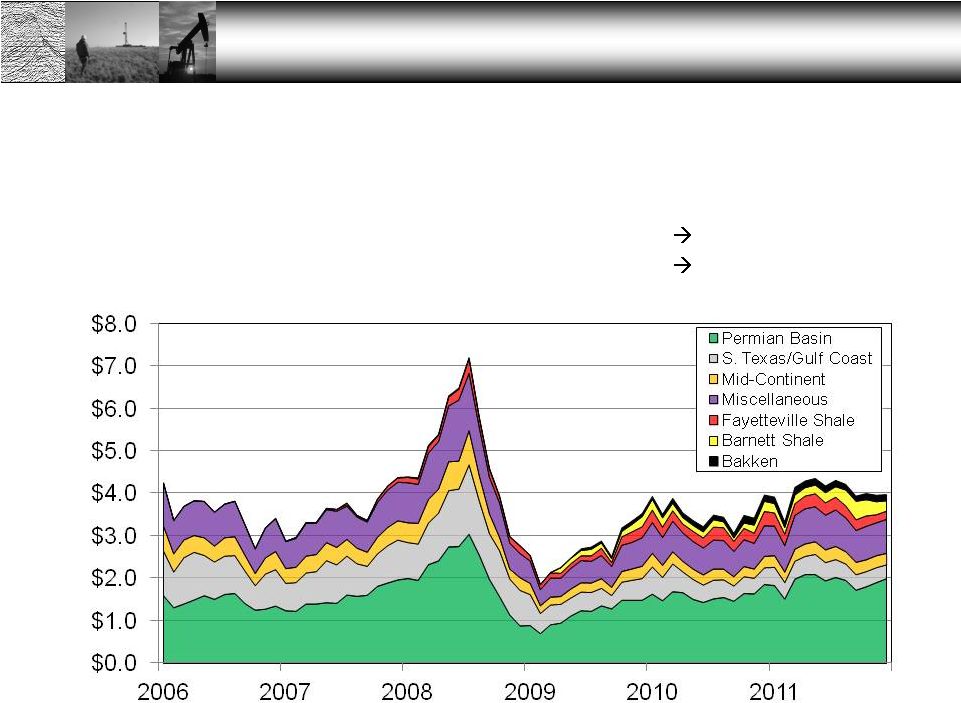

Dorchester Minerals

NASDAQ: DMLP

•

Revenue by Geographic Area

Royalty Overview

15

–

Permian Basin revenue share:

32% in March 2009

50% in December 2011

–

South Texas/Gulf Coast share:

30%

in March 2009

8% in December 2011

Net Revenue ($ millions)

Note: Journal Basis Net Revenue |

Dorchester Minerals

NASDAQ: DMLP

16

Royalty Overview

•

Leasing and Development Activity

–

Consummated 42 leases/elections on 1,127 net acres in 26 counties/ parishes in

seven states

–

Lease bonus payments up to $2,500/acre

–

Initial royalty terms up to 26%

–

Identified 356 new wells on royalty properties in nine states

–

Fayetteville Shale activity decreased in 2011

–

The price disparity between oil and gas has redistributed activity

•

Low gas prices

significant reduction of activity on legacy gas assets

•

High oil prices

increased infill drilling and redevelopment on legacy oil assets

–

85 active lease offers as of May 2012 |

Dorchester Minerals

NASDAQ: DMLP

17

Net Profits Interests

Overview |

Dorchester Minerals

NASDAQ: DMLP

18

Net Profits Interests Overview

•

NPI Provides LP Exposure to Working Interest

Potential Without Generating UBTI

–

Four NPI groups were created at the time of formation in 2003 and

two additional NPI groups created subsequently

–

Capitalize on strong negotiating position to capture additional value

–

Leverage information franchise

–

Optional working interest participation in numerous leases

–

Minerals NPI represents the majority of new development activity

–

Added 75 new wells located in Alabama, Arkansas, North Dakota,

Oklahoma and Texas |

Dorchester Minerals

NASDAQ: DMLP

19

Net Profits Interests Overview

Historical NPI CAPEX ($MM)

•

Actual Capital Expenditures Through Year-end 2011

–

$33.3 million of cumulative investments in all net profits interest

properties –

Majority of CAPEX was used to drill new wells in the Minerals NPI

–

Continue to reinvest Minerals NPI cash flow

2011 NPI CAPEX

Note: CAPEX

incurred

by

the

operating

partnership

on

a

cash

basis.

Capital

commitments

are

included

in

calculating

the

Minerals

NPI

payout

status.

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

$8.0

Capital Commitments

Development CAPEX

85%

6%

3%

6%

Fayetteville

Bakken

Permian

Other |

Dorchester Minerals

NASDAQ: DMLP

•

Relative contribution of NPI’s has shifted over time

Net Profits Interests Overview

–

Hugoton

accounted

for

96%

of

NPI

production

at

inception

64%

at

year-end

2011

–

Minerals NPI volumes prior to Q3 2011 were not included in DMLP results

Daily Equivalent Rate (Mcfed)

20 |

Dorchester Minerals

NASDAQ: DMLP

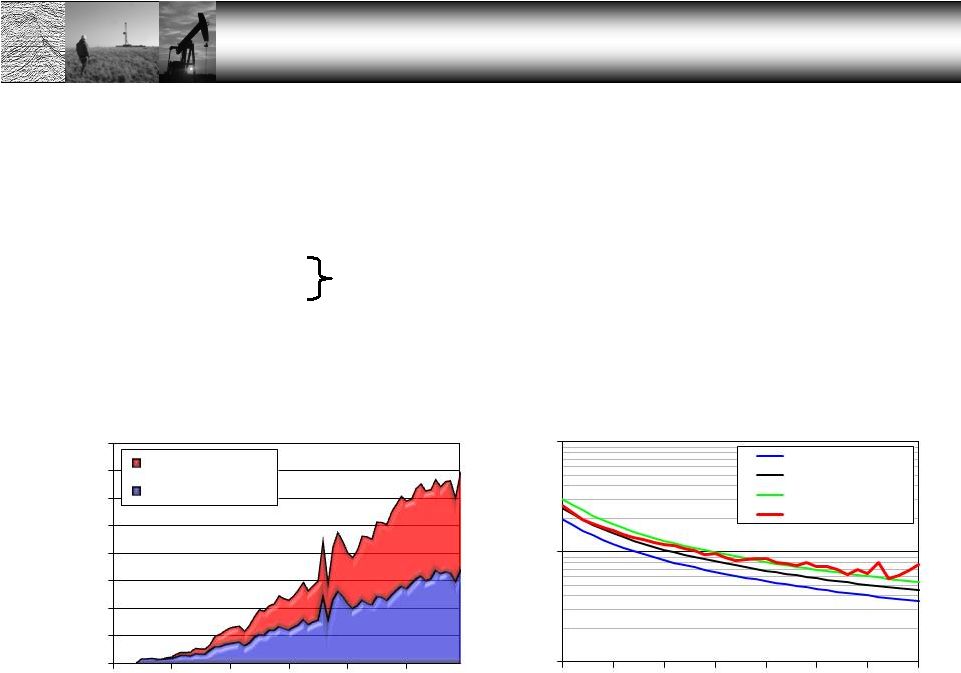

21

Net Profits Interests Overview

•

Minerals NPI Performance

–

Production and reserves have grown steadily since inception

–

337 wells/units producing in Q4 2011 (301 in pay status)

–

5.5 Bcfe in production receipts through year-end 2011

–

Total proved reserves of 7.5 Bcfe at year-end 2011, a 40% increase over 2010

–

Minerals NPI production and reserves are now included in DMLP results

Note: Gas rate based on sales volumes

Proved Reserves (Bcfe)

Net Daily Gas Rate (Mcfd) |

Dorchester Minerals

NASDAQ: DMLP

•

Minerals NPI Production

Net Profits Interests Overview

22

Daily Equivalent Rate (Mcfed)

–

New Areas: MT Bakken (2005), Fayetteville (2006), ND Bakken (2008), Permian

(2010) –

Additional participation opportunities in West Texas

|

Dorchester Minerals

NASDAQ: DMLP

23

Net Profits Interests Overview

($MM)

•

Minerals NPI Cash Flow –

Inception through Q1 2012

Cumulative Revenue

$39.4 MM

Cumulative Expense (LOE, taxes, etc)

($7.4 MM)

Cumulative Operating Income

$32.0 MM

Cumulative Investment/Commitments

($30.0 MM)

Cumulative Surplus (Deficit)

$2.0 MM

Cumulative Operating

Income exceeded

Cumulative Investments in

Q3 2011 and the Minerals

NPI began contributing to

LP distributions

Note: Figures provide on a cash basis

($5.0)

($4.0)

($3.0)

($2.0)

($1.0)

$0.0

$1.0

$2.0

$3.0

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Investment (including Budgeted Items)

Net Operating Income

Surplus (Deficit) |

Dorchester Minerals

NASDAQ: DMLP

24

Property Highlights

Barnett Shale |

Dorchester Minerals

NASDAQ: DMLP

•

Fort Worth Basin –

Tarrant County, Texas

25

–

NRIs range from 0.5% to 20% in 1,824 net mineral acres

–

Current Development Activity (CHK Operated)

•

42 producing wells (5 currently S/I)

•

1 well waiting on completion or pipeline

•

1 permitted location

–

Upside potential in undeveloped acreage, downspacing and improved

stimulation Barnett Shale (Royalty)

Gross Daily Gas Rate (Mcfepd)

Well Count

44 wells/permits

16 new wells brought

on production since

property was acquired

in June 2009

(Average NRI = 18.0%)

DMLP

0

10

20

30

40

50

60

1,000

10,000

100,000

2005

2006

2007

2008

2009

2010

2011 |

Dorchester Minerals

NASDAQ: DMLP

26

Property Highlights

Hugoton Operated Properties |

Dorchester Minerals

NASDAQ: DMLP

27

Hugoton Operated Properties (NPI)

•

Hugoton Field –

Oklahoma Panhandle & SW Kansas

–

2011 production within 4% of projection

–

Year-over-year production decline of 7.5% with a 11% decrease in net

reserves –

World-class asset but limited upside potential

–

Ongoing well optimization and cost-saving initiatives

Gas Rate (Mcfepd)

Well Count

Note: Gas rate based on sales volumes

0

50

100

150

200

1,000

10,000

100,000

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012 |

Dorchester Minerals

NASDAQ: DMLP

28

Property Highlights

Fayetteville

Shale |

Dorchester Minerals

NASDAQ: DMLP

29

Fayetteville Shale (Royalty & NPI)

•

Eastern

Arkoma

Basin

–

Northern

Arkansas

–

Ownership Summary

–

23,336 gross/11,464 net acres in 196 sections

–

June 2006: Leased 9,800 net acres in 179 sections for 25% royalty with optional

participation in 111 sections (subject to Minerals NPI)

–

June 2011: Leases covering 5,300 net acres expired with remainder of acreage

HBP –

Current development activity on DMLP acreage

375 wells/permits

Dorchester Acreage

Wells with IP > 6 MMcfd

Productive

Fairway

3,757 Producing Wells

637 Active Permits

256 Locations

“Active Permit”

–

well spud but not completed

“Location”

–

well permitted but not spud

•

31 wells permitted and/or proposed by operator

•

7 wells in various stages of drilling, completion or WOPL

•

337 wells completed (276 in pay status) |

Dorchester Minerals

NASDAQ: DMLP

Fayetteville Shale (Royalty & NPI)

–

Development activity by major operators (SWN, BHP, XOM) has slowed

–

In

2011

well

spuds

outpaced

new

permits

drilling

up

permit

inventory

–

Operators have put many old wells into pay status in 2011

–

Substantial

time-lag

between

permit

and

first

payment

408

days

•

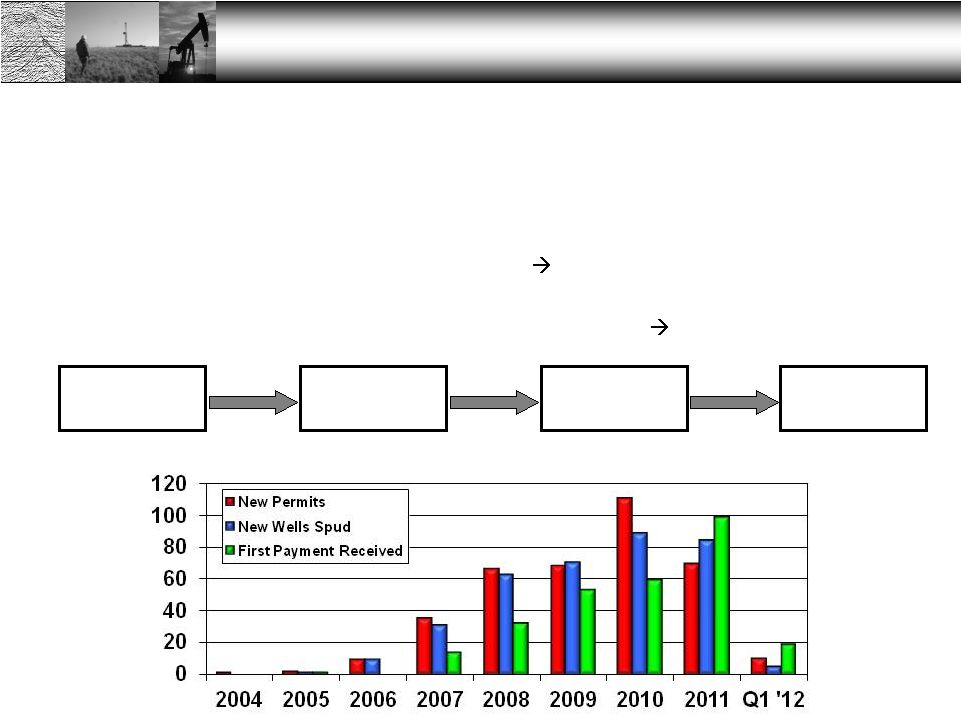

Permitting, Drilling and Payment History

First

Payment

First

Production

Well

Spud

Well

Permitted

62 days

132 days

215 days

Well Count

30 |

Dorchester Minerals

NASDAQ: DMLP

31

•

Capital Expenditures

Fayetteville Shale (Royalty & NPI)

•

2011 Reserves

Proved Reserves (Bcf)

–

Year-end reserves of 11.3 Bcf (285 wells)

•

5.5 Bcf (WI)

•

5.8 Bcf (RI)

–

47% Year-over-year reserve increase

–

Only completed wells with test rates are

included in reserve estimates (no PUDs)

Capital Expenditures ($MM)

–

Total Fayetteville investments of

$21.6 MM through year-end 2011

–

All expenditures within Minerals NPI

–

Average $3.0 MM per well in 2011

–

Drilling and completion costs

increase with longer lateral lengths |

Dorchester Minerals

NASDAQ: DMLP

32

•

Well Performance

•

Production Results

Fayetteville Shale (Royalty & NPI)

Net Daily Production (Mcfd)

–

301 wells producing at year-end 2011

•

3.3 MMcfd (WI)

•

3.5 MMcfd (RI)

–

31% Year-over-year rate increase

–

Produced 2.3 Bcf in 2011

–

51% of production from royalty interest

Normalized Production Rate (Mcfd)

Months on Production

–

Results indicate that average initial test

rates have reached a plateau

•

2008

2.4 MMcfd (Max 5.5 MMcfd)

•

2009

3.1 MMcfd (Max 5.9 MMcfd)

•

2010

3.0 MMcfd (Max 7.3 MMcfd)

•

2011

3.1 MMcfd (Max 5.5 MMcfd)

Note: Volumes from AOGC, 1 point

on

DMLP

normalize

curve

based

on

estimates

from

partial

month

data

6.8 MMcfd

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

2006

2007

2008

2009

2010

2011

Net RI Production

Net WI Production

100

1,000

10,000

0

5

10

15

20

25

30

35

2.0 Bcf (SEECO)

2.5 Bcf (SEECO)

3.0 Bcf (SEECO)

DMLP Average

st |

Dorchester Minerals

NASDAQ: DMLP

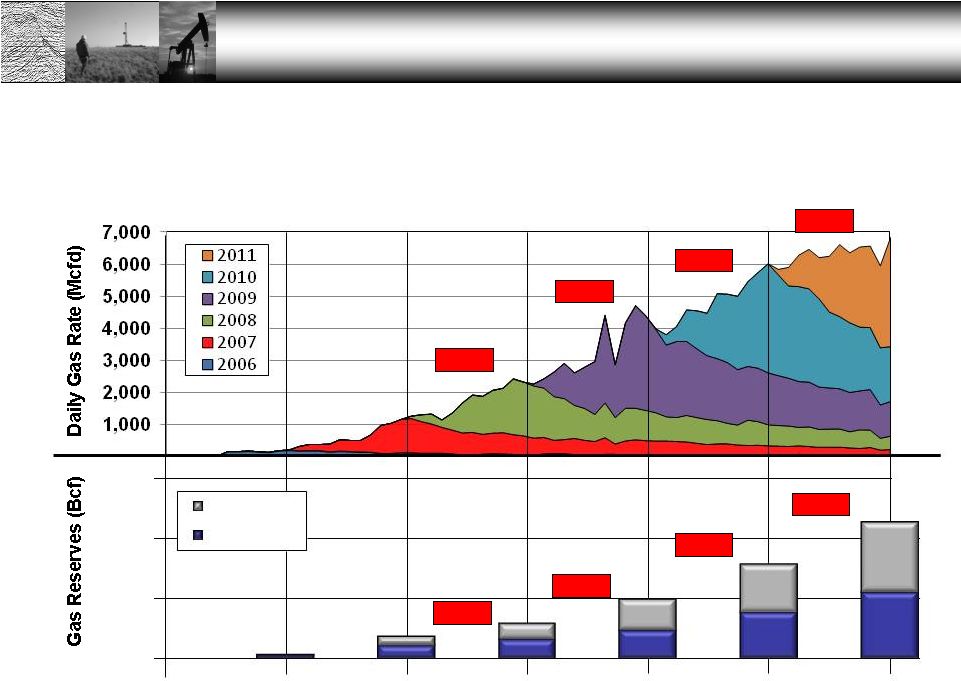

Fayetteville Shale (Royalty & NPI)

33

•

Historical production and reserve additions

+69%

+47%

+60%

+61%

+79%

+76%

+47%

+17%

2010

2009

2008

2007

2006

2011

Royalty Int.

Working Int.

Note: Volumes from AOGC, not all wells in production graph are currently in pay

status 12.0

10.0

8.0

6.0

4.0

2.0

0.0 |

Dorchester Minerals

NASDAQ: DMLP

34

Well

Number

Test

Date

Test Rate

(Mcfd)

#5-25H36

12/11/2011

3,237

#6-25H36

12/10/2011

3,356

#7-25H36

12/10/2011

3,457

#12-25H36

2/25/2012

3,236

#13-25H36

2/25/2012

3,442

#14-25H36

2/26/2012

3,881

#15-25H36

2/26/2012

3,345

#16-25H36

2/26/2012

4,228

•

Future

Development

Potential

-

Downspacing

–

Example: 25-9N-16W, Conway Co, AR (SWN)

400 ft offsets (50 ac spacing)

–

DMLP

(RI) Ownership:

1.563% NRI

–

DMOLP (WI) Ownership:

0.980% NRI

Deltic Timber 9-16 Unit

Fayetteville Shale (Royalty & NPI) |

Dorchester Minerals

NASDAQ: DMLP

35

Property Highlights

Bakken/Three Forks |

Dorchester Minerals

NASDAQ: DMLP

36

Bakken/Three Forks (Royalty & NPI)

•

Williston Basin –

Northwestern North Dakota

–

Diversified acreage position

•

70,390 gross acres/8,905 net acres

–

Operators: Continental, COP, EOG, Hess, Marathon

–

Elected non-consent option in 215 wells to date (125 in pay status)

•

Average royalty of all leases in unit (~16% royalty)

•

Back-in for 100% WI after payout + 50% penalty

•

Working interest subject to Minerals NPI

Well Count

Net Daily Production (boepd)

Initial Royalty Payment

WI Back-in APO |

Dorchester Minerals

NASDAQ: DMLP

37

Bakken/Three Forks (Royalty & NPI)

•

Six County Core Area

–

Current development activity on DMLP acreage

•

161 wells completed as producers (13 reached payout status)

•

34 wells in various stages of drilling or completion (or confidential)

•

22 wells permitted and/or proposed by operator

–

Rig count has increased +570% since May 2009

–

Eight rigs currently drilling on DMLP acreage

Parshall,

Sanish &

Stanley fields

(426 nma)

EN-Selby

157-93-805H1

King

1-5H

Well Name (Operator)

Test Rate

(boepd)

BPO NRI

APO NRI

Clifford Bakke 26-35 2H (BEXP)

4,291

1.10%

4.94%

Clifford Bakke 26-35 3H (BEXP)

2,807

1.10%

4.94%

Kovaloff 14-9H (Marathon)

1,285

1.88%

11.76%

Behr 16-21H (Fidelity)

1,500

1.00%

4.64%

Intervale 31-35H (COP)

2,750

0.47%

2.91%

EN-Selby 157-93-805H1 (Hess)

591

1.86%

11.65%

Jaguar 1-22H (Zavanna)

1,475

0.75%

4.66%

King 1-5H (Continental Resources)

808

1.16%

7.28%

Jaguar

Clifford Bakke

26-35 2H & 3H

217 wells/permits

Intervale

31-35H

Kovaloff

14-9H

Behr

16-21H

1-22H |

Dorchester Minerals

NASDAQ: DMLP

38

Property Highlights

Permian Basin |

Dorchester Minerals

NASDAQ: DMLP

39

Permian Basin (NPI)

•

Bone Springs Play –

Eddy County, New Mexico

–

DMOLP owns a 6.25% working interest in 320 acres

•

Declined farm-out offer and elected to participate with full interest

(Minerals NPI) •

Active operators include Cimarex, COG, Devon and Yates

•

Drilled two horizontal wells testing 859 and 977 boepd in Q1 2012

Gross Daily Rate (boepd)

1 mile |

Dorchester Minerals

NASDAQ: DMLP

40

Developing Plays |

Dorchester Minerals

NASDAQ: DMLP

41

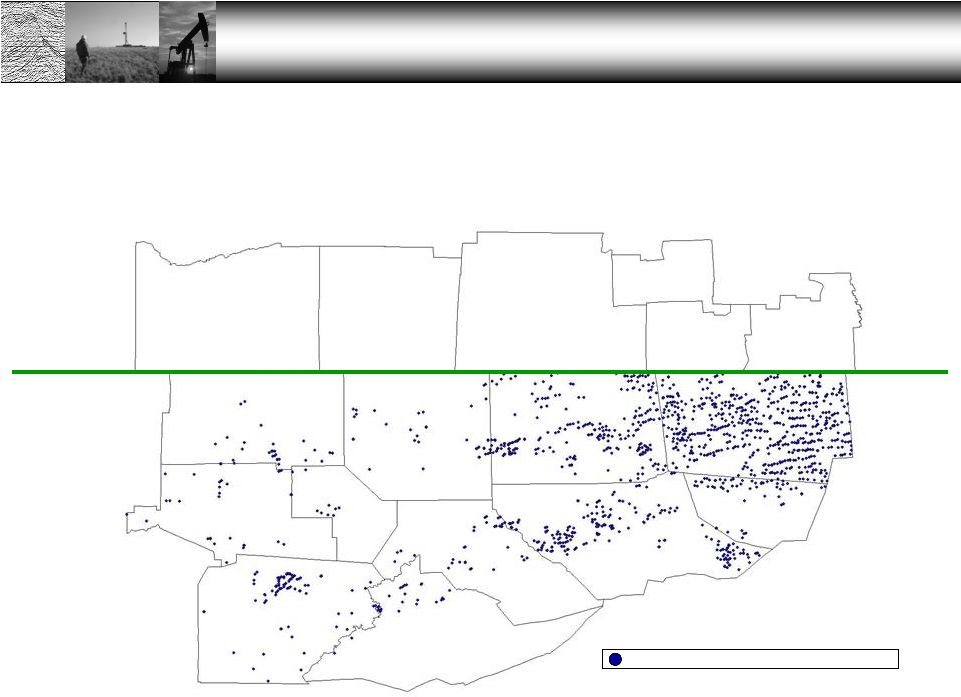

Developing Plays

•

Devonian Shale –

Appalachia

–

New York and Pennsylvania

–

Concentrated acreage position

•

32,395 gross acres

•

24,494 net acres

•

70% in Allegany and Steuben Counties, NY

–

Challenging political environment in New York

has limited activity relative to Pennsylvania

–

Potential targets

•

Upper Devonian oil (shallow)

•

Marcellus/Utica/Devonian shale gas (middle)

•

Trenton-Black River gas (deep)

–

Operators: Anadarko, Chesapeake, EOG,

EQT, EXCO, Range, Seneca, Shell, Talisman

–

No reserves booked in 2011

NY

PA

Allegany & Steuben

Counties |

Dorchester Minerals

NASDAQ: DMLP

•

Southern Tier NY & Northern Tier PA

42

Developing Plays

Allegany

13,216 nma

Steuben

4,714 nma

Chemung

308 nma

Schuyler

459 nma

Tioga

163 nma

Bradford

Potter

846 nma

McKean

1,158 nma

Cattaraugus

Tioga

41 nma

NY

PA

NY

PA

Horizontal Marcellus Well/Permit

Elk

28 nma

Cameron

56 nma

Clinton

256 nma

Lycoming

468 nma

Sullivan

Centre

196 nma

Clearfield

579 nma |

Dorchester Minerals

NASDAQ: DMLP

43

Dorchester Minerals, LP

Annual Meeting

May 16, 2012 |

Dorchester Minerals

NASDAQ: DMLP

44

Appendix |

Dorchester Minerals

NASDAQ: DMLP

45

•

What is the Minerals NPI and How Does it Work?

Appendix

–

Upon its formation, Dorchester Minerals, LP (DMLP, the public partnership and owner

of the mineral interests) provided for future development opportunities on its

undeveloped mineral interests by the creation of the Minerals Net Profits

Interest (Minerals NPI). –

DMLP has negotiated and may continue to negotiate the right but not the obligation to

participate in development activity in addition to retaining a royalty

interest. –

This right may take the form of an optional heads-up (unpromoted) working

interest, carried working interest or reversionary (back-in) working

interest. In some instances, an unleased mineral interest may be treated as a

working interest subject to statutory non-consent provisions.

–

DMLP assigns this right to Dorchester Minerals Operating LP (the

operating partnership or DMOLP)

subject to the terms of the Minerals NPI.

–

DMOLP is an indirect wholly owned affiliate of DMLP’s General Partner.

–

DMOLP funds all costs associated with this right, including drilling and completion

costs. –

DMLP and its partners are not liable for any costs or expenses.

–

DMOLP pays to DMLP 96.97% of the monthly “Net Proceeds”

attributable to the properties subject to the

Minerals NPI.

–

Net Proceeds is defined as total revenues less total expenses plus an amount

equivalent to interest at a prevailing rate on any prior period deficit

balance. In other words, DMOLP pays 100% of all costs, receives 100% of all

revenues plus interest, and thereafter (sometimes called “Payout”) pays 96.97% of

net cashflow to DMLP.

–

LP distributions reflect 96% of royalty net cashflow and 99% of NPI net cashflow

99% x 96.97% = 96%.

–

The Minerals NPI achieved payout status in September 2011 and contributed to our Q4

2011 distribution. |

Dorchester Minerals

NASDAQ: DMLP

46

Appendix

DMLP

Lease to third party for

royalty and optional

participation right

Participation right

assigned to DMOLP

NPI payment

(96.97% of cash flow)

Distributable Cash

DMOLP pays 100% of costs and

receives 100% of revenue

plus interest equivalent on

total NPI basis

Royalty

(100% of cash flow)

General

Partner

4% of

royalties

1% of NPI’s

4% of Expenses

Limited

Partners

96% of

royalties

99% of NPI’s

96% of Expenses

•

What is the Minerals NPI and How Does it Work? |

Dorchester Minerals

NASDAQ: DMLP

47

Appendix

•

Distribution Determinations

4% of Net Cash Receipts from Royalty Properties

$ --------

$1,682

96% of Net Cash Receipts from Royalty Properties

$40,365

$ --------

1% of Net Profits Interests Paid to our Partnership

$ --------

$ 104

Total Distributions

$50,719

$1,786

99% of Net Profits Interests Paid to our Partnership

$10,354

$ --------

Operating Partnership Share (3.03% of Net Proceeds)

$ --------

$ 327

Total General Partner Share

$2,113

% Total

96%

4%

Limited

Partners

General

Partner

–

Period from October 2010 through September 2011

($ thousands) |

Dorchester Minerals

NASDAQ: DMLP

48

Appendix

2011 Cash

Distributions

$52.5 MM

Mgmt GP

Mgmt LP*

Other LP

$1.8 MM

$6.0 MM

$44.7 MM

Mgmt LP is 3.3

times Mgmt GP

•

Alignment of GP and LP interests

–

GP

has

no

incentive

distribution

rights

–

fixed

sharing

ratio

–

Management’s LP interest exceeds its GP interest

–

Not incentivized to make dilutive transactions

85.2 %

11.4 %

3.4 %

* Management LP interest includes

LP units owned by officers, directors

and their immediate families. |

Dorchester Minerals

NASDAQ: DMLP

49

•

Operating Leverage –

Royalty Interest vs. NPI

Appendix

Net Profits Interest

Royalty Interest

1,000 Mcf

$4.00/Mcf

$4,000

($0)

$4,000

25% Royalty

$1,000

1,000 Mcf

$5.00/Mcf

$5,000

($0)

$5,000

25% Royalty

$1,250

1,000 Mcf

$4.00/Mcf

$4,000

($1,000)

$3,000

25% NPI

$750

1,000 Mcf

$5.00/Mcf

$5,000

($1,000)

$4,000

25% NPI

$1,000

25% Increase in

Royalty Cash Flow

33% Increase in

NPI Cash Flow

25% Increase in Gas Price

Production Volume

Gas Price

Revenue

Fixed Production Costs

Operating Income

Net Interest

Net Cash Flow

Production Volume

Gas Price

Revenue

Fixed Production Costs

Operating Income

Net Interest

Net Cash Flow |

Dorchester Minerals

NASDAQ: DMLP

50

Appendix

Oil and Gas

Produced

Cash

receipts

begin

1st Quarter

Distribution

declared

Dist. Paid

(Feb-Mar cash)

2nd Quarter

Distribution

declared

Dist. Paid

(Apr-Jun cash)

LP distribution of all cash attributable to January production

may occur as late as August, a 7-month time lag

•

Royalty Cash Receipts

–

Long delay between production and cash distribution

–

Cash receipts extend over multiple months due to adjustments, releases, etc.

–

Prices

can

change

dramatically

between

production

and

payment

of

distribution

–

Example of a typical cash receipt cycle :

Jan-11

Feb-11

Mar-11

Apr-11

May-11

Jun-11

Jul-11

Aug-11 |

Dorchester Minerals

NASDAQ: DMLP

51

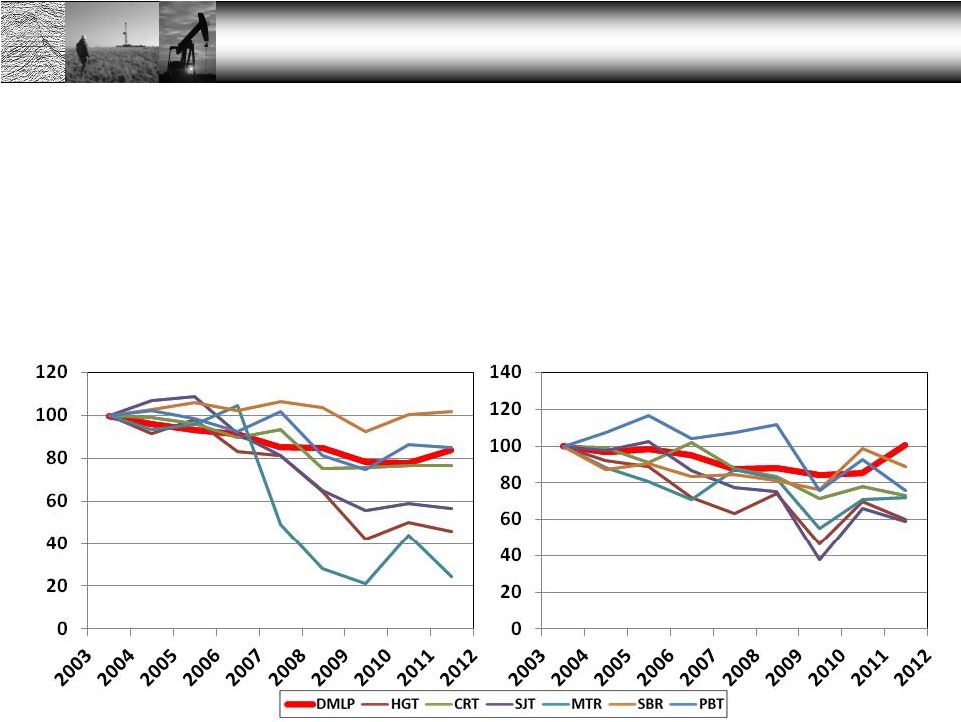

Peer Group Comparison

YTD 2012 Normalized Returns (reinvested)

2003-2011 Normalized Returns (reinvested)

•

Market Performance

–

Pure

royalties

lack

operating

leverage

inherent

in

net

profits

interests

Less

volatility

•

Underperforming in high price environment (mid-2008)

•

Outperforming in low price environment (mid-2009) due to lower fixed cost

structure Note: Dist. reinvested on last day of quarter

|

Dorchester Minerals

NASDAQ: DMLP

52

Peer Group Comparison

•

Reserves and Production Performance

–

DMLP is a cross between a royalty trust with 100% net profits interests (SJT) and

one with 100% royalties (SBR), plus the upside of a large non-producing

mineral portfolio with potential for future drilling and development

–

DMLP has the ability to expand its portfolio of assets through acquisitions

DMLP adjusted for issuance of additional units

Normalized Production (Indexed to 2003)

Normalized Reserves (Indexed to 2003) |