Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - LINC Logistics Co | d315534dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 9, 2012

Registration No. 333-167854

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 15

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LINC LOGISTICS COMPANY

(Exact name of registrant as specified in its charter)

| Michigan | 4731 | 38-3645748 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

11355 Stephens Road

Warren, MI 48089

(586) 467-1500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

H. E. “Scott” Wolfe

Chief Executive Officer

LINC Logistics Company

11355 Stephens Road

Warren, MI 48089

(586) 467-1500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| C. Douglas Buford, Jr. Mitchell, Williams, Selig, Gates & Woodyard, P.L.L.C. 425 W. Capitol Avenue, Ste. 1800 Little Rock, AR 72201 (501) 688-8800 |

Marc D. Jaffe Christopher D. Lueking Latham & Watkins LLP 233 S. Wacker Drive, Suite 5800 Chicago, IL 60606 (312) 876-7700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “accelerated filer”, “large accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |||

| Non-accelerated filer þ | (Do not check if a smaller reporting company) | Smaller reporting company ¨ | ||

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price (1)(2) |

Amount of registration fee | ||

| Common stock, no par value |

$208,533,328 | $16,568.09(3) | ||

| (1) | Estimated pursuant to Rule 457(o) under the Securities Act of 1933, as amended, solely for the purpose of calculating the registration fee. |

| (2) | Includes offering price of shares that the underwriters have the option to purchase to cover over-allotments, if any. |

| (3) | $12,069.66 of the registration fee has been previously paid. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated May 9, 2012

PRELIMINARY PROSPECTUS

11,333,333 Shares

LINC Logistics Company

Common Stock

$ per share

This is the initial public offering of our common stock. Prior to this offering, there has been no public market for our common stock. We are offering 9,913,333 shares of our common stock. We currently expect the initial public offering price to be between $14.00 and $16.00 per share. The selling shareholder identified in this prospectus is offering an additional 1,420,000 shares of our common stock. LINC Logistics Company will not receive any of the proceeds from the sale of the shares being sold by the selling shareholder.

The selling shareholder has granted the underwriters an option to purchase up to 1,700,000 additional shares of common stock to cover over-allotments. We will not retain any of the proceeds from the sale of these shares by the selling shareholder.

We have applied to have our common stock listed on the NASDAQ Global Select Market under the symbol “LLGX.” We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”).

Investing in our common stock involves risks. See “Risk Factors” beginning on page 14.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share |

Total |

|||||||

| Public Offering Price |

$ | $ | ||||||

| Underwriting Discount |

$ | $ | ||||||

| Proceeds to LINC Logistics Company (before expenses) |

$ | $ | ||||||

| Proceeds to the selling shareholder (before expenses) |

$ | $ | ||||||

The underwriters expect to deliver the shares to purchasers on or about , 2012 through the book-entry facilities of The Depository Trust Company.

| Citigroup | Stifel Nicolaus Weisel |

| RBC Capital Markets | Baird | |||||

| Comerica Securities | The Huntington Investment Company | |||||

, 2012

Table of Contents

Table of Contents

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

| Page |

||||

| 1 | ||||

| 14 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 37 | ||||

| 39 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

42 | |||

| 69 | ||||

| 73 | ||||

| 87 | ||||

| 92 | ||||

| 100 | ||||

| 104 | ||||

| 105 | ||||

| 108 | ||||

| Material United States Federal Income Tax Consequences to Non-U.S. Holders |

110 | |||

| 113 | ||||

| 115 | ||||

| 118 | ||||

| 118 | ||||

| 118 | ||||

| F-1 | ||||

Unless the context requires otherwise, the terms “LINC,” “we,” “Company,” “us” and “our” refer to LINC Logistics Company and its subsidiaries. Logistics Insight Corporation®, LINC®, Central Global Express®, and C.T.X.® are trademarks of LINC Logistics Company and its subsidiaries. All other trademarks, service marks or tradenames referred to in this prospectus are the property of their respective owners. This prospectus also contains references to trademarks and service marks of other companies.

The market and industry data and forecasts included in this prospectus are based upon independent industry sources, including Armstrong & Associates, CSM Worldwide and JD Power and Associates. Although we believe that these independent sources are reliable, we have not independently verified the accuracy and completeness of this information, nor have we independently verified the underlying economic or other assumptions relied upon in preparing any data or forecasts.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you. You should read this summary together with the entire prospectus, including the more detailed information regarding us and the common stock being sold in this offering and our consolidated financial statements and related notes appearing elsewhere in this prospectus. You should carefully consider, among other things, the matters discussed in the section entitled “Risk Factors.”

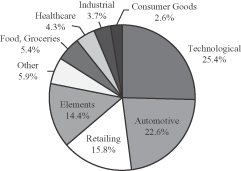

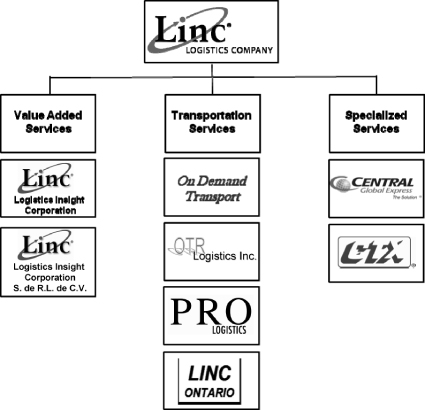

Our Business

We are a leading provider of custom-developed third-party logistics solutions that allow our customers and clients to reduce costs and manage their global supply chains more efficiently. We believe many of our services are essential to the successful operations of our customers’ production processes. We offer a comprehensive suite of supply chain logistics services, including value-added, transportation and specialized services. Our value-added logistics services include material handling and consolidation, sequencing and sub-assembling, kitting and repacking, and returnable container management. We also provide a broad range of transportation services, such as dedicated truckload, shuttle operations and yard management. Our specialized services include air and ocean freight forwarding, expedited ground transportation and final-mile delivery. Historically, our largest end-market has been the automotive segment, where we maintain strong and long-term relationships with our customers. For the fiscal year ended December 31, 2011, 79.2% of our revenue was derived from customers in the North American automotive industry, including 63.7% from affiliates of Ford, General Motors and Chrysler. We continue to expand our business outside of the automotive sector into the industrial products, aerospace, medical equipment and technology sectors. Our revenues in sectors outside of automotive grew from $22.4 million for the year ended December 31, 2007 to $60.4 million for the year ended December 31, 2011. For the year ended December 31, 2011, our business with non-automotive customers represented 20.8% of total revenues. For the years ended December 31, 2009, 2010 and 2011, we generated revenues of $177.9 million, $245.8 million, and $290.9 million respectively. Our net income for such years was $14.9 million, $33.0 million and $35.6 million respectively.

We operate, manage or provide transportation services at 43 locations in the United States, Canada and Mexico. Our facilities and services are often directly integrated into and located near the production processes of our customers and represent a critical piece of their supply chains. Our proprietary information technology platform is integrated with our customers’ and their vendors’ information technology networks, allowing real-time end-to-end supply chain visibility. As a result of our close integration with our customers, most of our value-added services are contracted for the duration of our customers’ production programs, which typically last three to five years. In 2011, over 89.0% of our value-added services revenue was derived from multi-year contracts.

We employ an asset-light business model that lowers our capital expenditure requirements and which we believe, based on our internal research, generates greater investment returns and cash-flow as compared with an asset-based model. We believe our asset-light business model is highly scalable and will continue to support our growth with relatively modest capital expenditure requirements. Our asset-light model, combined with a disciplined approach to contract structuring and pricing, creates a highly flexible cost structure that allows us to scale our business up and down quickly in response to changes in demand from our customers. This flexibility helped us to deliver positive operating income in each of the past sixteen quarters, despite an unprecedented slowdown in demand from our U.S. automotive customers as a result of the global recession and the government-led restructurings of General Motors and Chrysler.

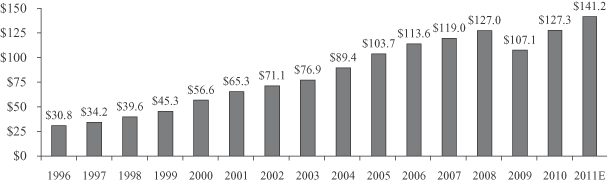

According to Armstrong & Associates, gross revenue for the U.S. third-party logistics (3PL) market grew at a compound annual rate of 10.7% from $30.8 billion in 1996 to $127.3 billion in 2010. Despite a 15.7% decline in the sector in 2009, Armstrong estimates that the 3PL market resumed its growth and expanded by 10.9% in 2011, reaching $141.2 billion. Growth in this sector is being driven primarily by the elongation and increasing complexity of supply chains and by the continued desire of manufacturers to reduce costs, increase efficiencies and improve customer service.

1

Table of Contents

For the years ended December 31, 2010 and 2011, we generated $245.8 million and $290.9 million in revenues, $33.0 million and $35.6 million in net income, and $42.7 million and $48.2 million in Adjusted EBITDA, respectively, representing year-over-year increases of 18.4%, 8.1% and 12.6%, respectively. See “— Summary Consolidated Financial and Operating Data” for our definition of Adjusted EBITDA and why we present it, and for a reconciliation of net income to Adjusted EBITDA.

Our Strengths

We believe the following strengths position us for sustainable growth:

Leading provider of custom-developed supply chain solutions to the North American automotive industry. Our single-source, comprehensive logistics solutions, extensive expertise serving automotive supply chains, and longstanding customer relationships have contributed to our position as a leading provider of third-party logistics services to the automotive industry. We are a core 3PL provider to many of our customers. For example, we operate the largest receiving and distribution operations for both Ford and Chrysler, delivering inbound components within stringent supply chain schedules. As a leading provider of logistics services to the automotive industry, we are well positioned to benefit from the continuation of favorable outsourcing trends within the automotive sector.

Broad portfolio of integrated third-party logistics services. We provide an extensive range of logistics services that includes value-added warehousing and material handling services, dedicated transportation services, international freight forwarding, and expedited freight delivery. We believe our ability to provide integrated logistics solutions is a competitive advantage as customers continue to seek a single point of contact for logistics services. For example, we can provide an integrated single-source solution incorporating value-added operations, transportation services and specialized logistics services to support one or multiple customer locations. Our broad range of capabilities also provides us with multiple growth platforms and significant cross-selling opportunities.

Multi-faceted labor strategies enhance value proposition. We believe our ability to structure effective labor contracts and our ability to draw from a variety of union, non-union and contract labor pools are strengths that differentiate us when competing for a contract. Our balanced labor structure allows us to provide customized and cost-effective solutions that accommodate our customers’ labor strategies. Our senior operational management team has extensive experience managing contract services in unionized environments. We currently have ten collective bargaining agreements with three different unions. Each collective bargaining agreement with each union covers a single facility with that union, enhancing our flexibility in developing our labor strategies. No single union has represented more than 38.4% of our employees in any given year over the past five years.

Disciplined customer contract pricing. We use a standard customer contract approval process to evaluate, develop and price contracts for new large program logistics opportunities. This mandatory process includes an evaluation of pricing, capital expenditure requirements, financial return and risk assessment prior to approval. Additionally, a significant percentage of our contracts for value-added services includes a fixed price component that produces a stable revenue stream regardless of a customer’s supply chain activity. Our disciplined contract pricing strategy and ability to include a fixed price component in our contracts has helped us to maintain profitability despite volatility in customer demand.

Enduring customer relationships. We have long-term relationships with most of our largest customers. We have provided services to our top five customers for an average of 16 years. Typically our services are directly linked into our customers’ production processes, requiring a high level of integration with our customers’ operations and technology systems, which improves our competitive position and increases our customers’ costs of switching logistics providers. Since December 31, 2006, our customers retained our services for over 90% of the value-added services agreements that were expiring and subsequently renewed with a 3PL provider. In 2011, over 89.0% of our value-added services revenue was derived from multi-year contracts, and over 95.0% of our

2

Table of Contents

transportation revenue was derived from contracts with existing durations or prospective terms of at least one year. The duration of these agreements improves the predictability of our cash flows. Approximately 38.0% of our revenue from continuing business in the fiscal year ended December 31, 2011, was derived from contracts subject to expiration on or before December 31, 2012. Approximately 44.2% of such revenues are related to value added or transportation contracts that are in renewal discussions, 35.0% have been renewed, and the balance are revenues related to our specialized services business, which is predominantly transactional. These contracts may or may not be renewed.

Flexible, asset-light business model. Our asset-light, variable-cost-based operating structure enables us to scale our business up and down in response to changing business conditions and generates strong cash flows and return on capital. Substantially all of our operating facilities are either provided to us by customers, leased by us on a month-to-month basis, or leased by us on terms that match the related customer contracts to the greatest extent possible. Additionally, to accommodate our customers’ freight transportation needs, we use a network of independent tractor owners (owner-operators) and third-party transportation providers in addition to our Company-owned tractors. As of December 31, 2011, owner-operators supplied approximately 32.5% of the tractors used over the road in our transportation services and specialized services operations. We believe that our highly scalable operating platform will continue to support our growth with limited capital expenditure requirements.

State-of-the-art proprietary information technology system. We have developed a proprietary, integrated and scalable information technology platform that allows us to efficiently manage key processes across our customers’ supply chains. The advanced functionality of our IT system enables seamless integration with customers’ and vendors’ IT networks and allows us to provide real-time end-to-end supply chain visibility. We believe that these applications improve our services and quality controls, strengthen our relationships with our customers and enhance our value proposition.

Highly experienced management team. Our management team has a track record of delivering strong, profitable growth. Senior management is comprised of experienced professionals with an average of over 26 years of experience in transportation and logistics services, and related outsourcing businesses, and who have an average of 31 years of experience in the global automotive industry.

Our Strategy

Our goal is to strengthen our position as a leading logistics services provider through the following strategies:

Continue to capitalize on strong industry fundamentals and outsourcing trends. The U.S. 3PL industry has expanded rapidly since 2006. According to Armstrong & Associates, the industry is expected to increase by 10.9% in 2011 to $141.2 billion. Although there is no guarantee such growth will continue, we believe long-term industry growth will be supported by manufacturers seeking to outsource non-core logistics functions to cost-effective third-party providers that can efficiently manage increasingly complex global supply chains. We intend to leverage our integrated suite of logistics services, our network of facilities in the United States, Canada and Mexico, our long-term customer relationships, and our reputation for operational excellence to capitalize on favorable industry fundamentals and growth expectations.

Target further penetration of key customers in the North American automotive industry. The automotive industry is one of the largest users of global outsourced logistics services, providing us growth opportunities with both existing and new customers. We intend to capitalize on anticipated continued growth in outsourcing of higher value logistics services in the automotive sector such as sub-assembly and sequencing, which link directly into production lines and require specialized capabilities, technological expertise and strict quality controls. We believe we are well positioned to capitalize on this increased outsourcing activity as a result

3

Table of Contents

of our extensive experience and enduring customer relationships. For example, we launched a value-added services operation inside a General Motors (GM) assembly plant in Michigan that assembles a new fuel-efficient subcompact passenger car. We believe this contract represents the first material handling outsourcing arrangement of its kind for a third-party vendor within a GM assembly facility in the U.S. We regularly pursue opportunities to further penetrate our core automotive customer base by leveraging our position in the supply chains of our original equipment manufacturer (OEM) customers to extend our services to their suppliers and by cross-selling a wide range of transportation and specialized services to existing customers. We are also targeting and expect to increase our services to foreign-owned automotive manufacturers operating in North America and to Tier I automotive component suppliers, who provide parts, subassemblies or systems directly to OEMs.

Continue to expand into new industry verticals. We have provided highly complex value-added logistics services to automotive customers for more than 19 years. These capabilities and our broad portfolio of other logistics services are highly transferable to other vertical markets. In recent years, we have successfully targeted other end-markets where we believe we can leverage the expertise we developed in the automotive sector. In addition to automotive, our targeted industries include industrial products, aerospace, medical equipment, and technology. In April 2011, we launched two U.S. consolidation centers for Wal-Mart Stores, which represents our first contract with a major national retail chain. Revenues from customers outside of the automotive industry increased to $60.4 million, or 20.8% of total revenues, in the year ended December 31, 2011. We believe our ability to provide a broad range of services in key markets in the U.S. and internationally provides us with additional growth platforms and cross-selling opportunities.

Expand our logistics services capabilities and geographical reach. We intend to continue to expand our portfolio of services in response to customer demands for greater innovation and responsiveness from their logistics providers. We will also continue to pursue high growth sectors within our specialized services, such as expedited ground transportation and international freight forwarding. In addition, we intend to increase penetration of our services into other regions of the United States and in international markets, such as Mexico, where we deliver logistics services to General Motors’ newest North American automotive assembly plant.

Continue to invest in technological advances to meet customer requirements. With continued outsourcing of supply chain activities, customers are requiring greater advances in information technology to support increasingly complex logistics solutions. We intend to continue to improve our proprietary IT system and expand the technology component of our service portfolio through a combination of internally and externally developed software. We believe that these ongoing technology investments will enhance the differentiation of our services relative to competing providers.

Grow through selected acquisitions. The 3PL industry is highly fragmented, with hundreds of small and mid-sized competitors that are either specialized in specific vertical markets, specific service offerings, or limited to local and regional coverage. We expect to selectively evaluate and pursue acquisitions that will enhance our service capabilities, expand our geographic network, diversify our customer base and accelerate our earnings growth. Although we regularly evaluate and engage in discussions with potential targets, we do not currently have any agreements in place for material acquisitions.

4

Table of Contents

RECENT DEVELOPMENTS

We are currently finalizing our unaudited interim financial statements as of and for the three months ended March 31, 2012, including our results of operations for that period. The preliminary financial data included herein has been prepared on a consistent basis with the audited financial statements included in the registration statement and our actual results are not expected to vary materially from that reflected in the preliminary first quarter 2012 financial data. While these financial statements are not available, based on the information currently available, we preliminarily estimate that, for the three months ended March 31, 2012:

| • | Revenue was between $79.0 million and $81.0 million, compared with $69.6 million for the three months ended April 2, 2011; |

| • | operating income was between $11.8 million and $12.2 million, compared with $10.7 million for the three months ended April 2, 2011; and |

| • | net income was between $9.9 million and $10.5 million, compared with net income of $9.5 million for the three months ended April 2, 2011. |

The estimated increase in revenue for the three months ended March 31, 2012 as compared to the three months ended April 2, 2011 was attributable to increased demand for services from existing and new value-added services operations. Increased revenue from value-added services reflects higher overall U.S. automotive production, a new operation launched inside a General Motors assembly plant, two consolidation centers launched for Wal-Mart Stores in April 2011, and four smaller, value-added services operations launched in 2011. The overall increase in revenue was somewhat offset by reduced demand for transportation services and specialized services, which primarily reflects the cancellation of selected transportation services provided in the United States to a Tier I automotive supplier. The estimated increase in operating income for the three months ended March 31, 2012 as compared to the three months ended April 2, 2011 was driven by the increase in net revenue as well as by increased operating margins as our business mix has changed.

On April 20, 2012, employees located at our new General Motors operation, representing approximately 4.0% of our total employees at December 31, 2011, voted to accept an offer from GM to join a collective bargaining unit contracted directly with GM. Although our contract for this operation has not been modified yet, it may result in lower revenues from this General Motors operation. We believe we will continue to deliver higher value-added workflow design, supervision and inventory management services to GM, with fewer workers.

The preliminary financial information above is unaudited and there can be no assurance that it will not vary from our actual financial results as of and for the three months ended March 31, 2012. The preliminary financial information above reflects estimates based only on preliminary information available to us as of the date of this prospectus, has not been subject to our normal quarterly closing procedures and adjustments, which may be material, and is not a comprehensive statement of our financial results for the three months ended March 31, 2012. Accordingly, you should not place undue reliance on these preliminary estimates. The estimates above are not necessarily indicative of any future period and should be read together with “Risk Factors,” “Selected Consolidated Financial and Operating Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and notes thereto included elsewhere in this prospectus. The foregoing constitutes forward-looking statements. Please see “Forward-Looking Statements.”

The preliminary financial information above has been prepared by, and is the responsibility of, our management. Our independent, registered public accounting firm has not audited, reviewed or performed any procedures with respect to the preliminary financial information and does not express an opinion or any other form of assurance with respect thereto.

5

Table of Contents

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the JOBS Act, and we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We have not made a decision whether to take advantage of any or all of these exemptions. If we do take advantage of any of these exemptions, we do not know if some investors will find our common stock less attractive as a result. The result may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

We could remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Risk Factors

Our business is subject to numerous risks, which are highlighted in the section titled “Risk Factors” immediately following this prospectus summary. These risks represent challenges to the successful implementation of our strategy and to the growth and future profitability of our business. Some of these risks are:

| • | our revenue is highly dependent on the automotive industry and any decrease in demand for outsourced services in this industry or our other targeted industries could reduce our revenue and seriously harm our business; |

| • | we derive a significant portion of our revenue from a few major customers, and the loss of one or more of them, or a reduction in their operations, could have a material adverse effect on our business; |

| • | customer manufacturing plant closures could have a material adverse effect on our performance; |

| • | competition and consolidation in the 3PL market may harm our business; and |

| • | our profitability could be negatively impacted by downward pricing pressure from certain of our customers. |

6

Table of Contents

Corporate Information

LINC Logistics Company was incorporated in Michigan on March 11, 2002, to combine certain logistics and transportation businesses of CenTra, Inc. (CenTra). One such business, Logistics Insight Corp., began operations in 1992 and is now one of our wholly-owned subsidiaries. On December 31, 2006, CenTra completed a corporate reorganization through which all entities included in our consolidated financial statements as of and for the year ended December 31, 2006 came under our direct ownership and control. In connection with that reorganization, on December 29, 2006, we declared a $93.0 million cash dividend payable to CenTra, and on December 31, 2006, we distributed a $33.4 million net receivable to CenTra. Immediately following the distribution of the net receivable, CenTra distributed all of our outstanding common stock in a spin-off transaction to its stockholders, Matthew T. Moroun and a trust controlled by Manuel J. Moroun, Matthew T. Moroun’s father.

On December 31, 2008, LINC issued a $25.0 million Dividend Distribution Promissory Note due December 31, 2013, to CenTra. The promissory note was issued in connection with extending the maturity and reducing to $68.0 million the value of the outstanding payment obligation to CenTra. On December 22, 2010, we paid $10.0 million to CenTra to further reduce the outstanding dividend payable.

On April 21, 2011, we executed a Revolving Credit and Term Loan Agreement with a syndicate of banks to refinance a substantial portion of outstanding secured debt and to pay an additional $31.0 million of our outstanding dividend payable to CenTra. The syndicated senior secured loan package includes a $40 million revolving credit facility, a $25 million equipment credit facility, and a $30 million senior secured term loan. The loan agreement incorporates an “accordion feature” that permits a future increase in the credit facility of up to $25 million.

Since January 1, 2007, we have been treated as an S-corporation for U.S. federal income tax purposes. Before completing this offering, we intend to terminate our S-corporation status. Historically, we have paid to shareholders, Matthew T. Moroun and a trust controlled by Manuel J. Moroun, and we expect to continue to pay dividends to our shareholders, Matthew T. Moroun and trusts controlled by Manuel J. Moroun and Matthew T. Moroun, equal to our taxable income including the period from January 1, 2012 to the termination date of our S-corporation status, plus taxable income for any prior years that has not previously been distributed. On April 23, 2012 we distributed an additional $28.0 million by promissory note to our shareholders in connection with the termination of our S-corporation status. These promissory notes were equal to our estimated taxable income for S-corporation periods prior to the termination date of our S-corporation status, less any dividends previously distributed. The promissory notes will be satisfied by payment of the lesser of its principal amount or the final determination of the applicable taxable income.

Our principal executive offices are located at 11355 Stephens Road, Warren, Michigan 48089, and our telephone number is (586) 467-1500. Our website address is www.4linc.com. Information on or accessed through our website is not incorporated into this prospectus and is not part of this prospectus.

7

Table of Contents

The Offering

| Common stock being offered by us |

9,913,333 shares |

| Common stock being offered by the selling shareholder |

1,420,000 shares |

| Common stock to be outstanding after |

30,666,667 shares |

| Use of proceeds |

We estimate that our net proceeds from this offering will be approximately $138.4 million. We intend to use $82.0 million of our net proceeds to repay our $30 million senior secured term loan, to pay an outstanding $27.0 million cash dividend payable to CenTra, our sole shareholder on December 29, 2006, the record date for that dividend, and to pay a related $25.0 million dividend distribution promissory note initially issued to CenTra plus accrued but unpaid interest. We also intend to use a portion of our net proceeds to repay the outstanding balance and to terminate our Fifth Third Bank Equipment Financing Facility. As of December 31, 2011, indebtedness in connection with this facility was $3.0 million. We also intend to use a portion of our net proceeds to repay the outstanding balance on our $40 million revolving credit facility. As of December 31, 2011, indebtedness in connection with this facility was $14.0 million. We may also use additional net proceeds to pay down the outstanding balance on our $25 million equipment credit facility, which was $11.1 million as of December 31, 2011. The balance of our net proceeds will be used for working capital and general corporate purposes. In addition, although we have no specific acquisition plans at this time, we may use a portion of our net proceeds to make acquisitions. We will not receive any of the proceeds from the sale of the shares to be offered by the selling shareholder. See “Use of Proceeds.” |

| Dividend policy |

Following this offering, we intend to pay quarterly cash dividends. We expect that our first dividend will be paid in the fourth quarter of 2012 and will be $0.038 per share of our common stock. See “Dividend Policy.” |

Any future determination to pay dividends will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements, any covenants included in our credit facilities, any legal or contractual restrictions on the payment of dividends and other factors the board of directors deems relevant.

| Risk factors |

See the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

8

Table of Contents

| Proposed NASDAQ Global Select |

We have applied to have the common stock listed on the NASDAQ Global Select Market under the symbol “LLGX.” |

| Conflict of interest |

Because affiliates of Comerica Securities, Inc. and The Huntington Investment Company are lenders under our Revolving Credit and Term Loan Agreement and will receive more than 5% of the net proceeds of the offering, which are being used to repay a portion of these facilities, Comerica Securities, Inc. and The Huntington Investment Company are deemed to have a conflict of interest under Rule 5121 of the Financial Industry Regulatory Authority, Inc., or FINRA. Accordingly, this offering will be conducted in accordance with all applicable provisions of FINRA Rule 5121. In accordance with FINRA Rule 5121, Comerica Securities, Inc. and The Huntington Investment Company will not make sales to discretionary accounts without the prior written consent of the account holders. |

Upon completion of this offering, it is expected that Matthew T. Moroun, the Chairman of our board of directors, and trusts controlled by Manuel J. Moroun and Matthew T. Moroun, will together own approximately 63.0% of our outstanding common stock or 57.5% of our common stock if the underwriters exercise their option to purchase additional shares from us in full. Because the Moroun family will continue to hold a controlling interest in the outstanding common stock of the Company, we intend to avail ourselves of the “controlled company” exemption under the corporate governance rules of the NASDAQ Stock Market. See “Management—Board Structure.”

Except as otherwise indicated, the number of shares shown to be outstanding after this offering is based on 20,753,334 shares outstanding as of December 31, 2011, and includes 39,000 shares of restricted common stock to be issued immediately subsequent to effectiveness of this offering pursuant to the Long-Term Incentive Plan and that will be vested upon issuance, and excludes the following:

| • | 156,000 shares of restricted common stock to be issued immediately subsequent to effectiveness of this offering pursuant to the Long-Term Incentive Plan and that will vest at a later date; |

| • | 105,000 shares of common stock issuable upon exercise of options to be granted immediately subsequent to effectiveness of this offering pursuant to the Long-Term Incentive Plan, at an exercise price equal to the initial public offering price; and |

| • | 200,000 additional shares of common stock available for issuance under the Long-Term Incentive Plan. |

The selling shareholder has granted the underwriters an option to purchase up to 1,700,000 additional shares of common stock to cover over-allotments.

Except as otherwise indicated, all information in this prospectus assumes:

| • | a 20,753.334-for-1 split of shares of our common stock, which will be effective on the effective date of our offering; |

| • | an initial public offering price of $15.00 per share, the midpoint of the range set forth on the cover of this prospectus; and |

| • | no exercise of the underwriters’ over-allotment option. |

9

Table of Contents

Summary Consolidated Financial and Operating Data

The following table sets forth a summary of our consolidated financial and operating data as of and for the periods presented. The table includes certain pro forma information that reflects the impact of our conversion from an S-corporation to a C-corporation in connection with this offering. We derived the summary consolidated statements of income data for the years ended December 31, 2009, 2010 and 2011 from our audited consolidated financial statements included elsewhere in this prospectus.

The information below should be read in conjunction with the information included under the headings “Selected Consolidated Financial and Operating Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes included elsewhere in this prospectus. The results for any interim period are not necessarily indicative of the results that may be expected for the full year. The following historical financial information may not be indicative of our future performance.

| Year Ended December 31, |

||||||||||||

| 2009

|

2010

|

2011

|

||||||||||

| (in thousands, except share and per share amounts and employee and facility counts) |

||||||||||||

| Statements of Income Data: |

||||||||||||

| Revenue |

$ | 177,938 | $ | 245,785 | $ | 290,929 | ||||||

| Operating expenses |

160,316 | 208,732 | 249,287 | |||||||||

| Operating income |

17,622 | 37,053 | 41,642 | |||||||||

| Interest expense, net |

1,354 | 1,514 | 2,215 | |||||||||

| Income before provision for income taxes |

16,268 | 35,539 | 39,427 | |||||||||

| Provision for income taxes |

1,339 | 2,574 | 3,794 | |||||||||

| Net income |

$ | 14,929 | $ | 32,965 | $ | 35,633 | ||||||

| Earnings Per Share |

||||||||||||

| Basic and diluted |

$ | 0.72 | $ | 1.59 | $ | 1.72 | ||||||

| Weighted Average Shares Outstanding |

20,753,334 | 20,753,334 | 20,753,334 | |||||||||

| Pro Forma Data (unaudited): |

||||||||||||

| Income before provision for income taxes |

$ | 16,268 | $ | 35,539 | $ | 39,427 | ||||||

| Pro forma provision for income taxes(1) |

6,257 | 13,611 | 15,810 | |||||||||

| Pro forma net income |

$ | 10,011 | $ | 21,928 | $ | 23,617 | ||||||

| Pro forma earnings per share, basic and diluted |

$ | 0.48 | $ | 1.06 | $ | 1.14 | ||||||

| Average common shares outstanding, basic and diluted |

20,753,334 | 20,753,334 | 20,753,334 | |||||||||

| Pro Forma As Adjusted Data (unaudited): |

||||||||||||

| Pro forma as adjusted earnings per common share(2) |

||||||||||||

| Basic |

$ | 0.80 | ||||||||||

| Diluted |

$ | 0.80 | ||||||||||

| Weighted Average Shares Outstanding |

||||||||||||

| Basic |

30,666,667 | |||||||||||

| Diluted |

30,966,667 | |||||||||||

| Other Data: |

||||||||||||

| Adjusted EBITDA(3) |

$ | 26,064 | $ | 42,749 | $ | 48,150 | ||||||

| Cash flow from operations |

$ | 16,892 | $ | 34,387 | $ | 44,537 | ||||||

| Capital expenditures |

$ | 1,655 | $ | 2,661 | $ | 8,559 | ||||||

| Cash dividends paid(4) |

$ | 71 | $ | 21,316 | $ | 22,790 | ||||||

| Employees at end of period |

1,504 | 1,528 | 1,721 | |||||||||

| Facilities managed at end of period |

27 | 29 | 37 | |||||||||

10

Table of Contents

| As of December 31, 2011 |

||||||||||||

| Actual |

Pro

Forma(5) |

Pro

Forma as Adjusted(6) |

||||||||||

| (unaudited, in thousands) | ||||||||||||

| Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 4,633 | $ | 633 | $ | 39,432 | ||||||

| Total assets. |

74,633 | 70,663 | 108,060 | |||||||||

| Total debt |

83,061 | 85,061 | 39,082 | |||||||||

| Dividend Payable |

27,000 | 27,000 | 0 | |||||||||

| (1) | Since January 1, 2007, we have been treated as an S-corporation for U.S. federal income tax purposes. As a result of our S-corporation status, our income since January 1, 2007 has not been subject to U.S. federal income taxes or state income taxes in those states where S-corporation status is recognized. In general, the corporate income or loss of an S-corporation is allocated to its stockholders for inclusion in their personal federal income tax returns and state income tax returns in those states where S-corporation status is recognized. The provision for income taxes in 2009, 2010 and 2011 reflects the amount of entity-level income taxes in those jurisdictions where S-corporation status is not recognized. In connection with this offering, our S-corporation status will be terminated and we will become subject to additional entity-level income taxes that will be reflected in our financial statements. Also, we will reestablish deferred tax accounts eliminated in 2007. As of December 31, 2011, such action, which has been contemplated in the pro forma provision for each of the periods presented, would have resulted in an estimated $3.0 million increase in our provision for income taxes. Pro forma provision for income taxes reflects combined federal, state and local income taxes, as if we had been treated as a C-corporation, using blended statutory federal, state and local income tax rates of 38.5%, 38.3% and 40.1% in 2009, 2010 and 2011 respectively. These tax rates reflect the sum of the federal statutory rate and a blended state rate based on our calculation of income apportioned to each state for each period. |

| (2) | Pro forma as adjusted earnings per common share for the year ended December 31, 2011 are provided to show the pro forma effect on net income, assuming (i) the termination of our S-corporation status in connection with this offering, (ii) the retirement of debt due to our April 21, 2011 debt refinancing, and (iii) the use of a portion of the net proceeds of this offering to repay outstanding indebtedness, as if all events had occurred on January 1, 2011. Pro forma as adjusted data is computed by dividing pro forma as adjusted net income by the number of shares outstanding after this offering. Such outstanding share amounts include 9,913,333 shares to be issued in connection with this offering and, on a diluted basis, 195,000 shares of restricted stock and 105,000 stock options to be issued immediately subsequent to effectiveness of this offering under our Long-Term Incentive Plan. See “Management’s Discussion and Analysis of Financial Condition and Results of Operation — Pro Forma as Adjusted Earnings per Common Share” and “Compensation Discussion and Analysis — Long Term Incentive Plan.” |

| (3) | We present Adjusted EBITDA as a supplemental measure of our performance. We define Adjusted EBITDA as net income plus (i) interest expense, net, (ii) provision for income taxes and (iii) depreciation and amortization, or EBITDA, adjusted to eliminate the impact of certain items that we do not consider indicative of our ongoing operating performance, including facility closing costs, a change in selected vacation policies, suspended capital market activity and legal settlement. These further adjustments are itemized below. You are encouraged to evaluate these adjustments and the reasons we consider them appropriate for supplemental analysis. In evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. |

11

Table of Contents

Set forth below is a reconciliation of net income, the most comparable GAAP measure, to EBITDA and Adjusted EBITDA for each of the periods indicated:

| Year Ended December 31, |

||||||||||||

| 2009 |

2010 |

2011 |

||||||||||

| (in thousands) | ||||||||||||

| Net income |

$ | 14,929 | $ | 32,965 | $ | 35,633 | ||||||

| Provision for income taxes |

1,339 | 2,574 | 3,794 | |||||||||

| Interest expense, net |

1,354 | 1,514 | 2,215 | |||||||||

| Depreciation and amortization |

6,952 | 6,543 | 6,094 | |||||||||

| EBITDA |

24,574 | 43,596 | 47,736 | |||||||||

| Facility closing costs(a) |

2,590 | (847 | ) | 414 | ||||||||

| Change in vacation policy(b) |

(1,100 | ) | — | — | ||||||||

| Adjusted EBITDA |

$ | 26,064 | $ | 42,749 | $ | 48,150 | ||||||

| (a) | Represents costs incurred as a result of our elections to close and exit selected operations, including, in subsequent years, adjustments to such costs to reflect final settlements or updated assumptions. Closing costs include facility lease costs (net of anticipated sublease revenues or similar offsets), employee severance payments, termination payments to contracted vendors, and other similar expenses. In 2008 and 2009, we closed five value-added services operations due to the unprecedented contraction in production capacity by our major automotive customers. In December 2011, seven months after launching five new freight consolidation centers in Europe to support a Tier I automotive supplier’s regional supply chain, we decided to close and exit these operations. Our decision followed lower-than-anticipated volumes and our customer’s decision to substantially alter their overall approach to freight transportation. |

| (b) | Represents a benefit received as a result of changing the roll-over period effective for salaried employees from their anniversary date to a uniform, year-end date. |

We present Adjusted EBITDA because we believe it assists investors and analysts in comparing our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance.

Adjusted EBITDA has limitations as an analytical tool. Some of these limitations are:

| • | Adjusted EBITDA does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments; |

| • | Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| • | Adjusted EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debts; |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements; |

| • | Adjusted EBITDA does not reflect the impact of certain cash charges resulting from matters we consider not to be indicative of our ongoing operations; and |

| • | other companies in our industry may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. |

12

Table of Contents

Because of these limitations, Adjusted EBITDA should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. We compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only supplementally.

| (4) | Includes cash dividends previously paid, and thus does not include the $27.0 million dividend payable or the related $25.0 million dividend distribution promissory note that are intended to be paid from the proceeds of this offering. Also includes state withholding taxes paid on behalf of our shareholders and treated as a distribution. |

| (5) | Pro forma balance sheet data as of December 31, 2011 are determined by giving effect to further distributions of S-corporation earnings to our current stockholders prior to the completion of our initial public offering and assumed pro forma borrowing of $2.0 million pursuant to our $40 million revolving credit facility to fund such distributions. Specifically, we paid dividend distributions aggregating to $6.0 million on January 4, 2012, January 30, 2012 and February 8, 2012. This does not include the issuance of $28.0 million of S-corporation dividend distribution promissory notes to our existing shareholders. |

| (6) | Pro forma as adjusted balance sheet data as of December 31, 2011 are determined by giving effect to (a) the issuance of 9,913,333 shares of common stock offered by us (at an assumed initial public offering price of $15.00 per share, the midpoint of the range set forth on the front cover of this prospectus), (b) the cash payment of the $27.0 million dividend payable to CenTra, which was our sole shareholder on the record date for such dividend, (c) the payment of the related $25.0 million dividend distribution promissory note, (d) the issuance of $28.0 million of S-corporation dividend distribution promissory notes to our existing shareholders on April 23, 2012, (e) the repayment of $47.0 million of our indebtedness and (f) an estimated $3.0 million non-cash charge to record a deferred tax liability that will result from the termination of the Company’s S-corporation status. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Spin-Off from Related Party and ‘Subchapter S’ Election.” |

13

Table of Contents

The value of your investment will be subject to the significant risks inherent in our business. You should carefully consider the risks and uncertainties described below and other information included in this prospectus before purchasing our common stock. If any of the events described below occur, our business and financial results could be seriously harmed. The trading price of our common stock could decline as a result of any of these risks, and you may lose all or part of your investment.

Risks Relating to Our Business

Our revenue is highly dependent on North American automotive industry production volume, and may be negatively affected by future downturns in North American automobile production.

A substantial portion of our customers are concentrated in the North American automotive industry. For the fiscal year ended December 31, 2011, 79.2% of our revenue was derived from customers in the North American automotive industry. Our business and growth largely depend on continued demand for our services from customers in this industry.

The global economic crisis that began in 2008 resulted in delayed and reduced purchases of automobiles. According to CSM Worldwide, light vehicle production in North America during 2009 decreased by 32% and 43% as compared to 2008 and 2007, respectively. As a result of plant closings and the general downturn in North American automobile production, the revenue we derive from customers in the North American automotive industry decreased from $276.8 million for the year ended December 31, 2007, to $151.5 million for the year ended December 31, 2009, a decline of more than 45.3%. Throughout the period 2008 to 2009, we experienced significant variability in our revenues from automotive industry customers, as General Motors and Chrysler restructured through bankruptcies, and other North American manufacturers re-scaled their operations to adjust to changing market demands.

These unprecedented conditions negatively impacted our revenues in 2008 and 2009. Any future downturns in North American automobile production may similarly affect our revenues in future periods.

Any decrease in demand for outsourced services in the industries we serve could reduce our revenue and seriously harm our business.

Our growth strategy is partially based on the assumption that the trend towards outsourcing logistics services will continue despite potentially adverse economic trends affecting our automotive and other customers. Declines in sales volumes in the industries we serve, particularly the automotive industry, may lead to a declining demand for logistics services.

Production volumes in the automotive industry are sensitive to consumer demand as well as employee and labor relations. Declines in sales volumes, or the expectation of declines, for the industry or for any of our individual customers could result in production cutbacks and unplanned plant shutdowns. Likewise, potential customers may see a risk, based on labor relations issues or other factors, in relying on third-party logistics service providers or may define these activities as their own core competencies and may seek means to deploy excess labor or other resources, and hence may prefer to perform logistics operations themselves. We therefore cannot assure you that the market for logistics services will not decline or will grow as we expect.

Other developments may also lead to a decline in the demand for our services in our targeted industries. For example, consolidation in these industries or acquisitions, particularly involving our customers, may decrease the potential number of buyers of our services. Similarly, the relocation or expansion of automotive or other production operations in locations where we do not have an established presence, or where our competitive position is not as strong, may adversely affect our business, even if production increases worldwide, if we are not

14

Table of Contents

able to effectively service these industries in such locations. Any significant reduction in or the elimination of the use of the services we provide within any of these industries would result in reduced revenue and harm our business.

Many of our customers experience rapid changes in their prospects, substantial price competition and pressure on their profitability. Although such pressures can encourage outsourcing as a cost-reduction measure, they may also result in increasing pressure on us from our automotive and other customers to lower our prices, which could negatively affect our business, results of operations, financial condition and cash flows.

We rely on subcontractors or suppliers to perform their contractual obligations.

Some of our contracts involve subcontracts with other companies upon which we rely to perform a portion of the services we must provide to our customers. There is a risk that we may have disputes with our subcontractors, including disputes regarding the quality and timeliness of their work or to customer concerns about a subcontractor. Failure by our subcontractors to perform the agreed-upon services or to provide on a timely basis the agreed-upon supplies may materially and adversely impact our ability to perform our obligations. A delay in our ability to obtain components and equipment parts from our suppliers may affect our ability to meet our customers’ needs and may have an adverse effect upon our profitability.

We derive a significant portion of our revenue from a few major customers, and the loss of any one or more of them as customers, or a reduction in their operations, could have a material adverse effect on our business.

A significant portion of our revenue is generated from a limited number of major customers. Approximately 26.5%, 24.9% and 12.3% of our revenue for the fiscal year ended December 31, 2011, was attributable to affiliates of Ford, General Motors and Chrysler, respectively, who together accounted for approximately 63.7% of our revenue for such period. Our contracts with our customers generally contain cancellation clauses, and there can be no assurance that these customers will continue to utilize our services or that they will continue at the same levels. Further, there can be no assurance that these customers will not be further affected by a future downturn in automotive demand, which would result in a reduction in their operations and corresponding need for our services. Moreover, our customers may individually lose market share, apart from trends in the automotive industry generally. In recent years, General Motors, Chrysler and Ford have lost market share in the United States. If our major customers lose U.S. market share they may have less need for our services. A reduction in or termination of our services by one or more of our major customers could have a material adverse effect on our business and results of operations.

Customer manufacturing plant closures could have a material effect on our performance.

We derive a substantial portion of our revenue from the operation and management of our operating facilities, which are often located adjacent to a customer’s manufacturing plant and are directly integrated into the customer’s production line process. We may experience significant revenue loss and shut-down costs, including costs related to early termination of leases, causing our business to suffer if our customers closed their plants or significantly modified their capacity or supply chains at a plant that we service.

In 2008 and 2009, we discontinued and closed operations at five locations in response to our customers closing their related manufacturing plants and recorded aggregate net shut-down charges of $4.8 million as a result of those closings. In December 2011, seven months after launching five new freight consolidation centers in Europe for the European subsidiary of a Tier I automotive supplier, we discontinued and closed the centers and recorded net shut-down charges of $0.9 million as a result of these closings. Our action was the result of lower-than-anticipated volumes through our customer’s European supply chain and the subsequent decision by our customer’s European subsidiary to substantially alter their overall approach to freight transportation. Although we do not currently operate any facilities linked to other announced plant closures, there can be no assurance that we will not be impacted by any future announcements of plant closures.

15

Table of Contents

Competition and consolidation in the market for third-party logistics services may harm our business.

The third-party logistics industry is intensely competitive, and our business may suffer if we are unable to address pricing pressures and other competitive factors that may adversely affect our revenue and costs relative to our competitors. We face competition from a number of global companies, some of which have greater financial and marketing resources. In the industry sectors and regions in which we are active, we also face competition from certain niche and local logistics providers, some of which have a significant market presence in their respective sectors or regional niche markets. If we cannot successfully compete with our competitors, this could result in reduced revenue and reduced margins, both of which could have a material adverse effect on our operating cash flows and results of operations.

In recent years, the third-party logistics market has seen a growing market presence of larger logistics companies. Many logistics companies are attempting to expand their operations through the acquisition of contract logistics providers and other transportation service providers. We have a focused strategy in selected industry sectors and regions where we believe we have competitive advantages and therefore a defensible market position. If we cannot maintain or gain sufficient market presence or are unable to differentiate ourselves from our competitors in our selected industry sectors, or regions, or if our strategy fails to achieve its intended results, we may not be able to compete successfully against other companies with global operations or niche-market competitors.

Other competitive factors that could adversely impact our operations and profitability include the following:

| • | the relative degree of leverage and cost of capital among third-party logistics suppliers can be a significant competitive factor, and any increase in either our debt or equity cost of capital as a result of increased borrowing, stock price volatility or our ability to raise capital in support of future growth or acquisitions could have a significant impact on our competitive position; |

| • | some companies hire lead logistics providers to manage their logistics operations, and these lead logistics providers may hire logistics providers on a non-neutral basis which may reduce the number of business opportunities available to us; and |

| • | many customers periodically accept bids from multiple providers for their logistics service needs, and this process may result in the loss of some of our business to competitors and in price reductions. |

Our profitability could be negatively impacted by downward pricing pressure from certain of our customers.

Given the nature of our services and the competitive environment in which we operate, our largest customers exert downward pricing pressure and often require modifications to our standard commercial terms. Due to their size and market concentration, some of our customers utilize competitive bidding procedures involving bids from a number of competitors or otherwise exert pressure on our prices and margins. Likewise, such customers’ increased bargaining power could have a negative effect on the non-monetary terms of our customer contracts, for example, in relation to the allocation of risk or the terms of payment. While we believe our ongoing cost reduction initiatives have helped mitigate the effect of price reduction pressures from our customers, there is no assurance that we will be able to maintain or improve our current levels of profitability.

Under most of our contractual arrangements with our customers, all or a portion of our pricing is based on certain assumptions regarding the scope of services, production volumes, operational efficiencies, the mix of fixed versus variable costs, productivity and other factors. If, as a result of subsequent changes in our customers’ business needs or market forces that are outside of our control, these assumptions prove to be invalid, we could have lower margins than anticipated or our contracts could prove unprofitable. Although certain of our contracts provide for renegotiation upon a material change, there is no assurance that we will be successful in obtaining the necessary price adjustments.

16

Table of Contents

If our customers are able to reduce their total cost structure regarding their employees that provide internal logistics and transportation services, our business and results of operations may be harmed.

A major driver for our customers to use third-party logistics providers instead of their own personnel is their inherent high cost of labor. Third-party logistics service providers such as ourselves are generally able to provide such services more efficiently than otherwise could be provided “in-house” primarily as a result of our lower and more flexible employee cost structure. Historically, this has been the case in the U.S. automotive industry. If, however, the U.S. automotive industry, which has received concessions from the United Auto Worker and other unions, or any other industry we serve, is able to renegotiate the terms of its labor contracts or otherwise reduce its total cost structure regarding its employees, or if it has to make concessions as a result of pressure from the unions with which it deals, we may not be able to provide our customers with an attractive alternative for their logistics needs and our business and results of operations may be harmed.

We face a variety of risks relating to our material handling services.

For certain value-added material handling services, we lease warehouses and distribution facilities on a long-term basis. In one situation, we also assumed employment arrangements from a customer. Such actions may require substantial investments in property, plant and equipment, personnel and management capacity. If we acquire or take over existing facilities of a customer or a competing provider, we may in some jurisdictions assume by operation of law all rights and obligations arising under the existing employment relationships between our customer or the competing provider and the employees employed at such facilities. This may result in additional costs and obligations to be incurred by us, such as wages and employee benefits, which may include severance or other employment-related obligations.

We commit facilities, labor and equipment on the basis of projections of future demand, and our projections may prove inaccurate as a result of changes to economic conditions or a decision by our customers to terminate or not to renew their contracts with us. We generally strive to minimize these risks for our dedicated warehouses and other assets by negotiating coterminous lease agreements, which have the same duration as that of the assets deployed to service the contract. Where we take assignment of existing employment relationships, we typically seek indemnities for employee service liabilities from the previous employer. Our revenue, cash flows and results of operations may be adversely affected if we are unable to secure terms coterminous with our customer commitments or be indemnified for employee service liabilities. This could result in an impairment of assets and adversely affect our cash flow.

Under some of our third-party logistics agreements, we have agreed to reduce our prices over time in accordance with anticipated cost savings and efficiency improvements. If we are compelled to perform our contractual obligations on unfavorable terms (including when such anticipated cost savings and improvements are not realized) our results of operations could be adversely affected.

Our customers may terminate contracts before completion or choose not to renew contracts, which could adversely affect our business and reduce our revenue.

The terms of our customer contracts, particularly for value-added services, often range up to five years. Many of our customer contracts may be terminated by our customers with or without cause, with one to six months’ notice and in most cases without significant penalty. The termination of a substantial percentage of these contracts could adversely affect our business and reduce our revenue. Contracts representing 38.0% of our revenue from continuing business in the fiscal year ended December 31, 2011, are subject to expiration on or before December 31, 2012. Failure to meet contractual or performance requirements could result in cancellation or non-renewal of a contract. In addition, a contract termination or significant reduction in work assigned to us by a major customer could cause us to experience a higher than expected number of unassigned employees or other underutilized resources, which would reduce our operating margin until we are able to reduce or reallocate our headcount or other overcapacity. We may not be able to replace any customer that elects to terminate or not renew its contract with us, which would adversely affect our business and revenues.

17

Table of Contents

Our business is highly dependent on dynamic information technology.

The provision and application of information technology is an important competitive factor in the logistics industry. Among other things, our information systems must frequently interact with those of our customers and transportation providers. Our future success will depend on our ability to employ logistics software that meets industry standards and customer demands. Although there are redundancy systems and procedures in place, the failure of the hardware or software that supports our information technology systems could significantly disrupt client workflows and cause economic losses for which we could be held liable and which would damage our reputation.

We expect customers to continue to demand more sophisticated and fully integrated information technology systems from their logistics providers, which are compatible with their own information technology environment. In addition, our competitors may have or develop information technology systems that permit them to be more cost effective and otherwise better situated to meet customer demands than we are able to develop. Larger competitors may be able to develop or license information technology systems more cost effectively than we can by spreading the cost across a larger customer base, and competitors with greater financial resources may be able to develop or purchase information technology systems that we cannot afford. If we fail to meet the demands of our customers or protect against disruptions of both our and our customers’ operations, we may lose customers, which could seriously harm our business and adversely affect our operating results and operating cash flow.

We license a variety of software that is used in our information technology system. As a result, the success and functionality of our information technology is dependent upon our ability to continue to license the software platforms upon which it is built. There can be no assurances that we will be able to maintain these licenses or replace the functionality provided by this software on commercially reasonable terms or at all. Additionally, while we are not aware of any infringement and we believe that we have all necessary licenses to implement our system, we could be subject to claims of infringement in the future. The failure to maintain these licenses or any significant delay in the replacement of, or interference in, our use of this software or any claims of infringement, even those without merit, could have a material adverse effect on our business, financial condition and results of operations.

A significant labor dispute involving us or one or more of our customers, or that could otherwise affect our operations, could reduce our revenues and harm our profitability.

A substantial number of our employees and of the employees of our largest customers are members of industrial trade unions and are employed under the terms of collective bargaining agreements. Each of our unionized facilities has a separate agreement with the union that represents the workers at only that facility. Labor disputes involving either us or our customers could affect our operations. For example, in February 2008, in connection with their contract renegotiation with American Axle, the UAW initiated a strike that lasted 84 days, significantly impacting General Motors. If the UAW and our customers are unable to negotiate new contracts and our customers’ plants experience slowdowns or closures as a result, our revenue and profitability could be negatively impacted. A labor dispute involving another supplier to our customers that results in a slowdown or closure of our customers’ plants to which we provide services could also have a material adverse effect on our business. Significant increases in labor costs as a result of the renegotiation of collective bargaining agreements could also be harmful to our business and our profitability. As of December 31, 2011, 826 of our 1,721 employees are subject to collective bargaining agreements, including 752 which are subject to contracts that expire in 2012. Additionally, we are currently negotiating a collective bargaining agreement that would cover an additional 69 of our employees.