Attached files

| file | filename |

|---|---|

| 8-K - STEEL PARTNERS HOLDINGS L.P. | form8k04197_05022012.htm |

| EX-99.2 - STEEL PARTNERS HOLDINGS L.P. | ex992to8k04197_05022012.htm |

Exhibit 99.1

Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022

(212) 520-2300

May 4, 2012

Dear Unitholders:

Steel Partners Holdings L.P. (NYSE: SPLP) (“SPH”) achieved many important milestones during 2011 and early 2012, as we completed our transformation into a global, publicly traded diversified holding company. At the holding company level, we fulfilled important regulatory and financial reporting requirements that enabled our recent listing on the New York Stock Exchange. Additionally, our operating companies did relatively well in 2011 and, in general, were able to increase revenues and profits, as well as grow through selective acquisitions.

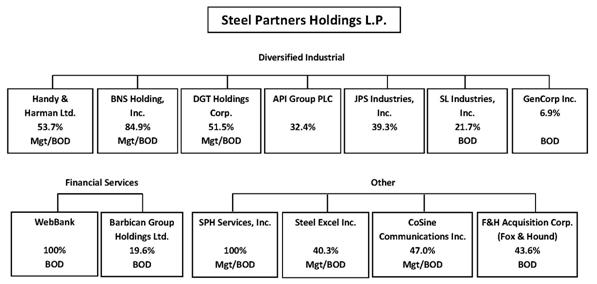

Below is an organizational chart which should give a better understanding of our main holdings structure, our role in management, and on the boards of directors of these companies.

Direct and indirect ownership interests above are as of March 31, 2012.

As of December 31, 2011, SPH’s total assets were $1.1 billion and unitholders’ equity was $415.8 million. Per-unit book value was $16.51. Estimated net assets of SPH at January 31, 2012 were $453.7 million, while estimated net asset value per SPH common unit at January 31, 2012 was $18.02.

Some of the highlights of the progress we made since the beginning of our restructuring in 2009 include:

|

|

·

|

In April 2010, SPH made a cash distribution of $54.4 million per unit, or approximately $1.947 per common unit, to SPH unitholders and in April 2011, SPH made a cash distribution of $33.1 million, or approximately $1.182 per common unit to the SPH unitholders. In total, SPH has distributed $87.5 million in cash, or approximately $3.129 per common unit.

|

1

|

|

·

|

As of December 31, 2011, SPH was debt-free at the holding company level and had over $14.5 million of cash and 25,183,039 common units outstanding. The number of outstanding common units has since increased to 31,586,041 common units due to the retirement of the deferred fee liability by the issuance of common units to an affiliate of the manager in April 2012.

|

|

|

·

|

SPH’s common units were listed on the NYSE under the ticker “SPLP” on April 10, 2012. Previously, SPH’s common units were quoted on the Pink Sheets, beginning in April 2011. On February 14, 2012, SPH’s registration statement on Form 10 was declared effective by the Securities and Exchange Commission (“SEC”).

|

|

|

·

|

SPH formed SPH Services, Inc. (“SPH Services”) as a wholly-owned subsidiary to consolidate the executive and corporate functions of SPH and certain affiliated companies. The goal is to reduce costs and improve shareholder value by optimizing and leveraging corporate functions across SPH companies. Services include legal, tax, accounting, treasury, consulting, auditing, administration, compliance, environmental health and safety, human resources, marketing and investor relations. This business was always envisioned as part of our restructuring, and we expect the implementation and consolidation of SPH Services will serve our affiliates and our investors well. (See SPH Services section below.)

|

|

|

·

|

SPH increased its ownership of Handy & Harman Ltd. (“HNH”) to over 53.7%, and its ownership of DGT Holdings Corp. (“DGT”) to 51.5%, thereby consolidating their financial statements with SPH.

|

|

|

·

|

In February 2011, BNS Holding, Inc. (“BNS”) purchased a North Dakota oil services company, Sun Well Service, Inc. (“Sun Well”), for $50.5 million in cash.

|

|

|

·

|

SPH increased its holding in Steel Excel Inc. (“Steel Excel”) (formally ADPT Corp.) to 40.3%. In 2011, Steel Excel entered into new businesses when it acquired Baseball Heaven, Inc., a premier venue for amateur baseball based in Long Island.

|

|

|

·

|

In December 2011, Steel Excel acquired an oil-services company, Rogue Pressure Services, LLC, and in February 2012, acquired another oil-services company, Eagle Well Services, Inc.

|

|

|

·

|

On May 1, 2012, Steel Excel and BNS, an 85% owned subsidiary of SPH, announced a definitive agreement that upon completion will increase SPH’s ownership in Steel Excel to about 51%.

|

|

|

·

|

In April 2012, the approximate $65 million deferred fee liability on SPH’s balance sheet was eliminated by issuing 6,403,002 restricted SPH Class B common units to an affiliate of SPH’s manager. This amount is subject to adjustment based on the determination of the final deferred fee liability as of March 31, 2012 pursuant to the terms of the deferred fee agreement. The transaction eliminates a significant liability of SPH that otherwise could have been payable in cash beginning December 31, 2012. Importantly, this transaction significantly increases management’s stake in SPH.

|

2

Steel Partners Holdings L.P. – Our Publicly Traded Limited Partnership

SPH is a global diversified holding company that engages in multiple businesses in various industries, including diversified industrial products, energy, defense, banking, insurance, food products and services, oilfield services, sports, training, education, and the entertainment and lifestyle industries. The securities of some of the companies in which we have interests are also traded on national securities exchanges, while others are privately held or not actively traded. We concentrate on return on invested capital and free cash flow to maximize long-term unitholder value. We are long-term holders in our companies and we expect to realize value by operating efficiently and prudently, and allocating capital over a long time period.

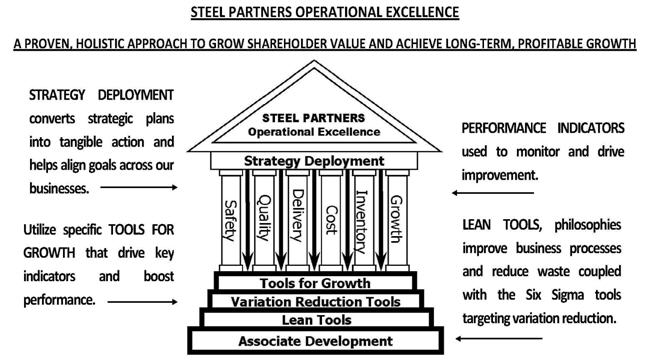

SPH’s transformation into a publicly-traded holding company has not fundamentally changed the way in which we do business. We are still deep-value active investors. We continue to organize and implement operational excellence programs such as the deployment of Lean Manufacturing, Design for Six Sigma, Six Sigma and Strategy Deployment to reduce and eliminate waste and increase unitholder value over a long-term time horizon. SPH continuously evaluates strategic alternatives available for our existing businesses as well as possible acquisitions of new businesses.

Consistent with our desire that SPH unitholders benefit from our diversified holding company structure, we are always looking for ways to reduce costs and integrate operations, and to build business relationships among our companies. We look for synergies, economies of scale and cost-saving opportunities when making decisions on capital allocation, and look to enhance revenue and earnings growth, new product development and customer satisfaction.

Our strategy and philosophy of investing in and managing businesses has enabled us to achieve superior risk-adjusted, tax-efficient returns over the long term. While many management teams focus on short-term performance, we focus on buying and operating companies in order to unlock and increase their value over the long term, for the benefit of all shareholders and stakeholders. As such, we are not concerned by short-term market fluctuations and volatility. As I have said many times before, and will continue to reiterate going forward, SPH invests on the basis of value, not on popularity.

We continue to be guided by certain enduring principles and strategies that have served us well over the years:

|

|

·

|

Invest in good companies with simple business models at prices which have a built-in margin of safety;

|

|

|

·

|

Create a continuous improvement culture and implement operational excellence programs;

|

|

|

·

|

Control costs and use leverage prudently, or not at all;

|

|

|

·

|

Avoid complex businesses or investments that cannot be easily explained or understood;

|

|

|

·

|

Reward people who deliver results; and

|

|

|

·

|

Ensure the right core principles and culture exists.

|

We believe in empowering people and giving them the tools to execute in order to achieve our common goals, and build businesses and shareholder value. We then hold our managers accountable for their performance. We have learned the hard way that potential is interesting, but execution is everything.

3

Think Globally and Act Locally

We have found that our approach to buying and managing businesses works on a global level. The fundamental importance of a relationship with management and other stakeholders transcends borders, cultures and economies. Our approach to investing and acquiring businesses and assets has enabled us to become a worldwide investor and operator of businesses. At Steel Partners, we think globally and act locally. With our new structure, we are well-positioned to capitalize on global opportunities by leveraging our experiences in various markets, including, but not limited to, the U.S., Europe and Japan, as well as China and South Korea.

With many of our companies holding leadership positions in North America, we will continue to help identify and facilitate their expansion overseas through acquisitions, joint ventures and strategic investments. While searching the globe for companies and businesses is exciting, it is difficult and painstaking work. The world is a very large place, but the businesses we are looking for must satisfy our requirements of offering substantial current value with a margin of safety and possessing the potential to create substantial future value. If anyone has any ideas to help grow our portfolio of businesses, we would love to hear from you.

SPH Services, Inc. – Our Corporate Services Subsidiary

SPH owns 100% of SPH Services, our newly-formed subsidiary that was created to consolidate the executive and corporate functions of SPH and certain of our affiliates and to provide services, including legal, tax, accounting, treasury, consulting, auditing, administration, compliance, environmental health and safety, human resources, marketing, investor relations and other similar services, to other affiliate companies. By consolidating corporate overhead and back office functions, we anticipate achieving cost savings over time for our affiliated companies while delivering more efficient and effective services. SPH Services operates through its wholly owned subsidiaries, SP Corporate Services LLC (“SP Corporate”) and Steel Partners LLC. SP Corporate currently has management services agreements with Handy & Harman, BNS, CoSine Communications Inc. (“CoSine”), DGT, F&H Acquisition Corp. (“Fox & Hound”), Steel Excel and WebBank.

Steel Partners Operational Excellence Programs and the Steel Partners Purchasing Council

Over the years, we have also seen that providing access to capital, strategic counsel and maintaining a sound and productive relationship with management is only part of the equation for success. If we expect excellence and search for excellence, we must also teach and promote excellence. That’s why the Steel Partners Operational Excellence Programs and Steel Partners Purchasing Council are important pillars of SPH’s efforts to enhance the business operations of our companies and increase long-term corporate value for all stakeholders.

Many SPH companies are using the Steel Partners Operational Excellence Programs, including Lean Manufacturing, Design for Six Sigma, Six Sigma and Strategy Deployment to reduce and eliminate waste, achieve long term profitable growth, and to increase value. SPH companies are also creating efficiencies through consolidated purchasing and materials sourcing provided by the Steel Partners Purchasing Council, which arranges shared purchasing programs, reducing costs and providing other benefits to our companies. All participating companies have achieved substantial savings on material purchases, freight, maintenance and repair items, office equipment and supplies and others areas.

4

We believe there is significantly more value to be created by continuing to deploy these programs. After all, we want continuous improvements.

Our Financial Reporting - Fair Value Or Sum Of The Parts

Our financial statements are complex and dictated by US GAAP and SEC reporting requirements. As such, book value does not necessarily reflect intrinsic value or even a “fair value” of SPH due to the inherent limitations of the accounting policies we must apply for financial reporting purposes. For instance, realized gains or losses on companies in which we own less than 20%, as well as certain other investments, flow through to net income. Unrealized gains and losses of companies in which we own greater than 50% do not. Unrealized gains and losses, along with some other items, are accounted for as “Other Comprehensive Income” which flows into partners’ capital. As a result, changes in value (either up or down) in some of our holdings and certain other accounting items during the period may not be reflected in net income. Additionally, if we sell an entire company, then the realized gain/loss runs through the net income line during that period. It’s complicated, but hopefully you will see in the footnotes that we try to lay it all out and make it as transparent as possible.

I personally believe a more meaningful valuation of SPH can be achieved by adding up the sum-of-parts.

Our financial statements and other information are posted on our website, www.SteelPartners.com.

5

Review of SPH Businesses

API Group PLC (API.LN) (www.apigroup.com)

API Group PLC (“API”) is a leading manufacturer of specialized materials for packaging, headquartered in the United Kingdom. We currently own approximately 32.4% of API, with a market value of $24.4 million as of March 31, 2012.

In January 2011, API sold its 51% interest in API Shen Yong, its loss-making Chinese joint venture. All the group's manufacturing businesses have maintained or improved profitability in the six months to September 2011. API Laminates has secured a major new supply agreement, starting April 2012, which is expected to generate additional revenues of £15-20 million per year. This may provide a significant increase in earnings for this business.

On February 8, 2012, SPH sent a letter to API expressing its belief that API’s market price does not reflect its intrinsic value and that this value will only be realized through a sale of the company. On March 30, 2012, the Board of API announced that it will explore a sale process during the third quarter of calendar 2012. Stay tuned.

Barbican Group Holdings Ltd. (Private) (www.barbicaninsurance.com)

Barbican Group Holdings Ltd. (“Barbican”) is a privately held property and casualty insurance and reinsurance company which operates a Lloyds of London syndicate. Barbican writes approximately £180 million in gross premiums in a mix of insurance and reinsurance contracts, predominantly through its Lloyd's syndicate. Along with the industry, Barbican experienced losses in the first half of 2011 as a result of the exceptional level of catastrophe losses. We directly and indirectly have an interest of approximately 19.6% in Barbican as of March 31, 2012. SPH, together with the other interests, have shared control of Barbican with Carlson Capital, L.P. of Dallas, Texas. Luke Wiseman is Chairman of the Board and Sanford Antignas is a director.

BNS Holding, Inc. (OTC: BNSSA.PK) (www.bnsholding.com, www.sunwellservice.com)

BNS operates through its Sun Well subsidiary, which is a provider of premium well services to exploration and production companies operating in the Bakken shale formation across North Dakota and Montana. We have an ownership interest of approximately 84.9% in BNS as of March 31, 2012, with a market value of $51.1 million.

As described in detail elsewhere, on May 1, 2012, Steel Excel and BNS announced the signing of a definitive agreement for Steel Excel to purchase Sun Well for cash and Steel Excel stock. BNS had a $21.2 million NOL as of December 31, 2011. Jack Howard and Ken Kong are on the Board of BNS, and John Quicke serves as President & CEO of Sun Well.

CoSine Communications, Inc. (OTC:COSN.PK) (www.cosinecom.com)

CoSine Communications, Inc. (“CoSine) is currently in the business of seeking to acquire one or more business operations and has net cash of $20.8 million and $355.6 million of NOLs as of December 31, 2011. We have an ownership interest of approximately 47% in CoSine as of March 31, 2012, with a market value of $10.3 million. Jack Howard is a director.

6

DGT Holdings Corp. (OTC: DGTC.OB) (www.dgtholdings.com)

DGT Holdings Corp. (“DGT”), formally Del Global Technologies Corp., is a leader in developing, manufacturing and marketing power conversion subsystems worldwide through its RFI subsidiary.

DGT sold its money-losing Del Medical Imaging business in November 2009 and began to focus on the RFI and Villa businesses. Steel Partners Operational Excellence programs were then implemented at both businesses. In September 2011, DGT completed the sale of Villa in a management-led buyout that generated approximately $23.3 million of after tax proceeds to DGT. Currently, DGT owns RFI as well as real estate, and has over $43.3 million in cash and an NOL of about $25 million, as of January 28, 2012. Jack Howard and John Quicke are on the Board of DGT and John Quicke serves as President & CEO. SPH owns approximately 51.5% of the company, with market value of $19.7 million at March 31, 2012.

Fox & Hound Acquisition Corp. (Private) (www.foxandhound.com)

Fox & Hound Acquisition Corp. (“Fox & Hound”) is a privately-held owner and operator of a chain of 129 casual dining and entertainment based restaurants in 25 states. In March 2012, SPH joined other investors in making a $10.9 million equity investment in connection with Fox & Hound’s refinancing of its debt. This increased SPH’s direct and indirect interest from 21.3% to approximately 43.6%. John McNamara and Ken Kong are directors.

GenCorp Inc. (NYSE:GY) (www.gencorp.com)

GenCorp Inc. (“GenCorp”) is a manufacturer of aerospace and defense systems and also has a real estate business, the activities of which include the entitlement, sale, and leasing of its real estate assets. GenCorp has $188 million cash, $326.4 million debt and total NOLs of $240.7 million as of November 30, 2011.

GenCorp’s net sales for 2011 totaled $918.1 million, compared to $857.9 million for 2010. Adjusted EBITDAP (Non-GAAP measure) for 2011 was $115.4 million or 12.6% of net sales, compared to $110.7 million or 12.9% of net sales, for 2010. Warren Lichtenstein is a director. SPH owns approximately 6.9% of GenCorp, with market value of $28.9 million at March 31, 2012.

Handy & Harman Ltd. (NASDAQ (CM): HNH) (www.handyharman.com)

Handy & Harman Ltd. (“HNH”), formerly known as WHX Corporation, is a diversified industrial company whose strategic business units encompass precious metal, tubing, engineered materials, electronic materials, and blades and route repair services. We have an ownership interest of approximately 53.7% in HNH, with a market value of $101.8 million as of March 31, 2012.

For the year ended December 31, 2011, HNH reported income from continuing operations, net of tax, of $136.6 million on net sales of $664 million compared with income from continuing operations, net of tax, of $4.5 million on net sales of $568.2 million in 2010. Income from continuing operations, net of tax, for the twelve months ended December 31, 2011 includes a net tax benefit of $104.6 million related to the reversal of HNH's deferred tax valuation allowance. HNH's income from continuing operations before tax was $32 million in 2011, as compared to income from continuing operations before tax of $7.8 million in 2010.

7

For the year ended December 31, 2011, Adjusted EBITDA was $75.6 million as compared to Adjusted EBITDA of $61.2 million for the same period of 2010, an increase of $14.4 million, or 23.5%. HNH holds $6.8 million in cash and total NOLs of over $183 million as of December 31, 2011.

We also hold, as of March 31, 2012, $20.7 million principal amount of 10% subordinated secured notes due 2017 issued by Handy & Harman Group Ltd., a wholly-owned subsidiary of HNH, and warrants to purchase 406,324 shares of HNH common stock at $11.00 per share. Warren Lichtenstein is Executive Chairman of the Board, Glen Kassan is Vice Chairman and CEO, Jack Howard is Vice-Chairman and John McNamara is a director.

JPS Industries, Inc. (OTC: JPST.PK) (www.jpscompositematerials.com)

JPS Industries, Inc. (“JPS”) is a major U.S. manufacturer of extruded urethanes, polypropylenes and mechanically formed glass substrates for specialty industrial applications. We have an ownership interest of approximately 39.3% in JPS as of March 31, 2012, with a market value of $30.2 million.

In September 2011, SPH delivered a letter to JPS expressing SPH’s willingness to acquire JPS for $8.00 per share in cash and encouraging the JPS Board to immediately commence a sale process overseen by a nationally recognized investment banking firm for the purpose of selling JPS, in whole or in parts, to the highest bidder. JPS responded by forming a special committee of independent directors to evaluate strategic alternatives in order to maximize value for all JPS stockholders. The Special Committee determined and the Board of Directors unanimously agreed that the offer (which was subsequently lowered to $7.50 per share) was inadequate and not in the best interest of JPS shareholders. The Board of Directors also determined to explore potential strategic alternatives for JPS and has engaged Houlihan Lokey to advise and assist the Board in developing and executing those alternatives should the Board determine that they would enhance shareholder value.

Nathan’s Famous, Inc (NASDAQ:NATH) (www.nathansfamous.com)

Nathan’s Famous, Inc. products, which include beef hot dogs, fries and other products, are currently distributed in 50 states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, the Cayman Islands and six foreign countries through its restaurant system, foodservice sales programs and product licensing activities. Nathan's restaurant system currently consists of 302 units, comprised of 297 franchised units and five company-owned units (including one seasonal unit). The company continues to grow its store count and cash flow, and is presently debt free with substantial cash reserves. With their free cash flow, the company has been a consistent buyer of its own shares, and recently completed a self tender for nearly 600,000 shares at $22 per share. We own approximately 10.2% of the company, with a market value of roughly $9.4 million, as of March 31, 2012.

SL Industries, Inc. (AMEX:SLI): (www.slindustries.com)

SL Industries, Inc. (“SLI”) designs, manufactures and markets power electronics, motion control, power protection, power quality electromagnetic and specialized communication equipment used in a variety of medical, commercial and military aerospace, computer, datacom, industrial, telecom, transportation, utility, rail and highway equipment applications.

SLI net sales from continuing operations for the year ended December 31, 2011, were $212.3 million, up 12% compared with net sales from continuing operations for the year ended December 31, 2010 of $189.8 million. Net income from continuing operations in 2011 was $12.8 million, or $2.80 per diluted share, a 31% increase over net income from continuing operations of $9.8 million, or $1.69 per diluted share, for the year ended December 31, 2010.

Glen Kassan is Chairman of the Board and Warren Lichtenstein is a director. SPH owns approximately 21.7% of SLI, with market value of $19.4 million as of March 31, 2012.

8

Steel Excel Inc. (OTC:SXCL.PK) (www.steelexcel.com)

Steel Excel Inc. (“Steel Excel”), formally ADPT Corporation, sold its operating business in June 2010 for $34.3 million to PMC-Sierra, a strategic buyer, and subsequently sold its office building and patent portfolio. As of December 31, 2011, Steel Excel had $323.4 million of cash and marketable securities, little debt and total NOLs of over $363 million.

Steel Excel recently set up a subsidiary, Steel Sports Inc. (“Steel Sports”), which is in the process of building a business in the youth sports market (a very large, profitable, and fragmented market). On July 28, 2011, Steel Sports acquired Baseball Heaven, Inc., a premier venue for amateur baseball, based in Long Island.

Steel Excel also set up new subsidiary to acquire two oil services companies. As noted above, in December 2011, Steel Excel acquired Rogue Pressure Services, LLC and in February 2012, purchased oil services company, Eagle Well Services, Inc. The signing of a definitive agreement for Steel Excel to purchase Sun Well will consolidate our oil services businesses under one entity and at the same time SPH will increase its direct and indirect ownership of Steel Excel to just over 50%, thereby consolidating Steel Excel into SPH’s financial statements going forward.

Warren Lichtenstein is Chairman of the Board, John Quicke is CEO and a director and Jack Howard is a director. SPH currently owns approximately 40.3% of Steel Excel, with a market value of $122.8 million as of March 31, 2012.

WebBank (Private) (www.webbank.com)

We own 100% of WebBank, an FDIC insured, Utah chartered industrial bank located in Salt Lake City, Utah. The bank is engaged in a full range of banking activities including making loans, issuing credit cards and taking federally insured deposits. The bank is a leading provider of national origination platforms for consumer and commercial private-label and bank card programs.

Revenue is largely derived from several strategic partnerships that provide fee income and interest income on loans held. The bank is solidly profitable with net income of $6.2 million and a return on average equity of 28.3% for the year ended December 31, 2011. John McNamara is Chairman of the Board.

Steel Partners China Access I L.P.

Steel Partners China Access I L.P. (the "Fund") is in the process of distributing cash resulting from the sale of shares of Mudanjiang Heng Feng Paper Co., Ltd (“Heng Feng”) (stock code 600356) during 2011. The shares were sold at an average price of RMB 10.72 per share, a 96.7% increase over the Fund's cost. The Fund is seeking to exit its remaining 14.2% interest in Heng Feng. SPH has an indirect interest in the Fund.

Steel Partners Japan Strategic Fund L.P.

Steel Partners Japan Strategic Fund L.P. (“SPJ”) owns 30% of Aderans Co., Ltd. (“Aderans”), a leading hair product and services company, and is the company’s largest shareholder. Since SPJ took control of Aderans’ Board following a shareholder vote in 2008, the company has reversed a seven-year negative trend in operating profits by, among other things, decreasing headcount, integrating and expanding its US subsidiary, Bosley, and selling non-core assets such as real estate. Aderans reported EBITDA of over 4.1 billion yen for the fiscal year ended February 28, 2012. Under SPJ’s guidance, Aderans continues to work on strategic initiatives aimed at growth and cost efficiency. Katsuyoshi Tanaka and Josh Schechter serve on the Board. SPH has an indirect interest in SPJ.

9

Management and Operations of SPH

Since the implementation of the SPII Restructuring Plan on July 15, 2009, when most of the former Steel Partners II investors, including our management team, became unitholders of SPH, we have remained focused and committed to building value for ourselves and our partners and we plan to continue to do so in the future. As such, the April 2012 payment of the deferred fee liability in SPH common units increased management’s ownership from approximately 18.3% at December 31, 2011 to 34.8%. We continue to eat our own cooking and we remain grateful for and committed to our partners.

As always, please feel free to call or email us with any questions or comments.

Respectfully,

/s/ Warren G. Lichtenstein

Warren G. Lichtenstein

Chairman & Chief Executive Officer

Steel Partners Holdings GP Inc.

10