Attached files

| file | filename |

|---|---|

| EX-10.3 - LETTER AGREEMENT - Gold & Gemstone Mining Inc. | exhibit10-3.htm |

| EX-10.4 - LETTER AGREEMENT - Gold & Gemstone Mining Inc. | exhibit10-4.htm |

| EX-10.5 - LETTER AGREEMENT - Gold & Gemstone Mining Inc. | exhibit10-5.htm |

| EX-10.2 - COLLABORATION AGREEMENT - Gold & Gemstone Mining Inc. | exhibit10-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of Earliest event Reported): May 4, 2012

GOLD AND GEMSTONE MINING

INC.

(Exact name of registrant as specified in its

charter)

| Nevada | 333-165929 | 98-0642269 |

| (State or other jurisdiction of | (Commission File Number) | (IRS Employer Identification No.) |

| incorporation or organization) |

2144 Whitekirk Way, Draper, Utah, 84020, USA

(Address of principal executive offices)

801-882-1179

(Registrant's telephone number,

including area code)

204 West Spear Street, Carson City, Nevada,

98703

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425)

[ ] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d -2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e -4(c))

1

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management's Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements include, among other things, statements relating to:

-

our anticipated growth strategies and our ability to manage the expansion of our business operations effectively;

-

our ability to maintain or increase our market share in the competitive markets in which we do business;

-

our ability to keep up with rapidly changing technologies and evolving industry standards, including our ability to achieve technological advances;

-

our dependence on the growth in demand for our services;

-

our ability to diversify our service offerings and capture new market opportunities; and

-

the loss of key members of our senior management.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Use of Certain Defined Terms

Except where the context otherwise requires and for the purposes of this report only:

-

the “Company,” “we,” “us,” and “our” refer to the business of Gold and GemStone Mining Inc., a Nevada corporation (formerly, Global GSM Solutions, Inc.) as well as our joint venture subsidiary Gold and Gemstone Sierra Leone Limited, a Sierra Leone company;

-

“Exchange Act” refers the Securities Exchange Act of 1934, as amended;

-

“SEC” refers to the Securities and Exchange Commission;

-

“Securities Act” refers to the Securities Act of 1933, as amended; and

-

“U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States.

2

ITEM 2.01

COMPLETION OF ACQUISITION OR DISPOSITION

OF ASSETS

ITEM 5.02

DEPARTURE OF DIRECTORS OR PRINCIPAL

OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF PRINCIPAL OFFICERS

On May 4, 2012, Gold and GemStone Mining Inc. (“we”, “us”, “our”) entered into a collaboration agreement (the “JV Agreement”) with Ridgeback Mining (Sierra Leone) Limited (“RMSL”) regarding a joint venture on three prospective diamond and gold properties in Sierra Leone (the “Properties”). Detailed descriptions of the Properties are included “Description of Property” found further in this Current Report. Pursuant to the JV Agreement, we have initiated the incorporation of Gold and Gemstone Sierra Leone Limited, a Sierra Leone company (the “JV Company”). The shares capital of the JV Company is distributed equally between our company and the shareholders of RMSL, with our company holding fifty percent and profits will be distributed evenly as well. Pursuant to the terms of the JV Agreement, RMSL will transfer the Properties into JV Company and we will provide ongoing financing for all joint venture operations. Our investment into the JV Company is required to reach $1,500,000 per concession for an aggregate total of $4,500,000 within the first twelve months of operation. If we do not invest the required $1,500,000 per concession within the first twelve months, each concession for which the requirement was not fulfilled will be returned to the ownership of RMSL. A copy of the JV Agreement as well as the letter agreements evidencing RMSL’s rights to the Properties are included as exhibits to this Current Report on Form 8-K.

In conjunction with the execution of the JV Agreement, on May 4, 2012 our company’s majority shareholders took a number of actions to reconfigure our capital structure. Our former directors and officers, Gennady Fedosov and Anna Ivashenko cancelled an aggregate of 180,000,000 shares of our common stock and transferred an additional 88,000,000 to incoming management. For more details on our incoming management and their shareholdings, please see detailed disclosure further in this Current Report on Form 8-K. Subsequent to all cancellations and transfers, we had 150,750,000 shares issued and outstanding as of May 4, 2012.

Also on May 4, 2012, we accepted the resignation from Geoffrey Dart as our sole director and officers and accepted the consents to act of Charmaine King, Timothy Cocker and Tom Tucker. Ms. King has been appointed as President, CEO, CFO, Secretary, Treasurer and a director of our company. Mr. Cocker has been appointed as our Chief Marketing Officer and a member of our board of directors, and Mr. Tucker has been appointed as our Vice President of African Mining Operations as well as a member of our board of directors. Detailed information on all of our new directors and board members is available further in this Current Report.

FORM 10 INFORMATION DISCLOSURE

As disclosed elsewhere in this report, on May 4, 2012, we entered into the JV Agreement and set up a joint venture with regard to the Properties: certain diamond and gold mining concessions in Sierra Leone. Item 2.01(f) of Form 8-K states that if the registrant was a shell company, as we were immediately before the acquisition of assets under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10.

Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to our company after the establishment of the joint venture with RMSL, unless otherwise specifically indicated.

DESCRIPTION OF BUSINESS

Our Corporate History and Background

We were incorporated in the State of Nevada as a for-profit company on March 5, 2008 and established a fiscal year end of January 31. We do not have revenues, have minimal assets and have incurred losses since inception. We are company formed to develop, manufacture, and distribute our product and services to the gaming and vending industry that allows remote monitoring of amusement and vending devices. Our product was intended to improve security, productivity, and profitability of devices such as arcade games, toy dispensing machines, redemption games and vending machines. We were not able to raise sufficient capital to carry out our business plan and our management changed our focus to acquiring operating assets or businesses. On May 4, 2012 we entered into the JV Agreement and changed our business to that of mineral exploration.

3

Our common stock was initially approved for quotation on the OTC Bulletin Board under the symbol “GGSM” on December 27, 2010. On April 24, 2012 the Nevada Secretary of State to change our name from Global GSM Solutions Inc. to Gold and GemStone Mining Inc. and to increase our authorized capital from 75,000,000 to 400,000,000 shares of common stock, par value of $0.001. These amendments became effective on April 30, 2012 upon approval from the Financial Industry Regulatory Authority (“FINRA”). Also effective April 30, 2012, our issued and outstanding shares of common stock increased from 7,350,000 to 330,750,000 shares of common stock, par value of $0.001, pursuant to a one old for 45 new forward split of our issued and outstanding shares of common stock. Our new CUSIP number is 380485102.

Other than as set out in this current report, we have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets not in the ordinary course of our business.

Our Business

Upon the execution of the JV Agreement, we have shifted our business focus to that of diamond exploration in Sierra Leone. The properties which are the subject of our joint venture with RMSL are currently in the exploration stage and no reserves have been proven. Through the joint venture arrangement, we will undertake exploration activity on the Properties, and will also make efforts to increase our own land holdings and assets in the gold and diamond exploration industry throughout Africa.

Pursuant to the JV Agreement with RMSL, we are required to finance each of the three claims subject to our joint venture with a minimum of $1,500,000 per claim, for an aggregate total of $4,500,000. If we fail to invest the required amount for any of the claims within 12 months, the claims will revert back to the sole ownership of RMSL. We do not currently have enough funds to meet our investment obligations for any of the claims.

We have little cash on hand, no financing arrangements and no lines of credit or other bank financing arrangements. There can be no assurance that we will be able to close any financing and if we do close any financings, there can be no assurance that they will be sufficient to meet our needs for the upcoming 12 months.

Market, Customers and Distribution Methods

Although there can be no assurance, large and well capitalized markets are readily available for diamonds and gold throughout the world. A very sophisticated futures market for the pricing and delivery of future production also exists. The price for diamonds and gold is affected by a number of global factors, including economic strength and resultant demand for diamonds and gold, fluctuating supplies, mining activities and production by others in the industry, and new and or reduced uses for diamonds and gold.

The mining industry is highly speculative and of a very high risk nature. As such, mining activities involve a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Few mining projects actually become operating mines.

The mining industry is subject to a number of factors, including intense industry competition, high susceptibility to economic conditions (such as price, foreign currency exchange rates, and capital and operating costs), and political conditions (which could affect such things as import and export regulations, foreign ownership restrictions). Furthermore, the mining activities are subject to all hazards incidental to mineral exploration, development and production, as well as risk of damage from earthquakes, any of which could result in work stoppages, damage to or loss of property and equipment and possible environmental damage. Hazards such as unusual or unexpected geological formations and other conditions are also involved in mineral exploration and development.

Competition

The diamond and gold exploration industry is highly competitive. We are a new exploration stage company and have a weak competitive position in the industry. We compete with junior and senior exploration companies, independent producers and institutional and individual investors who are actively seeking to acquire mineral exploration properties throughout the world together with the equipment, labor and materials required to operate on those properties. Competition for the acquisition of diamond and gold exploration interests is intense with many exploration leases or concessions available in a competitive bidding process in which we may lack the technological information or expertise available to other bidders.

Many of the mineral exploration companies with which we compete for financing and for the acquisition of mineral exploration properties have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquiring mineral exploration interests of merit or on exploring or developing their mineral exploration properties. This advantage could enable our competitors to acquire mineral exploration properties of greater quality and interest to prospective investors who may choose to finance their additional exploration and development. Such competition could adversely impact our ability to attain the financing necessary for us to acquire further mineral exploration interests or explore and develop our current or future mineral exploration properties.

4

We also compete with other junior mineral exploration companies for financing from a limited number of investors that are prepared to invest in such companies. The presence of competing junior mineral exploration companies may impact our ability to raise additional capital in order to fund our acquisition or exploration programs if investors perceive that investments in our competitors are more attractive based on the merit of their mineral exploration properties or the price of the investment opportunity. In addition, we compete with both junior and senior mineral exploration companies for available resources, including, but not limited to, professional geologists, land specialists, engineers, camp staff, helicopters, float planes, mineral exploration supplies and drill rigs.

General competitive conditions may be substantially affected by various forms of legislation and/or regulation introduced from time to time by the governments of the countries in which we operate, as well as factors beyond our control, including international political conditions, overall levels of supply and demand for mineral exploration.

In the face of competition, we may not be successful in acquiring, exploring or developing profitable mineral properties or interests, and we cannot give any assurance that suitable properties or interests will be available for our acquisition, exploration or development. Despite this, we hope to compete successfully in the mineral exploration industry by:

-

keeping our costs low;

-

relying on the strength of our management’s contacts; and

-

using our size and experience to our advantage by adapting quickly to changing market conditions or responding swiftly to potential opportunities.

Research and Development

During the year ended January 31, 2012 we did not spend any funds on research and development.

Employees

We are a development stage company and currently have no employees, other than our three officers and directors who provide their services on a consulting basis.

Intellectual Property

We also own all of the right to the website, and the content therein, of www.ggsmining.com.

Governmental Regulations

Mining operations in Sierra Leone are subject to a number of governmental regulations including the Mines and Minerals Act of 2009 and diamond mining specifically is regulated by the Diamond Trading Act. We are committed to complying with and are, to our knowledge, in compliance with, all governmental regulations applicable to our company and our properties. Permits from a variety of regulatory authorities are required for many aspects of mine operation and reclamation. We cannot predict the extent to which these requirements will affect our company or our properties if we identify the existence of minerals in commercially exploitable quantities. In addition, future legislation and regulation could cause additional expense, capital expenditure, restrictions and delays in the exploration of our properties.

The JV Company being formed with RMSL will be registered with a Small Scale Mining Licence from the Ministry of Mine and Mineral Resources in Sierra Leone. The Ministry overseas the conduct of all mining companies in the Country and ensures compliance with the Mines and Minerals Act of 2009. The first steps for the JV Company to meet Government Regulations as a Licensed Small Scale Mining Company are set out below:

- To prepare and maintain the companies Memorandum of Incorporation and Association

- To register the formation of the business with the Registrar of Companies at the Office of the Administrator and Registrar General ( OARG)

5

- To register the business at Ministry of Mines and Minerals

- To request a Small Scale Mining License from the Ministry of Mines and Minerals

- To pay for Small Scale Mining License

- To pay Mining Board sitting fees (25 Board Members)

- Finalize Mining Lease Agreement with each Chiefdom

- To prepare Mining Work plan for the Company including financial details for each Concession

- To prepare Environmental (EIA) Report for each Concession

- To pay Surface Rent for each Concession

- To get Listed in Cadastral Map as Mining Company owning rights in the three Concessions

We are in the process of forming the JV Company and completing the above mentioned business registration with the Ministry of Mines and Minerals and we will be ensuring that all the other requirements are met. In relation to ongoing business operations and continued compliance with the regulations as set out in the Mines and Minerals Act of 2009 we anticipate hiring a specialist advisor who has significant experience in complying with Government Regulation in Sierra Leone and specifically with the Ministry of Mines and Minerals.

The cost for completing the initial registrations and compliance with the regulations is approximately $113,450 which is broken down as follows:

| - | Registration of Company as Mining Company at Ministry of Mines - 1,000 USD | |

| - | Environmental Report (EIA) - 25,000 USD | |

| - | Work plan for the Mining process, including financial details - 15,000 USD | |

| - | Surface rent for 50 licenses - 20,000 USD | |

| - | Mining License for 50 licenses - 30,000 USD | |

| - | Application Small Scale Mining License - 250 USD | |

| - | Approval by the Board, sitting fees - 20,000 USD | |

| - | Small Scale Mining License - 2,000 USD | |

| - | Cadastral Map Listing - 2,000 USD | |

| - | Listing on Ministry of Mines Website - 200 USD |

Outside of the above mentioned regulations associated with the Mines and Minerals Act 2009 we do not foresee any specific government regulation that will have an impact on the day to day running of our operations in Sierra Leone. Other than of course operating within the relevant laws currently in force in the Republic of Sierra Leone and fulfilling all obligations to the community.

At this time, we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock or through a loan from our directors to meet our obligations with regard to the Properties, the initial registrations above, or general operations over the next twelve months. We do not have any arrangements in place for any future debt or equity financing.

Environmental Compliance

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Reports to Security Holders

We intend to furnish our shareholders with annual reports containing financial statements audited by our independent auditors and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year.

6

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

DESCRIPTION OF PROPERTY

Our business office is located at 2144 Whitekirk Way, Draper, Utah, 84020, USA. It is approximately 3,000 square feet in size and is being donated by our management. We have entered into a joint venture with RMSL to explore and develop three distinct diamond and gold mining concessions in Sierra Leone. A description of these concessions follows.

Location and Access

The Properties are split across three separate Chiefdoms in the Kono District of Sierra Leone; the Nimiyama Sewafe, Nimikoro & Sandoh Chiefdoms. This is located in the north eastern region of Sierra Leone. The concessions are located on the banks of the Sewa River, which is the main diamond bearing river in Sierra Leone, and also the Bagbe and Baafi rivers which flow together to form the Sewa River.

Specifically, these claims and sizes are as follows:

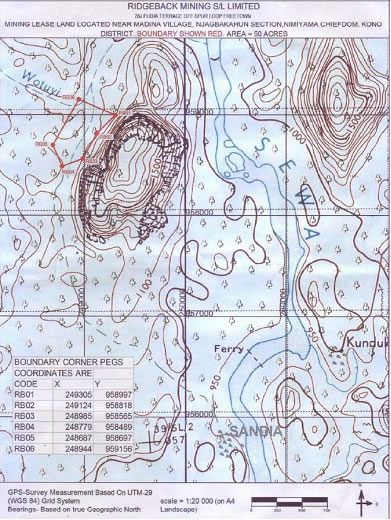

Nimiyama Sewafe Chiefdom (The Sandia Concession) – 50 Acres situated on the banks of the Sewa

| Grid Co-ordinates: | X | Y |

| RB01 | 249305 | 958997 |

| RB02 | 249124 | 958818 |

| RB03 | 248985 | 958565 |

| RB04 | 248779 | 958489 |

| RB05 | 248687 | 958697 |

| RB06 | 248944 | 959156 |

7

The Nimiyama Chiefdom has granted the concession in Sandia which is 17km from the nearest town which is Sewafe and it is a further 40km to the nearest major city which is Kono. There is no railway in the location of the concession. The road from Sewafe is serviceable by motor vehicle but is very rough and there may be some remedial works required for heavy plant machinery access. There is no electricity in the local town or at the concession area so the site would rely upon generators to begin operations. There is good mobile phone network coverage in the area.

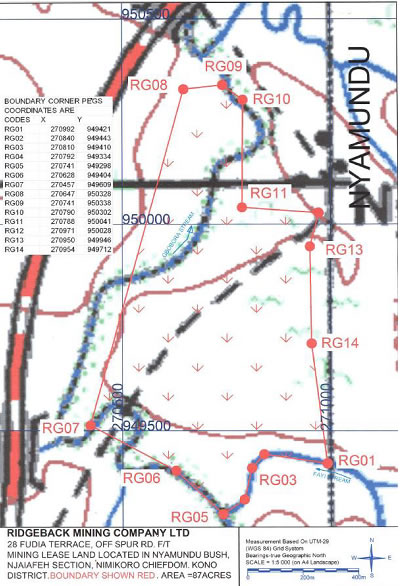

Nimikoro Chiefdom (The Nyamundu Concession) – 25 Acres of diamond and gold exploration land in the Nimikoro Chiefdom. The total claim area is 87 acres but RMSL has been granted an initial 25 acre concession with the option to extend later.

| Grid Co-ordinates: | X | Y |

| RG01 | 270992 | 949421 |

| RG02 | 270840 | 949443 |

| RG03 | 270810 | 949410 |

| RG04 | 270792 | 949334 |

| RG05 | 270741 | 949298 |

| RG06 | 270628 | 949404 |

| RG07 | 270457 | 949609 |

| RG08 | 270647 | 950328 |

| RG09 | 270741 | 950338 |

| RG10 | 270790 | 950302 |

| RG11 | 270788 | 950041 |

| RG12 | 270971 | 950028 |

| RG13 | 270950 | 949946 |

| RG14 | 270954 | 949712 |

8

The Nimikoro Chiefdom has granted a concession is located in Jaiama Nimikoro which is 8km from the nearest town which is Nyamandu and it is a further 16km to the nearest major city which is Koidu City. There is no railway in the location of the concession. The road from Nyamandu is serviceable by motor vehicle but is very rough and there may be some remedial works required for heavy plant machinery access. There is no electricity in the local town or at the concession area so the site would rely upon generators to begin operations. There is good mobile phone network coverage in the area.

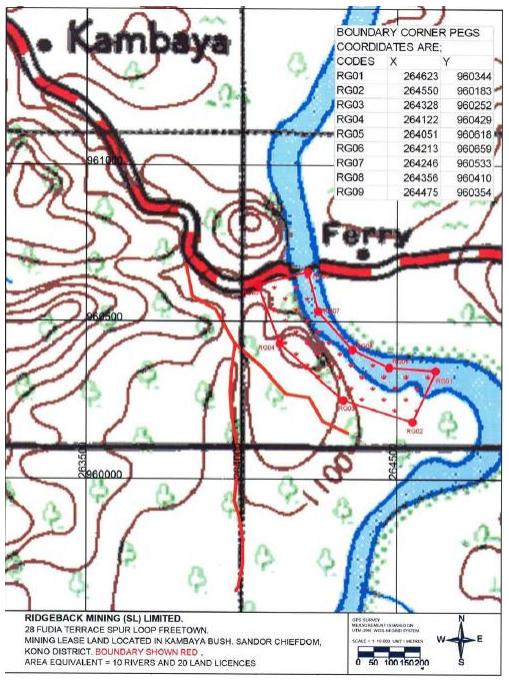

Sandoh Chiefdom (The Kambaya Concession) – 30 Acres of diamond and gold exploration land in the Sandor Chiefdom with an additional 50 acres available upon commencing of mining operations.

| Grid Co-ordinates: | X | Y |

| RG01 | 264623 | 960344 |

| RG02 | 264550 | 960183 |

| RG03 | 264328 | 960252 |

| RG04 | 264122 | 960429 |

| RG05 | 264051 | 960618 |

| RG06 | 264213 | 960659 |

| RG07 | 264246 | 960533 |

| RG08 | 264356 | 960410 |

| RG09 | 264475 | 960354 |

9

The Sandoh Chiefdom has granted a concession in Kambaya which is 10km from the nearest town which is Tefeya and it is a further 25km to the nearest major city which is Koidu City. There is no railway in the location of the concession. The road from Kambaya is serviceable by motor vehicle but is very rough and there may be some remedial works required for heavy plant machinery access. There is no electricity in the local town or at the concession area so the site would rely upon generators to begin operations. There is good mobile phone network coverage in the area.

Access to the country interior from Freetown, the capital of Sierra Leone, is by a combination of paved and dirt roads. New hydroelectric schemes are being developed to help address the electricity needs of the country’s power grids. Communications have improved significantly in the last few years, with the mobile phone network being regularly extended. Coverage now reaches most population centers and main roads.

Ownership Interest

We have entered into the JV Agreement with Ridgeback Mining Sierra Leone (RMSL) which owns the mining rights to the Properties. The claim lands are owned by the local Paramount Chiefs of each of the above mentioned Chiefdoms, and these chiefs have granted 100% mining rights to these claims to RMSL. In accordance with the terms of the JV Agreement we have incorporated the JV Company which will hold title to and operate the mining claims. The shares capital of the JV Company is distributed equally between our company and the shareholders of RMSL, with our company holding fifty percent and profits will be distributed evenly as well. Pursuant to the terms of the JV Agreement, RMSL will transfer the Properties into JV Company and we will provide ongoing financing for all joint venture operations. Our investment into the JV Company is required to reach $1,500,000 per concession for an aggregate total of $4,500,000 within the first twelve months of operation. If we do not invest the required $1,500,000 per concession within the first twelve months, each concession for which the requirement was not fulfilled will be returned to the ownership of RMSL.

10

RMSL has secured the three concessions, or claims, subject to the JV Agreement from Chiefdoms within Sierra Leone through letter agreements. These agreements expire in October of 2012. Tom Tucker, one of our directors and our Vice President of African Mining Operations has received guarantees from the Chiefdoms that the concessions will be extended, but until we have written agreements to that effect, we cannot provide any assurances. Our company and RMSL are currently working on updating, upgrading, extending and developing the concessions and we expect that these negotiations will be successful in extending all current claims prior to their expiry in October 2012.

History of Operations

The three concessions which make up the Properties subject to the JV Agreement with RMSL have not had any concerted historical operations. The general area in which the Properties are located has seen a significant amount of mining activity and a small summary is provided below.

Alluvial diamond mining by Sierra Leone Selection Trust commenced in the Kono area in 1932. Artisanal mining (legal and illegal) also accounted for a significant output in these areas. By 1997, diamond recovery was seriously disrupted by rebel activity; with most of the diamondiferous areas being overrun. Since January 2002 the federal government has re-established control of the diamond producing areas and rebel activity has ceased. Alluvial mining for diamonds recommenced in a number of areas, initially led by licensed and unlicensed artisanal workers and later by an increasing number of local and international mining companies.

In 2004 Koidu Holdings Ltd commenced hard rock mining on the kimberlite pipes at Koidu, in the same district as the Properties.

Present Condition

Much of Sierra Leone, including the Kono District where we intend to operate, is covered with dense secondary forest or bush, which has been cleared in many places for local subsistence agriculture. Over large areas the land surface comprises residual laterite, or detrital material. Mining in the area is open pit-style along the current banks of existing rivers, as well as coving sites of ancient riverbeds.

Broadly speaking, the eastern half of Sierra Leone, where the Properties lie, consists of a number of elevated plateaus and mountain ranges generally lying between 300m and 600m above sea level and rising to a maximum height of 1,950m. Most of the rivers descend from the plateau to the coastal plain in a series of rapids and waterfalls.

The Properties have not had any exploration work completed on them and do not exhibit any evidence of historical operations. They are undeveloped and will require significant exploration and surface work before any mining activity can begin. We plan to undertake exploration work on the Properties and generate a full geological survey and report.

Plan of Exploration

| PHASE 1 | ||

| Nature of Work | Timeframe | Cost |

| Incorporation and Registration of J/V Company | 4 Days | $4,000 |

| Registration at Ministry of Mines | 3 Days | $4,000 |

| Obtain Land from Landowners | 2 Weeks | $20,000 |

| Obtain Mining License from Ministry of Mines, incl. EIA report and Work Plan | 6 Weeks | $165,000 |

| Sourcing Equipment | 2 Weeks | $737,000 |

| Shipment of Equipment | 6 Weeks | $40,000 |

| Customs Clearing and Transport to Site | 2 Weeks | $50,000 |

| Contingency | $50,000 | |

| Total | 5 Months | $1,070,000.00 |

| PHASE 2 | ||

| Nature of Work | Timeframe | Cost |

| Start of Operation - Setup Camp | 2 Weeks | $10,000 |

| Clearing Overburden | 2 Weeks | $100,000 |

| Excavation of Gravel for First Production | 2 Weeks | $100,000 |

| Washing Gravel for First Production | 2 months | $220,000 |

| Total | 6 Weeks | $430,000.00 |

Please note that the Phase 2 is to reach First Production, after it is ongoing with a break in the clearing and excavation in the rainy season (April-October).

Geology

There has not been any geology conducted specifically on the Properties. What follows is a general description of the geology of Sierra Leone and specifically the region in which the Properties are located.

Most of the country is underlain by rocks of Precambrian age (Achaean and Proterozoic) with a coastal strip about 50km in width comprising marine and estuarine sediments of Tertiary and Quaternary to Recent age. The Precambrian (mainly Achaean) underlies about 75 percent of the country and typically comprises granite-greenstone terrain. It represents parts of an ancient continental nucleus located on the edge of the West African Craton. The Achaean basement can be subdivided into; infra-crustal rocks (gneisses and granitoids with metamorphic inclusions); supra-crustal rocks (containing greenstone belts); basic and ultra basic igneous intrusions.

The infra-crustal gneisses and granitoids were formed and reworked during two major orogenic cycles, an older Leonean episode (~ 2,950-3,200 Ma) and a younger Liberian episode (~ 2700 Ma). The granitoids represent the host unit for the later diamond-bearing kimberlite intrusions, believed to be of Cretaceous age. The supra-crustal greenstone belts, comprising mainly gneisses and schists, are the principal hosts of the gold mineralization of the country.

11

The basic and ultra basic intrusive are seen primarily on the coast of the Freetown peninsula. Dolerite intrusions are common, occurring as dykes trending mainly east-west or northwest-southeast within the basement complex, and as extensive sills. Tertiary, and more recent, weathering has led to lateralization across a large part of Sierra Leone, affecting mainly the greenstone belts and the extensive dolerite intrusions, diamondiferous kimberlitic dykes and pipes of Mesozoic age, trending 070°-074°, occur in the east of the country, at Koidu and Tongo, and new discoveries of narrow northwest-trending dykes are reported from the north and west of the country. Erosion of diamondiferous kimberlites during various phases of uplift resulted in the transportation and deposition of diamonds and other heavy minerals in alluvial deposits along rivers and river terraces over an area of almost 20,000km2 in the east and southeast of the country, representing more than one quarter of the land area of Sierra Leone.

Kimberlites, the primary source of diamonds, were first discovered in the Kono District in 1948, specifically in the Koidu area, where the Properties reside, and subsequently at Tongo. These were extensively tested and bulk sampled at the time, with limited mining being carried out.

Index of Geologic Terms

| Term | Definition |

| diamondiferous |

containing diamond or diamonds that can be extracted |

| dolerite |

an igneous rock of fine to medium grain size |

| igneous |

describes rock formed under conditions of intense heat or produced by the solidification of volcanic magma on or below the Earth's surface |

| inclusion |

a solid, liquid, or gas contained within a mineral or rock |

| granitoid |

a variety of coarse grained plutonic rock similar to granite which mineralogically are composed predominately of feldspar and quartz |

| gneiss |

a coarse-grained high-grade metamorphic rock formed at high pressures and temperatures, in which light and dark mineral constituents are segregated into visible bands |

| kimberlite |

a form of igneous rock, found especially in South Africa, composed mainly of peridotite and often containing diamonds |

| metamorphic |

relating to or involving a change in physical form |

| orogenic |

relating to or formed by the folding, faulting, and uplift of the Earth's crust |

| pipes |

a vertical passage through which molten lava flows |

| schist |

a rock whose minerals have aligned themselves in one direction in response to deformation stresses, with the result that the rock can be split in parallel layers |

12

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this current report on Form 8-K that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occur, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

Because our auditors have issued a going concern opinion, there is substantial uncertainty we will continue operations in which case you could lose your investment.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an ongoing business for the next 12 months. The financial statements do not include any adjustments that might result from the uncertainty about our ability to continue in business. As such we may have to cease operations and you could lose your investment.

Based upon current plans, we expect to incur operating losses in future periods because we will be incurring expenses and not generating significant revenues. We cannot guarantee that we will be successful in generating significant revenues in the future. Failure to generate revenues which are greater than our expenses will cause you to lose your investment.

We have a limited operating history with significant losses and expect losses to continue for the foreseeable future.

We have yet to establish any history of profitable operations. We have incurred net losses of $28,301 and $20,108 for the fiscal years ended January 31, 2012 and 2011, respectively. As a result, at January 31, 2012, we had an accumulated deficit of $54,149 and total stockholders’ deficit of $17,309. We have not generated any revenues since our inception and do not anticipate that we will generate revenues which will be sufficient to sustain our operations. We expect that our revenues will not be sufficient to sustain our operations for the foreseeable future. Our profitability will require the successful commercialization of our diamond mining properties. We may not be able to successfully commercialize our mines or ever become profitable.

We may not be able to secure additional financing to meet our future capital needs due to changes in general economic conditions.

We anticipate needing significant capital to conduct further exploration and development needed to bring our existing mining properties into production and/or to continue to seek out appropriate joint venture partners or buyers for certain mining properties. We may use capital more rapidly than currently anticipated and incur higher operating expenses than currently expected, and we may be required to depend on external financing to satisfy our operating and capital needs. We may need new or additional financing in the future to conduct our operations or expand our business. Any sustained weakness in the general economic conditions and/or financial markets in the United States or globally could adversely affect our ability to raise capital on favorable terms or at all. From time to time we have relied, and may also rely in the future, on access to financial markets as a source of liquidity to satisfy working capital requirements and for general corporate purposes. We may be unable to secure debt or equity financing on terms acceptable to us, or at all, at the time when we need such funding. If we do raise funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders would be reduced, and the securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock or may be issued at a discount to the market price of our common stock which would result in dilution to our existing stockholders. If we raise additional funds by issuing debt, we may be subject to debt covenants, which could place limitations on our operations including our ability to declare and pay dividends. Our inability to raise additional funds on a timely basis would make it difficult for us to achieve our business objectives and would have a negative impact on our business, financial condition and results of operations.

13

We may not have access to the supplies and materials needed for exploration, which could cause delays or suspension of our operations.

Competitive demands for contractors and unforeseen shortages of supplies and/or equipment could result in the disruption of planned exploration activities. Current demand for exploration drilling services, equipment and supplies is robust and could result in suitable equipment and skilled manpower being unavailable at scheduled times in our exploration programs. Furthermore, fuel prices are rising. We will attempt to locate suitable equipment, materials, manpower and fuel if sufficient funds are available. If we cannot find the equipment and supplies needed for our various exploration programs, we may have to suspend some or all of them until equipment, supplies, funds and/or skilled manpower can be obtained.

Attraction and retention of qualified personnel is necessary to implement and conduct our mineral exploration programs.

Our future success will depend largely upon the continued services of our Board members, executive officers and other key personnel. Our success will also depend on our ability to continue to attract and retain qualified personnel with mining experience. Key personnel represent a significant asset for us, and the competition for qualified personnel is intense in the mineral exploration industry.

We may have particular difficulty attracting and retaining key personnel in the initial phases of our exploration programs. We do not have key-person life insurance coverage on any of our personnel. The loss of one or more of our key people or our inability to attract, retain and motivate other qualified personnel could negatively impact our ability to complete our exploration programs.

Diamond exploration and development are risky and speculative activities. There can be no assurance that we will ever be able to reach profitability.

Diamond exploration and development is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover diamond deposits but also from finding diamond deposits that, though present, are insufficient in terms of tonnage, grade or diamond value to return a profit from production. The claims in which we hold an interest are in the exploration stage only and are without a known body of commercial ore. The business of diamond exploration in remote parts of Africa can be a lengthy, time consuming, expensive process and involves a high degree of risk. Several stages of assessment are required before its economic viability can be determined. Assessment includes a determination of deposit size (tonnage), grade (carats/stone), diamond value (US$/carat) and the associated costs of extracting and selling the diamonds. The long-term profitability of our operations will in part be directly related to the costs and success of our exploration programs, which may be affected by a number of factors.

The claims which are subject to our joint venture agreement with RMSL expire in October of 2012. If we are not able to get these claims renewed under reasonable conditions, our business may fail.

RMSL has secured the three concessions, or claims, subject to the JV Agreement from Chiefdoms within Sierra Leone through letter agreements. These agreements expire in October of 2012. Tom Tucker, one of our directors and our Vice President of African Mining Operations has received assurances from the Chiefdoms that the concessions will be extended, but until we have written agreements to that effect, we cannot provide any assurances. Our company and RMSL are currently working on extensions and size increases for the land. If we are unable to get the claims extended beyond October 2012, we will lose rights to the Properties and our business will fail.

Risks Associated with Joint Venture agreements

Our interests in our exploration properties may become subject to the risks normally associated with the conduct of joint ventures. Since our properties are subject to a joint venture, the existence or occurrence of one or more of the following circumstances and events could have a material adverse impact on the our profitability or the viability of our interests held through joint ventures, which could have a material adverse impact on our business prospects, results of operations and financial condition: (i) disagreements with joint venture partners on how to conduct exploration; (ii) inability of joint venture partners to meet their obligations to the joint venture or third parties; and (iii) disputes or litigation between joint venture partners regarding budgets, development activities, reporting requirements and other joint venture matters.

14

There is no assurance that we can formally establish the existence of any mineral reserve on any of our properties. Until we are able to establish a mineral reserve, there can be no assurance that production from these properties will continue for any period of time and if production fails, our business may ultimately fail.

Our properties have never been subject to a formal reserve estimation through scientific exploration techniques. Accordingly, there is no assurance that we can formally establish the existence of any mineral reserve on any of our properties. A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7 (which can be viewed over the Internet at http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination.

The probability of an individual prospect ever having a "reserve" that meets the requirements of the Securities and Exchange Commission's Industry Guide 7 is remote. If none of our current or future mineral resource properties contains any "reserve," any funds that we spend on exploration will be lost.

Even if we discover a mineral reserve, there can be no assurance that the related property will be developed.

Even if we eventually discover a mineral reserve on one or more of our properties, there can be no assurance that we will be able to develop the properties into producing mines. Both mineral exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the resource to infrastructure such as a power, roads and water for processing, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if we discover a mineral resource in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral resource. If we cannot exploit any mineral resource that it might discover on the properties, the business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could fail.

We believe that we are in compliance with all material laws and regulations that currently apply to our activities but there can be no assurance that we can continue to do so. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that it will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

In addition, environmental hazards unknown to us, which have been caused by previous or existing owners or operators of the Properties may exist on the properties in which we hold an interest. Even if we relinquish our licenses, we will still remain responsible for any required reclamation and rehabilitation of the properties.

Mineral exploration and development are subject to extraordinary operating risks. We do not currently insure against these risks. In the event of a cave-in or similar occurrence, our liability may exceed our resources, which would have an adverse impact on our operations.

Mineral exploration, development and production involve many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Hazards such as unusual or unexpected formations and other conditions are involved.

Our operations will be subject to all the hazards and risks inherent in the exploration, development and production of resources, including liability for pollution, cave-ins or similar hazards against which we cannot insure against or which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that arise from any such occurrence would have a material, adverse impact on our operations.

15

Mineral prices are subject to dramatic and unpredictable fluctuations.

We plan to derive revenues from the extraction and sale of diamonds. The prices of this commodity have fluctuated widely in recent years, and are affected by numerous factors beyond our control including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of diamonds and, therefore, the economic viability of any of our projects, cannot accurately be predicted.

The mining industry is highly competitive and there is no assurance that we will continue to be successful in acquiring mineral claims. If we cannot continue to acquire properties to explore for mineral resources, it may be required to reduce or cease operations.

The mineral exploration, development, and production industry is largely unintegrated. We compete with other exploration companies looking for mineral resource properties and the resources that can be produced from them. However, the mining business operates in a worldwide market, and prices for minerals are derived from relatively pure market forces.

We compete with many companies possessing greater financial resources and technical facilities. This competition could adversely affect our ability to acquire suitable prospects for exploration in the future. Accordingly, there can be no assurance that we will acquire any interest in additional mineral resource properties that might yield reserves or result in commercial mining operations.

Our properties are located in Sierra Leone and our operations there may be affected by varying degrees of political and economic uncertainties.

Our properties are located in Sierra Leone, and mineral exploration and mining activities in this country may be affected in varying degrees by political stability and economic uncertainties. Operations also may be affected in varying degrees by government regulations with respect to restrictions on production, repatriation of profits, price controls, export controls, income taxes, expropriations or property, environmental legislation and mine safety.

Sierra Leone has recently undergone major legislative changes to effect mineral title and mining operations. Accordingly, many laws may be considered relatively new, resulting in risks such as possible misinterpretation of new laws, modification of mining or exploration rights, operating restrictions, increased taxes, environmental regulation, mine safety and other risks arising out of a new sovereignty over mining, any or all of which could have an adverse impact upon us. Our operations may also be affected in varying degrees by political and economic instability, terrorism, crime, extreme fluctuations in currency exchange rates and inflation.

The JV Agreement entered into with RMSL requires us to invest a total of $4,500,000 into the Properties within 12 months. We do not have sufficient funds to meet this requirement and have no arrangements to raise the required funds. If we are not able to meet our financial obligations, we will lose all rights to the Properties and our business will fail.

Pursuant to the JV Agreement with RMSL, we are required to finance each of the three claims subject to our joint venture with a minimum of $1,500,000 per claim, for an aggregate total of $4,500,000. If we fail to invest the required amount for any of the claims within 12 months, the claims will revert back to the sole ownership of RMSL. We do not currently have enough funds to meet our investment obligations for any of the claims.

We have little cash on hand, no financing arrangements and no lines of credit or other bank financing arrangements. There can be no assurance that we will be able to close any financing and if we do close any financings, there can be no assurance that they will be sufficient to meet our needs for the upcoming 12 months. Generally, we have financed operations to date through the proceeds of the private placement of equity and debt instruments. We expect we will need to raise additional capital and generate revenues to meet long-term operating requirements. Additional issuances of equity or convertible debt securities will result in dilution to our current shareholders. Further, such securities might have rights, preferences or privileges senior to our common stock. Additional financing may not be available upon acceptable terms, or at all. If adequate funds are not available or are not available on acceptable terms, we may not be able to take advantage of prospective new business endeavours or opportunities, which could significantly and materially restrict our business operations. We currently do not have a specific plan of how we will obtain such funding; however, we anticipate that additional funding will be in the form of equity financing from the sale of our common stock. We have and will continue to seek to obtain short-term loans from our directors, although no future arrangement for additional loans has been made. We do not have any agreements with our directors concerning these loans. We do not have any arrangements in place for any future equity financing. If we are unable to meet our obligations for the claims subject to the joint venture with RMSL, then we will lose our interest in such claims and our business will fail.

16

RISKS RELATED TO OWNERSHIP OF OUR SECURITIES

Our stock price may be volatile, which may result in losses to our shareholders.

The stock markets have experienced significant price and trading volume fluctuations, and the market prices of companies listed on the Over-the-counter Bulletin Board quotation system in which shares of our common stock are listed, have been volatile in the past and have experienced sharp share price and trading volume changes. The trading price of our common stock is likely to be volatile and could fluctuate widely in response to many factors, including the following, some of which are beyond our control:

- variations in our operating results;

- changes in expectations of our future financial performance, including financial estimates by securities analysts and investors;

- changes in operating and stock price performance of other companies in our industry;

- additions or departures of key personnel; and

- future sales of our common stock.

Domestic and international stock markets often experience significant price and volume fluctuations. These fluctuations, as well as general economic and political conditions unrelated to our performance, may adversely affect the price of our common stock.

Our common shares may become thinly traded and you may be unable to sell at or near ask prices, or at all.

We cannot predict the extent to which an active public market for trading our common stock will be sustained. Although our common share’s trading volume increase significantly recently, it has historically been sporadically or “thinly-traded,” meaning that the number of persons interested in purchasing our common shares at or near bid prices at certain given time may be relatively small or non-existent.

This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community who generate or influence sales volume. Even if we came to the attention of such persons, those persons tend to be risk-averse and may be reluctant to follow, purchase, or recommend the purchase of shares of an unproven company such as ours until such time as we become more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained.

The market price for our common stock is particularly volatile given our status as a relatively small company, which could lead to wide fluctuations in our share price. You may be unable to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

17

We do not anticipate paying any cash dividends to our common shareholders.

We presently do not anticipate that we will pay dividends on any of our common stock in the foreseeable future. If payment of dividends does occur at some point in the future, it would be contingent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment of any common stock dividends will be within the discretion of our Board of Directors. We presently intend to retain all earnings after paying the interest for the preferred stock, if any, to implement our business plan; accordingly, we do not anticipate the declaration of any dividends for common stock in the foreseeable future.

If we are currently listed on the Over-the-Counter Bulletin Board quotation system and our common stock is subject to “penny stock” rules which could negatively impact our liquidity and our shareholders’ ability to sell their shares.

Our common stock is currently quoted on the Over-the-counter Bulletin Board. We must comply with numerous rules in order to maintain the listing of our common stock on the Over-the-counter Bulletin Board. There can be no assurance that we can continue to meet the requirements to maintain the quotation on the Over-the-counter Bulletin Board listing of our common stock. If we are unable to maintain our listing on the Over-the-counter Bulletin Board, the market liquidity of our common stock may be severely limited.

Volatility in Our Common Share Price May Subject Us to Securities Litigation.

The market for our common stock is characterized by significant price volatility as compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of our securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management's attention and resources.

The Elimination of Monetary Liability Against our Directors, Officers and Employees under Nevada law and the Existence of Indemnification Rights of our Directors, Officers and Employees May Result in Substantial Expenditures by our Company and may Discourage Lawsuits Against our Directors, Officers and Employees.

Our articles of incorporation do not contain any specific provisions that eliminate the liability of our directors for monetary damages to our company and shareholders; however, we are prepared to give such indemnification to our directors and officers to the extent provided for by Nevada law. We may also have contractual indemnification obligations under our employment agreements with our officers. The foregoing indemnification obligations could result in our company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors and officers even though such actions, if successful, might otherwise benefit our company and shareholders.

We may need additional capital, and the sale of additional shares or other equity securities could result in additional dilution to our shareholders.

In the future, we may require additional cash resources due to changed business conditions or other future developments, including any investments or acquisitions we may decide to pursue. If our resources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain a credit facility. The sale of additional equity securities could result in dilution to our shareholders. The incurrence of indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations. We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all.

Our business is subject to changing regulations related to corporate governance and public disclosure that have increased both our costs and the risk of noncompliance.

Because our common stock is publicly traded, we are subject to certain rules and regulations of federal, state and financial market exchange entities charged with the protection of investors and the oversight of companies whose securities are publicly traded. These entities, including the Public Company Accounting Oversight Board, the SEC and FINRA, have issued requirements and regulations and continue to develop additional regulations and requirements in response to corporate scandals and laws enacted by Congress, most notably the Sarbanes-Oxley Act of 2002. Our efforts to comply with these regulations have resulted in, and are likely to continue resulting in, increased general and administrative expenses and diversion of management time and attention from revenue-generating activities to compliance activities. Because new and modified laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This evolution may result in continuing uncertainty regarding compliance matters and additional costs necessitated by ongoing revisions to our disclosure and governance practices.

18

We will incur increased costs and compliance risks as a result of becoming a public company.

As a public company, we will incur significant legal, accounting and other expenses. We will incur costs associated with our public company reporting requirements. We also anticipate that we will incur costs associated with recently adopted corporate governance requirements, including certain requirements under the Sarbanes-Oxley Act of 2002, as well as new rules implemented by the SEC and FINRA. We expect these rules and regulations, in particular Section 404 of the Sarbanes-Oxley Act of 2002, to significantly increase our legal and financial compliance costs and to make some activities more time-consuming and costly. Like many smaller public companies, we face a significant impact from required compliance with Section 404 of the Sarbanes-Oxley Act of 2002. Section 404 requires management of public companies to evaluate the effectiveness of internal control over financial reporting and the independent auditors to attest to the effectiveness of such internal controls and the evaluation performed by management. The SEC has adopted rules implementing Section 404 for public companies as well as disclosure requirements. The Public Company Accounting Oversight Board, or PCAOB, has adopted documentation and attestation standards that the independent auditors must follow in conducting its attestation under Section 404. We are currently preparing for compliance with Section 404; however, there can be no assurance that we will be able to effectively meet all of the requirements of Section 404 as currently known to us in the currently mandated timeframe. Any failure to implement effectively new or improved internal controls, or to resolve difficulties encountered in their implementation, could harm our operating results, cause us to fail to meet reporting obligations or result in management being required to give a qualified assessment of our internal controls over financial reporting or our independent auditors providing an adverse opinion regarding management’s assessment. Any such result could cause investors to lose confidence in our reported financial information, which could have a material adverse effect on our stock price.

We also expect these new rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our Board of Directors or as executive officers. We are currently evaluating and monitoring developments with respect to these new rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the Financial Statements and Notes thereto of our company appearing elsewhere in this Current Report. The following discussion contains forward-looking statements relating to future events or our future performance. Actual results may materially differ from those projected in the forward-looking statements as a result of certain risks and uncertainties set forth in this prospectus. Although management believes that the assumptions made and expectations reflected in the forward-looking statements are reasonable, there is no assurance that the underlying assumptions will, in fact, prove to be correct or that actual results will not be different from expectations expressed in this report.

Results of Operations for our Years Ended January 31, 2012 and 2011

Our net loss and comprehensive loss for our year ended January 31, 2012, for our year ended January 31, 2011 and the changes between those periods for the respective items are summarized as follows:

19

Year Ended January 31, 2012 $ |

Year Ended January 31, 2011 $ |

Change Between Year Ended January 31, 2012 and Year Ended January 31, 2011 $ | |

| Revenue | Nil | Nil | Nil |

| Incorporation costs | Nil | Nil | Nil |

| Professional fees | 11,560 | 14,270 | (2,710) |

| Transfer agent expense | 12,319 | 4,080 | 8,239 |

| General and administrative | 4,422 | 1,758 | 2,664 |

| Net loss for the period | (28,301) | (20,108) | 8,193 |

General and Administrative

The increase in our general and administrative expenses as well as transfer agent fees for our year ended January 31, 2012 was due to an increase in costs for maintain our listing on the OTC Bulletin Board and applying for DTC eligibility.

Professional Fees

The decrease in professional fees for our year ended January 31, 2012 was due to a decrease amount of corporate activity.

Liquidity and Financial Condition

Working Capital

| As at | ||||||

| January 31 | ||||||

| 2012 | 2011 | |||||

| Current assets | $ | Nil | $ | 15,742 | ||

| Current liabilities | 17,309 | 8,590 | ||||

| Working capital | $ | (17,309 | ) | $ | 7,152 | |

Cash Flows

| Year Ended | ||||||

| January 31 | ||||||

| 2012 | 2011 | |||||

| Cash flows from (used in) operating activities | $ | (18,478 | ) | $ | (27,958 | ) |

| Cash flows provided by (used in) investing activities | Nil | $ | Nil | |||

| Cash flows provided by (used in) financing activities | 10,436 | $ | 30,000 | |||

| Net increase (decrease) in cash during period | $ | (8,042 | ) | $ | 2,042 | |

Operating Activities

Net cash used in operating activities was $18,478 for our year ended January 31, 2012 compared with cash used in operating activities of $27,958 in the same period in 2011.

20

Investing Activities

Net cash provided by investing activities was $Nil for our year ended January 31, 2012 compared to net cash used in investing activities of $Nil in the same period in 2011.

Financing Activities

Net cash from financing activities was $10,436 for our year ended January 31, 2012 compared to $30,000 in the same period in 2011.

Contractual Obligations

As a “smaller reporting company”, we are not required to provide tabular disclosure obligations.

Going Concern

The financial statements have been prepared in accordance with accounting principles generally accepted in the United States applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. Our company incurred a net loss of $28,301 for the year ended January 31, 2012 [2011 - $20,108] and at January 31, 2012 had a deficit accumulated of $54,149 [2011 – $25,848]. We have not generated revenue and we have an accumulated deficit and negative working capital of $17,309 as at January 31, 2012. Our company requires additional funds to meet its financial obligations as they relate to its operations and investment commitments on the Properties. These conditions raise substantial doubt about our company’s ability to continue as a going concern. Management’s plans in this regard are to raise equity and debt financing as required, but there is no certainty that such financing will be available or that it will be available at acceptable terms. The outcome of these matters cannot be predicted at this time.

These financial statements do not include any adjustments to reflect the future effects on the recoverability and classification of assets or the amounts and classification of liabilities that might result from the outcome of this uncertainty.

At this time, we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock or through a loan from our directors to meet our obligations over the next twelve months. We do not have any arrangements in place for any future debt or equity financing.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires our management to make assumptions, estimates and judgments that affect the amounts reported, including the notes thereto, and related disclosures of commitments and contingencies, if any. We have identified certain accounting policies that are significant to the preparation of our financial statements. These accounting policies are important for an understanding of our financial condition and results of operation. Critical accounting policies are those that are most important to the portrayal of our financial conditions and results of operations and require management's difficult, subjective, or complex judgment, often as a result of the need to make estimates about the effect of matters that are inherently uncertain and may change in subsequent periods. Certain accounting estimates are particularly sensitive because of their significance to financial statements and because of the possibility that future events affecting the estimate may differ significantly from management's current judgments. We believe the following critical accounting policies involve the most significant estimates and judgments used in the preparation of our financial statements:

Basis of Presentation

The financial statements of our company have been prepared in accordance with generally accepted accounting principles in the United States of America and are presented in US dollars.

21

Accounting Basis

Our company uses the accrual basis of accounting and accounting principles generally accepted in the United States of America (“GAAP” accounting). Our company has adopted a January 31 fiscal year end.

Cash and Cash Equivalents

Our company considers all highly liquid investments with the original maturities of three months or less to be cash equivalents. Our company had $0 and $8,042 of cash as of January 31, 2012 and 2011, respectively.