Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 7, 2012

CORONADO CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-53998

|

N/A

|

||

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

2212 Queen Anne Avenue N.

Seattle, WA 98109

(Address of principal executive offices)

800-508-6149

(Registrant’s telephone number, including area code)

518 17th Street, Suite 1000, Denver, Colorado 80202

(Registrant’s former name, address and telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Current Report on Form 8-K (this “Report”) contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “seeks,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Such statements may include, but are not limited to, information related to: anticipated operating results; our product offerings; relationships with our third party service providers and suppliers; consumer demand; financial resources and condition; revenues; profitability; changes in accounting treatment; cost of sales; selling, general and administrative expenses; interest expense; the ability to produce the liquidity or enter into agreements to acquire the capital necessary to continue our operations and take advantage of opportunities; product and commercial liability; legal proceedings and claims.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this Report. You should read this Report and the documents that we reference and file or furnish as exhibits to this Report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by the context, references in this report to “we,” “us,” “our,” “our Company,” or “the Company” are to the combined business of Coronado Corp. and its consolidated subsidiary.

In addition, unless the context otherwise requires and for the purposes of this Report only:

|

●

|

“Closing Date” means May 7, 2012;

|

|

●

|

“Coronado” refers to Coronado Corp., a Nevada corporation;

|

|

●

|

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

|

|

●

|

“Merger” means the merger by VB Acquisition and Vampt;

|

|

●

|

“SEC” refers to the Securities and Exchange Commission;

|

|

●

|

“Securities Act” refers to the Securities Act of 1933, as amended;

|

|

●

|

“Vampt” refers to Vampt Beverage USA, Corp., a Nevada corporation;

|

|

●

|

“Vampt Shareholders” means the shareholders of common shares in the capital of Vampt; and

|

|

●

|

“VB Acquisition” means VB Acquisition Corp. a Nevada corporation and a direct, wholly owned subsidiary of Coronado.

|

1

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Acquisition of Vampt

On the Closing Date, Coronado entered into a series of transactions pursuant to which to which it acquired an operating business by completing a merger of Coronado’s wholly-owned subsidiary, VB Acquisition, and Vampt in accordance with the Nevada Revised Statutes. The Merger was agreed to in a previously announced Merger Agreement entered into on December 8, 2011 by Coronado, Vampt and VB Acquisition, and was completed by converting all issued and outstanding common stock in the capital of Vampt and common share purchase warrants into the equivalent securities of Coronado at a ratio of three-quarters of a Coronado security for every 1 Vampt security issued at a price of less than $0.50 per share, and at a ratio of 1 Coronado security for every 1 Vampt security issued at a price of $0.50 or more, and outstanding as of the effective time of the Merger, for a total issuance of 10,568,751 Coronado Shares and Coronado Warrants to purchase up to an additional 476,250 Coronado Shares at a price of $0.75 per share until October 15, 2014, subject to adjustment upon certain events, such as stock splits, combinations, dividends, distributions, reclassifications, mergers or other corporate changes. As a result of the Merger, Vampt has become a controlled majority-owned subsidiary of Coronado. Vampt has one wholly-owned subsidiary, Vampt Brewing Company Limited.

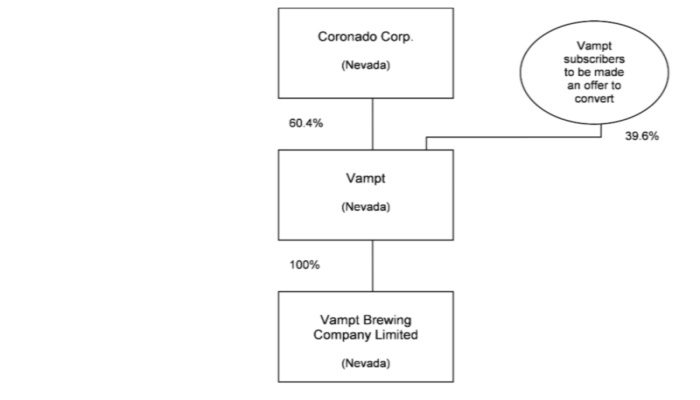

As of May 7, 2012, there were outstanding subscriptions to purchase approximately 9,246,399 Vampt shares and 8,029,667 Vampt warrants, options and convertible debt. Coronado plans to make an offer to outstanding subscribers for common shares of Vampt and subscribers for warrants, options and convertible debt to convert their securities into equivalent Coronado securities on the same terms and conditions applicable to the Merger for subscriptions up to December 8, 2011 and on a 1:1 basis thereafter. If all subscriptions are converted, this will result in the issuance of an additional 7,665,893 Coronado shares and 7,858,083 securities convertible into common shares, comprised of warrants, options and convertible debt exercisable at prices ranging from $0.50 to $0.75 per share. Provided all Vampt subscribers agree to convert their securities, following such conversion Vampt will become a wholly-owned subsidiary of Coronado and Coronado will have a total of 39,338,292 Coronado common shares on a fully-diluted basis.

Also pursuant to the Merger, Coronado created a class of Series A Preferred Stock (the “Preferred Shares”) and issued to Ian Toews, the former principal shareholder of Vampt, 100 Preferred Shares that carry the right for the holder to appoint two directors to Coronado’s board of directors for a period of 3 years after the effective time of the Merger and the right to receive 10% of the consideration tendered in the event of any take-over or buy-out of Coronado.

2

A diagram of Coronado’s corporate structure on completion of the Merger follows:

As a result of the foregoing transactions, Coronado is now a holding company operating through its controlled majority-owned subsidiary Vampt, a producer of and distributor of ready-to-drink flavored malt alcoholic beverages. Prior to completing the Merger, Coronado was a “shell company” as such term is defined in Rule 12b-2 under the Exchange Act. The transaction was accounted for as a reverse takeover/ recapitalization effected by a merger, wherein Vampt is considered the acquirer for accounting and financial reporting purposes.

The Merger was conditioned upon, among other things, approval by Vampt Shareholders, no legal impediment to the Merger, the absence of any material adverse effect on our company or Vampt, completion of due diligence reviews by both companies, and any other necessary approvals. The Agreement and Plan of Merger contained certain closing conditions that were satisfied or waived on or before the Closing Date, including the requirement that Coronado have no material liabilities as of the Closing Date, and that all common shares of Coronado issued to Vampt shareholders on the Closing Date be subject to a pooling agreement as further described below.

3

Coronado Settlement of Material Liabilities

In order to settle its material liabilities in advance of closing the Merger, Coronado completed a private placement financing by which it raised aggregate proceeds of $205,683.04 through the issuance of 1,285,519 Coronado Shares at a price of $0.16 per Coronado Share. The proceeds of the financing were used by Coronado to pay its outstanding accounts payable.

Coronado also settled certain current debts by issuing common shares pursuant to the following debt settlement and subscription agreements, dated effective as of December 16, 2011:

|

●

|

with Michael Bodino wherein Bodino has agreed to settle debt owed to Bodino in the amount of $162,500 by the issuance of 216,666 shares of our common stock at a deemed price of $0.75 per share; and

|

|

●

|

with D. Sharpe Management Inc., a company controlled by the sole director and officer of Coronado, wherein D. Sharpe Management has agreed to settle debt owed to it in the amount of $162,500 by the issuance of 216,666 shares of Coronado common stock at a deemed price of $0.75 per share.

|

Hold Period and Pooling Agreement

The 10,568,751 Coronado Shares issued to former holders of Vampt Shares will be subject to a 1 year hold period (the “Hold Period”) in accordance with Section 5 of the Securities Act of 1933 and Rule 144 of the general rule and regulations thereunder.

As a condition of closing the Merger, former shareholders of Vampt who received Coronado Shares upon closing of the Merger entered into a voluntary pooling agreement (the “Pooling Agreement”) dated as of the Closing Date, May 7, 2012, that will pool and release each holder’s shares in 25% increments, with the first release occurring 90 days after expiry of the Hold Period and subsequent releases occurring every 90 days thereafter. Former shareholders of Vampt also agreed pursuant to the Pooling Agreement not to vote their shares to effect a consolidation of the common shares in the capital of Coronado except in limited circumstances, including a failure of the business or inability to secure financing, as further described in the Merger Agreement, a copy of which is filed as an exhibit to this Report.

The foregoing descriptions of the Preferred Shares, the Warrants, and the Pooling Agreement are qualified in their entirety by reference to the provisions of the Certificate of Designation for Preferred Stock, form of Warrant, the Pooling Agreement and the provisions of the Merger Agreement with respect thereto, all of which are filed as exhibits to this Report and are incorporated by reference herein.

Coronado’s Business Prior to the Merger

From inception until mid-December 2009, Coronado’s business plan was to build and operate a dental clinic in Costa Rica. Coronado actively pursued this business until undergoing a change of control on March 31, 2009. From April 1, 2009 to December 2009, management redirected the focus of the business on launching and operating a website to promote dental services combined with vacation packages in Costa Rica to an international clientele. For a referral fee, Coronado intended to introduce third-party dentists and dental clinics to vacationers looking to combine dental procedures with vacations abroad. The company would also arrange for travel accommodations and tour packages for those individuals. Coronado elected to abandon this business plan in mid-December 2009 due to an inability to generate revenues sufficient to fund its operations.

Management was of the view that a change in business direction was in the best interests of its shareholders. To that end, on December 16, 2009, Coronado entered into a letter agreement to acquire a 15% working interest in an oil and gas project located in Alaska, which was a farm-out from BP Exploration (Alaska) Inc. However, the short time lines set out in the letter agreement prevented Coronado from securing the financing required for it to participate in the project and the letter agreement expired on January 15, 2010. From that time until entering into negotiations with Vampt to complete the Merger, Coronado’s management was actively involved in seeking out potential opportunities to acquire an operating business and was a declared “shell company” under Rule 12b-2 under the Exchange Act.

In accordance with the requirements of Item 2.01(a)(f) of Form 8-K, the remainder of this Report sets forth the information required to be securities in accordance with Form 10 under the Exchange Act with respect to the continuing operations of Coronado’s newly acquired controlled majority-owned subsidiary, Vampt.

4

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

The disclosure in Item 1.01 of this Report regarding the Merger is incorporated herein by reference in its entirety.

FORM 10 DISCLOSURE

As disclosed elsewhere in this Report, we acquired Vampt on the Closing Date by completing a merger of our wholly-owned subsidiary, VB Acquisition, and Vampt under the Nevada Revised Statutes, pursuant to which Vampt was the surviving entity and our controlled majority-owned subsidiary in which we hold a 60.4% ownership interest upon the effective time of the Merger. The following disclosure made on the basis of Form 10 under the Exchange Act, as required to be made by a former “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act), relates to the consolidated operations of Coronado and Vampt following the completion of the Merger on the Closing Date. References to “we”, “us” and “our” hereafter in this Report refer to the consolidated operations of Coronado and its controlled majority-owned subsidiary, Vampt, after completion of the Merger, and to Coronado alone any time prior to the Closing Date. References to “Vampt” refer to Vampt as a separate entity prior to and after completion of the Merger on the Closing Date, as the context so provides.

DESCRIPTION OF BUSINESS

Business Overview

We are a producer and distributor of premium, Ready-to-Drink ("RTD") flavored malt beverages. Our beverages follow a proven business model: made with malt beverage for U.S. consumption and with vodka or rum-based alcoholic spirits for Canadian consumption.

Our goal is to become the fourth ranked RTD brand in the U.S. within the next five years, as ranked by market share.

Our management, which is the former management of Vampt, are a world-class team of experienced management from the food & beverage industry. Our executive officers were behind the launch of the ‘hard’ lemonade products that created the category in 1999, which is now the second largest RTD brand in North America. Our executive officers joined Vampt and now our company to create and launch a unique product that we believe will satisfy a niche in the flavored malt beverage marketplace in the U.S.

Vampt, the Vampt logo, and our other registered or common law trademarks, service marks, or trade names appearing in this prospectus are the property of Vampt Beverage USA, Corp. Other trademarks, service marks, or trade names appearing in this prospectus are the property of their respective owners.

Our Corporate History and Background

Coronado

We were incorporated under the laws of Nevada on January 9, 2006. From inception until the closing of the Share Merger, we were in the business of dental and health related business services until mid-December 2009, followed by a planned entry into the oil and gas industry until January 15, 2010 which was not completed, all as further described under the heading “Introduction” herein. From January 15, 2010 until the entry into the Agreement and Plan of Merger with Vampt, our management was actively seeking a suitable business acquisition opportunity for us. Prior to the Merger, we had minimal revenue and no active business plan. As a result of the Merger, we now operate through Vampt as producer and distributor of RTD flavored malt beverages.

5

Vampt

Vampt was incorporated under the laws of Nevada on January 13, 2011, and was extra-provincially registered in British Columbia, Canada on March 15, 2012 as it conducts business in Canada. On November 25, 2011, Vampt acquired all right, interest and title in and to certain technology developed by Vampt Beverage Corp. (“Vampt Canada”), a company incorporated under the federal laws of Canada, under a “Technology Transfer Agreement” that was subsequently amended by an “Amendment Agreement” dated December 31, 2011 (collectively, the “Technology Agreements”), for consideration of the issuance of 750,000 common shares in the capital of Vampt to Vampt Canada. The technology Vampt acquired includes various beverage formulas to produce malt beverage products in the United States, trade names, marks and artwork employing the name “Vampt”, bottling, distribution and retail networks and contractual and other relationships (collectively, the “Technology”). Title to the Technology vested in Vampt upon execution of the Technology Agreements. Vampt has generated revenues of $517,462 from the acquisition of the Technology for the period from inception to December 31, 2011.

On April 11, 2012, Vampt entered into a trademark assignment agreement with Vampt Canada pursuant to which all rights, interests and title of Vampt Canada in and to certain U.S. trademarks were assigned, sold and transferred to Vampt.

Concurrent with being assigned the trademarks, Vampt assumed the obligations of Vampt Canada as co-debtor under an operating loan facility of up to $2,000,000 originally granted to Vampt Canada and Vampt’s wholly-owned subsidiary, Vampt Brewing Company Limited by way of a loan agreement dated August 11, 2011 (the “Original Loan Agreement”) with certain individual accredited lenders and Kalamalka Partners acting as their agent. In furtherance thereof, Vampt entered into a “Loan Transfer, Guarantee and Warrant Agreement” dated effective April 11, 2012 (the “New Loan Agreement”) with Vampt Canada, Vampt Brewing Company Limited and Kalamalka Partners, pursuant to which:

|

●

|

Vampt agreed to become a co-borrower with Vampt Brewing Company Limited under the New Loan Agreement (Vampt and Vampt Brewing Company Limited, collectively, the “Debtors”);

|

|

●

|

the principal sum advanced under the Original Loan Agreement of $600,000 shall be the principal sum advanced under the New Loan Agreement (the “Loan Balance”);

|

|

●

|

the maximum principal available under the loan facility will be $1,200,000, including the Loan Balance;

|

|

●

|

the term of the loan will end on March 31, 2014;

|

|

●

|

Vampt agreed to be jointly and severally liable together with Vampt Brewing Company Limited (collectively, the “Debtors”) for the amount of the Loan Balance plus any interest accruing from April 1, 2012 onward, which shall accrue at a rate 12% of the principal plus 4% of the balance of the credit facility from time to time that is in Kalamalka’s account but not yet drawn;

|

|

●

|

the Debtors paid $46,579.82 to Kalamalka on behalf of the lenders for interest accrued under the terms of the Original Loan Agreement from August 2011 to April 2012, and $50,400 to Kalamalka in respect of a monitoring fee for acting as agent during the same period under the terms of the Original Loan Agreement;

|

|

●

|

pursuant to completion of the Merger, Vampt will issue such number of securities to Kalamalka and the lenders such that upon conversion into securities of Coronado on the same terms applicable to the Merger, Kalamalka and the lenders will hold in aggregate: (i) warrants to purchase 800,000 Coronado common shares at an exercise price of $0.75 per share until March 31, 2014; (ii) warrants to purchase Coronado 400,000 common shares at an exercise price of $0.75 per share until May 7, 2014; and (iii) warrants to purchase 750,000 Coronado common shares at an exercise price of $0.17 per share until March 31, 2014;

|

6

|

●

|

Kalamalka may in its sole discretion elect to convert any funds lent under the New Loan Agreement, excluding the previously advanced Loan Balance, into Coronado common shares at an exercise price of $0.75 per share until March 31, 2014, as provided in a transferrable convertible warrant;

|

|

●

|

Vampt Canada agreed to act as guarantor until the completion of the Merger and the issuance of Coronado warrants in exchange for Vampt warrants held by the lenders and Kalamalka;

|

|

●

|

the Debtors are obligated to pay a monitoring fee to Kalamalka in respect of providing services as agent for the loan in the amount of $5,000 plus taxes per month from April 11, 2012 to April 30, 2012; from May 1, 2012 to March 31, 2013, the amount of $2,000 plus taxes per month; from April 1, 2013 to the time of repayment of the loan in full, the amount of $1,000 plus taxes per month;

|

|

●

|

Vampt Brewing Company Limited is required to maintain a borrowing base equal to a discount factor of 0.90 multiplied by the value of the sum of inventory plus accounts receivable;

|

|

●

|

Vampt Brewing Company Limited granted to the Kalamalka a security interest in all of its inventory, negotiable instruments, accounts, contract rights and other chattel paper, letters of credit, commercial tort claims, credit files, books, correspondence and other records in relation to the foregoing, and all cash and non-cash proceeds and interest; and

|

|

●

|

Vampt entered into a “Pledge and Security Agreement” dated April 11, 2012 pursuant to which it pledged to Kalamalka, as security and collateral for all amounts owed under the New Loan Agreement, an exclusive lien over and security interest in and to a total of 1,001 common shares in the capital of Vampt Brewing Company Limited owned by Vampt, as well as any convertible securities, dividends or other distributions payable received by Vampt from time to time, as well as all cash and non-cash proceeds relating to the foregoing.

|

By agreement dated April 30, 2012, Mark Wahlberg was engaged as an advisor to Vampt.

On March 14, 2012, Vampt entered into a “Barter and Marketing Services Agreement” with VamptX, a company whose directors are Ian Toews, Richard Ikebuchi and Gregory Darroch, who are also the directors of Vampt, for VamptX to provide product awareness and marketing services and manage any barter services, all such services to be provided to Vampt at a price of cost plus 5%. The term of the agreement ends on March 13, 2017 unless earlier terminated by the parties in accordance with the provisions of the agreement. As consideration, Vampt sold to VamptX 1,000,000 common shares of Vampt at a price of $0.0001 per share, all of which were converted to Coronado common shares upon completion of the Merger.

Acquisition of Vampt

On the Closing Date, we completed the Merger as further described in Item 1.01 of this Report. As a result of the Merger, Vampt became our 60.4% controlled majority-owned subsidiary. Unless the context suggests otherwise, when we refer in this Report to business and financial information for periods prior to the consummation of the Merger, we are referring to the business and financial information of Vampt.

In connection with the Merger, the Board of Directors of Vampt became the Board of Directors of the surviving corporation post-Merger (the “Surviving Corporation”), and the officers of Vampt became the officers of the Surviving Corporation. Ian Toews is the Chief Executive Officer, Secretary and Treasurer and a director, Richard Ikebuchi is the President and a director, Darren Battersby is the Chief Financial Officer, Gregory Darroch is the VP Finance and a director, and Jaime Guisto is the VP Sales.

Industry Overview

The market for single serve, ready-to-drink alcoholic beverages is expanding with new entries and flavors. Current products in the marketplace include both still and carbonated beverages that are primarily malt-based. Traditionally, flavored malt beverages are produced in glass bottles rather than aluminum cans. Current brands available in the market with flavors similar to those produced by Vampt include Smirnoff Ice, Mike’s Hard Lemonade, Bacardi Mojito, Sparks and Tilt.

The current flavored malt beverage market targets female consumers, leaving male consumers largely untargeted. Our goal is to tap into the male consumer segment of the market by developing unique flavors that will capture the interest of male consumers.

7

Products, Market and Target Market

We focus on the manufacture and sale of two product formats of our flavored malt beverage under the name “Vampt”: 12-ounce bottles sold in a 6 pack carrier and individual 16-ounce cans targeting the convenience store trade. The alcohol content is higher than other brand offerings at 8% and the beverage is less sweet to appeal to male consumers. The alcohol base in all U.S. products will be derived from malt beverage with additional flavors added, natural and/or artificial, including sweeteners.

Our products are sold in a number of states across the United States of America. We launched our products in 2011 by way of an aggressive guerrilla-style on premise marketing and promotional program, combined with online marketing using social media, including our accounts on Twitter and Facebook as well as our company website. In addition to this, we advertise online and sponsor local events attended by our target market, such as concerts, festivals, store and other openings and air shows, in markets where our products are sold.

Our primary target market is 21 to 32 year old males. This age group represents the largest consumer of progressive adult beverages. The Vampt consumer is single and upwardly mobile, lives in a cosmopolitan city and frequents bars and nightclubs as part of his lifestyle. The income for this core target group ranges from students juggling part-time jobs to young adults with professional careers. While income levels may vary, the members of our target market have disposable income spent primarily on entertainment and social activities. We also anticipate that women will be attracted to the brand as testing has shown that women are looking for sexier, stronger alternatives to traditional flavored malt beverage offerings. The Vampt target consumer is currently:

|

●

|

a drinker of flavored malt beverages;

|

|

●

|

consuming trendy drinks such as shooters, hard lemonade, mojitos, or other bar mixed drinks;

|

|

●

|

seeking an alternative beverage to beer that possesses a stronger, more masculine image;

|

|

●

|

highly social and image conscious;

|

|

●

|

fit, active and stylish; and

|

|

●

|

up on the latest trends and technology savvy.

|

In addition to the core customers described above we believe that our products will also appeal to an older demographic of people who are attracted to alternatives to the wine and coolers they are currently consuming that are perceived to be more grown-up product offerings.

Competition

The flavored malt beverage industry is highly competitive. We compete with a number of major global and regional competitors producing flavored malt beverages, each of which have several brands competing directly with our products, including Smirnoff Ice, Bacardi, Mike’s Hard Lemonade and Sparks. These companies enjoy brand recognition which exceeds that of our brand name. We compete with several producers who have significantly greater financial, managerial, distribution, advertising, and marketing resources than we do. We compete for product ideas, shelf space, and market share. We believe that our success will depend upon our ability to remain competitive in this field and establish a consumer base and brand recognition. The failure to compete successfully for market share and for resources could have a material adverse effect on our business.

We are a new entrant to the market and are aiming to differentiate our products by appealing to male customers who have largely been untargeted by the industry.

8

Brand

The Vampt brand is derived from two elements: high energy and sexiness.

The sexy image of the brand includes the following characteristics:

|

●

|

mystery

|

|

●

|

transformation

|

|

●

|

night

|

|

●

|

sexiness

|

|

●

|

maturity

|

|

●

|

masculinity

|

|

●

|

confidence

|

|

●

|

fearlessness

|

We will market the Vampt product as being the alcoholic beverage of choice for bold and outgoing consumers who enjoy letting loose, partying, living in the moment and loving life. This fearless attitude is traditionally male trait, which is a key component of our brand. Putting these elements together, the Vampt brand is sexy, masculine energy. We intend to market our product as unique and exciting as compared to other flavored malt beverage offerings. We intend to reinvent the flavored malt beverage category by pushing the boundaries of the current target market for this type of beverage, which we anticipate will garner the interest of our target market.

Distribution

Our products are distributed in the U.S. through a direct store delivery distribution system by beer distributors who deliver to grocery stores, including C-Stores, G-Stores and other retailers, as well as bars and taverns. This strategy is in compliance with regulatory requirements for the distribution of alcoholic beverages in the U.S. and ensures that outlets are serviced within industry standards that require a direct to store delivery system.

Sources and Availability of Raw Materials and Production

We have outsourced production of the Vampt product to a third party multi-national production service provider for start-up beverage companies, Associated Brewery Company Inc., who provides timely and cost-effective services to the beverage industry, which allows us to maintain a low level of overhead and achieve economies of scale. We have engaged Associated Brewery to oversee all phases of production, including procuring raw material, bottling and packaging, delivery, production planning and management, distribution, sampling and quality control, test marketing, product pricing and implementation of regional product roll-outs. Associated Brewery also holds a license to produce alcoholic beverages in the United States.

Product

Our product is currently sold in the states of Arizona, New Mexico, Oregon, Idaho, Washington, Montana, Colorado and Georgia.

Inventory

As a producer of beverage products for retail consumption, we are required to produce and hold inventory of our product. Such inventory is held on our behalf by our third party service provider, Associated Brewery Company Inc. As of December 31, 2011, we held total inventory of $570,541 on hand, including $64,389 in raw materials such as ingredients, concentrate and packaging, and $506,152, including product ready for shipment and promotional merchandise held for sale. Our allowance for inventory write-down of perishable goods subject to expiration prior to being sold amounted to $314,867.

We expect that the amount of inventory we will be required to have on hand will increase in proportion to the expansion of our operations.

9

Research and Development

For the period from January 13, 2011 to December 31, 2011 we spent $100,174 on product research and development, all of which were expensed as incurred. Our research and development expenses relate to the development of new products and the improvement of existing products.

Intellectual Property

The success of our product will be dependent on developing a customer base. Branding and protection of our brand, trademarks, trade names and other intellectual property rights is an integral component of the success of our business. To that end, we have registered the trademarks “VAMPT”, “GET VAMPT”, “VMPT”, “MIDNIGHT WARRIOR”, “SMOOTH TALKER”, “WANNA PLAY?”, “B 21 + TO HANDLE THIS”, “B 21+”, “VNATION”, “VAMPT NATION”, “VRACING”, “VN”, “NEVER FOLLOW, ALWAYS LEAD”, “VAMPTX” and “TRANSFORM THE NIGHT” in the United States.

Employees

As of the Closing Date, we had 2 full time employees, no part time employees and 10 contractors. From time to time, we may hire additional workers on a contract basis as the need arises. Our strategy to maintain a low level of overhead is to engage industry professionals on a contract basis rather than hiring in-house.

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our shares of common stock could decline and you may lose all or part of your investment. See “Cautionary Note Regarding Forward Looking Statements” above for a discussion of forward-looking statements and the significance of such statements in the context of this Report.

Risks Related to Our Business

We have a history of operating losses and there can be no assurance that we can establish a market for products, establish brand recognition or achieve profitability.

We are a development stage company with a limited operating history. We have only recently begun producing and distributing alcoholic flavored malt beverages. There is limited market awareness and brand recognition for our products. Our company will be subject to all of the business risks and uncertainties associated with any new business enterprise, including the risks that we will be unable to establish a market for our products and services, achieve our growth objectives or become profitable. We incurred a net loss of $1,888,612 from our inception on January 13, 2011 to December 31, 2011 and have an accumulated deficit of $1,612,196. Even if we achieve profitability, given the competitive nature of the industry in which we operate, we may be unable to sustain or increase our revenues and our failure to do so would adversely affect our business.

Although our management has significant experience in the beverage industry, our ability to successfully market and sell our products has not been established and cannot be assured. For us to achieve success, our products must receive broad market acceptance by consumers. Without this market acceptance, we will not be able to generate sufficient revenue to sustain our operations. In addition, we believe that the acceptance and success of our product by our target market, male consumers who have not been the traditional target market for flavored malt beverages, is integral to the success of our products. If our products are not widely accepted by our target market, or we are unable to establish a consumer base by pursuing a different target market, our business may fail.

10

Our independent registered public accounting firm has expressed doubt about our ability to continue as a going concern.

Our financial statements have been prepared under the assumption that we will continue as a going concern. Our independent registered public accounting firm has issued a report that included an explanatory paragraph referring to our working capital deficiency, net losses and accumulated deficit and expressing substantial doubt in our ability to continue as a going concern. Our ability to continue as a going concern is dependent upon our ability to generate sufficient cash flows to meet our obligations on a timely basis or to obtain additional financing, and ultimately attain profitability. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty. However, if adequate funds are not available to us when we need it, we may be required to curtail our operations or cease operating altogether.

The industry in which we operate is highly competitive, which presents an ongoing threat to the success of our business.

The alcoholic beverage industry is extremely competitive. Shelf space is limited and we compete with large numbers of our products and producers, ranging from other small ventures to large businesses with greater access to resources for marketing and product development than we have. We believe that our ability to compete depends upon many factors both within and beyond our control, including the following:

|

●

|

our selling and marketing efforts;

|

|

●

|

performance, pricing, quality and consistent reliability of our products and those on offer by our competitors;

|

|

●

|

the taste preferences of consumers;

|

|

●

|

our ability to change our products to meet changing consumer preferences or develop new products;

|

|

●

|

our ability manage our operations on a cost-effective basis; and

|

|

●

|

our ability to establish a consumer base and generate brand recognition for our products.

|

Many of our current and potential competitors have longer operating histories, significantly greater financial, marketing and other resources than we do. These factors may allow our competitors to respond more quickly than we can to changing preferences, higher costs for raw materials, enhanced regulations and other factors. These competitors may engage in more extensive research and development efforts, undertake more far-reaching marketing campaigns and adopt more aggressive pricing policies, which may allow them to generate revenue more effectively than we do.

We rely heavily on third party service providers and distributors whose ability to remain operations may impact our ability to successfully conduct business operations.

We have arrangements with Associated Brewery Company Inc. to oversee the production, marketing and distribution of our flavored malt beverages, and to act as the exclusive producer and seller of our products. We have entered into a formal agreement with Associated Brewery and we rely heavily on it to produce, distribute and market our products. Should Associated Brewery cease operations, dispute our arrangement with them, file for bankruptcy, unilaterally change the terms or pricing of our arrangement, or terminate their relationship with us, we may have significant difficulty replacing them in a timely manner or at all. Our business operations and name brand would likely suffer, and our financial condition could be materially adversely affected. This could have detrimental effects on our operations as we are a start-up company.

Regulatory decisions and changes in the legal and regulatory environment could increase our costs and liabilities or limit our business activities.

Our operations are subject to extensive regulatory requirements which include those in respect of production, product liability, distribution, marketing, promotion, sales, pricing, labeling, packaging, advertising, labor, and compliance and control systems. Changes in laws, regulations or governmental or regulatory policies and/or practices could cause us to incur material additional costs or liabilities that could adversely affect our business. In particular, governmental bodies in countries where we operate may impose new labeling, product or production requirements, limitations on the advertising and/or promotion activities used to market beverage alcohol, restrictions on retail outlets, other restrictions on marketing, promotion, importation and distribution or other restrictions on the locations or occasions where alcoholic beverages are sold which directly or indirectly limit the sales of our products. Regulatory authorities under whose laws we operate may also have enforcement power that can subject us to actions such as product recall, seizure of products or other sanctions, which could have an adverse effect on our sales or damage our reputation. An increase in the stringency of the regulatory environment could cause our company to incur material additional costs or liabilities that could adversely affect our business.

In addition, alcoholic beverage products are the subject of national excise, import duty and other duties in most countries around the world. To the extent that we export our products to foreign countries, an increase in excise, import duty or other duties could have an adverse effect on our sales revenue or margin, both through reducing overall consumption and by encouraging consumers to switch to lower-taxed categories of beverage alcohol.

Our reported after tax income is calculated based on extensive tax and accounting requirements in the U.S. jurisdictions in which we operate. Changes in tax law (including tax rates), accounting policies and accounting standards could materially reduce our reported after tax income.

11

We are subject to litigation directed at the beverage alcohol industry and other litigation.

Companies in the alcoholic beverage industry are, from time to time, exposed to class action or other litigation relating to alcohol advertising, product liability, alcohol abuse problems or health consequences from the misuse of alcohol. We may be subject to litigation with tax, customs and other regulatory authorities, including with respect to the methodology for assessing importation value, transfer pricing and compliance matters. We may also be routinely subject to litigation in the ordinary course of our operations. Such litigation may result in damages, penalties or fines as well as reputational damage to our business or our brand, and as a result, our business could be materially adversely affected.

Contamination or other events could harm our ability to establish a consumer base and brand recognition for our products.

Our ability to establish brand recognition and a consumer base depends upon the positive image that consumers have of our brand and product. Contamination, whether arising accidentally, or through deliberate third party action, or other events that harm the integrity or consumer support for those brands, could adversely affect our sales. The raw materials used in the production and packaging of our products is purchased from third party producers or on the open market. We may be subject to liability if contaminants in those raw materials or defects in the distillation, fermentation or bottling process lead to low beverage quality or illness among, or injury to, our consumers. In addition, we may voluntarily recall products in the event of contamination or damage. We maintain product liability and commercial insurance to reduce our exposure to this risk to the extent possible and practicable given that we are a start-up company; however, a significant product liability judgement or a widespread product recall may negatively impact our sales and profitability, affect our ability to establish a positive brand image for a period of time, depending on consumer attitudes, or even cause our business to fail if the resulting liability is in excess of the limit under our insurance policy. Even if a product liability claim is unsuccessful or is not fully pursued, any resulting negative publicity could adversely affect our reputation with existing and potential new customers, thereby jeopardizing our ability to establish a consumer base and generate sufficient revenues to sustain our operations.

Demand for our products may be adversely affected by changes in consumer preferences and tastes.

The launch and ongoing success of new products is inherently uncertain especially as to their appeal to consumers. The failure to launch a new product successfully can give rise to inventory write-offs and other costs and can affect consumer perception of a new brand. Any significant changes in consumer preferences and failure to anticipate and react to such changes could result in reduced demand for our products and the failure of our business plan.

Establishing a consumer base for our products depends on our ability to offer products that have a strong appeal to consumers. Consumer preferences may shift due to a variety of factors including changes in demographic and social trends, public health regulations, changes in travel, vacation or leisure activity patterns, weather effects and a downturn in economic conditions, which may reduce consumers' willingness to purchase alcoholic products. In addition, concerns about health effects due to negative publicity regarding consumption the consumption of alcohol, negative dietary effects, regulatory action or any litigation or customer complaints against companies in the industry may have an adverse effect on our business.

If the social acceptability of our products declines, we may be unable to generate sufficient sales volume to sustain our operations.

In recent years, there has been increased social and political attention directed to the alcoholic beverage industry. We believe that this attention is the result of public concern over problems related to alcohol abuse, including drink driving, underage drinking and health consequences from the misuse of alcohol. If, as a result, the general social acceptability of alcoholic beverages were to decline significantly, we may be unable to sell our products, which would have a negative adverse impact on our operations and may result in the failure of our business.

12

An increase in the cost of raw materials or energy could result in sustained losses from operations.

The raw materials that we use for the production of our beverage products are largely commodities that are subject to price volatility caused by changes in global supply and demand, weather conditions, agricultural uncertainty and/or governmental controls. Commodity price changes may result in unexpected increases in the cost of raw materials, glass bottles, flavors and other packaging materials and ultimately our beverage products. We may also be adversely affected by shortages of raw materials, glass bottles, flavors or packaging materials. In addition, energy cost increases result in higher transportation, freight and other operating costs may force us to increase our prices. We may not be able to increase our prices to offset these increased costs without suffering reduced volume, sales and operating profit. As a result of continuing increased global demand for commodities, we may experience significant increases in commodity costs and energy costs in the future.

Climate change, or legal, regulatory or market measures to address climate change, may negatively affect our business or operations, and water scarcity or poor quality could negatively impact our production costs.

There is a growing concern that carbon dioxide and other greenhouse gases in the atmosphere may have an adverse impact on global temperatures, weather patterns and the frequency and severity of extreme weather and natural disasters. In the event that such climate change has a negative effect on agricultural productivity, we may be subject to decreased availability or less favorable pricing for certain raw materials that are necessary components for the production of alcoholic beverages, such as sugar and barley. Water is the main ingredient in substantially all of our products. It is also a limited resource in many parts of the world, facing unprecedented challenges from climate change, overexploitation, increasing pollution, and poor management. As demand for water continues to increase around the world, and as water becomes scarcer and the quality of available water deteriorates, we may be affected by increasing production costs or capacity constraints, which could adversely affect our results of operations and profitability.

Our operations may be adversely affected by failure to maintain or renegotiate our production agreement on favorable terms.

We rely on a third party service provider, Associated Brewery Company Inc., to produce our products and oversee supply, production, packaging and distribution agreements. There can be no assurance that we will be able to renegotiate our rights on favorable terms when they expire or that this agreement will not be terminated. Failure to renew this agreement on favorable terms could have an adverse impact on our business, sales and the establishment of our brand.

We may not be able to protect our intellectual property rights.

Given the importance of brand recognition in the alcoholic beverage industry, we have registered a number of trademarks in the U.S. In the future, we expect to invest considerable effort in protecting our intellectual property rights, including trademark registration and domain names. We also use security measures and agreements to protect our confidential information and trade secrets. However, we cannot be certain that these steps will be sufficient or that third parties will not infringe on or misappropriate our intellectual property rights in their brands or products. If we are unable to effectively protect our intellectual property rights against infringement or misappropriation, our future financial results and ability to develop our business could be materially adversely affected.

Our business depends substantially on the continuing efforts of our senior management and other key personnel, and our business may be severely disrupted if we lost their services.

Our future success heavily depends on the continued service of our senior management and other key employees, many of whom have significant experience in the alcoholic beverage industry. If one or more of our senior executives are unable or unwilling to continue to work for us in their present positions, we may have to spend a considerable amount of time and resources searching, recruiting, and integrating replacements into our operations, which would substantially divert management’s attention from our business and could disrupt our operations. This may also adversely affect our ability to execute our business strategy. Moreover, if any of our senior executives joins a competitor or forms a competing company, we may lose consumers, know-how, and key employees.

Our products may infringe the intellectual property rights of third parties, and third parties may infringe our proprietary rights, either of which may result in lawsuits, distraction of management and the impairment of our business.

As the number of patents, copyrights, trademarks and other intellectual property rights in our industry increases, products based on our technology may increasingly become the subject of infringement claims. Third parties could assert infringement claims against us in the future. Infringement claims with or without merit could be time consuming, result in costly litigation, cause product shipment delays or require us to enter into royalty or licensing agreements. Royalty or licensing agreements, if required, might not be available on terms acceptable to us, or at all. We may initiate claims or litigation against third parties for infringement of our proprietary rights or to establish the validity of our proprietary rights. Litigation to determine the validity of any claims, whether or not the litigation is resolved in our favor, could result in significant expense to us and divert the efforts of our technical and management personnel from productive tasks. If there is an adverse ruling against us in any litigation, we may be required to pay substantial damages, discontinue the use and sale of infringing products, and expend significant resources to develop non-infringing technology or obtain licenses to infringing technology. Our failure to develop or license a substitute technology could prevent us from selling our products.

13

We will incur increased costs as a result of being a public company.

We will face increased legal, accounting, administrative and other costs and expenses as a public company that we did not incur as a private company. The Sarbanes-Oxley Act of 2002, including the requirements of Section 404, as well as new rules and regulations subsequently implemented by the SEC, the Public Company Accounting Oversight Board (the “PCAOB”), impose additional reporting and other obligations on public companies. We expect that compliance with these public company requirements will increase our costs and make some activities more time-consuming. A number of those requirements will require us to carry out activities we have not done previously. For example, we will adopt new internal controls and disclosure controls and procedures. In addition, we will incur additional expenses associated with our SEC reporting requirements. Furthermore, if we identify any issues in complying with those requirements (for example, if we or our accountants identify a material weakness or significant deficiency in our internal control over financial reporting), we could incur additional costs rectifying those issues, and the existence of those issues could adversely affect us, our reputation or investor perceptions of us. We also expect that it will be difficult and expensive to obtain director and officer liability insurance, and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers. Advocacy efforts by stockholders and third parties may also prompt even more changes in corporate governance and reporting requirements. We expect that the additional reporting and other obligations imposed on us by these rules and regulations will increase our legal and financial compliance costs and administrative fees significantly. These increased costs will require us to divert a significant amount of money that we could otherwise use to expand our business and achieve our strategic objectives.

Risks Related to our Stock

Our common stock is quoted on the OTCQB which may have an unfavorable impact on our stock price and liquidity.

Our common stock is quoted on the OTCQB, which is a significantly more limited trading market than the New York Stock Exchange or The NASDAQ Stock Market. The quotation of the Company’s shares on the OTCQB may result in a less liquid market available for existing and potential stockholders to trade shares of our common stock, could depress the trading price of our common stock and could have a long-term adverse impact on our ability to raise capital in the future.

Trading on the OTCQB may be volatile and sporadic, which could depress the market price of our common stock and make it difficult for our shareholders to resell their shares.

Our common stock is quoted on the OTCQB. Trading in stock quoted on the OTCQB is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market price of our common stock for reasons unrelated to operating performance. Moreover, the OTCQB is not a stock exchange, and trading of securities on the OTCQB is often more sporadic than the trading of securities listed on a quotation system like NASDAQ a stock exchange like the NYSE AMEX. Accordingly, shareholders may have difficulty reselling any of the shares.

There is limited liquidity on the OTCQB, which may result in stock price volatility and inaccurate quote information.

When fewer shares of a security are being traded on the OTCQB, volatility of prices may increase and price movement may outpace the ability to deliver accurate quote information. Due to lower trading volumes in shares of our common stock, there may be a lower likelihood of one’s orders for shares of our common stock being executed, and current prices may differ significantly from the price one was quoted at the time of one’s order entry.

We do not expect to pay dividends in the foreseeable future.

We do not intend to declare dividends for the foreseeable future, as we anticipate that we will reinvest any future earnings in the development and growth of our business. Therefore, our stockholders will not receive any funds unless they sell their common stock, and stockholders may be unable to sell their shares on favorable terms or at all.

Because we became public by means of a “reverse merger,” we may not be able to attract the attention of major brokerage firms.

Additional risks may exist since we will become public through a “reverse merger.” Securities analysts of major brokerage firms may not provide coverage of us since there is little incentive to brokerage firms to recommend the purchase of our common stock. We cannot assure you that brokerage firms will want to conduct any secondary offerings on behalf of our company in the future.

14

Future issuances of additional shares of common stock may result in dilution to existing stockholders.

We are authorized to issue up to 100,000,000 Coronado common shares, of which, after giving effect to and following closing of the Merger, a total of 17,287,602 Coronado common shares, and warrants to purchase up to 476,250 Coronado common shares, are issued and outstanding. Certain holders of unconverted subscriptions for securities of Vampt will be made an offer to convert their securities on the same terms and conditions of the Merger. Provided that all such outstanding Vampt subscriptions are converted into securities of Coronado, this will result in the issuance of an additional 7,665,893 Coronado common shares and securities convertible into an additional 7,858,083 Coronado common shares on an approximate basis, for a total of 31,003,959 Coronado common shares and securities convertible into an additional 8,334,333 Coronado common shares. A total of 39,338,292 Coronado common shares would be issued and outstanding on a fully diluted basis. Our board of directors has the authority to cause us to issue additional shares of common stock, and to determine the rights, preferences and privileges of such shares, without consent of any of our shareholders. Consequently, the shareholders may experience dilution in their ownership of our stock in the future.

We are subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock.

Our common stock is subject to the provisions of Section 15(g) and Rule 15g-9 of the Exchange Act, commonly referred to as the “penny stock rule.” Section 15(g) sets forth certain requirements for transactions in penny stock, and Rule 15g-9(d) incorporates the definition of “penny stock” that is found in Rule 3a51-1 of the Exchange Act. The SEC generally defines a penny stock to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. We are subject to the SEC’s penny stock rules.

Since our common stock is deemed to be penny stock, trading in the shares of our common stock is subject to additional sales practice requirements on broker-dealers who sell penny stock to persons other than established customers and accredited investors. “Accredited investors” are persons with assets in excess of $1,000,000 (excluding the value of such person’s primary residence) or annual income exceeding $200,000 or $300,000 together with their spouse. For transactions covered by these rules, broker-dealers must make a special suitability determination for the purchase of such security and must have the purchaser’s written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt the rules require the delivery, prior to the first transaction of a risk disclosure document, prepared by the SEC, relating to the penny stock market. A broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent price information for the penny stocks held in an account and information to the limited market in penny stocks. Consequently, these rules may restrict the ability of broker-dealer to trade and/or maintain a market in our common stock and may affect the ability of the Company’s stockholders to sell their shares of common stock.

There can be no assurance that our shares of common stock will qualify for exemption from the Penny Stock Rule. In any event, even if our common stock was exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock if the SEC finds that such a restriction would be in the public interest.

Trends, Risks and Uncertainties

We have sought to identify what we believe to be the most significant risks to our business, but we cannot predict whether, or to what extent, any of such risks may be realized nor can we guarantee that we have identified all possible risks that might arise. Investors should carefully consider all of such risk factors before making an investment decision with respect to our common stock.

Reports to Security Holders

We are subject to the reporting and other requirements of the Exchange Act and we intend to furnish our shareholders annual reports containing financial statements audited by our independent registered public accounting firm and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year. We will continue to file Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K with the Securities and Exchange Commission in order to meet our timely and continuous disclosure requirements. We may also file additional documents with the Commission if they become necessary in the course of our company’s operations.

The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

15

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

The information and financial data discussed below is derived from the audited financial statements of Vampt for the period from inception on January 13, 2011 to December 31, 2011. The financial statements of Vampt were prepared and presented in accordance with generally accepted accounting principles in the United States. The information and financial data discussed below is only a summary and should be read in conjunction with the financial statements and related notes of Vampt contained elsewhere in this Report, which fully represent the financial condition and operations of Vampt, but which are not necessarily indicative of future performance. See “Cautionary Note Regarding Forward Looking Statements” above for a discussion of forward-looking statements and the significance of such statements in the context of this Report.

Overview

We were incorporated on January 13, 2011 under the laws of the State of Nevada. Our business plan is the production and distribution of flavored malt beverages to markets in the U.S. Our products are primarily targeted at male consumers ranging in age from 21 to 32 years of age, which we believe is an untapped market that will allow us to develop a niche market. We have generated revenues of $517,462 from our inception to December 31, 2011 and we are optimistic that we have the right combination of management expertise and branding to successfully establish a consumer base for our products.

Vampt has one wholly-owned subsidiary, Vampt Brewing Company Limited, which was incorporated in the State of Nevada on July 21, 2011.

Recent Events

Reorganization

On May 7, 2012, Vampt completed the Merger with Coronado as described elsewhere in this Report.

Convertible Debenture

In February, 2012 Vampt borrowed a total of $385,000 from a group of accredited lenders pursuant to a convertible debenture bearing interest at a rate of 9% per annum. The convertible debenture is due February 28, 2013 (the “Debenture Due Date”), but is convertible as to principle and interest at any time at the holder’s election into units at a rate of $0.75 per unit. Each unit is comprised of one common share and one-half of a warrant. Each whole warrant is exercisable at a price of $0.75 until the Debenture Due Date .

Results of Operations from Inception on January 13, 2011 to December 31, 2011

Revenues

Vampt was incorporated on January 13, 2011 and set its fiscal year end as December 31st. For the period from inception to December 31, 2011, Vampt generated revenues of $517,462. Vampt’s operations to date have consisted of business formation, strategic development, marketing, product development, and an initial product launch in three markets in the United States, and have expanded to include 8 states as of the date of this Report.

Inventories

As at December 31, 2011, we held a total of $570,541 in inventory, including $64,389 in raw materials such as ingredients, concentrate and packaging, and $506,152 in finished goods, including product ready for shipment and promotional merchandise held for sale. Our allowance for write-down of inventory is in the amount of $314,867 for perishable items that we deem have a reasonable chance of expiring prior to being sold.

16

Cost of Goods Sold and Expenses

Cost of goods sold for the period from January 13, 2011 to December 31, 2011 totaled $916,376, including $513,202 relating to the sales of our products and $403,174 in inventory write-downs and adjustments. As of December 31, 2011, we held inventory worth $570,541, including $64,389 in raw materials and $506,152 in finished goods, of which we estimated $314,867 we wrote down as it was likely to reach its expiration date shortly.

Our expenses for the same period totaled $1,489,698, including costs associated with the development, marketing and launch of our products such as sales and marketing expenses of $514,764, product research and development expenses of $100,174 and travel expenses of $150,146. We also incurred $473,548 in expenses related to compensation and benefits for sales and marketing staff in the United States.

In addition, we incurred professional fees, including accounting, auditing and legal expenses, of $127,555. general and administrative expenses of $72,789 and interest and financing fees of $50,722 associated with the promissory notes payable pursuant to which we raised proceeds of $575,000. See “Liquidity and Capital Resources – Net cash flow from financing activities” below for further details.

Net loss

For the period from January 13, 2011 to December 31, 2011, we experienced a net loss of $1,888,612.

Liquidity and Capital Resources

As of December 31, 2011, we had cash of $13,469 and accounts receivable of $27,774. Our inventories as provided in our balance sheet as of December 31, 2011 totaled $255,674, and we held prepaid expenses and deposits of $11,299.

Net cash flow from operating activities

We used $1,622,068 in operating activities for the period from January 13, 2011 to December 31, 2011 to fund our initial product development, marketing and production and distribution, and related activities. This included a substantial amount of resources held in the form of product inventory as at December 31, 2011.

Net cash flow from investing activities

We did not engage in any investing activities for the period from January 13, 2011 to December 31, 2011.

Net cash flow from financing activities

Net cash provided by financing activities was $1,635,537 for the period from January 13, 2011 to December 31, 2011. This consisted of $754,016 received as advances from stockholders in the normal course of operations; $575,000 in proceeds from the issuance of promissory notes; $34,122 from the issuance of convertible debt; $754,016 in stockholder advances for the purchase of securities not yet issued by us; and $272,398 from subscribed for but unissued common stock. Further details concerning the stockholder advances, promissory notes and issuance of convertible debt follow:

|

●

|

Stockholder Advances (Proceeds of $754,016) – Vampt Canada advanced $754,016 to Vampt. The amount is unsecured, bears no interest and will be repaid at a minimum of 10% before tax profit of Vampt, calculated on an annual basis.

|

|

●

|

Promissory Notes (Proceeds of $575,000) – The promissory notes are payable by us to a group of accredited lenders, one of whom is acting as agent, who have made available to us under an agency and interlending revolving agreement up to $1,200,000. Interest is payable monthly in arrears at a rate of 4% per annum on advances from the lenders to the agent, and 12% per annum on advances from the agent to us. Repayment is due on or before March 31, 2014. We had also agreed to issue one warrant for every C$0.75 advanced to us; however, following year end we entered into negotiations with the lenders and agreed to instead issue 750,000 warrants exercisable at $0.17 per share and 400,000 warrants exercisable at $0.75 per share. The warrants will expire on March 31, 2014.

|

|

●

|

Convertible Debt (Proceeds of $34,122) – During the year ended December 31, 2011, Vampt issued preferred return convertible certificates that are convertible into common stock at a price of $0.50 per share on demand. The units are redeemable 18 months after issuance at twice the original face value, less previous payments made to the date of redemption. Each convertible debt certificate holder received common share purchase warrants at a rate of one warrant for every $10 of convertible certificates purchased. Each warrant has a 3-year exercise term and is exercisable at $0.50 per share.

|

17

Material Commitments for Capital Expenditures

We had no material commitments for capital expenditures as of December 31, 2011.

Going Concern

Our financial statements have been prepared on a going concern basis, which implies we will continue to realize our assets and discharge our liabilities in the normal course of business. As at December 31, 2011, we had a working capital deficiency of $225,917 including inventories and of $481,591 excluding inventories. Our accumulated deficit was $1,907,095. Our continuation as a going concern is dependent upon the ability to generate sales for our products and the attainment of profitable operations, or failing that, continued financial support from our shareholders and the ability to obtain necessary equity or debt financing to continue operations,. These factors raise substantial doubt regarding our ability to continue as a going concern. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should we be unable to continue as a going concern.

Critical Accounting Policies

Use of Estimates

Preparation of the financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates. Specific estimates include the realizability of receivables, inventory valuation, contingencies and forecasts supporting the going concern assumption.

Revenue Recognition

We recognize revenue when persuasive evidence of an arrangement exists, when title and risk of ownership have passed, the sales price is fixed or determinable, and collection is probable. Generally, this will be at the point of shipment from the processing facility as all sales are final and there is no right of return. We estimate provisions for product returns at the time of sale.

Research and Development

We engage in various research and development activities that principally involve the development of new products and improvements of existing products. We expense all research and development costs as incurred.

Inventories

Inventories are stated at the lower of cost or market value and include adjustments for estimated obsolete or excess inventory. Cost is based on actual cost on a weighted average basis. The costs of finished goods inventories include raw materials, direct labor and direct production costs. Reserves for excess inventories are based on an assessment of slow-moving and obsolete inventories, determined by future estimated sales in relation to the product approaching its expiration dates. Provisions for obsolete or excess inventory are recorded in cost of goods sold. We recorded a charge for the write-down of excess inventory during the period.

Financial Instruments

Fair value estimates of financial instruments are made at a specific point in time, based on relevant information about financial markets and specific financial instruments. As these estimates are subjective in nature, involving uncertainties and matters of significant judgment, they cannot be determined with precision. Changes in assumptions can significant affect estimated fair values. Our financial instruments consist of cash, accounts receivable, accounts payable and accrued liabilities. Their carrying values approximate fair values because of the short-term nature of these instruments. The fair value of advances from stockholder has not been considered practicable to determine given the related party nature of these transactions and uncertainties surrounding timing of payments.

18

Recent Accounting Pronouncements

In December 2011, the FASB issued guidance that revises the disclosure requirements about offsetting assets and liabilities on the face of the statement of financial position. Entities will be required to disclose both gross information and net information about both instruments and transactions eligible to be offset directly in the statement of financial position and instruments and transactions subject to an agreement similar to a master netting agreement. The adoption of this standard is effective for our fiscal year ending 2013 and will not have a material impact on our financial statements.

In June 2011, the FASB issued guidance that revises the manner in which entities present comprehensive income in their financial statements, which requires entities to report the components of comprehensive income in either a single, continuous statement or two separate but consecutive statements. The guidance will become effective for us at the beginning of fiscal 2013 and will result in a change in how we present comprehensive income components. The adoption of this standard will not have a material impact on our financial statements.

In May 2011, the FASB issued guidance to amend the fair value measurement and disclosure requirements. The guidance requires the disclosure of quantitative information about unobservable inputs used, a description of the valuation process used, and a qualitative discussion around the sensitivity of the measurements. The guidance will become effective for us at the beginning of fiscal 2012. The adoption of this new guidance will not have a material impact on our financial statements.

Off Balance Sheet Arrangements

We do not have any off balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, sales or expenses, results of operations, liquidity or capital expenditures, or capital resources that are material to an investment in our securities.

DESCRIPTION OF PROPERTY