Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MERCURY SYSTEMS INC | d346661d8k.htm |

©

2012 Mercury Computer Systems, Inc.

Lazard Capital Markets

Kansas City, MO/Dallas, TX

Road Show

May 8, 2012

Mark Aslett

President & CEO

Kevin Bisson

SVP & CFO

Exhibit 99.1 |

©

2012 Mercury Computer Systems, Inc.

2

Forward-Looking Safe Harbor Statement

This presentation contains certain forward-looking statements, as that term is

defined in the Private Securities Litigation Reform Act of 1995, including those

relating to fiscal 2012 business performance and beyond and the Company’s plans for growth and improvement in profitability and cash flow. You

can identify these statements by the use of the words “may,” “will,”

“could,” “should,” “plans,” “expects,” “anticipates,” “continue,” “estimate,”

“project,” “intend,” “likely,” “probable,” and

similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual

results to differ materially from those projected or anticipated. Such risks and

uncertainties include, but are not limited to, general economic and business

conditions, including unforeseen weakness in the Company’s markets, effects of continued geopolitical unrest and regional conflicts,

competition, changes in technology and methods of marketing, delays in completing engineering

and manufacturing programs, changes in customer order patterns, changes in product

mix, continued success in technological advances and delivering technological innovations, continued funding of

defense programs, the timing of such funding, changes in the U.S. Government’s

interpretation of federal procurement rules and regulations, market acceptance of the

Company's products, shortages in components, production delays due to performance quality issues with outsourced components,

inability to fully realize the expected benefits from acquisitions and divestitures or delays

in realizing such benefits, challenges in integrating acquired businesses and

achieving anticipated synergies, changes to export regulations, increases in tax rates, changes to generally accepted accounting principles,

difficulties in retaining key employees and customers, unanticipated costs under

fixed-price service and system integration engagements, and various other factors

beyond our control. These risks and uncertainties also include such additional risk factors as are discussed in the Company's filings with the

U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the

fiscal year ended June 30, 2011. The Company cautions readers not to place undue

reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no

obligation to update any forward-looking statement to reflect events or circumstances

after the date on which such statement is made. Use of Non-GAAP (Generally

Accepted Accounting Principles) Financial Measures In addition to reporting financial

results in accordance with generally accepted accounting principles, or GAAP, the Company provides adjusted EBITDA

and free cash flow, which are non-GAAP financial measures. Adjusted EBITDA excludes

certain non-cash and other specified charges. Free cash flow is defined as cash

flow from operating activities less capital expenditures. In addition the use of a last twelve months (“LTM”) period is not in accordance

with GAAP. The LTM period presented is the mathematical addition of the results of the

fourth quarter of fiscal 2011 and the first, second and third quarters of fiscal

2012. The Company believes these non-GAAP financial measures are useful to help investors better understand its past financial

performance and prospects for the future. However, the presentation of adjusted EBITDA and

free cash flow is not meant to be considered in isolation or as a substitute for

financial information provided in accordance with GAAP. Management believes the adjusted EBITDA and free cash flow financial

measures assist in providing a more complete understanding of the Company’s underlying

operational results and trends, and management uses these measures along with the

corresponding GAAP financial measures to manage the Company’s business, to evaluate its performance compared to prior

periods and the marketplace, and to establish operational goals. A reconciliation of GAAP to

non-GAAP financial results discussed in this presentation is contained in the

Appendix hereto. |

©

2012 Mercury Computer Systems, Inc.

Introducing Mercury Computer Systems

•

MRCY on NASDAQ

•

Real-time digital image,

signal and sensor processing

•

Commercial-item company

unique business model

•

Focused on DoD priorities

•

Deployed on ~300 programs

with 25+ Primes

•

$229M FY11 revenues;

18% Adj. EBITDA margin;

750+ employees

•

Defense revenue 61%

growth (13% CAGR) FY07–

FY11

Best-of-breed provider of open, commercially developed

application ready and multi-INT subsystems for the ISR market

3 |

©

2012 Mercury Computer Systems, Inc.

4

•

FY12 Defense budget approved -

$530B base spending

•

FY13 Defense budget request announced -

$525B base spending

•

Budget Control Act reduced FYDP spend growth vs 2012 request

•

Budget Control Act Jan 2013 sequester

•

2012 election year

©

2012 Mercury Computer Systems, Inc.

Slower

growth

in

defense

spending

anticipated

over

next

5

years

4

Defense industry turning the page on a decade of war

Source: DOD Comptroller 2012 Budget Request |

©

2012 Mercury Computer Systems, Inc.

5

•

New DoD roles and missions announced

•

Smaller force structure to protect readiness

•

Increased investment in key areas e.g. ISR, EW

•

Build capacity and capability of international partners

•

Defense procurement reform also underway

©

2012 Mercury Computer Systems, Inc.

…

where there will be clear winners and losers

5

In the near term we believe the industry is entering

an 18 month transition period … |

©

2012 Mercury Computer Systems, Inc.

6

Mercury investment highlights

Pure-play C4ISR, EW and defense electronics company entrenched

on a diverse mix of programs aligned with DoD priorities

Best-of-breed provider of specialized sensor processing

subsystems to large defense Primes targeting platform upgrades

Increased ISR usage, shift to onboard processing and exploitation and

evolving EW threats driving greater demand for Mercury solutions

Well positioned to benefit from DoD procurement reform, which

is driving increased outsourcing by the large defense Primes

Well-defined strategy with a demonstrated track record of

double-digit defense revenue growth and improved profitability

Successful transformation has positioned the business for strong

organic growth augmented through strategic acquisitions |

Mercury has

strategically positioned its business to grow Growth strategy summary

1.

Expand our capabilities and offerings along sensor chain

2.

Expand market presence within defense electronics

3.

Continue to grow our customer and program base

4.

Capitalize on Prime outsourcing / supply chain consolidation

5.

Acquire complementary companies

7

©

2012 Mercury Computer Systems, Inc. |

©

2012 Mercury Computer Systems, Inc.

8

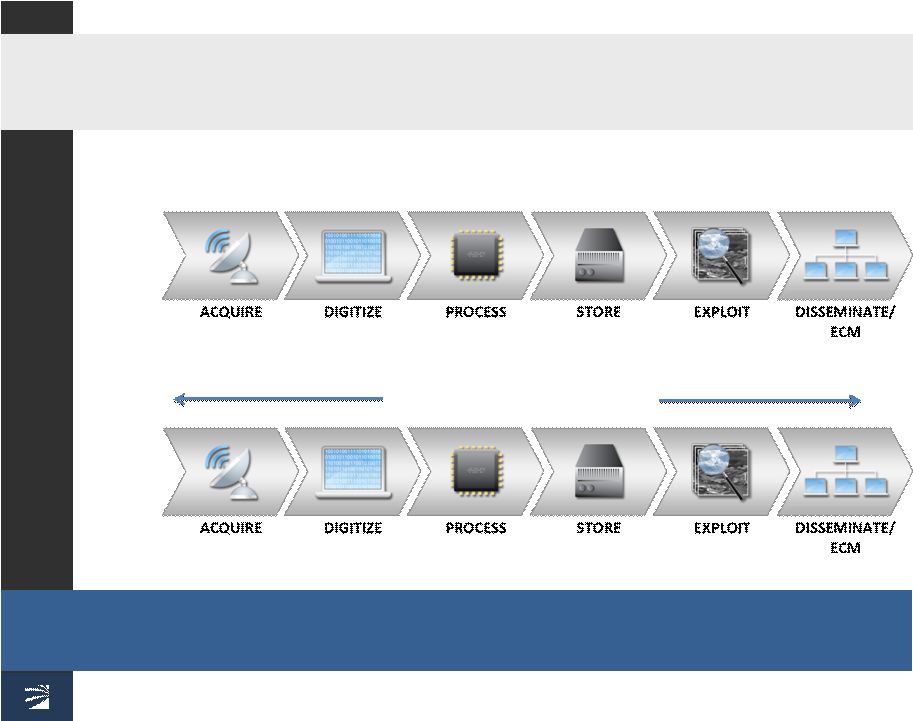

Historically, Mercury focused on one element of sensor chain

We are the leader in high-performance embedded computing

RACE++ Boards

From |

©

2012 Mercury Computer Systems, Inc.

9

We now view our market opportunity as providing end-to-end

open sensor processing subsystems –

a much larger opportunity

We are systematically growing our capabilities, services and

offerings along the sensor chain organically and by acquisition

Services

and Systems Integration

To

RACE++ Boards

From

Open Sensor Processing Subsystems |

©

2012 Mercury Computer Systems, Inc.

10

Mercury’s traditional market was narrowly defined

as airborne radar processing …

... limiting our growth potential within the C4ISR market

C4ISR

IMINT

C4I

RADAR

EW

EO/IR

$9,695M

25% |

©

2012 Mercury Computer Systems, Inc.

11

Since then, we have systematically broadened our

addressable market within C4ISR …

…

by investing in new products and capabilities

C4ISR

C4I

S

e

n

s

o

r,

P

r

o

g

r

a

m

a

n

d

P

l

a

t

f

o

r

m

A

g

n

o

s

t

i

c

RADAR

EO/IR

$9,695M

25%

$6,755M

17%

$7,801M

20%

$10,737M

28%

EW |

©

2012 Mercury Computer Systems, Inc.

12

We are deployed on 300+ programs with 25+ Primes

RADAR

EW

EO/IR –

C4I

BAMS

Global Hawk

BAMS

Global Hawk

SEWIP

SEWIP

AEGIS

AEGIS Ashore

AEGIS

AEGIS Ashore

Guardrail

Guardrail

Patriot

Patriot

Predator

Predator

Reaper

Gorgon Stare

Reaper

Gorgon Stare

F-16

F-16

JCREW 3.3

JCREW 3.3

ADAS

ADAS

Shadow

Shadow

Global Hawk

Global Hawk

F-35

F-35

F-35

F-35

F-16

F-16 |

©

2012 Mercury Computer Systems, Inc.

Aegis ballistic missile defense: SPY-1 BMD Radar

•

Countering rogue nations’

ballistic missile threats

•

Highest performance radar

processor Application Ready

Subsystem

•

19 ship sets booked FY08-11

•

$24M booked in FY11,

$75M+ booked to date

•

Additional 35 ship sets

scheduled through GFY16

•

AMDR pushout likely

•

Additional upside

Mercury’s largest single program in production to date

©

2012 Mercury Computer Systems, Inc.

13 |

©

2012 Mercury Computer Systems, Inc.

Program in production; FMS and US Army upgrade driving growth

Patriot missile defense: Next generation ground radar

•

Services-led design win –

Prime outsourcing example

•

Sophisticated radar

processor Application Ready

Subsystem

•

Production awards received

to date: $36M

–

UAE, Taiwan, Saudi Arabia

•

Potential future FMS awards

–

Up to 16 countries

•

MEADS funding termination

•

Major growth potential

beginning in GFY13 with US

Army Patriot upgrade

©

2012 Mercury Computer Systems, Inc.

14 |

©

2012 Mercury Computer Systems, Inc.

SEWIP Block 2: Countering new emerging peer threats

•

Naval surface fleet EW

upgrade: 100+ ships

•

Delivered best-of-breed EW

Application Ready Subsystem

•

Moving from EMD phase to

LRIP in next 12 months

•

Production begins GFY15

•

Upside opportunities with

Block 1 upgrade and Block 3

•

Lockheed and Raytheon

partnering on SEWIP Block 3

Strong partnership with Prime driving Mercury content expansion

©

2012 Mercury Computer Systems, Inc.

15 |

©

2012 Mercury Computer Systems, Inc.

JCREW I1B1 (3.3): Joint services CIED program of record

Software defined jammer to defeat roadside bombs

•

Program currently in EMD

(engineering) phase

•

Milestone C next official gate.

Signifies transition to Low Rate

Initial Production (LRIP)

•

LRIP and 1st year production

funded in GFY12 budget and

GFY13 budget request

•

JCREW I1B1 program of

record in FY13 budget

•

US Marine Corps req’ts:

–

Total : 3100 mounted,

790 man portable, 13 fixed sites

–

GFY13 : 1020 mounted,

790 man portable

Expect move from EMD phase into Low Rate Initial Production

Note: Mercury was not involved in prior generations

©

2012 Mercury Computer Systems, Inc.

16 |

©

2012 Mercury Computer Systems, Inc.

17

Gorgon Stare Increment 2

New program win

•

Increment 2

–

Total contract potential

$31-37M

–

$22M booked Q3 YTD FY12

–

Quick reaction capability;

delivery in 18 months

–

New onboard processor

and storage for advanced

wide area sensors

–

Potential upside: flight

systems and spares

•

Future Increments to GFY18

–

Processor upgrades

–

Onboard multi-INT fusion

–

PED improvements

Several opportunities for growth over the next 3-6 years

Several opportunities for growth over the next 3-6 years

17 |

©

2012 Mercury Computer Systems, Inc.

18

Program growth driver update

JCREW 3.3 (I1B1): Counter-IED

Program expected to transition from EMD phase to LRIP

Patriot: Missile Defense

Potential U.S. Army upgrades beginning in GFY13

Aegis: Ballistic Missile Defense

Well-defined upgrade provides foundational revenue

SEWIP: Naval Electronic Warfare

LRIP expected to begin GFY13

Gorgon Stare: Wide-area airborne surveillance

Received $22M for Increment 2 development |

©

2012 Mercury Computer Systems, Inc.

19

Embedded

computing consolidation

Primes reducing in-house engineering while

consolidating supply chain for subsystem

design & integration

Primes retaining platform system design & integration

RF component

/ assembly consolidation

•

Reduce risk given firm-fixed

price contracts

•

Address high-fixed cost

operating model

•

Increase success rate on new

programs and production

recompetes

•

Develop differentiated, more

affordable solutions with fewer

internal R&D dollars

•

Compress upgrade

development and deployment

cycles

•

Consolidate supply base at

subsystem level

Outsourcing could substantially increase our market

opportunity even with defense spending cuts

Mercury has strategically positioned its business to help |

©

2012 Mercury Computer Systems, Inc.

20

Exploitation

and

Fusion

Tailored feeds

directly to field

forces or ECM

RF acquisition targets:

RF transmitters / receivers

Power amplifiers

Synthesizers

DRFM

Mission

Computing

and

Embedded

Security

We are developing capabilities organically and are

looking to supplement that through acquisitions

ACS and MFS Acquisition Target Areas

We view our market opportunity as providing end-to-end,

open sensor processing subsystems to the Primes |

Positioned for

growth in a changing industry •

Focused on the right defense market segments

•

Well positioned on key programs and platforms

•

Capabilities help address today’s and tomorrow’s threats

•

Business model aligned with defense procurement reform

•

Outsourcing partner to the Primes for sensor subsystems

•

Strong defense revenue growth and improved profitability

•

Pursuing complementary acquisitions to accelerate growth

21

©

2012 Mercury Computer Systems, Inc. |

©

2012 Mercury Computer Systems, Inc.

Financial Overview |

©

2012 Mercury Computer Systems, Inc.

23

Defense revenue growth accelerating

Defense: 13% CAGR FY07-11

Notes:

•

FY07-10 figures adjusted for discontinued operations. |

©

2012 Mercury Computer Systems, Inc.

24

Profitability restored and improving

Notes:

•

FY07 figures are as reported in the Company’s fiscal 2007 Form 10K and have not been

restated for discontinued operations. •

FY08 –

FY11 figures are as reported in the Company’s fiscal 2011 Form 10K.

•

FY10 Earnings per Share of $1.22 were positively influenced by $0.68 from the partial

reversal of the valuation allowance against deferred tax assets and an effective FY10

tax rate benefit of approximately 5%. •

FY11 and LTM EPS includes the impact of 5.6M additional shares from our follow-on public

stock offering on February 16, 2011. |

©

2012 Mercury Computer Systems, Inc.

25

Adjusted EBITDA above pro forma target

Notes:

•

FY08 figures are as reported in the Company’s fiscal 2010 Form 10K. FY09-11 figures

are as reported in the Company’s fiscal 2011 Form 10K. •

Adjusted EBITDA excludes interest income and expense, income taxes, depreciation,

amortization of acquired intangible assets, restructuring expense, impairment of

long-lived assets, acquisition and other related expenses, and stock-based compensation costs. |

©

2012 Mercury Computer Systems, Inc.

26

Generating healthy free cash flow from operations

•

Engineering and supply

chain transformation

–

Engineering methods

–

Investments in DFM

–

Operational efficiencies

–

Reduced lead times

–

Improved cost of quality

–

Outsourced manufacturing

Note:

•

Free cash flow is defined as cash provided by operating activities less capital

expenditures. Efficient working capital

platform supports growth |

©

2012 Mercury Computer Systems, Inc.

27

Balance sheet poised for investment

No short and long term debt

Other financing sources available:

$500M Shelf Registration

•

$35M Operating line of credit

(no drawdowns) |

©

2012 Mercury Computer Systems, Inc.

28

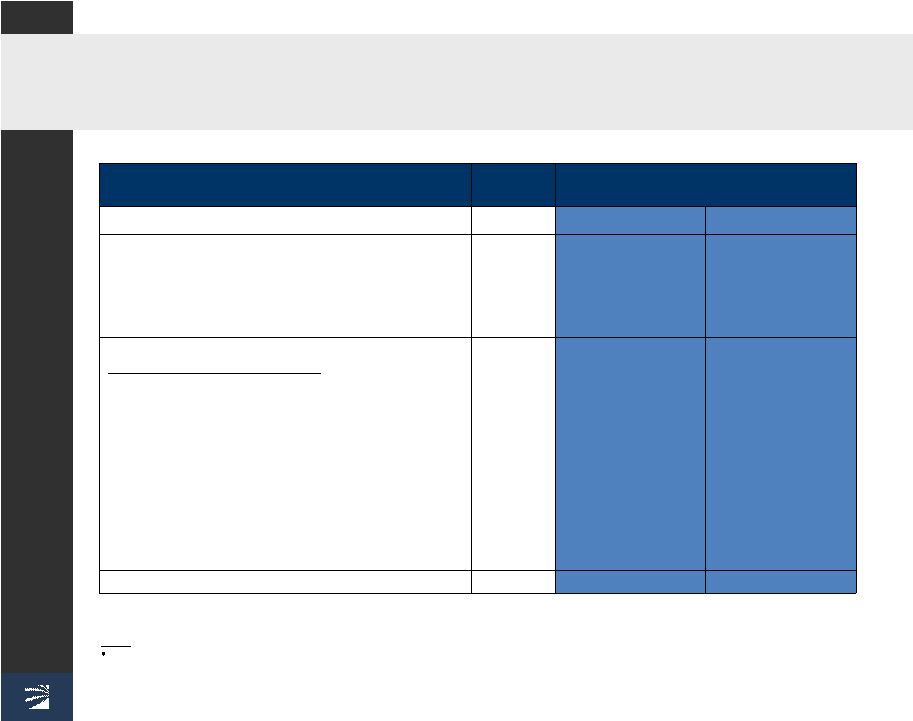

Performing at target business model

•

ACS : MFS LTM revenue split

92% : 8% respectively

•

High mix, low volume

•

R&D delivering significant

added value and returns

•

Increased lower margin

engineering services and

systems integration

•

Services-led design wins lead

to long-term production

subsystem annuity revenues

(1)

Other OPEX includes Amortization of Acquired Intangible Assets, Impairment of Goodwill and

Long Lived Assets, Restructuring, Gain on Sale of Long Lived Assets, and Acquisition

Costs and Other Related Expenses. |

©

2012 Mercury Computer Systems, Inc.

29

Q3 YTD FY12 year over year comparison (GAAP)

GAAP

Q3 YTD FY12

Q3 YTD FY11

Delta

Total Revenue ($M)

184

167

10%

Defense Revenue ($M)

173

127

36%

Gross Margin

% Revenue

57.5%

56.8%

70 bps

Operating Expenses ($M)

82

76

6

Operating Income ($M)

% Revenue

24

13.1%

19

11.2%

5

1.9 pts

Adj EBITDA

40

31

9

EPS (Continuing Operations)

$0.56

$0.57

($0.01)

Op Cash Flow ($M)

28

23

5

Bookings

Total Backlog ($M)

12-mo Backlog($M)

170

105

95

140

86

70

22%

23%

35%

Notes:

Q3 YTD FY12 tax rate 33%, Q3 YTD FY11 tax rate 29% |

©

2012 Mercury Computer Systems, Inc.

30

Q4 FY12 guidance

Q4 FY11

Actual

Quarter Ending June 30, 2012

Low

High

Revenue

$61

$60

$66

GAAP EPS (Continuing)

$0.14

$0.04

$0.10

Adj EBITDA

$10.1

$7.0

$9.5

Note -

Adj EBITDA Adjustments:

Net income (Continuing)

4.3

1.3

3.0

Interest (income) expense, net

0.0

0.0

0.0

Income tax (benefit) expense

2.3

0.7

1.6

Depreciation

1.7

2.3

2.3

Amortization of acquired intangible assets

0.7

1.1

1.1

Impairment of long-lived assets

0.2

0.0

0.0

Fair value adjustments from purchase accounting

(0.4)

(0.1)

(0.1)

Stock-based compensation cost

1.4

1.6

1.6

Adj EBITDA

$10.1

$7.0

$9.5

Notes:

Fiscal 2011 and 2012 EPS includes the impact of 5.6M additional shares from our follow-on

public stock offering on February 16, 2011. |

©

2012 Mercury Computer Systems, Inc.

31

FY12 full year financial guidance

•

Total revenue growth of 7% -

9% ($244 -

$250 million)

•

Defense revenue growth of approximately 30% ($230 -

$235 million)

•

Gross margin of approximately 55%

•

GAAP EPS of $0.60 to $0.66 per share

•

Adjusted EBITDA above 18% target business model |

©

2012 Mercury Computer Systems, Inc.

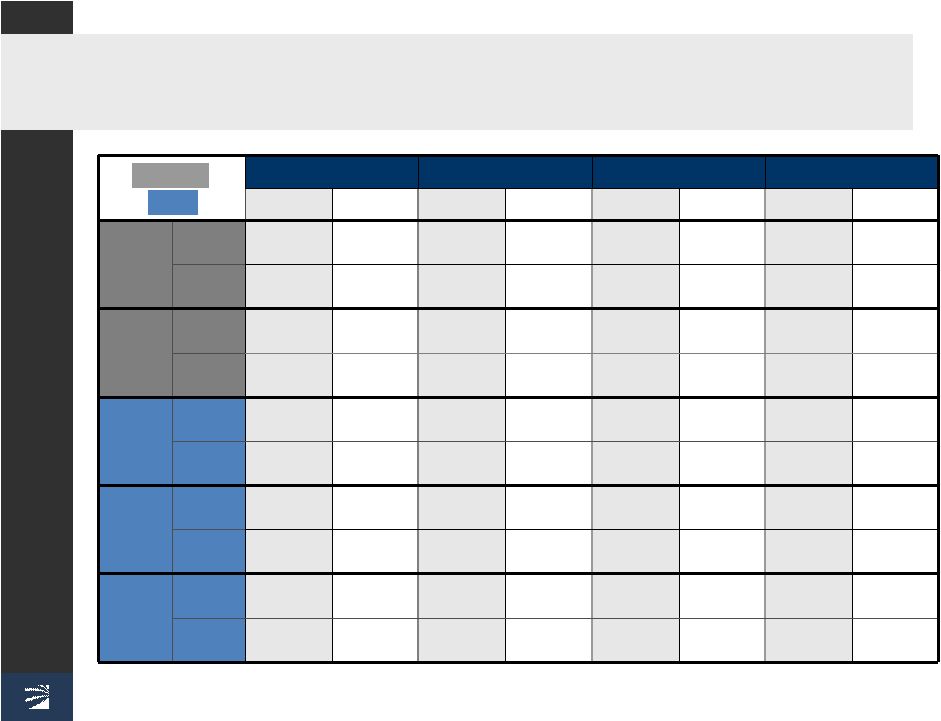

32

Guidance: Strong performance track record

Q1

Q2

Q3

Q4

Reported

Guidance

Reported

Guidance

Reported

Guidance

Reported

Guidance

2008

Revenue

($M)

49.2

48.0

52.6

51.0

56.5

53.0-55.0

55.2

53.0-56.0

EPS ($)

0.09

(0.08)

0.04

(0.05)

0.04

(0.04)-0.00

0.01

(0.05)-0.01

2009

Revenue

($M)

49.1

47.0-49.0

50.7

47.0-49.0

50.6

48.0-50.0

48.4

46.0-48.0

EPS ($)

0.07

(0.07)-(0.03)

0.03

(0.05)-0.00

0.20

0.05-0.09

0.13

0.05-0.08

2010

Revenue

($M)

47.4

43.0-45.0

45.2

40.0-42.0

43.6

41.0-43.0

63.6

58.0-60.0

EPS ($)

0.19

0.03-0.08

0.08

(0.08)-(0.04)

0.16

(0.15)-(0.11)

0.77

0.25-0.28

2011

Revenue

($M)

52.1

48.0-50.0

55.5

54.0-55.0

59.9

58.0-60.0

61.2

57.0-59.0

EPS ($)

0.16

0.03-0.06

0.22

0.10-0.12

0.20

0.16-0.18

0.14

0.11-0.13

2012

Revenue

($M)

49.1

54.0-56.0

68.0

67.0-69.0

67.0

65.0-68.0

60.0-66.0

EPS ($)

0.09

0.10-0.12

0.30

0.24-0.27

0.17

0.09-0.11

0.04-0.10

Non-GAAP

GAAP |

•

Strong bookings growth and rebuilding backlog

•

Defense revenue growth accelerating

•

Profitability restored and improving

•

Generating healthy free cash flows from operations

•

Scalable working capital platform

•

Strong balance sheet with no debt

•

Performing at target business model

Financial summary

33

©

2012 Mercury Computer Systems, Inc. |

©

2012 Mercury Computer Systems, Inc.

Appendix |

©

2012 Mercury Computer Systems, Inc.

35

Adjusted EBITDA reconciliation

Years Ended June

30,

(000'S)

2008

2009

2010

2011

LTM

Income (loss) from continuing operations

$ (4,437)

$ 7,909

$ 28,069

$ 18,507

$ 21,207

Interest expense (income), net

(3,129)

492

(151)

45

10

Income tax expense (benefit)

3,710

109

(9,377)

8,060

10,802

Depreciation

7,372

5,640

5,147

6,364

7,454

Amortization of acquired intangible assets

5,146

2,414

1,710

1,984

3,336

Restructuring

4,454

1,712

231

—

—

Impairment of long-lived assets

561

—

211

150

150

Acquisition costs and other related expenses

—

—

—

412

768

Fair value adjustments from purchase accounting

—

—

—

(219)

(612)

Stock-based compensation costs

8,848

4,582

4,016

5,580

6,552

Adjusted EBITDA

$ 22,525

$ 22,858

$ 29,856

$ 40,883

$ 49,667

|

©

2012 Mercury Computer Systems, Inc.

36

Free cash flow reconciliation

Years Ended June

30

2007

2008

2009

2010

2011

LTM

Cash flows from operating activities

$ (10,313)

$ 13,726

$ 11,199

$ 15,708

$ 31,474

$ 36,316

Capital expenditures

(8,109)

(4,625)

(4,126)

(7,334)

(8,825)

(9,927)

Free cash flow

$ (18,422)

$ 9,101

$ 7,073

$ 8,374

$ 22,649

$ 26,389 |