Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

EMC METALS CORP.

(Exact

name of registrant as specified in its charter)

| British Columbia, Canada | 1000 | Not Applicable |

| (State or other jurisdiction of | (Primary Standard Industrial | (IRS Employer |

| incorporation or organization) | Classification Code Number) | Identification Number) |

1430 Greg Street, Suite 501, Sparks, Nevada, 89431

(775) 355-9500

(Address and telephone number of principal

executive offices)

EMC Metals Corp.

1430 Greg Street, Suite

501, Sparks, Nevada, 89431 (775) 355-9500

(Address and telephone

number of agent for service)

Approximate date of proposed sale to the public: As soon as practicable and from time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filed [ ] Smaller reporting company [X]

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to Be Registered |

Amount to Be Registered |

Proposed Maximum Offering Price per Share(3) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee(4) |

| Common shares | 10,000,000(1) | $0.20 | $2,000,000 | $229.20 |

| Common shares | 3,750,000(2) | $0.20 | $750,000 | $85.95 |

| TOTAL | 13,750,000 | $315.15 |

(1) Represents common shares that may be acquired by selling

shareholders upon exercise of convertible debentures.

(2) Represents common

shares that may be acquired by selling shareholders upon exercise of

warrants.

(3) Offering price of $0.20 is based on the conversion or exercise

price of the convertible debentures and warrants, respectively, of CAD$0.20 at a

foreign currency exchange rate of CAD$1.00 per USD$1.00.

(4) Estimated solely

for the purpose of determining the amount of the registration fee in accordance

with Rule 457 under the Securities Act of 1933, as amended. The price per share

is based upon the exercise price of warrants.

This registration statement also covers additional common shares that shall become issuable by reason of any stock dividend, stock split, recapitalization, or other similar transaction effected without the receipt of consideration that results in an increase in the number of the outstanding common shares.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

2

The information in this Prospectus is not complete and will be amended and completed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold, nor may offers to buy be accepted, until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell securities, nor is it a solicitation of an offer to buy securities, in any state, province or other jurisdiction where the offer or sale would be unlawful.

PROSPECTUS

13,750,000 Common Shares

that may be offered for sale by Selling Shareholders

We are registering 13,750,000 common shares of EMC Metals Corp. that may be offered for sale by the selling shareholders named herein. The shares that may be sold hereunder consist of 10,000,000 of our common shares that may be issued to the selling shareholders upon conversion of outstanding convertible debentures having a principal amount of $2,000,000 and which are due on August 15, 2013, and 3,750,000 of our common shares that may be issued to the selling shareholders upon exercise of outstanding warrants expiring on February 15, 2014. We will receive no proceeds from the sale of the shares by the selling shareholders, however we will receive a reduction in our debt if the convertible debentures are converted into our common shares, and we will receive the proceeds from the exercise of the warrants if exercised by the selling shareholders.

Our common shares are listed on the Toronto Stock Exchange (TSX) and trade under the symbol “EMC”. Trades in our common shares are also quoted on the OTC Grey Market under the symbol “EMMCF”. On May 1, 2012, the closing sale price of our common stock on the TSX and the OTC Grey Market was CAD$0.085 and CAD$0.082 per share respectively.

YOU SHOULD CAREFULLY CONSIDER THE RISKS ASSOCIATED WITH AN INVESTMENT IN OUR COMMON SHARES, WHICH ARE DISCUSSED BEGINNING ON PAGE 4 OF THIS PROSPECTUS UNDER THE HEADING "RISK FACTORS".

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is May 8, 2012.

TABLE OF CONTENTS

2

ABOUT THIS PROSPECTUS

Please carefully read both this prospectus together with the documents incorporated herein by reference and the additional information described below under “Information With Respect to the Registrant.”

You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus. The information contained or incorporated by reference in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common shares. This document may be used only where it is legal to sell these securities.

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission ("SEC"). The shares covered by this prospectus include up to 10,000,000 common shares issuable on the conversion of a convertible debenture and 3,750,000 common shares issuable on the exercise of warrants. This prospectus also covers any of our common shares that may become issuable pursuant to anti-dilution adjustment provisions that would increase the number of shares issuable upon conversion of the convertible notes and/or exercise of the warrants as a result of issuances of our common shares in the future at a price less than the conversion price of the convertible notes or the exercise price of the warrants, as the case may be, subject to certain exceptions or as a result of stock splits, stock dividends or similar transactions.

We recommend that you read carefully this entire prospectus, especially the section entitled "Risk Factors" beginning on page 8, before making a decision to invest in our common shares.

Owning securities may subject you to tax consequences both in Canada and the United States. This prospectus may not describe these tax consequences fully. You should consult your own tax advisor with respect to your particular circumstances.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain “forward-looking statements” within the meaning of applicable Canadian and United States securities legislation. Such forward-looking statements concern our anticipated results and developments in our operations in future periods, planned exploration and development of our properties, plans related to our business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. These statements include, but are not limited to, comments regarding :

- the establishment and estimates of mineral reserves and resources;

- the grade of mineral reserves and resources;

- planned operations, including funding of capital cost and permitting requirements;

- planned exploration activities and the anticipated outcome of such exploration activities; and

- future financings and anticipated outcome of those financings.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

- risks related to our history of losses and our requirement for additional financing to fund exploration and, if warranted, development of our properties, or commencement of mining operations;

- risks related to our lack of historical production from our mineral properties;

3

- uncertainty and risks related to cost increases for our exploration and, if warranted, development projects;

- uncertainty and risks related to the effect of a shortage of equipment and supplies on our ability to operate our business;

- uncertainty and risks related to mining being inherently dangerous and subject to events and conditions beyond our control;

- uncertainty and risks related to our mineral resource estimates being based on assumptions and interpretations;

- risks related to changes in mineral resource estimates affecting the economic viability of our projects;

- risks related to differences in U.S. and Canadian practices for reporting reserves and resources;

- uncertainty and risks related to our exploration activities on our properties not being commercially successful;

- risks related to a dispute over our interest in the Nyngan scandium project;

- uncertainty and risks related to fluctuations in tungsten, scandium and other metal prices;

- Risks associated with recoveries of tungsten and scandium from mining operations;

- risks related to our lack of insurance for certain high-risk activities;

- uncertainty and risks related to our ability to acquire necessary permits and licenses to place our properties into production;

- risks related to government regulations that could affect our operations and costs;

- risks related to environmental regulations;

- uncertainty and risks related to evolving corporate governance standards and public disclosure regulations;

- risks related to land reclamation requirements on our properties;

- risks related to increased competition for capital funding in the mining industry;

- risks related to competition in the mining industry;

- risks related to our directors and officers having conflicts of interest;

- risks related to our ability to attract qualified management to meet our expected needs in the future;

- uncertainty and risks related to currency fluctuations;

- uncertainty and risks related to title to our properties being subject to claims;

- risks related to our status as a passive foreign investment company;

- risks related to our securities; and

- risks related to this offering.

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the section entitled “Risk Factors” in this prospectus. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required by law.

We qualify all the forward-looking statements contained in this prospectus and the documents incorporated by reference herein and therein by the foregoing cautionary statements.

4

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING RESOURCE ESTIMATES

The mineral estimates in this prospectus and the documents incorporated by reference herein have been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, or NI 43-101, and the Canadian Institute of Mining, Metallurgy and Petroleum, or CIM, - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in the United States Securities and Exchange Commission, or SEC, Industry Guide 7 under the United States Securities Act of 1993, as amended, or the Securities Act. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in the prospectus and the documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

FINANCIAL INFORMATION AND CURRENCY

Our financial information contained in the documents incorporated by reference in this prospectus is presented in accordance with generally accepted accounting principles, or GAAP, in the United States. Our financial information contained in the documents incorporated by reference is presented in Canadian dollars, unless otherwise indicated.

References in this prospectus to “$” are to United States dollars. Canadian dollars are indicated by the symbol “CAD$”. On May 1, 2012, the closing exchange rate for a Canadian dollar in terms of the United States dollar, as quoted by the Bank of Canada, was CAD$1.00 = $1.02.

The following table sets out the exchange rate for a Canadian dollar in terms of the United States dollar as at each of the years ended December 31, 2011 and 2010.

| Year Ended December 31 | ||||||

| ( Cdn.$ per $) | ||||||

| 2011 | 2010 | |||||

| Rate at end of Period | 1.0170 | 0.9946 | ||||

| Average during Period | 0.9891 | 1.0299 | ||||

| Low | 0.9428 | 0.9931 | ||||

| High | 1.0600 | 1.0848 | ||||

5

SUMMARY INFORMATION

This summary provides an overview of selected information contained in this prospectus. It does not contain all the information you should consider before making a decision to purchase the common shares we or our selling shareholders are offering. You should very carefully and thoroughly read the more detailed information in this prospectus and review our financial statements and all other information that is incorporated by reference in this prospectus.

EMC Metals Corp.

EMC Metals Corp. (the “Company” or “we” or “our”) incorporated on July 17, 2006 under the laws of British Columbia, Canada under the name Golden Predator Mines Inc. Effective March 12, 2009, we changed our name to EMC Metals Corp.

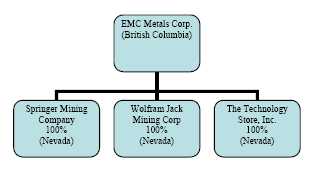

The chart below illustrates our corporate structure, including our subsidiaries, the jurisdictions of incorporation, and the percentage of voting securities held:

We are a mineral exploration and development company that is focused on the development of scandium, tungsten, vanadium, rare earth minerals, and other specialty metals, including nickel, cobalt, boron, manganese, tantalum, titanium and zirconium.

Our principal asset is our Springer Mine and mill complex in Nevada, which we hold a 100% interest in subject to certain access and usage rights granted to a third party. We are also claiming a 50% joint venture interest in the Nyngan Project in Australia, however as of February 28, 2012 our right to receive a 50% interest in the Nyngan Project became the subject of a dispute with the joint venture partner. We also hold a 100% ownership of the Carlin Vanadium project in Nevada which contains a significant vanadium resource and as well as interests four exploration stage specialty metals properties located in Norway, Nevada and Utah.

Our primary corporate focus over the last two years has been to complete the requirements to earn a 50% joint venture interest in the Nyngan Project. In February of 2012 we delivered a report to our joint venture partner on the feasibility of placing the Nyngan project into production, as well as a final cash payment, both as required to earn our 50% joint venture interest in the project. The report was not accepted by our joint venture partner and as a result we commenced a formal dispute process to claim a 50% joint venture interest. As at the current date, the dispute remains unresolved and is in progress.

None of our current projects or properties has advanced to the production stage and we are currently an exploration and development stage company. In the past we were seeking potential buyers for our Springer Mine and mill complex. EMC is now working to evaluate a number of restart options for the Springer Mine in 2012. Stronger tungsten prices and tight supply conditions, combined with the existing refurbished mill and tungsten resource on the property, support a strategy to seek a near term restart of the Springer Mine. A restart strategy will require significant additional capital, which remains our primary obstacle to executing on the strategy.

None of our current projects or properties has advanced to the production stage and we are currently an exploration and development stage company. Subject to our confirming our 50% joint venture interest in the Nyngan project, we intend to develop the Nyngan project for production of scandium, with a view to supplying the anticipated future demand for scandium oxide and scandium-content materials. Development plans of the Nyngan Project include construction of a commercial plant on the property that will process mineralized material extracted from the property. The time-frame for development of the project by us is subject to the timing of resolving the dispute over the status of the 50% joint venture interest in the Nyngan Project that we are claiming.

6

We have also conducted various development and testing activities to establish proprietary or unique mineral recovery techniques as well as techniques intended to produce high quality finished scandium metals. If effective at a commercial level, these recovery and finishing techniques will provide increased economic margins and returns on capital on any future scandium production. Presently our recovery and finishing technology remains in the testing phase, and there is no guarantee that we will be able to benefit from the commercial application of such techniques or that we will have scandium production in the future.

We are required to file continuous reports on our financial and business affairs with the SEC. These reports may be viewed at www.sec.gov or on our website at www.emcmetals.com. In addition to our obligations to file reports with the SEC, we are also a reporting company under the laws of the Canadian provinces of British Columbia, Alberta and Ontario. Our filings with the Canadian provincial securities commissions can be viewed at www.sedar.com. Our common shares are listed for trading on the Toronto Stock Exchange under the symbol “EMC”.

Our head office is located at 1430 Greg Street, Suite 501, Sparks, Nevada 89431. The address of our registered office is 1200 - 750 West Pender Street, Vancouver, British Columbia, Canada, V6C 2T8. Our telephone number is (775) 355-9500.

The Offering

The selling shareholders may offer and sell all or any portion of 10,000,000 common shares that may be acquired by selling shareholders upon exercise of a convertible debenture expiring on August 15, 2013 and 3,750,000 common shares that may be acquired by selling shareholders upon exercise of warrants expiring February 15, 2014. The convertible debenture may be converted at the rate of $0.20 per share, and warrants are exercisable at the rate of $0.20 per share.

The shares acquired on conversion of the convertible debenture and on exercise of the warrants may be offered and sold in one or more transactions through a variety of methods, including in ordinary market transactions at prevailing market prices or in privately negotiated transactions.

We will not receive any of the proceeds from the sale of the common shares that may be offered and sold hereunder, however we will receive the proceeds from the exercise by the selling shareholders of the warrants.

As at May 1, 2012, we had 150,678,713 common shares issued and outstanding on our record books as maintained by our transfer agent. A an aggregate of 3,750,000 common shares may be issued upon the exercise of outstanding warrants, and 11,823,750 common shares may be issued upon the exercise of outstanding stock options.

| Common shares offered by the selling Shareholders | An aggregate of up to 13,750,000 common shares held by or issuable to the selling shareholders described under "Principal and Selling Shareholders - Selling Shareholders," including their transferees, pledgees, donees or other successors, of which: | ||

| o |

up to 10,000,000 shares that may be issued upon the conversion of a convertible debenture; and | ||

|

| |||

| o |

up to 3,750,000 shares that may be issued upon the exercise of the warrants. | ||

7

| Common shares to be outstanding after the offering |

164,428,713 shares, based on 150,678,713 shares of common shares issued and outstanding as of May 1, 2012 and assuming that all convertible debentures and warrants held by the selling shareholders are converted into, or exercised for, common shares in accordance with their terms. | |

| Use of proceeds |

The selling shareholders will receive all of the net proceeds from the sale of our common shares offered by this prospectus. We will not receive any of the proceeds from the sale of shares of common shares offered by this prospectus. To the extent all of the outstanding warrants held by the selling shareholders are exercised at their current exercise prices, we would receive approximately $750,000 in cash proceeds, which would be used for general working capital purposes. The conversion price of the convertible debentures is $0.20 per share and the exercise price of warrants is $.20 per share. | |

| Plan of Distribution |

The shares of common shares offered for resale may be sold by the selling shareholders pursuant to this prospectus in the manner described under "Plan of Distribution." | |

| Risk Factors |

You should read the "Risk Factors" section of this prospectus and the risk factors incorporated by reference herein for a discussion of factors to consider carefully before deciding to invest in our common shares. | |

| Toronto Stock Exchange Symbol | EMC |

Selling Shareholders as Underwriters

The selling shareholders and any underwriters, agents, broker or dealers that participate with the selling shareholders in the distribution of any of the shares may be deemed to be "underwriters" within the meaning of the Securities Act, and any commissions received by them and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. See "Plan of Distribution" and "Principal and Selling Shareholders."

RISK FACTORS

You should carefully consider each of the following risk factors and all of the other information provided in this prospectus and attached hereto before purchasing our common shares. The risks described below is a non-exhaustive list of the risks we currently believe may materially affect us. Our future development is and will continue to be dependent upon a number of factors. You should carefully consider the following information as well as the more detailed information concerning our Company contained elsewhere in this prospectus before making any investment. An investment in our common shares involves a high degree of risk, and should be considered only by persons who can afford to lose the entire amount of their investment.

Risks Associated with the Springer Project

We may not be able to utilize the Springer Property. The Springer property, which includes an existing mine and refurbished mill facility, constitutes our largest asset. In September of 2008, we suspended work on the Springer property and placed the facility on care and maintenance pending improvement in the global financial markets and strengthening tungsten prices. While tungsten prices have improved, significant additional capital and additional management resources would be required to resume operations. If we make a decision to resume operations on the Springer property such operations will require the location of additional management and additional capital. Our inability to obtain such management and capital will result in the Springer property continuing to be on care and maintenance.

8

The price of tungsten is subject to significant volatility. If we elect to operate the Springer mine and mill, there is no certainty that economic conditions or tungsten prices will not again deteriorate, and that production at the Springer Mine will need to be again suspended. To the extent tungsten prices may deteriorate after we commence operations, such operations may not be profitable resulting in the closure of the mine and mill, and resulting loss in value of our company to investors.

We may not be able acquire additional capital to restart the Springer property. The Springer property has a significant book value on our financial statements. In the past we considered selling the Springer property among other strategic alternatives. However, we are now working to evaluate a number of restart options for the Springer Mine in 2012. A restart strategy will require significant additional capital, which remains our primary obstacle to executing on the strategy. There can be no assurance that we will be able to obtain necessary financing in a timely manner on commercially acceptable terms.

Risks Associated with the Nyngan Project

If we are not able to acquire an interest in the Nyngan Project our ability to develop a scandium project in the near term is unlikely. We are in the process of claiming a 50% joint venture interest to the Nyngan project that is being disputed by our joint venture partner. If we are not successful at establishing our claim, we will not hold a 50% interest in the Nyngan project and will need to seek an alternate scandium project in order to achieve our goal of scandium production. We have additional scandium exploration properties, however, development of an alternate project would likely significantly delay or possibly prevent us from proceeding to develop a scandium mining operation, which may have a significant impact on the future value of the company to the extent our company’s value is based on its scandium assets.

There are technical challenges to scandium production that may reduce the economic prospects of production. If we succeed at claiming our 50% joint venture interest in the Nyngan project, there is no assurance that we will not encounter technical challenges to the scandium recovery process. The economics of scandium recovery are known to be challenging. There are very few facilities producing scandium and the existing scandium producers are secretive in their techniques for recovery. There is a possibility that we will encounter unknown or unanticipated production and processing risks. Should any of these risks become actual, they could increase the cost of production thereby reducing margins on the project or rendering the project uneconomic. Presently our scandium recovery and finishing technology remains in the testing phase, and there is no guarantee that we will be able to benefit from the commercial application of such techniques or that we will have scandium production in the future.

There is no guarantee that we will be able to finance the Nyngan Project for production. Any decision to proceed with production on the Nyngan Project will require significant production financing. Scandium projects are very rare, and economic and production uncertainty may limit our ability to attract the required amount of capital to put the project into production. If we are unable to source production financing on commercially viable terms, we may not be able to proceed with the project and may have to write-off our investment in the project.

If we are successful at achieving production, we may have difficulty selling Scandium. Scandium is characterized by unreliable supply, resulting in limited development of markets for scandium oxide. Markets may take longer to develop than anticipated, and we and other potential scandium producers may have to wait for products and applications to create adequate demand. Certain applications may require lengthy certification processes that could delay usage or acceptance. In addition certain scandium applications require very high purity scandium product, which is much more difficult to produce than lower grade product. If we commence production, our inability to supply scandium in sufficient quantities, in a reliable and timely manner, and in the correct quality, could reduce the demand for any scandium produced from our projects and possibly render the project uneconomic.

9

Risks Associated with the Carlin Vanadium Property

There are technical challenges to production of Vanadium from the property that may reduce the value of the property. The Carlin property hosts vanadium contained in a black shale. This vanadium host is known to present challenging processing issues in the separation of vanadium. Techniques to separate vanadium in this environment are complex. As a result, shareholders may never see the property developed due to technical risks, and similarly the value of the property may be greatly reduced if such technical risks present an obstacle to further exploration or development of the property.

Industry requirements may limit market opportunities for vanadium production. New battery technologies are emerging that rely on vanadium, these markets may take longer than expected to develop and increase vanadium demand. These battery technologies require high purity vanadium product, which is difficult and costly to produce. The purity of any vanadium that may in the future be extracted from the Carlin property is unknown and uncertain. The inability to produce vanadium with sufficient purity for market purposes will likely reduce the economic prospects of any proposed development of the property.

General Risks Associated with our Mining Activities and Company

We may not receive permits necessary to proceed with the development of a mining project. The development of any of our properties will require additional local and national government approvals. Our ability to secure all necessary permits required to develop any of our projects is unknown until we make application for such permits. If we cannot obtain all necessary permits, the project cannot be developed, and our investment in the project will likely be lost. Our future market value will likely be significantly reduced to the extent one or more of our projects cannot proceed to the development or production stage due to an inability to secure all required permits.

Estimates of Resources on our properties are subject to uncertainty and may not reflect what may be economically extracted. Resource estimates included for scandium, tungsten, vanadium and other minerals on our Nyngan, Springer and Carlin properties are estimates only and no assurances can be given that the estimated levels of scandium, tungsten, vanadium and other minerals will actually be produced or that we will receive the scandium, tungsten, vanadium and other metal prices assumed in determining our resources. Such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling and exploration results and industry practices. Estimates made at any given time may significantly change when new information becomes available or when parameters that were used for such estimates change. By their nature resource estimates are imprecise and depend, to a certain extent, upon statistical inferences which may ultimately prove unreliable. Furthermore, market price fluctuations in scandium, tungsten, vanadium and other metals, as well as increased capital or production costs or reduced recovery rates, may limit our ability to establish reserves on any of our properties. The extent to which resources may ultimately be reclassified as proven or probable reserves is dependent upon the demonstration of their profitable recovery. The evaluation of reserves or resources is always influenced by economic and technological factors, which may change over time. Accordingly, current resource estimates on our material properties may never be converted into reserves, or be economically extracted, and we may have to write-off such properties or incur a loss on sale of our interest on such properties, which will likely reduce the value of our shares.

Our potential for a competitive advantage in specialty and rare metals production depends entirely on the availability of our Chief Technology Officer. We are dependent upon the personal efforts and commitment of Willem Duyvesteyn, our CTO, a director and significant shareholder of our company, for the continued development of new extractive technologies related to scandium and other rare and specialty metals production. The loss of the services of Mr. Duyvesteyn will likely limit our ability to use or continue the development of such technologies, which would remove the potential competitive and economic benefit of such technologies, which conceivably could render our planned projects uneconomic if prevailing commodity prices are not sufficiently strong or reliable.

Our operations are subject to losses due to exchange rate fluctuation. We maintain accounts in Canadian and U.S. currency. Our equity financings have to date been priced in Canadian dollars, however all of our material projects and non-cash assets are located outside of Canada and require regular currency conversions to local currencies where such projects and assets are located. Our operations are accordingly subject to foreign currency fluctuations and such fluctuations may materially affect our financial position and results. We do not engage in currency hedging activities.

10

Without additional funding, we will not be able to carry out our business plan, and if we raise additional funding existing securityholders may experience dilution. As an exploration stage mining company, we do not currently earn any revenue from mining operations on our principal properties. In order to continue our exploration activities and to meet our obligations under our joint venture agreement on the Nyngan Scandium Project and contemplated restart of the Springer Mine, we will need to raise additional funds. There can be no assurance that we will be able to obtain necessary financing in a timely manner on commercially acceptable terms. Recently, we have relied entirely on the sale of our securities to raise funding for operations. Our ability to continue to raise funds from the sale of our securities is subject to significant uncertainty due to volatility in the mineral exploration marketplace. If we are unable to raise funds from the sale of our securities, then we likely will not be able to carry out our business plan of achieving Scandium production, restart the Springer Mine or continue exploration activities on our current or future exploration properties.

We are subject to an extensive regulatory environment. Mining operations are subject to many different federal, state and local laws and regulations, including stringent environmental, health and safety laws. In the event we increase operations on our mining properties, it is possible that we will be unable to comply with current or future laws and regulations, which can change at any time. It is possible that changes to these laws will be adverse to any potential mining operations. Moreover, compliance with such laws may cause substantial delays and require capital outlays in excess of those anticipated, adversely affecting any potential mining operations. Our future mining operations, if any, may also be subject to liability for pollution or other environmental damage. It is possible that we will choose to not be insured against this risk because of high insurance costs or other reasons.

Our operations may be adversely affected by government and environmental regulations. Each phase of our operations are subject to government and environmental regulations promulgated by government agencies from time to time. A breach of such legislation may result in the imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments.

Environmental legislation is evolving in a manner which means that standards, enforcements, fines and penalties for non-compliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for us and our directors, officers and consultants. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of our operations.

Our activities are subject to extensive regulations governing various matters, such as management and use of toxic substances and explosives, management of natural resources, exploration, development of mines, production, exports, price controls, taxation, regulations concerning business dealings with indigenous peoples, labour standards on occupational health and safety, including mine safety, and historic and cultural preservation.

Failure to comply with applicable laws and regulations may result in civil or criminal fines or penalties, enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions, any of which could result in our incurring significant expenditures. We may also be required to compensate those suffering loss or damage by reason of a breach of such laws, regulations or permitting requirements. It is also possible that future laws and regulations, or more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expense, capital expenditures, restrictions on or suspension of our operations and delays in the exploration and development of our mineral properties

Our operations are subject to the inherent risk associated with mineral exploration activities. Mineral exploration activities and, if warranted, development activities generally involve a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Environmental hazards, industrial accidents, unusual or unexpected geological formations, fires, power outages, labour disruptions, flooding, explosions, cave-ins, land-slides and the inability to obtain suitable or adequate machinery, equipment or labour are other risks involved in the operation of mines and the conduct of exploration programs. Operations and activities in which we have a direct or indirect interest will be subject to all the hazards and risks normally incidental to exploration, development and production of precious and base metals, any of which could result in work stoppages, damage to or destruction of mines, if any, and other producing facilities, damage to life and property, environmental damage and possible legal liability for any or all damage. We may become subject to liability for certain hazards which we cannot insure against or which we may elect not to insure against because of premium costs or other reasons. The payment of such liabilities may have a material, adverse effect on our financial position. At the present time, we do not conduct any mining operations and none of our properties are under development, and, therefore, we do not carry insurance to protect us against certain inherent risks associated with mining. There is no assurance that the foregoing risks and hazards will not result in damage to, or destruction of, our mineral properties, personal injury or death, environmental damage, delays in our exploration or development activities, costs, monetary losses and potential legal liability and adverse governmental action, all of which could have a material and adverse effect on our future cash flows, earnings, results of operations and financial condition.

11

Calculations of mineralized material are estimates only, subject to uncertainty due to factors including metal prices, inherent variability of the ore, and recoverability of metal in the mining process. The estimating of mineral mineral resources under Canadian guidelines is a subjective process and the accuracy of such estimates is a function of the quantity and quality of available data and the assumptions used and judgments made in interpreting engineering and geological information. There is significant uncertainty in any estimate of mineral resources under Canadian guidelines, and the actual deposits encountered and the economic viability of mining a deposit may differ materially from our estimates. Estimated mineral resources under Canadian guidelines may have to be recalculated based on changes in metal prices, further exploration or development activity or actual production experience. This could materially and adversely affect estimates of the volume or grade of mineralization, estimated recovery rates or other important factors that influence estimates of mineral resources under Canadian guidelines. Any material change in the quantity of mineralization, grade or stripping ratio may affect the economic viability of our properties. In addition, there can be no assurance that metal recoveries in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

Economic conditions and fluctuation and volatility of stock price may negatively impact shareholder value. The market price of our common shares is volatile. If investors’ interest in the sector in which we operate declines, the price for our common shares would likely also decline. In addition, trading volumes in our common shares can be volatile and if the trading volume of our common shares experiences significant changes, the price of our common shares could be adversely affected. The price of our common shares could also be significantly affected by other factors, many of which are beyond our control.

Our ability to raise capital may be impacted by market conditions, which have been characterized over the last 3 years by ongoing uncertainty and volatility in the global credit and financial markets. These ongoing conditions may, among other things, make it more difficult to obtain, or increase the cost of obtaining, capital and financing for our operations. Our access to additional capital may not be available on terms acceptable to us or at all.

Our common stock is thinly traded and the market price is subject to volatility. The trading market for our common shares is not always liquid. The market price of our common shares is volatile, and has ranged from a high of Cdn.$0.36 and a low of Cdn.$0.07 during the twelve month period ended April 13, 2012. Although our common shares trade on the Toronto Stock Exchange, the volume of common shares traded at any one time can be limited, and, as a result, there may not be a liquid trading market for our common shares.

We may be dependant on joint venture partners for the development of certain properties. We are currently in dispute proceedings with our joint venture partner on the Nyngan project. If we are successful at establishing our joint venture interest in the project, our interest in the project will thereafter be subject to the risks normally associated with the conduct of joint ventures. The existence or occurrence of one or more of the following circumstances and events could have a material adverse impact on our profitability or the viability of the interests held through joint ventures, which could have a material adverse impact on our future cash flows, earnings, results of operations and financial condition: (i) disagreement with joint venture partners on how to proceed with exploration programs and how to develop and operate mines efficiently; (ii) our inability or the inability of joint venture partners to meet their obligations to the joint venture or third parties; and (iii) litigation between joint venture partners regarding joint venture matters.

12

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of our common shares by the selling shareholders in this offering. All proceeds from the sale of the common shares will be received by the selling shareholders. However, we will receive cash upon the exercise of the warrants to acquire 3,750,000 common shares, which will be applied towards ongoing operations and general working capital. The conversion of the convertible debentures to acquire 10,000,000 common shares will reduce our debt obligation.

DETERMINATION OF OFFERING PRICE

The selling shareholders may offer and sell their common shares at such times and in such manner as they may determine. The types of transactions in which the common shares are sold may include privately negotiated transactions or transaction at the market. Such transactions may or may not involve brokers or dealers. The selling shareholders do not have an underwriter or coordinating broker acting in connection with the proposed sale of the common shares. We will pay certain transfer agent expenses, our legal and audit expenses, SEC filing fees and other minor incidental expenses in connection with offers and sales by the selling shareholders. We will not pay for other expenses of the selling shareholders such as broker dealer or underwriter commissions.

Any commissions or profits that broker-dealers or agents receive from the resale of the shares they purchase may be deemed to be underwriting commissions and discounts under the federal securities rules and regulations. Any selling shareholder, broker-dealer or agent that is involved in this offering may be deemed to be an underwriter. None of the selling security holders are broker-dealers nor are any affiliates of broker-dealers.

SELLING SHAREHOLDERS

The selling shareholders named in this prospectus are offering 10,000,000 common shares underlying convertible debentures and 3,750,000 common shares underlying warrants. The convertible debentures and warrants were acquired by the selling shareholders in an offering completed by us in February of 2012. The offering resulted in the issuance of a $1,000,000 promissory note, a $2,000,000 convertible debenture, and 3,750,000 warrants. The convertible debenture is convertible into 10,000,000 common shares of the Company at a price of $0.20 per share for a period of 18 months from the closing date. Each warrant entitles the subscriber to purchase one common share of the Company at a price of $0.20 for a period of 24 months from the closing date. The securities were offered and sold to the selling shareholders in a private transaction pursuant to the exemption from registration provided by Regulation D of the Securities Act.

The following table provides as of the date of this prospectus certain information regarding the beneficial ownership of our common shares held by each of the selling shareholders, as currently known by us based on an examination of our records including the shareholder ledger maintained by our transfer agent.

Name of Selling Shareholder |

Shares Owned Prior to this Offering |

Percent of

Total Issued and Outstanding Owned Prior to this Offering |

Number of Shares to be Offered |

Number of Shares

Owned by Selling Shareholders After Offering |

| CR Magnetics Inc. | 13,000,000(1) | 8.6% | 13,000,000 | Nil |

| Spartan Securities Group Ltd. | 750,000(2) | 0.5% | 750,000 | Nil |

(1) Represents 10,000,000 common shares that may be acquired by

the Selling Shareholder upon exercise of convertible debentures exercisable at

any time until August 15, 2013 and 3,000,000 common shares that may be acquired

by the Selling Shareholder upon exercise of warrants exercisable at any time

until February 15, 2014.

(2) Represents 750,000 common shares that may be

acquired by the Selling Shareholder upon exercise of warrants exercisable at any

time until February 15, 2014.

13

Each selling shareholder may offer all or part of the shares owned for resale from time to time. A selling shareholder is under no obligation, however, to sell any shares immediately pursuant to this prospectus, nor are the selling shareholders obligated to sell all or any portion of the shares at any time. Therefore, no estimate can be given by us as to the number of common shares that will be sold pursuant to this prospectus or the number of common shares that will be owned by the selling shareholders upon termination of the offering.

To the best of our knowledge, the named parties in the table beneficially own and have sole voting and investment power over all shares or rights to their shares. Also in calculating the number of common shares that will be owned upon completion of this offering, we have assumed that none of the selling shareholders sells common shares not being offered in this prospectus or purchases additional common shares and have assumed that all common shares being offered by the selling shareholders are sold.

Except as indicated above, none of the selling shareholders or their beneficial owners has had a material relationship with us other than as a shareholder at any time within the past three years, has ever been one of our officers or directors, or is a broker-dealer registered under the United States Securities Exchange Act of 1934, as amended or an affiliate of such a broker-dealer.

We may require the selling shareholders to suspend the sales of the securities offered by this prospectus upon the occurrence of any material event that requires the changing of statements in this prospectus or related registration statement in order to make statements in those documents not misleading. We will file a post-effective amendment to the registration statement to reflect any such material changes.

PLAN OF DISTRIBUTION

Offering by the Selling Shareholders

The selling shareholders may sell their common shares in privately negotiated transactions. The selling shareholders may sell their common shares directly to purchasers or to or through broker-dealers, which may act as agents or principals. These broker-dealers may receive compensation in the form of discounts, concessions or commissions from the selling shareholders. They may also receive compensation from the purchasers of common shares for whom such broker-dealers may act as agents or to whom they sell as principal, or both. None of the selling security holders are broker-dealers nor are any affiliates of broker-dealers.

Duties of the Selling Shareholders

The sale of the common shares covered by this prospectus may be effected directly to purchasers by the selling shareholders from time to time on the Toronto Stock Exchange at prevailing market prices. The resale may also be made in a privately negotiated transaction. The common shares may be sold by one or more of the following methods: (a) a block trade in which the broker or dealer so engaged will attempt to sell the common shares as an agent, but may position and resell a portion of the block as principal to facilitate the transaction; (b) purchases by a broker or dealer as principal and resales by that broker or dealer for its own account pursuant to this prospectus; (c) an over-the-counter sale in accordance with the rules applicable to such sales; (d) in ordinary brokerage transactions or transactions in which the broker solicits purchasers; (e) in transactions otherwise than on any stock exchange or in the over-the-counter market, including privately negotiated transactions; and (f) pursuant to Rule 144. Any of these transactions may be effected at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at varying prices determined at the time of sale or at negotiated or fixed prices, in each case as determined by the selling shareholder, or by agreement between the selling shareholder and underwriters, brokers, dealers or agents, or purchasers.

In effecting sales, brokers or dealers engaged by the selling shareholders may arrange for other brokers or dealers to participate. Brokers or dealers may receive commissions or discounts from the selling shareholders in amounts to be negotiated prior to the sale. The selling shareholders, and any brokers, dealers or agents that participate in the distribution of the common shares may be deemed to be underwriters, and any profit on the sale of the common shares by them and any discounts, concessions or commissions received by any underwriters, brokers, dealers or agents may be deemed to be underwriting discounts and commissions under the Securities Act.

14

Under the securities laws of certain states, the shares may be sold in such states only through registered or licensed brokers or dealers. In addition, in certain states the shares may not be sold unless they have been registered or qualified for sale in that state or an exemption from registration or qualification is available and is met.

We have advised the selling shareholders that while they are engaged in a distribution of the common shares included in this prospectus they are required to comply with Regulation M promulgated under the Securities Exchange Act of 1934, as amended. With certain exceptions, Regulation M precludes the selling shareholders, any affiliated purchasers, and any broker-dealer or other person who participates in such distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the subject of the distribution until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price of a security in connection with the distribution of that security. All of the foregoing may affect the marketability of the shares offered hereby in this prospectus.

DESCRIPTION OF SECURITIES TO BE REGISTERED

Common Shares

Our authorized capital stock consists of an unlimited number of common shares without par value.

As at May 1, 2012, 150,678,713 common shares were issued and outstanding. The holders of the common shares are entitled to vote at all meetings of shareholders of common shares, to receive dividends if, as and when declared by the directors and to participate rateably in any distribution of property or assets upon our liquidation, winding-up or other dissolution. The common shares carry no pre-emptive rights, conversion or exchange rights, redemption, retraction, repurchase, sinking fund or purchase fund provisions. There are no provisions requiring the holder of common shares to contribute additional capital and no restrictions on the issuance of additional securities by us. There are no restrictions on the repurchase or redemption of common shares by us except to the extent that any such repurchase or redemption would render us insolvent pursuant to the British Columbia Business Corporations Act.

Transfer Agent

Our transfer agent is Olympia Trust Company, located at Suite 1003, 750 West Pender Street, Vancouver, British Columbia, V6C 2T8.

INTEREST OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common shares was employed on a contingency basis or had, or is to receive, in connection with the offering, a substantial interest, directly or indirectly, in the Company or any of our parents or subsidiaries. Nor was any such person connected with the registrant or any of our parents, subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer or employee.

Morton & Company will pass on the validity of the Company’s common stock being offered pursuant to this registration statement.

The annual financial statements incorporated by reference into this prospectus have been audited by Davidson & Company LLP, an independent registered public accounting firm, to the extent and for the periods set forth in their report appearing elsewhere herein and in the registration statement, and are included in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

15

INFORMATION WITH RESPECT TO THE REGISTRANT

The following documents or extracts of documents, which previously have been filed by the Company with the Commission, are incorporated herein by reference and made a part of this prospectus:

| (a) |

The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, filed with the Commission on February 14, 2012; |

| (b) |

The Company’s Amendment to Annual Report on Form 10-K/A for the fiscal year ended December 31, 2011, filed with the Commission on April 30, 2012; |

| (c) |

The Company’s Current Reports on Form 8-K filed with the Commission on February 22, 2012, and March 6, 2012 ; and |

| (d) |

All other reports filed by the Company pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") since the end of the fiscal year covered by the Annual Report referred to in (a) above and up to the date of this prospectus. |

The above documents will be provided to each person, including any beneficial owner, to whom a prospectus is delivered, upon written or oral request, without charge, by contacting Mr. George Putnam, President, at the address below.

EMC Metals Corp.

1430 Greg Street, Suite 501

Sparks,

Nevada, 89431

Telephone: (775) 355-9500

Website: www.emcmetals.com

The public may read and copy materials filed with the Commission at the Commission’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. Filings with the Commission may also be viewed at www.sec.gov and linking to the EDGAR database.

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITES

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

FINANCIAL STATEMENTS

The following Consolidated Financial Statements are incorporated by reference to this registration statement:

| Description |

| Consolidated Financial Statements for the years ended December 31, 2011 and December 31, 2010 and the Report of Independent Registered Public Accounting Firm thereon(1) |

(1) Incorporated by reference to the Form 10-K of the Company, filed with the SEC on February 14, 2012.

16

PART II. INFORMATION NOT REQUIRED IN PROSPECTUS

OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

The estimated expenses of the offering, whether or not all shares are sold, all of which are to be paid by the registrant, are as follows:

| Item | Amount |

| (USD) | |

| SEC Registration Fee | $315.15 |

| EDGAR Filing Expenses | $900.00 |

| Transfer Agent Fees | $400.00 |

| Legal Fees | $20,000.00 |

| Accounting Fees | $5,000.00 |

| Miscellaneous | $500.00 |

| Total | $22,115.15 |

INDEMNIFICATION OF DIRECTORS AND OFFICERS

As authorized by Section 160 of the Business Corporations Act (British Columbia), we may indemnify our officers and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment in a civil, criminal or administrative action or proceeding to which the person is made a party, so long as such persons acted honestly and in good faith and in a manner in which they reasonably believed to be in the best interests of the Company. If the legal proceeding, however, is by or in our right, the director or officer may not be indemnified in respect of any claim, issue or matter as to which he is adjudged to be liable for negligence or misconduct in the performance of his duty to us unless a court determines otherwise.

Under British Columbia law, corporations may also purchase and maintain insurance on behalf of any person who is or was a director or officer (or is serving at the request of the Company as a director or officer of another corporation) for any liability asserted against such person and any expenses incurred by him in his capacity as a director or officer.

Our corporate articles provide that subject to the provisions of the Business Corporations Act (British Columbia), we will indemnify our directors and former directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by him or them in a civil, criminal or administrative action or proceeding to which they are a party by reason of their role as a director of the company Such indemnification shall continue as to an indemnitee who has ceased to be a director or officer of the Company and shall enure to the benefit of the indemnitee’s heirs, executors and administrators.

The effect of these provisions is potentially to indemnify the Company’s directors and officers from all costs and expenses of liability incurred by them in connection with any action, suit or proceeding in which they are involved by reason of their affiliation with the Company.

RECENT SALES OF UNREGISTERED SECURITIES

During the past three years, the Company has sold the following securities which were not registered under the Securities Act of 1933, as amended:

On February 15, 2012, we completed a USD$3,000,000 brokered secured loan financing. The loan has a maturity date of 18 months from the closing date and interest is payable monthly in arrears at a rate of 7% per annum. The sole lender may convert a maximum of USD$2,000,000 of the principal amount of the loan into 10,000,000 common shares of the Company. In connection with the loan, the Company issued 3,000,000 warrants to the lender, each warrant exercisable into one common share of the Company at an exercise price of CAD$0.20 per share for a period of 24 months from the closing date. The Company also issued 750,000 agent’s warrants to the agent. Each agent’s warrant is exercisable into one common share of the Company at an exercise price of CAD$0.20 per share for a period of 24 months from the closing date. The securities were offered and sold in reliance on the exemptions from registration available to accredited investors under Rule 506 of Regulation D.

17

On December 3, 2010 we completed a private placement of 18,929,740 common shares at a price of $0.19 per share for proceeds of $3,596,651. The investors were Kudu Partners LLP and twenty-seven other private arm’s length investors and investment funds. The securities were offered and sold in reliance on the exemptions from registration available under Regulation S and to accredited investors under Rule 506 of Regulation D.

On November 25, 2010 we completed a private placement of 6,100,000 units at a price of $0.10 per unit for gross proceeds of $610,000. Each unit was comprised of one common share and one-half of a warrant. Each full warrant entitles the holder to acquire one common share at a price of $0.18 per share until November 25, 2011. The investors were Kudu Partners LLP, Barry Davies, George Putnam, William Sheriff, John Thompson and seven other private arm’s length investors. The securities were offered and sold in reliance on the exemptions from registration available under Regulation S and to accredited investors under Rule 506 of Regulation D.

On June 30, 2010, we completed a private placement of 2,947,702 units at a price of $0.10 per unit for gross proceeds of $294,770. Each unit was comprised of one common share and one-half of a warrant. Each full warrant entitled the holder to acquire one additional common share at a price of $0.18 per share until June 30, 2011. The investors were Kudu Partners LLP, Barry Davies, George Putnam and four other private arm’s length investors and investment funds. The securities were offered and sold in reliance on the exemptions from registration available under Regulation S and to accredited investors under Rule 506 of Regulation D.

On January 27, 2010, we completed a private placement of 2,275,000 units at a price of $0.20 per unit for gross proceeds of $455,000. Each unit consisted of one common share and one-half of a warrant. Each full warrant entitled the holder to purchase one common share at a price of $0.25 per share until January 27, 2011. The investors were William Sheriff, Peter Bosse and five other private arm’s length investors and investment funds. The securities were offered and sold in reliance on the exemptions from registration available under Regulation S and to accredited investors under Rule 506 of Regulation D.

On December 16, 2009, we acquired of all of the issued and outstanding capital stock of The Technology Store, Inc. in consideration for 19,037,386 common shares at a deemed price of $0.10 per share issued to Willem Duyvesteyn and Irene Duyvesteyn. The securities were offered and sold in reliance on the exemption from registration available to two accredited investors under Rule 506 of Regulation D.

On November 17, 2009, we completed a private placement of 13,000,000 units at a price of $0.08 per unit for gross proceeds of $1,040,000. Each unit consisted of one common share and one-half of a warrant. Each full warrant entitled the holder to purchase one common share at a price of $0.15 per share until November 17, 2010. The investors were Kudu Partners LLC, Peter Bosse, William Sheriff, and seven other private arm’s length investors. The securities were offered and sold in reliance on the exemptions from registration available under Regulation S and to accredited investors under Rule 506 of Regulation D.

On October 13, 2009, we issued 500,000 common shares at a deemed price of $0.08 per share to Breakwater Resources Ltd. pursuant to a purchase and sale agreement in consideration for a 100% interest in the Fostung property. The securities were offered and sold in reliance on the exemption from registration available under Regulation S.

In August 27, 2009 we completed a private placement of 1,500,000 units at a price of $0.10 per unit for gross proceeds of $150,000. Each unit consisted of one common share and one-half of a warrant. Each full warrant entitled the holder to purchase one common share at a price of $0.15 per share until August 27, 2010. The sole investor was Kudu Partners LLC. The securities were offered and sold in reliance on the exemption from registration available to an accredited investor under Rule 506 of Regulation D.

On May 13, 2009, we issued 89,254 common shares at a price of $0.11 per share in connection with a settlement with a former consultant to one of our subsidiaries. The securities were offered and sold in reliance on the exemption from registration available to an accredited investor under Rule 506 of Regulation D.

18

EXHIBITS

| Exhibit | Description |

| 3.1* | Certificate of Incorporation, Certificate of Name Change, Notice of Articles |

| 3.2* | Corporate Articles |

| 5.1 | Opinion of Morton & Company |

| 10.1* | 2008 Stock Option Plan |

| 10.3** | Stock Purchase Agreement dated November 19, 2009 between EMC Metals Corp., Willem P.C. Duyvesteyn, and Irene G. Duyvesteyn |

| 10.4* | Exploration Joint Venture Agreement dated February 5, 2010 between EMC Metals Corp. and Jervois Mining Limited |

| 10.5* | Services Agreement between EMC Metals Corp. and George Putnam dated May 1, 2010 |

| 10.6* | Extension Agreement dated September 29, 2010 between EMC Metals Corp. and Jervois Mining Limited |

| 10.7* | Stock Purchase Agreement dated November 16, 2010 between EMC Metals Corp. and Golden Predator US Holding Corp. |

| 21.1* | List of Subsidiaries |

| 23.1 | Consent of Davidson & Company LLP |

| 23.2 | Consent of Maxel Franz Rangott (BSc.) |

| 23.3 | Consent of Bart Stryhas, PhD., CPG, of SRK Consulting |

| * |

Previously filed as exhibits to the Form 10 filed May 24, 2011 and incorporated herein by reference. |

| ** |

Previously filed as an exhibit to the Form 10/A filed July 22, 2011 and incorporated herein by reference. |

UNDERTAKINGS

The undersigned registrant hereby undertakes as follows:

| 1. |

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: | |

| (i) |

To include any prospectus required by section 10(a)(3) of the Securities Act of 1933; | |

| (ii) |

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the "Calculation of Registration Fee" table in the effective registration statement. | |

| (iii) |

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; | |

| 2. |

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. | |

| 3. |

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. | |

19

| 4. |

That, for the purpose of determining liability of the undersigned registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to purchaser: | |

| (a) |

Any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424; | |

| (b) |

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned registrant; | |

| (c) |

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of undersigned registrant; and | |

| (d) |

Any other communication that is an offer in the offering made by the undersigned registrant to purchaser. | |

| 5. |

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant's annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan's annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| 6. |

The undersigned registrant hereby undertakes to deliver or cause to be delivered with the prospectus, to each person to whom the prospectus is sent or given, the latest annual report to security holders that is incorporated by reference in the prospectus and furnished pursuant to and meeting the requirements of Rule 14a-3 or Rule 14c-3 under the Securities Exchange Act of 1934; and, where interim financial information required to be presented by Article 3 of Regulation S-X are not set forth in the prospectus, to deliver, or cause to be delivered to each person to whom the prospectus is sent or given, the latest quarterly report that is specifically incorporated by reference in the prospectus to provide such interim financial information. |

| 7. |

For purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b) (1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared effective. |

|