Attached files

| file | filename |

|---|---|

| 8-K - HAMPDEN BANCORP, INC. 8-K - Hampden Bancorp, Inc. | a50267443.htm |

| EX-99.1 - EXHIBIT 99.1 - Hampden Bancorp, Inc. | a50267443-ex991.htm |

Exhibit 99.2

Stifel Nocolaus Hampden Bancorp, Inc. 24-hour Un-Conference: Southwest MA & Northern CT Presentation Monday, May 7

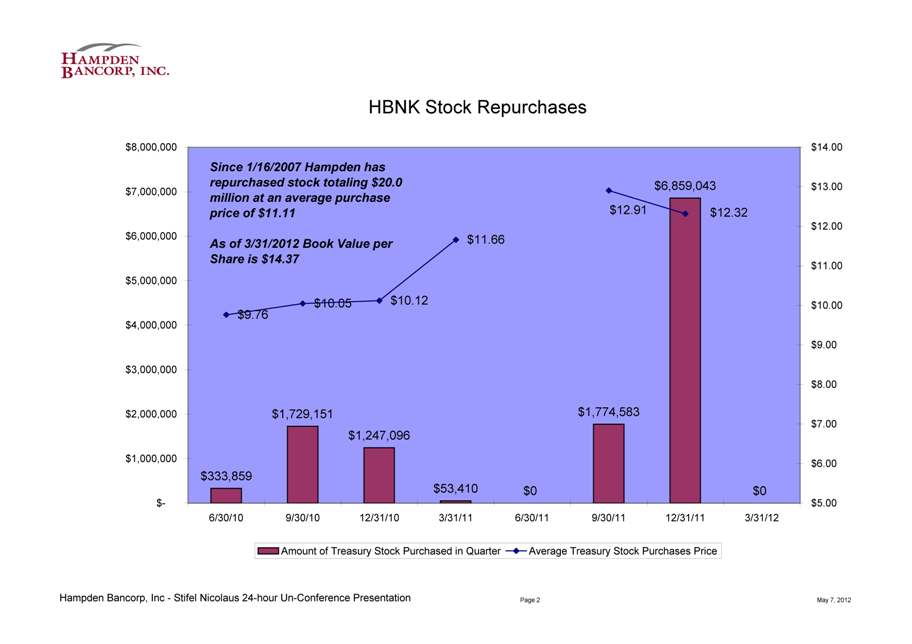

HBNK Stock Repurchases $333,859 $1,729,151 $1,247,096 $53,410 $0 $1,774,583 $6,859,043 $0 $9.76 $10.05 $10.12 $11.66 $12.32 $12.91 $- $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000 $8,000,000 6/30/10 9/30/10 12/31/10 3/31/11 6/30/11 9/30/11 12/31/11 3/31/12 $5.00 $6.00 $7.00 $8.00 $9.00 $10.00 $11.00 $12.00 $13.00 $14.00 Amount of Treasury Stock Purchased in Quarter Average Treasury Stock Purchases Price Since 1/16/2007 Hampden has repurchased stock totaling $20.0 million at an average purchase price of $11.11 As of 3/31/2012 Book Value per Share is $14.37 Page 2

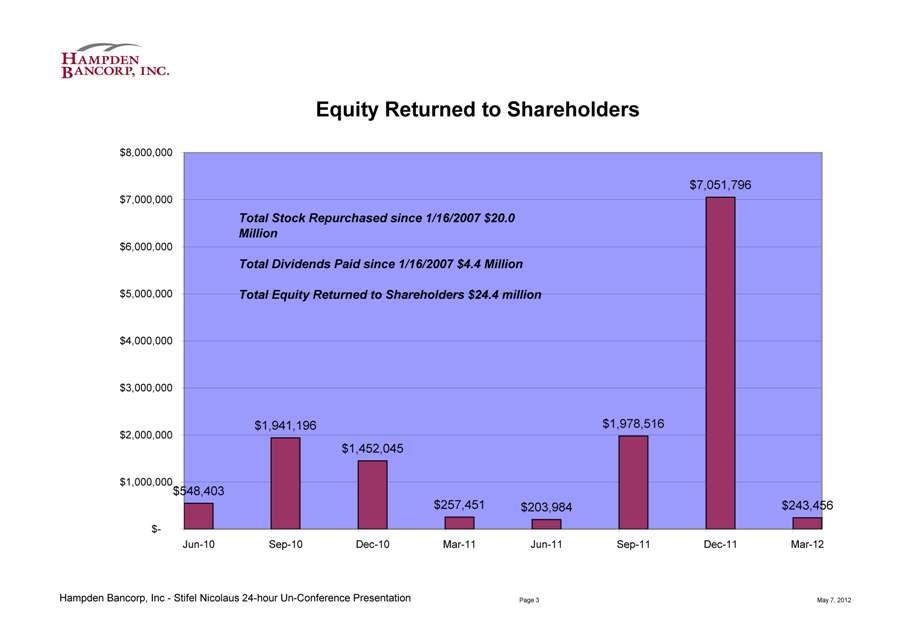

Equity Returned to Shareholders $548,403 $1,941,196 $1,452,045 $257,451 $203,984 $1,978,516 $7,051,796 $243,456 $- $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000 $8,000,000 Jun-10 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Total Stock Repurchased since 1/16/2007 $20.0 Million Total Dividends Paid since 1/16/2007 $4.4 Million Total Equity Returned to Shareholders $24.4 million Page 3

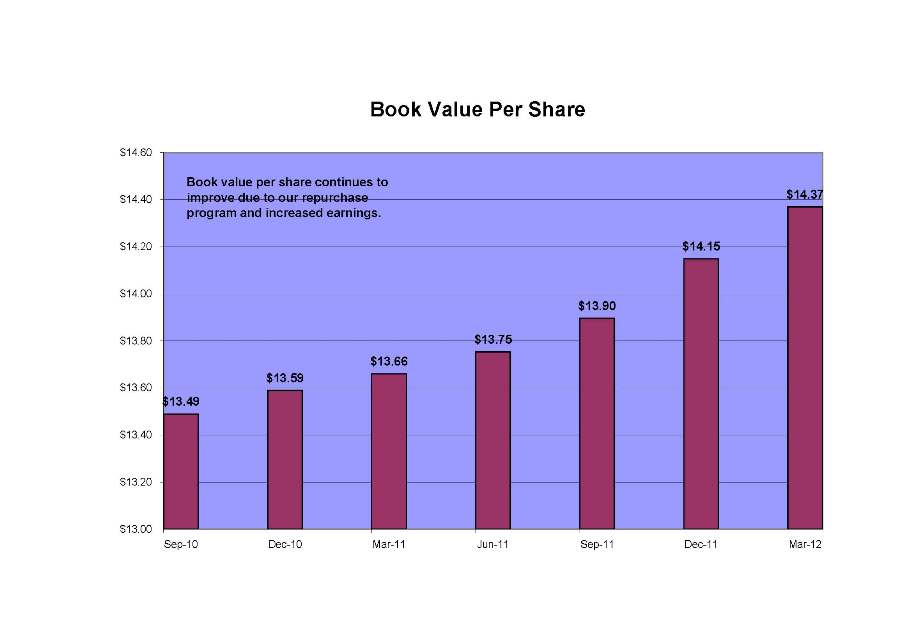

Book Value Per Share $13.49 $13.59 $13.66 $13.75 $13.90 $14.15 $14.37 $13.00 $13.20 $13.40 $13.60 $13.80 $14.00 $14.20 $14.40 $14.60 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Book value per share continues to improve due to our repurchase program and increased earnings. Page 4

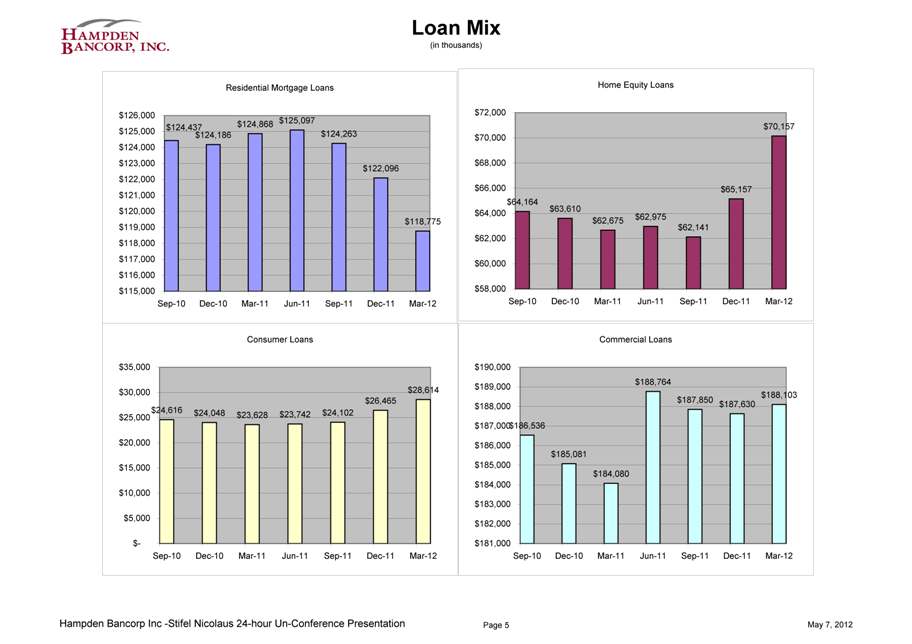

Loan Mix (in thousands) Residential Mortgage Loans $124,186 $124,868 $125,097 $124,263 $122,096 $118,775 $124,437 $115,000 $116,000 $117,000 $118,000 $119,000 $120,000 $121,000 $122,000 $123,000 $124,000 $125,000 $126,000 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Home Equity Loans $64,164 $63,610 $62,675 $62,975 $62,141 $65,157 $70,157 $58,000 $60,000 $62,000 $64,000 $66,000 $68,000 $70,000 $72,000 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Consumer Loans $24,616 $24,048 $23,628 $23,742 $24,102 $26,465 $28,614 $- $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Commercial Loans $186,536 $185,081 $184,080 $188,764 $187,850 $187,630 $188,103 $181,000 $182,000 $183,000 $184,000 $185,000 $186,000 $187,000 $188,000 $189,000 $190,000 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Hampden Bancorp Inc -Stifel Nicolaus 24-hour Un-Conference Presentation Page 5 May 7, 2012

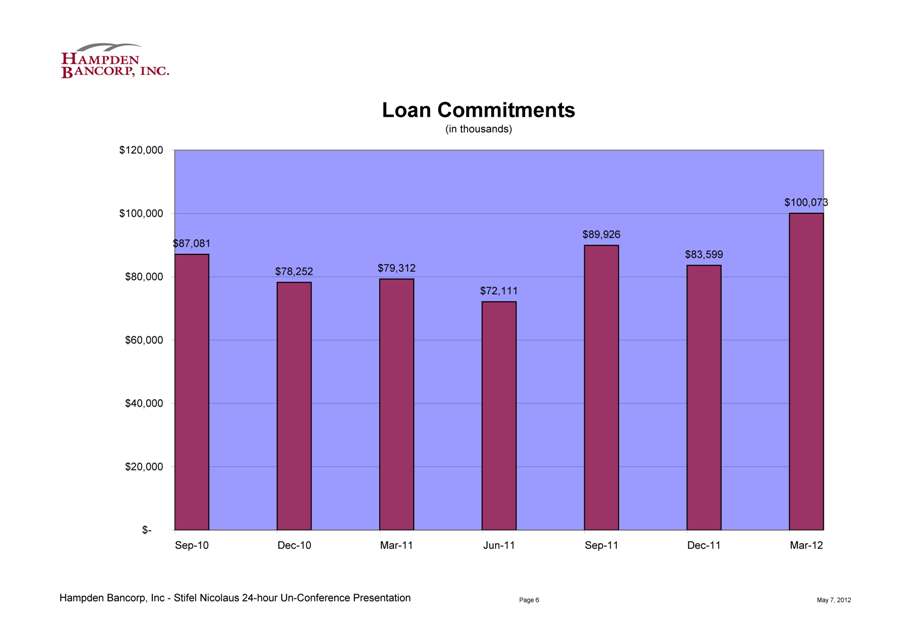

Loan Commitments (in thousands) $87,081 $78,252 $79,312 $72,111 $89,926 $83,599 $100,073 $- $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Page 6

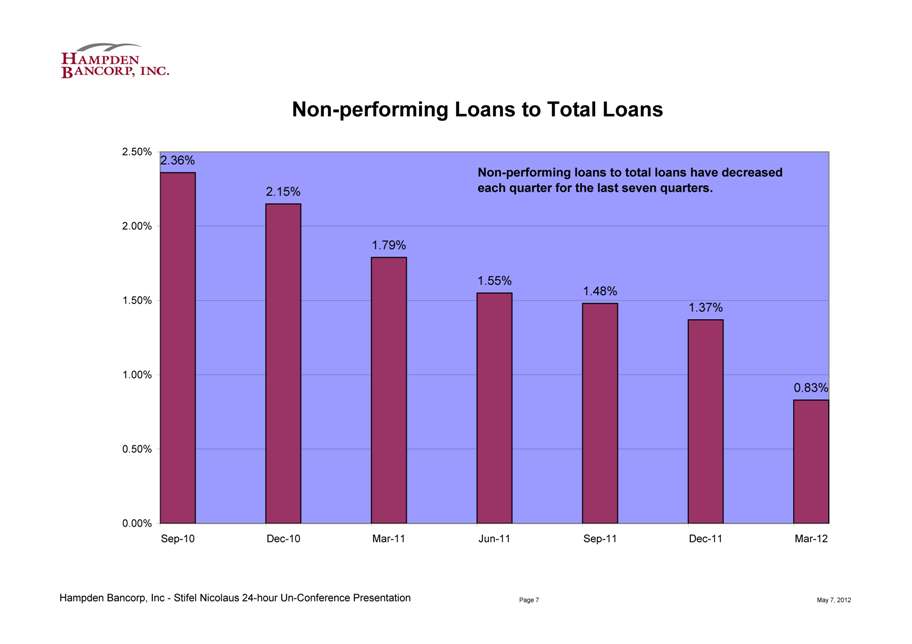

Non-performing Loans to Total Loans 2.36% 2.15% 1.79% 1.55% 1.48% 1.37% 0.83% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Non-performing loans to total loans have decreased each quarter for the last seven quarters. Page 7

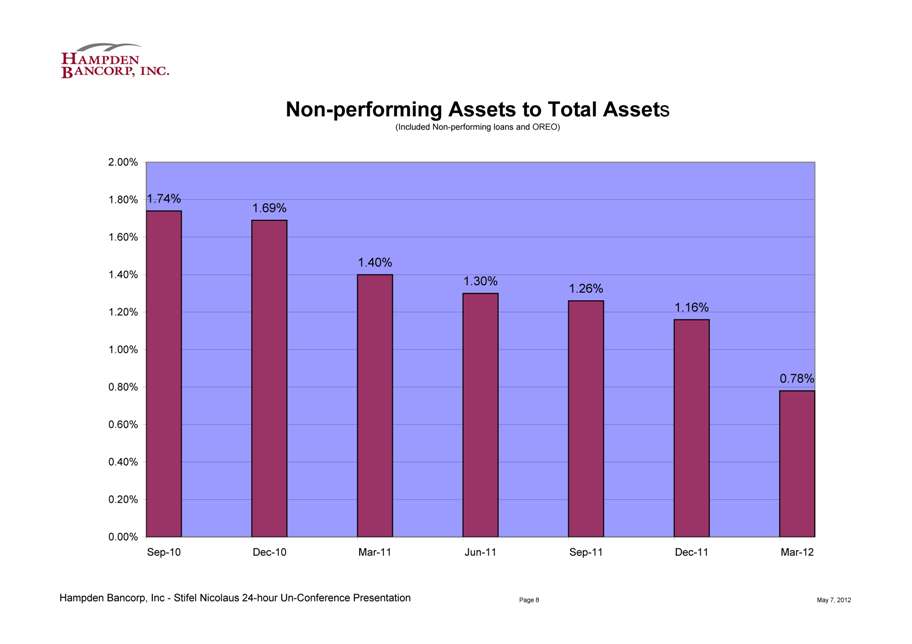

Non-performing Assets to Total Assets (Included Non-performing loans and OREO) 1.74% 1.69% 1.40% 1.30% 1.26% 1.16% 0.78% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Page 8

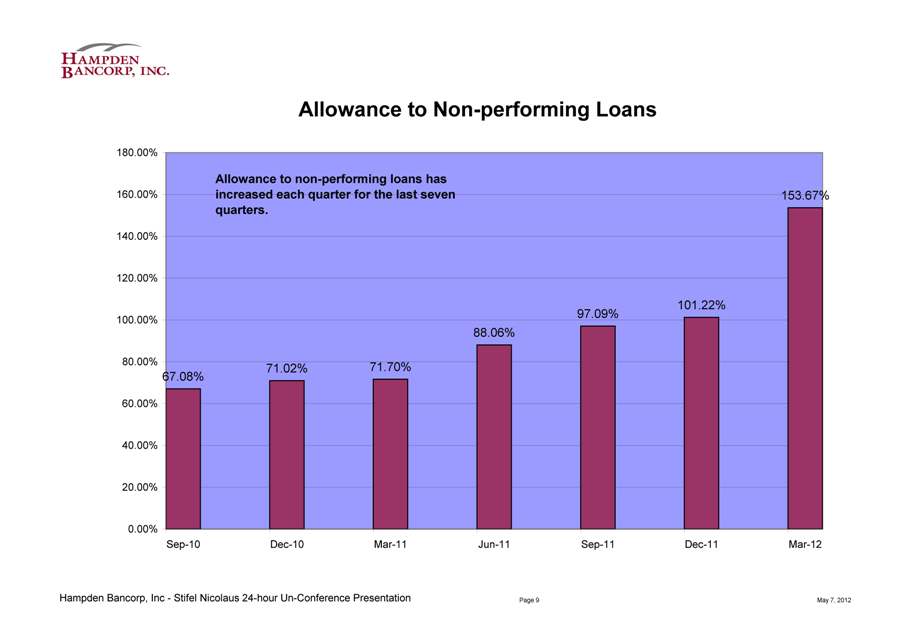

Allowance to Non-performing Loans 67.08% 71.02% 71.70% 88.06% 97.09% 101.22% 153.67% 0.00% 20.00% 40.00% 60.00% 80.00% 100.00% 120.00% 140.00% 160.00% 180.00% Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Allowance to non-performing loans has increased each quarter for the last seven quarters. Page 9

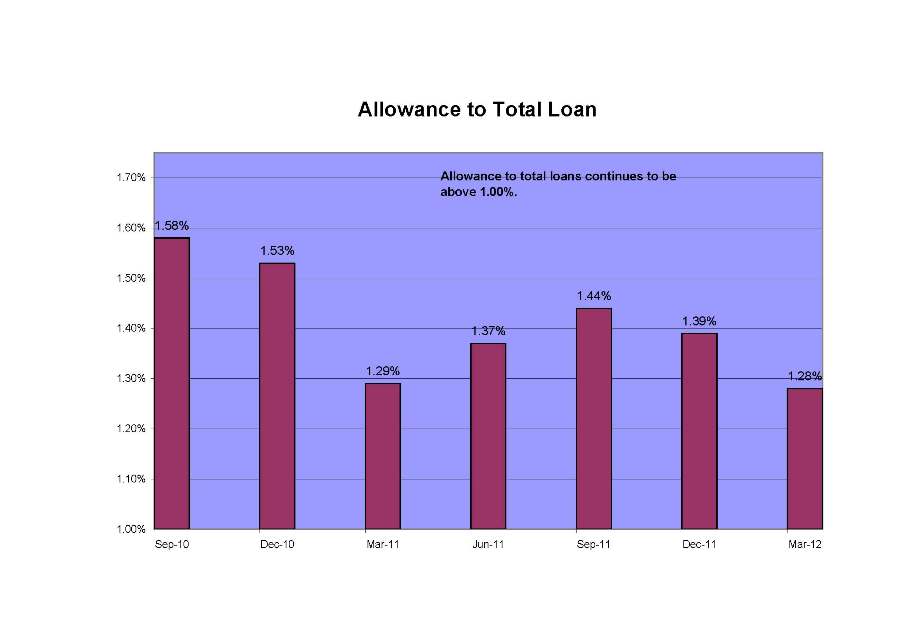

Allowance to Total Loan 1.58% 1.53% 1.29% 1.37% 1.44% 1.39% 1.28% 1.00% 1.10% 1.20% 1.30% 1.40% 1.50% 1.60% 1.70% Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Allowance to total loans continues to be above 1.00%. Page 10

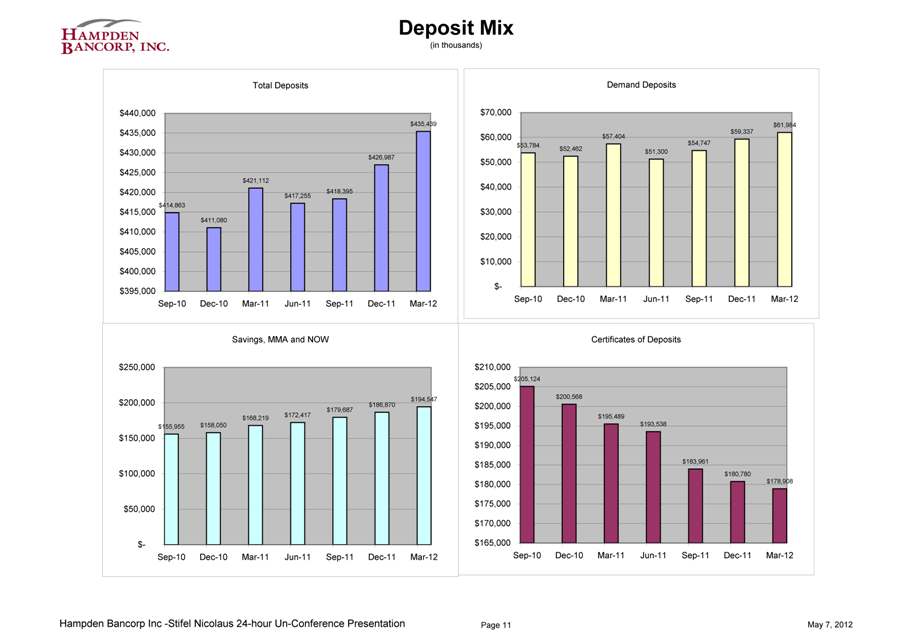

Deposit Mix (in thousands) Total Deposits $414,863 $411,080 $421,112 $417,255 $418,395 $435,439 $426,987 $395,000 $400,000 $405,000 $410,000 $415,000 $420,000 $425,000 $430,000 $435,000 $440,000 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Demand Deposits $53,784 $52,462 $57,404 $51,300 $54,747 $59,337 $61,984 $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Savings, MMA and NOW $155,955 $158,050 $168,219 $172,417 $179,687 $186,870 $194,547 $- $50,000 $100,000 $150,000 $200,000 $250,000 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Certificates of Deposits $205,124 $200,568 $195,489 $193,538 $183,961 $180,780 $178,908 $165,000 $170,000 $175,000 $180,000 $185,000 $190,000 $195,000 $200,000 $205,000 $210,000 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Page 11

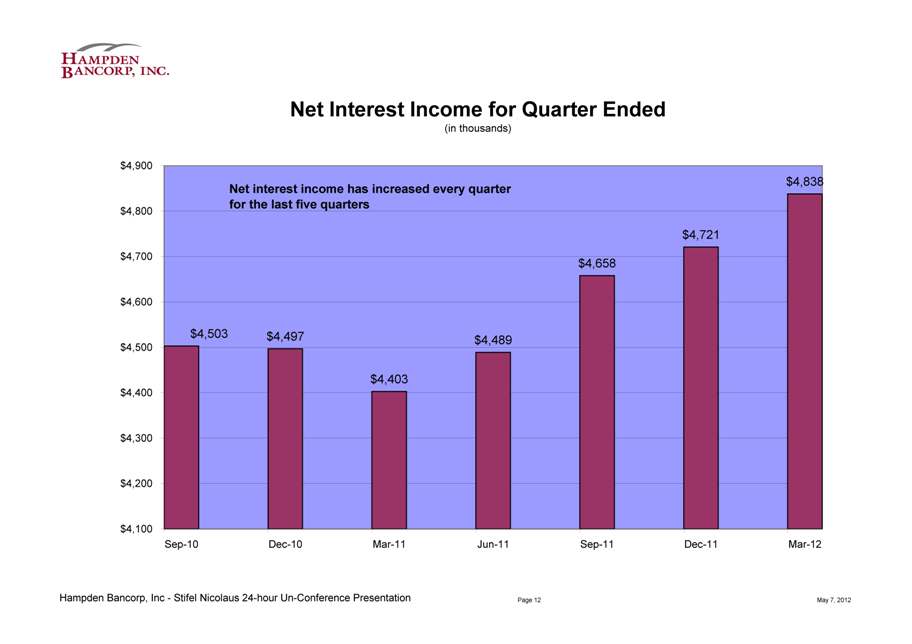

Net Interest Income for Quarter Ended (in thousands) $4,497 $4,403 $4,489 $4,658 $4,721 $4,838 $4,503 $4,100 $4,200 $4,300 $4,400 $4,500 $4,600 $4,700 $4,800 $4,900 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Net interest income has increased every quarter for the last five quarters Page 12

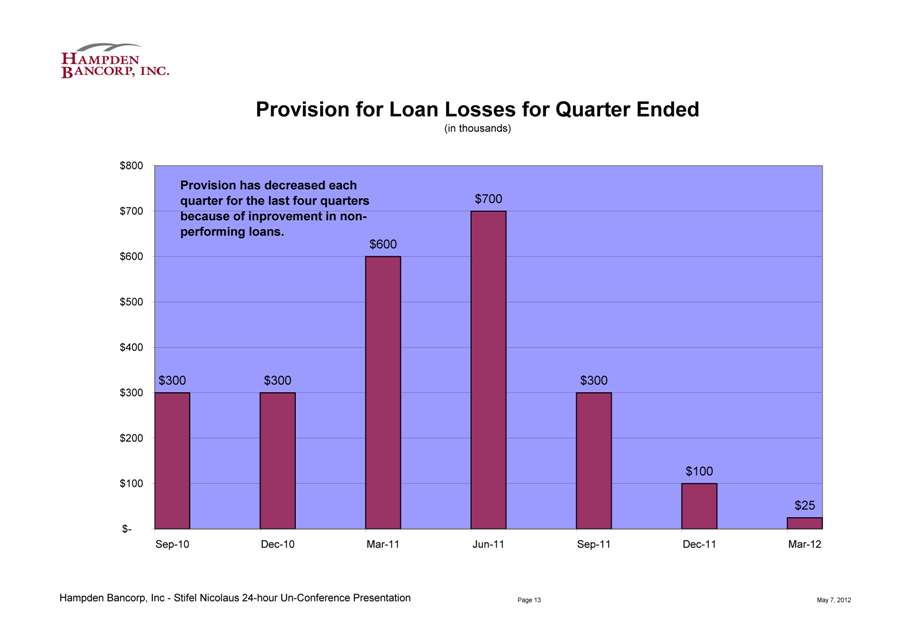

Provision for Loan Losses for Quarter Ended (in thousands) $300 $300 $600 $700 $300 $100 $25 $- $100 $200 $300 $400 $500 $600 $700 $800 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Provision has decreased each quarter for the last four quarters because of inprovement in nonperforming loans. Page 13

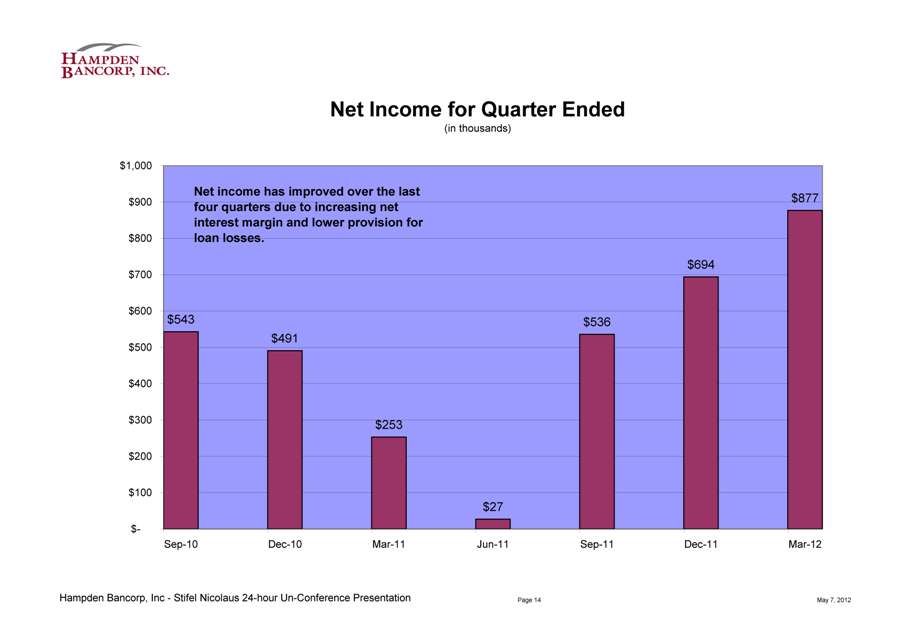

Net Income for Quarter Ended (in thousands) $543 $491 $253 $27 $536 $694 $877 $- $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Net income has improved over the last four quarters due to increasing net interest margin and lower provision for loan losses. Page 14

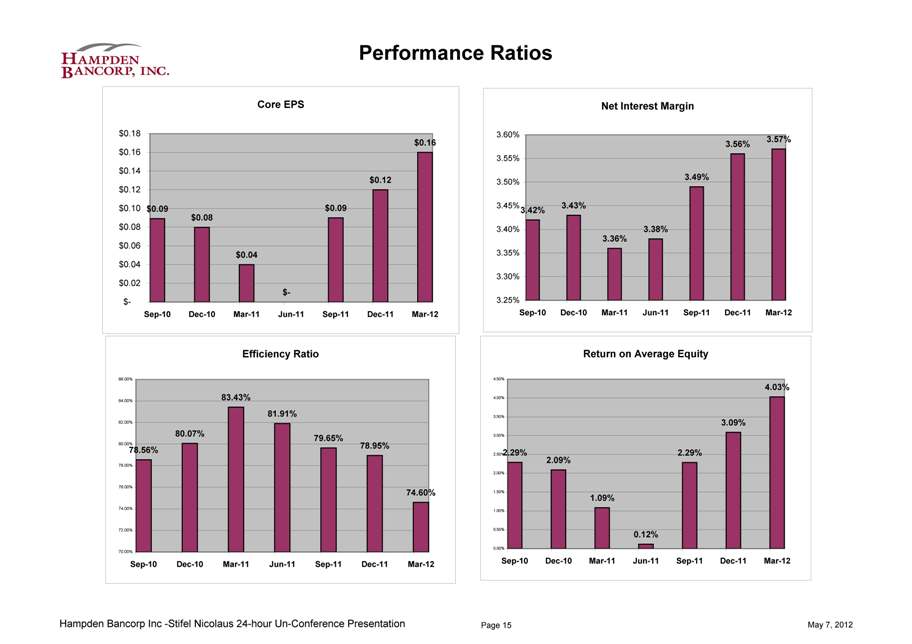

Performance Ratios Core EPS $0.09 $0.08 $0.04 $- $0.09 $0.12 $0.16 $- $0.02 $0.04 $0.06 $0.08 $0.10 $0.12 $0.14 $0.16 $0.18 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Net Interest Margin 3.42% 3.43% 3.36% 3.38% 3.49% 3.56% 3.57% 3.25% 3.30% 3.35% 3.40% 3.45% 3.50% 3.55% 3.60% Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Efficiency Ratio 78.56% 80.07% 83.43% 81.91% 79.65% 78.95% 74.60% 70.00% 72.00% 74.00% 76.00% 78.00% 80.00% 82.00% 84.00% 86.00% Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Return on Average Equity 2.29% 2.09% 1.09% 0.12% 2.29% 3.09% 4.03% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Hampden Bancorp Inc -Stifel Nicolaus 24-hour Un-Conference Presentation Page 15 May 7, 2012