Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - ATLANTIC POWER CORP | a2209404zex-23_2.htm |

| EX-23.3 - EX-23.3 - ATLANTIC POWER CORP | a2209404zex-23_3.htm |

| EX-23.5 - EX-23.5 - ATLANTIC POWER CORP | a2209404zex-23_5.htm |

| EX-12.1 - EX-12.1 - ATLANTIC POWER CORP | a2209404zex-12_1.htm |

| EX-23.4 - EX-23.4 - ATLANTIC POWER CORP | a2209404zex-23_4.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on May 8, 2012

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ATLANTIC POWER CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| British Columbia, Canada (State or Other Jurisdiction of Incorporation or Organization) |

4900 (Primary Standard Industrial Classification Code Number) |

55-0886410 (I.R.S. Employer Identification Number) |

200 Clarendon St., Floor 25

Boston, Massachusetts 02116

(617) 977-2400

(Address, Including Zip Code, and Telephone Number, Including

Area Code, of Registrant's Principal Executive Offices)

Barry E. Welch

President and Chief Executive Officer

Atlantic Power Corporation

200 Clarendon St., Floor 25

Boston, Massachusetts 02116

(617) 977-2400

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

Laura Hodges Taylor, Esq.

Yoel Kranz, Esq.

Goodwin Procter LLP

Exchange Place

Boston, Massachusetts 02109

Tel: (617) 570-1000

Fax: (617) 523-1231

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of "larger accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Securities to be Registered |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee |

||

|---|---|---|---|---|

Convertible Unsecured Subordinated Debentures |

$125,000,000(1) | $14,325(3) | ||

Common Shares, no par value |

(2) | (3) | ||

|

||||

- (1)

- Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended, or the

Securities Act. Includes the offering price of the Debentures that may be purchased by the underwriter pursuant to its option to purchase additional debentures.

- (2)

- Represents

the number of common shares, no par value, issuable upon conversion of the debentures. Pursuant to Rule 416 under the Securities Act, the

common shares being registered hereby also include an indeterminate number of additional shares resulting from stock splits, dividends or similar transactions.

- (3)

- Pursuant to Rule 457(i) under the Securities Act, there is no additional filing fee with respect to the common shares issuable upon conversion of the debentures because no additional consideration will be received in connection with the exercise of the conversion privilege.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale of such securities is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED MAY 8, 2012

PROSPECTUS

Cdn$

% Series C Convertible Unsecured Subordinated Debentures due

We are selling Cdn$ aggregate principal amount of our % series C convertible unsecured subordinated debentures due (the "Debentures"), at a price of Cdn$1,000 per Cdn$1,000 principal amount of Debentures. The Debentures have a maturity date of and bear interest at an annual rate of % payable semi-annually in arrears.

Each Debenture will be convertible into our common shares at the option of the holder at any time prior to the close of business on the earlier of the maturity date and the business day immediately preceding the date specified by us for redemption of the Debentures at a conversion price of Cdn$ per common share, being a conversion rate of approximately common shares per Cdn$1,000 principal amount of Debentures, subject to adjustment in accordance with the trust indenture governing the terms of the Debentures. We will not receive any proceeds from the issuance of the common shares upon conversion of the Debentures.

The Debentures may not be redeemed by us on or before (except in certain limited circumstances involving a change in control). After and prior to , we may redeem the Debentures, in whole or in part, at a redemption price equal to their principal amount plus accrued and unpaid interest, provided that the volume weighted average price of our common shares on the Toronto Stock Exchange (the "TSX") for the 20 consecutive trading days ending five trading days preceding the date on which notice of redemption is given is not less than 125% of the conversion price. On or after and prior to the maturity date, we may redeem the Debentures, in whole or in part, at a price equal to their principal amount plus accrued and unpaid interest. See "Description of Debentures—Redemption and purchase."

The Debentures constitute a new issue of our securities for which there is currently no public market. As of March 31, 2012, we had $726.1 million of debt outstanding that ranks equal with or senior to the Debentures, and we expect to incur additional debt in the future. The amount at March 31, 2012 is comprised of $72.8 million outstanding under our revolving credit facility, $193.3 million of outstanding convertible debentures and $460.0 million of outstanding senior notes. In addition, as of March 31, 2012, our subsidiaries had $72.2 million of liabilities, all of which would rank structurally senior to the Debentures. Our outstanding common shares are listed on the TSX under the symbol "ATP" and on the New York Stock Exchange ("NYSE") under the symbol "AT." The last reported sale price of our common shares on May 7, 2012 on the TSX and the NYSE was Cdn$14.00 and $14.11 per common share, respectively. See "Exchange rate information" on page 22 for information regarding the exchange rate between Canadian dollars and U.S. dollars.

Investing in the Debentures involves risks. You should read the section entitled "Risk factors" beginning on page 14 of this prospectus for a discussion of certain risk factors you should consider before buying the Debentures.

Neither the Securities and Exchange Commission ("SEC") nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

Per Debenture |

Total | |||||

|---|---|---|---|---|---|---|---|

Public offering price |

Cdn$ | 1,000 | Cdn$ | ||||

Underwriting discount |

$ | $ | |||||

Proceeds (before expenses to us) |

$ | $ | |||||

The underwriters have the option to purchase up to an additional Cdn$ aggregate principal amount of Debentures from us at the public offering price less the underwriting discount.

Book-entry only certificates representing the Debentures offered by this prospectus will be issued in registered form to CDS Clearing and Depository Services Inc. ("CDS") or its nominee as registered global securities and will be deposited with CDS on the date of issue of the Debentures, which is expected to occur on or about , 2012 or such later date as we and the underwriters may agree, but in any event no later than , 2012.

The date of this prospectus is , 2012.

You should rely only on information contained in this document or to which we have referred you. We have not, and our underwriters have not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared or, for purchasers in Canada, the Canadian prospectus relating to this offering. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not, and the underwriters are not, making an offer to sell the securities in any jurisdiction where the offer or sale is not permitted. This document may only be used where it is legal to sell these securities.

As used in this prospectus, the terms "Atlantic Power," the "Company," "we," "our" and "us" refer to Atlantic Power Corporation, together with those entities owned or controlled by Atlantic Power Corporation, unless the context indicates otherwise. Unless otherwise noted, all references to "Cdn$" and "Canadian dollars" are to the lawful currency of Canada and all references to "$," "US$" and "U.S. dollars" are to the lawful currency of the United States. This prospectus includes our trademarks and other trade names identified herein. All other trademarks and trade names appearing in this prospectus are the property of their respective holders.

The following summary may not contain all the information that may be important to you or that you should consider before deciding to purchase any Debentures and is qualified in its entirety by the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus, especially the risks set forth under the heading "Risk factors" in this prospectus, as well as the financial and other information included or incorporated by reference herein, before making an investment decision.

Atlantic Power Corporation owns and operates a diverse fleet of power generation and infrastructure assets in the United States and Canada. Our power generation projects sell electricity to utilities and large industrial customers under long-term power purchase agreements, which seek to minimize exposure to changes in commodity prices. Our power generation projects in operation have an aggregate gross electric generation capacity of approximately 3,397 megawatts (or "MW") in which our ownership interest is approximately 2,141 MW. Our current portfolio consists of interests in 31 operational power generation projects across 11 states in the United States and two provinces in Canada and an 84-mile, 500 kilovolt electric transmission line located in California. We also have one 53 MW biomass project under construction in Georgia and one approximately 300 MW wind project under construction in Oklahoma. We also own a majority interest in Rollcast Energy, a biomass power project developer and a 14.3% common equity interest in Primary Energy Recycling Holdings LLC ("PERH"). Twenty-three of our projects are wholly-owned subsidiaries.

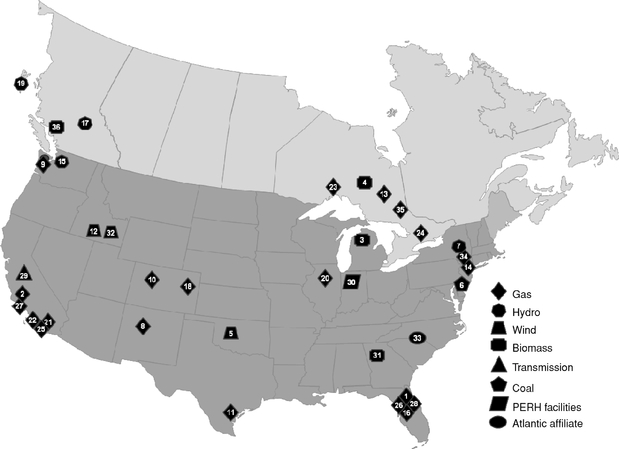

The following map shows the location of our currently-owned projects, including joint venture interests, across the United States and Canada:

1

| |

Project Name | Location | Fuel Type | Total MW | Ownership Interest | Net MW | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

1 |

Auburndale | Auburndale FL | Natural Gas | 155 | 100 | % | 155 | |||||||||

2 |

Badger Creek | Bakersfield CA | Natural Gas | 46 | 50 | % | 23 | |||||||||

3 |

Cadillac | Cadillac MI | Biomass | 40 | 100 | % | 40 | |||||||||

4 |

Calstock | Hearst ON | Biomass | 35 | 100 | % | 35 | |||||||||

5 |

Canadian Hills | El Reno OK | Wind | 298 | 99 | % | 295 | |||||||||

6 |

Chambers | Carney's Point NJ | Coal | 263 | 40 | % | 105 | |||||||||

7 |

Curtis Palmer | Corinth NY | Hydro | 60 | 100 | % | 60 | |||||||||

8 |

Delta Person | Albuquerque NM | Natural Gas | 132 | 40 | % | 53 | |||||||||

9 |

Frederickson | Tacoma WA | Natural Gas | 250 | 50 | % | 125 | |||||||||

| 10 | Greeley | Greeley CO | Natural Gas | 72 | 100 | % | 72 | |||||||||

| 11 | Gregory | Corpus Cristi TX | Natural Gas | 400 | 17 | % | 68 | |||||||||

| 12 | Idaho Wind | Twin Falls ID | Wind | 183 | 28 | % | 50 | |||||||||

| 13 | Kapuskasing | Kapuskasing ON | Natural Gas | 40 | 100 | % | 40 | |||||||||

| 14 | Kenilworth | Kenilworth NJ | Natural Gas | 30 | 100 | % | 30 | |||||||||

| 15 | Koma Kulshan | Concrete WA | Hydro | 13 | 50 | % | 6 | |||||||||

| 16 | Lake | Umatilla FL | Natural Gas | 121 | 100 | % | 121 | |||||||||

| 17 | Mamquam | Squamish BC | Hydro | 50 | 100 | % | 50 | |||||||||

| 18 | Manchief | Brush CO | Natural Gas | 300 | 100 | % | 300 | |||||||||

| 19 | Moresby Lake | Moresby Island BC | Hydro | 6 | 100 | % | 6 | |||||||||

| 20 | Morris | Morris IL | Natural Gas | 177 | 100 | % | 177 | |||||||||

| 21 | Naval Station | San Diego CA | Natural Gas | 47 | 100 | % | 47 | |||||||||

| 22 | Naval Training Ctr | San Diego CA | Natural Gas | 25 | 100 | % | 25 | |||||||||

| 23 | Nipigon | Nipigon ON | Natural Gas | 40 | 100 | % | 40 | |||||||||

| 24 | North Bay | North Bay ON | Natural Gas | 40 | 100 | % | 40 | |||||||||

| 25 | North Island | San Diego CA | Natural Gas | 40 | 100 | % | 40 | |||||||||

| 26 | Orlando | Orlando FL | Natural Gas | 129 | 50 | % | 65 | |||||||||

| 27 | Oxnard | Oxnard CA | Natural Gas | 49 | 100 | % | 49 | |||||||||

| 28 | Pasco | Tampa FL | Natural Gas | 121 | 100 | % | 121 | |||||||||

| 29 | Path 15 | California | Transmission | NA | 100 | % | NA | |||||||||

| 30 | PERH | Illinois | NA | NA | 14 | % | NA | |||||||||

| 31 | Piedmont | Barnsville GA | Biomass | 53 | 98 | % | 53 | |||||||||

| 32 | Rockland | American Falls ID | Wind | 80 | 30 | % | 24 | |||||||||

| 33 | Rollcast | Charlottesville NC | NA | NA | 60 | % | NA | |||||||||

| 34 | Selkirk | Bethlehem NY | Natural Gas | 345 | 18 | % | 64 | |||||||||

| 35 | Tunis | Tunis ON | Natural Gas | 43 | 100 | % | 43 | |||||||||

| 36 | Williams Lake | Williams Lake BC | Biomass | 66 | 100 | % | 66 | |||||||||

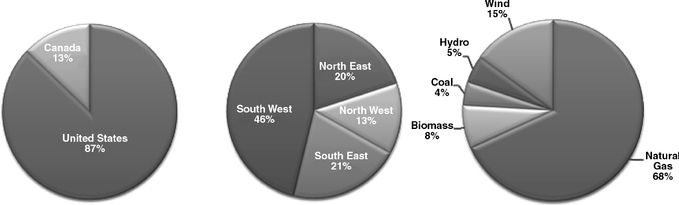

The following charts show, based on MW, the diversification of our portfolio by geography, reporting segment and fuel type:

2

We sell the capacity and energy from our power generation projects under power purchase agreements ("PPA") with a variety of utilities and other parties. Under the PPAs, which have expiration dates ranging from 2012 to 2037, we receive payments for electric energy sold to our customers (known as energy payments), in addition to payments for electric generation capacity (known as capacity payments). We also sell steam from a number of our projects to industrial purchasers under steam sales agreements. The transmission system rights ("TSRs") associated with our power transmission project entitles us to payments indirectly from the utilities that make use of the transmission line.

Our power generation projects generally have long-term fuel supply agreements, typically accompanied by fuel transportation arrangements. In most cases, the fuel supply and transportation arrangements correspond to the term of the relevant PPAs and many of the PPAs and steam sales agreements provide for the indexing or pass-through of fuel costs to our customers. In cases where there is no pass-through of fuel costs, we often attempt to mitigate the market price risk of changing commodity costs through the use of hedging strategies.

We directly operate and maintain more than half of our power generation fleet. We also partner with recognized leaders in the independent power industry to operate and maintain our other projects, including Caithness Energy, LLC ("Caithness"), Colorado Energy Management ("CEM"), Power Plant Management Services ("PPMS"), Delta Power Services ("DPS") and the Western Area Power Administration ("Western"). Under these operation, maintenance and management agreements, the operator is typically responsible for operations, maintenance and repair services.

Our common shares trade on the TSX under the symbol "ATP" and on the NYSE under the symbol "AT."

Our registered office is located at 355 Burrard Street, Suite 1900, Vancouver, British Columbia, Canada V6C 2G8 and our headquarters is located at 200 Clarendon Street, Floor 25, Boston, Massachusetts, 02116 USA. Our telephone number in Boston is (617) 977-2400 and the address of our website is www.atlanticpower.com. We make available, free of charge, on our website our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Additionally, we make available on our website, our Canadian securities filings.

We believe we distinguish ourselves from other independent power producers through the following competitive strengths:

- •

- Diversified

projects. Our power generation projects have an aggregate gross electric generation capacity of approximately 3,397 MW, and our net

ownership interest in these projects is approximately 2,141 MW. These projects are diversified by fuel type, electricity and steam customers, and project operators. The majority are located in the

deregulated and more liquid electricity markets of California, the U.S. Mid-Atlantic and New York. We also have a power transmission project, known as the Path 15 project, that is

regulated by the Federal Energy Regulatory Commission ("FERC"). Additionally, we have a 53.5 MW biomass project under construction in Georgia and an approximately 300 MW wind project under

construction in Oklahoma.

- •

- Experienced management team. Our management team has a depth of experience in commercial power operations and maintenance, project development, asset management, mergers and acquisitions, capital raising and financial controls. Our network of industry contacts and our reputation allow us to see proprietary acquisition opportunities on a regular basis.

3

- •

- Stability of project cash

flow. Many of our power generation projects currently in operation have been in operation for over ten years. Cash flows from each

project are generally supported by PPAs with investment-grade utilities and other creditworthy counterparties. We believe that each project's combination of PPAs, fuel supply agreements and/or

commodity hedges help stabilize operating margins.

- •

- Access to

capital. Our shares are publicly traded on the NYSE and the TSX. We have a history of successfully raising capital through public

offerings of equity and debt securities in Canada and the U.S., issuing public convertible debentures in Canada and bonds in the United States. We have also issued securities by way of private

placement in the U.S. and Canada. In addition, we have used non-recourse project-level financing as a source of capital. Project-level financing can be attractive as it typically has a

lower cost than equity, is non-recourse to Atlantic Power and amortizes over the term of the project's power purchase agreement. Having significant experience in accessing all of these

markets provides flexibility such that we can pursue transactions in the most cost-effective market at the time capital is needed.

- •

- Strong in-house operations team complemented by leading

third-party operators. We operate and maintain 17 of our power generation projects, which represent 44% of our portfolio's generating

capacity, and the remaining 14 generation projects are operated by third-parties, who are recognized leaders in the independent power business. Affiliates of Caithness, CEM and PPMS operate projects

representing approximately 19%, 14% and 8%, respectively, of the net electric generation capacity of our power generation projects. No other operator is responsible for the operation of projects

representing more than 3% of the net electric generation capacity of our power generation projects.

- •

- Strong customer base. Our customers are generally large utilities and other parties with investment-grade credit ratings. The largest customers of our power generation projects, including projects recorded under the equity method of accounting, are Public Service Company of Colorado ("PSCo"), Progress Energy Florida, Inc. ("PEF") and Ontario Electricity Financial Corp. ("OEFC"), which purchase approximately 17%, 15% and 9%, respectively, of the net electric generation capacity of our projects. No other electric customer purchases more than 6% of the net electric generation capacity of our power generation projects.

Our Objective and Business Strategy

Our corporate strategy is to increase the value of the Company through accretive acquisitions in North American markets while generating stable, contracted cash flows from our existing assets to sustain our dividend payout to shareholders. In order to achieve these objectives, we intend to focus on enhancing the operating and financial performance of our current projects and pursuing additional accretive acquisitions primarily in the electric power industry in the United States and Canada.

Organic growth

Since the time of our initial public offering on the TSX in late 2004, we have twice acquired the interest of another partner in one of our existing projects and will continue to look for additional such opportunities. We intend to enhance the operation and financial performance of our projects through:

- •

- achievement of improved operating efficiencies, output, reliability and operation and maintenance costs through the

upgrade or enhancement of existing equipment or plant configurations;

- •

- optimization of commercial arrangements such as PPAs, fuel supply and transportation contracts, steam sales agreements,

operations and maintenance agreements and hedge agreements; and

- •

- expansion of existing projects.

4

Extending PPAs following their expiration

PPAs in our portfolio have expiration dates ranging from 2012 to 2037. In each case, we plan for expirations by evaluating various options in the market. New arrangements may involve responses to utility solicitations for capacity and energy, direct negotiations with the original purchasing utility for PPA extensions, "reverse" request for proposals by the projects to likely bilateral counterparty arrangements with creditworthy energy trading firms for tolling agreements, full service PPAs or the use of derivatives to lock in value. We do not assume that revenues or operating margins under existing PPAs will necessarily be sustained after PPA expirations, since most original PPAs included capacity payments related to return of and return on original capital invested, and counterparties or evolving regional electricity markets may or may not provide similar payments under new or extended PPAs.

Acquisition and investment strategy

We believe that new electricity generation projects will continue to be required in the United States and Canada as a result of growth in electricity demand, transmission constraints and the retirement of older generation projects due to obsolescence or environmental concerns. In addition, Renewable Portfolio Standards in over 31 states as well as renewables initiatives in several provinces have greatly facilitated attractive PPAs and financial returns for significant renewable project opportunities. While we are not greenfield developers ourselves, we are teaming with experienced development companies to acquire pipelines of late stage development investment opportunities. There is also a very active secondary market for the purchase and sale of existing projects.

We intend to expand our operations by making accretive acquisitions with a focus on power generation, transmission and related facilities in the United States and Canada. We may also invest in other forms of energy-related projects, utility projects and infrastructure projects, as well as make additional investments in development stage projects or companies where the prospects for creating long-term predictable cash flows are attractive. In 2010, we purchased a 60% interest in Rollcast Energy ("Rollcast"), a biomass developer out of North Carolina with a pipeline of development projects, in which we have the option but not the obligation to invest capital. We continue to assess development companies with strong late-stage development projects, and believe that there are opportunities in the market to enter into joint ventures with strong development teams.

Our management has significant experience in the independent power industry and we believe that our experience, reputation and industry relationships will continue to provide us with enhanced access to future acquisition opportunities on a proprietary basis.

Our asset management strategy is to ensure that our projects receive appropriate preventative and corrective maintenance and incur capital expenditures, if required, to provide for their safety, efficiency, availability and longevity. We also proactively look for opportunities to optimize power, fuel supply and other agreements to deliver strong and predictable financial performance. In conjunction with our acquisition of Capital Power Income L.P. (subsequently renamed Atlantic Power Limited Partnership on February 1, 2012) (the "Partnership"), the personnel that operated and maintained the assets of the Partnership became employees of Atlantic Power. The staff at each of the facilities has extensive experience in managing, operating and maintaining the assets. Personnel at Capital Power Corporation regional offices that provided support in operations management, environmental, health and safety, and human resources also joined Atlantic Power. In combination with the existing staff of Atlantic Power, we have a dedicated and experienced operations and commercial management organization that is well regarded in the energy industry.

For operations and maintenance services at the 14 projects in our portfolio which we do not operate, we partner with recognized leaders in the independent power business. Most of our third-party

5

operated projects are managed by Caithness, CEM, PPMS, DPS and, in the case of Path 15, Western, a U.S. Federal power agency. On a case-by-case basis, these third-party operators may provide: (i) day-to-day project-level management, such as operations and maintenance and asset management activities; (ii) partnership level management tasks, such as insurance renewals and annual budgets; and (iii) partnership level management, such as acting as limited partner. In some cases these project managers or the project partnerships may subcontract with other firms experienced in project operations, such as General Electric, to provide for day-to-day plant operations. In addition, employees of Atlantic Power with significant experience managing similar assets are involved in all significant decisions with the objective of proactively identifying value-creating opportunities such as contract renewals or restructurings, asset-level refinancings, add-on acquisitions, divestitures and participation at partnership meetings and calls.

Caithness is one of the largest privately-held independent power producers in the United States. For over 25 years, Caithness has been actively engaged in the development, acquisition and management of independent power facilities for its own account as well as in venture arrangements with other entities. Caithness operates our Auburndale, Lake and Pasco projects and provides other asset management services for our Orlando, Selkirk and Badger Creek projects.

Colorado Energy Management is an energy infrastructure management company specializing in operations and maintenance, asset management and construction management for independent power producers and investors. With over 25 years of experience in operations and maintenance management, CEM focuses on revenue growth through continuous operational improvement and advanced maintenance concepts. Clients of CEM include independent power producers, municipalities and plant developers. CEM operates our Manchief facility.

Power Plant Management Services is a management services company focused on providing senior level energy industry expertise to the independent power market. Founded in 2006, PPMS provides management services to a large portfolio of solid fuel and gas-fired generating stations including our Selkirk and Chambers facilities. Previously, Cogentrix provided services to these facilities. Western owns and maintains the Path 15 transmission line. Western transmits and delivers hydroelectric power and related services within a 15-state region of the central and western United States. They are one of four power marketing administrations within the U.S. Department of Energy whose role is to market and transmit electricity from multi-use water projects. Western's transmission system carries electricity from 57 power plants. Together, these plants have an operating capacity of approximately 8,785 MW.

Acquisition of Capital Power Income L.P.

On November 5, 2011, we directly and indirectly acquired all of the issued and outstanding limited partnership units of the Partnership, in exchange for approximately Cdn$506.5 million in cash and 31.5 million of our common shares. The Partnership's portfolio consisted of 19 wholly-owned power generation assets located in both Canada and the United States, a 50.15% interest in a power generation asset in the state of Washington, and a 14.3% common ownership interest in PERH. At the acquisition date, the transaction increased the net generating capacity of our projects by 143% from 871 MW to approximately 2,116 MW. We did not purchase two of the Partnership's assets located in North Carolina. We remain headquartered in Boston, Massachusetts and added offices in Chicago, Illinois, Toronto, Ontario, Richmond and Vancouver, British Columbia. Additionally, the Capital Power Corporation employees that operated and maintained the Partnership's assets and most of those who provided management support of operations, accounting, finance, and human resources became employees of Atlantic Power.

6

Acquisition of Rockland Wind

On December 28, 2011, we purchased a 30% interest for $12.5 million in the Rockland Wind Project ("Rockland"), an 80 MW wind farm near American Falls, Idaho, that began operations in early December 2011. The Rockland Wind Project sells power under a 25-year power purchase agreement with Idaho Power. Rockland is accounted for under the equity method of accounting.

Acquisition of Canadian Hills Wind Power Development Project

On January 31, 2012, we acquired a 51% interest in Canadian Hills, a 300 MW wind power development project located near El Reno, Oklahoma, 20 miles west of Oklahoma City. On March 30, 2012, concurrent with the closing of a construction financing facility for Canadian Hills, we completed the acquisition of an additional 48% interest, bringing our total interest in the project to 99%. Canadian Hills was developed by Apex Wind Energy Holdings, LLC ("Apex"), which has retained a 1% interest in the project. The project, which is expected to deploy Mitsubishi 2.4 MW MWT102 and REpower 2.05 MW MM92 wind turbines, has long-term PPAs for 100% of its output with Southwestern Electric Power Company, Oklahoma Municipal Power Authority and Grand River Dam Authority. Apex earned a development fee and manages construction of the project, and, upon commencement of operations, currently expected in November 2012, we will oversee operations and be the asset manager.

Upon commencement of commercial operations, Canadian Hills is expected to generate enough clean, renewable energy to power the equivalent of over 100,000 homes. The investment is expected to increase our average remaining PPA life from 8.3 years to 9.9 years and increase the wind segment of our net generating capacity from 3% to 15%, while reducing the gas segment from 77% to 68%.

Construction and development costs for Canadian Hills are being initially funded with the proceeds of a $310 million non-recourse, project-level construction financing facility, which includes a $290 million construction loan and a $20 million five-year letter of credit facility. Construction under the terms of a fixed-price, balance of plant contract began in April 2012, with total cost for the project expected to be approximately $470 million. In connection with the closing of the construction financing facility, we committed to invest approximately $180 million in equity (net of financing costs) to cover the balance of the construction and development costs, expected to be drawn following disbursement of the construction loan. The construction loan is expected to be repaid with tax equity investments by institutional investors at the time the project commences commercial operations. We have received an approximately $360 million bridge facility commitment from Morgan Stanley to provide flexibility in the timing of the tax equity investment and our own equity commitment in the project.

Concurrent Offering of Common Shares

Concurrently with this offering, we are also conducting a separate public offering of common shares (plus up to an additional common shares that we may issue and sell upon the exercise of the underwriters' option to purchase additional shares).

This offering is not conditioned upon the successful completion of the concurrent offering of common shares and the concurrent offering of common shares is not conditioned upon the successful completion of this offering. See "Description of concurrent offering of common shares."

7

Issuer |

Atlantic Power Corporation, a British Columbia corporation. | |

Maturity |

The Debentures will mature on . |

|

Interest rate |

% per annum. |

|

Payment date |

Interest will be payable semi-annually in arrears on the day of and in each year (or the immediately following business day if any interest payment date would not otherwise be a business day) commencing on , computed on the basis of a 360-day year composed of twelve 30-day months. The interest payment will represent accrued interest for the period from the closing date of this offering up to, but excluding . See "Description of Debentures—General." |

|

Conversion privilege |

Each Debenture will be convertible into fully paid and non-assessable common shares at the option of the holder at any time prior to the close of business on the earlier of the maturity date and the business day immediately preceding the date specified by the Company for redemption of the Debentures, at a conversion price of Cdn$ per common share, being a ratio of approximately common shares per Cdn$1,000 principal amount of Debentures, subject to adjustment in accordance with the trust indenture governing the terms of the Debentures (the "Indenture"). See "Description of Debentures—Conversion privilege." |

|

Redemption |

The Debentures may not be redeemed by the Company on or before (except in certain limited circumstances following a change of control (as defined herein)). After and prior to , the Debentures may be redeemed by the Company, in whole or in part from time to time, on not more than 60 days and not less than 30 days prior notice, at a redemption price equal to the principal amount thereof plus accrued and unpaid interest, provided that the volume weighted average price of our common shares on the TSX for the 20 consecutive trading days ending five trading days preceding the date on which notice of redemption is given is not less than % of the conversion price. |

|

|

On or after and prior to the maturity date, the Debentures may be redeemed in whole or in part at the option of the Company on not more than 60 days and not less than 30 days prior notice at a price equal to their principal amount plus accrued and unpaid interest. See "Description of Debentures—Redemption and purchase." |

8

Optional payment at maturity or upon redemption |

On redemption or on maturity, provided that no event of default (as defined herein) shall have occurred and be continuing, the Company may, at its option, on not more than 60 days and not less than 40 days prior notice and subject to regulatory approval, elect to satisfy its obligation to repay the principal amount of the Debentures by issuing and delivering that number of common shares obtained by dividing the principal amount of the outstanding Debentures which are to be redeemed or have matured by 95% of the volume weighted average price of the common shares on the TSX for the 20 consecutive trading days ending five trading days preceding the date fixed for redemption or maturity, as the case may be. See "Description of Debentures—Payment upon redemption or maturity." |

|

Change of control |

Upon the occurrence of certain change of control events involving the Company, each holder of Debentures may require the Company to purchase, on a date which is within 30 days following the giving of notice of the Debentures at a price equal to 100% of the principal amount thereof plus accrued and unpaid interest thereon. If 90% or more of the principal amount of the Debentures outstanding on the date of the notice of change of control have been tendered, the Company will have the right to redeem all the remaining Debentures at the offer price. See "Description of Debentures—Repurchase upon a change of control." |

|

|

Subject to regulatory approval, in the event of a change of control where 10% or more of the consideration for our common shares in the transaction or transactions constituting a change of control consists of cash, equity securities that are not traded or intended to be traded immediately following such transactions on a stock exchange, or other property that is not traded or intended to be traded immediately following such transactions on a stock exchange, holders of the Debentures may elect to convert their Debentures and receive, in addition to the number of common shares they otherwise would have been entitled to under "Conversion Privilege," an additional number of common shares as outlined in the table set forth under "Description of Debentures—Cash change of control." |

9

Ranking |

The Debentures will rank subordinate to all existing and future senior secured and senior unsecured indebtedness of the Company including all trade creditors, and will rank pari passu to any future subordinated unsecured indebtedness. See "Description of Debentures—Subordination." As of March 31, 2012, we had $726.1 million of debt outstanding that ranks equal with or senior to the Debentures, and we expect to incur additional debt in the future. The amount at March 31, 2012 is comprised of $72.8 million outstanding under our revolving credit facility, $193.3 million of outstanding convertible debentures and $460.0 million of outstanding senior notes. In addition, as of March 31, 2012, our subsidiaries had $72.2 million of liabilities, all of which would rank structurally senior to the Debentures. |

|

Risk factors |

Prospective purchasers should carefully review and evaluate certain risk factors relating to an investment in the Debentures, including, but not limited to trading market for Debentures, repayment of the Debentures, absence of covenant protection, redemption on a change of control, redemption prior to maturity, conversion following certain transactions, credit risk, subordination of Debentures, discretion in the use of proceeds and possibility of withheld amounts. See "Risk factors." |

|

United States and Canadian federal income tax considerations |

You should consult your tax advisor with respect to the U.S. and Canadian federal income tax consequences of owning the Debentures and the common shares into which the Debentures may be converted in light of your own particular situation and with respect to any tax consequences arising under the laws of any state, local, foreign or other taxing jurisdiction. See "Certain United States federal income tax considerations" and "Certain Canadian federal income tax considerations." |

|

Concurrent public offering of common shares |

Concurrently with this offering, we are also conducting a separate public offering of common shares (plus up to an additional common shares that we may issue and sell upon the exercise of the underwriters' option to purchase additional shares). |

|

|

This offering is not conditioned upon the successful completion of the concurrent offering of common shares and the concurrent offering of common shares is not conditioned upon the successful completion of this offering. See "Description of concurrent offering of common shares." |

10

Use of proceeds |

We expect to receive net proceeds from this offering of approximately Cdn$ million after deducting the underwriting discount and our estimated expenses (or approximately Cdn$ million if the underwriters exercise their option to purchase additional Debentures in full). We intend to use the net proceeds from this offering, along with the net proceeds we receive from our concurrent offering of common shares, to fund our equity commitment in Canadian Hills. Any remaining net proceeds will be used to fund additional growth opportunities and for general corporate purposes. See "Use of proceeds." |

|

Listing |

The Debentures constitute a new issue of securities of the Company for which there is currently no public market. |

|

|

Our outstanding common shares are listed on the TSX under the symbol "ATP" and on the NYSE under the symbol "AT." |

11

Summary Historical Consolidated Financial Data

The following table presents summary consolidated financial information for Atlantic Power. The annual historical information as of December 31, 2011 and 2010 and for the years ended December 31, 2011, 2010 and 2009 has been derived from the audited consolidated financial statements appearing in Atlantic Power's Annual Report on Form 10-K for the year ended December 31, 2011, incorporated by reference into this prospectus. The annual historical information as of December 31, 2009, 2008 and 2007 and for the years ended December 31, 2008 and 2007 has been derived from historical financial statements not incorporated by reference into this prospectus. The historical information as of, and for the three-month periods ended March 31, 2012 and 2011 has been derived from the unaudited consolidated financial statements appearing in Atlantic Power's Quarterly Report on Form 10-Q for the quarter ended March 31, 2012, incorporated by reference into this prospectus. Data for all periods have been prepared under U.S. GAAP. You should read the following selected consolidated financial information together with Atlantic Power's consolidated financial statements and the notes thereto and the discussion under "Management's Discussion and Analysis of Financial Condition and Results of Operations" included as part of Atlantic Power's Annual Report on Form 10-K for the year ended December 31, 2011, as amended, and Quarterly Report on Form 10-Q for the quarter ended March 31, 2012, each of which is incorporated by reference into this prospectus. See "Where you can find more information" beginning on page 64 of this prospectus.

| |

Year Ended December 31, | Three Months Ended March 31, | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(in thousands of US dollars, except per share/subordinated note data and as otherwise stated)

|

||||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | 2012(a) | 2011(a) | ||||||||||||||||

Project revenue |

$ | 284,895 | $ | 195,256 | $ | 179,517 | $ | 173,812 | $ | 113,257 | $ | 167,610 | $ | 53,665 | ||||||||

Project (loss) income |

33,979 | 41,879 | 48,415 | 41,006 | 70,118 | (24,650 | ) | 14,869 | ||||||||||||||

Net (loss) income attributable to Atlantic Power Corporation |

(38,408 | ) | (3,752 | ) | (38,486 | ) | 48,101 | (30,596 | ) | (42,292 | ) | 6,136 | ||||||||||

Basic earnings (loss) per share |

(0.50 | ) | (0.06 | ) | (0.63 | ) | 0.78 | (0.50 | ) | (0.37 | ) | 0.09 | ||||||||||

Basic earnings (loss) per share, Cdn$(b) |

(0.49 | ) | (0.06 | ) | (0.72 | ) | 0.84 | (0.53 | ) | (0.37 | ) | 0.09 | ||||||||||

Diluted earnings (loss) per share(c) |

(0.50 | ) | (0.06 | ) | (0.63 | ) | 0.73 | (0.50 | ) | (0.37 | ) | 0.09 | ||||||||||

Diluted earnings (loss) per share, Cdn$(b)(c) |

(0.49 | ) | (0.06 | ) | (0.72 | ) | 0.78 | (0.53 | ) | (0.37 | ) | 0.09 | ||||||||||

Distribution per subordinated note(d) |

— | — | 0.51 | 0.60 | 0.59 | — | — | |||||||||||||||

Dividend declared per common share |

1.11 | 1.06 | 0.46 | 0.40 | 0.40 | 0.29 | 0.27 | |||||||||||||||

Total assets |

3,248,427 | 1,013,012 | 869,576 | 907,995 | 880,751 | 3,475,710 | 1,007,801 | |||||||||||||||

Total long-term liabilities |

1,940,192 | 518,273 | 402,212 | 654,499 | 715,923 | 1,940,073 | 504,492 | |||||||||||||||

- (a)

- Unaudited.

- (b)

- The

Cdn$ amounts were converted using the average exchange rates for the applicable reporting periods.

- (c)

- Diluted earnings (loss) per share is computed including dilutive potential shares, which include those issuable upon conversion of convertible debentures and under our long term incentive plan. Because we reported a loss during the years ended December 31, 2011, 2010, 2009 and 2007, the effect of including potentially dilutive shares in the calculation during those periods is anti-dilutive.

12

Please see the notes to our historical consolidated financial statements incorporated by reference into this prospectus for information relating to the number of shares used in calculating basic and diluted earnings per share for the periods presented.

- (d)

- At the time of our initial public offering, our publicly traded security was an income participating security, or an "IPS," each of which was comprised of one common share and Cdn$5.767 principal amount of 11% subordinated notes due 2016. On November 27, 2009, we converted from the IPS structure to a traditional common share structure. In connection with the conversion, each IPS was exchanged for one new common share.

13

Investing in the Debentures involves various risks, including those described below and those included in our Annual Report on Form 10-K for the year ended December 31, 2011, as amended, and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2012, each of which is incorporated herein by reference. These risks are not the only ones faced by us. Additional risks not presently known or that we currently deem immaterial could also materially and adversely affect our financial condition, results of operations, business and prospects. The trading price of the Debentures as well as our common shares into which the Debentures will be convertible could decline due to any of these risks, and you may lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this prospectus. Please refer to the section entitled "Cautionary statements regarding forward-looking statements" in this prospectus.

Risks Relating to this Offering

We have not identified any specific use of the net proceeds of this offering in the event we do not use net proceeds to fund our equity commitment in Canadian Hills.

This offering is not conditioned on our investment in Canadian Hills and there can be no assurance that Canadian Hills will commence commercial operations in a timely manner or at all. If we do not use the net proceeds of this offering to fund our equity commitment in Canadian Hills for any reason, our board of directors and management will have broad discretion over the use of the net proceeds we receive following this offering and might not apply the net proceeds in ways that increase the trading price of our common shares. Any funds received may be used by us for any corporate purpose, which may include pursuit of other business combinations, expansion of our operations, share repurchases or other uses. The failure of our management to use the net proceeds from this offering effectively could have an adverse effect on our business and may have an adverse effect on our earnings per share.

Our results of operations may differ significantly from the unaudited pro forma condensed combined consolidated statement of operations included in this prospectus.

This prospectus includes an unaudited pro forma condensed combined consolidated statement of operations for the fiscal year ended December 31, 2011 to illustrate the effects of our acquisition of the Partnership on our historical financial position and operating results. The unaudited pro forma condensed combined consolidated statement of operations combines the historical consolidated statements of operations of Atlantic Power and the Partnership, giving effect to the acquisition as if it had occurred on January 1, 2011. This unaudited pro forma financial information is presented for illustrative purposes only and does not necessarily indicate the results of operations that would have resulted had the acquisition been completed at the beginning of the period presented, nor is it indicative of the results of operations in future periods or the future financial position of the combined company.

Investment eligibility

There can be no assurance that our common shares or Debentures will continue to be qualified investments under relevant Canadian tax laws for trusts governed by registered retirement savings plans, registered retirement income funds, deferred profit sharing plans, registered education savings plans, registered disability savings plans and tax-free savings accounts.

14

Risks Relating to the Debentures

There is no trading market for the Debentures

The Debentures constitute a new issue of securities of the Company for which there is currently no public market. Even if the Debentures are listed on a public securities exchange or market, the Debentures may trade at a discount from their offering price depending on prevailing interest rates, the market for similar securities, our performance and other factors. No assurance can be given as to whether an active trading market will develop or be maintained for the Debentures. To the extent that an active trading market for the Debentures does not develop, the liquidity and trading prices for the Debentures may be adversely affected.

We may be unable to repay the Debentures

The Debentures mature on . We may not be able to refinance the principal amount of the Debentures in order to repay the principal outstanding or may not have generated enough cash from operations to meet this obligation. There is no guarantee that we will be able to repay the outstanding principal amount upon maturity of the Debentures. The Debentures will not be guaranteed by any of our subsidiaries, and any restrictions on the distribution of cash at the project level, such as due to restrictive covenants in project-level financing agreements, could materially limit our ability to pay principal and interest on the Debentures when due.

The Indenture will not have any covenant restriction protections

The trust indenture governing the Debentures does not restrict us or any of our subsidiaries from incurring additional indebtedness for borrowed money or otherwise from mortgaging, pledging or charging our real or personal property or properties to secure any indebtedness or other financing. The indenture does not contain any provisions specifically intended to protect holders of the Debentures in the event of a future leveraged transaction involving us or any of our subsidiaries.

We are obligated to redeem the Debentures on a change of control

We will be required to offer to purchase all outstanding Debentures upon the occurrence of a change of control. However, it is possible that following a change of control, we will not have sufficient funds at that time to make the required purchase of outstanding Debentures or that restrictions contained in other indebtedness will restrict those purchases. See "Description of Debentures—Change of control."

The Debentures may be redeemed prior to maturity

The Debentures may be redeemed, at our option, subject to certain conditions, after and prior to their maturity date in whole or in part, at a redemption price equal to the principal amount thereof, together with any accrued and unpaid interest, as described under "Description of Debentures—Redemption and purchase." Holders of Debentures should assume that this redemption option will be exercised if we are able to refinance at a lower interest rate or it is otherwise in our interest to redeem the Debentures.

The Debentures may become convertible into other securities, cash or property following certain transactions

In the event of certain transactions, pursuant to the terms of the indenture, each Debenture will become convertible into securities, cash or property receivable by a holder of common shares in such transactions. This change could substantially reduce or eliminate any potential future value of the conversion privilege associated with the Debentures. For example, if we were acquired in a cash merger, each Debenture would become convertible solely into cash and would no longer be convertible

15

into securities whose value would vary depending on our future prospects and other factors. See "Description of Debentures—Conversion privilege."

If you hold Debentures, you will not be entitled to any rights with respect to our common shares, but you will be subject to all changes made with respect to our common shares.

If you hold Debentures, you will not be entitled to any rights with respect to our common shares (including, without limitation, voting rights and rights to receive any dividends or other distributions on our common shares, other than extraordinary dividends that our board of directors designates as payable to the holders of the notes), but if you subsequently convert your notes into common shares, you will be subject to all changes affecting the common shares. You will have rights with respect to our common shares only if and when we deliver common shares to you upon conversion of your notes and, to a limited extent, under the conversion rate adjustments applicable to the notes. For example, in the event that an amendment is proposed to our constating documents requiring shareholder approval and the record date for determining the shareholders of record entitled to vote on the amendment occurs prior to delivery of common shares to you, you will not be entitled to vote on the amendment, although you will nevertheless be subject to any changes in the powers or rights of our common shares that result from such amendment.

The Debentures will initially be held in book-entry form and, therefore, you must rely on the procedures and the relevant clearing systems to exercise your rights and remedies.

Unless and until certificated Debentures are issued in exchange for book-entry interests in the Debentures, owners of the book-entry interests will not be considered owners or holders of Debentures. Instead, the depository or its nominee will be the sole holder of the Debentures. Payments of principal, interest and other amounts owing on or in respect of the Debentures in global form will be made to the paying agent, which will make payments to CDS. Thereafter, such payments will be credited to CDS participants' accounts that hold book-entry interests in the notes in global form and credited by such participants to indirect participants. Unlike holders of the Debentures themselves, owners of book-entry interests will not have the direct right to act upon our solicitations for consents or requests for waivers or other actions from holders of the Debentures.

Instead, if you own a book-entry interest, you will be permitted to act only to the extent you have received appropriate proxies to do so from CDS or, if applicable, a participant. We cannot assure you that procedures implemented for the granting of such proxies will be sufficient to enable you to vote on any requested actions on a timely basis.

We may not be able to refinance the Debentures if required or if we so desire.

We may need or desire to refinance all or a portion of the Debentures or any other future indebtedness that we incur on or before the maturity of the Debentures. There can be no assurance that we will be able to refinance any of our indebtedness on commercially reasonable terms, if at all.

There is a credit risk associated with payment of the principal and interest on the Debentures

The likelihood that purchasers of the Debentures will receive payments owing to them under the terms of the Debentures will depend on our financial health and creditworthiness.

The rights and privileges of the Debenture holders are subordinate to our senior indebtedness

The Debentures are our unsecured obligations and are subordinate in right of payment to all of our existing and future senior indebtedness, including our convertible debentures issued on October 11, 2006 and our senior notes issued on November 4, 2011. In the event of our insolvency, bankruptcy, liquidation, reorganization, dissolution or winding up, the assets that serve as collateral for any senior

16

indebtedness would be made available to satisfy the obligations of the creditors of such senior indebtedness before being available to pay our obligations to Debenture holders. Accordingly, all or a substantial portion of our assets could be unavailable to satisfy the claims of the Debenture holders.

We have discretion in the use of proceeds

Management will have discretion concerning the use of proceeds of this offering and the concurrent offering of common shares, as well as the timing of their expenditures. As a result, investors will be relying on the judgment of management as to the application of the proceeds of the offerings. Management may use the net proceeds of the U.S. and Canadian offerings in ways that an investor may not consider desirable. The results and effectiveness of the application of the proceeds are uncertain. If the proceeds are not applied effectively, our results of operations may suffer.

Withholding tax

Effective January 1, 2008, the Tax Act (as defined below) was amended to generally eliminate withholding tax on interest paid or credited to non-residents of Canada with whom the payor deals at arm's length. However, Canadian withholding tax continues to apply to payments of "participating debt interest". For purposes of the Tax Act, participating debt interest is generally interest that is paid on an obligation where all or any portion of such interest is contingent or dependent on the use of or production from property in Canada or is computed by reference to revenue, profit, cash flow, commodity price or any similar criterion.

Under the Tax Act, when a debenture or other debt obligation issued by a person resident in Canada is assigned or otherwise transferred by a non-resident person to a person resident in Canada (which would include a conversion of the obligation or payment on maturity), the amount, if any, by which the price for which the obligation was assigned or transferred exceeds the price for which the obligation was issued is deemed to be a payment of interest on that obligation made by the person resident in Canada to the non-resident (an "excess"). The deeming rule does not apply in respect of certain "excluded obligations", although it is not clear whether a particular convertible debenture would qualify as an "excluded obligation". If a convertible debenture is not an "excluded obligation", issues that arise are whether any excess would be considered to exist, whether any such excess which is deemed to be interest is "participating debt interest", and if the excess is participating debt interest, whether that results in all interest on the obligation being considered to be participating debt interest.

The Canada Revenue Agency (the "CRA") has stated that no excess, and therefore no participating debt interest, generally would arise on the conversion of a "traditional convertible debenture" and therefore, there would be no withholding tax in such circumstances (provided that the payor and payee deal at arm's length for purposes of the Tax Act). The CRA has published guidance on what it believes to be a "traditional convertible debenture" for these purposes. The Debentures generally meet the criteria set forth in CRA's published guidance; however, the Indenture also contains additional terms which are not contemplated in the CRA's published guidance. Accordingly, the application of the CRA's published guidance is uncertain and there is a risk that amounts paid or payable by the Company to a holder of Debentures that is not resident in Canada on account of interest or any "excess" amount may be subject to Canadian withholding tax at 25% (subject to any reduction in accordance with the provisions of an applicable tax treaty).

The trust indenture does not contain a requirement for us to increase the amount of interest or other payments to holders of Debentures should we be required to withhold amounts in respect of income or similar taxes on payments of interest or other amounts.

17

Other Canadian federal income tax risks

There can be no assurance that Canadian federal income tax laws and CRA's administrative policies respecting the Canadian federal income tax consequences generally applicable to us, to our subsidiaries, or to a U.S. or Canadian holder of Debentures or common shares will not be changed in a manner which adversely affects holders of our Debentures or common shares.

Conversion of the Debentures into common shares could result in tax

Holders of the Debentures that are subject to U.S. federal income tax could potentially recognize foreign currency gain or loss upon the conversion of the Debentures into common shares.

Passive foreign investment company treatment

We do not believe that we are a passive foreign investment company, and we do not expect to become a passive foreign investment company. However, if we were a passive foreign investment company while a taxable U.S. holder held common shares, such U.S. holder could be subject to an interest charge on any deferred taxation and the treatment of gain upon the sale of our stock as ordinary income. Additionally, if we were a passive foreign investment company while a taxable U.S. holder held Debentures, the interest charge and gain recharacterization rules described in the preceding sentence could potentially apply to such U.S. holder with respect to its Debentures, or to any common shares received upon a conversion of the Debentures.

Risks Relating to the Common Shares

Market conditions and other factors may affect the value of the common shares issuable upon conversion of the Debentures.

The trading price of the common shares issuable upon conversion of the Debentures will depend on many factors, which may change from time to time, including:

- •

- conditions in the power generation markets and the energy markets generally;

- •

- interest rates;

- •

- the market for similar securities;

- •

- government action or regulation;

- •

- general economic conditions or conditions in the financial markets;

- •

- our past and future dividend practice; and

- •

- our financial condition, performance, creditworthiness and prospects.

Accordingly, the common shares that a Debenture holder receives upon conversion of the Debentures, whether in this offering or in the secondary market, may trade at a price lower than the conversion price.

The market price and trading volume of the common shares issuable upon conversion of the Debentures may be volatile.

The market price of the common shares may be volatile, particularly given the current economic environment. In addition, the trading volume in our common shares may fluctuate and cause significant price variations to occur. If the market price of our common shares declines significantly, you may be unable to resell your shares at or above the price at the time of conversion. The market price of our common shares may fluctuate or decline significantly in the future.

18

Some of the factors that could negatively affect our share price or result in fluctuations in the price or trading volume of our common shares include:

- •

- quarterly variations in our operating results or the quality of our assets;

- •

- changes in applicable regulations or government action;

- •

- operating results that vary from the expectations of management, securities analysts and investors;

- •

- changes in expectations as to our future financial performance;

- •

- announcements of innovations, new products, strategic developments, significant contracts, acquisitions and other material

events by us or our competitors;

- •

- changes in financial estimates or publication of research reports and recommendations by financial analysts or actions

taken by rating agencies with respect to us or other companies in our industry;

- •

- the operating and securities price performance of other companies that investors believe are comparable to us;

- •

- changes in general market conditions, such as interest or foreign exchange rates, stock or commodity valuations, or

volatility; and

- •

- actions by our current shareholders, including sales of our common shares by existing shareholders and/or directors and executive officers.

Stock markets in general have experienced significant volatility over the past two years, and continue to experience significant price and volume volatility. As a result, the market price of our common shares may continue to be subject to similar market fluctuations that may be unrelated to our operating performance or prospects. Increased volatility could result in a decline in the market price of our common shares.

Present and future offerings of debt or equity securities, ranking senior to our common shares, may adversely affect the market price of the common shares issuable upon conversion of the Debentures.

If we decide to issue debt or equity securities ranking senior to our common shares in the future it is likely that they will be governed by an indenture or other instrument containing covenants restricting our operating flexibility. Additionally, any convertible or exchangeable securities that we issue in the future may have rights, preferences and privileges more favorable than those of holders of our common shares and may result in dilution to holders of our common shares. We and, indirectly, our shareholders, will bear the cost of issuing and servicing such securities. Because our decision to issue debt or equity securities in any future offering will depend on market conditions and other factors, we cannot predict or estimate the amount, timing or nature of our future offerings. Thus, holders of our common shares will bear the risk of our future offerings reducing the market price of our common shares and diluting the value of their share holdings in us.

The number of shares available for future sale could adversely affect the market price of the common shares issuable upon conversion of the Debentures.

We cannot predict whether future issuances of our common shares or the availability of shares for resale in the open market will decrease the market price per common share. We may issue additional common shares, including securities that are convertible into or exchangeable for, or that represent the right to receive common shares. Sales of a substantial number of common shares in the public market or the perception that such sales might occur could materially adversely affect the market price of our common shares. Because our decision to issue securities in any future offering will depend on market

19

conditions and other factors, we cannot predict or estimate the amount, timing or nature of our future offerings. Thus, our shareholders bear the risk of our future offerings reducing the market price of our common shares and diluting their share holdings in us.

The exercise of the underwriters' option to purchase additional Debentures, the exercise of any options granted to directors, executive officers and other employees under our stock compensation plans, and other issuances of our common shares could have an adverse effect on the market price of our common shares, and the existence of options may materially adversely affect the terms upon which we may be able to obtain additional capital through the sale of equity securities. In addition, future sales of our common shares may be dilutive to existing shareholders.

The redemption of Debentures for or repayment of principal by issuing common shares may cause common shareholders dilution.

We may determine to redeem outstanding Debentures for common shares or to repay outstanding principal amounts thereunder at maturity of the Debentures by issuing additional common shares. Concurrently with the offer of the Debentures, we are also conducting a separate public offering of common shares. The issuance of additional common shares may have a dilutive effect on shareholders and an adverse impact on the price of our common shares.

Provisions of our articles of continuance could discourage potential acquisition proposals and could deter or prevent a change in control.

We are governed by the Business Corporations Act (British Columbia). Our articles of continuance contain provisions that could have the effect of delaying, deferring or discouraging another party from acquiring control of our company by means of a tender offer, a proxy contest or otherwise. These provisions may make it more difficult for other persons, without the approval of our board of directors, to make a tender offer or otherwise acquire a substantial number of our common shares or to launch other takeover attempts that a shareholder might consider to be in his or her best interest. These provisions could limit the price that some investors might be willing to pay in the future for our common shares.

20

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, business strategies, operating efficiencies, synergies, revenue enhancements, competitive positions, plans and objectives of management and growth opportunities of Atlantic Power Corporation, and with respect to the markets for Atlantic Power common shares and other matters. Statements in this prospectus and the documents incorporated by reference herein that are not historical facts are hereby identified as forward-looking statements for the purpose of the safe harbor provided by Section 27A of the Securities Act and Section 21E of the Exchange Act and forward-looking information within the meaning defined under applicable Canadian securities legislation (collectively, "forward-looking statements").

These forward-looking statements relate to, among other things, the expected benefits of the Canadian Hills project, such as accretion, the ability to pay increased dividends, enhanced cash flow, growth potential, liquidity and access to capital, market profile and financial strength, the position of the combined company and the expected timing of the commencement of commercial operations (if at all).

Forward-looking statements can generally be identified by the use of words such as "should," "intend," "may," "expect," "believe," "anticipate," "estimate," "continue," "plan," "project," "will," "could," "would," "target," "potential" and other similar expressions. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors or assumptions are applied in making forward-looking statements, including, but not limited to, factors and assumptions regarding the items outlined above. Actual results may differ materially from those expressed or implied in such statements. Important factors that could cause actual results to differ materially from these expectations include, among other things:

- •

- the amount of distributions expected to be received from our projects and our estimated net cash tax refunds;

- •

- the expected use of proceeds from this offering and our concurrent offering of common shares;

- •

- the impact of legislative, regulatory, competitive and technological changes; and

- •

- other risk factors relating to us and the power industry, as detailed from time to time in our filings with the SEC and the Canadian Securities Administrators.

You are cautioned that any forward-looking statement speaks only as of the date of this prospectus or, if such statement is included in a document incorporated by reference into this prospectus, as of the date of such other document. We undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required by applicable law.

21

The following table sets forth, for each period indicated, the high and low exchange rates for one U.S. dollar, expressed in Canadian dollars, the average of such exchange rates on the last day of each month during such period and the exchange rate at the end of such period, based on the noon buying rate as quoted by the Bank of Canada. On May 7, 2012, the noon buying rate was $1.00 = Cdn$0.9935.

| |

Three Months Ended March 31, | Twelve Months Ended December 31, | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2012 | 2011 | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

High |

Cdn$ | 1.0272 | Cdn$ | 1.0022 | Cdn$ | 1.0604 | Cdn$ | 1.0778 | Cdn$ | 1.3000 | Cdn$ | 1.2969 | Cdn$ | 1.1853 | ||||||||

Low |

Cdn$ | 0.9849 | Cdn$ | 0.9686 | Cdn$ | 0.9449 | Cdn$ | 0.9946 | Cdn$ | 1.0292 | Cdn$ | 0.9719 | Cdn$ | 0.9170 | ||||||||

Average |

Cdn$ | 1.0011 | Cdn$ | 0.9855 | Cdn$ | 0.9891 | Cdn$ | 1.0299 | Cdn$ | 1.1420 | Cdn$ | 1.0660 | Cdn$ | 1.0748 | ||||||||

Period End |

Cdn$ | 0.9991 | Cdn$ | 0.9718 | Cdn$ | 1.0170 | Cdn$ | 0.9946 | Cdn$ | 1.0466 | Cdn$ | 1.2246 | Cdn$ | 0.9881 | ||||||||

Source: Bank of Canada

22

We expect to receive net proceeds from this offering of approximately $ million after deducting the underwriting discounts and our estimated expenses (or approximately $ million if the underwriters exercise their option to purchase additional Debentures in full). We intend to use the net proceeds from this offering, along with the net proceeds we receive from our concurrent offering of common shares, to:

- (i)

- fund

our equity commitment in Canadian Hills; and

- (ii)

- to the extent that any proceeds remain thereafter, to fund additional growth opportunities and for general corporate purposes.