Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PREFERRED APARTMENT COMMUNITIES INC | v312150_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - PREFERRED APARTMENT COMMUNITIES INC | v312150_ex99-1.htm |

FIRST QUARTER 2012

Supplemental Financial Data

| First Quarter 2012 |

|

Table of Contents

| Company Profile, First Quarter Highlights and AFFO Guidance | 3 |

| Consolidated Statements of Operations | 4 |

| Reconciliation of Funds From Operations Attributable to Common Stockholders and | |

| Adjusted Funds From Operations Attributable to Common Stockholders to Net loss | |

| Attributable to Common Stockholders | 5 |

| Consolidated Balance Sheets | 6 |

| Notes to Reconciliation of Funds From Operations Attributable to Common | |

| Stockholders and Adjusted Funds From Operations Attributable to Common | |

| Stockholders to Net loss Attributable to Common Stockholders | 7 |

| Capital Expenditures | 8 |

| Definitions of Non-GAAP Measures | 8 |

Forward-Looking Statements

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995: Estimates of future earnings and performance are, by definition, and certain other statements in this Supplemental Financial Data Report may constitute, "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance, achievements or transactions to be materially different from the results, performance, achievements or transactions expressed or implied by the forward looking statements. Factors that impact such forward looking statements include, among others, our business and investment strategy; legislative or regulatory actions; the state of the U.S. economy generally or in specific geographic areas; economic trends and economic recoveries; our ability to obtain and maintain debt or equity financing; financing and advance rates for our target assets; our leverage level; changes in the values of our assets; availability of attractive investment opportunities in our target markets; our ability to qualify and maintain our qualification as a REIT for U.S. federal income tax purposes; our ability to maintain our exemption from registration under the Investment Company Act; availability of quality personnel; our understanding of our competition; and market trends in our industry, interest rates, real estate values, the debt securities markets and the general economy.

Except as otherwise required by the federal securities laws, we assume no liability to update the information in this Supplemental Financial Data Report.

We refer you to the section entitled "Risk Factors" in our Annual Report on Form 10-K for the twelve months ended December 31, 2011 that was filed with the Securities and Exchange Commission, or SEC, on March 15, 2012, which discusses various factors that could adversely affect our financial results. Such risk factors may be updated or supplemented by our subsequent Form 10-Q and Form 10-K filings and other documents filed from time to time with the SEC.

| Supplemental Financial Data | Page 2 |

| First Quarter 2012 |

|

Preferred Apartment Communities, Inc.

Preferred Apartment Communities, Inc., or the Company (AMEX:APTS), is a Maryland corporation formed primarily to acquire and operate multifamily properties in select targeted markets throughout the United States. As part of our property acquisition strategy, we may enter into forward purchase contracts or purchase options for to-be-built multifamily communities and we may make mezzanine loans, provide deposit arrangements, or provide performance assurances, as may be necessary or appropriate, in connection with the construction of these properties. As a secondary strategy, we also may acquire senior mortgage loans, subordinate loans or mezzanine debt secured by interests in multifamily properties, membership or partnership interests in multifamily properties and other multifamily related assets and invest not more than 10% of our total assets in other real estate related investments, as determined by our manager as appropriate for us. We intend to elect and qualify as a real estate investment trust for U.S. federal income tax purposes, commencing with our tax year ended December 31, 2011.

Highlights of the first quarter 2012:

| · | Recorded Adjusted Funds From Operations Attributable to Common Stockholders, or AFFO, of $772,321 and net cash provided by operating activities of $927,394 for the three-month period ended March 31, 2012 (1) |

| · | Declared a quarterly dividend on our Common Stock of $673,181, or $0.13 per common share, which was paid on April 16, 2012 to all common stockholders of record as of March 30, 2012. We currently expect to continue our dividend distributions on our Common Stock at the $0.13 per share level for 2012. Our net cash from operations was more than sufficient to fund our first quarter dividend. (2) |

| · | We continue to hold no debt at the Company or operating partnership levels, have no cross-collateralization of our real estate assets, and have no contingent liabilities at the Company or operating partnership levels with regard to our secured mortgage debt on our communities. |

| · | Construction on the second phase of the Trail Creek community, upon which we hold a $6.0 million real estate loan with an option to purchase the property, is proceeding on schedule and within budget. Certificates of Occupancy have been obtained on 5 of 13 buildings, construction is expected to be completed in June 2012 and the community is currently in lease up stage. Our purchase option period begins on April 1, 2014 and runs through June 30, 2014. |

AFFO guidance:

| · | AFFO is projected to be in the range of $725,000 - $825,000 for the second quarter of 2012.(2) |

(1) See Reconciliation of Funds From Operations Attributable to Common Stockholders and Adjusted Funds From Operations Attributable to Common Stockholders to Net Loss Attributable to Common Stockholders and Definitions of Non-GAAP Measures on pages 5 and 8.

(2) Guidance on projected dividend distributions for 2012 and projected AFFO for the second quarter of 2012 excludes any proceeds from any securities that we may issue and potential dividends to be paid on unissued shares of our Series A Redeemable Preferred Stock.

| Supplemental Financial Data | Page 3 |

| First Quarter 2012 |

|

| Preferred Apartment Communities, Inc. | |||||

| Consolidated Statements of Operations | |||||

| (Unaudited) | |||||

| Three months ended | ||||||||

| March 31, 2012 | March 31, 2011 | |||||||

| Revenues: | ||||||||

| Rental revenues | $ | 2,231,722 | $ | - | ||||

| Other property revenues | 264,181 | - | ||||||

| Interest income on loan and note receivable | 138,998 | - | ||||||

| Total revenues | 2,634,901 | - | ||||||

| Operating expenses: | ||||||||

| Property operating and maintenance | 564,754 | - | ||||||

| Property management fees | 100,013 | - | ||||||

| Real estate taxes | 182,240 | - | ||||||

| General and administrative | 44,327 | - | ||||||

| Depreciation and amortization | 977,402 | - | ||||||

| Acquisition costs | 912 | 219,716 | ||||||

| Organizational costs | - | 87,300 | ||||||

| Insurance | 43,945 | - | ||||||

| Professional fees | 83,182 | 44,511 | ||||||

| Other | 36,383 | 3,797 | ||||||

| Total operating expenses | 2,033,158 | 355,324 | ||||||

| Operating income (loss) | 601,743 | (355,324 | ) | |||||

| Management fees | 180,555 | - | ||||||

| Insurance | 41,377 | 62,000 | ||||||

| Interest expense | 538,075 | 15,909 | ||||||

| Equity compensation to directors and executives | 319,580 | - | ||||||

| Other income | (1,207 | ) | - | |||||

| Net loss | (476,637 | ) | (433,233 | ) | ||||

| Less consolidated net loss attributable | ||||||||

| to non-controlling interests | - | - | ||||||

| Net loss attributable to the Company | (476,637 | ) | (433,233 | ) | ||||

| Dividends to preferred stockholders | (718 | ) | - | |||||

| Net loss attributable to common stockholders | $ | (477,355 | ) | $ | (433,233 | ) | ||

| Net loss per share of Common Stock, | ||||||||

| basic and diluted | $ | (0.09 | ) | $ | (11.82 | ) | ||

| Weighted average number of shares of Common | ||||||||

| Stock outstanding, basic and diluted | 5,151,164 | 36,666 | ||||||

| Supplemental Financial Data | Page 4 |

| First Quarter 2012 |

|

| Reconciliation of Funds From Operations Attributable to Common Stockholders and | |||||

| Adjusted Funds From Operations Attributable to Common Stockholders | |||||

| to Net Loss Attributable to Common Stockholders | |||||

| Three months ended: | ||||

| 3/31/2012 | ||||

| Net loss attributable to common stockholders | $ | (477,355 | ) | |

| Add: Depreciation of real estate assets | 971,518 | |||

| Funds from operations attributable to common stockholders | 494,163 | |||

| Add: Acquisition costs | 912 | |||

| Non-cash equity compensation to directors and executives | 319,580 | |||

| Amortization of loan closing costs (See note 1) | 21,493 | |||

| Depreciation/amortization on non-real estate assets | 5,884 | |||

| Less: Non-cash mezzanine loan interest income (See note 2) | (17,378 | ) | ||

| Normally recurring capital expenditures (See note 3) | (52,333 | ) | ||

| Adjusted funds from operations attributable to common stockholders | $ | 772,321 | ||

| Common Stock dividends: | ||||

| Declared | $ | 673,181 | ||

| Per share | $ | 0.130 | ||

| Weighted average shares outstanding - basic and diluted (1) | 5,151,164 | |||

| Actual shares outstanding at March 31, 2012, including | ||||

| 26,000 unvested shares of restricted Common Stock | 5,178,313 | |||

(1) The dilutive effect of potential common stock equivalents was excluded from the calculation of weighted average shares outstanding because the Company recorded a net loss for the three-month period ended March 31, 2012.

See Notes to Reconciliation of Funds From Operations Attributable to Common Stockholders and Adjusted Funds From Operations Attributable to Common Stockholders to Net loss Attributable to Common Stockholders on page 7

| Supplemental Financial Data | Page 5 |

| First Quarter 2012 |

|

| Preferred Apartment Communities, Inc. |

| Consolidated Balance Sheets |

| (Unaudited) |

| March 31, | December 31, | |||||||

| 2012 | 2011 | |||||||

| Assets | ||||||||

| Real estate | ||||||||

| Land | $ | 13,052,000 | $ | 13,052,000 | ||||

| Building and improvements | 60,273,282 | 60,268,867 | ||||||

| Furniture, fixtures, and equipment | 8,610,633 | 8,392,446 | ||||||

| Construction in progress | 3,023 | 67,877 | ||||||

| Gross real estate | 81,938,938 | 81,781,190 | ||||||

| Less: accumulated depreciation | (3,674,555 | ) | (2,698,305 | ) | ||||

| Net real estate | 78,264,383 | 79,082,885 | ||||||

| Real estate loan | 6,000,000 | 6,000,000 | ||||||

| Total real estate and real estate loan, net | 84,264,383 | 85,082,885 | ||||||

| Cash and cash equivalents | 5,237,372 | 4,548,020 | ||||||

| Restricted cash | 615,198 | 567,346 | ||||||

| Note receivable | 650,000 | - | ||||||

| Tenant receivables, net of allowance of $22,291 and $15,924 | 26,001 | 23,811 | ||||||

| Deferred loan costs, net of amortization of $85,973 and $64,480 | 530,167 | 551,660 | ||||||

| Deferred offering costs | 1,724,457 | 1,388,421 | ||||||

| Other assets | 442,539 | 303,397 | ||||||

| Total assets | $ | 93,490,117 | $ | 92,465,540 | ||||

| Liabilities and equity | ||||||||

| Liabilities | ||||||||

| Mortgage notes payable | $ | 55,637,000 | $ | 55,637,000 | ||||

| Accounts payable and accrued expenses | 928,606 | 1,158,530 | ||||||

| Accrued interest payable | 175,247 | 176,084 | ||||||

| Dividends payable | 673,899 | 646,916 | ||||||

| Security deposits and prepaid rents | 274,855 | 163,663 | ||||||

| Deferred income | 76,600 | 65,446 | ||||||

| Total liabilities | 57,766,207 | 57,847,639 | ||||||

| Commitments and contingencies | ||||||||

| Equity | ||||||||

| Stockholder's equity | ||||||||

| Series A Redeemable Preferred Stock, $0.01 par value per share; | ||||||||

| 150,000 shares authorized; 2,155 and 0 shares issued and outstanding | ||||||||

| at March 31, 2012 and December 31, 2011, respectively | 22 | - | ||||||

| Common Stock, $0.01 par value per share; 400,066,666 shares authorized; | ||||||||

| 5,152,313 and 5,149,325 shares issued and outstanding at | ||||||||

| March 31, 2012 and December 31, 2011, respectively | 51,523 | 51,493 | ||||||

| Additional paid in capital | 45,410,624 | 43,828,030 | ||||||

| Accumulated deficit | (9,738,260 | ) | (9,261,623 | ) | ||||

| Total stockholders' equity | 35,723,909 | 34,617,900 | ||||||

| Non-controlling interest | 1 | 1 | ||||||

| Total equity | 35,723,910 | 34,617,901 | ||||||

| Total liabilities and equity | $ | 93,490,117 | $ | 92,465,540 | ||||

| Supplemental Financial Data | Page 6 |

| First Quarter 2012 |

|

Notes to Reconciliation of Funds From Operations Attributable to Common Stockholders and

Adjusted Funds From Operations Attributable to Common Stockholders to Net loss Attributable to Common Stockholders

| 1) | We incurred loan closing costs of $616,140 on our mortgage loans, which are secured on a property-by-property basis by the three acquired multifamily communities. These loan costs are being amortized over the life of the loans, and the non-cash amortization expense is an addition to FFO in the calculation of AFFO. Neither we nor our Operating Partnership have any recourse liability in connection with any of these mortgage loans, nor do we have any cross-collateralization arrangements with respect to these assets. |

| 2) | On June 30, 2011, in conjunction with our real estate loan investment, we received a loan fee of $120,000, $60,000 of which was paid to our manager as an acquisition fee, and also a loan commitment fee of $14,333. The net proceeds of $74,333 will be recognized in income over the life of the loan as an adjustment of yield using the effective interest method. Correspondingly, the non-cash income recognized under the effective interest method is deducted in calculating AFFO. |

| 3) | We deduct from FFO normally recurring capital expenditures that are necessary to maintain the properties’ revenue streams. Excluded from the calculation of AFFO are non-recurring capital expenditures of $170,333 for the three-month period ended March 31, 2012. |

See Definitions of Non-GAAP Measures on page 8.

| Supplemental Financial Data | Page 7 |

| First Quarter 2012 |

|

Capital Expenditures

We regularly incur capital expenditures related to our owned properties. Capital expenditures may be nonrecurring and discretionary, as part of a strategic plan intended to increase a property’s value and corresponding revenue-generating power, or may be normally recurring and necessary to maintain the income streams and present value of a property. Certain capital expenditures may be budgeted and reserved for upon acquiring a property as initial expenditures necessary to bring a property up to our standards or to add features or amenities that we believe make the property a compelling value to prospective residents in its individual market. These budgeted nonrecurring capital expenditures in connection with an acquisition are funded from the capital source(s) for the acquisition and are not dependent upon subsequent property operational cash flows for funding.

For the three-month period ended March 31, 2012, our capital expenditures were:

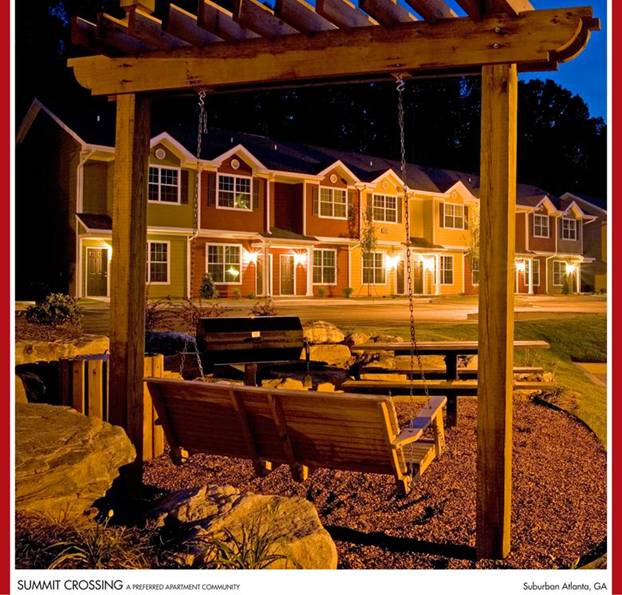

| Summit | Trail | Rise | Total | |||||||||||||

| Nonrecurring capital expenditures: | ||||||||||||||||

| Budgeted at property acquisition | $ | 4,993 | $ | 160,552 | $ | 4,788 | $ | 170,333 | ||||||||

| Other nonrecurring capital expenditures | - | - | - | - | ||||||||||||

| Total nonrecurring capital expenditures | 4,993 | 160,552 | 4,788 | 170,333 | ||||||||||||

| Normally recurring capital expenditures | 16,567 | 22,779 | 12,987 | 52,333 | ||||||||||||

| Total capital expenditures | $ | 21,560 | $ | 183,331 | $ | 17,775 | $ | 222,666 | ||||||||

Definitions of Non-GAAP Measures

Funds From Operations Attributable to Common Stockholders (“FFO”)

Analysts, managers, and investors have, since the first real estate investment trusts were created, made certain adjustments to reported net income amounts under U.S. GAAP in order to better assess these vehicles’ liquidity and cash flows. FFO is one of the most commonly utilized Non-GAAP measures currently in practice. In its 2002 “White Paper on Funds From Operations”, which was revised in 2004, the National Association of Real Estate Investment Trusts, or NAREIT, standardized the definition of how Net income/loss should be adjusted to arrive at FFO, in the interests of uniformity and comparability. The NAREIT definition of FFO (and the one reported by the Company) is:

Net income/loss:

| · | Excluding impairment charges on and gains/losses from sales of depreciable property; |

| · | Plus depreciation and amortization of real estate assets; and |

| · | After adjustments for unconsolidated partnerships and joint ventures |

Not all companies necessarily utilize the standardized NAREIT definition of FFO, and so caution should be taken in comparing the Company’s reported FFO results to those of other companies. The Company’s FFO results are comparable to the FFO results of other companies that follow the NAREIT definition of FFO and report these figures on that basis. We believe FFO is useful to investors as a supplemental gauge of our operating results. FFO is a non-GAAP measure that is reconciled to its most comparable GAAP measure, which the Company believes to be net income/loss available to common stockholders.

| Supplemental Financial Data | Page 8 |

| First Quarter 2012 |

|

Adjusted Funds From Operations Attributable to Common Stockholders (“AFFO”)

AFFO makes further adjustments to FFO results in order to arrive at a more refined measure of operating and financial performance. There is no industry standard definition of AFFO and practice is divergent across the industry. The Company calculates AFFO as:

FFO, plus:

| · | Acquisition costs; |

| · | Organization costs; |

| · | Equity compensation to directors and executives; |

| · | Amortization of loan closing costs; |

| · | REIT establishment costs; |

| · | Depreciation and amortization of non-real estate assets; and |

| · | Net loan origination fees received; |

Less:

| · | Non-cash mezzanine loan interest income; and |

| · | Normally recurring capital expenditures |

AFFO figures reported by us are not generally comparable to those reported by other companies. Investors are cautioned that AFFO excludes acquisition costs which are generally recorded in the periods in which the properties are acquired (and often preceding periods). We utilize AFFO to gauge the results of the operating performance of our portfolio of real estate assets. We believe AFFO is useful to investors as a supplemental gauge of our operating performance and is useful in comparing our operating performance with other real estate companies that are not as involved in ongoing acquisition activities. AFFO is a useful supplement to, but not a substitute for, its closest GAAP-compliant measure, which we believe to be net income/loss available to common stockholders.

For further information:

Leonard A. Silverstein, Executive Vice President

Preferred Apartment Communities, Inc.

lsilverstein@pacapts.com

+1-770-818-4147

| Supplemental Financial Data | Page 9 |