Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Enventis Corp | form8-k.htm |

Exhibit 99.1

Annual Shareholder Meeting

May 8, 2012

May 8, 2012

Information set forth in this presentation contains financial estimates

and other forward-looking statements that are subject to risks and

uncertainties; therefore, actual results might differ materially from such

statements, whether as a result of new information, future events or

otherwise. You are cautioned not to place undue reliance on these

forward-looking statements. A discussion of factors that may effect

future results is contained in HickoryTech’s filings with the Securities

and Exchange Commission. HickoryTech disclaims any obligation to

update and revise statements contained in this presentation based on

new information or otherwise. This presentation also contains certain

non-GAAP financial measures. Reconciliations of these non-GAAP

measures to the most directly comparable GAAP measures will be

available in our presentation to be filed with the SEC.

and other forward-looking statements that are subject to risks and

uncertainties; therefore, actual results might differ materially from such

statements, whether as a result of new information, future events or

otherwise. You are cautioned not to place undue reliance on these

forward-looking statements. A discussion of factors that may effect

future results is contained in HickoryTech’s filings with the Securities

and Exchange Commission. HickoryTech disclaims any obligation to

update and revise statements contained in this presentation based on

new information or otherwise. This presentation also contains certain

non-GAAP financial measures. Reconciliations of these non-GAAP

measures to the most directly comparable GAAP measures will be

available in our presentation to be filed with the SEC.

Safe Harbor Statement

2

Dale Parker

Board Chairman

Welcome

3

Agenda

4

Board of Directors

5

Business Meeting

6

Proposals

1. Election of three directors for three-year terms:

Lyle Bosacker, Myrita Craig and John Finke

Lyle Bosacker, Myrita Craig and John Finke

2. Ratification of Grant Thornton LLP as the

Company’s independent accounting firm and

auditor for 2012

Company’s independent accounting firm and

auditor for 2012

7

John Finke

President and CEO

Business Overview

8

Executive Team

9

Video Presentation

10

Highlights

11

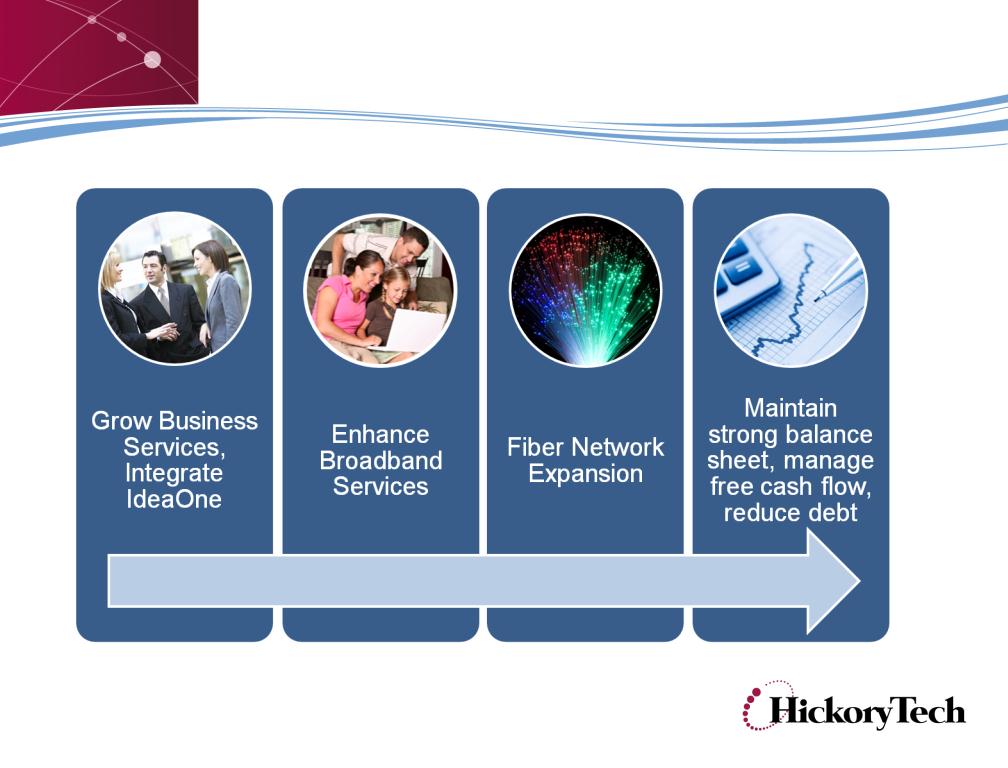

Strategic Initiatives

Goal: Diversify Revenue and Increase Shareholder Value

12

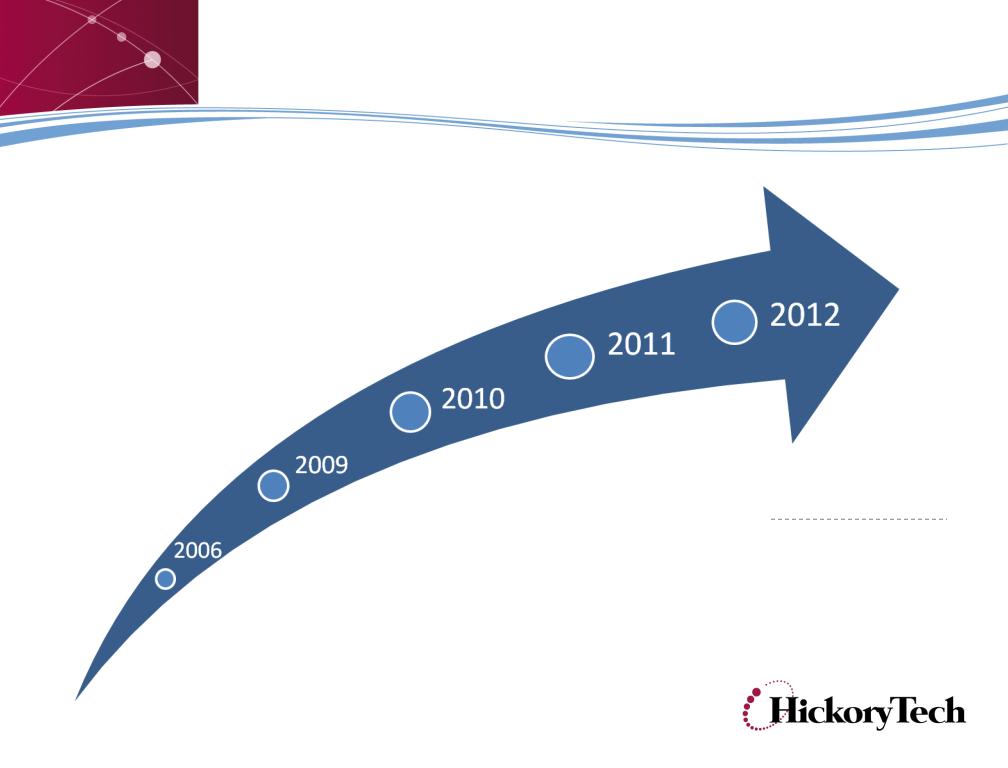

Transforming HickoryTech

Enventis

Acquisition

Acquisition

CP Telecom

Acquisition

Acquisition

Greater MN

Broadband

Collaborative

Project

Initiated

Broadband

Collaborative

Project

Initiated

Close on IdeaOne

Acquisition

Acquisition

Phase 2 of Broadband

Project fiber build

Building a Regional

Communications Company…

Communications Company…

Fiber network

expansion to

So. Dakota,

No. Dakota

expansion to

So. Dakota,

No. Dakota

13

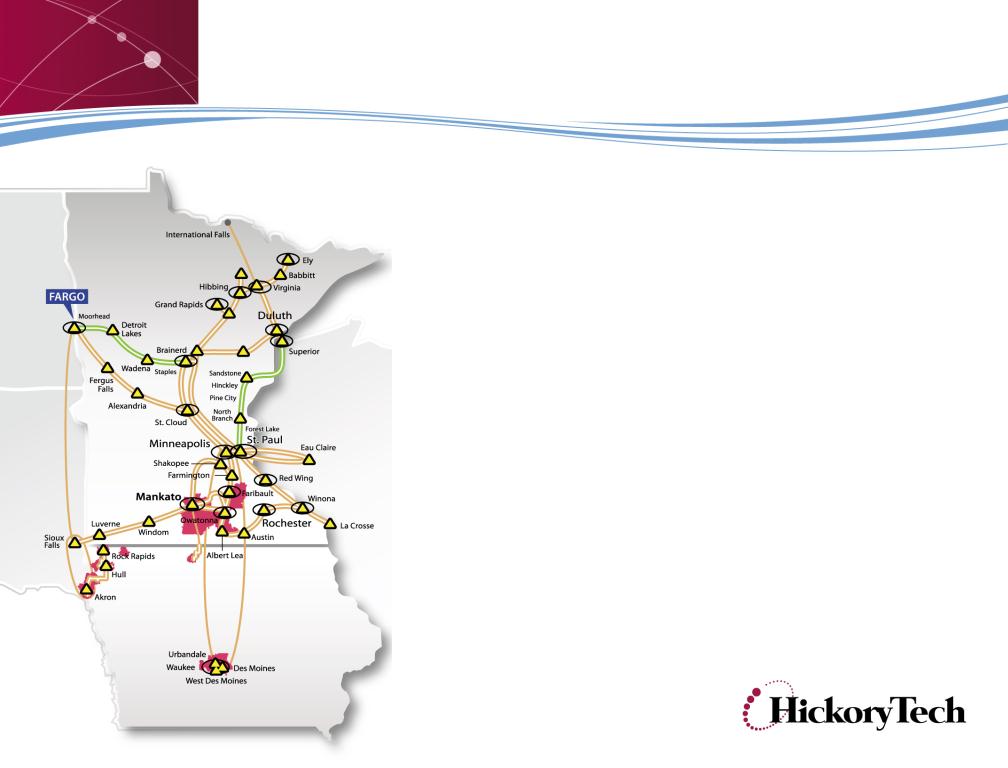

Idea One Acquisition

• Fiber-based communications

provider in Fargo, No. Dakota

provider in Fargo, No. Dakota

• Fits our strategy; primarily

business revenue

business revenue

• Further diversification

• Connects with our regional

fiber network

fiber network

• Free cash flow accretive in

2012

2012

14

IdeaOne Acquisition

|

Close Date

|

March 1, 2012

|

|

IdeaOne

|

CLEC based in Fargo, North Dakota focused on

business customers |

|

Transaction price

|

$28 million, cash transaction with routine

adjustments for capital expenditures and working capital adjustments |

|

Financing structure

|

$22 M of new term debt under existing credit

facility plus $6 M cash |

|

Fiber network

|

225 fiber route miles, 650 lit buildings,

|

|

Employees

|

40 based in Fargo, North Dakota

|

15

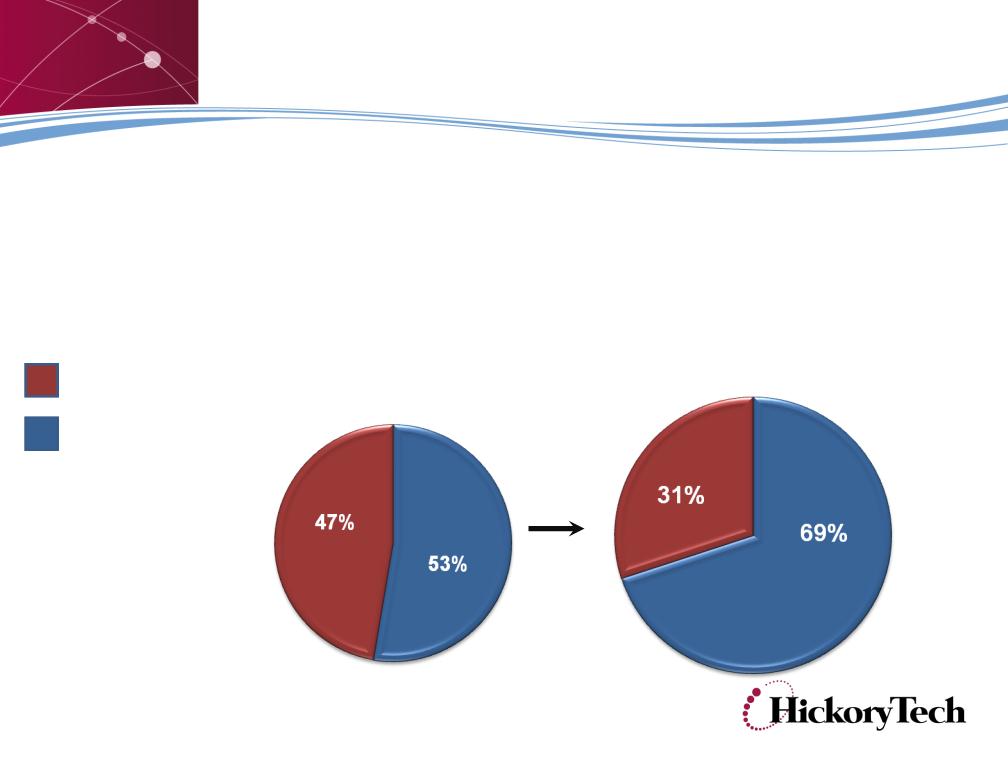

Revenue Growth & Diversification

69% of 2011 revenue was from Business and Broadband

Services

Services

2006 Revenue

$132.9 M

$132.9 M

2011 Revenue

$163.5 M

$163.5 M

Legacy Telecom

Business &

Broadband

Broadband

16

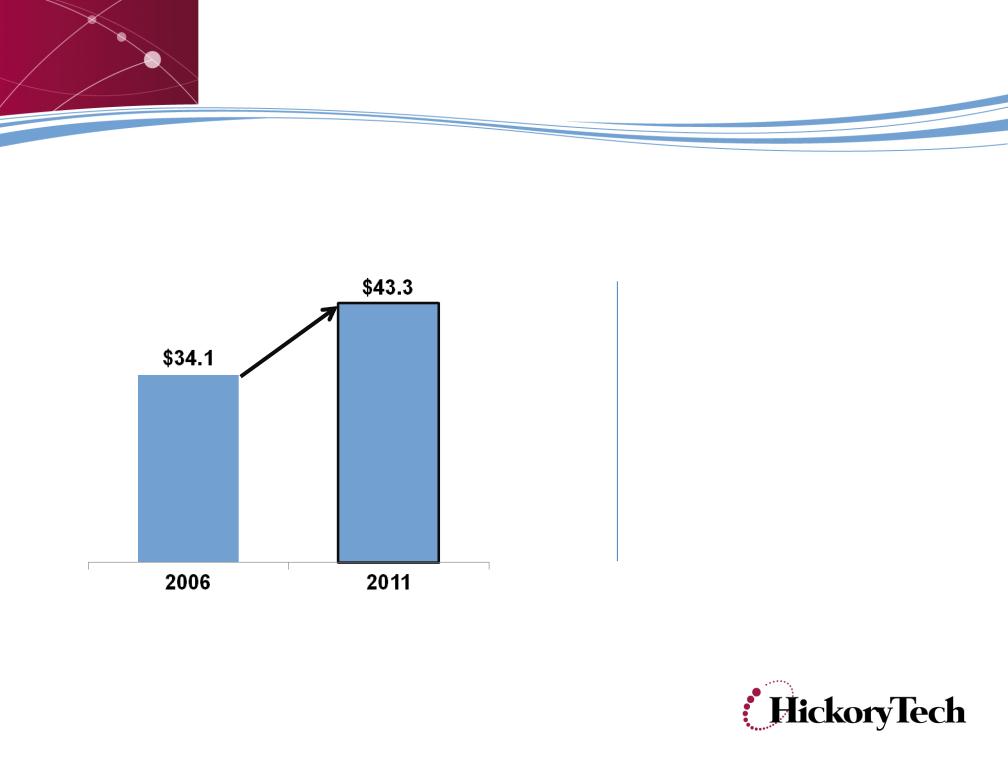

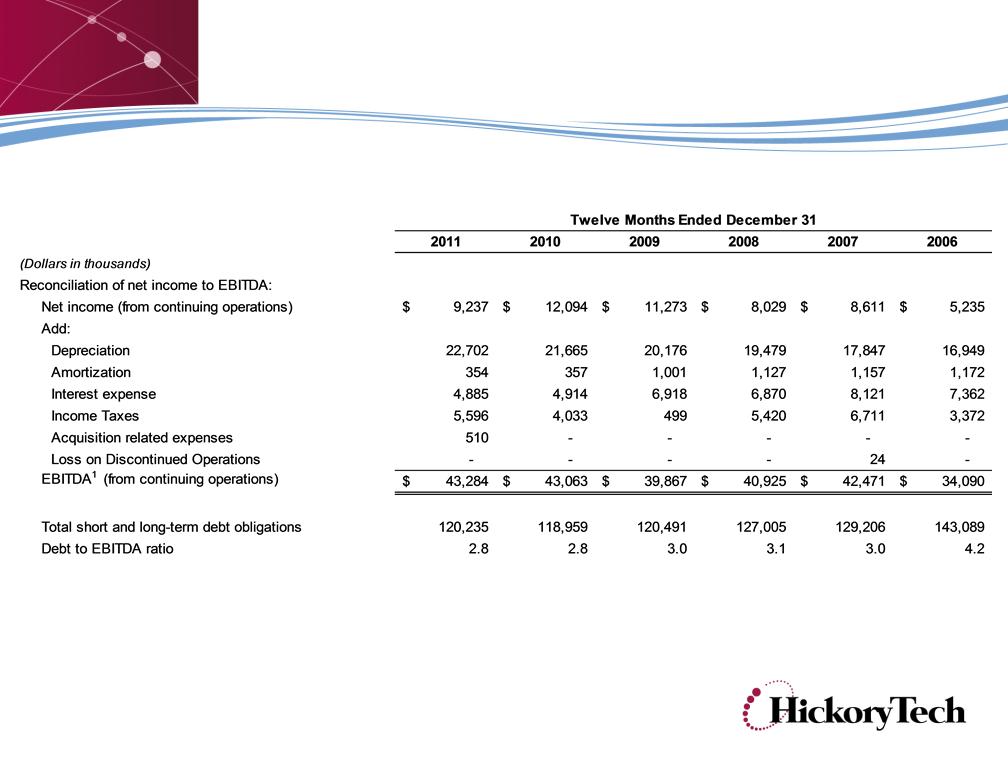

EBITDA Growth

• Grew EBITDA

$9.2 M since 2006

$9.2 M since 2006

• Compound annual

growth rate of 5%

growth rate of 5%

17

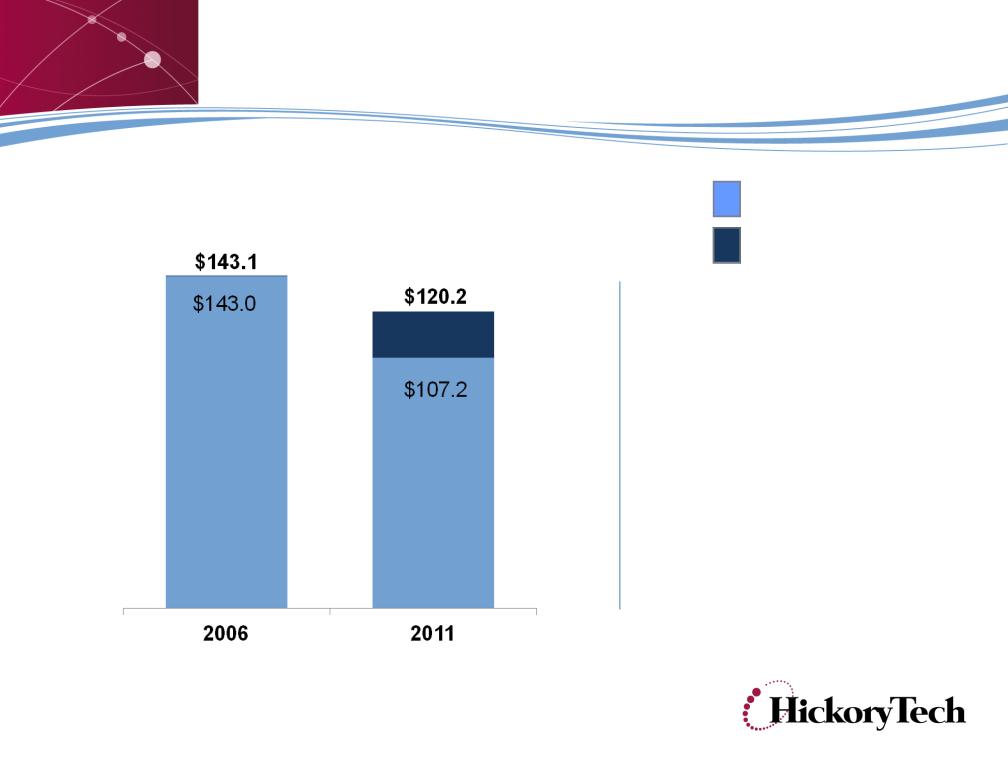

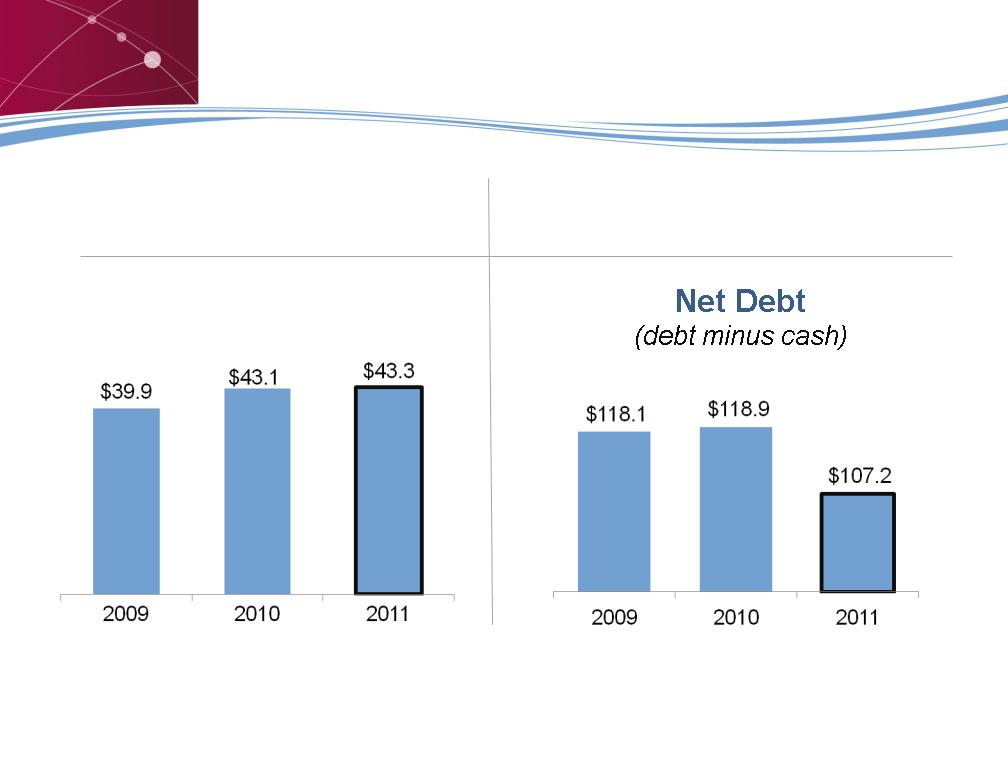

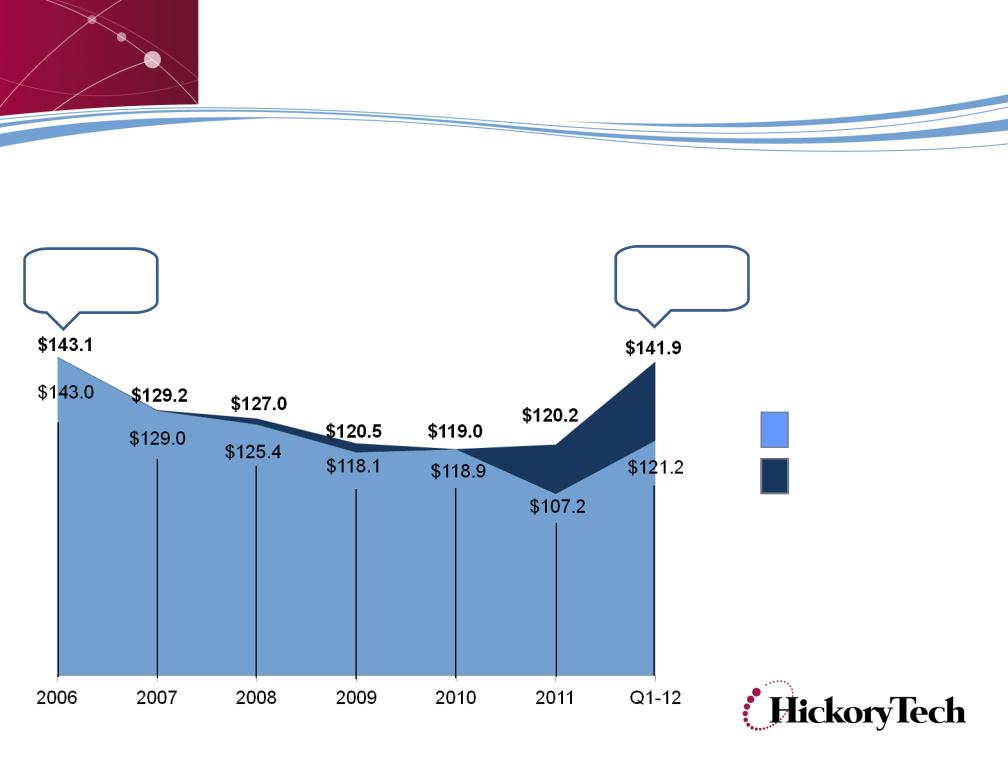

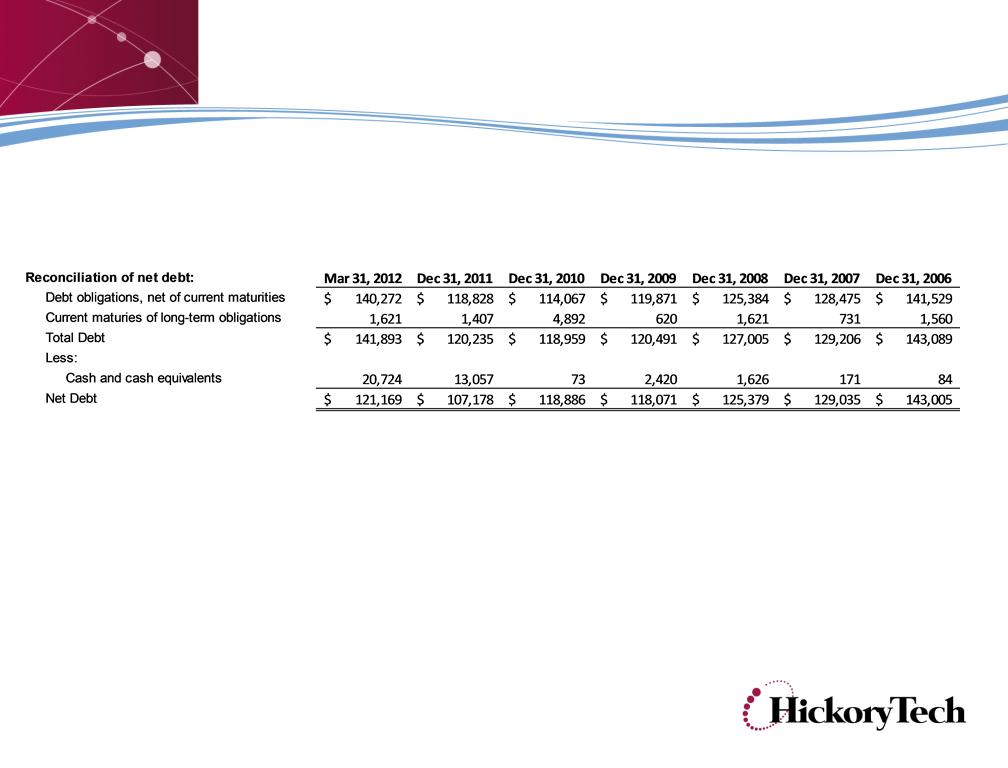

Debt Management

• Net debt reduced

$35.8 M since 2006

$35.8 M since 2006

• New senior debt

agreement secured

August 2011

agreement secured

August 2011

($ in Millions)

Net Debt Balance

Cash on hand

18

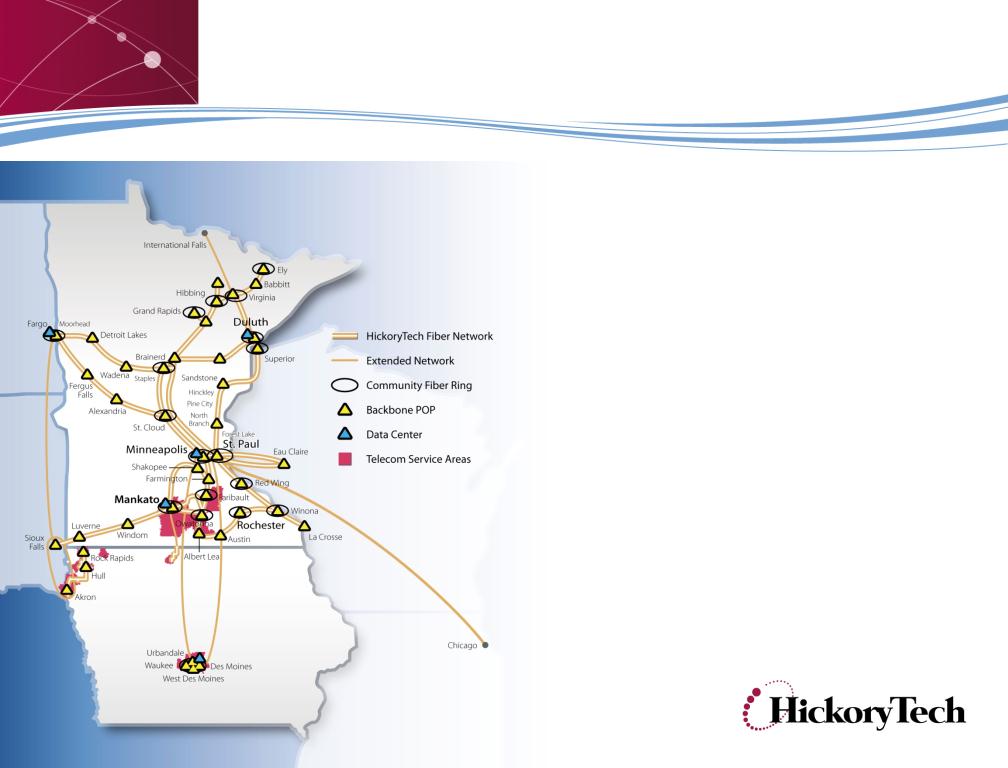

Continued Investment

Fiber network includes 3,250

fiber route miles

fiber route miles

•Sioux Falls, Fargo, Des Moines

expansion

expansion

•Broadband enhancements;

Digital TV services, DSL speeds

Digital TV services, DSL speeds

•CP Telecom Acquisition

•Broadband Stimulus Routes

•IdeaOne Acquisition

19

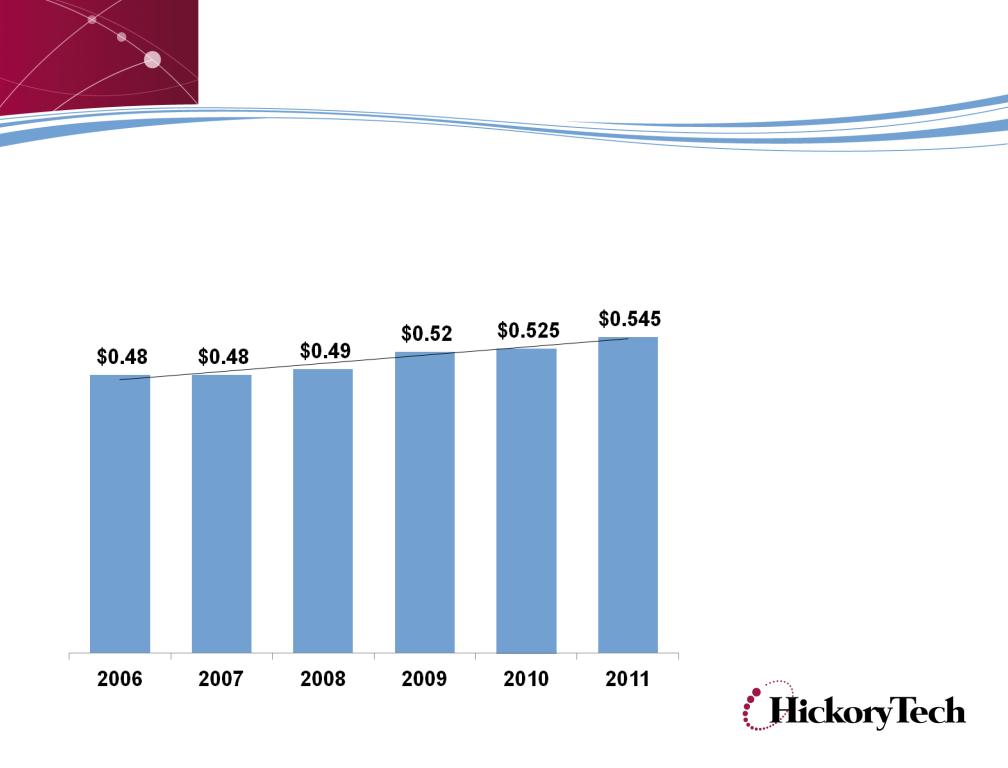

Shareholder Dividends

Increased dividend in 2011 and 2010

•More than 60 years of dividend payments

•Dividend yield: 5-6%

20

Executing on the Plan

• Diversified and grew revenue

• Grew business and broadband services

• Managed Telecom decline

• Increased EBITDA

• Continued to invest in growth opportunities

• Refinanced and managed debt

• Increased dividend

• Expanded fiber footprint; acquired IdeaOne

• Created value for shareholders

21

David Christensen,

Sr. Vice President and

Chief Financial Officer

Chief Financial Officer

Financial Overview

22

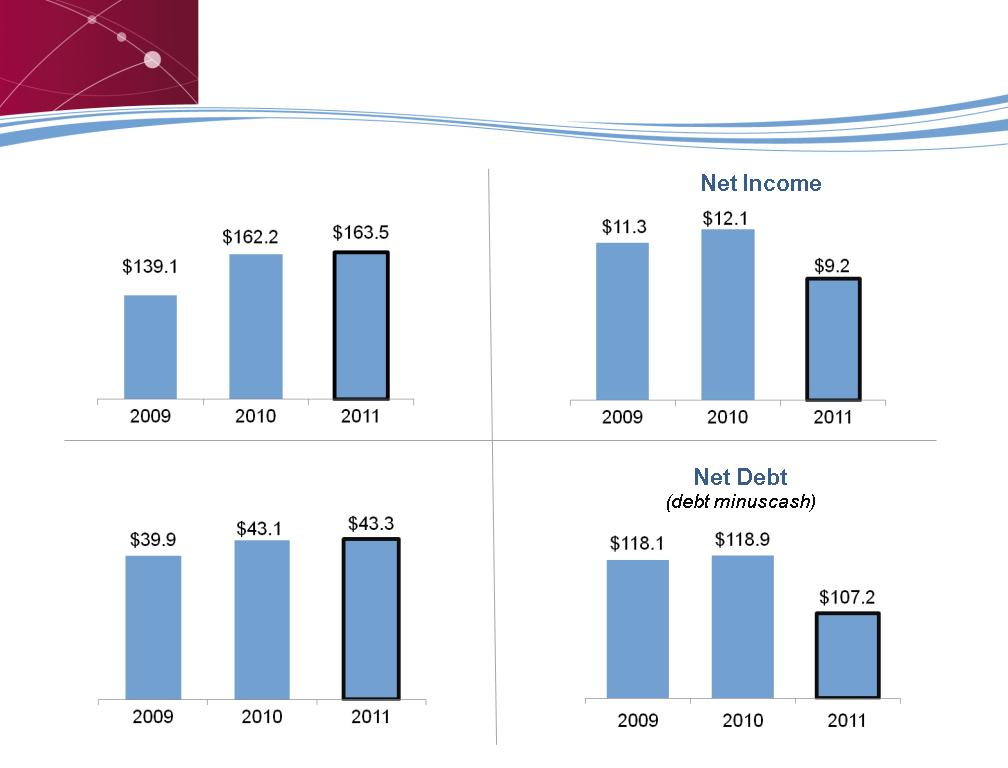

2011 Company Results

EBITDA

($ in Millions)

Revenue

23

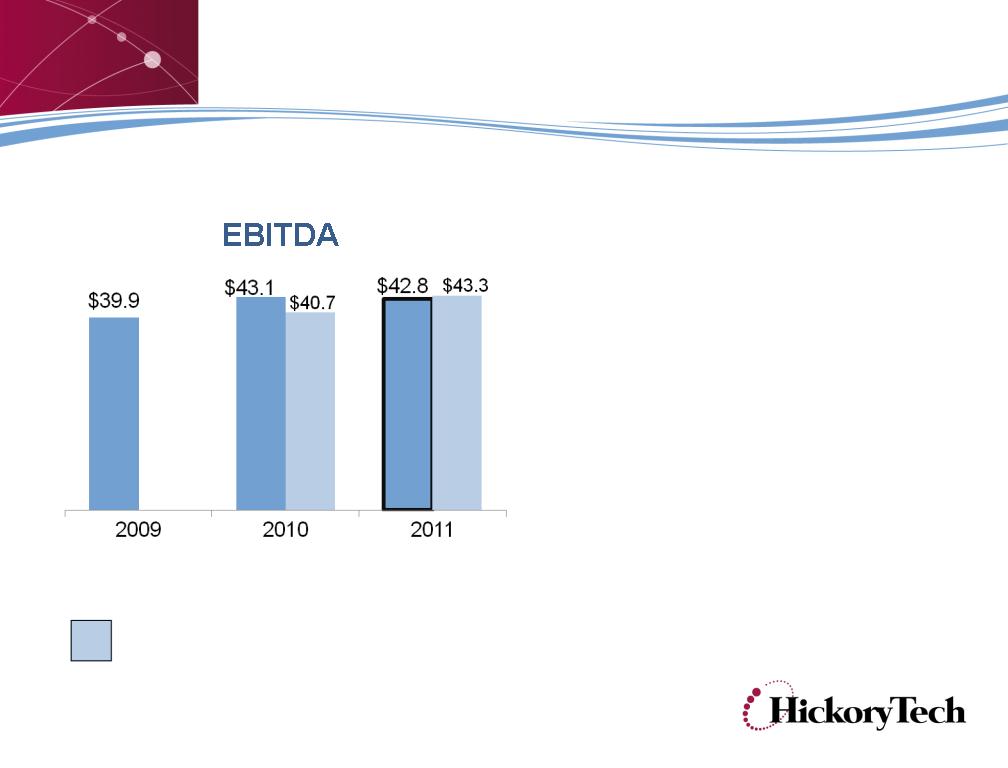

2011 Company Results

EBITDA

($ in Millions)

24

• 2011 adjusted EBITDA

increased 6.4% from 2010

increased 6.4% from 2010

• 2-year (2009-2011) compound

annual growth rate of 4.2%

adjusted EBITDA

annual growth rate of 4.2%

adjusted EBITDA

($ in Millions)

EBITDA

Excludes one-time fiber project profits of

$2.4 M in 2010 and $500K one-time

acquisition costs in 2011

$2.4 M in 2010 and $500K one-time

acquisition costs in 2011

as defined by our credit agreement

25

Debt Balance

($ in Millions)

Net Debt Balance

Cash on hand

Past acquisitions drove debt increase; history of debt pay down

Enventis

Acquisition

Acquisition

IdeaOne

Acquisition

Acquisition

26

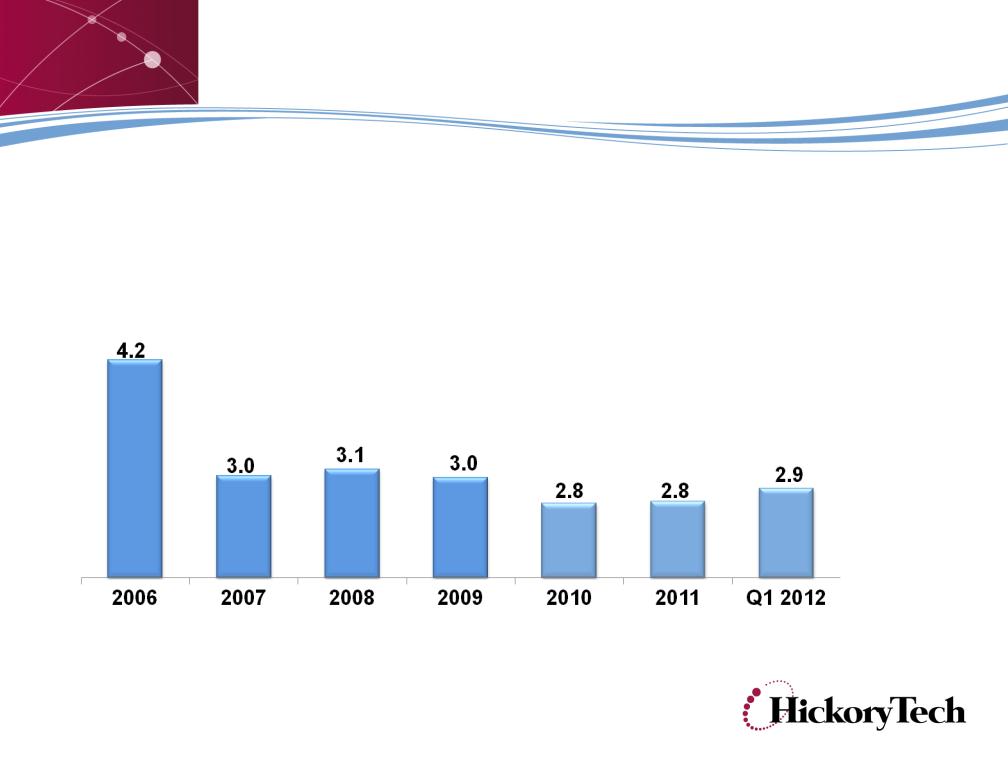

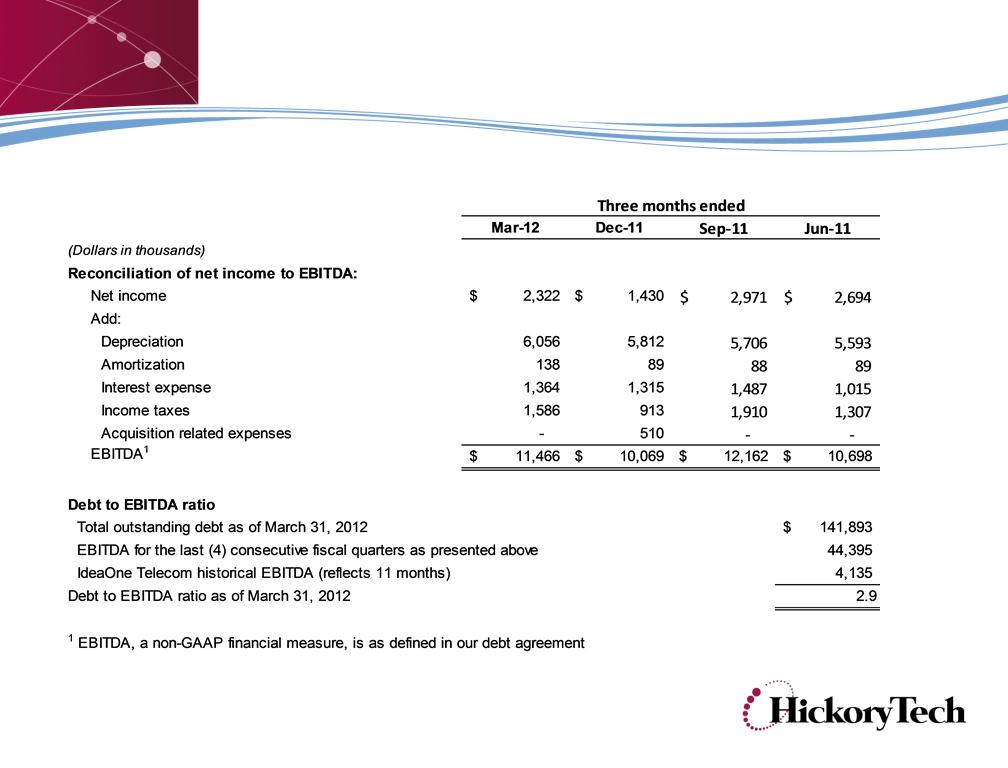

Leverage Ratio

Ratio of Debt to EBITDA = 2.9x at Q1-2012

27

First Quarter 2012 Highlights

First Quarter 2012 compared to First Quarter 2011

•Revenue totaled $46.9 M, +22%

– Equipment Segment +67%

– Fiber and Data revenue +22%

– Telecom revenue -6%

•Operating income totaled $5.3 M, +13%

•Net income totaled $2.3 M, +8%

•EPS was $0.17 per share, +6%

•Closed on IdeaOne Acquisition March 1, 2012

28

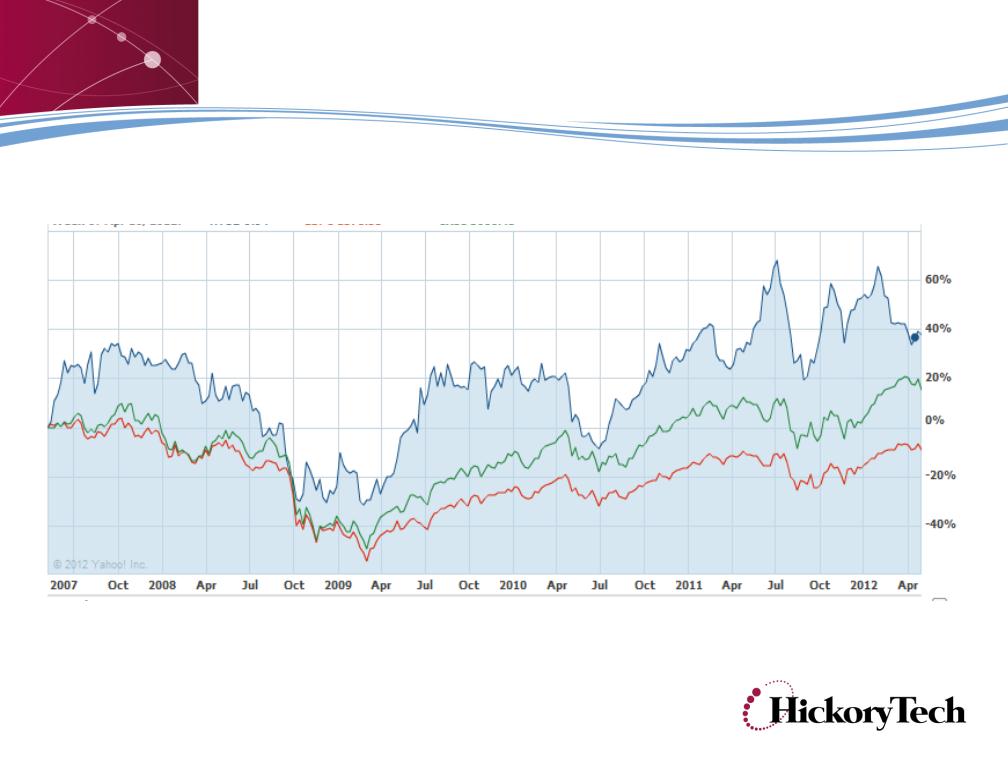

HTCO - Nasdaq - S&P 500 -

Five-year Stock Performance

Relative Stock Performance

29

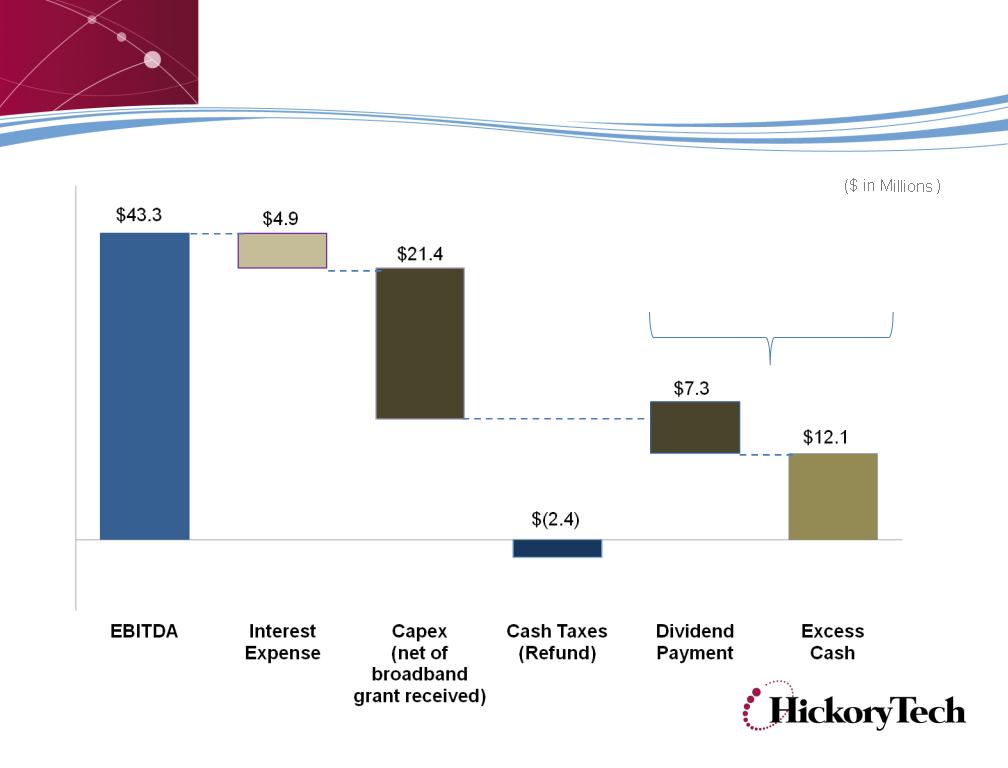

2011 Free Cash Flow

Free Cash Flow = $19.4 M

Dividend Payout is

38%

38%

30

Key Initiatives

Goal: Increase Shareholder Value

31

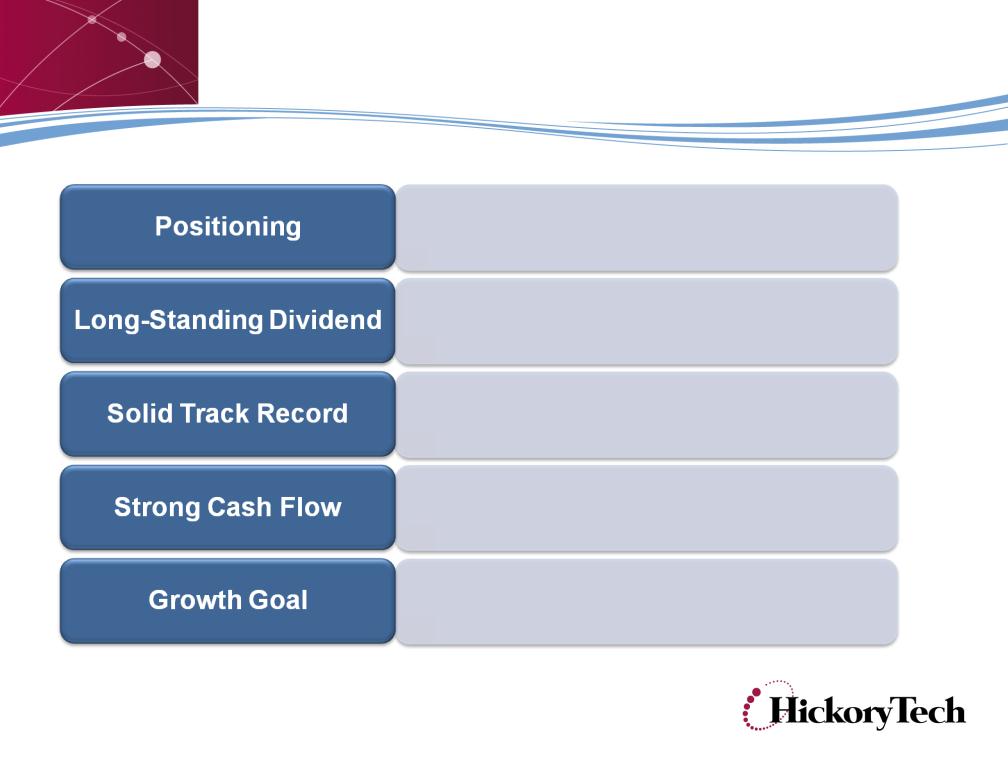

HickoryTech Strengths

Diverse revenue streams / markets, emerging

growth through business revenue stream and fiber

network expansion

growth through business revenue stream and fiber

network expansion

More than 60 years of dividend return, yield 5-6%

Increased dividend in 2011 and 2010

Experienced company with 114-year track record

of financial stability

of financial stability

Strong cash flow, strong balance sheet,

high level of recurring revenue

high level of recurring revenue

Focused on increasing the value of HickoryTech by

growing EBITDA, strategic services, managing debt

growing EBITDA, strategic services, managing debt

32

Questions

33

Follow us

Thank You

34

Reconciliation of Non-GAAP

35

Reconciliation of Non-GAAP

36

Reconciliation of Non-GAAP

37