Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - NOTOX TECHNOLOGIES CORP. | Financial_Report.xls |

| EX-32.1 - EXHIBIT 32.1 - NOTOX TECHNOLOGIES CORP. | v310490_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - NOTOX TECHNOLOGIES CORP. | v310490_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - NOTOX TECHNOLOGIES CORP. | v310490_ex31-1.htm |

U.S. Securities and Exchange Commission

Washington, D.C. 20549

Amendment No. 1 to

Form 10-K

| S | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

For the fiscal year ended October 31, 2011

or

| £ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to ______________

Commission File Number: 001-34911

Rockford Minerals Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 26-1434750 | |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) | |

| incorporation or organization) |

369 Shuter Street

Toronto, Ontario M5A 1X2

Canada

(Address of principal executive offices)

Registrant’s telephone number, including area code: (416) 937-3266

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.001 par value

Title of Class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed third fiscal quarter ended July 31, 2011: $0.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1943 subsequent to the distribution of securities under a plan confirmed by a court. Yes ¨ No ¨

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the last practicable date: February 3, 2012: 10,146,883 shares of common stock, $.001 par value.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933: None.

Explanatory Note

This amendment to the Form 10-K annual report of Rockford Minerals, Inc. is being filed to update its disclosures based upon the comments received from the U.S. Securities and Exchange Commission regarding its Form 10 registration statement, and amends Item 9A thereof.

Rockford Minerals Inc.

TABLE OF CONTENTS

| PART I | |||

| Item 1 | Business | 3 | |

| Item 1A | Risk Factors | 7 | |

| Item 1B | Unresolved Staff Comments | 16 | |

| Item 2 | Properties | 16 | |

| Item 3 | Legal Proceedings | 20 | |

| Item 4 | (Removed and Reserved) | 20 | |

| PART II | |||

| Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 20 | |

| Item 6 | Selected Financial Data | 21 | |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 21 | |

| Item 7A | Quantitative and Qualitative Disclosures About Market Risk | 23 | |

| Item 8 | Financial Statements and Supplementary Data | 23 | |

| Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 24 | |

| Item 9A | Controls and Procedures | 24 | |

| Item 9B | Other Information | 26 | |

| PART III | |||

| Item 10 | Directors, Executive Officers and Corporate Governance | 26 | |

| Item 11 | Executive Compensation | 27 | |

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 28 | |

| Item 13 | Certain Relationships and Related Transactions, and Director Independence | 29 | |

| Item 14 | Principal Accounting Fees and Services | 29 | |

| PART IV | |||

| Item 15 | Exhibits, Financial Statement Schedules | 30 | |

| Signatures | 31 | ||

| 2 |

PART I

Item 1. Business

Rockford Minerals Inc. (the “Company”) is seeking to be a producer of gold and silver ore, and of other precious metals.

Our principal objective is to enhance the value of the Company by evaluating the mining property that the Company presently owns in Nevada and to acquire additional undeveloped mining properties.

We intend to pursue growth opportunities through organic growth, as well as through an opportunistic acquisition strategy.

| . | Organic growth. We will evaluate opportunities to exploit previously untapped reserves |

| . | Acquisitions, reserve transactions and joint ventures. We intend to pursue value-enhancing acquisitions, reserve transactions and joint venture opportunities. |

For information regarding our mining property in Nevada, see “Item 3 - Properties.”

Mining Business

The Company was incorporated in the State of Nevada on October 29, 2007, for the primary purpose of the exploration and development of mining properties.

On July 19, 2008, the Company acquired an undeveloped mining claim called the Rockford Lode Mining Claim located in Clark County, Nevada, for which it has paid $12,000, including the cost of the geological report prepared by Sookochoff Consultants Inc. and Laurence Sookochoff, P. Eng., as a consulting geologist, for the purpose of recommending an exploration program of its Rockford Lode Claim. Laurence Sookochoff issued the Geological Evaluation Report dated October 29, 2009, that recommended a three phased exploration program: Phase I would consist of VLF-EM and magnetic surveys along the extensions of the known mineral zones to determine the potential structural controls to known mineral zones; followed by Phase II consisting of localized soil surveys, trenching and sampling over indicated extensions of the mineral zones; and a Phase III consisting of test diamond drilling of the prime indicated mineral zones.

Due to lack of capital, the Company has not commenced the recommended Phase I exploration program regarding its Rockford Lode Claim. The Company estimates that the Phase I surveys will cost approximately $7,500; that the Phase II program will cost approximately $13,500,; and that the Phase III program will cost approximately $75,000, for a total of approximately $95,000. The Company intends to conduct exploration regarding additional exploratory mining claims to the extent that investment capital is available, of which there is no assurance. Until the Company receives additional capital from an offering of its Common Stock or borrowings, the Company will not be able to commence its planned explanation program, and the Company is unable to predict when this will occur.

Market Outlook

Market indicators have shown increased strength for gold, silver and certain other metals.

One potential cause of constrained supply may be the difficulty in obtaining capital funding and obtaining mining permits.

Recent developments related to underground mining are expected to result in greater regulatory oversight, and may result in more stringent regulations and perhaps additional legislation. These developments add further uncertainty and may cause additional constraints. As the economy continues to recover, demand for gold, silver and certain other metals should rise. Increased demand, coupled with supply constraints, could result in increased demand.

Potential legislation, regulation, treaties and accords at the local, state, federal and international level, and changes in the interpretation or enforcement of existing laws and regulations, have created uncertainty and could have a significant impact on demand and our future operational and financial results. For example, the increased scrutiny of surface mining could make it difficult to receive permits or could otherwise cause production delays in the future.

Sales and Marketing

We intend to sell any gold, silver and other metals produced by our operations and third-party producers. Although the Company does not presently have any marketing staff, we may contract with third-party producers to mine our owned or leased properties on a rate per ounce or cost plus basis. We do not presently have any sales or marketing staff. Our future sales and marketing group may include personnel dedicated to performing sales functions, transportation, distribution, market research, contract administration, and credit/risk management activities.

| 3 |

Suppliers

The main types of goods we expect to purchase are mining equipment and replacement parts, steel-related (including roof control) products, belting products, lubricants, fuel and tires. We do not believe that we will become dependent on any individual supplier other than for purchases of certain underground mining equipment. The supplier base providing mining materials has been relatively consistent in recent years. Purchases of certain underground mining equipment are concentrated with one principal supplier; however, supplier competition continues to develop.

Competition

The U.S. gold and silver mining industry is highly competitive.

We do not currently compete directly with anyone for the exploration or removal of minerals from ou undeveloped property as we hold all of the interest and rights to our mining claim. Readily available commodities markets exist in the U.S. and around the world for the sale of gold, silver and other minerals. Therefore, we will likely be able to sell any minerals that we are able to recover in the future.

We may become subject ot competition and unforeseen limited sources of supplies in the future if the event spot shortages arise for supplies such as dynamite, and certain equipment such as bulldozers and excavators that we will need to conduct exploration. We have not yet attempted to locate or negotiate with any suppliers of products, equipment or services. If we are unsuccessful in securing the products, equipment and services in the future which we need, we may have to suspend our exploration plans until we are able to do so.

Asset Retirement Obligations

Asset retirement obligations will primarily represent the present value of future anticipated costs to restore surface land to levels equal to or greater than pre-mining conditions, as required by the Surface Mining Control and Reclamation Act (SMCRA). Because the Company has not commenced any production operations, it presently has no retirement obligations.

Remediation Obligations

Remediation obligations primarily represent the present value of future anticipated costs for water treatment of selenium and other similar discharges in excess of allowable limits, as required by mining permits. The Company presently has no remediation obligations

Regulatory Matters

Federal and state authorities regulate the mining industry with respect to matters such as employee health and safety, permitting and licensing requirements, the protection of the environment, plants and wildlife, the reclamation and restoration of mining properties after mining has been completed, surface subsidence from underground mining and the effects of mining on groundwater quality and availability. We may in the future be required to incur significant costs to comply with these laws and regulations.

Future legislation and regulations are expected to become increasingly restrictive, and there may be more rigorous enforcement of existing and future laws and regulations. Depending on the development of future laws and regulations, we may experience substantial increases in equipment and operating costs and may experience delays, interruptions or termination of operations. Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal fines or penalties, the acceleration of cleanup and site restoration costs, the issuance of injunctions to limit or cease operations and the suspension or revocation of permits and other enforcement measures that could have the effect of limiting production from our operations.

Mine Safety and Health

Our goal is to achieve excellent mine safety and health performance in the future. We will measure our progress in this area primarily through the use of accident frequency rates. We believe that it will be our responsibility to our employees to provide a good safety and healthy environment. We seek to implement this goal by: training employees in safe work practices; openly communicating with employees; establishing, following and improving safety standards; involving employees in the establishment of safety standards; and recording, reporting and investigating all accidents, incidents and losses to avoid reoccurrence. We intend to utilize best practices in emergency preparedness, which includes maintaining a mine rescue team.

| 4 |

Nevada and other states in which we will operate have programs for mine safety and health regulation and enforcement. As a result of industry-wide fatal accidents in recent years, primarily at underground mines, several states have adopted new safety and training regulations. In addition, MSHA has issued numerous new policies and regulations addressing, but not limited to, the following: emergency notification and response plans, increased fines for violations and additional training and mine rescue coverage requirements. Collectively, federal and state safety and health regulation in the mining industry is perhaps the most comprehensive and pervasive system for protection of employee health and safety affecting any segment of U.S. industry. While these changes may have a significant effect on our operating costs, our U.S. competitors with underground mines are subject to the same degree of regulation.

Mining Control and Reclamation Regulations

The SMCRA is administered by the Office of Surface Mining Reclamation and Enforcement (OSM) and establishes mining, environmental protection and reclamation standards for all aspects of U.S. surface mining as well as many aspects of underground mining. Mine operators must obtain SMCRA permits and permit renewals for mining operations from the OSM. Where state regulatory agencies have adopted federal mining programs under SMCRA, the state becomes the regulatory authority. States in which we expect to have active mining operations have achieved primary control of enforcement through federal authorization.

SMCRA permit provisions include requirements for prospecting; mine plan development; topsoil removal, storage and replacement; selective handling of overburden materials; mine pit backfilling and grading; protection of the hydrologic balance; subsidence control for underground mines; surface drainage control; mine drainage and mine discharge control and treatment; and revegetation.

The U.S. mining permit application process is initiated by collecting baseline data to adequately characterize the pre-mining environmental condition of the permit area. We will develop mine and reclamation plans by utilizing this geologic data and incorporating elements of the environmental data. Our mine and reclamation plans incorporate the provisions of SMCRA, the state programs and the complementary environmental programs that impact mining. Also included in the permit application are documents defining ownership and agreements pertaining to minerals, oil and gas, water rights, rights of way and surface land, and documents required of the OSM’s Applicant Violator System, including the mining and compliance history of officers, directors and principal stockholders of the applicant.

Once a permit application is prepared and submitted to the regulatory agency, it goes through a completeness and technical review. Public notice of the proposed permit is given for a comment period before a permit can be issued. Some SMCRA mine permit applications take over a year to prepare, depending on the size and complexity of the mine, and often take six months to two years to be issued. Regulatory authorities have considerable discretion in the timing of the permit issuance and the public has the right to comment on and otherwise engage in the permitting process, including public hearings and through intervention in the courts.

SMCRA requires compliance with many other major environmental programs. These programs include the Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act (RCRA), the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA) and employee right-to-know provisions. Besides OSM, other federal regulatory agencies are involved in monitoring or permitting specific aspects of mining operations. The Environmental Protection Agency (EPA) is the lead agency for states with no authorized programs under the Clean Water Act, RCRA and CERCLA. The U.S. Army Corps of Engineers (ACOE) regulates activities affecting navigable waters and the U.S. Bureau of Alcohol, Tobacco and Firearms regulates the use of explosive blasting.

Mine Closure Costs

Various federal and state laws and regulations, including SMCRA, will require us to obtain surety bonds or other forms of financial security to secure payment of certain long-term obligations, including mine closure or reclamation costs, federal and state workers’ compensation costs and other miscellaneous obligations. Many of these bonds are renewable on a yearly basis. Surety bond costs have increased in recent years.

| 5 |

Environmental Laws

We are subject to various federal and state environmental laws and regulations that will impose significant requirements on our operations. The cost of complying with current and future environmental laws and regulations and our liabilities arising from past or future releases of, or exposure to, hazardous substances, may adversely affect our business, results of operations or financial condition. In addition, environmental laws and regulations, particularly relating to air emissions, can reduce our profitability.

Numerous federal and state governmental permits and approvals are required for mining operations. When we apply for these permits or approvals, we may be required to prepare and present to federal or state authorities data pertaining to the effect or impact that a proposed exploration for, or production or processing of, may have on the environment. Compliance with these requirements can be costly and time-consuming and can delay exploration or production operations. A failure to obtain or comply with permits could result in significant fines and penalties and could adversely affect the issuance of other permits for which we may apply.

Clean Water Act

The U.S. Clean Water Act and corresponding state and local laws and regulations affect mining operations by restricting the discharge of pollutants, including dredged or fill materials, into waters of the United States. The Clean Water Act provisions and associated state and federal regulations are complex and subject to amendments, legal challenges and changes in implementation. As a result of recent court decisions and regulatory actions, permitting requirements have increased and could continue to increase the cost and time we expend on compliance with water pollution regulations.

These and other regulatory requirements, which have the potential to change due to legal challenges, Congressional actions and other developments, increase the cost of, or could even prohibit, certain current or future mining operations. Our operations may not always be able to remain in full compliance with all Clean Water Act obligations and permit requirements, and as a result we may be subject to compliance orders and private party litigation seeking fines or penalties or changes to our operations.

Clean Water Act requirements that may affect our operations include the following:

Section 404

Section 404 of the Clean Water Act requires mining companies to obtain ACOE permits to place material in streams for the purpose of creating slurry ponds, water impoundments, refuse areas, valley fills or other mining activities. Our construction and mining activities, including our surface mining operations, will frequently require Section 404 permits. ACOE issues two types of permits pursuant to Section 404 of the Clean Water Act: nationwide (or “general”) and “individual” permits. Nationwide permits are issued to streamline the permitting process for dredging and filling activities that have minimal adverse environmental impacts. An individual permit typically requires a more comprehensive application process, including public notice and comment, but an individual permit can be issued for ten years (and may be extended thereafter upon application).

The issuance of permits to construct valley fills and refuse impoundments under Section 404 of the Clean Water Act, whether general permits commonly described as the Nationwide Permit 21 (NWP 21), or individual permits, has been the subject of many recent court cases and increased regulatory oversight, the results of which may materially increase our permitting and operating costs, result in permitting delays, suspend any then current operations or prevent the opening of new mines.

| 6 |

Item 1A. Risk Factors

Rockford Minerals Inc. (the “Company”) is seeking to become a producer of gold and silver ore, and of other precious metals.

Our principal objective is to enhance the value of the Company by evaluating the mining property that the Company presently owns in Nevada and to acquire additional undeveloped mining properties.

We intend to pursue growth opportunities through organic growth, as well as through an opportunistic acquisition strategy.

| · | Organic growth . We will evaluate opportunities to exploit previously untapped reserves |

| · | Acquisitions, reserve transactions and joint ventures. We intend to pursue value-enhancing acquisitions, reserve transactions and joint venture opportunities. |

For information regarding our mining property in Nevada, see “Item 3 - Properties.”

Market Outlook

Market indicators have shown increased strength for gold, silver and certain other metals.

One potential cause of constrained supply may be the difficulty in obtaining capital funding and obtaining mining permits.

Recent developments related to underground mining are expected to result in greater regulatory oversight, and may result in more stringent regulations and perhaps additional legislation. These developments add further uncertainty and may cause additional constraints. As the economy continues to recover, demand for gold, silver and certain other metals should rise. Increased demand, coupled with supply constraints, could result in increased demand.

Potential legislation, regulation, treaties and accords at the local, state, federal and international level, and changes in the interpretation or enforcement of existing laws and regulations, have created uncertainty and could have a significant impact on demand and our future operational and financial results. For example, the increased scrutiny of surface mining could make it difficult to receive permits or could otherwise cause production delays in the future.

Sales and Marketing

We intend to sell any gold, silver and other metals produced by our operations and third-party producers. Although the Company does not presently have any marketing staff, we may contract with third-party producers to mine our owned or leased properties on a rate per ounce or cost plus basis. We do not presently have any sales or marketing staff. Our future sales and marketing group may include personnel dedicated to performing sales functions, transportation, distribution, market research, contract administration, and credit/risk management activities.

Suppliers

The main types of goods we expect to purchase are mining equipment and replacement parts, steel-related (including roof control) products, belting products, lubricants, fuel and tires. We do not believe that we will become dependent on any individual supplier other than for purchases of certain underground mining equipment. The supplier base providing mining materials has been relatively consistent in recent years. Purchases of certain underground mining equipment are concentrated with a limited number of principal suppliers; however, supplier competition continues to develop.

| 7 |

Competition

The U.S. gold and silver mining industry is highly competitive.

A number of factors beyond our control affect the markets for gold, silver and other metals. Continued demand for our production and the prices obtained by us depend primarily on the consumption patterns of such industries in the U.S. and elsewhere around the world; the availability, location, cost of and price of competing sources. The most important factors on which we compete are delivered price (i.e., including transportation costs, which may be paid by our customers), gold and silver quality characteristics and reliability of supply.

Asset Retirement Obligations

Asset retirement obligations will primarily represent the present value of future anticipated costs to restore surface land to levels equal to or greater than pre-mining conditions, as required by the Surface Mining Control and Reclamation Act (SMCRA).

Remediation Obligations

Remediation obligations primarily represent the present value of future anticipated costs for water treatment of selenium and other similar discharges in excess of allowable limits, as required by mining permits.

Regulatory Matters

Federal and state authorities regulate the mining industry with respect to matters such as employee health and safety, permitting and licensing requirements, the protection of the environment, plants and wildlife, the reclamation and restoration of mining properties after mining has been completed, surface subsidence from underground mining and the effects of mining on groundwater quality and availability. We may in the future be required to incur significant costs to comply with these laws and regulations.

Future legislation and regulations are expected to become increasingly restrictive, and there may be more rigorous enforcement of existing and future laws and regulations. Depending on the development of future laws and regulations, we may experience substantial increases in equipment and operating costs and may experience delays, interruptions or termination of operations. Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal fines or penalties, the acceleration of cleanup and site restoration costs, the issuance of injunctions to limit or cease operations and the suspension or revocation of permits and other enforcement measures that could have the effect of limiting production from our operations.

Mine Safety and Health

Our goal is to achieve excellent mine safety and health performance. We will measure our progress in this area primarily through the use of accident frequency rates. We believe that it will be our responsibility to our employees to provide a good safety and healthy environment. We seek to implement this goal by: training employees in safe work practices; openly communicating with employees; establishing, following and improving safety standards; involving employees in the establishment of safety standards; and recording, reporting and investigating all accidents, incidents and losses to avoid reoccurrence. We intend to utilize best practices in emergency preparedness, which includes maintaining a mine rescue team.

Nevada and other states in which we will operate have programs for mine safety and health regulation and enforcement. As a result of industry-wide fatal accidents in recent years, primarily at underground mines, several states have adopted new safety and training regulations. In addition, MSHA has issued numerous new policies and regulations addressing, but not limited to, the following: emergency notification and response plans, increased fines for violations and additional training and mine rescue coverage requirements. Collectively, federal and state safety and health regulation in the mining industry is perhaps the most comprehensive and pervasive system for protection of employee health and safety affecting any segment of U.S. industry. While these changes may have a significant effect on our operating costs, our U.S. competitors with underground mines are subject to the same degree of regulation.

| 8 |

Mining Control and Reclamation Regulations

The SMCRA is administered by the Office of Surface Mining Reclamation and Enforcement (OSM) and establishes mining, environmental protection and reclamation standards for all aspects of U.S. surface mining as well as many aspects of underground mining. Mine operators must obtain SMCRA permits and permit renewals for mining operations from the OSM. Where state regulatory agencies have adopted federal mining programs under SMCRA, the state becomes the regulatory authority. States in which we expect to have active mining operations have achieved primary control of enforcement through federal authorization.

SMCRA permit provisions include requirements for prospecting; mine plan development; topsoil removal, storage and replacement; selective handling of overburden materials; mine pit backfilling and grading; protection of the hydrologic balance; subsidence control for underground mines; surface drainage control; mine drainage and mine discharge control and treatment; and revegetation.

The U.S. mining permit application process is initiated by collecting baseline data to adequately characterize the pre-mining environmental condition of the permit area. We will develop mine and reclamation plans by utilizing this geologic data and incorporating elements of the environmental data. Our mine and reclamation plans incorporate the provisions of SMCRA, the state programs and the complementary environmental programs that impact mining. Also included in the permit application are documents defining ownership and agreements pertaining to minerals, oil and gas, water rights, rights of way and surface land, and documents required of the OSM’s Applicant Violator System, including the mining and compliance history of officers, directors and principal stockholders of the applicant.

Once a permit application is prepared and submitted to the regulatory agency, it goes through a completeness and technical review. Public notice of the proposed permit is given for a comment period before a permit can be issued. Some SMCRA mine permit applications take over a year to prepare, depending on the size and complexity of the mine, and often take six months to two years to be issued. Regulatory authorities have considerable discretion in the timing of the permit issuance and the public has the right to comment on and otherwise engage in the permitting process, including public hearings and through intervention in the courts.

SMCRA requires compliance with many other major environmental programs. These programs include the Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act (RCRA), the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA) and employee right-to-know provisions. Besides OSM, other federal regulatory agencies are involved in monitoring or permitting specific aspects of mining operations. The Environmental Protection Agency (EPA) is the lead agency for states with no authorized programs under the Clean Water Act, RCRA and CERCLA. The U.S. Army Corps of Engineers (ACOE) regulates activities affecting navigable waters and the U.S. Bureau of Alcohol, Tobacco and Firearms regulates the use of explosive blasting.

Mine Closure Costs

Various federal and state laws and regulations, including SMCRA, will require us to obtain surety bonds or other forms of financial security to secure payment of certain long-term obligations, including mine closure or reclamation costs, federal and state workers’ compensation costs and other miscellaneous obligations. Many of these bonds are renewable on a yearly basis. Surety bond costs have increased in recent years.

Environmental Laws

We are subject to various federal and state environmental laws and regulations that will impose significant requirements on our operations. The cost of complying with current and future environmental laws and regulations and our liabilities arising from past or future releases of, or exposure to, hazardous substances, may adversely affect our business, results of operations or financial condition. In addition, environmental laws and regulations, particularly relating to air emissions, can reduce our profitability.

| 9 |

Numerous federal and state governmental permits and approvals are required for mining operations. When we apply for these permits or approvals, we may be required to prepare and present to federal or state authorities data pertaining to the effect or impact that a proposed exploration for, or production or processing of, may have on the environment. Compliance with these requirements can be costly and time-consuming and can delay exploration or production operations. A failure to obtain or comply with permits could result in significant fines and penalties and could adversely affect the issuance of other permits for which we may apply.

| 10 |

Clean Water Act

The U.S. Clean Water Act and corresponding state and local laws and regulations affect mining operations by restricting the discharge of pollutants, including dredged or fill materials, into waters of the United States. The Clean Water Act provisions and associated state and federal regulations are complex and subject to amendments, legal challenges and changes in implementation. As a result of recent court decisions and regulatory actions, permitting requirements have increased and could continue to increase the cost and time we expend on compliance with water pollution regulations.

These and other regulatory requirements, which have the potential to change due to legal challenges, Congressional actions and other developments, increase the cost of, or could even prohibit, certain current or future mining operations. Our operations may not always be able to remain in full compliance with all Clean Water Act obligations and permit requirements, and as a result we may be subject to compliance orders and private party litigation seeking fines or penalties or changes to our operations.

Clean Water Act requirements that may affect our operations include the following:

Section 404

Section 404 of the Clean Water Act requires mining companies to obtain ACOE permits to place material in streams for the purpose of creating slurry ponds, water impoundments, refuse areas, valley fills or other mining activities. Our construction and mining activities, including our surface mining operations, will frequently require Section 404 permits. ACOE issues two types of permits pursuant to Section 404 of the Clean Water Act: nationwide (or “general”) and “individual” permits. Nationwide permits are issued to streamline the permitting process for dredging and filling activities that have minimal adverse environmental impacts. An individual permit typically requires a more comprehensive application process, including public notice and comment, but an individual permit can be issued for ten years (and may be extended thereafter upon application).

The issuance of permits to construct valley fills and refuse impoundments under Section 404 of the Clean Water Act, whether general permits commonly described as the Nationwide Permit 21 (NWP 21), or individual permits, has been the subject of many recent court cases and increased regulatory oversight, the results of which may materially increase our permitting and operating costs, result in permitting delays, suspend any then current operations or prevent the opening of new mines.

Our auditors have expressed a substantial uncertainty regarding whether we will be able to continue as a going concern due primarily to a lack of operating capital.

The probability of our mining claims having commercial reserves is remote, and any funds spent on exploration will probably be lost. In all probability, our claims do not contain any commercial reserves, or may contain reserves which are not economically feasible to recover. As such, any funds spent on exploration will, in all probability, be lost.

Our management has no technical training or experience in exploring for gold and silver resources or starting and operating a mining exploration program. Our management has no experience in exploring mineral for gold and silver and starting and operating an exploration program. Further, our management has no training or experience in these areas, and as a result, may not be fully aware of many of the specific requirements related to working the claims within such industry. Our management's decisions and choices may not take into account the standard engineering or managerial approaches that mineral exploration companies commonly use. Consequently our activities, earnings, and ultimate financial success could suffer irreparable harm due to our management's lack of experience in this industry. As a result, we may have to suspend or cease activities.

| 11 |

We will need additional funding to complete the exploration process recommended by engineers. Even if we raise all of the funds which we intend to raise in any future offerings, we may not have enough capital to complete the exploration phases recommended in the geological evaluation report of our contracted mining engineer with regard to our claims. To complete the recommended exploration phases, we may be required to raise additional capital through securities offerings, debt or loans, or from our officers or directors. We cannot guarantee that we will be able to raise the capital necessary to complete the recommended phases of exploration of our properties. If we are unable to raise additional capital, and cannot complete the recommended exploration phases, we will not be able to successfully begin operations and will not be able to realize any revenue. As a result, we would be forced to cease all operations.

The Company has not commenced any mining production, thus it has had no revenues and faces a high degree of risk. We do not own any currently producing properties, nor own any property that has proven reserves of commercially viable quantities of valuable metals. Accordingly, we have no revenues and we have no way to evaluate the likelihood that our business will be successful. We have been involved primarily in organizational activities, due diligence on our claims, and engaging a professional engineer to prepare an initial report and evaluation of our claims. We have not generated any revenues since our inception.

You should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications, and delays encountered in connection with the exploration of the mineral properties. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. Prior to completion of our exploration stages, we anticipate that we will continue to incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the development of our mining property and the production of minerals from our claims, we will not be able to earn profits or continue operations. If we are unsuccessful in addressing these risks, the business of the Company will most likely fail.

We lack an operating history and have losses which we expect to continue into the future. We were incorporated in October 2007, and we have not started our proposed business activities or realized any revenues. We have no operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon our ability to explore our mining claims and our ability to generate revenues from operations upon our claim. Based upon our current plans, we expect to incur operating losses in the foreseeable future. This will happen because there are expenses associated with the research and exploration of our mineral properties, and we may not generate revenues in the future. Failure to generate revenues may cause us to suspend or cease activities.

Because we are small and do not have much capital, we may have to limit our exploration activity which may result in a loss. Because we are small and do not have a large reserve of capital, we may be required to limit our exploration activity. As such, we may not be able to complete an exploration program that is as thorough as we would like. In that event, an existing reserve may go undiscovered. Without a reserve or commercial mining operations, we cannot generate revenues unless we sell our mining claims or other mining rights.

Because we will have to spend additional funds to determine if we have commercial reserves, we will have to raise additional money or risk having to cease our operations. Even if we complete our current exploration program and we are successful in identifying a mineral deposit, we will have to spend substantial funds on further drilling, testing, exploration, and engineering studies before we will know if we have a commercially viable gold and silver deposit. Because our current capitalization is insufficient to achieve such further drilling, testing, exploration, and engineering studies, it will be necessary to raise additional funds. If we are unable to raise such funds, we would be forced to suspend or cease our activities.

Our officers and directors have outside business activities and will only be devoting a limited amount of their time to our operations. Our operations may be sporadic and occur at times which are convenient to our officers and directors. The directors and officers of the Company currently devoteapproximately five hours a week to the operations of the Company; however, they expect to devote additional hours per week as the Company becomes better capitalized and expands its exploratory mining activity. As a result, exploration of our claims may be periodically interrupted or suspended.

The Company has obtained a Geological Evaluation Report regarding the Rockford Lode Claim located in the Sunset Mining District in southwestern Nevada dated October 29, 2009, prepared by Laurence Sookochoff, P. Eng., a consulting geologist, located in Vancouver, British Columbia, Canada. The information for the report was obtained from sources cited in the report and from his personal reports that he has written on mineral properties in the specific area.

Because the mining claim of the Company has not been specifically and physically examined in the field by Mr. Sookochoff, there is a risk that the geology of the claim may be materially different than other mineral properties in the specific area.

| 12 |

Risks in the Mining Industry

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages which could hurt our financial position and possibly result in the failure of our business. Mineral exploration and development involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins, and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material, adverse effect on our financial position, or could cause us to cease operations.

If we discover commercial reserves of precious metals on our mineral properties, we can provide no assurance that we will be able to successfully advance the mineral claims into commercial production. If our exploration program is successful in establishing the existence of gold and silver of commercially and economically viable tonnage and grade on any of our claims, we will require additional funds in order to begin operations of commercial production. Obtaining additional financing would be subject to a number of factors, including the market price for the minerals, investor acceptance of our claims, and general market conditions. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. The most likely source of future funds is through the sale of equity capital. Any sale of share capital will result in dilution to existing shareholders. We may be unable to obtain any such funds, or to obtain such funds on terms that we consider economically feasible.

If access to our mineral claims is restricted by inclement weather, we may be delayed in our exploration and any future mining efforts. It is possible that snow, rain, or other environmental factors could cause the mining roads providing access to our claims to become impassable. If the roads are impassable, we would be delayed in our exploration timetable and incur unforeseen expenses.

If we become subject to burdensome government regulation or other legal uncertainties, our business will be negatively affected. There are federal and state governmental regulations that oversee and materially restrict mineral property exploration and development. Under United States and State of Nevada mining laws, to engage in certain types of exploration will require work permits, the posting of bonds, and the performance of remediation work for any physical disturbance to the land. While such laws will not affect our current exploration plans, if we begin drilling operations on our property, we will incur such regulatory oversight and regulatory compliance costs.

In addition, the legal and regulatory environment that pertains to the exploration of gold and silver is subject to change. Change in existing regulations and new regulations could increase our costs of doing business, and prevent us from beginning or continuing operations.

We are in a highly competitive industry. Gold and silver exploration and development is highly competitive. The Company faces competition from multinational, national, and regional companies. Many of the Company’s competitors are larger, longer established, and have far greater financial resources and exploration and operational experience than our Company. The Company may be unable to compete effectively.

Because of consumer demand, the demand for any gold and silver that we may recover from our claims may be slowed, resulting in reduced revenues to the Company. Our success will be dependent on the demand for gold and silver. If consumer or industrial demand slows our revenues may be significantly affected. This could limit our ability to generate revenues, and our financial condition and operating results may be harmed, possibly resulting in loss of investment.

The price of gold and silver metal is volatile, and price changes are beyond our control. The price of base metal fluctuates. The prices of base metal have been and will continue to be affected by numerous factors beyond our control. Factors that affect such metals include the demand from consumers economic conditions, over supply from secondary sources, and costs of production. Price volatility and downward price pressure, which can lead to lower prices, could have a material adverse effect on the costs and the viability of our operations.

The volatility of gold and silver prices in general may adversely affect our exploration efforts. If prices for these metals decline, it may not be economically feasible for us to continue our exploration of our properties or to interest a joint venture partner in funding exploration or developing commercial production at our properties. We may make substantial expenditures for exploration or development of the properties, which cannot be recovered if production becomes uneconomical. Gold and silver prices historically have fluctuated widely, based on numerous factors including, but not limited to:

| 13 |

| o | industrial and jewelry demand; | |

| o | market supply from new production and release of existing bullion stocks; | |

| o | central bank lending, sales and purchases of gold or silver; | |

| o | forward sales of gold and silver by producers and speculators; | |

| o | production and cost levels in major metal-producing regions; | |

| o | rapid short-term changes in supply and demand because of speculative or hedging activities; and | |

| o | macroeconomic factors, including confidence in the global monetary system; inflation expectations; interest rates and global or regional political or economic events. |

Gold and silver exploration and prospecting is highly competitive and speculative business and we may not be successful in seeking available opportunities.

The process of gold and silver exploration and prospecting is a highly competitive and speculative business. Individuals are not subject to onerous accreditation and licensing requirements prior to beginning mineral exploration and prospecting activities, and as such the Company, in seeking available opportunities, will compete with numerous individuals and companies, including established, multi-national companies that have substantially more experience and resources than our Company. The exact number of active competitors at any one time is heavily dependent on current economic conditions; however, statistics provided by the AEBC (The Association for Mineral Exploration, British Columbia), state that approximately 1000 mining companies operate in North America, including gold and silver.

Limited Financial and Management Resources. Because we may not have the financial and managerial resources to compete with other companies, we may not be successful in our efforts to acquire projects of value, which, ultimately, become productive. However, while we compete with other exploration companies for the rights to explore other claims, there is no competition for the exploration or removal of mineral from our claims by other companies, as we have no agreements or obligations that limit our right to explore or remove minerals from our claims.

Environmental Laws. Compliance with environmental considerations and permitting could have a material adverse effect on the costs or the viability of our projects. The historical trend toward stricter environmental regulation may continue, and, as such, represents an unknown factor in our planning processes.

Mining Regulations. All mining is regulated by the government agencies at the federal, state and county levels of government in the United States. Compliance with such regulation has a material effect on the economics of our operations and the timing of project development. Our primary regulatory costs have been related to filing fees pertaining to the location of unpatented mining claims which were staked on Federal ground. In the event mineralization of commercial interest would be found by the proposed exploration program, obtaining licenses and permits from government agencies before the commencement of mining activities would be very expensive and time consuming. An environmental impact study may be required to be undertaken on our property in order to obtain governmental approval to commence and conduct mining on our properties.

The possibility of more stringent regulations exists in the areas of worker health and safety, the dispositions of wastes, the decommissioning and reclamation of mining and milling sites and other environmental matters, each of which could have an adverse material effect on the costs or the viability of a particular project. Compliance with environmental considerations and permitting could have a material adverse effect on the costs or the viability of our projects.

We face substantial governmental regulation.

Safety. If we commence mining operations, we will be subject to inspection and regulation by the Mine Safety and Health Administration of the United States Department of Labor ("MSHA") under the provisions of the Mine Safety and Health Act of 1977. The Occupational Safety and Health Administration ("OSHA") also has jurisdiction over safety and health standards not covered by MSHA.

| 14 |

Current Environmental Laws and Regulations. We must comply with environmental standards, laws and regulations that may result in greater or lesser costs and delays depending on the nature of the regulated activity and how stringently the regulations are implemented by the regulatory authority. The costs and delays associated with compliance with such laws and regulations could stop us from proceeding with the exploration of a project or the operation or future exploration of a mine. Laws and regulations involving the protection and remediation of the environment and the governmental policies for implementation of such laws and regulations are constantly changing and are generally becoming more restrictive. We expect to make in the future significant expenditures to comply with such laws and regulations. These requirements include regulations under many state and U.S. federal laws and regulations, including:

o the Comprehensive Environmental Response, Compensation and Liability Act of 1980 ("CERCLA" or "Superfund") which regulates and establishes liability for the release of hazardous substances;

o the U.S. Endangered Species Act;

o the Clean Water Act;

o the Clean Air Act;

o the U.S. Resource Conservative and Recovery Act ("RCRA");

o the Migratory Bird Treaty Act;

o the Safe Drinking Water Act;

o the Emergency Planning and Community Right-to-Know Act;

o the Federal Land Policy and Management Act;

o the National Environmental Policy Act; and

o the National Historic Preservation Act.

The United States Environmental Protection Agency continues the development of a solid waste regulatory program specific to mining operations such as ours, where the mineral extraction and beneficiation wastes are not regulated as hazardous wastes.

Our claim is in a historic mining district with past production and abandoned mines. We may be exposed to liability, or assertions of liability that would require expenditure of legal defense costs under joint and several liability statutes for cleanups of historical wastes that have not yet been completed.

Environmental Regulations. Environmental laws and regulations may also have an indirect impact on us, such as increased costs for electricity due to acid rain provisions of the United States Clean Air Act Amendments of 1990. Charges by refiners to which we may sell any metallic concentrates and products have substantially increased over the past several years because of requirements that refiners meet revised environmental quality standards. We have no control over the refiner's operations or their compliance with environmental laws and regulations.

Potential Legislation. Changes to the current laws and regulations governing the operations and activities of mining companies, including changes in permitting, environmental, title, health and safety, labor and tax laws, are actively considered from time to time. We cannot predict such changes, and such changes could have a material adverse impact on our business. Expenses associated with the compliance with such new laws or regulations could be material. Further, increased expenses could prevent or delay exploration projects and could, therefore, affect future levels of mineral production.

Governmental regulation. If we commence mining operations in the future, we will be subject to inspection and regulation by:

o Mine Safety and Health Administration of the United States Department of Labor ("MSHA") under the provisions of the Mine Safety and Health Act of 1977.

o The occupational Safety and Health Administration ("OSHA") also has jurisdiction over safety and health standards not covered by MSHA.

We are subject to environmental risks.

| 15 |

Environmental Liability. We are subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste rock and materials that could occur as a result of our mineral exploration and production. To the extent that we are subject to environmental liabilities, the payment of such liabilities or the costs that we may incur to remedy environmental pollution would reduce funds otherwise available to us and could have a material adverse effect on our financial condition or results of operations. If we are unable to fully remedy an environmental problem, we might be required to suspend operations or enter into interim compliance measures pending completion of the required remedy. The potential exposure may be significant and could have a material adverse effect on us. We have not purchased insurance for environmental risks (including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production) because it is not generally available at a reasonable price.

Environmental Permits. All of our exploration activities are subject to regulation under one or more of the various State and federal environmental laws and regulations in the U.S. Many of the regulations require us to obtain permits for our activities. We must update and review our permits from time to time, and are subject to environmental impact analyses and public review processes prior to approval of the additional activities. It is possible that future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have a significant impact on some portion of our business, causing those activities to be economically reevaluated at that time.

Those risks include, but are not limited to, the risk that regulatory authorities may increase bonding requirements beyond our financial capabilities. The posting of bonding in accordance with regulatory determinations is a condition to the right to operate under all material operating permits, and therefore increases in bonding requirements could prevent our operations from continuing even if we were in full compliance with all substantive environmental laws.

There may be possible title defects on our mining claim.

Undetected title defects could affect our interest in the mining claim owned by the Company and any future claims that may be acquired by the Company. We have investigated title to our claims have not obtained title opinions and title insurance with respect to our claim. To the best of our knowledge, the title to our claim is in good standing. This should not be construed as a guarantee of title and there is no guarantee that the title to our properties will not be challenged or impugned. Any challenge to our title could delay the exploration, financing, and development of the property and could ultimately result in the loss of some or all of our interest in our properties. Our properties may be subject to prior unregistered agreements or transfers or native land claims and title may be affected by undetected defects.

We may not have access to all of the supplies and materials we need to begin exploration which could cause us to delay or suspend activities.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as dynamite, and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials when financing becomes available. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

Item 1B. Unresolved Staff Comments.

None

Item 2. Properties.

The principal executive offices of the Company are leased and are located at 369 Shuter Street, Toronto M5A 1X2, Canada.

| 16 |

Rockford Lode Claim

The Company owns the Rockford Lode Claim which was filed in Clark County, Nevada recorder’s office in Las Vegas on June 19, 2008, as Instrument 20080619- 0000221, File 081, Page 0074, in the official records book, T20080120393.

The Rockford Lode Claim is located within Township 27S, Range 60E, Section 31, and adjoining Township 28S, Range 60E, Section 6, in the Sunset Mining District of Clark County, Nevada, and is a Lode claim, unpatented mining claim.

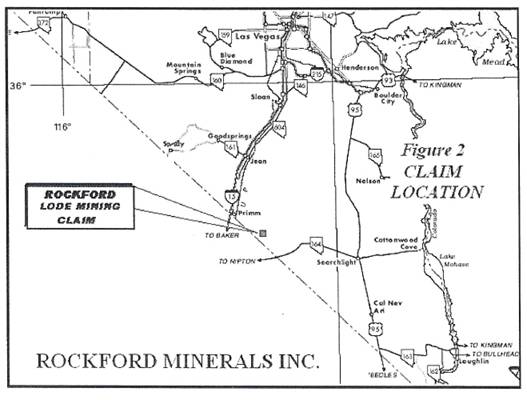

Access from Las Vegas, Nevada to the Rockford Lode Claim is southeastward to Boulder City, then southward via Highway 95 to Searchlight, then westward via Highway 164 to Crescent from where a sub-standard road is taken northward to the Rockford Lode Claim. The entire distance from Las Vegas to the Rockford Lode Claim is approximately 84 miles.

In addition to the State of Nevada regulations, Federal regulations require a yearly maintenance fee to keep the claim in good standing. In accordance with Federal regulations, the Rockford Lode Claim is in good standing to September 2011. A yearly maintenance fee of $125 is required to be paid to the Bureau of Land Management prior to the expiration date to keep the claim in good standing for an additional year.

For additional information regarding our gold property in Nevada, see Item 2 - Business.

Rockford Lode Claim Location Map

*Map drawn on October 29, 2009.

History

The Sunset Mining District was established in 1867 within an area comprised of a group of hills (the Lucy Grey Range) of relatively low relief about 16 miles south of Jean, Nevada in the extreme southern part of Township 27S, Range 60E. The Sunset Mining District is south of the Goodsprings Mining District, which ranks second only to Tonopah in total lead and zinc production in the State of Nevada. The Lucy Grey mine begun operations in 1905. Total production from the Lucy Grey mine is estimated (Vanderburg, 1937, p.80) at $50,000, principally in gold with lesser amounts of silver, lead, and copper.

There is no recorded production from the ground covered by the Rockford Lode Claim; however, inclusive prospect pits indicate the existence of mineralized zones.

Geological Setting

Physiography, Climate, Vegetation, and Water

The Rockford Lode Claim is situated midway through the approximate 14 mile Lucy Grey Mountain Range, a north-south trending range of mountains with crests reaching elevations up to 2,500 feet. The claim covers the southwesterly facing slopes of a ridge bisected by an eastwest trending valley. Topography on the claim is gentle to moderate, with an elevation of 760 feet at the southern portion of the claim near the valley floor, to an elevation of 820 feet in the northeast along a northerly trending ridge.

The climate of the claim area is typical of a desert climate, with relatively high temperatures and low precipitation. Vegetation on the claim consists mainly of desert shrubs and cactus. Sources of water would likely be available from valley wells.

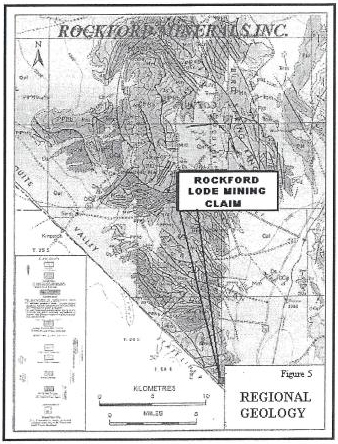

Regional Geology

Geologically, the Sunset Mining District is the southern extension of the Yellow Pine District where the Mountain Ranges consist mainly of Paleozoic sediments which have undergone intense folding accompanied by faulting. A series of Carboniferous sediments consist largely of siliceous limestones and include strata of pure crystalline limestone and dolomite with occasional intercalated beds of fine grained sandstone. These strata have a general west to southwest dip of 15 to 45 degrees, which is occasionally disturbed by local folds. Igneous rocks are scarce and are represented chiefly by quartz-monzonite porphyry dikes and sills. The quartz-monzonite porphyry is intruded into these strata and is of post-Jurassic age, perhaps Tertiary.

| 17 |

Stratigraphy

The sedimentary rocks in the Yellow Pine District range in age from Upper Cambrian to recent. The Paleozoic section includes the Cambrian Rockford King and Nopah Formations, the Devonian Sultan, Mississippian Monte Cristo Limestone, Pennsylvanian/Mississippian Bird Spring Formation, and Permian Kaibab Limestone.

Permian:

Red beds

Mississippian to Permian:

Bird Spring Formation

Local erosional unconformity

Mississippian:

Monte Cristo Limestone:

Yellowpine Limestone Member Arrowhead Limestone Member Bullion Dolomite

Member Anchor Limestone Member Dawn Limestone Member

Devonian:

Sultan Limestone:

Crystal Pass Limestone Member; Valentine Limestone Member; Ironside Dolomite

Member.

Cambrian to Devonian:

Goodsprings Dolomite

Precambrian

Schist, gneiss, and coarse-grained igneous rocks

The Mesozoic section is comprised only of the Triassic Moenkopi and Chinle Formations and an upper Mesozoic unit of uncertain age termed the Lavinia Wash Formation. The Paleozoic rocks are dominantly carbonates while the Mesozoic units are continental clastics. Tertiary rocks include gravels and minor volcanic tuffs.

Only two varieties of intrusive rocks are known in the district. The most abundant is granite porphyry which forms three large sill-like masses. The sills generally lie near major thrust faults and are thought to have been emplaced along breccia zones at the base of the upper plate of the thrust fault. Locally, small dikes of basaltic composition and uncertain age have been encountered in some of the mine workings.

Structure

The region reveals a significant record of folding, thrust faulting and normal faulting. Folding began in the early Jurassic, resulting in broad flexures in the more massive units and tight folds in the thinly bedded rocks. The thrust faults in the district are part of a belt of thrust faulted rocks, the Foreland Fold and Thrust Belt that stretches from southern Canada to southern California.

| 18 |

Deformation within this belt began in the Jurassic and continued until Cretaceous time. Within the Goodsprings District thrust faulting appears to post-date much of the folding, but despite intensive study the actual age of thrusting continues to be the subject of contentious debate. Three major thrusts have been mapped; from west to east, the Green Monster, Keystone and Contact thrusts.

Of these, the Keystone is the most persistent along strike having been mapped for a distance of over 50 kilometers. The stratigraphic relationships along the Keystone fault are similar to those for all the major thrusts in the area, Cambrian Rockford King Formation has been thrust eastward over younger Paleozoic rocks.

Ore Mineralogy and Alteration

In the Goodsprings District, proximally north of the Sunset Mining District, the ore deposits can at best be characterized as enigmatic. They appear to fall into two distinct types which may or may not be related: gold-copper deposits and lead-zinc deposits. Gold-copper deposits are clearly related to sill-like masses of granite porphyry. All existing mines worked the contact between the intrusive and surrounding sedimentary rocks. Gold occurred in both the intrusive and the carbonate wall rocks. It appears any carbonate unit was a suitable host. The lead-zinc deposits are often distant from intrusives and occur as veins or replacements of brecciated rocks along fault zones, either thrust faults or normal faults. Unlike the gold deposits, the productive lead-zinc deposits are restricted to the Monte Cristo Formation. Mineralogy of gold-copper deposits consists of native gold, pyrite, limonite, cinnabar, malachite, azurite, and chrysocolla. Lead-zinc deposits are comprised of hydrozincite, calamine, smithsonite, cerrusite, anglesite, galena, and iron oxides. The rather unusual mineralogy of the district is due to the great depth of surface oxidation, exceeding 600 feet.

Ore Mineralogy and Alteration

Typical sulfides such as chalcopyrite, sphalerite and pyrite have been partially or completely altered to more stable hydrated carbonates and sulfates. Only the highly insoluble lead sulfide, galena has successfully resisted surface oxidation. Primary alteration is difficult to characterize due to the supergene overprint, but again appears to differ for gold-copper deposits and lead-zinc deposits. Gold-copper ores have been extensively sericitized and kaolinized, altering the host pluton to a rock that can be mined through simple excavation with little or no blasting. The rock is so thoroughly altered it decrepitates on exposure to the atmosphere. On the other hand, lead-zinc deposits appear to be characterized by dolomitization and minor silicification.

Local Mineralization

Mineralization at the Lucy Grey mine is reported as gold, silver, lead, and zinc within a breccia pipe in Precambrian gneiss. The minerals are concentrated in secondary fractures which cut the quartz veins.

Property Mineralization

The mineralization on the Rockford Lode Claim is not known, however, the indicated prospect pits within the Claim may have explored mineralization gold, silver, lead, and copper hosted by fractures within a breccia pipe of the Precambrian gneiss as at the nearby Lucy Grey mine.

| 19 |

Recommended Exploration Program and Estimated Cost

| Phase I | ||||

| VLF-EM and magnetometer surveys | $ | 7,500.00 | ||

| Phase II | ||||

| Localized soil surveys, trenching and sampling over known and indicated mineralized zones | $ | 12,500.00 | ||

| Phase III | ||||

| Test diamond drilling | $ | 75,000.00 | ||

| Total Estimated Cost US approximately | $ | 95,000 | ||

Item 3. Legal Proceedings.

The Company is not currently a party in any legal proceedings, and there has been no previous bankruptcy, receivership, or similar proceedings involving the Company.

Item 4. Submission of Matters to a Vote of Security Holders

None.

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

General

The Company presently has 10,000,000 shares of Common Stock that are issued and outstanding which are held by 40 stockholders of record.

The Company plans to qualify its shares of Common Stock for trading on the OTC Electronic Bulletin Board (“OTCBB”). The OTCBB is a regulated quotation service that displays real-time quotes, last sale prices and volume information in over-the-counter (OTC) securities. The OTCBB is not an issuer listing service, market, or exchange. Issuers must remain current in their filings with the Securities and Exchange Commission and applicable regulatory authorities. Market Makers are not permitted to begin quotation of a security that do not meet this filing requirement. Securities already quoted on the OTCBB that become delinquent in their required filings will be removed following a 30 or 60 day grace period if they do not make their required filing during that time.

There is presently no public trading market for our securities. There has been no previous public trading of our securities on any market, and, therefore, no high and low bid pricing information is provided.

There are no outstanding stock options, warrants, or securities convertible into our Common Stock of the Company.

All of the issued and outstanding shares of Common Stock of the Company are eligible to be sold under Rule 144 under the Securities Act of 1933, subject to the volume limitations of Rule 144. There have been no re-sales of the Common Stock known to the Company.

There has been, and there is no publicly disclosed offering of securities of the Company of any kind that could have a material effect in the market price of the Company’s Common Stock.

Stock Transfer Agent

The transfer agent of the Company is Action Stock Transfer Corporation, 551 N.W. 77 th Street,

Salt Lake City, UT 84121. Telephone (801) 274-1088.

No Dividends

The Company has not declared or paid any dividends on its Common Stock and presently does not expect to declare or pay any such dividends in the foreseeable future. The Company has not yet formulated a future dividend policy in the event restrictions on its ability to pay dividends are created.

| 20 |

Item 6. Selected Financial Data

These following financial data has been derived from the audited financial statements of the Company at Item 8.

| Year Ended | Year Ended | |||||||

| October 31, 2010 | October 31, 2011 | |||||||

| Revenues | $ | 0 | $ | 0 | ||||

| Mining Development Rights | $ | 290 | $ | 140 | ||||

| Professional Fees | $ | 33,213 | $ | 47,812 | ||||

| General and administrative expense | $ | 7,877 | $ | 13,646 | ||||

| Net loss | $ | (41,541 | ) | $ | (62,275 | ) | ||

| Net loss per share | $ | — | $ | — | ||||

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Plan of Operation

As of October 31, 2011, the Company had a cash balance of $2,860 in comparison to $17,137 at October 31, 2010. In order to meet our budgeted cash requirements over the next 12 months, we anticipate raising money from equity financing from the sale of our Common Stock, additional shareholder loan commitments and/or the sale of part of our interest in our mineral claim.

If we are not successful in raising additional financing, we anticipate that we will not be able to proceed with our business plan. In such a case, we may decide to discontinue our current business plan and seek other business opportunities. Any business opportunity may require our management to perform diligence on possible acquisition of additional resource properties. Such due diligence would likely include purchase investigation costs, such as professional fees by consulting geologists, preparation of geological reports on the properties, conducting title searches and travel costs for site visits. Our current cash on hand will not be sufficient to acquire any resource property and additional funds will be required to close any possible acquisition. As a reporting company, we will need to maintain our periodic filings with the appropriate regulatory authorities and will incur legal and accounting costs. If no other such opportunities are available and we cannot raise additional capital to sustain minimum operations, we may be forced to discontinue business. We do not have any specific alternative business opportunities in mind and have not planned for any such contingency.

Based on the nature of our business, we anticipate incurring operating losses in the foreseeable future. We base this expectation, in part, on the fact that very few mineral claims in the exploration stage ultimately develop into producing, profitable mines. Our future financial results are also uncertain due to a number of factors, some of which are outside our control. These factors include the following:

| • | our ability to raise additional funding; |

| • | the market price for minerals that may be found on our Use1 – 4 and Little Butte mineral claims; |

| • | the results of our proposed exploration programs on our mineral properties; and |

| 21 |

| • | our ability to find joint venture partners for the development of our property interests |

Due to our lack of operating history and present inability to generate revenues, our auditors have stated their opinion that there currently exists substantial doubt about our ability to continue as a going concern.

Results of Operation

The Company did not have any operating revenues or income from its inception (October 29, 2007) through October 31, 2011. For the period from inception, October 29, 2007, through the fiscal year ended October 31, 2011, the Company recognized a net cumulative loss of $152,729. Some general and administrative expenses during the year were accrued. Expenses for the year were comprised of costs mainly associated with legal, accounting and office expenses.