Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ERHC Energy Inc | Financial_Report.xls |

| EX-32.2 - EXHIBIT 32.2 - ERHC Energy Inc | ex32_2.htm |

| EX-32.1 - EXHIBIT 32.1 - ERHC Energy Inc | ex32_1.htm |

| EX-31.1 - EXHIBIT 31.1 - ERHC Energy Inc | ex31_1.htm |

| EX-31.2 - EXHIBIT 31.2 - ERHC Energy Inc | ex31_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2012

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission File Number 0-17325

(Exact name of registrant as specified in its charter)

|

Colorado

|

|

88-0218499

|

|

(State of Incorporation)

|

|

(I.R.S. Employer Identification No.)

|

5444 Westheimer Road

Suite1440

Houston, Texas 77056

(Address of principal executive offices, including zip code)

(713) 626-4700

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and, (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer x

|

|

Non-accelerated filer o

|

Smaller reporting company o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

The number of shares of common stock, par value $0.0001 per share, outstanding as of April 30, 2012, was 738,933,854

ERHC ENERGY INC.

|

Page

|

||

|

|

|

|

|

Item 1.

|

5

|

|

|

|

5

|

|

|

|

|

|

|

|

6

|

|

|

|

|

|

|

7

|

||

|

|

8

|

|

|

|

|

|

|

|

10

|

|

|

|

|

|

|

Item 2.

|

16

|

|

|

|

|

|

|

Item 3.

|

28

|

|

|

|

|

|

|

Item 4.

|

28

|

|

|

|

||

|

|

|

|

|

Item 1.

|

30

|

|

|

|

|

|

|

Item 6.

|

32

|

|

|

|

|

|

|

|

33

|

|

Forward-Looking Statements

ERHC Energy Inc. (also referred to as “ERHC” or the “Company” and denoted by the use of the pronouns “we,” “our” and “us” as the case may be in this Report) or its representatives may, from time to time, make or incorporate by reference certain written or oral statements of historical fact, statements that include, but are not limited to, information concerning the Company’s possible or assumed future business activities and results of operations and statements about the following subjects:

|

●

|

business strategy;

|

|

●

|

growth opportunities;

|

|

●

|

future development of concessions, exploitation of assets and other business operations;

|

|

●

|

future market conditions and the effect of such conditions on the Company’s future activities or results of operations;

|

|

●

|

future uses of and requirements for financial resources;

|

|

●

|

interest rate and foreign exchange risk;

|

|

●

|

future contractual obligations;

|

|

●

|

outcomes of legal proceedings including, without limitation, the ongoing investigations of the Company;

|

|

●

|

future operations outside the United States;

|

|

●

|

competitive position;

|

|

●

|

expected financial position;

|

|

●

|

future cash flows;

|

|

●

|

future liquidity and sufficiency of capital resources;

|

|

●

|

future dividends;

|

|

●

|

financing plans;

|

|

●

|

tax planning;

|

|

●

|

budgets for capital and other expenditures;

|

|

●

|

plans and objectives of management;

|

|

●

|

compliance with applicable laws; and,

|

|

●

|

adequacy of insurance or indemnification.

|

These types of statements and other forward-looking statements inherently are subject to a variety of assumptions, risks and uncertainties that could cause actual results, levels of activity, performance or achievements to differ materially from those expected, projected or expressed in forward-looking statements. These risks and uncertainties include, among others, the following:

|

●

|

general economic and business conditions;

|

|

●

|

worldwide demand for oil and natural gas;

|

|

●

|

changes in foreign and domestic oil and gas exploration, development and production activity;

|

|

●

|

oil and natural gas price fluctuations and related market expectations;

|

|

●

|

termination, renegotiation or modification of existing contracts;

|

|

●

|

the ability of the Organization of Petroleum Exporting Countries, commonly referred to as “OPEC”, to set and maintain production levels and pricing, and the level of production in non-OPEC countries;

|

|

●

|

policies of the various governments regarding exploration and development of oil and gas reserves;

|

|

●

|

advances in exploration and development technology;

|

|

●

|

the political environment of oil-producing regions;

|

|

●

|

political instability in the Democratic Republic of Săo Tomé and Príncipe (“DRSTP”), the Federal Republic of Nigeria and the Republic of Chad;

|

|

●

|

casualty losses;

|

|

●

|

competition;

|

|

●

|

changes in foreign, political, social and economic conditions;

|

|

●

|

risks of international operations, compliance with foreign laws and taxation policies and expropriation or nationalization of equipment and assets;

|

|

●

|

risks of potential contractual liabilities;

|

|

●

|

foreign exchange and currency fluctuations and regulations, and the inability to repatriate income or capital;

|

|

●

|

risks of war, military operations, other armed hostilities, terrorist acts and embargoes;

|

|

●

|

regulatory initiatives and compliance with governmental regulations;

|

|

●

|

compliance with tax laws and regulations;

|

|

●

|

customer preferences;

|

|

●

|

effects of litigation and governmental proceedings;

|

|

●

|

cost, availability and adequacy of insurance;

|

|

●

|

adequacy of the Company’s sources of liquidity;

|

|

●

|

labor conditions and the availability of qualified personnel; and,

|

|

●

|

various other matters, many of which are beyond the Company’s control.

|

The risks and uncertainties included here are not exhaustive. Other sections of this report and the Company’s other filings with the U.S. Securities and Exchange Commission (“SEC”) include additional factors that could adversely affect the Company’s business, results of operations and financial performance. Given these risks and uncertainties, investors should not place undue reliance on our statements concerning future intent. Our statements included in this report speak only as of the date of this report. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any of our statements to reflect any change in its expectations with regard to the statements or any change in events, conditions or circumstances on which any forward-looking statements are based.

ERHC ENERGY INC.

|

|

March 31,

2012

|

|

|

September 30,

2011

|

|

|||

|

ASSETS

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

|

Current assets:

|

|

|

|

|

|

|

||

|

Cash and cash equivalents

|

|

$

|

4,982,872

|

|

|

$

|

7,137,151

|

|

|

United States Treasury bills

|

|

|

5,010,731

|

|

|

|

5,007,446

|

|

|

Investment in Exile Resources common stock, at market

|

|

|

-

|

|

|

|

524,346

|

|

|

Prepaid expenses and other

|

312,880

|

282,141

|

||||||

|

|

|

|

|

|

|

|

||

|

Total current assets

|

|

|

10,306,483

|

|

|

|

12,951,084

|

|

|

Oil and gas concession fees

|

|

|

4,671,130

|

|

|

|

4,620,531

|

|

|

Investment in Exile Resources common stock, at cost

|

524,346

|

-

|

||||||

|

Furniture and equipment, net

|

|

|

22,545

|

|

|

|

27,225

|

|

|

Restricted certificate of deposit

|

|

|

-

|

|

|

|

131,000

|

|

|

Deferred tax asset

|

|

|

2,018,398

|

|

|

|

2,018,398

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

17,542,902

|

|

|

$

|

19,748,238

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

$

|

519,761

|

|

|

$

|

539,519

|

|

|

|

|

|

|

|

|

|

||

|

Total current liabilities

|

|

|

519,761

|

|

|

|

539,519

|

|

|

|

|

|

|

|

|

|

||

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Shareholders' equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, par value $0.0001; authorized 10,000,000

shares; none issued and outstanding

|

|

|

-

|

|

|

|

-

|

|

|

Common stock, par value $0.0001; authorized 950,000,000

shares; issued and outstanding 738,933,854 shares

|

|

|

73,894

|

|

|

|

73,894

|

|

|

Additional paid-in capital

|

|

|

99,385,670

|

|

|

|

99,355,149

|

|

|

Accumulated other comprehensive income

|

|

|

(825,653

|

)

|

|

|

(825,653

|

)

|

|

Accumulated deficit

|

|

|

(81,610,770

|

)

|

|

|

(79,394,671

|

)

|

|

|

|

|

|

|

|

|

||

|

Total shareholders’ equity

|

|

|

17,023,141

|

|

|

|

19,208,719

|

|

|

|

|

|

|

|

|

|

||

|

Total liabilities and shareholders' equity

|

|

$

|

17,542,902

|

|

|

$

|

19,748,238

|

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

ERHC ENERGY INC.

A CORPORATION IN THE DEVELOPMENT STAGE

|

Three Months Ended

March 31,

|

Six Months Ended

March 31,

|

September 5,

1995

(Inception) to

March 31,

|

||||||||||||||||||

|

2012

|

2011

|

2012

|

2011

|

2012

|

||||||||||||||||

|

Costs and expenses:

|

||||||||||||||||||||

|

General and administrative

|

$ | 1,173,139 | $ | 1,030,474 | $ | 2,213,238 | $ | 2,250,967 | $ | 84,317,408 | ||||||||||

|

Depreciation and depletion

|

3,436 | 3,569 | 7,280 | 12,142 | 1,515,818 | |||||||||||||||

|

Gain on sale of partial interest in DRSTP concession

|

- | - | - | - | (30,102,250 | ) | ||||||||||||||

|

Write-offs and abandonments

|

- | - | - | - | 7,742,128 | |||||||||||||||

|

Total costs and expenses

|

(1,176,575 | ) | (1,034,043 | ) | (2,220,518 | ) | (2,263,109 | ) | (63,473,104 | ) | ||||||||||

|

Other income and (expenses):

|

||||||||||||||||||||

|

Interest income

|

2,950 | 4,804 | 4,419 | 9,779 | 4,849,402 | |||||||||||||||

|

Gain from settlements

|

- | - | - | - | 130,178 | |||||||||||||||

|

Other income

|

- | - | - | - | 439,827 | |||||||||||||||

|

Interest expense

|

- | (459 | ) | - | (920 | ) | (12,144,242 | ) | ||||||||||||

|

Provision for loss on deposits

|

- | - | - | - | (5,292,896 | ) | ||||||||||||||

|

Loss on extinguishment of debt

|

- | - | - | - | (5,749,575 | ) | ||||||||||||||

|

Total other income and (expenses), net

|

2,950 | 4,345 | 4,419 | 8,859 | (17,767,306 | ) | ||||||||||||||

|

Loss before benefit (provision) for income taxes

|

(1,173,625 | ) | (1,029,698 | ) | (2,216,099 | ) | (2,254,250 | ) | (81,240,410 | ) | ||||||||||

|

Benefit (provision) for income taxes:

|

||||||||||||||||||||

|

Current

|

- | - | - | - | (1,330,360 | ) | ||||||||||||||

|

Deferred

|

- | - | - | - | 960,000 | |||||||||||||||

|

Total benefit (provision) for income taxes

|

- | - | - | - | (370,360 | ) | ||||||||||||||

|

Net loss

|

$ | (1,173,625 | ) | $ | (1,029,698 | ) | $ | (2,216,099 | ) | $ | (2,254,250 | ) | $ | (81,610,770 | ) | |||||

|

Net loss per common share -basic and diluted

|

$ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||||||

|

Weighted average number of shares of common shares outstanding – basic and diluted

|

738,933,854 | 738,408,854 | 738,933,854 | 738,159,104 | ||||||||||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

ERHC ENERGY INC.

A CORPORATION IN THE DEVELOPMENT STAGE

|

Three Months Ended

March 31,

|

Six Months Ended

March 31,

|

September 5,

1995

(Inception) to

March 31,

|

||||||||||||||||||

|

2012

|

2011

|

2012

|

2011

|

2012

|

||||||||||||||||

|

Net loss

|

$ | (1,173,625 | ) | $ | (1,029,698 | ) | $ | (2,216,099 | ) | $ | (2,254,250 | ) | $ | (81,610,770 | ) | |||||

|

Other comprehensive income (loss) on available for sale securities

|

- | - | - | - | (825,653 | ) | ||||||||||||||

|

Other comprehensive loss

|

$ | (1,173,625 | ) | $ | (1,029,698 | ) | $ | (2,216,099 | ) | $ | (2,254,250 | ) | $ | (82,436,423 | ) | |||||

The accompanying notes are an integral part of these unaudited consolidated financial statements

ERHC ENERGY INC.

A CORPORATION IN THE DEVELOPMENT STAGE

|

Six Months Ended

March 31,

|

September 5,

1995

(Inception) to

March 31,

|

|||||||||||

|

2012

|

2011

|

2012

|

||||||||||

|

Cash Flows From Operating Activities:

|

||||||||||||

|

Net loss

|

$ | (2,216,099 | ) | $ | (2,254,250 | ) | $ | (81,610,770 | ) | |||

|

Adjustments to reconcile net loss to net cash used by operating activities:

|

||||||||||||

|

Depreciation and depletion expense

|

7,280 | 12,142 | 1,515,818 | |||||||||

|

Provision for loss on deposits

|

- | - | 5,292,896 | |||||||||

|

Write-offs and abandonments

|

- | - | 7,742,128 | |||||||||

|

Deferred income taxes

|

- | - | (2,018,398 | ) | ||||||||

|

Compensatory stock options

|

2,179 | - | 1,310,419 | |||||||||

|

Gain from settlement

|

- | - | (617,310 | ) | ||||||||

|

Gain on sale of partial interest in DRSTP concession

|

- | - | (30,102,250 | ) | ||||||||

|

Amortization of beneficial conversion feature associated with convertible debt

|

- | - | 2,793,929 | |||||||||

|

Amortization of deferred compensation

|

- | - | 1,257,863 | |||||||||

|

Loss on extinguishment of debt

|

- | - | 5,669,500 | |||||||||

|

Stock issued for services

|

- | - | 20,897,077 | |||||||||

|

Stock issued for settlements

|

- | - | 225,989 | |||||||||

|

Stock issued for officer bonuses

|

28,342 | 39,081 | 5,223,037 | |||||||||

|

Stock issued for interest and penalties on convertible debt

|

- | - | 10,631,768 | |||||||||

|

Stock issued for board compensation

|

- | - | 2,652,449 | |||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Prepaid expenses and other current assets

|

(30,739 | ) | (61,801 | ) | (312,879 | ) | ||||||

|

Accounts payable and other accrued liabilities

|

(19,758 | ) | (241,303 | ) | (2,572,375 | ) | ||||||

|

Accrued retirement obligation

|

- | - | 365,000 | |||||||||

|

Net cash used in operating activities

|

(2,228,795 | ) | (2,506,131 | ) | (51,656,109 | ) | ||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

ERHC ENERGY INC.

A CORPORATION IN THE DEVELOPMENT STAGE

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

Six Months Ended

March 31,

|

September 5,

1995

(Inception) to

March 31,

|

|||||||||||

|

2012

|

2011

|

2012

|

||||||||||

|

Cash Flows From Investing Activities:

|

||||||||||||

|

Purchase of long-term investment

|

$ | - | $ | - | $ | (5,292,896 | ) | |||||

|

Purchases of and deposits on oil and gas concessions

|

(50,599 | ) | - | (7,405,630 | ) | |||||||

|

Proceeds from sale of partial interest in DRSTP concession

|

- | - | 45,900,000 | |||||||||

|

Purchase of U.S. Treasury Bills and accrued interest

|

(3,285 | ) | (5,467 | ) | (5,010,731 | ) | ||||||

|

Purchase of investment in marketable equity securities

|

- | - | (1,350,000 | ) | ||||||||

|

Purchase of restricted certificate of deposit

|

- | - | (131,000 | ) | ||||||||

|

Proceeds from sale of restricted certificate of deposit

|

131,000 | - | 131,000 | |||||||||

|

Purchase of furniture and equipment

|

(2,600 | ) | (3,927 | ) | (965,135 | ) | ||||||

|

Net cash provided by (used in) investing activities

|

74,516 | (9,394 | ) | 25,875,608 | ||||||||

|

Cash Flows From Financing Activities:

|

||||||||||||

|

Proceeds from warrants exercised

|

- | - | 160,000 | |||||||||

|

Proceeds from common stock, net of expenses

|

- | 1,821,500 | 8,776,549 | |||||||||

|

Proceeds from line of credit, related party

|

- | - | 2,750,000 | |||||||||

|

Proceeds from non-convertible debt, related party

|

- | - | 158,700 | |||||||||

|

Proceeds from convertible debt, related party

|

- | - | 8,207,706 | |||||||||

|

Proceeds from sale of convertible debt

|

- | - | 9,019,937 | |||||||||

|

Proceeds from bank borrowing

|

- | - | 175,000 | |||||||||

|

Proceeds from stockholder loans

|

- | - | 1,845,809 | |||||||||

|

Proceeds from stock subscription Receivable

|

- | - | 913,300 | |||||||||

|

Repayment of shareholder loans

|

- | - | (1,020,607 | ) | ||||||||

|

Repayment of long-term debt

|

- | - | (223,021 | ) | ||||||||

|

Net cash provided by financing activities

|

- | 1,821,500 | 30,763,373 | |||||||||

|

Net increase (decrease) in cash and cash equivalents

|

(2,154,279 | ) | (694,025 | ) | 4,982,872 | |||||||

|

Cash and cash equivalents, beginning of period

|

7,137,151 | 12,913,249 | - | |||||||||

|

Cash and cash equivalents, end of period

|

$ | 4,982,872 | $ | 12,219,224 | $ | 4,982,872 | ||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

ERHC ENERGY INC.

A CORPORATION IN THE DEVELOPMENT STAGE

NOTE 1 – BASIS OF PRESENTATION AND BUSINESS ORGANIZATION

The consolidated financial statements included herein, which have not been audited pursuant to the rules and regulations of the Securities and Exchange Commission, reflect all adjustments which, in the opinion of management, are necessary to present a fair statement of the results for the interim periods on a basis consistent with the annual audited financial statements. All such adjustments are of a normal recurring nature. The results of operations for the interim periods are not necessarily indicative of the results to be expected for an entire year. Certain information, accounting policies and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America, have been omitted pursuant to such rules and regulations, although ERHC Energy Inc. (“ERHC” or the “Company”) believes that the disclosures are adequate to make the information presented not misleading. These financial statements should be read in conjunction with the Company’s audited financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2011.

Investment in Exile Resources common stock

The Company’s investment in Exile Resources (“Exile”) common stock are accounted under the cost method of accounting since it is no longer considered a publicly-traded equity security and the Company does not have the ability to exercise significant influence over Exile’s operations. Exile’s trading has been halted pending the completion of its reverse take over by Oando Plc, a public limited liability company in Nigeria.

NOTE 2 – FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company adopted new guidance as of October 1, 2008, related to the measurement of the fair value of certain of its financial assets required to be measured on a recurring basis. Under the new guidance, based on the observability of the inputs used in the valuation techniques, the Company is required to provide the following information according to the fair value hierarchy. The fair value hierarchy ranks the quality and reliability of the information used to determine fair values. Financial assets and liabilities carried at fair value will be classified and disclosed in one of the following three categories:

|

●

|

Level 1 — Quoted prices in active markets for identical assets or liabilities.

|

|

●

|

Level 2 — Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or, other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

|

|

●

|

Level 3 — Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

|

Interest income on cash and cash equivalents is recognized as earned on the accrual basis.

The following table summarizes financial assets and financial liabilities measured at fair value on a recurring basis as of March 31, 2012 and September 30, 2011, segregated by the level of the valuation inputs within the fair value hierarchy utilized to measure fair value:

March 31, 2012

|

Quoted Prices

|

Significant

|

|||||||||||||||

|

In an Active

|

Other

|

Significant

|

||||||||||||||

|

Market for

|

Observable

|

Unobservable

|

||||||||||||||

|

Identical Assets

|

Inputs

|

Inputs

|

||||||||||||||

|

(Level 1)

|

(Level 2)

|

(Level 3)

|

Total

|

|||||||||||||

|

United States Treasury Bills

|

$ | 5,010,731 | $ | - | $ | - | $ | 5,010,731 | ||||||||

| $ | 5,010,731 | $ | - | $ | - | $ | 5,010,731 | |||||||||

September 30, 2011

|

Quoted Prices

|

Significant

|

|||||||||||||||

|

In an Active

|

Other

|

Significant

|

||||||||||||||

|

Market for

|

Observable

|

Unobservable

|

||||||||||||||

|

Identical Assets

|

Inputs

|

Inputs

|

||||||||||||||

|

(Level 1)

|

(Level 2)

|

(Level 3)

|

Total

|

|||||||||||||

|

United States Treasury Bills

|

$ | 5,007,446 | $ | - | $ | - | $ | 5,007,446 | ||||||||

|

Marketable equity securities -Exile Resources

|

524,346 | - | - | 524,346 | ||||||||||||

|

Restricted certificate of deposit

|

131,000 | - | - | 131,000 | ||||||||||||

| $ | 5,662,792 | $ | - | $ | - | $ | 5,662,792 | |||||||||

During the year ended September 30, 2011, the Company acquired a $1,350,000 investment in the common stock of Exile Resources, a Canadian oil and gas company that trades on the Toronto Stock Exchange’s Venture Exchange. The $825,653 reduction in the value of the investment between the dates of purchase and the balance sheet dates is included as a reduction in stockholders' equity in accumulated other comprehensive income.

NOTE 3 – OIL AND GAS CONCESSIONS

The following is an analysis of the cost of oil and gas concessions at March 31, 2012 and September 30, 2011:

|

March 31,

2012

|

September 30,

2011

|

|||||||

|

DRSTP concession

|

$ | 2,839,500 | $ | 2,839,500 | ||||

|

Chad concession

|

1,760,000 | 1,760,000 | ||||||

|

Pending Concessions in Other African Countries

|

71,630 | 21,031 | ||||||

| $ | 4,671,130 | $ | 4,620,531 | |||||

Republic of Chad Concession Fees and Other Financial Commitments

On June 30, 2011, ERHC entered into a production sharing contract ("PSC") with Chad for certain land based hydrocarbon exploration and development.

As of March 31, 2012, the Company has paid or incurred:

|

|

a.

|

$1,000,000 out of a signature bonus commitment of $6,000,000 under the PSC (leaving a balance of $5,000,000 to be completed within 90 days of the later of [i] the publication of Approval Law in the Journel Officiel, an official publication of the Government of Chad or [ii] the notification to ERHC of the Order of Award of an Exclusive Exploration Authorization, neither of which has occurred as of the date hereof)

|

|

|

b.

|

$480,000 as legal fees and costs for the drafting and negotiation of the PSC, as provided for in the PSC

|

|

|

c.

|

$280,000 in advisers’ and ancillary costs related to the PSC

|

ERHC is also committed under the PSC to spend at least $15,000,000 over the first five years on a minimum work program and at least an additional $1,000,000 over a further period of up to three years.

Sao Tome Concession

In April 2003, the Company and the DRSTP entered into an Option Agreement (the “2003 Option Agreement”) in which the Company relinquished certain financial interests in the JDZ in exchange for exploration rights in the JDZ. The Company additionally entered into an administration agreement with the Nigeria-Sao Tome and Principe JDA. The administration agreement is the formal agreement by the JDA that it will fully implement ERHC’s preferential rights to working interests in the JDZ acreage as set forth in the 2003 Option Agreement and describes certain procedures regarding the exercising of these rights. However, ERHC retained under a previous agreement the following rights to participate in exploration and production activities in the EEZ subject to certain restrictions: (a) the right to receive 100% working interest signature free bonus of two blocks of ERHC’s choice and (b) the option to acquire up to a 15% paid working interest in up to two additional blocks of ERHC’s choice in the EEZ. The Company would be responsible for its proportionate share of exploration and exploitation costs in the EEZ blocks.

The following represents ERHC’s current rights in the JDZ and EEZ blocks:

|

Block

|

ERHC Original

Participating

Interest

|

ERHC Joint Bid

Participating

Interest

|

Participating

Interest(s) Sold

|

Current ERHC

Retained

Participating

Interest

|

Remaining

Cost

Allocated to

Blocks

|

|||||||

|

|

|

|

|

|||||||||

|

JDZ 2

|

30.00% | 35.00% | 43.00% | 22.00% | $ | - | ||||||

|

JDZ 3

|

20.00% | 5.00% | 15.00% | 10.00% | - | |||||||

|

JDZ 4

|

25.00% | 35.00% | 40.50% | 19.50% | - | |||||||

|

JDZ 5

|

15.00% | - | - |

15.00% (in arbitration)

|

567,900 | |||||||

|

JDZ 6

|

15.00% | - | - |

15.00% (in arbitration)

|

567,900 | |||||||

|

JDZ 9

|

20.00% | - | - | 20.00% | 567,900 | |||||||

|

EEZ 4

|

100.00% | 567,900 | ||||||||||

|

EEZ 11

|

100.00% | 567,900 | ||||||||||

The Original Participating Interest is the interest granted pursuant to the Option Agreement, dated April 2, 2003, between DRSTP and ERHC (the “2003 Option Agreement”).

Under the terms each of the Participation Agreements Sinopec and Addax agreed to pay all of ERHC’s future costs for petroleum operations (“the carried costs”) in respect of ERHC's retained interests in JDZ blocks 2,3 and 4. Additionally, Sinopec and Addax are entitled to 100% of ERHC’s allocation of cost oil plus up to 50% of ERHC’s allocation of profit oil from the retained interests on individual blocks until Sinopec and Addax Sub recover 100% of ERHC’s carried costs.

The remaining $2,839,500 of cost related to the DRSTP concession, as shown on the Company's balance sheet at March 31, 2012 and September 30, 2011, relate to blocks 5, 6 and 9 of the JDZ, and the Company's EEZ blocks on which Production Sharing Contracts are yet to be signed.

NOTE 4 - STOCKHOLDERS' EQUITY

On January 6, 2012, the Board of Directors granted a total of 4,750,000 stock options to officers and board of directors members of the Company under the Company’s 2004 Stock Option Plan. The options vest over two years, are exercisable for a period of 2 years and have a $0.20 strike price. However, the options are only exercisable if the Company’s share price reaches $0.75 per share and remains consistently at or above that level for a period of one month. They have a grant-date fair value of $63,711 or $0.013 per share based on and independent valuation of the options using a lattice model and the following weighted average assumptions:

|

Risk free interest rate

|

0.25 | % | ||

|

Dividend yield

|

0.00 | % | ||

|

Annual volatility

|

105.97 | % | ||

|

Exit/Attrition rates

|

2.00 | % | ||

|

Target exercise multiple

|

2.14 |

During the three months ended March 31, 2012, the Company recognized compensation expense of $2,179 related to the options grant as described above. As of March 31, 2012, none of the options are exercisable, the weighted average remaining term is 1.75 years and the intrinsic value is zero. Unamortized compensation cost related to these options amounted to $61,532 which is expected to be recognized over a remaining period of 1.75 years.

In February 2010, the Company granted 237,500 shares for 2010 employee services rendered which had a vesting period of 2 years and a fair value of $156,750. The Company recognized stock based compensation expense for the six months ended March 31, 2012 of $28,342 in connection with these shares. Unamortized compensation cost for these shares amounted to zero as of March 31, 2012

NOTE 5 – COMMITMENTS AND CONTINGENCIES

LEGAL PROCEEDINGS

JDZ BLOCKS 5 AND 6

Arbitration and Lawsuit

The Company’s rights in JDZ Blocks 5 and 6 are currently the subject of legal proceedings at the London Court of International Arbitration and the Federal High Court in Abuja, Nigeria. The Company instituted both proceedings in November 2008 against the JDA and the Governments of Nigeria and São Tomé and Príncipe. The Company seeks legal clarification that its rights in the Blocks remain intact.

The issue in contention is entirely contractual. The Company was awarded a 15 percent working interest in each of the Blocks in a 2004/5 bid/licensing round conducted by the JDA following the Company’s exercise of preferential rights in the Blocks as guaranteed by contract and treaty. The JDA and the Government of STP contend that certain correspondence issued by a previous CEO/President of the Company in 2006 amount to a relinquishment of the Company’s rights in Blocks 5 and 6 under the Company’s contracts with STP which provide for the rights. The Company contends that no such relinquishment has occurred and has sought recourse to arbitration accordingly. It also filed the suit to prevent any tampering with its said rights in JDZ Blocks 5 and 6 pending the outcome of arbitration.

Suspension of Proceedings on the Arbitration and Lawsuit

Proceedings on the suit and the arbitration are currently suspended while the Company pursues amicable settlement with the Governments of Nigeria and São Tomé Príncipe.

ROUTINE CLAIMS AND CLOSED MATTERS

On April 6, 2012 and April 20, 2012, the Company received letters from the United States Department of Justice and the Securities and Exchange Commission respectively that the agencies had closed all action related to the subpoenas served on the Company between 2006 and 2007.

From time to time, ERHC may be subject to routine litigation, claims, or disputes in the ordinary course of business. ERHC intends to defend these matters vigorously. The Company cannot predict with certainty, however, the outcome or effect of any of the arbitration or litigation specifically described above or any other pending litigation or claims.

The following discussion should be read in conjunction with the Company’s unaudited consolidated financial statements (including the notes thereto) and Item 1A of Part II; “Risk Factors,” included elsewhere in this report and the Company’s audited consolidated financial statements and the notes thereto, Item 7; and “Management’s Discussion and Analysis of Financial Condition and Plan of Operations” and Item 1A, “Risk Factors” included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2011. The Company’s historical results are not necessarily an indication of trends in operating results for any future period. References to “ERHC” or the “Company” mean ERHC Energy Inc., a Colorado corporation, and, unless expressly stated or the context otherwise requires, its wholly owned subsidiary.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

We are including the following cautionary statement to make applicable and take advantage of the safe harbor provision of the Private Securities Litigation Reform Act of 1995 for any forward-looking statements made by us, or on our behalf. This Quarterly Report on Form 10-Q contains forward-looking statements. Forward-looking statements include statements concerning plans, objectives, goals, strategies, expectations, future events or performance and underlying assumptions and other statements which are other than statements of historical facts. Certain statements contained herein are forward-looking statements and, accordingly, involve risks and uncertainties which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. Our expectations, beliefs and projections are expressed in good faith and are believed by us to have a reasonable basis, including without limitations, management's examination of historical operating trends, data contained in our records and other data available from third parties, but there can be no assurance that management's expectations, beliefs or projections will result or be achieved or accomplished. In addition to other factors and matters discussed elsewhere herein, the following are important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements: geopolitical instability where we operate; our ability to meet our capital needs; our ability to raise sufficient capital and/or enter into one or more strategic relationships with one or more industry partners to execute our business plan; our ability and success in finding, developing and acquiring oil and gas reserves; our ability to respond to changes in the oil exploration and production environment, competition, and the availability of personnel in the future to support our activities.

OVERVIEW

The Company was incorporated in 1986 as a Colorado Corporation.

The Company is in the business of exploration and exploitation of oil and gas resources in Africa including its rights to working interests in exploration acreage in the Republic of Chad (“Chad”), in the Joint Development Zone (“JDZ”) between the Democratic Republic of São Tomé and Príncipe (“STP”) and the Federal Republic of Nigeria (“FRN or “Nigeria”) and in the exclusive economic zone of São Tomé and Príncipe (the “Exclusive Economic Zone” or “EEZ”).

The Company’s strategy in the JDZ and EEZ is to farm down its working interests to well established oil and gas operators for upfront cash payments and be carried for our share of the exploration costs. This was done successfully on Blocks 2, 3 and 4 of the JDZ. In the JDZ Blocks 2, 3 and 4, ERHC entered into partnerships with two major international companies, Addax Petroleum and the Sinopec Corporation, to operate the license areas on behalf of ERHC.

Apart from its oil and gas exploration activities in Chad, the JDZ and the EEZ, ERHC is actively pursuing other oil and gas opportunities on the African continent. These other opportunities include the acquisition of significant equity stakes in other oil and gas exploration and production companies and therefore an indirect interest in the underlying exploration and production assets of such other companies.

CURRENT BUSINESS OPERATIONS

REPUBLIC OF CHAD

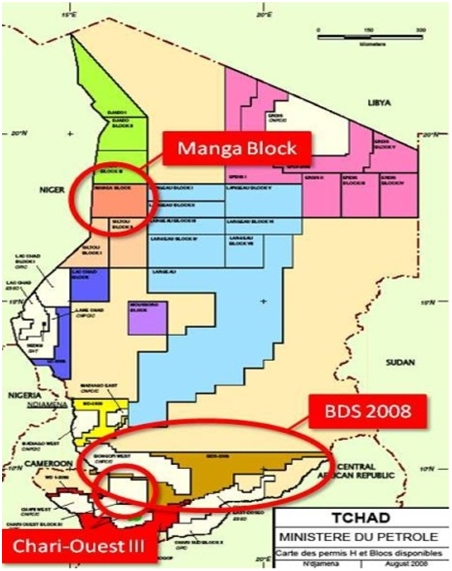

In June 2011, after several months of negotiations between ERHC and the Government of Chad, the Government awarded three blocks for oil and gas exploration and development in Chad to the Company. Management believes that the three blocks in Chad are of strategic importance because they diversify ERHC’s portfolio beyond the Gulf of Guinea, significantly increase the size of exploration acreage under the Company’s control and are onshore, in a country with proven production and reserves.

Names and Sizes of ERHC’s Chad Blocks

The names of the blocks and the sizes of Company's respective interests are as follows:

|

Block

|

ERHC Interest

|

Net ERHC acreage

|

|

|

|

|

|

Manga

|

100% |

6,477 square kilometers or 1,600,501 acres

|

|

|

||

|

BDS 2008

|

100% |

16,360 square kilometers or 4,042,644 acres

|

|

|

||

|

Chari-OuestOust III

|

50% |

4,500 square kilometers or 1,111,974 acres

|

Chad Oil Background and Overview

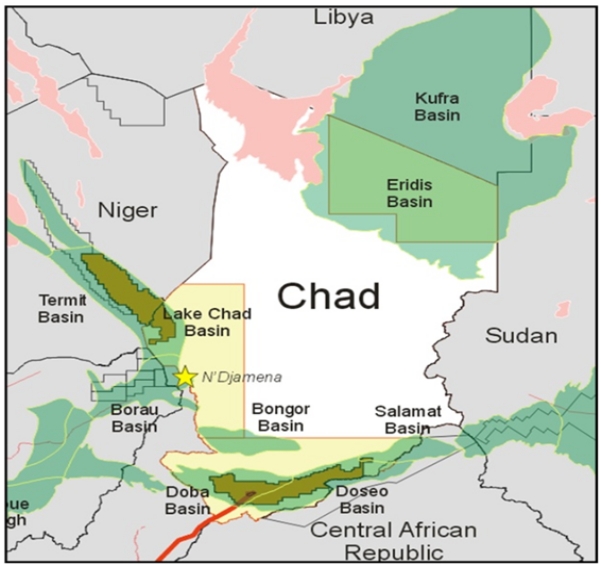

Chad is one of the most exciting new areas for oil exploration and production in Africa. The country covers almost 1,284,000 km2 and is situated in what has become a golden triangle of African oil production. Chad is bordered in the North by Libya which has the largest crude oil reserves in Africa and is Africa’s second largest producer. Nigeria, to the West, is Africa’s largest crude oil producer and has Africa’s largest reserves of natural gas. Chad is bordered in the East by Sudan which is Sub-Saharan Africa’s third largest producer of crude oil. Cameroon which borders Chad in the South West is also a net exporter of crude oil.

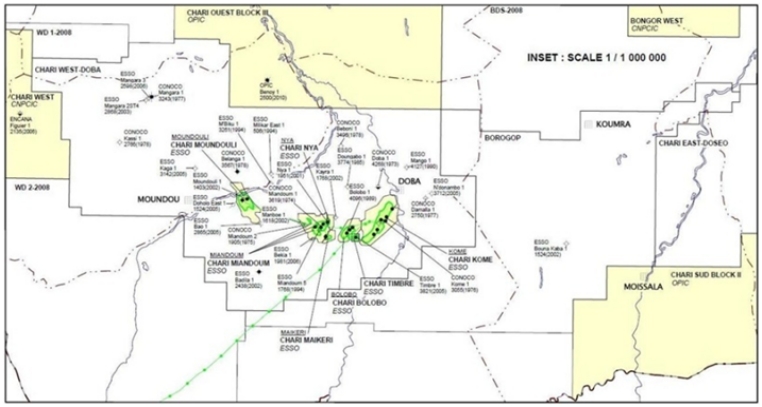

Chad is now amongst Sub-Saharan Africa’s most significant crude oil producers. The country has proven oil reserves of 1.5 billion barrels with recent studies indicating that there is the potential for more discoveries. Production came on stream in 2003 when a consortium of Chevron, Esso E&P (Exxon) and PETRONAS brought the Miandoum field into production. Production followed from the Kome and Bolobo fields in 2004 while the Nya, Moundouli and Maikeri fields went into production between 2005 and 2007. In 2007, the Chinese National Petroleum Company (“CNPC”) began producing from the Mimosa and Ronier fields in the Bongor basin in South Western Chad.

Chad began to export oil in 2004. The export route is through the Chad-Cameroon pipeline completed in 2003 at a cost of over $3.7 billion. The pipeline runs 1,000 km from Chad’s prolific Doba basin through Cameroon’s Logone Birni basin to the port of Kribi in the Gulf of Guinea with an estimated capacity of 225,000 bopd. The capacity of the pipeline is significantly larger than Chad’s current production which in 2010 averaged 122,500 bopd. A new 300 km pipeline has been constructed to transport crude oil from the Koudalwa field in the South Western Chari-Buguirmi region to the Djarmaya refinery. The Djarmaya refinery, situated about 40 km North of N’Djamena, Chad’s capital, was built as a joint venture between CNPC and the Chadian state oil company, SHT. The refinery became operational in July 2011 and has an initial capacity of 20,000 barrels of oil per day which is planned to rise to 60,000 barrels of oil per day.

ERHC has a 100% interest in the Manga Block which is north of Lake Chad, along the border with Niger. The Company also has 100% and 50% interests respectively in BDS 2008 and Chari-Ouest Block 3 which lie next to the prolific Doba and Doseo Basin oilfields. In 2010, the Doba and Doseo Basin oilfields had an average production of 122,500 barrels of crude oil per day. BDS 2008 is also bounded by the Bongor basin which hosts the producing Mimosa and Ronier fields. Extensive exploration activity in the three basins has resulted in a large number of recent discoveries, including the Benoy-1 in Chari-Ouest Block 3 by the Taiwanese Company, OPIC. The Benoy-1 discovery, adjacent to ERHC’s license area, is estimated to have the potential for up to 9,800 barrels of high-quality, light crude per day and 1.2 million cubic feet of natural gas per day.

The Doba and Doseo basins are part of the Central African rift system. They contain up to 10 km of non-marine sediments recording the complex tectonic and climatic evolution of the region from Early Cretaceous to the present. The Doba basin is within the oil-proved zone confirmed by the M’biku and Belanga Wells. The Doseo Basin is one of the tertiary–cretaceous Chad rift basins. The basin is bordered by the Central African Republic in the South and South East. Wells drilled in this basin include Kedini-1, Keita-1, Kibea-1, Kikwey-1, Maku-1, Nya-1, North Sako-1, Tega-1, Bambara-1 and Bona Kaba-1. These wells were drilled by Exxon and Conoco and all discovered hydrocarbons except for Keita-1 and Bona Kaba-1

Production Sharing Contract on ERHC’s Three Blocks in Chad

On July 6, 2011, the Company announced that it had signed a Production Sharing Contract (PSC) on the three oil blocks with the Government of Chad. A PSC is an agreement that governs the relationship between ERHC (and any future joint-venture partners) and the Government of Chad in respect of exploration and production in the Blocks awarded to the Company. The PSC details, among other things, the work commitments (including acquisition of data, drilling of wells, social projects, etc.), the time frame for completion of the work commitments, production sharing between the parties and the Government, and how the costs of exploration, development and production will be recovered.

Exploration Term

Under the PSC, ERHC is entitled to be issued an Exclusive Exploration Authorization over the Blocks for an initial period of five years which can be renewed for a further three years. The Exclusive Exploration Authorization is to be issued by the Government of Chad by an Award Order issued by the Government Minister in charge of hydrocarbons of Chad. The initial period of five years of the Exclusive Exploration Authorization begins to run from the date of the publication of the Award Order in the Journal Officiel (an official publication of the Government of Chad).

Proposed Exploration Work Program

ERHC has proposed a minimum exploration work program on the basis of the full 8-year exploration period subject to such modification as might be required following the exploration work undertaken during the initial 5-year period of the Exclusive Exploration Authorization. The minimum expenditure over the 8 years is $16 million.

In the event of a discovery and commercial production from the Company’s blocks, the Company and any partners that have participated in the exploration will be entitled to recover up to 70% of the net hydrocarbon production (less any production royalty) as cost oil, until all the costs for exploration and development have been recovered. Production royalty is 14.25% in the case of crude oil and 5% in the case of natural gas. No guarantee can be given that there will be production in commercial quantities from the Company’s exploration acreage in Chad.

ERHC’s proposed exploration work program covers the three blocks as a whole and is broadly as follows:

Initial Work Phase (4 years)

The first two-year sub-period covers geological work including regional geology and field studies utilizing existing well logs and 2D seismic data, construction of regional structure isopach and facies maps and cross-sections at key formation tops, acquisition and studying of satellite seep data on a regional scope, organization of G&G database and basin evaluation and modeling to describe petroleum system and migration paths. The sub-period also includes such geophysical work as the acquisition and study of available gravity and magnetic surveys to define the major structural elements, reprocessing of the existing 2D seismic data, interpretation of the existing 2D seismic data to prepare regional structure maps at key formations and tectonic horizons, acquisition of 2D seismic over the prospects and leads based on the outcome of gravity/magnetic and 2D seismic interpretations and mappings, geophysical analysis to enhance the prospects, and acquisition of 3D seismic data over mature prospects.

The second two-year sub-period includes geological and geophysical work such as merging and editing the reprocessed 2D seismic data with newly acquired 3D seismic data, detailed interpretation and mapping of 3D seismic, generation, upgrading and prioritizing of drilling prospects. During this period, the contractor shall also determine the most practical method of drilling applicable to the area, taking into account health, safety, environmental issues and other factors.

Second Work Phase (2 years)

This period covers geological work including the conduct of play analysis to define charge, seal, trap, reservoir, timing, source and maturation. It also covers geophysical work such as the acquisition and interpretation of seismic data over the prospective area to add to or enhance the prospect inventory. One exploration well is expected to be drilled during this period.

Third Work Phase (2 years)

This period covers geological work including the re-evaluation of the maps and studies with respect to the information from the well, acquisition of 2D seismic data over the prospective area and upgrading and increasing of the prospect inventory utilizing the new seismic data. One exploration well is expected to be drilled during this period.

NIGERIA – SAO TOME AND PRINCIPE JOINT DEVELOPMENT ZONE (“JDZ”)

Background of the JDZ

In the spring of 2001, the governments of Săo Tomé & Príncipe and Nigeria reached an agreement over a long-standing maritime border dispute. Under the terms of the agreement, the two countries established the JDZ to govern commercial activities within the disputed boundaries. The JDZ is administered by the JDA which oversees all future exploration and development activities in the JDZ. The revenues derived from the JDZ will be shared 60/40 between the governments of Nigeria and Săo Tomé & Príncipe, respectively.

Origin of ERHC’s Rights in the JDZ

In April 2003, the Company and the DRSTP entered into an Option Agreement (the “2003 Option Agreement”) in which the Company relinquished certain financial interests in the Joint Development Zone (“JDZ”) in exchange for exploration rights in the JDZ. The Company additionally entered into an Administration Agreement with the Nigeria-São Tomé and Príncipe Joint Development Authority (“JDA”). The Administration Agreement is the formal agreement by the JDA that it will fully implement ERHC’s preferential rights to working interests in the JDZ acreage as set forth in the 2003 Option Agreement and describes certain procedures regarding the exercising of these rights. Following the exercise of ERHC’s rights as set forth in the 2003 Option Agreement, the JDA confirmed the award in 2004 of participating interests to ERHC in JDZ Blocks 2, 3, 4, 5, 6 and 9 of the JDZ. Subsequently, ERHC jointly bid with internationally renowned technical partners for additional participating interests in the JDZ during the 2004/5 licensing round conducted by the JDA.

ERHC’s Current Rights in the JDZ

The following represents ERHC’s current rights in the JDZ blocks:

|

JDZ Block

|

ERHC Original

Participating Interest

|

ERHC Joint Bid

Participating Interest

|

Participating

Interest(s) Assigned

|

Current ERHC

Retained Participating

Interest

|

||||

|

|

|

|

|

|

||||

| 2 | 30.00% | 35.00% | 43.00% | 22.00% | ||||

| 3 | 20.00% | 5.00% | 15.00% | 10.00% | ||||

| 4 | 25.00% | 35.00% | 40.50% | 19.50% | ||||

| 5 | 15.00% | - | - |

15.00% (in arbitration)

|

||||

| 6 | 15.00% | - | - |

15.00% (in arbitration )

|

||||

| 9 | 20.00% | - | - | 20.00% |

The Original Participating Interest is the interest granted pursuant to the 2003 Option Agreement. ERHC has not assigned or transferred any of its participating interests in Blocks 5, 6 and 9.

Particulars of ERHC’s Participating Agreements in the JDZ

The following are the particulars of the Participating Agreements by which ERHC transferred some of its participating interests in JDZ Blocks 2, 3 and 4 to technical partners so that the technical partners would operate the Blocks and carry ERHC’s proportionate share of costs in the Blocks until production, if any, commenced from the Blocks:

|

Date of Participation

Agreement

|

Party(ies) to the Participation Agreement

|

|

Participating

Interest(s)

Assigned

|

|

|

Participating

Interest Assigned

Price

|

|

||

|

|

|

|

|

|

|

|

|

||

|

JDZ Block 2 - Participation Agreement - ERHC Retained Interest of 22.00%

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||

|

March 2, 2006

|

Sinopec International Petroleum Exploration Production Co. Nigeria Ltd - a subsidiary of Sinopec International Petroleum and Production Corporation

|

|

|

28.67

|

%

|

|

$

|

13,600,000

|

|

|

|

|

|

|

|

|

|

|

||

|

Addax Energy Nigeria Limited - an Addax Petroleum Corporation subsidiary

|

|

|

14.33

|

%

|

|

$

|

6,800,000

|

|

|

|

|

|

|

|

||||||

|

JDZ Block 3 - Participation Agreement - ERHC Retained Interest of 10.00%

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||

|

February 15, 2006

|

Addax Petroleum Resources Nigeria Limited - a subsidiary of Addax Petroleum Corporation

|

|

|

15.00

|

%

|

|

$

|

7,500,000

|

|

|

|

|

|

|

|

|

|

|

||

|

JDZ Block 4 - Participation Agreement - ERHC Retained Interest of 19.50%

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||

|

November 15, 2005

|

Addax Petroleum Nigeria (Offshore 2) Limited - a subsidiary of Addax Petroleum Corporation

|

|

|

40.50

|

%

|

|

$

|

18,000,000

|

|

Under the terms of the Participation Agreements Sinopec and Addax agreed to pay all of ERHC’s future costs for petroleum operations (“the carried costs”) in respect of ERHC's retained interests in the blocks. Additionally, Sinopec and Addax are entitled to 100% of ERHC’s allocation of cost oil plus up to 50% of ERHC’s allocation of profit oil from the retained interests on individual blocks until Sinopec and Addax Sub recover 100% of ERHC’s carried costs.

On or about October 2, 2009, Sinopec International Petroleum Exploration and Production Corporation acquired all of the outstanding shares of Addax Petroleum Corporation

OPERATIONS IN THE JDZ

ERHC has working interests in six of the nine Blocks in the JDZ, as follows:

|

●

|

JDZ Block 2: 22.0%

|

|

●

|

JDZ Block 3: 10.0%

|

|

●

|

JDZ Block 4: 19.5%

|

|

●

|

JDZ Block 5: 15.0% (in arbitration)

|

|

●

|

JDZ Block 6: 15.0% (in arbitration)

|

|

●

|

JDZ Block 9: 20.0%

|

The working interest percentages represent ERHC’s share of all the hydrocarbon production from the blocks and obligates ERHC to pay a corresponding percentage of the costs of drilling, production and operating the blocks. Through Exploration Phase 1 in blocks 2, 3 and 4, these costs have been carried by the operators. The operators can only recover their costs by carrying ERHC until production whereupon the operators will recover their costs from production revenues.

ERHC’s interests in the JDZ Blocks are in various stages of exploration. JDZ Blocks 2, 3 and 4 were the focus of an exploration campaign that concluded in January 2010. To date, no Production Sharing Contracts have been signed in either JDZ Block 5 or 6, and no operatorship has been awarded in JDZ Block 9.

In 2009, Sinopec and Addax, ERHC’s technical partners and operators in Blocks 2, 3 and 4 undertook an exploratory drilling campaign across the three blocks that was completed in January 2010. That drilling campaign was a coordinated effort made possible by two important transactions undertaken by Addax and Sinopec during 2009: (1) Addax’s acquisition of Anadarko Petroleum’s interest in Block 3, allowing Addax to become the operator in the Block 3 and (2) Sinopec’s acquisition of Addax.

The drilling campaign was completed in January 2010 with five wells drilled in the following locations and order:

|

●

|

The Kina-1 well in JDZ Block 4

|

|

●

|

The Bomu-1 well in JDZ Block 2

|

|

●

|

The Lemba-1 well in JDZ Block 3

|

|

●

|

The Malanza-1 well and Oki East-1 well in Block 4

|

The following is an analysis of activity that took place in each block in connection with the drilling campaign:

|

JDZ Block

|

|

Operator

|

|

Name of Well

|

|

Date Drilling

Began

|

|

Date Well Completed

|

|

Rig/Vessel Used

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

|

|

Sinopec

|

|

Bomu-1

|

|

August 2009

|

|

October 2009

|

|

SEDCO 702

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3

|

|

Addax Sub

|

|

Lemba-1

|

|

October 2009

|

|

November 2009

|

|

Deepwater Pathfinder

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

Addax

|

|

Kina-1

|

|

August 2009

|

|

October 2009

|

|

Deepwater Pathfinder

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

Addax

|

|

Malanza 1

|

|

November 2009

|

|

December 2009

|

|

Deepwater Pathfinder

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

Addax

|

|

Oki East-1

|

|

December 2009

|

|

January 2010

|

|

Deepwater Pathfinder

|

The following is a summary of results of the drilling campaign:

|

JDZ Block

|

|

Results of Drilling Released by Operators

|

|

|

|

|

|

2

|

|

The Bomu-1 well was drilled on time and within budget to a total depth of 3,580 meters resulting in the discovery of biogenic methane gas. As of March 31, 2012, the operator has not made any declaration of commerciality.

|

|

|

|

|

|

3

|

|

The Lemba-1 well was drilled on time and below budget to a total depth of 3,758 meters, biogenic methane gas was discovered in two sands. As of March 31, 2012, the operator has not made any declaration of commerciality.

|

|

|

|

|

|

4

|

|

Three (3) wells were drilled on time and within budget to the planned depth. Biogenic methane gas was discovered in multiple sands in both Kina well and Oki East well. As of March 31, 2012, the operator has not made any declaration of commerciality.

|

General Information on Current Operations in Blocks 2, 3 and 4

Exploration Phase 1 (as extended) in Joint Development Zone (JDZ) Blocks 2, 3 and 4 expired on March 14, 2012.

Under the contractual terms governing the Blocks, the three potential courses of action at the expiration of an Exploration Phase are:

|

|

1.

|

The operators (Addax and Sinopec), the rest of the parties and the JDA could agree to enter into Phase 2 of the exploration program which requires the drilling of at least one more well in each Block.

|

|

|

2.

|

The operators, the rest of the parties and the JDA could agree upon a further extension of Exploration Phase 1.

|

|

|

3.

|

The operators could decide not to pursue future exploration of the Blocks and terminate their involvement in the Blocks, leaving the rest of the parties and the JDA to decide whether to adopt any of the two other courses of action stated before.

|

|

|

The operators’ decision whether to continue or not is the key factor in determining what course of action will be adopted next in JDZ Blocks 2, 3 and 4. That decision is expected to be made public in the near future. |

Of significance is the 2012 two well drilling campaign by Total and partners in JDZ Block 1. ERHC does not hold interests in JDZ Block 1 but considers that the entry of one of the oil majors as the new operator of Block 1 may positively impact on exploration in the JDZ as a whole. Drilling in Block 1 could also provide potentially valuable information to assist further exploration in Blocks 2, 3 and 4 in which ERHC holds interests.

ERHC and its technical partners have obtained very valuable information regarding the stratigraphy, sedimentology and structure of JDZ Blocks 2, 3 and 4 in the five-well drilling campaign undertaken between 2009 and 2010. There are still more than a dozen additional prospects identified in the three Blocks as potential exploration targets.

Management also understands that analyzing drilling results and incorporating them into the relevant geologic and fluid models takes time. Further, moving from field appraisal and development to production takes even more time. As has been the practice in the JDZ, accurate material information on the progress in the JDZ Blocks will emanate from the operators or the JDA. ERHC will publish such information in a timely manner in accordance with ERHC’s contractual and regulatory obligations.

SAO TOME AND PRINCIPE EXCLUSIVE ECONOMIC ZONE (“EEZ”)

Background of the EEZ

An exclusive economic zone is an area beyond and adjacent to the territorial waters of a coastal nation which is subject to specific legal regimes established by international law. In an exclusive economic zone, the coastal nation has sovereign rights established by international law to explore and exploit the natural resources in the zone. The STP EEZ delineates an expanse of waters offshore Săo Tomé and Principe covering approximately 160,000 square km. The EEZ is measured from claimed archipelagic baselines. The territorial waters of STP extend to 12 nautical miles from the coast while the exclusive economic zone extends from the edge of the territorial waters to 200 nautical miles from the coast. The STP EEZ is the largest such zone in the Gulf of Guinea. Oceanic water depths around the two islands exceed 1,524 meters, depths that have only become feasible for oil production in the past few years; however, oil and gas are produced in the neighboring countries of Nigeria, Equatorial Guinea, Gabon and Congo.

Origin of ERHC’s Rights and in the EEZ

Under an agreement with the government Sao Tome and Principe (“STP”) prior to the 2003 Option Agreement, ERHC was vested with the rights to participate in exploration and production activities in the EEZ. These rights included (a) the right to receive up to 100% of two blocks of ERHC’s choice and (b) the option to acquire up to a 15% paid working interest in each of two additional blocks of ERHC’s choice in the EEZ. In 2010, ERHC exercised its rights to receive up to 100% of two blocks of ERHC’s choice in the EEZ and was duly awarded Blocks 4 and 11 of the EEZ by the Government of STP. ERHC will decide whether to take up the option to acquire up to a 15% paid working interest in each of two additional blocks of the EEZ when called upon to exercise the option by the Government of STP in accordance with the agreements which provide for the rights and option.

PSC Negotiations for the EEZ

A PSC is an agreement that governs the relationship between the Company (and its joint venture partners) and the Government of Săo Tomé and Príncipe in respect of exploration and production in any Block awarded to the Company. The PSC spells out, among other things, the work commitments (including acquisition of data, drilling of wells, social projects, etc.), the time frames for accomplishing the work commitments, how production will be shared between the parties and the government, and how the costs of exploration, development and production will be recovered.

The PSC negotiations between ERHC and the National Petroleum Agency of São Tomé and Príncipe (ANP-STP) opened on November 14, 2011 in Sao Tome and are continuing. Good progress has been made in the first two rounds of negotiations but the Company expects that it will take several more rounds to conclude the negotiations. The PSCs pertain to ERHC’s 100 percent working interest in Blocks 4 and 11 of the São Tomé and Príncipe Exclusive Economic Zone (“EEZ”). ERHC’s management is looking to negotiate PSCs for the EEZ Blocks that will be attractive to potential joint venture partners. Discussions are continuing simultaneously with prospective operating partners for ERHC’s EEZ Blocks

Overview of ERHC’s EEZ Blocks

The Săo Tomé and Príncipe EEZ is a frontier region that sits south of the Niger Delta, and west of the Gabon salt basin, retaining similarities with each of those prolific hydrocarbon regions. The regional seismic database comprises approximately 12,000 kilometers of seismic data. Interpretation of that seismic data shows numerous structures that have similar characteristics to known hydrocarbon accumulations in the area.

EEZ Block 4 is 5,808 square kilometers, situated directly east of the island of Príncipe. The northeastern area near EEZ Block 4 contains a large graben structure, which is bound by the Kribi Fracture Zone.

EEZ Block 11 totals 8,941 square kilometers, situated directly east of the island of Săo Tomé and abuts the territorial waters of Gabon. The southern area of the EEZ, where EEZ Block 11 is situated, contains parts of the Ascension and Fang Fracture Zones.

INVESTMENT IN EXILE RESOURCES

In On July 20, 2011 ERHC announced that it had increased its ownership interest in Exile Resources Inc. ("Exile") to approximately 7.35%. Exile is a Canadian independent oil and gas company trading on the Toronto Stock Exchange’s Venture Exchange under the symbol ERI. During the three months ended June 30, 2011, ERHC invested $1,350,000 in Exile stock in open market purchases. ERHC’s intention was to gain an indirect interest in Exile’s underlying oil and gas exploration and production assets as well as an ability to participate in the Exile’s decision making in respect of those assets. ERHC was particularly interested in Exile’s carried interest in the Akepo field in the Niger Delta, which is expected to begin producing in 2012.

The Akepo field is located in the shallow waters of the southeastern area of Nigeria in OML 90. Exile Resources has 10 percent equity and up to a 17.5% economic interest in the field, with Oando Petroleum and Exploration Company (“Oando”) carrying its costs. Sogenal Ltd is the operator of the field. The Akepo-1STdiscovery is expected to produce between 2,500 and 3,000 barrels of oil per day when production begins.

ACQUISITION OF OTHER OIL AND GAS EXPLORATION AND PRODUCTION ASSETS

Although ERHC is making considerable progress toward realizing the value of our oil and gas assets in Chad, the JDZ and the EEZ, it will be some time before any of these oil and gas assets begin to produce revenues. ERHC, therefore, seeks to identify and acquire assets with a shorter time horizon for revenue generation.

ERHC has identified and is examining a large number of potential acquisitions and is actively in discussion regarding a number of potential exploration and production opportunities in Africa. Ultimately, ERHC seeks a portfolio of assets and companies from which it can derive significant strategic value. Securing such potential acquisitions will of course depend on the availability of adequate financing.

CURRENT PLANS FOR OPERATIONS

ERHC’s principal assets are its interests in Chad, the JDZ and the EEZ. ERHC has no current sources of income from its operations. In addition to the existing Participation Agreements in JDZ Blocks 2, 3 and 4, the Company hopes to enter into Participation Agreements in some or all of its other Blocks, but the timing or likelihood of such transactions cannot be predicted. The Company believes that the Participation Agreements that it has entered into will be its primary source of future cash flow; however, the Company is exploring plans to generate operating income from new sources. The Company plans to diversify its business activity by pursuing other growth opportunities which may include acquisition of revenue-producing assets in diverse geographical areas and forging strategic, new, business partnerships and alliances. To expand operations, ERHC is currently in negotiations for potential investments that would increase the Company’s presence in the African oil and gas industry and elsewhere. ERHC cannot currently predict the outcome of negotiations for acquisitions in Africa, or, if successful, their impact on the Company's operations.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The process of preparing financial statements requires that the Company make estimates and assumptions that affect the reported amounts of liabilities and stockholders’ equity at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Such estimates primarily relate to realization of oil and gas concession assets and the valuation allowance related to deferred tax assets as of the date of the financial statements; accordingly, actual results may differ from estimated amounts. ERHC’s estimates and assumptions are based on current facts, historical experience and various other factors we believe to be reasonable under the circumstances. The most significant estimates with regard to the financial statements included with this report relate to realization of oil and gas concession assets and the valuation allowance related to deferred tax assets.

These estimates and assumptions are reviewed periodically and, as adjustments become necessary, they are reported in earnings in the periods in which they become known.

RECENT ACCOUNTING PRONOUNCEMENTS

In preparing its financial statements and filings, the company considers recent guidance issued related to accounting principles generally accepted in the United States. The Company believes that there has been no new guidance since its most recent annual report on Form 10-K that have a significant impact on its financial statements.

RESULTS OF OPERATIONS

Three Months Ended March 31, 2012 Compared with the Three Months Ended March 31, 2011

General and administrative expenses increased from $1,030,474 in the three months ended March 31, 2011 to $1,184,779 in the three months ended March 31, 2012. Both periods reflect a normal level of expenses with increased travel in 2012 as the Company continues to evaluate and develop its interests in Chad and $108,500 of accrued bonuses for key executives.

During the three months ended March 31, 2012, the Company had a net loss of $1,185,265 compared with a net loss of $1,029,698 for the three months ended March 31, 2011.

Six Months Ended March 31, 2012 Compared with the Six Months Ended March 31, 2011

General and administrative expenses decreased from $2,250,967 in the six months ended March 31, 2011 to $2,213,238 in the six months ended March 31, 2012. The decrease is due to ongoing efforts to cut general and administrative expenses.

During the six months ended March 31, 2012, the Company had a net loss of $2,216,099 compared with a net loss of $2,254,250 for the six months ended March 31, 2011.

LIQUIDITY AND CAPITAL RESOURCES

As of March 31, 2012, the Company had $9,993,603 in cash, cash equivalents and short-term investments and positive working capital of $9,786,722. Management believes that this cash position should be sufficient to support the Company’s working capital requirements for more than 12 months.

OFF-BALANCE SHEET ARRANGEMENTS

At March 31, 2012, the Company had no off-balance sheet arrangements.

DEBT FINANCING ARRANGEMENTS

At March 31, 2012, the Company had a total of $519,761 in short term obligations, including $86,225 in accrued compensation owed to directors for serving on the ERHC board, $108,500 of accrued bonuses for two key executives and $153,642 of accounts payable.

The Company’s current focus is to exploit its primary assets, which are rights to working interests oil and gas exploration blocks in Chad, the JDZ and EEZ under agreements with the government of Chad, the JDA and the government of STP respectively. The Company intends to continue to form relationships with other oil and gas companies with operational, technical and financial capabilities, to partner with the Company in leveraging its interests. The Company currently has no other operations.

As of March 31, 2012, all the Company’s exploration and production acreages were located outside the United States. The Company’s primary assets are agreements with Chad, STP and the JDA which provide ERHC with rights to participate in exploration and production activities in Chad, the EEZ and the JDZ in Africa. This geographic area of interest is controlled by foreign governments that have historically experienced volatility of which is out of management’s control. The Company’s operations and its ability to exploit its interests in the agreements in this area may be impacted by this circumstance.