Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HomeStreet, Inc. | d352063d8k.htm |

D.A. Davidson & Co. Conference

Seattle, WA -

May 10, 2012

Exhibit 99.1 |

2

2

Important Disclosures

Forward-Looking Statements

We may make forward-looking statements during today's presentation that are

subject to many risks and uncertainties. These forward-looking

statements are based on the Company’s current expectations, beliefs, projections, future plans and

strategies,

anticipated

events

or

trends

and

similar

expressions

concerning

matters

that

are

not

historical

facts,

as

well

as

a

number

of

assumptions

concerning

future

events.

These

statements

are

subject

to

risks,

uncertainties,

assumptions

and

other important factors set forth in our SEC filings, including but not limited to

our 2011 annual report on form 10-K, our proxy statement and the form

8-K containing our earnings release, many of which are outside of the Company’s control. Such

factors

could

cause

actual

results

to

differ

materially

from

the

results

discussed

or

implied

in

the

forward-looking

statements.

Actual results may differ materially from those expressed or implied and there can

be no assurance that estimated returns or projections will be realized or

that actual returns will not be materially different than estimated herein. Accordingly you are

cautioned not to place undue reliance on such forward-looking statements. All

forward looking statements are based on information available to the Company

as of the date hereof and the Company assumes no obligation to, and expressly

disclaims any obligation to, update or revise any forward looking statements, for

any reason. Basis of Presentation of Financial Data

Unless noted otherwise in this presentation, all reported financial data is being

presented as of the period ending March 31, 2012.

Non-GAAP Financial Measures

Information on any non-GAAP financial measures referenced in today’s

presentation, including a reconciliation of those measures to GAAP measures,

may also be found in our SEC filings and in the earnings release available on our web site. |

3

3

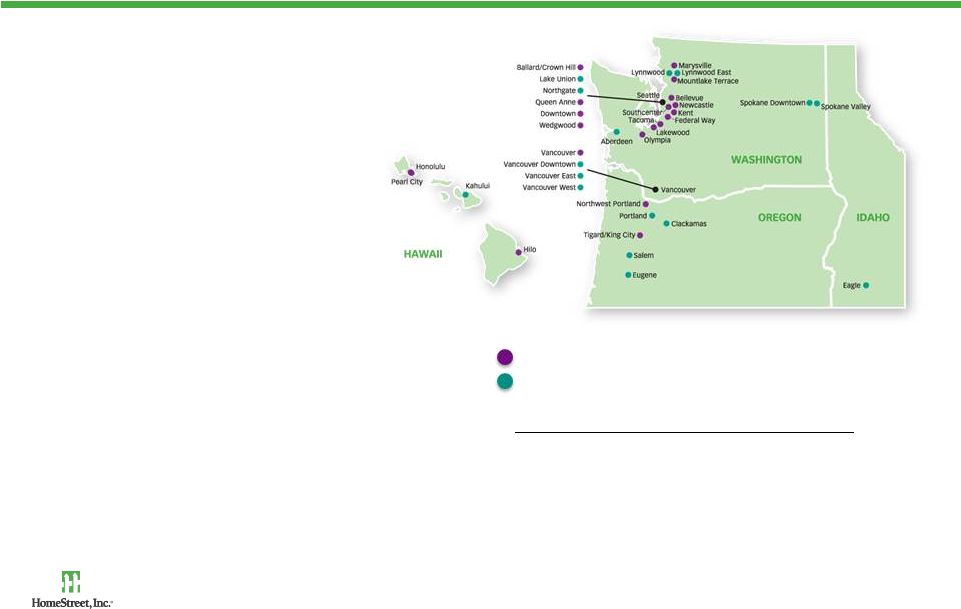

Established Pacific Northwest Franchise

•

90-year-old diversified

financial services company

headquartered in Seattle

•

$2.37 billion institution with

20 retail branches and 18

lending centers

•

Large high-quality

mortgage banking

operation

•

Over $2 billion in deposits

•

Attractive PNW

demographics

•

Largest community bank

headquartered in Seattle

State

# of Branches

Washington

26

Oregon

6

Hawaii

5

Idaho

1

HomeStreet retail branches (20)

HomeStreet lending centers (18) |

4

4

4

Diversified Lines of Business

Community Banking

•

Deposit products

•

Investment product

•

Cash management services

•

Consumer and business loans

•

Insurance products

Single Family Mortgage Lending

•

Originate and sell loans into secondary

market directly and through WMS

•

Originate and service portfolio loans

•

Includes home equity loans and lines

•

Oldest continuous relationship of all

FM seller servicers in nation

Income Property Lending

Residential Construction Lending

•

Focus on multifamily

•

One of 25 Fannie Mae DUS

®

lenders;

only one based in PNW

•

Originate and service commercial

construction, bridge and permanent

loans for portfolio and sale

•

Originate residential construction

portfolio loans

•

Generally short duration

•

Primarily home building

•

Limited land exposure |

5

5

Recent Developments

•

Initial Public Offering completed in February 2012

–

4,361,816 shares issued, raising $88.7 million of net proceeds

–

$65 million of net proceeds subsequently contributed to HomeStreet Bank

•

Termination of Bank regulatory order in March 2012

–

Replaced

with

informal

agreement

–

9%

Tier

1

minimum

•

Increased Single Family mortgage origination personnel by 50%

-

Hired

170

originators

and

support

personnel

–

previously

with

MetLife

Home

Loans

-

New personnel contributed $207 million of Single Family rate lock volume in Q1

-

Opening 13 new mortgage lending centers in Washington, Oregon and Idaho |

6

6

Q1 2012 Results

Q1 2012

Q4 2011

Net Income

$19.1 million

$7.0 million

Diluted EPS

$3.55

$2.42

ROAA

3.3%

1.2%

ROAE

54.1%

33.4%

Net Interest Margin

2.53%

2.50%

Operating Efficiency

(1)

62%

75%

Tier 1 Leverage Ratio

9.3%

6.0%

Total Risk-Based Capital

15.5%

11.2%

(1)

See Appendix for reconciliation of non-GAAP financial measures.

|

7

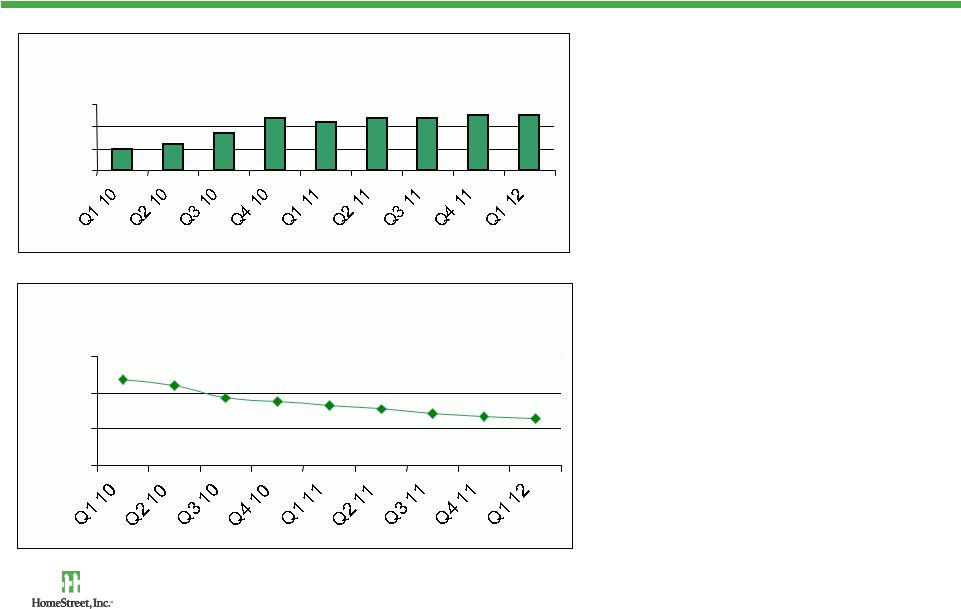

Retail Deposit Funding Base

•

NIM increased to 2.53% in Q1

•

Cost of funding declined to

1.27% in Q1

–

Repricing, roll off or

conversion of CDs

–

Reduction in borrowings and

brokered deposits

–

Acquisition of new core

customers

Net Income Margin (%)

0.96%

1.16%

1.68%

2.34%

2.17%

2.35%

2.38%

2.50%

2.53%

0.00%

1.00%

2.00%

3.00%

Average Cost of Funds

2.35%

2.20%

1.87%

1.74%

1.65%

1.56%

1.43%

1.34%

1.27%

0.00%

1.00%

2.00%

3.00% |

8

8

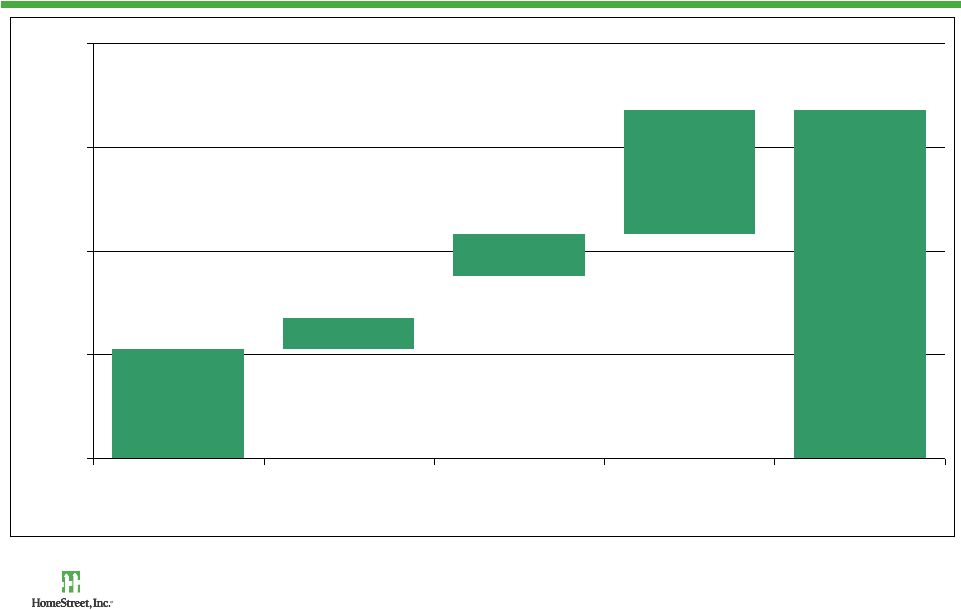

Net Interest Margin Expansion Opportunity

2.00%

2.50%

3.00%

3.50%

4.00%

03/31/12 NIM

Invested Net IPO

Proceeds

Increase Yields &

Reduction in NPLs

Change Balance

Sheet Mix

Q4 2013 Target

2.53%

.10% - 20%

.15% - .25%

.50% - .60%

3.50% -

3.75% |

9

9

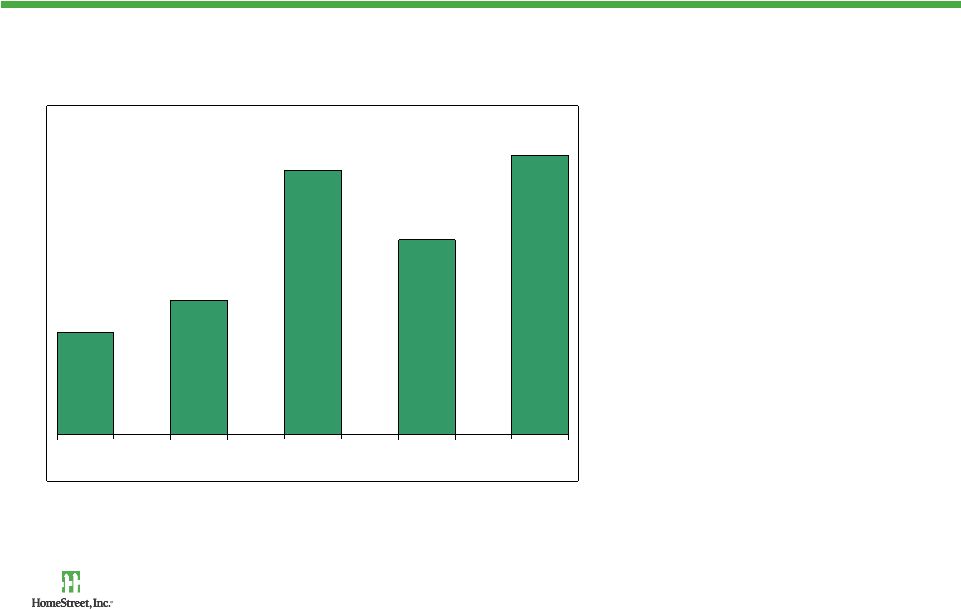

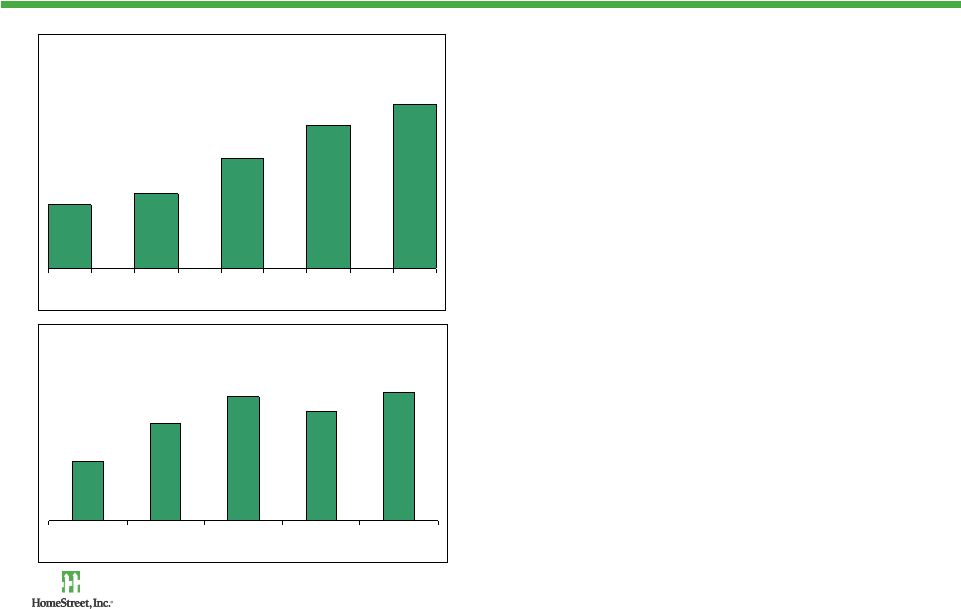

Noninterest Income

($ in thousands)

•

Up 173% over Q1 2011 and

44% over Q4 2011

•

Driven by mortgage loan

origination and servicing

revenue

•

Q1 Noninterest Income/

Total Assets of 6.83%

(annualized)

$14,456

$18,916

$37,268

$27,473

$39,501

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12 |

10

10

Highly Profitable Mortgage Origination Franchise

•

Volume driven by low interest rates,

industry consolidation, increasing

capacity and HARP 2.0

•

High concentration of government and

purchase money mortgages

•

Joint venture with Windermere Real

Estate, largest real estate brokerage

in PNW

•

230 retail loan originators, including

WMS mortgage consultants

•

All retail –

direct origination

•

350 basis points on Q1 production

•

Nominal repurchase claims and losses

Single Family Mortgage Originations

$275,568

$323,906

$478,025

$624,111

$712,302

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Total Revenue (bps)

160

268

338

296

350

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

($ in thousands) |

11

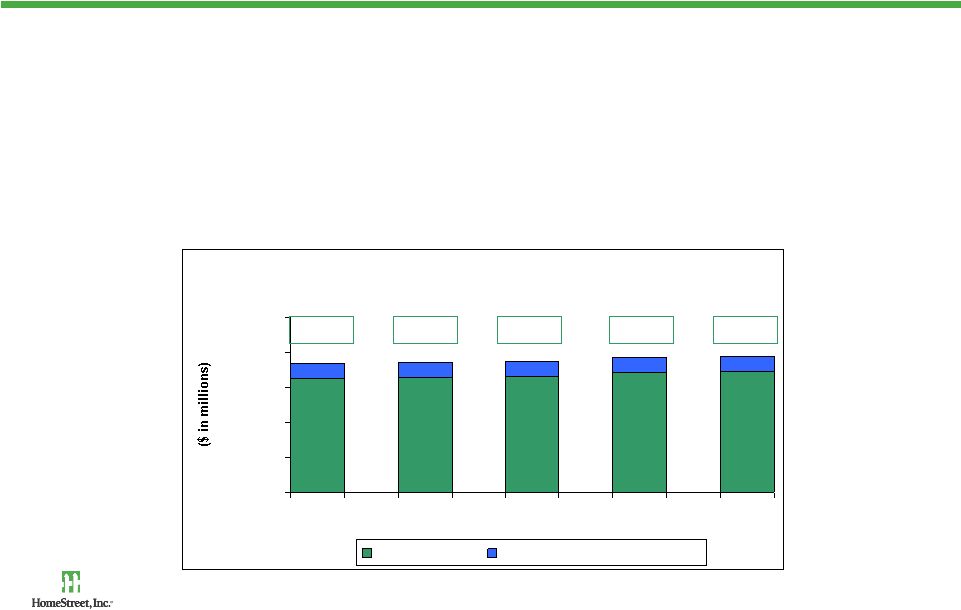

Growth in Mortgage Servicing Portfolio

•

Weighted average servicing fee of 34.8 bps

•

Single Family MSRs

1.14% of end UPB –

3.3x average fee

•

Composition 23% government, 77% conventional

•

Total delinquency of 1.96%

•

Weighted average note rate of 4.83%

•

80

+

% recapture of portfolio refinances

Mortgage Servicing Portfolio

$6,521

$6,603

$6,650

$6,885

$6,947

$843

$857

$828

$815

$826

$0

$2,000

$4,000

$6,000

$8,000

$10,000

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

SF Residential

Commercial (Primarily DUS)

$7,364

$7,460

$7,478

$7,700

$7,773 |

12

12

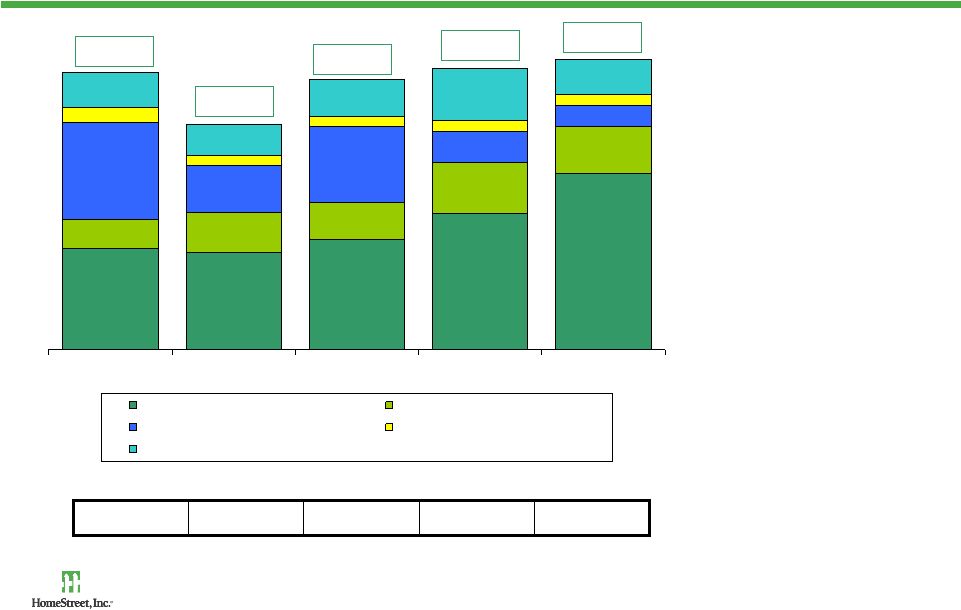

Noninterest Expense

($ in thousands)

•

Q1 operating efficiency

ratio of 62%

(1)

•

Near-term expense

reductions

–

FDIC assessments

–

Legal & collections

–

OREO expenses

•

Noninterest expense

will continue to vary

based on headcount

and mortgage

origination activity

(1)

See Appendix for reconciliation of non-GAAP financial measures.

821

613

598

577

566

Headcount at quarter-end

$12,139

$11,700

$13,217

$16,462

$21,351

$3,601

$4,859

$4,599

$6,194

$5,663

$11,754

$5,666

$9,113

$3,748

$2,520

$1,749

$1,265

$1,264

$1,256

$1,240

$4,218

$3,773

$4,425

$6,255

$4,303

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Salaries and related costs

General and administrative

OREO

FDIC assessments

Legal, Consulting, Occupancy, IT

$33,461

$27,263

$32,618

$33,915

$35,077 |

13

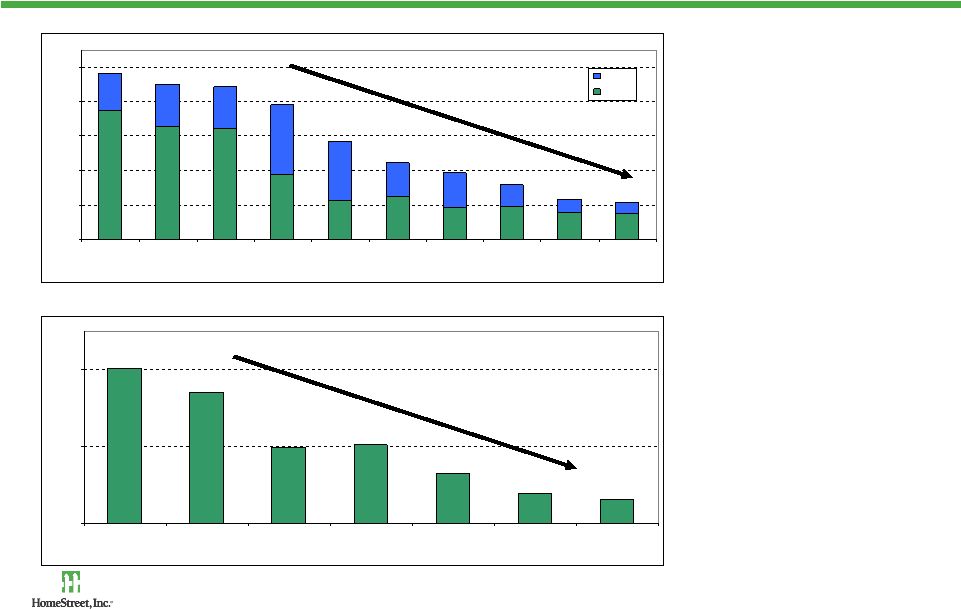

Significant Improvement in Asset Quality

Non-Performing Assets ($ in millions)

•

NPAs

down 78%

from 2009 peak

•

NPAs

as a percent of

total assets down to

4.6%

•OREO declined 84%

from 2010 peak

•

As of 5/10, 65% of

Q1 2012 OREO sold or

contracted for sale

OREO ($ millions)

$107

$115

$160

$194

$223

$284

$391

$442

$450

$482

$0

$100

$200

$300

$400

$500

4Q09

PEAK

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

OREO

NPL

(78%)

$32

$39

$64

$103

$99

$170

$202

$0

$100

$200

3Q10

PEAK

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

(84%) |

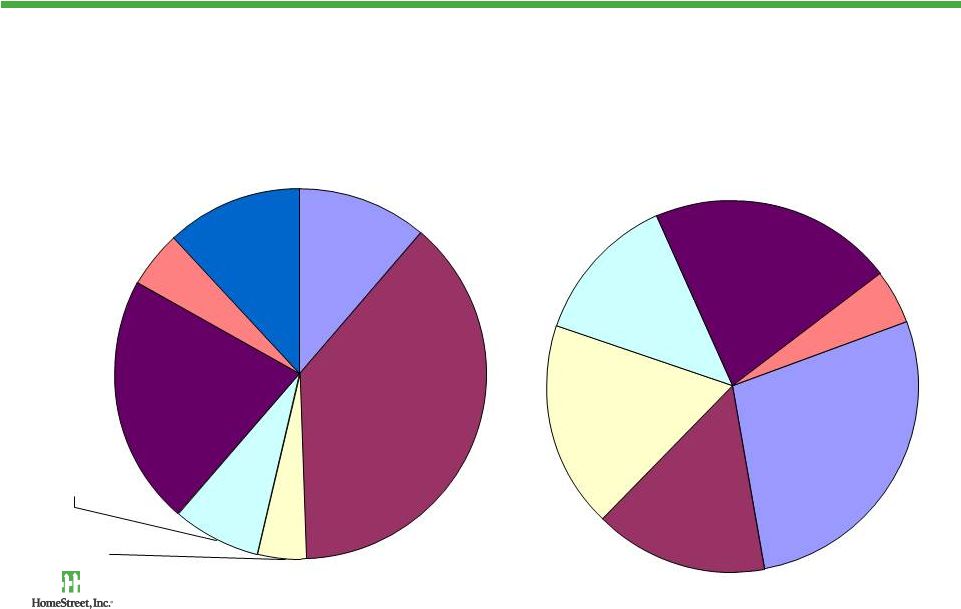

14

Loan Portfolio Characteristics

•

Focus on reducing exposure to high-risk property types

•

Restarting

traditional

lending

lines

–

business

banking,

commercial

real

estate

construction lending

Loan Composition

(1)

CRE by Property Type

(1)

(1)

As of March 31, 2012

Other $21

5%

Retail $125

28%

Industrial/

Warehouse

$67 15%

Mixed Use

$80 18%

Multifamily

$59 13%

Office $96

21%

C&I $69 5%

Multifamily

$56 4%

CRE -

Owner

Occupied

$103 8%

Construction

$159 12%

CRE -

Non-

Owner

Occupied

$289 22%

1-4 Family

$506 38%

Consumer

$153 11

($ in millions) |

15

Single Family 49%

CRE 26%

C&I 13%

(1)

Construction 12%

March 31, 2012

Target

30-40%

20-30%

15-20%

30-40%

Near-Term Goals –

Portfolio Mix

(1)

CRE includes owner-occupied properties |

16

16

Composition of Deposits

•

Total deposits of $2.0

billion at 3/31/12

•

No material change in

total deposit balance

over past 5 quarters

•

Transaction accounts

increased by $134

million in Q1 to 55%

of total deposits

•

Time deposits

decreased by

$143 million

•

New retail branches

planned to increase

density

62%

59%

53%

51%

45%

38%

41%

47%

49%

55%

0%

25%

50%

75%

100%

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Time Deposits

Transaction Accounts |

17

17

Long-Term Growth Strategies

•

Organic growth opportunities driven by attractive market demographics

–

Job growth and housing recovery is expected to outpace the overall economy

–

Well educated workforce, high incomes and strong population trends

•

Expand commercial and consumer banking activities

–

Commercial: lending, cash management, insurance

–

Consumer: mortgage loans, deposits, investments, insurance

•

Expand single family mortgage banking activities

•

Expand multifamily mortgage banking through the Fannie Mae DUS program

•

Restart and grow traditional portfolio lending –

Business Banking, Commercial Real

Estate and Construction |

18

Appendix |

19

19

Non-GAAP Reconciliation

Three Months Ended

($ in millions)

3/31/2012

12/31/2011

9/30/2011

6/30/2011

3/31/2011

Noninterest expense

$35.1

$33.9

$32.6

$27.3

$33.5

Less: OREO expense

2.5

3.7

9.1

5.7

11.8

Adjusted noninterest expense

$30.6

$27.8

$23.5

$21.6

$21.7

Net interest income before provisions

12.9

12.9

12.0

11.9

11.6

Noninterest income

39.5

27.5

37.3

18.9

14.5

Adjusted operating revenue

$52.4

$40.3

$49.2

$30.8

$26.0

Operating efficiency ratio

62.1%

74.8%

47.7%

70.1%

83.3%

Efficiency ratio

66.9%

84.1%

66.3%

88.4%

128.4% |