Attached files

ORYON TECHNOLOGIES, LLC AND SUBSIDIARIES

Table of Contents

|

Report of Independent Registered Public Accounting Firm

|

1 |

|

Financial Statements

|

|

|

Consolidated Balance Sheets

|

3 |

|

Consolidated Statements of Operations

|

4 |

|

Consolidated Statements of Changes in Members’ Equity (Deficit)

|

5 |

|

Consolidated Statements of Cash Flows

|

6 |

|

Notes to Consolidated Financial Statements

|

7-24 |

1

|

Montgomery Coscia Greilich LLP

|

|

Certified Public Accountants

|

|

2500 Dallas Parkway, Suite 300

|

|

Plano, Texas 75093

|

|

972.748.0300 p

|

|

972.748.0700 f

|

|

Thomas A. Montgomery, CPA

Matthew R. Coscia, CPA

Paul E. Greilich, CPA

Jeanette A. Musacchio

James M. Lyngholm

Christopher C. Johnson, CPA

J. Brian Simpson, CPA

|

Rene E. Balli, CPA

Erica D. Rogers, CPA

Dustin W. Shaffer, CPA

Gary W. Boyd, CPA

Michal L. Gayler, CPA

Gregory S. Norkiewicz, CPA

Karen R. Soefje, CPA

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Members

of OryonTechnologies, LLC and Subsidiaries

We have audited the accompanying consolidated balance sheets of OryonTechnologies, LLC and Subsidiaries as of December 31, 2011 and 2010, and the related consolidated statements of operations, changes in members’ equity (deficit), and cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the auditing standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of OryonTechnologies, LLC and Subsidiaries as of December 31, 2011 and 2010, and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 17 to the financial statements, the Company has accumulated losses from inception through December 31, 2011 of $8,069,326, has minimal assets, and has negative working capital. These conditions raise substantial doubt about its ability to continue as a going concern. Management’s plans regarding those matters also are described in Note 17. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ MONTGOMERY COSCIA GREILICH LLP

Montgomery Coscia Greilich LLP

Plano, Texas

January 30, 2012

2

|

ORYON TECHNOLOGIES, LLC AND SUBSIDIARIES

|

||||||||

|

Consolidated Balance Sheets

|

||||||||

|

December 31, 2011 and 2010

|

||||||||

|

December 31,

|

December 31,

|

|||||||

|

2011

|

2010

|

|||||||

|

ASSETS

|

||||||||

|

CURRENT ASSETS

|

||||||||

|

Cash

|

$ | 86,685 | $ | 144,787 | ||||

|

Accounts receivable, net of allowance for doubtful accounts of $19,740 and $0, respectively

|

1,106 | 15,438 | ||||||

|

Inventory (see note 3)

|

75,768 | 112,155 | ||||||

|

Other

|

6,964 | 99,846 | ||||||

|

Total current assets

|

170,523 | 372,226 | ||||||

|

PROPERTY AND EQUIPMENT, NET (see note 4)

|

27,826 | 63,598 | ||||||

|

INTANGIBLE ASSETS, NET (see note 5)

|

160,819 | 183,903 | ||||||

|

OTHER LONG-TERM ASSETS (see note 6)

|

20,832 | 28,491 | ||||||

|

TOTAL ASSETS

|

$ | 380,000 | $ | 648,218 | ||||

|

LIABILITIES AND MEMBERS' EQUITY (DEFICIT)

|

||||||||

|

CURRENT LIABILITIES

|

||||||||

|

Accounts payable

|

$ | 324,027 | $ | 373,742 | ||||

|

Accrued interest on notes payable (see note 10)

|

139,727 | 13,912 | ||||||

|

Deferred compensation (see note 7)

|

166,465 | 152,993 | ||||||

|

Other short-term debt (see note 8)

|

739,824 | - | ||||||

|

Other current liabilities (see note 9)

|

24,760 | 70,469 | ||||||

|

Due to affiliates

|

14,487 | 20,863 | ||||||

|

Total current liabilities

|

1,409,290 | 631,979 | ||||||

|

NOTES PAYABLE, NET (see note 10)

|

1,649,874 | 1,386,279 | ||||||

|

Total liabilities

|

3,059,164 | 2,018,258 | ||||||

|

MEMBERS' EQUITY (DEFICIT)

|

||||||||

|

Paid in capital (see note 14)

|

5,381,683 | 5,036,496 | ||||||

|

Foreign currency translation adjustment

|

12,119 | 17,516 | ||||||

|

Accumulated deficit

|

(8,069,326 | ) | (6,421,740 | ) | ||||

|

Non-controlling interest

|

(3,640 | ) | (2,312 | ) | ||||

|

Total members' equity (deficit)

|

(2,679,164 | ) | (1,370,040 | ) | ||||

|

TOTAL LIABILITIES AND MEMBERS' EQUITY

|

$ | 380,000 | $ | 648,218 | ||||

The accompanying notes are an integral part of these financial statements.

3

|

ORYON TECHNOLOGIES, LLC AND SUBSIDIARIES

|

||||||||

|

Consolidated Statements of Operations

|

||||||||

|

For the Years Ended December 31, 2011 and 2010

|

||||||||

|

For the year ended December 31,

|

||||||||

|

2011

|

2010

|

|||||||

|

REVENUES

|

||||||||

|

Product sales

|

$ | 95,165 | $ | 100,126 | ||||

|

Cost of goods sold

|

(64,501 | ) | (68,477 | ) | ||||

|

Gross profit

|

30,664 | 31,649 | ||||||

|

Royalty and license fees

|

303 | 350,699 | ||||||

|

Other

|

65,473 | 72,246 | ||||||

|

Total Revenues

|

96,440 | 454,594 | ||||||

|

OPERATING EXPENSES

|

||||||||

| Applications development | ||||||||

|

Wages

|

216,309 | 337,766 | ||||||

|

Payroll taxes and benefits

|

43,371 | 68,902 | ||||||

|

Materials, equipment, services

|

109,283 | 209,676 | ||||||

|

Office and overhead

|

14,236 | 13,667 | ||||||

|

Travel and entertainment

|

4,554 | 36,260 | ||||||

|

Total applications development expenses

|

387,753 | 666,271 | ||||||

| Sales and marketing | ||||||||

|

Wages

|

35,643 | 252,063 | ||||||

|

Payroll taxes and benefits

|

14,815 | 51,499 | ||||||

|

Overhead

|

844 | 28,368 | ||||||

|

Outside services

|

11,459 | - | ||||||

|

Travel and entertainment

|

2,555 | 27,772 | ||||||

|

Total sales and marketing expenses

|

65,316 | 359,702 | ||||||

|

General and administrative

|

||||||||

|

Wages

|

350,642 | 198,800 | ||||||

|

Payroll taxes and benefits

|

51,343 | 158,669 | ||||||

|

Overhead

|

185,434 | 220,656 | ||||||

|

Outside services

|

424,920 | 215,151 | ||||||

|

Travel and entertainment

|

21,518 | 46,274 | ||||||

|

Total general and administrative expenses

|

1,033,857 | 839,550 | ||||||

|

Depreciation and amortization

|

58,855 | 86,089 | ||||||

|

Total loss from operations

|

(1,449,341 | ) | (1,497,018 | ) | ||||

|

OTHER INCOME (EXPENSE)

|

||||||||

|

Interest income

|

9 | 879 | ||||||

|

Interest expense

|

(262,750 | ) | (281,592 | ) | ||||

|

Other income (expense)

|

63,168 | 21,397 | ||||||

|

Gain on extinguishment of debt (see note 10)

|

- | 264,676 | ||||||

|

Loss on disposal of fixed assets

|

- | (49,216 | ) | |||||

|

Total other expense

|

(199,573 | ) | (43,856 | ) | ||||

|

NET LOSS BEFORE TAX

|

(1,648,914 | ) | (1,540,874 | ) | ||||

|

INCOME TAX (see note 13)

|

- | - | ||||||

|

NET LOSS AFTER TAX

|

(1,648,914 | ) | (1,540,874 | ) | ||||

|

LOSS ATTRIBUTABLE TO NON-CONTROLLING INTEREST

|

1,328 | 1,960 | ||||||

|

NET LOSS ATTRIBUTABLE TO MEMBERS

|

$ | (1,647,586 | ) | $ | (1,538,914 | ) | ||

|

Loss per unit:

|

||||||||

|

Basic and diluted

|

$ | (0.86 | ) | $ | (0.88 | ) | ||

|

Weighted average units outstanding

|

1,908,233 | 1,741,286 | ||||||

The accompanying notes are an integral part of these financial statements.

4

|

ORYON TECHNOLOGIES, LLC AND SUBSIDIARIES

|

|

Consolidated Statements of Changes in Members' Equity (Deficit)

|

|

For the Years Ended December 31, 2011 and 2010

|

|

Units

|

Paid in Capital

|

Non-Controlling Interest

|

Accumulated Other Comprehensive Income (Loss)

|

Accumulated Deficit

|

Total

|

|||||||||||||||||||

|

Balances at December 31, 2009

|

1,741,286 | $ | 4,862,416 | $ | (352 | ) | $ | 12,235 | $ | (4,882,826 | ) | $ | (8,527 | ) | ||||||||||

|

Operating results for the year ended December 31, 2010

|

- | - | (1,960 | ) | - | (1,538,914 | ) | (1,540,874 | ) | |||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | 5,281 | - | 5,281 | ||||||||||||||||||

|

Stock-based compensation expense

|

- | 10,352 | - | - | - | 10,352 | ||||||||||||||||||

|

Issuance of warrants

|

- | 79,608 | - | - | - | 79,608 | ||||||||||||||||||

|

Beneficial conversion feature

|

- | 84,120 | - | - | - | 84,120 | ||||||||||||||||||

|

Balances at December 31, 2010

|

1,741,286 | $ | 5,036,496 | $ | (2,312 | ) | $ | 17,516 | $ | (6,421,740 | ) | $ | (1,370,040 | ) | ||||||||||

|

Operating Results for the year ended December 31, 2011

|

- | - | (1,328 | ) | - | (1,647,586 | ) | (1,648,914 | ) | |||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | (5,397 | ) | - | (5,397 | ) | ||||||||||||||||

|

Stock-based compensation expense

|

- | 20,896 | - | - | - | 20,896 | ||||||||||||||||||

|

Issuance of warrants

|

- | 2,812 | - | - | - | 2,812 | ||||||||||||||||||

|

Issuance of membership units

|

321,479 | 321,479 | - | - | - | 321,479 | ||||||||||||||||||

|

Balances at December 31, 2011

|

2,062,765 | $ | 5,381,683 | $ | (3,640 | ) | $ | 12,119 | $ | (8,069,326 | ) | $ | (2,679,164 | ) | ||||||||||

The accompanying notes are an integral part of these financial statements.

5

|

ORYON TECHNOLOGIES, LLC AND SUBSIDIARIES

|

||||||||

|

Consolidated Statements of Cash Flows

|

||||||||

|

For the Years Ended December 31, 2011 and 2010

|

||||||||

|

For the years ended December 31,

|

||||||||

|

2011

|

2010

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

||||||||

|

Net loss

|

$ | (1,647,586 | ) | $ | (1,538,914 | ) | ||

|

Adjustments to reconcile net loss to net cash

|

||||||||

|

used in operating activities:

|

||||||||

|

Gain on extinguishment of debt

|

- | (264,672 | ) | |||||

|

Noncash interest expense on short-term notes

|

13,646 | - | ||||||

|

Noncash interest expense on notes payable

|

125,815 | 97,447 | ||||||

|

Noncash interest expense on warrants related to convertible notes

|

18,255 | 1,431 | ||||||

|

Noncash interest expense - beneficial conversion feature

|

103,472 | 182,151 | ||||||

|

Non-controlling interest

|

(1,328 | ) | (1,960 | ) | ||||

|

Stock-based compensation expense

|

20,896 | 10,352 | ||||||

|

Issuance of membership units in lieu of cash payment (see note 10)

|

311,479 | - | ||||||

|

Issuance of convertible notes in lieu of rent

|

69,582 | - | ||||||

|

Bad debt expense

|

19,739 | 746 | ||||||

|

Loss on disposal of fixed assets

|

- | 49,216 | ||||||

|

Depreciation and amortization

|

58,855 | 86,089 | ||||||

|

Gain on foreign currency transactions

|

- | (8,650 | ) | |||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts receivable decrease (increase)

|

(5,407 | ) | 334,445 | |||||

|

Inventory decrease (increase)

|

36,387 | 76,086 | ||||||

|

Other current assets decrease (increase)

|

92,882 | (90,588 | ) | |||||

|

Other assets decrease (increase)

|

7,659 | (6,922 | ) | |||||

|

Accounts payable increase (decrease)

|

237,430 | 156,012 | ||||||

|

Deferred compensation increase (decrease)

|

13,472 | 152,993 | ||||||

|

Other current liabilities increase (decrease)

|

(45,709 | ) | (504,162 | ) | ||||

|

Due to affiliates increase (decrease)

|

(6,376 | ) | 22,073 | |||||

|

Net cash used in operating activities

|

(576,837 | ) | (1,246,827 | ) | ||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

||||||||

|

Purchase of property and equipment

|

- | (17,063 | ) | |||||

|

Leasehold improvements

|

- | (7,279 | ) | |||||

|

Net cash flows used in investing activities

|

- | (24,342 | ) | |||||

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

||||||||

|

Proceeds from issuance of convertible notes

|

75,000 | 418,000 | ||||||

|

Proceeds from issuance of short-term notes payable

|

439,033 | - | ||||||

|

Proceeds from issuance of membership units

|

10,000 | - | ||||||

|

Issuance of non-cash warrants other than convertible notes related

|

99 | 563 | ||||||

|

Net cash provided by financing activities

|

524,132 | 418,563 | ||||||

|

Effect of exchange rates on changes in cash

|

(5,397 | ) | 5,281 | |||||

|

Net decrease in cash and cash equivalents

|

(58,102 | ) | (847,325 | ) | ||||

|

Cash and cash equivalents, beginning of year

|

144,787 | 992,112 | ||||||

|

Cash and cash equivalents, end of year

|

$ | 86,685 | $ | 144,787 | ||||

|

SUPPLEMENTAL DISCLOSURES:

|

||||||||

|

Cash paid for interest

|

$ | 1,562 | $ | 563 | ||||

The accompanying notes are an integral part of these financial statements.

6

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

1. Organization

OryonTechnologies, LLC (“OTLLC” or the “Company”) is the parent of three wholly-owned companies: OryonTechnologies Licensing, LLC (“OTLIC”), OryonTechnologiesDevelopment, LLC (“OTD”), and OryonTechnologies International Pte. Ltd. (“OTI”). OTLLC, OTLIC and OTD are Texas Limited Liability Companies (“LLC”). OTI is a Singapore-based corporation. Operations at OTI were suspended in May 2009 and OTI is inactive. OTI originally owned 51% of Oryon-Asia Pacific Safety, Limited (“OAPS”), which was formed in December 2006 as a Hong Kong Limited Company. During 2011, the 51% ownership was transferred to OTLLC. The other 49% of OAPS is owned by two non-affiliated individuals. Operations of OAPS were suspended in February 2011 and OAPS is inactive. The Company is a developer of a patented electroluminescent (“EL”) lighting technology, trademarked as “ELastolite”, which enables thin, flexible, crushable, water-resistant lighting systems to be incorporated into multiple applications such as safety apparel, sporting goods, consumer goods and membrane switches, among others.

2. Significant Accounting Policies

Principles of Consolidation and Basis of Presentation

The Company uses the accrual method of accounting and all amounts are denominated in United States dollars. The accounts for OTI, which are maintained in Singapore dollars, have been converted from Singapore dollars to United States dollars at historical exchange rates.

All significant intercompany accounts and transactions have been eliminated in the consolidation. “Due to affiliates” represents amounts due to entities that own membership units or indebtedness of the Company but that are not part of the consolidated company presented herein.

Revenue Recognition

The Company recognizes revenue from products when the goods are shipped pursuant to a customer’s purchase order. Revenue from royalties is recorded in the period in which the sales of the underlying products are made. Revenue from license fees is recognized in the period in which they are due and payable.

7

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

2. Significant Accounting Policies, Continued

Use of Estimates

The preparation of the consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates that affect the amounts reported in the consolidated financial statements and the accompanying notes. Accounting estimates and assumptions are those that management considers to be the most critical to an understanding of the consolidated financial statements because they inherently involve significant judgments and uncertainties. All of these estimates reflect management’s judgment about current economic and market conditions and their effects based on information available as of the date of these consolidated financial statements. If such conditions persist longer or deteriorate further than expected, it is reasonably possible that the judgments and estimates could change, which may result in future impairments of assets, among other effects.

Significant estimates include the carrying value of intangible assets and the value of equity instruments, including convertible notes, stock options, warrants, and membership units issued in lieu of cash.

Cash and Cash Equivalents

Cash and cash equivalents consist of cash held in bank demand deposits. The Company considers all highly liquid investments purchased with original maturities of three months or less to be cash equivalents.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are accounted for at fair value, do not bear interest, and are short-term in nature. The Company maintains an allowance for doubtful accounts for estimated losses resulting from the inability to collect on accounts receivable. Based on management’s assessment, the Company provides for estimated uncollectible amounts through a charge to earnings and a credit to the valuation allowance. Balances that remain outstanding after the Company has used reasonable collection efforts are written off through a charge to the valuation allowance and a credit to accounts receivable. The Company does not require collateral.

8

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

2. Significant Accounting Policies, Continued

Concentrations of Credit Risk

Certain balance sheet items that potentially subject the Company to concentrations of credit risk are primarily accounts receivable. Concentrations of credit risk with accounts receivable are generally mitigated by the size of the Company’s customers. The Company performs ongoing credit evaluations of its customers and maintains an allowance for doubtful accounts based upon the expected collectability of all accounts receivable.

Inventory

Inventory is carried at the lower of cost or market. A physical inventory count is taken at the end of each calendar quarter and the accounting records are adjusted to match the physical inventory.

Property and Equipment

Property, equipment, computer hardware and software, and leasehold improvements are carried at historical cost. Expenditures are capitalized only if the cost of the individual asset exceeds $1,200 and the asset is expected to have a business use for greater than 12 months.

Depreciation is calculated on a straight line basis over the estimated useful life of the property acquired. Equipment and furniture is depreciated over 60 months. Computer software and hardware is depreciated over 36 months. Leasehold improvements are amortized over the life of the lease or the life of the improvement, whichever is shorter.

Inter-company transfers of assets are recorded at depreciated cost, with no change in estimated life or monthly depreciation.

Research and Development

The Company expenses all costs associated with the development of applications for the Company’s technology as the costs are incurred.

9

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

2. Significant Accounting Policies, Continued

Intangible Assets

Amortization is computed based on the straight line method over the life of the patent, which is 180 months beginning with the month when the patent is granted. The amortization is based on the historical cost of each individual patent. Costs incurred to renew or extend the terms of patents are expensed as incurred.

The Company annually assesses whether the carrying value of its intangible assets exceeds their fair value and records an impairment loss equal to any excess.

Income Taxes

OTI and OAPS are not consolidated into the Company for purposes of United States tax filings and computations. OTLLC, OTD and OTLIC are limited liability corporations and, as such, do not pay federal or state income taxes. Accordingly, no taxes have been accrued on the Company’s records.

Stock-Based Compensation

The Company utilizes equity based awards as a form of compensation for employees, officers and managers. The Company records compensation expense for all awards granted. After assessing alternative valuation models and amortization methods, the Company uses the Black-Scholes valuation model and straight-line amortization of compensation expense over the requisite service period for each grant. The Company will reconsider use of this model if additional information becomes available in the future that indicates another model would be more appropriate or if grants issued in future periods have characteristics that cannot be reasonably estimated using this model.

Leases

The company leases office and data facilities under non-cancelable operating leases. The Company recognizes rent on a straight-line basis over the lease term.

10

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

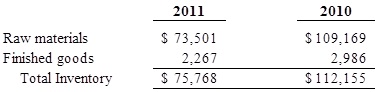

3. Inventory

Inventory consists of the following at December 31,

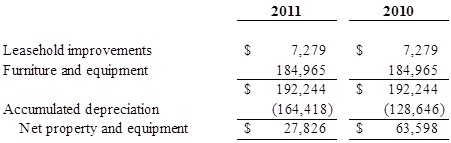

4. Property and Equipment

Property and equipment consist of the following at December 31,

Depreciation expense was $35,771 and $59,758 for the years ended December 31, 2011 and 2010, respectively.

11

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

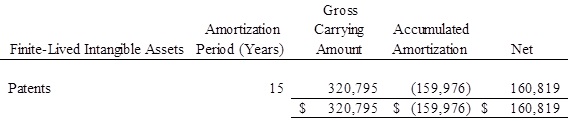

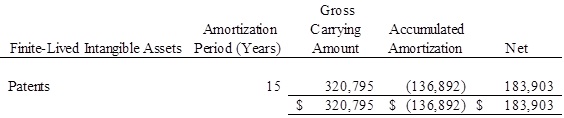

5. Intangible Assets

As of December 31, 2011 and 2010, the Company’s only intangible assets consisted of patents with a gross carrying cost of $320,795 and accumulated amortization of $159,976 and $136,892, respectively. The remaining weighted average amortization period is 8.6 years at December 31, 2011. The estimated aggregate amortization expense in each of the years ending December 31, 2012 through December 31, 2015, is $23,084 per year.

The balances as of December 31, 2011, including intangible assets and accumulated amortization are detailed as follows:

The balances as of December 31, 2010, including intangible assets and accumulated amortization are detailed as follows:

Amortization expense for the years ended December 31, 2011 and 2010 was $23,084 and $26,331, respectively.

12

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

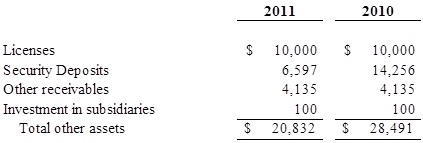

6. Other Long Term Assets

Other long term assets consist of the following at December 31,

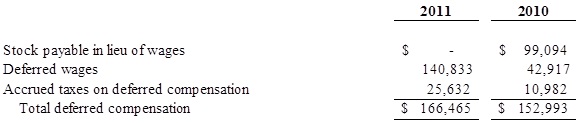

7. Deferred Compensation

Deferred compensation consists of the following at December 31,

Prior to August 31, 2011, the Company was obligated to issue membership units to certain senior level employees in lieu of cash wages in connection with employee agreements with those employees. The employment agreements provided that the employees would receive membership units in lieu of cash compensation until such time as the Company obtains sufficient capital (as defined in the agreements) to begin paying their agreed-upon compensation in cash. The obligation for additional issuances was accrued each pay period and the Company was obligated to issue the membership units at the beginning of each calendar quarter, provided that the employee was still employed by the Company.

No membership units were issued in 2010. As of December 31, 2010, the Company was obligated to issue membership units in lieu of $99,094 in wages for the year ended December 31, 2010 on the first day of the subsequent quarter. Accordingly, a total of 99,094 membership units were issued on January 1, 2011 at a value of $1.00 per unit. An additional 194,222 membership units were issued on October 1, 2011 at a value of $1.00 per unit under the employment agreements in lieu of compensation earned between January 1, 2011 and August 31, 2011, for a total of 293,316 membership units issued in 2011 in lieu of cash wages.

13

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

Deferred Compensation, Continued

Effective September 1, 2011, the agreements were revised to provide for the indefinite deferral of unpaid wages until sufficient external funding was obtained. Deferred wages at December 31, 2011 and 2010 of $140,833 and $42,917, respectively, is included in deferred compensation.

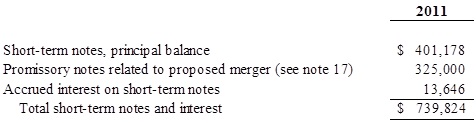

8. Other Short-Term Debt

Other short-term debt consists of the following at December 31,

During the year ended December 31, 2011 the Company was unable to complete a financing with a private equity firm that had been expected to provide the Company with adequate capital. To fund continuing operations at a reduced level of expenditures, the Company issued short-term notes to several individuals. In addition, one vendor required that the outstanding accounts payable balance of $287,145 be converted to a promissory note. Such note accrues interest at 10% annually and is payable upon demand.

In October 2011, the Company signed a binding letter of intent to negotiate a merger agreement with a publicly-listed company. In connection with the letter of intent, the Company was advanced a total of $325,000, in exchange for promissory notes, to fund the Company’s activities. The promissory notes are payable at the time of closing of the proposed merger. In the event that the merger is not completed, the notes accrue interest at 5% annually and become payable when the Company experiences one of several events as defined in the promissory notes.

14

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

9. Other Current Liabilities

Other liabilities consisted of the following at December 31,

Unearned Grant Income

During the year ended December 31, 2007, OTI received a grant from the Singapore Economic Development Board (EDB). OTI was not able to fulfill its obligations under the grant agreement and was therefore liable to return the grant to the EDB.

OTI recognized the income in April of 2011, after receiving confirmation that the EDB had agreed to waive the clawback of funds disbursed for the grant.

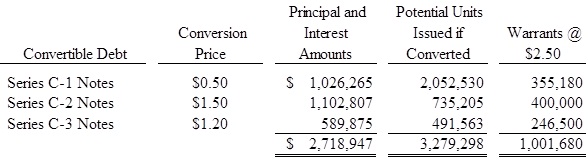

10. Notes Payable

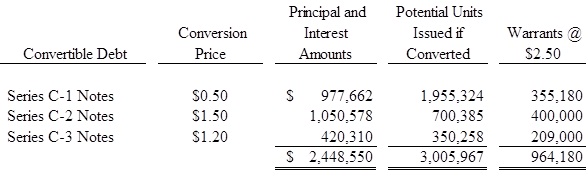

The Company has outstanding three series of convertible notes issued November 2010 (the Series C-1 notes, the Series C-2 notes, and the Series C-3 notes, collectively the “Notes”) with a combined total principal obligation of $2,579,220 at December 31, 2011 and $2,434,637 at December 31, 2010. Combined interest obligations as of December 31, 2011 and 2010 of $139,728 and $13,912 result in a total obligation of $2,718,947 and $2,448,550 as of December 31, 2011 and 2010, respectively. Each series of Notes is convertible under certain circumstances into the Company’s membership units at different conversion rates. The holders of the Notes received detachable warrants to purchase membership units at $2.50/unit in connection with their investment in the Notes. In November 2010, the Company issued the Series C-1 notes as payoff of the previously outstanding Series A convertible notes and the Series C-2 notes for the previously outstanding Series B convertible notes.

15

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

10. Notes Payable,

The following table shows the number of potential units if all the Notes were converted and the related warrants were all exercised as of December 31, 2011:

The following table shows the number of potential units if all the Notes were converted and the related warrants were all exercised as of December 31, 2010:

The Company has not included these units in earnings per unit calculations as they are anti-dilutive.

16

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

10. Notes Payable, Continued

Interest on the Notes accrues at the rate of 5% per annum, compounded annually, and is payable at the election of the Company on the last day of each calendar quarter. Accrued but unpaid interest is added to the principal. Accrued and unpaid interest will be converted to membership units if the related Note principal is converted to membership units. The accrued and unpaid interest becomes payable on the maturity date of December 31, 2012. If not converted or paid on the maturity date, then any accrued and unpaid interest on the Notes will be added to the Note principal and the then outstanding principal balance will be payable in two equal annual installments on December 31, 2013 and December 31, 2014, together with interest earned at the rate of 5% per annum, compounded annually, which interest shall be paid quarterly commencing in the first quarter of 2013. The Notes are secured by substantially all assets of the Company.

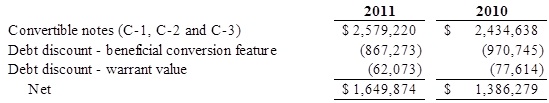

Notes payable consist of the following at December 31,

The previously outstanding Series A convertible notes payable were determined to have an embedded beneficial conversion feature under the provisions of FASB ASC 470-20, “Debt with Conversion and Other Options” based on the 2008 and 2009 issuances at market value of $2 per share and an exercise price of $1.00 per share. In accordance with ASC 470-20, an embedded conversion feature present in a convertible instrument shall be recognized separately at issuance by allocating a portion of the proceeds equal to the intrinsic value of that feature to additional paid-in capital. A discount of $887,950 was recorded for Series A convertible note issuances during 2008 thru 2009 and amortization expense recognized in the amounts of $0 and $ 180,826 for years ended December 31, 2011 and December 31, 2010, respectively.

17

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

10. Notes Payable, Continued

In November 2010, the Company extinguished previously issued Series A and Series B convertible notes and issued new Series C-1 and Series C-2 convertible notes to replace the Series A and Series B notes. As a result of this transaction a gain on extinguishment of debt was recognized in the amount of $264,676 under the provisions of ASC 470-50, “Modifications and Extinguishments”.

The Series C-1 convertible notes, issued in exchange for the Series A convertible notes, were also determined to have an embedded beneficial conversion feature under the provisions of FASB ASC 470-20, “Debt with Conversion and Other Options” based on the November 2010 market value of $1 per share and an exercise price of $.50 per share. In accordance with ASC470-20, an embedded conversion feature present in a convertible instrument shall be recognized separately at issuance by allocating a portion of the proceeds equal to the intrinsic value of that feature to additional paid-in capital. A discount of $972,070 was recorded at November 2010 for the Series C-1 convertible note issuances and amortization expense recognized in the amounts of $103,472 and $1,325 for years ended December 31, 2011 and December 31, 2010, respectively. The unamortized discount balance as of December 31, 2011 and 2010 was $867,273 and $970,745, respectively.

18

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

11. Leases

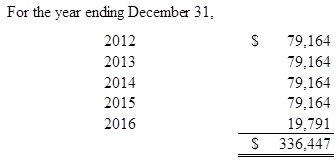

Rent expense relating to the operating lease agreement was $91,670 and $67,038 for the years ended December 31, 2011 and 2010, respectively. As of December 31, 2011, the future minimum payments required under all operating leases with terms in excess of one year are as follows:

The Company’s only lease is for its office and production facility, consisting of approximately 9,957 square feet in a building located at 4251 Kellway Circle in Addison Texas. The Company is obligated to pay $6,597 per month through March 31, 2016.

The Company began leasing its current facilities in April of 2010 under an operating lease that extends through March of 2016. In August of 2011 the Company reached an agreement with the lessor to issue Series C-3 notes as payment for the July 2011 through January 2012 rent. The Company also agreed to issue an additional $30,000 Series C-3 convertible note in exchange for the lessor’s acceptance of such agreement. This payment is amortized over the 7 months of rent paid by note and charged to rent.

As of December 31, 2010, the Company remained obligated, under certain circumstances, to contractors for the leasehold improvements to the space in the amount of $37,287 (recorded as an accounts payable) and the lessor, 4257 Kellway Circle General Partnership, was contractually obligated to the Company in the amount of $40,000 (carried on the books as an other receivable) to compensate the Company for leasehold improvements. The Company was not obligated to pay the contractors until the lessor paid the Company. In 2011, the lessor paid the Company, which subsequently paid the contractors. These leasehold improvements have been depreciated over the remaining life of the lease.

19

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

12. Commitments and Contingencies

The Company is engaged in various legal proceedings that are routine in nature and incidental to its business. None of these proceedings, either individually or in the aggregate, is believed, in management’s option, to have a material adverse effect on either its consolidated financial position or its consolidated results of operations.

As of December 31, 2011, a number of the Company’s employees were covered by employment agreements. In general, the employment agreements contain non-compete provisions ranging from six months to one year following the term of the applicable agreement.

13. Income Taxes

The Company is a Limited Liability Company and, as such, does not pay income taxes. The Company does file separate tax returns for each LLC and provide the applicable investors with appropriate personally individualized documentation. All returns for OTLLC, OTD and OTLLC are current through 2010 tax years and returns for the 2011 tax year are expected to be filed on a timely basis.

OTI is taxed in Singapore. The tax return for the year 2008 was filed on a timely basis but the returns for the 2009 and 2010 tax years were filed overdue. OTI generated substantial tax losses during its existence and therefore received a tax refund of $5,181 in 2011 for estimated taxes paid prior to 2009. No anticipated tax liability exists at December 31, 2011.

OAPS is taxed in Hong Kong. The tax return for the year 2008 was filed on a timely basis but the returns for the 2009 and 2010 tax years were filed overdue. OAPS generated substantial tax losses during its existence and no anticipated tax liability exists at December 31, 2011.

14. Capital

As of December 31, 2011 and 2010, the Company has issued and outstanding a total of 2,062,765 and 1,741,286 membership units, respectively. During 2011, membership units of 293,316 were issued under employment agreements as described in note 7 and valued at $1.00 per unit, membership units of 18,163 were issued in lieu of cash payment for various liabilities and were valued at $1 per unit, and membership units of 10,000 were issued to new investors and were valued at $1 per unit for a total of 321,479 membership units issued in 2011.

20

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

15. Membership Unit Options and Warrants

The Company adopted the 2004 Unit Option Plan under which officers, employees, advisors and managers may be awarded membership unit option grants. Under the 2004 Unit Option Plan, the board may fix the term and vesting schedule of each option. Vested options generally remain exercisable for up to three months after a participant's termination of service or up to 12 months after a participant's death or disability. Typically, exercise price of a nonqualified option must not be less than the fair market value of the units on the grant date. The exercise price of each unit option granted under the 2004 Plan must be paid in cash when the option is exercised. Generally, options are not transferable except by will or the laws of descent and distribution.

Stock Options

The Company used the modified Black-Scholes model to estimate the fair value of employee unit options on the date of grant utilizing the assumptions noted below. The risk-free rate is based on the U.S. Treasury bill yield curve in effect at the time of grant for the expected term of the option. The expected term of options granted represents the period of time that the options are expected to be outstanding. Expected volatilities are based on historical volatilities of selected technology stock mutual funds. The dividend yield was zero since the Company will not be paying dividends for the foreseeable future.

Range of risk-free interest rates 1.62% - 3.19%

Expected term of options in years 5.839 – 6.5058

Range of expected volatility 34.74% – 38.42%

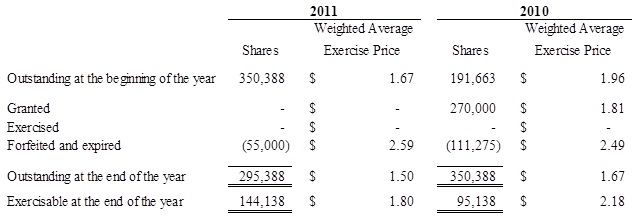

A summary of unit option activity for the years ended December 31, 2011 and 2010 follows:

21

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

15. Membership Unit Options and Warrants, Continued

Stock Options, Continued

The Company recognized total compensation expense related to the unit options of $20,896 and $10,352 during 2011 and 2010, respectively. Compensation expense is included in selling, general and administrative expenses in the consolidated statement of operations. Total unrecognized compensation expense related to unvested unit options was $33,710 and $55,176 at December 31, 2011 and 2010, respectively.

No options were granted during 2011. The weighted average grant date fair value of unit options granted during 2010 was $0.26.

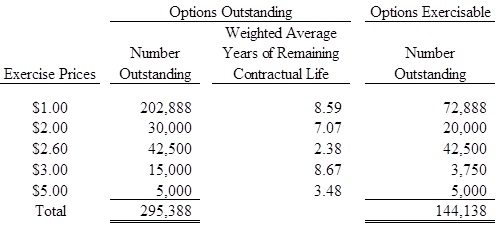

Unit options outstanding and exercisable at December 31, 2011 were as follows:

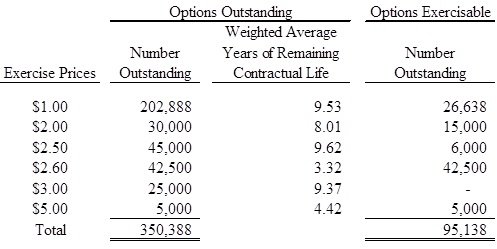

Unit options outstanding and excercisable at December 31, 2010 were as follows:

22

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

15. Membership Unit Options and Warrants, Continued

Stock Options, Continued

The membership unit options outstanding and exercisable at December 31, 2011 and 2010 had an aggregate intrinsic value of zero as the aggregate exercise price was greater than the aggregate market value. No options were exercised during 2011 or 2010.

The Company has not included these units in earnings per unit calculations as they are anti-dilutive.

Warrants

At December 31, 2011, the Company has issued warrants for 1,001,680 membership units to the holders of the Notes (see note 8) and additional warrants for 13,459 membership units to other individuals for a total of 1,015,139 warrants outstanding. Of the warrants outstanding, 5,334 were issued in 2009, exercisable at $3.00 per unit and had a weighted average grant date fair value of $0.073. In 2010, 971,055 warrants were issued, exercisable at $2.50 per unit, that had a weighted average grant date fair value of $0.082. The remaining 38,750 warrants were issued in 2011, exercisable at $2.50 per unit and had a weighted average grant date fair value of $0.061. The Company uses the modified Black-Scholes model to estimate the fair value of warrants on the date of issuance. Under the provisions of FASB ASC 470-20-25, the Company allocated the fair value of the warrants at issuance and recorded debt discount and additional paid in capital in the amounts of $2,812 and$79,608 for the years ended December 31, 2011 and 2010, respectively. Amortization of debt discount related to the warrant issuances of $18,353 (including $99 for warrants not related to the convertible notes) and $1,994 (including $563 for warrants not related to the convertible notes) was recorded for the years ended December 31, 2011 and 2010, respectively.

The company has not included these units in earnings per share calculations as they are anti-dilutive.

23

ORYONTECHNOLOGIES, LLC AND SUBSIDIARIES

Notes to Consolidated Financial Statements

December 31, 2011 and 2010

16. Benefit Plans

The Company established a 401(k) Plan (the “Plan”) for eligible employees of the Company. Generally, all employees of the Company who are twenty-one years of age and who have completed one-half year of service are eligible to participate in the Plan. The Plan is a defined contribution plan that provides that participants may make voluntary salary deferral contributions, on a pretax basis, between 1% and 15% of their compensation in the form of voluntary payroll deductions, up to a maximum amount as indexed for cost of living adjustments. The Company may make discretionary contributions. In 2011 the Company made contributions of $833 and paid $2,775 in maintenance fees. In 2010, the Company made contributions of $3,922 and paid $2,775 in maintenance fees.

17. Going Concern

The Company has accumulated losses from inception through December 31, 2011 of $8,069,326, has minimal assets, and has negative working capital. These factors raise substantial doubt about the Company’s ability to continue as a going concern. These factors may have potential adverse effects on the Company including the ceasing of operations.

Management is presently in negotiations with a publicly-listed company regarding a merger which, if completed, is expected to provide substantial additional equity capital to finance the Company’s operations through at least 2012. If management is unsuccessful in these efforts, discontinuance of operations is possible. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

18. Subsequent Events

The Company has evaluated subsequent events that occurred after December 31, 2011 through January 30, 2012, the date these reports were available to be issued. Any material subsequent events that occurred during that time period have been properly recognized or disclosed in the Company’s financial statements.

24